Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Discover Financial Services | d920325d8k.htm |

2015 Financial Community Briefing

May 5, 2015

©2015 DISCOVER FINANCIAL SERVICES

Exhibit 99.1 |

The

following slides are part of a presentation by Discover Financial Services (the "Company") and are intended to be viewed as part of that

presentation. No representation is made that the information in these slides is

complete. Company

financial

data

presented

herein

is

based

on

a

calendar

year.

As

previously

reported,

the

Company

changed

its

fiscal

year

end

from

November 30 to December 31 of each year, effective beginning with the 2013 fiscal

year. For historical calendar year financial data, see the Company's Current

Report on Form 8-K dated March 5, 2013 and the Company’s Annual Report on Form 10-K for the year ended December

31, 2013.

Throughout

these

materials,

direct-to-consumer

deposits

are

referred

to

as

DTC

deposits.

DTC

deposits

include

deposit

products

that

we

offer

to customers through direct marketing, internet origination and affinity

relationships. DTC deposits include certificates of deposits, money

market accounts, online savings and checking accounts, and IRA certificates of

deposit. The

information

provided

herein

includes

certain

non-GAAP

financial

measures.

The

reconciliations

of

such

measures

to

the

comparable

GAAP

figures

are

included

at

the

end

of

this

presentation,

which

is

available

on

the

Company’s

website

at

www.discover.com

and

the

SEC’s

website.

The presentation contains forward-looking statements. You are cautioned not to

place undue reliance on forward-looking statements, which speak only as

of the date on which they are made, which reflect management’s estimates, projections, expectations or beliefs at that time, and

which are subject to risks and uncertainties that may cause actual results to

differ materially. For a discussion of certain risks and uncertainties that

may affect the future results of the Company, please see "Special Note Regarding Forward-Looking Statements," "Risk Factors," "Business

–

Competition," "Business –

Supervision and Regulation" and "Management’s Discussion and Analysis

of Financial Condition and Results of Operations" in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2014 and "Management’s Discussion and

Analysis of Financial Condition and Results of Operations" in the

Company’s Quarterly Report on Form 10-Q for the quarter ended March 31,

2015

which

is

filed

with

the

SEC

and

available

at

the

SEC's

website

(www.sec.gov

). The

Company

does

not

undertake

to

update

or

revise

forward-looking statements as more information becomes available.

We own or have rights to use the trademarks, trade names and service marks that we

use in conjunction with the operation of our business, including,

but

not

limited

to:

Discover®,

PULSE®,

Cashback

Bonus®,

Discover

Cashback

Checking®,

Discover

it®,

Freeze

It

SM

,

Discover®

Network and Diners Club International®. All other trademarks, trade names and

service marks included in this presentation are the property of their

respective owners. 2

Notice |

Agenda

3

David Nelms

CHAIRMAN & CHIEF EXECUTIVE OFFICER

Overview

Julie Loeger

CHIEF MARKETING OFFICER

U.S. Cards

Jim Panzarino

PRESIDENT –

CREDIT & CARD OPERATIONS

Credit

Roger Hochschild

PRESIDENT & CHIEF OPERATING OFFICER

Payments and Other Consumer Lending

Mark Graf

CHIEF FINANCIAL OFFICER

Funding, Capital and Financials

Break

Q&A |

Overview

2015 Financial Community Briefing

David Nelms

Chairman & Chief Executive Officer |

Executive Summary

Attractive business model with a solid record of success

5

•

Delivering strong card growth through new accounts, wallet share gain,

lower attrition and great credit results

•

Proprietary network driving value for Card through brand recognition,

expanding global acceptance and rewards

•

Leveraging a payments partnership strategy to position the business for

growth

•

Direct Banking growth diversifying assets and funding •

Capital position/generation supporting growth and robust capital

deployment

|

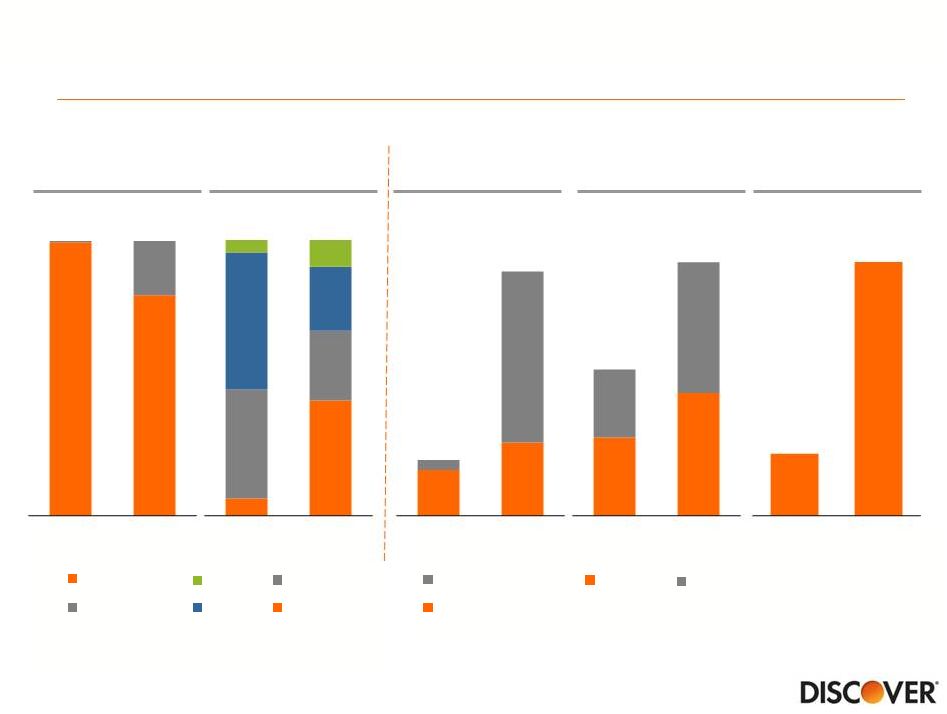

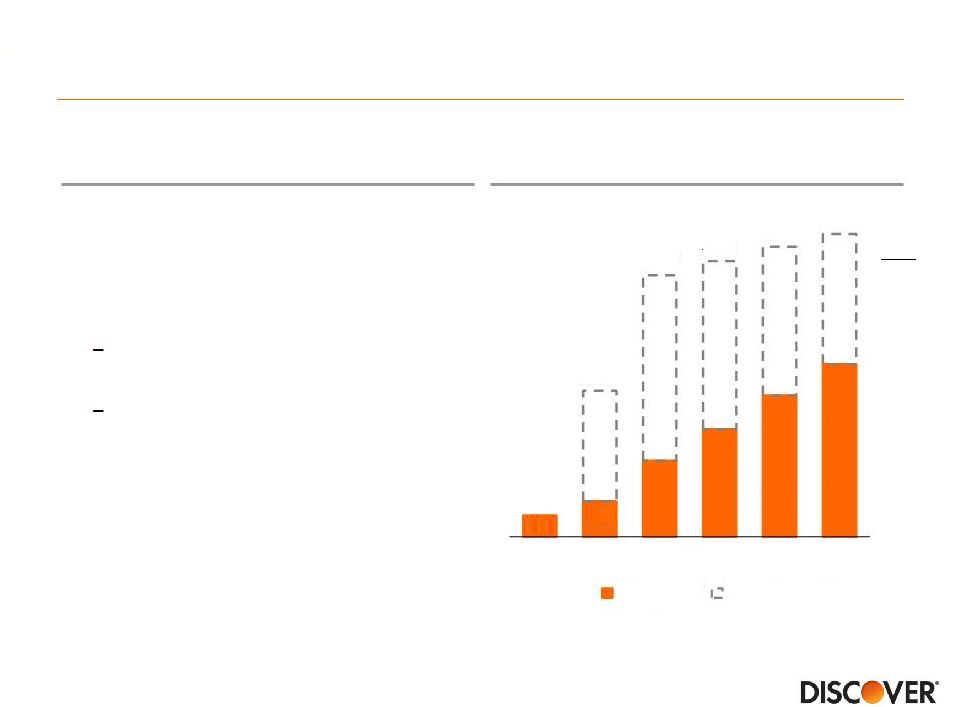

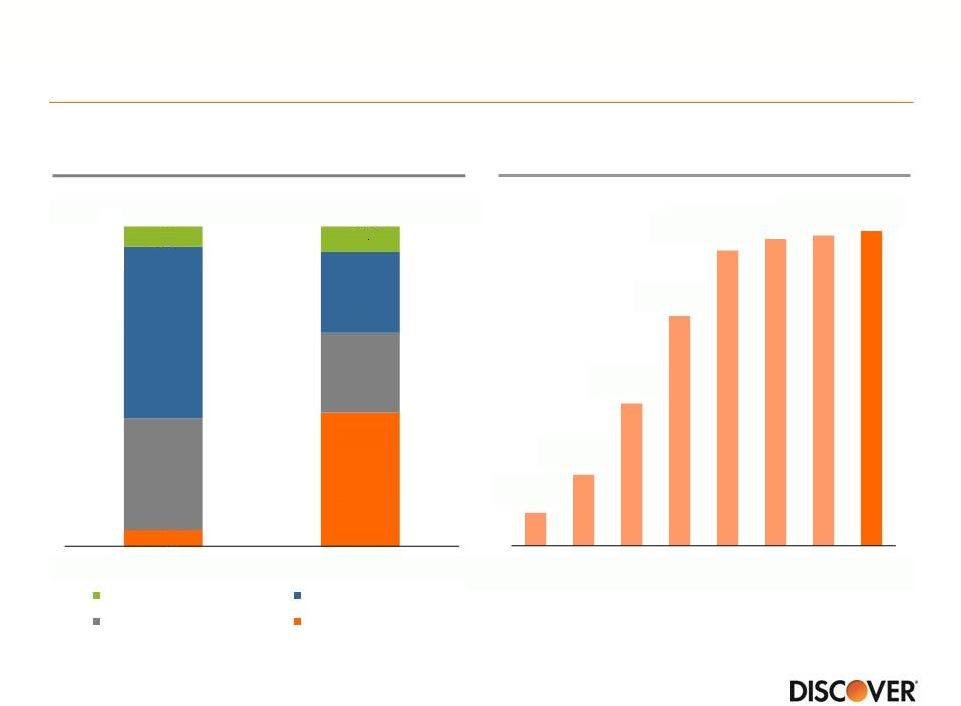

Business model has expanded and diversified

6

Loans

Funding

Acceptance

Outlets

Volume

Other

ABS

Brokered

Direct

Deposits

Note(s)

1.

Fiscal year ending November 30, 2007

2.

Includes affinity deposits

3.

Includes network-to-network acceptance agreements; merchant acceptance

based on third-party and internal estimates 4.

Includes business-to-business volume

(3)

Net Income

All data in billions, except Acceptance Outlets in millions

(1)

$53

$70

$54

$69

7

31

$186

$322

$0.6

$2.3

(4)

(2)

Card

Non-Card

2007

2014

2007

2014

2007

2014

International

Domestic

2007

2014

Credit

Debit

2007

2014 |

Product diversification has leveraged large, loyal card base

7

Discover Card

Student Loans

Personal Loans

Deposits

Cross-sell /

Overlap (%)

(1)

~65%

~65%

~50%

Note(s)

1.

Cross-sell is defined as 12/31/14 percentage of accounts with another DFS

relationship; Student Loan cross-sell includes co-signers

•

1 in 4 U.S.

households

•

Proprietary

network |

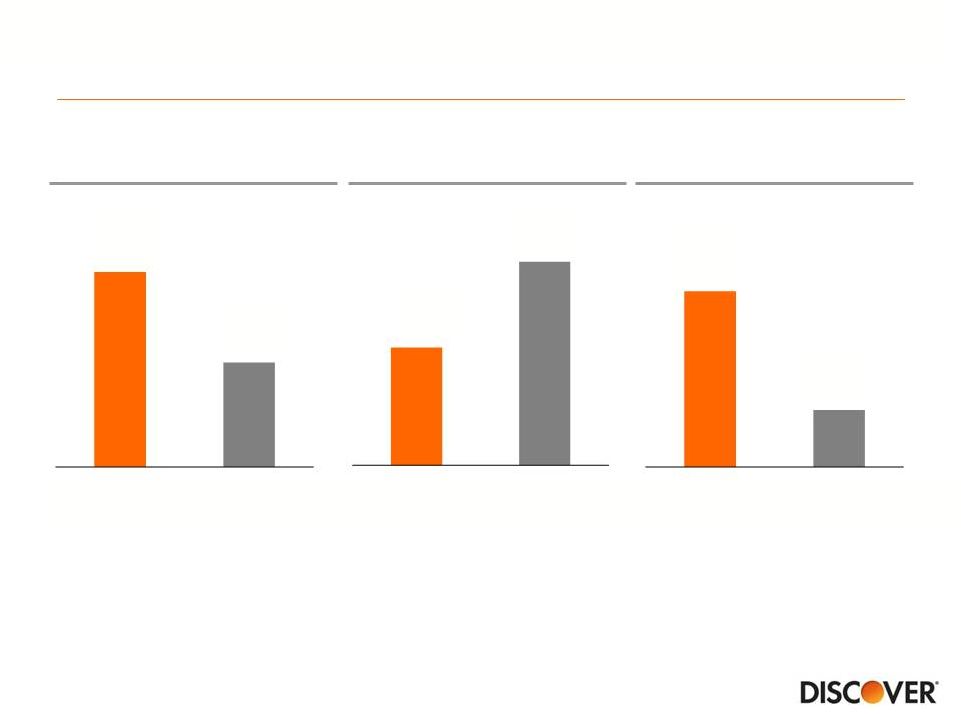

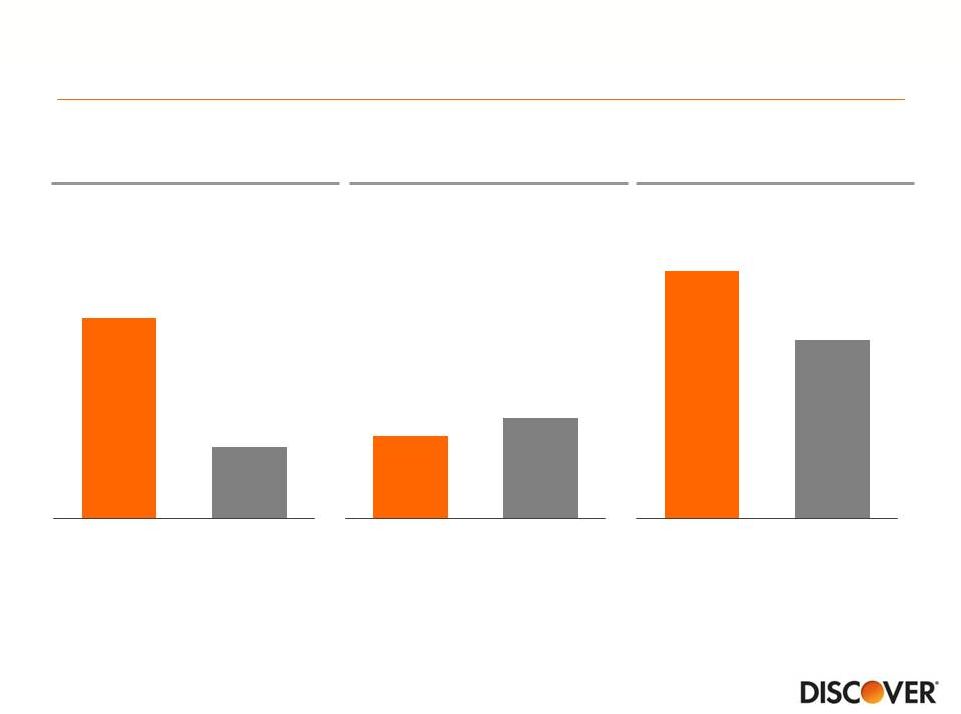

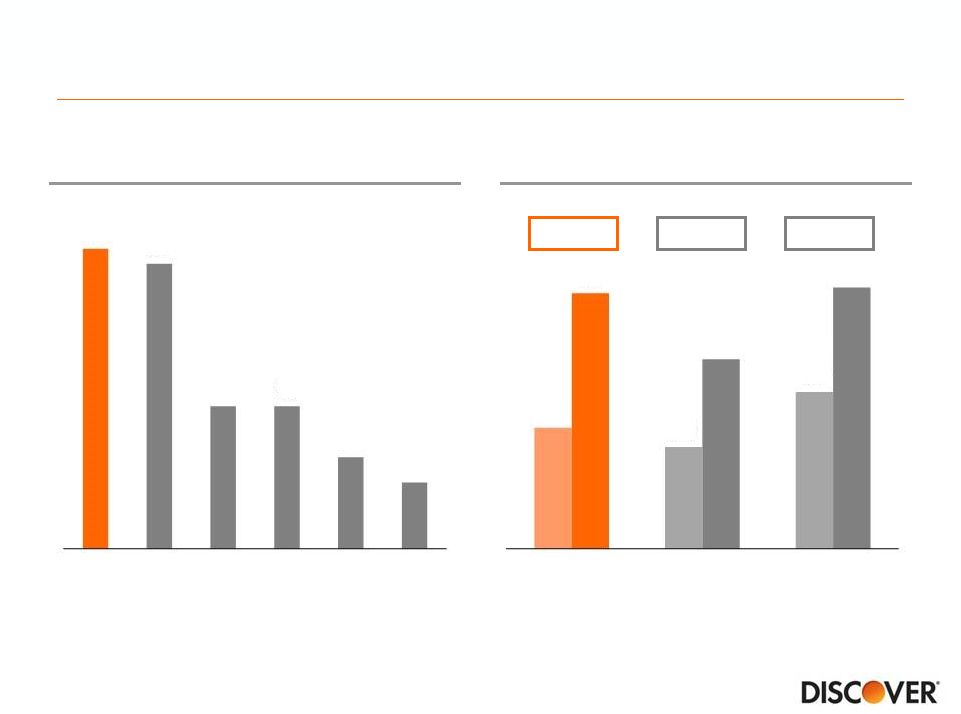

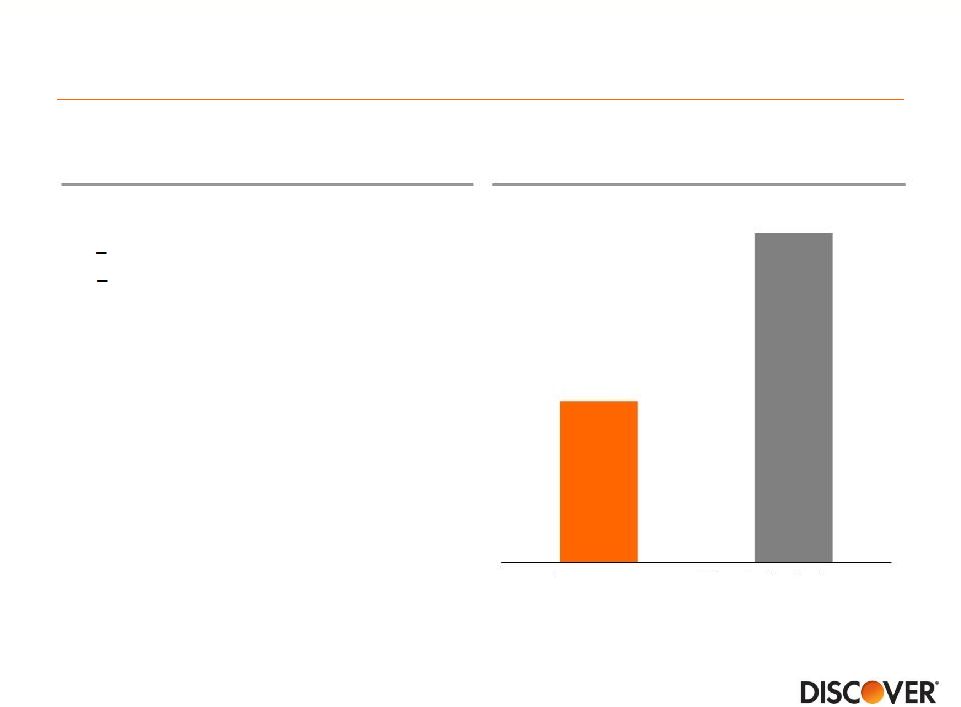

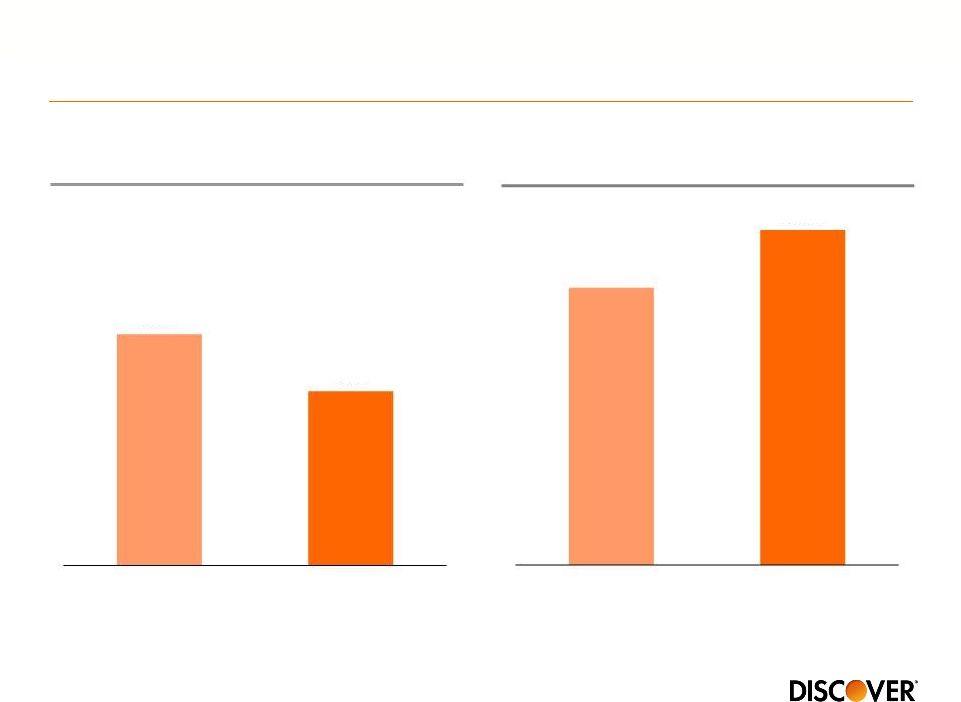

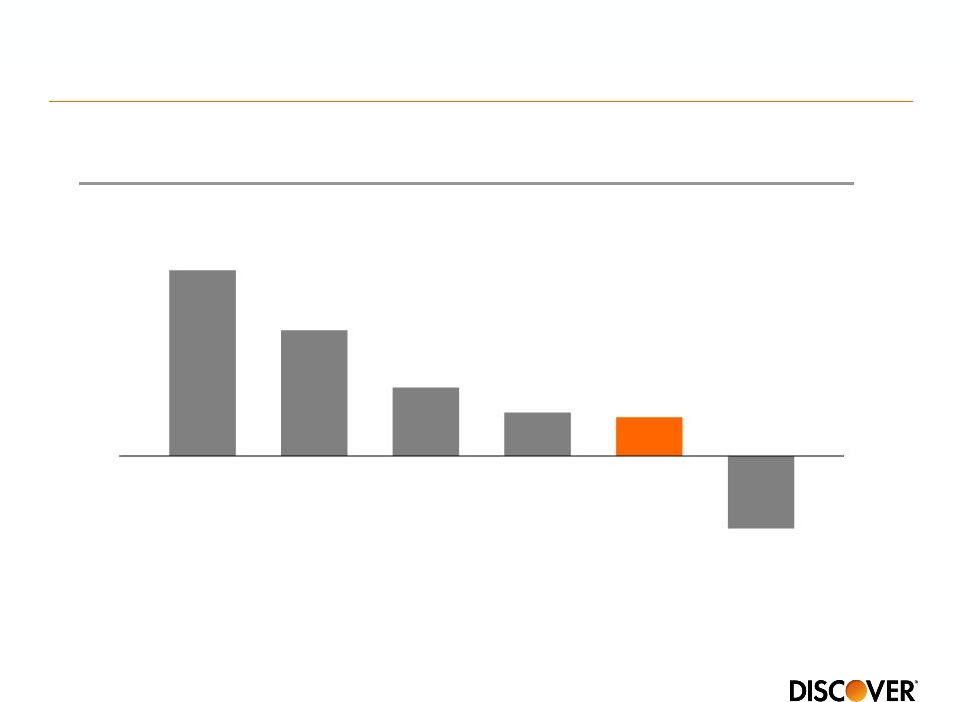

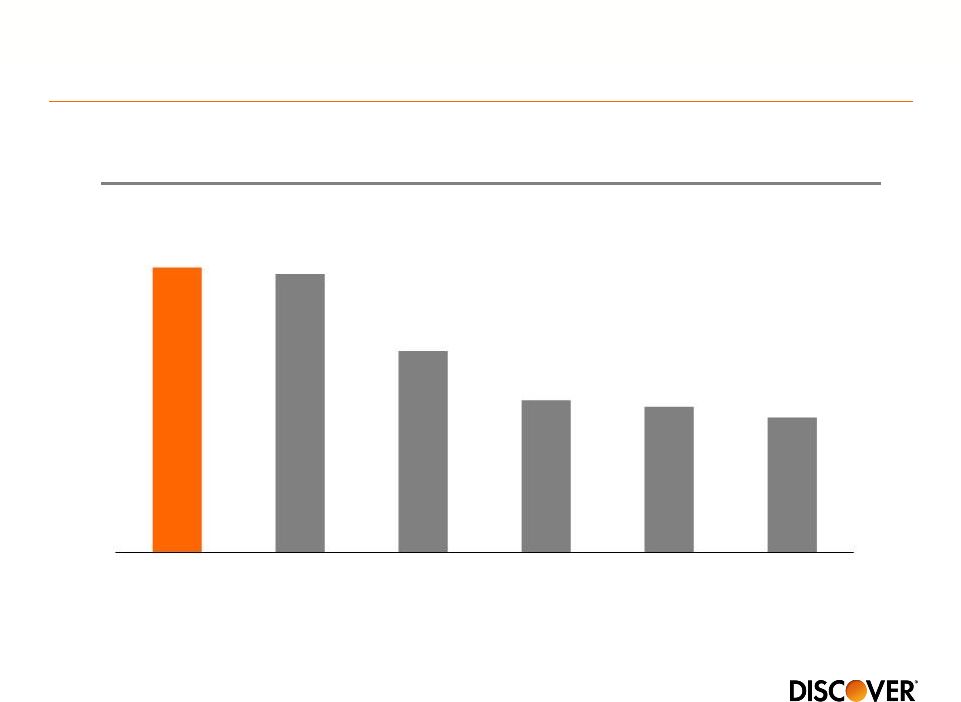

Business model has outperformed large banks

2009-2014 Average

Efficiency Ratio

(1)

(2)

Note(s)

1.

Non-interest expense divided by total revenue (net interest income and

noninterest income) 2.

Bank

holding

companies

participating

in

the

2015

Comprehensive

Capital

Analysis

and

Review

(CCAR);

excludes

Synchrony

Financial,

Santander

Holdings

USA,

Goldman

Sachs,

BMO Financial, HSBC USA and Deutsche Bank from some metrics due to limited

information; excludes Discover 3.

2009

adjusted

to

exclude

$1.4

billion

($0.9

billion

after

taxes)

Visa

and

MasterCard

settlement

2009-2014 Average

Return on Equity

(3)

(2)

Source

SNL, regulatory reports; Discover

2009-2014 CAGR

Total Loan Growth (%)

(2)

8

(3)

6%

3%

Discover

Large Banks

37%

Discover

Large Banks

63%

19%

6%

Discover

Large Banks |

The

Discover Way VISION

MISSION

KEY PRIORITIES

VALUES

To be the leading

direct bank and

payments partner

To help people spend smarter, manage

debt better and save more so they can

achieve a brighter financial future

Grow Discover

card loans while

maintaining leading credit performance

Expand direct consumer banking products

Grow global network volume and acceptance

Optimize funding, cost structure and capital position

Enhance operating model including effective controls, risk

management and leadership development

Doing

the Right Thing Innovation

Simplicity

Collaboration

Openness

Volunteerism

Enthusiasm

Respect

9 |

10

Discover’s Vision:

To be the leading direct bank and payments partner

Rewards

Discover

Proprietary

Payment

Network

Risk

Management

Loyal

Customer

Base

Customer

Service |

Discover’s Mission & Values:

Aligned with evolving regulatory landscape

•

Expanding regulatory oversight with new laws, regulations and statutes

–

Dodd-Frank enhanced prudential standards

–

Creation of Consumer Financial Protection Bureau (CFPB)

–

Capital planning rules (CCAR)

•

Well positioned in this environment

–

Business model:

•

Simple, direct model

•

Strong value propositions

•

Leading customer service and operations

–

Company culture:

•

Clear tone at the top

•

Employees who “treat you like you’d treat you”

•

Long-term consistent values, including “do the right thing”

11 |

Key

Priorities 12

•

Grow card loans while maintaining leading credit performance

•

Expand direct consumer banking products

•

Grow global network volume and acceptance

•

Optimize funding, cost structure and capital position

•

Enhance operating model including effective controls, risk management and

leadership development |

Attractive business model with a solid record of success

13

•

Proprietary network driving value for Card through brand recognition,

expanding global acceptance and rewards

•

Leveraging a payments partnership strategy to position the business for

growth

•

Direct Banking growth diversifying assets and funding

•

Capital position/generation supporting growth and robust capital deployment

•

Delivering strong card growth through new accounts, wallet share

gain, lower attrition and great credit results |

U.S. Cards

2015 Financial Community Briefing

Julie Loeger

Chief Marketing Officer |

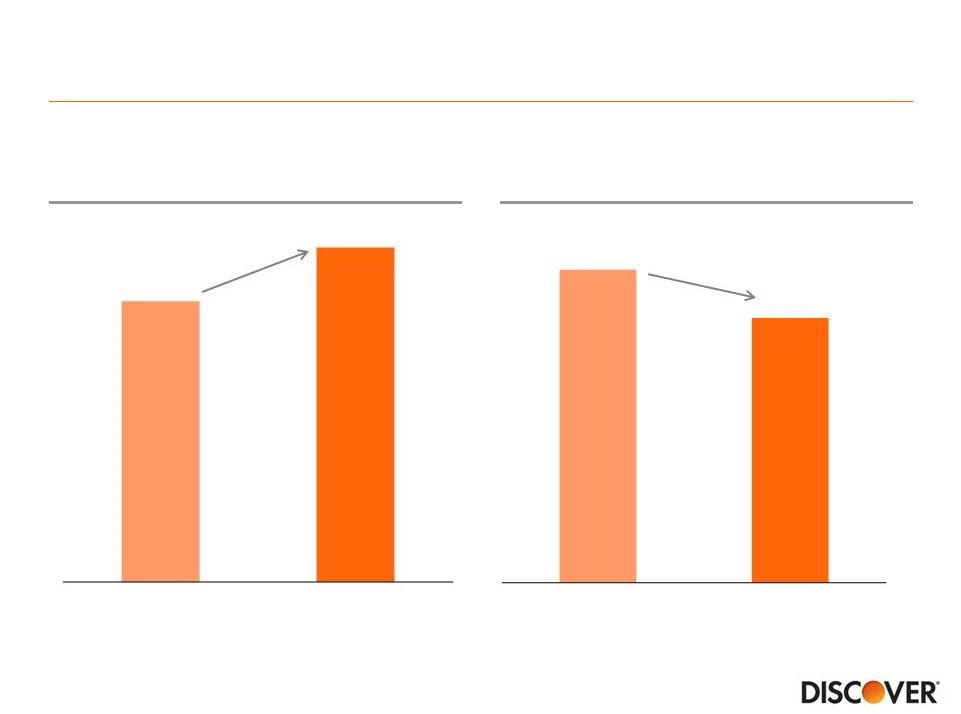

Outperforming peers in growth and profitability

Note(s)

1.

JP Morgan (Card Services excluding Commercial Card), Citi (Citi-branded cards

N.A.), American Express (U.S. Card), Capital One (U.S. Card), and Bank of America (U.S. Card)

2.

JP Morgan (Card Services excluding Commercial Card), Citi (Citi-branded cards

N.A.), American Express, (U.S. Card) and Capital One (U.S. Card) 3.

Credit card pre-tax pre-reserve ROA is defined as pre-tax credit card

income adjusted for loan loss reserve changes. Discover pre-tax income excludes 4Q14 charges related to

the elimination of the credit card rewards estimated forfeiture reserve. This is a

non-GAAP measure: see appendix for GAAP reconciliation 2014

Loan Growth (%YOY)

2014

Net Charge-off Rate (%)

2014 Pre-tax

Pre-reserve ROA

(3)

Source

15

(1)

(1)

(2)

5.6%

2.0%

Discover

Peer Group

2.3%

2.8%

Discover

Peer Group

6.9%

5.0%

Discover

Peer Group

Public company data, calendar year |

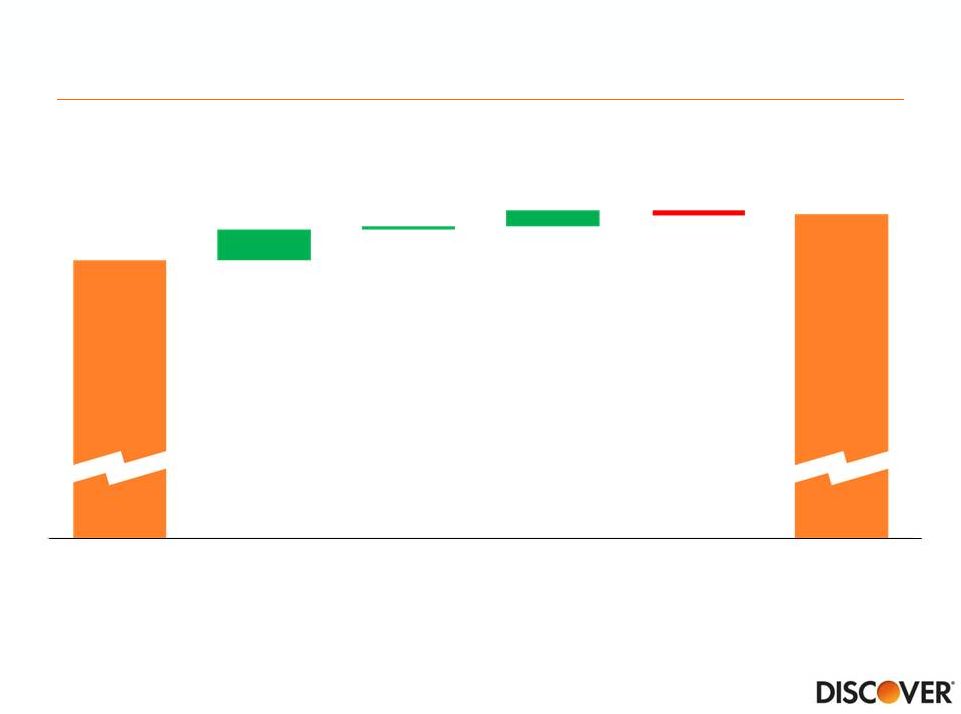

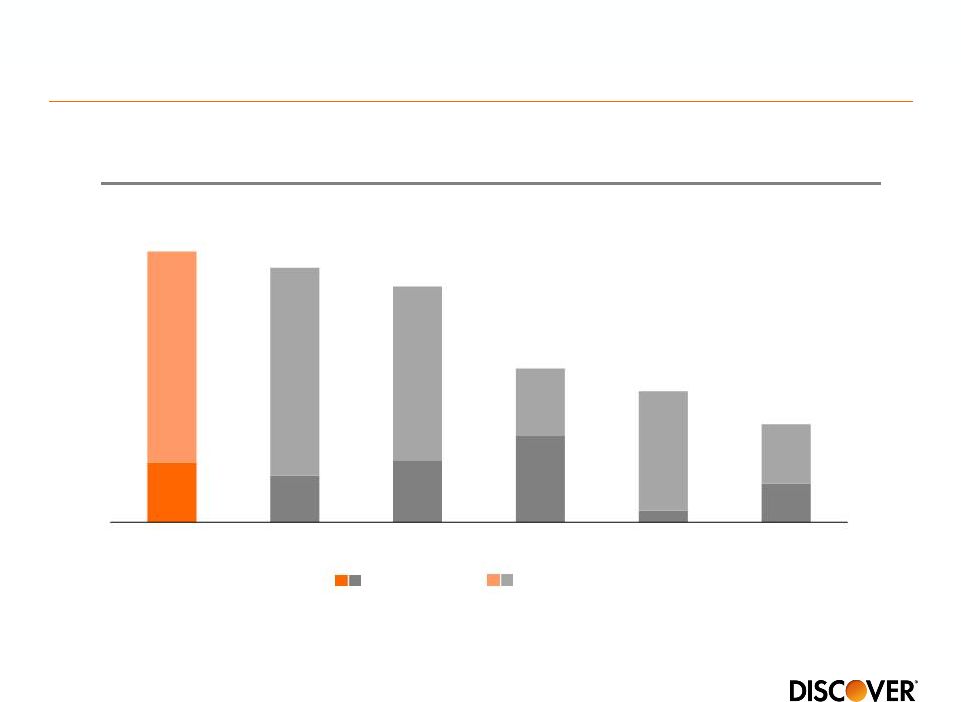

Purchase revolving behavior driving profitable loan growth

2013

Purchase

Revolvers

(1)

Purchase

Transactors

Balance Transfer/

Promotional

Cash

2014

$53Bn

$56Bn

Note(s)

1.

Balances of accounts that incurred finance charges in the period

16 |

Strong performance from new and existing customers

2013

New Accounts

Wallet Share

from Existing

Customers

Attrition

Net

Charge-offs

2014

$53Bn

$56Bn

17 |

Discover it accelerating customer acquisition & performance

2014 (YOY)

New Accounts

Average FICO

(1)

~730

Note(s)

1.

Average 2014 acquired account FICO, weighted by credit line exposure

15%

22%

-1%

Purchase

Balance

Cost Per Account

18 |

Seeding future growth through prudent focus on students

2014 (YOY)

Note(s)

1.

Average 2014 acquired student account FICO, weighted by credit line exposure

Average FICO

(1)

~700

14%

-24%

New Accounts

Cost Per Account

19 |

Deepening relationships with existing customers

Note(s)

1.

Argus Information and Advisory Services, LLC; Discover internal analysis of 3Q14 vs

3Q13; share of loans for mature active accounts 2.

Loan balances and the accounts with a balance after attrition and

charge-offs 71

bps

3%

2014 (YOY)

Loan Balance

Per Account

(2)

Share of Customer

Loans

(1)

20 |

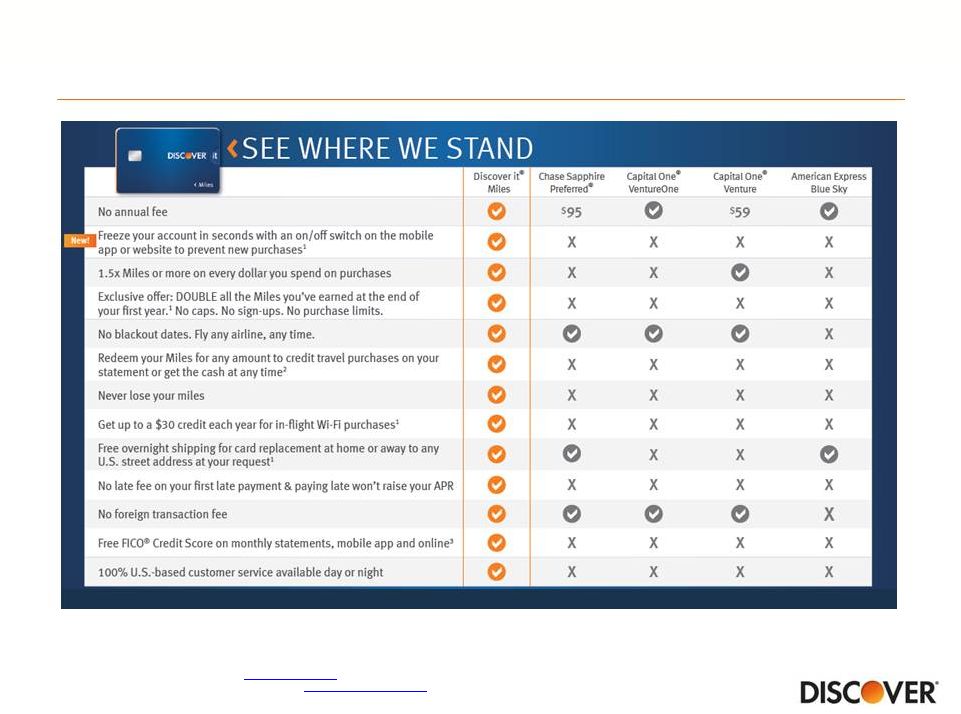

Discover it -

Miles to accelerate future growth

21

Note(s)

1.

Comparison conducted by an independent research firm and based on competitor data

compiled in April 2015 from company websites, customer service agents, and

consumer credit offers

2.

For

full

miles

redemption

terms,

visit

www.discover.com

3.

For

full

version

of

FICO

Credit

Score

Terms,

visit

www.discover.com/FICO |

Innovative features resonating strongly with customers

Note(s)

1.

Based on 2014 customer activity on discover.com since Free FICO feature launch

•

Top 5 most visited page

(1)

•

46% of customers actively engaged

with the feature

(1)

•

Launched April 15

th

•

Allows customers to freeze new

purchases, if card is misplaced

Free

FICO Score

®

Freeze It

New!

SM

22 |

Customers recognize Discover as cashback leader

Source

Best Cash Rewards

Cash Rewards Penetration

Source

Note(s)

1.

The ratio of ownership of a Discover card to total household ownership of a

cashback rewards card based on survey results 2.

Results based on unaided survey of each brand’s primary cardmembers

23

(1)

(2)

43%

25%

21%

17%

15%

9%

DFS

JPM

AXP

BAC

COF

C

58%

38%

34%

32%

29%

25%

DFS

JPM

COF

AXP

BAC

C

2014 Consumer Payment Strategies Research Program, TNS

2014

annual

averages,

Brand

Tracking

Study,

Millward

Brown |

Consumer insights driving innovation in rewards

Note(s)

1.

Defined as growth in Discover Deals site visits since rewards program enhancements

implemented in July 2014 2.

Includes partner funded incremental value of the reward or discount availed by the

cardmember 3.

2014 full calendar year

4.

2014 year-over-year increase in total dollar value of redemptions

Redeem:

Any amount.

Any time.

No expiration.

•

Over 5x growth in site visits

(1)

•

Over $130MM in value funded by

over 150 merchant partners

(2)

•

~25MM redemptions

(3)

•

25% increase in total redemptions,

35% increase at Amazon

(4)

24 |

Digital driving customer acquisition and early engagement

Marketing Channel

(1)

Accounts Booked

(2)

51%

75%

Note(s)

1.

Percentage of 2014 new accounts solicited digitally

2.

Percentage

of

2014

new

accounts

that

applied

digitally

(website,

mobile)

25 |

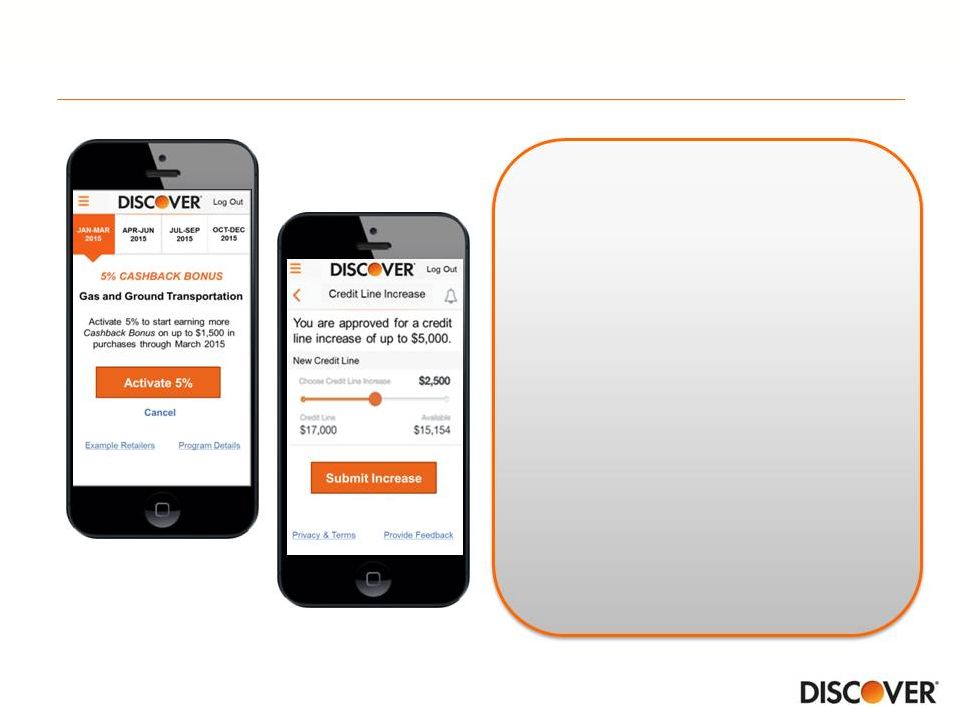

Digital driving customer experience and efficiencies

Customer Interactions

(1)

Payments

(2)

Mobile Logins

(3)

85%

58%

35%

Custom Credit Line

Rewards Signup

26

Note(s)

1.

2014 digital customer interactions (logins) as a percentage of total interactions

(logins and calls) 2.

Percentage of 2014 payments through digital channel (website, mobile)

3.

Percentage of 2014 logins through mobile channel |

Recognized as industry leader in digital

Note(s)

1.

Ranking

represents

J.D.

Power

Website

Interaction

Factor,

which

is

a

subset

of

J.D.

Power

2014

Credit

Card

Satisfaction

Study

based

on

consumer

opinions

about

the

issuer

of

their primary credit card

2.

2014

Credit

Card

Scorecard

Keynote

digital

channel

ranking

among

American

Express,

Bank

of

America,

Barclaycard,

Capital

One,

Chase,

Citi,

PNC,

US

Bank,

and

Wells

Fargo

3.

Apple iOS and Android weighted average of app store ratings (star count) across

phone and tablet devices as end of 1Q 2015 Consumer App Reviews

DFS

4.5

4.5

JPM

4.0

4.5

COF

4.5

4.0

AXP

3.0

4.5

BAC

3.5

4.0

C

3.0

4.0

iOS

Android

27

J.D. Power:

Website Interaction

Factor

(1)

Third Party Industry Surveys

Highest

Score

Keynote:

Digital Channel

Ranking

(2)

Highest

Score

(3)

SM |

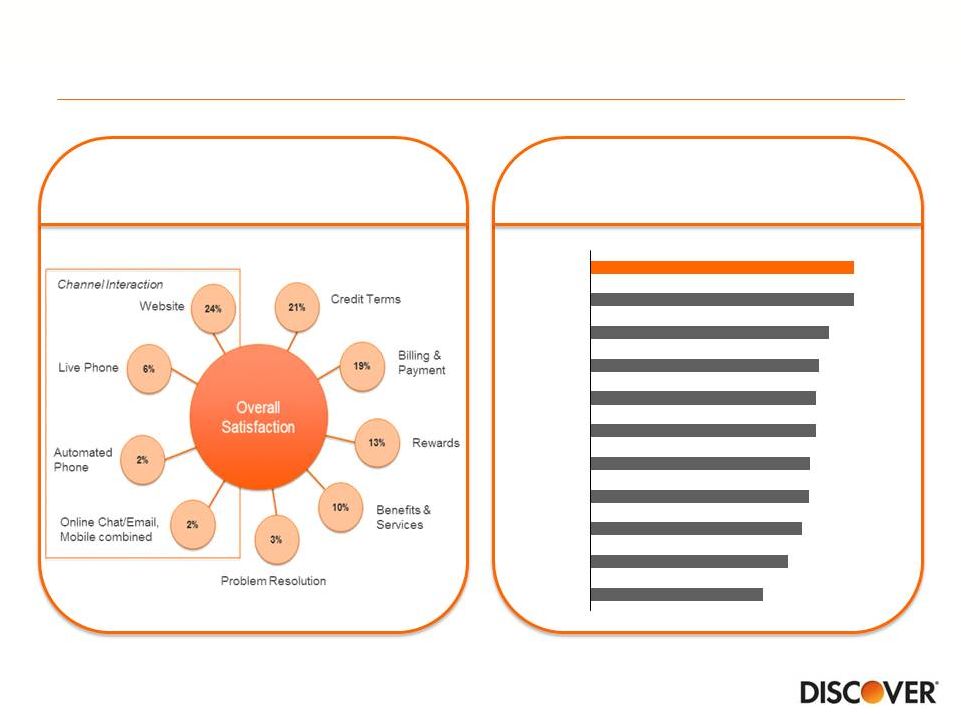

Highest score in overall satisfaction

Overall

Satisfaction

Note(s)

1.

Includes general purpose consumer credit cards only; excludes charge, corporate,

private label, small business and debit J.D. Power Evaluation

Categories 28

709

739

756

765

766

773

773

776

789

819

819

HSBC

GE

C

COF

BAC

WFC

USB

BCS

JPM

AXP

DFS

(1)

2014 J.D. Power |

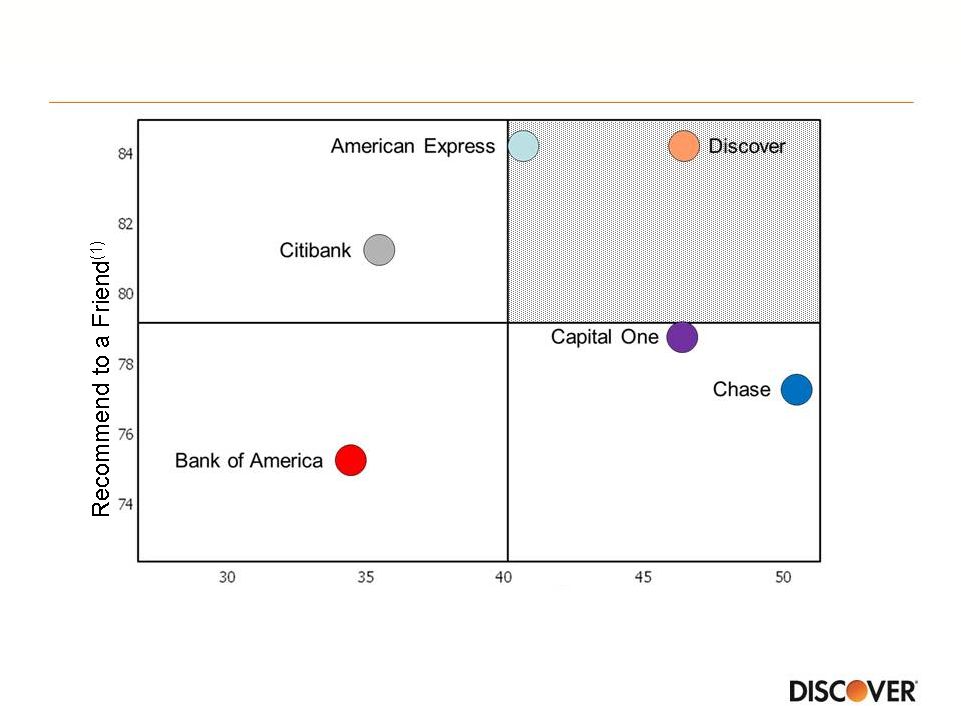

Brand strength driving growth with customers & prospects

Consideration

(2)

Source

29

1Q-4Q 2014 Brand Tracking Study, Millward Brown

Note(s)

2.

“Consideration” is the percentage of survey participants saying either “it would be my

first choice” or “I would seriously consider it”; among general population

1.

“Recommend to a Friend” is the percentage of survey participants who strongly / somewhat

agree with the statement "I would recommend to a friend"; among

cardholders who say they use that brand's card most often to make purchases |

Card Summary

Note(s)

1.

Credit card pre-tax pre-reserve ROA is defined as pre-tax credit card

income adjusted for loan loss reserve changes and credit card rewards program changes that

eliminated

the

forfeiture

reserve

divided

by

average

credit

card

receivables.

This

is

a

non-GAAP

measure:

see

appendix

for

GAAP

reconciliation

2.

Argus Information and Advisory Services, LLC for attrition rate data

30

Focus on prime customers who use the card to spend and borrow is

driving

performance:

In 2014, 5.6% loan growth, 2.3% net charge-off, 6.9% pre-tax

pre-reserve ROA

(1)

Driven by acceleration in new accounts, continued increase in wallet share

with existing customers and industry low attrition rate

To continue gaining market share and sustain momentum, will maintain focus:

Differentiated products, features, and rewards

Leading digital capabilities

Exceptional customer experience

Superior brand equity

Delivering strong credit performance

(2) |

Credit

2015 Financial Community Briefing

Jim Panzarino

President –

Credit & Card Operations |

Credit Summary

•

Organizational alignment throughout customer lifecycle fosters innovation and

enables rapid execution of new processes

•

Disciplined underwriting approach to new account growth

•

Credit assessment and management of total portfolio leveraging investments

in data, analytics and operations

•

Credit environment continues to be benign

32 |

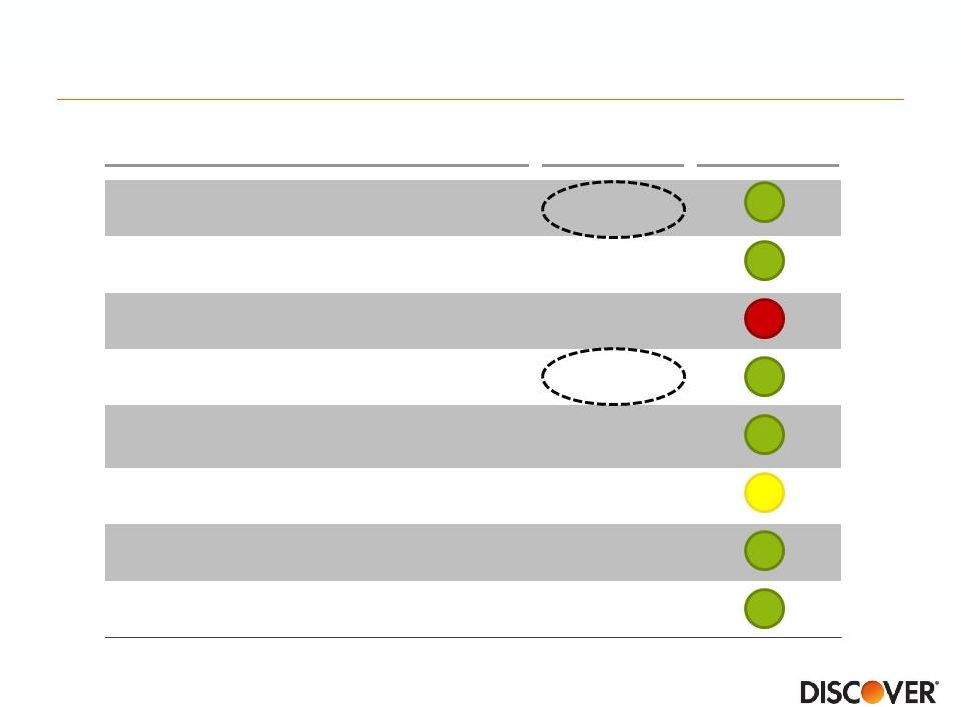

Organizational alignment enables growth, prudent credit

management and customer focus

Prudent

profitable

growth

Industry leading

credit management

Exceptional

customer experience

33

Customer Service &

Operations

Processing Services

Workforce Management

Customer Service and Credit Management

Credit Risk

Management

Card Risk Management

Fraud

Consumer Lending

Decision Management

Credit Operations

New Accounts

Collections

Recovery

Cross functional alignment & accelerated implementation

|

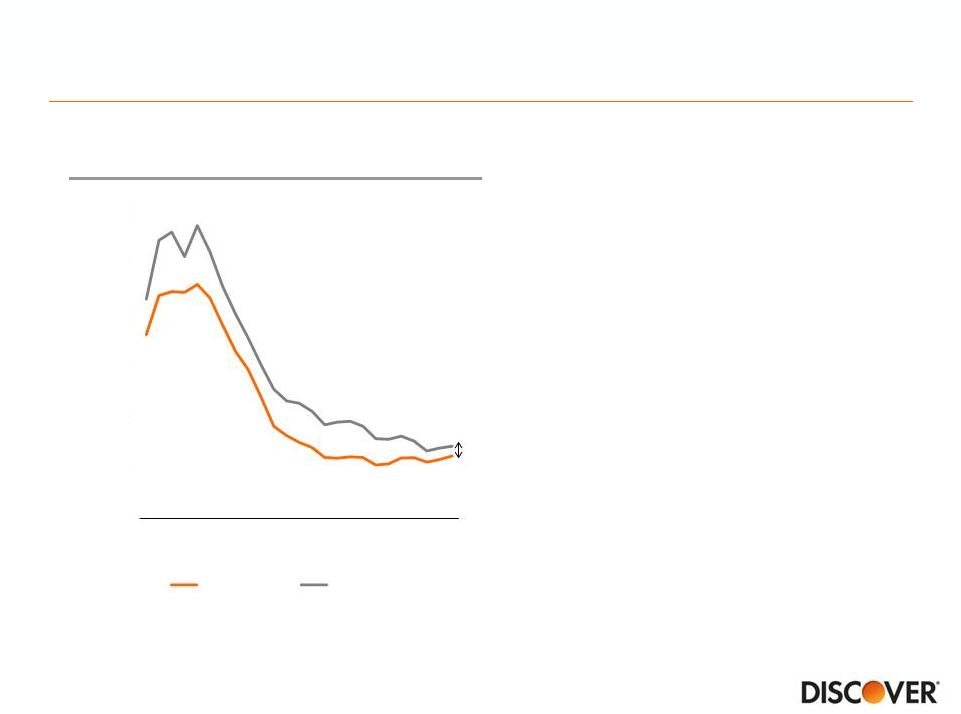

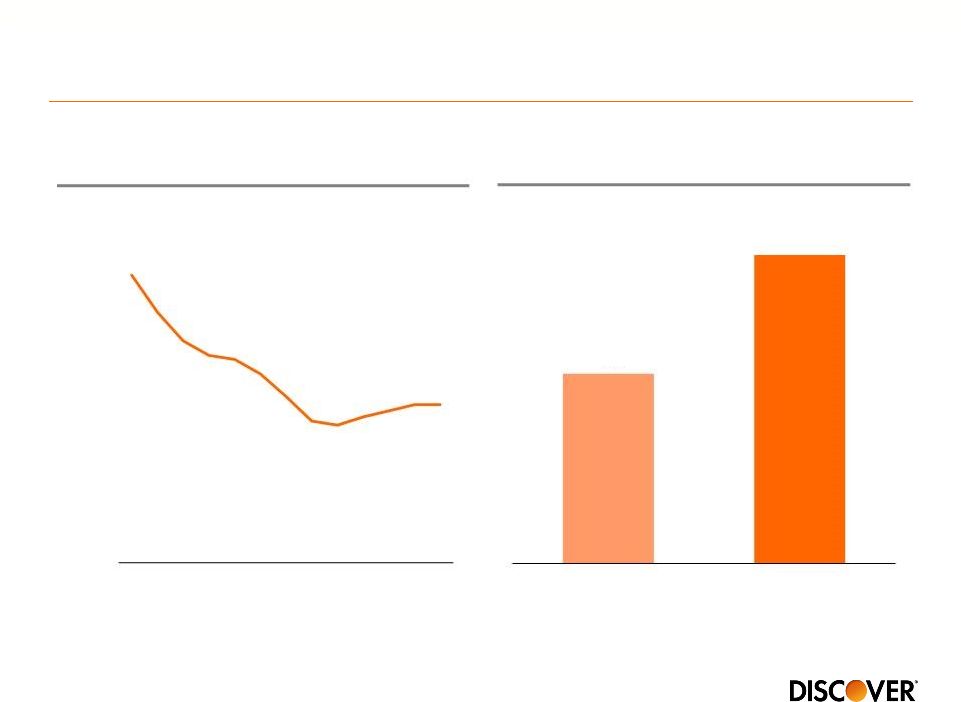

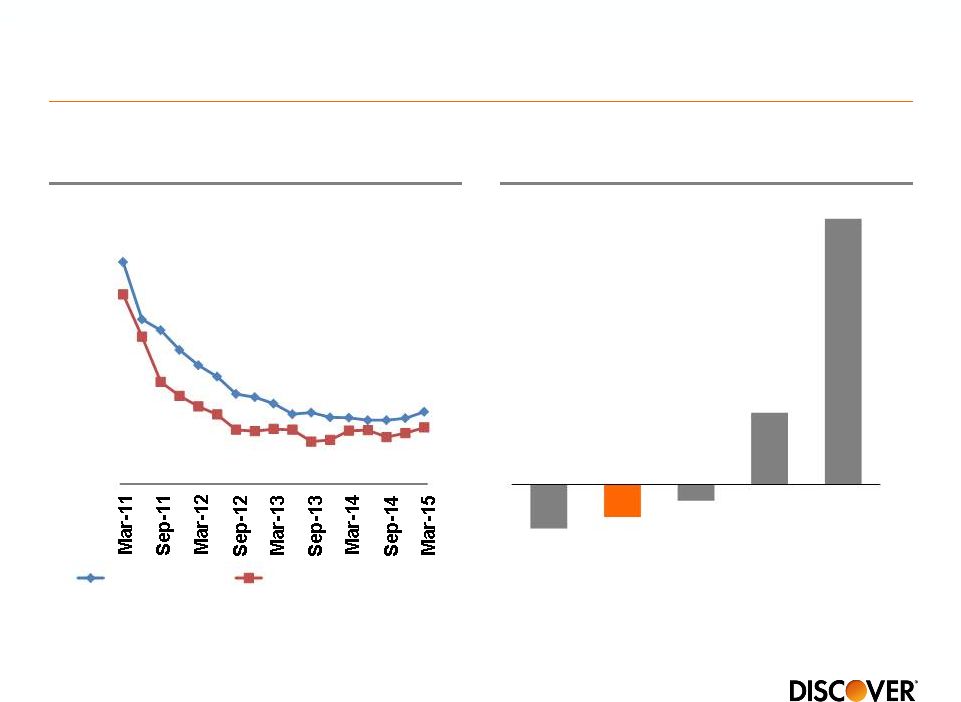

Superior credit performance

•

Disciplined new bookings

•

Profitability based line assignments

•

Proactive and targeted portfolio

management

•

Innovative use of credit and data in

decision making

•

Stronger payment preference

through in-house collection

activities

Card Net Charge-off Rates

Source

Public company data

Note(s)

1.

Weighted average rate; includes U.S. card net charge-off rates for American

Express (U.S. Card), Bank of America (U.S. Card), Capital One (U.S. Card),

Citi (Citi-branded Cards N.A.), JPMorgan Chase (Card Services) and Wells Fargo (1Q11-1Q15)

37

bps

(1)

34

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

1Q09

1Q10

1Q11

1Q12

1Q13

1Q14

1Q15

Discover

Peer Group |

Customer Account Resolution Experts (CARE)

•

Dedicated account manager

•

Specialized training

•

Contact by appointment

•

Custom tailored payment

solutions

•

Increased customer engagement

“I like the fact that it’s more personal

CARE Process

Collections Approach

Decline in

delinquency during

second cycle

5.1%

Example:

Customers with high

risk attributes entering

collections for the first time

35

and I don’t have to repeat my situation

each time I speak to Discover Card. ”

-CARE Customer |

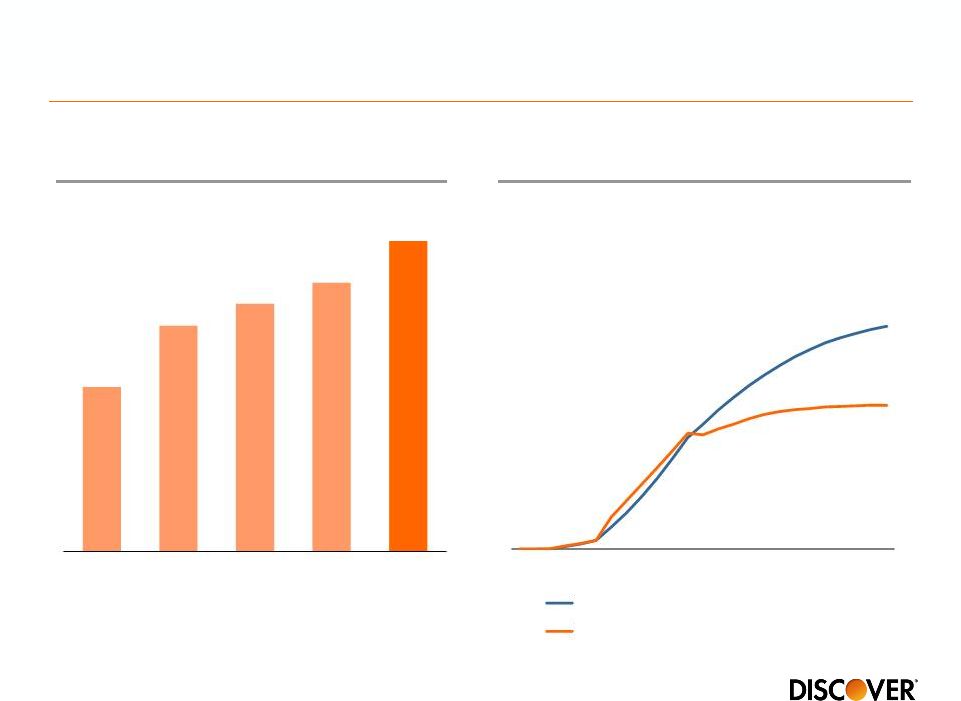

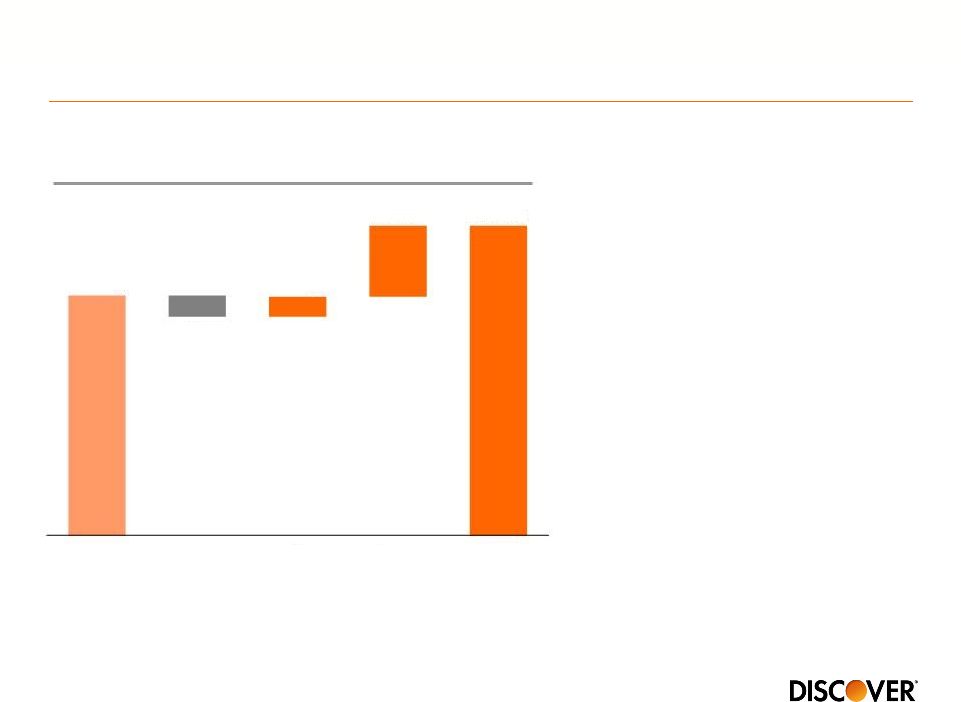

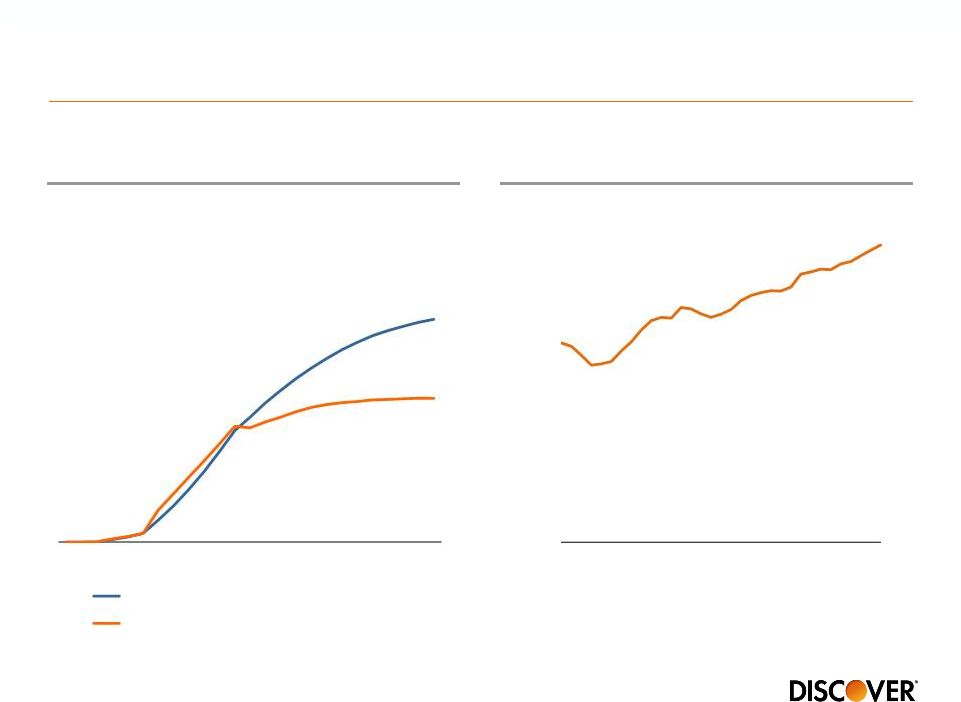

Growing new accounts while managing credit risk

Card Vintage Gross Loss Rate

(1)

New Account Bookings (MM)

Note(s)

1.

Blended vintage 6-month moving average gross principal charge-off rate

(excludes recoveries) 36

2010

2011

2012

2013

2014

0

4

8

12

16

20

24

2002-2006 Historical Benchmark

2010-2013 |

Growing card receivables while managing credit risk

Receivables ($Bn)

30+ Delinquencies (%)

37

Note(s)

1.

Calendar year end figures

(1)

(1)

$51

$56

2012

2014

10%

1.79%

1.73%

2012

2014

6 bps |

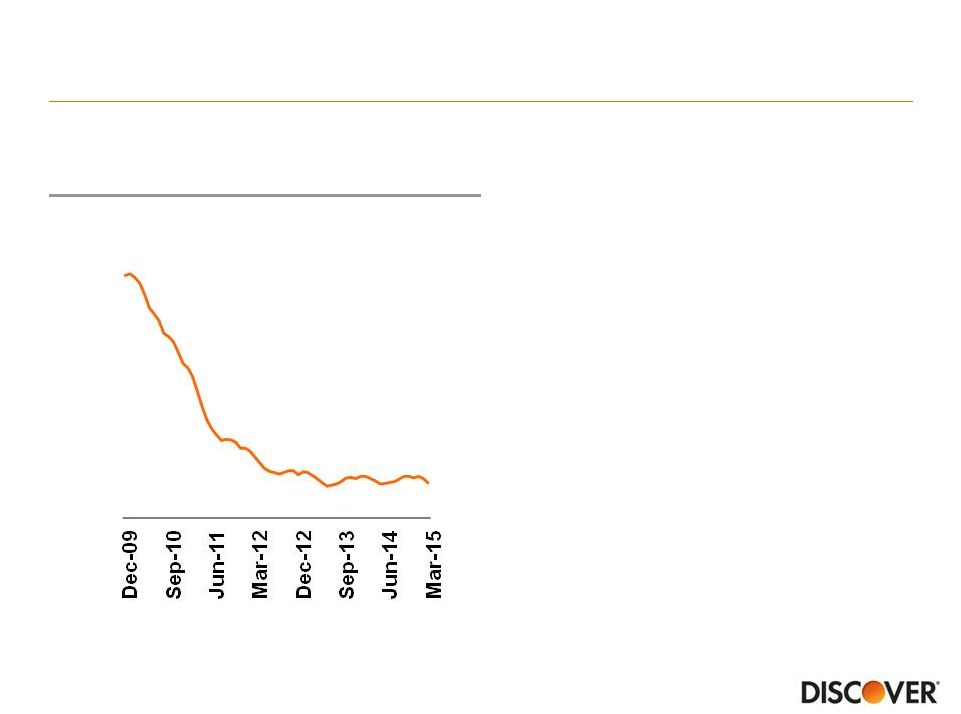

Where is credit headed?

•

Credit performance across all

products remains benign

•

Quarterly card net charge-off rates

are expected to remain below 3%

through at least the end of 2016

absent any external shock

Card 30+ Delinquency Rate

(1)

Note(s)

1.

Monthly figures through March 2015

38

1.64%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0% |

Attractive business model with a solid record of success

•

•

•

•

39

Delivering

strong

card

growth

through

new

accounts,

wallet

share

gain,

lower attrition and great credit results

Proprietary network driving value for Card through brand recognition,

expanding global acceptance and rewards

Leveraging a payments partnership strategy to position the business

for growth

Direct Banking growth diversifying assets and funding

Capital

position/generation

supporting

growth

and

robust

capital

deployment |

Payments and Other Consumer Lending

2015 Financial Community Briefing

Roger Hochschild

President & Chief Operating Officer |

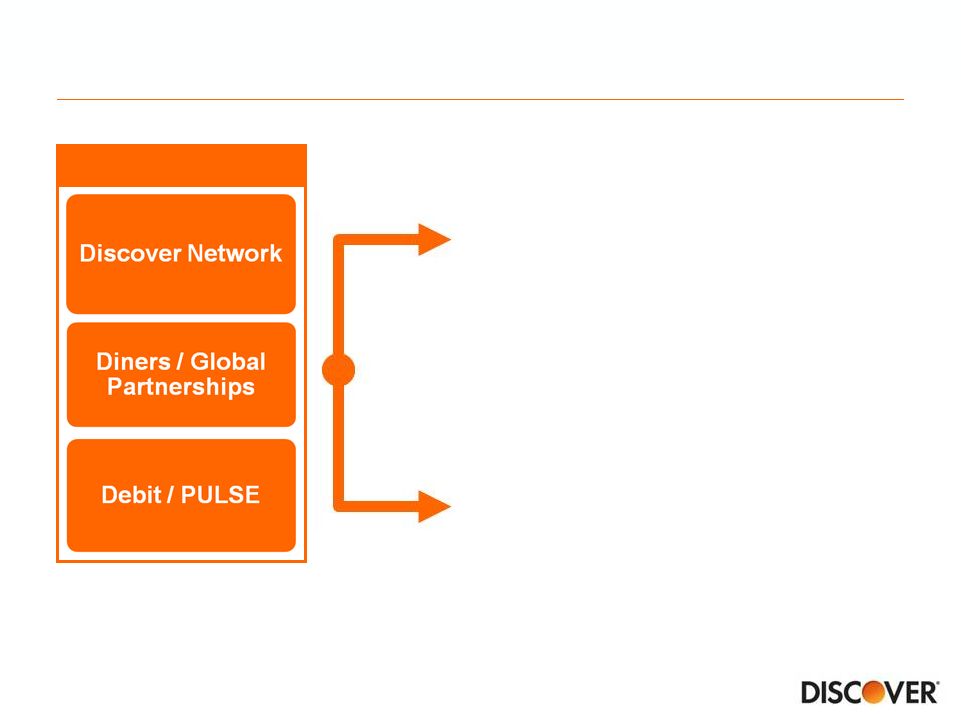

Payments sources of value

Payments Assets

Significant Value to Card

•

•

•

•

Independent Value Creation

•

•

•

41

Brand recognition

Merchant funded rewards

Emerging technologies

Flexibility and control

Traditional third-party transaction

processing

Nontraditional partnerships

Business-to-business |

Discover

American

Express

Visa /

MasterCard

Proprietary network drives brand recognition and

increasing acceptance

Source

2014 Millward Brown Brand Tracking Study

Average Unaided Card

Brand Awareness

Domestic Acceptance Growth

Source

The Nilson Report, February 2005 and February 2015 issues

2004 2014

2004 2014

2004 2014

+111%

+86%

+67%

42

59

56

28

28

18

13

DFS

AXP

COF

JPM

C

BAC

4.4

3.7

5.7

9.3

6.9

9.5 |

Cash rewards program –

leveraging merchant relationships

•

Deals platform provides actionable

insight and rapid campaign

turnaround

•

Secured merchant campaigns up

significantly year-to-date due to

strong test campaign performance

Indexed

Merchant-Funded Rewards

(1)

Note(s)

1.

Indexed to 100; includes Discover Deals, estimated point-of-sale coupons,

CBB offers, statement credits and gift card redemptions 43

100

12

112

Discover

Funded

Partner

Funded

Customer

Cash Reward |

Continued focus on payments security

•

Discover owns one of four EMV specifications in

the U.S. that are being loaded on merchant

terminals

•

Expecting to issue EMV cards to majority of active

accounts in 2015 and be ready for October 2015

liability shift

•

Increased costs in 2015 due to issuance of chip

cards, expect fraud savings to ramp up in 2016

•

Tokenization for mobile and card not present

transactions

–

Currently in testing phase

–

Launching Apple Pay in fall of 2015

•

Opportunities to offer additional digital services

44 |

Positioning Payments business for the future

Industry

Trends

45

Consumer shift to electronic payments

Continued intense competition in debit

International growth

B2B payments electronification

Commerce and payments convergence |

Defend PULSE PIN position and increase signature debit

PIN

Signature

•

Building pipeline

•

Long sales cycle

46

Debit

Enable PIN, PINless and

signature transactions at

the point of sale and online |

Expand in target markets

Grow and expand

Maximize growth

Stabilize and transition

Diners Club

Alliance Partners

Grow international partnerships in target markets

47

(Japan)

(Italy)

(China)

(Japan)

(S. Korea)

(China)

(Turkey)

(India)

(Middle East)

(Canada)

(Mexico) |

•

Flexible partner in rapidly changing payments landscape

–

Alternative to Visa/MasterCard

–

White label opportunities (e.g., PayPal)

–

Full product suite (credit, debit, prepaid)

•

Proprietary network enables partnership in all areas of mobile commerce

–

Mobile Points of Sale (Merchant capabilities)

–

Mobile Payments (Customer capabilities –

mobile wallets, merchant

wallets, NFC, QR codes, bar codes)

–

Mobile Marketing (e-coupons)

Capitalize on evolving payment technology

48

1

2

•

5 buyer agreements in place

•

2,200+ suppliers boarded

•

Award winning innovation

(1)

Future Digital Services

•

Note(s)

1.

Token services leveraging

the digital platform currently

in development

2015 PYMNTS Innovator Awards for Most Disruptive Company and Best B2B

Innovation |

Attractive business model with a solid record of success

49

Delivering

strong

card

growth

through

new

accounts,

wallet

share

gain,

lower attrition and great credit results

Proprietary network driving value for Card through brand recognition,

expanding global acceptance and rewards

Leveraging a payments partnership strategy to position the business for

growth

•

•

Direct Banking growth diversifying assets and funding

Capital position/generation supporting growth and robust capital

deployment |

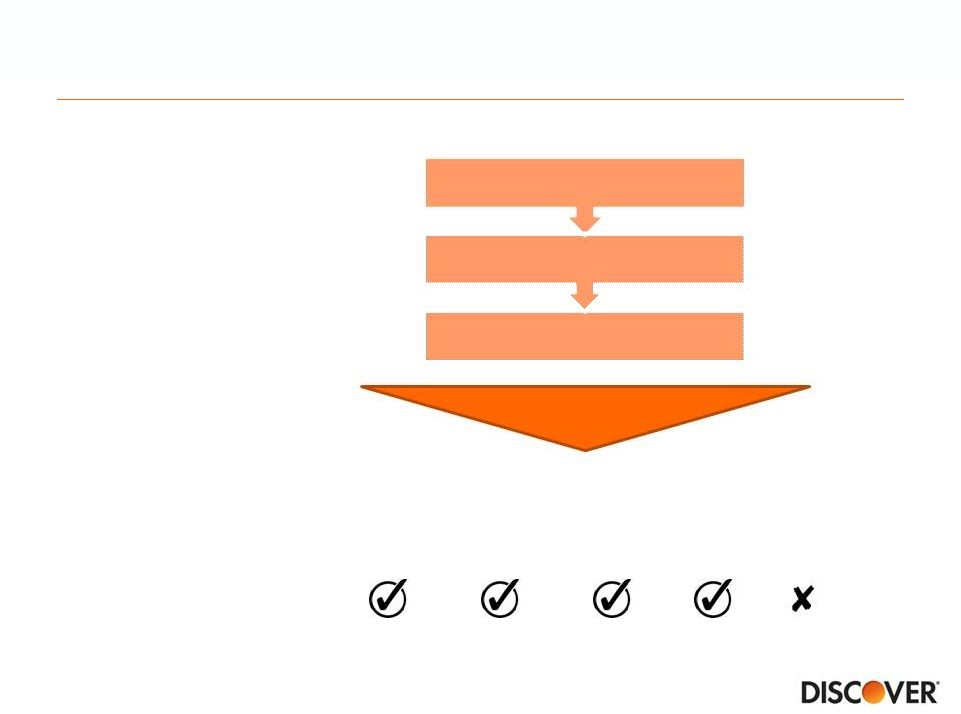

Consumer lending product offerings aligned to Discover

business model

Business model matched to

market characteristics

Other considerations

•

•

•

•

50

Market size

Competitive set

Brand fit

Cross-sell potential

Direct Model

Prime Credit Risk

Profit Potential

Consumer Lending Products

Credit

Card

Personal

Loans

Student

Loans

Home

Loans

Auto

Loans |

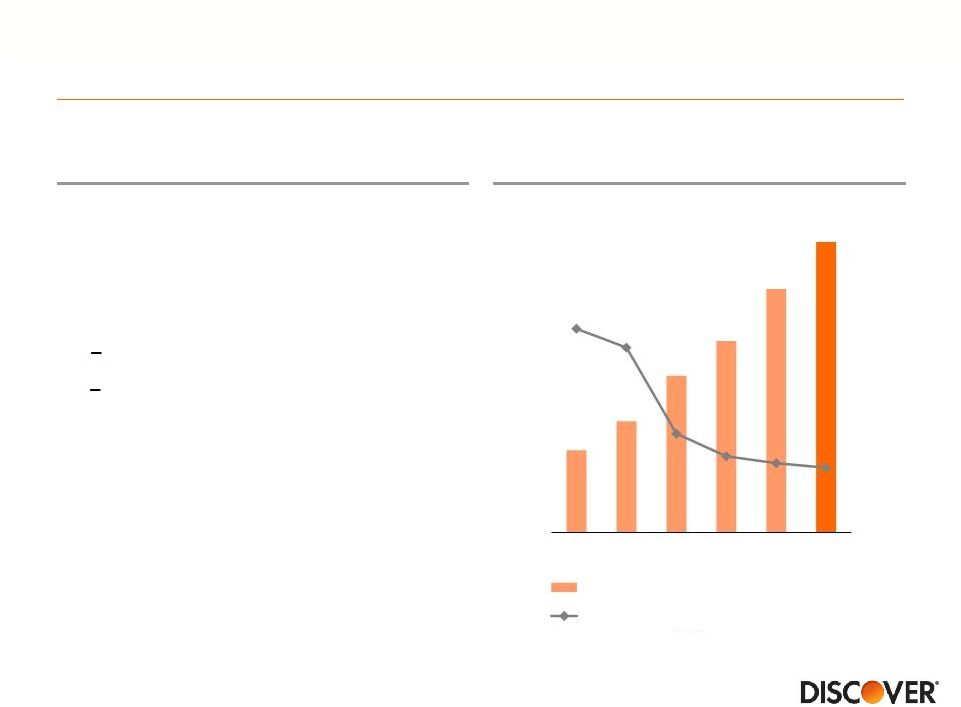

Driving profitable growth in personal loans

Overview

Personal Loans ($Bn)

•

Good alternative for consolidating

debt

•

Typical installment loan

characteristics:

51

0%

2%

4%

6%

8%

10%

$0

$1

$2

$3

$4

$5

2009

2010

2011

2012

2013

2014

Total Loans Outstanding

6 Month Lagged Charge-off Rate

•

Average FICO of ~750

•

~65% of portfolio has another

Discover relationship

•

Portfolio to date built almost

entirely “by invitation only”

3-5 year term

300-400bps rate reduction |

Discover’s personal lending product is well positioned in

competitive environment

•

New marketplace competition

-

Mail volumes have increased

-

Raising awareness of product

-

Focused on broader credit

segment

•

Business models often based on

originate and sell with little to no

risk retention

•

Rapid growth in low interest rate,

benign credit environment,

unproven through cycle

New Entrants

Discover’s Position

•

Leveraging brand and customer

experience

•

Prime segment focus with credit and

collections expertise developed

through cycles

•

Retaining loans on the balance sheet

with diversified funding

52 |

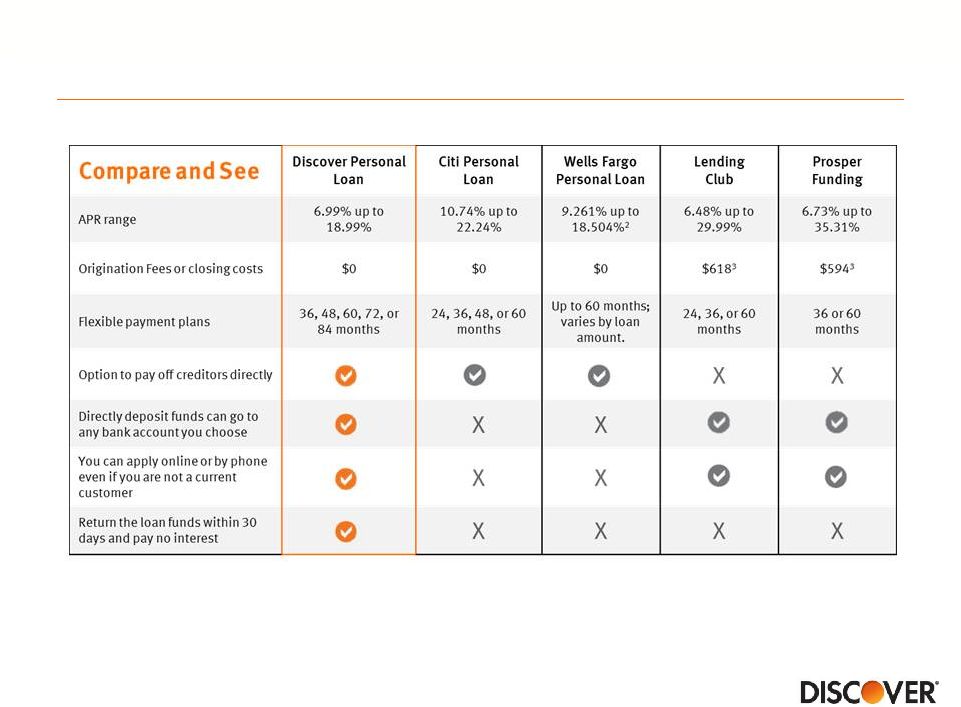

Not

all personal loans deliver the same advantages 53

Note(s)

1.

Comparison conducted by an independent research firm and based on data compiled in March 2015 from

company websites, customer service agents, and consumer credit offers 2.

Wells Fargo APR range is based on a $5,000 loan with a 36-month term 3.

Origination fee estimates are based on average loan amount and average origination fee % listed in

company filings (10-Q)

|

Home lending update

Mortgage Originations ($Bn)

Note(s)

1.

Freddie Mac conforming mortgage rates, quarterly averages

Purchase

Refinance

30

Yr

Fixed

Mortgage

Rates

(1)

54

2.0%

3.0%

4.0%

5.0%

$0.0

$0.2

$0.4

$0.6

$0.8

$1.0

$1.2

$1.4

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

1Q15 |

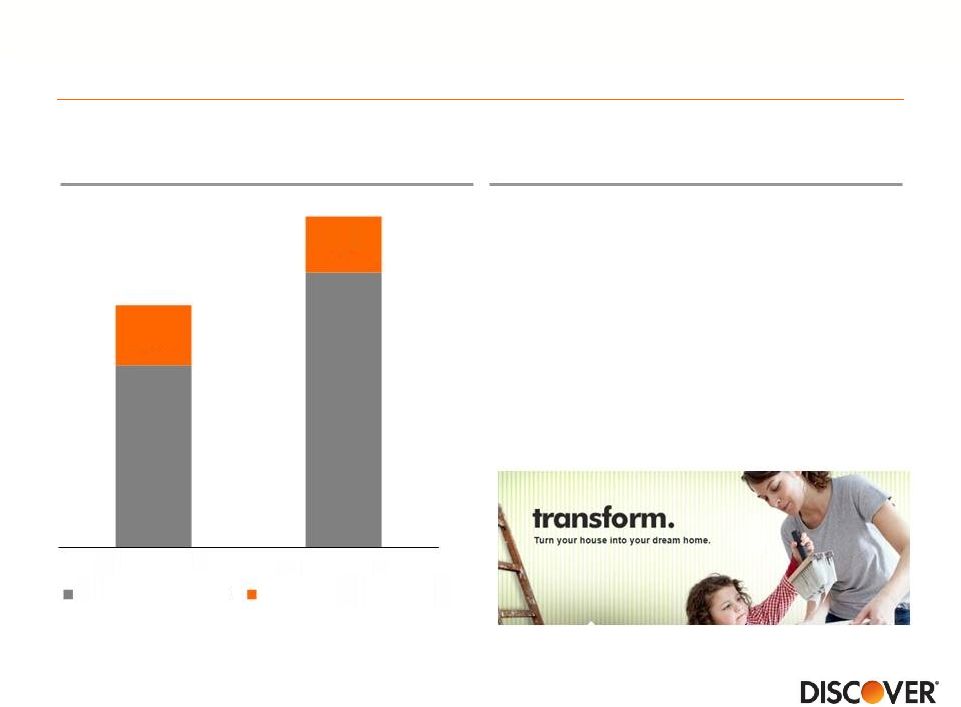

Home equity market is another opportunity for growth

Discover’s Position

•

Complements personal loans

•

Leveraging brand and customer

experience

•

Credit expertise

•

~80% of Discover cardmembers

own their own home

Home Equity

Industry Originations ($Bn)

Source

Moody’s Economics database

55

$79

$120

$26

$24

2012

2014

HE Line of Credit

HE Installment Loan |

•

Target not-for-profit schools with

4-year undergraduate or graduate

degree programs, bar and

residency loans

Generating organic growth in private student loans

Overview

Note(s)

1.

Placement of Discover brand at schools that use a lender list; based on 2015 U.S.

News and World Report online rankings 2.

Includes CitiAssist branded originated loans for 2011 and 2012

Student Loan Receivables ($Bn)

(2)

YOY

(12%)

22%

56

1.0

2.1

3.0

4.0

4.9

$4.1

$7.3

$7.7

$8.1

$8.5

2009

2010

2011

2012

2013

2014

0.6

Purchased

Organic

•

Fixed and variable interest rates, no

origination fees

99 of top 100 national

universities

(1)

All top 50 graduate business,

medical and law schools

(1) |

•

Strong credit characteristics

(1)

Disciplined underwriting approach drives better student loan

credit performance

Underwriting Approach

2014 Net Charge-off Rate (%)

Note(s):

1.

Reflects organic originations; FICO is the higher of either the borrower or

cosigner, weighted by loan balance 2.

Defined as 3Q14 annualized net losses to 3Q14 average managed contractual

receivables, which is a non-GAAP measure; see appendix for a reconciliation

3.

Based

on

MeasureOne

industry

net

charge-off

rates

for

3Q14

annualized;

Industry

data

includes:

The

First

Marblehead

Corporation,

PNC

Bank,

RBS

Citizens,

Sallie

Mae,

Sun

Trust Banks, Navient, and Wells Fargo Bank

(2)

(3)

57

•

School certification for all borrowers

and direct disbursement of funds to

school

Cosigner rate approximately 90%

Average FICO greater than 750 at

acquisition

0.9%

1.9%

Discover

Other Private Lenders |

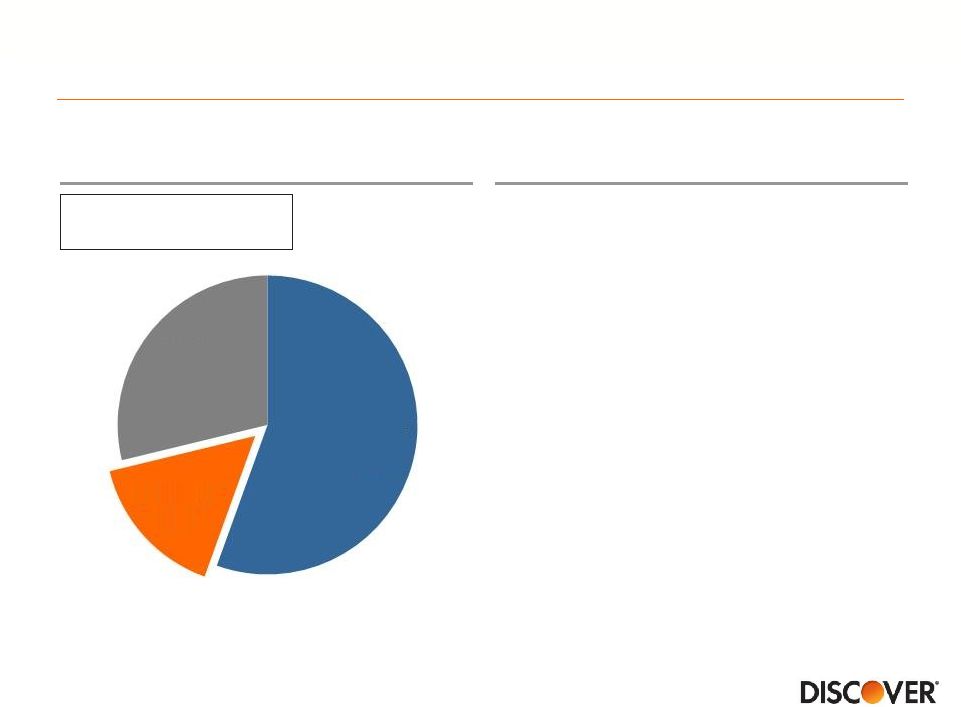

Discover product awareness expected to drive growth

Priorities for 2015 and Beyond

Note(s)

1.

December 2014 Measure One report: industry-wide private student loan

disbursements; Sallie Mae company reports •

Grow brand awareness

•

Expand integrated marketing

campaigns

•

Enhance customer experience

•

Increase borrower assistance

options

2014 Private Student Loan

Industry Originations

(1)

Total Size: $7.1Bn

2010 –

2014 CAGR: 7%

58

Sallie

Mae

55%

Discover

16%

Other

29% |

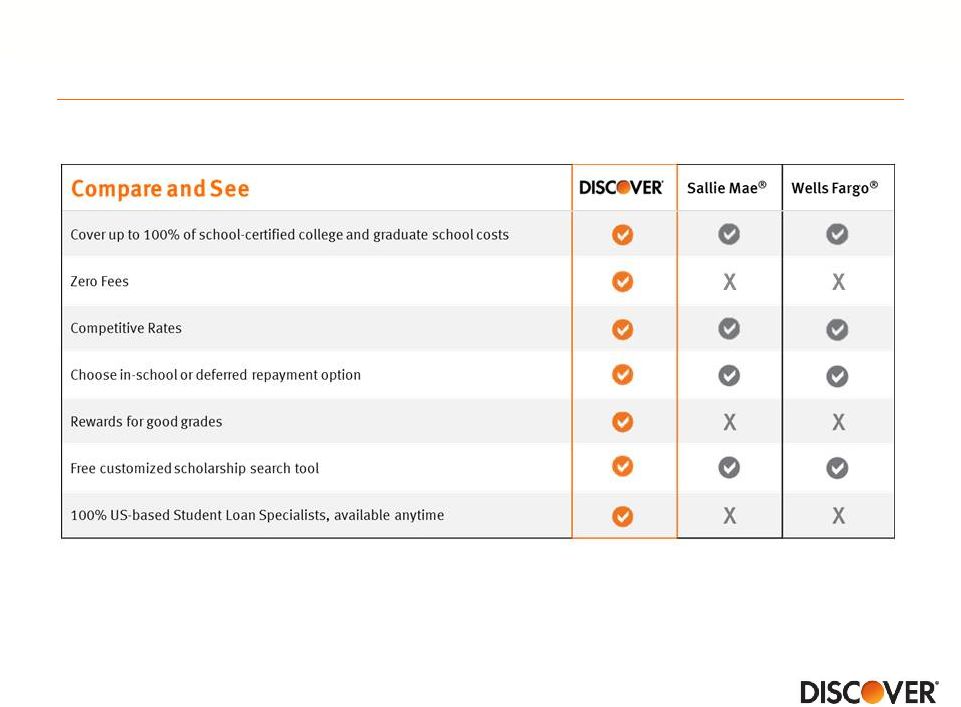

Not

all student loans are created equal 59

Note(s)

Comparisons based on information obtained on lenders’ websites or from customer service

representatives as of March 2015. At least a 3.0 GPA (or equivalent) qualifies for a

one-time cash reward of 1% of the loan amount of each new Discover student loan. Reward redemption period is limited

|

Consumer Lending Summary

Well positioned for profitable growth in personal loans despite competitive

environment

Home lending business continues to face challenges in growing purchase

market originations

Continuing to pursue growth opportunity in home equity market

Student loan business expected to grow as tuition, enrollment and

Discover product awareness increases

Targeting 5-10% long-term receivables growth in other consumer lending

60 |

Attractive business model with a solid record of success

61

Direct Banking growth diversifying assets and funding

Capital position/generation supporting growth and robust capital

deployment

Delivering strong card growth through new accounts, wallet share

gain,

lower attrition and great credit results

Proprietary network driving value for Card through brand recognition,

expanding global acceptance and rewards

Leveraging a payments partnership strategy to position the business for

growth |

Funding, Capital and Financials

2015 Financial Community Briefing

Mark Graf

Chief Financial Officer |

Financial considerations for 2015 and beyond

•

Positioning liabilities for rising rates, tailwind from lower funding costs

completed

•

Provisioning largely driven by loan growth, credit quality remains

relatively stable

•

Core expense growth is well disciplined, in 2015 expense growth

expected to be driven by some non-recurring items

•

Robust capital position supporting growth, share repurchases and

dividend actions

63 |

Continuing to strengthen and diversify funding sources

Funding Mix ($Bn)

$49.7

Note(s)

1.

Includes unsecured debt and other funding

2.

Includes affinity deposits

$68.7

Direct-to-Consumer

Deposits ($Bn)

(2)

Other

(1)

Brokered Deposits

ABS

Direct Deposits

(2)

64

$3

$7

$13

$21

$27

$28

$28

$29

2007

2008

2009

2010

2011

2012

2013

2014

5%

42%

35%

25%

54%

25%

6%

8%

Spin (6/30/07)

4Q14 |

Optimizing deposit product mix to manage rate sensitivity

Indeterminate Balance Acquired at

10%+ Above Competitor Rates

(1,2)

Note(s)

1.

Indeterminate Balances defined as savings and money market balances

2.

Competitor

Rates

reflects

monthly

average

of

rates

posted

online

by

peer

banks,

which

include

banks

without

a

traditional

branch

network

Indeterminate Balances as a % of

Deposits Portfolio

(1)

65

39%

29%

2011

2014

48%

58%

2011

2014 |

•

Achieves cost of funds benefit in a

rising rate environment

•

Deepens customer relationships

given transactional nature of product

•

Delivers richer product features and

better value given lower direct

banking cost structure

•

Leverages Discover and PULSE

networks

Establish core banking presence and lower long term cost

of funds with checking product

Strategic Rationale

Note(s)

Checking product currently limited to existing deposit and card customers

66 |

Discover direct deposit betas will be less than “1”

•

Similar to “traditional”

bank, strong

synergy between right and left

hand side of balance sheet

~65% of depositors have a loan

product relationship with DFS

~80% of new deposit accounts have

a loan product relationship with DFS

•

Different from “traditional”

bank…

Note(s)

1.

Defined as the ratio of expected change in deposit pricing relative to Federal

Reserve increases in short term interest rates 67

0.0

0.5

1.0

Traditional

Bank Deposit

Pricing

Discover DTC

Deposit

Pricing

Brokered CD

Pricing

DFS vs. Traditional Bank

Illustrative Betas

(1)

Checking deposits are still relatively

small (<1% of DFS funding)

Funding stack relies on ABS, direct

deposits and brokered deposits |

Funding costs will increase as we continue to position the

balance sheet for rising rates

Cost of Funds

(1)

Note(s)

1.

Rate on total interest-bearing liabilities

2.

Excludes all indeterminate maturity deposits (savings and money market) and

preferred stock; includes derivatives and hedging activities Avg Months to

Liability Repricing (2)

68

1.0%

1.2%

1.4%

1.6%

1.8%

2.0%

2.2%

2.4%

2.6%

1Q12

3Q12

1Q13

3Q13

1Q14

3Q14

1Q15

16

26

1Q12

1Q15 |

Lower funding costs drove NIM expansion in recent past

2012-2014

Net Interest Margin

Note(s)

1.

Includes interest income on all interest earnings assets

(1)

•

Expect modest 2015 NIM

compression driven by funding

costs and card yield

•

Expect to be at or above 9.5%,

on an annual basis, at least

through 2016

69

9.29%

(0.16%)

0.15%

0.53%

9.81%

2012

Gross

Yield

Interest

Charge-off

Interest

Expense

2014 |

Discover is slightly asset sensitive

1-Year

Net

Interest

Income

Impact

from

100bps

Parallel

Shift

(1)

Note(s)

1.

Calculated based on reported net interest income impact divided by period ending

net interest income. Capital One (COF) estimated using 200 basis point parallel shift divided

by 2 to approximate 100 basis point parallel shift

Source

4Q14 Company disclosures

70

BAC

JPM

C

COF

DFS

AXP

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

12% |

Revenue growth has outperformed peers but certain fee

revenue categories face headwinds

2014

Revenue

Growth

(YOY)

(1)

•

Protection Products Revenue –

expect continued decline

•

Other Income –

Mortgage gain on

sale volatility driven in part by refi

market

•

Payment Services Revenue –

continued negative competitive

impact, B2B volume growth strong

but lower margin

Note(s)

1.

Revenues

net

of

interest

expense;

American

Express

(U.S.

Card),

Capital

One

(U.S.

Card),

Citi

(Citi-branded

Cards

N.A.),

JPMorgan

Chase

(Card

Services)

and

Discover

(Direct

Banking segment) excludes elimination of rewards forfeiture reserve of $178 million

from 2014 Fee Revenue Categories

71

5.6%

4.8%

1.0%

-2.8%

-4.7%

DFS

AXP

C

JPM

COF |

Total charge-off rate remains low and 2014 profits not

driven by reserve releases

Card Credit Trends

Note(s)

1.

Reserve release/build divided by pre-tax profit; American Express (U.S. Card),

Capital One (U.S. Card), Citi (Citi-branded Cards N.A.), Discover (Direct Banking segment) and

JPMorgan Chase (Card Services)

2014 Reserve Release/Build

Contribution

to

Pre-tax

Profit

(1)

72

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

Reserve Rate

Net Charge-off Rate

-4%

-3%

-1%

6%

22%

AXP

DFS

COF

JPM

C |

Recent vintage performance is better than historical but

seasoning of growth will drive provisioning

2010-2013

Card

Vintage

Gross

Loss

Rate

(1)

Note(s)

1.

Blended vintage 6-month moving average gross principal charge-off rate

(excludes recoveries) % of Card Portfolio on

Book for <3 Years

73

0

4

8

12

16

20

24

2002-2006 Historical Benchmark

2010-2013

10%

11%

12%

13%

14%

15%

16%

17%

18%

Jan-12

Jan-13

Jan-14 |

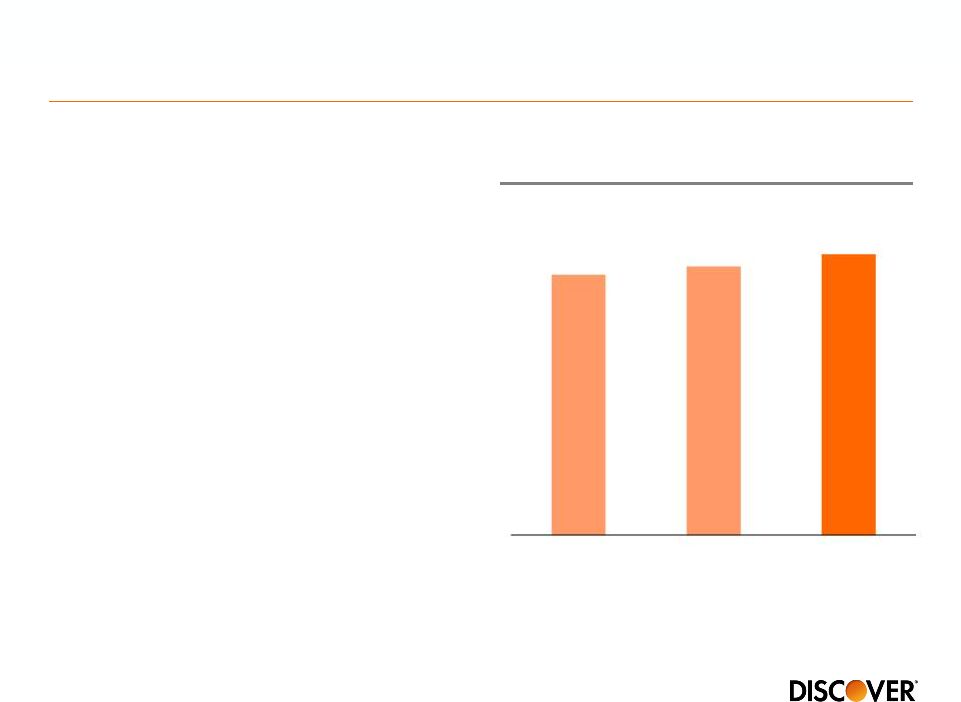

Higher costs in 2015 driven by some non-recurring items

Total Expense ($Bn)

Note(s)

1.

Defined

as

reported

noninterest

expense

divided

by

total

revenue

(net

interest

income

and

noninterest

income)

2.

Adjusted efficiency ratio excludes charges associated with Diners Club from 2013

results and one-time charges associated with the rewards forfeiture change, Diners

Club and Discover Home Loans from 2014 results. See appendix for

reconciliation Efficiency

Ratio

(1)

38.8%

39.4%

--

Adj.

Efficiency

Ratio

(2)

38.4%

38.0%

•

2015 will be impacted by

–

AML/BSA program

remediation

–

EMV roll out

–

1Q15 legal reserve

–

Debit litigation

•

Continue to target long-term

efficiency ratio of 38%+/-

for the

total company

74

$3.2

$3.3

$3.5

2013

2014

2015E |

Strongest capital ratio in stress scenario

Source

Federal Reserve Dodd-Frank Act Stress Test 2015: Supervisory Stress Test

Methodology and Results, Table 3. Projected stressed capital ratios under the severely adverse scenario,

DFAST Severely Adverse Results

Min. Common Equity Tier 1 Capital Ratio

75

13.3%

13.0%

9.4%

7.1%

6.8%

6.3%

DFS

AXP

COF

BAC

C

JPM

2014:Q4-2016:Q4; 31 participating bank holding companies

|

Planned capital actions generate highest yield

Estimated

Dividend

and

Buyback

Yield

(1)

Note(s)

1.

CCAR announced capital actions (buybacks and dividends) pro-rated for four

quarters ending 1Q16 divided by market capitalization as of 4/30/15

Source

Public company disclosures

76

9%

8%

8%

5%

4%

3%

DFS

AXP

COF

JPM

C

BAC

Dividend

Buyback |

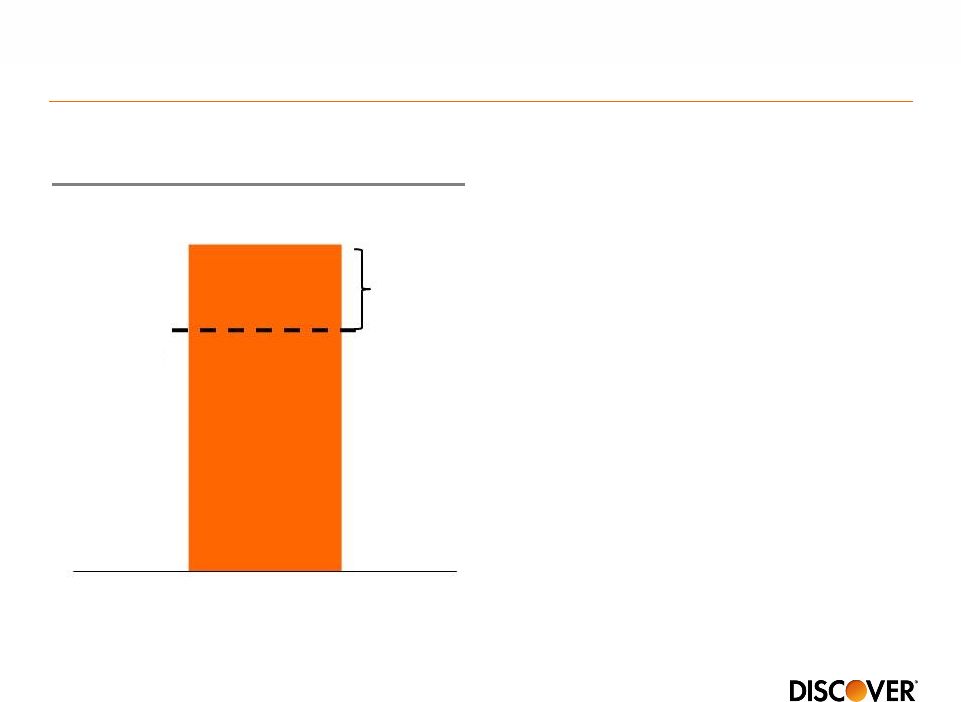

Excess capital can help drive shareholder returns

Note(s)

Common Equity Tier 1

Capital Ratio

(1)

11%

Target

$2.5Bn+/-

77

14.7%

1Q15

1.

Common Equity Tier 1 Capital Ratio (Basel III fully phased-in) is calculated using Basel III fully

phased-in common equity tier 1 capital, a non-GAAP measure. The Company believes

that the common equity tier 1 capital ratio based on fully phased-in Basel III rules is an important complement to the existing capital ratios and for

comparability to other financial institutions. For the corresponding reconciliation of common

equity tier 1 capital and risk weighted assets calculated under fully phased-in Basel III

rules to common equity tier 1 capital and risk weighted assets calculated under Basel III transition rules, see appendix

dividend actions

–

Portfolio purchases

–

Disciplined acquisitions

–

Organic growth

–

Share repurchases and

•

Long-term capital priorities: |

Key

long-term targets remain largely the same Card Loan Growth

3-5%

Non-Card Lending Growth

5-10%

Payments Volume Growth

10%+

Total Company NIM

9%+/-

Card Net Charge-Offs

3.5-4.5%

Efficiency Ratio

38%+/-

Common Equity Tier I Ratio (Basel III)

11%

ROE

15%+

78

Near-term

Long-term |

2015 Guidance

Category

Target

Rationale

Revenue

Margin

(1)

Modest

Decline

•

Modest net interest margin

compression

•

Lower protection products revenue

•

Higher rewards rate

•

Payments volume

Provision for Loan Losses

Rate

(1)

2.5%+/-

•

Seasoning of new vintages and

modestly lower recoveries on aged

charge-offs

Operating Expenses

$3.5Bn+/-

•

Higher marketing,

regulatory/compliance and

technology costs

Note(s)

1.

As a percentage of average receivables

79 |

Conclusion

•

Loan growth at high end of range

•

Net interest margin expected to remain above long-term target

•

Only modest increase in “core”

operating expenses near-term

•

Card delinquency trends do not indicate a change in credit environment

•

Capital position/generation supports growth, share repurchases and dividend

actions

80 |

Q&A

2015 Financial Community Briefing |

Reconciliation of GAAP to Non-GAAP Data

Note(s)

1.

Credit card pre-tax return on assets excluding the forfeiture reserve

elimination and loss reserve changes is a non-GAAP measure and represents pre-tax earnings of Discover's

U.S. credit card business excluding the impact of the elimination of the credit

card rewards program forfeiture reserve and changes to the allowance for loan loss reserve. Credit

card pre-tax return on assets excluding the forfeiture reserve elimination and

loss reserve changes is a meaningful measure to investors because it provides a competitive

performance benchmark

82

Twelve Months Ended

(unaudited, $ in millions)

12/31/14

GAAP Direct Banking pre-tax income

$3,605

Excluding non-credit card pre-tax income

228

Credit card pre-tax income

$3,377

Excluding elimination of credit card rewards program forfeiture reserve

178

Excluding credit card reserve changes

68

Credit card pre-tax income excluding forfeiture reserve and reserve

changes $3,623

GAAP average credit card receivables

$52,600

Credit

card

pre-tax

return

on

assets

(excluding

forfeiture

reserve

and

reserve

changes)

(1)

6.9% |

Reconciliation of GAAP to Non-GAAP Data (cont’d)

Note(s)

83

(unaudited, $ in billions)

Three Months Ended

9/30/2014

GAAP Recorded Balance Purchased (Private) Credit Impaired Student Loans (average

loans) $3.9

Adjustment for Purchase Accounting

0.2

Contractual

Value

Purchased

(Private)

Credit

Impaired

Student

Loans

(average

loans)

(1)

$4.1

GAAP Private Student Loans (average loans)

4.5

Contractual

Value

Private

Student

Loans

(average

loans)

(1)

$8.6

(unaudited, $ in millions)

Three Months Ended

9/30/2014

GAAP Private Student Loan Net Principal Charge-offs

$12.8

Adjustment

for

Purchased

(Private)

Credit

Impaired

Student

Loans

Net

Principal

Charge-offs

6.1

Contractual

Private

Student

Loan

Net

Principal

Charge-offs

(2)

$18.9

Contractual Net Charge-off Rate

0.9%

1.

The contractual value of the purchased private student loan portfolio is a non-GAAP measure and

represents purchased private student loans excluding the purchase accounting discount. The

contractual value of the private student loan portfolio is meaningful to investors to understand total outstanding loan balances without the purchase

accounting discount

2.

Contractual private student loan net principal charge-offs is a non-GAAP measure and include

net charge-offs on purchase credit impaired loans. Under GAAP any losses on such

loans are charged against the nonaccretable difference established in purchased credit impaired accounting and are not reported as charge-offs. Contractual net

principal charge-offs is meaningful to investors to see total portfolio losses |

Reconciliation of GAAP to Non-GAAP Data (cont’d)

Note(s)

1.

Adjusted operating efficiency is calculated using adjusted operating expense

divided by adjusted revenue net of interest expense, a non-GAAP financial measure which should be

viewed in addition to, and not as a substitute for, the company's reported results.

Management believes this information provides investors with a useful metric to evaluate the

ongoing operating performance of the company

84

Twelve Months Ended

Twelve Months Ended

(unaudited, $ in millions)

12/31/14

12/31/13

Revenue net of interest expense

$8,477

$8,224

Excluding Elimination of credit card rewards program forfeiture reserve

178

-

Adjusted revenue net of interest expense (excluding one-time charge)

$8,655

$8,224

Total operating expense

$3,340

$3,194

Excluding Discover Home Loans goodwill impairment

(27)

Excluding Diners Club Italy held-for-sale fair value adjustment

(21)

Excluding Diners Club international franchise support

-

(40)

Adjusted operating expense (excluding one-time charges)

$3,292

$3,154

Adjusted

operating

efficiency

(excluding

one-time

charges)

(1)

38.0%

38.4% |

Reconciliation of GAAP to Non-GAAP Data (cont’d)

Note(s)

1.

Adjustments related to capital components for fully phased-in Basel III include

the phase-in of the intangible asset exclusion[ 2.

Key

differences

under

fully

phased-in

Basel

III

rules

in

the

calculation

of

risk-weighted

assets

include

higher

risk

weighting

for

past

due

loans

and

unfunded

commitments[

3.

As of January 1, 2015 regulatory capital ratios are calculated under Basel III

rules subject to transition provisions. We reported under Basel I at December 31, 2014, September

30, 2014, June 30, 2014 and March 31, 2014

4.

Common equity tier 1 capital ratio (Basel III fully phased-in) is calculated

using common equity tier 1 capital (Basel III fully phased-in), a non-GAAP measure, divided by risk

weighted assets (Basel III fully phased-in)

85

Quarter Ended

(unaudited, $ in millions)

3/31/15

Common equity Tier 1 capital (Basel III transition)

$10,497

Adjustments

related

to

capital

componentes

during

transition

(1)

(87)

Common equity Tier 1 capital (Basel III fully phased-in)

$10,410

Risk weighted assets (Basel III transition)

$70,864

Risk

weighted

assets

(Basel

III

fully

phased-in)

(2)

$70,757

Common

equity

Tier

1

capital

(Basel

III

transition)

(3)

14.8%

Common equity Tier 1 capital (Basel III fully phased-in)

(3,4)

14.7% |