Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - STAG Industrial, Inc. | stag-20150331ex31170a9c0.htm |

| EXCEL - IDEA: XBRL DOCUMENT - STAG Industrial, Inc. | Financial_Report.xls |

| EX-32.1 - EX-32.1 - STAG Industrial, Inc. | stag-20150331ex3215376cd.htm |

| EX-31.2 - EX-31.2 - STAG Industrial, Inc. | stag-20150331ex312e481c8.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended March 31, 2015

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission file number 1-34907

STAG INDUSTRIAL, INC.

(Exact name of registrant as specified in its charter)

|

Maryland |

|

27-3099608 |

|

(State or other jurisdiction |

|

(IRS Employer |

|

|

|

|

|

One Federal Street, 23rd Floor |

|

02110 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(617) 574-4777

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Check one:

|

Large accelerated filer ☒ |

|

Accelerated filer ☐ |

|

|

|

|

|

Non-accelerated filer ☐ |

|

Smaller reporting company ☐ |

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common and preferred stock as of the latest practicable date.

|

Class |

|

Outstanding at April 30, 2015 |

|

|

Common Stock ($0.01 par value) |

|

65,155,340 |

|

|

9.0 % Series A Cumulative Redeemable Preferred Stock ($0.01 par value) |

|

2,760,000 |

|

|

6.625 % Series B Cumulative Redeemable Preferred Stock ($0.01 par value) |

|

2,800,000 |

|

STAG INDUSTRIAL, INC.

2

STAG Industrial, Inc.

(unaudited, in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

||

|

|

|

2015 |

|

2014 |

|

||

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

Rental Property: |

|

|

|

|

|

|

|

|

Land |

|

$ |

202,930 |

|

$ |

191,238 |

|

|

Buildings and improvements, net of accumulated depreciation of $117,106 and $105,789, respectively |

|

|

1,171,160 |

|

|

1,118,938 |

|

|

Deferred leasing intangibles, net of accumulated amortization of $159,206 and $146,026, respectively |

|

|

254,155 |

|

|

247,904 |

|

|

Total rental property, net |

|

|

1,628,245 |

|

|

1,558,080 |

|

|

Cash and cash equivalents |

|

|

11,688 |

|

|

23,878 |

|

|

Restricted cash |

|

|

7,233 |

|

|

6,906 |

|

|

Tenant accounts receivable, net |

|

|

18,554 |

|

|

16,833 |

|

|

Prepaid expenses and other assets |

|

|

26,397 |

|

|

22,531 |

|

|

Interest rate swaps |

|

|

111 |

|

|

959 |

|

|

Due from related parties |

|

|

121 |

|

|

130 |

|

|

Total assets |

|

$ |

1,692,349 |

|

$ |

1,629,317 |

|

|

Liabilities and Equity |

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

Unsecured credit facility |

|

$ |

73,000 |

|

$ |

131,000 |

|

|

Unsecured term loans |

|

|

150,000 |

|

|

150,000 |

|

|

Unsecured notes |

|

|

300,000 |

|

|

180,000 |

|

|

Mortgage notes payable |

|

|

224,131 |

|

|

225,347 |

|

|

Accounts payable, accrued expenses and other liabilities |

|

|

17,543 |

|

|

21,558 |

|

|

Interest rate swaps |

|

|

4,037 |

|

|

873 |

|

|

Tenant prepaid rent and security deposits |

|

|

11,644 |

|

|

11,480 |

|

|

Dividends and distributions payable |

|

|

7,696 |

|

|

7,355 |

|

|

Deferred leasing intangibles, net of accumulated amortization of $7,242 and $6,565, respectively |

|

|

10,246 |

|

|

10,180 |

|

|

Total liabilities |

|

|

798,297 |

|

|

737,793 |

|

|

Commitments and contingencies (Note 10) |

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

|

|

Preferred stock, par value $0.01 per share, 10,000,000 shares authorized, |

|

|

|

|

|

|

|

|

Series A, 2,760,000 shares (liquidation preference of $25.00 per share) issued and outstanding at March 31, 2015 and December 31, 2014 |

|

|

69,000 |

|

|

69,000 |

|

|

Series B, 2,800,000 shares (liquidation preference of $25.00 per share) issued and outstanding at March 31, 2015 and December 31, 2014 |

|

|

70,000 |

|

|

70,000 |

|

|

Common stock, par value $0.01 per share, 100,000,000 shares authorized, 64,947,384 and 64,434,825 shares issued and outstanding at March 31, 2015 and December 31, 2014, respectively |

|

|

649 |

|

|

644 |

|

|

Additional paid-in capital |

|

|

949,467 |

|

|

928,242 |

|

|

Common stock dividends in excess of earnings |

|

|

(229,006) |

|

|

(203,241) |

|

|

Accumulated other comprehensive loss |

|

|

(4,302) |

|

|

(489) |

|

|

Total stockholders’ equity |

|

|

855,808 |

|

|

864,156 |

|

|

Noncontrolling interest |

|

|

38,244 |

|

|

27,368 |

|

|

Total equity |

|

|

894,052 |

|

|

891,524 |

|

|

Total liabilities and equity |

|

$ |

1,692,349 |

|

$ |

1,629,317 |

|

The accompanying notes are an integral part of these consolidated financial statements.

3

STAG Industrial, Inc.

Consolidated Statements of Operations

(unaudited, in thousands, except per share data)

|

|

|

Three months ended March 31, |

|

||||

|

|

|

2015 |

|

2014 |

|

||

|

Revenue |

|

|

|

|

|

|

|

|

Rental income |

|

$ |

43,249 |

|

$ |

34,118 |

|

|

Tenant recoveries |

|

|

7,587 |

|

|

5,416 |

|

|

Other income |

|

|

153 |

|

|

209 |

|

|

Total revenue |

|

|

50,989 |

|

|

39,743 |

|

|

Expenses |

|

|

|

|

|

|

|

|

Property |

|

|

10,246 |

|

|

7,985 |

|

|

General and administrative |

|

|

7,530 |

|

|

5,475 |

|

|

Property acquisition costs |

|

|

318 |

|

|

559 |

|

|

Depreciation and amortization |

|

|

26,129 |

|

|

19,854 |

|

|

Other expenses |

|

|

186 |

|

|

237 |

|

|

Total expenses |

|

|

44,409 |

|

|

34,110 |

|

|

Other income (expense) |

|

|

|

|

|

|

|

|

Interest income |

|

|

3 |

|

|

4 |

|

|

Interest expense |

|

|

(8,010) |

|

|

(5,666) |

|

|

Gain on sale of rental property |

|

|

— |

|

|

50 |

|

|

Total other income (expense) |

|

|

(8,007) |

|

|

(5,612) |

|

|

Net income (loss) from continuing operations |

|

$ |

(1,427) |

|

$ |

21 |

|

|

Net income (loss) |

|

$ |

(1,427) |

|

$ |

21 |

|

|

Less: loss attributable to noncontrolling interest after preferred stock dividends |

|

|

(198) |

|

|

(364) |

|

|

Net income (loss) attributable to STAG Industrial, Inc. |

|

$ |

(1,229) |

|

$ |

385 |

|

|

Less: preferred stock dividends |

|

|

2,712 |

|

|

2,712 |

|

|

Less: amount allocated to unvested restricted stockholders |

|

|

101 |

|

|

88 |

|

|

Net loss attributable to common stockholders |

|

$ |

(4,042) |

|

$ |

(2,415) |

|

|

Weighted average common shares outstanding — basic and diluted |

|

|

64,286,213 |

|

|

45,139,481 |

|

|

Loss per share — basic and diluted |

|

|

|

|

|

|

|

|

Loss from continuing operations attributable to common stockholders |

|

$ |

(0.06) |

|

$ |

(0.05) |

|

|

Loss per share — basic and diluted |

|

$ |

(0.06) |

|

$ |

(0.05) |

|

The accompanying notes are an integral part of these consolidated financial statements.

4

STAG Industrial, Inc.

Consolidated Statements of Comprehensive Income (Loss)

(unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31, |

||||

|

|

|

2015 |

|

2014 |

||

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(1,427) |

|

$ |

21 |

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

Loss on interest rate swaps |

|

|

(4,005) |

|

|

(1,082) |

|

Other comprehensive loss |

|

|

(4,005) |

|

|

(1,082) |

|

Comprehensive loss |

|

|

(5,432) |

|

|

(1,061) |

|

Net loss attributable to noncontrolling interest after preferred stock dividends |

|

|

198 |

|

|

364 |

|

Other comprehensive loss attributable to noncontrolling interest |

|

|

192 |

|

|

146 |

|

Comprehensive loss attributable to STAG Industrial, Inc. |

|

$ |

(5,042) |

|

$ |

(551) |

The accompanying notes are an integral part of these consolidated financial statements

5

STAG Industrial, Inc.

Consolidated Statements of Equity

(unaudited, in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noncontrolling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

|

|

|

|

|

Interest — Unit |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

Dividends |

|

Accumulated Other |

|

Total |

|

Holders in |

|

|

|

|

|||||

|

|

|

Preferred |

|

Common Stock |

|

Paid-in |

|

in Excess of |

|

Comprehensive |

|

Stockholders' |

|

Operating |

|

Total |

|

||||||||||

|

|

|

Stock |

|

Shares |

|

Amount |

|

Capital |

|

Earnings |

|

Income (Loss) |

|

Equity |

|

Partnership |

|

Equity |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2014 |

|

$ |

139,000 |

|

64,434,852 |

|

$ |

644 |

|

$ |

928,242 |

|

$ |

(203,241) |

|

$ |

(489) |

|

$ |

864,156 |

|

$ |

27,368 |

|

$ |

891,524 |

|

|

Proceeds from sale of common stock |

|

|

— |

|

417,115 |

|

|

4 |

|

|

10,129 |

|

|

— |

|

|

— |

|

|

10,133 |

|

|

— |

|

|

10,133 |

|

|

Offering costs |

|

|

— |

|

— |

|

|

— |

|

|

(202) |

|

|

— |

|

|

— |

|

|

(202) |

|

|

— |

|

|

(202) |

|

|

Issuance of restricted stock, net |

|

|

— |

|

92,119 |

|

|

1 |

|

|

(1) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Issuance of common stock |

|

|

— |

|

3,298 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Dividends and distributions, net |

|

|

(2,712) |

|

— |

|

|

— |

|

|

— |

|

|

(21,824) |

|

|

— |

|

|

(24,536) |

|

|

(1,120) |

|

|

(25,656) |

|

|

Non-cash compensation |

|

|

— |

|

— |

|

|

— |

|

|

710 |

|

|

— |

|

|

— |

|

|

710 |

|

|

1,137 |

|

|

1,847 |

|

|

Redemption of common units for cash |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(64) |

|

|

(64) |

|

|

Issuance of units |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

21,902 |

|

|

21,902 |

|

|

Rebalancing of noncontrolling interest |

|

|

— |

|

— |

|

|

— |

|

|

10,589 |

|

|

— |

|

|

— |

|

|

10,589 |

|

|

(10,589) |

|

|

— |

|

|

Other comprehensive loss |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(3,813) |

|

|

(3,813) |

|

|

(192) |

|

|

(4,005) |

|

|

Net income (loss) |

|

|

2,712 |

|

— |

|

|

— |

|

|

— |

|

|

(3,941) |

|

|

— |

|

|

(1,229) |

|

|

(198) |

|

|

(1,427) |

|

|

Balance, March 31, 2015 |

|

$ |

139,000 |

|

64,947,384 |

|

$ |

649 |

|

$ |

949,467 |

|

$ |

(229,006) |

|

$ |

(4,302) |

|

$ |

855,808 |

|

$ |

38,244 |

|

$ |

894,052 |

|

|

Three months ended March 31, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2013 |

|

$ |

139,000 |

|

44,764,377 |

|

$ |

447 |

|

$ |

577,039 |

|

$ |

(116,877) |

|

$ |

3,440 |

|

$ |

603,049 |

|

$ |

71,515 |

|

$ |

674,564 |

|

|

Proceeds from sales of common stock |

|

|

— |

|

3,431,459 |

|

|

34 |

|

|

77,534 |

|

|

— |

|

|

— |

|

|

77,568 |

|

|

— |

|

|

77,568 |

|

|

Offering costs |

|

|

— |

|

— |

|

|

— |

|

|

(1,270) |

|

|

— |

|

|

— |

|

|

(1,270) |

|

|

— |

|

|

(1,270) |

|

|

Issuance of restricted stock, net |

|

|

— |

|

101,934 |

|

|

1 |

|

|

(1) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Issuance of common stock |

|

|

— |

|

2,544 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Dividends and distributions, net |

|

|

(2,712) |

|

— |

|

|

— |

|

|

— |

|

|

(14,540) |

|

|

— |

|

|

(17,252) |

|

|

(2,238) |

|

|

(19,490) |

|

|

Non-cash compensation |

|

|

— |

|

— |

|

|

— |

|

|

441 |

|

|

— |

|

|

— |

|

|

441 |

|

|

618 |

|

|

1,059 |

|

|

Redemption of common units for cash |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(342) |

|

|

(342) |

|

|

Rebalancing of noncontrolling interest |

|

|

— |

|

— |

|

|

— |

|

|

(6,899) |

|

|

— |

|

|

— |

|

|

(6,899) |

|

|

6,899 |

|

|

— |

|

|

Other comprehensive income |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(936) |

|

|

(936) |

|

|

(146) |

|

|

(1,082) |

|

|

Net income (loss) |

|

|

2,712 |

|

— |

|

|

— |

|

|

— |

|

|

(2,327) |

|

|

— |

|

|

385 |

|

|

(364) |

|

|

21 |

|

|

Balance, March 31, 2014 |

|

$ |

139,000 |

|

48,300,314 |

|

$ |

482 |

|

$ |

646,844 |

|

$ |

(133,744) |

|

$ |

2,504 |

|

$ |

655,086 |

|

$ |

75,942 |

|

$ |

731,028 |

|

The accompanying notes are an integral part of these consolidated financial statements.

6

STAG Industrial, Inc.

Consolidated Statements of Cash Flows

(unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31, |

|

||||

|

|

|

2015 |

|

2014 |

|

||

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(1,427) |

|

$ |

21 |

|

|

Adjustment to reconcile net income (loss) to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

26,129 |

|

|

19,854 |

|

|

Non-cash portion of interest expense |

|

|

299 |

|

|

315 |

|

|

Intangible amortization in rental income, net |

|

|

2,065 |

|

|

1,510 |

|

|

Straight-line rent adjustments, net |

|

|

(1,293) |

|

|

(1,024) |

|

|

Gain on sale of rental property |

|

|

— |

|

|

(50) |

|

|

Non-cash compensation expense |

|

|

1,847 |

|

|

1,090 |

|

|

Change in assets and liabilities: |

|

|

|

|

|

|

|

|

Tenant accounts receivable, net |

|

|

(468) |

|

|

966 |

|

|

Restricted cash |

|

|

(162) |

|

|

(174) |

|

|

Prepaid expenses and other assets |

|

|

(3,105) |

|

|

(2,324) |

|

|

Accounts payable, accrued expenses and other liabilities |

|

|

(2,242) |

|

|

(5,752) |

|

|

Tenant prepaid rent and security deposits |

|

|

164 |

|

|

98 |

|

|

Due from related parties |

|

|

9 |

|

|

(2) |

|

|

Total adjustments |

|

|

23,243 |

|

|

14,507 |

|

|

Net cash provided by operating activities |

|

|

21,816 |

|

|

14,528 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Acquisitions of land and buildings and improvements |

|

|

(48,621) |

|

|

(29,368) |

|

|

Additions to building and other capital improvements |

|

|

(2,644) |

|

|

(2,232) |

|

|

Proceeds from sale of rental property, net |

|

|

— |

|

|

473 |

|

|

Restricted cash |

|

|

(165) |

|

|

167 |

|

|

Acquisition deposits, net |

|

|

(480) |

|

|

(340) |

|

|

Additions to deferred leasing intangibles |

|

|

(14,795) |

|

|

(7,540) |

|

|

Net cash used in investing activities |

|

|

(66,705) |

|

|

(38,840) |

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

Redemption of common units for cash |

|

|

(64) |

|

|

(342) |

|

|

Proceeds from unsecured credit facility |

|

|

62,000 |

|

|

38,000 |

|

|

Repayment of unsecured credit facility |

|

|

(120,000) |

|

|

(96,500) |

|

|

Proceeds from unsecured term loans |

|

|

— |

|

|

50,000 |

|

|

Proceeds from unsecured notes |

|

|

120,000 |

|

|

— |

|

|

Repayment of mortgage notes payable |

|

|

(12,942) |

|

|

(1,101) |

|

|

Payment of loan fees and costs |

|

|

(930) |

|

|

(1,169) |

|

|

Dividends and distributions |

|

|

(25,314) |

|

|

(18,838) |

|

|

Proceeds from sales of common stock |

|

|

10,133 |

|

|

77,568 |

|

|

Offering costs |

|

|

(184) |

|

|

(1,270) |

|

|

Net cash provided by financing activities |

|

|

32,699 |

|

|

46,348 |

|

|

Increase (decrease) in cash and cash equivalents |

|

|

(12,190) |

|

|

22,036 |

|

|

Cash and cash equivalents—beginning of period |

|

|

23,878 |

|

|

6,690 |

|

|

Cash and cash equivalents—end of period |

|

$ |

11,688 |

|

$ |

28,726 |

|

|

Supplemental disclosure: |

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

6,990 |

|

$ |

5,420 |

|

|

Supplemental schedule of non-cash investing and financing activities |

|

|

|

|

|

|

|

|

Issuance of units for acquisition of land and buildings and improvements |

|

$ |

16,873 |

|

$ |

— |

|

|

Issuance of units for acquisition of deferred leasing intangibles |

|

$ |

5,029 |

|

$ |

— |

|

|

Acquisition of land and buildings and improvements |

|

$ |

(25,936) |

|

$ |

— |

|

|

Acquisition of deferred leasing intangibles |

|

$ |

(7,731) |

|

$ |

— |

|

|

Assumption of mortgage note payable |

|

$ |

11,765 |

|

$ |

— |

|

|

Non-cash investing activities included in additions of land and building improvements |

|

$ |

1,747 |

|

$ |

308 |

|

|

Non-cash financing activities included in payment of loan fees and costs and offering costs |

|

$ |

(22) |

|

$ |

(144) |

|

|

Dividends and distributions declared but not paid |

|

$ |

7,696 |

|

$ |

5,818 |

|

The accompanying notes are an integral part of these consolidated financial statements.

7

STAG Industrial, Inc.

Notes to Consolidated Financial Statements

(unaudited)

1. Organization and Description of Business

STAG Industrial, Inc. (the “Company”) is an industrial real estate operating company focused on the acquisition and management of single-tenant industrial properties throughout the United States. The Company was formed as a Maryland corporation on July 21, 2010 and has elected to be treated as a real estate investment trust (“REIT”) under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended (the “Code”), and intends to continue to qualify as a REIT. The Company is structured as an umbrella partnership REIT, commonly called an UPREIT, and owns substantially all of its assets and conducts substantially all of its business through its operating partnership, STAG Industrial Operating Partnership, L.P., a Delaware limited partnership (the “Operating Partnership”). As of March 31, 2015 and December 31, 2014, the Company owned a 94.93% and 96.36%, respectively, equity interest in the Operating Partnership. The Company, through its wholly owned subsidiary, is the sole general partner of the Operating Partnership. As used herein, the “Company” refers to STAG Industrial, Inc. and its consolidated subsidiaries and partnerships except where context otherwise requires.

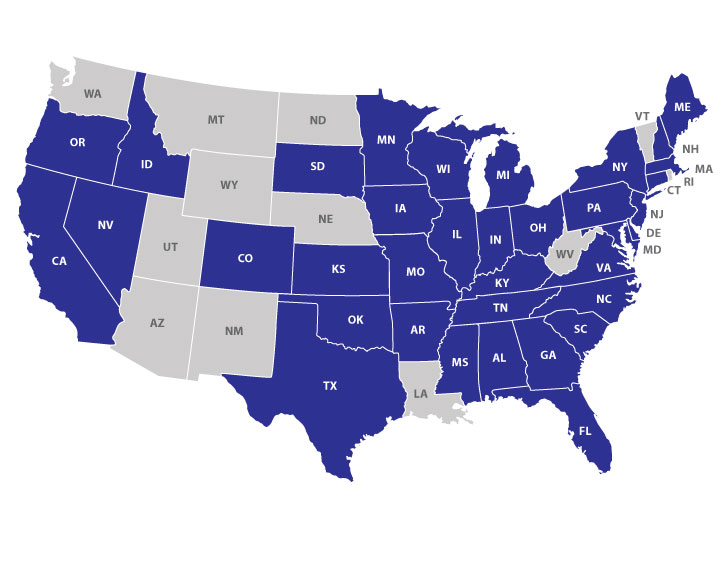

As of March 31, 2015, the Company owned 253 buildings in 36 states with approximately 48.5 million square feet, consisting of 183 warehouse/distribution buildings, 50 light manufacturing buildings and 20 flex/office buildings. The Company also owned three vacant developable land parcels adjacent to three of the Company’s buildings. The Company’s buildings were 94.4% leased to 231 tenants as of March 31, 2015.

2. Summary of Significant Accounting Policies

Interim Financial Information

The accompanying interim financial statements have been presented in conformity with accounting principles generally accepted in the United States of America (“GAAP”) and with the instructions to Form 10-Q and Regulation S-X for interim financial information. Accordingly, these statements do not include all of the information and notes required by GAAP for complete financial statements. In the opinion of management, the accompanying interim financial statements include all adjustments, consisting of normal recurring items, necessary for their fair presentation in conformity with GAAP. Interim results are not necessarily indicative of results for a full year. The year-end consolidated balance sheet data was derived from audited financial statements, but does not include all disclosures required by GAAP. The information included in this Quarterly Report on Form 10-Q should be read in conjunction with the Company’s consolidated financial statements and notes thereto contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014.

Basis of Presentation

The Company’s consolidated financial statements include the accounts of the Company, the Operating Partnership and their subsidiaries. The equity interests of other limited partners in the Operating Partnership held in the form of common units and long term incentive plan units issued pursuant to the 2011 equity incentive plan; herein together referred to as Noncontrolling Common Units are reflected as noncontrolling interest. The equity interests of the Company along with the Noncontrolling Common Units in the Operating Partnership are common units (“Common Units”). All significant intercompany balances and transactions have been eliminated in the consolidation of entities. The financial statements of the Company are presented on a consolidated basis, for all periods presented.

Reclassifications and New Accounting Pronouncements

Certain prior year amounts have been reclassified to conform to the current year presentation.

In April of 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2015-03, Simplifying the Presentation of Debt Issuance Costs. ASU 2015-03 requires incremental debt issuance costs paid

8

to third parties other than the lender to be presented in the balance sheet as a direct deduction from the carrying value of the associated debt liability. Prior to this standard, debt issuance costs paid to third parties other than the lender were presented as an asset on the balance sheet. ASU 2015-03 is effective for the annual period ended December 31, 2016 and for annual periods and interim periods thereafter with early adoption permitted. Upon the adoption of ASU 2014-15, the Company will present debt issuance costs paid to third parties other than the lender as a direct deduction from the carrying value of the associated debt liability.

In August of 2014, the FASB issued ASU 2014-15, Presentation of Financial Statements-Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. ASU 2014-15 requires management to evaluate whether there are conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern, and to provide certain disclosures when it is probable that the entity will be unable to meet its obligations as they become due within one year after the date that the financial statements are issued. ASU 2014-15 is effective for the annual period ended December 31, 2016 and for annual periods and interim periods thereafter with early adoption permitted. The adoption of ASU 2014-15 is not expected to materially impact the Company’s consolidated financial statements.

In May of 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606). ASU 2014-09 is a comprehensive new revenue recognition model requiring a company to recognize revenue to depict the transfer of goods or services to a customer at an amount reflecting the consideration it expects to receive in exchange for those goods or services. Revenue from a lease contract with a tenant is not within the scope of this revenue standard. In adopting ASU 2014-09, companies may use either a full retrospective or a modified retrospective approach. Additionally, this guidance requires improved disclosures regarding the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. ASU 2014-09 is effective for the first interim period within annual reporting periods beginning after December 15, 2016, and early adoption is not permitted. The Company is currently in the process of evaluating the impact the adoption of ASU 2014-09 will have on the Company’s financial position or results of operations.

Tenant Accounts Receivable, net

Tenant accounts receivable, net on the Consolidated Balance Sheets, includes both tenant accounts receivable, net and accrued rental income, net. The Company provides an allowance for doubtful accounts against the portion of tenant accounts receivable that is estimated to be uncollectible. As of March 31, 2015 and December 31, 2014, the Company had an allowance for doubtful accounts of $0.3 million and $0.1 million, respectively.

The Company accrues rental revenue earned, but not yet receivable, in accordance with GAAP. As of March 31, 2015 and December 31, 2014, the Company had accrued rental revenue of $14.1 million and $12.8 million, respectively. The Company maintains an allowance for estimated losses that may result from those revenues. If a tenant fails to make contractual payments beyond any allowance, the Company may recognize additional bad debt expense in future periods equal to the amount of unpaid rent and accrued rental revenue. As of March 31, 2015 and December 31, 2014, the Company had an allowance for estimated losses on accrued rental revenue of $0.1 million and $0, respectively.

As of March 31, 2015 and December 31, 2014, the Company had a total of approximately $6.3 million and $6.7 million, respectively, of total lease security deposits available in existing letters of credit, which are not reflected on the Company’s Consolidated Balance Sheets; and $3.5 million and $3.5 million, respectively, of lease security deposits available in cash, which are included in cash and cash equivalents and restricted cash on the accompanying Statements of Consolidated Balance Sheets.

Revenue Recognition

By the terms of their leases, certain tenants are obligated to pay directly the costs of their properties’ insurance, real estate taxes, ground lease payments, and certain other expenses, and these costs are not reflected on the Company’s consolidated financial statements. To the extent any tenant responsible for these costs under its respective lease defaults on its lease or it is deemed probable that the tenant will fail to pay for such costs, the Company would record a liability for such obligation. The Company estimates that real estate taxes, which are the responsibility of these certain tenants, was approximately $2.5 million and $2.5 million for the three months ended March 31, 2015 and March 31, 2014, respectively. This would have been the maximum liability of the Company had the tenants not met their contractual obligations. The Company does not

9

recognize recovery revenue related to leases where the tenant has assumed the cost for real estate taxes, insurance, ground lease payments and certain other expenses.

On December 17, 2014, the Company entered into the first amendment to the lease with the tenant located at the Belfast, ME buildings. The terms of the amendment renewed 90,051 square feet of the premise and early terminated the remaining 228,928 square feet effective November 30, 2015. The tenant is required to pay a termination fee for the returned premise on or before October 31, 2015 in the amount of $2.1 million. The Company continues to recognize this termination fee over the shortened lease life of the returned premise. The termination fee of $0.5 million for the three months ended March 31, 2015 is included in rental income on the accompanying Consolidated Statements of Operations.

Taxes

The Company elected to be taxed as a REIT under the Code commencing with its taxable year ended December 31, 2011 and intends to continue to qualify as a REIT. As a REIT, the Company is required to distribute at least 90% of its REIT taxable income to its stockholders and meet the various other requirements imposed by the Code relating to such matters as operating results, asset holdings, distribution levels and diversity of stock ownership. The Company is generally not subject to corporate level income tax on the earnings distributed currently to its stockholders that it derives from its REIT qualifying activities. If the Company fails to qualify as a REIT in any taxable year, and is unable to avail itself of certain savings provisions set forth in the Code, all of the Company’s taxable income would be subject to federal income tax at regular corporate rates, including any applicable alternative minimum tax. In addition, we would generally be disqualified from treatment as a REIT for the next four taxable years following the year in which we failed to qualify as a REIT.

The Company will not be required to make distributions with respect to income derived from the activities conducted through subsidiaries that the Company elects to treat as taxable REIT subsidiaries (“TRS”) for federal income tax purposes. Certain activities that the Company undertakes must or should be conducted by a TRS, such as performing non-customary services for its tenants and holding assets that it cannot hold directly. A TRS is subject to federal and state income taxes. The Company’s TRS did not have any activity during the three months ended March 31, 2015 and March 31, 2014.

The Company and certain of its subsidiaries are subject to certain state and local income, excise and franchise taxes. Taxes in the amount of $0.2 million and $0.2 million have been recorded in other expenses in the accompanying Consolidated Statements of Operations for the three months ended March 31, 2015 and March 31, 2014, respectively.

Tax benefits of uncertain tax positions are recognized only if it is more likely than not that the tax position will be sustained based solely on its technical merits, with the taxing authority having full knowledge of all relevant information. The measurement of a tax benefit for an uncertain tax position that meets the “more likely than not” threshold is based on a cumulative probability model under which the largest amount of tax benefit recognized is the amount with a greater than 50% likelihood of being realized upon ultimate settlement with the taxing authority having full knowledge of all the relevant information. As of March 31, 2015 and December 31, 2014, there were no liabilities for uncertain tax positions.

3. Rental Property

The following table summarizes the components of rental property as of March 31, 2015 and December 31, 2014 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2015 |

|

December 31, 2014 |

|

||

|

Land |

|

$ |

202,930 |

|

$ |

191,238 |

|

|

Buildings, net of accumulated depreciation of $82,836 and $75,116, respectively |

|

|

1,093,054 |

|

|

1,042,086 |

|

|

Tenant improvements, net of accumulated depreciation of $22,358 and $20,943, respectively |

|

|

22,175 |

|

|

22,619 |

|

|

Building and land improvements, net of accumulated depreciation of $11,912 and $9,730, respectively |

|

|

55,931 |

|

|

54,233 |

|

|

Deferred leasing intangibles, net of accumulated amortization of $159,206 and $146,026, respectively |

|

|

254,155 |

|

|

247,904 |

|

|

Total rental property, net |

|

$ |

1,628,245 |

|

$ |

1,558,080 |

|

10

Acquisitions

The following table summarizes the acquisitions of the Company during the three months ended March 31, 2015:

|

|

|

|

|

|

|

|

|

|

|

Location of property acquired during the three months ended March 31, 2015 |

|

Square Feet |

|

Buildings |

|

|

Purchase Price (in thousands) |

|

|

Burlington, NJ(1) |

|

503,490 |

|

1 |

|

$ |

34,883 |

|

|

Greenville, SC |

|

157,500 |

|

1 |

|

|

4,800 |

|

|

North Haven, CT |

|

824,727 |

|

3 |

|

|

57,400 |

|

|

Total |

|

1,485,717 |

|

5 |

|

$ |

97,083 |

|

|

(1) |

The Company also acquired a vacant developable land parcel adjacent to the building. |

The following table summarizes the allocation of the consideration paid at the date of acquisition during the three months ended March 31, 2015 for the acquired assets and liabilities in connection with the acquisitions of buildings identified in the table above.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

|

|

|

|

|

|

Amortization |

|

|

|

|

|

|

Three Months Ended |

|

Period (years) |

|

|

|

|

Acquired assets and liabilities (dollars in thousands) |

|

March 31, 2015 |

|

Lease Intangibles |

|

|

|

|

Land |

|

$ |

11,692 |

|

N/A |

|

|

|

Buildings |

|

|

58,686 |

|

N/A |

|

|

|

Tenant improvements |

|

|

1,048 |

|

N/A |

|

|

|

Building and land improvements |

|

|

3,132 |

|

N/A |

|

|

|

Deferred leasing intangibles - In-place leases |

|

|

13,540 |

|

5.6 |

|

|

|

Deferred leasing intangibles - Tenant relationships |

|

|

7,595 |

|

8.1 |

|

|

|

Deferred leasing intangibles - Above market leases |

|

|

2,133 |

|

8.3 |

|

|

|

Deferred leasing intangibles - Below market leases |

|

|

(743) |

|

7.7 |

|

|

|

Total Aggregate purchase price |

|

$ |

97,083 |

|

|

|

|

|

Less: Mortgage note payable assumed |

|

|

(11,765) |

|

N/A |

|

|

|

Net assets acquired |

|

$ |

85,318 |

|

|

|

|

On January 22, 2015, the Company acquired a property located in Burlington, NJ. As partial consideration for the property acquired, the Company granted 812,676 Noncontrolling Common Units in the Operating Partnership with a fair value of approximately $21.9 million based on the Company’s New York Stock Exchange (“NYSE”) closing stock price on January 22, 2015. The number of Noncontrolling Common Units granted was calculated based on the trailing 10-day average common stock price ending on the business day that immediately preceded the grant date. The fair value of the shares of the Noncontrolling Common Units granted was calculated based on the closing stock price per the NYSE on the grant date multiplied by the number of Noncontrolling Common Units granted. The issuance of the Noncontrolling Common Units was effected in reliance upon an exemption from registration provided by Section 4(2) under the Securities Act of 1933, as amended. The Company relied on the exemption based on representations given by the holders of the Noncontrolling Common Units. The remaining purchase price of approximately $13.0 million was paid by $1.2 million in cash and the assumption of an $11.8 million mortgage note. The mortgage note was immediately paid in full in conjunction with the acquisition.

The table below sets forth the results of operations during the three months ended March 31, 2015 for the properties acquired during the three months ended March 31, 2015 included in the Company’s Consolidated Statements of Operations from the date of acquisition:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

|

|

Results of operations (in thousands) |

|

March 31, 2015 |

|

|

|

Revenue |

|

$ |

885 |

|

|

Property acquisition costs |

|

$ |

246 |

|

|

Net loss |

|

$ |

(247) |

|

11

The following tables set forth pro forma information for the three months ended March 31, 2015 and March 31, 2014, respectively. The below pro forma information does not represent what the actual results of operations of the Company would have been had the acquisitions outlined above occurred on the first day of the applicable reporting period, nor do they predict the results of operations of future periods. The pro forma information has not been adjusted for property sales.

|

|

|

Three months ended |

|

|

|

|

|

March 31, 2015 |

|

|

|

Pro Forma |

|

(in thousands, except share data) (1) |

|

|

|

Total revenue |

|

$ |

52,483 |

|

|

Net loss |

|

$ |

(1,627) |

(2) |

|

Net loss attributable to common stockholders |

|

$ |

(4,232) |

|

|

Weighted average shares outstanding |

|

|

64,286,213 |

|

|

Loss per share attributable to common stockholders |

|

$ |

(0.07) |

|

|

|

|

Three months ended |

|

|

|

|

|

March 31, 2014 |

|

|

|

Pro Forma |

|

(in thousands, except share data) (3) |

|

|

|

Total revenue |

|

$ |

42,895 |

|

|

Net income |

|

$ |

113 |

(2) |

|

Net loss attributable to common stockholders |

|

$ |

(2,335) |

|

|

Weighted average shares outstanding |

|

|

45,139,481 |

|

|

Loss per share attributable to common stockholders |

|

$ |

(0.05) |

|

|

(1) |

The pro forma information for the three months ended March 31, 2015 is presented as if the acquisition of the properties acquired during the three months ended March 31, 2015 had occurred at January 1, 2014, the beginning of the reporting period prior to acquisition. |

|

(2) |

The net loss for the three months ended March 31, 2015 excludes $0.2 million of property acquisition costs related to the acquisition of properties that closed during the three months ended March 31, 2015, and the net income for the three months ended March 31, 2014 was adjusted to include these acquisition costs. Net income for the three months ended March 31, 2014 excludes $0.4 million of property acquisition costs related to the acquisition of buildings that closed during the three months ended March 31, 2014. |

|

(3) |

The pro forma information for the three months ended March 31, 2014 is presented as if the acquisition of the properties acquired during the three months ended March 31, 2015 and the properties acquired during the three months ended March 31, 2014 had occurred at January 1, 2014 and January 1, 2013, respectively, the beginning of the reporting period prior to acquisition. |

Deferred Leasing Intangibles

For all acquisitions of property that are accounted for as a business combination, the Company allocates the purchase price of the property based upon the fair value of the assets and liabilities acquired, which generally consist of land, buildings, tenant improvements, mortgage debt assumed, and deferred leasing intangibles including in‑place leases, above market and below market leases, and tenant relationships. The portion of the purchase price that is allocated to above and below market leases is valued based on the present value of the difference between prevailing market rates and the in‑place rates measured over a period equal to the remaining term of the lease for above market leases and the initial term plus the term of any below market lease bargain renewal options. The above market lease values are amortized as a reduction of rental income over the remaining term of the respective leases, and the below market lease values are amortized as an increase to rental income over the remaining term plus the terms of bargain renewal options of the respective leases. The purchase price is further allocated to in‑place lease values and tenant relationships based on the Company’s evaluation of the specific characteristics of each tenant’s lease and its overall relationship with the respective tenant. The value of in‑place lease intangibles and tenant relationships, which are included as components of deferred leasing intangibles, are amortized over the remaining lease term (and expected renewal periods of the respective lease for tenant relationships) as adjustments to depreciation and amortization expense. If a tenant terminates its lease, the unamortized portion of above and below market leases, the in‑place lease value and tenant relationships are immediately written off.

The purchase price allocated to deferred leasing intangible assets are included in rental property on the accompanying Consolidated Balance Sheets and the purchase price allocated to deferred leasing intangible liabilities are included in the deferred leasing intangibles on the accompanying Consolidated Balance Sheets under the liabilities section.

12

Deferred leasing intangibles on the accompanying Consolidated Balance Sheets consist of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2015 |

|

December 31, 2014 |

|

||||||||||||||

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

Gross |

|

|

Amortization |

|

|

Net |

|

|

Gross |

|

|

Amortization |

|

|

Net |

|

|

Other intangible lease assets |

|

$ |

349,785 |

|

$ |

(133,470) |

|

$ |

216,315 |

|

$ |

330,100 |

|

$ |

(120,645) |

|

$ |

209,455 |

|

|

Above market leases |

|

|

63,576 |

|

|

(25,736) |

|

|

37,840 |

|

|

63,830 |

|

|

(25,381) |

|

|

38,449 |

|

|

Total assets |

|

$ |

413,361 |

|

$ |

(159,206) |

|

$ |

254,155 |

|

$ |

393,930 |

|

$ |

(146,026) |

|

$ |

247,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Below market leases |

|

$ |

17,488 |

|

$ |

(7,242) |

|

$ |

10,246 |

|

$ |

16,745 |

|

$ |

(6,565) |

|

$ |

10,180 |

|

|

Total liabilities |

|

$ |

17,488 |

|

$ |

(7,242) |

|

$ |

10,246 |

|

$ |

16,745 |

|

$ |

(6,565) |

|

$ |

10,180 |

|

The following table sets forth the amortization expense and the net decrease to rental revenue for deferred leasing intangible amortization for the three months ended March 31, 2015 and March 31, 2014, respectively (in millions):

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31, |

|

||||

|

|

|

2015 |

|

2014 |

|

||

|

Net decrease to rental revenue related to above and below market lease amortization |

|

$ |

2.1 |

|

$ |

1.5 |

|

|

Other intangible lease assets amortization expense |

|

$ |

14.3 |

|

$ |

11.5 |

|

The amortization of deferred leasing intangibles over the next five years is as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

Net Decrease to Rental |

|

||

|

|

|

Amortization of |

|

Revenue Related to Above and |

|

||

|

|

|

Other Intangible |

|

Below Market Lease |

|

||

|

|

|

Lease Assets |

|

Amortization |

|

||

|

Remainder of 2015 |

|

$ |

40,909 |

|

$ |

6,002 |

|

|

2016 |

|

$ |

46,997 |

|

$ |

5,606 |

|

|

2017 |

|

$ |

37,992 |

|

$ |

3,941 |

|

|

2018 |

|

$ |

29,114 |

|

$ |

2,699 |

|

|

2019 |

|

$ |

20,604 |

|

$ |

2,408 |

|

13

4. Debt

The following table sets forth a summary of the Company’s outstanding indebtedness, including borrowings under the Company’s unsecured credit facility, unsecured term loans, unsecured notes and mortgage notes payable as of March 31, 2015 and December 31, 2014 (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal |

|

Principal |

|

|

|

|

|

||

|

|

|

|

|

outstanding as |

|

outstanding as |

|

|

|

|

|

||

|

|

|

|

|

of |

|

of |

|

|

|

Pre- |

|

||

|

|

|

Interest |

|

March 31, |

|

December 31, |

|

Current |

|

payment |

|

||

|

Loan |

|

Rate (1) |

|

2015 |

|

2014 |

|

Maturity |

|

Terms (2) |

|

||

|

Unsecured credit facility: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$300 Million Wells Fargo Unsecured Credit Facility |

|

L + 1.15 |

% |

|

73,000 |

|

|

131,000 |

|

Dec-18-2019 |

|

i |

|

|

Total unsecured credit facility |

|

|

|

$ |

73,000 |

|

$ |

131,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unsecured term loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$150 Million Wells Fargo Unsecured Term Loan A |

|

L + 1.65 |

% |

|

150,000 |

|

|

150,000 |

|

Mar-31-2022 |

|

ii |

|

|

$150 Million Wells Fargo Unsecured Term Loan B |

|

L + 1.70 |

% |

|

— |

|

|

— |

|

Mar-21-2021 |

|

ii |

|

|

Total unsecured term loans |

|

|

|

$ |

150,000 |

|

$ |

150,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unsecured notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$50 Million Series A Unsecured Notes |

|

4.98 |

% |

|

50,000 |

|

|

50,000 |

|

Oct-1-2024 |

|

ii |

|

|

$50 Million Series B Unsecured Notes |

|

4.98 |

% |

|

50,000 |

|

|

50,000 |

|

Jul-1-2026 |

|

ii |

|

|

$80 Million Series C Unsecured Notes |

|

4.42 |

% |

|

80,000 |

|

|

80,000 |

|

Dec-30-2026 |

|

ii |

|

|

$100 Million Series D Unsecured Notes |

|

4.32 |

% |

|

100,000 |

|

|

— |

|

Feb-20-2025 |

|

ii |

|

|

$20 Million Series E Unsecured Notes |

|

4.42 |

% |

|

20,000 |

|

|

— |

|

Feb-20-2027 |

|

ii |

|

|

Total unsecured notes |

|

|

|

$ |

300,000 |

|

$ |

180,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage notes payable (secured debt): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sun Life Assurance Company of Canada (U.S.) |

|

6.05 |

% |

$ |

3,393 |

(3) |

$ |

3,445 |

(3) |

Jun-1-2016 |

|

ii |

|

|

Webster Bank, National Association |

|

4.22 |

% |

|

5,636 |

|

|

5,677 |

|

Aug-4-2016 |

|

ii |

|

|

Union Fidelity Life Insurance Co. |

|

5.81 |

% |

|

6,017 |

(3) |

|

6,103 |

(3) |

Apr-30-2017 |

|

ii |

|

|

Webster Bank, National Association |

|

3.66 |

% |

|

3,013 |

|

|

3,035 |

|

May-29-2017 |

|

ii |

|

|

Webster Bank, National Association |

|

3.64 |

% |

|

3,244 |

|

|

3,268 |

|

May-31-2017 |

|

ii |

|

|

Wells Fargo, National Association |

|

5.90 |

% |

|

4,165 |

(3) |

|

4,182 |

(3) |

Aug-1-2017 |

|

iii |

|

|

Connecticut General Life Insurance Company -1 Facility |

|

6.50 |

% |

|

57,835 |

|

|

58,050 |

|

Feb-1-2018 |

|

iv |

|

|

Connecticut General Life Insurance Company -2 Facility |

|

5.75 |

% |

|

58,825 |

|

|

59,065 |

|

Feb-1-2018 |

|

iv |

|

|

Connecticut General Life Insurance Company -3 Facility |

|

5.88 |

% |

|

16,587 |

|

|

16,647 |

|

Feb-1-2018 |

|

iv |

|

|

Wells Fargo Bank, National Association CMBS Loan |

|

4.31 |

% |

|

65,146 |

|

|

65,567 |

|

Dec-1-2022 |

|

v |

|

|

Total mortgage notes payable |

|

|

|

$ |

223,861 |

|

$ |

225,039 |

|

|

|

|

|

|

Total unamortized fair market value premium |

|

|

|

|

270 |

|

|

308 |

|

|

|

|

|

|

Total carrying value mortgage notes payable |

|

|

|

$ |

224,131 |

|

$ |

225,347 |

|

|

|

|

|

|

Total / weighted average interest rate(4) |

|

4.47 |

% |

$ |

747,131 |

|

$ |

686,347 |

|

|

|

|

|

|

(1) |

Current interest rate as of March 31, 2015. At March 31, 2015 and December 31, 2014, the one-month LIBOR (“L”) was 0.17625% and 0.17125%, respectively. The current interest rate presented in the table above are not adjusted to include the amortization of deferred financing fees incurred in obtaining debt or the unamortized fair market value premium. |

|

(2) |

Prepayment terms consist of (i) pre-payable with no penalty; (ii) pre-payable with penalty; (iii) pre-payable with penalty beginning May 1, 2017, however can be defeased; (iv) pre-payable without penalty six months prior to the maturity date; and (v) not pre-payable, however can be defeased beginning January 1, 2016. |

|

(3) |

The principal outstanding does not include an unamortized fair market value premium. |

|

(4) |

The weighted average interest rate was calculated using the current swapped notional amount of $300 million of debt, and excludes fair market value premiums. |

The borrowing capacity for the Wells Fargo, National Association (“Wells Fargo”) unsecured credit facility as of March 31, 2015, was $227.0 million. As of March 31, 2015 there was no remaining borrowing capacity for the Wells Fargo unsecured term loan A. The remaining borrowing capacity for the Wells Fargo unsecured term loan B as of

14

March 31, 2015 was $150.0 million. The total borrowing capacity on the combined unsecured credit facility and unsecured term loan as of March 31, 2015 was $377.0 million.

On January 22, 2015, the Company assumed a mortgage note of approximately $11.8 million in connection with the acquisition of the Burlington, NJ property. The mortgage note was immediately paid in full at par in conjunction with the acquisition.

On February 20, 2015, the Company issued the $100 million 4.32% Series D 10-year unsecured notes and the $20 million 4.42% Series E 12-year unsecured notes in the amount of $100 million and $20 million, respectively.

The Company incurred $1.0 million of deferred financing fees during the three months ended March 31, 2015. Deferred financing fees, net of accumulated amortization were $8.4 million and $7.8 million as of March 31, 2015 and December 31, 2014, respectively, and are included in prepaid expenses and other assets on the accompanying Consolidated Balance Sheets. During the three months ended March 31, 2015 and March 31, 2014, amortization of deferred financing fees included in interest expense was $0.3 million and $0.3 million, respectively.

Financial Covenant Considerations

The Company’s unsecured credit facility, unsecured term loans, unsecured notes, and mortgage notes are subject to ongoing compliance with a number of customary financial covenants. The Company was in compliance with all financial covenants as of March 31, 2015 and December 31, 2014.

Fair Value of Debt

The fair value of the Company’s debt was determined by discounting the future cash flows using the current rates at which loans would be made to borrowers with similar credit ratings for loans with similar remaining maturities, similar terms, and similar loan-to-value ratios. The discount rates ranged from 1.33% to 3.89% and 1.32% to 4.27% at March 31, 2015 and December 31, 2014, respectively, and were applied to each individual debt instrument. The fair value of the Company’s debt is based on Level 3 inputs. Level 3 is defined as unobservable inputs. The following table presents the aggregate carrying value of the Company’s debt and the corresponding estimate of fair value as of March 31, 2015 and December 31, 2014 (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2015 |

|

December 31, 2014 |

||||||||

|

|

|

Principal |

|

Fair |

|

Principal |

|

Fair |

||||

|

|

|

Outstanding |

|

Value |

|

Outstanding |

|

Value |

||||

|

Unsecured credit facility |

|

$ |

73,000 |

|

$ |

73,000 |

|

$ |

131,000 |

|

$ |

131,000 |

|

Unsecured term loans |

|

|

150,000 |

|

|

150,493 |

|

|

150,000 |

|

|

150,000 |

|

Unsecured notes |

|

|

300,000 |

|

|

318,941 |

|

|

180,000 |

|

|

187,587 |

|

Mortgage notes payable |

|

|

223,861 |

|

|

239,366 |

|

|

225,039 |

|

|

237,602 |

|

Total principal amount |

|

|

746,861 |

|

$ |

781,800 |

|

|

686,039 |

|

$ |

706,189 |

|

Total unamortized fair market value premium |

|

|

270 |

|

|

|

|

|

308 |

|

|

|

|

Total carrying value |

|

$ |

747,131 |

|

|

|

|

$ |

686,347 |

|

|

|

5. Use of Derivative Financial Instruments

Risk Management Objective of Using Derivatives

The Company’s use of derivative instruments is limited to the utilization of interest rate swaps to manage interest rate risk exposure on existing and future liabilities and not for speculative purposes. The principal objective of such arrangements is to minimize the risks and/or costs associated with the Company’s operating and financial structure.

On January 8, 2015, the Company entered in to seven interest rate swaps, thereby fixing the interest rates of all of the Company’s outstanding variable rate debt as of March 31, 2015.

15

The following table details the Company’s outstanding interest rate swaps as of March 31, 2015 (collectively, the “Unsecured Debt Swaps”) (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current |

|

|

|

|

Fixed |

|

Variable |

|

|

|

|

|

Interest Rate |

|

|

|

Effective |

|

Notional |

|

|

|

|

Interest |

|

Interest |

|

|

|

|

|

Derivative Counterparty |

|

Trade Date |

|

Date |

|

Amount |

|

|

Fair Value |

|

Rate |

|

Rate |

|

Maturity Date |

|

|

|

PNC Bank, N.A. |

|

Sep-14-2012 |

|

Oct-10-2012 |

|

$ |

10,000 |

|

$ |

4 |

|

0.7945 |

% |

One-month L |

|

Sep-10-2017 |

|

|

Bank of America |

|

Sep-14-2012 |

|

Oct-10-2012 |

|

|

10,000 |

|

$ |

4 |

|

0.7945 |

% |

One-month L |

|

Sep-10-2017 |

|

|

UBS AG |

|

Sep-14-2012 |

|

Oct-10-2012 |

|

|

10,000 |

|

$ |

4 |

|

0.7945 |

% |

One-month L |

|

Sep-10-2017 |

|

|

Royal Bank of Canada |

|

Sep-14-2012 |

|

Oct-10-2012 |

|

|

10,000 |

|

$ |

4 |

|

0.7945 |

% |

One-month L |

|

Sep-10-2017 |

|

|

RJ Capital Services, Inc. |

|

Sep-14-2012 |

|

Oct-10-2012 |

|

|

10,000 |

|

$ |

3 |

|

0.7975 |

% |

One-month L |

|

Sep-10-2017 |

|

|

Bank of America |

|

Sep-20-2012 |

|

Oct-10-2012 |

|

|

25,000 |

|

$ |

35 |

|

0.7525 |

% |

One-month L |

|

Sep-10-2017 |

|

|

RJ Capital Services, Inc. |

|

Sep-24-2012 |

|

Oct-10-2012 |

|

|

25,000 |

|

$ |

51 |

|

0.7270 |

% |

One-month L |

|

Sep-10-2017 |

|

|

Regions Bank |

|

Mar-1-2013 |

|

Mar-01-2013 |

|

|

25,000 |

|

$ |

6 |

|

1.3300 |

% |

One-month L |

|

Feb-14-2020 |

|

|

Capital One, N.A. |

|

Jun-13-2013 |

|

Jul-01-2013 |

|

|

50,000 |

|

$ |

(801) |

|

1.7030 |

% |

One-month L |

|

Feb-14-2020 |

|

|

Capital One, N.A. |

|

Jun-13-2013 |

|

Aug-01-2013 |

|

|

25,000 |

|

$ |

(427) |

|

1.6810 |

% |

One-month L |

|

Feb-14-2020 |

|

|

Regions Bank |

|

Sep-30-2013 |

|

Feb-03-2014 |

|

|

25,000 |

|

$ |

(782) |

|

1.9925 |

% |

One-month L |

|

Feb-14-2020 |

|

|

Royal Bank of Canada |

|

Jan-8-2015 |

|

Mar-20-2015 |

|

|

25,000 |

|

$ |

(297) |

|

1.7090 |

% |

One-month L |

|

Mar-21-2021 |

|

|

The Toronto-Dominion Bank |

|

Jan-8-2015 |

|