Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UMB FINANCIAL CORP | d915975d8k.htm |

| EX-99.1 - EX-99.1 - UMB FINANCIAL CORP | d915975dex991.htm |

| EX-99.3 - EX-99.3 - UMB FINANCIAL CORP | d915975dex993.htm |

Strength in Balance.

Annual Meeting of Shareholders

April 28, 2015

UMB Financial

Exhibit 99.2 |

2

Cautionary Notice about Forward-Looking Statements

This presentation contains, and our other communications may contain,

forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or

current

facts.

Forward-looking

statements

often

use

words

such

as

“believe,”

“expect,”

“anticipate,”

“intend,”

“estimate,”

“project,”

“outlook,”

“forecast,”

“target,”

“trend,”

“plan,”

“goal,”

or other words of comparable meaning or future-tense or conditional verbs such

as “may,”

“will,”

“should,”

“would,”

or “could.”

Forward-looking statements convey our expectations, intentions, or forecasts

about future events, circumstances, results, or aspirations.

All forward-looking statements are subject to assumptions, risks, and

uncertainties, which may change over time and many of which are beyond

our

control.

You

should

not

rely

on

any

forward-looking

statement

as

a

prediction

or

guarantee

about

the

future.

Our

actual

future

objectives, strategies, plans, prospects, performance, condition, or results may

differ materially from those set forth in any forward- looking statement.

Some of the factors that may cause actual results or other future events, circumstances, or aspirations to differ from

those in forward-looking statements are described in our Annual Report on Form

10-K for the year ended December 31, 2014, our subsequent Quarterly

Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished

with the Securities and Exchange Commission (SEC).

Any forward-looking statement made by us or on our behalf speaks only as of the

date that it was made. We do not undertake to update any forward-looking

statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was

made. You, however, should consult further disclosures (including disclosures of a

forward-looking nature) that we may make in any subsequent Annual Report

on Form 10-K, Quarterly Report on Form 10-Q, Current Report on Form 8-K, or other applicable document

that is filed or furnished with the SEC. |

Agenda

Authenticity

2014 Performance & Highlights

1

st

Quarter 2015 Financials

Questions & Answers |

Genuine

Not easily replicated

Trustworthy

Original

Experienced

Strong

Consistent |

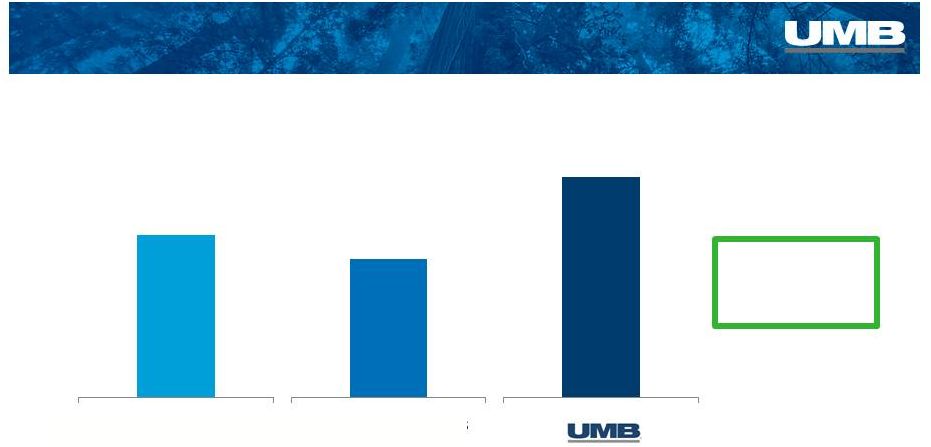

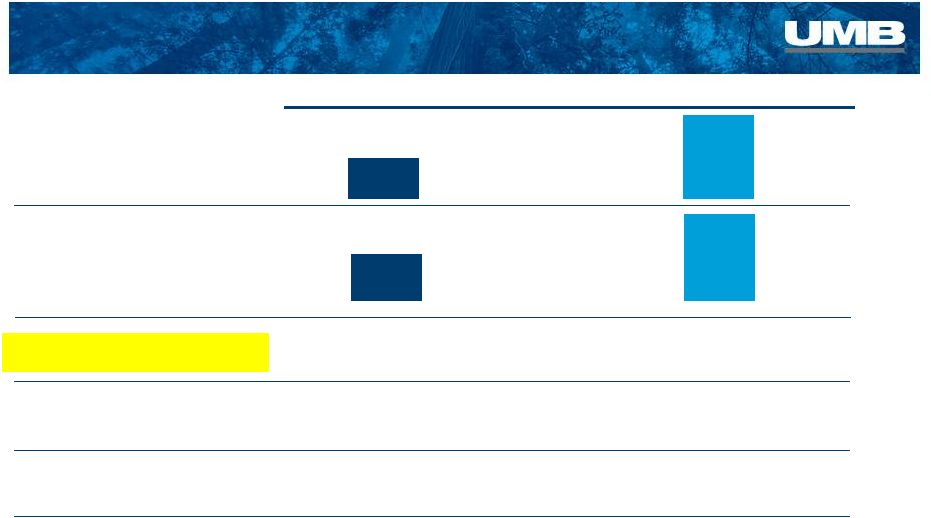

5

Continuity –

We’re in it for the long run

•

CEO tenure

4 generations

of consistent

leadership

All company and large bank CEO tenure statistics source: The Motley Fool,

Sept. 5, 2013. All Companies

8.1 years

Largest US Banks

6.9 years

11 years |

6

Continuity –

We’re in it for the long run

•

Company-wide

•

Our Loan Committee—12 senior executives who guide our

lending—average 23 years at UMB

•

In Kansas City—our commercial lenders average 13 years

•

Footprint-wide—the average commercial lender has been

with UMB for 9 years

•

Lending team tenure

long-tenured

lenders

build

relationships.

—

—associates

average

nearly

9

years

with UMB |

#1

7

Consistency –

Steady business practices

Consistently independent—no government assistance, no

FDIC assisted deals

Consistent actions to diversify and innovate our business

Named as one of the best by Forbes for 6

th

year**

* Source FDIC reports

** Source: Forbes “Best Banks in America”

list, 2010 -

2015

o

1933 –

UMB turned down Emergency Banking Act assistance during the

Great Depression

o

2008 –

UMB did not participate in the Troubled Asset Relief Program

deposit market share in Kansas City for past 4 years*

|

8

Consistency –

Independence

“If we were to liquidate this bank today, we could

pay our depositors one hundred cents on the

dollar and collect our entire Surplus and Capital

Account of $700,000 and a large part of the

Undivided Profits Account.”

No need for government assistance –

then or now.

-R.

Crosby

Kemper,

Sr.

in a 1933 letter to the Missouri

Banking Commissioner |

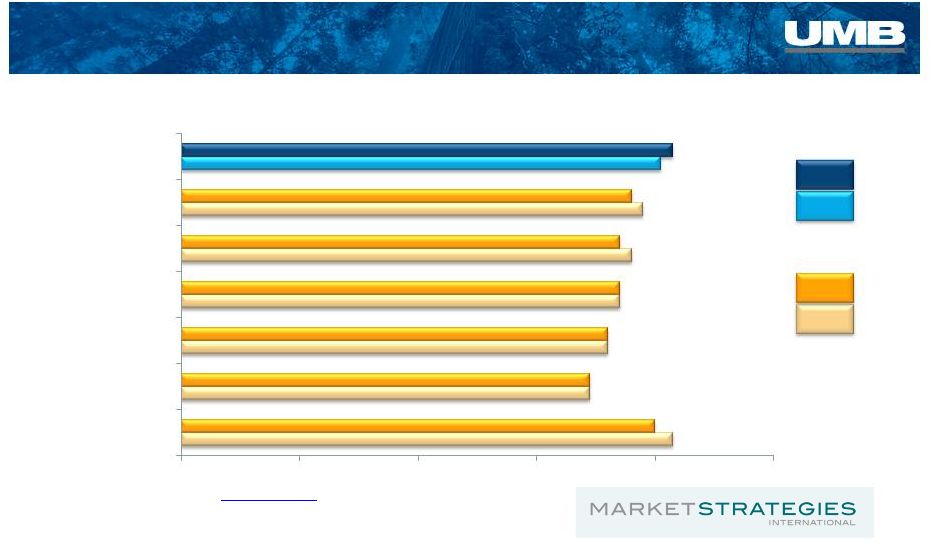

9

Consistency –

Stability Breeds Confidence

American Customer Satisfaction Index (ACSI)

“Score”

on 100-Point Scale

2013

2014

For ACSI:

2013

2014

For UMB:

Source

for

non-UMB

ACSI

scores:

www.theacsi.org

Source for UMB scores: Average of 3 questions, converted to 100-point

scale Q1: How satisfied would you say you are with UMB? Q2: To what extent

has UMB exceeded or fallen short of your expectations? Q3: Now, I want you to imagine an

ideal bank. How well do you think UMB compares with that ideal bank?

83

69

72

74

76

78

81

80

69

72

74

74

76

83

0

20

40

60

80

100

All other banks

Bank of America

Wells Fargo

Citibank

J. P. Morgan Chase

Banking Industry Total

UMB |

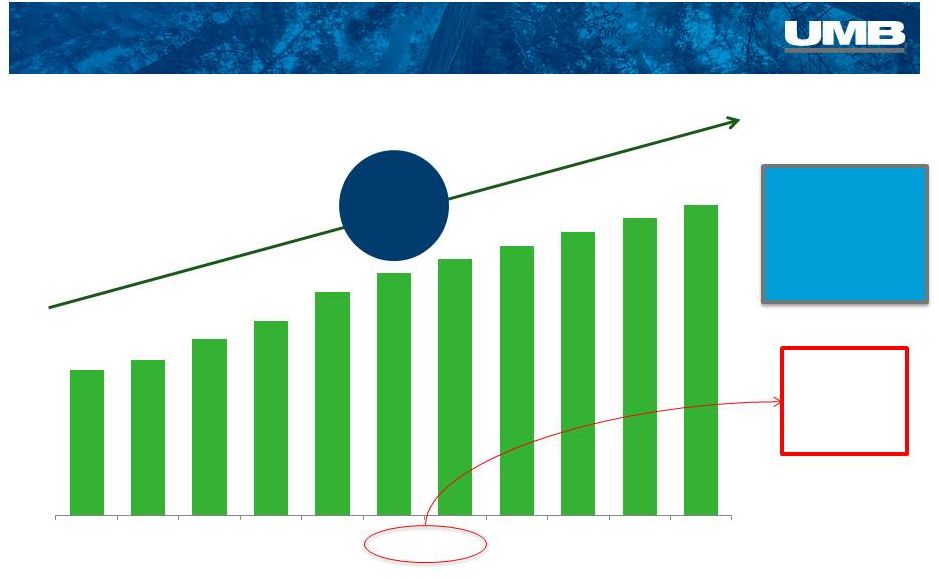

10

Consistency –

Returning Value to Shareholders

Annual Dividends Per Share Declared

Dividend

increase

= 114.1%

Industry

Median

+17.1%

increase

Industry is defined as all publicly traded banks with dividends reported in 2004

and 2014. Source: SNL Financial More than

half of banks

decreased

dividends in

2009 or 2010

$0.425

$0.910

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014 |

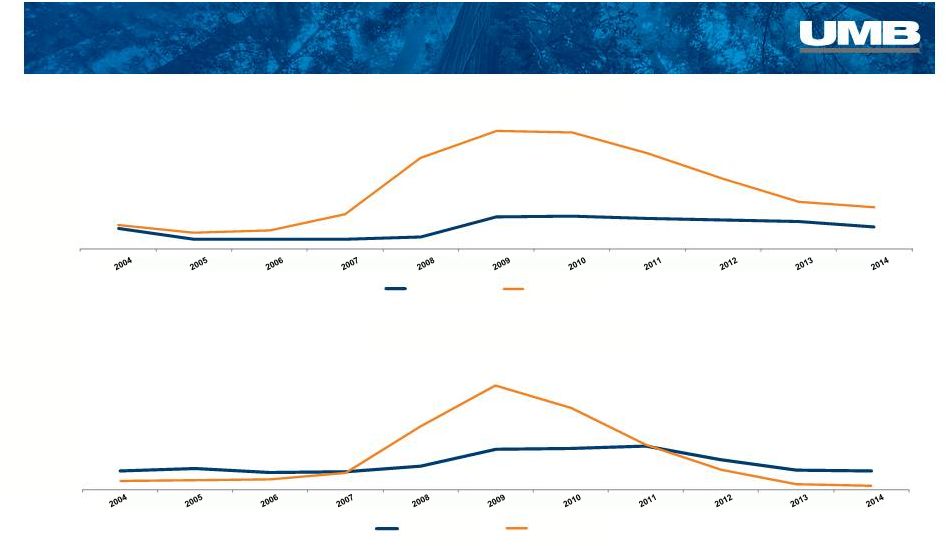

11

Peer group consists of Bank of Oklahoma, Boston Private, Commerce, Cullen/Frost,

CoBiz, City Natl., First Midwest, Hancock, Old Natl., Prosperity, Signature,

Silicon Valley, Trustmark, and Webster. Source for peer data: SNL Financial.

Consistency –

Unwavering Credit Standards

0.00%

0.50%

1.00%

1.50%

2.00%

Non-Performing Loans/Loans

UMBF

Peer Median

0.00%

0.50%

1.00%

1.50%

Net Chargeoffs/Avg. Loans

UMBF

Peer Median |

Net

Charge-Offs

(000’s)

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

Commercial

Loans*

6,459

3,881

7,310

11,880

6,007

4,113

2,943

1,569

2,367

1,818

893

Credit Card

8,301

8,811

9,382

11,127

14,279

12,291

6,839

4,577

3,449

4,917

4,412

Other**

851

1,483

1,399

1,128

1,411

3,854

1,973

2,127

1,176

938

836

Total Net

Charge-Offs

15,611

14,175

18,091

24,135

21,697

20,258

11,755

8,273

6,992

7,673

6,141

Average

Total Loans

(billions)

NCOs as %

of average

loans

0.22%

0.23%

0.35%

0.51%

0.48%

0.47%

0.28%

0.21%

0.20%

0.25%

0.22%

12

Consistency –

Quality Underwriting

* Commercial Loans includes Commercial Loans and Commercial Real

Estate. ** Other includes Consumer, Consumer Real Estate, Home Equity, and

DDA Charge-offs. 6.98

$

6.22

$

5.25

$

4.76

$

4.49

$

4.38

$

4.19

$

3.90

$

3.58

$

3.13

$

2.78

$ |

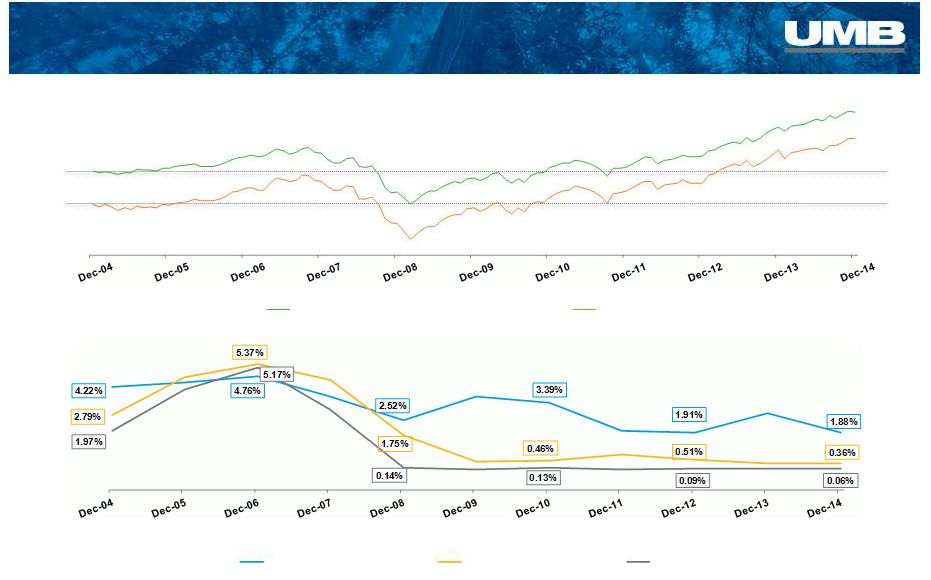

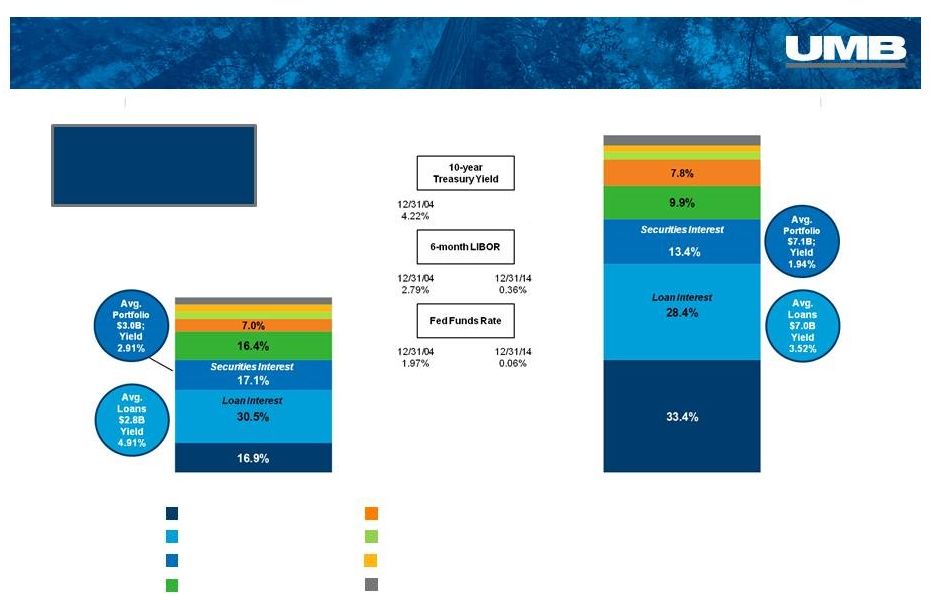

13

Consistency –

Change is Constant

Key Interest Rates

Index Prices

December

31,

2004

–

December

31,

2014

10-yr Treasury

6-mo LIBOR

Fed Funds Rate

$0

$70

$0

$65

S&P 500: +69.9%

DJIA: +65.3% |

$18.93

$36.10

Book Value

Evolution –

Then and Now

$1.23 Billion

$2.59 Billion

Market Capitalization

Average Deposits –

Full Year

$5.0 billion

$12.7 billion

14

Share Price -

UMBF

$28.33

$56.89

Total Assets

$7.8 billion

$17.5 billion

Average Loans –

Full Year

$2.8 billion

$7.0 billion

2004

2014

At December 31, except for averages |

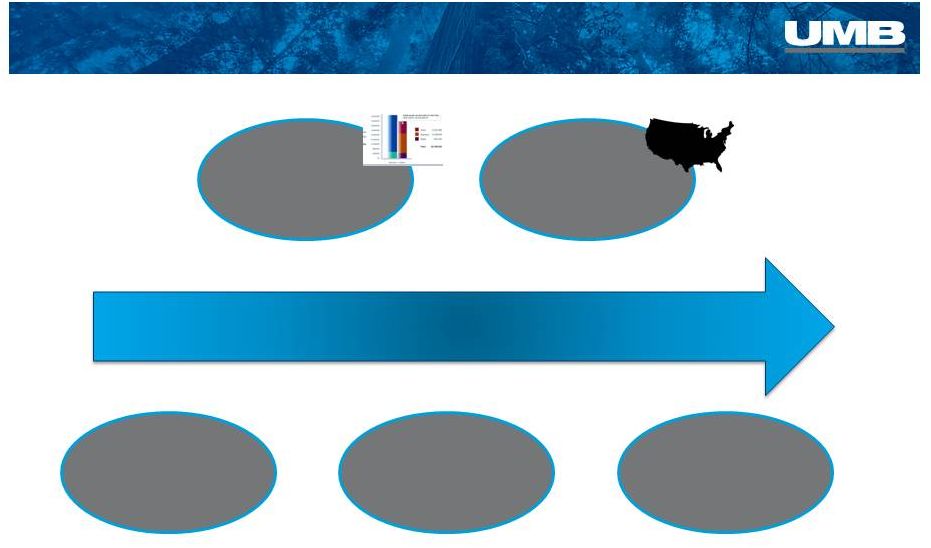

Building Strength & Balance |

Evolution –

Optimizing our Balance Sheet

2014

16

Geographic

Expansion &

Penetration

Changing

Balance

Sheet

Asset

Management:

Growth &

Diversification

Asset

Servicing:

Adapting to

Changes

Healthcare

Services:

Evolving with

the Industry

2004 |

41.8%

51.6%

17.9%

20.8%

8.6%

4.3%

4.2%

21.0%

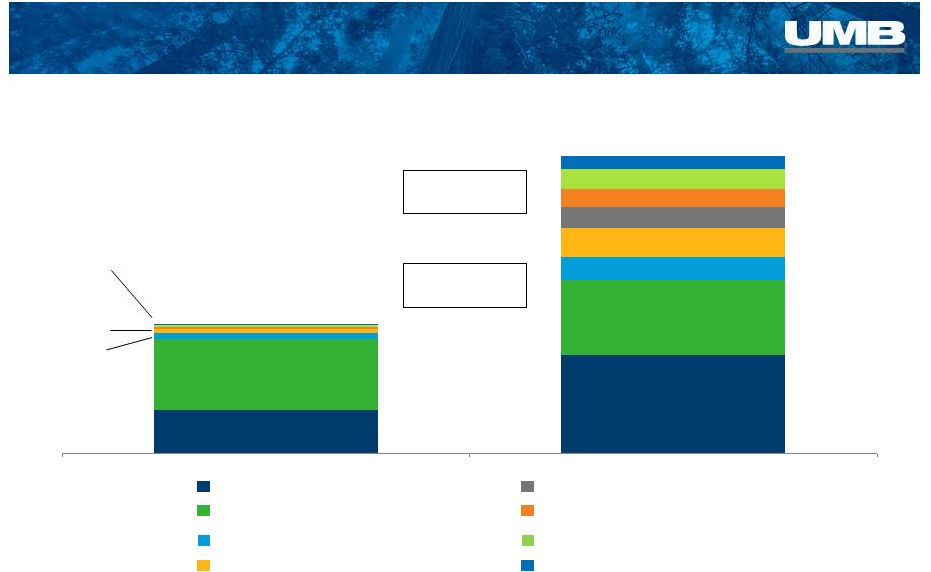

Evolution –

Loan Composition

2006

12/31/06 Loans -

$3.8 billion

2014

12/31/14 Loans -

$7.5 billion

4.0%

4.6%

5.1%

*Note: unlabeled categories comprise <4% each of total loans

CRE

C&I

CRE

C&I

Commercial Real Estate

C&I –

including leases

Farm RE (CRE category)

Residential RE (1-4 Family)

HELOC

RE Construction & Land Dev.

Multifamily RE (CRE category)

Consumer Credit Card

Consumer -

other

Commercial Credit Card

Consumer Loans

17

2004

2014

18.4%

39.9%

81.6%

60.1%

Commercial/Consumer Mix

annual averages

Commercial

Consumer

Real Estate –

related loans

32.0%

41.3%

Indirect Loans

Runoff from

$700M, June ‘07 -

Dec ‘11 |

33.9%

33.5%

54.8%

24.9%

7.5%

9.8%

6.8%

6.2%

6.8%

4.5%

Evolution –

Deposit Sources

Consumer Banking

Commercial & Small Business

Inst. Banking & Investor Services

Asset Servicing

Healthcare Services

Private Wealth Management

Institutional Asset Management

Small Business Banking

4.0% combined

•Private Wealth

•Healthcare

•Inst. Asset Mgmt

•Small Business

3.2%

4.1%

18

% Noninterest-

Bearing

12/31/06

33.5%

12/31/14

42.1%

Average Cost

of Deposits

12/31/06

1.77%

12/31/14

0.10%

2006

Average

Deposits

-

$5.5

billion

2014

Average

Deposits

-

$12.7

billion |

Evolution –

Pushing our Boundaries

2014

Healthcare

Services:

Evolving with

the Industry

19

Geographic

Expansion &

Penetration

Changing

Balance

Sheet

2004

Asset

Management:

Growth &

Diversification

Asset

Servicing:

Adapting to

Changes |

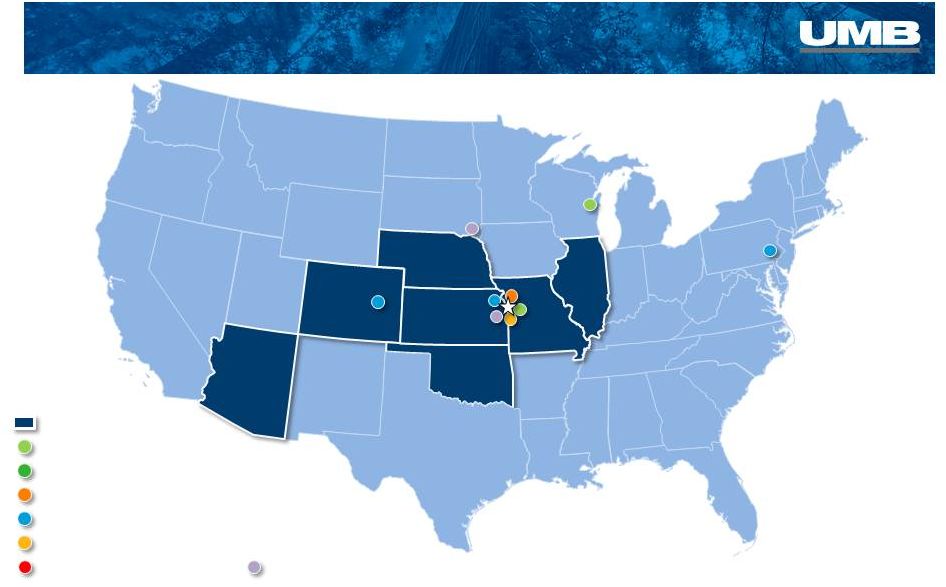

20

Fund Services

Prairie Capital

Healthcare Services –

National Sales

Scout Investments –

National Sales

Corporate Trust/Inst. Asset Mgmt.

UMB Bank presence

Loan Production Office

2004

Private Wealth/Personal Trust |

21

2014

Fund Services

Prairie Capital

Healthcare

Services

–

National

Sales

Scout

Investments

–

National

Sales

Corporate Trust/Inst. Asset Mgmt.

UMB Bank presence

Loan Production Office

Private Wealth/Personal Trust |

Evolution –

Scale in Asset Management

Asset

Management:

Growth &

Diversification

Asset

Servicing:

Adapting to

Changes

Healthcare

Services:

Evolving with

the Industry

22

Changing

Balance

Sheet

Geographic

Expansion &

Penetration

2004

2014 |

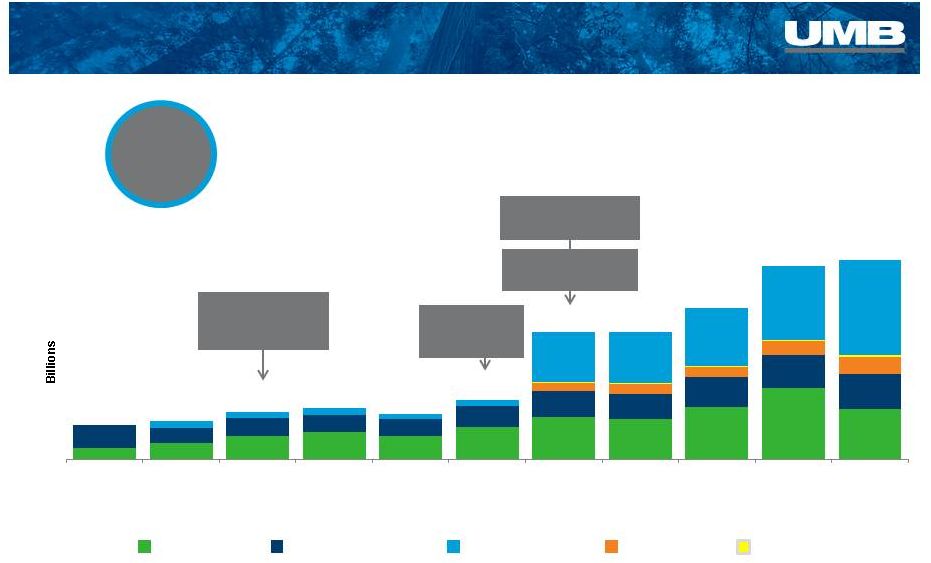

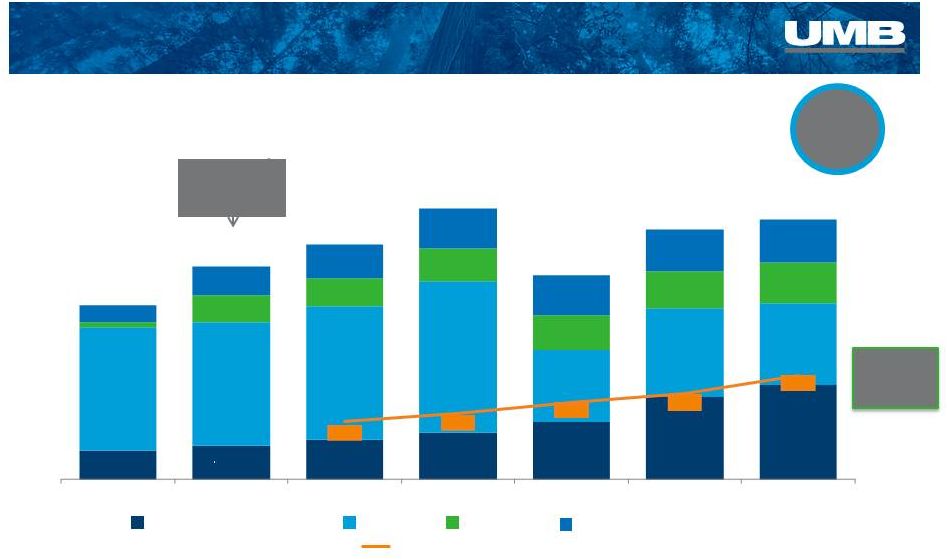

$8.2B

$10.1B

$9.7B

$11.0B

$12.8B

$27.3B

$27.3B

$32.4B

$41.4B

$42.8B

Rolled out

MidCap strategy

–

Oct 2006

Assets Under Management

Evolution

–

Designed to Grow

10-year

CAGR

19.2%

Private Wealth/Trust

Scout Institutional

Scout Funds

Prairie Capital

Brokerage

23

Scout became

a sub of

UMBFC –

2009

Acquired PCM,

$2.2B –

July 2010

Acquired Reams,

$9.8B–

Dec 2010

At Dec. 31,

$2.4

$3.5

$5.0

$5.8

$4.9

$6.9

$8.8

$8.7

$11.3

$15.4

$10.7

$5.0

$3.2

$3.7

$3.7

$3.6

$4.5

$5.5

$5.4

$6.4

$7.0

$7.6

$1.7

$2.0

$2.2

$2.9

$3.6

$1.5

$1.4

$1.5

$1.2

$1.4

$10.9

$11.0

$12.3

$15.8

$20.5

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

$7.4B |

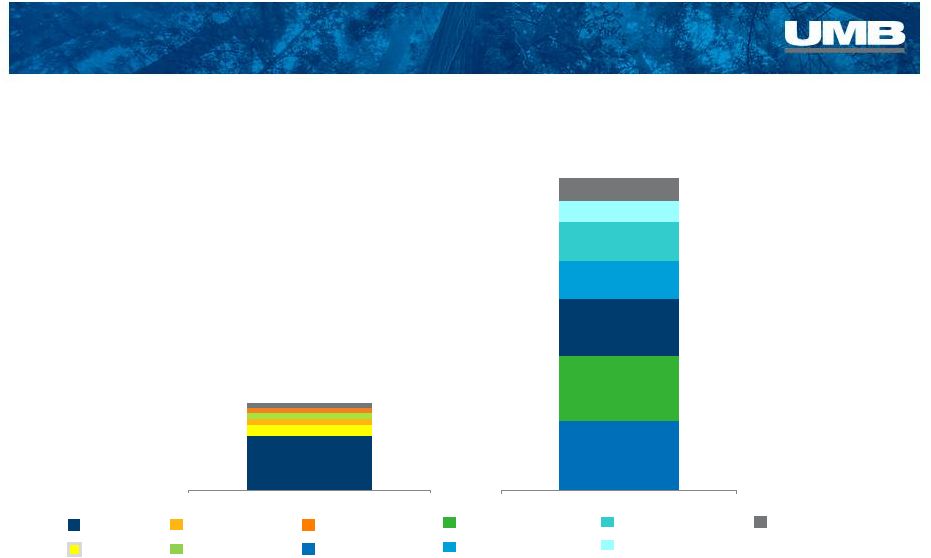

24

Evolution –

Asset

Diversification

Scout AUM Diversification

$31.2 billion

* Asset mix by strategy not available prior to 2009 due to system constraints

Intl Equity

Money Mkt

Small Cap Equity

Core Bond

Balanced Equity

Core Plus Bond

Low Duration Bond

Unconstrained Bond

Mid Cap Equity

Long Duration Bond

Other

21.8%

20.7%

18.4%

12.2%

12.2%

6.7%

8.0%

62.7%

12.2%

2009*

2014

$8.2 billion

5.3%

5.7%

7.0%

7.1%

At December 31, |

25

Evolution –

Building

Wealth for our Customers

Private Wealth Management

Assets Under Management

$5.0B

$11.6B

2004

2014

At December 31,

PCM added 13 funds

since acquisition for a

total of 23 funds

2014

Offerings

expanded to

151 products

2010

Acquired Prairie

Capital -$2.2B in AUM

2004

We offered ~40

products to our

clients

10-year

CAGR

8.9%

2009

Rolled out wrap

accounts, began

building brokerage

assets

Private Wealth/Trust

Prairie Capital

Brokerage

$7.6

$3.6

$0.4

$5.0 |

Evolution –

Adapting Asset Servicing Capabilities

Asset

Management:

Growth &

Diversification

Asset

Servicing:

Adapting to

Changes

Healthcare

Services:

Evolving with

the Industry

26

Changing

Balance

Sheet

2004

2014

Geographic

Expansion &

Penetration |

27

Evolution –

UMB Fund Services

10-year

CAGR

30.5%

Assets Under Administration

($billions)

$132.6

$179.3

$162.4

$206.4

$191.0

$156.0

$198.3

Fund Accounting & Admin.

Alternative

Custody

Other (transfer agent/distribution)

* Current segment reporting was initiated in 2010. Comparative revenue data

not available before that time. 42.7%

Revenue

growth

42.7%

Revenue

growth

Revenue (millions)

At December 31,

16.6%

15.8%

17.0%

17.4%

28.2%

33.0%

36.4%

71.3%

57.9%

56.5%

56.0%

35.2%

35.6%

31.5%

2.5%

12.6%

11.9%

11.9%

16.8%

14.6%

15.9%

9.6%

13.7%

14.5%

14.7%

19.7%

16.8%

16.3%

2008

2009

2010

2011

2012

2013

2014

$77.5

$66.0

$71.1

$83.0

$94.2

Acquired JD

Clark $18B

AUA–2009 |

Evolution

–

A Changing Healthcare Industry

2004

2014

Asset

Management:

Growth &

Diversification

Asset

Servicing:

Adapting to

Changes

Healthcare

Services:

Evolving with

the Industry

28

Geographic

Expansion &

Penetration

Changing

Balance

Sheet |

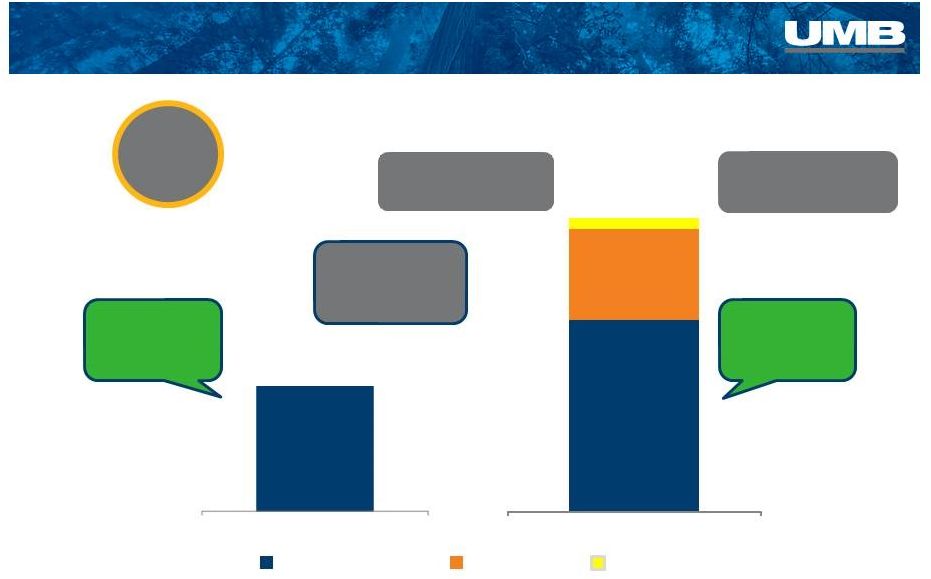

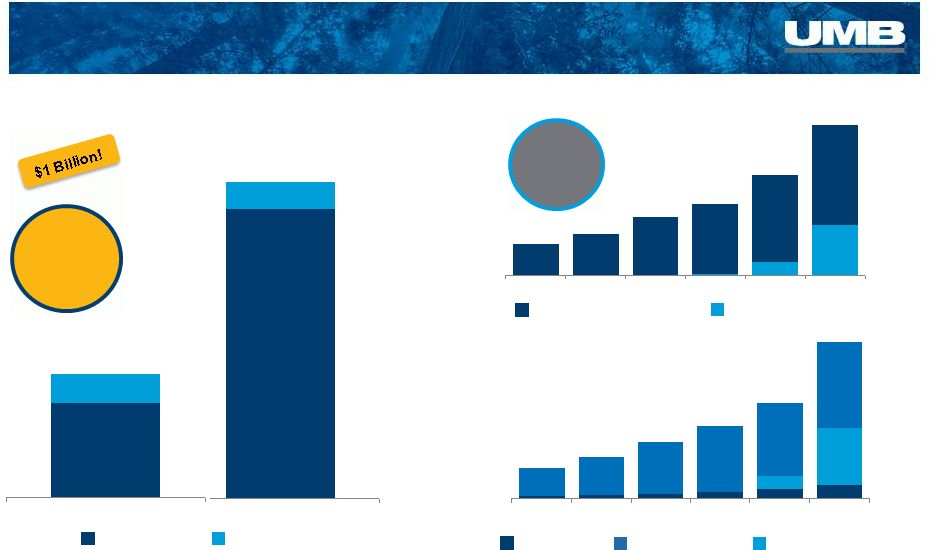

Healthcare Deposits and Assets

$millions

2014

2005

HSA Assets

HSA Deposits

$36.6

$917.5

$841.8

$75.8

$28.3

$8.3

29

Evolution

–

Healthcare Services

Jan ‘15

Deposits

& assets

+ $1B

13.3%

33.2%

$0.9

$1.2

$1.7

$2.1

$3.0

$4.4

2009

2010

2011

2012

2013

2014

315

438

588

567

2,451

1,212

1,630

2,245

2,824

3,161

3,765

2009

2010

2011

2012

2013

2014

Healthcare Card Purchase Volume

$millions

Healthcare Accounts

thousands

Virtual Card Volume

HSA & FSA Card Volume

FSA Benefit Cards

HSA Accounts

V-Cards Issued*

*Virtual Cards are single-use; one-time transaction, not an open account.

At December 31

At Dec. 31

5yr

CAGR

36.7% |

Evolution

–

A Journey, Not a Destination

2004

2014

Healthcare

Services:

Evolving with

the Industry

30

Geographic

Expansion &

Penetration

Changing

Balance

Sheet

Asset

Management:

Growth &

Diversification

Asset

Servicing:

Adapting to

Changes |

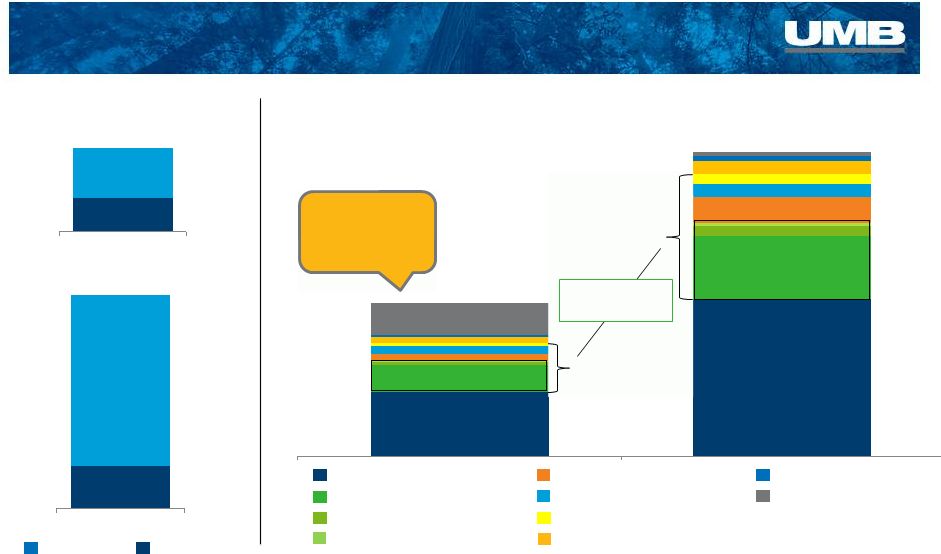

31

Evolution –

Diverse Revenue = Fewer Dependencies

Total Revenue

$862.6 million

Total Revenue

$447.6 million

2004

2014

Interest on Loans

Trust & Securities Processing

Interest on Securities

Deposit Service Charges

Trading & Investment Banking

Bankcard Fees

Other

“Other”

includes:

•

Brokerage fees

•

Gains on Securities Sales

•

Equity Earnings on Alt Investments

•

Insurance Fees & Commissions

•

Interest income from repo, due from, etc.

Other Noninterest Income

12/31/14

2.17%

Revenue nearly

doubled during the

past decade.

4.0%

4.1%

4.0%

2.9%

2.0%

2.2% |

Growth |

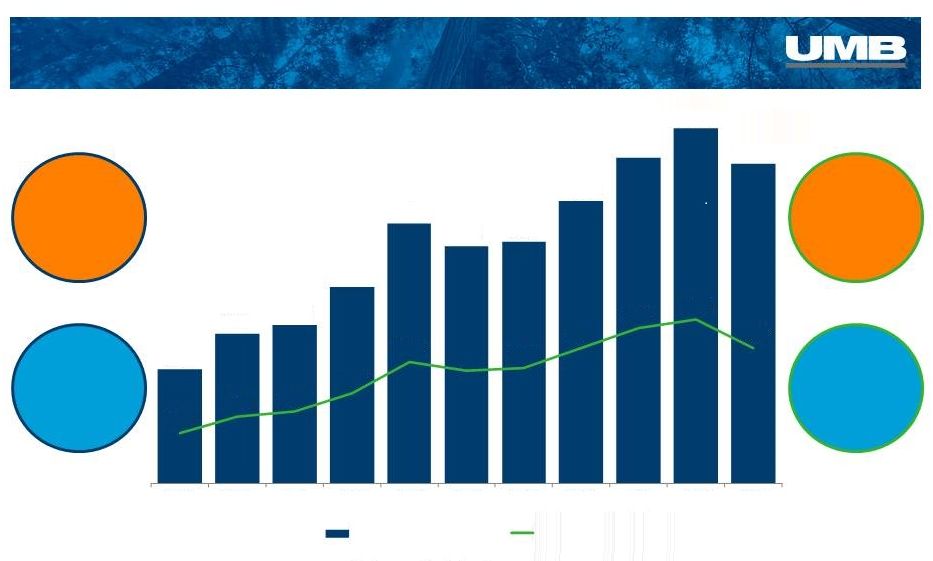

33

Growth

–

Net Income & EPS

UMB

Net

Income

‘04-’14

+181.6%

Industry

Median

Net Income

‘04-’14

+33.3%

UMB

EPS*

‘04-’14

+167.7%

Industry

Median

EPS*

‘04-’14

+17.0%

Industry

is

defined

as

all

publicly

traded

banks

with

net

income

reported

in

2004

and

2014.

Source:

SNL

Financial.

*EPS

is

diluted.

$42.8

$56.3

$59.8

$74.2

$98.1

$89.5

$91.0

$106.5

$122.7

$134.0

$120.7

$0.99

$1.30

$1.40

$1.77

$2.38

$2.20

$2.26

$2.64

$3.04

$3.20

$2.65

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

Net Income ($ millions)

Diluted EPS |

34

Growth

–

A 10-year Picture

95.4%

Net Interest Income

Diluted Earnings Per Share

UMBF

(2004 –

2014)

108.6%

Total Revenue

58.5%

17.0%

Industry Median

(2004 –

2014)

62.3%

118.6%

Noninterest Income

58.7%

167.7%

Average Loans

Average Total Deposits

150.8%

155.0%

69.2%

79.4%

Industry is defined as all publicly traded banks with data reported in 2004 and

2014. Source: SNL Financial |

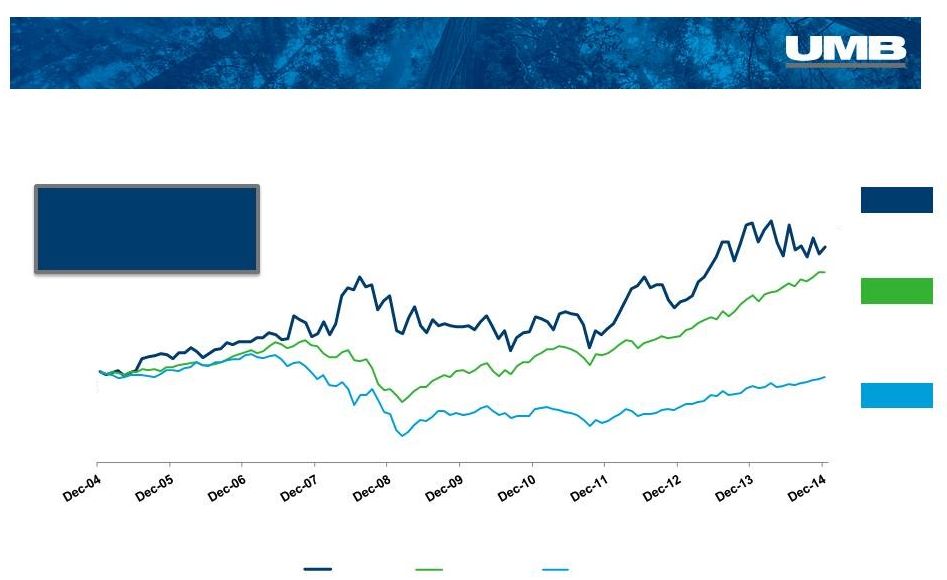

35

December 31, 2004 –

December 31, 2014

Reinvesting all cash dividends

+137.6%

+109.5%

-6.5%

UMBF

Compound Annual

Growth Rate 9.0%

Growth

–

Total Shareholder Return

$100

$238

$209

$94

UMBF

S&P 500

SNL U.S. Bank |

Agenda

Authenticity

2014 Performance & Highlights

1

st

Quarter 2015 Financials

Questions & Answers |

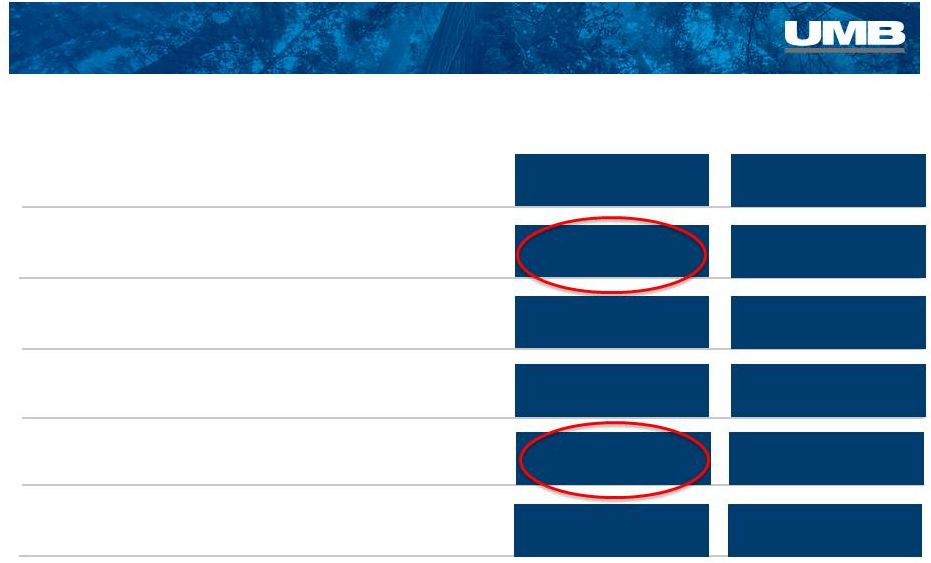

37

Overview of 2014 Results

All comparisons are full-year 2014 vs. full-year 2013 unless

otherwise noted •

Net Income: $120.7 million, a decrease of $13.3 million compared

to 2013

•

EPS: $2.65 per diluted share

•

Average loans increased 12.1% to $7.0 billion

•

Net interest income, driven by loan volume and mix, increased 5.0% to $350.0

million •

Nonperforming loans decreased to 0.37% of loans from 0.47% in 2013

•

Total assets under management stood at $42.8 billion at 12/31/14, an increase of

3.4% •

Announced agreement to acquire Marquette Financial Companies, pending regulatory

approval |

38

Strategically Compelling Combination

Compatible cultures

Complementary balance sheet

o

Combining MFC’s higher-yielding loans with UMB’s low-cost

funding Enhances UMB’s market share in Dallas and Phoenix markets

Adds national specialty-lending businesses and an asset-management

business +

Pending Acquisition of Marquette Financial Companies |

39

About Marquette

$1.4 billion in assets, $970 million in net loans & leases, $959

million in deposits

Original bank formed 36 years ago in Phoenix

Privately-owned by the Pohlad family

Community Banking Franchise

Dallas

5 branches

$323 million in net loans

$376 million in deposits

Phoenix

8 branches

$341 million in net loans

$583 million in deposits

High Quality National Specialty Lending

Middle-Market Asset-Based Lending

$207 million in net loans

Factoring business

$96 million in net loans

Note: Financial data as of 03/31/2015 Source: MFC financial reports and regulatory

filings. |

Agenda

2014 Performance & Highlights

1st

Quarter 2015 Financials

Questions & Answers

Authenticity |

41

First Quarter 2015

All comparisons are first quarter 2015 vs. first quarter 2014 unless otherwise

noted •

Net Income: $33.8 million, an increase of $10.4 million

•

EPS: $0.74 per diluted share

•

Average loans increased 11.9% to $7.5 billion

•

Noninterest income increased 1.8% to $125.2 million

•

Nonperforming loans decreased to 0.39% of loans from 0.45%

•

Total company assets under management stood at $42.3 billion at March 31,

2015 •

Return on average assets increased to 0.81% from 0.58%

•

Return on average equity increased to 8.18% from 6.13%

•

Tier 1 capital ratio at 03/31/15 remains strong at 12.91% under the new Basel III

requirements |

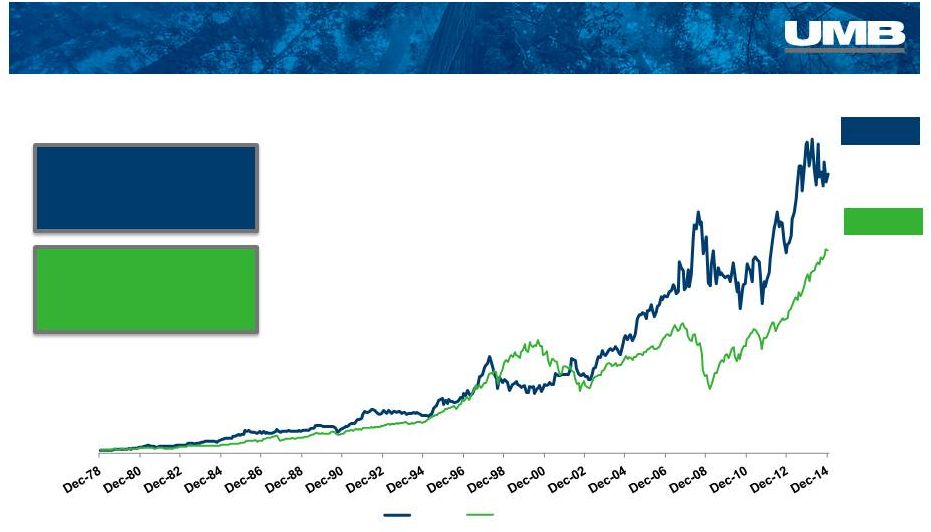

Built for the Decades

42

UMBF

Compound Annual

Growth Rate 13.0%

UMBF

Compound Annual

Growth Rate 13.0%

S&P 500

Compound Annual

Growth Rate 12.0%

S&P 500

Compound Annual

Growth Rate 12.0%

+5,837%

+8,069%

Total Shareholder Return

December 31, 1978 –

December 31, 2014

$100

$8,169

$5,937

UMBF

S&P 500 |

Agenda

2014 Performance & Highlights

1

st

Quarter 2015 Financials

Questions & Answers

Authenticity |

Strength in balance –

today and tomorrow.

Annual Meeting of Shareholders

–

April 2015

UMB Financial |