Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INTERPUBLIC GROUP OF COMPANIES, INC. | ipgq12015earningsrelease8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - INTERPUBLIC GROUP OF COMPANIES, INC. | ipgq12015earningsreleaseex.htm |

FIRST QUARTER 2015 EARNINGS CONFERENCE CALL April 24, 2015

• Organic revenue growth was 5.7% from Q1-14, 2.4% as reported U.S. organic growth was 6.1% International organic growth was 5.1% Currency impact was -4.4% • Operating income was $8 million, improved from loss of $12 million a year ago, in seasonally small Q1 • Operating margin improved 120 basis points • EPS was break-even, compared with a loss of $0.05 a year ago Overview – First Quarter 2015 Page 2 See reconciliation of organic revenue change on page 15.

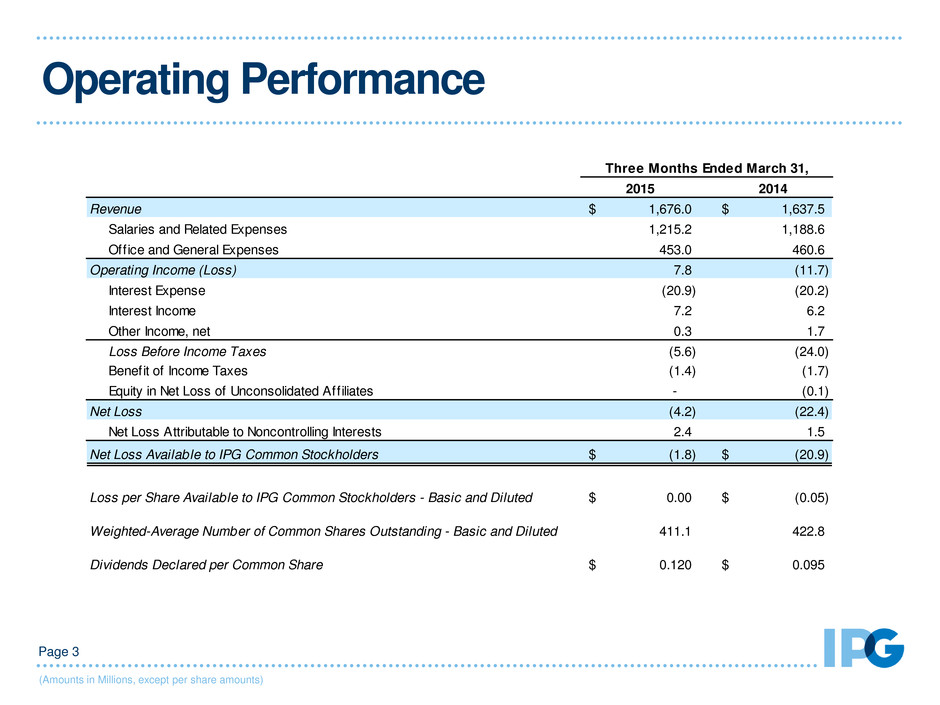

Operating Performance (Amounts in Millions, except per share amounts) Page 3 2015 2014 Revenue 1,676.0$ 1,637.5$ Salaries and Related Expenses 1,215.2 1,188.6 Office and General Expenses 453.0 460.6 Operating Income (Loss) 7.8 (11.7) Interest Expense (20.9) (20.2) Interest Income 7.2 6.2 Other Income, net 0.3 1.7 Loss Before Income Taxes (5.6) (24.0) Benefit of Income Taxes (1.4) (1.7) Equity in Net Loss of Unconsolidated Affiliates - (0.1) Net Loss (4.2) (22.4) Net Loss Attributable to Noncontrolling Interests 2.4 1.5 (1.8)$ (20.9)$ Loss per Share Available to IPG Common Stockholders - Basic and Diluted 0.00$ (0.05)$ Weighted-Average Number of Common Shares Outstanding - Basic and Diluted 411.1 422.8 Dividends Declared per Common Share 0.120$ 0.095$ Three Months Ended March 31, Net L ss Available to IPG Common Stockholders

Revenue ($ in Millions) Page 4 See reconciliation of segment organic revenue change on page 15. Integrated Agency Networks (“IAN”): McCann Worldgroup, FCB (Foote, Cone & Belding), Lowe & Partners, IPG Mediabrands, our digital specialist agencies and our domestic integrated agencies Constituency Management Group (“CMG”): Weber Shandwick, Golin, Jack Morton, FutureBrand, Octagon and our other marketing service specialists 2015 2014 Total Organic IAN 1,349.9$ 1,315.7$ 2.6% 6.7% CMG 326.1$ 321.8$ 1.3 1.6 Change Three Months Ended March 31, $ % Change March 31, 2014 1,637.5$ Total change 38.5 2.4% Foreign currency (71.9) (4.4%) Net acquisitions/(divestitures) 17.3 1.1% Organic 93.1 5.7% March 31, 2015 1,676.0$ Three Months Ended

Total Organic United States 6.9% 6.1% International (3.8%) 5.1% United Kingdom (1.6%) 6.4% Continental Europe (7.5%) 3.5% Asia Pacific (0.4%) 6.0% Latin America (14.5%) (0.7%) All Other Markets 3.5% 10.4% Worldwide 2.4% 5.7% Three Months Ended March 31, 2015 Geographic Revenue Change Page 5 “All Other Markets” includes Canada, Africa and the Middle East. See reconciliation of organic revenue change on page 15.

(0.9%) 0.9% 3.8% 3.7% (10.8%) 7.0% 6.1% 0.7% 2.8% 5.5% (12.0%) (10.0%) (8.0%) (6.0%) (4.0%) (2.0%) 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% Q4-05 Q4-06 Q4-07 Q4-08 Q4-09 Q4-10 Q4-11 Q4-12 Q4-13 Q4-14 Organic Revenue Growth Page 6 See reconciliation on page 16. Trailing Twelve Months Q1-15 5.4%

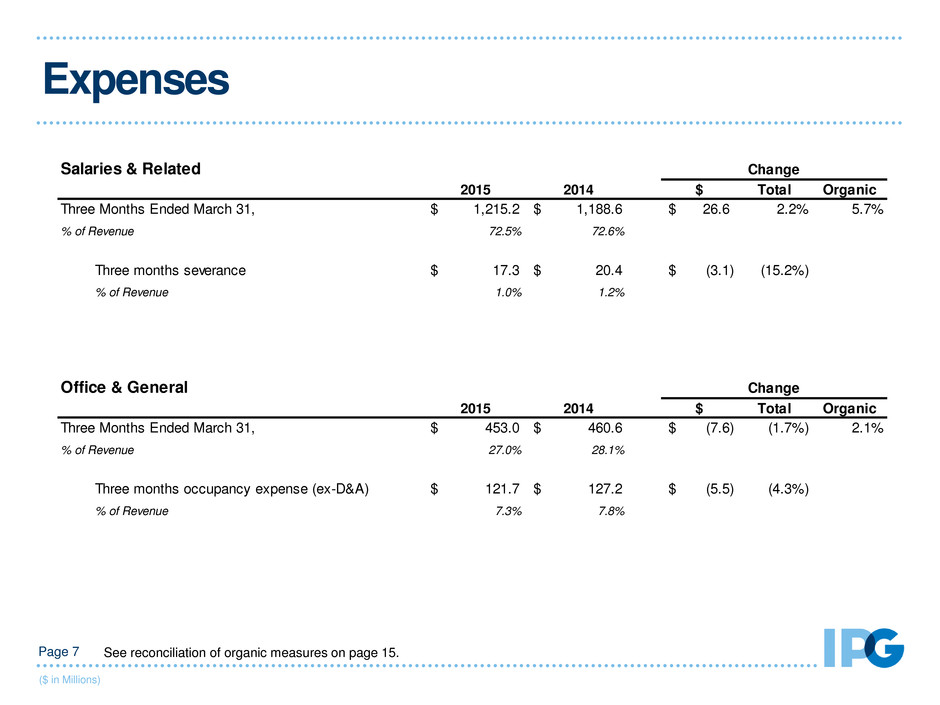

Expenses ($ in Millions) Page 7 See reconciliation of organic measures on page 15. Salaries & Related 2015 2014 $ Total Organic Three Months Ended March 31, 1,215.2$ 1,188.6$ 26.6$ 2.2% 5.7% % of Revenue 72.5% 72.6% Three months severance 17.3$ 20.4$ (3.1)$ (15.2%) % of Revenue 1.0% 1.2% Office & General 2015 2014 $ Total Organic Three Months Ended March 31, 453.0$ 460.6$ (7.6)$ (1.7%) 2.1% % of Revenue 27.0% 28.1% Three months occupancy expense (ex-D&A) 121.7$ 127.2$ (5.5)$ (4.3%) % of Revenue 7.3% 7.8% Change Change

(1.7%) 1.7% 5.3% 8.5% 5.7% 8.4% 9.8% 9.8% 8.4% 10.5% 10.7% 9.3% (4.0%) (2.0%) 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Q4-05 Q4-06 Q4-07 Q4-08 Q4-09 Q4-10 Q4-11 Q4-12 Q4-13 Q4-14 Operating Margin Page 8 Trailing Twelve Months Q1-15 For the twelve months ended December 31, 2013, reported operating income of $598.3 includes our Q4 2013 restructuring charge of $60.6. Excluding this charge, adjusted operating income was $658.9, and adjusted operating margin is represented in green. ($ in Millions)

Balance Sheet – Current Portion ($ in Millions) Page 9 March 31, December 31, March 31, 2015 2014 2014 CURRENT ASSETS: Cash and cash equivalents 734.3$ 1,660.6$ 771.0$ Marketable securities 6.9 6.6 5.6 Accounts receivable, net 3,781.4 4,376.6 4,013.4 Expenditures billable to clients 1,497.8 1,424.2 1,692.7 Other current assets 367.1 342.2 399.2 Total current assets 6,387.5$ 7,810.2$ 6,881.9$ CURRENT LIABILITIES: Accounts payable 5,468.5$ 6,558.0$ 6,048.5$ Accrued liabilities 618.7 796.0 587.4 Short-term borrowings 135.7 107.2 171.1 Current portion of long-term debt 2.0 2.1 353.2 Total current liabilities 6,224.9$ 7,463.3$ 7,160.2$

2015 2014 NET LOSS (4)$ (22)$ OPERATING ACTIVITIES Depreciation & amortization 57 57 Deferred taxes (32) (23) Other non-cash items 13 7 Change in working capital, net (801) (723) Other non-current assets & liabilities (30) (22) Net cash used in Operating Activities (797) (726) INVESTING ACTIVITIES Capital expenditures (20) (27) Acquisitions & deferred payments, net - (22) Business, investment & fixed asset purchases/sales, net - 2 Net cash used in Investing Activities (20) (47) FINANCING ACTIVITIES Repurchase of common stock (51) (45) Common stock dividends (49) (40) Acquisition-related payments (2) (3) Distributions to noncontrolling interests (1) (6) Net increase (decrease) in short-term bank borrowings 34 (7) Exercise of stock options 9 6 Excess tax benefit from share-based payment arrangements 9 3 Other financing activities - 1 Net cash used in Financing Activities (51) (91) Currency Effect (58) (2) Decrease in Cash & S/T Marketable Securities (926)$ (866)$ Three Months Ended March 31, Cash Flow ($ in Millions) Page 10

$2,349 $2,120 $1,947 $1,737 $1,769 $1,652 $1,663 $1,733 $1,758 $1,000 $1,500 $2,000 $2,500 $3,000 12/31/2007 12/31/2008 12/31/2009 12/31/2010 12/31/2011 12/31/2012 12/31/2013 12/31/2014 3/31/2015 $2,450 Total Debt (1) ($ in Millions) Page 11 (2) (1) Includes current portion of long-term debt, short-term borrowings and long-term debt. (2) Includes our November 2012 debt issuances of $800 aggregate principal amount of Senior Notes, which pre-funded our plan to redeem a similar amount of debt in 2013.

• Q1 a solid start on FY-15 performance objectives • Traction from key strategic initiatives Quality of our agency offerings, creative talent and “open architecture” solutions Digital strength across disciplines Effective expense management • Focus is on continued margin improvement • Financial strength continues to be a source of value creation Investment grade ratings at all three credit rating agencies Raised dividend and authorized new share repurchase program (in February) Summary Page 12

Appendix

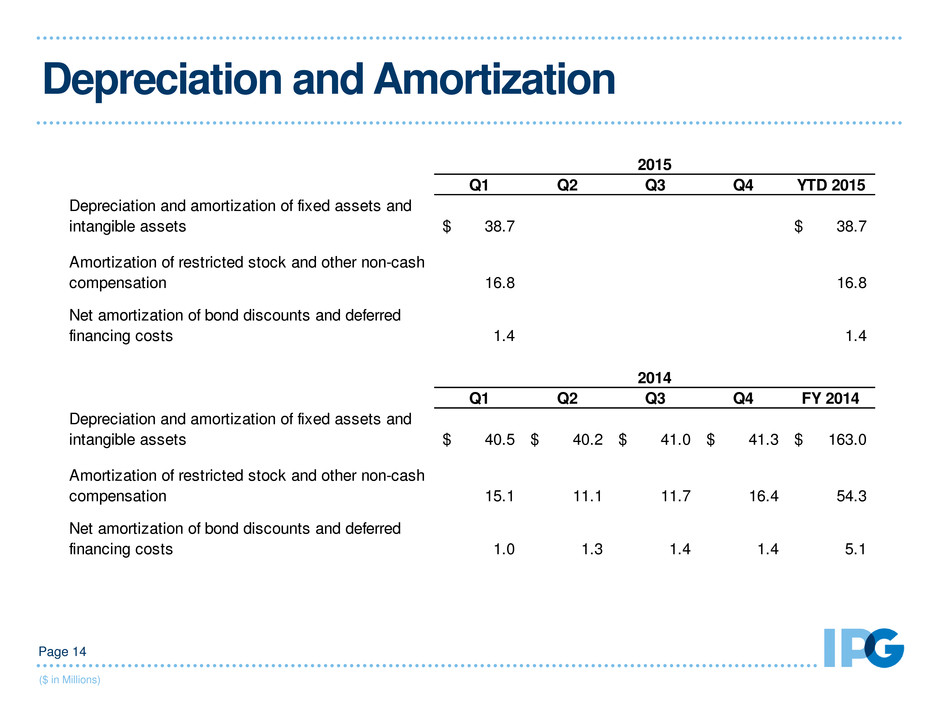

Depreciation and Amortization ($ in Millions) Page 14 Q1 Q2 Q3 Q4 YTD 2015 Depreciation and amortization of fixed assets and intangible assets 38.7$ 38.7$ Amortization of restricted stock and other non-cash compensation 16.8 16.8 Net amortization of bond discounts and deferred financing costs 1.4 1.4 Q1 Q2 Q3 Q4 FY 2014 Depreciati n and amortization of fixed assets and intangible assets 40.5$ 40.2$ 41.0$ 41.3$ 163.0$ Amortization of restricted stock and other non-cash compensation 15.1 11.1 11.7 16.4 54.3 Net amortization of bond discounts and deferred financing costs 1.0 1.3 1.4 1.4 5.1 2015 2014

Three Months Ended March 31, 2014 Foreign Currency Net Acquisitions / (Divestitures) Three Months Ended March 31, 2015 Organic Total Segment Revenue IAN 1,315.7$ (60.4)$ 6.8$ 87.8$ 1,349.9$ 6.7% 2.6% CMG 321.8 (11.5) 10.5 5.3 326.1 1.6% 1.3% Total 1,637.5$ (71.9)$ 17.3$ 93.1$ 1,676.0$ 5.7% 2.4% Geographic United States 939.0$ -$ 7.6$ 57.2$ 1,003.8$ 6.1% 6.9% International 698.5 (71.9) 9.7 35.9 672.2 5.1% (3.8%) United Kingdom 167.6 (13.4) - 10.7 164.9 6.4% (1.6%) Continental Europe 167.7 (28.3) 9.9 5.8 155.1 3.5% (7.5%) Asia Pacific 188.6 (12.0) (0.1) 11.3 187.8 6.0% (0.4%) Latin America 90.6 (12.4) (0.1) (0.6) 77.5 (0.7%) (14.5%) All Other Markets 84.0 (5.8) - 8.7 86.9 10.4% 3.5% Worldwide 1,637.5$ (71.9)$ 17.3$ 93.1$ 1,676.0$ 5.7% 2.4% Expenses Salaries & Related 1,188.6$ (53.5)$ 12.3$ 67.8$ 1,215.2$ 5.7% 2.2% Office & General 460.6 (20.9) 3.5 9.8 453.0 2.1% (1.7%) Total 1,649.2$ (74.4)$ 15.8$ 77.6$ 1,668.2$ 4.7% 1.2% Components of Change Change Organic Reconciliation of Organic Measures ($ in Millions) Page 15

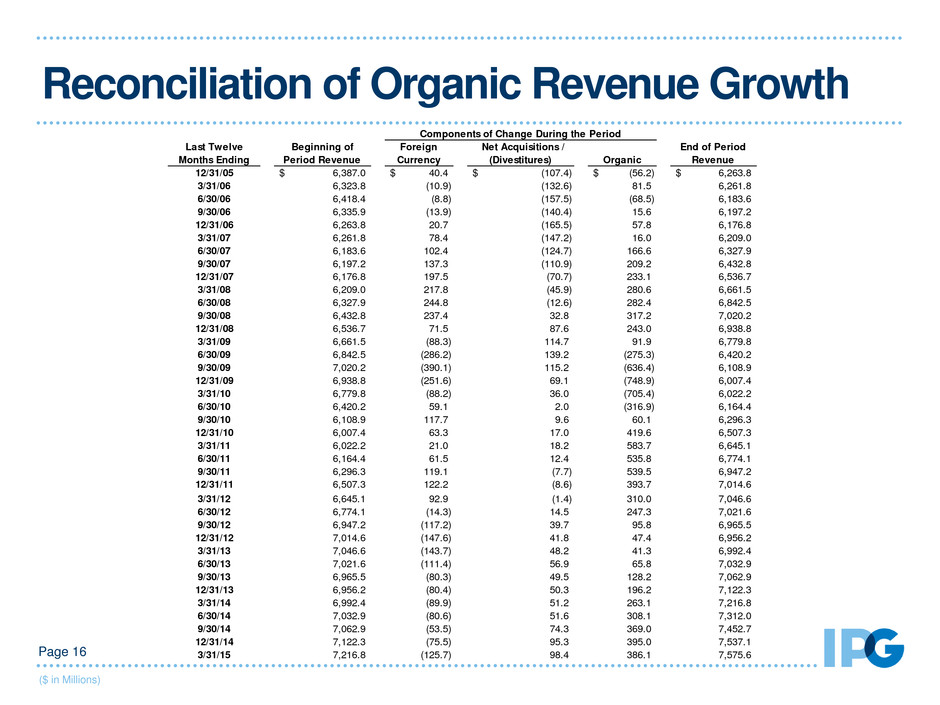

Last Twelve Months Ending Beginning of Period Revenue Foreign Currency Net Acquisitions / (Divestitures) Organic End of Period Revenue 12/31/05 6,387.0$ 40.4$ (107.4)$ (56.2)$ 6,263.8$ 3/31/06 6,323.8 (10.9) (132.6) 81.5 6,261.8 6/30/06 6,418.4 (8.8) (157.5) (68.5) 6,183.6 9/30/06 6,335.9 (13.9) (140.4) 15.6 6,197.2 12/31/06 6,263.8 20.7 (165.5) 57.8 6,176.8 3/31/07 6,261.8 78.4 (147.2) 16.0 6,209.0 6/30/07 6,183.6 102.4 (124.7) 166.6 6,327.9 9/30/07 6,197.2 137.3 (110.9) 209.2 6,432.8 12/31/07 6,176.8 197.5 (70.7) 233.1 6,536.7 3/31/08 6,209.0 217.8 (45.9) 280.6 6,661.5 6/30/08 6,327.9 244.8 (12.6) 282.4 6,842.5 9/30/08 6,432.8 237.4 32.8 317.2 7,020.2 12/31/08 6,536.7 71.5 87.6 243.0 6,938.8 3/31/09 6,661.5 (88.3) 114.7 91.9 6,779.8 6/30/09 6,842.5 (286.2) 139.2 (275.3) 6,420.2 9/30/09 7,020.2 (390.1) 115.2 (636.4) 6,108.9 12/31/09 6,938.8 (251.6) 69.1 (748.9) 6,007.4 3/31/10 6,779.8 (88.2) 36.0 (705.4) 6,022.2 6/30/10 6,420.2 59.1 2.0 (316.9) 6,164.4 9/30/10 6,108.9 117.7 9.6 60.1 6,296.3 12/31/10 6,007.4 63.3 17.0 419.6 6,507.3 3/31/11 6,022.2 21.0 18.2 583.7 6,645.1 6/30/11 6,164.4 61.5 12.4 535.8 6,774.1 9/30/11 6,296.3 119.1 (7.7) 539.5 6,947.2 12/31/11 6,507.3 122.2 (8.6) 393.7 7,014.6 3/31/12 6,645.1 92.9 (1.4) 310.0 7,046.6 6/30/12 6,774.1 (14.3) 14.5 247.3 7,021.6 9/30/12 6,947.2 (117.2) 39.7 95.8 6,965.5 12/31/12 7,014.6 (147.6) 41.8 47.4 6,956.2 3/31/13 7,046.6 (143.7) 48.2 41.3 6,992.4 6/30/13 7,021.6 (111.4) 56.9 65.8 7,032.9 9/30/13 6,965.5 (80.3) 49.5 128.2 7,062.9 12/31/13 6,956.2 (80.4) 50.3 196.2 7,122.3 3/31/14 6,992.4 (89.9) 51.2 263.1 7,216.8 6/30/14 7,032.9 (80.6) 51.6 308.1 7,312.0 9/30/14 7,062.9 (53.5) 74.3 369.0 7,452.7 12/31/14 7,122.3 (75.5) 95.3 395.0 7,537.1 3/31/15 7,216.8 (125.7) 98.4 386.1 7,575.6 Components of Change During the Period Reconciliation of Organic Revenue Growth ($ in Millions) Page 16

Metrics Update

Metrics Update Page 18 SALARIES & RELATED Trailing Twelve Months (% of revenue) Base, Benefits & Tax Incentive Expense Severance Expense Temporary Help OFFICE & GENERAL Trailing Twelve Months (% of revenue) Professional Fees Occupancy Expense (ex-D&A) T&E, Office Supplies & Telecom All Other O&G FINANCIAL Available Liquidity $1.0 Billion 5-Year Credit Facility Covenants Category Metric

Salaries & Related Expenses Page 19 63.8% 64.0% 64.0% 60.0% 62.0% 64.0% 66.0% 3/31/2014 12/31/2014 3/31/2015 % of Revenue, Trailing Twelve Months

1.0% 1.2% 0.0% 1.0% 2.0% 3.0% Severance Expense 3.9% 3.9% 0.0% 2.0% 4.0% 6.0% Temporary Help 3.9% 3.9% 0.0% 2.0% 4.0% 6.0% Incentive Expense 60.5% 60.3% 50.0% 55.0% 60.0% 65.0% Base, Benefits & Tax 2015 2014 Salaries & Related Expenses (% of Revenue) Page 20 Three Months Ended March 31 “All Other Salaries & Related,” not shown, was 3.2% and 3.3% for the three months ended March 31, 2015 and 2014, respectively.

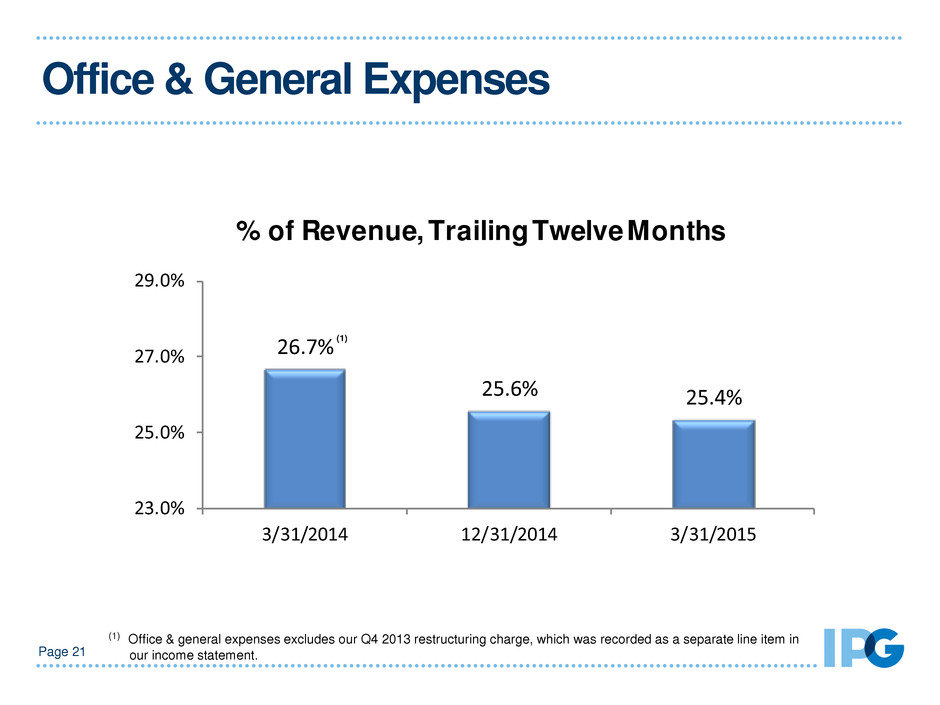

26.7% 25.6% 25.4% 23.0% 25.0% 27.0% 29.0% 3/31/2014 12/31/2014 3/31/2015 % of Revenue, Trailing Twelve Months Office & General Expenses Page 21 (1) Office & general expenses excludes our Q4 2013 restructuring charge, which was recorded as a separate line item in our income statement. (1)

1.7% 1.7% 0.0% 1.0% 2.0% 3.0% Professional Fees 7.3% 7.8% 4.0% 6.0% 8.0% 10.0% Occupancy Expense (ex-D&A) 14.4% 14.7% 10.0% 12.0% 14.0% 16.0% All Other O&G 3.6% 3.9% 2.0% 3.0% 4.0% 5.0% T&E, Office Supplies & Telecom Office & General Expenses (% of Revenue) Page 22 Three Months Ended March 31 “All Other O&G” includes production expenses, depreciation and amortization, bad debt expense, adjustments for contingent acquisition obligations, foreign currency (gains) losses, restructuring and other reorganization-related charges (reversals), long-lived asset impairments and other expenses. 2015 2014

$777 $901 $902 $1,667 $741 $985 $985 $984 $984 $983 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 3/31/2014 6/30/2014 9/30/2014 12/31/2014 3/31/2015 Cash, Cash Equivalents and Short-Term Marketable Securities Available Committed Credit Facility Available Liquidity ($ in Millions) Page 23 Cash, Cash Equivalents and Short-Term Marketable Securities + Available Committed Credit Facility

Last Twelve Months Ending March 31, 2015 I. Interest Coverage Ratio (not less than): 5.00x Actual Interest Coverage Ratio: 18.40x II. Leverage Ratio (not greater than): 3.25x Actual Leverage Ratio: 1.72x Interest Coverage Ratio - Interest Expense Reconciliation Last Twelve Months Ending March 31, 2015 Interest Expense: $85.6 - Interest income 28.4 - Other 1.5 Net interest expense : $55.7 EBITDA Reconciliation Last Twelve Months Ending March 31, 2015 Operating Income: $807.9 + Depreciation and amortization 217.2 EBITDA : $1,025.1 Covenants $1.0 Billion 5-Year Credit Facility Covenants ($ in Millions) Page 24 (1) Calculated as defined in the Credit Agreement. (1) (1)

Cautionary Statement Page 25 This investor presentation contains forward-looking statements. Statements in this investor presentation that are not historical facts, including statements about management’s beliefs and expectations, constitute forward-looking statements. These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in our most recent Annual Report on Form 10-K under Item 1A, Risk Factors. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events. Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Such factors include, but are not limited to, the following: ➔ potential effects of a challenging economy, for example, on the demand for our advertising and marketing services, on our clients’ financial condition and on our business or financial condition; ➔ our ability to attract new clients and retain existing clients; ➔ our ability to retain and attract key employees; ➔ risks associated with assumptions we make in connection with our critical accounting estimates, including changes in assumptions associated with any effects of a weakened economy; ➔ potential adverse effects if we are required to recognize impairment charges or other adverse accounting-related developments; ➔ risks associated with the effects of global, national and regional economic and political conditions, including counterparty risks and fluctuations in economic growth rates, interest rates and currency exchange rates; and ➔ developments from changes in the regulatory and legal environment for advertising and marketing and communications services companies around the world. Investors should carefully consider these factors and the additional risk factors outlined in more detail in our most recent Annual Report on Form 10-K under Item 1A, Risk Factors.