Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - PEPCO HOLDINGS LLC | t1500894_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - PEPCO HOLDINGS LLC | t1500894_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

| Commission File Number |

Exact Name of Registrant as Specified in its Charter, State or Other Jurisdiction of Incorporation, Address of Principal Executive Offices, Zip Code and Telephone Number (Including Area Code) |

I.R.S. Employer Identification Number | ||

|

001-31403 |

PEPCO HOLDINGS, INC. |

52-2297449 |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, $.01 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether each registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large |

Accelerated Filer |

Non-Accelerated |

Smaller |

| x | ¨ | ¨ | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

| Aggregate Market Value of Voting and Non- Voting Common Equity Held by Non- Affiliates of the Registrant at June 30, 2014 |

Number of Shares of Common Stock of the Registrant Outstanding at April 1, 2015 | |

| $6,893.8 million (a) | 253,043,362 ($.01 par value) |

| (a) | Solely for purposes of calculating this aggregate market value, PHI has defined its affiliates to include (i) those persons who were, as of June 30, 2014, its executive officers, directors and beneficial owners of more than 10% of its common stock, and (ii) such other persons who were deemed, as of June 30, 2014, to be controlled by, or under common control with, PHI or any of the persons described in clause (i) above. |

| TABLE OF CONTENTS | |||

| Page | |||

| Explanatory Notes | ii | ||

| PART III | |||

| Item 10. | - | Directors, Executive Officers and Corporate Governance | 1 |

| Item 11. | - | Executive Compensation | 5 |

| Item 12. | - | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 77 |

| Item 13. | - | Certain Relationships and Related Transactions, and Director Independence | 79 |

| PART IV | |||

| Item 15(a)(3). | - | Exhibits | 85 |

| Signatures | 86 | ||

| i |

This Amendment No. 1 (this Amendment) to the Annual Report on Form 10-K for the year ended December 31, 2014 (the Original Form 10-K) for Pepco Holdings, Inc., is being filed solely to amend the Original Form 10-K to include the Part III information omitted therefrom in reliance upon General Instruction G(3) thereto. The reference to the definitive proxy statement on the cover page of the Original Form 10-K as a document that may be incorporated by reference has been deleted, references to subsidiary registrants that were included in the Original Form 10-K have been removed, and the number of shares of Pepco Holdings, Inc. common stock has been updated as of a recent practicable date.

Other than as set forth above, no other items or sub-items of the Original Form 10-K are being revised by this Amendment. Information in the Original Form 10-K is generally stated as of December 31, 2014 and this Amendment does not reflect any subsequent information or events other than those described above. As required by Rule 12b-15 under the Exchange Act, Item 15(a)(3) of this Amendment includes the certifications from the Chief Executive Officer and Chief Financial Officer of Pepco Holdings, Inc. required under Rule 13a-14(a) under the Exchange Act (attached hereto as Exhibits 31.1 and 31.2), and they have been abbreviated as permitted under interpretations of the Staff of the Division of Corporation Finance of the SEC. Because no financial statements are contained in this Amendment, the certifications specified by Rule 13a-14(b) under the Exchange Act have not been included.

The section of this Amendment entitled “Compensation/Human Resources Committee Report”:

| · | is not deemed to be “soliciting material” or “filed” with the SEC; |

| · | is not subject to Regulation 14A under the Exchange Act; |

| · | is not subject to the liabilities of Section 18 of the Exchange Act; and |

| · | shall not be incorporated by reference or deemed to be incorporated by reference into any filing by the Company under either the Securities Act of 1933 or the Exchange Act, unless otherwise specifically provided for in such filing. |

Capitalized terms not otherwise defined in this Amendment shall have the meanings ascribed to them in the Original Form 10-K, including as provided in the section thereof entitled “Glossary of Terms.”

Unless the context requires otherwise, references to “we,” “us,” “our,” the “Company,” “Pepco Holdings” or “PHI” in the Part III information contained in this Amendment are to Pepco Holdings, Inc. without its subsidiaries.

| ii |

Item 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors of Pepco Holdings

Paul M. Barbas, age 57, was President and Chief Executive Officer of DPL Inc., the utility holding company of The Dayton Power and Light Company (DP&L) from October 2006 until December 2011. He also served on the board of directors of DPL Inc. and DP&L from October 2006 to November 2011. He has served as a director of Dynegy, Inc., a publicly traded electricity generation company, since October 2012. Mr. Barbas previously served as Executive Vice President and Chief Operating Officer of Chesapeake Utilities Corporation, a diversified utility company engaged in natural gas distribution, transmission and marketing, propane gas distribution and wholesale marketing and other related services, from 2005 until October 2006, as an Executive Vice President from 2004 until 2005, and as President of Chesapeake Service Company and Vice President of Chesapeake Utilities Corporation, from 2003 until 2004. From 2001 until 2003, Mr. Barbas was Executive Vice President of Allegheny Power, responsible for the operational and strategic functions of Allegheny Energy, Inc.’s regulated utility operations, serving 1.6 million customers with 3,200 employees. Mr. Barbas joined Allegheny Energy in 1999 as President of its Ventures unit. He has been a director of Pepco Holdings since September 25, 2013.

Mr. Barbas’s qualifications for election to the Company’s Board of Directors (the Board) include his perspective and experience as a former President and Chief Executive Officer of a regulated public utility company. Mr. Barbas brings extensive utility, management and oversight experience, having served in executive management positions with various utility and other companies. He also has a broad background in finance and marketing and brings a strong understanding of power operations and energy markets. He contributes significantly to oversight responsibilities on matters relating to executive compensation and compensation strategy and has served as the Chairman of Dynegy, Inc.’s Compensation and Human Resources Committee since October 2012.

Jack B. Dunn, IV, age 64, served as Chief Executive Officer of FTI Consulting, Inc. (FTI), a publicly held, multi-disciplined global consulting firm located in West Palm Beach, Florida, from October 1995 to January 2014, and served as President of FTI from October 2004 to January 2014. He also served as a director of FTI from 1992 to January 2014, and served as its Chairman of the Board from December 1998 to October 2004. He remains a part-time employee of FTI. Mr. Dunn served as a director of Aether Systems, Inc., which became Aether Holdings, Inc., and then NexCen Brands, Inc., from June 2002 through September 2008. Mr. Dunn is also a limited partner in the Baltimore Orioles and a member of the Board of Trustees of Johns Hopkins Medicine. He has been a director of Pepco Holdings since May 21, 2004.

Mr. Dunn’s qualifications for election to the Board include his broad knowledge of corporate finance and his perspective and experience as a former Chief Executive Officer of a global business advisory firm with a particular emphasis on customer service and assisting public companies in the areas of finance and governance, among others. Prior to joining FTI, Mr. Dunn spent over ten years with Legg Mason, Inc., a major regional investment banking firm, where he was Managing Director, Senior Vice President, a member of its broker-dealer’s board of directors and head of its corporate finance group. Prior to his investment banking career, Mr. Dunn practiced corporate and securities law.

H. Russell Frisby, Jr., age 64, since 2009 has been a partner in the Energy, Mining, Transportation and Telecommunications Group of Stinson Leonard Street LLP, a law firm located in Washington, D.C. From 1995 to 1998, he served as Chairman of the Maryland Public Service Commission (the MPSC). Mr. Frisby also was the President and Chief Executive Officer of the Competitive Telecommunications Association from 1998 to 2005 and a partner with the law firms of Kirkpatrick & Lockhart Nicholson Graham LLP from 2005 to 2006 and Fleischman and Harding LLP from 2006 to 2008. He served as a director of PAETEC Holding Corp., a broadband communications provider, from February 2007 until November 2011. Mr. Frisby has been a director of Pepco Holdings since September 27, 2012.

| 1 |

Mr. Frisby’s qualifications for election to the Board include his experience as a regulatory and corporate lawyer, as well as the regulatory, public policy and governmental affairs knowledge that he gained as a Chairman of the MPSC and Chief Executive Officer of a telecommunications industry organization, as well as his prior service as a public company director. Mr. Frisby also lives, works and has served as a director of several non-profit organizations in the Company’s operating territory, and therefore has significant community ties within the region.

Terence C. Golden, age 70, since 2000 has been Chairman of Bailey Capital Corporation in Washington, D.C. Bailey Capital Corporation is a private investment company. From 1995 until May 2000, Mr. Golden was President and Chief Executive Officer of Host Hotels and Resorts (formerly Host Marriott Corporation), the lodging real estate company that includes among its holdings Marriott, Ritz-Carlton, Four Seasons, Hyatt, Hilton, Westin, W, Sheraton and Fairmont hotels. Mr. Golden has also served as a director of Host Hotels and Resorts since 1995. From May 2008 to March 2013, he served as a trustee and member of the Audit Committee of Washington Real Estate Investment Trust. Mr. Golden also serves as a trustee of the Federal City Council. He has been a director of Pepco Holdings since August 1, 2002, and was a director of Potomac Electric Power Company (Pepco), from 1998 until it merged with Conectiv on August 1, 2002.

Mr. Golden’s qualifications for election to the Board include his extensive accounting and financial management experience, as well as his perspective and experience as a former Chief Executive Officer and Chief Financial Officer of Host Hotels and Resorts with responsibility for accounting, cash management, tax and corporate and project financing. In addition to his experience described above, Mr. Golden served as the Chief Financial Officer of the Oliver Carr Company, one of the largest real estate companies in the mid-Atlantic region. Mr. Golden also was national managing partner of Trammell Crow Residential Companies, one of the largest residential development companies in the United States. Mr. Golden lives, works and serves as a director for several non-profit organizations in the Company’s operating territory, and therefore has significant community ties within the region.

Patrick T. Harker, age 56, since 2007 has been President of the University of Delaware (UDel), located in Newark, Delaware. Concurrent with his appointment as President, Dr. Harker was appointed professor of Business Administration in the Alfred Lerner College of Business and Economics and a professor of Civil and Environmental Engineering in UDel’s College of Engineering. From 2000 to 2007, he was Dean of the Wharton School of the University of Pennsylvania and served as a Professor of Electrical and Systems Engineering in the University of Pennsylvania’s School of Engineering and Applied Science. Dr. Harker served as a Trustee of the Goldman Sachs Trust and Goldman Sachs Variable Insurance Trust from 2000 through September 2010. From 2004 to 2009, he was a member of the Board of Managers of the Goldman Sachs Hedge Fund Partners Registered Fund LLC. Dr. Harker was a member of the Board of Trustees of Howard University from May 2009 to June 2013. He has served as a director of Huntsman Corporation, a global manufacturer of chemical products, since March 2010 and was elected as a director of the Federal Reserve Bank of Philadelphia in January 2012. Dr. Harker has been a director of Pepco Holdings since May 15, 2009. On March 6, 2015, Dr. Harker notified PHI of his intention to resign from the Board effective as of June 30, 2015, as required by his election as President of the Federal Reserve Bank of Philadelphia effective July 1, 2015.

Dr. Harker’s qualifications for election to the Board include his leadership skills and public and government affairs experience. Holding a Ph.D. in engineering and as the former Dean of the Wharton School, Dr. Harker brings to the Board a unique blend of technical expertise and business knowledge. Through his experience on the Board of Trustees of the Goldman Sachs Trust, Dr. Harker also contributes a strong background in capital markets. Dr. Harker lives, works and serves as a director for several non-profit organizations in the Company’s operating territory, and therefore has significant community ties within the region.

Barbara J. Krumsiek, age 62, from 2006 to April 2015 was Chair of Calvert Investments, Inc. (Calvert), an investment management and research firm based in Bethesda, Maryland. Ms. Krumsiek was President and Chief

| 2 |

Executive Officer of Calvert from 1997 to 2014. Calvert offers a range of fixed income, money market and equity mutual funds including a full family of socially responsible mutual funds. Ms. Krumsiek has been a director of Pepco Holdings since May 18, 2007.

Ms. Krumsiek’s qualifications for election to the Board include her financial knowledge from an investor standpoint and her insights as a former Chief Executive Officer, including her familiarity with issues of corporate governance, compensation, risk assessment and technology. Ms. Krumsiek served as Chief Executive Officer of Calvert for 17 years, after 23 years of experience with Alliance Capital Management. In her capacity as CEO of Calvert, she oversaw all aspects of corporate operations, including strategic planning, compliance and risk management, financial management, financial statement preparation, and information technology. Ms. Krumsiek also has experience with environmental and corporate social responsibility issues. Ms. Krumsiek lives and works in the Company’s operating territory, is a former Chair of the Greater Washington Board of Trade, and serves as a director for several other non-profit organizations in the Company’s operating territory, and therefore has significant community ties within the region.

Lawrence C. Nussdorf, age 68, since 1998 has been President and Chief Operating Officer of Clark Enterprises, Inc., a privately held investment and real estate company based in Bethesda, Maryland, whose interests include Clark Construction Group, LLC, a general contracting company, of which Mr. Nussdorf has been Vice President and Treasurer since 1977. He served as a director of CapitalSource Inc. from March 2007 through April 2010. Since September 2010, Mr. Nussdorf has served as a director of Leidos Holdings, Inc. (formerly SAIC, Inc.), a science and technology solutions company. He has been a director of Pepco Holdings since August 1, 2002, and was a director of Pepco from 2001 until it merged with Conectiv on August 1, 2002.

Mr. Nussdorf’s qualifications for election to the Board include his perspectives as a board member of two other New York Stock Exchange (NYSE)-listed companies and as a long-serving Chief Operating Officer and former Chief Financial Officer. In addition to being the current President and Chief Operating Officer of Clark Enterprises, Mr. Nussdorf served for over 30 years as Chief Financial Officer. He has been at the forefront of strategic and long-term planning, as well as all aspects of management, operations, and finance of multiple businesses, involving different asset classes. Mr. Nussdorf lives, works and serves as a director for several non-profit organizations in the Company’s operating territory and, therefore, has significant community ties within the region.

Patricia A. Oelrich, age 61, from 2001 to 2009 was Vice President, IT Risk Management for GlaxoSmithKline Pharmaceuticals, a Global 100 public company. From 1995 to 2000, Ms. Oelrich served as Vice President, Internal Audit for GlaxoSmithKline. She was employed at Ernst & Young from 1975 to 1994, and was a partner from 1988 to 1994. Since December 2014, she has served as a board member of the Office of Finance of the Federal Home Loan Bank. She has been a director of Pepco Holdings since May 21, 2010.

Ms. Oelrich’s qualifications for election to the Board include her perspectives on corporate governance, information technology, audit, compliance, and finance issues. Ms. Oelrich is a Certified Public Accountant and a Certified Information Systems Auditor. In her roles at GlaxoSmithKline, Ms. Oelrich directed internal audit activities worldwide, established GlaxoSmithKline’s IT Risk Management Program, and participated in establishing GlaxoSmithKline’s Corporate Compliance and Corporate Risk Management Oversight Programs. As a partner at Ernst & Young, Ms. Oelrich was in charge of the Chicago Office Information Systems Audit and Security practice that provided internal audit services and security consulting to highly regulated industries, including the financial services, insurance and healthcare industries. She also was lead financial audit partner on various engagements.

Joseph M. Rigby, age 58, is Chairman, President and Chief Executive Officer of Pepco Holdings. He has been President and Chief Executive Officer of Pepco Holdings since March 1, 2009. From March 2008 to March 2009, Mr. Rigby served as President and Chief Operating Officer of Pepco Holdings and from September 2007 to March 2008, he served as Executive Vice President and Chief Operating Officer of Pepco Holdings. He was

| 3 |

Senior Vice President of Pepco Holdings from August 2002 to September 2007 and Chief Financial Officer from May 2004 to September 2007. From September 2007 to March 2009, Mr. Rigby was President and Chief Executive Officer of the Company’s utility subsidiaries. He has been Chairman of the Company’s utility subsidiaries since March 1, 2009. Mr. Rigby has been a director and Chairman of Pepco Holdings since May 15, 2009. Since October 10, 2014, Mr. Rigby has served as a director of Dominion Midstream GP, LLC, the general partner of Dominion Midstream Partners, LP (NYSE: DM), a publicly-traded limited partnership.

Mr. Rigby’s qualifications for election to the Board include his ability to provide unique insights as the Company’s current Chief Executive Officer, as well as his 36 years of experience with Pepco Holdings, its subsidiaries and in the utility industry. Because of the various positions he has held within Pepco Holdings, Mr. Rigby has broad experience across operations, finance and human resources, including mergers and acquisitions. Mr. Rigby also lives and works in the Company’s operating territory, was previously Chairman of the Greater Washington Board of Trade and of the United Way of the National Capital Area, and serves as a director for several non-profit organizations in the Company’s operating territory, and therefore has significant community ties within the region.

Lester P. Silverman, age 68, is Director Emeritus of McKinsey & Company, Inc. (McKinsey), having retired from the international management consulting firm in 2005. Mr. Silverman joined McKinsey in 1982 and was head of the firm’s Electric Power and Natural Gas practice from 1991 to 1999. From 2000 to 2004, Mr. Silverman was the leader of McKinsey’s Global Nonprofit Practice. Previous positions included Principal Deputy Assistant Secretary for Policy and Evaluation in the U.S. Department of Energy from 1980 to 1981 and Director of Policy Analysis in the U.S. Department of the Interior from 1978 to 1980. He is a trustee of and advisor to several national and Washington, D.C.-area non-profit organizations. He has been a director of Pepco Holdings since May 19, 2006, and since May 2014 has served as Lead Independent Director.

Mr. Silverman’s qualifications for election to the Board include his broad experience with the energy industry and extensive experience in government and public policy. Mr. Silverman was a consultant to electric and gas utilities for 23 years and has public policy experience in the energy field. Mr. Silverman also lives, works and serves as a director for several non-profit organizations in the Company’s operating territory, and therefore has significant community ties within the region.

Audit Committee of the Board of Directors

The Company has a separately-designated standing Audit Committee. The members of the Audit Committee are presently Ms. Oelrich (who is the Chairman), Mr. Golden, Dr. Harker and Mr. Nussdorf. The Board of Directors has determined that each Audit Committee member is “independent” as defined under the Company’s Corporate Governance Guidelines and applicable NYSE listing standards and that each of Ms. Oelrich, Mr. Golden and Mr. Nussdorf is an “audit committee financial expert” as defined under SEC regulations.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers and any beneficial owner of more than 10% of the Company’s common stock to file with the SEC initial reports of beneficial ownership and reports of changes in beneficial ownership of the Company’s common stock. Based on a review of such reports filed during or with respect to 2014 and on written confirmations provided by its directors and executive officers, the Company believes that during 2014 all of its directors and executive officers filed on a timely basis the reports required by Section 16(a), except that a single Form 4 was not timely filed by Laura L. Monica, our Vice President Corporate Communications, to report two transactions in connection with the vesting of shares under a time-based restricted stock unit (RSU) award, each of which occurred in August 2014 and was exempt from the short-swing profit provisions of Section 16(b) of the Exchange Act. The Company is not aware of any person or entity that beneficially owns more than 10% of its common stock.

| 4 |

Code of Conduct

The Company has adopted Corporate Business Policies, which in their totality constitute the Company’s code of business conduct and ethics. These policies apply to all of the Company’s directors, employees and others working at the Company and its subsidiaries. The Board has also adopted Corporate Governance Guidelines and charters for the Audit Committee, the Compensation/Human Resources Committee (the Compensation Committee) and the Corporate Governance/Nominating Committee (the Nominating Committee). The Board has also adopted charters for the Executive Committee and Finance Committee. Copies of these documents are available on the Company’s Web site at http://www.pepcoholdings.com/corporategovernance and also can be obtained by writing to: Corporate Secretary, 701 Ninth Street, N.W., Suite 1300, Washington, D.C. 20068.

Item 11. EXECUTIVE COMPENSATION

Compensation/Human Resources Committee Report

The Compensation Committee reviewed and discussed with the Company’s management the Compensation Discussion and Analysis (the CD&A) required by Item 402(b) of Regulation S-K. Based on such review and discussion, the Compensation Committee recommended to the Board that the CD&A be included in this Form 10-K/A.

Patrick T. Harker, Chairman

Paul M. Barbas

Jack B. Dunn, IV

H. Russell Frisby, Jr.

Lester P. Silverman

Compensation Discussion and Analysis

Executive Summary

The following is a brief overview of the more detailed discussion and analysis set forth in this CD&A section, which focuses on compensation paid with respect to 2014 to each of the Company’s executive officers who are named in the 2014 Summary Compensation Table (each, a named executive officer, or NEO). The NEOs include:

| · | Joseph M. Rigby, the Company’s Chairman, President and Chief Executive Officer; |

| · | Frederick J. Boyle, the Company’s Senior Vice President and Chief Financial Officer; |

| · | David M. Velazquez, the Company’s Executive Vice President; |

| · | Kevin C. Fitzgerald, the Company’s Executive Vice President and General Counsel; and |

| · | John U. Huffman, the President and Chief Executive Officer of Pepco Energy Services, Inc., our wholly owned subsidiary. |

Exelon Merger Agreement

On April 29, 2014, Pepco Holdings entered into the Merger Agreement with Exelon Corporation (Exelon) and an indirect, wholly owned subsidiary of Exelon. Upon closing of the Merger, Pepco Holdings will be the surviving corporation and will become an indirect, wholly owned subsidiary of Exelon. The Merger Agreement provides for the treatment of award opportunities under the PHI Amended and Restated Annual Executive Incentive Compensation Plan (the EICP) and the 2012 LTIP. For more information, please refer to the descriptions of the EICP and 2012 LTIP in “— Executive Compensation — Amended and Restated

| 5 |

Annual Executive and Incentive Compensation Plan” and “— Executive Compensation — 2012 Long-Term Incentive Plan.”

Compensation Philosophy

Our executive compensation philosophy is straightforward: we reward our executives for their contributions to our business and operational performance and stockholder value creation by tying a significant portion of their total compensation directly to our short-term and long-term performance.

Our executive compensation program is designed to:

| · | provide executives with competitive compensation opportunities and benefits; |

| · | tie a significant portion of compensation to our operational and financial performance; |

| · | align the financial interests of our named executive officers with those of the stockholders; |

| · | provide rewards for executive performance that target recognized key drivers of performance in the utility industry; |

| · | utilize performance metrics that serve to measure increases in value to our stockholders and reflect key operational and regulatory criteria; |

| · | strike a careful balance between risk and reward so as to not encourage executives to take excessive risk; and |

| · | ensure that executives’ interests are aligned with stockholders through the use of executive stock ownership requirements. |

Pay for Performance

We have designed a compensation program that makes a substantial percentage of executive pay variable, subject to payout or increase when performance goals are achieved or exceeded and forfeiture or reduction when they are not achieved. Also, a significant portion of the compensation paid to our President and Chief Executive Officer during 2014 was equity-based, which further aligns his compensation with the interests of our stockholders and provides for compensation that is tied directly to the continued positive performance of the Company. See “— Executive Summary — Highlights of Significant 2014 Compensation Actions” and “— Corporate Governance and Pay for Performance.”

2014 Business Results

During 2014, we continued to focus on the successful achievement of our 2014 financial and operational objectives. For the year ended December 31, 2014, the Company reported consolidated net income from continuing operations of $242 million, or $0.96 per diluted share, as compared to $110 million, or $0.45 per diluted share, for the year ended December 31, 2013. Our core Power Delivery Business remained strong and performed well, with net income from continuing operations of $320 million in 2014 compared to $289 million in 2013. Pepco Energy Services’ consolidated net income from continuing operations decreased to a net loss of $39 million in 2014 as compared to net income of $3 million in 2013.

Our 2014 consolidated earnings included $48 million ($81 million pre-tax) of asset impairment losses associated with Pepco Energy Services’ combined heat and power thermal generating facilities and operations in Atlantic City, New Jersey. During 2014, we also incurred $23 million in incremental Merger-related transaction costs ($25 million pre-tax), and $8 million of incremental Merger-related integration costs ($9 million pre-tax). Excluding all of these items, our adjusted consolidated net income from continuing operations would have been $321 million, or $1.27 per diluted share, for 2014.

Our 2013 consolidated earnings included interest associated with changes in the assessment of corporate tax benefits related to our former cross-border energy lease investments totaling $66 million; the establishment of valuation allowances related to certain deferred tax assets of $101 million; and impairment charges related to

| 6 |

Pepco Energy Services’ long-lived assets of $3 million. Excluding these items, our adjusted consolidated net income from continuing operations for 2013 would have been $280 million, or $1.14 per diluted share.

Our management believes that adjusted consolidated net income from continuing operations is representative of our ongoing consolidated business operations. Our management uses this information internally to evaluate the Company’s period-over-period consolidated financial performance and, therefore, believes that this information is useful to investors. The presentation of our adjusted consolidated net income from continuing operations is intended to complement, and should not be considered as an alternative to, reported earnings presented in accordance with generally accepted accounting principles in the United States.

During 2014, we also spent a significant amount of our business focus on supporting activities that are helping us comply with the many conditions necessary to close the Merger, including obtaining required regulatory approvals.

Highlights of Significant 2014 Compensation Actions

To further align compensation received by our named executive officers with the interests of our stockholders and to reinforce good corporate governance practices, the Compensation Committee approved the following actions related to our executive compensation programs in 2014:

| · | We increased 2013 base salaries modestly, with the goal of providing a level of fixed compensation that is competitive with other comparable utilities. |

| · | In connection with the extension of Mr. Rigby’s employment agreement with the Company in April 2014 (which employment agreement was effective as of January 1, 2012) (the Original Employment Agreement), the Company issued to Mr. Rigby vested and unvested restricted stock awards under the 2012 LTIP. The unvested shares will vest upon the last day of the Employment Extension Period (as defined in “— Executive Compensation — Employment Agreements – Joseph M. Rigby”), subject to certain exceptions. None of the vested shares may be transferred or sold until after his employment with the Company ends. |

| · | We continued the practice of using relative total shareholder return (TSR) as the sole performance goal for annual performance-based awards under the 2012 LTIP, for all named executive officers. |

| · | We continued the practice of using RSUs, instead of restricted stock, for grants of annual time-based awards, because dividend equivalents under RSUs will not vest except to the extent that the underlying RSUs vest. |

| · | We continued the practice of including compensation recovery (clawback) provisions in our equity award agreements. |

Throughout this CD&A section, unless the context otherwise requires, with respect to compensation decisions involving our President and Chief Executive Officer, references to the “Compensation Committee” shall mean the independent members of the Board.

Base Salary

Base salary increases for our named executive officers have been modest, ranging from 1.31% to 3.09% (excluding a $16,000 special base salary upward adjustment provided to Mr. Boyle) in 2014, and 2.36% to 3.00% in 2015. Two of our five named executive officers did not receive a base salary increase for 2014, and, in accordance with the terms of that certain Employment Extension Agreement, dated April 29, 2014, by and between Mr. Rigby and the Company (the Employment Extension Agreement), Mr. Rigby did not receive a base salary increase for 2015. For a description of the Employment Extension Agreement, see “—Executive Compensation — Employment Agreements — Joseph M. Rigby.”

| 7 |

Annual Executive Incentive Compensation Plan

To recognize the efforts, contributions and accomplishments of our executive team which led to the Company’s positive performance in 2014, in December 2014, the Compensation Committee approved a partial cash payment to our executives (other than Messrs. Rigby, Velazquez, Fitzgerald and Huffman, who received restricted stock in settlement of this award) of 2014 EICP awards in amounts that reflected target level of performance (or, with respect to the energy services executives in Pepco Energy Services, performance at 75%). These awards were subject to clawback to the extent that this level of performance was not ultimately achieved.

In February 2015, the Compensation Committee made a final determination that the 2014 EICP awards were earned at levels ranging from 109.5% to 140.8%, based on the performance criteria set forth in these awards, and the amount of each EICP award that exceeded target (or 75%) was paid to each executive in cash.

Long-Term Incentive Plans

The Compensation Committee determined to settle and pay time-based RSU awards with respect to the 2012 to 2014 cycle in shares of common stock on December 31, 2014. Also, the Compensation Committee determined on December 31, 2014, the end of the 2012 to 2014 performance period, that the performance-based RSU awards for that performance period were earned at approximately the 71st percentile, or at a level of 141.2%, based on relative TSR.

For 2014, the Company granted to Messrs. Rigby and Fitzgerald performance-based RSU awards pursuant to the terms of the Original Employment Agreement and Mr. Fitzgerald’s employment agreement, respectively. These awards featured performance criteria and goals tied to key regulatory and business initiatives that the Company believes are drivers of its operational success, and in turn, positive financial performance and creation of stockholder value.

In February 2015, the Compensation Committee determined that 98% of Mr. Rigby’s award and 99% of Mr. Fitzgerald’s award vested based upon the executive’s performance under each of the applicable goals. However, under the terms of these awards, no shares will be issued in settlement of these awards until the day after each executive’s employment with the Company terminates.

Employment Extension Agreement with Mr. Rigby

In April 2014, in view of the execution of the Merger Agreement, the Board requested that Mr. Rigby extend his employment with the Company until the completion of the Merger, and Mr. Rigby agreed to do so. The Board determined that Mr. Rigby’s continued leadership of the Company was an important factor in securing the required regulatory approvals necessary to consummate the Merger. On April 29, 2014, the Company and Mr. Rigby entered into the Employment Extension Agreement, which extended the term of Mr. Rigby’s employment as the Company’s President and Chief Executive Officer for the duration of the Employment Extension Period.

As consideration for the extension of the term of the Original Employment Agreement, the Company granted to Mr. Rigby awards of vested and unvested restricted stock, all of which were subject to restrictions on transferability until Mr. Rigby’s employment terminates. Subject to certain exceptions, the shares of unvested restricted stock will be forfeited if Mr. Rigby’s employment with the Company terminates before the end of the Employment Extension Period.

| 8 |

Say on Pay

In connection with the special meeting of stockholders in September 2014 to approve the Merger, we submitted a merger compensation proposal to our stockholders for an advisory vote. This proposal received the support of the holders of approximately 55% of the shares of common stock present and eligible to vote at the special meeting.

In addition, at our 2011 annual meeting of stockholders, our stockholders indicated their preference, on an advisory basis, that the say on pay proposal be submitted annually for an advisory vote rather than every two or three years. In response, the Board determined to hold an annual advisory say on pay vote.

Compensation Objectives and Philosophy

The objectives of our executive compensation program are to attract, motivate and retain talented executives while promoting the interests of the Company and its customers and stockholders. The core of our compensation philosophy is to reward executives for the achievement by the Company and its business segments of targeted levels of operational excellence and financial performance and for the achievement of individual performance goals.

As a company that owns three public utilities with operations focused on the transmission and distribution of electricity, and, to a lesser extent, natural gas, substantially all of our revenues and net income are derived directly from our utility subsidiaries’ ability to earn their allowed rates of return as determined through distribution base rate case decisions rendered by the applicable public service commission. The Compensation Committee believes that positive rate case outcomes stem from our ability to meet or exceed reliability requirements established by our regulators. These positive outcomes also represent the single greatest factor driving the Company’s financial results, and in turn, stockholder value. In light of these considerations, our compensation philosophy rewards our executives when their performance contributes to the achievement by our utilities of key operational, reliability and customer satisfaction metrics, as well as when stockholder value increases, as measured by reference to our stock price and dividend yield.

Our executive compensation program is designed to:

| · | provide executives with base salaries, incentive compensation opportunities and other benefits that are competitive with comparable companies in our industry; |

| · | tie a significant portion of the total compensation of our executives to our short-term and long-term operational and financial performance; |

| · | align the financial interests of our named executive officers with those of the stockholders with compensation that is substantially variable, that is, subject to payout or increase when corporate targets are achieved or exceeded and forfeiture or reduction when corporate targets are not achieved; |

| · | provide rewards for executive performance that target key drivers of performance in the utility industry, the achievement of which we believe directly contributes to our long-term financial health and is responsible for creating long-term value for our stockholders; |

| · | utilize performance metrics that not only serve to measure increases in value to our stockholders, but also reflect operational and regulatory criteria that are important to the successful resolution of our utility subsidiaries’ base rate cases, as well as to our regulators, customers and other stakeholders; |

| · | strike a careful balance between risk and reward so as to not encourage executives to take excessive risk which could have a material adverse impact on our business, operations and financial results; and |

| 9 |

| · | ensure that executives’ interests are aligned with stockholders through the use of executive stock ownership requirements of between one and five times base salary, depending on the executive’s position. |

Corporate Governance and Pay for Performance

The cornerstones of our 2014 compensation program are the Company’s compensation governance framework and pay-for-performance philosophy, which includes the following features:

| · | We have established a pay-for-performance environment by linking short-term and long-term incentive-based compensation to the achievement of measurable business and individual performance goals. |

| · | Our executive compensation program continued to focus on both long-term and short-term performance, and to emphasize at-risk over fixed compensation. |

| · | Our Compensation Committee regularly receives advice on pay composition and levels of compensation from an independent compensation consultant. |

| · | Base salary increases for the named executive officers are generally modest, and we evaluate base salaries and increases by reference to a named executive officer’s performance and position, as well as to the salary range for that position using competitive market survey data compiled by the Compensation Committee’s independent compensation consultant. |

| · | We use equity-based, long-term incentive compensation as a means to align the interests of our named executive officers with those of our stockholders. To do this, in 2014 we granted RSUs, two-thirds of which are to vest based on performance over a three-year performance period. We have not granted stock options since 2002 and no named executive officer holds any PHI stock options. |

| · | We believe that the reliability of utility service and the positive performance of our utilities have a direct impact on our financial success. Public utility commissions view our utilities’ performance and acceptable levels of compensation through the lens of specific operating metrics. We believe our use of these metrics as a part of incentive compensation performance goals supports our mission to seek positive relationships with our regulators, customers and other stakeholders. As a result, we have continued to incorporate critical utility operating metrics into our short-term and long-term incentive awards as permitted by the relevant plans. |

| · | We have a common stock ownership requirement that applies to all of our named executive officers, except Mr. Huffman, who is not an officer of the Company. Each of these officers has satisfied this requirement. |

| · | We provide our named executive officers with reasonable amounts of perquisites and personal benefits compared to their total compensation. |

| · | We maintain a strong risk management program which includes our Compensation Committee’s ongoing evaluation and oversight of the relationship between our compensation programs and risk. |

| · | We will recoup certain incentive compensation payments made to our Chief Executive Officer and Chief Financial Officer when required under the Sarbanes-Oxley Act of 2002 (the Sarbanes-Oxley Act). Employment agreements and award agreements under the 2012 LTIP include clawback provisions intended to satisfy the requirements of the Sarbanes-Oxley Act, and, when implemented, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act). |

| · | We have adopted “no hedging”, “no pledging” and “no margining” policies that apply to all of our directors, officers and certain other employees. |

The Compensation Process

The Compensation Committee is responsible for all executive compensation decisions with respect to each of the named executive officers, except for Mr. Rigby’s compensation, which is approved by all of the independent directors. To assist it in carrying out its responsibilities, the Compensation Committee requests

| 10 |

and receives recommendations from the Chief Executive Officer with respect to the compensation packages of the other named executive officers, including the selection and weighting of the specific performance objectives applicable to short-term and long-term incentive awards.

When structuring compensation arrangements for the named executive officers and other executives, the Compensation Committee typically receives advice from its independent compensation consultant concerning pay mix and levels of compensation, as well as information with respect to the financial costs and tax and accounting consequences associated with the various elements of compensation. Since 2007, the Compensation Committee has engaged Pearl Meyer & Partners (PM&P) as its independent compensation consultant to advise it on various executive compensation matters. Pursuant to this engagement, PM&P annually:

| · | attends Compensation Committee meetings and provides advice to the Compensation Committee, including a review of materials related to the meeting; |

| · | conducts peer group reviews and periodically provides benchmarking analyses for the Compensation Committee; |

| · | analyzes certain compensation practices of the companies in our peer group; |

| · | upon request of the Compensation Committee, prepares an update on executive compensation trends and changes in proxy advisory firm policies; |

| · | provides advice on compensation packages and proposed new salary ranges to be provided to Company executives, as well as total executive compensation, as requested by the Compensation Committee; |

| · | conducts pay-for-performance analyses; and |

| · | provides other various industry and compensation data. |

Compensation Levels and Benchmarking

Compensation levels for our named executive officers are determined based on a number of factors, including the individual’s roles and responsibilities within the Company, the individual’s experience, pay levels in the marketplace for similar positions and performance of the individual and the Company as a whole.

The Compensation Committee uses Company-prepared tally sheets for each named executive officer to assist it in its annual compensation review process. The tally sheet identifies each material element of the named executive officer’s compensation, including salary, short-term and long-term incentive compensation opportunities, pension accruals and other benefits, and shows the severance and other payouts to which the executive would be entitled under various employment termination scenarios. The tally sheet allows the Compensation Committee to review the totality of each named executive officer’s compensation.

Based on benchmarking data provided by PM&P, as well as other data sources, the Compensation Committee assesses competitive market compensation practices. One of the primary ways the Compensation Committee evaluates the Company’s executive compensation arrangements relative to other companies is to compare the Company’s practices to a group of companies that are primarily electricity and natural gas distribution companies with similar amounts of assets and revenues, and similar market capitalization. The composition of this group of peer companies is reassessed annually and its composition may be changed by the Compensation Committee from year to year to reflect corporate transactions or other events that may affect the comparability of one or more of the constituent companies.

For 2014, the Utility Peer Group consisted of the 18 companies listed below, which we refer to as the 2014 Utility Peer Group. At December 31, 2014, the Company ranked at the 42nd percentile in total assets and at

| 11 |

the 21st percentile in market capitalization, relative to the companies that comprised the 2014 Utility Peer Group.

| 2014 Utility Peer Group | ||

| Alliant Energy Corporation | Great Plains Energy Incorporated | Public Service Enterprise Group |

| Ameren Corporation | Northeast Utilities | SCANA Corporation |

| CenterPoint Energy, Inc. | OGE Energy Corp. | TECO Energy, Inc. |

| CMS Energy Corporation | Pinnacle West Capital Corporation | Westar Energy, Inc. |

| Consolidated Edison, Inc. | Portland General Electric Company | Wisconsin Energy Corporation |

| DTE Energy Company | PPL Corporation | Xcel Energy Inc. |

Based on discussions with PM&P, the Compensation Committee has retained the components of the Utility Peer Group without change for 2015.

Components of the Executive Compensation Program

The compensation program for the Company’s executives (currently consisting of 59 persons), including the named executive officers, consists of the following components:

| · | base salary; |

| · | where extraordinary efforts or special circumstances warrant, discretionary cash bonuses; |

| · | annual cash incentive opportunities under the EICP; |

| · | significant use of stock-based incentive awards in the form of restricted stock, performance-based RSUs, and, to a lesser extent, time-based RSU awards (and, with respect to RSU awards, dividend equivalents), granted under our 2012 LTIP; |

| · | retirement and deferred compensation programs; |

| · | health and welfare benefits; and |

| · | limited perquisites and personal benefits. |

Compensation Mix

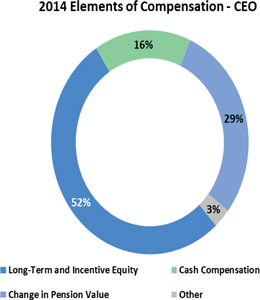

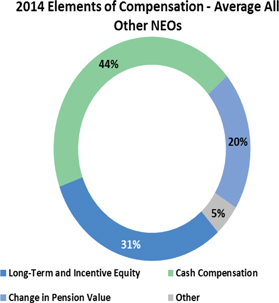

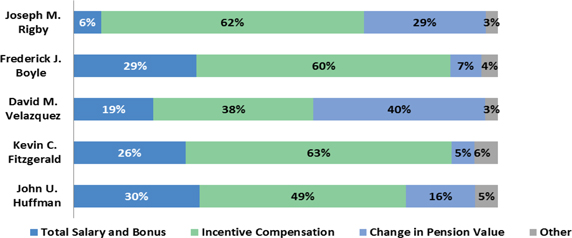

The following charts highlight elements of the compensation mix for our Chief Executive Officer, as well as our other named executive officers on an average basis, using data contained in our 2014 Summary Compensation Table.

| 12 |

|

|

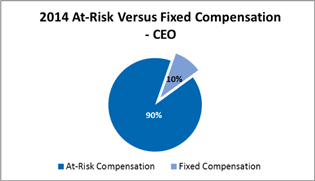

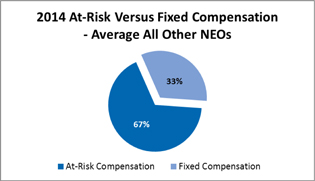

Consistent with our pay-for-performance philosophy, the percentages of each named executive officer’s at-risk compensation as compared to fixed compensation are designed to reflect the Compensation Committee’s view that a significant percentage of each named executive officer’s compensation should be at-risk and tied to Company, business unit or individual performance. Furthermore, the Compensation Committee generally believes that, as the level of an executive’s overall responsibility increases, the percentage of the executive’s compensation that is at-risk should likewise increase.

The following charts show the relationship of at-risk to fixed compensation with respect to our Chief Executive Officer, as well as our other named executive officers on an average basis. For purposes of these charts, fixed compensation is composed of base salary, and at-risk compensation is composed of EICP awards paid with respect to 2014 performance and the grant date fair value of equity awards granted under the 2012 LTIP during 2014, based on data contained in our 2014 Summary Compensation Table.

|

|

Base Salary

The Compensation Committee considers adjustments to base salary levels annually and also may consider base salary adjustments in connection with promotions and other special circumstances. The Original Employment Agreement provided, and Mr. Fitzgerald’s employment agreement provides, for a minimum base salary that may be increased, but not subsequently decreased, during the term of each

| 13 |

agreement. The Employment Extension Agreement provides for a fixed base salary. Neither Mr. Rigby’s nor Mr. Fitzgerald’s base salary was increased for 2014. Furthermore, Mr. Rigby’s base salary was not increased for 2015 in accordance with the terms of the Employment Extension Agreement.

In order to provide greater consistency within the Company, the Compensation Committee has developed base salary levels for the named executive officers and assigned a level to each position based primarily on the decision-making responsibility associated with the position. Each base salary level has a range, with the midpoint of the range fixed at approximately the median of the competitive range as determined by a market survey of salary levels for comparable positions. Each named executive officer’s base salary is determined based on a combination of factors, including the executive’s level of experience, tenure with the Company in the position and performance; however, in reviewing these factors, the Compensation Committee has the discretion to select a base salary for a named executive officer that is outside the base salary range.

The Compensation Committee annually considers adjustments to the base salary range for each salary level and to individual salaries. The process of setting an executive’s annual base salary begins with a review by the Compensation Committee of available information on salary levels of executives at other companies. If the information shows a change in the base salary range for a particular salary level, the Compensation Committee has the discretion to adjust the Company’s base salary range for that salary level as it believes is appropriate to reflect such change. The Compensation Committee also may consider whether a further base salary adjustment for a particular executive is warranted if the executive’s compensation is significantly below the median of the competitive range for that position, based on the goal of generally paying an executive a competitive salary for the executive’s position.

The Compensation Committee, and in the case of Mr. Rigby, the independent directors, have approved the following base salaries for each of the named executive officers:

| Name | 2015 Base Salary Level |

2014 Base Salary Level |

2013 Base Salary Level |

| Joseph M. Rigby | $ 1,015,000 | $1,015,000 | $ 1,015,000 |

| Frederick J. Boyle | 515,000 | 500,000 | 470,000 |

| David M. Velazquez | 549,000 | 534,000 | 518,000 |

| Kevin C. Fitzgerald | 563,000 | 550,000 | 550,000 |

| John U. Huffman | 398,000 | 388,000 | 383,000 |

2014 Base Salary Determinations

To establish base salaries for 2014, the Compensation Committee obtained from PM&P published data, compiled from the same sources as the information used to adjust salary levels, which showed an average base salary budget increase of 3%. Based on this data, the Compensation Committee approved a merit budget increase equal to 3% of total base salaries, which it allocated among the executive group.

The Compensation Committee recommended to the independent directors that Mr. Rigby’s 2014 base salary be retained at the same level as in 2013. In making this recommendation, the Compensation Committee reviewed the benchmarking data for Mr. Rigby’s position provided by PM&P and noted that Mr. Rigby’s 2013 base salary was 102% of the median salary for his position. The Compensation Committee also reviewed chief executive officer compensation data from the Utility Peer Group provided by PM&P.

The Compensation Committee noted Mr. Rigby's strong performance during 2013 in executing plans to improve and enhance reliability and customer service, and executing the Company’s business strategy, including regulatory, financing and smart grid initiatives. The Compensation Committee also recognized

| 14 |

that Mr. Rigby’s leadership, evidenced by his oversight of the Company through customer service and reputational change and changes in regulatory strategy designed to reduce regulatory lag, has been key to the forward progress the Company has made in addressing these issues. However, because Mr. Rigby’s 2013 base salary was already higher than the median salary of the competitive range for his position, the Compensation Committee recommended to the independent directors that his base salary for 2014 be retained at its current level, and the independent directors approved this recommendation.

The Compensation Committee increased Mr. Boyle’s 2013 base salary by 2.98%, and provided for an additional upward adjustment to bring Mr. Boyle’s 2013 base salary slightly higher than the midpoint of the competitive range for his position. The Compensation Committee found that Mr. Boyle’s 2013 base salary was below the midpoint of the competitive range for his position. In approving the base salary increase for Mr. Boyle, the Compensation Committee noted Mr. Boyle’s performance in executing the Company’s strategic, financing and regulatory plan, as well as his efforts to address accounting and financial issues associated with the early termination in 2013 of PHI’s cross-border energy lease investments. In light of this performance, the Compensation Committee approved a base salary increase for Mr. Boyle, which brought his base salary to 97.8% of the midpoint of the competitive range for his position. In addition, the Compensation Committee approved a special base salary adjustment of $16,000, which brought his base salary to 101.0% of the midpoint of the competitive range for his position.

The Compensation Committee increased Mr. Velazquez’s 2013 base salary by 3.09%. In approving the base salary increase for Mr. Velazquez, the Compensation Committee noted the following:

| · | his continued efforts to execute plans to improve and enhance reliability and customer service; |

| · | the achievement of key initiatives related to the implementation of the Smart Grid; |

| · | his role in implementing a new billing and customer service information system for all of our utilities; |

| · | his leadership and guidance in navigating storm restoration efforts primarily in New Jersey following Hurricane Sandy; |

| · | his leadership in overseeing the utilities’ cybersecurity efforts; and |

| · | his sound management of the utilities’ budgets. |

The Compensation Committee also considered Mr. Velazquez’s key role in various regulatory proceedings and public meetings related to our utilities’ base rate cases and undergrounding initiatives in the District of Columbia. The Compensation Committee noted that Mr. Velazquez’s 2013 base salary was slightly below the midpoint of the competitive range for his position, but believed that an upward adjustment was appropriate in light of Mr. Velazquez’s significant contributions to the Company’s utility operations during 2013. In light of all of the foregoing considerations, the Compensation Committee recommended an increase that brought Mr. Velazquez’s 2014 base salary to 107.9% of the midpoint of the competitive range for his position.

The Compensation Committee noted Mr. Fitzgerald’s contributions in 2013 to improving regulatory processes throughout the Company, supporting the effort to pursue undergrounding initiatives in the District of Columbia, and supporting the work related to the Company’s cross-border energy lease investments, and his support of Company-wide cultural initiatives within the legal department. Noting that Mr. Fitzgerald’s 2013 base salary was at 111.1% of the midpoint of the competitive range for his position, the Compensation Committee did not increase Mr. Fitzgerald’s base salary for 2014.

The Compensation Committee increased Mr. Huffman’s 2013 base salary by 1.31%. In approving the base salary increase for Mr. Huffman, the Compensation Committee noted that his 2013 base salary was slightly less than the midpoint of the competitive range for his position. The Compensation Committee also considered Mr. Huffman’s achievements in 2013, including:

| 15 |

| · | the improved financial performance for Pepco Energy Services; |

| · | his leadership in continuing the wind-down of the Pepco Energy Services retail energy supply business; |

| · | the growth of Pepco Energy Services’ underground transmission and distribution construction and maintenance business; and |

| · | his leadership during the strategic review of Pepco Energy Services. |

In light of the foregoing considerations, the Compensation Committee recommended an increase that brought Mr. Huffman’s 2014 base salary to 98.2% of the midpoint of the competitive range for his position.

2015 Base Salary Determinations

To establish base salaries for 2015, and based on published compensation data obtained from PM&P, the Compensation Committee approved a merit budget increase equal to 3% of total base salaries, which it allocated among the executive group.

The Compensation Committee recommended to the independent directors that Mr. Rigby’s 2015 base salary be retained at the same level as in 2014, in accordance with the terms of the Employment Extension Agreement. In making this recommendation, the Compensation Committee reviewed compensation data for Mr. Rigby’s position for the Utility Peer Group provided by PM&P and noted that Mr. Rigby’s 2014 base salary was 98.1% of the median salary for his position.

The Compensation Committee also noted:

| · | Mr. Rigby’s strong performance in executing plans to improve and enhance reliability and customer service, and executing the Company’s business strategy, including regulatory, financing and Smart Grid initiatives; and |

| · | Mr. Rigby’s leadership, evidenced by: |

| o | his oversight of the Company through the Merger negotiation process with Exelon and others; |

| o | regulatory strategy changes designed to obtain the requisite Merger approvals; and |

| o | strategies implemented to continue to address improvements in reliability and customer satisfaction and enhanced regulatory relationships. |

In light of all of the foregoing, the Compensation Committee recommended to the independent directors that Mr. Rigby’s 2015 base salary be retained at the same level as for 2014, and the independent directors approved this recommendation.

The Compensation Committee increased Mr. Boyle’s 2014 base salary by 3.00%. The Compensation Committee found that Mr. Boyle’s 2014 base salary was slightly below the midpoint of the competitive range for his position. In approving the base salary increase for Mr. Boyle, the Compensation Committee noted his:

| · | performance in executing the Company’s strategic, financing and regulatory plans; |

| · | efforts in leading the Merger financial analysis process and navigating the accounting and benefits implications of the Merger; and |

| · | leadership of the global tax settlement process. |

| 16 |

In light of this performance, the Compensation Committee approved an increase that brought Mr. Boyle’s base salary to 102.0% of the midpoint of the competitive range for his position.

The Compensation Committee increased Mr. Velazquez’s 2014 base salary by 2.81%. In approving the base salary increase for Mr. Velazquez, the Compensation Committee noted:

| · | his continued efforts in executing plans to improve and enhance reliability and customer service, including the District of Columbia power line undergrounding initiative; |

| · | his involvement in implementation efforts related to the Company’s integrated customer information system; |

| · | his efforts to advance the Company’s activities with respect to cybersecurity; and |

| · | his key role in various regulatory proceedings and public meetings related to rate case filings and the Merger. |

The Compensation Committee noted that Mr. Velazquez’s 2014 base salary was above the midpoint of the competitive range for his position, but believed that, in light of Mr. Velazquez’s significant contributions to the Company’s utility operations during 2014, an upward adjustment was appropriate. As a result, the Compensation Committee approved an increase that brought Mr. Velazquez’s 2015 base salary to 108.7% of the midpoint of the competitive range for his position.

The Compensation Committee increased Mr. Fitzgerald’s 2014 base salary by 2.36%. The Compensation Committee found that Mr. Fitzgerald’s 2014 base salary was above the midpoint of the competitive range for his position. In approving the base salary increase for Mr. Fitzgerald, the Compensation Committee noted his performance during the year, including:

| · | his leadership of the Company’s legal department; and |

| · | his oversight of several key legal initiatives, including: |

| o | Utility 2.0; |

| o | the Merger negotiation and transaction process; and |

| o | various regulatory proceedings. |

In light of this performance, the Compensation Committee approved an increase that brought Mr. Fitzgerald’s 2015 base salary to 111.5% of the midpoint of the competitive range for his position.

The Compensation Committee increased Mr. Huffman’s 2014 base salary by 2.58%. In approving the base salary increase for Mr. Huffman, the Compensation Committee noted that his 2014 base salary was below the midpoint of the competitive range for his position. The Compensation Committee also considered Mr. Huffman’s achievements in 2014, including:

| · | the improved financial performance of Pepco Energy Services; |

| · | the growth of its underground transmission and distribution construction business; and |

| · | Mr. Huffman’s leadership of issues related to the Atlantic City economy and Pepco Energy Services’ thermal business. |

In light of the foregoing considerations, the Compensation Committee approved an increase that brought Mr. Huffman’s 2015 base salary to 98.3% of the midpoint of the competitive range for his position.

| 17 |

Annual Cash Incentive Awards under the EICP

Overview of the EICP

In 2014, the Company provided its executives, including the NEOs, with an opportunity to receive an annual cash incentive award under the EICP. For each participating executive, a target short-term incentive opportunity was established, which is equal to a percentage of the executive’s annual base salary. Each executive’s EICP opportunity percentage was determined by the Compensation Committee and was intended to place the executive’s total cash compensation opportunity (consisting of annual base salary and target annual incentive compensation) at a level approximating the midpoint of the competitive range for that position. Annual cash incentive awards were made under the EICP to the extent performance goals established by the Compensation Committee are achieved.

The performance criteria used as the basis for awards and the specific targets can vary from year to year. The performance criteria can consist entirely, or be a combination, of financial and operational performance objectives for the Company as a whole or performance objectives for a particular business unit. Some executives also have individual performance objectives. The performance criteria and goals for the Company and the respective business units are selected to reward the executive for the achievement of targeted financial results and operational goals. Each executive’s goal allocation is designed to align the executive’s award opportunity with the executive’s management responsibilities. Generally, the financial targets are based on the Company’s annual financial plan. Other quantitative targets are set at levels that, in most cases, exceed the level of performance in prior years.

A payment of an award under the EICP may be made only if the performance goals for the award have been determined by the Compensation Committee to have been satisfied. Except with respect to executives who are covered by Section 162(m) of the Internal Revenue Code of 1986, as amended (the Code), the Compensation Committee retains the discretion to adjust awards under the EICP either up or down (up to 30%) taking into account such factors and circumstances as it determines to be appropriate. The Compensation Committee may not adjust an award with respect to an executive covered by Section 162(m) of the Code if the adjustment would prevent such payment from being performance-based compensation as defined thereunder.

2014 EICP Award Opportunities

In 2014, each of the named executive officers was granted an opportunity to earn a cash incentive award under the EICP. Regardless of an executive’s performance, the award may not exceed 180% of the target award opportunity. The target award opportunity granted in 2014 under the EICP, as a percentage of annual base salary, for each of the eligible named executive officers was as follows:

| Name | Target Award Opportunity as a Percentage of Annual Base Salary (%) |

| Joseph M. Rigby | 100 |

| Frederick J. Boyle | 60 |

| David M. Velazquez | 60 |

| Kevin C. Fitzgerald | 60 |

| John U. Huffman | 60 |

These 2014 award opportunities are shown in the 2014 Grants of Plan-Based Awards table under the heading “Estimated Future Payouts Under Non-Equity Incentive Plan Awards.”

| 18 |

2014 EICP Performance Criteria

The performance criteria for EICP award opportunities granted in 2014 to our named executive officers consisted of both financial and operational performance criteria. The financial performance criteria for 2014 EICP award opportunities were selected from the following:

|

2014 EICP Financial Performance Criteria |

Description/Definition | Purpose | Applicable NEO(s) | |||

|

PHI adjusted earnings per share (EPS) or Utility adjusted EPS or Pepco Energy Services adjusted EPS |

Adjusted EPS is based on PHI consolidated net income (or the consolidated net income from our utility subsidiaries, or Pepco Energy Services), after adjustments, divided by the diluted weighted average shares outstanding.

Achieving at least the threshold target for adjusted EPS is required for an EICP award to be earned. |

This goal rewards the executive for financial performance of PHI, our utility subsidiaries or Pepco Energy Services. |

· PHI adjusted EPS for Messrs. Rigby, Boyle and Fitzgerald · Utility adjusted EPS for Mr. Velazquez · Pepco Energy Services adjusted EPS for Mr. Huffman | |||

| Power Delivery operation and maintenance (O&M) expenses, as compared to budget | Measures the amount of transmission and distribution O&M expenses in our Power Delivery segment, excluding accruals for PHI’s cash incentive programs. | Our ability to keep the amount of our O&M expenditures below budget is one way we evaluate the financial performance of our Power Delivery operations. The level of O&M expenditures directly impacts our level of earnings, and thus maintaining O&M spending within budgeted amounts helps contribute to the achievement of our earnings goals. | Mr. Velazquez | |||

| Core capital expenditures, as compared to budget | Measures our capital expenditures, excluding expenditures on long-term, multi-year projects which are managed on a total cost basis. | The use of prudently deployed and controlled capital expenditures is an important way for our utilities to achieve improved reliability, connect new customers and replace aging infrastructure. Completion of capital improvements within budgeted amounts is critical to our financial and operating performance. | Mr. Velazquez | |||

| Gross margin value of new energy services construction (ESCO) contracts signed |

Means the gross margin value of energy efficiency and combined heat and power contracts signed during 2014. For O&M contracts, gross margin beyond 2018 has been excluded as it is beyond a five-year planning horizon.

The gross margin value of new ESCO contracts signed during 2014 reflects the amount of gross profit we expect to earn from these contracts. |

We use this metric to assess the strength of our ESCO business development efforts during the year. | Mr. Huffman |

| 19 |

|

2014 EICP Financial Performance Criteria |

Description/Definition | Purpose | Applicable NEO(s) | |||

| Gross margin percentage from energy efficiency construction contracts | Means the gross margin percentage of energy efficiency construction contracts in place in 2014. Gross margin percentage is calculated by dividing the gross margin by the total revenues generated by these contracts. | We use this metric to measure whether Pepco Energy Services is achieving the expected profitability of its energy efficiency construction contracts. | Mr. Huffman | |||

| Contracted revenue for underground transmission and distribution construction and maintenance contracts signed during 2014 | Means the total amount of contracted revenue under these contracts. | We use this metric to track the amount of new contract activity that this business has generated during the year. | Mr. Huffman | |||

| Net loss from Pepco Energy Services generating facilities | Means net loss recognized in 2014 from the previously announced decommissioning of two Pepco Energy Services generating plants, including salvage credits. | We use this metric to assess the effectiveness of the generating facility decommissioning plan. | Mr. Huffman |

The operational performance criteria for 2014 EICP award opportunities were selected from the following:

| 2014 EICP Operational Performance Criteria |

Description/Definition | Purpose |

Applicable NEO(s) | |||

| Residential utility customer satisfaction | Overall customer satisfaction during 2014 is measured quarterly by Market Strategies International, an independent market research firm (MSI), using a statistically significant, industry standard methodology. | Public service commissions formulate decisions regarding our base rate cases based upon, in significant part, the views expressed by our customers about our utilities. |

Mr. Rigby Mr. Boyle Mr. Velazquez Mr. Fitzgerald | |||

| Compliance | We measure the compliance goal with respect to specific elements of our compliance with standards of the North American Electric Reliability Corporation (NERC), which is responsible for ensuring the reliability of the bulk power system. | The Federal Energy Regulatory Commission (FERC), which determines the return on equity on transmission assets that we own, considers NERC compliance in making this determination. Furthermore, since NERC is charged with overseeing the reliability of the bulk power system, compliance with NERC’s requirements is an important part of PHI’s efforts to maintain and protect that system. | Mr. Velazquez | |||

| On-time ESCO project completion rate | Means the percentage of energy efficiency and combined heat and power contracts projects completed during 2014 on schedule, which is defined as being 99% complete and with all punchlist items completed. | We use this as an efficiency metric to measure the ability of Pepco Energy Services to complete its projects on a timely basis. | Mr. Huffman |

| 20 |

|

2014 EICP Operational Performance Criteria |

Description/Definition | Purpose | Applicable NEO(s) | |||

| SAIDI and SAIFI |

SAIDI stands for “system average interruption duration index,” and it measures the amount of time our average electricity customer is without service over a specified period of time.

SAIFI stands for “system average interruption frequency index,” and it measures the number of sustained outages the average electricity customer has experienced over a specified period of time.

Transmission and distribution system reliability performance targets are set internally based on mandated requirements in our various service territories as well as recent historical performance. |

SAIDI and SAIFI are objective, quantifiable metrics used by our public service commissions to measure the reliability of the distribution system. These metrics are part of the mandated reliability standards against which our utilities are measured by applicable public service commissions in our electric distribution base rate cases. |

Mr. Rigby Mr. Boyle Mr. Velazquez Mr. Fitzgerald | |||

| Safety | This goal measures the number or rate of “recordable injuries” (as defined by the Occupational Safety and Health Administration (OSHA)) in the calendar year, and preventable fleet accidents, which refer to accidents involving our vehicles which could have been avoided if the driver had acted in a reasonably expected manner. For this goal to be achieved, there can be no fatalities during the year. | Safety is one of our core values. Being safe in everything we do ensures the protection of our employees, contractors, vendors and customers, as well as the communities in which we serve. | All | |||

| Diversity |

This goal seeks to support our inclusive and diverse workplace. For Corporate and Power Delivery, this goal measures PHI’s progress in diversity in employee hiring and promotions for the most recent year as well as participation by employees in various diversity activities throughout the year.