Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Global Net Lease, Inc. | v412062_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - Global Net Lease, Inc. | v412062_ex99-2.htm |

Exhibit 99.1

NYSE Listing

Forward Looking Statements Certain statements made in this presentation are forward - looking statements . These forward - looking statements include statements regarding our intent, belief or current expectations and are based on various assumptions . These statements involve substantial risks and uncertainties . Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward - looking statements that we make . Forward - looking statements may include, but are not limited to, statements regarding stockholder liquidity and investment value and returns . The words "anticipates," "believes," "expects," "estimates," "projects," "plans," "intends," "may," "will," "would" and similar expressions are intended to identify forward - looking statements, although not all forward - looking statements contain these identifying words . Actual results may differ materially from those contemplated by the forward - looking statement . Further, forward - looking statements speak only as of the date they are made, and we undertake no obligation to update or reverse any forward - looking statement to reflect changed assumptions, the occurrence of unanticipated events on changes to future operating results, unless required to do so by law . Factors that might cause such differences include, but are not limited to : our ability to complete the listing of our shares of common stock on the New York Stock Exchange (“NYSE”) ; our ability to complete the tender offer ; the price at which our shares of common stock may trade on the NYSE, which may be higher or lower than the purchase price in the tender offer ; the number of shares acquired in the tender offer ; the cost of any indebtedness incurred to fund this offer ; the impact of current and future regulation ; the effects of competition ; the ability of our advisor to attract, develop and retain executives and other qualified employees ; changes in general economic or market conditions ; and other factors, many of which are beyond our control . 1

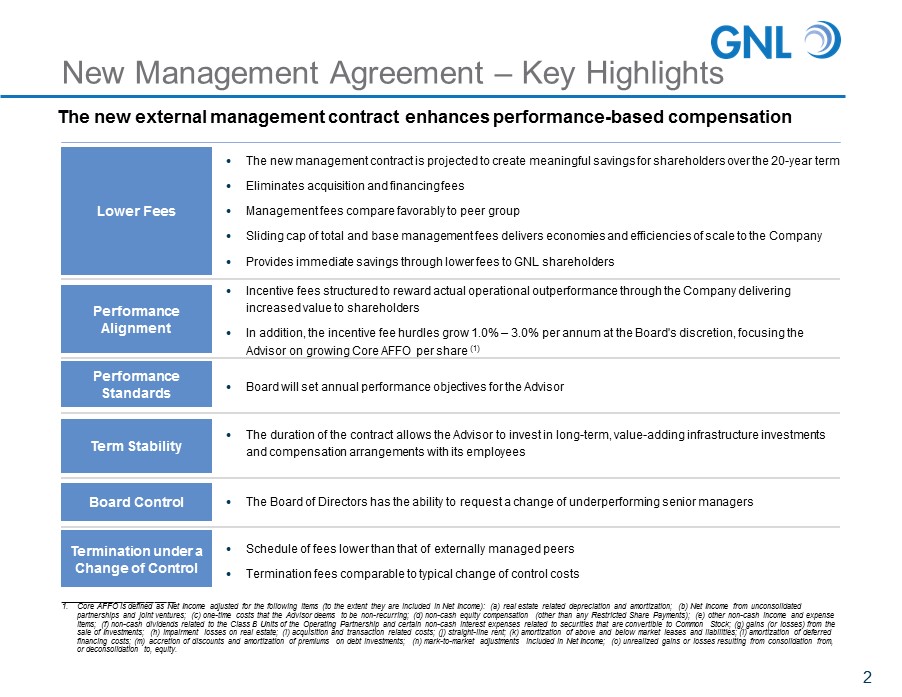

New Management Agreement – Key Highlights 2 Lower Fees Term Stability Board Control The new management contract is projected to create meaningful savings for shareholders over the 20 - year term Eliminates acquisition and financing fees Management fees compare favorably to peer group Sliding cap of total and base management fees delivers economies and efficiencies of scale to the Company Provides immediate savings through lower fees to GNL shareholders The duration of the contract allows the Advisor to invest in long - term, value - adding infrastructure investments and compensation arrangements with its employees The new external management contract enhances performance - based compensation The Board of Directors has the ability to request a change of underperforming senior managers Performance Standards Performance Alignment Incentive fees structured to reward actual operational outperformance through the Company delivering increased value to shareholders In addition, the incentive fee hurdles grow 1.0% – 3.0% per annum at the Board's discretion, f ocusing the Advisor on growing Core AFFO per share (1) Board will set annual performance objectives for the Advisor Termination under a Change of Control Schedule of fees lower than that of externally managed peers Termination fees comparable to typical change of control costs ___________________________ 1. Core AFFO is defined as Net Income adjusted for the following items (to the extent they are included in Net Income): (a) real es tate related depreciation and amortization; (b) Net Income from unconsolidated partnerships and joint ventures; (c) one - time costs that the Advisor deems to be non - recurring; (d) non - cash equity compensation (other than any Restricted Share Payments); (e) other non - cash income and expense items; (f) non - cash dividends related to the Class B Units of the Operating Partnership and certain non - cash interest expenses r elated to securities that are convertible to Common Stock; (g) gains (or losses) from the sale of Investments; (h) impairment losses on real estate; (i) acquisition and transaction related costs; (j) straight - line rent ; (k) amortization of above and below market leases and liabilities; (l) amortization of deferred financing costs; (m) accretion of discounts and amortization of premiums on debt investments; (n) mark - to - market adjustments inc luded in Net Income; (o) unrealized gains or losses resulting from consolidation from, or deconsolidation to, equity.

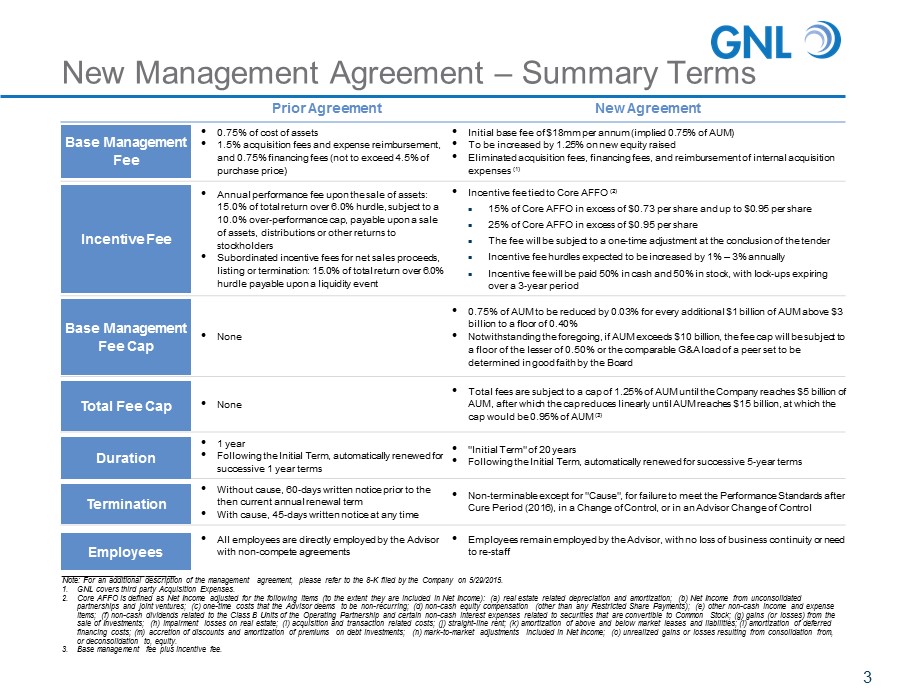

Prior Agreement New Agreement • 0.75% of cost of assets • 1.5% acquisition fees and expense reimbursement, and 0.75% financing fees (not to exceed 4.5% of purchase price) • Initial base fee of $18mm per annum (implied 0.75% of AUM) • To be increased by 1.25% on new equity raised • Eliminated acquisition fees, financing fees, and reimbursement of internal acquisition expenses (1) • Annual performance fee upon the sale of assets: 15.0% of total return over 6.0% hurdle, subject to a 10.0% over - performance cap, payable upon a sale of assets, distributions or other returns to stockholders • Subordinated incentive fees for net sales proceeds, listing or termination: 15.0% of total return over 6.0% hurdle payable upon a liquidity event • Incentive fee tied to Core AFFO (2) 15% of Core AFFO in excess of $0.73 per share and up to $0.95 per share 25% of Core AFFO in excess of $0.95 per share The fee will be subject to a one - time adjustment at the conclusion of the tender Incentive fee hurdles expected to be increased by 1% – 3% annually Incentive fee will be paid 50% in cash and 50% in stock, with lock - ups expiring over a 3 - year period • None • 0.75% of AUM to be reduced by 0.03% for every additional $1 billion of AUM above $3 billion to a floor of 0.40% • Notwithstanding the foregoing, if AUM exceeds $10 billion, the fee cap will be subject to a floor of the lesser of 0.50% or the comparable G&A load of a peer set to be determined in good faith by the Board • None • Total fees are subject to a cap of 1.25% of AUM until the Company reaches $5 billion of AUM, after which the cap reduces linearly until AUM reaches $15 billion, at which the cap would be 0.95% of AUM (3) • 1 year • Following the Initial Term, automatically renewed for successive 1 year terms • "Initial Term" of 20 years • Following the Initial Term, automatically renewed for successive 5 - year terms • Without cause, 60 - days written notice prior to the then current annual renewal term • With cause , 45 - days written notice at any time • Non - terminable except for "Cause", for failure to meet the Performance Standards after Cure Period (2016), in a Change of Control, or in an Advisor Change of Control • All employees are directly employed by the Advisor with non - compete agreements • Employees remain employed by the Advisor, with no loss of business continuity or need to re - staff New Management Agreement – Summary Terms Base Management Fee Incentive Fee Base Management Fee Cap Total Fee Cap Duration Termination 3 ___________________________ Note: For an additional description of the management agreement, please refer to the 8 - K filed by the Company on 5/29/2015. 1. GNL covers third party Acquisition Expenses. 2. Core AFFO is defined as Net Income adjusted for the following items (to the extent they are included in Net Income): (a) real es tate related depreciation and amortization; (b) Net Income from unconsolidated partnerships and joint ventures; (c) one - time costs that the Advisor deems to be non - recurring; (d) non - cash equity compensation (other than any Restricted Share Payments); (e) other non - cash income and expense items; (f) non - cash dividends related to the Class B Units of the Operating Partnership and certain non - cash interest expenses r elated to securities that are convertible to Common Stock; (g) gains (or losses) from the sale of Investments; (h) impairment losses on real estate; (i) acquisition and transaction related costs; (j) straight - line rent ; (k) amortization of above and below market leases and liabilities; (l) amortization of deferred financing costs; (m) accretion of discounts and amortization of premiums on debt investments; (n) mark - to - market adjustments inc luded in Net Income; (o) unrealized gains or losses resulting from consolidation from, or deconsolidation to, equity. 3. Base management fee plus incentive fee . Employees