Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Cooper-Standard Holdings Inc. | earningspresentationq12015.htm |

1 First Quarter 2015 Conference Call and Webcast May 8, 2015

2 2 Forward-Looking Statements There are a number of risks and uncertainties that could cause the Company's actual results to differ materially from the forward-looking statements contained in this announcement. Important factors that could cause the Company's actual results to differ materially from the forward-looking statements made herein include, but are not limited to: prolonged or material contractions in automotive sales and production volumes, the Company's liquidity, the viability of the Company's supply base and the financial conditions of the Company's customers; loss of large customers or significant platforms; foreign currency exchange rate fluctuations; the Company’s substantial indebtedness; the Company's ability to obtain financing in the future; ability to generate sufficient cash to service all of the Company's indebtedness; operating and financial restrictions imposed on the Company by the credit agreements governing the Company’s term loan and ABL facilities; underfunding of pension plans; availability and increasing volatility in costs of manufactured components and raw materials; escalating pricing pressures; the Company's ability to meet significant increases in demand; the Company's ability to successfully compete in the automotive parts industry; risks associated with the Company's non-U.S. operations; ability to control the operations of the Company's joint ventures for the Company’s sole benefit; effectiveness of continuous improvement programs and other cost savings plans; product liability, warranty and recall claims that may be brought against the Company; work stoppages or other labor conditions; natural disasters; ability to meet the Company's customers' needs for new and improved products on a timely or cost-effective basis; the possibility that the Company's acquisition strategy may not be successful; the ability of the Company's intellectual property portfolio to withstand legal challenges; a disruption in, or the inability to successfully implement upgrades to, the Company's information technology systems; compliance with environmental, health and safety laws and other laws and regulations; the volatility of the Company's annual effective tax rate; significant changes in discount rates and the actual return on pension assets and other factors; the possibility of future impairment charges to the Company's goodwill and long-lived assets; the concentration of stock ownership which may allow a few owners to exert significant control over the Company; stock volatility; and dependence on the Company's subsidiaries for cash to satisfy the obligations of the holding Company.

3 Business Highlights First Quarter 2015 Jeff Edwards Chairman and CEO

4 4 Business Highlights • Expanding Margins in Key Markets • Optimizing Global Footprint • Outpacing Industry Growth • Improving Safety Performance

5 5 Expanding Margins in Key Markets • Achieved double-digit adjusted EBITDA margins as planned • Consolidated adjusted EBITDA margin reached 10.1% of sales Region Segment Profit Margin Change (Bps) 1Q 2015 vs. 1Q 2014 North America +140 Europe +530 (excl. restructuring) Asia Pacific +170 South America Continuing macro-economic challenges

6 6 Optimizing Global Footprint • Finalized acquisition of Huayu-Cooper Standard Sealing • Advancing Cooper Standard INOAC FTS joint venture • Initiated Japanese customer technical reviews • Signed agreement for a new JV in India • Progressing through Europe restructuring as planned

7 7 Outpacing Industry Growth • Revenue increased by 4.7% on an FX neutral basis • FX impact of $77.0 million • Significantly outpaced light vehicle production growth 837.6 800.1 877.1 1Q 2014 1Q 2015 Revenue as Reported Rev. ex FX Impact + 4.7% Revenue Highlights

8 8 1Q 2014 vs 1Q 2015 Revenue Bridge Revenue Up 4x Market (millions) +3% +2% -1% $837.6 $800.1 $877.1 -9%

9 9 Revenue by Region Asia Pacific Revenue Growth Accelerating Growth in Asia North America 52% Europe 33% South America 4% 1Q 2014 1Q 2015 (millions) +48% +23% Organic Acq./Div. +25% $57.1 $85.7 Asia Pacific 11%

10 Financial Review First Quarter 2015 Matt Hardt EVP and CFO

11 11 Q1 2015 Financial Results First Quarter 2014 2015 Sales $837.6 $800.1 Gross Profit 134.3 130.9 % Margin 16.0% 16.4% SGA&E 79.6 76.3 Operating Profit 47.2 32.2 % Margin 5.6% 4.0% Other Income - 11.1 Adjusted EBITDA $80.6 $80.8 % Margin 9.6% 10.1% Net Income $19.7 $21.0 Fully Diluted EPS $1.10 $1.15 $ USD Millions, except Fully Diluted EPS / % Note: Numbers subject to rounding

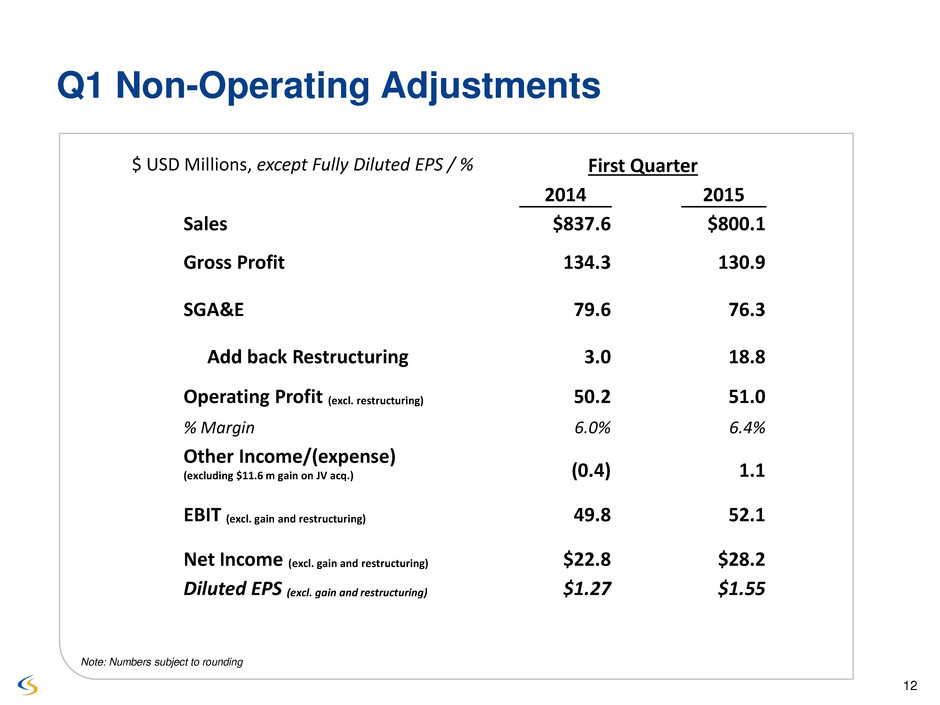

12 12 Q1 Non-Operating Adjustments First Quarter 2014 2015 Sales $837.6 $800.1 Gross Profit 134.3 130.9 SGA&E 79.6 76.3 Add back Restructuring 3.0 18.8 Operating Profit (excl. restructuring) 50.2 51.0 % Margin 6.0% 6.4% Other Income/(expense) (excluding $11.6 m gain on JV acq.) (0.4) 1.1 EBIT (excl. gain and restructuring) 49.8 52.1 Net Income (excl. gain and restructuring) $22.8 $28.2 Diluted EPS (excl. gain and restructuring) $1.27 $1.55 $ USD Millions, except Fully Diluted EPS / % Note: Numbers subject to rounding

13 13 Adjusted EBITDA Bridge $60 $85 $110 (millions) +20% +9% -8% -13% -8% $80.6 $80.8

14 14 Q1 2015 Balance Sheet and Liquidity Note: Numbers subject to rounding Liquidity Cash Balance as of December 31, 2014 $ 267.3 Cash consumed (72.9) Cash Balance as of March 31, 2015 $ 194.4 ABL Revolver 180.0 Letters of Credit (35.6) Total Liquidity $ 338.8 Key Financial Ratios EBITDA, Adjusted EBITDA and Financial Ratios are Non-GAAP measures. See appendix. Net Leverage $ 606 M Net Leverage to LTM Adj. EBITDA 1.9 x Int. Coverage Ratio 7.8 x Net Leverage to Book Capitalization 45.1%

15 15 Cash Flow Improvement Plan Optimizing cash generation through 4 key areas: • Capital Expenditures • Working Capital • Restructuring • Cash Taxes

16 Company Outlook Jeff Edwards Chairman and CEO

17 17 Driving for Profitable Growth • Driving cash flow improvements • Capturing margin improvement through BBP • Marketing new technologies • Expanding market share in core businesses • Managing headwinds • Pursuing strategic acquisitions

18 18 2015 Guidance Previous Guidance Feb 28, 2015 Current Guidance May 8, 2015 Revenue $3.3 - $3.4 billion Unchanged Capital Expenditure $185 - $210 million $185 - $200 million Restructuring $35 - $45 million $30 - $40 million Cash Tax $45 - $55 million Unchanged Adj. EBITDA Margin 50 – 75 bps improvement Unchanged Key Assumptions NA Production 17.4 million units Unchanged European Production 20.3 million units Unchanged Avg. full year FX rates Euro 1 EUR = $1.19 USD 1 EUR = $1.12 USD Canadian Dollar 1 CAD = $0.84 USD 1 CAD = $0.80 USD

19 Q&A

20 Appendix

21 21 Non-GAAP Financial Measures EBITDA and adjusted EBITDA are measures not recognized under Generally Accepted Accounting Principles (GAAP) which exclude certain non-cash and non-recurring items. Management considers EBITDA and adjusted EBITDA as key indicators of the Company's operating performance and believes that these and similar measures are widely used by investors, securities analysts and other interested parties in evaluating the Company's performance. Adjusted EBITDA is defined as net income adjusted to exclude income tax expense, interest expense net of interest income, depreciation and amortization, and certain unusual, non-operating, non-cash or non-recurring items that management considers to be outside the scope of the Company's core operating performance. When analyzing the company’s operating performance, investors should use EBITDA and adjusted EBITDA in addition to, and not as alternatives for, net income (loss), operating income, cash flow from operating activities or any other performance measure derived in accordance with GAAP. EBITDA and adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of the company’s results of operations as reported under GAAP. Other companies may report EBITDA and adjusted EBITDA differently and therefore Cooper Standard’s results may not be comparable to other similarly titled measures of other companies. This presentation of adjusted EBITDA should not be construed as an inference that Cooper Standard's future results will be unaffected by unusual or non- recurring items.

22 22 EBITDA and Adjusted EBITDA Reconciliation 2014 2015 Net income attributable to Cooper-Standard Holdings Inc. 19.7$ 21.0$ Income tax expense 12.1 14.7 Interest expense, net of interest income 15.0 9.2 Depreciation and amortization 28.3 26.6 EBITDA 75.1$ 71.5$ Gain on remeasurement of previously held equity interest (1) — (11.6) Restructuring (2) 3.0 18.8 Inventory write-up (3) — 1.4 Stock-based compensation (4) 2.1 — Acquisition costs — 0.6 Other 0.4 0.1 Adjusted EBITDA 80.6$ 80.8$ Three Months Ended March 31, (dollar amounts in millions) (2) Includes non-cash restructuring and is net of noncontrolling interest. (4) Non-cash stock amortization expense and non-cash stock option expense for grants issued at emergence from bankruptcy. (3) Write-up of inventory to fair value for the Shenya acquisition. (1) Gain on remeasurement of previously held equity interest in Shenya.

23 23 Note: Numbers subject to rounding Adj. EBITDA % Margin – Twelve Months Ended March 31, 2015 (1) Includes noncash restructuring and is net of noncontrolling interest. (2) Non-cash stock amortization expense and non-cash stock option expense for grants issued at time of the Company’s 2010 reorganization. (3) Impairment charges in 2014 related to fixed assets of $24.6 million and intangible assets of $1.7 million.. (4) Loss on extinguishment of debt relating to the repurchase of our Senior Notes and Senior PIK Toggle Notes. (5) Gain on sale of thermal and emissions product line. (6) Settlement charges relating to the US pension plans that were amended to offer a one-time voluntary lump sum window to certain terminated vested participants. (7) Gain related to the Shenya acquisition ($ USD Millions) Twelve Months Ended 30-Jun-14 30-Sep-14 31-Dec-14 31-Mar-15 31-Mar-15 Net income (loss) $13.2 $22.7 (12.8) $21.0 $44.1 Income tax expense 4.4 18.9 7.4 14.7 45.4 Interest expense, net of interest income 10.9 9.4 10.3 9.2 39.8 Depreciation and amortization 28.5 28 27.9 26.6 111 EBITDA 57 79 32.8 71.5 240.3 Restructuring (1) 3.8 4.7 5.7 18.8 33 Stock-based compensation (2) 0.7 - - - 0.7 Impairment Charges (3) - - 26.3 - 26.3 Acquisition Costs - 0.4 0.3 0.6 1.3 Loss on extinguishment of debt (4) 30.3 - - - 30.3 Gain on divestiture (5) - (17.9) 3.3 - (14.6) Settlement charges (6) - - 3.6 - 3.6 Gain on remeasurement of previously held equity interest (7) - - - (11.6) (11.6) Other 0.4 0.4 0.1 1.5 2.4 Adjusted EBITDA $92.2 $66.6 $72.1 $80.8 $311.7 Net Leverage Debt payable within one year $55.0 Long-term debt 745.4 Less: cash and cash equivalents (194.4) Net Leverage $606.0 Net Leverage Ratio 1.9 Interest coverage ratio 7.8 Sales $857.6 $781.0 $767.9 $800.1 $3,206.6 Adjusted EBITDA as a percent of Sales 10.8% 8.5% 9.4% 10.1% 9.7% Three Months Ended