Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - LIFE TIME FITNESS, INC. | d916840dex32.htm |

| EX-31.2 - EX-31.2 - LIFE TIME FITNESS, INC. | d916840dex312.htm |

| EX-31.1 - EX-31.1 - LIFE TIME FITNESS, INC. | d916840dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended: December 31, 2014

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-32230

Life Time Fitness, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Minnesota | 41-1689746 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

2902 Corporate Place, Chanhassen, Minnesota 55317

(Address of Principal Executive Offices, Including Zip Code)

(952) 947-0000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $.02 par value | New York Stock Exchange | |

| Preferred Share Purchase Rights | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Table of Contents

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (do not check if smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting common stock held by non-affiliates of the registrant as of June 30, 2014 was $1,779,437,157, based on the closing sale price for the registrant’s common stock on that date.

The number of shares outstanding of the registrant’s common stock as of April 27, 2015 was 39,043,889.

DOCUMENTS INCORPORATED BY REFERENCE

None.

2

Table of Contents

| 4 | ||||||

| 5 | ||||||

| Item 10. |

5 | |||||

| Item 11. |

8 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

42 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence. |

44 | ||||

| Item 14. |

45 | |||||

| 47 | ||||||

| Item 15. |

47 | |||||

3

Table of Contents

This Amendment No. 1 on Form 10-K/A (the “Amendment”) amends the Annual Report on Form 10-K of Life Time Fitness, Inc. (the “Company,” “our” or “we”) for the year ended December 31, 2014, which was originally filed with the Securities and Exchange Commission (“SEC”) on March 2, 2015 (the “Original Filing”), and is being filed to solely for the purpose of providing the information required by Items 10, 11, 12, 13, and 14 of Part III.

This information was previously omitted from the Original Filing in reliance on General Instruction G(3) to Form 10-K, which permits the information in the above referenced items to be incorporated in the Form 10-K by reference from our definitive proxy statement if such statement is filed no later than 120 days after our fiscal year end. We are filing this Amendment to include Part III information in our Form 10-K because a definitive proxy statement containing this information will not be filed by us within 120 days after the end of the fiscal year covered by the Form 10-K. The reference on the cover of the Original Filing to the incorporation by reference to portions of our definitive proxy statement into Part III of the Original Filing is hereby deleted.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended, Part III, Items 10 through 14 of the Original Filing are hereby amended and restated in their entirety, and Part IV, Item 15 of the Original Filing is hereby amended and restated in its entirety, with the only changes being the addition of Exhibits 31.3, 31.4 and 32.2 filed herewith and related footnotes.

Except as specifically set forth herein, this Amendment does not amend or otherwise update any other information in the Original Filing. Accordingly, this Amendment should be read in conjunction with the Original Filing and with our filings with the SEC subsequent to the Original Filing.

4

Table of Contents

| Item 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

Directors

All of the directors named below are the current directors of our company. The following table sets forth certain information regarding each director of our company:

| Name |

Age | Position | ||

| Bahram Akradi |

53 | Chairman of the Board of Directors, President and Chief Executive Officer | ||

| Giles H. Bateman |

70 | Director | ||

| Jack W. Eugster |

69 | Director | ||

| Guy C. Jackson |

73 | Director | ||

| John K. Lloyd |

69 | Director | ||

| Martha A. Morfitt |

57 | Director | ||

| John B. Richards |

66 | Director | ||

| Joseph S. Vassalluzzo |

67 | Director |

Set forth below are the biographies of each director, as well as a discussion of the specific experience, qualifications, attributes and skills that led to the board of directors’ conclusion that the individual should serve as a director:

Bahram Akradi founded our company in 1992 and has been a director since our inception. Mr. Akradi was elected chief executive officer and chairman of the board of directors in May 1996. In December 2009, Mr. Akradi was appointed president of our company, a position he also held from 1992 through December 2007. Mr. Akradi has over 30 years of experience in healthy way of life initiatives. From 1984 to 1989, he led U.S. Swim & Fitness Corporation as its co-founder and executive vice president. Mr. Akradi was a founder of the health and fitness Industry Leadership Council.

Through his leadership roles in our industry, Mr. Akradi has gained extensive experience in the development and operation of health and fitness companies. As our founder, he has significant knowledge of all facets of our company, including the day-to-day operations of our in-center programs and offerings and the construction and design of our centers. Mr. Akradi’s long history with our company, combined with his leadership skills and operating experience, makes him particularly well suited to be our chairman.

Giles H. Bateman was elected a director of our company in March 2006. Mr. Bateman was one of four co-founders of Price Club in 1976 and served as its chief financial officer and vice chairman until 1991. Mr. Bateman served as non-executive chairman of CompUSA Inc., a publicly traded retailer of computer hardware, software, accessories and related products, from 1993 until he retired in 2000. Mr. Bateman serves as a director and the chair of the audit committee of WD-40 Company. Within the last five years, Mr. Bateman also served on the board of directors of United PanAm Finance Corporation.

Mr. Bateman has more than 20 years of public company operating experience, including as founder, chief financial officer and vice chairman of big-box retailer, Price Club, and has served on numerous public company boards. In addition to his leadership experience with a big-box retailer, he also has background and expertise in finance through his tenure as chief financial officer at Price Club as well as his service on numerous audit committees in the past. This experience allows him to provide guidance and counsel in his role as chairman of our finance committee.

Jack W. Eugster was elected a director of our company in October 2009. Mr. Eugster served as the chairman, president and chief executive officer of Musicland Stores Corporation, a retail music and home video company, for 21 years before his retirement in 2001. Prior to Musicland, Mr. Eugster held executive leadership positions with The Gap, Inc. and Target Corporation. He currently serves on the board of directors of two other public companies, Graco Inc. and Black Hills Corporation. Within the last five years, Mr. Eugster also served on the board of directors of Donaldson Company, Inc.

Mr. Eugster has a history of demonstrated leadership with major retail organizations. His significant experience in leadership positions, including chief executive officer, of retail companies is particularly valuable for us as he can provide strategic input on center development and in-center offerings and programs. Mr. Eugster also brings extensive governance experience to our board and company as he has served as a director of numerous public companies, including big-box retailers.

5

Table of Contents

Guy C. Jackson was elected a director of our company in March 2004. In June 2003, Mr. Jackson retired from the accounting firm of Ernst & Young LLP after 35 years with the firm and one of its predecessors, Arthur Young & Company. During his career, Mr. Jackson served as the audit partner for numerous public companies. He also serves as a director, and the chair of the audit committee, of two other public companies, Cyberonics, Inc. and Digi International Inc. Within the last five years, Mr. Jackson has also served on the board of directors, and chaired the audit committees, of EpiCept Corporation and Urologix, Inc.

Mr. Jackson brings more than 35 years of finance, audit and accounting experience to our board. Along with his years of experience with the accounting firm of Ernst & Young, LLP serving many different companies and industries, Mr. Jackson is currently also a director, and chair of the audit committee, for two other public companies. Mr. Jackson’s significant experience in the finance area allows him to provide input to our finance, accounting and internal audit functions and the external audit process. This experience, and his service on other boards and audit committees, qualifies Mr. Jackson to serve as chairman of our audit committee.

John K. Lloyd was elected a director of our company in October 2009. Since 1997, Mr. Lloyd has been the president of Meridian Health, a New Jersey-based integrated health system which encompasses five hospitals and an extensive network of non-hospital healthcare services. Prior to Meridian Health, Mr. Lloyd held executive leadership positions with Jersey Shore University Medical Center, Modern Health Affiliates, Inc. and Episcopal Hospital. He currently serves as chairman of the board of directors of QualCare Preferred Providers and QualCare Alliance Networks, Inc.

As the president of Meridian Health, Mr. Lloyd has significant experience in the strategic development and operation of a network of health and wellness businesses within one corporate system. This experience allows Mr. Lloyd to provide valuable insight and guidance on organizational structure and employee programs within the health and wellness sector, as well as our technological systems and information safeguarding processes and procedures.

Martha (Marti) A. Morfitt was elected a director of our company in August 2008. Ms. Morfitt is a principal of River Rock Partners, Inc., a business and cultural transformation consulting firm, a position she has held since 2008. Ms. Morfitt is the former chief executive officer of Airborne, Inc., a privately held manufacturer and marketer of dietary supplements. Ms. Morfitt held this position from October 2009 through April 2012. Prior to her service at Airborne, Inc., Ms. Morfitt was the president and chief executive officer of CNS, Inc., a manufacturer and marketer of consumer healthcare products. She held this position from 2001 through March 2007. From 1998 to 2001, she was chief operating officer of CNS, Inc. Ms. Morfitt left her position at CNS, Inc. effective March 2007 as a result of the acquisition of CNS, Inc. by GlaxoSmithKline plc in December 2006. Prior to 1998, Ms. Morfitt held an executive position at the Pillsbury Company. Ms. Morfitt is also a director of Graco Inc. and lululemon athletica inc. Within the last five years, Ms. Morfitt has also served on the board of directors of Solta Medical, Inc.

As the president and chief executive officer of CNS, Inc., Ms. Morfitt gained significant experience leading a publicly held consumer products company. Ms. Morfitt also gained significant leadership experience in the consumer products industry as the chief executive officer of Airborne, Inc. and as a senior executive at the Pillsbury Company. In addition to her leadership experience at CNS, Inc. and Airborne, Inc., Ms. Morfitt also serves as a director of two other public companies. Ms. Morfitt is well suited as a director of our company, as her consumer marketing and business strategy expertise allows Ms. Morfitt to provide insight on strategic plans relating to our business.

John B. Richards was elected a director of our company in October 2006. Mr. Richards is currently the chief executive officer of The Joint Corp., a publicly traded franchisor of chiropractic clinics, a position he has held since July 2014. Prior to this position, Mr. Richards was a managing partner of the New England Consulting Group, a firm specializing in creative marketing and growth strategies for a wide range of branded consumer businesses, where Mr. Richards served as interim consulting executive to various retail companies from September 2007 to July 2014. In addition, Mr. Richards previously served as the president and chief executive officer of Elizabeth Arden Red Door Spa Holdings from October 2001 until May 2006. Elizabeth Arden Red Door Spa Holdings is a developer and operator of prestige day and resort spas. Mr. Richards also served as President of North American Operations of Starbucks Coffee Company, and held senior leadership and management positions with Four Seasons Hotels, Inc., Royal Viking Line, McKinsey & Company and The Procter & Gamble Company. Mr. Richards currently serves on the board of directors of The Joint Corp.

In his senior leadership roles at companies in the hospitality industry, Mr. Richards gained significant marketing and operating experience. Also, his expertise in marketing health and beauty services, gained through his role as president and chief executive officer at Elizabeth Arden Red Door Spa Holdings and his current role at The Joint Corp., is particularly valuable as we continue to provide health and wellness services in a resort-like environment.

6

Table of Contents

Joseph S. Vassalluzzo was elected a director of our company in October 2006 and our lead director in October 2008. Since August 2005, Mr. Vassalluzzo has been an independent advisor to retail organizations, with a primary emphasis on real estate. From 1989 until August 2005, Mr. Vassalluzzo held executive and senior leadership positions with Staples, Inc., an office products retailer, including vice chairman from 2000 to 2005. Previously, Mr. Vassalluzzo has held management, sales, operations and real estate positions with Mobile Corp., Amerada Hess Corp. and American Stores Company. Mr. Vassalluzzo is the non-executive chairman of the Board of Trustees of Federal Realty Investment Trust, a publicly held real estate investment trust. He is also a director, chairman of the finance and integration committee and member of the audit committee of Office Depot, Inc. Within the last five years, Mr. Vassalluzzo also served on the board of directors, and chaired the nominating committee, for iParty Corporation, a publicly held chain of party supply superstores, until its sale to Party City Holdings Inc. in May 2013.

Mr. Vassalluzzo has a history of demonstrated leadership in real estate acquisition and expansion in his roles at Staples, Inc. His real estate and expansion experience is particularly valuable as we continue to research and develop sites for new centers. His executive and senior leadership positions at numerous retailers make him well suited to be our lead director.

None of the above directors is related to each other or to any of our executive officers.

Section 16(a) Beneficial Ownership Reporting Compliance

Based upon a review of reports and written representations furnished to it, our company believes that during the fiscal year ended December 31, 2014, all filings with the SEC by its executive officers and directors complied with requirements for reporting ownership and changes in ownership of our stock pursuant to Section 16(a) of the Exchange Act.

Code of Business Conduct and Ethics

We have adopted the Life Time Fitness, Inc. Code of Business Conduct and Ethics, which applies to all of our employees, directors, agents, consultants and other representatives. The Code of Business Conduct and Ethics includes particular provisions applicable to our senior financial management, which includes our chief executive officer, chief financial officer, controller and other employees performing similar functions. A copy of our Code of Business Conduct and Ethics is available on the Corporate Governance section of the Investor Relations page on our website at lifetimefitness.com. We intend to post on our website any amendment to, or waiver from, a provision of our Code of Business Conduct and Ethics that applies to any director or officer, including our principal executive officer, principal financial officer, principal accounting officer, controller and other persons performing similar functions, promptly following the date of such amendment or waiver.

Audit Committee

Our company has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act. Our audit committee consists of Messrs. Jackson (Chair) and Eugster and Ms. Morfitt. Our board of directors has determined that all members of our audit committee are “independent,” as defined in Section 10A of the Securities Exchange Act of 1934 and pursuant to the rules of the New York Stock Exchange (“NYSE”), and that each member of our audit committee also qualifies as an “audit committee financial expert,” as defined by applicable regulations of the SEC.

7

Table of Contents

| Item 11. | EXECUTIVE COMPENSATION. |

Compensation Discussion and Analysis

This compensation, discussion and analysis (“CD&A”) provides information about our company’s compensation philosophy and 2014 executive compensation programs for the following named executive officers (“NEOs”):

| Name |

Title |

Year Employed | ||

| Bahram Akradi |

Chairman, President and Chief Executive Officer |

1992 | ||

| Jeffrey G. Zwiefel |

Executive Vice President and Chief Operating Officer |

1998 | ||

| Eric J. Buss |

Executive Vice President and Chief Financial Officer |

1999 | ||

| Tami A. Kozikowski |

Executive Vice President, Life Spa and Chief Administrative Officer |

2012 | ||

| Jess R. Elmquist |

Executive Vice President, Human Resources and Life Time University |

2005 | ||

| Michael R. Robinson(1) |

Former Executive Vice President and Chief Financial Officer |

2002 |

| (1) | Michael R. Robinson retired from his position as executive vice president and chief financial officer effective March 1, 2014. Mr. Robinson’s separation arrangement is summarized on page 24. |

While you should read the entire CD&A and the related compensation tables beginning on page 29 to fully understand our company’s executive compensation program, you may find the following helpful:

| Summary |

Page |

Description | ||||

| Executive Summary | 9 | We provide an executive summary, which includes: | ||||

| • |

Our 2014 performance; | |||||

| • | A summary of our 2013 and 2014 shareholder engagement and changes made in connection with the outreach; and | |||||

| • | 2014 compensation highlights. | |||||

| Compensation Philosophy | 13 | We describe our compensation committee’s compensation philosophy. | ||||

| Process for Establishing 2014 Compensation | 14 | We provide information on our compensation committee and independent compensation consultant as well as the roles that our executive officers play in setting NEO compensation. We describe the process in which 2014 executive compensation was established, which includes a summary of the market data considered in establishing our compensation program, our compensation committee’s evaluation of the compensation and the company’s performance and a review of the chief executive officer’s realized compensation. | ||||

| 2014 Executive Compensation Program | 18 | We summarize the elements and mix of our 2014 executive compensation and then summarize the core elements in tabular format. We then summarize our executive compensation program for 2014, which is comprised of cash (both base salary and annual incentive compensation), equity compensation in the form of annual grants of restricted stock (both time-based and performance vesting) and other items. We also provide a reconciliation of GAAP to non-GAAP financial metrics, which were used in determining the attainment of 2014 performance goals for our annual cash incentive compensation and restricted stock grants. | ||||

| Governance | 26 | We summarize our compensation-related governance policies and other considerations. | ||||

| May 2012 Grant | 27 | We provide disclosures surrounding the May 2012 grant of performance-based restricted stock, which was a grant designed to encourage transformational company performance. | ||||

8

Table of Contents

Executive Summary

2014 Performance

As shown below, we had strong financial performance in 2014 and continued to execute on our long term strategy of accelerated growth. We did miss, however, some of our previously set performance goals and, as a consequence, our incentive compensation elements paid out at below target levels. See page 25 for a reconciliation of the adjusted non-GAAP performance metrics to the corresponding GAAP financial metrics referenced throughout this CD&A.

| • | Total revenue for the year grew 7.0% to $1.291 billion from $1.206 billion in 2013. Reported net income for the year decreased 5.5% to $114.4 million from $121.0 million in 2013, and net income, adjusted to exclude non-recurring expenses associated with the exploration of converting our real estate assets into a real estate investment trust (“REIT”), the Telephone Consumer Protection Act (“TCPA”) litigation settlement , the immaterial correction of the accounting treatment of a previous financing transaction and the impact of the adjustment of a contingent liability associated with a prior acquisition, decreased to $117.8 million from $121.0 million in 2013. |

| • | Our company’s 2014 adjusted income before income taxes (also referred to as earnings before taxes, or “EBT”, throughout this CD&A) adjusted to exclude non-recurring expenses associated with the exploration of the REIT and the immaterial correction of the accounting treatment of a previous financing transaction was $192.8 million, which was less than our company’s budgeted EBT for 2014 of $211.2 million. As a result, our company’s actual payout of annual cash incentive compensation was at 91.3% of target annual cash incentive compensation. |

| • | Our company’s adjusted diluted EPS, adjusted to exclude non-recurring expenses associated with the exploration of the REIT, the TCPA litigation settlement and the immaterial correction of the accounting treatment of a previous financing transaction, for 2014 was $3.12 per share, which was greater than our company’s budgeted diluted EPS for 2014 of $3.10 per share. As a result, none of the shares subject to the NEOs’ annual restricted stock grants associated with this metric were forfeited, and the shares will vest in 25% installments over a four-year period (with the first installment having vested on March 1, 2015). |

| • | Because we did not achieve the aggressive 2014 financial objectives associated with additional restricted stock grants to our NEOs in 2014, 100% of those awards were forfeited. |

| • | With respect to the May 2012 long-term performance-based restricted stock awards, our company continues to believe that achievement of any of the cumulative diluted EPS or the return on invested capital (“ROIC”) targets are not probable. Consequently, we expect all such shares to be forfeited unless accelerated vesting was to occur in connection with a change in control transaction. To provide context for the future aggressiveness of the diluted EPS targets, the average quarterly year-over-year adjusted diluted EPS growth that would be necessary to meet 2015 and 2016 diluted EPS targets for the four quarters between January 1, 2015 and December 31, 2015 and the eight quarters between January 1, 2015 and December 31, 2016 is 97.1% and 50.6%, respectively. |

| • | In 2014, we opened six centers, of which three were in new markets. We now operate 113 centers in 32 markets in 25 states and one Canadian province. We continued to develop a pipeline for new clubs to execute on our long-term growth plans, including plans for six new center openings in existing and new markets in 2015. |

| • | Our company’s compound annual growth rate for revenue for the three-year period ended 2014 was 7.0%. |

9

Table of Contents

Summary of Shareholder Engagement and Resulting Change

Shareholder Engagement Relating to 2014 Annual Meeting

In response to a shareholder vote of 62.1% at our 2013 annual meeting approving the compensation of our NEOs as described in our 2013 proxy statement, at our compensation committee’s direction we contacted our 20 largest shareholders (representing approximately 73% of our shares), and had meaningful discussions with holders of approximately 52% of our shares. The discussions helped our compensation committee understand any concerns that may have led some of our shareholders to vote against the compensation and to receive general feedback on our executive compensation program. Conversations with two of our largest shareholders also included Mr. Vassalluzzo, the chair of our compensation committee. As a result of this feedback, we made a number of changes to our executive compensation policies and practices as described below.

Following the mailing of our proxy statement for our 2014 annual meeting, we again contacted our 20 largest shareholders to discuss the proxy statement and any concerns or comments regarding executive compensation that they may have.

In response to our outreach and the changes described in our proxy statement for our 2014 annual meeting, the shareholders vote at our 2014 annual meeting in favor of the compensation of our NEOs increased to 80.7%.

Shareholder Engagement in 2015

For 2015, again at our compensation committee’s direction we contacted shareholders representing approximately 55.98% of our shares, and had meaningful discussions with holders of approximately 29.85% of our shares. The shareholders we spoke to appreciated our continued engagement, encouraging efforts to ensure “pay for performance.”

Resulting Changes

As a result of feedback from our shareholders, over the past two years we made a number of changes to our executive compensation policies and practices as described on page 11, including the following:

| • | Our compensation committee made significant changes to our 2014 executive compensation program as described in the table below, including: |

| • | The compensation committee increased the number of shares subject to forfeiture for our annual restricted stock grant from 25% to 50%. |

| • | The compensation committee granted a new performance-based restricted stock grant that included four rigorous performance targets. If any one of those performance targets were not met, 100% of the shares would be forfeited. |

| • | Of most recent significance, the compensation committee provided that the maximum payout under our annual cash incentive program for the chief executive officer will be 200% of his base salary (and 100% of base salary with respect to the other NEOs). |

| • | We disclosed the performance metrics surrounding the May 2012 grant of performance-based restricted stock. |

| • | We adopted a number of governance-related compensation policies, including: |

| • | A stock ownership policy; |

| • | All future restricted equity grants will include double trigger vesting in the event of a change of control; |

| • | A clawback policy; |

| • | An anti-hedging policy; and |

| • | A cap on annual incentive cash compensation for the chief executive officer of 200% of his base salary (with a 100% base salary cap for the other NEOs). |

We already had an anti-pledging policy.

10

Table of Contents

The following table summarizes the primary comments from our shareholders and the actions we took in response to those comments:

| Shareholder Comments |

Compensation Committee Comments and/or Action Taken | |

| The most common comment was to ensure “pay for performance.”

• Some requested that executive compensation be aligned with total shareholder return (“TSR”).

• A few shareholders mentioned that they compared the CEO’s annual compensation against our one- and three- year TSR (as compared to our peer group’s CEO compensation against their one- and three- year TSRs).

• Many suggested use of a return metric, with ROIC as the most common metric referenced.

• A few shareholders favored TSR as a metric, while others strongly resisted its use.

• A few shareholders also requested that our compensation committee consider relative performance metrics. |

Our 2014 executive compensation program included the following changes:

• On February 25, 2014, our compensation committee made two restricted stock grants to our NEOs—the annual long-term time-based restricted stock grant, a portion of which is subject to an EPS performance condition, and a new performance- and time-based restricted stock grant, all of which is subject to aggressive performance conditions.

• With regard to the annual long-term time-based restricted stock grant, which vests in 25% installments over a four-year period, up to 50% of the shares (as opposed to 25% of the shares as provided in prior years) were subject to forfeiture if the company’s diluted EPS for 2014 fiscal year did not equal or exceed our budgeted diluted EPS for the year.

• With regard to the performance-based restricted stock grants, 100% of the shares would be forfeited if our company failed to meet any one of the following four performance targets:

• 12% TSR for fiscal 2014;

• Diluted EPS for fiscal 2014 of $3.23, representing 10% growth;

• 2014 revenue of $1.326 billion, representing 10% revenue growth; and

• Earnings before Interest, Taxes, Depreciation and Amortization (“EBITDA”) for 2014 of $374.3 million (with EBITDA calculated in the same manner as provided in our earnings releases), representing a 10% EBITDA growth.

Because these targets were not met in 2014, 100% of the performance-based restricted stock grants were forfeited.

For 2014, 57% of the cash portion of Mr. Akradi’s total target cash compensation and 36% of our other NEOs’ total target cash compensation (excluding Mr. Robinson’s) is subject to a performance metric. The financial objective for such cash compensation is EBT for the year-to-date period as compared against our 2014 budget.

Seventy percent of Mr. Akradi’s total direct compensation (which we define as total target cash compensation and incentive compensation in the form of annual equity grants) for 2014 was in the form of stock, the value of which directly ties to stock appreciation. | |

|

Many of our shareholders requested disclosure of the performance metrics underlying our May 2012 grant of performance-based restricted stock. |

Our company filed a current report on Form 8-K on December 20, 2013, which disclosed the aggressive, “stretch” long-term diluted EPS and ROIC performance goals related to the May 2012 grant and an unredacted copy of the underlying restricted stock agreement. See page 27 for more discussion of this grant. | |

|

Certain shareholders identified governance and risk mitigation policies related to executive compensation as factors they consider when evaluating our overall executive compensation program. |

Our compensation committee and/or board took the following actions related to our 2014 executive compensation:

• Adopted a stock ownership policy.

• Resolved that that all future restricted equity grants would include double trigger vesting in the event of a change of control. | |

|

• Adopted a clawback policy. | ||

|

• Adopted an anti-hedging policy. | ||

|

• Adopted a cap on annual incentive cash compensation for the chief executive officer of 200% of his base salary (with a 100% base salary cap for the other NEOs). | ||

|

We already had an anti-pledging policy.

| ||

11

Table of Contents

2014 Compensation Highlights

Establishing 2014 Compensation

In the fourth quarter of 2013, the compensation committee set executive compensation for 2014 as part of its annual review of our most recent three-year compensation program. Our compensation committee considered our then most recent financial performance as compared to both our peers and a broader selection of surveyed companies as discussed on page 15. Most important, our performance was in the top quartile for the trailing 12 month, three year and five year periods for revenue growth and EBITDA margin versus our peer group, and was either in or near the top quartile for the trailing 12 month, three year and five year periods for revenue growth and EBITDA margin versus our surveyed companies. Our market capitalization was in the 72nd percentile of our peer group and our trailing 12 month revenue was in the 59th percentile.

As a result of the positive and favorable performance of our company compared to our peer group and the survey data—generally delivering top-quartile performance versus revenue growth and EBITDA margin—as well as the factors discussed in our Compensation Philosophy section beginning on page 13, the compensation committee determined to increase our NEOs’ total direct compensation as set forth on pages 21 through 23 of this CD&A. In addition, the compensation committee noted that while our NEO’s total target direct compensation was high compared to the peer group, the increased forfeiture component of the annual stock grants and inclusion of aggressive performance metrics in much of the compensation package would serve as appropriate incentive to the NEOs.

Other highlights include:

| • | With respect to our 2014 compensation, our compensation committee engaged Mercer, its independent compensation consultant, to update its market data with respect to our peers and to provide additional, broader survey data to evaluate our executive compensation program. The compensation committee met with the consultant in executive sessions separate from management. |

| • | For our 2014 compensation we continued to engage in, or adopt, a number of best practices with respect to executive compensation: |

| • | We adopted a number of compensation-related governance policies and practices, including a stock ownership policy, double trigger vesting for future equity grants, a clawback policy and an anti-hedging policy. We had already adopted an anti-pledging policy. |

| • | A significant portion of Mr. Akradi’s total target cash compensation continued to be tied to a performance metric; fifty-seven percent. |

| • | A significant portion of Mr. Akradi’s restricted stock grants were subject to forfeiture; fifty-nine percent. |

| • | We continued to not provide tax gross-ups for perquisites or other benefits. |

| • | Our compensation committee continued to be comprised only of independent directors. |

| • | Our company’s management again conducted a comprehensive risk analysis of our executive compensation program to ensure that our program does not encourage inappropriate risk-taking and reviewed their conclusions with the compensation committee. In particular, while the performance metrics and targets are designed to incent performance, they do not incent our NEOs to engage in inappropriate risk taking. See page 27 for a full discussion of our comprehensive risk analysis of our executive compensation program. |

12

Table of Contents

| • | We engaged with our shareholders and made changes to our executive compensation program based on their feedback as described more fully above. |

| • | In late 2014, the compensation committee adopted a cap on the amount of annual incentive cash compensation payable to the chief executive officer equal to 200% of his base salary (with a 100% of base salary cap for the other NEOs). |

Compensation Philosophy

Compensation Committee’s Compensation Philosophy

Our compensation committee’s philosophy is to provide compensation to our NEOs that align their interests with the long-term interest of our shareholders. In line with this philosophy, our executive compensation goals are to:

| • | pay for performance; |

| • | attract and retain qualified talent; |

| • | motivate executives to improve the overall performance of our company; and |

| • | ensure that compensation levels are externally competitive. |

Our compensation committee considers various factors when designing a compensation program to achieve our compensation philosophy and related goals, including:

| • | how the executive’s compensation compares to market data; |

| • | the elements of compensation and the appropriate portion of compensation that should be fixed versus performance-based; |

| • | the metrics and targets used in the performance-based compensation such that it aligns our executives with our company’s goals and shareholder interests; |

| • | the actual performance of our company and our executives; |

| • | the recommendations of the chief executive officer; and |

| • | whether the compensation should be structured so as to provide for tax deductibility under Section 162(m) of the Internal Revenue Code and the potential accounting treatment for compensation. |

Compensation Philosophy as Applied to Our CEO

Our compensation committee believes that Mr. Akradi’s interests should be aligned with those of our shareholders. As such, our compensation committee has consistently provided a substantial portion of his compensation in the form of restricted stock. For 2014, approximately 70% of his total direct compensation was in the form of either performance-based or time-based restricted stock, and 57% of his total cash compensation was performance-based. Our compensation committee believes that a larger portion of Mr. Akradi’s compensation should be performance-based as compared to the other NEOs’ compensation due to his levels of responsibility and decision-making impact.

Our compensation committee also considers the following factors with respect to setting Mr. Akradi’s compensation:

| • | Mr. Akradi founded our company in 1992 and has remained one of the critical driving forces behind our mission, brand and service differentiation. Mr. Akradi has a deep understanding of the health and fitness industry through more than 30 years of work in many different capacities within the industry, including real estate and construction, finance, sales and marketing and operations. |

13

Table of Contents

| • | Mr. Akradi is heavily involved in the design, construction and day-to-day operation of our large and unique centers, as well as the comprehensive array of programs and services we deliver. |

| • | Through his leadership and continued strategic and tactical direction, Mr. Akradi has created a proven business model that continues to deliver strong results and financial performance on behalf of our shareholders by positioning our company as a market leader. |

| • | Our compensation committee recognizes that retention is key to our company’s continued success and, consequently, is an important part of its compensation program for Mr. Akradi. |

Ultimately, the compensation committee believes that Mr. Akradi’s unique role and leadership has directly contributed to our strong performance and growth and should be appropriately rewarded even when Mr. Akradi’s target opportunity is greater than the target opportunity of our peers’ CEOs.

Application of Our Philosophy – Aligning Compensation with Our Long-Term Strategy

As a company that focuses on long-term performance, our compensation committee established a three-year annual compensation program beginning in 2014 that will be reviewed annually. The program anticipates that compensation targets would be flat for three years, with any increase in compensation payout to come from exceeding budgeted goals or from an increase in stock price. The compensation committee explicitly reserved the right to revisit the program each year.

Process for Establishing 2014 Compensation

Participants Involved in Establishing Compensation

Compensation Committee

Our compensation committee, which is composed of four non-employee directors, determines all forms of compensation of our company’s executive officers. Joseph S. Vassalluzzo chairs our compensation committee. Giles H. Bateman, John K. Lloyd and Martha A. Morfitt are the other members. At all times in 2014, all of the members of our compensation committee were independent, as defined by the standards of the NYSE, and satisfied the qualification standards of Section 162(m) of the Code and Section 16 of the Securities Exchange Act of 1934.

You can read their biographies beginning on page 5.

Independent Compensation Consultant

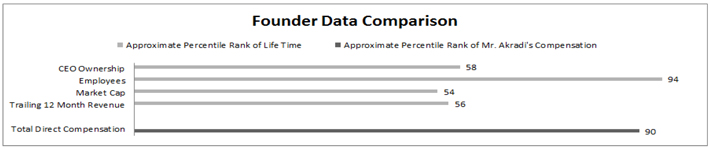

For the review of our 2014 compensation, the compensation committee engaged its independent compensation consultant, Mercer. Mercer benchmarked the company’s executive compensation relative to the company’s peer group, survey data and, with respect to the CEO’s compensation, a new supplemental peer group of founder CEOs. Mercer also reviewed the alignment of CEO realized pay and performance of the company as compared to its peer group over a one- and three-year period.

Our compensation committee assessed Mercer’s independence pursuant to SEC and NYSE rules and concluded that no conflict of interest exists that would prevent Mercer from independently advising the compensation committee.

Management Retained Compensation Consultant

In addition, for the review of Mr. Akradi’s 2014 compensation, we engaged our own compensation consultant, Buck Consultants LLC (“Buck Consultants”), which provided information to us that included an analysis of the company’s peer group, a recommendation on a different peer group and a benchmark of the CEO’s compensation to the CEO compensation provided by the companies in the different peer group. Certain of the information Buck Consultants provided was also shared with our compensation committee.

While the compensation committee determined that Buck Consultants was not independent from management because they were retained by management, all of the information provided by Buck Consultants was also analyzed by Mercer, which provided its assessment of and recommendations regarding the information to the compensation committee, as discussed above.

14

Table of Contents

Role of Executive Officers in Compensation Decisions

In making compensation decisions for executive officers reporting to Mr. Akradi, the compensation committee solicited the views of Mr. Akradi and the compensation committee’s independent consultant. Mr. Akradi was not present during the compensation committee’s executive sessions. Our executive officers had no role in making compensation decisions.

Executive Compensation Review

Consideration of Peer Group, Founder Group (for the CEO Only) and Survey Data

As part of its review of the executive compensation, our compensation committee engaged Mercer to provide updated market compensation data. For the compensation committee’s use in setting the 2014 executive compensation program, Mercer updated the prior peer group by removing Gaylord Entertainment Co., which had converted to a REIT, and added Texas Roadhouse Inc., a consumer focused company within the targeted revenue range and with a founder CEO. The updated peer group is comprised of 12 publicly traded companies of similar size and characteristics from the consumer services global industry classification. Mercer updated the market data with respect to our peers and provided the following information relating to such peer group:

| Peer Company Name |

Trailing 12 Month Revenue ($M) |

Market Cap ($M) |

Number of Employees |

CEO Ownership (%) |

||||||||||||

| Cheesecake Factory Inc. |

1,836 | 2,220 | 33,900 | 8.3 | ||||||||||||

| Marriott Vacations Worldwide |

1,665 | 1,528 | 9,500 | <1.0 | ||||||||||||

| Texas Roadhouse Inc. |

1,298 | 1,747 | 40,000 | 9.6 | ||||||||||||

| Pinnacle Entertainment Inc. |

1,217 | 1,148 | 8,479 | 1.8 | ||||||||||||

| Ameristar Casinos Inc. |

1,178 | 869 | 7,115 | 2.0 | ||||||||||||

| Vail Resorts Inc. |

1,122 | 2,209 | 20,500 | 2.2 | ||||||||||||

| Six Flags Entertainment Corp. |

1,091 | 3,389 | 40,900 | 3.7 | ||||||||||||

| Cedar Fair |

1,082 | 2,306 | 42,700 | <1.0 | ||||||||||||

| Jos A Bank Clothiers Inc. |

1,044 | 1,156 | 6,342 | 0.5 | ||||||||||||

| Steiner Leisure Ltd. |

825 | 773 | 7,144 | <1.0 | ||||||||||||

| Ethan Allen Interiors Inc. |

732 | 832 | 5,000 | 14.0 | ||||||||||||

| Intl. Speedway Corp. |

614 | 1,452 | 840 | 4.1 | ||||||||||||

| Life Time Fitness, Inc. |

1,149 | 2,157 | 21,700 | 6.3 | % | |||||||||||

| Percentile Rank of Life Time Fitness, Inc. |

59 | % | 72 | % | 64 | % | 79 | % | ||||||||

15

Table of Contents

In addition, the following group of peers with founder CEOs was used as supplemental data for the CEO position:

| Founder Company Name |

Trailing 12 Month Revenue ($M) |

Market Cap ($M) |

Number of Employees |

CEO Ownership (%) |

||||||||||||

| Men’s Wearhouse Inc. |

2,518 | 1,904 | 17,500 | 3.5 | ||||||||||||

| Panera Bread Co. |

2,193 | 5,481 | 36,300 | 4.5 | ||||||||||||

| Under Armour Inc. |

1,922 | 6,274 | 5,900 | 20.0 | ||||||||||||

| Hain Celestial Group Inc. |

1,622 | 3,027 | 3,720 | 4.8 | ||||||||||||

| Papa Johns International Inc. |

1,367 | 1,427 | 18,800 | 26.9 | ||||||||||||

| Meritage Homes Corp. |

1,327 | 1,561 | 830 | 5.3 | ||||||||||||

| Gentex Corp. |

1,078 | 3,310 | 3,605 | 3.3 | ||||||||||||

| Ellis Perry Int’l Inc. |

966 | 318 | 2,600 | 11.6 | ||||||||||||

| Bridgepoint Education Inc. |

940 | 659 | 9,520 | 3.5 | ||||||||||||

| J&J Snack Foods Corp. |

861 | 1,463 | 3,200 | 20.0 | ||||||||||||

| K12 Inc. |

816 | 976 | 3,300 | 4.0 | ||||||||||||

| Tripadvisor Inc. |

809 | 8,725 | 1,575 | <1.0 | ||||||||||||

| Dreamworks Animation Inc. |

748 | 2,156 | 2,400 | 11.8 | ||||||||||||

| Morningstar Inc. |

666 | 3,607 | 3,495 | 53.0 | ||||||||||||

| Life Time Fitness, Inc. |

1,149 | 2,157 | 21,700 | 6.3 | % | |||||||||||

| Percentile Rank of Life Time Fitness, Inc. |

56 | % | 54 | % | 94 | % | 58 | % | ||||||||

The compensation committee then compared our NEOs’ 2013 base salaries, annual cash incentives and annual incentive equity award elements using the peer group for similarly positioned executives and, for the CEO only, the founder-led group.

In addition, the compensation committee reviewed survey data consisting of publicly traded companies reflecting a revenue range from $600 million to $2.4 billion from different industries. The survey data was gathered from the 2012 Mercer US Global Premium Executive Remuneration survey and provided a sample size of 181, which helped to minimize the risks associated with outliers from a smaller group. The compensation committee then compared our NEOs’ base salaries, annual cash incentives and annual long-term incentive award elements using the survey data for similarly positioned executives.

Performance as Compared to Market Data

The compensation committee does not rely on predetermined formulas or criteria when evaluating executive compensation, but considers comparable market data provided by Mercer. The following table compares the approximate percentile rank of our CEO’s compensation with the compensation of CEOs in our peer group, the surveyed companies and the founder company group:

| Total Target Cash Compensation |

Incentive Compensation (Annual Equity Grants) |

Total Direct Compensation | ||||||

| Percentile of Market Data | ||||||||

| Bahram Akradi | Peer Group Data | 75th to 90th | Above 90th | Above 90th | ||||

| Survey Data | App. 75th | App. 75th | Mod Above 75th | |||||

| Founder Group Data | App. 75th | 90th | 90th | |||||

For our other NEOs, the total direct compensation of Mr. Robinson, the company’s prior CFO, benchmarked within the 50th to 75th percentile with respect to both the peer group and survey data; Mr. Zwiefel’s total direct compensation benchmarked at approximately the 75th percentile with respect to the peer group and between the 75th and 90th percentile with respect to the survey data; Mr. Buss’s total direct compensation benchmarked at approximately the 75th percentile with respect to both the peer group and survey data; and Ms. Kozikowski’s total direct compensation benchmarked between the 25th and 50th percentile of the peer group and at approximately the 75th percentile of the survey data. Our compensation committee believed it was appropriate to pay most of our other NEOs above the 50th percentile as compared to our peer group because our company’s performance was generally in the top quartile for revenue growth and EBITDA margin as compared to our peer group. In addition, while Mr. Zwiefel’s total direct compensation benchmarked between the 75th and 90th percentile versus our peer group, Mr. Zwiefel had been compared to a combination of 3rd, 4th and 5th pay ranked executives (excluding chief financial officers) despite his position as the chief operating officer of the company. Mr. Elmquist’s compensation was not evaluated as he was not yet an executive officer.

16

Table of Contents

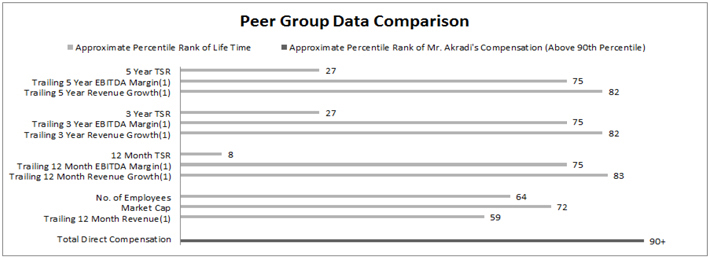

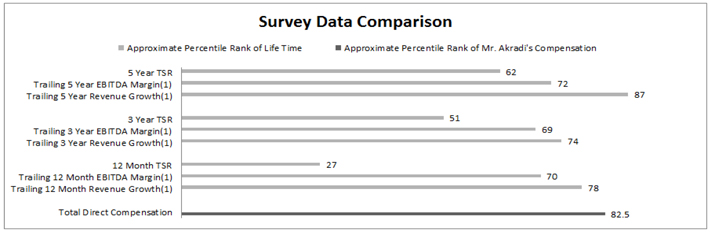

The following graphics show how Mr. Akradi’s total direct compensation benchmarked to the various metrics of our peer group, survey data and founder company group that our compensation committee considered.

| (1) | The trailing 12-month revenue and EBITDA margin data used the most recently reported financials. Three-year and five-year data used the mostly recently reported quarter and the period 12 quarters and 20 quarters prior, respectively. Total shareholder return is as of July 31, 2013. |

| (1) | The trailing 12-month revenue and EBITDA margin data used the most recently reported financials. Three-year and five-year data used the mostly recently reported quarter and the period 12 quarters and 20 quarters prior, respectively. Total shareholder return is as of July 31, 2013. |

Overall, our company’s performance as compared to both our peers and the broader survey companies was quite favorable. We placed in the 83rd, 82nd and 82nd percentile ranks for the trailing 12 month, three year and five year period for revenue growth, respectively, versus our peer group, and the 75th percentile ranks for each of the trailing 12 month, three year and five year EBITDA margin, respectively, versus our peer group. We placed in the 78th, 74th and 87th percentile ranks for

17

Table of Contents

the trailing 12 month, three year and five year period for revenue growth, respectively, versus our surveyed companies, and the 70th, 69th and 72nd percentile ranks for each of the trailing 12 month, three year and five year period for EBITDA margin, respectively, versus our surveyed companies. Our market capitalization was in the 72nd percentile of our peer group and our trailing 12 month revenue was in the 59th percentile. Ultimately, the compensation committee believed that longer-term metrics were more relevant in evaluating our company’s performance.

Overview of CEO Realized Pay and Performance

In connection with the compensation committee’s review of 2014 executive compensation, the compensation committee also evaluated the alignment of the chief executive officers’ realized pay to the performance of Life Time as compared to its peer companies over one- and three-year periods ended December 31, 2012. Realized compensation approximates W-2 earnings and includes the value of exercised options and vested shares. The compensation committee reviewed a metric including revenue growth, operating income growth, operating margin and net income margin and return on investment for the one-year performance measures, and total shareholder return for the three-year performance measure. The compensation committee used actual total cash compensation for each company’s most recent fiscal year for the one-year performance, and realized total direct compensation of three year average cash compensation and three year realized long-term incentive compensation.

The compensation committee observed that for both one- and three-year periods ended December 31, 2012, our chief executive officer’s realized pay and relative performance were aligned.

|

One Year Realized Pay to Relative Performance |

Three Year Realized Pay to Relative Performance | |||||||

| Combined Performance |

Total Cash Compensation |

TSR Percentile Rank |

Total Direct Compensation | |||||

| Peer Group |

92nd | 83rd | 73rd | 92nd | ||||

2014 Executive Compensation Program

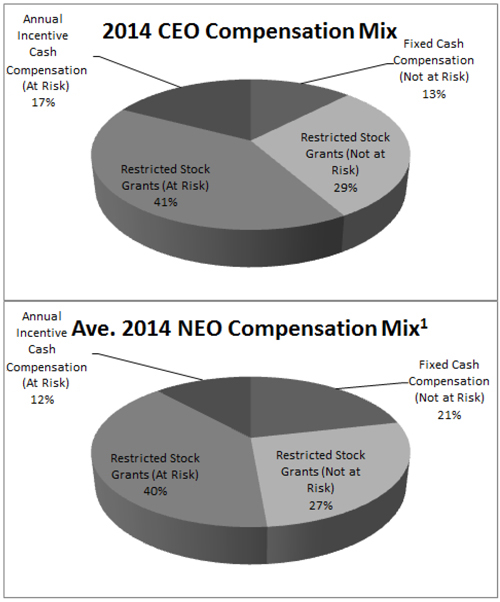

Elements and Mix of 2014 Compensation

For 2014, our executive compensation included a mix of annual cash compensation, some of which varies based on company performance, long-term incentive compensation in the form of annual restricted stock grants, up to 50% of the shares of which are forfeitable if performance goals derived from our company’s annual budget are not achieved and, performance-based restricted stock grants, 100% of the shares of which are forfeited if our company failed to meet any of four aggressive performance targets: 12% TSR for fiscal 2014; 10% growth in diluted EPS for fiscal 2014; 10% growth in revenue for fiscal 2014; and 10% growth in EBITDA for fiscal 2014. The compensation committee believes that a substantial portion of compensation should either tie to performance or align the long-term interest of our executives with those of our shareholders. The compensation committee believes that compensation tied to specific performance metrics and grants of restricted stock meet those goals.

18

Table of Contents

The following tables show the mix of elements of total direct compensation for Mr. Akradi and the average total direct compensation for our other NEOs (excluding Mr. Robinson, who resigned from the position of executive vice president and chief financial officer in March 2014):

| (1) | Excludes Mr. Robinson, who retired as executive vice president and chief financial officer in March 2014. |

19

Table of Contents

Core Elements of Our Company’s 2014 Executive Compensation Program

| Element |

Goal |

Basic Design |

Performance Based | |||

| Base Salary | To provide recurring compensation for the fulfillment of regular duties and responsibilities and to attract and retain talented executives | Cash payment which represents approximately 13% of the CEO’s target total direct compensation and an average of 21% of our other NEOs’ target total direct compensation | No | |||

| Annual Cash Incentive | To incent executives to deliver upon our annual financial performance goals | Cash bonuses paid on a monthly basis throughout the year based upon year-to-date EBT performance as compared to budgeted performance with a portion withheld to offset potential excess payment due to poor performance in later parts of the year | Yes | |||

| Performance goal derived from our company’s annual budgeted EBT | ||||||

| Restricted Stock (Long-Term Incentive Compensation) |

To align executives’ interests with shareholders interests and to foster an ownership culture | Three categories of restricted stock grants

59% of the CEO’s grants are subject to forfeiture and 41% are not

Subject to forfeiture, all shares of stock vest in 25% installments over a four-year period |

Yes | |||

|

To retain talented executives

|

Restricted stock grants with no forfeiture component |

No. Value increases or decreases in correlation to share price | ||||

|

To incent executives to deliver upon our financial performance goals and to retain talented executives |

Performance-based restricted stock grants with up to 100% of the shares forfeitable if our company fails to achieve an annual budgeted diluted EPS goal |

Yes | ||||

|

To incentive executives to deliver exceptional financial performance |

Performance-based restricted stock grants with 100% of the shares forfeited if our company fails to meet any one of the following four “stretch” performance goals for fiscal 2014: |

Yes | ||||

|

• 12% TSR for fiscal 2014; |

||||||

|

• 10% growth in diluted EPS; |

||||||

|

• 10% growth in revenue; and |

||||||

|

• 10% growth in EBITDA |

||||||

| Retirement Plans | To provide retirement savings in a tax-efficient manner | 401(k) plan (subject to ERISA limits) and a non-qualified deferred compensation plan, with a matching contribution, if any, determined by the compensation committee and provided to participants generally | No | |||

| Perquisites | To assist executives in carrying out their duties | Described on page 23 | No | |||

20

Table of Contents

Annual Compensation – Cash

Our compensation committee generally establishes the total cash compensation opportunity for each executive and then determines the proportion of the total cash compensation amount that will be a performance-based opportunity. The target cash compensation was increased for 2014 following the annual review of compensation.

Individually, Mr. Zwiefel continued to expand his role as chief of operations throughout 2013, in which he is responsible for all operational aspects of our Healthy Way of Life destinations along with his oversight of multiple corporate businesses and corporate services functions. He was then promoted to executive vice president and chief operating officer in October of 2013. Mr. Buss expanded his role first as interim chief financial officer in March 2014 and then as chief financial officer in July 2014. Mr. Akradi recommended, and the compensation committee approved, an increase to their total target cash compensation effective January 1, 2014.

Base Salary – NEOs

| Name |

2012 Salary($) | Change(%) | 2013 Salary($) | Change(%) | 2014 Salary($) | |||||||||||||||

| Bahram Akradi |

940,000 | — | 940,000 | 6.4 | 1,000,000 | |||||||||||||||

| Jeffrey G. Zwiefel |

300,150 | 22.2 | 366,850 | 9.0 | 400,000 | |||||||||||||||

| Eric J. Buss |

300,150 | — | 300,150 | 22.3 | 367,000 | |||||||||||||||

| Tami A. Kozikowski(1) |

— | — | 300,150 | — | 300,000 | |||||||||||||||

| Jess R. Elmquist(2) |

— | — | — | — | 240,000 | |||||||||||||||

| (1) | Ms. Kozikowski was hired in August of 2012. |

| (2) | Mr. Elmquist was promoted to Executive Vice President, Human Resources and Life Time University, and first became an NEO, for fiscal 2014. |

Annual Incentive Compensation – NEOs

With respect to performance-based cash compensation, the compensation committee determined that our company’s budgeted EBT for 2014, which was $211.2 million, was the appropriate performance metric for the performance-based portion of cash compensation to incent NEOs to improve our company’s performance. Our compensation committee believes that individual executive performances should not be highlighted in the area of cash-based incentive pay due to the executive team’s focus on collaborative decision making and on meeting our company’s financial performance goals.

Actual bonuses paid to participants equal the total cash compensation target multiplied by 2014 adjusted EBT divided by 2014 budgeted EBT, with base salary then subtracted from the resulting number. For the chief executive officer, the maximum incentive payout is capped at 200% of base salary, and for the other NEOs, the maximum incentive payout is capped at 100% of base salary. Under our cash incentive program, our company pays cash bonuses to each participant on a monthly basis throughout the year based upon its year-to-date EBT performance in relation to predetermined year-to-date budgeted EBT. Our company withholds payout on a portion of the monthly portion of the year-to-date incentive component to offset a potential excess payment in case performance falls below thresholds in later months of the year. For 2014, our adjusted EBT performance of $192.8 million was 91.3% of budgeted EBT, resulting in actual payout of our annual incentive compensation below the incentive target, which aligns with our pay-for-performance philosophy:

| Name |

2014 Incentive Cash Target($) |

2014 Incentive Cash Maximum($) |

2014 Incentive Payout($) |

|||||||||

| Bahram Akradi |

1,400,000 | 2,000,000 | 1,190,634 | |||||||||

| Jeffrey G. Zwiefel |

250,000 | 400,000 | 193,297 | |||||||||

| Eric J. Buss |

183,500 | 367,000 | 135,477 | |||||||||

| Tamara A. Kozikowski |

150,000 | 300,000 | 110,744 | |||||||||

| Jess R. Elmquist |

135,000 | 240,000 | 102,287 | |||||||||

As discussed on page 25, the compensation committee excluded the impact of the non-recurring costs associated with the exploration of the REIT and the immaterial correction of the accounting treatment of a previous financing transaction when determining whether the EBT performance target was met for 2014.

21

Table of Contents

The following table shows the payout of the annual incentive compensation as compared to the target annual incentive compensation for our NEOs over the past three years:

| Name |

2012 Incentive Comp. Payout($) |

2012 Payout vs. Target Incentive Comp(%) |

2013 Incentive Comp. Payout($) |

2013 Payout vs. Target Incentive Comp(%) |

2014 Incentive Comp. Payout($) |

2014 Payout vs. Target Incentive Comp(%) |

||||||||||||||||||

| Bahram Akradi |

1,310,225 | 100.0 | 1,237,655 | 94.5 | 1,190,634 | 85.0 | ||||||||||||||||||

| Jeffrey G. Zwiefel |

149,895 | 100.0 | 165,466 | 90.3 | 193,297 | 77.3 | ||||||||||||||||||

| Eric J. Buss |

149,895 | 100.0 | 135,381 | 90.3 | 135,477 | 73.8 | ||||||||||||||||||

| Tami A. Kozikowski(1) |

53,078 | 100.0 | 135,381 | 90.3 | 110,744 | 73.8 | ||||||||||||||||||

| Jess R. Elmquist(2) |

— | — | — | — | 102,287 | 75.8 | ||||||||||||||||||

| (1) | Ms. Kozikowski was hired in August of 2012. |

| (2) | Mr. Elmquist was promoted to Executive Vice President, Human Resources and Life Time University, and first became and NEO, for fiscal 2014. |

Long-Term Compensation – Annual Grants of Restricted Stock

For fiscal year 2014, our compensation committee determined that our NEOs should each be granted two types of restricted stock awards. The first involves shares of restricted stock that are eligible to vest 25% per year on March 1 of each of 2015, 2016, 2017 and 2018, but up to 50% of which are subject to forfeiture if the company does not reach its 2014 diluted EPS targets. The second form of award involves shares of restricted stock that are eligible to vest 25% per year on March 1 of each of 2015, 2016, 2017 and 2018, but 100% of which are forfeited if the company does not meet any one of the following targets: 12% TSR for fiscal 2014; 10% growth in diluted EPS; 10% growth in revenue; and 10% growth in EBITDA. The compensation committee believes restricted stock aligns the long-term pay our NEOs would realize upon vesting with our company’s TSR during the same period and encourages our executives to drive shareholder value.

Annual Grants of Restricted Stock – Diluted EPS Metrics

Our compensation committee determined that our NEOs should each be granted the first form of award described above involving the following number of restricted shares, subject to the forfeiture component described below:

| Name |

Number of Shares | |||

| Bahram Akradi |

100,000 | |||

| Jeffrey G. Zwiefel |

24,000 | |||

| Eric J. Buss |

20,000 | |||

| Tami A. Kozikowski |

18,000 | |||

| Jess R. Elmquist |

8,000 | |||

Our compensation committee also believes that subjecting 50% of the above annual restricted stock grant to a performance-based metric, budgeted diluted EPS for 2014 of $3.10 would incent the NEOs to meet our company’s goals while ensuring alignment with shareholder interests. Accordingly, up to 50% of the shares referenced above were subject to forfeiture in the event that our diluted EPS for 2014 was less than our budgeted diluted EPS for 2014 of $3.10 per share according to the following table:

| Diluted EPS for 2014 as a Percentage of |

Percentage of Original Restricted Shares Granted to be Forfeited | |

| 100% or Above |

0% | |

| 90% to 99% |

2% forfeited for each percent below 100% of Budgeted Diluted EPS | |

| 83% to 90% |

20% forfeited plus an additional 4% forfeited for each percent below 90% of Budgeted Diluted EPS | |

| 83% or Less |

50% |

As discussed on page 25, the compensation committee excluded the impact of the non-recurring costs associated with the exploration of the REIT, TCPA litigation settlement and the immaterial correction of the accounting treatment of a previous financing transaction when determining whether the EPS performance target was met for 2014. Because our adjusted diluted EPS of $3.12 for 2014 was higher than the budgeted diluted EPS goal for 2014, none of these shares were forfeited.

22

Table of Contents

Annual Grants of Restricted Stock – Four Targets

Our compensation committee determined that our NEOs should each be granted the second form of restricted stock award involving the following number of restricted shares that vest 25% per year on March 1 of each of 2015, 2016, 2017 and 2018, subject to the forfeiture component described below:

| Name |

Number of Shares | |||

| Bahram Akradi |

20,000 | |||

| Jeffrey G. Zwiefel |

6,000 | |||

| Eric J. Buss |

4,000 | |||

| Tami A. Kozikowski |

4,000 | |||

| Jess R. Elmquist |

2,000 | |||

Our compensation committee believed that subjecting 100% of the above annual restricted stock grant to four aggressive performance-based metrics would incent the NEOs to return exceptional performance while ensuring alignment with shareholder interests. Accordingly, all of the shares referenced above were subject to forfeiture in the event that any one of the metrics referenced in the following table was not met. The metrics were not met; consequently, all of the shares were forfeited.

| Name |

12% TSR for fiscal 2014($)(1) |

10% growth in diluted EPS ($)(2) |

10% growth in revenue($) (in thousands) |

10% growth in EBITDA($) (in thousands)(2) |

||||||||||||

| Target |

53.60 | 3.23 | 1,326,495 | 386,981 | ||||||||||||

| Performance |

53.53 | 3.12 | 1,290,620 | 383,698 | ||||||||||||

| Metric Met |

No | No | No | No | ||||||||||||

| (1) | TSR is defined as the average closing price of the company’s common stock as reported on the New York Stock Exchange on and between the dates of October 1 through December 31 of the applicable year, plus the per share amount of cash dividends paid during such year, if any. |

| (2) | As discussed on page 25, the compensation committee excluded the impact of the non-recurring costs associated with the exploration of the REIT, TCPA litigation settlement and the immaterial correction of the accounting treatment of a previous financing transaction when determining whether the EPS and EBITDA performance targets were met for 2014. |

Perquisites

We provide our executive officers with perquisites and benefits that our compensation committee believes are reasonable, competitive and consistent with our overall executive compensation program in order to attract and retain talented executives. Our executives are entitled to few benefits that are not otherwise available to all of our employees. Our compensation committee periodically reviews the levels of perquisites and other personal benefits provided to executive officers. Page 30 summarizes the perquisites.

Other Benefits

We offer the Executive Nonqualified Excess Plan of Life Time Fitness, a nonqualified deferred compensation plan, for the benefit of our highly compensated employees. Participants may voluntarily elect to defer up to 50% of their annual base salary and/or annual bonus earnings to be paid in any coming year. The investment choices available to participants are of the same type and risk categories as those offered under our 401(k) plan. We may make matching contributions and/or discretionary contributions to this plan; however, any matching contribution made by us under this plan is limited to the maximum matching contribution as a percentage of covered compensation that such participant would have received under our 401(k) plan. For 2014, our company matched 35% of the total contribution of each participant, including our NEOs, to the 401(k) and nonqualified plans.

Our NEOs are eligible for additional, company-wide benefits on the same basis as other full-time employees, including a 401(k) plan (and related matching, if any) as well as health, medical and welfare programs.

23

Table of Contents

Employment Agreements and Change in Control Provisions

Executive Employment Agreement

Messrs. Buss and Zwiefel have the same form of executive employment agreement. Messrs. Akradi and Elmquist and Ms. Kozikowski do not have an employment agreement.

We believe that our company has enjoyed considerable growth and success in the industry because of our company’s innovative, confidential and proprietary management and marketing methods and plans. We also desire to assure our executive’s continuing services including, but not limited to, under circumstances in which there is a possible threatened or actual change in control of our company. We believe it is important to diminish the inevitable distraction of the executive by virtue of the personal uncertainties and risks created by a potential severance of employment; to encourage the executive’s full attention and dedication to our company, including in the event of any threatened or impending change in control; and to provide the executive with compensation and benefits arrangements upon a severance of employment which are competitive with those of other corporations. The employment agreements address the above concerns as further described on page 36.

A summary of the payments under the executive employment agreement is included on page 36.

Change in Control Provisions

Our compensation committee requires that all equity awards granted since 2014 be subject to double trigger vesting, which means that the awards will accelerate if the employee’s employment is also terminated by our company or its successor for any reason other than cause within two years following a change in control (or if the award is not assumed by the acquiring company in the transaction). Historical grants of restricted stock made prior to 2014 (except for the May 2012 performance-based grants) provide for single trigger vesting. Further explanation of our accelerated vesting of equity award in certain situations is described on page 36.

Our agreements do not provide for any gross-up compensation with respect to any excise tax as a result of any change in control.

Transition Agreement with Mr. Robinson

On March 1, 2014, Mr. Robinson retired from his position as Executive Vice President and Chief Financial Officer. The company has retained Mr. Robinson as a part-time employee through September 1, 2015. In exchange for his continued service, the company provides the following compensation and benefits to Mr. Robinson: (i) his current annual target cash compensation for the 18 month transition period, totaling $825,000, to be paid out over the 18 month period; (ii) monthly phone and auto allowance of $1,050 to be paid out over the 18 month period; (iii) continued coverage, or reimbursement for coverage, of medical and dental benefits; and (iv) a continued Life Time Athletic membership. As a condition to such payments, Mr. Robinson agreed to a non-competition covenant for the term of his continued service. Mr. Robinson also forfeited all restricted stock that had not vested as of the end of day March 1, 2014.

24

Table of Contents

Reconciliation of 2014 Performance Metrics

In considering 2014 performance against various financial metrics for purposes of determining compensation amounts payable, the compensation committee used its discretion to exclude the impact of the non-recurring costs associated with the exploration of the REIT, TCPA litigation settlement, the immaterial correction of the accounting treatment of a previous financing transaction and the impact of the adjustment of a contingent liability associated with a prior acquisition, as explained below.

2014 Diluted EPS Reconciled to 2014 Adjusted Diluted EPS

| Fiscal Year Ended December 31, 2014 |

Explanation of Non-Recurring Adjustments | |||||

| Diluted EPS, as reported |

$ | 2.94 | ||||

| REIT exploration costs |

0.09 | Exclude the diluted per share impact of non-recurring REIT exploration costs. | ||||

| TCPA settlement accrual |

0.07 | Exclude the diluted per share impact of non-recurring TCPA settlement costs. | ||||

| Impact of financing transaction classification |

0.02 | Exclude the diluted per share impact of the correction of the accounting treatment of a previous financing transaction. | ||||

| Adjusted diluted EPS |

$ | 3.12 | ||||

2014 Income Before Income Taxes (EBT) Reconciled to 2014 Adjusted Income Before Income Taxes (Adjusted EBT)

| Fiscal Year Ended December 31, 2014 (In thousands) |

Explanation of Non-Recurring Adjustments | |||||

| Income Before Income Taxes, as reported |

$ | 188,121 | ||||

| REIT exploration costs |

3,542 | Exclude the impact of non-recurring REIT exploration costs (which are not tax deductible). | ||||

| Impact of financing transaction classification |

1,111 | Exclude the diluted per share impact of the correction of the accounting treatment of a previous financing transaction. | ||||

| Adjusted Income Before Income Taxes |

$ | 192,774 | ||||

2014 Net Income Reconciled to 2014 Adjusted Net Income

| Fiscal Year Ended December 31, 2014 (In thousands) |

Explanation of Non-Recurring Adjustments | |||||

| Net Income, as reported |

$ | 114,370 | ||||

| Impact of contingent liability reduction |

(3,634 | ) | Exclude the impact of the adjustment of a contingent liability associated with a prior acquisition | |||

| REIT exploration costs |

3,542 | Exclude the impact of non-recurring REIT exploration costs (which are not tax deductible). | ||||

| TCPA settlement accrual |

2,856 | Exclude the after-tax impact of non-recurring TCPA settlement costs. | ||||

| Impact of financing transaction classification |

677 | Exclude the diluted per share impact of the correction of the accounting treatment of a previous financing transaction. | ||||

| Adjusted Net Income |

$ | 117,811 | ||||