Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CF BANKSHARES INC. | cfbk-20150520x8k.htm |

Exhibit 99

Central Federal Corporation CFBankAnnual Stockholders Meeting Wednesday May 20, 2015Columbus Cleveland Fairlawn Columbiana County

PRESENTATION.2014 Highlights .2015 Growth & Opportunities.Financial Highlights

TRANSFORMATIONAL 2014.Attained critical asset size.Achieved profitability in Q2 .Continued further improvements in credit quality.Strengthened infrastructure to support future growth and expansion

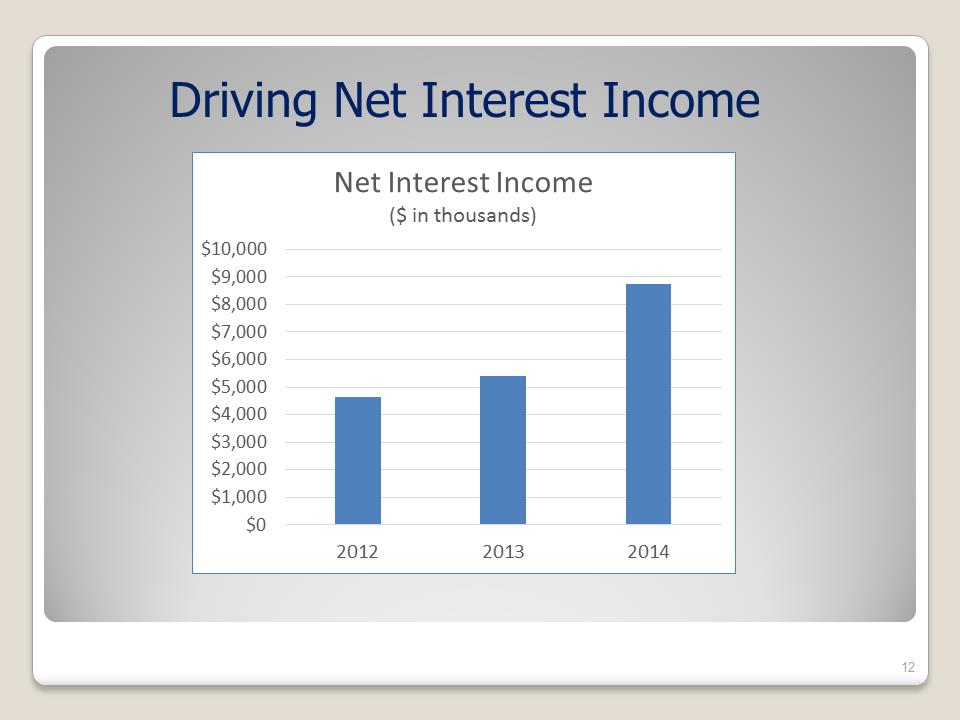

2014 HIGHLIGHTS .Loans increased 24%.Net interest income increased 62%.Nonperforming loans (NPL’s) declined by 73%.ALLL to NPL’s improved to 408% at year end

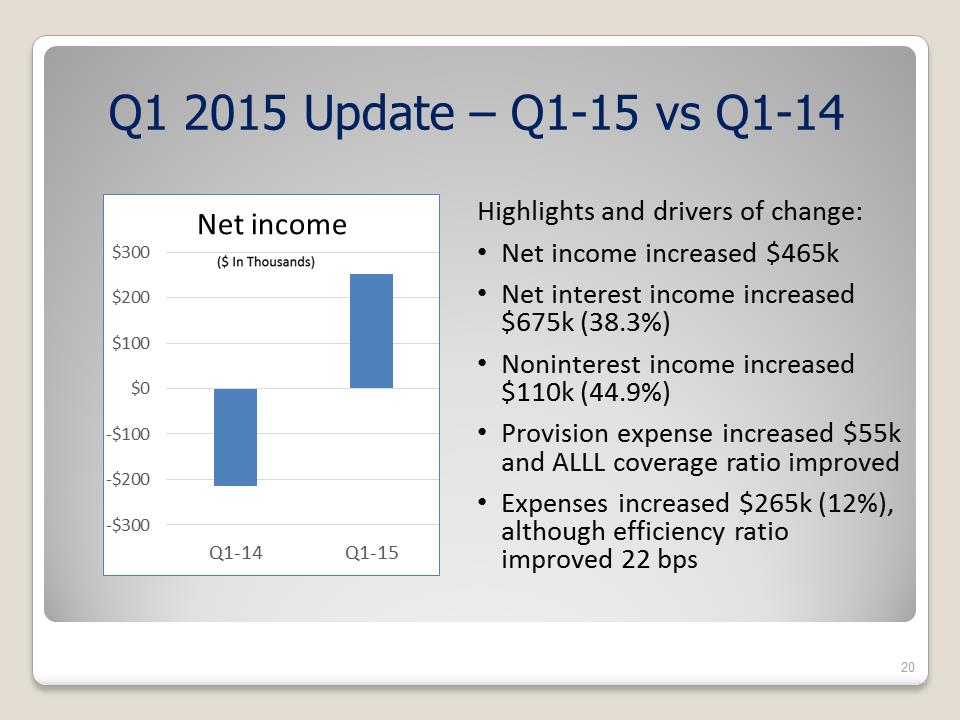

SOLID START2015Q1 2015 vs. Q1 2014 .Net income increased $465K in Q1 2015 vs. Q1 2014.Net interest income increased $675k (38.3%).Noninterest income increased $110k (44.9%).Criticized and classified loans decreased $1.9M (12.5%) since December 31, 2014

SOLID START2015.Continued benefit of net operating tax loss carryforward which reduced taxable income.These tax savings accelerate capital accumulation through increased earnings retention

GROWTH AND EARNINGS OPPORTUNITIES.Solid organic growth with potential for future acquisitions.Niche Business Bank now in three major Ohio metro markets. Looking at a potential presence in Cincinnati in the future..Residential Mortgage Lending presence expected to follow same footprint in Ohio metro markets..Cleveland expansion in 2014 is being well received and accounts for nearly 50% of Commercial Lending Business Geography & Business Model = A Uniquely Positioned,Franchise & Value Proposition

IN SUMMARY.We remain committed to our strategic business plan and objectives(i.e. growth, profits, deep relationships and risk management).Our focus is to be a TOP PERFORMER consistent with disciplined execution!! .Net income trends over the previous nine (9) quarters show consistent improvement.Our business model is validated by our customers

HIGHLY ENTHUSED AND CONFIDENT ABOUT OUR FUTURE .Access to growth.Presence in multiple metro markets, and.Depth and experience of management and our Board of Directors is a key differentiatorONWARD AND UPWARD!!

Financial HighlightsJohn Helmsdoerfer, EVP & CFO

Financial Highlights .Keys to Success and Earnings Improvements.Driving net interest income.Continued growth in noninterest income.Quality loan growth.Optimizing funding sources and mix.Continued credit quality improvement.Maintaining capital strength through earnings.Infrastructure and operational efficiencies.Our trajectory … “Onward & Upward!!”

Driving Net Interest Income Net Interest Income ($ in thousands)

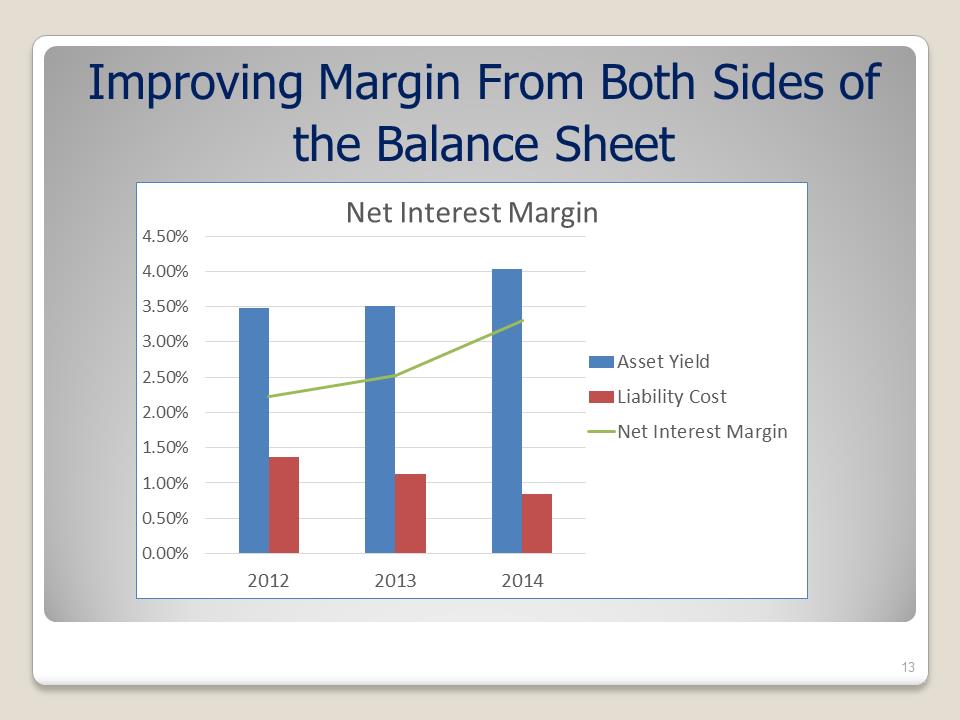

Improving Margin From Both Sides of the Balance SheetNet Interest Margin

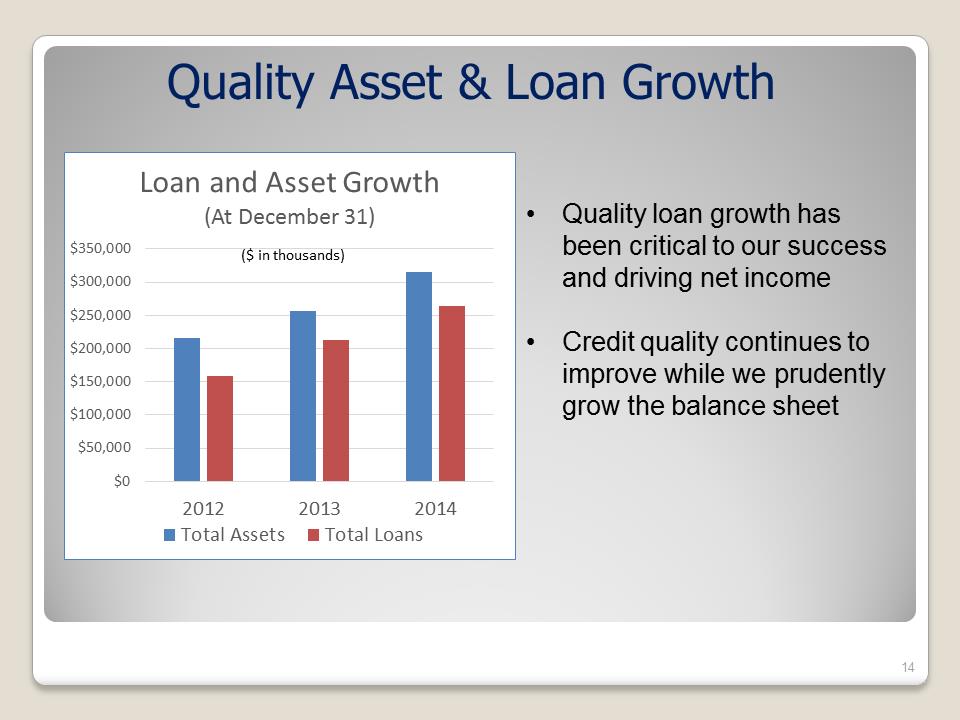

Quality Asset & Loan Growth•Quality loan growth has been critical to our success and driving net income•Credit quality continues to improve while we prudently grow the balance sheet Loan and Asset Growth (At December 31)

Growing Non-Interest Bearing Relationships to Fund Our GrowthNon-Interest Bearing Deposits(At December 31)($ In thousands)

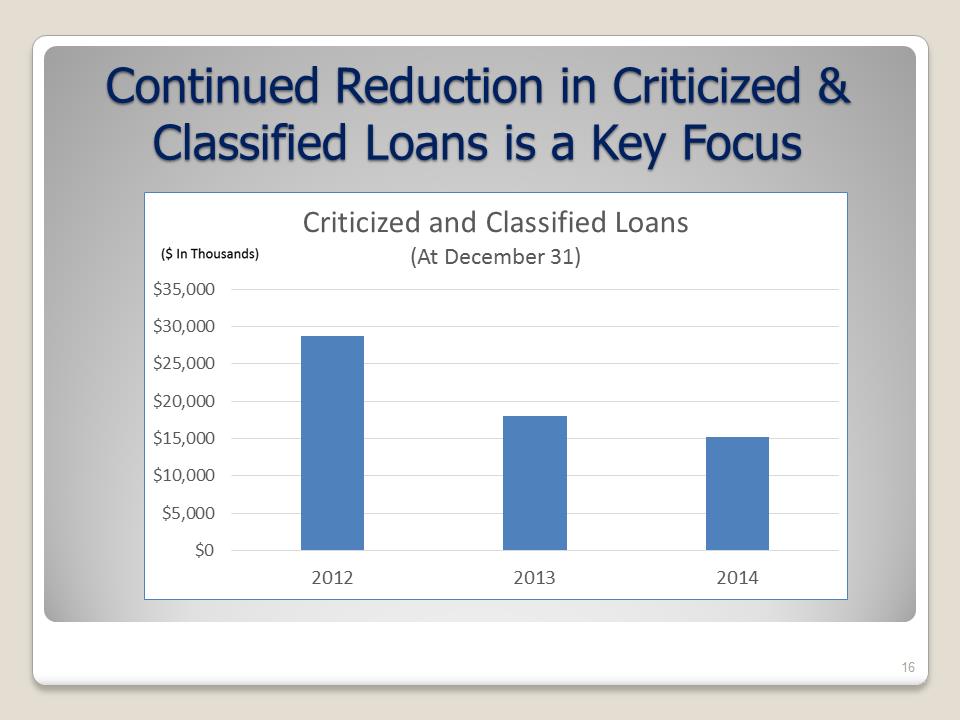

Continued Reduction in Criticized & Classified Loans is a Key FocusCriticized and Classified Loans(At December 31)

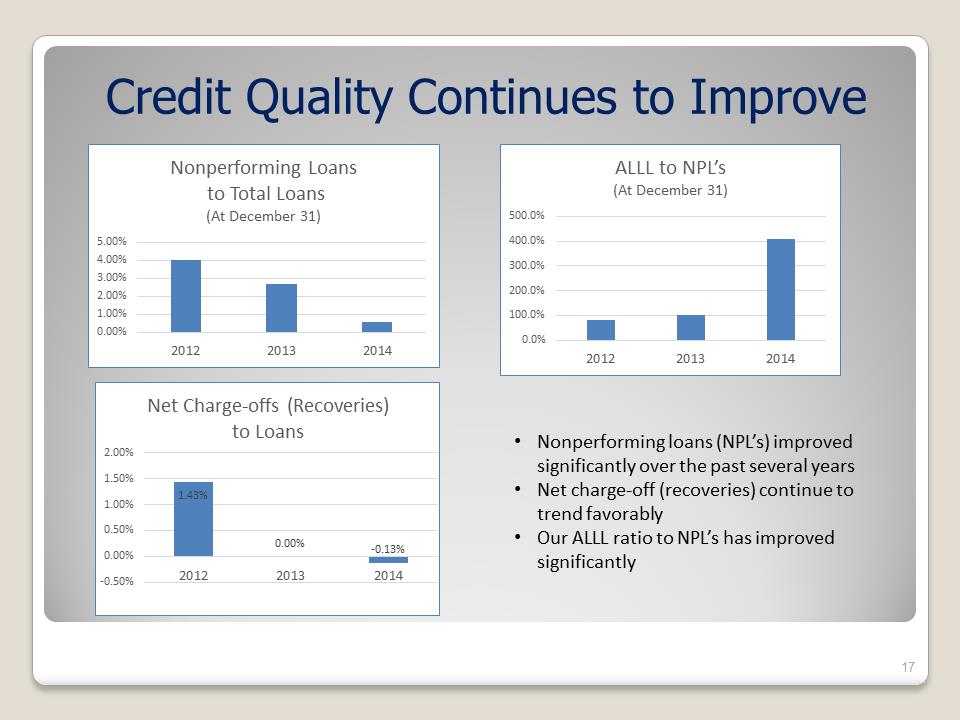

Credit Quality Continues to Improve•Nonperforming loans (NPL’s) improved significantly over the past several years•Net charge-off (recoveries) continue to trend favorably•Our ALLL ratio to NPL’s has improved significantlyALLL to NPL’s(At December 31)Nonperforming Loans to Total Loans(At December 31)Net Charge-offs (Recoveries) to Loans

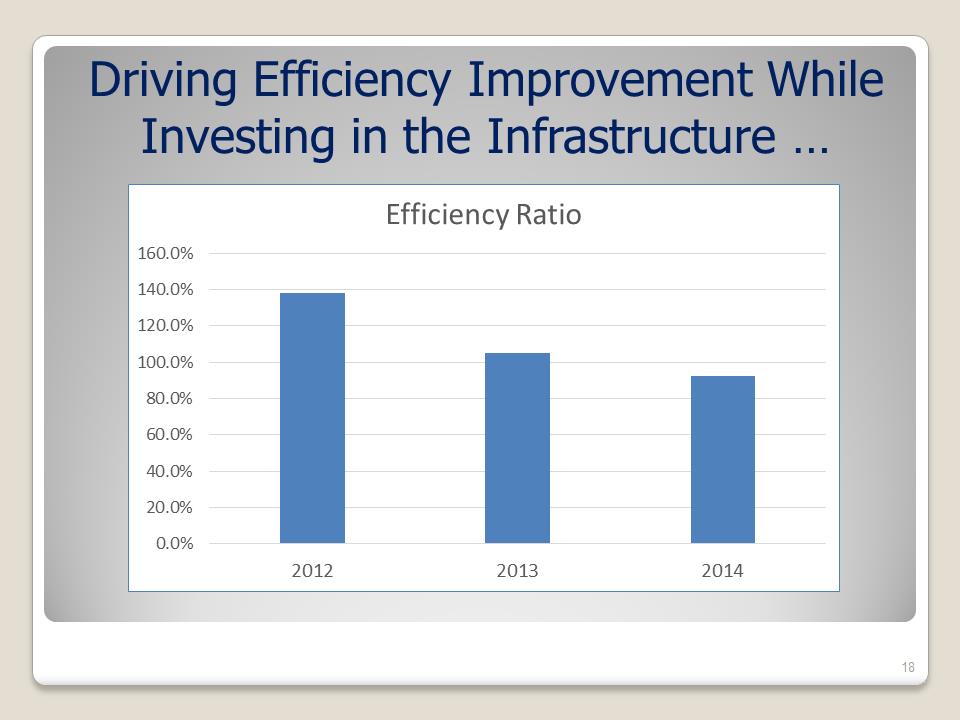

Driving Efficiency Improveme nt While Investing in the Infrastructure … Efficiency Ratio

nt While Investing in the Infrastructure … Efficiency Ratio

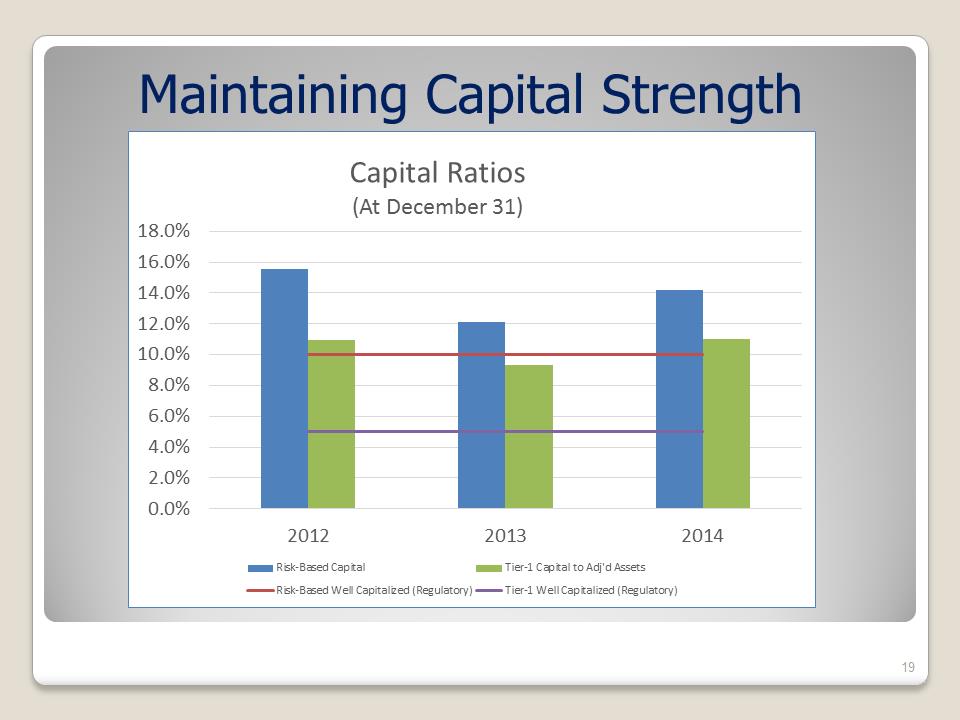

Maintaining Capital Strength Capital Ratios (At December 31)

Q1 2015 Update –Q1-15 vs Q1-14Highlights and drivers of change:•Net income increased $465k•Net interest income increased $675k (38.3%)•Noninterest income increased $110k (44.9%)•Provision expense increased $55k and ALLL coverage ratio improved•Expenses increased $265k (12%), although efficiency ratio improved 22 bps

Our Trajectory …ONWARD & UPWARD!!Continued earnings improvementQuality earning asset growthOptimizing funding sourcesMaintaining capital strengthActing on opportunities… while focusing on Improving efficiency ratio Reducing criticized and classified assets

Thank you for your support!