Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FEDERAL HOME LOAN MORTGAGE CORP | d909226d8k.htm |

| EX-99.1 - EXHIBIT 99.1 - FEDERAL HOME LOAN MORTGAGE CORP | d909226dex991.htm |

First Quarter 2015

Financial Results Supplement

May 5, 2015

Exhibit 99.2 |

©

Freddie Mac

Table of contents

1

Financial Results

Segment Business Information

2 -

Quarterly Financial Results

11 -

Single-Family New Funding Volume

3 -

Financial Results - Key Drivers

12 -

Single-Family Guarantee Fees Charged on New Acquisitions

4 -

Financial Results - Key Drivers: Derivative Gains (Losses)

13 -

Single-Family Risk Transfer Transactions

5 -

Comprehensive Income

14 -

6 -

Treasury Draw Requests and Dividend Payments

15 -

7 -

Segment Financial Results

16 -

17 -

Housing Market

18 -

8 -

National Home Prices

19 -

9 -

Home Price Performance by State: March 2014 to March 2015

20 -

10 -

21 -

22 -

23 -

24 -

25 -

Interest Rate Risk Measures

Investments - Mortgage-Related Investments Portfolio Composition

Single-Family Real Estate Owned

Multifamily Business Volume and Portfolio Composition

Multifamily Securitization Volume

Single-Family Mortgage Market and Freddie Mac Delinquency Rates

Investments - Mortgage-Related Investments Portfolio:

More Liquid versus Less Liquid Assets

Single-Family Credit Quality - Purchases

Housing Market Support

Single-Family Credit Quality - Credit Guarantee Portfolio

Multifamily Market and Freddie Mac Delinquency Rates

Investments - Purchase Agreement Portfolio Limits

Multifamily Percentage of Affordable Units Financed |

©

Freddie Mac

Quarterly financial results

Note: Columns and rows may not add due to rounding.

2

$ Millions

1Q15

vs

1Q15

4Q14

4Q14

1

Net interest income

3,647

$

3,587

$

60

$

2

Benefit (provision) for credit losses

499

(17)

516

3

Derivative losses

(2,403)

(3,397)

994

4

Other non-interest income

256

815

(559)

5

Non-interest income (loss)

(2,147)

(2,582)

435

6

Non-interest expense

(1,211)

(823)

(388)

7

Pre-tax income

788

$

165

$

623

$

8

Income tax (expense) benefit

(264)

62

(326)

9

Net income

524

$

227

$

297

$

10

Total other comprehensive income,

net of taxes

222

24

198

11

Comprehensive income

746

$

251

$

495

$

12

Total equity / GAAP net worth (ending balance)

2,546

$

2,651

$

(105)

$ |

©

Freddie Mac

Financial

results

–

key

drivers

Net Interest Income

$ Billions

Benefit (Provision)

for Credit Losses

$ Billions

Other Non-Interest Income (Loss)

$ Billions

Total Other Comprehensive Income

$ Billions

1

Includes settlement benefits from private-label securities litigation.

3

Annual

2013: $16.5

2014: $14.3

Annual

2013: $2.5

2014: ($0.1)

Annual

2013: $2.9

2014: $1.7

Annual

2013: $5.9

2014: $8.2

$0.5

$0.5

$0.7

$0.02

$0.2

1Q14

2Q14

3Q14

4Q14

1Q15

$3.5

$3.5

$3.7

$3.6

$3.6

1Q14

2Q14

3Q14

4Q14

1Q15

$5.5

$0.5

$1.4

$0.8

$0.3

1Q14

2Q14

3Q14

4Q14

1Q15

($0.1)

$0.6

($0.6)

($0.02)

$0.5

1Q14

2Q14

3Q14

4Q14

1Q15

1 |

©

Freddie Mac

Financial

results

–

key

drivers:

Derivative gains (losses)

2-Year and 10-Year LIBOR Rates

Percent (%)

Derivative Gains (Losses)

Fair Value Changes vs. Interest Carry

$ Billions

4

($2.4)

($1.9)

($0.6)

($3.4)

1

Represents

the net amount the company accrues for interest-rate swap payments it will

make or receive during a period. ($2.4)

$1.0

($0.1)

$1.4

$0.4

0.38

0.42

0.51

0.46

0.49

0.55

0.58

0.83

0.89

0.71

0.87

0.81

1.79

2.01

2.69

2.77

3.07

2.85

2.61

2.66

2.29

1.81

2.12

2.03

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

Jan-15

Feb-15

Mar-15

2-Year

10-Year

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

1Q15

Derivative Interest Carry

Derivative Fair Value Changes

Note: Totals may not add due to rounding.

1 |

©

Freddie Mac

Comprehensive income

1

1

Consists of the after-tax changes in: (a) the unrealized gains and losses on

available-for-sale securities; (b) the effective portion of derivatives previously designated as cash flow

hedges; and (c) defined benefit plans.

A

B

C = A + B

$ Billions

5

$4.5

$1.9

$2.8

$0.3

$0.7

1Q14

2Q14

3Q14

4Q14

1Q15

Net income

Total other comprehensive income (loss), net of taxes

Comprehensive income |

©

Freddie Mac

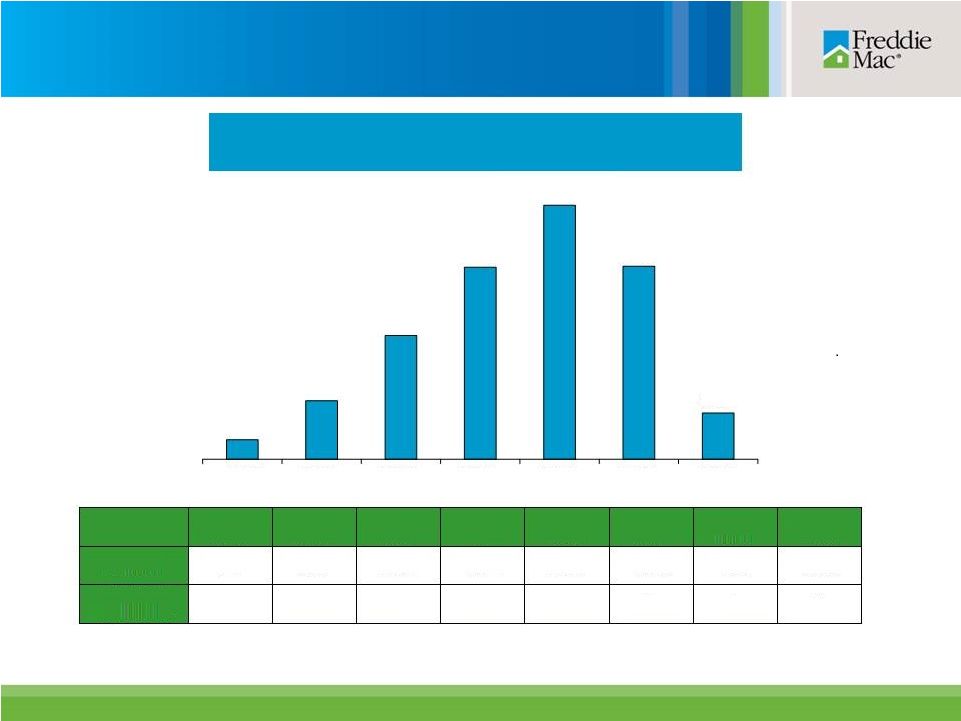

Dividend Payments to Treasury

Draw Requests from Treasury

Treasury draw requests and dividend payments

1

The initial $1 billion liquidation preference of senior preferred stock was issued

to Treasury in September 2008 as consideration for Treasury’s funding commitment. The company

received

no

cash

proceeds

as

a

result

of

issuing

this

initial

$1

billion

liquidation

preference

of

senior

preferred

stock.

2

Amounts may not add due to rounding.

3

Amount does not include the June 2015 dividend obligation of $0.7 billion.

4

Annual amounts represent the total draws requested based on Freddie Mac’s

quarterly net deficits for the periods presented. Draw requests are funded in the subsequent quarter

(e.g., $19 million draw request for 1Q12 was funded in 2Q12).

5

Represents quarterly cash dividends paid by Freddie Mac to Treasury during the

periods presented. Through December 31, 2012, Treasury was entitled to receive cumulative

quarterly cash dividends at the annual rate of 10% per year on the liquidation

preference of the senior preferred stock. However, the fixed dividend rate was replaced with a net

worth sweep dividend payment beginning in the first quarter of 2013. See the

company’s Annual Report on Form 10-K for the year ended December 31, 2014 for more information.

$ Billions

5

4

Draws From Treasury

Dividend Payments to Treasury

6

3

Cumulative

Total

Dividend Payments as of 3/31/15

$91.8

2Q15 Dividend Obligation

$0.7

Total Dividend Payments

2

$92.6

Cumulative

Total

Total Senior Preferred Stock

Outstanding

$72.3

Less: Initial Liquidation Preference

1

$1.0

Treasury Draws

$71.3

$44.6

$6.1

$13.0

$7.6

$0.0

$0.0

$0.0

2008

2009

2010

2011

2012

2013

2014

1Q15

$4.1

$5.7

$6.5

$7.2

$47.6

$19.6

$0.9

2008

2009

2010

2011

2012

2013

2014

1Q15

$0.02

$0.2 |

©

Freddie Mac

Segment financial results

$ Billions

Investments

Multifamily

Single-Family

Guarantee

1

Comprehensive Income

Segment Earnings

Segment Other Comprehensive Income (Loss)

1

Comprehensive

income

approximated

segment

earnings

for

both

4Q14

and

1Q15.

Note: Totals may not add due to rounding.

7 |

©

Freddie Mac

1

National home prices

1

Cumulative decline of 10% since June 2006

(NSA Series)

Freddie Mac House Price Index (December 2000=100)

8

100

110

120

130

140

150

160

170

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

United States (SA)

United States (NSA)

2015Q1 NSA Index Growth: 1.6%

2015Q1 SA Index Growth: 1.6%

National home prices use the Freddie Mac House Price Index for the U.S., which is a

value-weighted average of the state indices where the value weights are based on Freddie

Mac’s single-family credit guarantee portfolio. Other indices of home prices may have

different results, as they are determined using home prices relating to different pools of

mortgage loans and calculated under different conventions than Freddie Mac’s. Quarterly

growth rates are calculated as a 3-month change based on the final month of each

quarter. ‘SA’ denotes ‘Seasonally Adjusted’ and ‘NSA’ denotes

‘Not Seasonally Adjusted’; seasonal factors typically result in stronger house-price appreciation during the second

and third quarters. Historical growth rates change as new data becomes available. Values for the

most recent periods typically see the largest changes. Cumulative decline, based on the

NSA series, calculated as the percent change from June 2006 to March 2015.

Source: Freddie Mac. |

©

Freddie Mac

8%

4 to 7%

-2 to -1%

0 to 3%

Home price performance by state

March 2014 to March 2015

1

United States 5%

1

The Freddie Mac House Price Index for the U.S. is a value-weighted average of

the state indexes where the value weights are based on Freddie Mac’s single-family credit guarantee

portfolio. Other indices of home prices may have different results, as

they are determined using different pools of mortgage loans and calculated under different conventions. The

Freddie Mac House Price Index for the U.S. is a non-seasonally adjusted monthly

series. Percent changes were rounded to nearest whole percentage point.

Source: Freddie Mac

9

2%

AL

0%

AK

0%

AR

5%

AZ

7%

CA

11%

CO

CT -1%

DC 5%

DE 0%

11%

FL

7%

GA

8%

HI

2%

IA

4%

ID

3%

IL

5%

IN

4%

KS

KY 4%

3%

LA

-1%

1%

ME

7%

MI

2%

MN

3%

MO

0%

MS

2%

MT

NC 6%

5%

ND

3%

NE

NJ 2%

3%

NM

9%

NV

2%

NY

3%

OH

5%

OK

6%

OR

2%

PA

RI 4%

5%

SC

2%

SD

TN 4%

8%

TX

5%

UT

0%

VA

10%

WA

3%

WI

2%

WV

5%

WY

0%

-2%

VT

3%

MD

MA

NH |

©

Freddie Mac

Housing market support

Number of Families Freddie Mac Helped

to

Own

or

Rent

a

Home

In Thousands

Single-Family

Loan

Workouts

Number of Loans (000)

1

Based on the company’s purchases of loans and issuances of

mortgage-related securities. For the periods presented, a borrower may be counted more than once if the company

purchased more than one loan (purchase or refinance mortgage) relating to the same

borrower. 2

Consists of both home retention actions and foreclosure alternatives.

3

These categories are not mutually exclusive and a borrower in one category may also

be included in another category in the same or another period. For example, a borrower

helped through a home retention action in one period may subsequently lose his or

her home through a short sale or deed-in-lieu transaction in a later period.

133

275

208

169

168

Repayment

plans

Loan

modifications

Forbearance

agreements

Short sales and deed-in-lieu of

foreclosure

transactions

Home Retention Actions

Foreclosure Alternatives

Cumulative Since 2009: 13,450

Cumulative Since 2009: 1,100

10

120

27

2,480

2,089

1,830

2,472

2,458

1,627

494

2009

2010

2011

2012

2013

2014

1Q15

2009

2010

2011

2012

2013

2014

1Q15

1

3

3

3

3

2 |

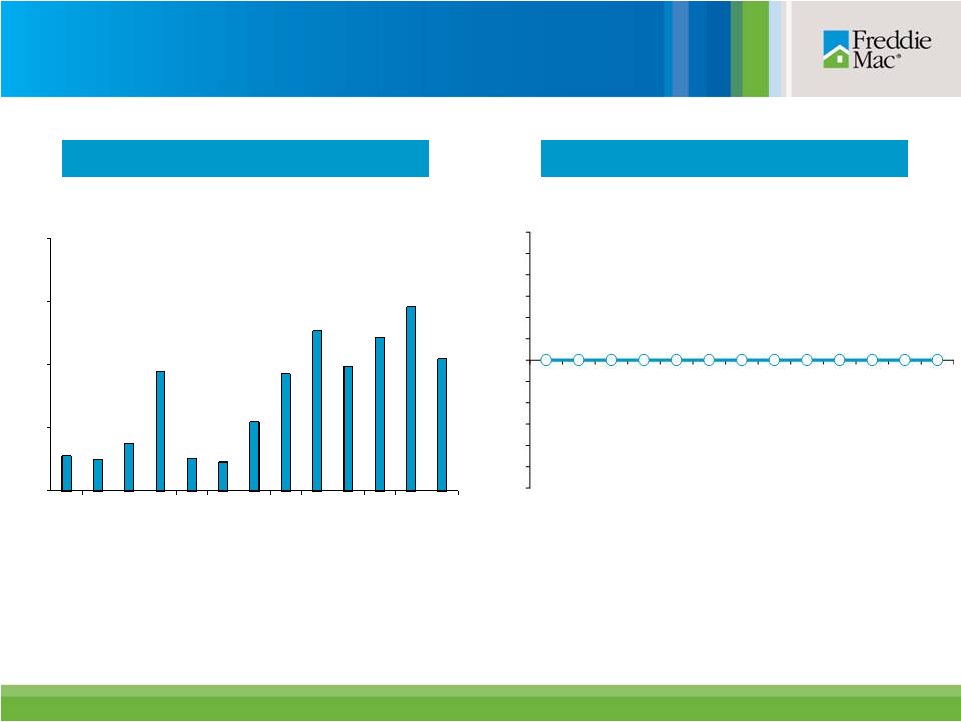

Single-family new funding volume

$ Billions

$49

$59

$77

$71

11

Note: Totals may not add due to rounding.

Annual

2013: $423

2014: $255

$80

$26

$26

$33

$36

$52

$23

$33

$43

$35

$28

1Q14

2Q14

3Q14

4Q14

1Q15

Refi UPB

Purchase UPB

©

Freddie Mac |

©

Freddie Mac

Single-family guarantee fees charged on new

acquisitions

1

Includes

the

effect

of

pricing

adjustments

that

are

based

on

the

relative

performance

of

Freddie

Mac’s

PCs

compared

to

comparable

Fannie

Mae

securities.

2

Effective April 1, 2012, guarantee fees charged on single-family loans sold to

Freddie Mac were increased by 10 basis points. Under the Temporary Payroll Tax Cut Continuation Act

of

2011,

Freddie

Mac

is

required

to

remit

the

proceeds

from

this

increase

to

Treasury.

3

Represents the estimated average rate of management and guarantee fees for new

acquisitions during the period assuming amortization of delivery fees using the estimated life of the

related

loans

rather

than

the

original

contractual

maturity

date

of

the

related

loans.

Quarterly

In Basis Points (bps), Annualized

Legislated 10 Basis Point Guarantee Fee Remitted to Treasury

Single-Family Guarantee Fee Charged on New Acquisitions (excluding amounts

remitted to Treasury)

3

2

12

Annual

In Basis Points (bps)

20

25

27

38

51

57

2009

2010

2011

2012

2013

2014

56

58

57

57

57

1Q14

2Q14

3Q14

4Q14

1Q15

1 |

©

Freddie Mac

Single-family risk transfer transactions

Structured Agency Credit Risk

(STACR

®

)

Debt Note Issuances

$ Billions

Agency

Credit

Insurance

Structure

13

1

At issuance. Includes $44.2 billion of UPB related to 1Q15 credit risk

transfer transactions. $1.1

$4.9

$1.7

2013

2014

1Q15

$77.4

$709.2

$706.7

2013

2014

1Q15

Cumulative

$ Billions

STACR Issuances

$7.8

ACIS Reinsurance Transactions

$1.5

Reference Pool UPB

1

$249.6

SM

SM

(ACIS

Reinsurance) Transactions

$ Millions |

©

Freddie Mac

Single-family

credit

quality

-

purchases

Weighted Average Original LTV Ratio

1

Percent (%)

Weighted Average Credit Score

2

14

1

Original LTV ratios are calculated as the unpaid principal balance (UPB) of the mortgage Freddie Mac

guarantees including the credit-enhanced portion, divided by the lesser of the appraised

value of the property at the time of mortgage origination or the mortgage borrower’s purchase price. Second liens not owned or

guaranteed by Freddie Mac are excluded from the LTV ratio calculation. The existence of a second

lien mortgage reduces the borrower’s equity in the home and, therefore, can increase the

risk of default.

2

Credit score data is based on FICO scores at the time of loan origination or Freddie Mac’s

purchase and may not be indicative of the borrowers’ current creditworthiness. FICO scores can range between approximately 300 to 850 points. |

©

Freddie Mac

Single-family

credit

quality

–

credit

guarantee

portfolio

1

Loans

acquired

after

2008.

HARP

and

other

relief

refinance

loans

are

presented

separately.

Concentration of Credit Risk

Percent (%)

Serious Delinquency Rates

Percent (%)

15

% of Portfolio

As of March 31, 2015

% of Credit Losses

For Three Months Ended March 31, 2015

New

single-family

book

2005 -

2008 legacy single-family book

HARP and other relief refinance loans

Pre-2005 legacy single-family book

HARP and other relief refinance loans

Pre-2005 legacy single-family book

New

single-family

book

2005 -

2008 legacy single-family book

Total

1

1 |

©

Freddie Mac

Single-family real estate owned

Property Inventory

1Q15 Activity

Historical Trend

Ending Property Inventory

(Number of Properties)

(Number of Properties)

16

25,768

22,738

7,201

(10,231)

12/31/14

Inventory

Acquisitions

Dispositions

3/31/15

Inventory

48k

26k

45k

47k

47k

44k

36k

29k

23k

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

1Q15 |

©

Freddie Mac

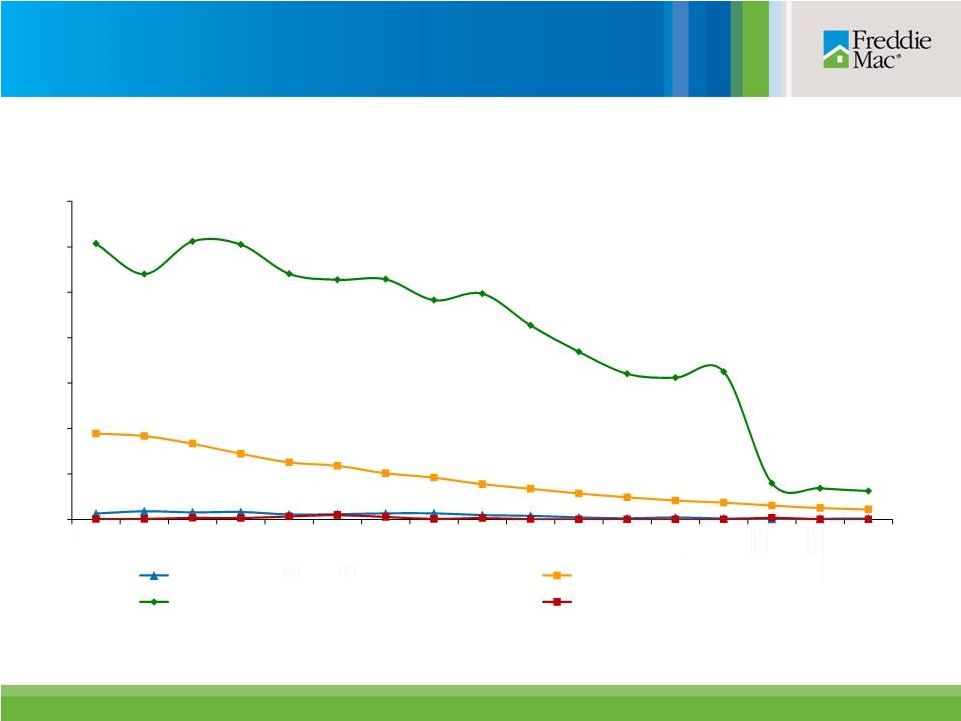

1

Single-family Serious Delinquency Rates

Single-family mortgage market and Freddie Mac

delinquency rates

17

0

4

8

12

16

20

24

28

32

Dec-10

Jun-11

Dec-11

Jun-12

Dec-12

Jun-13

Dec-13

Jun-14

Dec-14

17.68%

4.52%

2.60%

1.88%

Total Mortgage Market

Prime

Subprime

Freddie Mac

1

1

1

2

Source: National Delinquency Survey from the Mortgage Bankers Association. Categories represent

first lien single-family loans. Data is not yet available for the first quarter of 2015.

See “MD&A – RISK MANAGEMENT – Credit Risk Overview –

Single-Family Mortgage Credit Risk Framework and Profile– Monitoring Loan Performance” in Freddie Mac’s Form 10-K

for the year ended December 31, 2014, for information about the company’s reported delinquency

rates. The single-family serious delinquency rate at March 31, 2015 was 1.73%.

2 |

©

Freddie Mac

1

Total Multifamily Portfolio

UPB $ Billions

Multifamily business volume and portfolio

composition

Multifamily New Business Volume

$ Billions

1

Primarily K-Deals.

18

$15

$20

$29

$26

$28

$10

2010

2011

2012

2013

2014

1Q15

$174

12/31/10

12/31/11

12/31/12

12/31/13

12/31/14

3/31/15

MF unsecuritized loan portfolio

MF investment securities portfolio

MF guarantee portfolio

$169

$167

$180

$177

$169 |

©

Freddie Mac

Multifamily percentage of affordable units financed

Multifamily Acquisitions of Units by Area Median Income (AMI)

% of Units Acquired

19

91% of units

acquired in 2015

are affordable to

households

earning at or

below 100% AMI

Note: Totals may not add due to rounding.

62%

56%

61%

67%

63%

58%

61%

60%

2008

2009

2010

2011

2012

2013

2014

YTD 2015

11%

8%

14%

12%

16%

17%

13%

16%

17%

19%

15%

14%

13%

14%

16%

15%

11%

18%

10%

7%

8%

11%

10%

9%

50% AMI or less

>50%-80% AMI

>80%-100% AMI

>100% AMI |

©

Freddie Mac

K-Deal Securitization Volume

UPB $ Billions

Multifamily securitization volume

1

Represents the UPB of multifamily loans sold via Freddie Mac’s K Certificate

transactions. Note: Totals may not add due to rounding.

20

2009

2010

2011

2012

2013

2014

1Q15

Total

Total UPB

$2.1

$6.4

$13.7

$21.2

$28.0

$21.3

$5.1

$98.0

Number of

Transactions

2

6

12

17

19

17

5

78

$2.1

$6.4

$13.7

$21.2

$28.0

$21.3

$5.1

2009

2010

2011

2012

2013

2014

1Q15

1

1 |

©

Freddie Mac

0.00%

Multifamily market and Freddie Mac delinquency rates

Percent

1

1.25%

0.44%

0.04%

1

21

0

2

4

6

8

10

12

14

4Q10

2Q11

4Q11

2Q12

4Q12

2Q13

4Q13

2Q14

4Q14

Freddie Mac (60+ day)

FDIC Insured Institutions (90+ day)

MF CMBS Market (60+ day)

ACLI Investment Bulletin (60+ day)

See “MD&A – RISK MANAGEMENT – Credit Risk Overview – Multifamily Mortgage

Credit Risk Profile” in Freddie Mac’s Form 10-K for the year ended December 31, 2014, for

information about the company’s reported multifamily delinquency rate. The multifamily

delinquency rate at March 31, 2015 was 0.03%. Source: Freddie Mac, FDIC Quarterly Banking Profile, TREPP (CMBS multifamily 60+ delinquency rate,

excluding REOs), American Council of Life Insurers (ACLI). Non-Freddie Mac data is

not yet available for the first quarter of 2015. |

©

Freddie Mac

Mortgage-related investments portfolio ending balance

Mortgage-related investments portfolio limit

Investments

–

Purchase

Agreement

portfolio

limits

Indebtedness

1, 3

$ Billions

Mortgage Assets

1, 2

$ Billions

1

The

company’s

Purchase

Agreement

with

Treasury

limits

the

amount

of

mortgage

assets

the

company

can

own

and

indebtedness

it

can

incur.

Under

the

Purchase

Agreement,

mortgage assets and indebtedness are calculated without giving effect to the

January 1, 2010 change in the accounting guidance related to the transfer of financial assets and

consolidation of variable interest entities (VIEs). See the company’s

Annual Report on Form 10-K for the year ended December 31, 2014 for more information.

2

Represents the unpaid principal balance (UPB) of the company’s

mortgage-related investments portfolio. The company discloses its mortgage assets on this basis monthly in its

Monthly Volume Summary reports, which are available on its Web site and in Current

Reports on Form 8-K filed with the Securities and Exchange Commission (SEC).

3

Represents the par value of the company’s unsecured short-term and

long-term debt securities issued to third parties to fund its business activities. The company discloses its

indebtedness

on

this

basis

monthly

in

its

Monthly

Volume

Summary

reports,

which

are

available

on

its

Web

site

and

in

Current

Reports

on

Form

8-K

filed

with

the

SEC.

Indebtedness limit

Total debt outstanding

22

$408

$406

$470

$470

$470

$470

$399

12/31/14

03/31/15

06/30/15

09/30/15

12/31/15

$454

$451

$663

$564

$564

$564

$564

12/31/14

03/31/15

06/30/15

09/30/15

12/31/15 |

©

Freddie Mac

1

Based on unpaid principal balances and excludes mortgage-related securities

traded, but not yet settled. The mortgage-related investments portfolio is determined without giving

effect to the January 1, 2010 change in accounting standards related to the

transfer of financial assets and consolidation of variable interest entities (VIEs).

2

Mortgage loans totaled $166.1 billion at March 31, 2015 of which $110.5 billion

were single-family and $55.6 billion were multifamily. Investments

–

mortgage-related

investments

portfolio

composition

Mortgage-Related

Investments

Portfolio

1

$ Billions

2

$755

$697

$653

$558

$461

23

$408

$406

12/31/09

12/31/10

12/31/11

12/31/12

12/31/13

12/31/14

03/31/15

Mortgage Loans

Non-Freddie Mac Mortgage-Related Securities (Non-Agency)

Non-Freddie Mac Mortgage-Related Securities (Agency)

Freddie Mac PCs and Structured Securities |

©

Freddie Mac

Investments

–

mortgage-related

investments

portfolio:

More liquid versus less liquid assets

More Liquid versus Less Liquid Assets

$ Billions

24

1

1

62%

63%

62%

59%

59%

58%

36%

38%

37%

38%

41%

41%

42%

$558

$461

$434

$420

$414

$408

$406

12/31/12

12/31/13

03/31/14

06/30/14

03/30/14

12/31/14

03/31/15

Less Liquid Assets

More Liquid Assets

64%

Less liquid assets include unsecuritized single-family and multifamily mortgage loans, certain

structured agency securities collateralized with non-agency mortgage-related securities,

and the company’s investments in non-agency mortgage-related securities.

|

©

Freddie Mac

$ Millions

Average

Monthly

PMVS-Level

1

Interest-rate risk measures

Average

Monthly

Duration

Gap

2

Months

1

Portfolio Market Value Sensitivity, or PMVS, is an estimate of the change in the

market value of Freddie Mac’s net assets and liabilities from an instantaneous 50 basis point shock to

interest rates, assuming no rebalancing actions are undertaken and assuming the

mortgage-to-LIBOR basis does not change. PMVS-Level or PMVS-L measures the estimated

sensitivity of the company’s portfolio market value to parallel movements in

interest rates. 2

Duration gap measures the difference in price sensitivity to interest rate changes

between Freddie Mac’s financial assets and liabilities, and is expressed in months relative to the

market value of assets.

25

$28

$25

$38

$95

$26

$23

$55

$93

$127

$99

$122

$146

$105

0

50

100

150

200

Mar

14

Apr

14

May

14

Jun

14

Jul

14

Aug

14

Sep

14

Oct

14

Nov

14

Dec

14

Jan

15

Feb

15

Mar

15

(6)

(5)

(4)

(3)

(2)

(1)

0

1

2

3

4

5

6

Mar

14

Apr

14

May

14

Jun

14

Jul

14

Aug

14

Sep

14

Oct

14

Nov

14

Dec

14

Jan

15

Feb

15

Mar

15 |

©

Freddie Mac

Safe Harbor Statements

Freddie Mac obligations

Freddie Mac’s securities are obligations of Freddie Mac only. The securities,

including any interest or return of discount on the securities, are not

guaranteed by and are not debts or obligations of the United States or any federal agency or instrumentality other than Freddie

Mac.

No offer or solicitation of securities

This

presentation

includes

information

related

to,

or

referenced

in

the

offering

documentation

for,

certain

Freddie

Mac

securities,

including offering circulars and related supplements and agreements. Freddie Mac

securities may not be eligible for offer or sale in certain

jurisdictions

or

to

certain

persons.

This

information

is

provided

for

your

general

information

only,

is

current

only

as

of

its

specified

date and does not constitute an offer to sell or a solicitation of an offer to buy

securities. The information does not constitute a sufficient basis

for

making

a

decision

with

respect

to

the

purchase

or

sale

of

any

security.

All

information

regarding

or

relating

to

Freddie

Mac

securities

is

qualified

in

its

entirety

by

the

relevant

offering

circular

and

any

related

supplements.

Investors

should

review

the

relevant

offering circular and any related supplements before making a decision with

respect to the purchase or sale of any security. In addition, before

purchasing any security, please consult your legal and financial advisors for information about and analysis of the security, its

risks and its suitability as an investment in your particular circumstances.

Forward-looking statements

Freddie Mac's presentations may contain forward-looking statements, which may

include statements pertaining to the conservatorship, the company’s

current expectations and objectives for its single-family, multifamily and investment businesses, its loan workout

initiatives and other efforts to assist the U.S. residential mortgage market,

liquidity, capital management, economic and market conditions and trends,

market share, the effect of legislative and regulatory developments and new accounting guidance, credit quality of

loans we guarantee, and results of operations and financial condition on a GAAP,

Segment Earnings and fair value basis. Forward- looking statements

involve known and unknown risks and uncertainties, some of which are beyond the company’s control.

Management’s expectations for the company’s future necessarily involve a

number of assumptions, judgments and estimates, and various factors,

including changes in market conditions, liquidity, mortgage spreads, credit outlook, actions by the U.S. government

(including FHFA, Treasury and Congress), and the impacts of legislation or

regulations and new or amended accounting guidance, could cause actual

results to differ materially from these expectations. These assumptions, judgments, estimates and factors are discussed in

the

company’s

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2014,

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended March 31, 2015 and Current Reports on Form 8-K, which are available on

the Investor Relations page of the company’s Web site at

www.FreddieMac.com/investors and the SEC’s Web site at www.sec.gov. The company undertakes no obligation to update forward-

looking statements it makes to reflect events or circumstances occurring after the

date of this presentation. 26 |