Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DUNE ENERGY INC | d919691d8k.htm |

Exhibit 99.1

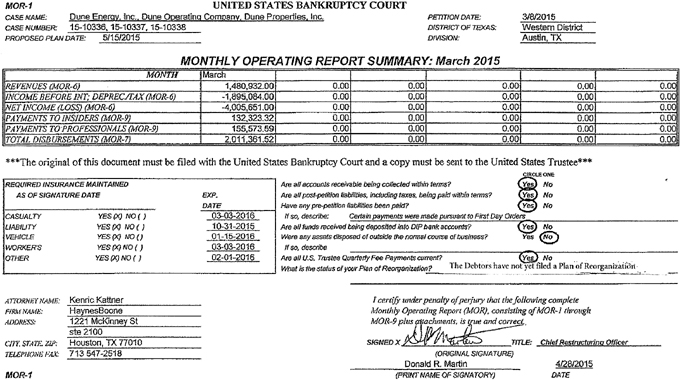

MOR-1 UNITED STATES BANKRUPTCY COURT CASE NAME: Dune Energy, Inc., Dune Operating Company, Dune Properties, Inc. PETITION DATE: 3/8/2015 CASE NUMBER: 15-10336, 15-10337, 15-10338 DISTRICT OF TEXAS: Western District PROPOSED PLAN DATE: 5/15/2015 DIVISION: Austin, TX MONTHLY OPERATING REPORT SUMMARY: March 2015 MONTH March REVENUES (MOR-6) 1,480,932.00 0.00 0.00 0.00 0.00 0.00 INCOME BEFORE INT; DEPREC./TAX (MOR-6) -1,895,084.00 0.00 0.00 0.00 0.00 0.00 NET INCOME (LOSS) (MOR-6) -4,005,651.00 0.00 0.00 0.00 0.00 0.00 PAYMENTS TO INSIDERS (MOR-9) 132,323.32 0.00 0.00 0.00 0.00 0.00 PAYMENTS TO PROFESSIONALS (MOR-9) 155,573.59 0.00 0.00 0.00 0.00 0.00 TOTAL DISBURSEMENTS (MOR-7) 2,011,361.52 0.00 0.00 0.00 0.00 0.00 ***The original of this document must be filed with the United States Bankruptcy Court and a copy must be sent to the United States Trustee*** CIRCLE ONE REQUIRED INSURANCE MAINTAINED Are all accounts receivable being collected within terms? Yes No AS OF SIGNATURE DATE EXP. Are all post-petition liabilities, including taxes, being paid within terms? Yes No DATE Have any pre-petition liabilities been paid? Yes No CASUALTY YES (X) NO ( ) _03-03-2016_ If so, describe: Certain payments were made pursuant to First Day Orders LIABILITY YES (X) NO ( ) _10-31-2015_ Are all funds received being deposited into DIP bank accounts? Yes No VEHICLE YES (X) NO ( ) _01-15-2016_ Were any assets disposed of outside the normal course of business? Yes No WORKER’S YES (X) NO ( ) _03-03-2016_ If so, describe OTHER YES (X) NO ( ) _02-01-2016_ Are all U.S. Trustee Quarterly Fee Payments current? Yes No What is the status of your Plan of Reorganization? We expect to file a plan of reorganization by May 15, 2015 ATTORNEY NAME: Kenric Kattner I certify under penalty of perjury that the following complete FIRM NAME: HaynesBoone Monthly Operating Report (MOR), consisting of MOR-1 through ADDRESS: 1221 McKinney St MOR-9 plus attachments, is true and correct. ste 2100 CITY, STATE, ZIP: Houston, TX 77010 SIGNED X TITLE: _Chief Restructuring Officer TELEPHONE/FAX: 713 547-2518 (ORIGINAL SIGNATURE) Donald R. Martin 4/28/2015 MOR-1 (PRINT NAME OF SIGNATORY) DATE

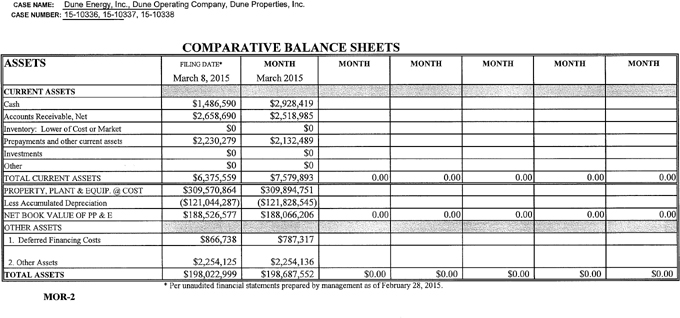

CASE NAME: Dune Energy, Inc., Dune Operating Company, Dune Properties, Inc. CASE NUMBER: 15-10336, 15-10337, 15-10338 COMPARATIVE BALANCE SHEETS ASSETS FILING DATE* MONTH MONTH MONTH MONTH MONTH MONTH March 8, 2015 March 2015 CURRENT ASSETS Cash $1,486,590 $2,928,419 Accounts Receivable, Net $2,658,690 $2,518,985 Inventory: Lower of Cost or Market $0 $0 Prepayments and other current assets $2,230,279 $2,132,489 Investments $0 $0 Other $0 $0 TOTAL CURRENT ASSETS $6,375,559 $7,579,893 0.00 0.00 0.00 0.00 0.00 PROPERTY, PLANT & EQUIP. @ COST $309,570,864 $309,894,751 Less Accumulated Depreciation ($121,044,287) ($121,828,545) NET BOOK VALUE OF PP & E $188,526,577 $188,066,206 0.00 0.00 0.00 0.00 0.00 OTHER ASSETS 1. Deferred Financing Costs $866,738 $787,317 2. Other Assets $2,254,125 $2,254,136 TOTAL ASSETS $198,022,999 $198,687,552 $0.00 $0.00 $0.00 $0.00 $0.00 * Per unaudited financial statements prepared by management as of February 28, 2015. MOR-2

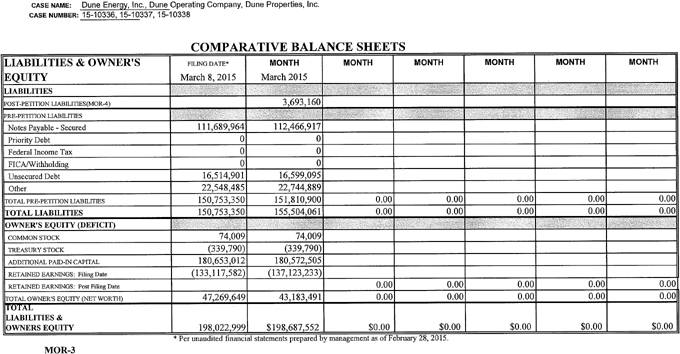

CASE NAME: Dune Energy, Inc., Dune Operating Company, Dune Properties, Inc. CASE NUMBER: 15-10336, 15-10337, 15-10338 COMPARATIVE BALANCE SHEETS LIABILITIES & OWNER’S FILING DATE* MONTH MONTH MONTH MONTH MONTH MONTH EQUITY March 8, 2015 March 2015 LIABILITIES POST-PETITION LIABILITIES(MOR-4) 3,693,160 PRE-PETITION LIABILITIES Notes Payable—Secured 111,689,964 112,466,917 Priority Debt 0 0 Federal Income Tax 0 0 FICA/Withholding 0 0 Unsecured Debt 16,514,901 16,599,095 Other 22,548,485 22,744,889 TOTAL PRE-PETITION LIABILITIES 150,753,350 151,810,900 0.00 0.00 0.00 0.00 0.00 TOTAL LIABILITIES 150,753,350 155,504,061 0.00 0.00 0.00 0.00 0.00 OWNER’S EQUITY (DEFICIT) COMMON STOCK 74,009 74,009 TREASURY STOCK (339,790) (339,790) ADDITIONAL PAID-IN CAPITAL 180,653,012 180,572,505 RETAINED EARNINGS: Filing Date (133,117,582) (137,123,233) RETAINED EARNINGS: Post Filing Date 0.00 0.00 0.00 0.00 0.00 TOTAL OWNER’S EQUITY (NET WORTH) 47,269,649 43,183,491 0.00 0.00 0.00 0.00 0.00 TOTAL LIABILITIES & OWNERS EQUITY 198,022,999 $198,687,552 $0.00 $0.00 $0.00 $0.00 $0.00 * Per unaudited financial statements prepared by management as of February 28, 2015. MOR-3

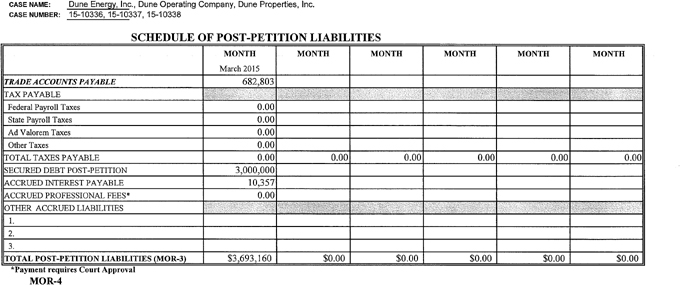

CASE NAME: Dune Energy, Inc., Dune Operating Company, Dune Properties, Inc. CASE NUMBER: 15-10336, 15-10337, 15-10338 SCHEDULE OF POST-PETITION LIABILITIES MONTH MONTH MONTH MONTH MONTH MONTH March 2015 TRADE ACCOUNTS PAYABLE 682,803 TAX PAYABLE Federal Payroll Taxes 0.00 State Payroll Taxes 0.00 Ad Valorem Taxes 0.00 Other Taxes 0.00 TOTAL TAXES PAYABLE 0.00 0.00 0.00 0.00 0.00 0.00 SECURED DEBT POST-PETITION 3,000,000 ACCRUED INTEREST PAYABLE 10,357 ACCRUED PROFESSIONAL FEES* 0.00 OTHER ACCRUED LIABILITIES 1. 2. 3. TOTAL POST-PETITION LIABILITIES (MOR-3) $3,693,160 $0.00 $0.00 $0.00 $0.00 $0.00 MOR-4

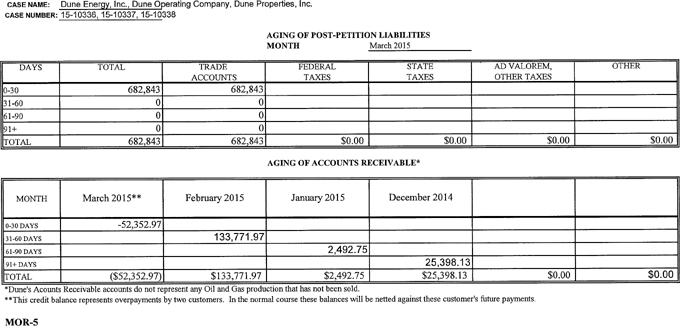

CASE NAME: Dune Energy, Inc., Dune Operating Company, Dune Properties, Inc. CASE NUMBER: 15-10336, 15-10337, 15-10338 AGING OF POST-PETITION LIABILITIES MONTH March 2015 DAYS TOTAL TRADE FEDERAL STATE AD VALOREM, OTHER ACCOUNTS TAXES TAXES OTHER TAXES 0-30 682,843 682,843 31-60 0 0 61-90 0 0 91+ 0 0 TOTAL 682,843 682,843 $0.00 $0.00 $0.00 $0.00 AGING OF ACCOUNTS RECEIVABLE* MONTH March 2015** February 2015 January 2015 December 2014 0-30 DAYS -52,352.97 31-60 DAYS 133,771.97 61-90 DAYS 2,492.75 91+ DAYS 25,398.13 TOTAL ($52,352.97) $133,771.97 $2,492.75 $25,398.13 $0.00 $0.00 *Dune’s Acounts Receivable accounts do not represent any Oil and Gas production that has not been sold. **This credit balance represents overpayments by two customers. In the normal course these balances will be netted against these customer’s future payments. MOR-5

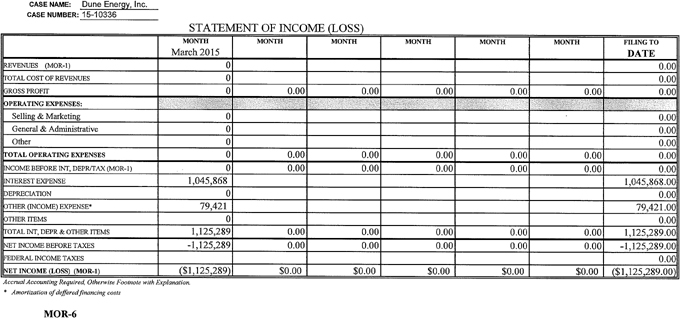

CASE NAME: Dune Energy, Inc. CASE NUMBER: 15-10336 STATEMENT OF INCOME (LOSS) MONTH MONTH MONTH MONTH MONTH MONTH FILING TO March 2015 DATE REVENUES (MOR-1) 0 0.00 TOTAL COST OF REVENUES 0 0.00 GROSS PROFIT 0 0.00 0.00 0.00 0.00 0.00 0.00 OPERATING EXPENSES: Selling & Marketing 0 0.00 General & Administrative 0 0.00 Other 0 0.00 TOTAL OPERATING EXPENSES 0 0.00 0.00 0.00 0.00 0.00 0.00 INCOME BEFORE INT, DEPR/TAX (MOR-1) 0 0.00 0.00 0.00 0.00 0.00 0.00 INTEREST EXPENSE 1,045,868 1,045,868.00 DEPRECIATION 0 0.00 OTHER (INCOME) EXPENSE* 79,421 79,421.00 OTHER ITEMS 0 0.00 TOTAL INT, DEPR & OTHER ITEMS 1,125,289 0.00 0.00 0.00 0.00 0.00 1,125,289.00 NET INCOME BEFORE TAXES -1,125,289 0.00 0.00 0.00 0.00 0.00 -1,125,289.00 FEDERAL INCOME TAXES 0.00 NET INCOME (LOSS) (MOR-1) ($1,125,289) $0.00 $0.00 $0.00 $0.00 $0.00 ($1,125,289.00) Accrual Accounting Required, Otherwise Footnote with Explanation. * Amortization of deffered financing costs MOR-6

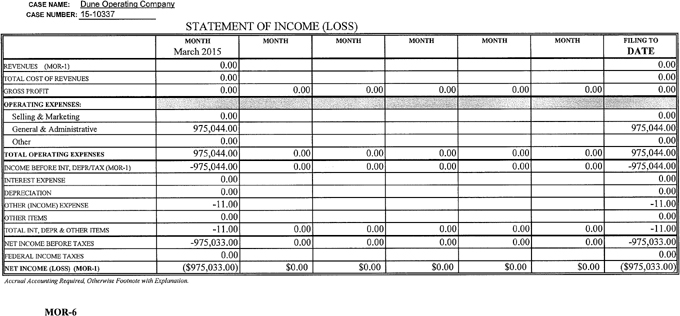

CASE NAME: Dune Operating Company CASE NUMBER: 15-10337 STATEMENT OF INCOME (LOSS) MONTH MONTH MONTH MONTH MONTH MONTH FILING TO March 2015 DATE REVENUES (MOR-1) 0.00 0.00 TOTAL COST OF REVENUES 0.00 0.00 GROSS PROFIT 0.00 0.00 0.00 0.00 0.00 0.00 0.00 OPERATING EXPENSES: Selling & Marketing 0.00 0.00 General & Administrative 975,044.00 975,044.00 Other 0.00 0.00 TOTAL OPERATING EXPENSES 975,044.00 0.00 0.00 0.00 0.00 0.00 975,044.00 INCOME BEFORE INT, DEPR/TAX (MOR-1) -975,044.00 0.00 0.00 0.00 0.00 0.00 -975,044.00 INTEREST EXPENSE 0.00 0.00 DEPRECIATION 0.00 0.00 OTHER (INCOME) EXPENSE -11.00 -11.00 OTHER ITEMS 0.00 0.00 TOTAL INT, DEPR & OTHER ITEMS -11.00 0.00 0.00 0.00 0.00 0.00 -11.00 NET INCOME BEFORE TAXES -975,033.00 0.00 0.00 0.00 0.00 0.00 -975,033.00 FEDERAL INCOME TAXES 0.00 0.00 NET INCOME (LOSS) (MOR-1) ($975,033.00) $0.00 $0.00 $0.00 $0.00 $0.00 ($975,033.00) Accrual Accounting Required, Otherwise Footnote with Explanation. MOR-6

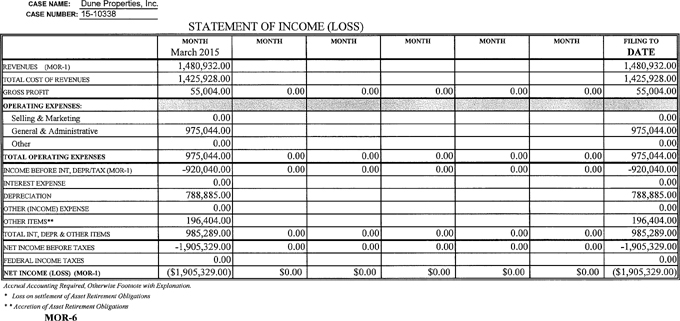

CASE NAME: Dune Properties, Inc. CASE NUMBER: 15-10338 STATEMENT OF INCOME (LOSS) MONTH MONTH MONTH MONTH MONTH MONTH FILING TO March 2015 DATE REVENUES (MOR-1) 1,480,932.00 1,480,932.00 TOTAL COST OF REVENUES 1,425,928.00 1,425,928.00 GROSS PROFIT 55,004.00 0.00 0.00 0.00 0.00 0.00 55,004.00 OPERATING EXPENSES: Selling & Marketing 0.00 0.00 General & Administrative 975,044.00 975,044.00 Other 0.00 0.00 TOTAL OPERATING EXPENSES 975,044.00 0.00 0.00 0.00 0.00 0.00 975,044.00 INCOME BEFORE INT, DEPR/TAX (MOR-1) -920,040.00 0.00 0.00 0.00 0.00 0.00 -920,040.00 INTEREST EXPENSE 0.00 0.00 DEPRECIATION 788,885.00 788,885.00 OTHER (INCOME) EXPENSE 0.00 0.00 OTHER ITEMS** 196,404.00 196,404.00 TOTAL INT, DEPR & OTHER ITEMS 985,289.00 0.00 0.00 0.00 0.00 0.00 985,289.00 NET INCOME BEFORE TAXES -1,905,329.00 0.00 0.00 0.00 0.00 0.00 -1,905,329.00 FEDERAL INCOME TAXES 0.00 0.00 NET INCOME (LOSS) (MOR-1) ($1,905,329.00) $0.00 $0.00 $0.00 $0.00 $0.00 ($1,905,329.00) Accrual Accounting Required, Otherwise Footnote with Explanation. * Loss on settlement of Asset Retirement Obligations * * Accretion of Asset Retirement Obligations MOR-6

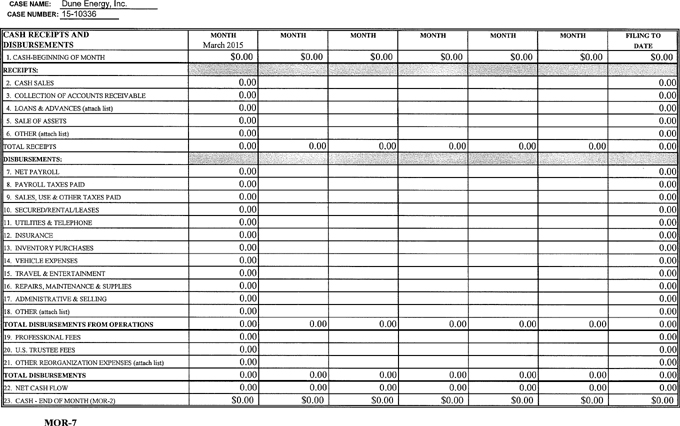

CASE NAME: Dune Energy, Inc. CASE NUMBER: 15-10336 CASH RECEIPTS AND MONTH MONTH MONTH MONTH MONTH MONTH FILING TO DISBURSEMENTS March 2015 DATE 1. CASH-BEGINNING OF MONTH $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 RECEIPTS: 2. CASH SALES 0.00 0.00 3. COLLECTION OF ACCOUNTS RECEIVABLE 0.00 0.00 4. LOANS & ADVANCES (attach list) 0.00 0.00 5. SALE OF ASSETS 0.00 0.00 6. OTHER (attach list) 0.00 0.00 TOTAL RECEIPTS 0.00 0.00 0.00 0.00 0.00 0.00 0.00 (Withdrawal) Contribution by Individual Debtor MFR-2* 0.00 DISBURSEMENTS: 7. NET PAYROLL 0.00 0.00 8. PAYROLL TAXES PAID 0.00 0.00 9. SALES, USE & OTHER TAXES PAID 0.00 0.00 10. SECURED/RENTAL/LEASES 0.00 0.00 11. UTILITIES & TELEPHONE 0.00 0.00 12. INSURANCE 0.00 0.00 13. INVENTORY PURCHASES 0.00 0.00 14. VEHICLE EXPENSES 0.00 0.00 15. TRAVEL & ENTERTAINMENT 0.00 0.00 16. REPAIRS, MAINTENANCE & SUPPLIES 0.00 0.00 17. ADMINISTRATIVE & SELLING 0.00 0.00 18. OTHER (attach list) 0.00 0.00 TOTAL DISBURSEMENTS FROM OPERATIONS 0.00 0.00 0.00 0.00 0.00 0.00 0.00 19. PROFESSIONAL FEES 0.00 0.00 20. U.S. TRUSTEE FEES 0.00 0.00 21. OTHER REORGANIZATION EXPENSES (attach list) 0.00 0.00 TOTAL DISBURSEMENTS 0.00 0.00 0.00 0.00 0.00 0.00 0.00 22. NET CASH FLOW 0.00 0.00 0.00 0.00 0.00 0.00 0.00 23. CASH—END OF MONTH (MOR-2) $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 MOR-7

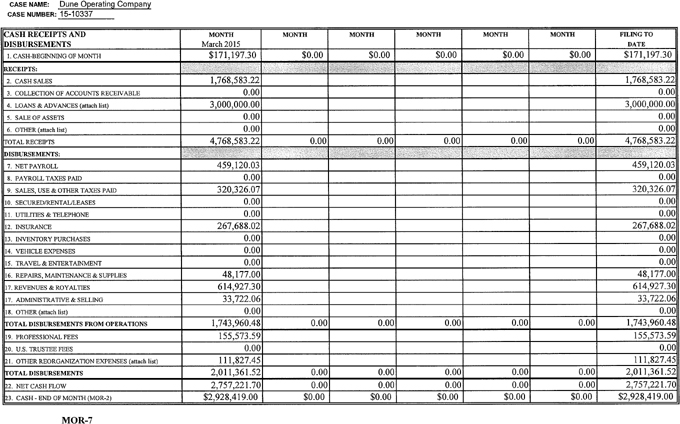

CASE NAME: Dune Operating Company CASE NUMBER: 15-10337 CASH RECEIPTS AND MONTH MONTH MONTH MONTH MONTH MONTH FILING TO DISBURSEMENTS March 2015 DATE 1. CASH-BEGINNING OF MONTH $171,197.30 $0.00 $0.00 $0.00 $0.00 $0.00 $171,197.30 RECEIPTS: 2. CASH SALES 1,768,583.22 1,768,583.22 3. COLLECTION OF ACCOUNTS RECEIVABLE 0.00 0.00 4. LOANS & ADVANCES (attach list) 3,000,000.00 3,000,000.00 5. SALE OF ASSETS 0.00 0.00 6. OTHER (attach list) 0.00 0.00 TOTAL RECEIPTS 4,768,583.22 0.00 0.00 0.00 0.00 0.00 4,768,583.22 (Withdrawal) Contribution by Individual Debtor MFR-2* 0.00 DISBURSEMENTS: 7. NET PAYROLL 459,120.03 459,120.03 8. PAYROLL TAXES PAID 0.00 0.00 9. SALES, USE & OTHER TAXES PAID 320,326.07 320,326.07 10. SECURED/RENTAL/LEASES 0.00 0.00 11. UTILITIES & TELEPHONE 0.00 0.00 12. INSURANCE 267,688.02 267,688.02 13. INVENTORY PURCHASES 0.00 0.00 14. VEHICLE EXPENSES 0.00 0.00 15. TRAVEL & ENTERTAINMENT 0.00 0.00 16. REPAIRS, MAINTENANCE & SUPPLIES 48,177.00 48,177.00 17. REVENUES & ROYALTIES 614,927.30 614,927.30 17. ADMINISTRATIVE & SELLING 33,722.06 33,722.06 18. OTHER (attach list) 0.00 0.00 TOTAL DISBURSEMENTS FROM OPERATIONS 1,743,960.48 0.00 0.00 0.00 0.00 0.00 1,743,960.48 19. PROFESSIONAL FEES 155,573.59 155,573.59 20. U.S. TRUSTEE FEES 0.00 0.00 21. OTHER REORGANIZATION EXPENSES (attach list) 111,827.45 111,827.45 TOTAL DISBURSEMENTS -2,011,361.52 0.00 0.00 0.00 0.00 0.00 2,011,361.52 22. NET CASH FLOW 2,757,221.70 0.00 0.00 0.00 0.00 0.00 2,757,221.70 23. CASH—END OF MONTH (MOR-2) $2,928,419.00 $0.00 $0.00 $0.00 $0.00 $0.00 $2,928,419.00 MOR-7

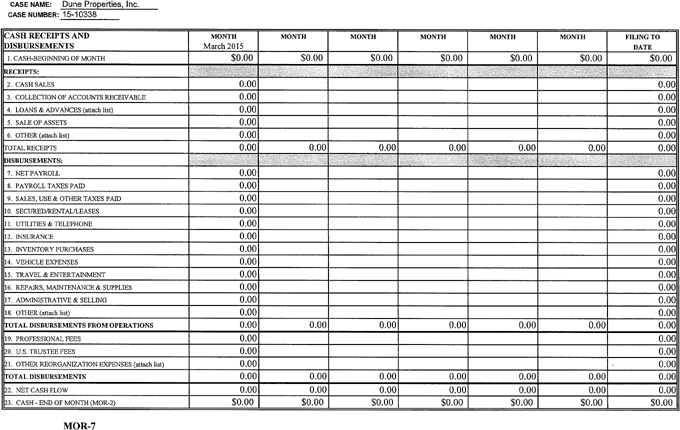

CASE NAME: Dune Properties, Inc. CASE NUMBER: 15-10338 CASH RECEIPTS AND MONTH MONTH MONTH MONTH MONTH MONTH FILING TO DISBURSEMENTS March 2015 DATE 1. CASH-BEGINNING OF MONTH $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 RECEIPTS: 2. CASH SALES 0.00 0.00 3. COLLECTION OF ACCOUNTS RECEIVABLE 0.00 0.00 4. LOANS & ADVANCES (attach list) 0.00 0.00 5. SALE OF ASSETS 0.00 0.00 6. OTHER (attach list) 0.00 0.00 TOTAL RECEIPTS 0.00 0.00 0.00 0.00 0.00 0.00 0.00 (Withdrawal) Contribution by Individual Debtor MFR-2* 0.00 DISBURSEMENTS: 7. NET PAYROLL 0.00 0.00 8. PAYROLL TAXES PAID 0.00 0.00 9. SALES, USE & OTHER TAXES PAID 0.00 0.00 10. SECURED/RENTAL/LEASES 0.00 0.00 11. UTILITIES & TELEPHONE 0.00 0.00 12. INSURANCE 0.00 0.00 13. INVENTORY PURCHASES 0.00 0.00 14. VEHICLE EXPENSES 0.00 0.00 15. TRAVEL & ENTERTAINMENT 0.00 0.00 16. REPAIRS, MAINTENANCE & SUPPLIES 0.00 0.00 17. ADMINISTRATIVE & SELLING 0.00 0.00 18. OTHER (attach list) 0.00 0.00 TOTAL DISBURSEMENTS FROM OPERATIONS 0.00 0.00 0.00 0.00 0.00 0.00 0.00 19. PROFESSIONAL FEES 0.00 0.00 20. U.S. TRUSTEE FEES 0.00 0.00 21. OTHER REORGANIZATION EXPENSES (attach list) 0.00 0.00 TOTAL DISBURSEMENTS 0.00 0.00 0.00 0.00 0.00 0.00 0.00 22. NET CASH FLOW 0.00 0.00 0.00 0.00 0.00 0.00 0.00 23. CASH—END OF MONTH (MOR-2) $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 MOR-7

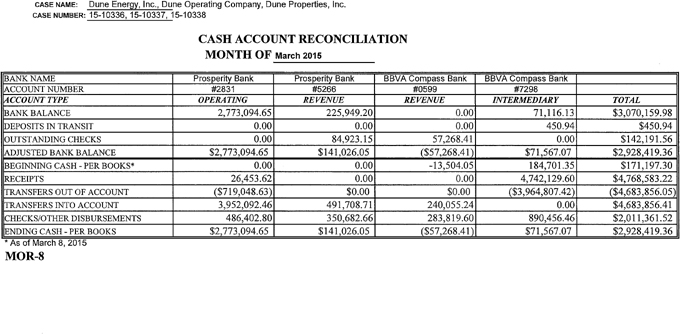

CASE NAME: Dune Energy, Inc., Dune Operating Company, Dune Properties, Inc. CASE NUMBER: 15-10336, 15-10337, 15-10338 CASH ACCOUNT RECONCILIATION MONTH OF March 2015 BANK NAME Prosperity Bank Prosperity Bank BBVA Compass Bank BBVA Compass Bank ACCOUNT NUMBER #2831 #5266 #0599 #7298 ACCOUNT TYPE OPERATING REVENUE REVENUE INTERMEDIARY TOTAL BANK BALANCE 2,773,094.65 225,949.20 0.00 71,116.13 $3,070,159.98 DEPOSITS IN TRANSIT 0.00 0.00 0.00 450.94 $450.94 OUTSTANDING CHECKS 0.00 84,923.15 57,268.41 0.00 $142,191.56 ADJUSTED BANK BALANCE $2,773,094.65 $141,026.05 ($57,268.41) $71,567.07 $2,928,419.36 BEGINNING CASH—PER BOOKS* 0.00 0.00 -13,504.05 184,701.35 $171,197.30 RECEIPTS 26,453.62 0.00 0.00 4,742,129.60 $4,768,583.22 TRANSFERS OUT OF ACCOUNT ($719,048.63) $0.00 $0.00 ($3,964,807.42) ($4,683,856.05) TRANSFERS INTO ACCOUNT 3,952,092.46 491,708.71 240,055.24 0.00 $4,683,856.41 CHECKS/OTHER DISBURSEMENTS 486,402.80 350,682.66 283,819.60 890,456.46 $2,011,361.52 ENDING CASH—PER BOOKS $2,773,094.65 $141,026.05 ($57,268.41) $71,567.07 $2,928,419.36 * As of March 8, 2015 MOR-8

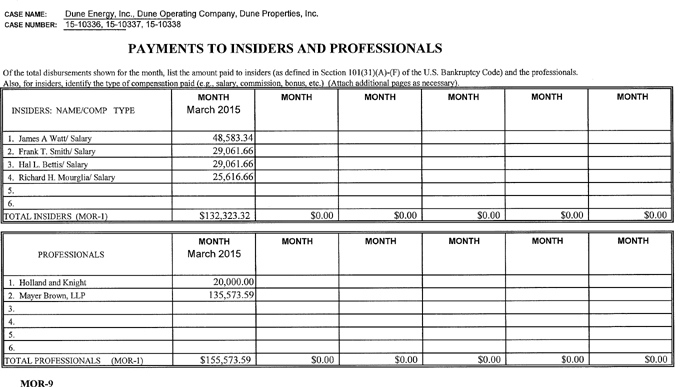

CASE NAME: Dune Energy, Inc., Dune Operating Company, Dune Properties, Inc. CASE NUMBER: 15-10336, 15-10337, 15-10338 PAYMENTS TO INSIDERS AND PROFESSIONALS Of the total disbursements shown for the month, list the amount paid to insiders (as defined in Section 101(31)(A)-(F) of the U.S. Bankruptcy Code) and the professionals. Also, for insiders, identify the type of compensation paid (e.g., salary, commission, bonus, etc.) (Attach additional pages as necessary). MONTH MONTH MONTH MONTH MONTH MONTH INSIDERS: NAME/COMP TYPE March 2015 1. James A Watt/ Salary 48,583.34 2. Frank T. Smith/ Salary 29,061.66 3. Hal L. Bettis/ Salary 29,061.66 4. Richard H. Mourglia/ Salary 25,616.66 5. 6. TOTAL INSIDERS (MOR-1) $132,323.32 $0.00 $0.00 $0.00 $0.00 $0.00 MONTH MONTH MONTH MONTH MONTH MONTH PROFESSIONALS March 2015 1. Holland and Knight 20,000.00 2. Mayer Brown, LLP 135,573.59 3. 4. 5. 6. TOTAL PROFESSIONALS (MOR-1) $155,573.59 $0.00 $0.00 $0.00 $0.00 $0.00 MOR-9