Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Sprague Resources LP | d931218d8k.htm |

Sprague Resources LP

NAPTP Annual Investor Conference

Exhibit 99.1 |

2

Safe Harbor

Forward-Looking Statements /Non-GAAP Measures

Some of the statements in this presentation may contain forward-looking statements within the

meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of

1995. Forward-looking statements can be identified by words such as “may,” “assume,”

“forecast,” “position,” “predict,” “strategy,”

“expect,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” “will,” “project,” “budget,” “potential,” or

“continue,” and similar references to future periods. However, the absence of these

words does not mean that a statement is not forward looking. Descriptions of our

objectives, goals, plans, projections, estimates, anticipated capital expenditures, cost savings, strategy for

customer retention and strategy for risk management and other statements of future events or

conditions are also forward looking statements. Forward-looking statements are

neither historical facts nor assurances of future performance. Instead, they are based only on our current

beliefs, expectations and assumptions regarding the future of our business, future plans and

strategies, projections, anticipated events and trends, the economy and other future

conditions. Our actual future results and financial condition may differ materially from those indicated in

the forward-looking statements. Therefore, you should not rely on any of these forward-looking

statements. Important factors that could cause our actual results and financial condition to

differ materially from those indicated in the forward-looking statements include, but are not limited to

a significant decrease in in a demand for refined products, natural gas or our materials handling

services in the areas we serve; derivatives legislation could impact our ability to use

derivatives to reduce the effect of commodity price risk, interest rate risk, and adversely affect our

hedging activities; and, warmer weather during winter months and non-performance by our customers,

suppliers and counterparties. Any forward-looking statement made by us in this

presentation is based only on information currently available to us and speaks only as of the

date on which it is made. We undertake no obligation to publicly update any forward-looking

statement, whether written or oral, that may be made from time to time, whether as a result of

new information, future developments or otherwise. For additional information about risks and

uncertainties that could cause actual results to differ materially from the expectations, please refer

to Sprague’s current Quarterly Report on Form 10-Q and our most recent 10-K

available in the “Investor Relations” section of our website www.spragueenergy.com.

In this presentation we refer to certain financial measures not prepared in accordance with generally accepted accounting principles, or GAAP,

including adjusted gross margin and adjusted EBITDA. For a description of how we define these

non-GAAP financial measures see “Part I, Item 2, Management’s Discussion and

Analysis of Financial Condition and Results of Operations – How Management Evaluates Our Results of

Operations.” in Sprague’s current Quarterly Report on Form 10-Q and our most recent

10-K available in the “Investor Relations” section of our website

www.spragueenergy.com. |

|

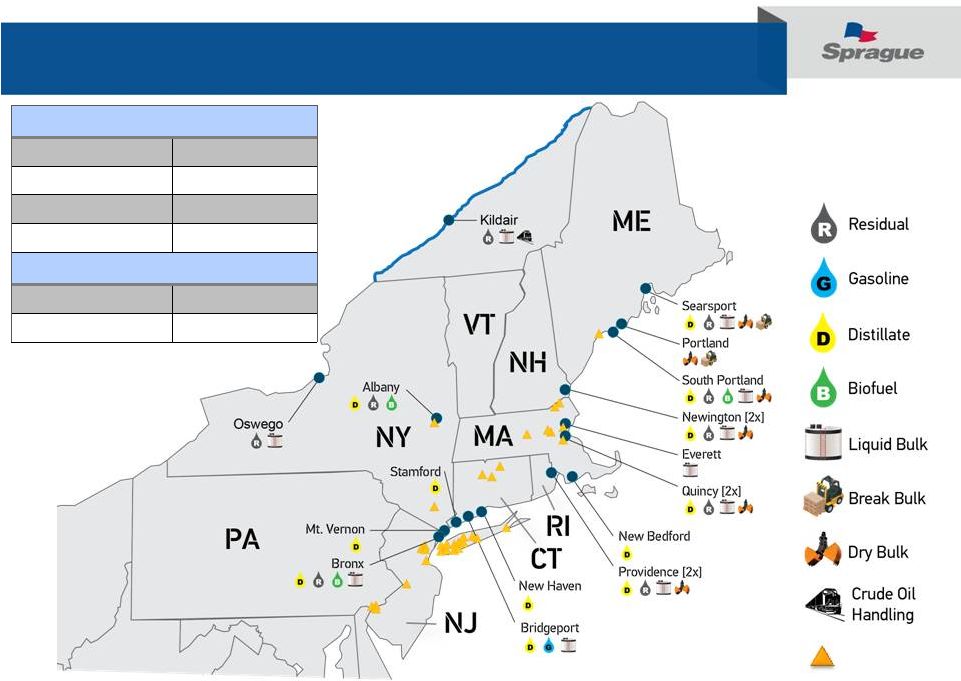

4

Refined Products and Materials Handling Network

(1)

Does not include ~2.1 million barrels of storage capacity (46 storage tanks)

currently out of service and not necessary for current operations

3

rd

Party

Locations

Storage Metrics

Storage Tanks:

208

Tank Capacity

(1)

:

14.1 MMbbl

18 Pads:

1,226,000 ft

2

10 Warehouses:

316,000 ft

2

Marketing Metrics

~ Volume (2014):

40 million barrels

~ Customers

3,000 |

Natural Gas Service

Area Supply Metrics

Pipelines:

15

States/Utilities:

13/46

Marketing Metrics

~ MMBtus (2014):

54,430,000

~ Customer Accounts:

15,000

5 |

Sprague Resources LP

(SRLP) Overview Ticker

SRLP

Exchange

NYSE

SRLP Price Per Unit on May 15, 2015

$28.06

Total Units Outstanding

21.1 million

Market Capitalization

$548 million

1Q 2015 Distribution Per Unit

$0.4725

Annualized 1Q 2015 Distribution Per Unit

$1.89

Yield as of May 15, 2015

6.74%

Distribution Growth Guidance for 2015

13.1%

2015 Adjusted EBITDA Guidance

$105 -

$120 million

1) Includes re-investment of distributions as of May 15, 2015

SRLP Total Return

(1)

Investment Highlights

Distribution Per LP Unit

6

Distribution Per LP Unit

$0.2825

$0.4125

$0.4275

$0.4425

$0.4575

$0.4725

$ / Unit

$0.4125

$0.38

$0.39

$0.40

$0.41

$0.42

$0.43

$0.44

$0.45

$0.46

$0.47

$0.48

MQD

4Q 2013*

1Q 2014

2Q 2014

3Q 2014

4Q 2014

1Q 2015

* Actual

distribution

of

$0.2825

per

unit

reflected

proration

of

minimum

quarterly

distribution

rate

for the October 30, 2013 closing of the SRLP IPO |

Fee-Based

Income River Road Terminal

Sprague’s terminals integrate refined product distribution with contractual income from

materials handling services

7 |

Fee-Based

Income Kildair Terminal

Recent expansion into crude trans-shipment / storage at our Kildair facility

8 |

9

Converting Rack Business to Contracted Sales

•

Offers from Sprague move with market

•

Buyers contract for supply at known price

•

Volatility presents opportunity for

customers

•

Forward programs de-risk customer

business

•

“Chat”

feature promotes

communication and negotiation

•

Sprague has ability to enhance margin as

market costs shift

“Real-Time”

Wholesale Marketing

Percentage of Wholesale Volume Sold on

Sprague Real-Time Pricing Platform

Traditional Wholesale Rack Marketing

•

Multiple sellers in market

•

No commitment from buyers

•

Focus on price

•

Volatile markets make posted prices “stale”

and increase risk of hedge imbalance |

Natural Gas Contract Margin

•

Standard pathway to meter assumed

•

Contract offer reflects market cost to supply

•

Customer signs contract –

sale is locked in

•

Supply costs are hedged

Base

contract

margin

established

2-Leg Traditional Supply

Route

10 |

Natural Gas Margin Optimization

Schedulers have flexibility to supply gas

utilizing many pathways prior to delivery

Broad portfolio of customer accounts

enables “swaps”

Cash market volatility presents additional

opportunities

Margin Enhancement Opportunities

4-Leg Alternative Supply

Route

11 |

Integrated Business Model

Supply

and

logistics

expertise,

coupled

with

product

and

service

innovations,

used

to

enhance returns on the asset base

Refined Products Adjusted Unit Margin ($/gallon)

Natural Gas Adjusted Unit Margin ($/MMBtu)

Representative Throughput Model

Margin

Representative Wholesale Supply

Services Margin

12 |

Integrated Business Model

Refined Products Adjusted Unit Margin ($/gallon)

Natural Gas Adjusted Unit Margin ($/MMBtu)

Proprietary terminal marketers

Local market competitive intelligence

Control of our own supply in extreme

conditions

Superior product/service offer to customer

Management of gas from hub to burner tip

Ability to enhance margin in certain market

conditions

13 |

Limited Commodity Exposure

•

Sprague’s Risk Policy sets authorized position limits for all commodities

handled •

Inventory is tracked daily and Risk team monitors all open positions relative to

inventory levels and sales to ensure Sprague maintains a hedged book of

business •

Outright short/long positions due to daily imbalances are minimal relative to total

volume

•

Daily VAR calculation monitored

Risk Management

Business Model’s Exposure to Commodity Price Levels

•

Agnostic to outright price levels

•

Working capital requirements reduced with lower commodity prices

•

Some bid contracts benefit from declining prices

•

Product slate continues to evolve to meet customer energy requirements

14 |

15

Searsport Terminal –

circa 1950

Organic Growth –

Sprague’s DNA |

Rail Transfer Pad

Nacelles

Road Salt

Pads

Clay Slurry

Rail connection to CP,

CMQ and Pan Am

Liquid

Finger

Dock

Bulk Dock

Food Grade

Warehouses

Available for Development

Blades

Hopper

Coal /

Petcoke

Third Party

Tanks

Third Party

Tanks

Third-party storage

Unloading

Blades

Organic Growth –

Sprague’s DNA

Searsport Terminal today

16 |

Organic Growth –

Sprague’s DNA

October 2007

Kildair Terminal

17 |

Organic Growth –

Sprague’s DNA

October 2012

Kildair Terminal

18 |

Organic Growth –

Sprague’s DNA

Kildair Terminal

June 2014

19 |

20

Visible Return Growth In Recent Acquisitions

•

Replacement of 3

rd

party supplier

•

Growth in assigned capacity portfolio and

associated optimization

•

Electricity brokerage platform

•

Investing expansion capital at terminal

•

Distillates / Biofuels

•

Space for Materials Handling growth

•

Cost-effective servicing of existing Sprague NYC

contractual business

•

Efficiency gains in multiple processes

Very low effective multiple on recent acquisitions |

21

Strong Financial Performance and Growth

Adjusted EBITDA

•

Refined Products

-

19% increase in heating degree days with colder than

normal weather; benefit from recent Castle acquisition; strong margin

generation resulting in record quarter

•

Natural Gas

–

Uplift from Q4 Metromedia acquisition contributing higher

volumes; offset partially by marginally lower unit margins as a result of

decreased

volatility

in

the

Northeast

cash

markets

compared

to

a

year

ago

•

Materials Handling

–

Strong results in break bulk activity (windmills and

newsprint), benefit of crude storage and handling project at Kildair, increased

asphalt volumes; leveraging of the shared petroleum assets and workforce

Adjusted Gross Margin

Key Q1 2015 Events

Distributable Cash Flow

(1)

(1)

The presented period 2012 is pro forma per page 56 in Sprague’s S-1

Prospectus. 2013 is a pro forma calculation as presented in Sprague’s March 13, 2015 press and earnings release.

$139.4

$189.1

$245.0

$114.3

$0

$30

$60

$90

$120

$150

$180

$210

$240

$270

2012

2013

2014

2015 Q1

Refined Products

Natural Gas

Materials Handling

Other

($ millions)

$49.8

$76.2

$105.3

$63.5

$0

$20

$40

$60

$80

$100

$120

2012

2013

2014

2015 Q1

($ millions)

$29.9

$40.1

$74.9

$58.6

$0

$15

$30

$45

$60

$75

2012

2013

2014

2015 Q1

($ millions) |

22

Distribution Growth and Coverage

•

Ratable

$0.015

per

unit

distribution

growth

by

quarter

planned

for

the

next

12 -

24 months

•

Strong

coverage

ratio

enables

Sprague

to

“naturally

delever”

by

paying

down

debt

with

excess

cash

flow

without

the

need

to

access

the

equity

markets

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

2012

2013

2014

TTM March 2015

Distributions

Excess Distributable Cash Flow

($ millions)

1.0x

1.2x

2.1x

2.4x

$29.9

$40.1

$74.9

$89.5 |

23

(in millions)

Debt

Liquidity

Acquisition Facility

$312

$88

Accordion

$200

Credit Facility, Liquidity and Leverage

•

$1.12 billion Working Capital facility (includes $120 million multicurrency Working

Capital facility) •

$400 million Acquisition facility

•

Accordions:

•

Combined Working Capital facilities -

$200 million

•

Acquisition

facility

-

$200

million

•

Maximum size is $2.0 billion (including optional contango facility of $125

million) •

Significant capacity and liquidity to finance our ongoing business requirements and

growth •

JPMorgan Chase is Administrative Agent (Syndicate of 24 Diverse Lenders)

(in millions)

Debt

Liquidity

Working Capital Facility

$416

$187

Accordion

$200

Total

Facility

Size

-

$1.52

billion

(Committed

5

years,

expiring

December

2019)

Debt and Liquidity as of March 31, 2015

1.3x

1.6x

3.0x

2.7x

Permanent

Leverage

Ratio

$0

$200

$400

$600

$800

$1,000

Q2 2014

Q3 2014

Q4 2014

Q1 2015

Acquisition Line

Working Capital Facility

$248

$392

$815

$728 |

24

Guidance

Full Year 2015 Guidance

•

Adjusted EBITDA guidance range of $105 to $120 million

•

Assumes normal weather, market conditions and no acquisitions

•

Maintenance CapEx range of $7 million to $10 million

•

Cash Interest expense range of $23 million to $26 million

•

Distribution

growth

of

$0.0150/unit

per

quarter

for

the

next

12

–

24

months |

Key

Investment Considerations Materials Handling is 100% fee-based,

multi-year contracts More than 50% of Refined Product sales are under

contract Natural Gas contract base margin enhanced by optimization

activities Experts in unique Northeast logistical challenges

Product and service innovation drives enhanced margins

Marketing emphasis does not translate to commodity exposure

Synergy realization from recent acquisitions

Organic growth prospects at Kildair, Bronx, and Searsport

Active acquisition market

Strong performance resulting in high coverage

Modest leverage and ample acquisition facility liquidity

Distribution growth above guidance at IPO

Terminaling,

Logistics and

Marketing

Expertise

Contract-Based

Income with

Upside Potential

Strong Capital

Position

Visible Growth

Prospects

25 |

26

Appendix |

27

Condensed Consolidated Balance Sheet

March 31,

December 31,

2015

2014

(Unaudited)

Assets

Current assets:

Cash and cash

equivalents…………………………………………………….

$

21,609

$

4,080

Accounts receivable,

net………………………………………………………

342,174

289,424

Inventories…………………………………………………………………….

217,912

390,555

Fair value of derivative assets.

……………………………………………….

169,298

229,890

Deferred income

taxes………………………………………………………..

961

895

Other current assets.

………………………………………………………….

50,115

52,416

Total current

assets………………………………………………………

802,069

967,260

Property, plant, and equipment, net.

………………………………………………

251,336

250,126

Assets held for sale

………………………………………………………………..

68

1,321

Intangibles, net

…………………………………………………………………….

25,585

27,626

Other assets,

net…………………………………………………………………….

26,322

30,219

Goodwill.

………………………………………………………………………….

63,288

63,288

Total assets

……………………………………………………………………

$

1,168,668

$

1,339,840

Liabilities and unitholders' equity

Current liabilities:

Accounts payable.

$

124,972

$

198,609

Accrued liabilities

……………………………………………………………

56,510

63,816

Fair value of derivative

liabilities…………………………………………….

55,685

89,176

Due to General Partner and affiliates

…………………………………………

11,969

15,340

Current portion of log-term

debt

…………………………………………….

258,678

397,214

Current portion of capital leases

……………………………………………..

1,004

1,313

Total current liabilities

………………………………………………….

508,818

765,468

Commitments and

contingencies…………………………………………………..

-

Long

-

term debt

…………………………………………………………………..

469,708

418,356

Long-term capital leases

…………………………………………………………..

4,245

5,424

Other liabilities

18,157

17,884

Due to General Partner

…………………………………………………………….

848

988

Deferred income taxes

………………………………………………………………

15,190

15,826

Total liabilities

…………………………………………………………………

1,016,966

1,223,946

Unitholders' equity:

Common unitholders

-

public (8,969,914 units and 8,777,922 units issued and

outstanding, as of March 31, 2015 and December 31, 2014,

respectively)…. 186,997

171,055

Common unitholders

-

affiliated (2,034,378 units issued and

outstanding, as of March 31, 2015 and December 31, 2014,

respectively)…. (1,908)

(5,566)

Subordinated unitholders

-

affiliated (10,071,970 units issued and outstanding)

(21,652)

(39,762)

Accumulated other comprehensive loss, net of tax

……………………………

(11,735)

(9,833)

Total unitholders'

equity………………………………………………………

151,702

115,894

Total liabilities and

unitholders'

equity…………………………………

$

1,168,668

$

1,339,840

- |

28

Adjusted Gross Margin by Segment –

Q1 2015

Three Months Ended March 31,

2015

2014

(unaudited)

(unaudited)

($ and volumes in thousands)

Volumes:

Refined products (gallons)

726,432

588,756

Natural gas (MMBtus)

…...……………………………………………………………………………..……………

20,013

16,496

Materials handling (short

tons)………………………………………………………………………………………

585

694

Materials handling

(gallons)…………………………………………………………………………………………

74,760

66,822

Net Sales:

Refined

products…………………………………………………………………………………………………….

$

1,431,845

$

1,844,973 Natural

gas…………………………………………………………………………………………………………..

146,679

134,340

Materials

handling…………………………………………………………………………………………………..

10,184

8,079

Other

operations……………………………………………………………………………………………………..

9,650

7,307

Total net

sales……………………………………………………………………………………………………….

$

1,598,358

$

1,994,699 Adjusted Gross Margin:

(2)

Refined

products……………………………………………………………………………………………………

$

66,306

$

51,530 Natural

gas………………………………………………………………………………………………………….

34,817

35,344

Materials

handling………………………………………………………………………………………………….

10,184

8,077

Other

operations…………………………………………………………………………………………………….

2,983

1,336

Total adjusted gross

margin…………………………………………………………………………………………

$

114,290

$

96,287 Calculation of

Adjusted Gross Margin: Total net

sales………………………………………………………………………………………………………..

$

1,598,358

$

1,994,699 Less cost of products sold (exclusive of

depreciation and amortization)……………………………………………

(1,490,373)

(1,864,419)

Add: unrealized (gain) loss on

inventory……………………………………………………………………………..

3,534

(5,866)

Add: unrealized (gain) loss on natural gas transportation

contracts…………………………………………………

2,771

(28,127)

Total adjusted gross

margin………………………………………………………………………………………….

$

96,287

………………………………………………………………………………………….

$

114,290 1) On December 9, 2014, the

Partnership acquired all of the equity interests in Kildair through the acquisition of the equity interests of Kildair’s parent Sprague Canadian Properties LLC. As the

acquisition of Kildair by the Partnership represents a transfer of

entities under common control, the Consolidated and Financial Statements for the three months ended March 31, 2014, and related

information presented herein have been recast by including the

historical financial results of Kildair for all periods that were under common control.

2) Adjusted gross margin is defined as net sales less cost of products

sold (exclusive of depreciation and amortization) increased by unrealized hedging losses and decreased by unrealized hedging

gains, in each case with respect to refined products and natural gas

inventory and natural gas transportation contracts. (1)

|

29

Adjusted Gross Margin by Segment –

YE 2014

(1)

Three Months Ended

Year Ended

December 31,

December 31,

2013

2013

2014

Predecessor

2014

Predecessor

(unaudited)

(unaudited)

($ and volumes in thousands)

($ and volumes in thousands)

Volumes:

Refined products (gallons)

475,398

399,462

1,668,240

1,472,100

Natural gas (MMBtus)

……………………………………………………………………………………………….

16,166

13,667

54,430

51,979

Materials handling (short

tons)………………………………………………………………………………………

703

529

2,663

2,145

Materials handling

(gallons)…………………………………………………………………………………………

96,474

69,678

309,834

246,708

Net Sales:

Refined

products…………………………………………………………………………………………………….

1,076,410

$

1,182,667

$

4,650,871 $

Natural

gas…………………………………………………………………………………………………………..

104,926

82,139

359,984

304,843

Materials

Handling…………………………………………………………………………………………………..

10,908

6,733

37,776

28,446

Other

operations……………………………………………………………………………………………………..

5,750

4,762

21,131

18,650

Total net

sales……………………………………………………………………………………………………….

$

$

5,069,762

$

4,683,349 Adjusted Gross Margin:

(2)

Refined

products……………………………………………………………………………………………………

$

44,153

$

36,151

$

146,021

$

114,744 Natural

gas………………………………………………………………………………………………………….

12,922

11,972

55,536

40,373

Materials

Handling………………………………………………………………………………………………….

10,925

6,730

37,811

28,430

Other

operations…………………………………………………………………………………………………….

1,660

2,178

5,599

5,547

Total adjusted gross

margin…………………………………………………………………………………………

$

$

244,967

$

189,094 Calculation of Adjusted Gross

Margin: Total net

sales………………………………………………………………………………………………………..

$

1,276,301

$

5,069,762

$

4,683,349 Less cost of products sold (exclusive of

depreciation and amortization)……………………………………………

(1,076,155)

(1,271,750)

(4,755,031)

(4,554,188)

Add: unrealized (gain) loss on

Inventory……………………………………………………………………………..

241

8,487

(11,070)

4,188

Add: unrealized (gain) loss on natural gas transportation

contracts…………………………………………………

(52,420)

43,993

(58,694)

55,745

Total adjusted gross

margin………………………………………………………………………………………….

$

57,031

$

244,967

$

189,094 1) On December 9, 2014, the

Partnership acquired all of the equity interests in Kildair through the acquisition of the equity interests of Kildair’s parent Sprague Canadian Properties LLC. As the

acquisition of Kildair by the Partnership represents a transfer of

entities under common control, the Consolidated and Combined Financial Statements and related information presented herein have

been recast by including the historical financial results of Kildair

for all periods that were under common control. 2) Adjusted

gross margin is defined as net sales less cost of products sold (exclusive of depreciation and amortization) increased by unrealized hedging losses and decreased by unrealized hedging

gains, in each case with respect to refined products and natural gas

inventory and natural gas transportation contracts.

………………………………………………………………………………………….

$

69,660 $

$

$

$

1,197,994

69,660

1,197,994

1,276,301

57,031

4,331,410 |

30

Statement of Operations Data:

Net sales

$

1,598,358

$

1,994,699

Operating costs and expenses:

Cost of products sold (exclusive of depreciation and amortization)

1,490,373

1,864,419

Operating expenses

18,883

16,838

Selling, general and administrative

32,381

27,411

Depreciation and amortization

4,992

3,955

Total operating costs and expenses

1,546,629

1,912,623

Operating income

51,729

82,076

Other income

514

-

Interest income

112

110

Interest expense

(7,766)

(8,016)

Income before income taxes

44,589

74,170

Income tax provision

(650)

(1,038)

Net income

43,939

73,132

Adjust: Loss attributable to Kildair from January 1, 2014

through March 31, 2014

-

2,203

Limited partners’ interest in net income

$

43,939

$

75,335

Net income per limited partner unit:

Common - basic

$

2.10

$

3.74

Common - diluted

$

2.06

$

3.74

Subordinated - basic and diluted

$

2.10

$

3.74

Units used to compute net income per limited partner unit:

Common - basic

10,897,488

10,072,186

Common - diluted

11,064,510

10,073,176

Subordinated - basic and diluted

10,071,970

10,071,970

Reconciliation of net income to adjusted EBITDA:

Net income

$

43,939

$

73,132

Add/(Deduct):

Interest expense, net

7,654

7,906

Tax expense

650

1,038

Depreciation and amortization

4,992

3,955

EBITDA

$

57,235

$

86,031

Add: unrealized (gain) loss on inventory

3,534

(5,866)

Add: unrealized (gain) loss on natural gas transportation contracts

2,771

(28,127)

Adjusted EBITDA

$

63,540

$

52,038

(1)

Summary Financial Data –

Q1 2015

1) On December 9, 2014, the Partnership acquired all of the equity

interests in Kildair through the acquisition of the equity interests of Kildair’s parent Sprague Canadian Properties LLC.

As the acquisition of Kildair by the Partnership represents a transfer

of entities under common control, the Consolidated Financial Statements for the three months ended March 31, 2014,

and related information presented herein have been recast by including

the historical financial results of Kildair for all periods that were under common control.

2) EBITDA represents net income before interest, income taxes,

depreciation and amortization.

3) Adjusted EBITDA represents EBITDA increased by unrealized hedging

losses and decreased by unrealized hedging gains, in each case with respect to refined products and natural gas

inventory and natural gas transportation contracts.

(3)

(2)

Three Months Ended March 31,

2015

2014

(unaudited)

(unaudited)

($ in thousands)

………………………………………………………………………………….……….

………………………………

……………………………………………………………………………

………………………………………………………………

………………………………………………………….………

…………………………………………………….…

……………………………………………………………………………….…

…………………………………………………………………………………

…………………………………………………………………………….…

………………………………………………………………………………

…………………………………………………………………………

……………………………………………………………………….…

………………………………………………………………………………….……

…………………………………………………………………………

…………………………………………..……….………

……………………………………………………………………………..………

…………………………………………………………………

…………………………………………………………………………

…………………………………………………………

……………………………………………………………………………..………

…………………….………………………………..

…………………….………

…………………….……………………….……………………………..

|

31

Summary Financial Data –

YE 2014

(1)

1) On December 9, 2014, the Partnership acquired all of the equity

interests in Kildair through the acquisition of the equity interests of Kildair’s parent Sprague Canadian Properties LLC.

As the acquisition of Kildair by the Partnership represents a transfer

of entities under common control, the Consolidated and Combined Financial Statements and related information

presented herein have been recast by including the historical financial

results of Kildair for all periods that were under common control.

2) Adjusted EBITDA respresents EBITDA increased by unrealized hedging

losses and decreased by unrealized hedging gains, in each case with respect

to refined products and natural gas inventory and natural gas

transportation contracts, and adjusted for bio-fuel excise tax credits.

3) Net loss per unit for three months ended and year ended December 31,

2013, is only calculated for the Partnership after the IPO as no units were outstanding prior to October 30, 2013.

(3)

…………………………………………………………………..........

…………………………………………………

…………………………………………………………

………………………………………………………

………………………………………

……………………………………….

………………………………

…………………………………………………………

…………………………………………………

…………………………………………………………

…………………………………………………………

………………………………………………

…………………………………………

……………………………………………………………….

…………………

………………………………………..…………

………………………..………

10,271,010

10,453,910

10,071,970

10,071,970

10,071,970

10,071,970

4,554,188

51,979

(2)

Three Months Ended

Year Ended

December 31,

December 31,

2014

2013

Predecessor

2014

2013

Predecessor

(unaudited)

(unaudited)

($ in thousands)

($ in thousands)

Statement of Operations Data:

Net sales

$

1,197,994 $

1,276,301 $ 5,069,762

$ 4,683,349

Operating costs and expenses:

Cost of products sold (exclusive of depreciation and

amortization)

1,076,155

1,271,750

4,755,031 Operating expenses

17,199

12,829

62,993

53,273

Selling, general and administrative

22,159

15,521

76,420

55,210

Depreciation and amortization

5,167

4,044

17,625

16,515

Total operating costs and expenses

1,120,680

1,304,144

4,912,069

4,679,186 Operating income (loss)

77,314

(27,843)

157,693

4,163

Other (expense) income

(288)

(33)

(288)

568

Interest income

168

83

569

604

Interest expense

(8,103)

(9,068)

(29,651)

(30,914) Income (loss) before

income taxes

69,091

(36,861)

128,323

(25,579) Income tax

(provision) benefit (3,503)

1,819

(5,509)

(4,259) Net income

(loss)

65,588

(35,042)

122,814

(29,838) Adjust: Predecessor (loss) income through October 29, 2013

-

(2,470)

-

2,734

Adjust: Income (loss) attributable to Kildair from October 29, 2013

through December 8th, 2014

1,977

(2,338) 4,080

(2,338) Limited partners' interest in net income (loss)

$ 63,611

$ (30,234)

$ 118,734

$ (30,234)

Net income (loss) per limited partner unit :

Common - basic

$ 3.13

$ (1.50)

$ 5.88

$ (1.50)

Common - diluted

$ 3.07

$ (1.50)

$ 5.84

$ (1.50)

Subordinated - basic and diluted

$ 3.13

$ (1.50)

$ 5.88

$ (1.50)

Units used to compute net income per limited partner unit -

Common - basic

10,071,970 10,131,928

Common - diluted

10,071,970 10,195,566

Subordinated - basic and diluted

10,071,970

10,071,970 Adjusted EBITDA (unaudited)

$ 30,014

$ 28,648

$ 105,266

$ 76,158

Other Financial and Operating Data (unaudited)

Capital expenditures

$ 5,266

$ 11,016

$

18,580

$ 28,090

Total refined products volumes sold (gallons)

475,398

399,462 1,668,240

1,472,100 Total natural gas volumes sold (MMBtus)

16,166

13,667 54,430

|

32

($ in thousands)

Reconciliation of adjusted EBITDA to distributable cash flow:

Adjusted EBITDA

$

63,540

$

52,038

Add/(Deduct):

Cash interest expense, net

.............................................................

Cash taxes

.....................................................................................

Maintenance capital expenditures

.................................................

Elimination of expense relating to incentive compensation

and directors fees expected to be paid in common units .........

4,068

538

Other

.............................................................................................

802

41

Eliminate the effects of Kildair

-

Distributable cash flow

$

58,575

$

43,953

1) On December 9, 2014, the Partnership acquired all of the equity

interests in Kildair through the acquisition of the equity

interests of Kildair’s parent Sprague Canadian Properties LLC. As

the acquisition of Kildair by the Partnership represents a

transfer of entities under common control, the Consolidated Financial

Statements for the three months ended March 31, 2014, and

related information presented herein have been recast by including the historical financial results of Kildair for all

periods that were under common control.

2) Adjusted EBITDA represents EBITDA increased by unrealized hedging

losses and decreased by unrealized hedging gains, in each case

with respect to refined products and natural gas inventory and natural gas transportation contracts.

3) To report distributable cash flow excluding Kildair for the periods

that were under common control and prior to the Kildair

acquisition on December 9, 2014.

.......................................................................................

................................................................

...............................................................................

Adjusted EBITDA to DCF Reconciliation –

Q1 2015

(1)

(2)

(3)

(unaudited)

(unaudited)

2015

2014

Three Months Ended March 31,

(6,748)

(1,327)

(1,760)

(6,714)

(593)

(1,263)

(94) |

33

.........................................................................................................

Adjusted

EBITDA

to

DCF

Reconciliation

–

YE

2014

(1)

1) On December 9, 2014, the Partnership acquired all of the equity

interests in Kildair through the acquisition of the equity interests of Kildair’s parent Sprague Canadian

Properties LLC. As the acquisition of Kildair by the Partnership

represents a transfer of entities under common control, the Consolidated and Combined Financial

Statements and related information presented herein have been recast by

including the historical financial results of Kildair for all periods that were under common

control.

2) The unaudited pro forma information gives effect to certain pro

forma adjustments as if they had occurred as of January 1, 2013. The adjustments are based upon

available information and certain estimates and assumptions; therefore,

actual adjustments will differ from the pro forma adjustments. Pro forma adjustments reflect the

following:

a) The pro forma adjustment for interest expense and deferred financing

fees under the new credit agreement. The calculation is based on the monthly average working

capital and acquisition facility multiplied by the decreases in the

borrowing rate of 0.50% for borrowings under the working capital facility, less the increase of

commitment fees due to the increased size of the facility.

b) The elimination of corporate overhead charges from the Parent offset

by increases in incentive compensation.

c) The adjustments to reflect the conversion of the Predecessor to a

partnership resulting in the elimination of all U.S. federal income taxes, as well as an adjustment of

income taxes in certain state jurisdictions in which the partnership

operates, and to record estimated taxes for the activities conducted by the Partnership at the applicable

state statutory rates.

3) Adjusted EBITDA respresents EBITDA increased by unrealized hedging

losses and decreased by unrealized hedging gains, in each case with respect to refined

products and natural gas inventory and natural gas transportation

contracts, and adjusted for bio-fuel excise tax credits.

4) To report distributable cash flow excluding Kildair for the periods

that were under common control and prior to the Kildair acquisition on December 9, 2014.

2014

2013

Predecessor

2014

2013

Predecessor

(unaudited)

Pro Forma

(unaudited)

(unaudited)

Pro Forma

(unaudited)

($ in thousands)

($ in thousands)

Adjusted EBITDA

$

30,014

$

28,654

$

105,266

$

76,156

Add/(Deduct):

Cash interest expense, net

......................................................................................

Cash taxes

..............................................................................................................

Maintenance capital expenditures

..........................................................................

Estimated incremental selling, general and administrative expense of

being a publicly traded partnership

................................................................................

-

-

Elimination of expense relating to incentive compensation and directors

fees expected to be paid in common units

................................................................

2,915

761

8,182

1,975

Other

......................................................................................................................

4,711

7

6,102

609

Eliminate the effects of Kildair

476

1,306

Distributable cash flow

$

21,166

$

18,173

$

74,897

$

40,063

.......................................................................................

...........................................................................................................

Reconciliation of adjusted EBITDA to distributable cash flow: (2)

(3)

(2)

(4)

(7,362)

(1,220)

(2,971)

(24,265)

(3,042)

(8,290)

(9,056)

(1,716)

(7,680)

(6,156)

(24,431)

(4,206)

(4,231)

(1,350)

(6,687)

Three Months Ended

December 31,

Year Ended

December 31, |