Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Coca-Cola Consolidated, Inc. | d925528d8k.htm |

| EX-99.2 - EX-99.2 - Coca-Cola Consolidated, Inc. | d925528dex992.htm |

Exhibit 99.1

COCA-COLA PLAZA

ATLANTA, GEORGIA

| J. ALEXANDER M. DOUGLAS, JR. PRESIDENT, COCA-COLA NORTH AMERICA |

P. O. BOX 1734 ATLANTA, GA 30301

404 676-4421 FAX 404-598-4421 |

May 12, 2015

J. Frank Harrison III

Chairman and Chief Executive Officer

Coca-Cola Bottling Co. Consolidated

4100 Coca-Cola Plaza

Charlotte, NC 28211

Dear Frank:

Congratulations on your company’s successful completion of Lead Market territory transactions. During 2014 and the first half of 2015, we made great strides together in implementing the 21st century beverage model for sustained competitive advantage for our respective companies. We look forward to working closely with you and your team to continue our successful collaboration and joint work to date. It goes without saying that we very much appreciate the invaluable System leadership demonstrated by you and your company throughout this process.

During recent alignment sessions we have discussed the continued refinement and implementation of the new operating model in depth, and we believe that we are poised for continued success in 2015 and beyond. To that end, this letter (this “Letter of Intent”) sets forth the general terms and conditions pursuant to which Coca-Cola Refreshments USA, Inc. (“CCR”), a wholly owned subsidiary of The Coca-Cola Company (“TCCC”), or one of its affiliates, will grant certain exclusive territory rights and sell certain assets to Coca-Cola Bottling Co. Consolidated (“Bottler”) in connection with the contemplated transactions with respect to certain additional geographic territories (the “Sub-Bottling Territory Transactions”), as further described below:

1. Grant of Exclusive Territory Rights for TCCC Beverages & Comprehensive Beverage Agreement. CCR will grant Bottler certain exclusive rights for the distribution, promotion, marketing and sale of TCCC-owned and -licensed beverage products in the geographic area described in Exhibit A (the “Next Phase Territory”) and Exhibit B (the “Subsequent Phase Territory”). Such rights will be granted in the Next Phase Territory initially via a Comprehensive Beverage Agreement (the “Lead Market CBA”) among TCCC, CCR and Bottler in the form currently in effect in the Lead Market Territories (as used herein, the term “Lead Market Territories” refers to the exclusive distribution territories that were transferred/granted to Bottler by CCR during 2014 and the first half of 2015). Such rights will be granted in the Subsequent Phase Territory via the final form of CBA (the “CBA”) pursuant to

the process described in Section 11 below. The Next Phase Territory and the Subsequent Phase Territory are collectively referred to herein as the “Sub-Bottling Territory.” The grant of exclusive territory rights for the Sub-Bottling Territory will not include the right to produce the Covered Beverages or the Related Products (as those terms are defined in the Lead Market CBA).

2. Sale of Exclusive Territory Rights for Certain Cross-Licensed Brands. CCR will also sell, transfer and assign to Bottler certain exclusive territory rights for the distribution, promotion, marketing and sale in the Sub-Bottling Territory of the cross-licensed brands (if any) then distributed by CCR in the Sub-Bottling Territory (the “Cross-Licensed Brands”). Such sale, transfer and assignment will be via such agreements as are mutually agreed by the parties, including the Definitive Agreement (as defined below), and will be subject to the consent of third party brand owners.

3. Sale of Distribution Assets and Working Capital. In connection with the grant of the exclusive territory rights referred to in the two preceding sections, CCR will sell, transfer and assign to Bottler certain distribution assets and the working capital associated therewith, all as may be necessary to distribute, promote, market and sell the Covered Beverages, Related Products and Cross-Licensed Brands in the Sub-Bottling Territory and as will be more particularly described in the Definitive Agreement.

4. Product Supply Arrangements. The parties are currently discussing a mutually agreeable Finished Goods Supply Agreement (“FGSA”) to take effect in the Sub-Bottling Territory as of the date of the Closing of the Sub-Bottling Territory Transactions. They anticipate that such arrangement will be generally consistent with their existing product supply arrangements, with such enhancements and refinements as are mutually agreed by the parties (including, without limitation, the implementation of a national product supply system with such provisions regarding asset ownership, management provisions and System governance mechanisms as the parties may mutually agree).

5. Execution of Lead Market CBA and FGSA for Territory. As part of the transactions described in this Letter of Intent, the parties will execute the Lead Market CBA to govern initially the distribution, promotion, marketing and sale of TCCC-owned and -licensed beverage products in the Next Phase Territory, and will execute the CBA to govern such activity in the Subsequent Phase Territory. In addition, Bottler will execute a FGSA for the Sub-Bottling Territory. Although the Lead Market CBA and CBA do not authorize Bottler to produce the Covered Beverages or the Related Products in the Sub-Bottling Territory, the parties anticipate that if the parties mutually agree that Bottler should produce the Covered Beverages or the Related Products in the Sub-Bottling Territory, applicable production rights would be granted under a mutually satisfactory Manufacturing Agreement.

6. Implementation of CONA and Anticipated Formation of New IT Services Entity. As part of the Sub-Bottling Territory Transactions, Bottler and CCR intend to implement the CONA information technology platform throughout Bottler’s distribution territories for Coca-Cola products (i.e., all of Bottler’s geographic territories in the United States other than the Lead Market Territory and the Sub-Bottling Territory (the “Legacy Territory”), as well as the Lead Market Territory and the Sub-Bottling Territory). The parties anticipate that Bottler’s

implementation of CONA will be consistent with their ongoing discussions on this topic and will include Bottler’s participation in and part ownership of a new IT services entity (“NewCo”). The parties anticipate that NewCo will provide IT services to Bottler, CCR and its other bottler owners/members on mutually acceptable terms, which terms are consistent with their discussions to date.

7. Participation in System Governance Activities. As part of the Sub-Bottling Territory Transactions, Bottler and CCR/TCCC intend to implement binding System governance with effect throughout all of Bottler’s distribution territories for Coca-Cola products, to become fully effective during 2016. The parties anticipate that their implementation of System governance will be consistent with their ongoing discussions on this topic, and will include a detailed joint plan for transitioning from current System governance routines and mechanisms to future System governance routines and mechanisms.

8. Economic Participation. As part of the Sub-Bottling Territory Transactions, Bottler, CCR and TCCC intend to engage in good faith discussions to document the process pursuant to which TCCC will make commercially reasonable offer(s) for Bottler to be provided opportunities to participate economically in (a) the U.S. existing non-DSD businesses, and (b) future non-DSD products and/or business models. The parties are committed to continuing their good faith discussions on this topic.

9. Definitive Agreement. The transactions described in this Letter of Intent will be subject to the terms of a definitive purchase and sale agreement(s) (whether one or more, the “Definitive Agreement”) in a form that is substantially the same as for the Lead Market definitive agreements. The parties anticipate that they will attach to and reference in the Definitive Agreement (i) the form of FGSA to apply to all Sub-Bottling Territory, (ii) the form of Lead Market CBA to apply to the Next Phase Territory, and (iii) the form of the CBA to apply to the Subsequent Phase Territory. For ease of transition and to manage resources effectively, the parties may mutually agree in the Definitive Agreement to implement the Sub-Bottling Territory Transactions via a series of separate closings and transitions.

10. Economic Consideration for Sub-Bottling Territory Transactions. In exchange for the grant of exclusive territory rights for the Covered Beverages and Related Products, the sale of distribution rights for the Cross-Licensed Brands, and the sale of the distribution assets and working capital as described above, Bottler will pay to CCR: (a) a cash amount that reflects (i) the agreed value of the exclusive territory rights for certain of the Cross-Licensed Brands (including the distribution assets and working capital applicable thereto), and (ii) the net book value of the other distribution assets and working capital, which amount will be payable to CCR at the closing of the Sub-Bottling Territory Transactions (the “Closing”); and (b) sub-bottling payments for the grant of exclusive rights for the distribution, promotion, marketing and sale of Covered Beverages and Related Products in the Sub-Bottling Territory, which payments will be made to CCR on a regular basis after the Closing. The calculation of such amounts to be paid, and any adjustments to those amounts, will be determined in the same manner as in the Lead Market transaction. Economic consideration hereunder may also include the like-kind value of exchanged or “swapped” territory, as mutually agreed by the parties.

11. Implementation of Final Form of Comprehensive Beverage Agreement. The parties are currently engaged in good faith negotiations regarding a final form of CBA to take effect in the future under certain circumstances throughout Bottler’s Legacy Territory, Lead Market Territories and the Sub-Bottling Territories. The parties are committed to continuing such negotiations in good faith and to completing the mutually agreed form of the CBA on or before the execution of the Definitive Agreement for the Next Phase Territory transaction. The parties will document separately their mutual agreement regarding the process, timing and other terms and conditions related to implementation of the CBA throughout Bottler’s territories in a legally binding agreement. This separate agreement will be executed by the parties as soon as is practicable, but in any event no later than their execution of the Definitive Agreement for the Next Phase Territory transaction.

12. Conditions to Closing. Each of TCCC and Bottler intend for conditions substantially the same as for the Lead Market definitive agreements, and for the following express conditions, to be satisfied prior to the Closing and/or to be addressed in the Definitive Agreement for the Next Phase Territory transaction and/or the Subsequent Phase Territory transaction:

(a) in the case of each of the Next Phase Territory transaction and the Subsequent Phase Territory transaction:

| (i) | the parties will engage in such pre-Closing activities related to governance, product supply, information technology and shared services as they deem to be necessary and appropriate prior to the Closing, including, without limitation, the negotiation, execution and delivery to each party’s reasonable satisfaction of any agreements or other documents as may be required to operate the Sub-Bottling Territory as of and after the Closing; |

| (ii) | the parties will have entered into detailed written agreement(s) establishing the Product Supply Arrangements described in Section 4 of this Letter of Intent; and |

| (iii) | the parties will have performed and complied with such other terms and conditions as are customary for transactions of this nature and complexity and as will be more fully set forth in the Definitive Agreement, including, without limitation, the grant, assignment and/or transfer of such bottling agreements, licenses and other agreements as may be necessary to operate the business in the Sub-Bottling Territory in the manner in which it is operated as of the Closing, the securing of applicable government clearances and/or approvals, if applicable, etc. |

(b) in the case of the Next Phase Territory transaction, the parties will have executed:

| (i) | the Lead Market CBA applicable to the Next Phase Territory, as described above; and |

| (ii) | a legally binding agreement setting forth the circumstances and terms and conditions under which the CBA will replace and supersede (a) the Lead Market CBA with respect to the Lead Market Territories and Next Phase Territory and (b) all of the bottling and distribution agreements with respect to Covered Beverages and Related Products (and other agreements expressly identified in applicable Exhibits to the CBA) previously issued by TCCC for Bottler’s Legacy Territory; |

(c) in the case of the Subsequent Phase Territory transactions, the parties will have executed the CBA that will be applicable, subject to the terms and conditions of the agreement described in Section 12(b)(ii) above, to all of the Bottler’s territories (the Legacy Territory, the Lead Market Territory, and the Sub-Bottling Territory).

13. Anticipated Schedule. The parties anticipate that, shortly after their execution of this Letter of Intent, there may be a joint public announcement by the parties of the transactions contemplated herein and, subject to applicable regulatory requirements, detailed due diligence and joint integration planning and change management activities will then begin. The parties further anticipate that the Definitive Agreement and other formal legal agreements for the Next Phase Territory transaction will be executed on or before July 15, 2015. Finally, the parties anticipate the Closing (and/or Closings) pursuant to the Definitive Agreement will occur beginning in fall 2015. Notwithstanding the foregoing, the parties acknowledge and agree that the before mentioned dates are estimates only, and are subject to change based on the parties’ discussions, changing business conditions, and other matters.

14. Board Approvals. This Letter of Intent is subject to the approval processes of the respective parties, including approval of each of their Boards of Directors.

15. Transition Planning Period and Activities. The parties anticipate that, in order to ensure a smooth transition of the business in the Sub-Bottling Territory to Bottler and subject to applicable regulatory requirements, beginning on the date of execution of this Letter of Intent and continuing until the earlier of the termination of this Letter of Intent, execution of the Definitive Agreement, or the Closing (as applicable), subject to any restrictions under applicable law, they will engage in a number of joint integration planning and change management activities.

16. Due Diligence; Pre-Closing Activities. The parties anticipate that prior to execution of the Definitive Agreement and continuing until Closing, Bottler will perform such due diligence on the business and operations in the Sub-Bottling Territory as is customary for a transaction of this nature and complexity including, without limitation, in the areas of finance, operations, environmental, legal, tax, and employment, and CCR will provide reasonable and customary access in this regard.

17. Expenses. Except as otherwise expressly agreed by the parties, each party will bear its own fees and expenses incurred in connection with the transactions contemplated by this Letter of Intent, including with respect to any due diligence, negotiation, preparation of documentation, the Closing and legal, accounting, consulting, travel and other similar fees or expenses, whether or not a Definitive Agreement is reached.

18. Termination. This Letter of Intent may be terminated: (a) by mutual written consent of CCR and Bottler; or (b) upon written notice by CCR or Bottler to the other party if the Definitive Agreement has not been executed on or prior to December 31, 2015.

19. Non-Binding. This Letter of Intent expresses the present intent of the parties to enter into a Definitive Agreement and supporting operating agreements based on the principal terms and conditions set forth herein. Notwithstanding anything to the contrary contained herein, this Letter of Intent shall not be binding on the parties hereto except as to the captioned sections “Expenses”, “Termination”, “Non-Binding”, “Assignment”, “Amendment; Modification; Waiver”, “Counterparts”, “Confidentiality” and “Governing Law”, which shall be binding and expressly survive any termination hereof.

20. Assignment. This Letter of Intent and the rights and obligations set forth herein shall not be assignable by any party hereto without the prior written consent of the other party hereto. Subject to the preceding sentence, the binding provisions of this Letter of Intent (as noted in the “Non-Binding” section above) shall be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns.

21. Amendment; Modification; Waiver. This Letter of Intent may not be amended or terminated or any provision hereof waived or modified except by an instrument in writing signed by each of the parties hereto.

22. Counterparts. This Letter of Intent may be executed in counterparts, each of which shall be an original and all of which, when taken together, shall constitute one agreement, and delivery of an executed signature page by facsimile transmission or other electronic transmission shall be effective as delivery of a manually executed counterpart.

23. Confidentiality. This Letter of Intent is strictly confidential and is covered by the parties’ Confidentiality Agreement – Bottler Discussions relating to System Operational Design Project. Neither this Letter of Intent nor any of its contents may be disclosed by CCR or Bottler or any of their respective directors, officers, employees, agents, advisors or representatives, except as permitted in such agreement, and each of the parties will cause such persons not to make any such disclosure.

24. Governing Law. This Letter of Intent will be governed by the laws of the State of Georgia.

Frank, we appreciate your team’s efforts and dedication in our System of the Future work to date. We look forward to continuing to work closely with your team to finalize the Definitive Agreement, close this transaction and move forward with our joint work.

Please acknowledge your acceptance of the terms and conditions of this Letter of Intent by signing where indicated below and returning it to us.

| Very truly yours,

/s/ J. Alexander M. Douglas, Jr. |

| Agreed to and Accepted | ||||

| as of the date first written above: | ||||

| COCA-COLA BOTTLING CO. CONSOLIDATED | ||||

| By: | /s/ J. Frank Harrison III | |||

| Name: | J. Frank Harrison III | |||

| Title: | Chairman and Chief Executive Officer | |||

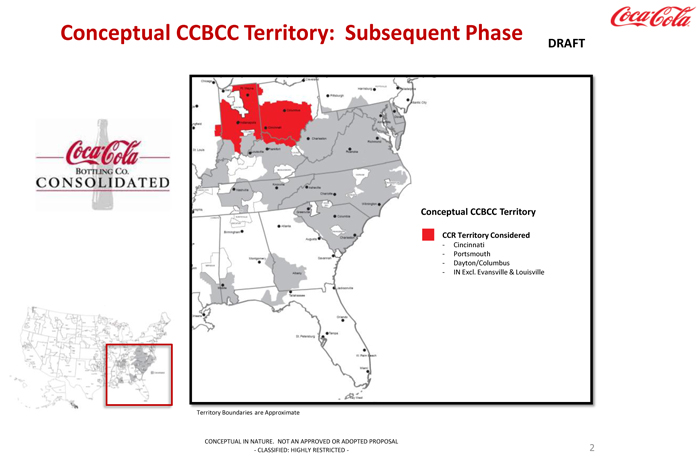

Exhibit A

Next Phase Territory

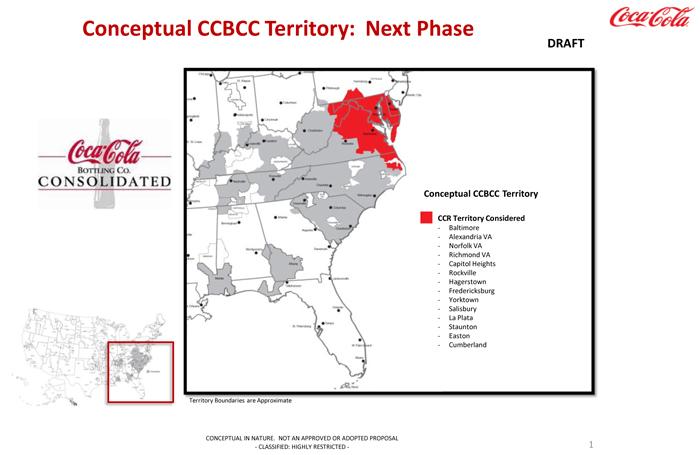

Exhibit B

Subsequent Phase Territory