Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CUMULUS MEDIA INC | regulationfddisclosure.htm |

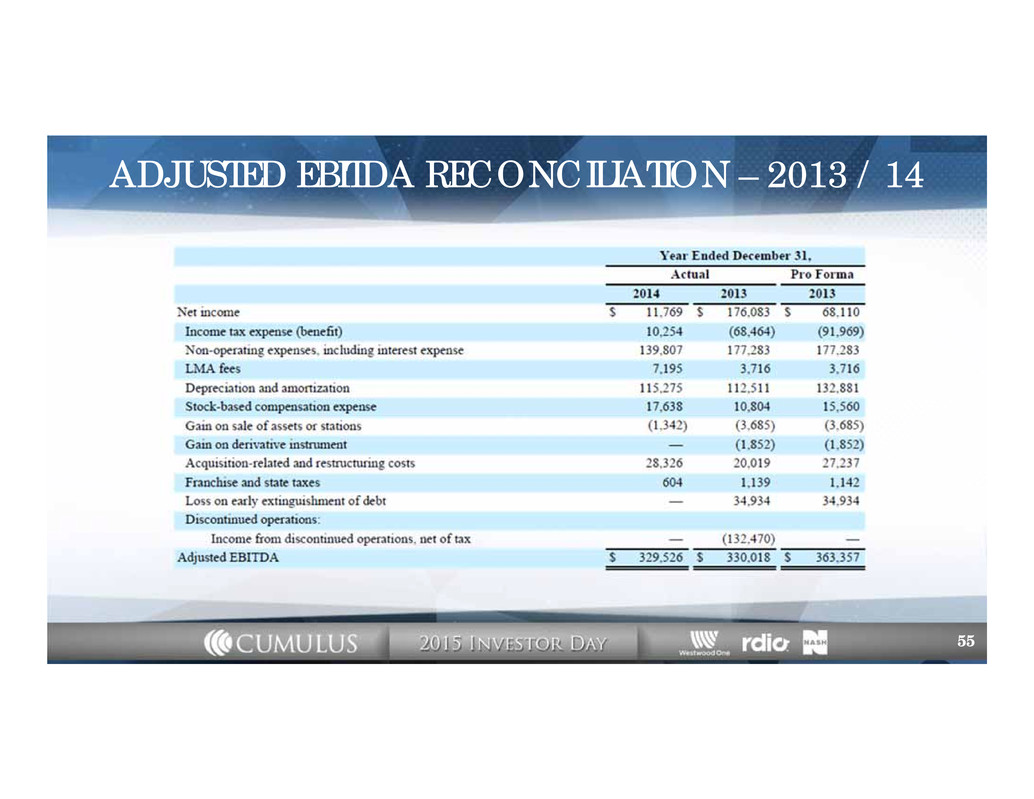

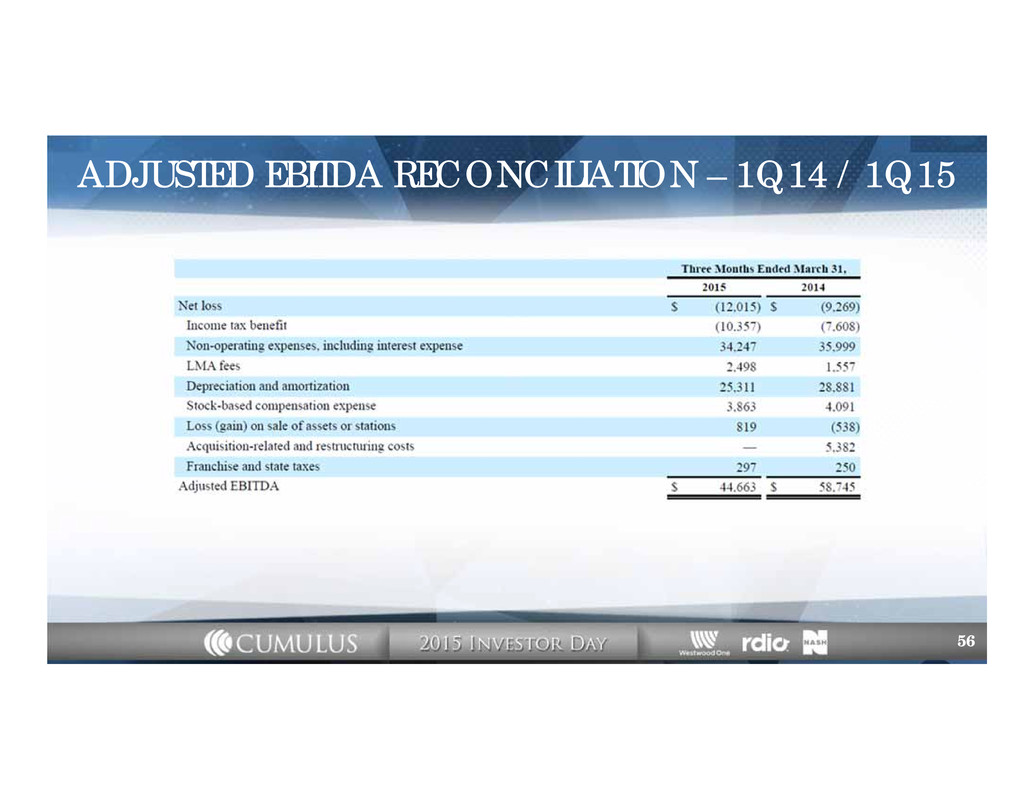

SAFE HARBOR STATEMENT Cautionary Note Regarding Forward-Looking Statements This presentation contains and refers to statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Such statements are statements other than historical fact, and may relate to our intent, belief or current expectations primarily with respect to our future operating, financial and strategic performance. Any such forward-looking statements are not guarantees of future performance and may involve risks and uncertainties. Actual results may differ from those contained in or implied by the forward-looking statements as a result of various factors, including, but not limited to, risks and uncertainties relating to the need for additional funds to execute our business strategy, our ability to access borrowings under our revolving credit facility, our ability from time to time to renew one or more of our broadcast licenses, changes in interest rates, our ability to complete any acquisitions pending from time to time, the timing, costs and synergies resulting from the integration of any completed acquisitions, our ability to eliminate certain costs, our ability to manage rapid growth, the popularity of radio as a broadcasting and advertising medium, changing consumer tastes, any material changes from the preliminary to final purchase price allocations in completed acquisitions, the impact of general economic conditions in the United States or in specific markets in which we currently do, or expect to do, business, industry conditions, including existing competition and future competitive technologies, cancellation, disruptions or postponements of advertising schedules in response to national or world events, our ability to generate revenue from new sources, including technology-based initiatives, the impact of regulatory rules or proceedings that may affect our business, or any acquisitions, from time to time, and other risk factors described from time to time in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2014 and any subsequently filed Quarterly Reports Forms 10-Q. Many of these risks and uncertainties are beyond our control, and the unexpected occurrence or failure to occur of any such events or matters could significantly alter our actual results of operations or financial condition. Although we believe that the expectations reflected in these forward-looking statements are reasonable when and as made, we cannot provide any assurances that the expectations will prove to be correct. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no responsibility to update forward-looking statements after the date they are made. Non-GAAP Financial Measures We supplement our review of financial results and measures prepared in accordance with United States generally accepted accounting principles ("GAAP") with certain measures not prepared in accordance with GAAP. Adjusted EBITDA is the financial metric utilized by management to analyze the cash flow generated by our business. This measure isolates the amount of income generated by our core operations after the incurrence of corporate, general and administrative expenses. Management also uses this measure to determine the contribution of our core operations, including the corporate resources employed to manage the operations, to the funding of our other operating expenses and to the funding of debt service and acquisitions. In addition, Adjusted EBITDA is a key metric for purposes of calculating and determining our compliance with certain covenants contained in our Credit Agreement. In deriving this measure, management excludes depreciation, amortization, and stock-based compensation expense, as these do not represent cash payments for activities directly related to our core operations. Management excludes any gain or loss on the exchange or sale of any assets as it does not represent a cash transaction. Management also excludes any gain or loss on derivative instruments as it does not represent a cash transaction nor are they associated with core operations. Expenses relating to acquisitions and restructuring costs are also excluded from the calculation of Adjusted EBITDA as they are not directly related to our core operations. Management excludes any impairment of goodwill and intangible assets as they do not require a cash outlay. Management believes that Adjusted EBITDA, although not a measure that is calculated in accordance with GAAP, nevertheless is commonly employed by the investment community as a measure for determining the market value of a media company. Management has also observed that Adjusted EBITDA is routinely employed to evaluate and negotiate the potential purchase price for media companies and is a key metric for purposes of calculating and determining compliance with certain covenants in our credit facility. Given the relevance to our overall value, management believes that investors consider the metric to be extremely useful. Adjusted EBITDA should not be considered in isolation or as a substitute for net income, operating income, cash flows from operating activities or any other measure for determining the Company’s operating performance or liquidity that is calculated in accordance with GAAP. Our calculation of Adjusted EBITDA may differ materially from the calculation used by other companies and, accordingly, comparability may be limited. A quantitative reconciliation of Adjusted EBITDA to net income, the most directly comparable financial measure calculated and presented in accordance with GAAP, is included in Section 8 at this presentation. 2

A COMPELLING INVESTMENT OPPORTUNITY National Scale with Local Activation Industry-Leading Content Platform Ability to Leverage Audience in New Ways Comprehensive Digital Strategy Consistent Cash Flow for Debt Paydown Experienced Management Team 3

TABLE OF CONTENTS 1 2 3 4 5 6 7 8 Industry Update Company Overview Station Group Westwood One NASH rdio Financial Summary Non-GAAP Reconciliations 5 13 16 23 33 42 46 53 4

Industry Update 5

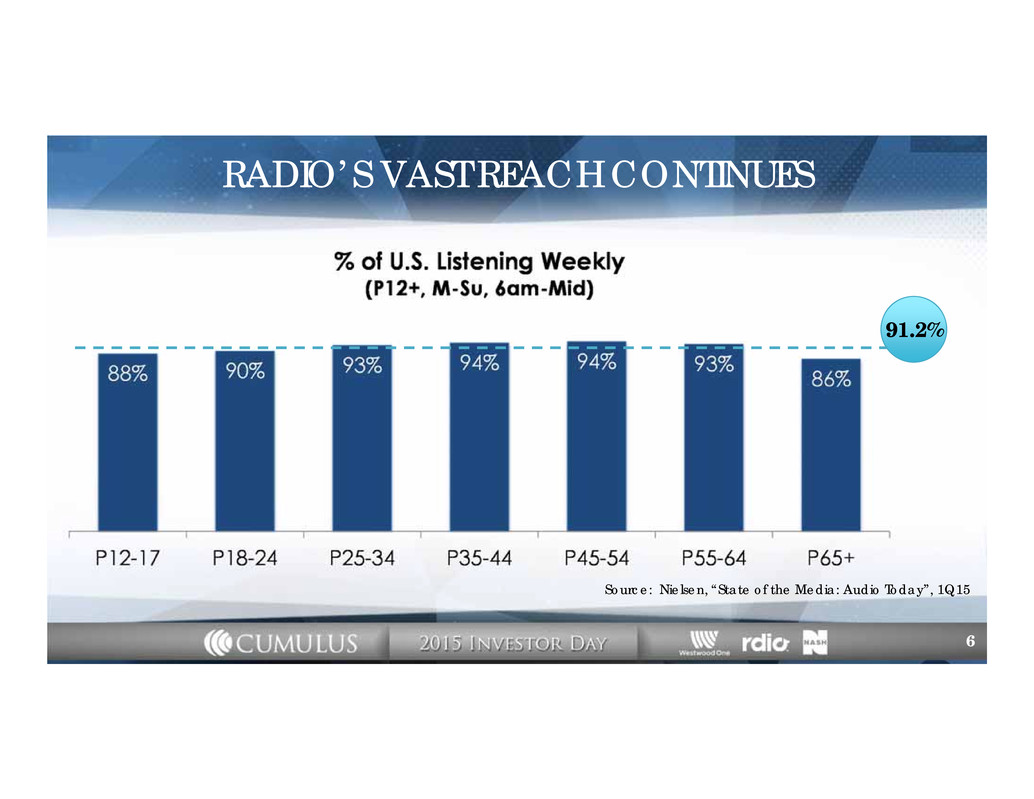

RADIO’S VAST REACH CONTINUES 91.2% Source: Nielsen, “State of the Media: Audio Today”, 1Q15 6

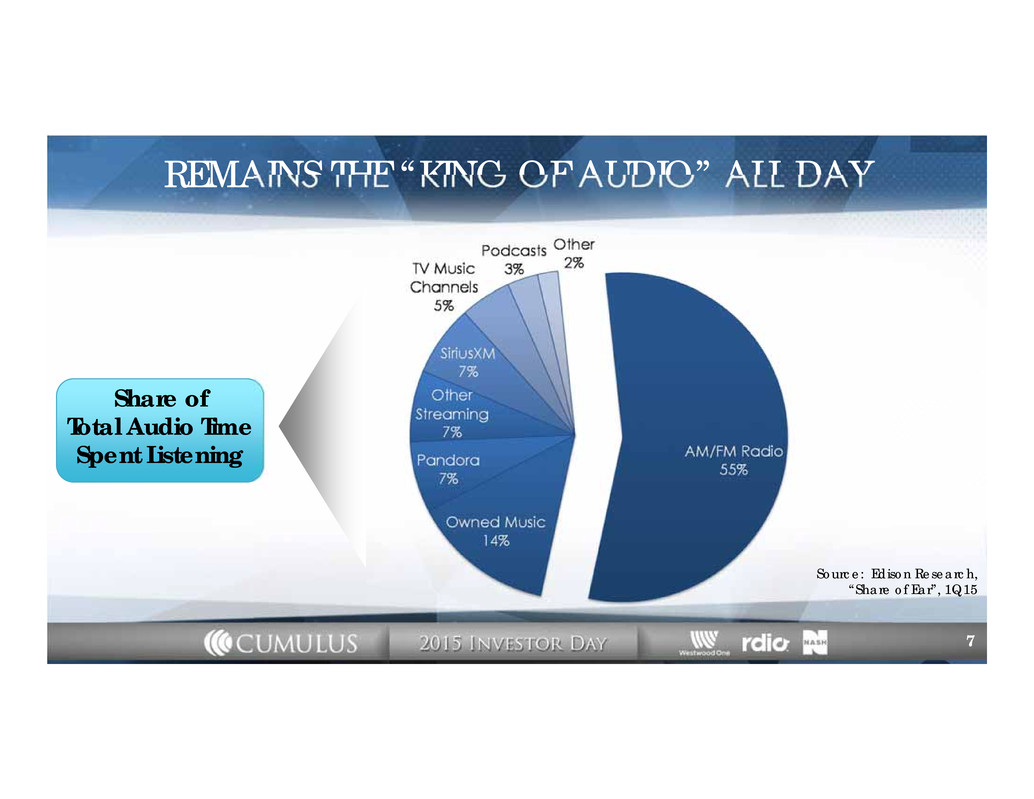

REMAINS THE “KING OF AUDIO” ALL DAY Share of Total Audio Time Spent Listening Source: Edison Research, “Share of Ear”, 1Q15 7

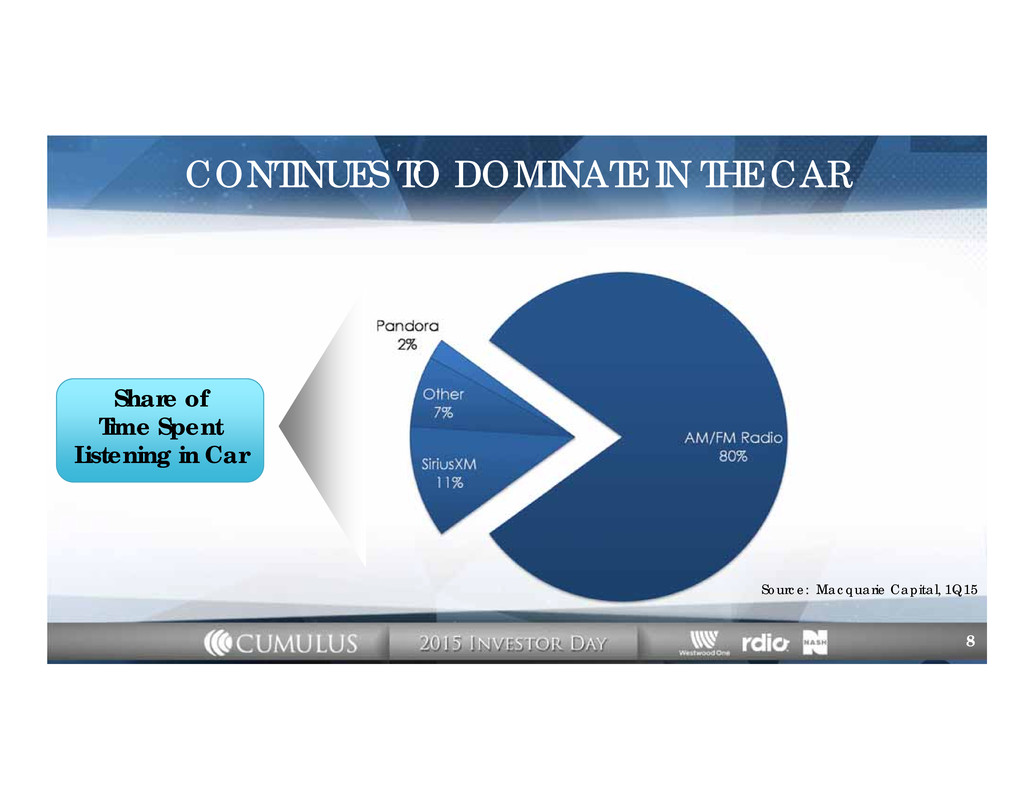

CONTINUES TO DOMINATE IN THE CAR Share of Time Spent Listening in Car Source: Macquarie Capital, 1Q15 8

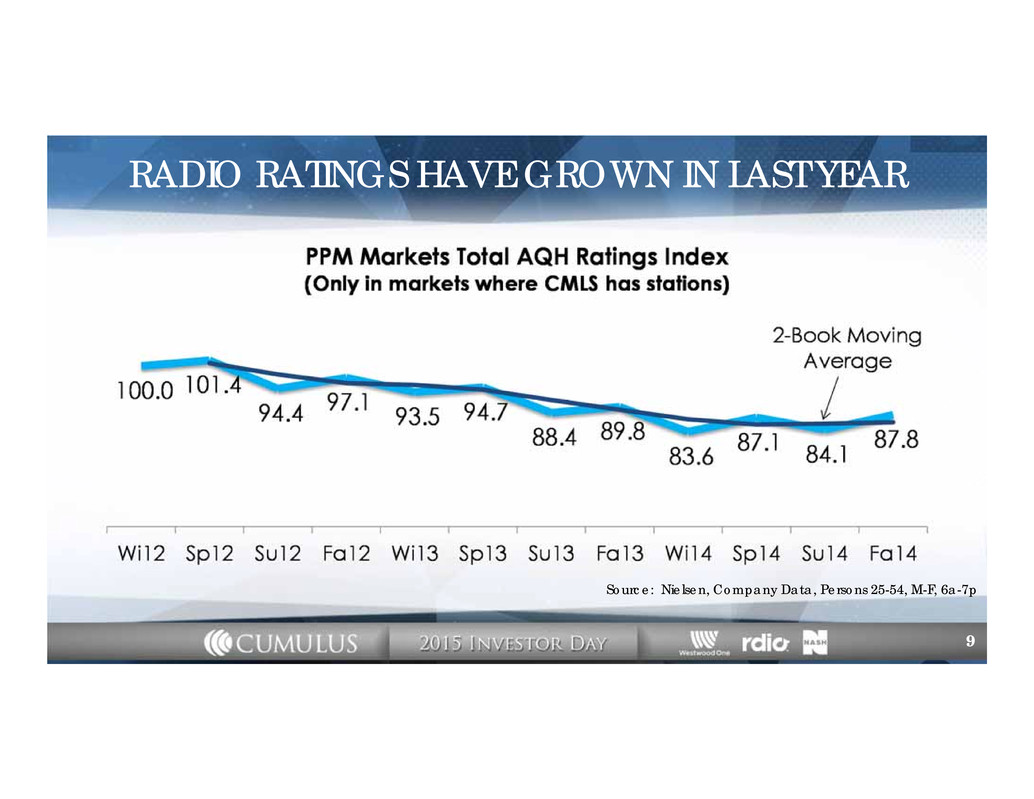

RADIO RATINGS HAVE GROWN IN LAST YEAR Source: Nielsen, Company Data, Persons 25-54, M-F, 6a-7p 9

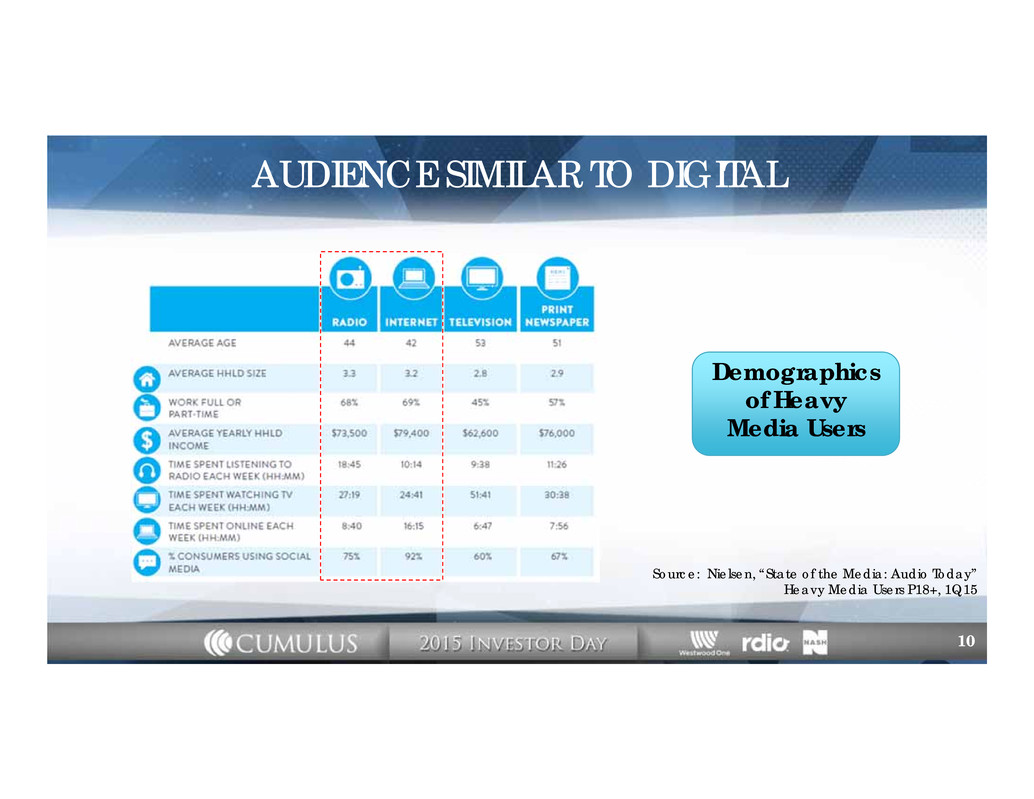

AUDIENCE SIMILAR TO DIGITAL Demographics of Heavy Media Users Source: Nielsen, “State of the Media: Audio Today” Heavy Media Users P18+, 1Q15 10

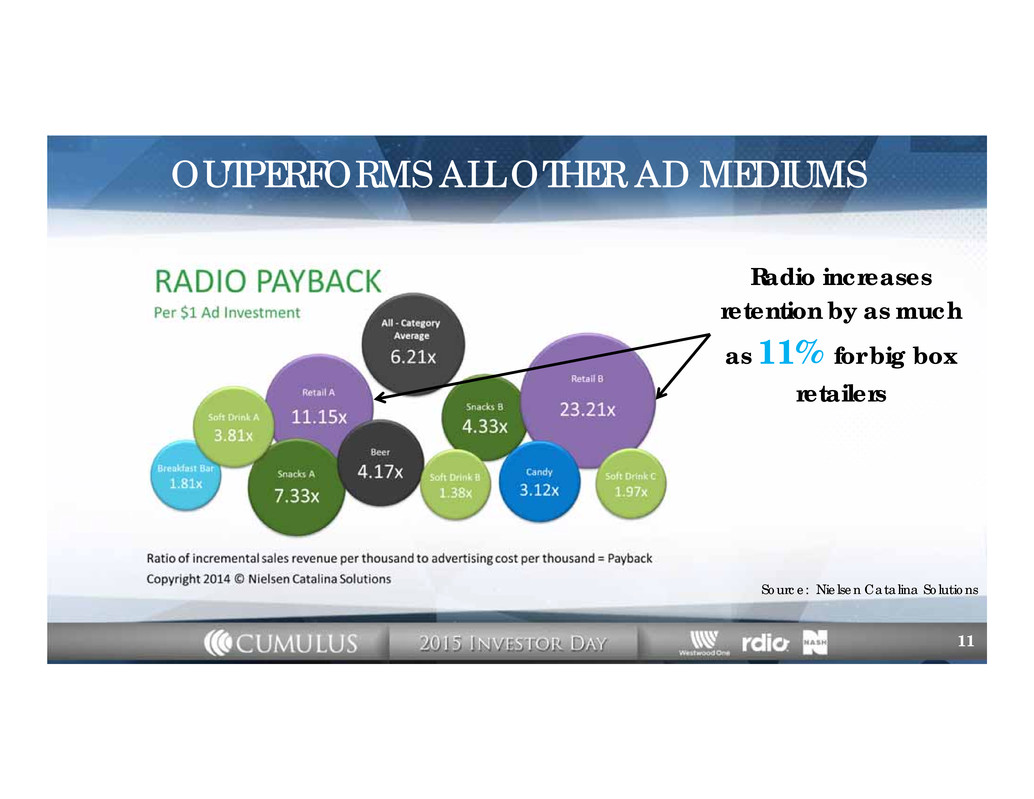

OUTPERFORMS ALL OTHER AD MEDIUMS Source: Nielsen Catalina Solutions Radio increases retention by as much as 11% for big box retailers 11

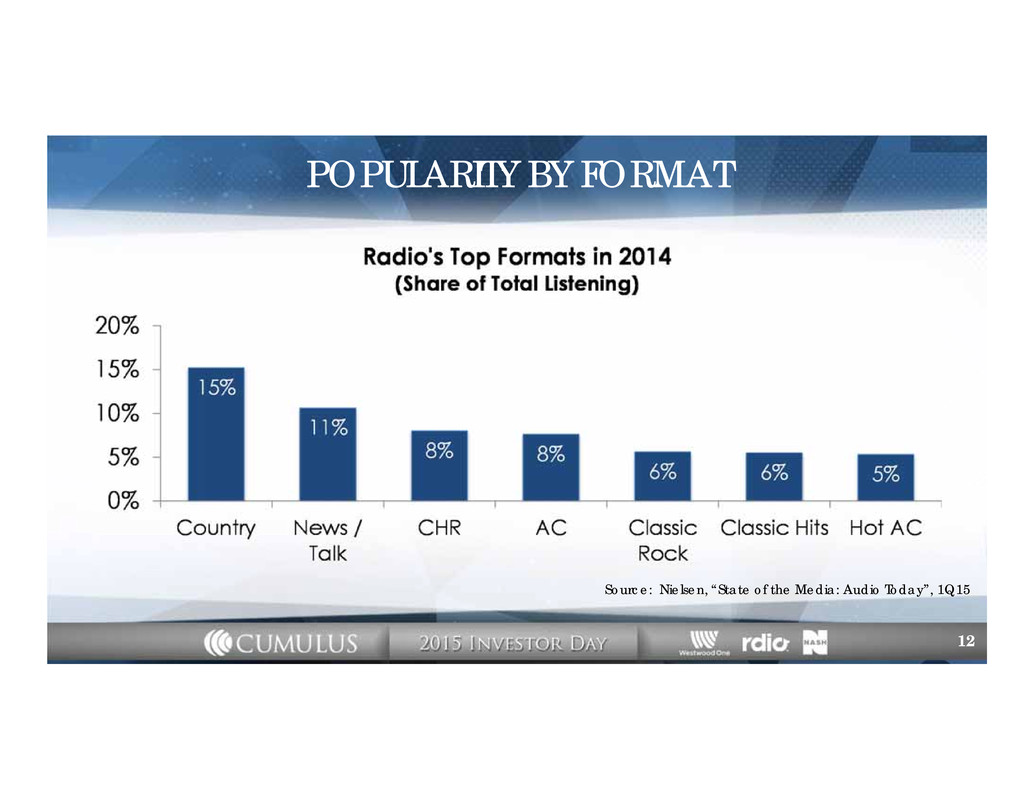

POPULARITY BY FORMAT Source: Nielsen, “State of the Media: Audio Today”, 1Q15 12

Company Overview 13

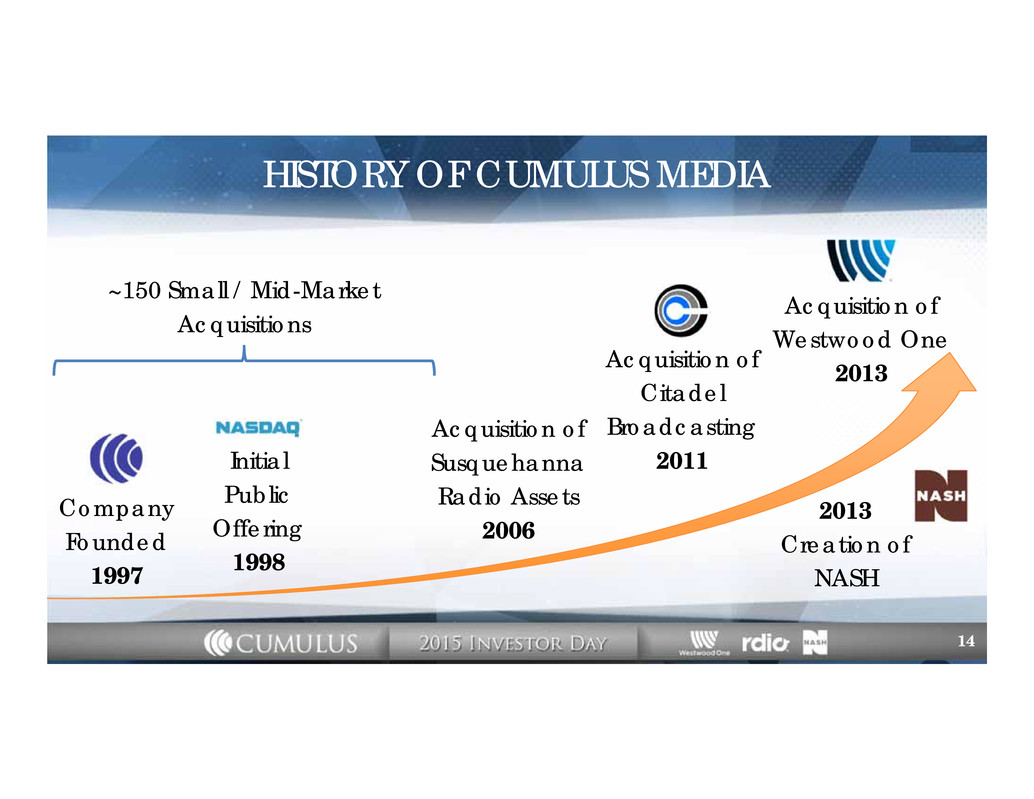

HISTORY OF CUMULUS MEDIA Company Founded 1997 Initial Public Offering 1998 ~150 Small / Mid-Market Acquisitions Acquisition of Susquehanna Radio Assets 2006 Acquisition of Citadel Broadcasting 2011 Acquisition of Westwood One 2013 2013 Creation of NASH 14

THE CUMULUS PLATFORM 460 Stations in 90+ U.S. Markets Leading local brands & talent Event / digital activation Premium, iconic content 8,500+ affiliate relationships Substantial U.S. pop. coverage Multi-platform lifestyle & entertainment brand Leveraging reach to country fans New monetization opportunities Global digital platform On-demand, custom playlist and streaming broadcast radio Exclusive ad sales agent 15

Station Group 16

NATIONAL SCALE CMLS Headquarters WW1 Headquarters NASH Headquarters 460 Stations in 90+ U.S. Markets Weekly Reach 65+ MM People 17

LOCAL ACTIVATION Iconic DJs Storied Radio Brands 1,000+ Local Events Digital Platform 18

Y-o-Y PERFORMANCE VS. MARKET – 2014 Source: Miller Kaplan, Company Data 19

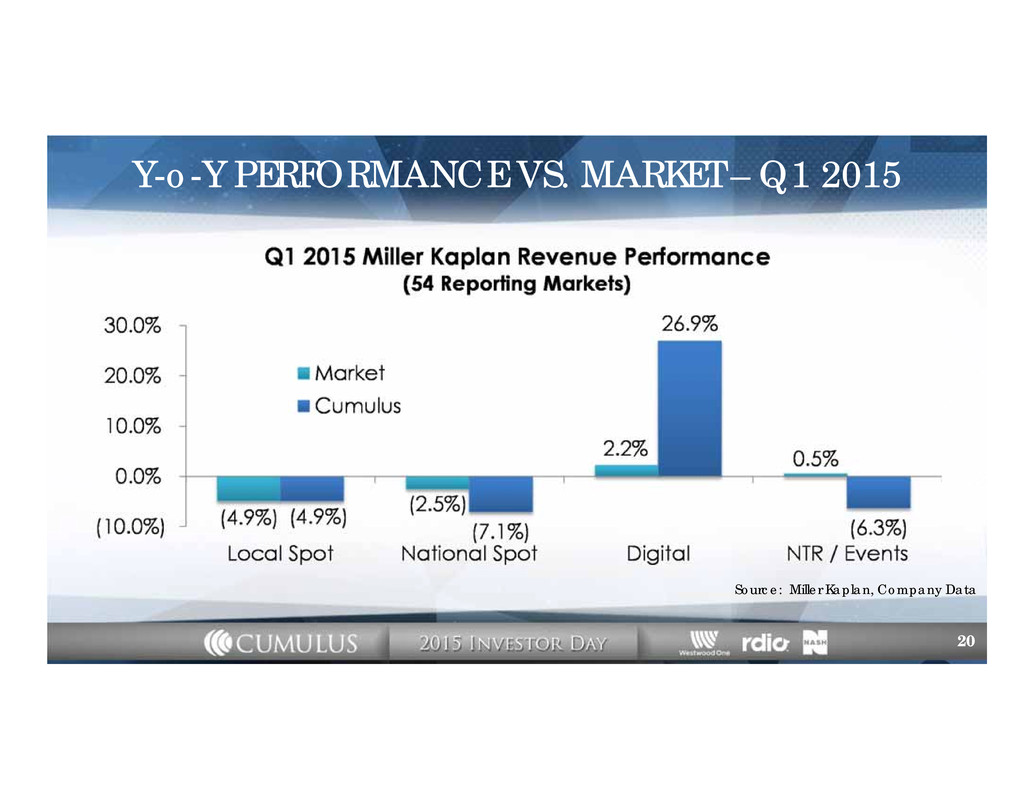

Y-o-Y PERFORMANCE VS. MARKET – Q1 2015 Source: Miller Kaplan, Company Data 20

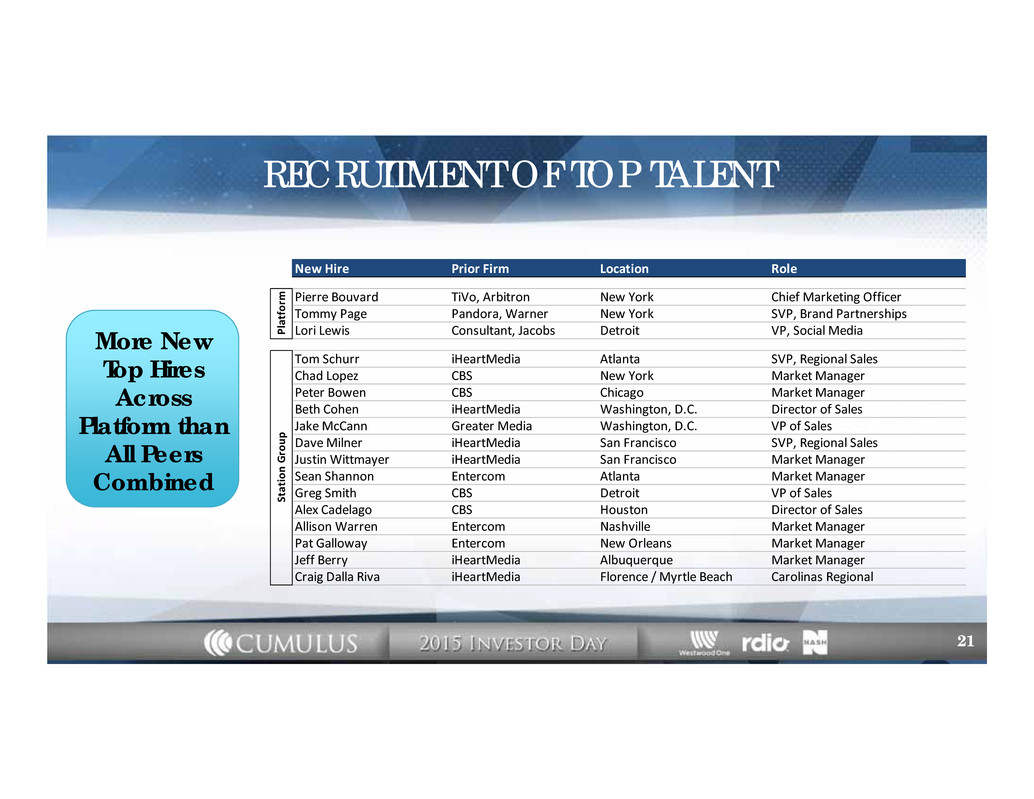

RECRUITMENT OF TOP TALENT New Hire Prior Firm Location Role Pierre Bouvard TiVo, Arbitron New York Chief Marketing Officer Tommy Page Pandora, Warner New York SVP, Brand Partnerships Lori Lewis Consultant, Jacobs Detroit VP, Social Media Tom Schurr iHeartMedia Atlanta SVP, Regional Sales Chad Lopez CBS New York Market Manager Peter Bowen CBS Chicago Market Manager Beth Cohen iHeartMedia Washington, D.C. Director of Sales Jake McCann Greater Media Washington, D.C. VP of Sales Dave Milner iHeartMedia San Francisco SVP, Regional Sales Justin Wittmayer iHeartMedia San Francisco Market Manager Sean Shannon Entercom Atlanta Market Manager Greg Smith CBS Detroit VP of Sales Alex Cadelago CBS Houston Director of Sales Allison Warren Entercom Nashville Market Manager Pat Galloway Entercom New Orleans Market Manager Jeff Berry iHeartMedia Albuquerque Market Manager Craig Dalla Riva iHeartMedia Florence / Myrtle Beach Carolinas Regional P l a t f o r m S t a t i o n G r o u p More New Top Hires Across Platform than All Peers Combined 21

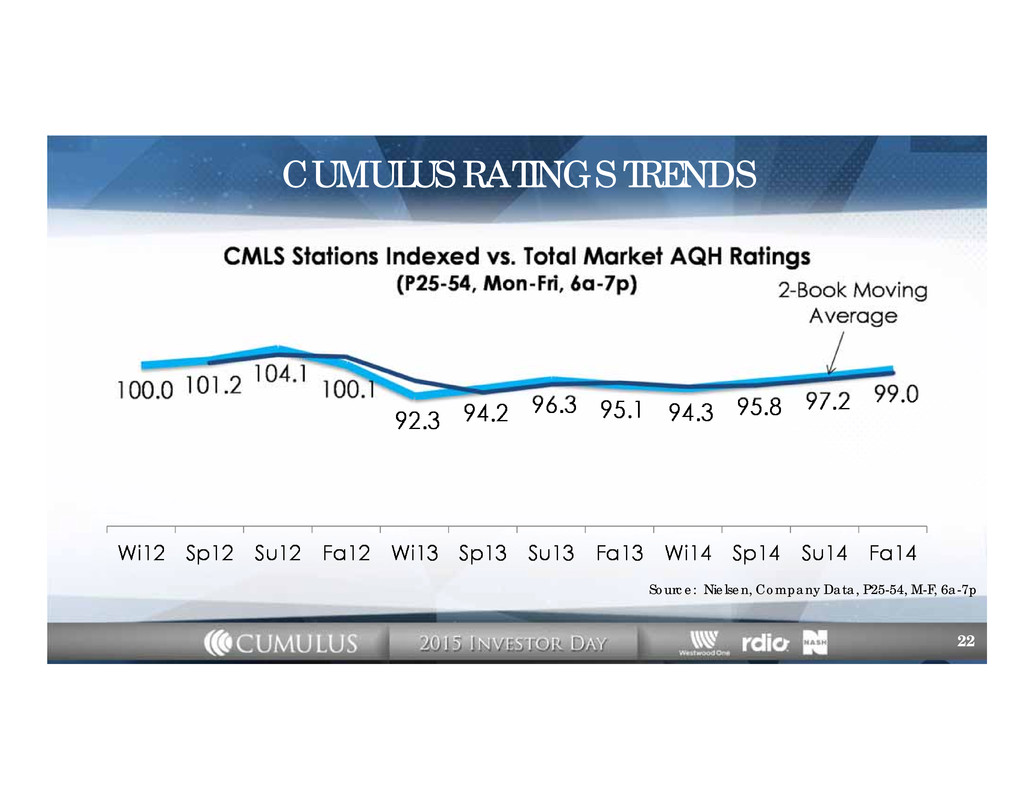

CUMULUS RATINGS TRENDS Source: Nielsen, Company Data, P25-54, M-F, 6a-7p 22

Westwood One 23

NATIONAL CONTENT PLATFORM Premium Sports Brands Music & Entertainment News / Talk / Features 24/7 Content Platform 24

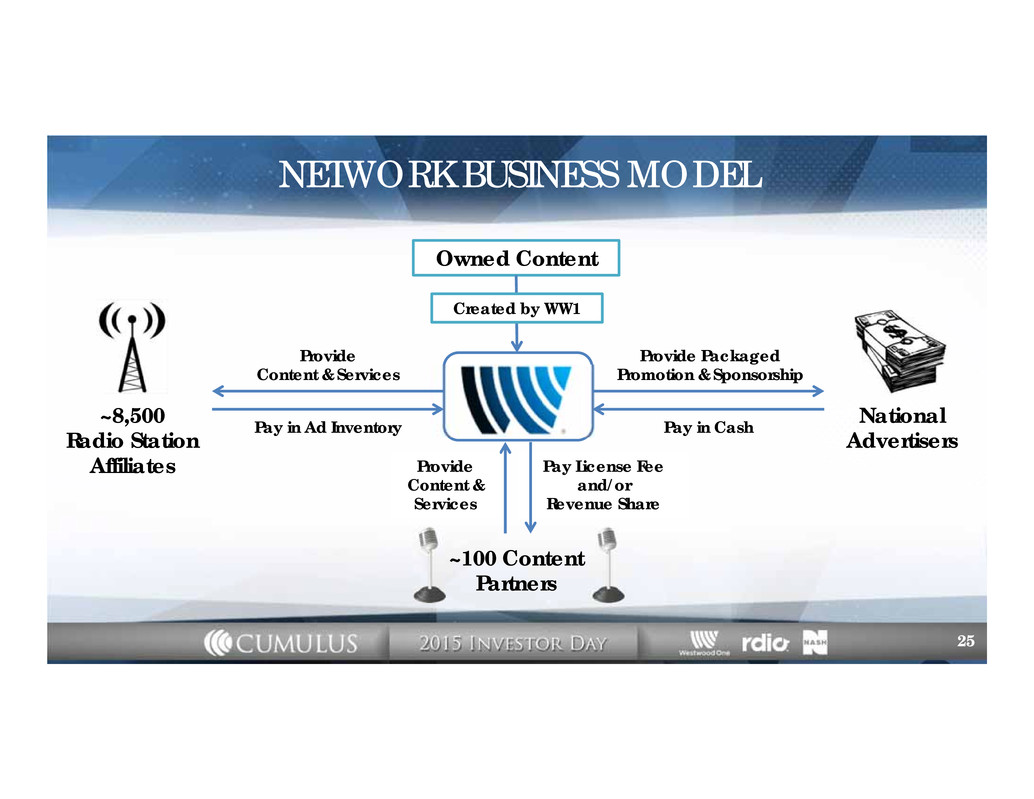

NETWORK BUSINESS MODEL ~8,500 Radio Station Affiliates Owned Content National Advertisers Provide Content & Services Pay in Ad Inventory Provide Packaged Promotion & Sponsorship Pay in Cash Created by WW1 ~100 Content Partners Pay License Fee and/or Revenue Share Provide Content & Services 25

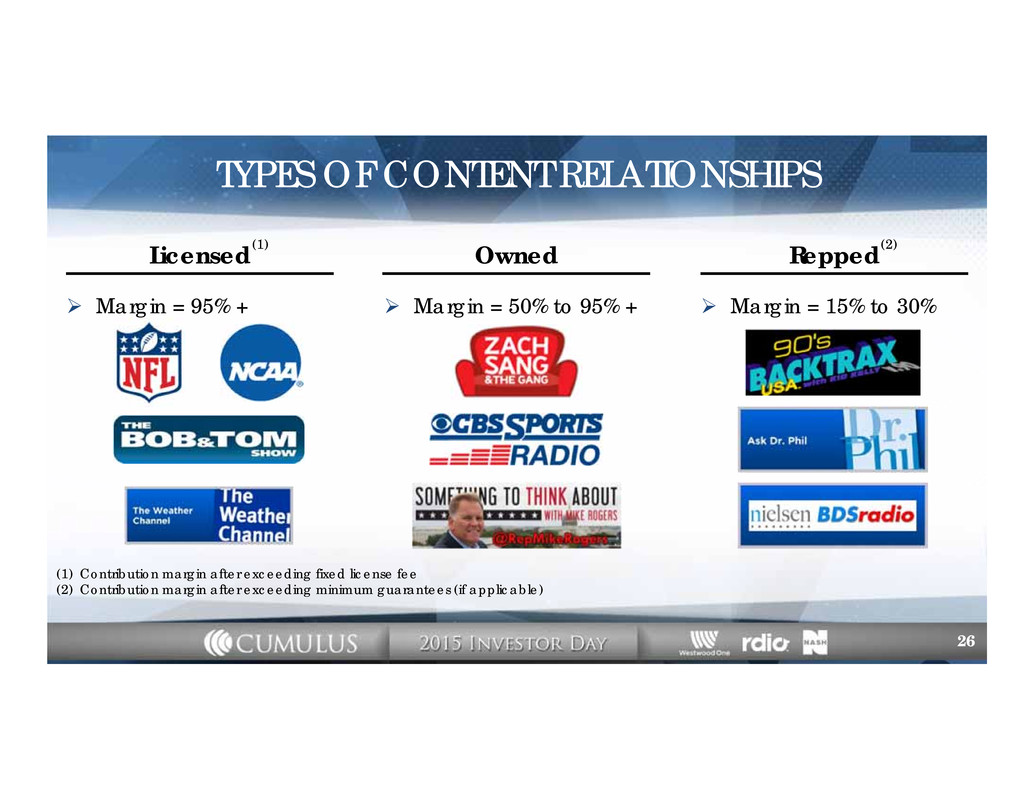

TYPES OF CONTENT RELATIONSHIPS Licensed Owned Repped Margin = 95% + Margin = 50% to 95% + Margin = 15% to 30% 26 (1) (1) Contribution margin after exceeding fixed license fee (2) Contribution margin after exceeding minimum guarantees (if applicable) (2)

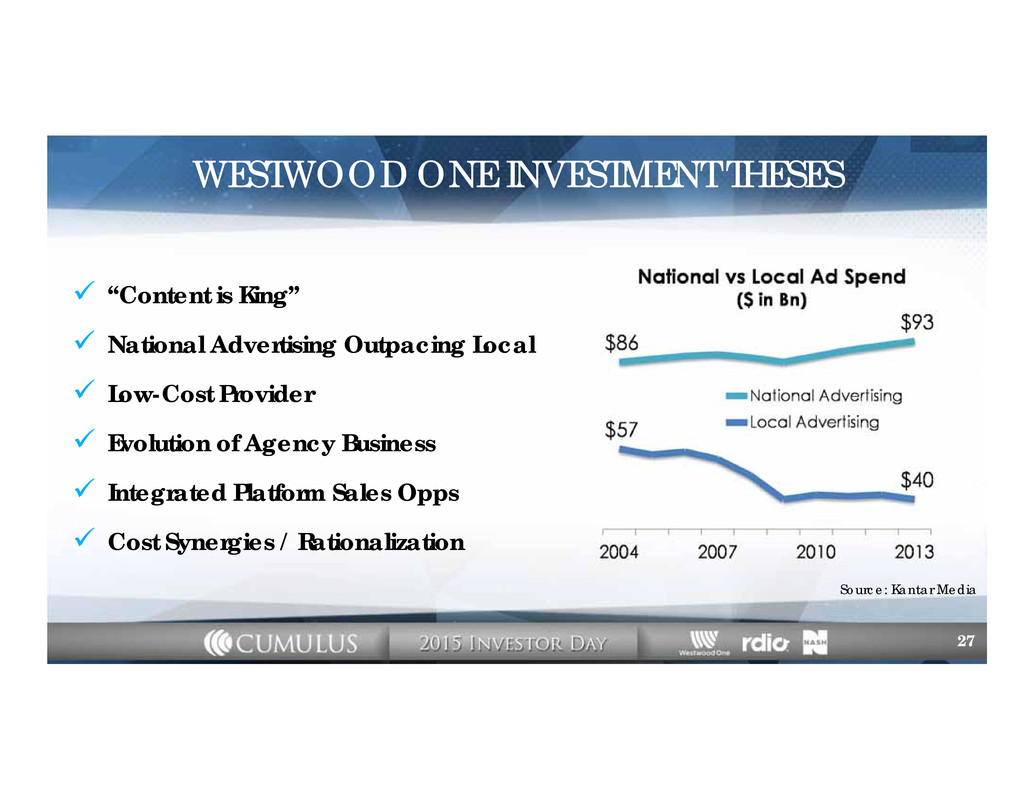

WESTWOOD ONE INVESTMENT THESES “Content is King” National Advertising Outpacing Local Low-Cost Provider Evolution of Agency Business Integrated Platform Sales Opps Cost Synergies / Rationalization Source: Kantar Media 27

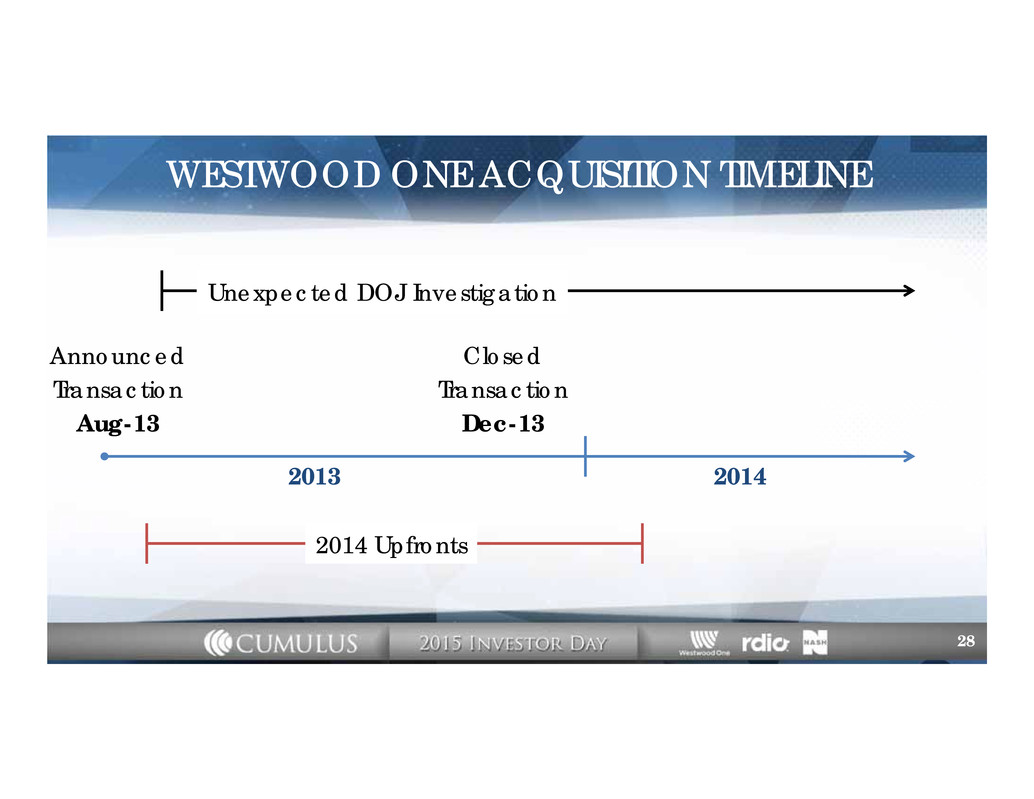

WESTWOOD ONE ACQUISITION TIMELINE Announced Transaction Aug-13 Closed Transaction Dec-13 Unexpected DOJ Investigation 2014 Upfronts 2013 2014 28

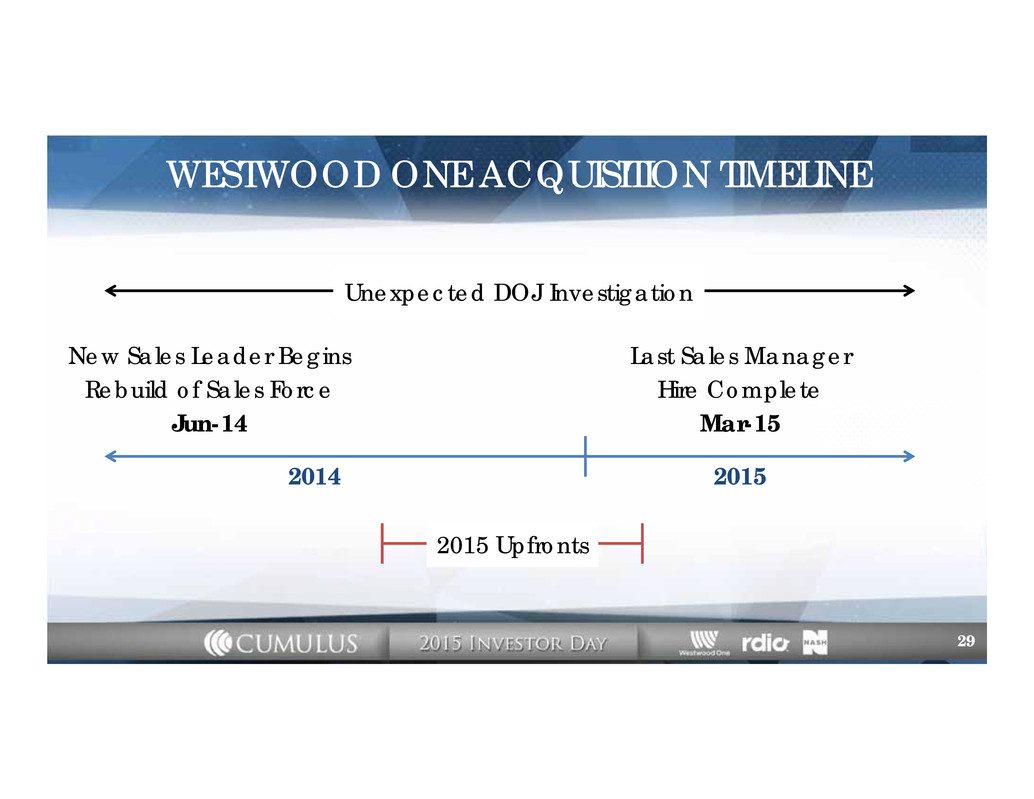

WESTWOOD ONE ACQUISITION TIMELINE New Sales Leader Begins Rebuild of Sales Force Jun-14 Unexpected DOJ Investigation 2015 Upfronts 2014 2015 Last Sales Manager Hire Complete Mar-15 29

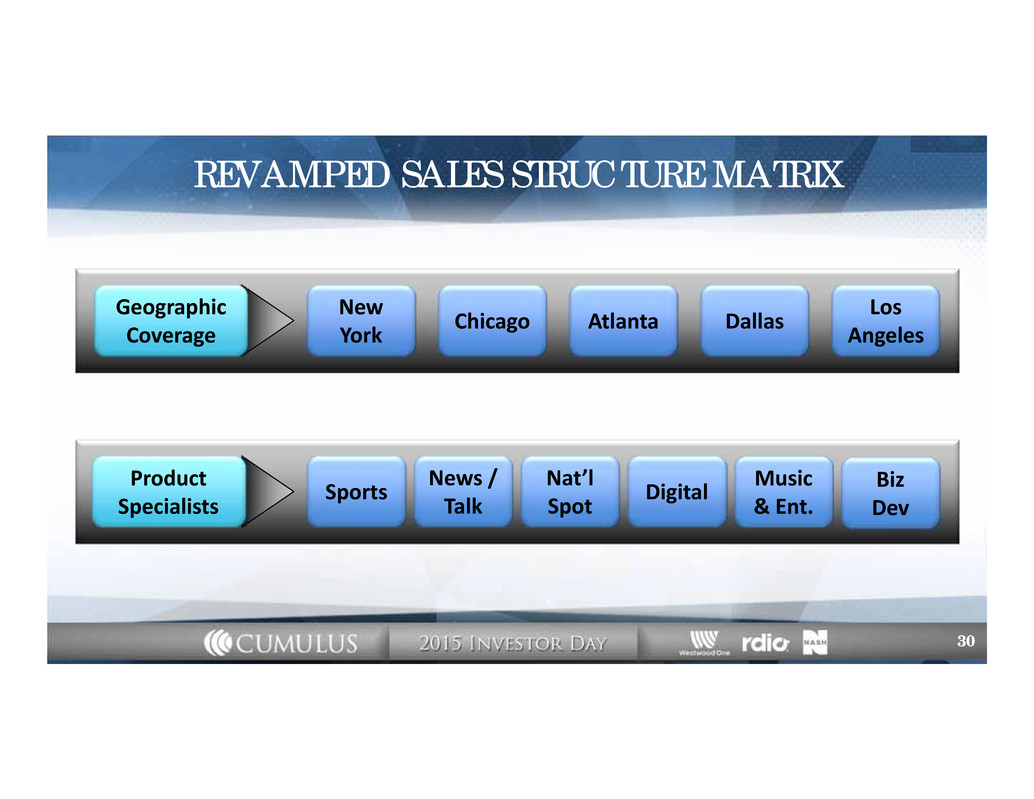

REVAMPED SALES STRUCTURE MATRIX New York Chicago Atlanta Dallas Los Angeles Sports News / Talk Nat’l Spot Digital Music & Ent. Biz Dev 30 Geographic Coverage Product Specialists

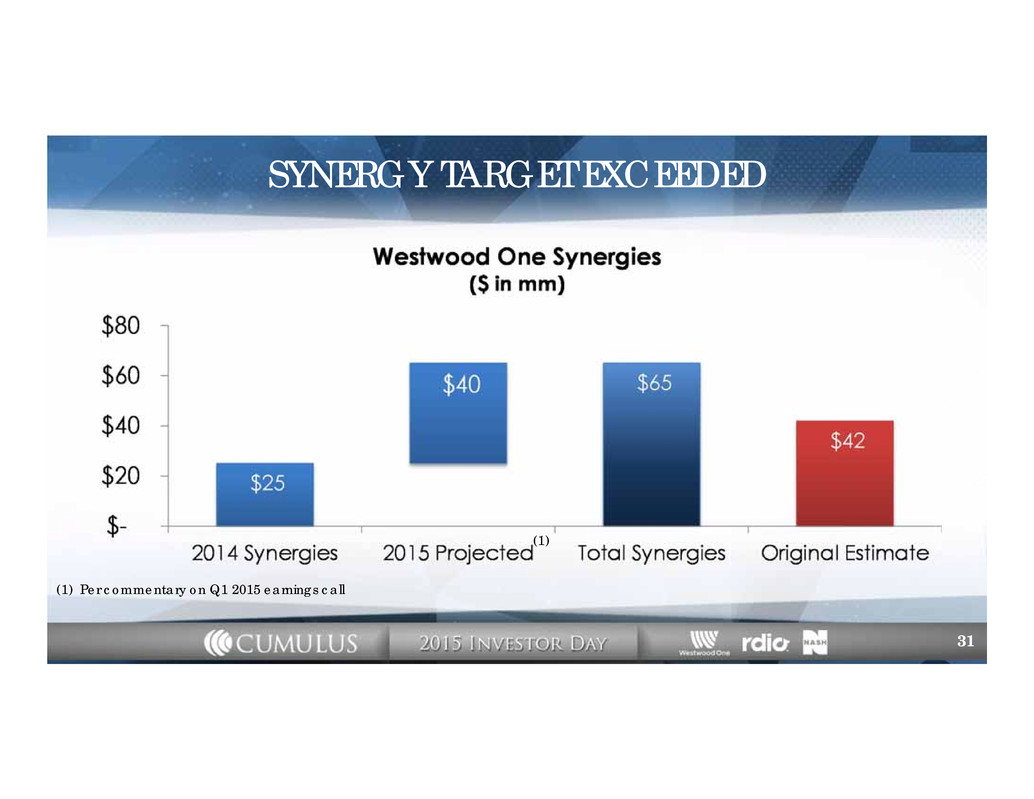

SYNERGY TARGET EXCEEDED (1) (1) Per commentary on Q1 2015 earnings call 31

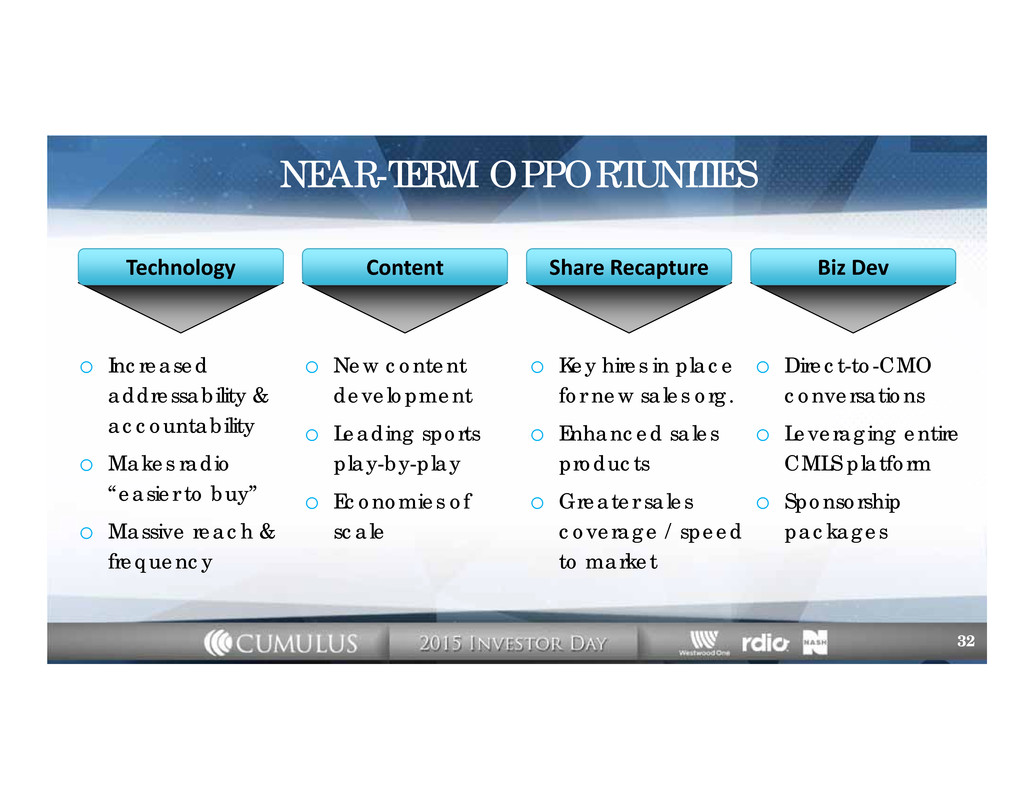

NEAR-TERM OPPORTUNITIES Technology Content Share Recapture Biz Dev o New content development o Leading sports play-by-play o Economies of scale o Increased addressability & accountability o Makes radio “easier to buy” o Massive reach & frequency o Direct-to-CMO conversations o Leveraging entire CMLS platform o Sponsorship packages o Key hires in place for new sales org. o Enhanced sales products o Greater sales coverage / speed to market 32

NASH 33

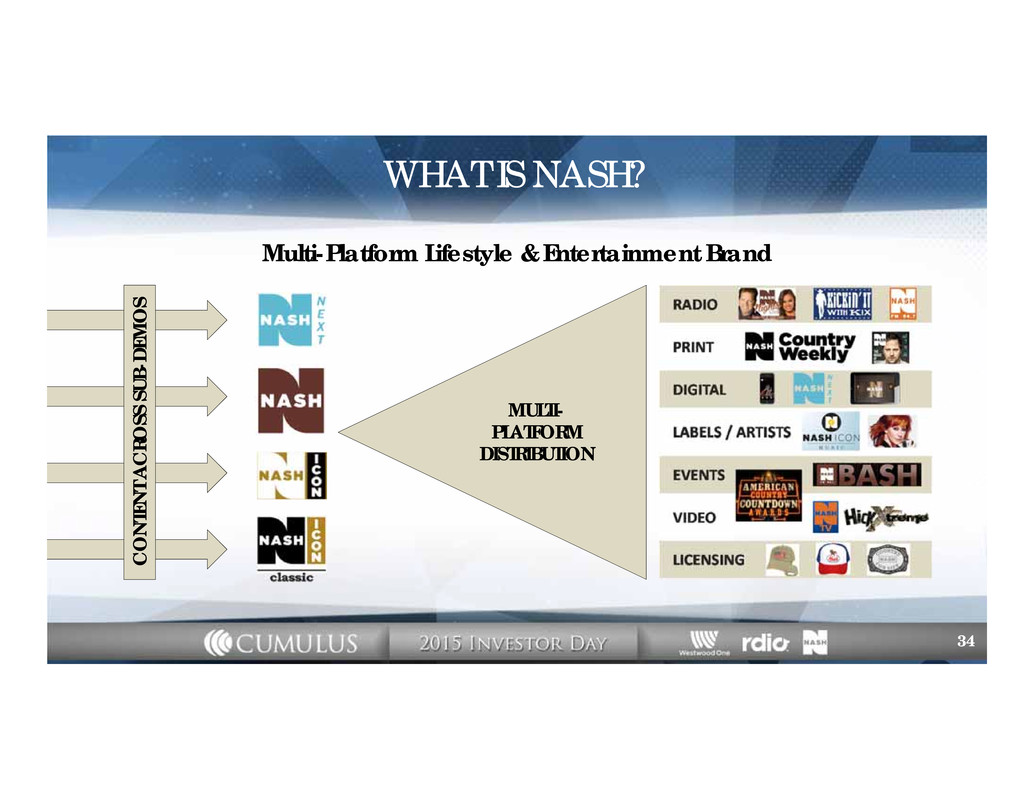

WHAT IS NASH? Multi-Platform Lifestyle & Entertainment Brand CONTENT ACROSS SUB-DEMO S MULTI- PLATFORM DISTRIBUTION 34

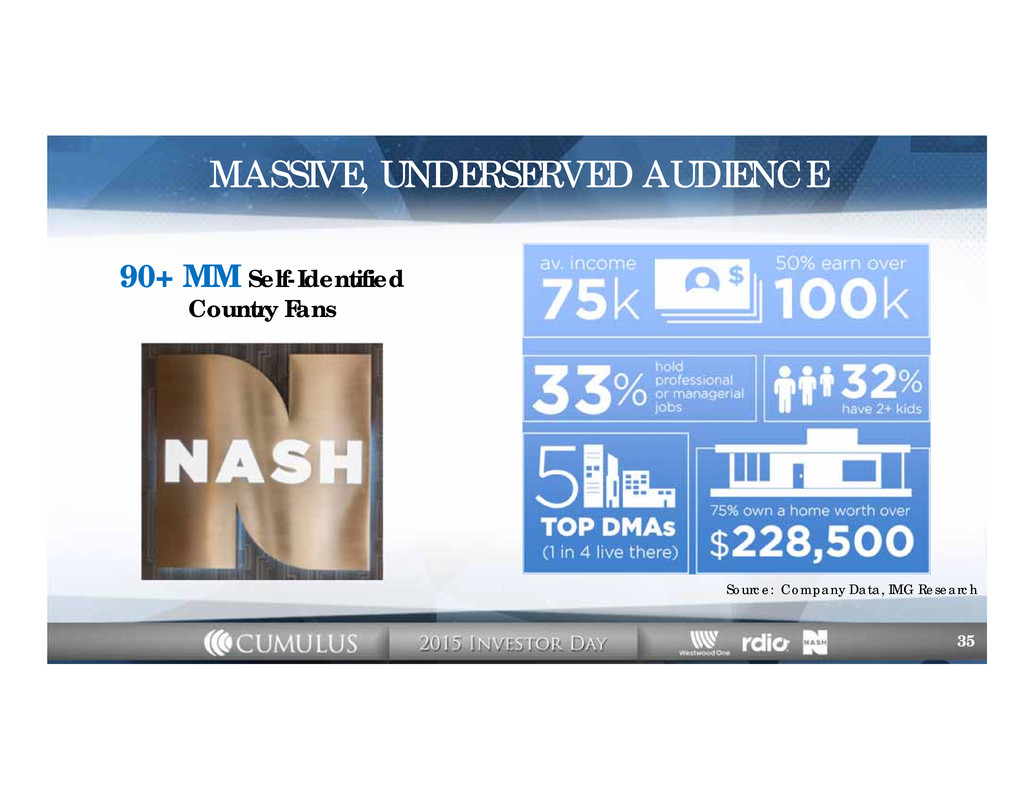

MASSIVE, UNDERSERVED AUDIENCE 90+ MM Self-Identified Country Fans 35 Source: Company Data, IMG Research

RADIO: OWNED & SYNDICATED O&O Country Stations Nationally Syndicated Brands 200+ clearances nationwide reaching 45+ MM weekly ~85 O&O country stations reaching 30+ MM weekly 36

NASH COUNTRY WEEKLY Nation’s definitive weekly country lifestyle publication 20+ year heritage Current circulation reaches over 500k / year Digital content platform 37

ARTIST DEVELOPMENT: 360-degree country label in partnership with Big Machine Label Group Targeting icons from the 80’s, 90’s and 2000’s Reba McEntire’s new album “Love Somebody” sold over 100k in first week Artist slate also includes Martina McBride, Ronnie Dunn and Hank Williams, Jr. 38

LOCAL & NATIONAL EVENTS Nationwide event platform, including: Local concerts and festivals Country-lifestyle events American Country Countdown Awards ACM’s Red Carpet Radio Touring Platform advertiser sponsorship opportunities 39

NASH TV Short-form, episodic digital video content on www.nashcountry.com Digital content portal currently in development Specials / features (in partnership with Sinclair Broadcasting) Distribution via audio and video-on-demand through MusicChoice partnership on cable and satellite in 55+ MM homes 40

WHAT’S NEXT FOR NASH? Launch of NASH Next talent competition (May 18, 2015) Release of global content portal app Subscription fan club model Merchandising / retail strategy NASH Icon tour (tentatively Fall 2015) Additional strategic / capital partnerships 41

rdio 42

UNIQUE DIGITAL AUDIO EXPERIENCE connects people with the music they love – everywhere, on every device Catalogue of over 35 million songs in 85 countries Most highly regarded design and user experience of any music service Free, ad-supported custom playlists Full on-demand subscription service Streaming broadcast radio 43

RDIO LIVE – COMING SOON l i ve Same best-in-class user experience Live stations with enhanced features & functionality Increased targeting for advertisers Short-form on-demand content Dedicated station & DJ profiles 44

PARTNERSHIP STRUCTURE 15% Equity Stake plus Exclusive Sales Rep Agent Content, Sales & On-Air Promotional Commitment 45

Financial Summary 46

HISTORICAL FINANCIALS (1) (1) Pro forma for 2012 transaction with Townsquare Media only (2) Pro forma for 2013 transaction with Townsquare Media & acquisition of Westwood One (3) See reconciliations to GAAP in appendix (1) (2) (2) (1) (1) (2) (2) (3) 47

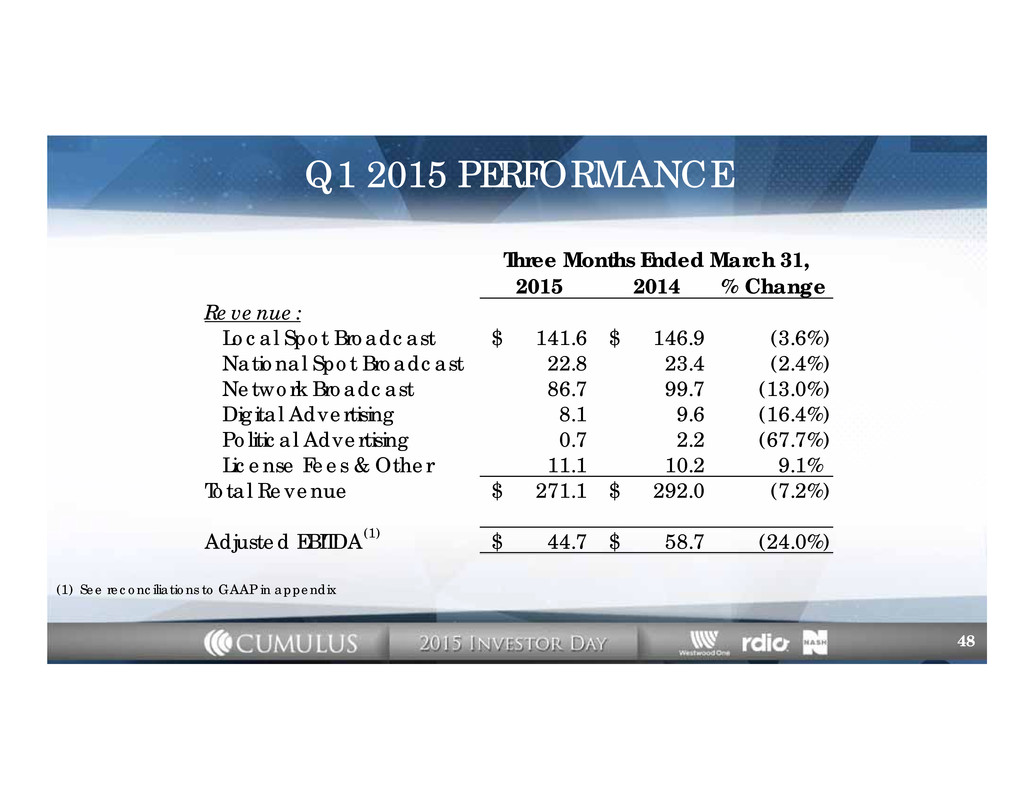

Q1 2015 PERFORMANCE Three Months Ended March 31, 2015 2014 % Change Revenue: Local Spot Broadcast 141.6$ 146.9$ (3.6%) National Spot Broadcast 22.8 23.4 (2.4%) Network Broadcast 86.7 99.7 (13.0%) Digital Advertising 8.1 9.6 (16.4%) Political Advertising 0.7 2.2 (67.7%) License Fees & Other 11.1 10.2 9.1% Total Revenue 271.1$ 292.0$ (7.2%) Adjusted EBITDA 44.7$ 58.7$ (24.0%)(1) (1) See reconciliations to GAAP in appendix 48

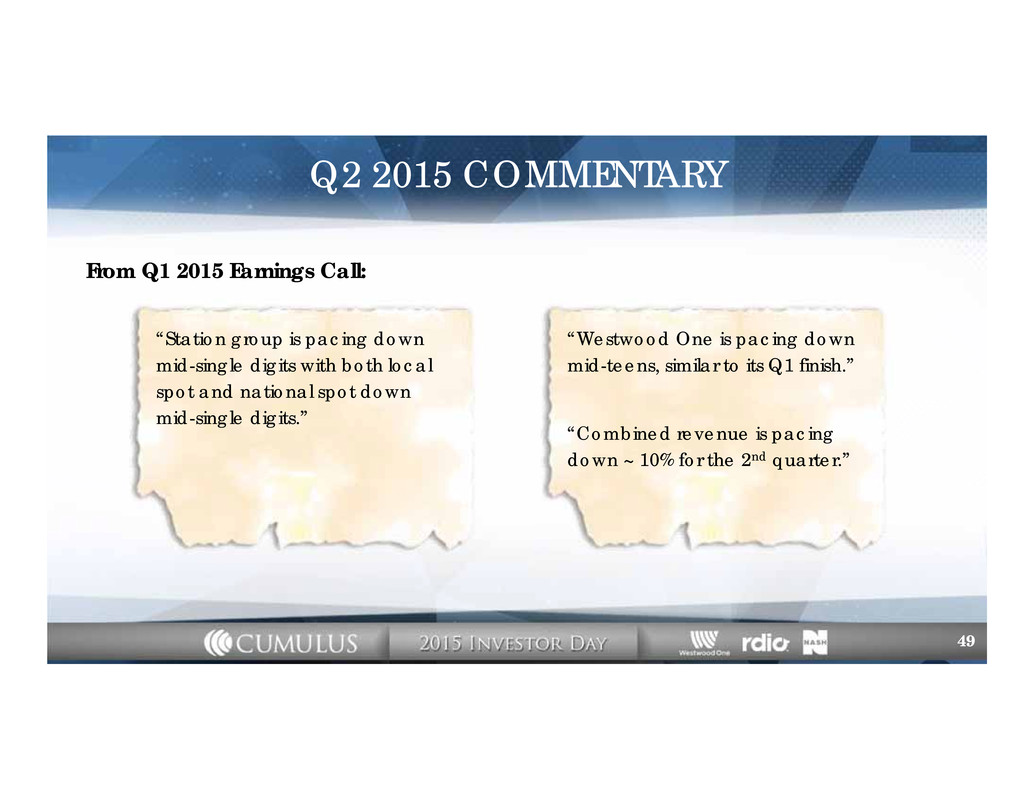

Q2 2015 COMMENTARY From Q1 2015 Earnings Call: “Station group is pacing down mid-single digits with both local spot and national spot down mid-single digits.” “Westwood One is pacing down mid-teens, similar to its Q1 finish.” “Combined revenue is pacing down ~ 10% for the 2nd quarter.” 49

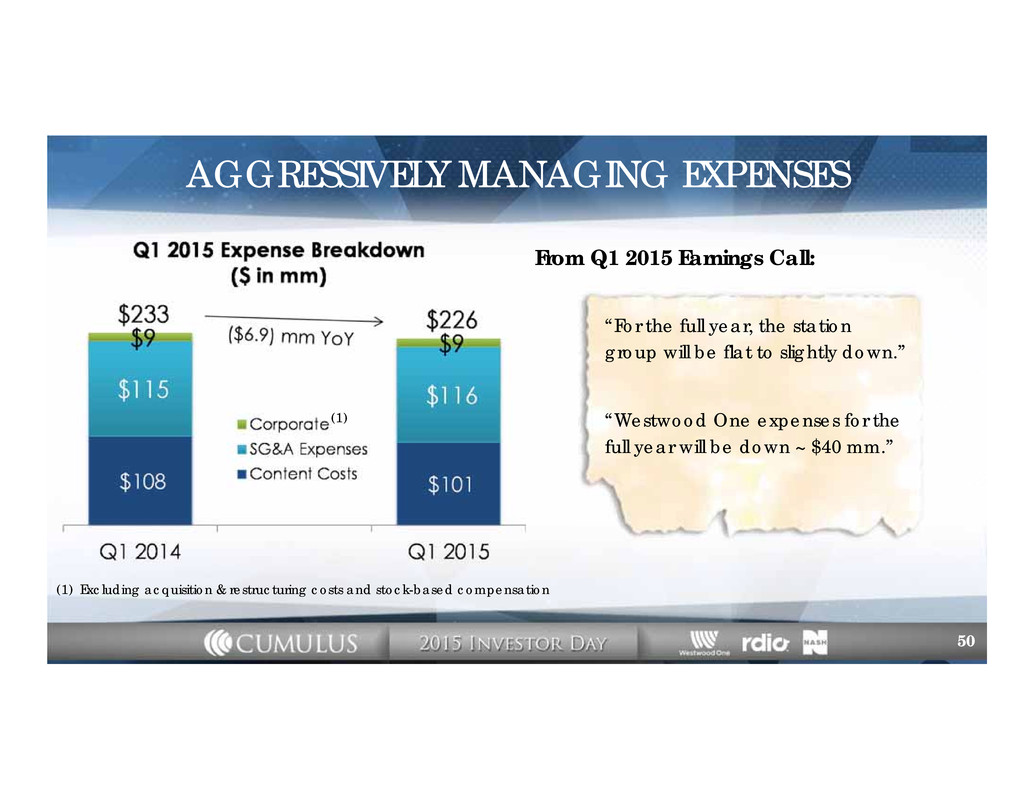

AGGRESSIVELY MANAGING EXPENSES From Q1 2015 Earnings Call: “For the full year, the station group will be flat to slightly down.” “Westwood One expenses for the full year will be down ~ $40 mm.” (1) (1) Excluding acquisition & restructuring costs and stock-based compensation 50

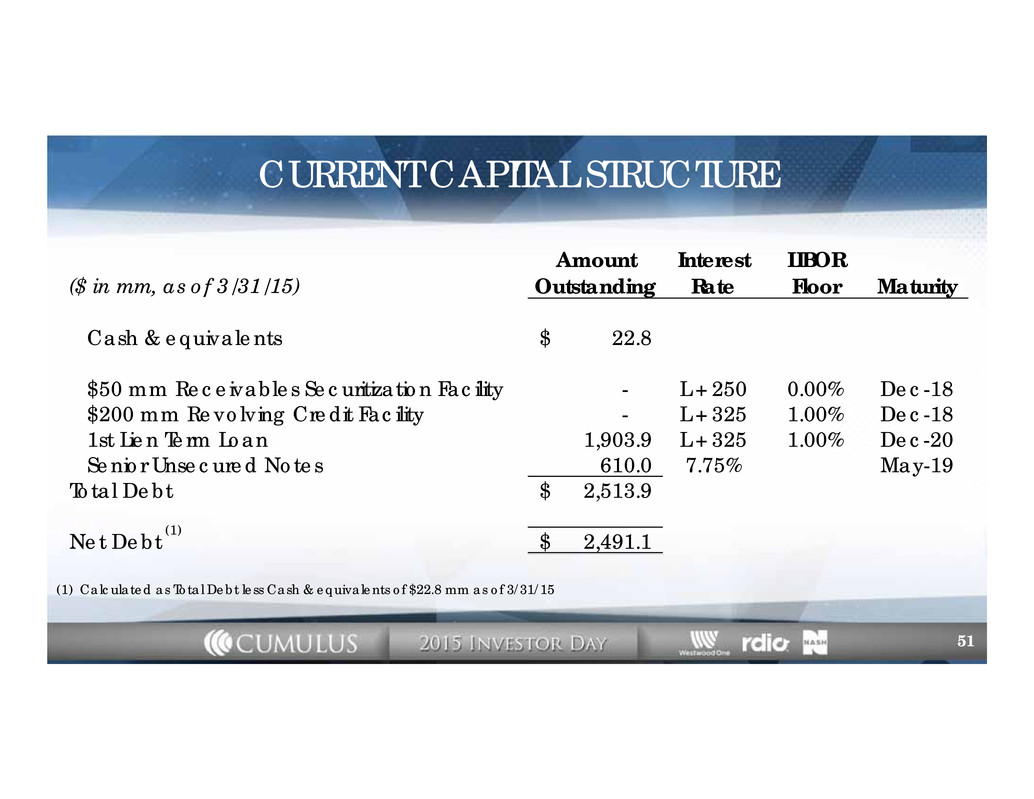

CURRENT CAPITAL STRUCTURE Amount Interest LIBOR ($ in mm, as of 3/31/15) Outstanding Rate Floor Maturity Cash & equivalents 22.8$ $50 mm Receivables Securitization Facility - L + 250 0.00% Dec-18 $200 mm Revolving Credit Facility - L + 325 1.00% Dec-18 1st Lien Term Loan 1,903.9 L + 325 1.00% Dec-20 Senior Unsecured Notes 610.0 7.75% May-19 Total Debt 2,513.9$ Net Debt 2,491.1$ (1) (1) Calculated as Total Debt less Cash & equivalents of $22.8 mm as of 3/31/15 51

A COMPELLING INVESTMENT OPPORTUNITY National Scale with Local Activation Industry-Leading Content Platform Ability to Leverage Audience in New Ways Comprehensive Digital Strategy Consistent Cash Flow for Debt Paydown Experienced Management Team 52

Non-GAAP Reconciliations 53

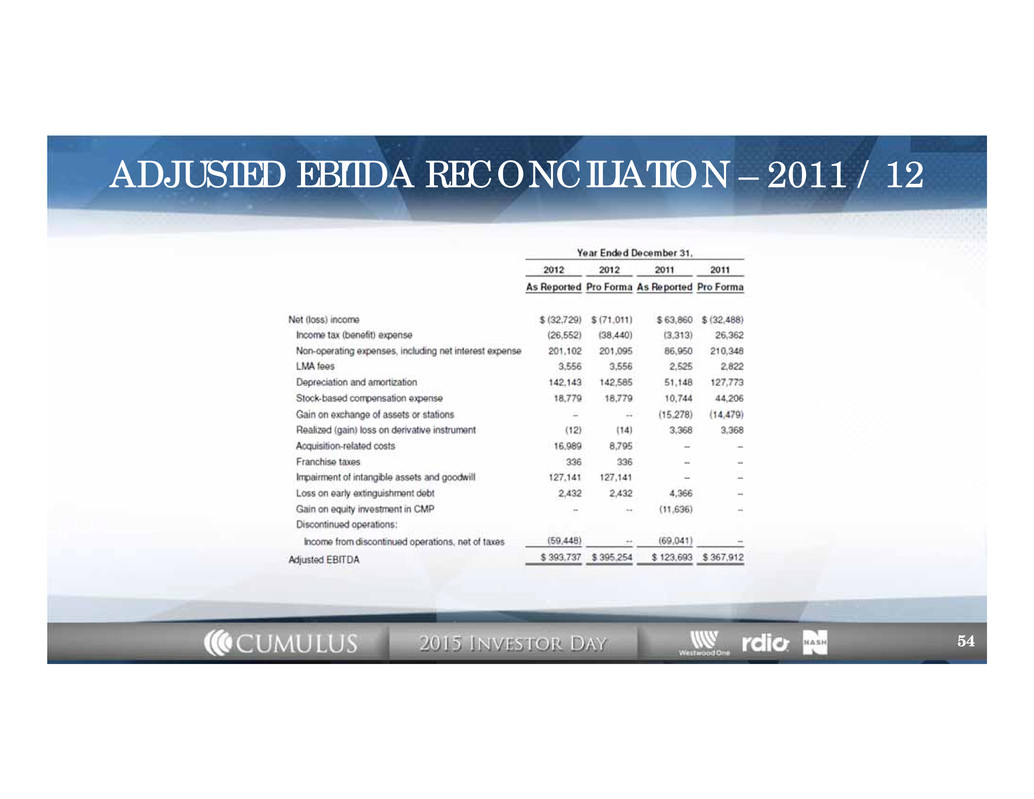

ADJUSTED EBITDA RECONCILIATION – 2011 / 12 54

ADJUSTED EBITDA RECONCILIATION – 2013 / 14 55

ADJUSTED EBITDA RECONCILIATION – 1Q14 / 1Q15 56

Collin Jones, Director of IR P: 404-260-6600 E: collin@cumulus.com J.P. Hannan, Chief Financial Officer P: 404-260-6600 E: jp.hannan@cumulus.com 57