Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ORMAT TECHNOLOGIES, INC. | Financial_Report.xls |

| EX-32.2 - EXHIBIT 32.2 - ORMAT TECHNOLOGIES, INC. | ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - ORMAT TECHNOLOGIES, INC. | ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - ORMAT TECHNOLOGIES, INC. | ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - ORMAT TECHNOLOGIES, INC. | ex31-1.htm |

| 10-Q - FORM 10-Q - ORMAT TECHNOLOGIES, INC. | ora20150331_10q.htm |

Exhibit 3.5

AMENDED AND RESTATED

LIMITED LIABILITY COMPANY AGREEMENT

OF

ORPD LLC

a Delaware Limited Liability Company

dated as of April 30, 2015

TABLE OF CONTENTS

Page

|

Article I | ||

|

DEFINITIONS |

2 | |

|

Section 1.1. |

Definitions |

2 |

|

Section 1.2. |

Other Definitional Provisions |

2 |

|

Article II | ||

|

CONTINUATION; OFFICES; TERM |

3 | |

|

Section 2.1. |

Continuation of the Company |

3 |

|

Section 2.2. |

Name, Office and Registered Agent |

3 |

|

Section 2.3. |

Purpose |

3 |

|

Section 2.4. |

Term |

3 |

|

Section 2.5. |

Organizational and Fictitious Name Filings; Preservation of Limited Liability |

3 |

|

Section 2.6. |

No Partnership Intended |

4 |

|

Article III | ||

|

RIGHTS AND OBLIGATIONS OF THE MEMBERS |

4 | |

|

Section 3.1. |

Membership Interests |

4 |

|

Section 3.2. |

Meetings of the Members; Actions by the Members |

5 |

|

Section 3.3. |

Management Rights |

6 |

|

Section 3.4. |

Other Activities |

7 |

|

Section 3.5. |

No Right to Withdraw |

7 |

|

Section 3.6. |

Limitation on Liability of Members |

8 |

|

Section 3.7. |

No Liability for Deficits |

9 |

|

Section 3.8. |

Company Property |

9 |

|

Section 3.9. |

Retirement, Resignation, Expulsion, Incompetency, Bankruptcy or Dissolution of a Member |

9 |

|

Section 3.10. |

Withdrawal of Capital |

9 |

|

Section 3.11. |

Representations and Warranties |

9 |

|

Section 3.12. |

Covenants |

11 |

|

Article IV | ||

|

CAPITAL CONTRIBUTIONS; CAPITAL ACCOUNTS; RESERVES |

12 | |

|

Section 4.1. |

Capital Contributions |

12 |

|

Section 4.2. |

Capital Accounts |

12 |

|

Section 4.3. |

Additional Capital Contributions |

13 |

|

Section 4.4. |

Dilution Mechanism |

14 |

|

Section 4.5. |

Additional Activities Contribution |

14 |

|

Section 4.6. |

Pre-Emptive Rights |

17 |

|

Article V | ||

|

ALLOCATIONS |

18 | |

|

Section 5.1. |

Allocations |

18 |

|

Section 5.2. |

Adjustments |

18 |

|

Section 5.3. |

Tax Allocations |

19 |

|

Section 5.4. |

Transfer or Change in Company Interest |

19 |

|

Section 5.5. |

Other Allocation Rules |

19 |

|

Article VI | ||

|

DISTRIBUTIONS |

20 | |

|

Section 6.1. |

Distributions |

20 |

|

Section 6.2. |

Withholding Taxes |

20 |

|

Section 6.3. |

Limitation upon Distributions |

21 |

|

Section 6.4. |

Special Ormat Distribution |

21 |

|

Section 6.5. |

Special Puna Distributions |

21 |

|

Section 6.6. |

No Return of Distributions |

23 |

|

Article VII | ||

|

ACCOUNTING AND RECORDS |

23 | |

|

Section 7.1. |

Reports |

23 |

|

Section 7.2. |

Books and Records and Inspection |

24 |

|

Section 7.3. |

Financial Statements |

25 |

|

Section 7.4. |

Bank Accounts, Notes and Drafts |

26 |

|

Section 7.5. |

Partnership Status and Tax Elections |

26 |

|

Section 7.6. |

Company Tax Returns |

27 |

|

Section 7.7. |

Tax Audits |

28 |

|

Section 7.8. |

Cooperation |

29 |

|

Section 7.9. |

Fiscal Year |

29 |

|

Section 7.10. |

Tax Year |

29 |

|

Section 7.11. |

Recapture Related Obligations |

29 |

|

Article VIII | ||

|

MANAGEMENT |

30 | |

|

Section 8.1. |

Management |

30 |

|

Section 8.2. |

Managing Member |

31 |

|

Section 8.3. |

Major Decisions |

31 |

|

Article IX | ||

|

TRANSFERS |

32 | |

|

Section 9.1. |

Prohibited Transfers |

32 |

|

Section 9.2. |

Lock-Up Period |

32 |

|

Section 9.3. |

Requirements for Transfers of Membership Interests |

32 |

|

Section 9.4. |

Right of First Offer |

34 |

|

Section 9.5. |

Tag-Along Sale |

36 |

|

Section 9.6. |

Regulatory and Other Authorizations and Consents |

37 |

|

Section 9.7. |

Admission |

38 |

|

Article X | ||

|

DISSOLUTION AND WINDING-UP |

38 | |

|

Section 10.1. |

Events of Dissolution |

38 |

|

Section 10.2. |

Distribution of Assets |

38 |

|

Section 10.3. |

In-Kind Distributions |

39 |

|

Section 10.4. |

Certificate of Cancellation |

40 |

|

Article XI | ||

|

MISCELLANEOUS |

40 | |

|

Section 11.1. |

Notices |

40 |

|

Section 11.2. |

Amendment |

40 |

|

Section 11.3. |

Partition |

40 |

|

Section 11.4. |

Waivers and Modifications |

41 |

|

Section 11.5. |

Severability |

41 |

|

Section 11.6. |

Successors; No Third-Party Beneficiaries |

41 |

|

Section 11.7. |

Entire Agreement |

41 |

|

Section 11.8. |

Governing Law |

41 |

|

Section 11.9. |

Further Assurances |

41 |

|

Section 11.10. |

Counterparts |

42 |

|

Section 11.11. |

Dispute Resolution |

42 |

|

Section 11.12. |

Confidentiality |

45 |

|

Section 11.13. |

Joint Efforts |

45 |

|

Section 11.14. |

Specific Performance |

46 |

|

Section 11.15. |

Survival |

46 |

|

Section 11.16. |

Working Capital Loans and Letter of Credit Reimbursement Obligations |

46 |

|

Section 11.17. |

Recourse Only to Member |

47 |

|

ANNEX 1: |

Definitions |

|

EXHIBITS: |

|

|

Exhibit A: |

Form of Certificate of Class A Membership Interests |

|

Exhibit B: |

Form of Certificate of Class B Membership Interests |

|

Exhibit C-1: |

Form of Quarterly Operations Reports |

|

Exhibit C-2: |

Form of Monthly Operations Reports |

|

Exhibit D: |

Form of Working Capital Loan Note |

|

Exhibit E: |

Form of ORNI 37 Purchase Agreement |

|

Exhibit F: |

Capacity Test Procedures |

|

SCHEDULES |

|

|

Schedule I |

Register |

|

Schedule 4. 2(d) |

Capital Accounts |

|

Schedule 9.4(e) |

ROFO Representations and Warranties of Selling Member |

AMENDED AND RESTATED

LIMITED LIABILITY COMPANY AGREEMENT

OF

ORPD LLC

This Amended and Restated Limited Liability Company Agreement (this "Agreement") of ORPD LLC, a Delaware limited liability company (the "Company"), dated as of April 30, 2015 (the "Effective Date"), by and among Ormat Nevada Inc., a Delaware corporation ("Ormat"), Northleaf Geothermal Holdings LLC, a Delaware limited liability company ("Northleaf") and ORPD Holdings LLC, a Delaware limited liability company (the "1% Member"), adopted, executed and agreed to, for good and valuable consideration, by the Members, as defined below.

Preliminary Statements

A. The Company was formed by the filing of its Certificate of Formation with the Secretary of State of the State of Delaware on February 2, 2015 (the "Certificate of Formation") and is governed by the limited liability company agreement of the Company dated as of February 2, 2015 executed by Ormat (the "Original LLC Agreement").

B. The Company owns, of record and beneficially, 100% of the membership interests in each of OREG 1, OREG 2, OREG 3, ORNI 8, ORNI 47 and OrPuna; ORNI 8 and OrPuna collectively own, of record and beneficially, 100% of the partnership interests of PGV (each of the foregoing entities, a "Project Company" and, collectively with any other Subsidiaries of the Company, the "Project Companies"). Each of the Project Companies owns and operates, directly or indirectly, one or more geothermal or recovered energy generation facilities (collectively, the "Projects").

C. Pursuant to the Agreement for Purchase of Membership Interests between Ormat and Northleaf, dated as of February 5, 2015 (the "Purchase Agreement") Ormat has agreed to sell (and as of the Effective Date has sold) to Northleaf, and Northleaf has agreed to purchase (and as of the Effective Date has purchased) from Ormat, all of the Class B Membership Interests (as defined in Annex I hereto) of the Company.

D. Ormat, Northleaf and the 1% Member desire for Northleaf to be admitted as a Member (as defined in Annex I hereto) of the Company and for the Company to continue and for the Original LLC Agreement to be amended and restated as stated herein.

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Members hereby agree to adopt this Agreement with respect to various matters relating to the Company and Members to read as follows:

Article I

DEFINITIONS

Section 1.1. Definitions. Capitalized terms used but not otherwise defined in this Agreement have the meanings given to such terms in Annex I.

Section 1.2. Other Definitional Provisions.

(a) All terms in this Agreement shall have the defined meanings when used in any certificate or other document made or delivered pursuant hereto unless otherwise defined therein.

(b) As used in this Agreement and in any certificate or other documents made or delivered pursuant hereto or thereto, accounting terms not defined in this Agreement or in any such certificate or other document, and accounting terms partly defined in this Agreement or in any such certificate or other document to the extent not defined, shall have the respective meanings given to them under GAAP. To the extent that the definitions of accounting terms in this Agreement or in any such certificate or other document are inconsistent with the meanings of such terms under GAAP, the definitions contained in this Agreement or in any such certificate or other document shall control.

(c) The words "hereof," "herein," "hereunder," and words of similar import when used in this Agreement shall refer to this Agreement as a whole and not to any particular provision of this Agreement. Section references contained in this Agreement are references to Sections in this Agreement unless otherwise specified. The term "including" shall mean "including without limitation."

(d) The definitions contained in this Agreement are applicable to the singular as well as the plural forms of such terms and to the masculine as well as to the feminine and neuter genders of such terms.

(e) Any agreement, instrument or statute defined or referred to herein or in any instrument or certificate delivered in connection herewith means such agreement, instrument or statute as from time to time amended, modified or supplemented and includes (in the case of agreements or instruments) references to all attachments thereto and instruments incorporated therein.

(f) Any references to a Person are also to its permitted successors and assigns.

(g) Unless otherwise specified, all references contained in this Agreement, in any Exhibit or Schedule referred to herein or in any instrument or document delivered pursuant hereto to dollars or "$" shall mean United States dollars.

Article II

CONTINUATION; OFFICES; TERM

Section 2.1. Continuation of the Company. The Members hereby acknowledge the continuation of the Company as a limited liability company pursuant to the Act, the Certificate of Formation and this Agreement. This Agreement amends and restates the Original LLC Agreement in its entirety.

Section 2.2. Name, Office and Registered Agent.

(a) The name of the Company is "ORPD LLC" or such other name or names as may be agreed to by the Members from time to time. The principal office of the Company shall be: 6225 Neil Road, Reno, Nevada 89511-1136. The Managing Member may at any time change the location of such office to another location, provided, that the Managing Member gives prompt written notice of any such change to the Members and the registered agent of the Company.

(b) The registered office of the Company in the State of Delaware is located at c/o HIQ Corporate Services, 800 North State Street, Dover, Delaware 19901. The registered agent of the Company for service of process at such address is HIQ Corporate Services, Inc. The registered office and registered agent may be changed by the Managing Member at any time in accordance with the Act; provided, that the Managing Member gives prompt written notice of any such change to all Members. The registered agent's primary duty as such is to forward to the Company at its principal office and place of business any notice that is served on it as registered agent.

Section 2.3. Purpose. The nature of the business or purpose to be conducted or promoted by the Company is: (a) to acquire, own, hold or dispose of the limited liability company interests or partnership interests, as applicable, in the Project Companies and/or the Projects; (b) to enter into the Transaction Documents to which it is a party, and to engage in the transactions contemplated by the Transaction Documents; and (c) to engage in any lawful act or activity, enter into any agreement and to exercise any powers permitted to limited liability companies formed under the Act that are incidental to or necessary, suitable or convenient for the accomplishment of the purposes specified above.

Section 2.4. Term. The term of the Company commenced on February 2, 2015 and shall continue indefinitely or until the Company is dissolved in accordance with the terms hereof or as otherwise provided by law (the "Termination Date").

Section 2.5. Organizational and Fictitious Name Filings; Preservation of Limited Liability. Prior to the Company's conducting business in any jurisdiction other than Delaware, the Managing Member shall cause the Company to register as a foreign limited liability company and file such fictitious or trade names, statements or certificates in such jurisdictions and offices as are necessary or appropriate for the conduct of the Company's operation of its business. The Managing Member may take any and all other actions as may be reasonably necessary or appropriate to perfect and maintain the status of the Company as a limited liability company or similar type of entity under the laws of Delaware and any other state or jurisdiction other than Delaware in which the Company engages in business and continue the Company as a limited liability company and to protect the limited liability of the Members as contemplated by the Act.

Section 2.6. No Partnership Intended. Other than for purposes of determining the status of the Company under the Code and the applicable Treasury Regulations and under any applicable state, municipal or other income tax law or regulation, the Members intend that the Company not be a partnership, limited partnership, joint venture or other arrangement, and this Agreement shall not be construed to suggest otherwise.

Article III

RIGHTS AND OBLIGATIONS OF THE MEMBERS

Section 3.1. Membership Interests.

(a) The Membership Interests of the Company shall consist of 632.5 Class A Membership Interests (the "Class A Membership Interests") and 367.5 Class B Membership Interests (the "Class B Membership Interests").

(b) The Class A Membership Interests and the Class B Membership Interests shall (i) have the rights and obligations ascribed to such Membership Interests in this Agreement and the Act; (ii) be evidenced solely by certificates in the forms annexed hereto as Exhibit A and Exhibit B, respectively, or such other form as may be prescribed from time to time by any Applicable Law; (iii) be recorded in a register of Membership Interests (the "Register"), which shall be in the form attached hereto as Schedule I setting forth, with respect to all Members, such Member's name; the number and class of Membership Interests held by such Member, and which the Managing Member shall maintain; (iv) be transferable only in compliance with the provisions of Article IX hereof and upon presentation of the certificates duly endorsed for Transfer, or accompanied by assignment documentation in accordance with Article IX; (v) be "securities" governed by Article 8 of the UCC in any jurisdiction (x) that has adopted revisions to Article 8 of the UCC substantially consistent with the 1994 revisions to Article 8 adopted by the American Law Institute and the National Conference of Commissioners on Uniform State Laws and (y) whose laws may be applicable, from time to time, to the issues of perfection, the effect of perfection or non-perfection, and the priority of a security interest in Membership Interests in the Company; and (vi) be personal property.

(c) The Company shall be entitled to treat the registered holder of a Membership Interest, as shown in the Register, as a Member for all purposes of this Agreement, except that the Managing Member may record in the Register any security interest of a secured party pursuant to any security interest permitted by this Agreement. The Managing Member shall from time to time update the Register as necessary to accurately reflect the information therein. Any reference in this Agreement to the Register shall be deemed to be a reference to the Register as in effect at that time. Each Member shall receive, upon such Member's request, the information set forth on the Register with respect to such Member's Membership Interest as of the date of such request. Revisions to the Register made by the Managing Member as a result of changes to the information set forth therein made in accordance with this Agreement shall not constitute an amendment of this Agreement, and shall not require the consent of any Member.

(d) If a Member transfers all of its Membership Interest to another Person pursuant to and in accordance with the terms set forth in Article IX, the transferor shall automatically cease to be a Member.

Section 3.2. Meetings of the Members; Actions by the Members.

(a) Meetings of the Members shall be held quarterly and may also be called at any time by the Managing Member within 10 days following the written request of a Member. Except as otherwise permitted by this Agreement (including Section 3.2(e) below), all actions of the Members shall be taken at meetings of the Members. The Members may conduct any Company business at any such meeting that is permitted under the Act or this Agreement. Meetings shall be at a reasonable time and place. Accurate minutes of any meeting shall be taken and filed with the minute books of the Company. Following each meeting, the minutes of the meeting shall be sent to each Member.

(b) Members may participate in any meeting of the Members by means of conference telephone or other communications equipment so that all persons participating in the meeting can hear each other or by any other means permitted by law. Such participation shall constitute presence in person at such meeting. A Member may designate a third party (non-employee of the Member) as its representative for any meeting of the Members; provided, that such designee (i) is not then currently employed directly or indirectly as an employee, consultant, or advisor (or in any similar capacity) of or by a Competitor, (ii) prior to, and as a condition of, attending any meeting of the Members, such designee has executed a confidentiality agreement which shall include customary confidentiality undertakings and restrictions on use provisions, which shall be in all respects acceptable to the Managing Member (or, if Ormat is no longer the Managing Member, acceptable to the Managing Member and Ormat) and (iii) the Member designating such third party shall be responsible and liable for the acts or omissions of its designee.

(c) The presence in person or by proxy of Members owning more than 50% of the aggregate Class A Membership Interests and more than 50% of the aggregate Class B Membership Interests shall constitute a quorum for purposes of transacting business at any meeting of the Members.

(d) Written notice stating the place, day and hour of the meeting of the Members, and the purpose or purposes for which the meeting is called, shall be delivered by or at the direction of the Managing Member, to each Member of record not less than 5 Business Days nor more than 30 days prior to the meeting. Notwithstanding the foregoing, meetings of the Members may be held without notice so long as all the Members are present in person or by proxy.

(e) Any action of the Members that may be taken at a meeting of the Members may be taken by the Members without a meeting if such action is proposed by written notice to the Members as provided in this Section 3.2(e) and is authorized or approved by the written consent of Members representing sufficient Membership Interests (based on voting power of such Membership Interests) to authorize or approve such action pursuant to this Agreement. Written notice stating the proposed Member action, authorization or approval to be considered, together with relevant materials and information reasonably necessary for the Members to consider such action, authorization or approval, shall be delivered by or at the direction of the Managing Member to each Member of record entitled to vote on such matter not less than 5 Business Days nor more than 30 days prior to the time that such action, authorization or approval is proposed to take effect. Where such action by written consent is authorized by unanimous written consent, no such prior notice is required. A copy of any action taken by written consent shall be sent promptly to all Members and all actions by written consent shall be filed with the minute books of the Company.

(f) With respect to those matters required or permitted to be voted upon by the Members, or for which a consent or approval of Members is required or permitted, the affirmative vote, consent or approval by a simple majority of Membership Interests (based on voting power of such Membership Interests) (the "Majority Vote") shall be required to authorize or approve any such matter; provided, that, the affirmative unanimous vote, consent or approval of the Class A Members and Class B Members shall be required for any Major Decisions. Notwithstanding anything to the contrary in this Agreement, (x) either the Managing Member or Northleaf (for so long as Northleaf and its Affiliates, collectively hold the majority of the Class B Membership Interests) may determine and so instruct the Company pursuant to written notice delivered to the Company (with a copy to each Member), to cause the relevant Project Company to exercise (i) the purchase option under Section 21 of the Puna Project Lease Agreement and (ii) the renewal option under Section 15 of the Puna Project Lease Agreement and (y) the Class B Member shall have the right to enforce the provisions of any Affiliate Contract and the warranties and indemnities under the Don A. Campbell Expansion EPC Agreement and the ORNI 37 Purchase Agreement on behalf of the Project Company party thereto (including ORNI 37). Except as otherwise expressly provided in this Agreement, no separate vote, consent or approval of either the Class A Members, acting as a class, or the Class B Members, acting as a class, shall be required to authorize or approve any matter for which a vote, consent or approval of Members is required under this Agreement.

(g) The voting power of each Membership Interest for purposes of any vote, consent or approval of Members required under this Agreement or the Act shall be as follows:

(i) each Class A Membership Interest shall be entitled to 1 vote; and

(ii) each Class B Membership Interest shall be entitled to 1 vote.

Section 3.3. Management Rights. Except as otherwise provided in this Agreement with respect to matters which are expressly required to be approved by the Members under this Agreement or as otherwise mandatorily required by the Act, no Member other than the Managing Member shall have any right, power or authority to take part in the management or control of the business of, or transact any business for, the Company, to sign for or on behalf of the Company or to bind the Company in any manner whatsoever. Except as otherwise provided herein, neither the Managing Member nor the Manager shall hold out or represent to any third party that any other Member has any such power or right or that any Member is anything other than a member in the Company. A Member shall not be deemed to be participating in the control of the business of the Company by virtue of its possessing or exercising any rights set forth in this Agreement or the Act or any other agreement relating to the Company.

Section 3.4. Other Activities. Notwithstanding any duty otherwise existing at law or in equity, any Member or the Manager may engage in or possess an interest in other business ventures of every nature and description, independently or with others, even if such activities compete directly with the business of the Company, and, except as and to the extent expressly set forth in this Agreement, neither the Company nor any of the Members shall have any rights by virtue of this Agreement in and to such independent ventures or any income, profits or property derived from them. Without limiting the generality of the foregoing, the Members recognize and agree that:

(a) the Members and their respective Affiliates currently engage in certain activities involving the generation, transmission, distribution, marketing and trading of electricity and other energy products (including futures, options, swaps, exchanges of future positions for physical deliveries and commodity trading), and the gathering, processing, storage and transportation of such products, as well as other commercial activities related to such products, and that these and other activities by Members and their Affiliates (herein referred to as "Outside Activities") may be made possible or more profitable by reason of the Company's activities. The Members agree that (i) no Member or Affiliate of a Member shall be restricted in its right to conduct, individually or jointly with others, for its own account any Outside Activities, and (ii) no Member or its Affiliates shall have any duty or obligation, express or implied, to account to, or to share the results or profits of such Outside Activities with, the Company, any other Member or any Affiliate of any other Member, by reason of such Outside Activities.

(b) Except for the Don A. Campbell Expansion (which shall be contributed to the Company in accordance with Section 4.5 hereof), neither party has an exclusivity obligation for future investments.

(c) Each Member, for itself and its Affiliates, retain any and all rights to directly or indirectly pursue future development and acquisition opportunities outside of the Company and without participation of the Company or the other Member.

(d) The Members hereby agree that each of the Puna Project and the Don A. Campbell Project utilizes specific geothermal resources as set forth in the Puna GeothermEx Report and the DAC GeothermEx Report, respectively, located on such land owned or leased by the relevant Project Company as set forth in Schedule 3.1(m) to the Purchase Agreement (for purposes hereof, the "Geothermal Resource Area"). Notwithstanding anything in this Section 3.4 to the contrary, Ormat agrees that it shall not separately develop any geothermal power project (other than the Don A. Campbell Expansion) that relies on the same Geothermal Resource Area or any contiguous tract unless it shall have first delivered to each Class B Member a resource report from a recognized geothermal reservoir engineering firm mutually selected by the Members that confirms that such new project development and use of such Geothermal Resource Area could not reasonably be expected to adversely affect the relevant Project Company's existing Project.

Section 3.5. No Right to Withdraw. Except as otherwise expressly provided in this Agreement, no Member shall have any right to voluntarily resign or otherwise withdraw from the Company without the prior written consent of the remaining Members of the Company in their sole and absolute discretion.

Section 3.6. Limitation on Liability of Members.

(a) Each Member's liability shall be limited as set forth in the Act and other Applicable Laws. Except as otherwise required by the Act, the debts, obligations and liabilities of the Company, whether arising in contract, tort or otherwise, shall be the debts, obligations and liabilities solely of the Company, and the Members of the Company shall not be obligated personally for any of such debts, obligations or liabilities solely by reason of being a Member of the Company. In no event shall any Member or the Manager be liable under this Agreement to another Member for any lost profits of, or any consequential, punitive, special or incidental damages incurred by, such Member arising from a breach of this Agreement; provided, that this Section 3.6(a) shall in no way limit any such liability of a Member or the Manager to the Company, any of its Subsidiaries or another Member under any other Transaction Document or for gross negligence, fraud or willful misconduct.

(b) Each Covered Person shall be fully protected in relying in good faith upon the records of the Company and upon such information, opinions, reports or statements presented to the Company by any other Person who is a Member, the Manager or any officer or employee of the Company, or by any other individual as to matters such Covered Person reasonably believe are within such other individual's professional or expert competence, including information, opinions, reports or statements as to the value and amount of the assets, liabilities, profits or losses of the Company or any other facts pertinent to the existence and amount of assets from which distribution to the Members might properly be paid.

(c) To the extent that, at law or in equity, a Member, in its capacity as a member (or manager) of the Company or otherwise, has duties (including fiduciary duties) and liabilities relating thereto to the Company or to any Member or other Person bound by this Agreement, such Member, acting under this Agreement shall not be liable to the Company or to any Member or other Person bound by this Agreement for its good faith reliance on the provisions of this Agreement; provided, that this Section 3.6(c) shall not be construed to limit obligations or liabilities therefor, in each case as expressly stated in this Agreement or any other Transaction Document, or in the event of gross negligence, fraud or willful misconduct. The provisions of this Agreement, to the extent that they restrict the duties and liabilities of a Member, in its capacity as a member (or manager) of the Company or otherwise, otherwise existing at law or in equity, are agreed by the Members to replace such other duties and liabilities of such Member.

(d) No Member, in its capacity as a Member, Managing Member or Manager, shall have any liability for breach of contract (except as provided in (i) and (ii) below) or breach of duties (including fiduciary duties) of a member or manager to the Company or to any other Person that is a party to or is otherwise bound by this Agreement, in each case, to the fullest extent permitted by the Act; provided, that (i) this Agreement shall not limit or eliminate liability for any (x) obligations expressly imposed on such Member, as Member, Managing Member or Manager, pursuant to this Agreement or any other Transaction Document or (y) act or omission that constitutes a bad faith violation of the implied contractual covenant of good faith and fair dealing or (z) fraud, willful misconduct or gross negligence and (ii) this Section 3.6(d) shall not limit or eliminate liabilities expressly stated in this Agreement or any other Transaction Document.

(e) Liability to the Company, any Class B Member or any other Person bound by this Agreement for damages resulting from a breach or breaches by (i) the Manager of any of its obligations, covenants or agreements under the Management Services Agreement or (ii) by the Operator of any of its obligations, covenants or agreements under any O&M Agreement shall be separate and distinct from liabilities of Ormat in its capacity as a Class A Member.

(f) Except as otherwise mandatorily required under Applicable Law, whenever in this Agreement a Member is permitted or required to make a decision (i) in its "sole discretion" or "discretion" or under a grant of similar authority or latitude, the Member may consider such interests and factors as it desires, including expressly its own interests, and shall have no duty or obligation to give any consideration to any interests of or factors affecting the Company or any other Member, or (ii) in its "good faith" or under another expressed standard, a Member shall act under such express standard and shall not be subject to any other or different standard imposed by this Agreement or any other agreement contemplated herein or by relevant provisions of law (whether common or statutory) or in equity or otherwise.

Section 3.7. No Liability for Deficits. Except to the extent otherwise provided by law with respect to third party creditors of the Company and in Section 10.2(f), none of the Members shall be liable to the Company for any deficit in its Capital Account, nor shall such deficits be deemed assets of the Company.

Section 3.8. Company Property. All property owned by the Company, whether real or personal, tangible or intangible and wherever located, shall be deemed to be owned by the Company, and no Member, individually, shall have any ownership of such property.

Section 3.9. Retirement, Resignation, Expulsion, Incompetency, Bankruptcy or Dissolution of a Member. The retirement, resignation, expulsion, Bankruptcy or dissolution of a Member shall not, in and of itself, dissolve the Company. The successors in interest to the bankrupt Member shall, for the purpose of settling the estate, have all of the rights of such Member, including the same rights and subject to the same limitations that such Member would have had under the provisions of this Agreement to Transfer its Membership Interest. A successor in interest to a Member shall not become a substituted Member except as provided in this Agreement.

Section 3.10. Withdrawal of Capital. No Member shall have the right to withdraw capital from the Company or to receive or demand distributions (except as to distributions of Distributable Cash as set forth in Article VI) or return of its Capital Contributions until the Company is dissolved in accordance with this Agreement and applicable provisions of the Act. No Member shall be entitled to demand or receive any interest on its Capital Contributions.

Section 3.11. Representations and Warranties.

(a) Each Member hereby represents and warrants to the Company and each other Member that the following statements are true and correct as of the date it becomes a Member (both immediately before and after the time it becomes a Member):

(i) That the Member is duly incorporated, organized or formed (as applicable), validly existing and (if applicable), in good standing under the law of the jurisdiction of its incorporation, organization or formation; if required by applicable law, that Member is duly qualified and in good standing in the jurisdiction of its principal place of business, if different from its jurisdiction of incorporation, organization or formation; and that Member has full power and authority to execute and deliver this Agreement and to perform its obligations hereunder, and all necessary actions by the board of directors, shareholders, managers, members, partners, trustees, beneficiaries, or other applicable Persons necessary for the due authorization, execution, delivery, and performance of this Agreement by that Member have been duly taken.

(ii) That the Member has duly executed and delivered this Agreement and the other documents contemplated herein, and they constitute the legal, valid and binding obligation of the Member enforceable against it in accordance with their terms (except as may be limited by Bankruptcy, insolvency or similar laws of general application and by the effect of general principles of equity, regardless of whether considered at law or in equity).

(iii) That the Member's authorization, execution, delivery, and performance of this Agreement does not and will not (x) conflict with, or result in a breach, default or violation of, (A) the Organizational Documents of such Member, (B) any material contract or agreement to which the Member is a party or is otherwise subject, or (C) any law, rule, regulation, order, judgment, decree, writ, injunction or arbitral award to which the Member is subject, except in the case of clauses (B) and (C) if any such breach, default or violation would not reasonably be expected to have a Material Adverse Effect; or (y) require any consent, approval or authorization from, filing or registration with, or notice to, any Governmental Authority or other Person, unless such requirement has already been satisfied.

(iv) That the Member is not a Disqualified Person.

(v) That the Member is a United States Person within the meaning of Section 7701(a)(30) of the Code.

(vi) That either (x) no part of the aggregate Capital Contribution made by that Member, constitutes assets of any "employee benefit plan" within the meaning of Section 3(3) of the Employee Retirement Income Security Act of 1974, as amended, or other "benefit plan investor" (as defined in U.S. Department of Labor Reg. §§2510.3-101 et seq.) or assets allocated to any insurance company separate account or general account in which any such employee benefit plan or benefit plan investor (or related trust) has any interest or (y) the source of the funding used to pay the Capital Contribution made by that Member is an "insurance company general account" within the meaning of Department of Labor Prohibited Transaction Exemption 95-60, issued July 12, 1995, and there is no employee benefit plan, treating as a single plan all plans maintained by the same employer or employee organization, with respect to which the amount of the general account reserves and liabilities for all contracts held by or on behalf of such plan exceeds 10% of the total reserves and liabilities of such general account (exclusive of separate account liabilities) plus surplus, as set forth in the National Association of Insurance Commissioners "Annual Statement" filed with such Member's state of domicile.

(vii) That the Member is an "Accredited Investor" as such term is defined in Regulation D under the Securities Act of 1933, as amended (the "Securities Act"). That the Member has had a reasonable opportunity to ask questions of and receive answers from the Company concerning the Membership Interests and the Company, and all such questions have been answered to the full satisfaction of that Member. That the Member understands that the Membership Interests have not been registered under the Securities Act in reliance on an exemption therefrom, and that the Company is under no obligation to register the Membership Interests. That the Member will not transfer the Membership Interests in violation of the Securities Act or any other applicable securities laws. That the Member is purchasing the Membership Interests for its own account and not for the account of any other Person and not with a view to distribution or resale to others.

(b) It is expressly understood and agreed that all representations and warranties in this Section 3.11 shall terminate upon the termination of the Company; provided however, that any representations and warranties that relate to Taxes shall survive until 90 days after the end of the applicable statute of limitations (including extensions thereto.)

Section 3.12. Covenants.

(a) Each Member covenants to the Company and each other Member that it will not become a Disqualified Person and will continue to be a United States Person within the meaning of Section 7701(a)(30) of the Code.

(b) Each Member covenants that it will not cause the Company to claim, and it will not claim for itself, an investment tax credit or production tax credit with respect to the Puna Project or the Don A. Campbell Project.

(c) Each Member agrees to cooperate with the Company and the Managing Member in order to make any filings with FERC that are reasonably necessary in order to ensure that the Company remains in compliance with or exempt from the Federal Power Act and FERC rules and regulations thereunder.

(d) The Managing Member shall take such actions, acting in accordance with the Prudent Operator Standard, to (i) cause the Company and/or PGV, as applicable, to comply in all material respects with the terms and conditions of the Puna Operative Documents, and (ii) cause the Project Companies to perform and observe their respective covenants and obligations under the Material Contracts to which they are party except where the failure to do so could not reasonably be expected to result in a Material Adverse Effect; provided, that (x) it shall not be a breach of the Managing Member's obligations under this Section 3.12(d) if any failure to comply with any obligation under the Puna Operative Documents or the other Material Contracts, as the case may be, is not reasonably susceptible to cure within the requisite time period (if any) by the Managing Member, Company or relevant Project Company, as the case may be, or funds are not available from Distributable Cash as needed to effect such cure, (y) the Managing Member shall have no obligation to cause Company funds to be applied towards any payments due and owing under the applicable Puna Operative Documents or with respect to any Project Company's other obligations (in either such case only to the extent that adequate funds are not available at such Project Company) other than from Distributable Cash available in accordance with this Agreement, and (z) for the avoidance of doubt, the Managing Member shall have no obligation to use its own funds to perform any obligation hereunder.

(e) Each Class B Member, on behalf of itself and its Affiliates (other than the Company and its Subsidiaries) covenants that, without the prior written consent of the Company, it shall not solicit for employment or otherwise induce, influence or encourage to terminate employment with Ormat or any Affiliate of Ormat or employ any officer or employee of Ormat or any Affiliate of Ormat (each, a "Covered Employee"), except (i) pursuant to a general solicitation through the media that is not directed specifically to any officers or employees of Ormat or any Affiliate of Ormat, (ii) if Ormat or any Affiliate of Ormat terminated the employment of such Covered Employee prior to the Class B Member having solicited or otherwise contacted such Covered Employee or discussed the employment or other engagement of the Covered Employee, or (iii) such Covered Employee terminated their employment with Ormat or any Affiliate of Ormat at least 120 days prior to the Class B Member having solicited or otherwise contacted such covered Employee or discussed the employment or other engagement of the Covered Employee.

Article IV

CAPITAL CONTRIBUTIONS; CAPITAL ACCOUNTS; RESERVES

Section 4.1. Capital Contributions. Except as provided in this Article IV and Section 10.2(f) of this Agreement, no Member will be required to make any Capital Contributions to the Company after the Effective Date.

Section 4.2. Capital Accounts.

(a) A capital account (a "Capital Account") will be established and maintained for each Member. If there is more than one Member in a class, then each of the Members in that class will have a separate Capital Account.

(b) A Member's Capital Account will be increased by (i) the amount of money the Member contributes to the Company, (ii) the net value of any property the Member contributes or is deemed to contribute to the Company (i.e., the fair market value of the property net of liabilities secured by the property that the Company is considered to assume or take subject to under Section 752 of the Code), and (iii) the income and gain the Member is allocated by the Company, including any income and gain that are exempted from tax. A Member's Capital Account will be decreased by (w) the amount of Distributable Cash distributed or deemed distributed to the Member by the Company, (x) the net value of any property distributed to the Member by the Company (i.e., the fair market value of the property net of liabilities secured by the property that the Member is considered to assume or take subject to under Section 752 of the Code), (y) any expenditures of the Company described in Section 705(a)(2)(B) of the Code (i.e., that cannot be capitalized or deducted in computing taxable income) that are allocated to the Member; and (z) losses and deductions that are allocated to the Member.

(c) [Intentionally Deleted].

(d) The Capital Account balances and Membership Interests of each Member on the Effective Date are shown in Schedule 4.2(d).

(e) The Managing Member will update Schedule 4.2(d) from time to time as necessary to reflect accurately the information therein. Any such updating will be consistent with how this Article IV requires that the Capital Accounts be maintained. Any reference in this Agreement to Schedule 4.2(d) will be treated as a reference to Schedule 4.2(d) as amended and in effect from time to time.

(f) If all or a portion of a Membership Interest in the Company is Transferred in accordance with the terms of this Agreement, then the transferee will succeed to the Capital Account of the transferor to the extent it relates to the Membership Interests so Transferred.

(g) The provisions of this Agreement relating to maintenance of Capital Accounts are intended to comply with Treasury Regulation Section 1.704-1(b) and 1.704-2, and will be interpreted and applied in a manner consistent with such Treasury Regulations or any successor provision.

Section 4.3. Additional Capital Contributions.

(a) Subject to Section 3.2(f), if the Managing Member determines that the Company requires additional capital to cover working capital, maintenance or capital expenditure needs of the Company, then the Managing Member shall call for additional Capital Contributions in cash (each such Capital Contribution, an "Additional Capital Contribution") from the Members in accordance with the terms and conditions set forth in clause (b) below. Upon any such call for an Additional Capital Contribution, the Members shall contribute to the Company such Additional Capital Contribution as is designated by the Managing Member to be needed.

(b) Each such capital call, if any, shall consist of notice to each Member specifying the following:

(i) the total Additional Capital Contribution required from all Members and the purpose of the Additional Capital Contribution;

(ii) the amount of each Member's pro rata share of the Additional Capital Contribution required (allocated among the Members pro rata in accordance with the percentage of the Membership Interests held by each Member);

(iii) the date on which such Additional Capital Contribution is due (which shall not be less than 10 Business Days after the date that notice of such capital call is given pursuant to the notice provisions in Section 11.1); and

(iv) the account of the Company to which such Additional Capital Contribution should be made.

(c) If any Member (a "Non-Funding Member") fails to deliver to the Company any amount requested to be contributed by such Member pursuant to a capital call under this Section 4.3 within the time prescribed, the Managing Member may request the amount of such Non-Funding Member's share of the capital call from other Members, in which event, each other Member may, at its election, contribute to the Company such Non-Funding Member's Additional Capital Contribution. For the avoidance of doubt, in no event shall a Member have the obligation to fund any portion of a Non-Funding Member's Additional Capital Contribution.

Section 4.4. Dilution Mechanism. Notwithstanding Section 4.3(c) above, following a failure to make an Additional Capital Contribution by a Non-Funding Member, the Managing Member shall cause the units of Membership Interests of each Member to be adjusted accordingly by issuing additional units of Membership Interests to the Members who have funded their portion of such Additional Capital Contribution in an amount equal to the amount of the Additional Capital Contribution divided by the Fair Market Value of the units of Membership Interests as of the date such Additional Capital Contribution was made, and recording such issuance in the Register. For purposes of this Agreement, "Fair Market Value" means the value (a) unanimously agreed by the Members or (b) failing agreement within 15 Business Days, determined by a nationally-recognized independent financial advisor having specific expertise in the valuation of assets similar to the Membership Interests (the "Independent Appraiser") selected by the Members. The Independent Appraiser shall determine the Fair Market Value based on the following assumptions and bases: (i) the value that a third-party purchaser would pay in an arm's length sale between a willing seller and a willing purchaser, (ii) if the Company is carrying on business as a going concern, on the assumption that it will continue to do so, and (iii) taking into account any information that the Independent Appraiser reasonably thinks fit, including submissions from the Members, based on then current customary market practices for valuing geothermal assets similar to the Project. The Independent Appraiser shall determine the Fair Market Value within 20 Business Days after being engaged. In the event that the Independent Appraiser provides a range of values, then the Fair Market Value shall be deemed to be the mid-point of that range. The cost of the Independent Appraiser shall be borne equally by the Members.

Section 4.5. Additional Activities Contribution.

(a) Additional Project Commencement. Ormat, in its sole discretion, may determine to proceed with an expansion of the Don A. Campbell Project (the "Don A. Campbell Expansion").

(i) If Ormat determines to proceed with the Don A. Campbell Expansion, Ormat shall bear the cost of and be solely responsible for the development and construction thereof (which shall be performed pursuant to the Don A. Campbell Expansion EPC Agreement and the related purchase orders) and, on the 12th Business Day after determination of the DAC Expansion Capital Contribution and satisfaction of the closing conditions set forth in Sections 2.4 and 2.5 of the ORNI 37 Purchase Agreement, (x) Ormat and the Company shall enter into the ORNI 37 Purchase Agreement pursuant to which Ormat will sell all of the membership interests of ORNI 37 to the Company and (y) the Members shall make a capital contribution (the "DAC Expansion Capital Contribution") in the manner described below.

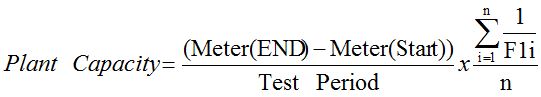

(ii) The DAC Expansion Capital Contribution will be calculated on the basis of the generation capacity of the Don A. Campbell Project and the Don A. Campbell Expansion (collectively, the "Don A. Campbell Facility") demonstrated by the capacity tests (the "Capacity Tests"). Each Capacity Test shall be performed in accordance with the capacity test procedures set forth in Exhibit F attached hereto and mutually agreed to by the Members (the "Capacity Test Procedures"). The results of any Capacity Test conducted under this Section 4.5(a) will not be deemed final until the Independent Engineer confirms that (x) such Capacity Tests were performed in accordance with the Capacity Test Procedures and that (y) the results of such Capacity Test were correctly calculated.

(iii) The first Capacity Test will be conducted at the end of the second month following the Don A. Campbell 2 COD and the second Capacity Test will be conducted at the end of the fourth month following the Don A. Campbell 2 COD. If the average result of such Capacity Tests (the "First Tested Capacity") is less than or equal to 40.82 MW, but greater than or equal to 37.82 MW, then the "Final Tested Capacity" will be equal to the First Tested Capacity. If the First Tested Capacity is outside of the ranges described in the prior sentence, the Final Tested Capacity will be calculated in accordance with clauses (iv) and (v) below (as applicable).

(iv) If the First Tested Capacity is less than 37.82MW, Ormat shall be entitled, at its option (exercised in its sole discretion by providing written notice to the Company and Northleaf within 14 days from the end of the second Capacity Test described in clause (iii) above) to delay the transfer of ORNI 37 to the Company for a period of up to 12 months following the Don A. Campbell 2 COD. During such 12 month period, Ormat shall undertake at its sole cost and expense such additional work and investment as it may deem appropriate to improve the generation capacity of the Don A. Campbell Expansion (which costs and expenses shall not be funded from revenues received by ORNI 37 under the Don A. Campbell 2 PPA or otherwise or be deemed to be capital contributions, loans or other amounts contributed by Ormat to the Company, ORNI 47 or ORNI 37). At any time during such 12-month period, upon written notification by Ormat to the Company and Northleaf, a single Capacity Test will be performed, and the "Revised Tested Capacity" will be equal to the result of such Capacity Test.

(v) If the First Tested Capacity is lower than 37.82 MW but greater than or equal to 36.82 MW and Ormat has not exercised its option under clause (iv) above, then the Final Tested Capacity will be equal to the First Tested Capacity. If Ormat has exercised its option under clause (iv) and the Revised Tested Capacity is within a tolerance of plus/minus 2 MW of 38.82 MW, then the Final Tested Capacity will be equal to the Revised Tested Capacity.

(vi) If (x) the First Tested Capacity is higher than 40.82 MW or lower than 36.82 MW and Ormat has not exercised its option under clause (iv) above, or (y) if Ormat has exercised its option under clause (iv) above and the Revised Tested Capacity is higher than 40.82 MW or lower than 36.82 MW, then the Independent Engineer shall verify the validity of such First Tested Capacity or the Revised Tested Capacity (as applicable). If the Independent Engineer confirms the validity of such First Tested Capacity or the Revised Tested Capacity, then the Final Tested Capacity will be equal to such First Tested Capacity or the Revised Tested Capacity (as applicable). If the Independent Engineer invalidates the First Tested Capacity or the Revised Tested Capacity, a Capacity Test will be performed again in accordance with the Capacity Test Procedures until the Independent Engineer has validated the results of a Capacity Test, and the Final Tested Capacity will be equal to the result of such Capacity Test.

(vii) If the Final Tested Capacity is within a tolerance of plus/minus 1 MW of 38.82 MW, then the DAC Expansion Capital Contribution shall be $87.8 million, and each Member shall contribute its pro-rata share within twelve (12) Business days following the determination of the Final Tested Capacity.

(viii) If the Final Tested Capacity is not within a tolerance of plus/minus 1 MW of 38.82 MW, then the DAC Expansion Capital Contribution shall be equal to the sum of (x) $87.8 million plus (y) (1) Final Tested Capacity minus 38.82 MW times (2) $7.72 million per MW, and each Member shall contribute its pro-rata share within twelve (12) Business days following the determination of the Final Tested Capacity. All amounts contributed pursuant to clause (vii) or clause (viii) shall be used by the Company to pay the purchase price under the ORNI 37 Purchase Agreement.

(ix) If closing under the ORNI 37 Purchase Agreement occurs more than 90 days after the date on which the Don A. Campbell 2 COD occurs, Northleaf shall pay to the Company, in addition to its pro-rata share of the DAC Expansion Capital Contribution calculated in accordance with subclauses (vii) or (viii) of this Section 4.5(a) (the "Northleaf DAC Pro-Rata Amount"), in an amount equal to (x) the Northleaf DAC Pro-Rata Amount multiplied by (y) 8% multiplied by the number of days between the 91st day after Don A. Campbell 2 COD and the date of satisfaction of the conditions precedent under the ORNI 37 Purchase Agreement divided by 365.

(x) (A) If Ormat and Northleaf have not agreed on a Tax Equity Transaction as of the closing date of the transfer of ORNI 37 to the Company and counsel to Northleaf has opined that the Don A. Campbell Expansion will qualify for the federal production tax credit under the rules and guidance promulgated by the IRS, the Class B Member's portion of the DAC Expansion Capital Contribution shall be increased by $3.1 million; provided, that if Northleaf owns less than 40% of the Membership Interests, such amount shall be adjusted by multiplying $3.1 million by a fraction, the numerator of which is the percentage of Membership Interests actually owned by Northleaf and the denominator of which is 40%. (B) Ormat and Northleaf agree to cooperate in good faith to achieve a mutually beneficial Tax Equity Transaction. If Ormat and Northleaf do not agree on a Tax Equity Transaction, and a Member, directly or indirectly through an Affiliate, desires to enter into a Tax Equity Transaction, then such Member shall first comply with its obligations under Section 9.5 as if such transaction was a Tag-Along Transfer and the other Member shall have the right to participate in such Tax Equity Transaction on the same terms. (C) If (i) Ormat and Northleaf have not agreed on a Tax Equity Transaction, (ii) counsel to Northleaf has not opined that the Don A. Campbell Expansion will qualify for the federal production tax credit under the rules and guidance promulgated by the IRS, and as result the Class B Member's portion of the DAC Expansion Capital Contribution has not been increased pursuant to sublcause (A) above, and (iv) Northleaf subsequently claims federal production tax credits with respect to the Don A. Campbell Expansion, Northleaf will pay to Ormat $3.1 million; provided, that if Northleaf owns less than 40% of the Membership Interests, such amount shall be adjusted by multiplying $3.1 million by a fraction, the numerator of which is the percentage of Membership Interests actually owned by Northleaf and the denominator of which is 40%.

(xi) Ormat shall remain solely responsible for the payment of any outstanding costs to complete any remaining items on the Punchlist (as defined in the Don A. Campbell Expansion EPC Agreement) after the purchase of ORNI 37 by the Company.

(xii) From the Don A. Campbell 2 COD and until the transfer of ORNI 37 to the Company, Ormat shall not permit ORNI 37 to, and shall cause ORNI 37 not to, make any Restricted Payment.

(b) Ormat may contribute additional projects to the Company on terms to be negotiated by the parties.

Section 4.6. Pre-Emptive Rights. If the Company proposes to issue any additional Membership Interests or other equity securities or interests convertible or exchangeable into Membership Interests ("New Equity Interests") by the Company (other than pursuant to Section 4.4), the Company shall give written notice (an "Issuance Notice") to each of the Members setting forth the material terms and conditions upon which they are proposed to be issued. Both Members will have the right to purchase a pro rata share of such New Equity Interests based upon their proportionate share of the Membership Interests in the Company at the time. Each of the Members may exercise such right by delivering an irrevocable written notice to the Company (the "Acceptance Notice"), within 10 Business Days after receiving the Issuance Notice from the Company (the "Preemptive Right Notice Period"), specifying the number of New Equity Interests (up to its pro rata portion of such New Equity Interests (based on its respective percentage of the Membership Interests)) that it desires to purchase upon the terms and conditions and for the purchase price set forth in the notice. The delivery of an Acceptance Notice shall be a binding and irrevocable offer by such Member to purchase the New Equity Interests described therein. If a Member has failed to exercise its preemptive rights in full (a "Non-Exercising Member"), each Member that has exercised its preemptive rights in full shall have the right to purchase its pro rata portion (based on its respective percentage of the Membership Interests) of the Non-Exercising Member's unpurchased allotment of New Equity Interests, by delivering an irrevocable written notice to the Company within 5 Business Days after receipt of notice from the Company.

Article V

ALLOCATIONS

Section 5.1. Allocations. For purposes of maintaining Capital Accounts, after giving effect to Section 5.2, Profits and Losses and credit for any Fiscal Year will be allocated among the Members pro rata in proportion to the Membership Interests held by each Member.

Section 5.2. Adjustments. The following adjustments will be made to the allocations in Section 5.1 to comply with Treasury Regulation Section 1.704-1(b):

(a) In any Fiscal Year in which there is a net decrease in Company Minimum Gain, income in the amount of the net decrease will be allocated to Members in the ratio required by Treasury Regulation Section 1.704-2 or any successor provision.

(b) In any Fiscal Year in which there is a net decrease in Minimum Gain Attributable to Member Nonrecourse Debt, then income in the amount of the net decrease will be allocated to each Member who was considered to have had a share of such minimum gain at the beginning of the Fiscal Year in the ratio required by Treasury Regulation Sections 1.704-2(i)(4) and 1.704-2(j)(2)(ii) or any successor provisions.

(c) Any Member Nonrecourse Deductions for any Fiscal Year will be specially allocated to the Member who bears the economic risk of loss with respect to the Member Nonrecourse Debt to which such Member Nonrecourse Deductions are attributable in accordance with Treasury Regulation Section 1.704-2(i)(1). Nonrecourse Deductions for any Fiscal Year will be allocated to the Members in the same ratio as other income and loss under Section 5.1 or Section 10.2(c) as applicable.

(d) To the extent an adjustment to the adjusted tax basis of any Company asset pursuant to Section 734(b) or Section 743(b) of the Code is required under Treasury Regulation Section 1.704-1(b)(2)(iv)(m)(2) or Section 1.704-1(b)(2)(iv)(m)(4) to be taken into account in determining Capital Accounts as the result of a distribution to a Member in complete liquidation of such Member's interest in the Company, the amount of the adjustment to Capital Accounts will be treated as an item of gain (if the adjustment increases the basis of the asset) or loss (if the adjustment decreases such basis) and the gain or loss will be specially allocated to the Members in accordance with Sections 5.2(a) or (b), as in effect at the time of the adjustment, in the event Treasury Regulation Section 1.704-1(b)(2)(iv)(m)(2) applies, or to the Member to whom such distribution was made in the event Treasury Regulation Section 1.704-1(b)(2)(iv)(m)(4) applies.

(e) Items of income or gain for any taxable period shall be allocated to the Members in the manner and to the extent required by the "qualified income offset" provisions of Regulation Section 1.704-1(b)(2)(ii)(d). In no event shall Losses of the Company be allocated to a Member if such allocation would cause or increase a negative balance in such Member's Capital Account (determined for purposes of this Section only, by increasing the Member's Capital Account balance by the amount the Member is obligated to restore to the Company pursuant to Regulation Section 1.704-1(b)(2)(ii)(c) and the amount the Member is deemed obligated to restore to the Company pursuant to Regulation Sections 1.704-2(g)(1) and 1.704-2(i)(5)).

(f) The allocations in this Section 5.2 are required to comply with the Treasury Regulations. To the extent the Company can do so consistently with the Treasury Regulations, the net amount of the allocations under Article V and Section 10.2 to each Member will be the net amount that would have been allocated to each Member if this Agreement did not have Section 5.2.

Section 5.3. Tax Allocations.

(a) All allocations of tax items of Company income, gain, deductions and losses for each Fiscal Year will be allocated in the same proportions as the allocations of book items of Company income, gain, deductions and losses were made for such Fiscal Year pursuant to Sections 5.1 and 5.2.

(b) Notwithstanding Section 5.3(a), if, as a result of contributions of property by a Member to the Company or an adjustment to the Gross Asset Value of Company assets pursuant to this Agreement, there exists a variation between the adjusted basis of an item of Company property for federal income tax purposes and as determined under the definition of Gross Asset Value, then allocations of income, gain, loss, and deduction will be allocated among the Members so as to take into account any variation between the adjusted basis of such property to the Company for federal income tax purposes and its initial Gross Asset Value using the traditional method in Treasury Regulation Section 1.704-3(b).

(c) Allocations pursuant to this Section 5.3 are solely for purposes of federal, state and local taxes and shall not affect, or in any way be taken into account in computing, any Member's Capital Account or share of income, gain, deductions or losses or distributions pursuant to any other provision of this Agreement.

(d) To the extent that an adjustment to the adjusted tax basis of any Company asset is made pursuant to Section 743(b) of the Code as the result of a purchase of a Membership Interest in the Company, any adjustment to the depreciation, amortization, gain or loss resulting from such adjustment shall affect the transferee only and shall not affect the Capital Account of the transferor or transferee. In such case, the transferee shall be required to agree to provide to the Company (i) information about the allocation of any step-up or step-down in basis to the Company's assets and (ii) the depreciation or amortization method for any step-up in basis to the Company's assets.

Section 5.4. Transfer or Change in Company Interest. If the respective Membership Interests or allocation ratios described in this Article V of the existing Members in the Company change or if a Membership Interest is Transferred in compliance with this Agreement to any other Person, then, for the Fiscal Year in which the change or Transfer occurs, all income, gains, losses, deductions, credits and other tax incidents resulting from the operations of the Company shall be allocated, as between the Members for the Fiscal Year in which the change occurs or between the transferor and transferee, by taking into account their varying interests using the proration method permitted by Treasury Regulation Section 1.706-1(c)(2)(ii), unless otherwise agreed by all the Members.

Section 5.5. Other Allocation Rules.

(a) For purposes of determining the amount of any item of income, gain, loss, deduction or credit allocable to any period, such items shall be determined on a quarterly basis (and prorating the items in such quarterly period to each day within such quarterly period), unless another method is required under Section 706 of the Code and the Treasury Regulations thereunder or expressly agreed to by the Members.

(b) The Company shall allocate 100% of the "excess nonrecourse liabilities" of the Company for purposes of Treasury Regulation Section 1.752-3(a) in the ratio in which Profits and Losses are shared under Section 5.1.

(c) For any Fiscal Year, if a distribution is paid to any Member pursuant to Section 6.5 that varies from what such Member would have been distributed without regard to Section 6.5, then the Company shall increase or decrease its allocation of income and deductions to such Member (with a corresponding increase or decrease with respect to the other Member) to reflect such variation in the amount distributed; provided, the foregoing shall not apply to the extent such allocation would result in (i) an allocation of any Tax credits provided for in Sections 45 or 48 of the Code pertaining to the Don A. Campbell Expansion other than in proportion to the Membership Interest held by each Member or (ii) recapture of any such federal income Tax credit; provided, further, the previous proviso shall be inapplicable to the extent the Don A. Campbell Expansion is subject to a Tax Equity Transaction between the Company or a subsidiary of the Company and one or more investors, purchasers or lessees.

Article VI

DISTRIBUTIONS

Section 6.1. Distributions. Except as provided otherwise in Section 10.2 and subject to Section 6.3, Section 6.4 and Section 6.5, Distributable Cash will be distributed to the Members pro rata in proportion to the Membership Interests held by each such Member.

(a) Subject to Section 6.3, the Company will make distributions of Distributable Cash pursuant to this Section 6.1 on each Distribution Date.

Section 6.2. Withholding Taxes. If the Company is required to withhold taxes with respect to any allocation or distribution of Distributable Cash to any Member pursuant to any applicable federal, state or local tax laws, the Company may, after first notifying the Member and permitting the Member, if legally permitted, to contest the applicability of such taxes, withhold such amounts and make such payments to taxing authorities as are necessary to ensure compliance with such tax laws. Any funds withheld by reason of this Section 6.2 shall nonetheless be deemed distributed to the Member in question for all purposes under this Agreement. If the Company did not withhold from actual distributions Distributable Cash any amounts it was required to withhold, the Company may, at its option, (a) require the Member to which the withholding was credited to reimburse the Company for such withholding, or (b) reduce any subsequent distributions of Distributable Cash by the amount of such withholding. This obligation of a Member to reimburse the Company for taxes that were required to be withheld shall continue after such Member Transfers its Membership Interests in the Company. Each Member agrees to furnish the Company with any representations and forms as shall reasonably be requested by the Company to assist it in determining the extent of, and in fulfilling, any withholding obligations it may have.

Section 6.3. Limitation upon Distributions. No distribution or deemed distribution of Distributable Cash shall be made: (a) if such distribution would violate any contract or agreement to which the Company is then a party or any Applicable Law then applicable to the Company, (b) to the extent that, in accordance with the Prudent Operator Standard, any amount otherwise distributable should be retained by the Company to pay, or to establish a reserve for the payment of, any liability or obligation of the Company or any Project Company, whether liquidated, fixed, contingent or otherwise, or to hedge an existing investment, including funding reserve accounts for spare parts and operational and maintenance costs for the Projects, or (c) to the extent that the Managing Member, acting in accordance with the Prudent Operator Standard, determines that the Distributable Cash is insufficient to permit such distribution.

Section 6.4. Special Ormat Distribution. Notwithstanding anything in the agreement to the contrary, all distributions following the Closing shall be made to Ormat, until Ormat has received $1 million, and thereafter, all distributions shall be made in accordance with this Article 6.

Section 6.5. Special Puna Distributions. On the Effective Date, the initial values of the Puna Class A Tracking Amount and Puna Class B Tracking Amount will be calculated in accordance with Sections 6.5(a) and 6.5(b) with respect to each payment received from HELCO prior to the Effective Date relating to invoicing periods beginning on January 1, 2015. Thereafter, (x) upon PGV's receipt of any payment from HELCO made under the Puna On-Peak/Off-Peak PPA, excluding any payments made under any extension thereof, relating to any invoicing period beginning on January 1, 2015 and ending upon the termination of the Puna On-Peak/Off-Peak PPA (a "PGV Special Revenue Payment") or (y) each distribution made to Members, the Puna Class A Tracking Amount and the Puna Class B Tracking Amount shall be recalculated as follows:

(a) Immediately following each PGV Special Revenue Payment, if such amount paid by HELCO for electricity delivered under the Puna On-Peak/Off-Peak PPA (excluding, for the avoidance of doubt, any capacity payment) is higher than the product of (w) the MWh delivered to HELCO under the Puna On-Peak/Off-Peak PPA during such applicable invoice period(s), multiplied by (x) the applicable fixed price per MWh shown in the Puna Fixed Price Table, then the Puna Class A Tracking Amount shall be increased by an amount equal to (A) (y) such positive excess minus (z) the absolute value of any increase in the variable expense items incurred by PGV during such invoice period(s) that is attributable to the excess amounts paid by HELCO relating to such invoice period(s) (including, without limitation, royalties and taxes), multiplied by (B) the Class B Percentage Interest, with such amount never being less than zero;

(b) Immediately following each PGV Special Revenue Payment, if such amount paid by HELCO for electricity delivered under the Puna On-Peak/Off-Peak PPA (excluding, for the avoidance of doubt, any capacity payment) is lower than the product of (w) the MWh delivered to HELCO under the Puna On-Peak/Off-Peak PPA during such applicable invoice period(s), multiplied by (x) the applicable fixed price per MWh shown in the Puna Fixed Price Table, then the Puna Class B Tracking Amount shall be increased by an amount equal to (A) (y) the absolute value of such differential, minus (z) the absolute value of any decrease in the variable expense items incurred by PGV during such invoice period that is attributable to the reduced amounts paid by HELCO relating to such invoice period(s) (including, without limitation, royalties and taxes), multiplied by (B) the Class B Percentage Interest, with such amount never being less than zero;

(c) Any Puna Class A Tracking Amount and Puna Class B Tracking Amount that are outstanding as of any date of calculation, shall be set-off against each other immediately following any calculation undertaken in accordance with clause (a) and (b) above, such that at all times one of either the Puna Class A Tracking Amount or the Puna Class B Tracking Amount shall be equal to zero;

(d) Upon each Distribution Date, if the Puna Class A Tracking Amount is greater than zero, then any Distributable Cash available on the applicable Distribution Date will be distributed:

(i) to the Class A Member, in an amount equal to (x) the Class A Percentage Interest multiplied by the Distributable Cash available on the applicable Distribution Date plus (y) the Puna Class A Tracking Amount(with the aggregate amount under clauses (x) and (y) not to exceed the amount of available Distributable Cash);

(ii) to the Class B Member, in an amount equal to (x) the Class B Percentage Interest multiplied by the Distributable Cash available on the applicable Distribution Date minus (y) the Puna Class A Tracking Amount (with the aggregate amount under clauses (x) and (y) to be not less than zero);

(e) Upon each Distribution Date, if the Puna Class B Tracking Amount is greater than zero, then any Distributable Cash available on the applicable Distribution Date will be distributed:

(i) to the Class A Member, in an amount equal to (x) the Class A Percentage Interest multiplied by the Distributable Cash available on the applicable Distribution Date minus (y) the Puna Class B Tracking Amount (with the aggregate amount under clauses (x) and (y) to be not less than zero);

(ii) to the Class B Member, in an amount equal to (x) the Class B Percentage Interest multiplied by the Distributable Cash available on the applicable Distribution Date plus (y) the Puna Class B Tracking Amount (with the aggregate amount under clauses (x) and (y) not to exceed the amount of available Distributable Cash);