Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - GULF RESOURCES, INC. | Financial_Report.xls |

| EX-32.1 - GULF RESOURCES, INC. | e613660_ex32-1.htm |

| EX-31.1 - GULF RESOURCES, INC. | e613660_ex31-1.htm |

| EX-31.2 - GULF RESOURCES, INC. | e613660_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the quarterly period ended March 31, 2015

|

|

|

Or

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from _________ to _________

|

Commission File Number: 001-34499

GULF RESOURCES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

13-3637458

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

Level 11,Vegetable Building, Industrial Park of the East City,

Shouguang City, Shandong,

|

262700

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: +86 (536) 567 0008

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every, Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer (Do not check if a smaller reporting company) o

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

As of May 1, 2015, the registrant had outstanding 45,909,876 shares of common stock.

|

Part I – Financial Information

|

|

|

Item 1. Financial Statements

|

1

|

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

17

|

|

Item 3. Quantitative and Qualitative Disclosures about Market Risk

|

29

|

|

Item 4. Controls and Procedures

|

29

|

|

Part II – Other Information

|

|

|

Item 1. Legal Proceedings

|

30

|

|

Item 1A. Risk Factors

|

30

|

|

Item 2. Unregistered Shares of Equity Securities and Use of Proceeds

|

30

|

|

Item 3. Defaults Upon Senior Securities

|

30

|

|

Item 4. Mine Safety Disclosure

|

30

|

|

Item 5. Other Information

|

30

|

|

Item 6. Exhibits

|

31

|

|

Signatures

|

32

|

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

|

GULF RESOURCES, INC.

|

|

AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

(Expressed in U.S. dollars)

|

|

March 31, 2015

Unaudited

|

December 31, 2014

Audited

|

|||||||

|

Current Assets

|

||||||||

|

Cash

|

$

|

111,412,589

|

$

|

146,585,601

|

||||

|

Accounts receivable

|

60,377,576

|

41,997,862

|

||||||

|

Inventories

|

7,000,453

|

5,367,868

|

||||||

|

Prepayments and deposits

|

8,485

|

86,301

|

||||||

|

Prepaid land leases

|

346,269

|

51,024

|

||||||

|

Other receivable

|

559

|

38,272

|

||||||

|

Deferred tax assets

|

861

|

864

|

||||||

|

Total Current Assets

|

179,146,792

|

194,127,792

|

||||||

|

Non-Current Assets

|

||||||||

|

Property, plant and equipment, net

|

134,469,582

|

124,350,781

|

||||||

|

Property, plant and equipment under capital leases, net

|

1,245,955

|

1,339,602

|

||||||

|

Prepaid land leases, net of current portion

|

5,507,730

|

733,560

|

||||||

|

Deferred tax assets

|

2,502,601

|

2,430,417

|

||||||

|

Goodwill

|

31,452,271

|

-

|

||||||

|

Total non-current assets

|

175,178,139

|

128,854,360

|

||||||

|

Total Assets

|

$

|

354,324,931

|

$

|

322,982,152

|

||||

|

Liabilities and Stockholders’ Equity

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable and accrued expenses

|

$

|

16,300,543

|

$

|

4,004,728

|

||||

|

Retention payable

|

44,667

|

326,959

|

||||||

|

Capital lease obligation, current portion

|

254,972

|

205,128

|

||||||

|

Taxes payable

|

5,287,813

|

3,545,429

|

||||||

|

Total Current Liabilities

|

21,887,995

|

8,082,244

|

||||||

|

Non-Current Liabilities

|

||||||||

|

Capital lease obligation, net of current portion

|

2,815,773

|

2,826,495

|

||||||

|

Total Liabilities

|

$

|

24,703,768

|

$

|

10,908,739

|

||||

|

|

||||||||

|

Stockholders’ Equity

|

||||||||

|

PREFERRED STOCK; $0.001 par value; 1,000,000 shares authorized; none outstanding

|

$

|

$

|

||||||

|

COMMON STOCK; $0.0005 par value; 80,000,000 shares authorized; 46,179,025 and 38,911,014 shares issued; and 45,909,876 and 38,672,865 shares outstanding as of March 31, 2015 and December 31, 2014, respectively

|

23,090

|

19,456

|

||||||

|

Treasury stock; 269,149 and 238,149 shares as of March 31, 2015 and December 31, 2014 at cost

|

(599,441

|

)

|

(561,728

|

)

|

||||

|

Additional paid-in capital

|

93,756,914

|

80,380,008

|

||||||

|

Retained earnings unappropriated

|

188,533,961

|

183,480,402

|

||||||

|

Retained earnings appropriated

|

18,340,104

|

18,078,392

|

||||||

|

Cumulative translation adjustment

|

29,566,535

|

30,676,883

|

||||||

|

Total Stockholders’ Equity

|

329,621,163

|

312,073,413

|

||||||

|

Total Liabilities and Stockholders’ Equity

|

$

|

353,324,931

|

$

|

322,982,152

|

||||

See accompanying notes to the condensed consolidated financial statements.

GULF RESOURCES, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(Expressed in U.S. dollars)

(UNAUDITED)

|

Three-Month Period Ended

March 31,

|

||||||||

|

2015

|

2014

|

|||||||

|

NET REVENUE

|

||||||||

|

Net revenue

|

$

|

34,910,829

|

$

|

25,592,176

|

||||

|

OPERATING EXPENSES/INCOME

|

||||||||

|

Cost of net revenue

|

(25,480,858

|

)

|

(18,734,404

|

)

|

||||

|

Sales, marketing and other operating expenses

|

(81,430

|

)

|

(22,514

|

)

|

||||

|

Research and development cost

|

(48,235

|

)

|

(30,780

|

)

|

||||

|

Exploration cost

|

(325,840

|

)

|

-

|

|||||

|

General and administrative expenses

|

(1,981,117

|

)

|

(1,320,518

|

)

|

||||

|

Other operating income

|

117,302

|

117,684

|

||||||

|

(27,800,178

|

)

|

(19,990,532

|

)

|

|||||

|

INCOME FROM OPERATIONS

|

7,110,651

|

5,601,644

|

||||||

|

OTHER INCOME (EXPENSE)

|

||||||||

|

Interest expense

|

(50,853

|

)

|

(52,712

|

)

|

||||

|

Interest income

|

126,961

|

106,475

|

||||||

|

INCOME BEFORE TAXES

|

7,186,759

|

5,655,407

|

||||||

|

INCOME TAXES

|

(1,871,488

|

)

|

(1,369,069

|

)

|

||||

|

NET INCOME

|

$

|

5,315,271

|

$

|

4,286,338

|

||||

|

COMPREHENSIVE INCOME:

|

||||||||

|

NET INCOME

|

$

|

5,315,271

|

$

|

4,286,338

|

||||

|

OTHER COMPREHENSIVE INCOME

|

||||||||

|

- Foreign currency translation adjustments

|

(1,110,348

|

)

|

(2,904,188

|

)

|

||||

|

COMPREHENSIVE INCOME

|

$

|

4,204,923

|

$

|

1,382,150

|

||||

|

EARNINGS PER SHARE:

|

||||||||

|

BASIC

|

$

|

0.12

|

$

|

0.11

|

||||

|

DILUTED

|

$

|

0.12

|

$

|

0.11

|

||||

|

WEIGHTED AVERAGE NUMBER OF SHARES:

|

||||||||

|

BASIC

|

42,680,899

|

38,598,424

|

||||||

|

DILUTED

|

43,477,401

|

39,277,957

|

||||||

See accompanying notes to the condensed consolidated financial statements.

|

GULF RESOURCES, INC.

|

|

AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

|

|

THREE-MONTH PERIOD ENDED MARCH 31, 2015

|

|

(Expressed in U.S. dollars)

|

|

Common stock

|

||||||||||||||||||||||||||||||||||||||||

|

Number

|

Number

|

Number

|

Additional

|

Retained

|

Retained

|

Cumulative

|

||||||||||||||||||||||||||||||||||

|

of shares

|

of shares

|

of treasury

|

Treasury

|

paid-in

|

earnings

|

earnings

|

translation

|

|||||||||||||||||||||||||||||||||

|

issued

|

outstanding

|

stock

|

Amount

|

stock

|

capital

|

unappropriated

|

appropriated

|

adjustment

|

Total

|

|||||||||||||||||||||||||||||||

|

BALANCE AT DECEMBER 31, 2014 (Audited)

|

38,911,014 | 38,672,865 | 238,149 | $ | 19,456 | $ | (561,728 | ) | $ | 80,380,008 | $ | 183,480,402 | $ | 18,078,392 | $ | 30,676,883 | $ | 312,073,413 | ||||||||||||||||||||||

|

Translation adjustment

|

-

|

- | - |

-

|

-

|

-

|

-

|

(1,110,348 | ) | (1,110,348 | ) | |||||||||||||||||||||||||||||

|

Common stock repurchased

|

(31,000 | ) | 31,000 | (37,713 | ) | - | - | - | - | (37,713 | ) | |||||||||||||||||||||||||||||

|

Common stock issued for business acquisition

|

7,268,011 | 7,268,011 | - | 3,634 | 13,369,506 | - | - | 13,373,140 | ||||||||||||||||||||||||||||||||

|

Issuance of stock options to employees

|

- | - | - | - | - | 7,400 | - | - | - | 7,400 | ||||||||||||||||||||||||||||||

|

Net income for three-month period ended March 31, 2015

|

-

|

- | - |

-

|

- |

-

|

5,315,271

|

- |

-

|

5,315,271 | ||||||||||||||||||||||||||||||

|

Transfer to statutory common reserve fund

|

- | - | - | - | - | - | (261,712 | ) | 261,712 | - | - | |||||||||||||||||||||||||||||

|

BALANCE AT MARCH 31, 2015 (Unaudited)

|

46,179,025 | 45,909,876 | 269,149 | $ | 23,090 | $ | (599,441 | ) | $ | 93,756,914 | $ | 188,533,961 | $ | 18,340,104 | $ | 29,566,535 | $ | 329,621,163 | ||||||||||||||||||||||

See accompanying notes to the condensed consolidated financial statements.

|

GULF RESOURCES, INC.

|

|

AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(Expressed in U.S. dollars)

|

|

(UNAUDITED)

|

|

Three-Month Period Ended March 31,

|

||||||||

|

2015

|

2014

|

|||||||

|

|

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

||||||

|

Net income

|

$

|

5,315,271

|

$

|

4,286,338

|

||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Interest on capital lease obligation

|

50,657

|

52,554

|

||||||

|

Amortization of prepaid land leases

|

125,331

|

104,972

|

||||||

|

Depreciation and amortization

|

7,378,988

|

6,938,240

|

||||||

|

Unrealized exchange gain on translation of inter-company balances

|

(101,359

|

)

|

(235,424

|

)

|

||||

|

Stock-based compensation expense

|

7,400

|

13,900

|

||||||

|

Deferred tax asset

|

(81,459

|

)

|

-

|

|||||

|

Changes in assets and liabilities, net of effects of acquisition :

|

||||||||

|

Accounts receivable

|

810,129

|

3,165,013

|

||||||

|

Inventories

|

(8,173

|

)

|

(519,826

|

)

|

||||

|

Prepayments and deposits

|

84,009

|

(26,875

|

)

|

|||||

|

Other receivables

|

37,713

|

-

|

||||||

|

Accounts payable and accrued expenses

|

3,649,074

|

527,536

|

||||||

|

Retention payable

|

(281,241

|

)

|

-

|

|||||

|

Taxes payable

|

793,740

|

(1,486,106

|

)

|

|||||

|

Net cash provided by operating activities

|

17,780,080

|

12,820,322

|

||||||

|

CASH FLOWS USED IN INVESTING ACTIVITIES

|

||||||||

|

Additions of prepaid land leases

|

(325,533

|

)

|

(311,040

|

)

|

||||

|

Purchase of property, plant and equipment

|

-

|

(39,586

|

)

|

|||||

|

Consideration paid for business acquisition

|

(66,305,606

|

)

|

-

|

|||||

|

Cash acquired from acquisition

|

14,074,720

|

-

|

||||||

|

Net cash used in investing activities

|

(52,556,419

|

)

|

(350,626

|

)

|

||||

|

CASH FLOWS USED IN FINANCING ACTIVITIES

|

||||||||

|

Repurchase of common stock

|

(37,713

|

)

|

-

|

|||||

|

Net cash used in financing activities

|

(37,713

|

)

|

-

|

|||||

|

EFFECTS OF EXCHANGE RATE CHANGES

ON CASH AND CASH EQUIVALENTS

|

(358,960

|

)

|

(1,035,488

|

)

|

||||

|

NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS

|

(35,173,012

|

)

|

11,434,208

|

|||||

|

CASH AND CASH EQUIVALENTS - BEGINNING OF PERIOD

|

146,585,601

|

107,828,800

|

||||||

|

CASH AND CASH EQUIVALENTS - END OF PERIOD

|

$

|

111,412,589

|

$

|

119,263,008

|

||||

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION

|

||||||||

|

Cash paid during the period for:

|

||||||||

|

Income taxes

|

$

|

1,311,695

|

$

|

2,571,399

|

||||

|

SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING

AND FINANCING ACTIVITIES

|

||||||||

|

Issuance of common stock upon cashless exercise of options

|

$

|

-

|

$

|

73

|

||||

|

Issuance of common stock for acquisition of business

|

$

|

13,373,140

|

$

|

-

|

||||

See accompanying notes to the condensed consolidated financial statements.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2015

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of Presentation and Consolidation

The accompanying condensed financial statements have been prepared by Gulf Resources, Inc. a Delaware corporation and its subsidiaries (collectively, the “Company”), without audit, in accordance with the instructions to Form 10-Q and, therefore, do not necessarily include all information and footnotes necessary for a fair statement of its financial position, results of operations and cash flows in accordance with accounting principles generally accepted in the United States (“US GAAP”).

In the opinion of management, the unaudited financial information for the quarter ended March 31, 2015 presented reflects all adjustments, which are only normal and recurring, necessary for a fair statement of results of operations, financial position and cash flows. These condensed financial statements should be read in conjunction with the financial statements included in the Company’s 2014 Form 10-K. Operating results for the interim periods are not necessarily indicative of operating results for an entire fiscal year.

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the amounts that are reported in the financial statements and accompanying disclosures. Although these estimates are based on management’s best knowledge of current events and actions that the Company may undertake in the future, actual results may be different from the estimates. The Company also exercises judgments in the preparation of these condensed financial statements in the areas including classification of leases and related party transactions.

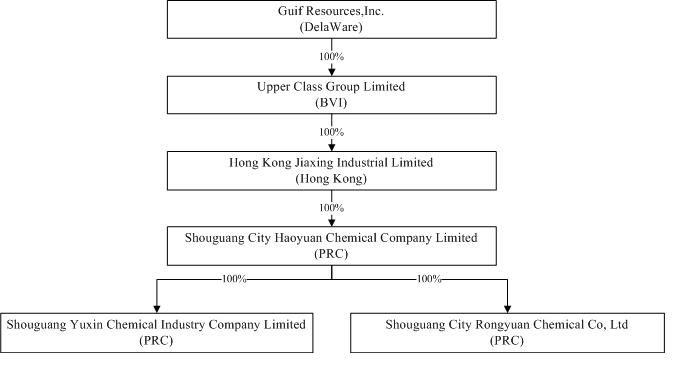

The consolidated financial statements include the accounts of Gulf Resources, Inc. and its wholly-owned subsidiary, Upper Class Group Limited, a company incorporated in the British Virgin Islands, which owns 100% of Hong Kong Jiaxing Industrial Limited, a company incorporated in Hong Kong (“HKJI”). HKJI owns 100% of Shouguang City Haoyuan Chemical Company Limited ("SCHC") which owns 100% of Shouguang Yuxin Chemical Industry Co., Limited (“SYCI”) and Shouguang City Rongyuan Chemical Co, Ltd (“SCRC”). All material intercompany transactions have been eliminated on consolidation.

(b) Nature of the Business

The Company manufactures and trades bromine and crude salt through its wholly-owned subsidiary, Shouguang City Haoyuan Chemical Company Limited ("SCHC"), manufactures chemical products for use in the oil industry, pesticides and paper manufacturing industry through its wholly-owned subsidiary, Shouguang Yuxin Chemical Industry Co., Limited ("SYCI"), and manufactures chemical products used for human and animal antibiotics through its wholly-owned subsidiary, Shouguang City Rongyuan Chemical Co, Ltd (“SCRC”) in the People’s Republic of China (“PRC”).

(c) Allowance for Doubtful Accounts

As of March 31, 2015 and December 31, 2014, allowances for doubtful accounts were nil. No allowances for doubtful accounts were charged to the income statement for the three-month periods ended March 31, 2015 and 2014.

(d) Concentration of Credit Risk

The Company is exposed to credit risk in the normal course of business, primarily related to accounts receivable and cash and cash equivalents. Substantially all of the Company’s cash and cash equivalents are maintained with financial institutions in the PRC, namely, Industrial and Commercial Bank of China Limited and China Merchants Bank Company Limited, which are not insured or otherwise protected. The Company placed $111,412,589 and $146,585,601 with these institutions as of March 31, 2015 and December 31, 2014, respectively. The Company has not experienced any losses in such accounts in the PRC.

Concentrations of credit risk with respect to accounts receivable exists as the Company sells a substantial portion of its products to a limited number of customers. However, such concentrations of credit risks are limited since the Company performs ongoing credit evaluations of its customers’ financial condition. Approximately 76% and 66.5% of the balance of accounts receivable as of March 31, 2015 and December 31, 2014, respectively, are outstanding for less than three months. For the balances of accounts receivable aged more than 90 days as of March 31, 2015, approximately 69% were settled in April 2015.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2015

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

(e) Property, Plant and Equipment

Property, plant and equipment are stated at cost less accumulated depreciation and any impairment losses. Expenditures for new facilities or equipment, and major expenditures for betterment of existing facilities or equipment are capitalized and depreciated using the straight-line method at rates sufficient to depreciate such costs over the estimated productive lives. All other ordinary repair and maintenance costs are expensed as incurred.

Mineral rights are recorded at cost less accumulated depreciation and any impairment losses. Mineral rights are amortized ratably over the term of the lease, or the equivalent term under the units of production method, whichever is shorter.

Construction in progress primarily represents direct costs of construction of plant, machinery and equipment. Costs incurred are capitalized and transferred to property and equipment upon completion, at which time depreciation commences.

The Company’s depreciation and amortization policies on property, plant and equipment, other than mineral rights and construction in progress, are as follows:

|

Useful life

(in years)

|

||

|

Buildings (including salt pans)

|

8 - 20

|

|

|

Plant and machinery (including protective shells, transmission channels and ducts)

|

3 - 8

|

|

|

Motor vehicles

|

5

|

|

|

Furniture, fixtures and equipment

|

3-8

|

Property, plant and equipment under capital leases are depreciated over their expected useful lives on the same basis as owned assets, or where shorter, the term of the lease, which is 20 years.

(f) Retirement Benefits

Pursuant to the relevant laws and regulations in the PRC, the Company participates in a defined contribution retirement plan for its employees arranged by a governmental organization. The Company makes contributions to the retirement scheme at the applicable rate based on the employees’ salaries. The required contributions under the retirement plans are charged to the consolidated income statement on an accrual basis when they are due. The Company’s contributions totaled $193,148 and $125,301 for the three-month periods ended March 31, 2015 and 2014, respectively.

(g) Revenue Recognition

The Company recognizes revenue, net of value-added tax, when persuasive evidence of an arrangement exists, delivery of the goods has occurred, customer acceptance has been obtained, which means the significant risks and ownership have been transferred to the customer, the price is fixed or determinable and collectability is reasonably assured.

(h) Recoverability of Long-lived Assets

In accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 360-10-35 “Impairment or Disposal of Long-lived Assets” , long-lived assets to be held and used are analyzed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be fully recoverable or that the useful lives of those assets are no longer appropriate. The Company evaluates at each balance sheet date whether events and circumstances have occurred that indicate possible impairment.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2015

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 1 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

(h) Recoverability of Long-lived Assets – Continued

The Company determines the existence of such impairment by measuring the expected future cash flows (undiscounted and without interest charges) and comparing such amount to the carrying amount of the assets. An impairment loss, if one exists, is then measured as the amount by which the carrying amount of the asset exceeds the discounted estimated future cash flows. Assets to be disposed of are reported at the lower of the carrying amount or fair value of such assets less costs to sell. Asset impairment charges are recorded to reduce the carrying amount of the long-lived asset that will be sold or disposed of to their estimated fair values. Charges for the asset impairment reduce the carrying amount of the long-lived assets to their estimated salvage value in connection with the decision to dispose of such assets.

For the three-month period ended March 31, 2015 and 2014, the Company determined that there are no events or circumstances indicating possible impairment of its long-lived assets.

(i) Basic and Diluted Net Income per Share of Common Stock

Basic earnings per common share are based on the weighted average number of shares outstanding during the periods presented. Diluted earnings per share are computed using weighted average number of common shares plus dilutive common share equivalents outstanding during the period. Anti-dilutive common stock equivalents which were excluded from the calculation of number of dilutive common stock equivalents amounted to 358,836 and 1,593,686 shares for the three-month periods ended March 31, 2015 and 2014, respectively.

The following table sets forth the computation of basic and diluted earnings per share:

|

Three-Month Period Ended

March 31,

|

||||||||

|

2015

|

2014

|

|||||||

|

Numerator

|

||||||||

|

Net income

|

$

|

5,315,271

|

$

|

4,286,338

|

||||

|

Denominator

|

||||||||

|

Basic: Weighted-average common shares outstanding during the period

|

42,680,899

|

38,598,424

|

||||||

|

Add: Dilutive effect of stock options

|

796,502

|

679,533

|

||||||

|

Diluted

|

43,477,401

|

39,277,957

|

||||||

|

Net income per share

|

||||||||

|

Basic

|

$

|

0.12

|

$

|

0.11

|

||||

|

Diluted

|

$

|

0.12

|

$

|

0.11

|

||||

(j) Reporting Currency and Translation

The financial statements of the Company’s foreign subsidiaries are measured using the local currency, Renminbi (“RMB”), as the functional currency; whereas the functional currency and reporting currency of the Company is the United States dollar (“USD” or “$”).

As such, the Company uses the “current rate method” to translate its PRC operations from RMB into USD, as required under FASB ASC 830 “Foreign Currency Matters”. The assets and liabilities of its PRC operations are translated into USD using the rate of exchange prevailing at the balance sheet date. The capital accounts are translated at the historical rate. Adjustments resulting from the translation of the balance sheets of the Company’s PRC subsidiaries are recorded in stockholders’ equity as part of accumulated comprehensive income. The statement of income and comprehensive income is translated at average rate during the reporting period. Gains or losses resulting from transactions in currencies other than the functional currencies are recognized in net income for the reporting periods as part of general and administrative expense. The statement of cash flows is translated at average rate during the reporting period, with the exception of the consideration paid for the acquisition of business which is translated at historical rates.

(k) Foreign Operations

All of the Company’s operations and assets are located in PRC. The Company may be adversely affected by possible political or economic events in this country. The effect of these factors cannot be accurately predicted.

(l) Exploration Costs

Exploration costs, which included the cost of researching for appropriate places to drill wells and the cost of well drilling in search of potential natural brine or other resources, are charged to the income statement as incurred.

(m) Goodwill

Goodwill represents the excess of the purchase price over the net of the fair value of the identifiable tangible and intangible assets acquired and the fair value of liabilities assumed in business acquisitions. Management of the Company evaluates the carrying value of goodwill annually or when a possible impairment is indicated. The Company performs its impairment assessment annually and determined that there was no impairment of goodwill. Goodwill impairment is assessed using the expected present value of associated future cash flows.

(n) New Accounting Pronouncements

No accounting standards and guidance with an effective date during the three-month period ended March 31, 2015 or issued during 2015 had or are expected to have a significant impact on the Company’s condensed consolidated financial statements through 2016.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2015

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 2 – BUSINESS ACQUISITION

In order to increase the Company’s profit margins, produce more consistent and reliable earnings and lessen dependence on the economically sensitive bromine industry, on January 12, 2015, Gulf Resources, Inc. (the“Company” or “Gulf”) and Shouguang City Haoyuan Chemical Company Limited, a wholly owned subsidiary of the Company (“SCHC”), entered into an Equity Interest Transfer Agreement (the “Agreement”) to acquire 100% of SCRC for a total consideration of $79,678,746 to be settled in cash and in the shares of the commons stock of the Company.

On February 4, 2015, the Company closed the transactions contemplated by the Agreement between the Company, SCHC and SCRC. The Closing Date is deemed to be the acquisition date.

On the Closing Date, the Company issued 7,268,011shares of its common stock, par value $0.0005 per share (the “Shares”), at a the closing market price of $1.84 per Share on the Closing Date to the four former equity owners of SCRC. The sellers of SCRC agreed as part of the purchase price to accept 7,268,011 shares of Gulf Resources stock, based on a valuation of $2.00, which was a 73% premium to the price on the day the agreement was reached. For accounting purposes, these shares are being valued at $1.84, which was the closing price of the Company’s stock on the day of the closing of the agreement. There is no change in the number of shares issued. The total purchase consideration consisted of $66,305,606 in cash and $13,169,506 in the shares of the common stock of the Company.

The issuance of the Shares was exempt from registration pursuant to Regulation S of the Securities Act of 1933, as amended. On the Closing Date, the Company entered into a lock-up agreement with the four former equity owners of SCRC. In accordance with the terms of the lock-up agreement, the shareholders have agreed not to sell or transfer the Shares for five years from the date the stock certificates evidencing the Shares are issued.

The following table represents the fair value of identifiable assets and liabilities of SCRC acquired and goodwill recognized at acquisition date.

|

Cash

|

$ | 14,074,720 | ||

|

Accounts receivable

|

19,365,259 | |||

|

Inventories

|

1,646,196 | |||

|

Other current assets

|

82,562 | |||

|

Property, plant and equipment, net

|

17,891,360 | |||

|

Prepaid land leases, net of current portion

|

4,800,404 | |||

|

Goodwill

|

31,452,271 | |||

|

Accounts payable and accrued expenses

|

(8,670,568 | ) | ||

|

Taxes payable

|

(963,458 | ) | ||

|

Total purchase price

|

$ | 79,678,746 |

The net revenue and net income of SCRC since the acquisition date that are included in the condensed consolidated statement of income for the three months ended March 31, 2015 are $10,503,369 and $2,584,760. Goodwill is not expected to be deductible for tax purpose.

Costs of $121,512 related to the acquisition, which included audit fee and valuation fees, have been charged directly to operations and are included in general and administrative expenses in the condensed consolidated statement of income for the three months ended March 31, 2015.

The following table shows supplemental information of the results of operations on a pro forma basis for the three months ended March 31, 2015 and 2014, as if the acquisition of SCRC had been completed at the beginning of the Company’s interim periods presented:

|

For the three months ended

|

||||||||

|

March 31, 2015

|

March 31, 2014

|

|||||||

|

Net Revenue

|

$ | 40,625,092 | $ | 40,655,098 | ||||

|

Net Income

|

$ | 6,785,305 | $ | 7,704,318 | ||||

|

EARNINGS PER SHARE

|

||||||||

|

-Basic

|

$ | 0.15 | $ | 0.17 | ||||

|

-Diluted

|

$ | 0.15 | $ | 0.17 | ||||

The pro forma information for all periods presented has been calculated after adjusting for results of SCRC to reflect the business combination accounting effect resulting from this acquisition including the elimination of intercompany sales, depreciation and amortization on the increase in valuation of property, plant and equipment and prepaid land lease.

NOTE 3 – INVENTORIES

Inventories consist of:

|

March 31,

2015

|

December 31,

2014

|

|||||||

|

Raw materials

|

$

|

1,101,873

|

$

|

625,160

|

||||

|

Finished goods

|

5,117,949

|

4,746,163

|

||||||

|

Work-in-progress

|

784,073

|

-

|

||||||

|

Allowance for obsolete and slow-moving inventory

|

(3,442

|

)

|

(3,455

|

)

|

||||

|

$

|

7,000,453

|

$

|

5,367,868

|

|||||

NOTE 4 – PREPAID LAND LEASES

The Company prepaid for land leases with lease terms for periods ranging from one to fifty years to use the land on which the office premises, production facilities and warehouses of the Company are situated. The prepaid land lease is amortized on a straight line basis.

During the three-month periods ended March 31, 2015 and 2014, amortization of prepaid land lease totaled $126,503 and $104,972, respectively, which were recorded as cost of net revenue.

The Company has the rights to use certain parcels of land located in Shouguang, the PRC, through lease agreements signed with local townships or government authority. For parcels of land that are collectively owned by local townships, the Company could not obtain land use rights certificates. The parcels of land of which the Company could not obtain land use rights certificates covers a total of approximately 59.43 square kilometers of aggregate carrying value of $962,149 and approximately 59.39 square kilometers of aggregate carrying value of $742,820 as at March 31, 2015 and December 31, 2014, respectively.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2015

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 5 – PROPERTY, PLANT AND EQUIPMENT, NET

Property, plant and equipment, net consist of the following:

|

March 31,

2015

|

December 31,

2014

|

|||||||

|

At cost:

|

||||||||

|

Mineral rights

|

$

|

6,481,984

|

$

|

6,506,668

|

||||

|

Buildings

|

72,570,939

|

53,231,127

|

||||||

|

Plant and machinery

|

185,313,740

|

177,485,689

|

||||||

|

Motor vehicles

|

9,354

|

9,389

|

||||||

|

Furniture, fixtures and office equipment

|

5,142,913

|

4,884,991

|

||||||

|

Total

|

269,518,930

|

242,117,864

|

||||||

|

Less: Accumulated depreciation and amortization

|

(135,049,348

|

)

|

(117,767,083

|

)

|

||||

|

Net book value

|

$

|

134,469,582

|

$

|

124,350,781

|

||||

The Company has certain buildings and salt pans erected on parcels of land located in Shouguang, PRC, and such parcels of land are collectively owned by local townships or the government authority. The Company has not been able to obtain property ownership certificates over these buildings and salt pans. The aggregate carrying values of these properties situated on parcels of the land are $47,090,544 and $37,219,221 as at March 31, 2015 and December 31, 2014, respectively.

During the three-month period ended March 31, 2015, depreciation and amortization expense totaled $7,290,364, of which $6,932,259 and $358,105 were recorded as cost of net revenue and administrative expenses, respectively. During the three-month period ended March 31, 2014, depreciation and amortization expense totaled $6,849,327, of which $6,527,898 and $321,430 were recorded as cost of net revenue and administrative expenses, respectively.

NOTE 6 – PROPERTY, PLANT AND EQUIPMENT UNDER CAPITAL LEASES, NET

Property, plant and equipment under capital leases, net consist of the following:

|

March 31,

2015

|

December 31,

2014

|

|||||||

|

At cost:

|

||||||||

|

Buildings

|

$

|

133,979

|

$

|

134,489

|

||||

|

Plant and machinery

|

2,518,416

|

2,528,007

|

||||||

|

Total

|

2,652,395

|

2,662,496

|

||||||

|

Less: Accumulated depreciation and amortization

|

(1,406,440

|

)

|

(1,322,894

|

)

|

||||

|

Net book value

|

$

|

1,245,955

|

$

|

1,339,602

|

||||

The above buildings erected on parcels of land located in Shouguang, PRC, are collectively owned by local townships. The Company has not been able to obtain property ownership certificates over these buildings as the Company could not obtain land use rights certificates on the underlying parcels of land.

During the three-month period ended March 31, 2015, depreciation and amortization expense totaled $88,624, which was recorded as cost of net revenue. During the three-month period ended March 31, 2014, depreciation and amortization expense totaled $88,912, which was recorded as cost of net revenue.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2015

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 7 – ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses consist of the following:

|

March 31,

|

December 31,

|

|||||||

|

2015

|

2014

|

|||||||

|

Accounts payable

|

$

|

15,193,104

|

$

|

3,181,465

|

||||

|

Salary payable

|

300,060

|

234,932

|

||||||

|

Social security insurance contribution payable

|

111,332

|

89,232

|

||||||

|

Other payables

|

696,047

|

499,099

|

||||||

|

Total

|

$

|

16,300,543

|

$

|

4,004,728

|

||||

NOTE 8 – RELATED PARTY TRANSACTIONS

During the three-month period ended March 31, 2015, the Company borrowed a sum of $300,000 from Jiaxing Lighting Appliance Company Limited (Jiaxing Lighting”), in which Mr. Ming Yang, a shareholder and the Chairman of the Company, has a 100% equity interest. The amount due to Jiaxing Lighting was unsecured, interest free and repayable on demand and was fully settled in the three-month period ended March 31,2015. There was no balance owing to Jiaxing Lighting as of March 31, 2015 and December 31, 2014.

During the fiscal year 2013, the Company entered into an agreement with the Shandong Shouguang Vegetable Seed Industry Group Co., Ltd, a related party, to provide property management services for an annual amount of approximately $100,704 for five years from January 1, 2013 to December 31, 2017. The expense associated with this agreement for the three months ended March 31, 2015 and 2014 was approximately $25,500.

NOTE 9 – TAXES PAYABLE

|

Taxes payable consists of the following:

|

|

March 31,

|

December 31,

|

|||||||

|

2015

|

2014

|

|||||||

|

Income tax payable

|

$

|

2,518,809

|

$

|

1,388,341

|

||||

|

Mineral resource compensation fee payable

|

250,609

|

292,026

|

||||||

|

Value added tax payable

|

1,313,636

|

724,915

|

||||||

|

Land use tax payable

|

956,091

|

949,544

|

||||||

|

Other tax payables

|

248,668

|

190,603

|

||||||

|

Total

|

$

|

5,287,813

|

$

|

3,545,429

|

||||

NOTE 10 – CAPITAL LEASE OBLIGATIONS

The components of capital lease obligations are as follows:

|

Imputed

|

March 31,

|

December 31,

|

|||||||

|

Interest rate

|

2015

|

2014

|

|||||||

|

Total capital lease obligations

|

6.7%

|

$

|

3,070,745

|

$

|

3,031,623

|

||||

|

Less: Current portion

|

(254,972

|

)

|

(205,128

|

)

|

|||||

|

Capital lease obligations, net of current portion

|

$

|

2,815,773

|

$

|

2,826,495

|

|||||

Interest expenses from capital lease obligations amounted to $50,657 and $52,554 for the three-month periods ended March 31, 2015 and 2014, respectively, were charged to the income statements. See Note 19 for future minimum lease payments disclosure.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2015

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 11 –EQUITY

|

(a)

|

Authorized shares

|

During the annual general meeting held on June 18, 2013, the shareholders of the Company approved the amendment to the Certificate of Incorporation to decrease the number of the authorized shares of the Company’s common stocks to 80,000,000. The Company has completed the filing of the amendment and restatement of the Certificate of Incorporation with the Secretary of the State of Delaware to decrease the number of authorized shares of the Company’s common stock and accordingly 80,000,000 is disclosed as the authorized shares of the Company’s common stock in the consolidated balance sheets as of March 31, 2015 and December 31, 2014.

|

(b)

|

Retained Earnings - Appropriated

|

In accordance with the relevant PRC regulations and the PRC subsidiaries’ Articles of Association, the Company’s PRC subsidiaries are required to allocate its profit after tax to the following reserve:

Statutory Common Reserve Funds

SCHC, SYCI and SCRC are required each year to transfer at least 10% of the profit after tax as reported under the PRC statutory financial statements to the Statutory Common Reserve Funds until the balance reaches 50% of the registered share capital. This reserve can be used to make up any loss incurred or to increase share capital. Except for the reduction of losses incurred, any other application should not result in this reserve balance falling below 25% of the registered capital. The Statutory Common Reserve Fund as of March 31, 2015 for SCHC, SYCI and SCRC is 38%, 50% and 6% of its registered capital respectively.

NOTE 12 – TREASURY STOCK

In January 2015, the Company repurchased 31,000 shares of common stock of the Company at an average price of $1.22 per share for a total cost of $37,713 under the approval of the Board of Directors. The Company recorded the entire purchase price of the treasury stock as a reduction of equity.

NOTE 13 – STOCK-BASED COMPENSATION

Pursuant to the Company’s Amended and Restated 2007 Equity Incentive Plan, the aggregate number shares of the Company’s common stock available for grant of stock options and issuance is 4,341,989 shares. As of March 31, 2015, the number of shares of the Company’s common stock available for issuance is 1,623,489.

The fair value of each option award below is estimated on the date of grant using the Black-Scholes option-pricing model. The risk free rate is based on the yield-to-maturity in continuous compounding of the US Government Bonds with the time-to-maturity similar to the expected tenor of the option granted, volatility is based on the annualized historical stock price volatility of the Company, and the expected life is based on the estimated average of the life of options using the “simplified” method, as prescribed in FASB ASC 718, due to insufficient historical exercise activity during recent years as a basis from which to estimate future exercise patterns.

In early March 2015, the Company granted to an independent director an option to purchase 12,500 shares of the Company’s common stock at an exercise price of $1.66 per share and the options vested immediately. The options were valued at $7,400 fair value, with assumed 73.55% volatility, a three-year expiration term with expected tenor of 1.49 years, a risk free rate of 0.42% and no dividend yield. For the three-month period ended March 31, 2015, $7,400 was recognized as general and administrative expenses.

The following table summarizes all Company stock option transactions between January 1, 2015 and March 31, 2015.

|

Number of Option

and Warrants

Outstanding and exercisable

|

Weighted- Average Exercise price of Option

and Warrants

|

Range of

Exercise Price per Common Share

|

|||||||||

|

Balance, January 1, 2015

|

2,744,000 | $ | 2.38 | $0.95 - $12.60 | |||||||

|

Granted and vested during the period

ended March 31, 2015

|

12,500 | $ | 1.66 | $1.66 | |||||||

|

Expired during the

period ended March 31, 2015

|

(792,500 | ) | $ | 4.94 | $2.77-$4.97 | ||||||

|

Balance, March 31, 2015

|

1,964,000 | $ | 1.35 | $0.95 - $12.60 | |||||||

|

Stock and Warrants Options Exercisable and Outstanding

|

||||||

|

Weighted Average

|

||||||

|

Remaining

|

||||||

|

Outstanding at March 31, 2014

|

Range of

Exercise Prices

|

Contractual Life

(Years)

|

||||

|

Exercisable and outstanding

|

1,964,000

|

$0.95 - $12.60

|

2.41

|

|||

The aggregate intrinsic value of options outstanding and exercisable as of March 31, 2015 was $1,246,277.

The total intrinsic value of options exercised was $0 and $400,954 for the three-month periods ended March 31, 2015 and 2014.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2015

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 14 – INCOME TAXES

The Company utilizes the asset and liability method of accounting for income taxes in accordance with FASB ASC 740-10.

(a) United States

Gulf Resources, Inc. is subject to the United States of America Tax law at tax rate of 34%. No provision for the US federal income taxes has been made as the Company had no US taxable income for the three-month periods ended March 31, 2015 and 2014, and management believes that its earnings are permanently invested in the PRC.

(b) BVI

Upper Class Group Limited, a subsidiary of Gulf Resources, Inc., was incorporated in the BVI and, under the current laws of the BVI, it is not subject to tax on income or capital gain in the BVI. Upper Class Group Limited did not generate assessable profit for the three-month periods ended March 31, 2015 and 2014.

(c) Hong Kong

Hong Kong Jiaxing Industrial Limited, a subsidiary of Upper Class Group Limited, was incorporated in Hong Kong and is subject to Hong Kong profits tax. The Company is subject to Hong Kong taxation on its activities conducted in Hong Kong and income arising in or derived from Hong Kong. No provision for profits tax has been made as the Company has no assessable income for the three-month periods ended March 31, 2015 and 2014. The applicable statutory tax rates for the three-month periods ended March 31, 2015 and 2014 are 16.5%.

(d) PRC

Enterprise income tax (“EIT”) for SCHC, SYCI and SCRC in the PRC is charged at 25% of the assessable profits.

The operating subsidiaries SCHC, SYCI and SCRC are wholly foreign-owned enterprises (“FIE”) incorporated in the PRC and are subject to PRC Foreign Enterprise Income Tax Law.

On February 22, 2008, the Ministry of Finance (“MOF”) and the State Administration of Taxation (“SAT”) jointly issued Cai Shui [2008] Circular 1 (“Circular 1”). According to Article 4 of Circular 1, distributions of accumulated profits earned by a FIE prior to January 1, 2008 to foreign investor(s) in 2008 will be exempted from withholding tax (“WHT”) while distribution of the profit earned by an FIE after January 1, 2008 to its foreign investor(s) shall be subject to WHT at 5% effective tax rate.

As of March 31, 2015 and December 31, 2014, the accumulated distributable earnings under the Generally Accepted Accounting Principles (GAAP”) of PRC are $248,799,535 and $242,440,917, respectively. Since the Company intends to reinvest its earnings to further expand its businesses in mainland China, its foreign invested enterprises do not intend to declare dividends to their immediate foreign holding companies in the foreseeable future. Accordingly, as of March 31, 2015 and December 31, 2014, the Company has not recorded any WHT on the cumulative amount of distributable retained earnings of its foreign invested enterprises in China. As of March 31, 2015 and December 31, 2014, the unrecognized WHT are $11,331,092 and $$11,008,938, respectively.

The Company’s tax returns are subject to the various tax authorities’ examination. The federal, state and local authorities of the United States may examine the Company’s tax returns filed in the United States for three years from the date of filing. The Company’s US tax returns since 2011 are currently subject to examination. Inland Revenue Department of Hong Kong may examine the Company’s tax returns filed in Hong Kong for seven years from date of filing. The Company’s Hong Kong tax returns since incorporation in year 2007 are currently subject to examination. The tax authorities of the PRC may examine the Company’s PRC tax returns for three years from the date of filing. The Company’s PRC tax returns since 2011 are currently subject to examination.

The components of the provision for income taxes from continuing operations are:

|

Three-Month Period Ended March 31,

|

||||||||

|

2015

|

2014

|

|||||||

|

Current taxes – PRC

|

$

|

1,952,947

|

$

|

1,369,069

|

||||

|

Deferred taxes – PRC

|

(81,459

|

)

|

-

|

|||||

|

$

|

1,871,488

|

$

|

1,369,069

|

|||||

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2015

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 14 – INCOME TAXES – Continued

The effective income tax expenses differ from the PRC statutory income tax rate of 25% from continuing operations in the PRC as follows:

|

Three-Month Period Ended March 31,

|

||||||||

|

Reconciliations

|

2015

|

2014

|

||||||

|

Statutory income tax rate

|

25 | % | 25 | % | ||||

|

US federal net operating loss

|

1 | % | - | |||||

|

Non-taxable item

|

- | (1 | %) | |||||

|

Effective tax rate

|

26 | % | 24 | % | ||||

Significant components of the Company’s deferred tax assets and liabilities at March 31, 2015 and December 30, 2014 are as follows:

|

March 31,

|

December 31,

|

|||||||

|

2015

|

2014

|

|||||||

|

Deferred tax liabilities

|

$

|

-

|

$

|

-

|

||||

|

Deferred tax assets:

|

||||||||

|

Allowance for obsolete and slow-moving inventories

|

$

|

861

|

$

|

864

|

||||

|

Impairment on property, plant and equipment

|

475,616

|

477,427

|

||||||

|

Exploration costs

|

2,026,986

|

1,952,990

|

||||||

|

Compensation costs of unexercised stock options

|

539,754

|

1,427,296

|

||||||

|

US federal net operating loss

|

9,816,518

|

9,692,379

|

||||||

|

Total deferred tax assets

|

12,859,735

|

13,550,956

|

||||||

|

Valuation allowance

|

(10,356,273

|

)

|

(11,119,675

|

)

|

||||

|

Net deferred tax asset

|

$

|

2,503,462

|

$

|

2,431,281

|

||||

|

Current deferred tax asset

|

$

|

861

|

$

|

864

|

||||

|

Long-term deferred tax asset

|

$

|

2,502,601

|

$

|

2,430,417

|

||||

The increase in valuation allowance for the three-month periods ended March 31, 2014 is $20,204.

The decrease in valuation allowance for the three-month periods ended March 31, 2015 is $763,402.

There were no unrecognized tax benefits and accrual for uncertain tax positions as of March 31, 2015 and December 31, 2014.

NOTE 15 – BUSINESS SEGMENTS

The Company has three reportable segments: bromine, crude salt and chemical products. The reportable segments are consistent with how management views the markets served by the Company and the financial information that is reviewed by its chief operating decision maker.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2015

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 15 – BUSINESS SEGMENTS – Continued

An operating segment’s performance is primarily evaluated based on segment operating income, which excludes share-based compensation expense, certain corporate costs and other income not associated with the operations of the segment. These corporate costs (income) are separately stated below and also include costs that are related to functional areas such as accounting, treasury, information technology, legal, human resources, and internal audit. The Company believes that segment operating income, as defined above, is an appropriate measure for evaluating the operating performance of its segments. All the customers are located in PRC.

|

Three-Month Period Ended March 31, 2015

|

Bromine *

|

Crude

Salt *

|

Chemical

Products

|

Segment

Total

|

Corporate

|

Total

|

||||||||||||||||||

|

Net revenue

(external customers)

|

$

|

11,033,249

|

$

|

1,963,731

|

$

|

21,913,849

|

$

|

34,910,829

|

$

|

-

|

$

|

34,910,829

|

||||||||||||

|

Net revenue

(intersegment)

|

1,505,677

|

-

|

-

|

1,505,677

|

-

|

1,505,677

|

||||||||||||||||||

|

Income (loss) from operations before taxes

|

136,959

|

187,535

|

7,046,740

|

7,371,234

|

(260,583

|

)

|

7,110,651

|

|||||||||||||||||

|

Income taxes

|

75,406

|

9,057

|

1,787,025

|

1,871,488

|

-

|

1,871,488

|

||||||||||||||||||

|

Income (loss) from operations after taxes

|

61,553

|

178,478

|

5,259,715

|

5,499,746

|

(260,583

|

)

|

5,239,163

|

|||||||||||||||||

|

Total assets

|

140,192,979

|

37,708,081

|

176,388,517

|

354,289,577

|

35,354

|

354,324,931

|

||||||||||||||||||

|

Depreciation and amortization

|

4,735,301

|

1,401,296

|

1,242,391

|

7,378,988

|

-

|

7,378,988

|

||||||||||||||||||

|

Goodwill

|

-

|

-

|

31,452,271

|

31,452,271

|

-

|

31,452,271

|

||||||||||||||||||

|

Three-Month Period Ended March 31, 2014

|

Bromine *

|

Crude

Salt *

|

Chemical

Products

|

Segment

Total

|

Corporate

|

Total

|

||||||||||||||||||

|

Net revenue

(external customers)

|

$

|

11,761,916

|

$

|

2,441,895

|

$

|

11,388,365

|

$

|

25,592,179

|

$

|

-

|

$

|

22,592,176

|

||||||||||||

|

Net revenue

(intersegment)

|

783,993

|

-

|

-

|

783,993

|

-

|

783,993

|

||||||||||||||||||

|

Income (loss) from operations before taxes

|

1,018,271

|

643,308

|

3,769,733

|

5,431,312

|

170,332

|

5,601,644

|

||||||||||||||||||

|

Income taxes

|

364,585

|

55,240

|

949,244

|

1,369,069

|

-

|

1,369,069

|

||||||||||||||||||

|

Income (loss) from operations after taxes

|

653,687

|

588,067

|

2,820,489

|

4,062,243

|

170,322

|

4,232,575

|

||||||||||||||||||

|

Total assets

|

187,576,805

|

53,277,324

|

68,675,614

|

309,529,743

|

84,675

|

309,614,418

|

||||||||||||||||||

|

Depreciation and amortization

|

4,550,142

|

1,494,758

|

893,340

|

6,938,240

|

-

|

6,938,240

|

||||||||||||||||||

|

Capital expenditures

|

34,378

|

5,208

|

-

|

39,586

|

-

|

39,586

|

||||||||||||||||||

* Certain common production overheads, operating and administrative expenses and asset items (mainly cash and certain office equipment) of bromine and crude salt segments in SCHC were split by reference to the average selling price and production volume of respective segment.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2015

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 15 – BUSINESS SEGMENTS – Continued

|

Three-Month Period Ended March 31,

|

||||||||

|

Reconciliations

|

2015

|

2014

|

||||||

|

Total segment operating income

|

$

|

7,371,234

|

$

|

5,431,312

|

||||

|

Corporate costs

|

(361,942

|

)

|

(65,092

|

)

|

||||

|

Unrealized gain on translation of intercompany balance

|

101,359

|

235,424

|

||||||

|

Income from operations

|

7,110,651

|

5,601,644

|

||||||

|

Other income

|

76,108

|

53,763

|

||||||

|

Income before taxes

|

$

|

7,186,759

|

$

|

5,655,407

|

||||

The following table shows the major customer(s) (10% or more) for the three-month period ended March 31, 2015.

|

Number

|

Customer

|

Bromine

(000’s)

|

Crude Salt

(000’s)

|

Chemical Products

(000’s)

|

Total

Revenue

(000’s)

|

Percentage of

Total

Revenue (%)

|

|||||||||||||||||

| 1 |

Shandong Morui Chemical Company Limited

|

$ | 1,690 | $ | 464 | $ | 1,710 | $ | 3,864 | 11.1 | % | ||||||||||||

|

TOTAL

|

$ | 1,690 | $ | 464 | $ | 1,710 | $ | 3,864 | 11.1 | % | |||||||||||||

The following table shows the major customer(s) (10% or more) for the three-month period ended March 31, 2014.

|

Number

|

Customer

|

Bromine

(000’s)

|

Crude Salt

(000’s)

|

Chemical Products

(000’s)

|

Total

Revenue

(000’s)

|

Percentage of

Total

Revenue (%)

|

|||||||||||||||||

| 1 |

Shandong Morui Chemical Company Limited

|

$ | 1,582 | $ | 571 | $ | 1,386 | $ | 3,539 | 13.4 | % | ||||||||||||

|

TOTAL

|

$ | 1,582 | $ | 571 | $ | 1,386 | $ | 3,539 | 13.4 | % | |||||||||||||

NOTE 16 – MAJOR SUPPLIERS

During the three-month period ended March 31, 2015 and 2014, the Company purchased 57.0% and 89.8% of its raw materials from its top five suppliers, respectively. As of March 31, 2015 and 2014, amounts due to those suppliers included in accounts payable were $5,698,079 and $3,988,704, respectively. This concentration makes the Company vulnerable to a near-term severe impact, should the relationships be terminated.

NOTE 17– CUSTOMER CONCENTRATION

During the three-month periods ended March 31, 2015 and 2014, the Company sold 31.2% and 39.5% of its products to its top five customers, respectively. As of March 31, 2015 and 2014, amounts due from these customers were $19,719,116 and $19,258,917, respectively. This concentration makes the Company vulnerable to a near-term severe impact, should the relationships be terminated.

GULF RESOURCES, INC.

AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2015

(Expressed in U.S. dollars)

(UNAUDITED)

NOTE 18 – FAIR VALUE OF FINANCIAL INSTRUMENTS

The carrying values of financial instruments, which consist of cash, accounts receivable and accounts payable and other payables, approximate their fair values due to the short-term nature of these instruments. There were no unrecognized financial assets and liabilities as of March 31, 2015 and December 31, 2014.

NOTE 19 – RESEARCH AND DEVELOPMENT EXPENSES

The total research and development expenses recognized in the income statements during the three-month period ended March 31, 2015 was $48,235, of which the consumption of bromine produced by the Company amounted to $12,321. The total research and development expenses recognized in the income statements during the three-month period ended March 31, 2014 was $30,780, of which the consumption of bromine produced by the Company amounted to $8,934.

NOTE 20 – CAPITAL COMMITMENT AND OPERATING LEASE COMMITMENTS

As of March 31, 2015, the Company has leased a real property adjacent to Factory No. 1, with the related production facility, channels and ducts, other production equipment and the buildings located on the property, under capital lease. The future minimum lease payments required under capital lease, together with the present value of such payments, are included in the table show below.

The Company has leased ten pieces of land under non-cancelable operating leases, which are fixed in rentals and expired through December 2021, December 2023, December 2030, December 2031, December 2032, December 2040, February 2059, August 2059 and June 2060, respectively. The Company accounts for the leases as operating leases.

The Company has no purchase commitment as of March 31, 2015.

The following table sets forth the Company’s contractual obligations as of March 31, 2015:

|

Capital Lease Obligations

|

Operating Lease Obligations

|

Property

Management Fees

|

||||||||||

|

Payable within:

|

||||||||||||

|

the next 12 months

|

$

|

305,594

|

$

|

1,003,889

|

$

|

101,571

|

||||||

|

the next 13 to 24 months

|

305,594

|

1,025,194

|

101,571

|

|||||||||

|

the next 25 to 36 months

|

305,594

|

1,047,330

|

101,571

|

|||||||||

|

the next 37 to 48 months

|

305,594

|

1,070,651

|

-

|

|||||||||

|

the next 49 to 60 months

|

305,594

|

1,094,894

|

-

|

|||||||||

|

thereafter

|

3,361,539

|

20,422,528

|

-

|

|||||||||

|

Total

|

$

|

4,889,509

|

$

|

25,664,486

|

$

|

304,713

|

||||||

|

Less: Amount representing interest

|

(1,818,764

|

)

|

||||||||||

|

Present value of net minimum lease payments

|

$

|

3,070,745

|

||||||||||

Rental expenses related to operating leases of the Company amounted to $265,297 and $245,250, which were charged to the income statements for the three-month ended March 31, 2015 and 2014, respectively.

NOTE 21 – SUBSEQUENT EVENTS

On January 30, 2015 the Company announced that it had found natural gas resources under its bromine well in Sichuan. The Company subsequently hired a third party (a subsidiary of Sinopec) to conduct a survey of this well and confirmed the economics of the natural gas under this well. Based on the assessment report, the Company estimated that this well should produce annual revenue of $4.7 million and annual net income $2.3 million per year.

The Company intend to apply for permission to begin trial production, which is expected to commence in the third quarter of 2015. As of March 31, 2015, the Company has spent approximately $7.85 million and will spend another $2 million on this well before production commences.

After the trial production is completed, the Company intends to apply for permission to drill approximately 10 more wells. Before this permission is granted, the government will consider the trial production results as well as the capabilities and financial strength of the Company. As the Company is the first company to find natural gas in this small county area, it believes it has a strong advantage in obtaining this permission. The cost of future wells is expected to be lower than the cost of the initial well.

On April 8, 2015, the Company granted to 20 management staff options to purchase 575,000 shares of the Company’s common stock at an exercise price of $1.428 per share and the options vested immediately. The options have a four-year expiration term with expected tenor of 2 years and no dividend yield.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Cautionary Note Regarding Forward-Looking Statements

The discussion below contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act. We have used words such as “believes,” “intends,” “anticipates,” “expects” and similar expressions to identify forward-looking statements. These statements are based on information currently available to us and are subject to a number of risks and uncertainties that may cause our actual results of operations, financial condition, cash flows, performance, business prospects and opportunities and the timing of certain events to differ materially from those expressed in, or implied by, these statements. These risks, uncertainties and other factors include, without limitation, those matters discussed in Item 1A of Part I of our 2014 Form 10-K. Except as expressly required by the federal securities laws, we undertake no obligation to update such factors or to publicly announce the results of any of the forward-looking statements contained herein to reflect future events, developments, or changed circumstances, or for any other reason. The following discussion should be read in conjunction with our consolidated financial statements and notes thereto appearing in our 2014 Form 10-K and Item 1A, “Risk Factors” for the year ended December 31, 2014.

Overview

Gulf Resources conducts operations through its two wholly-owned China subsidiaries, SCHC and SYCI. Our business is also reported in these three segments, Bromine, Crude Salt, and Chemical Products.

Through SCHC, we produce and sell bromine and crude salt. We are one of the largest producers of bromine in China, as measured by production output. Elemental bromine is used to manufacture a wide variety of brominated compounds used in industry and agriculture. Bromine is commonly used in brominated flame retardants, fumigants, water purification compounds, dyes, medicines, and disinfectants.

Through SYCI, we manufacture and sell chemical products that are used in oil and gas field exploration, oil and gas distribution, oil field drilling, wastewater processing, papermaking chemical agents and inorganic chemicals.

Through SCRC, we manufacture and sell chemical products that are used for human and animal antibiotics

Our Corporate History

We were incorporated in Delaware on February 28, 1989. From November 1993 through August 2006, we were engaged in the business of owning, leasing and operating coin and debit card pay-per copy photocopy machines, fax machines, microfilm reader-printers and accessory equipment under the name “Diversifax, Inc.”. Due to the increased use of internet services, demand for our services declined sharply, and in August 2006, our Board of Directors decided to discontinue our operations.