Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CYPRESS SEMICONDUCTOR CORP /DE/ | d926287d8k.htm |

Advancing Global Leadership in Embedded

Systems

Cypress Makes Offer to Acquire ISSI

May 13, 2015

EXHIBIT 99.1 |

2

Offer Announcement

Cypress Semiconductor Corp. (“Cypress”) has made an offer to acquire

Integrated Silicon Solution, Inc. (“ISSI”) for $19.75 per share in

an all-cash transaction The Cypress offer is clearly superior to the

$19.25 per share price ISSI agreed to in its sale to the Chinese consortium

on March 12, 2015 The acquisition would:

Grow Cypress’s revenue in Embedded Systems Memories by ~$330M

Grow automotive and industrial revenue and enhance end customer

diversification Add DRAM capability to Cypress’s Memory Products

Division, which now offers NOR Flash, NAND Flash, SRAM, F-RAM, and

NVSRAM Provides a highly complementary product portfolio with significant

cross-selling opportunities Expected to be immediately accretive to

earnings Acquisition is anticipated to close Q415, subject to approval

by ISSI shareholders and

necessary regulatory approvals |

3

Strategic Rationale

Enables Cypress to better serve high growth Automotive & Industrial

sectors ~75% of ISSI revenue is in automotive and industrial, with continued

growth through focus on quality and new technologies

Extend position in

Automotive &

Industrial sectors

Highly complementary to Cypress’s embedded memory and MCU product

portfolio

ISSI

Automotive

DRAM

increases

Cypress

product

portfolio

in

high

CAGR

Automotive

Systems

including

Infotainment

and

Advance

Driver

Assistance

Drive cross-selling

of complementary

solutions

Significant

player

in

specialty

DRAM

–

Approximately

65%

of

ISSI

revenue

Specialty DRAM is a growing business with a long-term outlook

Customers demand long-term supply, high temperature grades and

automotive quality

Add increasingly

important specialty

DRAM technology

Advancing leadership in embedded systems

Embedded specialty memory portfolio with DRAM, NOR Flash, NAND Flash,

SRAM, F-RAM, and NVSRAM

Consistently builds

on Spansion

combination

strategy |

4

ISSI’s Established Presence in

Attractive Target Applications

Automotive

Advance Driver Assistance

Infotainment

Satellite Radio

Engine Control

Braking Systems

Instrument Cluster

Body Electronics

Camera Systems

Communications

Base Station

Switches

Routers

xDSL, xPON

VoIP, WLAN

Fiber Channel Storage

ISSI CY2014 Revenue: $330M

Digital Consumer

DTV / LCDTV

Set Top Boxes

Digital Cameras

Gaming / PC Peripherals

Portable Media Players

Cell Phones / Camera

HDD

Industrial

Imaging & Diagnostics

POS Terminal

Bar Code Scanning

Medical Instrumentation

Data Acquisition / PLC

Energy Meters

ISSI Fiscal Q2 2015

Revenue by Segment

1

75% of ISSI Revenue from

Automotive and Industrial

1

Source: ISSI fiscal Q2 2015 earnings call transcript

Comms

12%

Automotive

51%

Industrial

24%

Consumer

13% |

5

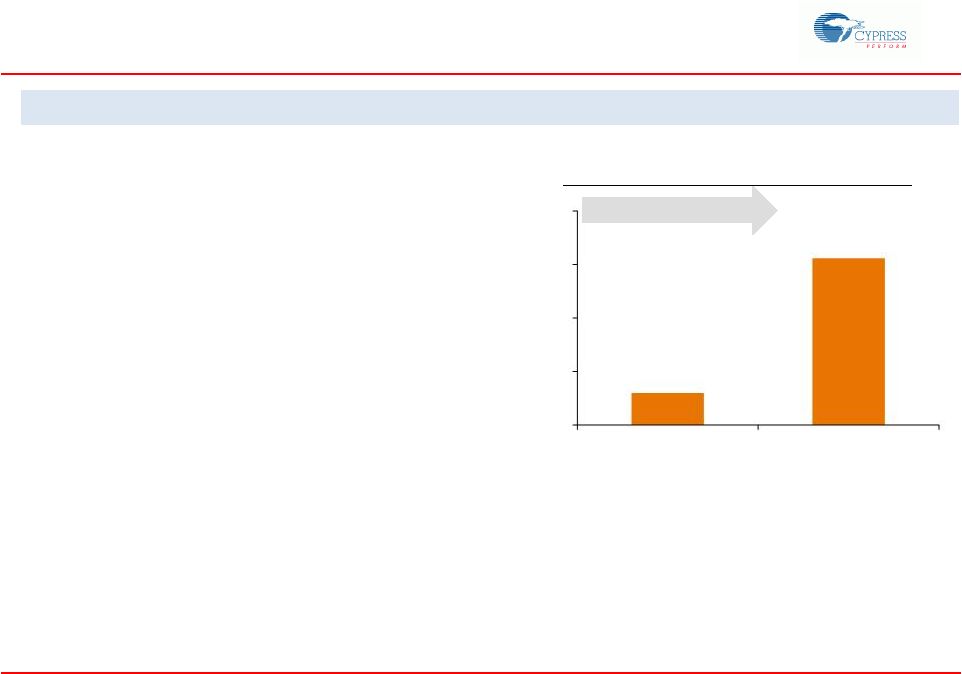

Adds Increasingly Important

Specialty DRAM Technology

ISSI is the #2 DRAM supplier to automotive customers

The acquisition adds an increasingly important technology in a rapidly growing

space ISSI

Automotive

DRAM

increases

Cypress

product

portfolio

in

high

CAGR

Automotive

Systems

$26

$155

$0

$50

$100

$150

$200

FY 2009

FY 2014

ISSI

Fiscal

Year

Automotive

Revenue

($

in

millions)

2

2009 –

2014 CAGR: 43%

Qualified Auto memory supplier since 1999

Focus on high quality and long-term support

Automotive DRAM CAGR is 12% (2014-19)

1

Automotive DRAM growing from $337M in 2014 to $654M in 2019

Automotive DRAM Growth Drivers

More intelligent Automotive Systems require more memory

Advanced Driver Assistance (ADAS)

Instrument Cluster

Heads Up Display (HUD)

Infotainment

Safety

Advanced functionality requires higher performance memories: DDR2, DDR3,

LPDDR2 1

Source: Strategy Analytics

2

Source: ISSI Management Presentation |

6

Extends Position in Industrial Market

Industrial: 24% of ISSI Q1 2015 Revenue

2009 –

2014 CAGR: 39%

Strong Industrial memory supplier

Focus on high quality and long-term product support

Supply Automotive-quality memories into industrial market

Industrial Growth Drivers

Increases in efficiency requires greater electronics content to

Medical and industrial products are becoming more intelligent,

ISSI

Fiscal

Year

Industrial

Revenue

($

in

millions)

Source: ISSI fiscal Q2 2015 earnings call transcript, ISSI Investor Presentation

(March 2015) ISSI increases Cypress product portfolio in the Industrial

Market $0

$25

$50

$75

$100

FY 2009

FY 2014

produce clean energy

requiring more processing and memory |

7

The Leader in Memories for

Embedded Systems

New Cypress = New leader in memories for embedded systems

Cypress was the worldwide leader in SRAMs and nonvolatile RAMs

Spansion was the leader in NOR flash

New Cypress + ISSI has all the memory types in a typical embedded system

NAND Flash to store and retrieve system data

NOR Flash to store the retrieve the program for the CPU

SRAM to buffer data and feed the CPU at full speed

DRAM to buffer data and/or execute the program

F-RAM and NVSRAM to log & protect the most critical data

Automotive Electronics

Industrial Control

Networking and Storage

NOR

Flash

SRAM

Output

DRAM

Memory

NAND

Flash

Storage

MCU

Cypress is a one-stop shop for the high-performance, specialized memories

used in embedded systems Spansion

Cypress

ISSI

F-RAM

NVSRAM

Communication

Interfaces

Input |

8

Cypress & ISSI Summary

Enhances position and growth potential in embedded systems

Consistently builds on Spansion combination strategy

Embedded specialty memory portfolio with DRAM, NOR Flash, NAND Flash, SRAM,

F-RAM, and NVSRAM

Immediately adds strong capability in DRAM for automotive, industrial and other

embedded applications

Automotive

DRAM

adds

to

Cypress

strong

product

portfolio

in

high

CAGR

Automotive

Systems

Highly complementary product portfolios with cross-selling opportunities

Expected to be immediately accretive to earnings

Acquisition

is

anticipated

to

close

Q415,

subject

to

approval

by

ISSI

shareholders

and

necessary

regulatory approvals |

| 9

Forward-Looking Statements

In preparing this presentation, we, Cypress Semiconductor Corporation (“Cypress”), have used

information regarding Integrated Silicon Solution, Inc. (“ISSI”) obtained from

publicly available information, including reports and other documents filed or furnished by ISSI with the Securities and Exchange Commission

(“SEC”) and from other third party materials, including industry data. We have not

independently verified such information and do not make any representation or warranty as to the

accuracy or completeness thereof. This presentation contains “forward-looking” statements and information about our current

and future prospects and our operations and financial results, which are based on currently

available information. These forward-looking statements include, but are not limited to, statements about our offer to acquire ISSI; statements

about future financial and operating results; benefits of the proposed transaction to customers,

stockholders and employees; potential synergies and cost savings; the ability of the combined

company to drive growth and expand customer and partner relationships; the anticipated timing for closing of the proposed transaction;

that the proposed transaction is expected to be accretive to earnings per share and other statements

regarding the proposed transaction. Risks and uncertainties that may affect our business or

future financial results include, among others, risks associated with the economy; conditions in the overall semiconductor market;

acceptance and demand for our products; technological and development risks; legal and regulatory

matters and other competitive factors. Risks and uncertainties related to the proposed

transaction include, among others, the ultimate outcome of any possible transaction between Cypress and ISSI, including the possibilities

that Cypress will not pursue a transaction with ISSI and that ISSI will reject a transaction with

Cypress; the risk that if ISSI’s board of directors agrees to negotiate a definitive

acquisition agreement with Cypress and Cypress and ISSI enter into a definitive agreement with respect to the proposed transaction, that ISSI’s

stockholders do not approve the proposed transaction; potential adverse reactions or changes to

business relationships resulting from the announcement or completion of the proposed

transaction; uncertainties as to the timing of the proposed transaction; competitive responses to the proposed transaction; the risk that

regulatory or other approvals required for the proposed transaction are not obtained or are obtained

subject to conditions that are not anticipated; the risk that other conditions to the closing

of the proposed transaction are not satisfied; costs and difficulties related to the closing of the proposed transaction and the

integration of ISSI’s businesses and operations with Cypress’ businesses and operations; the

inability to obtain or delays in obtaining anticipated cost savings and synergies from the

proposed transaction; unexpected costs, charges or expenses resulting from the proposed transaction; litigation relating to the proposed

transaction; the inability to retain key personnel, customers and suppliers; and any changes in

general economic and/or industry specific conditions. Additional factors that could cause

future results or events to differ from those expected are those risks discussed under Item 1A. “Risk Factors,” in Cypress’ Annual Report

on Form 10-K for the fiscal year ended December 28, 2014, Cypress’ Quarterly Report on Form

10-Q for the quarter ended March 29, 2015, ISSI’s Annual Report on Form 10-K, as

amended, for the fiscal year ended September 30, 2014, ISSI’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2014, ISSI’s

Quarterly Report on Form 10-Q for the quarter ended March 31, 2015 and other reports filed by

Cypress and ISSI with the SEC. Please read the “Risk Factors” and other cautionary

statements contained in these filings. We undertake no obligation to update or revise any forward-looking statements, whether as a result of

new information, the occurrence of certain events or otherwise. As a result of these risks and others,

actual results could vary significantly from those anticipated in this presentation, and our

financial condition and results of operations could be materially adversely affected. No Offer or Solicitation

This communication does not constitute an offer to buy any securities or a solicitation of any vote or

other approval with respect to any proposed transaction. |

10 |