Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

FORM 10-Q

———————

|

þ

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

|

|

ACT OF 1934

|

|

|

For the quarterly period ended March 31, 2015

|

|

|

Or

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

|

|

ACT OF 1934

|

|

|

For the transition period from: _____________ to _____________

|

|

———————

|

|

TRIBUTE PHARMACEUTICALS CANADA INC.

|

(Exact name of small business issuer as specified in its charter)

———————

|

ONTARIO, CANADA

|

0-31198

|

N/A

|

|

(State or Other Jurisdiction

|

(Commission

|

(I.R.S. Employer

|

|

of Incorporation)

|

File Number)

|

Identification No.)

|

151 Steeles Avenue, East Street, Milton, Ontario, Canada L9T 1Y1

(Address of Principal Executive Office) (Zip Code)

|

(519) 434-1540

|

(Issuer’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

———————

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller Reporting Company þ

|

|

(Do not check if a smaller reporting company)

|

|||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

|

The number of outstanding common shares, no par value, of the Registrant at: March 31, 2015: 99,907,488

|

TABLE OF CONTENTS

|

PART I – CONDENSED INTERIM FINANCIAL STATEMENTS

|

|

Item 1.

|

Unaudited Condensed Interim Financial Statements

|

|

|

(A)

|

|

Condensed Interim Balance Sheets

|

3

|

|

(B)

|

|

Condensed Interim Statements of Operations, Comprehensive Loss and Deficit

|

4

|

|

(C)

|

|

Condensed Interim Statements of Cash Flows

|

5

|

|

(D)

|

|

Notes to the Condensed Interim Financial Statements

|

6

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Conditions and Results of Operations

|

17

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

22

|

|

Item 4.

|

Evaluation of Disclosure Controls and Procedures

|

22

|

|

PART II – OTHER INFORMATION

|

|

Item 1.

|

Legal Proceedings

|

22

|

|

Item 1a.

|

Risk Factors

|

22

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

23

|

|

Item 3.

|

Defaults Upon Senior Securities

|

23

|

|

Item 4.

|

Mine Safety Disclosures

|

23

|

|

Item 5.

|

Other Information

|

23

|

|

Item 6.

|

Exhibits

|

23

|

2

TRIBUTE PHARMACEUTICALS CANADA INC.

CONDENSED INTERIM BALANCE SHEETS

(Expressed in Canadian dollars)

(Unaudited)

|

As at

March 31,

2015

|

As at

December 31,

2014

|

|||||||

|

ASSETS

|

||||||||

|

Current

|

||||||||

|

Cash and cash equivalents

|

$ | 5,550,766 | $ | 3,505,791 | ||||

|

Accounts receivable, net of allowance of $nil (December 31, 2014 - $nil)

(Note 16 d)

|

3,124,207 | 2,145,319 | ||||||

|

Inventories (Note 2)

|

1,193,968 | 1,037,387 | ||||||

|

Taxes recoverable

|

119,062 | 130,623 | ||||||

|

Loan receivable

|

15,814 | 15,814 | ||||||

|

Prepaid expenses and other receivables (Note 3)

|

227,722 | 187,279 | ||||||

|

Current portion of debt issuance costs, net (Note 6)

|

139,758 | 128,134 | ||||||

|

Other current asset (Note 17)

|

43,400 | - | ||||||

|

Total current assets

|

10,414,697 | 7,150,347 | ||||||

|

Property, plant and equipment, net (Note 4)

|

978,956 | 1,012,285 | ||||||

|

Intangible assets, net (Note 5)

|

40,464,367 | 40,958,870 | ||||||

|

Goodwill

|

3,599,077 | 3,599,077 | ||||||

|

Debt issuance costs, net (Note 6)

|

366,404 | 359,161 | ||||||

|

Total assets

|

$ | 55,823,501 | $ | 53,079,740 | ||||

|

LIABILITIES

|

||||||||

|

Current

|

||||||||

|

Accounts payable and accrued liabilities

|

$ | 4,287,067 | $ | 4,344,606 | ||||

|

Current portion of long term debt (Note 6)

|

1,525,656 | 1,319,030 | ||||||

|

Warrant liability (Note 7 c)

|

5,359,374 | 3,107,880 | ||||||

|

Total current liabilities

|

11,172,097 | 8,771,516 | ||||||

|

Long term debt (Note 6)

|

15,260,858 | 13,967,493 | ||||||

|

Total liabilities

|

26,432,955 | 22,739,009 | ||||||

|

Contingencies and commitments (Notes 6 and 10)

|

||||||||

|

SHAREHOLDERS’ EQUITY

|

||||||||

|

Capital Stock

|

||||||||

|

AUTHORIZED

|

||||||||

|

Unlimited Non-voting, convertible redeemable and retractable preferred shares with no par value

|

||||||||

|

Unlimited Common shares with no par value

|

||||||||

| ISSUED (Note 7 a) | ||||||||

| Common shares 99,907,488 (December 31, 2014 – 94,476,238) | 45,022,189 | 41,182,630 | ||||||

| Additional paid-in capital options (Note 7 b) | 3,061,924 | 2,713,605 | ||||||

|

Warrants (Note 7 c)

|

6,347,349 | 6,347,349 | ||||||

|

Accumulated other comprehensive income (Note 17)

|

43,400 | - | ||||||

|

Deficit

|

(25,084,316 | ) | (19,902,853 | ) | ||||

|

Total shareholders’ equity

|

29,390,546 | 30,340,731 | ||||||

|

Total liabilities and shareholders’ equity

|

$ | 55,823,501 | $ | 53,079,740 | ||||

See accompanying notes to the condensed interim financial statements.

3

TRIBUTE PHARMACEUTICALS CANADA INC.

CONDENSED INTERIM STATEMENTS OF OPERATIONS,

COMPREHENSIVE LOSS AND DEFICIT

(Expressed in Canadian dollars)

(Unaudited)

|

For the Three Month Periods

Ended March 31

|

||||||||

|

2015

|

2014

|

|||||||

|

Revenues

|

||||||||

|

Licensed domestic product net sales

|

$ | 2,521,080 | $ | 2,276,383 | ||||

|

Other domestic product sales

|

2,601,622 | 734,779 | ||||||

|

International product sales

|

469,595 | 463,978 | ||||||

|

Royalty and licensing revenues

|

- | 18,414 | ||||||

|

Total revenues (Notes 11 and 14)

|

5,592,297 | 3,493,554 | ||||||

|

Cost of Sales

|

||||||||

|

Licensor sales and distribution fees

|

1,452,064 | 1,413,043 | ||||||

|

Cost of products sold

|

575,246 | 345,864 | ||||||

|

Total Cost of Sales

|

2,027,310 | 1,758,907 | ||||||

|

Gross Profit

|

3,564,987 | 1,734,647 | ||||||

|

Expenses

|

||||||||

|

Selling, general and administrative (Notes 7 b, 12 and 15)

|

3,325,922 | 3,222,661 | ||||||

|

Amortization of assets

|

621,623 | 290,352 | ||||||

|

Total operating expenses

|

3,947,545 | 3,513,013 | ||||||

|

Loss from operations

|

(382,558 | ) | (1,778,366 | ) | ||||

|

Non-operating income (expenses)

|

||||||||

|

Gain on derivative instrument (Note 17)

|

- | 200,000 | ||||||

|

Change in warrant liability (Notes 7 c and 16 b)

|

(2,695,600 | ) | (1,411,774 | ) | ||||

|

Unrealized foreign currency exchange on debt (Note 17)

|

(1,433,456 | ) | - | |||||

|

Accretion expense (Note 6)

|

(73,999 | ) | (31,118 | ) | ||||

|

Interest income

|

125 | 372 | ||||||

|

Interest expense

|

(595,975 | ) | (267,292 | ) | ||||

|

Net loss for the period

|

$ | (5,181,463 | ) | $ | (3,288,178 | ) | ||

|

Unrealized gain loss on derivative instrument, net of tax (Note 17)

|

43,400 | (103,488 | ) | |||||

|

Net loss and comprehensive (loss) for the period

|

$ | (5,138,063 | ) | $ | (3,391,666 | ) | ||

|

Deficit, beginning of period

|

(19,902,853 | ) | (14,295,911 | ) | ||||

|

Deficit, end of period

|

$ | (25,084,316 | ) | $ | (17,584,089 | ) | ||

|

Loss per share (Note 8) – Basic and diluted

|

$ | (0.05 | ) | $ | (0.06 | ) | ||

|

Weighted Average Number of Common Shares – Basic

|

96,685,405 | 51,420,127 | ||||||

|

Weighted Average Number of Common Shares - Diluted

|

96,685,405 | 51,420,127 | ||||||

See accompanying notes to the condensed interim financial statements.

4

TRIBUTE PHARMACEUTICALS CANADA INC.

CONDENSED INTERIM STATEMENTS OF CASH FLOWS

(Expressed in Canadian dollars)

(Unaudited)

For the Periods Ended March 31,

|

For Three Month Periods Ended

|

||||||||

|

2015

|

2014

|

|||||||

|

Cash flows from (used in) operating activities

|

||||||||

|

Net loss

|

$ | (5,181,463 | ) | $ | (3,288,178 | ) | ||

|

Items not affecting cash:

|

||||||||

|

Amortization

|

644,458 | 295,128 | ||||||

|

Changes in warrant liability (Note 7 c)

|

2,695,600 | 1,411,774 | ||||||

|

Stock-based compensation (Note 7 b)

|

348,320 | 117,133 | ||||||

|

Accretion expense

|

73,999 | 31,118 | ||||||

|

Paid-in common shares for services

|

- | 211,812 | ||||||

|

Change in non-cash operating assets and liabilities (Note 9)

|

(1,221,890 | ) | (796,497 | ) | ||||

|

Cash flows (used in) operating activities

|

(2,640,976 | ) | (2,017,710 | ) | ||||

|

Cash flows from (used in) investing activities

|

||||||||

|

Additions to property, plant and equipment

|

(4,972 | ) | (4,353 | ) | ||||

|

Increase in patents and licensing agreements

|

(85,210 | ) | (16,593 | ) | ||||

|

Cash flows (used in) investing activities

|

(90,182 | ) | (20,946 | ) | ||||

|

Cash flows from (used in) financing activities

|

||||||||

|

Financing costs deferred

|

- | (128,181 | ) | |||||

|

Long term debt issued (Note 6)

|

- | 2,211,000 | ||||||

|

Common shares issued (Note 7 a)

|

3,395,453 | - | ||||||

|

Cash flows from financing activities

|

3,395,453 | 2,082,819 | ||||||

|

Changes in cash and cash equivalents

|

664,295 | 44,163 | ||||||

|

Change in cash and cash equivalents due to changes in foreign exchange

|

1,380,680 | 215,706 | ||||||

|

Cash and cash equivalents, beginning of period

|

3,505,791 | 2,813,472 | ||||||

|

Cash and cash equivalents, end of period

|

$ | 5,550,766 | $ | 3,073,341 | ||||

See accompanying notes to the condensed interim financial statements.

5

TRIBUTE PHARMACEUTICALS CANADA INC.

NOTES TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

(Expressed in Canadian dollars)

(Unaudited)

|

1.

|

Basis of Presentation

|

These unaudited condensed interim financial statements should be read in conjunction with the annual financial statements for Tribute Pharmaceuticals Canada Inc.’s ("Tribute" or the "Company") most recently completed fiscal year ended December 31, 2014. These unaudited condensed interim financial statements do not include all disclosures required in annual financial statements, but rather are prepared in accordance with recommendations for interim financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). These unaudited condensed interim financial statements have been prepared using the same accounting policies and methods as those used by the Company in the annual audited financial statements for the year ended December 31, 2014, except when disclosed below.

The unaudited condensed interim financial statements contain all adjustments (consisting of only normal recurring adjustments) which are necessary to present fairly the financial position of the Company as at March 31, 2015, and the results of its operations for the three month periods ended March 31, 2015 and 2014 and its cash flows for the three month periods ended March 31, 2015 and 2014. Note disclosures have been presented for material updates to the information previously reported in the annual audited financial statements.

|

|

a)

|

Estimates

|

The preparation of these financial statements has required management to make estimates and assumptions that affect the amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of the revenues and expenses during the reporting period. On an ongoing basis, the Company evaluates its estimates, including those related to provision for doubtful accounts, accrued liabilities, income taxes, stock based compensation, revenue recognition, intangible assets and derivative financial instruments. The Company bases its estimates on historical experiences and on various other assumptions believed to be reasonable under the circumstances. Actual results could differ from those estimates. As adjustments become necessary, they are reported in earnings in the period in which they become known.

|

2.

|

Inventories

|

|

March 31,

2015

|

December 31,

2014

|

|||||||

|

Raw materials

|

$ | 322,450 | $ | 290,197 | ||||

|

Finished goods

|

450,736 | 399,830 | ||||||

|

Packaging materials

|

74,557 | 70,870 | ||||||

|

Work in process

|

346,225 | 276,490 | ||||||

| $ | 1,193,968 | $ | 1,037,387 | |||||

|

3.

|

Prepaid Expenses and Other Receivables

|

|

March 31,

2015

|

December 31,

2014

|

|||||||

|

Prepaid operating expenses

|

$ | 220,747 | $ | 180,304 | ||||

|

Interest receivable on loan receivables

|

6,975 | 6,975 | ||||||

| $ | 227,722 | $ | 187,279 | |||||

6

|

4.

|

Property, Plant and Equipment

|

|

March 31, 2015

|

||||||||||||

|

Cost

|

Accumulated

Amortization

|

Net Carrying

Amount

|

||||||||||

|

Land

|

$ | 90,000 | $ | - | $ | 90,000 | ||||||

|

Building

|

618,254 | 308,526 | 309,728 | |||||||||

|

Leasehold improvements

|

10,359 | 5,180 | 5,179 | |||||||||

|

Office equipment

|

61,308 | 53,024 | 8,284 | |||||||||

|

Manufacturing equipment

|

1,103,524 | 623,971 | 479,553 | |||||||||

|

Warehouse equipment

|

17,085 | 17,085 | - | |||||||||

|

Packaging equipment

|

111,270 | 66,319 | 44,951 | |||||||||

|

Computer equipment

|

147,844 | 106,583 | 41,261 | |||||||||

| $ | 2,159,644 | $ | 1,180,688 | $ | 978,956 | |||||||

|

December 31, 2014

|

||||||||||||

|

Cost

|

Accumulated

Amortization

|

Net Carrying

Amount

|

||||||||||

|

Land

|

$ | 90,000 | $ | - | $ | 90,000 | ||||||

|

Building

|

618,254 | 300,798 | 317,456 | |||||||||

|

Leasehold improvements

|

10,359 | 4,662 | 5,697 | |||||||||

|

Office equipment

|

61,308 | 52,124 | 9,184 | |||||||||

|

Manufacturing equipment

|

1,103,525 | 602,667 | 500,858 | |||||||||

|

Warehouse equipment

|

17,085 | 17,085 | - | |||||||||

|

Packaging equipment

|

111,270 | 62,744 | 48,526 | |||||||||

|

Computer equipment

|

142,873 | 102,309 | 40,564 | |||||||||

| $ | 2,154,674 | $ | 1,142,389 | $ | 1,012,285 | |||||||

|

5.

|

Intangible Assets

|

|

March 31, 2015

|

||||||||||||

|

Cost

|

Accumulated

Amortization

|

Net Carrying

Amount

|

||||||||||

|

Patents

|

$ | 436,964 | $ | 6,463 | $ | 374,501 | ||||||

|

Licensing asset

|

1,005,820 | 193,427 | 812,393 | |||||||||

|

Licensing agreements

|

10,377,325 | 2,575,022 | 7,802,303 | |||||||||

|

Product rights

|

32,117,521 | 642,351 | 31,475,170 | |||||||||

| $ | 43,937,630 | $ | 3,473,263 | $ | 40,464,367 | |||||||

|

December 31, 2014

|

||||||||||||

|

Cost

|

Accumulated

Amortization

|

Net Carrying

Amount

|

||||||||||

|

Patents

|

$ | 351,754 | $ | 53,242 | $ | 298,512 | ||||||

|

Licensing asset

|

1,005,820 | 174,084 | 831,736 | |||||||||

|

Licensing agreements

|

10,377,325 | 2,345,049 | 8,032,276 | |||||||||

|

Product rights

|

32,117,521 | 321,175 | 31,796,346 | |||||||||

| $ | 43,852,420 | $ | 2,893,550 | $ | 40,958,870 | |||||||

Amortization expense of intangible assets for the three month period ended March 31, 2015 was $579,712 (2014 - $252,185).

The Company has patents pending of $45,942 at March 31, 2015 (December 31, 2014 - $45,392) and licensing agreements of $373,325 (December 31, 2014 - $373,325) not currently being amortized.

7

|

6.

|

Long Term Debt and Debt Issuance Costs

|

On August 8, 2013, SWK Funding LLC ("SWK"), a wholly-owned subsidiary of SWK Holdings Corporation, entered into a credit agreement (the "Credit Agreement") with the Company and SWK pursuant thereto, provided to the Company a term loan in the principal amount of US$6,000,000 ($6,381,600) which was increased, as per the terms of the Credit Agreement, by an additional US$2,000,000 ($2,211,000) at the Company's request on February 4, 2014. SWK served as the agent under the Credit Agreement.

On October 1, 2014 (the “Amendment Closing Date”), the Company entered into the First Amendment to the Credit Agreement and Guarantee (the “First Amendment,” and together with the Credit Agreement, the “Amended Credit Agreement”) with SWK. The Amended Credit Agreement provides for a multi-draw term loan to the Company for up to a maximum amount of US$17,000,000 ($21,561,100) (the “Loan Commitment Amount”). On the Amendment Closing Date, SWK advanced the Company an additional amount equal to US$6,000,000 ($6,724,800) pursuant to the terms of a promissory note executed on the Amendment Closing Date (the “October 2014 Note”). The October 2014 Note is for a total principal amount of US$14,000,000 ($17,756,200) (the "Loan") (comprised of US$8,000,000 ($8,592,600) advanced under the Credit Agreement and the additional US$6,000,000 ($6,724,800) advanced on October 1, 2014) due and payable on December 31, 2018 (the “Term Loan Maturity Date”).

The Loan accrues interest at an annual rate of 11.5% plus the Libor Rate (as defined in the Amended Credit Agreement), with the Libor Rate being subject to a minimum floor of 2%, such that the minimum interest rate is 13.5%. In the event of a change of control, a merger or a sale of all or substantially all of the Company’s assets, the Loan shall be due and payable.

The discount to the carrying value of the Loan is being amortized as a non-cash interest expense over the term of the Loan using the effective interest rate method.

During the three month period ended March 31, 2015, the Company accreted $73,999 (2014 - $31,118) in non-cash accretion expense in connection with the long term loans, which is included in accretion expense on the condensed interim statements of operations, comprehensive loss and deficit.

Legal fees and costs associated with the Loan Commitment Amount were classified as debt issuance costs on the balance sheet. These assets are being amortized as a non-cash interest expense over the term of the outstanding Loan using the effective interest rate method. During the three month period ended March 31, 2015, the Company amortized $26,446 (2014 – $24,764) in non-cash interest expense, which is included in amortization expense on the condensed interim statements of operations, comprehensive loss and deficit.

During the three month period ended March 31, 2015, the Company made no principal payments (year ended December 31, 2014 - $nil) and interest payments of US$477,750 ($606,474) (year ended December 31, 2014 – US$1,090,500 ($1,207,262)) under the Credit Agreement and Amended Credit Agreement. The Company has estimated the following revenue-based principal and interest payments over the next four years ended December 31 based on the assumption that only the minimum revenue requirements will be met under the Amended Credit Agreement:

| Principal Payments |

Interest Payments

|

|||||

|

2015

|

US$1,136,997 | ($1,442,053) | US$1,390,095 | ($1,763,057) | ||

|

2016

|

US$1,454,476 | ($1,844,712) | US$1,704,169 | ($2,161,398) | ||

|

2017

|

US$1,666,664 | ($2,113,830) | US$1,489,600 | ($1,889,260) | ||

|

2018

|

US$9,741,863 | ($12,355,605) | US$1,428,903 | ($1,812,278) | ||

|

7.

|

Capital Stock

|

|

|

(a)

|

Common Shares

|

During the three month period ended March 31, 2015, the Company issued 5,431,250 common shares on the exercise of 5,431,250 common share purchase warrants exercised at an average exercise price of US$0.50 ($0.625) for gross proceeds of US$2,715,600 ($3,395,453).

8

|

Common Shares

|

Number of Shares

|

Amount

|

||||||

|

Balance, December 31, 2014

|

94,476,238 | $ | 41,182,630 | |||||

|

Warrants exercised

|

5,431,250 | 3,395,453 | ||||||

|

Fair value of warrants exercised

|

- | 444,106 | ||||||

|

Balance, March 31, 2015

|

99,907,488 | $ | 45,022,189 | |||||

(b) Stock Based Compensation

The Company’s stock-based compensation program ("Plan") includes stock options in which some options vest based on continuous service, while others vest based on performance conditions such as profitability and sales goals. For those equity awards that vest based on continuous service, compensation expense is recorded over the service period from the date of grant. For performance-based awards, compensation expense is recorded over the remaining service period when the Company determines that achievement is probable.

During the three month period ended March 31, 2015, there were 3,158,903 options, granted to officers, employees and consultants of the Company (2014 – 1,298,245). The exercise price of 2,908,903 of these options is $0.62, vesting quarterly one-eighth over two years on each of March 31, June 30, September 30 and December 31, in 2016 and 2017. Of these options 864,000 are time-based, while the remaining 2,044,903 are based upon achieving certain financial objectives. Since stock-based compensation is recognized only for those awards that are ultimately expected to vest, the Company has applied an estimated forfeiture rate (based on historical experience and projected employee turnover) to unvested awards for the purpose of calculating compensation expense. The grant date fair value of these options was estimated as $0.51 using the Black-Scholes option pricing model, based on the following assumptions: expected dividend yield of 0%; expected volatility of 121%; expected risk free interest rate of 0.61%; and expected term of 5 years.

In addition, 200,000 options were granted with an exercise price of $0.62 and will fully vest on January 4, 2016 (Note 12). The grant date fair value of these options was estimated as $0.43 using the Black-Scholes option pricing model, based on the following assumptions: expected dividend yield of 0%; expected volatility of 121%; expected risk free interest rate of 0.87%; and expected term of 5 years.

The remaining 50,000 options were granted with an exercise price of $0.62, with one quarter vesting over one year on each of April 29, July 29, October 29 in 2015 and January 29, 2016. The grant date fair value of these options was estimated as $0.52 using the Black-Scholes option pricing model, based on the following assumptions: expected dividend yield of 0%; expected volatility of 122%; expected risk free interest rate of 0.87%; and expected term of 5 years.

For the three month period ended March 31, 2015, the Company recorded $348,320 (2014 – $117,133) as additional paid in capital for options issued to directors, officers, employees and consultants based on continuous service. Included in this amount is $171,759 for options issued to consultants for services (Note 12). This expense was recorded as selling, general and administrative expense on the condensed interim statements of operations, comprehensive loss and deficit. Due to termination of employment and non-achievement of performance-based awards, 129,587 options were removed from the number of options issued during the three month period ended March 31, 2015 (year ended December 31, 2014 – 817,830).

The activities in additional paid in-capital options are as follows:

|

Amount

|

||||

|

Balance, December 31, 2014

|

$ | 2,713,605 | ||

|

Expense recognized for options issued to employees

|

176,560 | |||

|

Expense recognized for options issued to consultants

|

171,759 | |||

|

Balance, March 31, 2015

|

$ | 3,061,924 | ||

The total number of options outstanding as at March 31, 2015 was 7,864,307 (December 31, 2014 – 4,834,991). The weighted average grant date fair value of the options granted during the three month period ended March 31, 2015, was $0.51 (2014 - $0.34).

The maximum number of options that may be issued under the Plan is floating at an amount equivalent to 10% of the issued and outstanding common shares, or 9,990,749 as at March 31, 2015 (December 31, 2014 – 9,447,624).

9

|

(c)

|

Warrants

|

As at March 31, 2015, the following warrants were outstanding:

Warrant Liability

|

Expiration Date

|

Number of

Warrants

|

Weighted Average

Exercise Price

|

Fair Value at

March 31, 2015

|

Fair Value at

December 31, 2014

|

|||||||||||

|

May 11, 2017

|

750,000 | US$0.43 | ($0.55) | $ | 430,905 | $ | 227,090 | ||||||||

|

February 27, 2015

|

- | US$0.50 | ($0.63) | $ | - | $ | 184,999 | ||||||||

|

February 27, 2018

|

4,429,687 | US$0.60 | ($0.76) | $ | 2,522,559 | $ | 1,310,414 | ||||||||

|

March 5, 2015

|

- | US$0.50 | ($0.63) | $ | - | $ | 56,691 | ||||||||

|

March 5, 2018

|

1,253,000 | US$0.60 | ($0.76) | $ | 713,542 | $ | 372,123 | ||||||||

|

March 11, 2015

|

- | US$0.50 | ($0.63) | $ | - | $ | 17,547 | ||||||||

|

March 11, 2018

|

343,750 | US$0.60 | ($0.76) | $ | 195,754 | $ | 102,089 | ||||||||

|

August 8, 2018

|

755,794 | US$0.5954 | ($0.7551) | $ | 588,564 | $ | 334,060 | ||||||||

|

September 20, 2018

|

108,696 | US$0.55 | ($0.70) | $ | 67,275 | $ | 36,442 | ||||||||

|

February 4, 2021

|

347,222 | US$0.4320 | ($0.5479) | $ | 281,404 | $ | 160,319 | ||||||||

|

October 1, 2021

|

740,000 | US$0.70 | ($0.89) | $ | 559,371 | $ | 306,106 | ||||||||

| 8,728,149 | US$0.59 | ($0.74) | $ | 5,359,374 | $ | 3,107,880 | |||||||||

ASC 815 "Derivatives and Hedging" indicates that warrants with exercise prices denominated in a currency other than an entity’s functional currency should not be classified as equity. As a result, these warrants have been treated as derivatives and recorded as liabilities carried at their fair value, with period-to-period changes in the fair value recorded as a gain or loss in the condensed interim statements of operations, comprehensive loss and deficit. The Company treated the compensation warrants as a liability upon their issuance. The warrant liability is classified as Level 3 within the fair value hierarchy (see Note 16(b)).

As at March 31, 2015, the fair value of the aggregate warrant liability of $5,359,374 (December 31, 2014 - $3,107,880) was estimated using the Black-Scholes option pricing model based on the following weighted average assumptions: expected dividend yield of 0% (December 31, 2014 – 0%) expected volatility of 100% (December 31, 2014 – 88%) risk-free interest rate of 0.78% (December 31, 2014 – 1.22%) and expected term of 3.32 years (December 31, 2014 – 2.18 years).

Warrants – Equity

|

Expiration Date

|

Number of

Warrants

|

Weighted Average

Exercise Price

|

Grant Date

Fair Value at

March 31, 2015

|

|||||||||

|

July 15, 2016

|

21,447,500 | $ | 0.90 | $ | 5,169,881 | |||||||

|

July 15, 2016

|

3,217,125 | $ | 0.70 | $ | 1,177,468 | |||||||

| 24,664,625 | $ | 0.90 | $ | 6,347,349 | ||||||||

|

8.

|

Loss Per Share

|

The treasury stock method assumes that proceeds received upon the exercise of all warrants and options outstanding in the period is used to repurchase the Company’s shares at the average share price during the period. The diluted loss per share is not computed when the effect of such calculation is anti-dilutive. In periods when losses are reported, the weighted-average number of common shares outstanding excludes common stock equivalents because their inclusion would be anti-dilutive. Potentially dilutive securities, which were not included in diluted weighted average shares for the three month periods ended March 31, 2015 and 2014, consisted of outstanding stock options (7,864,307 and 5,109,330, respectively) and outstanding warrant grants (33,392,774 and 14,014,587, respectively).

10

The following table sets forth the computation of loss per share:

|

For the Three Month Period

Ended March 31

|

||||||||

|

Numerator:

|

2015

|

2014

|

||||||

|

Net loss available to common shareholders

|

$ | (5,181,463 | ) | $ | (3,288,178 | ) | ||

|

Denominator:

|

||||||||

|

Weighted average number of common shares

|

96,685,405 | 51,420,127 | ||||||

|

Effect of dilutive common shares

|

- | - | ||||||

|

Diluted weighted average number of common shares outstanding

|

96,685,405 | 51,420,127 | ||||||

|

Loss per share – basic and diluted

|

$ | (0.05 | ) | $ | (0.06 | ) | ||

|

9.

|

Statement of Cash Flows

|

Changes in non-cash balances related to operations are as follows:

|

For the Three Months Ended

March 31

|

||||||||

|

2015

|

2014

|

|||||||

|

Accounts receivable

|

$ | (978,888 | ) | $ | (1,065,085 | ) | ||

|

Inventories

|

(156,581 | ) | (59,101 | ) | ||||

|

Prepaid expenses and other receivables

|

(40,443 | ) | (9,036 | ) | ||||

|

Taxes recoverable

|

11,561 | 529,381 | ||||||

|

Accounts payable and accrued liabilities

|

(57,539 | ) | (192,656 | ) | ||||

| $ | (1,221,890 | ) | $ | (796,497 | ) | |||

Included in accounts payable and accrued liabilities at March 31, 2015, is an amount related to patents and licenses of $2,605 (December 31, 2014 - $31,655).

During the three month period ended March 31, 2015, there was $606,474 (2014 - $267,291) in interest paid and $nil in taxes paid (2014 – $nil).

During the three month period ended March 31, 2015, there was $26,446 (2014 - $24,764) of non-cash debt issuance costs (see Note 6) expensed as amortization of assets.

|

10.

|

Contingencies and Commitments

|

The Company has royalty, licensing and manufacturing agreements that have remained in effect for the Company during the quarter. In addition, there were no material changes to the lease agreements during the period.

|

(a)

|

License Agreements

|

On December 1, 2011, the Company acquired 100% of the outstanding shares of Tribute Pharmaceuticals Canada Ltd. and Tribute Pharma Canada Inc. Included in this transaction were the following license agreements:

On June 30, 2008, Tribute signed a Sales, Marketing and Distribution Agreement with Actavis Group PTC ehf (“Actavis”) to perform certain sales, marketing, distribution, finance and other general management services in Canada in connection with the importation, marketing, sales and distribution of Bezalip® SR and Soriatane® (the “Actavis Products”). On January 1, 2010, a first amendment was signed with Actavis to grant the Company the right and obligation to more actively market and promote the Actavis Products in Canada. On March 31, 2011, a second amendment was signed with Actavis that extended the term of the agreement, modified the terms of the agreement and increased the Company’s responsibilities to include the day-to-day management of regulatory affairs, pharmacovigilance and medical information relating to the Actavis Products. The Company pays Actavis a sales and distribution fee up to an annual base-line net sales forecast plus an incremental fee for incremental net sales above the base-line. On May 4, 2011, the Company signed a Product Development and Profit Share Agreement with Actavis to develop, obtain regulatory approval of and market Bezalip SR in the U.S. The Company shall pay US$5,000,000 ($6,341,500) to Actavis within 30 days of receipt of the regulatory approval to market Bezalip SR in the U.S.

11

On November 9, 2010, the Company signed a license agreement with Nautilus Neurosciences, Inc. (“Nautilus”) for the exclusive rights to develop, register, promote, manufacture, use, market, distribute and sell Cambia® in Canada. On August 11, 2011, the Company and Nautilus executed the first amendment to the license agreement and on September 30, 2012 executed the second amendment to the license agreement. Aggregate payments of US$1,000,000 ($1,005,820) were issued under this agreement, which included an upfront payment to Nautilus upon the execution of the agreement and an amount payable upon the first commercial sale of the product. These payments have been included in intangible assets and will be amortized over the life of the license agreement, as amended. Up to US$6,000,000 ($7,609,800) in additional one-time performance based sales milestones, based on a maximum of six different sales tiers, are payable over time, due upon achieving annual net sales ranging from US$2,500,000 ($3,170,750) to US$20,000,000 ($25,366,000) in the first year of the achievement of the applicable milestone. Royalty rates are tiered and payable at rates ranging from 22.5% to 25.0% of net sales.

On December 30, 2011, the Company signed a license agreement with Apricus Bioscience, Inc. to commercialize MycoVa in Canada. As of March 31, 2015, this product has not been filed with Health Canada and to-date no upfront payments have been paid. Within 10 days of execution of a manufacturing agreement, the Company shall pay an up-front license fee of $200,000. Upon Health Canada approval of MycoVa, the Company shall pay $400,000. Sales milestones payments of $250,000 each are based on the achievement of aggregate net sales in increments of $5,000,000. Royalties are payable at rates ranging from 20% to 25% of net sales.

On May 13, 2014, the Company entered into an exclusive license and supply agreement with Faes Farma, S.A. (“Faes”), a Spanish pharmaceutical company, for the exclusive right to sell bilastine, a product for the treatment of allergic rhinitis and chronic idiopathic urticaria (hives) in Canada. The exclusive license is inclusive of prescription and non-prescription rights for bilastine, as well as adult and paediatric presentations in Canada. Sales of bilastine are subject to receiving regulatory approval from Health Canada. Payment for the licensing rights is based on an initial fee of €250,000 ($368,337), these payments have been included in intangible assets and will be amortized over the life of the license agreement. Any remaining milestone payments based on the achievement of specific events, including regulatory and sales milestones of up to $3,497,949 (€1,466,600 ($1,997,949) and $1,500,000) are payable over time, beginning with an approval for bilastine from Health Canada. Thereafter, milestones are payable upon attainment of cumulative net sales targets, up to net sales of $60,000,000. The license agreement is also subject to certain minimum purchase obligations upon regulatory approval and commercial sale of product.

(b) Executive Termination Agreements

The Company currently has employment agreements with the provision of termination and change of control benefits with officers and executives of the Company. The agreements for the officers and executives provide that in the event that any of their employment is terminated during the term (i) by the Company for any reason other than just cause or death; (ii) by the Company because of disability; (iii) by the officer or executive for good reason; or (iv) following a change of control, the officers and executives shall be entitled to an aggregate amount of $1,979,540 as of March 31, 2015 (December 31, 2014 - $247,200) or if a change of control occurs while the officers or executives are employed on an indefinite basis, a lump sum payment of up to an aggregate amount of $3,499,562 (based on current base salaries) (December 31, 2014 - $2,072,200).

11. Significant Customers

During the three month period ended March 31, 2015, the Company had three significant wholesale customers (2014 – three) that represented 69.8% (2014 – 65.6%) of product sales.

The Company believes that its relationship with these customers is satisfactory.

|

12.

|

|

Related Party Transactions

|

During the three month period ended March 31, 2015 the Company granted 200,000 (2014 - 200,000) stock options to LMT Financial Inc. ("LMT"), a company beneficially owned by a director and former interim officer of the Company, and his spouse for consulting services. For the three month period ended March 31, 2015, the Company recorded $49,147 (2014 - $16,222) as a non-cash expense. These amounts have been recorded as selling, general and administrative expense in the condensed interim statements of operations, comprehensive loss and deficit.

12

|

13.

|

Income Taxes

|

The Company has no taxable income under Canadian Federal and Provincial tax laws for the three month period ended March 31, 2015 and 2014. The Company has non-capital loss carry-forwards at March 31, 2015 totaling approximately $13,953,400, which may be offset against future taxable income. If not utilized, the loss carry-forwards will expire between 2015 and 2034. The cumulative carry-forward pool of SR&ED expenditures as at March 31, 2015, that may be offset against future taxable income, with no expiry date, is $1,798,300.

The non-refundable portion of the tax credits as at March 31, 2015 was $341,300.

14. Segmented Information

The Company is a specialty pharmaceutical company with a primary focus on the acquisition, licensing, development and promotion of healthcare products in Canada. The Company targets several therapeutic areas in Canada, but has a particular interest in products for the treatment of pain, dermatology and endocrinology/cardiology. The Company also sells Uracyst® and NeoVisc® internationally through a number of strategic partnerships. Currently, all of the Company’s manufacturing assets are located in Canada. All direct sales take place in Canada. Licensing arrangements have been obtained to distribute and sell the Company’s products in various countries around the world.

Revenue for the three month periods ended March 31, 2015 and 2014 includes products sold in Canada and international sales of products through licensing agreements. Revenue earned is as follows:

|

For the Three Month Period

Ended March 31

|

||||||||

|

2015

|

2014

|

|||||||

|

Product sales:

|

||||||||

|

Domestic sales

|

$ | 5,109,509 | $ | 2,999,912 | ||||

|

International sales

|

469,595 | 463,978 | ||||||

|

Other revenue

|

13,193 | 11,250 | ||||||

|

Total

|

$ | 5,592,297 | $ | 3,475,140 | ||||

|

Royalty revenues

|

$ | - | $ | 18,414 | ||||

|

Total revenues

|

$ | 5,592,297 | $ | 3,493,554 | ||||

The Company currently sells its own products and is in-licensing other products in Canada. In addition, revenues include products which the Company out-licenses throughout most countries in Europe, the Caribbean, Austria, Germany, Italy, Lebanon, Kuwait, Malaysia, Portugal, Romania, Spain, South Korea, Turkey, Egypt, Hong Kong and the United Arab Emirates. The operations reflected in the condensed interim statements of operations, comprehensive loss and deficit includes the Company’s activity in these markets.

15. Foreign Currency Gain (Loss)

|

|

The Company enters into foreign currency transactions in the normal course of business. Expenses incurred in currencies other than Canadian dollars are therefore subject to gains or losses due to fluctuations in these currencies. As at March 31, 2015, the Company held cash of $5,326,943 (US$4,129,010 and €66,152) in denominations other than in Canadian dollars (December 31, 2014 - $1,319,013 (US$1,135,304 and €1,387)); had accounts receivables of $389,930 (US$101,157 and €192,052) denominated in foreign currencies (December 31, 2014 - $319,764 (US$67,125 and €172,313); had accounts payable and accrued liabilities of $230,109 (US$109,785 and €66,703) denominated in foreign currencies (December 31, 2014 – $32,857 (US$26,125 and €1,816)); warrant liability of $5,359,374 (US$4,225,636) (December 31, 2014 - $3,107,880 (US$2,682,994)); and long term debt of $17,756,200 (US$14,000,000) (December 31, 2014 - $16,241,400 (US$14,000,000)). For the three month period ended March 31, 2015, the Company had a foreign currency loss of $1,179,509 (2014 –$196,066). These amounts have been included in selling, general and administrative expenses in the condensed interim statements of operations, comprehensive loss and deficit.

|

|

16.

|

Financial Instruments

|

|

|

(a)

|

Financial assets and liabilities – fair values |

13

The carrying amounts of cash and cash equivalents, accounts receivable, certain other current assets, accounts payables and accrued liabilities are a reasonable estimate of their fair values because of the short maturity of these instruments.

Warrant liability and other current asset/liabilities are financial assets/liabilities where fluctuations in market rates will affect the fair value of these financial instruments. The Company uses the following hierarchy for determining and disclosing the fair value of financial instruments by valuation technique:

Level 1: quoted prices in active markets for identical assets or liabilities.

Level 2: other techniques for which all inputs which have a significant effect on the recorded fair value are observable, either directly or indirectly.

Level 3: techniques which use inputs which have a significant effect on the recorded fair value that are not based on observable market data.

Cash equivalents and other current asset/liabilities are classified as Level 2 financial instruments within the fair value hierarchy.

|

|

(b)

|

Derivative liability – warrant liability |

In connection with various financing arrangements, the Company has granted warrants to purchase up to 8,728,149 common shares of the Company as disclosed in Note 7c. The warrants have a weighted average exercise price of US$0.59 ($0.74). The warrants expire at dates ranging from May 11, 2017 to October 1, 2021. The warrants are accounted for as derivative liabilities because the exercise price is denominated in a currency other than the Company’s functional currency.

The table below summarizes the fair value of the Company’s financial liabilities measured at fair value:

|

Fair Value at

|

Fair Value Measurement Using

|

|||||||||||||||

|

March 31, 2015

|

Level 1

|

Level 2

|

Level 3

|

|||||||||||||

|

Derivative liability - Warrants

|

$ | 5,359,374 | $ | - | $ | - | $ | 5,359,374 | ||||||||

|

Fair Value at

|

Fair Value Measurement Using

|

|||||||||||||||

|

December 31, 2014

|

Level 1

|

Level 2

|

Level 3

|

|||||||||||||

|

Derivative liability - Warrants

|

$ | 3,107,880 | $ | - | $ | - | $ | 3,107,880 | ||||||||

The table below sets forth a summary of changes in the fair value of the Company’s Level 3 financial liabilities (warrant derivative liability) for the periods ended March 31, 2015 and December 31, 2014:

|

Three months ended March 31, 2015

|

Year ended

December 31, 2014

|

|||||||

|

Balance at beginning of period

|

$ | 3,107,880 | $ | 2,966,714 | ||||

|

Additions (deletions) to derivative instruments

|

(444,106 | ) | 424,471 | |||||

|

Change in fair market value, recognized in earnings as

Change in warrant liability

|

2,695,600 | (283,305 | ) | |||||

|

Balance end of period

|

$ | 5,359,374 | $ | 3,107,880 | ||||

The following is quantitative information about significant unobservable inputs (Level 3) for the Company as of March 31, 2015.

|

Liability Category

|

Fair Value

|

Valuation Technique

|

Unobservable Input

|

Input Value

|

||||||

|

Warrant Liability

|

$ | 5,359,374 |

Black-Scholes valuation model

|

Volatility

|

100 | % | ||||

The following represents the impact on fair value measurements to changes in unobservable inputs:

|

Unobservable Inputs

|

Increase in Inputs Increase in Valuation

|

Decreases in Inputs Increase in Valuation

|

|

Volatility

|

Increase

|

Decrease

|

14

These instruments were valued using pricing models that incorporate the price of a common share (as quoted on the relevant over-the-counter trading market in the U.S.), volatility, risk free rate, dividend rate and estimated life. The Company computed the value of the warrants using the Black-Scholes model. There were no transfers of assets or liabilities between Level 1, Level 2, or Level 3 during the periods ended March 31, 2015 and December 31, 2014.

The following are the key weighted average assumptions used in connection with this computation:

|

Three Months Period

March 31, 2015

|

Year Ended

December 31, 2014

|

||||

|

Number of shares underlying the warrants

|

8,728,149

|

14,754,587

|

|||

|

Fair market value of the stock

|

US$0.48 ($0.61)

|

US$0.18 ($0.21)

|

|||

|

Exercise price

|

US$0.59 ($0.75)

|

US$0.55 ($0.64)

|

|||

|

Expected volatility

|

100%

|

88%

|

|||

|

Risk-free interest rate

|

0.78%

|

1.22%

|

|||

|

Expected dividend yield

|

0%

|

0%

|

|||

|

Expected warrant life (years)

|

3.32

|

2.18

|

| (c) | Liquidity risk |

The Company generates sufficient cash from operating and financing activities to fund its operations and fulfill its obligations as they become due. The Company has sufficient funds available through its cash, cash equivalents, and financing arrangements, should its cash requirements exceed cash generated from operations to cover financial liability obligations. The Company’s investment policy is to invest excess cash resources into highly liquid short-term investments purchased with an original maturity of three months or less with tier one financial institutions. As at March 31, 2015, there were no restrictions on the flow of these funds nor have any of these funds been committed in any way, except as outlined in the detailed notes.

In the normal course of business, management considers various alternatives to ensure that the Company can meet some of its operating cash flow requirements through financing activities, such as private placements of our common stock, preferred stock offerings and offerings of debt and convertible debt instruments as well as through merger or acquisition opportunities. Management may also consider strategic alternatives, including strategic investments and divestitures. As future operations may be financed out of funds generated from financing activities, the Company’s ability to do so is dependent on, among other factors, the overall state of capital markets and investor appetite for investments in the pharmaceutical industry and our securities in particular. Should the Company elect to satisfy its cash commitments through the issuance of securities, by way of either private placement or public offering or otherwise, there can be no assurance that its efforts to obtain such additional funding will be successful, or achieved on terms favorable to the Company or its existing shareholders. If adequate funds are not available on terms favorable to the Company, it may have to reduce substantially or eliminate expenditures such as promotion, marketing or production of its current or proposed products, or obtain funds through other sources such as divestiture or monetization of certain assets or sublicensing (where permitted) of certain rights to certain of its technologies or products.

| (d) | Concentration of credit risk and major customers |

The Company considers its maximum credit risk to be $3,140,021 (December 31, 2014 - $2,161,133). This amount is the total of the following financial assets: accounts receivable and loan receivable. The Company’s cash and cash equivalents are held through various high grade financial institutions.

The Company is exposed to credit risk from its customers and continually monitors its customers’ credit. It establishes the provision for doubtful accounts based upon the credit risk applicable to each customer. In line with other pharmaceutical companies, the Company sells its products through a small number of wholesalers and retail pharmacy chains in addition to hospitals, pharmacies, physicians and other groups. Note 11 discloses the significant customer details and the Company believes that the concentrations on the Company’s customers are considered normal for the Company and its industry.

As at March 31, 2015, the Company had three customers which made up 67.1% of the outstanding accounts receivable in comparison to two customers which made up 65.7% at December 31, 2014. As at March 31, 2015, 28.5% (December 31, 2014 – 12.2%) of the outstanding accounts receivable was related to product sales related to two wholesale accounts (December 31, 2014 – one wholesale account) and 38.6% (December 31, 2014 – 53.5%) was related to an amount owing related to the product sales.

15

| (e) |

Foreign exchange risk

|

|

|

The Company principally operates within Canada; however, a portion of the Company’s revenues, expenses, and current assets and liabilities, are denominated in United States dollars and the EURO. The Company’s long term debt is repayable in U.S. dollars, which exposes the Company to foreign exchange risk due to changes in the value of the Canadian dollar. As at March 31, 2015, a 5% change in the foreign exchange rate would increase/decrease the long term debt balance by $700,000 and would increase/decrease both interest expense and net loss by approximately $29,800 for the three month period ended March 31, 2015. As at March 31, 2015, a 5% change in the foreign exchange rate would increase/decrease the warrant liability balance by $268,000 and would increase/decrease both changes in warrant liability and net loss by $268,000 for the three month period ended March 31, 2015.

|

| (f) |

Interest rate risk

|

The Company is exposed to interest rate fluctuations on its cash and cash equivalents as well as its long term debt. At March 31, 2015, the Company had an outstanding long term debt balance of US$14,000,000 ($17,756,200), which bears interest annually at a rate of 11.5% plus the Libor Rate with the Libor Rate being subject to a minimum floor of 2%, such that that minimum interest rate is 13.5%, which may expose the Company to market risk due to changes in interest rates. For the three month period ended March 31, 2015, a 1% increase in interest rates would increase interest expense and net loss by approximately $44,400. However, based on current LIBOR interest rates, which are currently under the minimum floor set at 2% and based on historical movements in LIBOR rates, the Company believes a near-term change in interest rates would not have a material adverse effect on the financial position or results of operations.

|

17.

|

Derivative Financial Instruments

|

The Company enters into foreign currency contracts with financial institutions to reduce the risk that its cash flows and earnings will be adversely affected by foreign currency exchange rate fluctuations. In accordance with the Company’s current foreign exchange rate risk management policy, this program is not designated for trading or speculative purposes.

The Company recognizes derivative instruments as either assets or liabilities in the accompanying balance sheets at fair value.

During the three month period ended March 31, 2015, the Company entered into foreign currency call options designated as cash flow hedges to hedge certain forecasted expenses related to its loan obligation denominated in United States Dollars. The notional principal of the foreign currency call option to purchase US$3,500,000 was $4,397,400 at July 23, 2015.

The Company initially reports any gain or loss on the effective portion of the cash flow hedge as a component of other comprehensive income and subsequently reclassifies to the statements of operations when the hedged transaction occurs.

Valuation techniques used to measure fair value are intended to maximize the use of observable inputs and minimize the use of unobservable inputs.

The Company has determined the foreign currency call option to be Level 2. The fair value of the foreign currency call option at March 31, 2015 was a gain of $43,400 (December 31, 2014 – $nil), and is reported in other current asset/liability in the accompanying balance sheets. During the three month period ended March 31, 2015, the Company had not settled any foreign exchange contracts (2014 - recognized a gain of $200,000).

At March 31, 2015 and December 31, 2014, the notional principal and fair value of the Company’s outstanding foreign currency derivative financial instruments were as follows:

|

March 31, 2015

|

December 31, 2014

|

|||||||||||||||||

|

Notional Principal

|

Fair Value

|

Notional Principal

|

Fair Value

|

|||||||||||||||

|

Foreign currency sold – call options

|

USD$

|

3,500,000 | $ | 43,400 |

USD$

|

- | $ | - | ||||||||||

The notional principal amounts provide one measure of the transaction volume outstanding as of March 31, 2015 and December 31, 2014, and do not represent the amount of the Company’s exposure to market loss. The estimates of fair value are based on applicable and commonly used pricing models using prevailing financial market information as of March 31, 2015 and December 31, 2014. The amounts ultimately realized upon settlement of these financial instruments, together with the gains and losses on the underlying exposures, will depend on actual market conditions during the remaining life of the instruments.

18. Subsequent Events

Subsequent to March 31, 2015, the Company issued 700,000 common shares in connection with the exercise of 620,000 common share purchase warrants and 80,000 compensation options exercised at a weighted average exercise price of $0.88 per common share, for aggregate proceeds of $614,000. In addition, the Company issued 40,000 common share purchase warrants on the exercise of 80,000 compensation options. Each such warrant has an exercise price of $0.90 and an expiry date of July 15, 2016 (Note 7c).

16

|

ITEM 2.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

FORWARD-LOOKING STATEMENTS AND SUPPLEMENTARY DATA

The following discussion should be read in conjunction with our condensed interim financial statements and other financial information appearing elsewhere in this quarterly report. In addition to historical information, the following discussion and other parts of this quarterly report contain forward-looking statements under applicable securities laws. You can identify these statements by forward-looking words such as “plan,” “may,” “will,” “expect,” “intend,” “anticipate,” believe,” “estimate” and “continue” or similar words. Forward-looking statements are statements that are not historical facts, and include, but not limited to, statements regarding the Company’s estimates of principal and interest payments on loans, the expansion of the Company’s sales force and marketing expenses, the proposed increase in business development activities, the anticipated development and commercialization date of bilastine for Canada, the future sources and availability of additional funding, and the effect of funding arrangements on projects and products. You should read statements that contain these words carefully because they discuss future expectations and plans, which contain projections of future results of operations or financial condition or state other forward-looking information. We believe that it is important to communicate future expectations to investors. However, there may be events in the future that we are not able to accurately predict or control. Accordingly, we do not undertake any obligation to update any forward-looking statements for any reason, even if new information becomes available or other events occur in the future, except as required by law.

The forward-looking statements included herein are based on current expectations that involve a number of risks and uncertainties set forth under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and other periodic reports filed with the United States Securities and Exchange Commission (“SEC”). Accordingly, to the extent that this quarterly report contains forward-looking statements regarding the financial condition, operating results, business prospects or any other aspect of the Company, please be advised that the Company’s actual financial condition, operating results and business performance may differ materially from that projected or estimated by the Company in forward-looking statements.

All amounts are stated in Canadian dollars unless otherwise stated and have been rounded to the nearest one hundredth dollar.

CRITICAL ACCOUNTING POLICIES

The SEC defines critical accounting policies as those that are, in management’s view, important to the portrayal of the Company’s financial condition and results of operations and require management’s judgment. The Company’s discussion and analysis of its financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of these statements requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue and expenses. The Company bases its estimates on experience and on various assumptions that it believes are reasonable under the circumstances, the results of which form the basis for making judgments about its carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from those estimates. The Company’s critical accounting policies include:

Revenue Recognition

The Company recognizes revenue when persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, the price is fixed or determinable, and collectability is reasonably assured. License fees which are comprised of initial fees and milestone payments are recognized upon achievement of each such milestone, provided the milestone is meaningful, and provided that collectability is reasonably assured and other revenue recognition criteria are met. Milestone payments are recognized into income upon the achievement of the specified milestones when the Company has no further involvement or obligation to perform services, as related to that specific element of the arrangement. Upfront fees and other amounts received in excess of revenue recognized are recorded as deferred revenues.

Revenues from the sale of products, net of trade discounts, returns and allowances, are recognized when legal title to the goods has been passed to the customer and collectability is reasonably assured. Revenues associated with multiple-element arrangements are attributed to the various elements, if certain criteria are met, including whether the delivered element has stand-alone value to the customer and whether there is objective and reliable evidence of the fair value of the undelivered elements. Non-refundable up-front fees for the transfer of methods and technical know-how, not requiring the Company to perform additional research or development activities or other significant future performance obligations, are recognized upon delivery of the methods and technical know-how.

17

Royalty revenue is recognized when the Company has fulfilled the terms in accordance with the contractual agreement and has no material future obligation, other than inconsequential and perfunctory support, as would be expected under such agreements and the amount of the royalty fee is determinable and collection is reasonably assured.

A customer is obligated to pay for products sold to it within a specified number of days from the date that title to the products is transferred to the customer. The Company’s standard terms are typically 0.5% to 2% prompt payment discount when payment is received within 15 to 20 days from the date of invoice.

The Company has a product returns policy on some of its products, which allows the customer to return pharmaceutical products that have expired, for full credit, provided the expired products are returned within twelve months from the expiration date.

Transfer of title occurs and risk of ownership passes to a customer at the time of shipment or delivery, depending on the terms of the agreement with a particular customer. The sale price of the Company’s products is substantially fixed or determinable at the date of sale based on purchase orders generated by a customer and accepted by the Company. A customer’s obligation to pay the Company for products sold to it is not contingent upon the resale of those products. The Company recognizes revenues for the sale of products from the date the title to the products is transferred to the customer.

Long Term Debt and Debt Issuance Costs

On August 8, 2013, SWK Funding LLC ("SWK"), a wholly-owned subsidiary of SWK Holdings Corporation, entered into a credit agreement (the "Credit Agreement") with the Company, Pursuant thereto SWK, provided to the Company a term loan in the principal amount of US$6,000,000 ($6,381,600) which was increased, as per the terms of the Credit Agreement, by an additional US$2,000,000 ($2,211,000) at the Company's request on February 4, 2014. SWK served as the agent under the Credit Agreement.

On October 1, 2014 (the “Amendment Closing Date”), the Company entered into the First Amendment to the Credit Agreement and Guarantee (the “First Amendment,” and together with the Credit Agreement, the “Amended Credit Agreement”) with SWK. The Amended Credit Agreement provides for a multi-draw term loan to the Company for up to a maximum amount of US$17,000,000 ($21,561,100) (the “Loan Commitment Amount”). On the Amendment Closing Date, SWK advance the Company an additional amount equal to US$6,000,000 ($6,724,800) pursuant to the terms of a promissory note executed on the Amendment Closing Date (the “October 2014 Note”). The October 2014 Note is for a total principal amount of US$14,000,000 ($17,756,200) (the "Loan") (comprised of US$8,000,000 ($8,592,600) advanced under the Credit Agreement and the additional US$6,000,000 ($6,724,800) advanced on October 1, 2014) due and payable on December 31, 2018 (the “Term Loan Maturity Date”).

The Loan accrues interest at an annual rate of 11.5% plus the Libor Rate (as defined in the Amended Credit Agreement), with the Libor Rate being subject to a minimum floor of 2%, such that the minimum interest rate is 13.5%. In the event of a change of control, a merger or a sale of all or substantially all of the Company’s assets, the Loan shall be due and payable.

The discount to the carrying value of the Loan is being amortized as a non-cash interest expense over the term of the Loan using the effective interest rate method.

During the three month period ended March 31, 2015, the Company accreted $73,999 (2014 - $31,118) in non-cash accretion expense in connection with the long term loans, which is included in accretion expense on the condensed interim statements of operations, comprehensive loss and deficit.

Legal fees and costs associated with the Loan Commitment Amount were classified as debt issuance costs on the balance sheet. These assets are being amortized as a non-cash interest expense over the term of the outstanding Loan using the effective interest rate method. During the three month period ended March 31, 2015, the Company amortized $26,446 (2014 – $24,764) in non-cash interest expense, which is included in amortization expense on the condensed interim statements of operations, comprehensive loss and deficit.

During the three month period ended March 31, 2015, the Company made no principal payments (year ended December 31, 2014 - $nil) and interest payments of US$477,750 ($606,474) (year ended December 31, 2014 – US$1,090,500 ($1,207,262)) under the Credit Agreement and Amended Credit Agreement. The Company has estimated the following revenue-based principal and interest payments over the next four years ended December 31 based on the assumption that only the minimum revenue requirements will be met under the Amended Credit Agreement:

18

| Principal Payments | Interest Payments | |||||

|

2015

|

US$1,136,997 | ($1,442,053) | US$1,390,095 | ($1,763,057) | ||

|

2016

|

US$1,454,476 | ($1,844,712) | US$1,704,169 | ($2,161,398) | ||

|

2017

|

US$1,666,664 | ($2,113,830) | US$1,489,600 | ($1,889,260) | ||

|

2018

|

US$9,741,863 | ($12,355,605) | US$1,428,903 | ($1,812,278) | ||

OVERVIEW

Tribute a Canadian specialty pharmaceutical company with a primary focus on the acquisition, licensing, development and promotion of healthcare products in Canada and the U.S. The Company targets several therapeutic areas in Canada with a particular interest in products for the treatment of neurology, pain, dermatology and endocrinology and cardiology. In addition to developing and selling healthcare products in Canada, Tribute also sells products globally through a number of international partners.

Tribute’s current portfolio consists of ten marketed products in Canada, including: NeoVisc® (Triple and Single Dose), Uracyst®, Bezalip® SR, Soriatane®, Cambia®, Fiorinal®, Fiorinal® C, Visken®, Viskazide® and Collatamp® G. NeoVisc® and Uracyst® are also sold in several countries globally through strategic partners of the Company. Tribute also has an exclusive license for the development and commercialization of Bezalip® SR (bezafibrate) for the U.S. market and an exclusive license for the development and commercialization of bilastine in Canada with an anticipated approval date in 2016.

Tribute markets its products in Canada through its own sales force and currently has licensing agreements for the distribution of NeoVisc® and Uracyst® in over 20 countries, and continues to expand this footprint. The Company’s focus on business development is twofold: utilizing in-licensing and out-licensing for immediate impact on its revenue stream, as well as product development for future growth and stability.

The first quarter of 2015 ending March 31, 2015 was highlighted by the following events:

|

●

|

Total revenues for the three month period ended March 31, 2015 increased by 60.1% or $2,098,700, compared to the same period in 2014.

|

|

●

|

Other domestic product sales increased 254.1% or $1,866,800, in the three month period ended March 31, 2015 compared to the same period in 2014.

|

|

●

|

Income from operations excluding amortization for the three month period ended March 31, 2015 was $239,100 which was $1,727,100 or 116.1%, better than the same period in 2014.

|

|

●

|

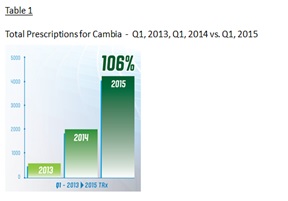

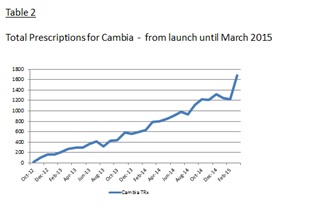

IMS Health, an audited third party provider of sales data, reported a 10.8% increase in total prescriptions written for Cambia® during the three months ended March 31, 2015 compared to the three months ended December 31, 2014, or 106.0% increase when comparing Q1 2015 and Q1 2014. See table 1 & 2 below.

|

|

●

|

On March 19, 2015, Tribute announced that holders of 5,431,250 or 90.1%, of the Series A Warrants issued in connection with the Company’s 2013 unit financing were exercised prior to their expiry resulting in proceeds to the Company of US$2,715,600.

|

|

●

|

On April 20, 2015, Tribute was added to the S&P/TSX Venture Select Index. The S&P/TSX Venture Select Index measures the combined performance of constituents in the S&P/TSX Venture Composite Index that meet specific market capitalization and liquidity criteria. Tribute was one of eight TSX Venture Exchange companies added to the S&P/TSX Venture Select Index.

|

|

|

Source: IMS Data

19

RESULTS FOR THE THREE MONTHS ENDED MARCH 31, 2015

For the three month period ended March 31, 2015, total revenue from all sources was $5,592,300 which increased by 60.1% or $2,098,700, compared to $3,493,600 for the same period in 2014. The increase in sales between the corresponding periods was attributable to an increase in licensed domestic product net sales of $244,700 or 10.8% and other domestic product sales of $1,866,800 or 254.1%.

For the three month period ended March 31, 2015, the net loss before tax was $5,181,500 compared to a net loss of $3,288,200 for the three month period ended March 31, 2014. Contributing factors include:

|

●

|

Increased gross profit of $1,830,300 or 105.5%, due to higher revenues of $2,098,700:

|

|

●

|

An increase in selling, general and administrative expenses of $103,300 or 3.2%;

|

|

●

|

An increase in amortization of assets of $331,300;

|

|

●

|

An increase in expense related to the revaluation of warrants of $1,283,800 (non-cash);

|

|

●

|

Loss on unrealized foreign exchange on debt of $1,433,400 (non-cash);

|

|

●

|

An increase in interest expense net of interest income of $328,900; and

|

|

●

|

Other increased expenses $242,900.

|

Excluding non-operating expenses for the three month period ended March 31, 2015, of $4,798,900, loss from operations was $382,600. This compares to the same period last year for the three month period net loss from operations of $1,778,400, which represents an improvement in the operational loss of $1,395,800 or 78.5%. Income from operations excluding amortization for the three month period ended March 31, 2015 was $239,100 compared to a loss in the same period in the prior year of $1,488,000, which represents an improvement in the operational loss of $1,727,100 or 116.1%.

Gross Profit of Product Sales and Cost of Sales

For the three month period ended March 31, 2015, gross profit was $3,565,000, higher by 105.5% or $1,830,300, compared to the prior year. Underlying improvements in gross profit for the three month period ended March 31, 2015 were due primarily to licensed domestic product net sales of $205,700, domestic product sales and international product sales of $1,643,100.

Selling, General and Administrative Expenses

For the three month period ended March 31, 2015, selling, general and administrative expenses were $3,325,900 compared to $3,222,700 in 2014, an increase of $103,200 or 3.2%.

Warrant Liability

The exercise price of the outstanding common share purchase warrants is denominated in U.S. dollars while the Company’s functional and reporting currency is the Canadian dollar. As a result, the fair value of the warrants fluctuates based on the current stock price, volatility, the risk free interest rate, time remaining until expiry and changes in the exchange rate between the U.S. and Canadian dollar.

For the three month period ended March 31, 2015, the revaluation of the warrant liability resulted in a loss of $2,695,600 (2014 - $1,411,800).

Interest and Other Income

Interest and other income for the three month period ended March 31, 2015, was $125 (2014 - $372).

Net Loss

For the three month period ended March 31, 2015, the net loss was $5,181,500, compared to a net loss of $3,288,200 for the same period in the prior year. For the three month period ended March 31, 2015, this equates to a loss of ($0.05) per share compared to a loss of ($0.06) per share in 2014.

LIQUIDITY AND CAPITAL RESOURCES

The Company’s cash and cash equivalents position amounted to $5,550,800 at March 31, 2015, compared to $3,505,800 at December 31, 2014.

20

Cash used by operations for the three month period ended March 31, 2015, was $2,641,000 (2014 - $2,017,700). Also included are changes in non-cash operating assets and liabilities, which increased by $1,221,900 (2014 - $796,500).