Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DUNKIN' BRANDS GROUP, INC. | a8kinvpres1.htm |

Investor Presentation Dunkin’ Brands Group, Inc. 1 Nigel Travis Chairman & CEO

Forward-Looking Statements • Certain information contained in this presentation, particularly information regarding future economic performance, finances, and expectations and objectives of management constitutes forward-looking statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and are generally contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates” or “anticipates” or similar expressions. Our forward-looking statements are subject to risks and uncertainties, which may cause actual results to differ materially from those projected or implied by the forward- looking statement. • Forward-looking statements are based on current expectations and assumptions and currently available data and are neither predictions nor guarantees of future events or performance. You should not place undue reliance on forward- looking statements, which speak only as of the date hereof. We do not undertake to update or revise any forward- looking statements after they are made, whether as a result of new information, future events, or otherwise, except as required by applicable law. For discussion of some of the important factors that could cause these variations, please consult the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K. Nothing in this presentation should be regarded as a representation by any person that these targets will be achieved and the Company undertakes no duty to update its targets. • Regulation G This presentation contains certain non-GAAP measures which are provided to assist in an understanding of the Dunkin’ Brands Group, Inc. business and its performance. These measure should always be considered in conjunction with the appropriate GAAP measure. Reconciliations of non-GAAP amounts to the relevant GAAP amount are available on www.investor.dunkinbrands.com. 2

3 YEARS OF BRAND HERITAGE SIGNIFICANT U.S. & GLOBAL GROWTH OPPORTUNITY ASSET-LIGHT, NEARLY 60+ 100% FRANCHISED BUSINESS NEARLY 19,000 RESTAURANTS WORLDWIDE

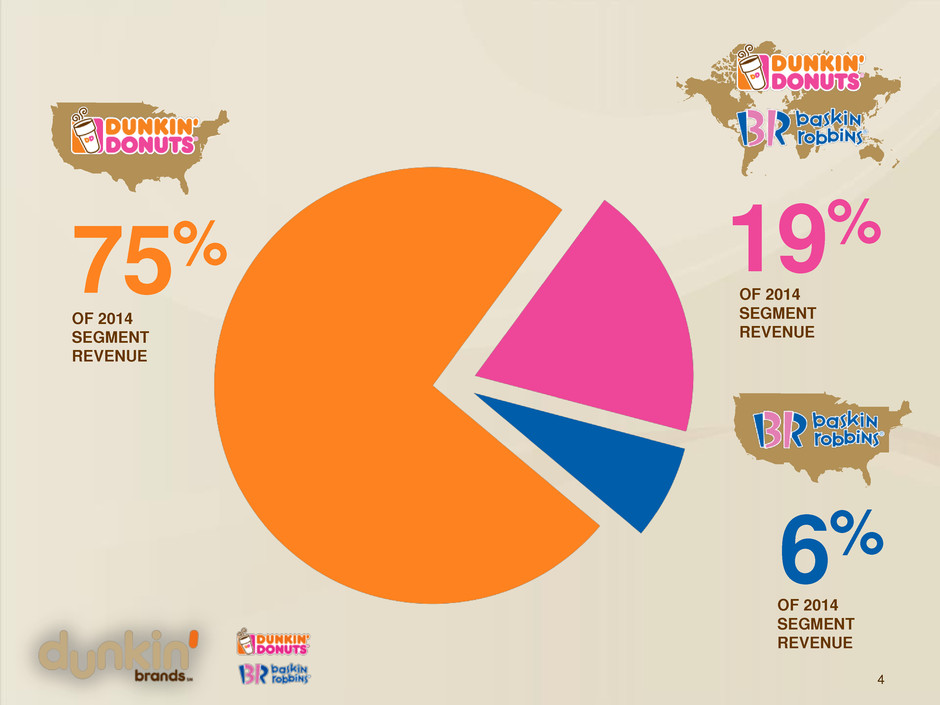

4 75% 19 % 6% OF 2014 SEGMENT REVENUE OF 2014 SEGMENT REVENUE OF 2014 SEGMENT REVENUE

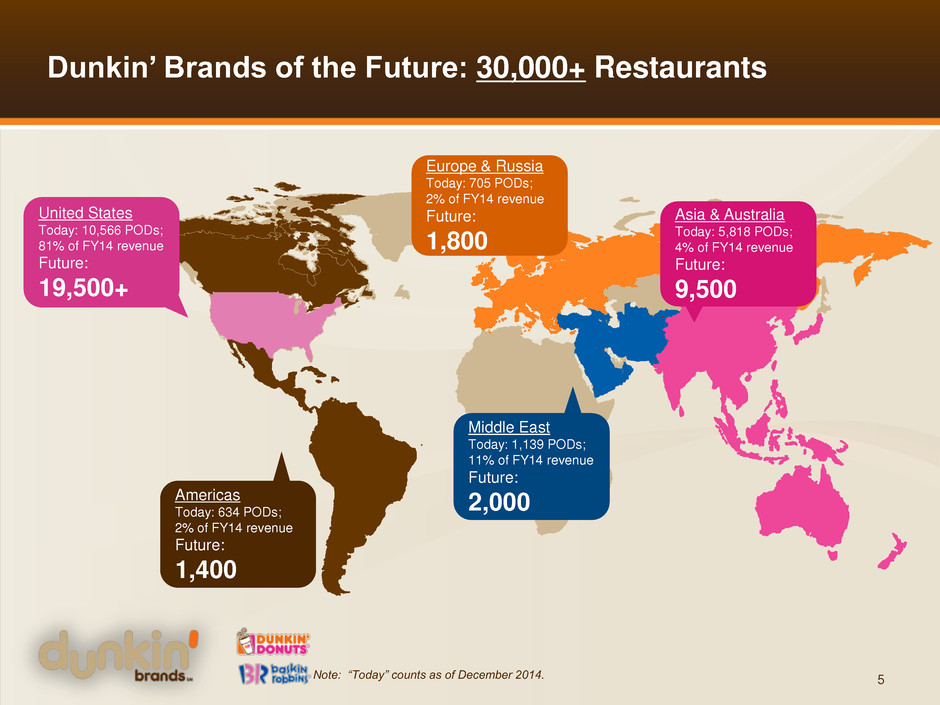

5 Dunkin’ Brands of the Future: 30,000+ Restaurants United States Today: 10,566 PODs; 81% of FY14 revenue Future: 19,500+ Americas Today: 634 PODs; 2% of FY14 revenue Future: 1,400 Europe & Russia Today: 705 PODs; 2% of FY14 revenue Future: 1,800 Asia & Australia Today: 5,818 PODs; 4% of FY14 revenue Future: 9,500 Middle East Today: 1,139 PODs; 11% of FY14 revenue Future: 2,000 Note: “Today” counts as of December 2014.

Focused strategies to drive incremental profitable growth for Dunkin’ Brands and franchisees 6 INCREASE COMPARABLE STORE SALES AND PROFITABILITY IN DD U.S. INCREASE COMPARABLE STORE SALES AND DRIVE STORE GROWTH FOR BR U.S. CONTINUE DD U.S. CONTIGUOUS STORE EXPANSION DRIVE ACCELERATED INTERNATIONAL GROWTH ACROSS BOTH BRANDS ENHANCE GLOBAL BRAND RELEVANCE BY EXPANDING PRODUCT AVAILIBILITY ACROSS RETAIL CHANNELS

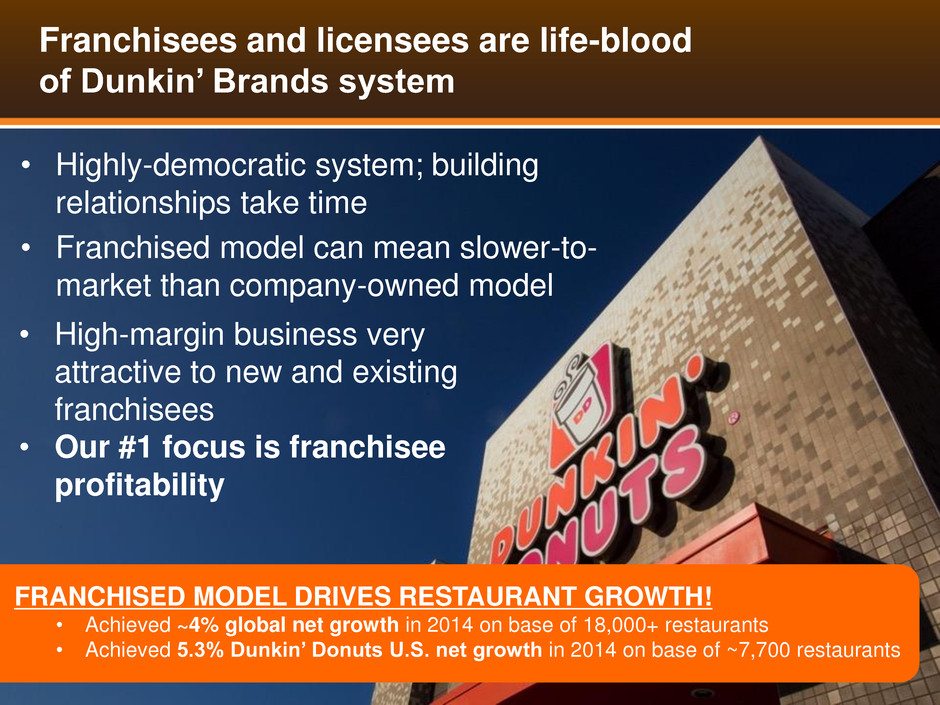

Franchisees and licensees are life-blood of Dunkin’ Brands system • Highly-democratic system; building relationships take time • Franchised model can mean slower-to- market than company-owned model FRANCHISED MODEL DRIVES RESTAURANT GROWTH! • Achieved ~4% global net growth in 2014 on base of 18,000+ restaurants • Achieved 5.3% Dunkin’ Donuts U.S. net growth in 2014 on base of ~7,700 restaurants • High-margin business very attractive to new and existing franchisees • Our #1 focus is franchisee profitability

8 INCREASE COMPARABLE STORE SALES AND PROFITABILITY IN DD U.S.

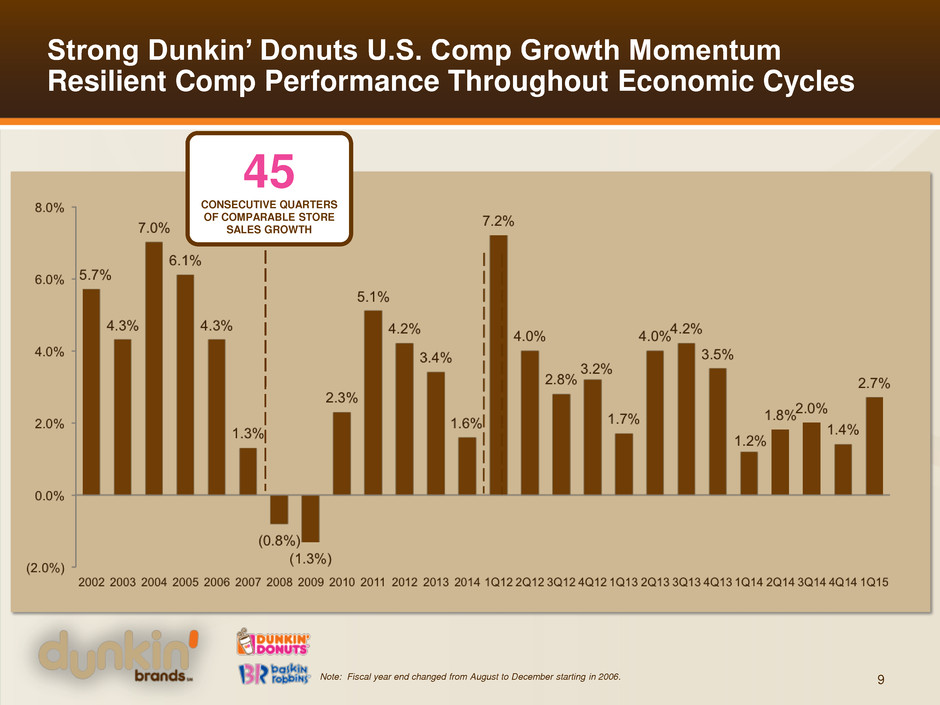

9 Note: Fiscal year end changed from August to December starting in 2006. Strong Dunkin’ Donuts U.S. Comp Growth Momentum Resilient Comp Performance Throughout Economic Cycles 45 CONSECUTIVE QUARTERS OF COMPARABLE STORE SALES GROWTH

2015 Product Strategy: Limited Time Offers bring regular news to the guest 10

2015 Product Strategy: Product platforms enabling affective advertising and reducing menu complexity 11

Using Digital to Drive Our Comps 12M+ app downloads & 2.8M+ Perks members Enabling 1:1 marketing 12

13 CONTINUE DD U.S. CONTIGUOUS STORE EXPANSION

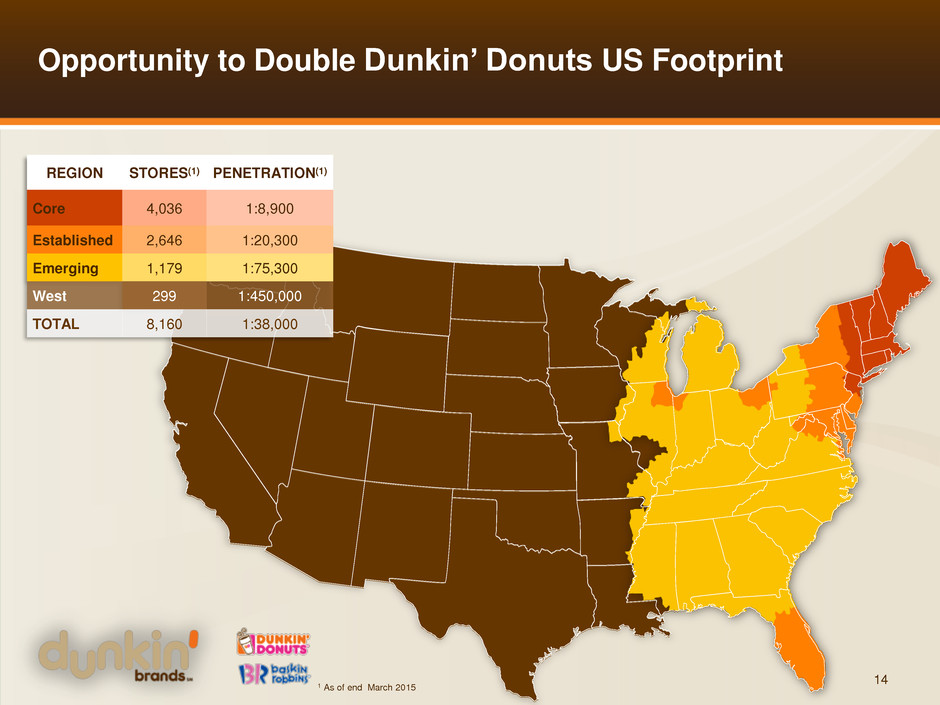

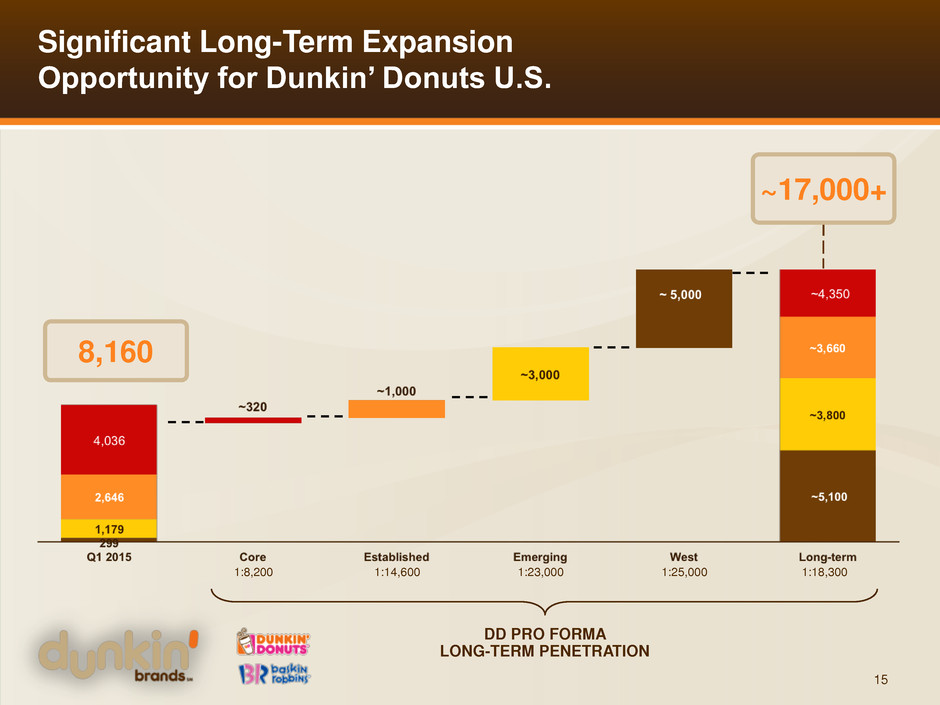

Opportunity to Double Dunkin’ Donuts US Footprint 14 REGION STORES(1) PENETRATION(1) Core 4,036 1:8,900 Established 2,646 1:20,300 Emerging 1,179 1:75,300 West 299 1:450,000 TOTAL 8,160 1:38,000 1 As of end March 2015

15 DD PRO FORMA LONG-TERM PENETRATION 8,160 Significant Long-Term Expansion Opportunity for Dunkin’ Donuts U.S. ~17,000+ 1:8,200 1:14,600 1:23,000 1:25,000 1:18,300

Proven Track Record of Accelerating Growth 16 171 206 243 291 371 410 - 440 DUNKIN’ DONUTS U.S. NET DEVELOPMENT 405

Compelling unit economics driving accelerated growth 17 2013 COHORT STORE-LEVEL ECONOMICS – TRADITIONAL STORES AVERAGE UNIT VOLUMES $890,000 CASH-ON-CASH RETURNS ~25% AVERAGE INITIAL CAPEX $450,000 As of 3/1/2015 Standalone, Traditional Dunkin Donuts Restaurants only • 2013 West & Emerging Cohort achieved 20%+ cash-on-cash returns • 2014 Cohort (all regions) expected to achieve 20%+ cash-on-cash returns

Successful debut in California: New restaurants outperforming expectations MODESTO SANTA MONICA CAMP PENDLETON EMBASSY SUITES SAN DIEGO BARSTOW STATION DOWNEY LAGUNA HILLS WHITTIER SAN DIEGO UPLAND RAMONA LONG BEACH

19 DRIVE ACCELERATED INTERNATIONAL GROWTH ACROSS BOTH BRANDS

Targeting International Growth in Highest AWS/Profit Opportunity Markets 20 SIGNED LARGEST DEVELOPMENT AGREEMENT IN COMPANY HISTORY IN CHINA FOR 1,400 DUNKIN’ DONUTS RESTAURANTS SIGNED RESTAURANT DEVELOPMENT AGREEMENT WITH STRONG U.S. FRANCHISEE FOR 100 DUNKIN’ DONUTS RESTAURANTS IN MEXICO STRONG DUNKIN’ DONUTS EUROPE OPENINGS – RECENTLY OPENED IN COPENHAGEN MIDDLE EAST IS A POWERHOUSE FOR BOTH BRANDS DUNKIN’ DONUTS SUPPLY CHAIN IMPROVEMENTS SUPPORTING FRANCHISEE ECONOMICS EXCELLENT NEW BR FRANCHISEES IN SOUTHEAST ASIA

21 INCREASE COMPARABLE STORE SALES GROWTH OF BR U.S.

8.0% Q1 2015 comps; 4.7% FY 2014 comps Expecting 1% - 3% comp store sales in 2015 Driving topline sales with technology Attractive franchising offers Growing with top- performing franchisees 22 Restaurant base optimization complete Growing brand advertising fund 22 Returning Baskin-Robbins U.S. to Growth Expecting 5 to 10 net new restaurants in 2015 Improving unit economics Opened 17 net new restaurants in 2014

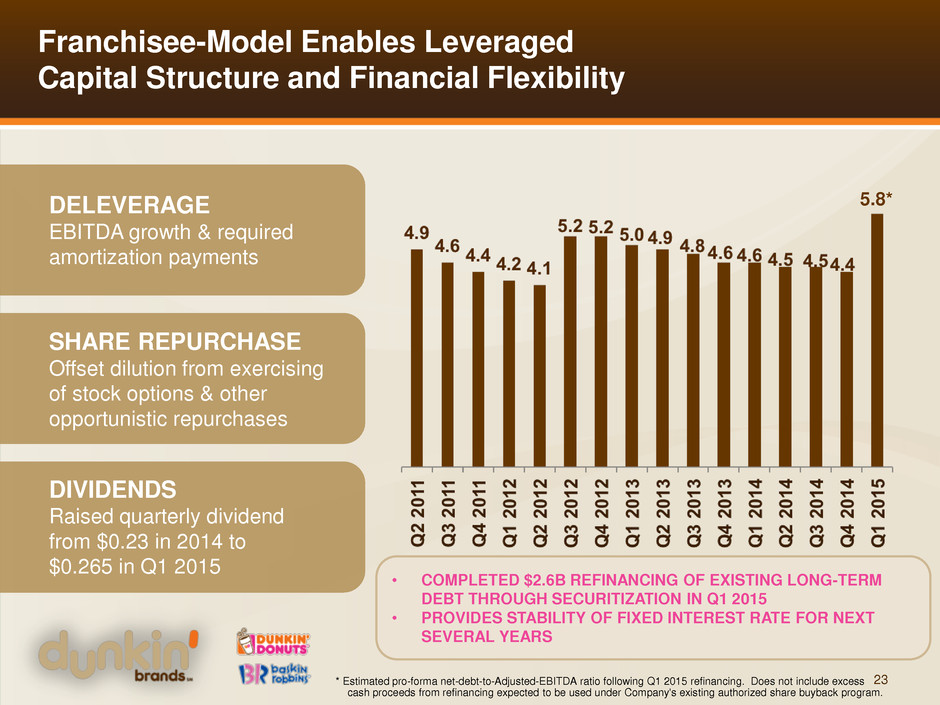

Franchisee-Model Enables Leveraged Capital Structure and Financial Flexibility 23 DELEVERAGE EBITDA growth & required amortization payments SHARE REPURCHASE Offset dilution from exercising of stock options & other opportunistic repurchases DIVIDENDS Raised quarterly dividend from $0.23 in 2014 to $0.265 in Q1 2015 • COMPLETED $2.6B REFINANCING OF EXISTING LONG-TERM DEBT THROUGH SECURITIZATION IN Q1 2015 • PROVIDES STABILITY OF FIXED INTEREST RATE FOR NEXT SEVERAL YEARS 5.8* * Estimated pro-forma net-debt-to-Adjusted-EBITDA ratio following Q1 2015 refinancing. Does not include excess cash proceeds from refinancing expected to be used under Company's existing authorized share buyback program.

Driving growth in 2015 and beyond Drive beverage category growth Expand global consumer engagement efforts in mobile, loyalty and social media 1 2 3 4 5 24 Enhance guest experience in all regions Intensify focus in high potential markets in U.S. and globally (California, Europe, Middle East, China) Continue to implement sustainability plan Franchisee economics is underlying priority

25