Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

RETROPHIN, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-36257 | 27-4842691 | ||

|

(State or other incorporation or |

(Commission File No.) |

(I.R.S. Employer Identification No.) |

12255 El Camino Real, Suite 250,

San Diego, CA 92130

(Address of Principal Executive Offices)

(760) 260-8600

(Registrant’s Telephone number including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ¨ | Accelerated filer | þ |

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The number of shares of outstanding common stock, par value $0.0001 per share, of the Registrant as of May 1, 2015 was 34,960,979.

RETROPHIN, INC. AND SUBSIDIARIES

Form 10-Q

March 31, 2015

| 2 |

FORWARD LOOKING STATEMENTS

This report contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this report. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the headings “Risks Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our annual report on Form 10-K for the fiscal year ended December 31, 2014, as amended, in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Form 10-Q and information contained in other reports that we file with the Securities and Exchange Commission (the “SEC”). You are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

We file reports with the SEC. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us. You can also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, except as required by law. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this quarterly report, which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

| 3 |

RETROPHIN, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| March 31, 2015 | December 31, 2014 | |||||||

| (unaudited) | ||||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 120,174,877 | $ | 18,204,282 | ||||

| Marketable securities | 6,159,962 | 9,556,098 | ||||||

| Accounts receivable, net | 8,162,535 | 7,959,411 | ||||||

| Inventory, net | 1,718,365 | 800,507 | ||||||

| Pediatric priority review voucher-held for sale | 96,250,000 | - | ||||||

| Prepaid expenses and other current assets | 1,077,355 | 813,364 | ||||||

| Total current assets | 233,543,094 | 37,333,662 | ||||||

| Property and equipment, net | 618,620 | 670,796 | ||||||

| Security deposits | 337,014 | 337,014 | ||||||

| Restricted cash | 40,000 | 40,000 | ||||||

| Other asset | 1,987,364 | 1,888,035 | ||||||

| Intangible assets, net | 169,835,098 | 94,265,530 | ||||||

| Goodwill | 935,935 | 935,935 | ||||||

| Deferred tax asset | 8,691,307 | - | ||||||

| Total assets | $ | 415,988,432 | $ | 135,470,972 | ||||

| Liabilities and Stockholders' Equity (Deficit) | ||||||||

| Current liabilities: | ||||||||

| Deferred technology purchase liability | $ | 1,000,000 | $ | 1,000,000 | ||||

| Accounts payable | 5,913,027 | 7,124,330 | ||||||

| Accrued expenses | 19,346,699 | 27,882,995 | ||||||

| Other liability | 943,615 | 938,209 | ||||||

| Acquisition-related contingent consideration | 2,880,577 | 2,117,565 | ||||||

| Derivative financial instruments, warrants | 63,390,000 | 27,990,000 | ||||||

| Deferred income tax liability | 8,691,307 | - | ||||||

| Note payable | - | 40,485,452 | ||||||

| Total current liabilities | 102,165,225 | 107,538,551 | ||||||

| Convertible debt | 43,439,333 | 43,287,814 | ||||||

| Note payable | 40,803,627 | - | ||||||

| Other liability | 12,294,520 | 12,234,513 | ||||||

| Acquisition-related contingent consideration, less current portion | 48,718,710 | 9,519,662 | ||||||

| Deferred income tax liability, net | - | 141,151 | ||||||

| Total liabilities | 247,421,415 | 172,721,691 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders' Equity (Deficit): | ||||||||

| Preferred stock $0.001 par value; 20,000,000 shares authorized; 0 issued and outstanding as of March 31, 2015 and December 31, 2014 | - | - | ||||||

| Common stock $0.0001 par value; 100,000,000 shares authorized; 34,845,450 and 26,428,071 issued and 34,845,450 and 26,048,480 outstanding as of March 31, 2015 and December 31, 2014, respectively | 3,485 | 2,643 | ||||||

| Additional paid-in capital | 310,210,811 | 140,850,551 | ||||||

| Treasury stock, at cost, 0 and 379,591 shares as of March 31, 2015 and December 31, 2014, respectively | - | (3,214,608 | ) | |||||

| Accumulated deficit | (142,734,440 | ) | (179,174,858 | ) | ||||

| Accumulated other comprehensive income | 1,087,161 | 4,285,553 | ||||||

| Total stockholders' equity (deficit) | 168,567,017 | (37,250,719 | ) | |||||

| Total liabilities and stockholders' equity (deficit) | $ | 415,988,432 | $ | 135,470,972 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 4 |

RETROPHIN, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS)

(Unaudited)

| Three Months Ended March 31, | ||||||||

| 2015 | 2014 | |||||||

| (As Restated) | ||||||||

| Net product sales | $ | 17,371,800 | $ | 27,900 | ||||

| Operating expenses: | ||||||||

| Cost of goods sold | 274,447 | 900 | ||||||

| Research and development | 10,346,456 | 6,942,323 | ||||||

| Selling, general and administrative | 14,855,340 | 15,146,346 | ||||||

| Total operating expenses | 25,476,243 | 22,089,569 | ||||||

| Operating loss | (8,104,443 | ) | (22,061,669 | ) | ||||

| Other income (expenses), net: | ||||||||

| Gain on sale of asset | 204,198 | - | ||||||

| Interest income (expense), net | (3,798,533 | ) | 536 | |||||

| Finance expense | (600,000 | ) | - | |||||

| Realized gain on sale of marketable securities, net | 107,368 | 4,664 | ||||||

| Change in fair value of derivative instruments - loss | (36,752,960 | ) | (53,613,802 | ) | ||||

| Bargain purchase gain | 48,578,208 | - | ||||||

| Total other income (expense), net | 7,738,281 | (53,608,602 | ) | |||||

| Loss before provision for income taxes | (366,162 | ) | (75,670,271 | ) | ||||

| Income tax benefit (provision) | 40,021,151 | (65,376 | ) | |||||

| Net income (loss) | $ | 39,654,989 | $ | (75,735,647 | ) | |||

| Net income (loss) per common share, basic | $ | 1.46 | $ | (3.25 | ) | |||

| Net income (loss) per common share, diluted | $ | 1.32 | $ | (3.25 | ) | |||

| Weighted average common shares outstanding, basic | 27,157,883 | 23,334,967 | ||||||

| Weighted average common shares outstanding, diluted | 30,380,694 | 23,334,967 | ||||||

| Comprehensive income (loss): | ||||||||

| Net income (loss) | $ | 39,654,989 | $ | (75,735,647 | ) | |||

| Foreign currency translation | 23,006 | - | ||||||

| Unrealized gain (loss) on sale of marketable securities | (3,221,397 | ) | 622,076 | |||||

| Comprehensive income (loss) | $ | 36,456,598 | $ | (75,113,571 | ) | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 5 |

RETROPHIN, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Three Months Ended March 31, | ||||||||

| 2015 | 2014 | |||||||

| (As Restated) | ||||||||

| Cash Flows From Operating Activities: | ||||||||

| Net income (loss) | $ | 39,654,989 | $ | (75,735,647 | ) | |||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 1,778,747 | 127,187 | ||||||

| Realized gain on marketable securities | (107,368 | ) | (4,664 | ) | ||||

| Gain upon divestiture of asset | (200,000 | ) | - | |||||

| Deferred income tax provision (benefit) | (40,021,151 | ) | 65,376 | |||||

| Amortization of deferred financing costs | 32,507 | - | ||||||

| Amortization of debt discount | 469,694 | - | ||||||

| Lease liability | (160,034 | ) | - | |||||

| Settlement expense | - | 6,711,400 | ||||||

| Bargain purchase gain | (48,578,208 | ) | - | |||||

| Share based compensation | 5,573,277 | 3,404,876 | ||||||

| Derivative financial instruments, warrants, issued, recorded in interest expense | 1,050,000 | - | ||||||

| Change in estimated fair value of derivative financial instruments, warrants | 36,752,960 | 53,613,802 | ||||||

| Changes in operating assets and liabilities, net of acquisitions: | ||||||||

| Accounts receivable | (203,124 | ) | (28,800 | ) | ||||

| Inventory | (352,740 | ) | 900 | |||||

| Prepaid expenses and other assets | 127,392 | 462,861 | ||||||

| Accounts payable and accrued expenses | (3,150,374 | ) | 1,577,036 | |||||

| Net cash used in operating activities | (7,333,433 | ) | (9,805,673 | ) | ||||

| Cash Flows From Investing Activities: | ||||||||

| Purchase of fixed assets | (24,812 | ) | (166,144 | ) | ||||

| Purchase of intangible assets | - | (61,343 | ) | |||||

| Proceeds from the sale of marketable securities | 282,107 | 1,604,456 | ||||||

| Purchase of marketable securities | - | (2,669,454 | ) | |||||

| Proceeds from securities sold, not yet purchased | - | 4,314,953 | ||||||

| Securities sold, not yet purchased | - | (4,985,462 | ) | |||||

| Cash received upon divestiture of asset | 3,310,931 | - | ||||||

| Cash paid upon acquisition, net of cash acquired | (33,430,315 | ) | (29,150,000 | ) | ||||

| Net cash used in investing activities | (29,862,089 | ) | (31,112,994 | ) | ||||

| Cash Flows From Financing Activities: | ||||||||

| Payment of acquisition-related contingent consideration | (1,763,745 | ) | - | |||||

| Proceeds from the exercise of warrants | 519,602 | 4,039,152 | ||||||

| Proceeds from the exercise of stock options | 157,319 | - | ||||||

| Purchase of treasury stock, at cost | - | (2,257,336 | ) | |||||

| Proceeds received from issuance of common stock | 149,454,000 | 40,000,000 | ||||||

| Financing costs from issuance of common stock | (9,201,059 | ) | (3,164,993 | ) | ||||

| Net cash provided by financing activities | 139,166,117 | 38,616,823 | ||||||

| Net increase (decrease) in cash | 101,970,595 | (2,301,844 | ) | |||||

| Cash, beginning of year | 18,204,282 | 5,997,307 | ||||||

| Cash, end of period | $ | 120,174,877 | $ | 3,695,463 | ||||

| Supplemental Disclosure of Cash Flow Information: | ||||||||

| Cash paid for interest | $ | 2,502,500 | $ | - | ||||

| Non-cash investing and financing activities: | ||||||||

| Reclassification of derivative liability to equity due to exercise of warrants | $ | 2,402,960 | $ | 9,300,160 | ||||

| Present value of contingent consideration payable to sellers of Manchester Pharmaceuticals LLC | $ | - | $ | 12,797,210 | ||||

| Note payable entered into upon consummation of Manchester Pharmaceuticals LLC | $ | - | $ | 31,282,972 | ||||

| Present value of contingent consideration payable to sellers of Asklepion Pharmaceuticals LLC | $ | 42,209,000 | $ | - | ||||

| Shares issued –Cholbam acquisition | $ | 15,843,584 | $ | - | ||||

| Unrealized gain (loss) on marketable securities | $ | (3,221,397 | ) | $ | 537,516 | |||

| Accrued financing costs from issuance of common stock | $ | 266,181 | $ | - | ||||

| Unrealized gain on securities sold, not yet purchased | $ | - | $ | 84,560 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 6 |

RETROPHIN, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. DESCRIPTION OF BUSINESS

Organization and Description of Business

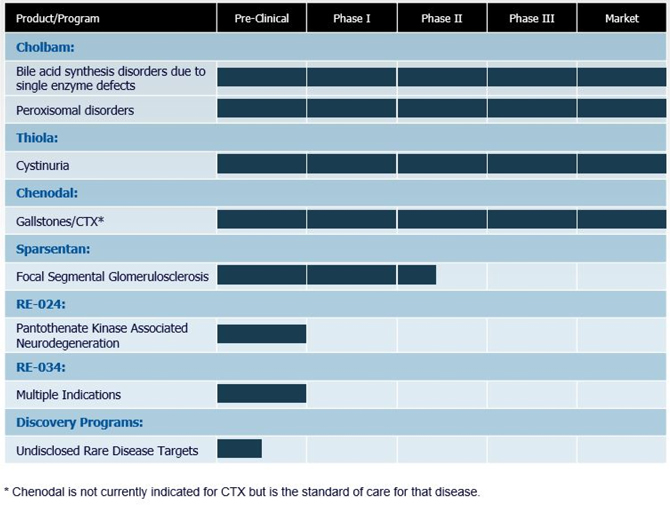

In this Quarterly Report on Form 10-Q, unless the context requires otherwise, the terms “we”, “our”, “us”, “Retrophin” and the “Company” refer to Retrophin, Inc., a Delaware corporation, as well as our direct and indirect subsidiaries. We are a fully integrated biopharmaceutical company with approximately 120 employees headquartered in San Diego, California focused on the development, acquisition and commercialization of therapies for the treatment of serious, catastrophic or rare diseases. We regularly evaluate and, where appropriate, act on opportunities to expand our product pipeline through licenses and acquisitions of products in areas that will serve patients with serious, catastrophic or rare diseases and that we believe offer attractive growth characteristics.

We currently sell the following three products:

| · | Chenodal® is approved in the United States for the treatment of patients suffering from gallstones in whom surgery poses an unacceptable health risk due to disease or advanced age. Chenodal® has been the standard of care for cerebrotendinous xanthomatosis (“CTX”) patients for more than three decades and the Company is currently pursuing adding this indication to the label. |

| · | Thiola® is approved in the United States for the prevention of cysteine (kidney) stone formation in patients with severe homozygous cystinuria. |

| · | Cholbam™ is approved in the United States and Europe for the treatment of bile acid synthesis disorders due to single enzyme defects. In the United States it is further indicated for treatment patients with peroxisomal disorders. |

The Company is developing RE-024, a novel small molecule, as a potential treatment for pantothenate kinase-associated neurodegeneration (“PKAN”). PKAN is a genetic neurodegenerative disorder that is typically diagnosed in the first decade of life. Consequences of PKAN include dystonia, dysarthria, rigidity, retinal degeneration, and severe digestive problems. There are currently no viable treatment options for patients with PKAN. RE-024 is a phosphopantothenate prodrug therapy that aims to restore levels of this key substrate in PKAN patients. Certain ex-US health regulators have approved the initiation of dosing RE-024 in PKAN under physician-initiated studies in accordance with local regulations in their respective countries. The Company filed a U.S. IND for RE-024 with the U.S. Food and Drug Administration (“FDA”) in the first quarter of 2015 to support the initiation of Company-sponsored studies, which became effective on April 28, 2015. RE-024 was granted orphan drug designation on May 5, 2015.

Sparsentan, also known as RE-021, is an investigational therapeutic agent which acts as both a potent angiotensin receptor blocker (“ARB”), as well as a selective endothelin receptor antagonist (“ERA”), with selectivity toward endothelin receptor type A. We are developing sparsentan as a treatment for FSGS, which is a leading cause of end-stage renal disease. We are currently enrolling patients for the DUET Phase 2 clinical study of sparsentan for the treatment of FSGS. Based on the robustness of the data obtained in the DUET study, we may be able to support an application for accelerated approval for sparsentan on the basis of proteinuria as a surrogate endpoint. In the first quarter of 2015, sparsentan received orphan drug designation.

RE-034 (Tetracosactide Zinc). RE-034 is a synthetic hormone analog of the first 24 amino acids of the 39 amino acids contained in ACTH formulated using a novel process by the Company. RE-034 exhibits similar physiological actions as endogenous ACTH by binding to melanocortin receptors, resulting in its anti-inflammatory and immunomodulatory effects. The Company has successfully formulated and manufactured RE-034 at proof-of-concept scale using a novel formulation process that allows modulation of the release of the active ingredient from the site of administration. The Company intends to continue preclinical development of RE-034 to enable multiple strategic options, which may include the initiation of IND-enabling studies in 2015.

Carbetocin. Carbetocin, similar to Oxytocin, has potential utility for the treatment of milk let-down in post pregnant women, inducing contractions during labor, postpartum hemorrhage, as well as for autism and schizophrenia. We are currently exploring options relating to the future development of Carbetocin.

On January 9, 2015, the Company entered into an asset purchase agreement with Turing Pharmaceuticals A.G. (“Turing Pharmaceuticals”), a company controlled by the Company’s former Chief Executive Officer, pursuant to which the Company sold Turing Pharmaceuticals its ketamine licenses and assets (the “Assets”) for a purchase price of $1.0 million. Turing Pharmaceuticals also assumed all future liabilities related to the Assets.

| 7 |

On February 12, 2015, the Company, its wholly-owned subsidiaries Manchester Pharmaceuticals LLC (“Manchester”) and Retrophin Therapeutics International, LLC (collectively, the “Sellers”), entered into a purchase agreement with Waldun Pharmaceuticals, LLC (“Waldun”), pursuant to which the Sellers sold Waldun their product rights to Vecamyl for a purchase price of $0.7 million. Waldun in turn sold Vecamyl to Turing Pharmaceuticals. In connection therewith, on February 12, 2015, the Company and Manchester entered into an asset purchase agreement with Turing Pharmaceuticals, pursuant to which the Company and Manchester sold Turing Pharmaceuticals their Vecamyl inventory for a purchase price of $0.3 million. Turing Pharmaceuticals also assumed certain liabilities related to the Vecamyl product rights and inventory.

On February 12, 2015, the Company entered into an asset purchase agreement with Turing Pharmaceuticals, pursuant to which the Company sold Turing Pharmaceuticals its Syntocinon licenses and assets, including related inventory, for a purchase price of $1.1 million. Turing Pharmaceuticals also assumed certain liabilities related to the Syntocinon assets and licenses.

2015 Public Offering

On March 24, 2015, we completed a public offering of 7,866,000 shares of common stock at a price of $19.00 per share. We received net proceeds from the offering of $140.0 million, after deducting underwriting fees and other offering costs of $9.5 million. The shares of common stock were offered by us pursuant to a shelf registration statement that was declared effective by the SEC on March 13, 2015.

Acquisition of Cholic Acid

On January 12, 2015, the Company announced the signing of a definitive agreement under which it acquired the exclusive right to purchase from Asklepion Pharmaceuticals, LLC (“Asklepion”), all worldwide rights, titles, and ownership of Cholbam™ (cholic acid) for the treatment of bile acid synthesis defects, if approved by the FDA. Under the terms of the agreement, Retrophin paid Asklepion an upfront payment of $5.0 million and agreed to pay milestones based on FDA approval and net product sales, plus tiered royalties on future net sales of Cholbam™. Retrophin secured a commitment for a line of credit from its existing lenders to cover necessary payments (see Note 10).

On March 18, 2015, the Company announced that the FDA approved Cholbam™ capsules, the first FDA approved treatment for pediatric and adult patients with bile acid synthesis disorders due to single enzyme defects, and for patients with peroxisomal disorders (including Zellweger spectrum disorders). As a result of the approval, Retrophin exercised its right to purchase from Asklepion all worldwide rights, titles, and ownership of Cholbam™ and related assets. The FDA also granted Asklepion a Rare Pediatric Disease Priority Review Voucher ("Pediatric PRV"), awarded to encourage development of new drugs and biologics for the prevention and treatment of rare pediatric diseases. This Pediatric PRV is transferable and provides the bearer with FDA priority review classification for a new drug application. The Pediatric PRV was transferred to Retrophin under the original terms of the agreement with Asklepion. The Pediatric PRV is classified as a current asset in the condensed consolidated balance sheet as the Company intends to sell the Pediatric PRV in 2015, and is currently in negotiations.

On March 31, 2015, the Company completed its acquisition from Asklepion of all worldwide rights, titles and ownership of Cholbam™, including all related contracts, data assets, intellectual property, regulatory assets and the Pediatric PRV (see Note 5). The Company utilized cash proceeds from its 2015 public offering to complete the acquisition, and as a result, did not utilize the commitment from its lenders.

NOTE 2. BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements of the Company should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 (the “2014 10-K”) filed with the Securities and Exchange Commission (the “SEC”) on March 11, 2015, and amended on March 13, 2015. The accompanying condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information, the instructions to Form 10-Q and the rules and regulations of the SEC. Accordingly, since they are interim statements, the accompanying condensed consolidated financial statements do not include all of the information and notes required by GAAP for annual financial statements, but reflect all adjustments consisting of normal, recurring adjustments, that are necessary for a fair presentation of the financial position, results of operations and cash flows for the interim periods presented. Interim results are not necessarily indicative of results for a full year. The December 31, 2014 balance sheet information was derived from the audited financial statements as of that date.

| 8 |

NOTE 3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

A summary of the significant accounting policies applied in the preparation of the accompanying condensed consolidated financial statements follows:

Principles of Consolidation

The unaudited condensed consolidated financial statements represent the consolidation of the accounts of the Company and its subsidiaries in conformity with GAAP. All intercompany accounts and transactions have been eliminated in consolidation.

Restatement of Prior Quarters

We held a Special Meeting of Stockholders on February 3, 2015, at which our stockholders voted to approve a proposal ratifying the prior issuance of stock options to purchase 1,928,000 shares of common stock and 230,000 restricted shares of common stock granted to employees between February 24, 2014 and August 18, 2014 (the “Ratified Equity Grants”). Our Form 10-Q for the three months ended March 31, 2014 contained errors related to the non-cash compensation expense recognized in connection with the Ratified Equity Grants, because the grant/measurement date of the Ratified Equity Grants for financial accounting purposes did not occur until their ratification at the Special Meeting of Stockholders on February 3, 2015. In addition, our Form 10-Q for the three months ended March 31, 2014 contained errors related to certain consulting agreements entered into by the Company, pursuant to which an expense and a settlement liability related to the entire amount of the stock to be issued under such consulting agreements should have been taken and revaluated at each reporting period based on changes in the Company’s stock price, until the stock had been entirely issued. We believe that the errors in the Form 10-Q for the three months ended March 31, 2014 do not cause the financial statements included therein to be misleading, and therefore such financial statements can still be relied upon. However, we have corrected such errors, including any related disclosures, in this Form 10-Q for the three months ended March 31, 2015, and will restate future quarters to correct such errors, as applicable. The impact for the three months ended March 31, 2014, was an increase to operating expenses of $5.1 million, and an increase in net loss of $5.1 million.

Recently Issued Accounting Pronouncements

In May 2014, the Financial Accounting Standard Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers. While the standard supersedes existing revenue recognition guidance, it closely aligns with current GAAP. Under the new standard, revenue is recognized at the time a good or service is transferred to a customer for the amount of consideration received for that specific good or service. Entities may use a full retrospective approach or report the cumulative effect as of the date of adoption. On April 1, 2015, the FASB proposed deferring the effective date by two years to December 15, 2018 for annual reporting periods beginning after that date. The FASB also proposed permitting early adoption of the standard, but not before the original effective date of December 15, 2016. We are currently evaluating the impact, if any, the adoption of this standard will have on our consolidated financial statements.

In February 2015, the FASB issued ASU No. 2015-02, Consolidation (Topic 810): Amendments to the Consolidation Analysis. The new consolidation standard changes the way reporting enterprises evaluate whether (a) they should consolidate limited partnerships and similar entities, (b) fees paid to a decision maker or service provider are variable interests in a variable interest entity ("VIE"), and (c) variable interests in a VIE held by related parties of the reporting enterprise require the reporting enterprise to consolidate the VIE. The guidance is effective for public business entities for annual and interim periods in fiscal years beginning after December 15, 2015. Early adoption is allowed, including early adoption in an interim period. A reporting entity may apply a modified retrospective approach by recording a cumulative-effect adjustment to equity as of the beginning of the fiscal year of adoption or may apply the amendments retrospectively. The Company is currently assessing the impact of the adoption of this guidance, if any, on the consolidated financial statements.

In April 2015, the FASB issued ASU No. 2015-03, Simplifying the Presentation of Debt Issuance Costs. This standard amends existing guidance to require the presentation of debt issuance costs in the balance sheet as a deduction from the carrying amount of the related debt liability instead of a deferred charge. It is effective for annual reporting periods beginning after December 15, 2015, but early adoption is permitted. The Company has chosen not to early adopt this standard.

NOTE 4. INCOME TAXES

The Company follows FASB ASC 740, Income Taxes, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are based on the differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the asset will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled.

The standard addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under FASB ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the tax authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement. FASB ASC 740 also provides guidance on de-

| 9 |

recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. As of March 31, 2015 and December 31, 2014, the Company had recorded an indemnification asset with a corresponding liability in the amount of $1.5 million, respectively, for an uncertain tax position related to the acquisition of Manchester Pharmaceuticals, LLC. The Company is indemnified with respect to the liability and has recorded an indemnification asset on the balance sheet.

In connection with the acquisition of Cholbam™, the Company recorded a deferred tax liability of $39.9 million. Based on the fact that the reversal of the deferred tax liability is viewed as a source of income pursuant to ASC 740, the Company was able to reduce its existing valuation allowance by $39.9 million in the first quarter. The deferred tax liabilities supporting the ability to realize the deferred tax assets in the above acquisition will reverse in the same period, are in the same jurisdiction and are of the same character as the temporary differences that gave rise to those deferred tax assets.

NOTE 5. BUSINESS ACQUISITION

Acquisition of Cholic Acid

On January 12, 2015, the Company announced the signing of a definitive agreement under which it acquired the exclusive right to purchase from Asklepion, all worldwide rights, titles, and ownership of Cholbam™ (cholic acid) for the treatment of bile acid synthesis defects, if approved by the FDA. Under the terms of the agreement, Retrophin paid Asklepion an upfront payment of $5.0 million and agreed to pay milestones based on FDA approval and net product sales, plus tiered royalties on future net sales of Cholbam™.

On March 18, 2015, the Company announced that the FDA has approved Cholbam™ capsules, the first FDA approved treatment for pediatric and adult patients with bile acid synthesis disorders due to single enzyme defects, and for patients with peroxisomal disorders (including Zellweger spectrum disorders). As a result of the approval, Retrophin exercised its right to purchase from Asklepion all worldwide rights, titles, and ownership of Cholbam™ and related assets. The FDA also granted Asklepion a Pediatric PRV, awarded to encourage development of new drugs and biologics for the prevention and treatment of rare pediatric diseases. This Pediatric PRV is transferable and provides the bearer with FDA priority review classification for a new drug application. The Pediatric PRV was transferred to Retrophin under the original terms of the agreement with Asklepion. The Pediatric PRV is classified as a current asset in the condensed consolidated balance sheet as the company intends to sell the Pediatric PRV in 2015, and is currently in negotiations.

On March 31, 2015, the Company completed its acquisition from Asklepion of all worldwide rights, titles and ownership of Cholbam™, including all related contracts, data assets, intellectual property, regulatory assets and the Pediatric PRV, in exchange for a cash payment of $28.4 million, in addition to approximately 661,279 shares of the Company’s common stock (initially valued at $9 million at the time of the Purchase Agreement, and $15.8 million at the time of acquisition completion date). The Company may also be required to pay contingent consideration consisting of milestones and tiered royalties with a present value of $42.2 million.

The Pediatric PRV is fair valued at $96.3 million. In this valuation process, we considered various factors which included data from recent sales of similar vouchers. The consideration paid did not contemplate the voucher because the issuance of a voucher is extremely rare. Therefore when the FDA granted the Pediatric PRV with the Cholbam™ approval, a gain resulted.

The acquisition was accounted for under the purchase method of accounting in accordance with ASC 805. The fair value of assets acquired and liabilities assumed was based upon a preliminary valuation and the Company’s estimates and assumptions are subject to change within the measurement period. Critical estimates in valuing certain intangible assets include but are not limited to future expected cash flows from acquired product rights-Cholbam™, Pediatric PRV, trade names and developed technologies, present value and discount rates. Management’s estimates of fair value are based upon assumptions believed to be reasonable, but which are inherently uncertain and unpredictable and, as a result, actual results may differ from estimates. Management’s valuation is preliminary. Once the valuation is complete, the Company will make any necessary adjustments.

The purchase price allocation of $91.5 million as of the Asklepion closing date of March 31, 2015 was as follows:

| Amount (in thousands) | ||||

| Cash paid upon consummation | $ | 33,429 | ||

| Present value of contingent consideration | 42,209 | |||

| Fair Value of 661,279 Shares issued to Asklepion | 15,844 | |||

| Total Purchase Price | $ | 91,482 | ||

| Fair Value of Assets Acquired | ||||

| Acquired product rights-Cholbam™ (Intangible Asset) | $ | 82,915 | ||

| Pediatric Priority Review Voucher | 96,250 | |||

| Inventory | 777 | |||

| Total Allocation of Purchase Price | $ | 179,942 | ||

| Bargain Purchase Gain | (88,460 | ) | ||

| Total Purchase Price | $ | 91,482 | ||

| 10 |

The bargain purchase gain of $88.5 million is shown net of tax of $39.9 million for a net gain of $48.6 million on the consolidated statements of operations.

Unaudited pro forma information for the transaction completed in the current quarter is not presented, because the effects of such transaction is considered immaterial to the Company.

NOTE 6. MARKETABLE SECURITIES

The Company measures marketable securities on a recurring basis. Generally, the types of securities the Company invests in are traded on a market such as the NASDAQ Global Market, which the Company considers to be Level 1 inputs.

Marketable securities at March 31, 2015 consisted of the following:

| Cost | Unrealized Gains | Estimated Fair Value | ||||||||||

| Marketable securities available-for-sale | $ | 5,095,807 | $ | 1,064,155 | $ | 6,159,962 | ||||||

Marketable securities at December 31, 2014 consisted of the following:

| Cost | Unrealized Gains | Unrealized Losses | Estimated Fair Value | |||||||||||||

| Marketable securities available-for-sale | $ | 5,160,558 | $ | 4,498,730 | $ | (103,190 | ) | $ | 9,556,098 | |||||||

NOTE 7. DERIVATIVE FINANCIAL INSTRUMENTS

The Company accounts for derivative financial instruments in accordance with ASC 815-40, Derivative and Hedging – Contracts in Entity’s Own Equity (“ASC 815-40”), pursuant to which instruments which do not have fixed settlement provisions are deemed to be derivative instruments. The Company’s warrants are classified as liability instruments due to an anti-dilution provision that provides for a reduction to the exercise price of the warrants if the Company issues additional equity or equity linked instruments in the future at an effective price per share less than the exercise price then in effect.

The warrants are re-measured at each balance sheet date based on estimated fair value. Changes in estimated fair value are recorded as non-cash valuation adjustments within other income (expenses) in the Company’s accompanying consolidated statements of operations. The Company recorded a loss on a change in the estimated fair value of warrants of $36.8 million and $53.6 million during the three months ended March 31, 2015 and 2014, respectively.

The Company calculated the fair value of the warrants using the Monte Carlo Simulation as of March 31, 2015 and the Binomial Lattice options pricing model as of December 31, 2014, and the assumptions are as follows:

| March 31, 2015 | December 31, 2014 | |||||||

| Fair value of common stock | $ | 23.96 | $ | 12.24 | ||||

| Expected life (in years), represents the weighted average period until next liquidity event | 5 years | .33 years | ||||||

| Risk-free interest rate | .86% – 1.32 | % | 1.13-1.69 | % | ||||

| Expected volatility | 85-90 | % | 85 | % | ||||

| Dividend yield | 0.00 | % | 0.00 | % | ||||

Expected volatility is based on analysis of the Company’s volatility, as well as the volatilities of guideline companies. The risk free interest rate is based on the U.S. Treasury security rates for the remaining term of the warrants at the measurement date.

| 11 |

NOTE 8. FAIR VALUE MEASUREMENTS

Financial Instruments and Fair Value

The Company accounts for financial instruments in accordance with ASC 820, Fair Value Measurements and Disclosures (“ASC 820”). ASC 820 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under ASC 820 are described below:

Level 1 – Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 – Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly; and

Level 3 – Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable.

In estimating the fair value of the Company’s marketable securities available-for-sale, the Company used quoted prices in active markets.

In estimating the fair value of the Company’s derivative liabilities, the Company used the Monte Carlo Simulation as of March 31, 2015 and the Binomial Lattice options pricing model as of December 31, 2014. Based on the fair value hierarchy, the Company classified the derivative liability within Level 3.

In estimating the fair value of the Company’s contingent consideration, the Company used the comparable uncontrolled transaction (“CUT”) method for royalty payments based on projected revenues. Based on the fair value hierarchy, the Company classified contingent consideration within Level 3 because valuation inputs are based on projected revenues discounted to a present value.

Financial instruments with carrying values approximating fair value include cash, accounts receivable, deposits on license agreements, and accounts payable, convertible notes payable and credit facility. Factors that we considered when estimating the fair value of our debt include market conditions, prepayment and make-whole provisions, variability in pricing from multiple lenders and term of debt.

The following table presents the Company’s assets and liabilities that are measured and recognized at fair value on a recurring basis classified under the appropriate level of the fair value hierarchy as of March 31, 2015:

| As of March 31, 2015 | Fair Value Hierarchy at March 31, 2015 | |||||||||||||||

| Total carrying and estimated fair value | Quoted prices in active markets (Level 1) | Significant other observable inputs (Level 2) | Significant unobservable inputs (Level 3) | |||||||||||||

| Asset: | ||||||||||||||||

| Marketable securities, available-for-sale | $ | 6,159,962 | $ | 6,159,962 | $ | - | $ | - | ||||||||

| Liabilities: | ||||||||||||||||

| Derivative liability related to warrants | $ | 63,390,000 | $ | - | $ | - | $ | 63,390,000 | ||||||||

| Acquisition-related contingent consideration | $ | 51,599,287 | $ | - | $ | - | $ | 51,599,287 | ||||||||

The following table presents the Company’s asset and liabilities that are measured and recognized at fair value on a recurring basis classified under the appropriate level of the fair value hierarchy as of December 31, 2014:

| As of December 31, 2014 | Fair Value Hierarchy at December 31, 2014 | |||||||||||||||

| Total carrying and estimated fair value | Quoted prices in active markets (Level 1) | Significant other observable inputs (Level 2) | Significant unobservable inputs (Level 3) | |||||||||||||

| Asset: | ||||||||||||||||

| Marketable securities, available-for-sale | $ | 9,556,098 | $ | 9,556,098 | $ | - | $ | - | ||||||||

| Liabilities: | ||||||||||||||||

| Derivative liability related to warrants | $ | 27,990,000 | $ | - | $ | - | $ | 27,990,000 | ||||||||

| Acquisition-related contingent consideration | $ | 11,637,227 | $ | - | $ | - | $ | 11,637,227 | ||||||||

| 12 |

The following table sets forth a summary of changes in the estimated fair value of the Company’s derivative financial instruments, warrants liability for the period from January 1, 2015 through March 31, 2015:

| Fair

Value Measurements of Common Stock Warrants Using Significant Unobservable Inputs (Level 3) | ||||

| Balance at January 1, 2015 | $ | 27,990,000 | ||

| Reclassification of derivative liability to equity upon exercise of warrants | (2,402,960 | ) | ||

| Issuance of warrants | 1,050,000 | |||

| Change in estimated fair value of liability classified warrants | 36,752,960 | |||

| Balance at March 31, 2015 | $ | 63,390,000 | ||

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. At each reporting period, the Company performs a detailed analysis of the assets and liabilities that are subject to ASC 820.

The following table sets forth a summary of changes in the estimated acquisition-related contingent consideration for the period from January 1, 2015 through March 31, 2015:

| Fair

Value Measurements of Acquisition-Related Contingent Consideration | ||||

| Balance at January 1, 2015 | $ | 11,637,227 | ||

| Present value of contingent consideration of Cholbam™, upon acquisition | 42,209,446 | |||

| Decrease of contingent consideration, asset divestiture | (603,663 | ) | ||

| Contractual Payments | (1,643,723 | ) | ||

| Balance at March 31, 2015 | $ | 51,599,287 | ||

NOTE 9. INTANGIBLE ASSETS

As of March 31, 2015, the net book value of amortizable intangible assets was approximately $169.8 million. Amortization expense recorded as research and development expenses amounted to $0.2 million and $0.1 million for the three months ended March 31, 2015 and March 31, 2014, respectively. Amortization expense recorded as general and administrative expenses amounted to $1.5 million and $0 for the three months ended March 31, 2015 and March 31, 2014, respectively.

Amortizable intangible assets as of March 31, 2015 consisted of the following:

| March 31, 2015 | ||||||||||||

| Gross Carrying Amount | Accumulated Amortization | Net Book Value | ||||||||||

| Acquired product rights-Cholbam™ | $ | 82,915,120 | $ | - | $ | 82,915,120 | ||||||

| Product Rights-Chenodal® | 67,849,000 | (4,295,710 | ) | 63,553,290 | ||||||||

| Thiola® License | 17,546,681 | (1,262,809 | ) | 16,283,872 | ||||||||

| Carbetocin Assets | 5,567,736 | (570,568 | ) | 4,997,168 | ||||||||

| Ligand License | 2,300,000 | (576,533 | ) | 1,723,467 | ||||||||

| Customer Relationships | 403,000 | (40,819 | ) | 362,181 | ||||||||

| Trade Name | 175,000 | (175,000 | ) | - | ||||||||

| Total | $ | 176,756,537 | $ | (6,921,439 | ) | $ | 169,835,098 | |||||

Amortizable intangible assets as of December 31, 2014 consisted of the following:

| December 31, 2014 | ||||||||||||

| Gross Carrying Amount | Accumulated Amortization | Net Book Value | ||||||||||

| Product Rights-Chenodal® | $ | 71,372,000 | $ | (3,419,603 | ) | $ | 67,952,397 | |||||

| Thiola® License | 15,049,648 | (870,607 | ) | 14,179,041 | ||||||||

| Syntocinon License | 5,000,000 | (190,437 | ) | 4,809,563 | ||||||||

| Carbetocin Assets | 5,567,736 | (429,493 | ) | 5,138,243 | ||||||||

| Ligand License | 2,300,000 | (526,578 | ) | 1,773,422 | ||||||||

| Customer Relationships | 403,000 | (30,890 | ) | 372,110 | ||||||||

| Trade Name | 175,000 | (134,246 | ) | 40,754 | ||||||||

| Total | $ | 99,867,384 | $ | (5,601,854 | ) | $ | 94,265,530 | |||||

| 13 |

NOTE 10. NOTES PAYABLE

Convertible Notes Payable

On May 29, 2014, the Company entered into a Note Purchase Agreement relating to a private placement by the Company of $46.0 million aggregate principal senior convertible notes due 2019 (the “Notes”) which are convertible into shares of the Company’s common stock at an initial conversion price of $17.41 per share. The conversion price is subject to customary anti-dilution protection. The Notes bear interest at a rate of 4.5% per annum, payable semiannually in arrears on May 15 and November 15 of each year. The Notes mature on May 30, 2019 unless earlier converted or repurchased in accordance with the terms. At March 31, 2015 and December 31, 2014, the aggregate carrying value of the Notes was $43.4 million and $43.3, respectively, which bore a weighted average annual interest rate of 4.5% during the three months ended March 31, 2015 and December 31, 2014, respectively.

Credit Facility

On June 30, 2014, the Company entered into a $45 million Credit Agreement (“Credit Facility”) which matures on June 30, 2018 and bears interest at an annual rate of (i) the Adjusted LIBOR Rate (as such term is defined in the Credit Facility) plus 10.00% or (ii) in certain circumstances, the Base Rate (as such term is defined in the Credit Agreement) plus 9.00% and is payable quarterly. The Credit Facility contains certain financial and non-financial covenants. The Company was in compliance with all of its debt covenants as of March 31, 2015.

At December 31, 2014, the Company reclassified the note payable to short term due to its inability to meet debt covenant requirements related to its cash balances over the next twelve months. On March 24, 2015, the Company received $140.0 million in proceeds from its equity financing, therefore, the Company expects to have the ability to meet future covenant requirements and therefore reclassified the debt back to long term.

On January 12, 2015, the Company entered into Amendment No. 3 (“Amendment No. 3”) to the Credit Facility in which the Company obtained a commitment letter from Athyrium Capital Management, LLC and Perceptive Credit Opportunities Fund, LP (collectively, the “Lenders”), the Company’s existing lenders, providing a commitment for a senior secured incremental term loan under the Company’s existing term loan facility in an aggregate principal amount of $30.0 million, which could be drawn down at the Company’s option to finance the acquisition of the Cholbam™ assets from Asklepion.

As consideration for Amendment No. 3, the Company made a $0.6 million cash payment to the Lenders, recorded in finance expense in the consolidated statements of operations, and issued the Lenders warrants initially exercisable to purchase up to an aggregate of 125,000 shares of the Company’s common stock which were valued at $1.1 million on January 12, 2015 and are recorded in interest expense in the consolidated statements of operations. Due to the closing of the public offering on March 24, 2015, the Company received cash proceeds of $140.0 million, after deducting underwriting fees and other offering costs, which the Company used to make the $27.0 million payment due to Asklepion upon the closing of the Company’s acquisition of the Cholbam™ assets, and as a result, the Company did not utilize the commitment from the lenders.

On March 24, 2015, the Company entered into Amendment No. 4 to the Credit Facility, which amended the Credit Facility to make certain changes to the definition of “change of control” contained therein.

At March 31, 2015 and December 31, 2014, the aggregate carrying value of the Credit Facility was $40.8 million and $40.5, respectively, which bore a weighted average annual interest rate of 11.0% during the three months ended March 31, 2015 and December 31, 2014, respectively.

Total interest income (expense), net, recognized was $3.8 million expense and $536 income for the three months ended March 31, 2015 and 2014, respectively.

Debt Maturities

The stated maturities of the Company’s long-term debt are as follows (in millions) as of March 31, 2015:

| 2015 | $ | - | ||

| 2016 | - | |||

| 2017 | - | |||

| 2018 | 45 | |||

| 2019 | 46 | |||

| Thereafter | - | |||

| $ | 91 |

| 14 |

NOTE 11. INCOME (LOSS) PER SHARE

Basic and diluted net income (loss) per share is calculated as follows:

| Three Months Ended | ||||||||||||||||

| March 31, 2015 | March 31, 2014 | |||||||||||||||

| Shares | EPS | Shares | EPS | |||||||||||||

| Basic Earnings per Share | 27,157,883 | $ | 1.46 | 23,334,967 | $ | (3.25 | ) | |||||||||

| Employee Stock Options | 368,962 | |||||||||||||||

| Convertible Debt | 2,642,160 | |||||||||||||||

| Restricted Common Stock | 211,688 | |||||||||||||||

| Diluted Earnings per Share | 30,380,694 | $ | 1.32 | 23,334,967 | $ | (3.25 | ) | |||||||||

Basic net income (loss) per share is based on the weighted average number of common and common equivalent shares outstanding.

At March 31, 2015, warrants and portions of unvested employee stock options were excluded from the calculation because they were anti-dilutive. At March 31, 2014, common stock options, restricted stock units, and warrants were excluded from the calculation because they were anti-dilutive.

NOTE 12. COMMITMENTS AND CONTINGENCIES

Leases and Sublease Agreements

On October 1, 2013, the Company entered into building lease for office space located at One Kendall Square in Cambridge, Massachusetts. In August 2014, Retrophin ceased use of the facility at One Kendall Square and all employees formerly located at this facility moved into the new facility on Binney Street, Cambridge, Massachusetts. In March 2015, the Company entered into a termination agreement with the landlord and paid an $80,000 lease termination fee.

On February 28, 2014, the Company amended its lease agreement for its offices located in Carlsbad, California. In October 2014, Retrophin ceased use of this facility, and all employees formerly located at that facility moved into the new headquarters facility in San Diego, California. In March 2015, the Company entered into an agreement to sublease the Carlsbad California lease for a three year term with an annual rent of approximately $56,000 annually with annual rent escalations.

Research Collaboration and Licensing Agreements

As part of the Company's research and development efforts, the Company enters into research collaboration and licensing agreements with unrelated companies, scientific collaborators, universities, and consultants. These agreements contain varying terms and provisions which include fees and milestones to be paid by the Company, services to be provided, and ownership rights to certain proprietary technology developed under the agreements. Some of these agreements contain provisions which require the Company to pay royalties, in the event the Company sells or licenses any proprietary products developed under the respective agreements.

| 15 |

Contractual Commitments

The following table summarizes our principal contractual commitments, excluding open orders that support normal operations, as of March 31, 2015:

| Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | ||||||||||||||||

| Operating Leases | $ | 2,339,386 | $ | 1,019,627 | $ | 1,319,759 | $ | - | $ | - | ||||||||||

| Other commitments | 3,073,575 | 436,980 | 1,273,440 | 1,363,155 | - | |||||||||||||||

| $ | 5,412,961 | $ | 1,456,607 | $ | 2,593,199 | $ | 1,363,155 | $ | - | |||||||||||

Legal Proceedings

On March 28, 2013, Chun Yi Huang (“Huang”) sued the Company, MSMB Group, MSMB Capital Management, LLC, Retrophin Pharmaceutical, Inc., Marek Biestek, and Martin Shkreli in state court in New York (Huang v. MSMB Group, Index No. 152829-2013). Huang claims that he is owed past due salary and benefits totaling $36,387. The Company answered the complaint in April 2013, and the parties have since been engaged in discovery. In June 2014, Huang’s counsel filed a motion seeking to be relieved as counsel for Huang. The Court denied that motion in October 2014. In September 2014, Huang noticed an appeal of a discovery order, which was withdrawn on February 25, 2015.

On June 13, 2014, Charles Schwab & Co., Inc. (“Schwab”) sued the Company, Standard Registrar and Transfer Company (“Standard”), Jackson Su (“Su”), and Huang in federal court in the Southern District of New York (Charles Schwab & Co. v. Retrophin, Inc., Case No. 14-cv-4294). The complaint alleges that the defendants misled Schwab in connection with its sale of Company stock owned by Su and Huang. Schwab contends that Su and Huang improperly advised it that their Company stock was not restricted. Schwab’s claim against the Company is based on an agency theory. Schwab contends that it has incurred in excess of $2.5 million in damages as a result of the alleged misinformation. Su and Huang have asserted cross-claims against the Company and Standard for alleged negligent misrepresentation premised upon an alleged failure to inform them of restrictions on the sale of their Company stock. Su and Huang have also impleaded Katten Muchin Rosenman LLP as a third-party defendant. The Company has filed motions to dismiss Schwab’s claims, as well as Su’s and Huang’s cross claims. Those motions are fully briefed, but have not yet been decided by the court.

On September 19, 2014, a purported shareholder of the Company sued Mr. Shkreli in federal court in the Southern District of New York (Donoghue v. Retrophin, Inc., Case No. 14-cv-7640). The Company is a nominal defendant in this action. The plaintiff seeks, on behalf of the Company, disgorgement of short-swing profits from Mr. Shkreli under section 16(b) of the Securities Exchange Act of 1934 (15 U.S.C. 78(p)(b)). The complaint alleges that, based on trades in the Company’s stock between November 2013 and November 2014, Mr. Shkreli realized short-swing profits in excess of $1.75 million, which belong to the Company. In December 2014, Mr. Shkreli filed an answer to the operative complaint, in which he, among other things, admitted to owing the Company over $0.6 million in short-swing profits. The parties are currently engaged in discovery. The Company will record the money to be received from this claim at such time in the future should cash be received by the Company from Shkreli.

On October 20, 2014, a purported shareholder of the Company filed a putative class action complaint in federal court in the Southern District of New York against the Company, Mr. Shkreli, Marc Panoff, and Jeffrey Paley (Kazanchyan v. Retrophin, Inc., Case No. 14-cv-8376). On December 16, 2014, a second, related complaint was filed in the Southern District of New York against the same defendants (Sandler v. Retrophin, Inc., Case No. 14-cv-9915). The complaints assert violations of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 in connection with defendants’ public disclosures during the period from November 13, 2013 through September 30, 2014. In December 2014, plaintiff Kazanchyan filed a motion to appoint lead plaintiff, to approve lead counsel, and to consolidate the two related actions. On February 10, 2015, the Court consolidated the two actions, appointed lead plaintiff, and approved lead counsel. Lead plaintiff’s filed a consolidated amended complaint on March 4, 2015. An initial pretrial conference is currently scheduled for June 4, 2015.

On January 7, 2014, the Company sued Questcor Pharmaceuticals, Inc. (“Questcor”) in federal court in the Central District of California (Retrophin, Inc. v. Questcor Pharmaceuticals, Inc., Case No. SACV14-00026-JLS). The Company contends that Questcor violated antitrust laws in connection with its acquisition of rights to the drug Synacthen, and seeks injunctive relief and damages. The Company has asserted claims under sections 1 and 2 of the Sherman Act, section 7 of the Clayton Act, California antitrust laws, and California’s unfair competition law. In August 2014, the Court denied Questcor’s motion to dismiss. The parties are now engaged in discovery. A trial is currently set for March 2016.

In January 2015, the Company received a subpoena relating to a criminal investigation by the U.S. Attorney for the Eastern District of New York. The subpoena requests information regarding, among other things, the Company’s relationship with Mr. Shkreli and individuals or entities that had been investors in investment funds previously managed by Mr. Shkreli. The Company has been informed that it is not a target of the U.S. Attorney’s investigation, and intends to cooperate with the investigation.

As of March 31, 2015 no accruals for loss contingencies have been recorded since these cases are neither probable nor reasonably estimable. From time to time the Company is involved in legal proceedings arising in the ordinary course of business. The Company believes there is no other litigation pending that could have, individually or in the aggregate, a material adverse effect on its results of operations or financial condition.

NOTE 13. STOCKHOLDERS’ EQUITY/DEFICIT

2015 Public Offering

On March 24, 2015, we completed a public offering of 7,866,000 shares of common stock at a price of $19.00 per share. We received net proceeds from the offering of $140.0 million, after deducting underwriting fees and other offering costs of $9.5 million. The shares

| 16 |

of common stock were offered by us pursuant to a shelf registration statement that was declared effective by the SEC on March 13, 2015.

Restricted Shares

The following table summarizes the Company’s restricted stock activity during the three months ended March 31, 2015:

| Number

of shares | Weighted Average Grant Date Fair Value | |||||||

| Outstanding December 31, 2014 | 691,668 | $ | 10.83 | |||||

| Granted | 40,000 | 18.32 | ||||||

| Vested | (97,999 | ) | 7.95 | |||||

| Forfeited/cancelled | (53,335 | ) | 11.47 | |||||

| Outstanding March 31, 2015 | 580,334 | $ | 12.07 | |||||

Stock Options

The following table summarizes information about stock option activity during the three months ended March 31, 2015:

| Shares Underlying Options | Weighted Average Exercise Price | |||||||

| Outstanding at December 31, 2014 | 4,892,208 | $ | 10.93 | |||||

| Granted | 320,000 | 14.08 | ||||||

| Exercised | (16,525 | ) | 12.84 | |||||

| Forfeited/cancelled | (208,125 | ) | 12.40 | |||||

| Outstanding at March 31, 2015 | 4,987,558 | $ | 10.67 | |||||

At March 31, 2015, outstanding options to purchase 1.5 million shares were exercisable with a weighted-average exercise price per share of $9.88.

Share Based Compensation

Total employee non-cash stock-based compensation by operating statement classification is as follows for the three months ended March 31, 2015 and 2014:

| Three Months Ended | ||||||||

| March

31, 2015 | March

31, 2014 | |||||||

| Selling, General & Administrative-Consultants | $ | - | $ | 1,525,065 | ||||

| Selling, General & Administrative | 3,353,580 | 1,332,078 | ||||||

| Research & Development | 2,219,697 | 547,733 | ||||||

| Total | $ | 5,573,277 | $ | 3,404,876 | ||||

Exercise of Warrants

During the three months ended March 31, 2015, the Company issued 124,334 shares of common stock upon the exercise of warrants for cash, pursuant to which the Company received $0.5 million. The Company reclassified $2.4 million derivative liability as equity for the value of these warrants on the date of exercise. The warrants were revalued immediately prior to exercise and the change in the fair value of the warrants was recorded as other expense in the condensed consolidated financial statements of the Company. The number of warrants outstanding at March 31, 2015 was 3,422,021.

| 17 |

NOTE 14. SALE OF ASSETS

On January 9, 2015, the Company entered into an asset purchase agreement with Turing Pharmaceuticals A.G. (“Turing Pharmaceuticals”), pursuant to which the Company sold Turing Pharmaceuticals its ketamine licenses and assets (the “Assets”) for a purchase price of $1.0 million. Turing Pharmaceuticals also assumed all future liabilities related to the Assets.

On February 12, 2015, the Company, its wholly-owned subsidiaries Manchester Pharmaceuticals LLC (“Manchester”) and Retrophin Therapeutics International, LLC (collectively, the “Sellers”), entered into a purchase agreement with Waldun Pharmaceuticals, LLC (“Waldun”), pursuant to which the Sellers sold Waldun their product rights to Vecamyl for a purchase price of $0.7 million. Waldun in turn sold Vecamyl to Turing Pharmaceuticals. In connection therewith, on February 12, 2015, the Company and Manchester entered into an asset purchase agreement with Turing Pharmaceuticals, pursuant to which the Company and Manchester sold Turing Pharmaceuticals their Vecamyl inventory for a purchase price of $0.3 million. Turing Pharmaceuticals also assumed certain liabilities related to the Vecamyl product rights and inventory.

On February 12, 2015, the Company entered into an asset purchase agreement with Turing Pharmaceuticals, pursuant to which the Company sold Turing Pharmaceuticals its Syntocinon licenses and assets, including related inventory, for a purchase price of $1.1 million. Turing Pharmaceuticals assumed certain liabilities related to the Syntocinon assets and licenses.

In conjunction with the sale of the Vecamyl, Syntocinon and ketamine assets, the Company recorded a gain of $0.2 million and wrote off the unamortized book value of the Vecamyl Product Rights Intangible Asset of $3.3 million and Syntocinon License Intangible Asset of $4.8 million.

| 18 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and related notes included in this Quarterly Report on Form 10-Q and the audited financial statements and notes thereto as of and for the year ended December 31, 2014 and the related Management’s Discussion and Analysis of Financial Condition and Results of Operations, both of which are contained in our Annual Report on Form 10-K for the year ended December 31, 2014, filed with the Securities and Exchange Commission (SEC) on March 11, 2015, and amended on March 13, 2015. Past operating results are not necessarily indicative of results that may occur in future periods.

Forward-Looking Statements

The information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements concerning our strategy, future operations, future financial position, future revenues, projected costs, prospects and plans and objectives of management. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including, without limitation, the risks set forth in Part II, Item IA, “Risk Factors” in this Quarterly Report on Form 10-Q and in our other filings with the SEC. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements.

Overview

We are a fully integrated biopharmaceutical company with approximately 120 employees headquartered in San Diego, California focused on the development, acquisition and commercialization of therapies for the treatment of serious, catastrophic or rare diseases. We regularly evaluate and, where appropriate, act on opportunities to expand our product pipeline through licenses and acquisitions of products in areas that will serve patients with serious, catastrophic or rare diseases and that we believe offer attractive growth characteristics.

We currently sell the following three products:

| · | Chenodal® is approved in the United States for the treatment of patients suffering from gallstones in whom surgery poses an unacceptable health risk due to disease or advanced age. Chenodal® has been the standard of care for CTX patients for more than three decades and the Company is currently pursuing adding this indication to the label. |

| · | Thiola® is approved in the United States for the prevention of cysteine (kidney) stone formation in patients with severe homozygous cystinuria. |

| · | Cholbam™ is approved in the United States and Europe for the treatment of bile acid synthesis disorders due to single enzyme defects. In the United States it is further indicated for treatment patients with peroxisomal disorders. |

| 19 |

On January 9, 2015, the Company entered into an asset purchase agreement with Turing Pharmaceuticals A.G. (“Turing Pharmaceuticals”), a company controlled by the Company’s former CEO, pursuant to which the Company sold Turing Pharmaceuticals its ketamine licenses and assets for a purchase price of $1.0 million. Turing Pharmaceuticals also assumed all future liabilities related to the Assets.

On February 12, 2015, the Company, its wholly-owned subsidiaries Manchester Pharmaceuticals LLC (“Manchester”) and Retrophin Therapeutics International, LLC (collectively, the “Sellers”), entered into a purchase agreement with Waldun Pharmaceuticals, LLC (“Waldun”), pursuant to which the Sellers sold Waldun their product rights to Vecamyl for a purchase price of $0.7 million. Waldun in turn sold Vecamyl to Turing Pharmaceuticals. In connection therewith, on February 12, 2015, the Company and Manchester entered into an asset purchase agreement with Turing Pharmaceuticals, pursuant to which the Company and Manchester sold Turing Pharmaceuticals their Vecamyl inventory for a purchase price of $0.3 million. Turing Pharmaceuticals also assumed certain liabilities related to the Vecamyl product rights and inventory.

On February 12, 2015, the Company entered into an asset purchase agreement with Turing Pharmaceuticals, pursuant to which the Company sold Turing Pharmaceuticals its Syntocinon licenses and assets, including related inventory, for a purchase price of $1.1 million. Turing Pharmaceuticals also assumed certain liabilities related to the Syntocinon assets and licenses.

We held a Special Meeting of Stockholders on February 3, 2015, at which our stockholders voted to approve a proposal ratifying the prior issuance of stock options to purchase 1,928,000 shares of common stock and 230,000 restricted shares of common stock granted to employees between February 24, 2014 and August 18, 2014 (the “Ratified Equity Grants”). Our Form 10-Q for the three months ended March 31, 2014 contained errors related to the non-cash compensation expense recognized in connection with the Ratified Equity Grants, because the grant/measurement date of the Ratified Equity Grants for financial accounting purposes did not occur until their ratification at the Special Meeting of Stockholders on February 3, 2015. In addition, our Form 10-Q for the three months ended March 31, 2014 contained errors related to certain consulting agreements entered into by the Company, pursuant to which an expense and a settlement liability related to the entire amount of the stock to be issued under such consulting agreements should have been taken and revaluated at each reporting period based on changes in the Company’s stock price, until the stock had been entirely issued. We believe that the errors in the Form 10-Q for the three months ended March 31, 2014 do not cause the financial statements included therein to be misleading, and therefore such financial statements can still be relied upon. However, we have corrected such errors, including any related disclosures, in this Form 10-Q for the three months ended March 31, 2015, and will restate future quarters to correct such errors, as 1applicable. The impact for the three months ended March 31, 2014, was an increase to operating expenses of $5.1 million, and an increase in net loss of $5.1 million.

On March 24, 2015, we completed a public offering of 7,866,000 shares of common stock at a price of $19.00 per share. We received net proceeds from the offering of $140.0 million, after deducting underwriting fees and other offering costs of $9.5 million. The shares of common stock were offered by us pursuant to a shelf registration statement that was declared effective by the SEC on March 13, 2015.

On January 12, 2015, the Company announced the signing of a definitive agreement under which it acquired the exclusive right to purchase from Asklepion, all worldwide rights, titles, and ownership of Cholbam™ (cholic acid) for the treatment of bile acid synthesis defects, if approved by the FDA. Under the terms of the agreement, Retrophin paid Asklepion an upfront payment of $5.0 million and agreed to pay milestones based on FDA approval and net product sales, plus tiered royalties on future net sales of Cholbam™.

On March 18, 2015, the Company announced that the FDA approved Cholbam™ capsules, the first FDA approved treatment for pediatric and adult patients with bile acid synthesis disorders due to single enzyme defects, and for patients with peroxisomal disorders (including Zellweger spectrum disorders). As a result of the approval, Retrophin exercised its right to purchase from Asklepion all worldwide rights, titles, and ownership of Cholbam™ and related assets. The FDA also granted Asklepion a Rare Pediatric Disease Priority Review Voucher ("Pediatric PRV"), awarded to encourage development of new drugs and biologics for the prevention and treatment of rare pediatric diseases. This Pediatric PRV is transferable and provides the bearer with FDA priority review classification for a new drug application. The Pediatric PRV was transferred to Retrophin under the original terms of the agreement with Asklepion. The Pediatric PRV is classified as a current asset in the condensed consolidated balance sheet as the company intends to sell the Pediatric PRV in 2015, and is currently in negotiations.

On March 31, 2015, the Company completed its acquisition from Asklepion of all worldwide rights, titles and ownership of Cholbam™, including all related contracts, data assets, intellectual property, regulatory assets and the Pediatric PRV, in exchange for a one-time cash payment of $28.4 million, in addition to approximately 661,279 shares of the Company’s common stock (initially valued at $9 million at the time of the Purchase Agreement, and $15.8 million at the time of acquisition completion date). The Company may also be required to pay contingent consideration consisting of milestones and tiered royalties with a present value of $42.2 million.

| 20 |

Products and Research and Development Programs

Changes to Product and Research and Development Programs

In conjunction with the sale of the Company’s Vecamyl, Syntocinon and ketamine licenses to Turing Pharmaceuticals, the Company has stopped future investment in these products.

Cholbam™

On March 18, 2015, the Company announced that the U.S. Food and Drug Administration (FDA) approved Cholbam™ capsules, the first FDA approved treatment for pediatric and adult patients with bile acid synthesis disorders due to single enzyme defects, and for patients with peroxisomal disorders (including Zellweger spectrum disorders). The effectiveness of Cholbam™ has been demonstrated in clinical trials for bile acid synthesis disorders and the adjunctive treatment of peroxisomal disorders. There are approximately 30 patients currently receiving Cholbam™ through an open label extension of these trials. The estimated incidence of bile acid synthesis disorders due to single enzyme defects is 1 to 9 per million live births. Peroxisomal disorders are believed to affect approximately 1 in 50,000 live births.

Thiola® (Tiopronin)

Thiola® is approved by the FDA for the treatment of cystinuria, a rare genetic cystine transport disorder that causes high cystine levels in the urine and the formation of recurring kidney stones. The resulting long-term damage can cause long term kidney damage in addition to substantial pain and loss of productivity associated with renal colic and stone passage. The worldwide prevalence of the disease is believed to be one in 7,000. We have built a salesforce to promote Thiola® to targeted physicians and are exploring alternative formulations that may enhance the value of Thiola® for patients with cystinuria.

| 21 |

Chenodal® (chenodiol tablets)

Chenodal® is a synthetic oral form of chenodeoxycholic acid, a naturally occurring primary bile acid synthesized from cholesterol in the liver, indicated for the treatment of radiolucent stones in well-opacifying gallbladders in whom selective surgery would be undertaken except for the presence of increased surgical risk due to systemic disease or age. Discussions with the FDA have been initiated to determine the path for revising the Chenodal® label to include CTX, a rare genetic disease which causes multiple symptoms including neurologic impairment. Chenodeoxycholic acid has been utilized as the standard of care for CTX patients for several decades.

Sparsentan