Attached files

| file | filename |

|---|---|

| EX-31.02 - Windstream Technologies, Inc. | ex31-2.htm |

| EX-32.01 - Windstream Technologies, Inc. | ex32-1.htm |

| EX-31.01 - Windstream Technologies, Inc. | ex31-1.htm |

| EX-3.04 - Windstream Technologies, Inc. | ex3-04.htm |

| EX-21.01 - Windstream Technologies, Inc. | ex21-01.htm |

| EX-10.23 - Windstream Technologies, Inc. | ex10-23.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2014

Commission File Number 000-54360

WINDSTREAM TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Wyoming | 98-0178621 | |

| (State or other jurisdiction of | (IRS Employer | |

| incorporation or organization) | Identification No.) |

| 819 Buckeye Street | ||||

| North Vernon, Indiana | 47265 | (812) 953-1481 | ||

| (Address of principal executive office) | (Zip Code) | (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | Smaller reporting company [X] | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the voting common equity held by non-affiliates as of June 30, 2014, based on the closing sales price of the common stock as quoted on the OTCQB market was $57,784,759. For purposes of this computation, all officers, directors, and 5 percent beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed an admission that such directors, officers, or 5 percent beneficial owners are, in fact, affiliates of the registrant.

As of April 13, 2015, there were 93,604,796 shares of registrant’s common stock outstanding.

TABLE OF CONTENTS

| 2 |

This Annual Report on Form 10-K (including the section regarding Management’s Discussion and Analysis of Financial Condition and Results of Operations) contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this Annual Report on Form 10-K. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our Management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Risks Factors” below, as well as those discussed elsewhere in this Annual Report on Form 10-K. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We file reports with the Securities and Exchange Commission (“SEC”). You can read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

This Annual Report on Form 10-K includes the accounts of WindStream Technologies, Inc., a Wyoming corporation (“WindStream”), together with its wholly-owned subsidiaries, as follows, collectively referred to as “we”, “us” or the “Company”: WindStream Technologies, Inc., a California corporation (“WindStream Sub”), and WindStream Technologies Latin America Inc., a Peru corporation (“WTLA”) as well as the Company’s majority-owned subsidiary, WindStream Energy Technologies Pvt. Ltd., an Indian corporation (“WET”).

“TurboMill®”, “TurboMills®”, “SolarMill®”, “TowerMill™”, “MobileMill™” and other trademarks and intellectual property of ours appearing in this report are our property. This report contains additional trade names and trademarks of other companies. We do not intend our use or display of other companies’ trade names or trademarks to imply an endorsement or sponsorship of us by such companies, or any relationship with any of these companies.

Corporate History

We were originally incorporated as Solarte Hotel Corporation in May 2008 to purchase real estate in the archipelago of Bocas Del Toro, Panama and to develop a luxury eco-lodge hotel on the property. In June 2009, we abandoned this business plan and embarked on a new plan to market incorporation services, including U.S. jurisdictions, Panama and other offshore jurisdictions, as a form of estate planning or asset protection for our clients.

In October 2011, a new interim President was appointed with the intention that we would acquire a Spokane, Washington-based company named Blue Star Technologies, as soon as an audit of that entity could be completed. In December 2011, we changed our name to Blue Star Entertainment Technologies, Inc., in connection with that proposed acquisition. However, no audit was ever completed for, nor did we acquire, Blue Star Technologies.

In November 2012, we entered into that certain Share Exchange Agreement (the “Original Share Exchange”), by and among the Company, Windaus Global Energy, Inc., a company incorporated pursuant to the laws of the Province of Ontario (“OpCo”) and Maurice and Judy Dechamps, the sole shareholders of OpCo (the “Shareholder”), pursuant to which we were to acquire all of the outstanding shares of OpCo (the “Opco Stock”) in exchange for the right to receive 36 million shares of our common stock (the “Windaus Stock”).

| 3 |

Subsequent to the execution of the Original Share Exchange, in December 2012, we entered into that certain Technology Transfer Agreement (the “Technology Transfer Agreement”) by and between the Company, as buyer, and OpCo, as seller, whereby we sought to acquire certain patent rights and other technology owned by OpCo in exchange for the issuance of approximately 36 million shares of our common stock, and mutually cancel and rescind the Original Share Exchange together with the obligations thereunder.

Effective on May 22, 2013 (the “Closing Date”), we entered into that certain Rescission Agreement (the “Rescission Agreement”) by and among the Company, OpCo and the Shareholder. Pursuant to the terms of the Rescission Agreement, the parties confirmed and ratified the rescission of the Original Share Exchange and the Technology Transfer Agreement. In addition, the Shareholder agreed to surrender the Windaus Stock held by it, if any, to us for cancellation and cancel or terminate any instructions to issue shares to any other recipients, the OpCo Stock was returned by the Company to the Shareholder and any assets transferred to the Company by OpCo were transferred and conveyed back to OpCo.

Simultaneously on the Closing Date, we entered into that certain Share Exchange Agreement (the “New Share Exchange Agreement”) by and among the Company, WindStream Sub and certain shareholders of WindStream Sub. Pursuant to the New Share Exchange Agreement, the outstanding common and preferred stock of WindStream Sub held by the WindStream Shareholders were exchanged for shares of our common stock. 955,000 shares of WindStream Sub common stock and 581,961 shares of WindStream Sub preferred stock were exchanged for 39,665,899 new shares of our common stock. Also, approximately 13.4 million shares were reserved for issuance upon the exercise of options under WindStream Sub’s stock option plan. As a result of the New Share Exchange Agreement and the other transactions contemplated thereunder, WindStream Sub became our wholly-owned subsidiary. The share exchange is accounted for as a reverse merger with Windstream Sub being the accounting acquirer. The historical financial statements of WindStream Sub are our historical financial statements and information as of the date of the merger.

Prior to May 22, 2013, the Company was a shell company. Subsequent to that date, the Company was no longer a shell company.

Business Overview

We are developing low-cost, high efficient products that harness renewable energy resources in urban and rural environments as well as both on- and off-grid. As the cost of energy rises, both in monetary and environmental terms, we believe consumers and governments will increasingly seek inexpensive and renewable alternatives to fossil fuels. We believe billions of people around the world could see direct benefit from the clean, renewable, distributed energy solutions that our products provide.

We have already begun to capitalize on these enormous market opportunities by creating products designed to meet the demands of any customer, whether on- or off-grid. We currently are shipping or have shipped products to over 34 countries around the world. These products can be scaled up to expand the generation needs of the individual consumer, business or industry.

The SolarMill®, our core product, is a unique, hybrid energy solution that allows customers to achieve cost savings and access to an uninterrupted supply of clean, renewable energy. The SolarMill® is a modular, renewable energy system designed and optimized for both on- and off- grid applications. It utilizes three low-profile, vertical-axis wind turbines mounted on a single base, which can be interconnected to maximize wind energy production in low and turbulent wind environments, commonly found in urban settings. This modular, scalable system integrates photovoltaic panels into the structure, using the same mounting structure, electronics and inverters to capture the complementary solar and wind resources.

|

|

|

| 4 |

Our Strategy

Our strategy is to focus on developing regional distribution relationships. Companies with deep expertise about their own local or regional markets will be selected to handle product promotion and manage sales channels. We provide all the necessary training to enable our partners to handle all aspects of the sale process: assembly; siting; installation; maintenance and service. We are positioning ourselves to mainly be a business-to-business supplier, with distributors handling relationships with the ultimate customers. We may get directly involved in a customer installation for particularly large projects.

We target markets that have one or more of the following properties:

| ● | Electricity is expensive; | |

| ● | Electricity supply is inconsistent or non-existent; | |

| ● | Government mandates exist to introduce renewable and hybrid energy solutions; or | |

| ● | Electricity consumers exhibit a high level of concern for sustainability. |

As a result, developing economies make a perfect target market for us because they often suffer from electricity shortages and/or high energy costs. At the same time, developed economies are potential markets as governments and consumers realize the importance of switching to environmentally-friendly and sustainable energy sources and are willing to adopt solutions that may be more expensive than conventional sources, which are often based on burning fossil fuels.

Target Markets

The greatest opportunity for our products is in markets where consumers have no access to electricity at all or where the cost of electricity is very high. This demand-driven opportunity is also attractive due to abundant sun and wind typical of many of these regions. The population in these markets is vast and our products provide less expensive renewable energy generation than is typically available.

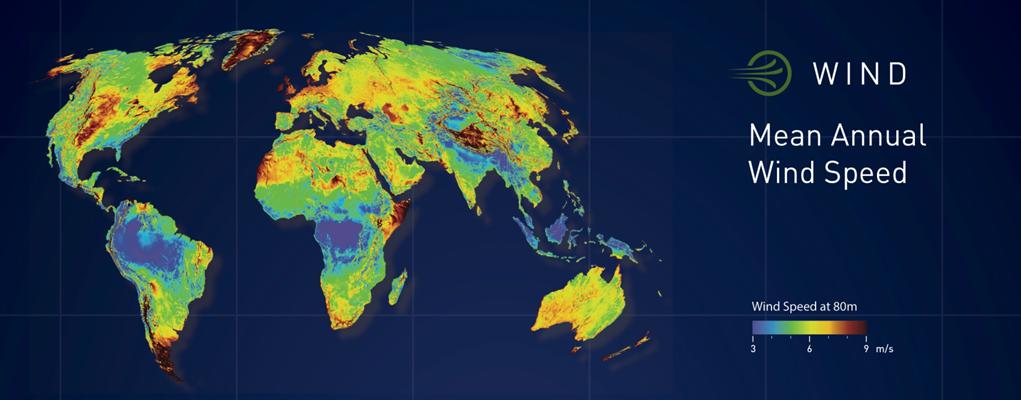

We target countries with a mean wind speed of greater than 5 m/s and a solar resource in excess of 4 direct normal insolation (DNI) a day. See the maps below showing worldwide solar and wind data. If both of these parameters are met and local cost of energy is greater than $0.20 per kilowatt-hour (kWh), then the period of time it would take a consumer to see savings from energy production to recover their initial costs, without government incentives, will be less than 10 years, which is the period of time we believe most consumers, commercial property owners, and governments/municipalities look for when making such investments in energy-related infrastructure.

| 5 |

Markets Where Energy Is Expensive

One of our primary market opportunities comes from the high cost of electricity in many parts of the world. Typically, renewable energy sources are associated with a higher price per kWh than conventional electricity, but this is not a universal rule and generally applies to developed markets with high rates of electrification and/or countries with ample energy from conventional sources, such as hydro, coal, oil and gas.

| 6 |

However, even with conventional energy sources, many countries have very expensive electricity. Island nations, for instance, often have to import fuel to produce electricity, and shipping costs add significantly to the users’ electric bills. The table below shows energy rates in selected countries around the world.

| Country/Territory | US cents/kWh | Date | ||

| Argentina (Concordia) | 19.13 | 2013 | ||

| Australia | 30.817 kWh plus 91.755 cents per day service fee | 2012 | ||

| Belgium | 18.66 | 2013 | ||

| Bulgaria | 13.38 day (between 7:00-23:00 DST); 9.13 night | 2014 | ||

| Brazil | 16.20 | 2011 | ||

| Cambodia (Phnom Penh) | 15.63 to 21.00 | 2014 | ||

| Canada, Ontario, Toronto | 6.52 to 11.69 depending on time of day plus transmission, delivery, and other charges of about 3.75/kWh | 2014 | ||

| China | 7.5 to 10.7 | 2012 | ||

| Chile | 23.11 | 2011 | ||

| Colombia (Bogota) | 18.05 | 2013 | ||

| Denmark | 38 | 2013 | ||

| Egypt | 1.24 to 12.21, depending on total monthly consumption, subsidized | 2014 | ||

| Ethiopia | 6.7 to 7.7 | 2012 | ||

| France | 20 | 2011 | ||

| Germany | 28.49 | 2013 | ||

| Romania | 18.40 | 2013 | ||

| Hungary | 17 | 2013 | ||

| India | 0.1 to 18 (average 7) | 2013 | ||

| Indonesia | 8.75 | 2013 | ||

| Israel | 18 | 2013 | ||

| Italy | 32 | 2013 | ||

| Jamaica | 33 to 34 (reduction due to lower fuel prices) | 2015 | ||

| Jordan | 5 to 33 | 2012 | ||

| Korea (South) | 5.50 to 52.2 | 2013 | ||

| Malaysia | 7.09 to 14.76 | 2013 | ||

| Netherlands | 26 | 2013 | ||

| New Zealand | 19.15 | 2012 | ||

| Nicaragua | 10 to 48, depending on total monthly consumption | 2014 | ||

| Nigeria | 2.58 to 16.55 | 2013 | ||

| Philippines | 36.13 | 2013 | ||

| Russia | 2.4 to 14 | 2013 | ||

| Singapore | 20.88 | 2013 | ||

| Spain | 30 | 2013 | ||

| South Africa | 8 to 16 | 2012 | ||

| Thailand | 6 to 13 | 2013 | ||

| Turkey | 12.57 to 18.63 | 2014 | ||

| United Kingdom | 24 | 2013 | ||

| United States | 12 | 2013 | ||

| Vietnam | 6.20 to 10.01 | 2011 |

Sources:

http://en.wikipedia.org/wiki/Electricity_pricing#Global_electricity_price_comparison;

http://www.eia.gov/todayinenergy/detail.cfm?id=18851

http://cleantechnica.com/2013/09/30/average-electricity-prices-around-world/

| 7 |

Island nations have some of the highest energy prices in the world, an average of $0.39/kWh in 2010, according to data from the Pacific Power Association. Yet most of them are located in areas with ample solar and wind resources, a combination of factors that makes them good markets for our products. For example, Jamaica was the country of one of our first large-scale deployments.

Markets Where Energy Supply Is Inconsistent or Non-Existent

Places where the supply of electricity either does not exist or is very unreliable or sporadic represent a huge opportunity for us. The “World Energy Outlook 2011” (WEO-2011), published by the International Energy Agency (IEA) and the World Bank, reports that 1.3 billion people lived without any access to electricity in 2009:

| Region | Population

without | Electrification rate | Urban electrification rate | Rural electrification rate | ||||||||||||

| Africa | 587 | 41.8 | % | 68.8 | % | 25.0 | % | |||||||||

| North Africa | 2 | 99.0 | % | 99.6 | % | 98.4 | % | |||||||||

| Sub-Saharan Africa | 585 | 30.5 | % | 59.9 | % | 14.2 | % | |||||||||

| Developing Asia | 675 | 81.0 | % | 94.0 | % | 73.2 | % | |||||||||

| China & East Asia | 182 | 90.8 | % | 96.4 | % | 86.4 | % | |||||||||

| South Asia | 493 | 68.5 | % | 89.5 | % | 59.9 | % | |||||||||

| Latin America | 31 | 93.2 | % | 98.8 | % | 73.6 | % | |||||||||

| Middle East | 21 | 89.0 | % | 98.5 | % | 71.8 | % | |||||||||

| Developing countries | 1,314 | 74.7 | % | 90.6 | % | 63.2 | % | |||||||||

| World* | 1,317 | 80.5 | % | 93.7 | % | 68.0 | % | |||||||||

*World total includes OECD and Eastern Europe/Eurasia

Source: http://www.worldenergyoutlook.org/resources/energydevelopment/accesstoelectricity/

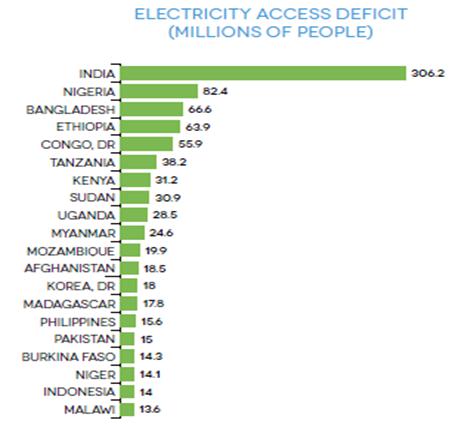

The countries with the greatest number of people without access to electricity are shown below; these twenty countries are home to almost 890 million people who lack electricity, representing about three-quarters of the global total.

Source: http://www.iea.org/publications/freepublications/publication/Global_Tracking_Framework.pdf.

| 8 |

In addition to those who lack any access to electricity, the United Nations Foundation reports that about 1 billion people have only intermittent access to electricity, which is in addition to those without access to power. In India, according to the World Bank, “grid-based power shortages during peak hours averaged 17 percent in the first half of 2009.” Moreover, the World Bank also notes that, “To cope with widespread outages in Sub-Sahara Africa, a number of countries have had to contract short term leases for emergency generation in the form of containerized mobile diesel units costing as much as $0.35 per kilowatt-hour, with lease payment absorbing more than 1 percent of GDP in many cases.”

According to the United Nations Foundation, “The lack of modern energy services stifles income-generating activities and hampers the provision of basic services such as health care and education. In addition, smoke from polluting and inefficient cooking, lighting, and heating devices kills nearly two million people a year and causes a range of chronic illnesses and other health impacts. These emissions are important drivers of climate change and local environmental degradation. They also consume time that women and girls could spend in more productive activities and pose security risks for them as they forage for fuel.” As a result, the UN has called for reaching 100% electrification rate by 2030, as part of its very ambitious “Sustainable Energy for All” (SE4ALL) initiative. In financial terms, it is estimated that the costs to implement the three objectives of the SE4ALL initiative will be at least $600–$800 billion per year in addition to current spending.

The many local, national and international projects aimed at improving access to electricity in poor countries represent a huge opportunity for us. We believe that our products are more affordable than many alternatives from competitors, allowing our products to electrify more villages for any given budget. At the same time, our units are small, scalable and easily installed. They can be delivered to remote areas with an ordinary pick-up truck (or even a cart) and do not require an installation team or specialized equipment (such as a truck or lifting equipment) to be installed, reducing deployment time and the cost to local communities, authorities and sponsors.

Recognizing the urgent need to provide power to the Sub-Saharan region of Africa, the Obama Administration has established the “Power Africa” initiative, a $7 billion effort to bring energy to the continent. Project partners have committed an additional $20 billion in the form of direct loans, guarantee facilities, and equity investments. Power Africa works with African governments, the private sector, and other partners such as the World Bank and African Development Bank to add more than 30,000 megawatts (MW) of cleaner, more efficient electricity generation capacity in Sub-Saharan Africa. By expanding mini-grid and off-grid solutions and building out power generation, transmission, and distribution structures, Power Africa will also increase electricity access by adding more than 60 million new household and business connections. At the same time, Power Africa will enhance energy resource management capabilities, allowing partner countries to meet their critical energy needs and achieve sustainable, long-term energy security.

Government Mandates for Renewable Energy

Another strong market for our products is the global trend of government incentives or legal mandates to utilize renewable energy sources. There are several reasons for government intervention:

| ● | Need to control climate change; | |

| ● | Need to reduce pollution and other negative externalities; | |

| ● | Need to ensure adequate electricity supply to the growing population or the need to increase electrification rates and the quality of supplied electricity; | |

| ● | Need to switch to sustainable energy sources in the context of rising energy prices and finite fossil fuels; and | |

| ● | Political pressure from environmentally conscious citizens. |

Because of the relatively high cost of renewable energy (especially in markets where conventional electricity is quite cheap due to an abundant supply of fossil fuels or hydro-electric power), such government intervention and incentivizing is often necessary to make sure that renewables are being actively researched and introduced and that they are not prohibitively expensive for consumers.

By early 2014, at least 144 countries had renewable energy targets and 138 countries had renewable energy support policies in place. Developing and emerging economies have led the expansion in recent years and account for 95 of the countries with support policies, up from 15 in 2005.

| 9 |

| Share of electricity generation from renewables, existing in 2012 and targets | ||||||||||

| COUNTRY | SHARE 20121 | TARGET | COUNTRY | SHARE 20121 | TARGET | |||||

| EU-27 | 23.80% | Madagascar | 0% non-hydro | 75% by 2020 | ||||||

| Algeria | 0.80% | 5% by 2017 | 49% total | |||||||

| 40% by 2030 | Malaysia | 5% | 5% by 2015 | |||||||

| Antigua | 0% | 5% by 2015 | 9% by 2020 | |||||||

| and | 10% by 2020 | 11% by 2030 | ||||||||

| Barbuda | 15% by 2030 | 15% by 2050 | ||||||||

| Argentina2 | 8% by 2016 | Maldives | 16% by 2017 | |||||||

| Australia | 9.60% | 20% by 2020 | Mali5 | 57% | 10% by 2015 | |||||

| Austria | 75% | 70.6% by 2020 | 25% by 2033 | |||||||

| Azerbaijan | 20% by 2020 | Malta | 0.80% | 3.8% by 2020 | ||||||

| Bahamas | 0% | 15% by 2020 | Marshall Islands | 20% by 2020 | ||||||

| 30% by 2030 | Mauritius | 21% | 35% by 2025 | |||||||

| Bangladesh | 3.80% | 5% by 2015 | Mexico | 15% | 35% by 2026 | |||||

| 10% by 2020 | Mongolia | 20–25% by 2020 | ||||||||

| Barbados | 29% by 2029 | Netherlands | 12% | 37% by 2020 | ||||||

| Belgium | 14% | 20.9% by 2020 | New Zealand | 72% | 90% by 2025 | |||||

| Belize | 50% (no date) | Nicaragua | 43% | 74% by 2018 | ||||||

| Bulgaria | 12% | 20.6% by 2020 | 90% by 2020 | |||||||

| Cape Verde | 21% | 50% by 2020 | Nigeria6 | 16.40% | 10% by 2020 | |||||

| Chile3 | 38% | 20% by 2025 | Niue | 100% by 2020 | ||||||

| Cook Islands | 50% by 2015 | Palestinian Territories | 0.40% | 10% by 2020 | ||||||

| 100% by 2020 | Philippines | 29% | 40% by 2020 | |||||||

| Costa Rica | 92% | 100% by 2021 | Poland | 11% | 19.3% by 2020 | |||||

| Croatia | 48% | 39% by 2020 | Portugal | 48% | 45% by 2020 | |||||

| Cyprus | 4.90% | 16% by 2020 | Qatar | 2% by 2020 | ||||||

| Czech Republic | 10% | 14.3% by 2020 | 20% by 2030 | |||||||

| Denmark4 | 48% | 50% by 2020 | Romania | 25% | 43% by 2020 | |||||

| 100% by 2050 | Russia7 | 16% | 2.5% by 2015 | |||||||

| Djibouti | 100% by 2020 | 4.5% by 2020 | ||||||||

| Dominica | 14% | 100% (no date) | Senegal | 10% | 15% by 2021 | |||||

| Dominican Republic | 14% | 25% by 2025 | Seychelles | 5% by 2020 | ||||||

| Egypt | 9.20% | 20% by 2020 | 15% by 2030 | |||||||

| Eritrea | 50% (no date) | Solomon Islands | 50% by 2015 | |||||||

| Estonia | 12% | 18% by 2015 | Slovakia | 20% | 24% by 2020 | |||||

| Fiji | 67% | 100% by 2030 | Slovenia | 29% | 39.3% by 2020 | |||||

| Finland | 40% | 33% by 2020 | South Africa | 2.60% | 9% by 2030 | |||||

| France | 16% | 27% by 2020 | Spain | 7.9% non-hydro | 38.1% by 2020 | |||||

| Gabon | 40% | 70% by 2020 | 30% total | |||||||

| Germany | 25% | 40–45% by 2025 | Sri Lanka | 28% | 10% by 2016 | |||||

| (2013) | 55–60% by 2035 | 20% by 2020 | ||||||||

| 65% by 2040 | St. Kitts and Nevis | 0.40% | 20% by 2015 | |||||||

| 80% by 2050 | St. Lucia | 5% by 2013 | ||||||||

| Ghana2 | 0% | 10% by 2020 | 15% by 2015 | |||||||

| Greece | 16% | 40% by 2020 | 30% by 2020 | |||||||

| Guatemala | 64% | 80% by 2027 | St. Vincent and | 17% | 30% by 2015 | |||||

| Guyana | 90% (no date) | The Grenadines | 60% by 2020 | |||||||

| Honduras | 44% | 60% by 2022 | Sudan | 47% | 10% by 2016 | |||||

| 80% by 2038 | Sweden | 58% | 62.9% by 2020 | |||||||

| Hungary | 7.80% | 11% by 2020 | Thailand8 | 7.60% | 10% by 2021 | |||||

| Indonesia | 12% | 26% by 2025 | Timor-Leste | 50% by 2020 | ||||||

| Iraq | 8.60% | 2% by 2030 | Tokelau | 100% (no date) | ||||||

| Ireland | 20% | 42.5% by 2020 | Tonga | 50% by 2015 | ||||||

| Israel | 0.40% | 5% by 2014 | Tunisia | 1.20% | 16% by 2016 | |||||

| 10% by 2020 | 40% by 2030 | |||||||||

| Italy | 31% | 26% by 2020 | Turkey | 3% non-hydro | 30% by 2023 | |||||

| Jamaica | 4.70% | 15% by 2020 | 27% total | |||||||

| Kazakhstan | 15% | 1% by 2014 | Tuvalu | 100% by 2020 | ||||||

| 3% by 2020 | Uganda | 79% | 61% by 2017 | |||||||

| Kiribati | 10% (no date) | United Kingdom | 12% | 50% by 2015 | ||||||

| Kuwait | 15% by 2030 | Scotland | 100% by 2020 | |||||||

| Latvia | 64% | 60% by 2020 | Ukraine | 8% | 20% by 2030 | |||||

| Lebanon | 12% by 2020 | Uruguay | 60% | 90% by 2015 | ||||||

| Liberia | 30% by 2021 | Vanuatu | 23% by 2014 | |||||||

| Libya | 0% | 20% by 2020 | Vanuatu | 40% by 2015 | ||||||

| Lithuania | 23% | 21% by 2020 | 65% by 2020 | |||||||

| Luxembourg | 36% | 11.8% by 2020 | Vietnam | 5% by 2020 | ||||||

| Yemen | 15% by 2025 | |||||||||

Notes: 1 National share is for 2012 unless otherwise noted. 2 National target(s) exclude(s) large hydropower. 3 Chile’s target excludes hydropower plants over 40 MW. 4 Denmark set a target of 50% electricity consumption supplied by wind power by 2020 in March 2012. 5 Mali’s target excludes large hydropower. 6 Nigeria’s target excludes hydropower plants over 30 MW. 7 Russia’s targets exclude hydropower plants over 25 MW. 8 Thailand does not classify hydropower installations larger than 6 MW as renewable energy sources, so large-scale hydro >6 MW is excluded from national shares and targets. 9 India does not classify hydropower installations larger than 25 MW as renewable energy sources, so large-scale hydro >25 MW is excluded from national shares and targets.

Source: http://www.ren21.net/portals/0/documents/resources/gsr/2014/gsr2014_full%20report_low%20res.pdf

| 10 |

Sustainability-Conscious Market

Another market segment of interest to us is the “voluntary” market, which is driven by individuals and corporations that want to switch to environmentally-friendly energy alternatives. These consumers are prepared to pay a premium for electricity generated from the sun, wind, or other sustainable and non-polluting sources.

It is difficult to clearly separate the part of renewable energy demand that is motivated purely by voluntary sustainability-driven decisions from the part driven by government mandates, prices or lack of alternatives. Nonetheless, we believe that this demand factor will be more prominent in developed economies, where consumers can afford to be environmentally conscious.

On the corporate side, many businesses wish to communicate to their customers that they are environmentally aware in order to build brand equity. According to a 2012 National Renewable Energy Laboratory report, the motivation behind such labeling is driven by several factors, including:

| ● | Product differentiation; | |

| ● | Enhancing the brand image and building customer loyalty; | |

| ● | Targeting a specific consumer segment (the environmentally-conscious consumers); and | |

| ● | Ability to charge a price premium. |

We believe this demonstrates that there is significant demand for sustainable products among consumers, and that this demand extends to energy as well, as a “green” consumer will try to be green in everything, not just in products bought from a supermarket.

Distributed Energy Generation (DEG)

Many areas in the world lack access to energy infrastructure, often due to the prohibitive cost of its construction or insufficient generating capacity. Such infrastructure is not only expensive but also time-consuming to build. This often means that it is quicker, often cheaper, and more reliable to introduce point-of-use generation capacity, also called a Distributed Energy Generation model. For example, in India, where the overall electrification rate stands at 75%, one-third of total installed capacity is so-called “captive” generation—electricity produced by firms for their own consumption. In addition, sustainability-conscious consumers who lack a choice of renewable energy options may conclude that installing their own generation equipment is the only way to consume sustainable, reliable energy. According to a report by Grand View Research, Inc., it is expected that an increase in consumer awareness with regard to benefits offered by distributed energy generation in terms of air pollution, climate changes and greenhouse emission are expected to drive demand for DEG.

The DEG market is a logical consequence of infrastructure problems and various goals set by international organizations and local governments. It is hard to imagine 100% electrification through the conventional large-scale utility business model alone, as this would require building transmission lines to serve every single remote community, no matter its size or energy demands. The cost of such construction and subsequent maintenance would be so great that such infrastructure would eventually be abandoned due to the inability of consumers or governments to pay the full cost. As a result, DEG could be an effective and cost-efficient method of providing electricity to areas that otherwise would not be economically feasible.

One report estimates that 36% of all new generation capacity added by 2030 will come from mini-grids and another 20% from off-grid stand-alone installations. In addition, more and more countries are integrating off-grid energy solutions into broader rural development policies and frameworks, such as:

| ● | Bangladesh, where over 2 million solar systems with capacities of 10–200W had been installed as of May 2013, with over 1,000 systems estimated to be installed every day; and | |

| ● | Inner Mongolia, China, where around 130,000 wind systems with capacities between 200W and 1,000W each were in operation as of early 2013, serving more than 500,000 people. |

The Grand View Research report estimates that the DEG market will grow to $179.7 billion by 2020. Currently the most active DEG regions are Europe and Asia Pacific. Europe has dominated the market as a result of massive corporate investments spurred by generous government incentives. However, Asia Pacific is expected to experience the strongest regional growth due to cheap labor and financial incentives, significantly driven by growing energy demand in India and China. Overall, Europe, the Middle East and Africa are expected to benefit from abundant solar and wind resources as strong drivers for the DEG market.

While the commercial and industrial DEG market segments have dominated to date, the residential sector is expected to post the fastest growth of all segments in coming years with a compounded annual growth rate of 13.5% expected between 2014 and 2020. This provides us with a great opportunity, as we believe our products are better suited for residential and small commercial projects than for large-scale industrial ones.

| 11 |

Our Products

Although we started with the wind-only TurboMill® product, which forms the basic building block of all of our energy solutions, we have evolved the product into a hybrid SolarMill® solution, which combines wind with solar power. We also have two additional products in various stages of development, the MobileMill™ and the TowerMill™.

SolarMill®

Our concept is that this product will be simple to operate, elegant and appealing to place in any setting, yet durable, reliable, efficient, affordable and safe. We believe that the renewable resources available in 90% of the world can justify a hybrid energy system, not just to balance annual energy output, but also to capture the available resources at the lowest cost per watt in the market for a renewable energy platform. Our engineers have developed a product that overcomes the “inconsistent” nature of renewable energy resources. By integrating wind and solar technologies in a single unit, the SolarMill is a reliable renewable energy generation device that a customer can depend on year round.

The SolarMill® is a modular, scalable, distributed renewable energy system designed and optimized for on- and off-grid installations. It utilizes three low-profile vertical axis wind turbines mounted on a single base with integrated photovoltaic (PV) panels. By incorporating wind and PV technology within a compact footprint, we believe that it can be an effective solution in markets where the natural resources available for wind energy alone cannot justify any small wind product.

Each SolarMill® is constructed as a stand-alone, small power generator and is equipped with all necessary circuitry, electronics and sensors. At the same time, multiple SolarMills can be interconnected to maximize wind energy production in low and turbulent wind environments, commonly found in urban settings. Additional modules can be attached at a later date, if the customer desires greater power generation capability.

Proprietary generators are coreless, permanent magnet machines, which offer increased energy generation capabilities while operating at lower speeds, eliminating gearboxes that are more prone to failure. Each unit has a solid-state independent control circuit that extracts power from the wind, which power is then sent to an industry standard grid-tie inverter for transfer to a building’s electrical system or a battery bank for off-grid applications.

When grid-connected, the electrical energy created is directly fed into the building’s electrical service panel, offsetting portions of the building’s overall draw. In off-grid or direct-to-storage applications, the products utilize the on-board charge controller to regulate a 48V direct current battery system and then output via a DC/AC or DC/DC converter, based on the type of loads that need to be served. Onboard each SolarMill® is our proprietary Maximum Power Point Tracking (MPPT) electronics and solar charge controller, which is designed to maximize the power handling and generation capabilities of both the wind turbines and solar panels. This system maintains all power generation at maximum efficiency without the need for additional hardware or software.

SolarMills are designed to be aesthetically pleasing and are manufactured in a variety of colors to match the needs and aesthetic choices of specific customers and installation requirements. All aspects of the product, including bases, turbine blades and mounting assemblies, are designed to be lightweight but durable enough to withstand the elements. Designed for longevity, the products incorporate fault and failure protection and come with a 5-year warranty on all parts and labor. The bases and turbine blades are interchangeable and easily configured.

MobileMill™

In October 2014, we launched a unique mobile product, the MobileMill™. The MobileMill™ is designed to meet the needs of “first responders” around the world. By providing a self-contained solution for the rapid deployment of renewable energy generation and “command and control” operations, the MobileMill™ speeds up the deployment of operations for those who serve on the front line of disaster relief and assists in saving the lives of those who have been affected by these tragedies.

| 12 |

Originally designed and developed for the Indiana Department of Homeland Security (IDHS), the MobileMill™ is a renewable energy platform that features rapid deployment and operation, extreme energy efficiency and redundant power generation. From a customized vehicle, solar panels and wind turbines deploy in under 60 seconds, powering computers and communication equipment while storing energy on-site for an uninterrupted 24-hour power supply. The batteries may be charged in transit allowing the MobileMill™ to be fully functional upon arrival at a disaster zone. To meet customer needs, the MobileMill™ will be available in a variety of configurations, with generation capability between 3 kW and 8 kW, a scalable battery array for energy storage, and required peripherals, such as laptops, communication devices, task lighting, and device charging. This first-of-its-kind mobile technology will replace or supplement the traditional diesel generators required to operate the primary systems IDHS uses to provide location-based emergency support. Drawing energy from wind and solar resources, the MobileMill™ ensures that the stored system will stay charged by offering a generator and grid-tied energy as a backup.

Our representatives have presented the MobileMill™ to decision makers in the Philippines, India, Malaysia and Japan, all of whom have shown excitement about the technology. The MobileMill™ was featured at the 99th Annual League of Municipalities in Atlantic City, New Jersey, and drew wide interest from city representatives and the emergency responders’ community. The MobileMill™ will be a separate manufacturing line within WindStream’s growing suite of products. We expect MobileMill™ production to commence in the fourth quarter of 2015.

TowerMill™

We are developing what we believe is a unique technology, a derivative of our SolarMill® products, which harnesses the available renewable resources to power communication towers. By taking the efficient and affordable design of the SolarMill® technology and installing the turbine and solar components of the product along the side of a communications tower, the electronic components can then be powered from clean renewable energy with a fail-safe generator used only at times when natural resources alone cannot provide the needed energy. This new product line, the TowerMill™, is now being piloted in the Bahamas as a means of providing clean and consistent energy to a telecom tower insuring 100% uptime for the telecommunications company. We believe that these early-phase trials will prove the efficiency of the product and the ultimate cost savings to the owner and/or operator of the tower and its supporting electronics.

Distribution Channels

Our products are sold primarily through distribution agreements.

Project Partnering

Our business plan involves “partnering” with various entities such as utilities, sovereign and independent power producers, to provide the ability to bring solutions to the market as rapidly as possible. Our involvement in each project is to facilitate product development with our expertise, intellectual property and project management team. This project partnering allows us to increase our penetration in various international markets without committing costly “on the ground” resources for extended periods of time and reducing the amount of upfront capital that we need to commit to new markets.

Jamaica

We began 2014 with a large purchase order from Jamaica Public Service (JPS), the billion dollar utility of Jamaica. This contract called for $14.5 million of products that we began delivery upon the first quarter of 2014, and in May 2014 JPS ordered an additional $8.1 million in products. We continue to build and ship products to JPS to fulfill the current purchase orders, which are expected to be fulfilled in 2015. With energy rates in the Caribbean close to three times greater than the U.S. average of $0.12kWh, the cost of grid supplied energy on Jamaica is very high, providing us with an opportunity that makes our SolarMills an attractive option. SolarMills offset their initial cost with renewable energy while reducing the demand on the JPS generation and distribution infrastructure. JPS now offers our products to its customers as a direct sale through its chain of eStores and retail outlets as well as advertising the products on national television.

In addition to marketing to residential customers, JPS has also begun marketing the SolarMill® products to businesses throughout the country. Large installations have been sold to customers ranging from 10 kW to 300 kW. As well, JPS has agreed to be an authorized distributor for the SolarMill® and our related technologies in the Caribbean. JPS is one of the largest public utilities in the Caribbean and its commercial commitment and promotional activities have generated significant interest in other countries in the region. To date, we have initiated shipments to Curacao, Grand Cayman and the Bahamas. Our joint business plan with JPS includes our goal is to increase our penetration in the Caribbean and replicate our relationship with JPS with other public utilities in other parts of the Caribbean.

India

To better position ourselves to capitalize on this huge potential market, on October 26, 2013, we created a wholly-owned subsidiary, WindStream Energy Technologies India, Pvt. Ltd. (WET), which is an Indian entity located in Hyderabad. WET will provide sales, marketing, engineering, and service support for our products and customers as well as manage the Indian manufacturing operations. We are in the process of acquiring certifications for our products from the Ministry of New and Renewable Energy (MNRE), Gujarat Energy Research & Management Institute, and the Center for Wind Energy Technologies. Once certified, the SolarMill® and its associated products will be eligible to be included as authorized products for use within any government-promoted initiatives. Additionally, customers of the products will be eligible for the government incentives offered for the use of renewable energy products.

| 13 |

In October 2014, we announced our entrance into an agreement with West Coast Ventures (India) Pvt. Ltd. (WCV), based in Chennai, India, and a group of strategic investors. A new entity, DEEPAN Energy Venture LLP (Deepan), has been created by WCV for this investment, which has committed $2 million for an equity stake. WET has received $873,000 of the $2 million dollars and expects the balance of the funding to arrive during April 2015. We have accounted for WCV’s interest in WET as a non-controlling 45% interest as of December 31, 2014, although WCV will legally own and receive its shares representing its 45% interest only upon full payment of the subscription amount.

Deepan and WET are in the process of establishing a manufacturing presence in India and South Asia. WET was slated to take occupancy of its manufacturing facility in April 2015, and begin manufacturing our SolarMill® products in the second quarter of 2015, which will rapidly accelerate our penetration into that market. Due to delays in the construction of the manufacturing facility, WET is now scheduled to take occupancy of the factory by May 4, 2015. This delay will not adversely affect the production schedule of WET as assembly of products has continued in the adjacent facility.

Manufacturing

In August 2011, we leased a 50,000 sq. ft. building in North Vernon, Indiana and retrofitted the facility for mass production of our renewable energy products. This facility houses all the necessary elements for us to manufacture, assemble and deliver our products. The facility houses the following disciplines: assembly of turbines; painting; metal fabrication; electronics fabrication; generator assembly; final product assembly; testing; and shipping and receiving.

Utilizing one assembly line and one shift of workers, we are currently capable of producing 500 units a month with 35 employees, which can be scaled up to 1,000 units/month by hiring additional employees and adding a second shift as demand for the products warrant. We plan to expand our manufacturing capability, when needed. To meet demand for the MobileMill™ product, specifically designed fabrication and manufacturing areas will be added to this facility.

As discussed above, the factory in India will use the same design and manufacturing model as the North Vernon facility and the disciplines will also be the same. Initially, the U.S. facility will be supplying WET with component parts, which WET will use to build our products. Over time, the WET operation will phase out the need for the U.S.-supplied components, as the tooling for the individual parts are manufactured and the component parts are inspected, tested and meet the approval of WindStream’s engineers. We expect to deliver between 2,000 and 3,000 SolarMills from the WET facility in 2015.

Governmental Regulation

We are subject to laws and regulations affecting our domestic and international operations in a number of areas. These U.S. and foreign laws and regulations affect the Company’s activities which include, but are not limited to, the areas of labor, advertising, consumer protection, real estate, billing, quality of services, intellectual property and ownership and infringement, tax, import and export requirements, anti-corruption, foreign exchange controls and cash repatriation restrictions, data privacy requirements, anti-competition, environmental, and health and safety.

In the U.S., our operations are subject to stringent and complex federal, state and local laws and regulations governing the occupational health and safety of our employees and wage regulations. For example, we are subject to the requirements of the federal Occupational Safety and Health Act, as amended, or OSHA, and comparable state laws that protect and regulate employee health and safety. We expend resources to maintain compliance with OSHA requirements and industry best practices that could otherwise be spent on sales or business development.

| 14 |

Compliance with these laws and regulations may be onerous and expensive, and they may be inconsistent from jurisdiction to jurisdiction, which further increases the cost of doing business. Any such costs, which may rise in the future as a result of changes in these laws and regulations or in their interpretation, could individually or in the aggregate make our products and services less attractive to our customers, delay the introduction of new products in one or more regions, or cause us to change or limit our business practices. We have implemented policies and procedures designed to ensure compliance with applicable laws and regulations, but there are no assurances that our employees, contractors or agents will not violate such laws and regulations or our policies and procedures.

Regulatory Matters

To operate our systems, our customers may need to obtain interconnection agreements from the applicable local primary electricity utility. This frequently depends on the size of the energy system and the specific utility tariffs, but the interconnection agreements are between the local utility and our customers. In almost all cases, interconnection agreements are standard form agreements that have been pre-approved by the local public utility commission or other regulatory body with jurisdiction over interconnection. As such, no additional regulatory approvals are required once interconnection agreements are signed.

Environmental Considerations

Environmental regulations may affect us by restricting the manufacturing or use of our products. Regulatory or legislative changes may cause future increases in our operating cost or otherwise affect operations. Although we believe we are and have been in complete compliance with such regulations, there is no assurance that in the future we may not be adversely affected by such regulations or incur increased operating costs in complying with such regulations. However, neither the compliance with regulatory requirements nor our environmental procedures can ensure that we will not be subject to claims for personal injury, property damages or governmental enforcement.

Government Incentives

Each of the United States, Canada, the United Kingdom and Chile has established various incentives and financial mechanisms to reduce the cost of solar and wind energy and to accelerate the adoption of solar and wind energy. These incentives include tax credits, cash grants, tax abatements, rebates and renewable energy credits or green certificates and net energy metering programs. These incentives help catalyze private sector investments in solar energy and positively impact our products’ financial performance.

Intellectual Property

We believe that we have an extensive patent portfolio and substantial know-how relating to our renewable energy solutions. We strive to protect the proprietary technology that we believe is important to our business, including our proprietary products and our processes. We seek patent protection in the United States and internationally for our products, their methods of use and processes of manufacture, and any other technology to which we have rights, where available and when appropriate. We also rely on trade secrets that may be important to the development of our business.

Our success will depend on 1) the ability to obtain and maintain patent and other proprietary rights in commercially important technology, inventions and know-how related to our business, 2) the validity and enforceability of our patents, 3) the continued confidentiality of our trade secrets, and 4) our ability to operate without infringing the valid and enforceable patents and proprietary rights of third parties. We also rely on continuing technological innovation and in-licensing opportunities to develop and maintain our proprietary position.

We cannot be certain that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications we may own or license in the future, nor can we be certain that any of our existing patents or any patents we may own or license in the future will be useful in protecting our technology.

The term of individual patents depends upon the legal term of the patents in the countries in which they are obtained. In most countries in which we file, the patent term is 20 years from the date of filing the first non-provisional priority application. In the United States, a patent’s term may be lengthened by patent term adjustment, which compensates a patentee for administrative delays by the U.S. Patent and Trademark Office, or PTO, in granting a patent, or may be shortened if a patent is terminally disclaimed over an earlier-filed patent.

| 15 |

Issued Patents

Our current patents owned are as follows:

| Patent No. | Title | Country/Region | Expiration Date | |||||

| 8,823,194 | Modular Alternative Energy Unit | U.S.A. | January 29, 2030 | |||||

| 8,536,720 | Modular Wind Energy Unit with Simple Electrical Connections | U.S.A. | January 29, 2030 |

Pending Patent Applications

Our current pending patent applications are as follows:

| Application No. | Title | Country/Region | ||

| PCT/US2010/001011 | Modular Alternative Energy Unit | PCT | ||

| P10910897-1 | Brazil | |||

| 10 767 409.5 | European Patent Office | |||

| 8985/DELNP/2011 | India | |||

| 2012-507193 | Japan | |||

| 10-2011-7027840 | South Korea | |||

| MX/a/2011/011042 | Mexico |

Trademarks and Service Marks

We seek trademark and service mark protection in the United States and outside of the United States where available and when appropriate. We have registered the following trademarks: TurboMill®, TurboMills® and SolarMill® and have filed trademark applications for TowerMill™ and MobileMill™.

Competition

Our products require specific site locations and appropriate weather conditions. Given these constraints and the increasing focus on renewable energy to offset the environmental problems caused by fossil fuels, the renewable energy industry is highly competitive, and rapidly evolving. Our major competitors include leading global players, and other regional and international developers.

In the markets where we plan to conduct business, we will compete with many energy producers including electric utilities and large independent power producers. There is also competition from fossil fuel sources such as natural gas and coal, and other renewable energy sources such as solar, traditional wind, hydro and geothermal. The competition depends on the resources available within the specific markets. However, we are selling our products to the user that either does not have access to a connection or is connecting to supplement their use of energy that is high in cost or inconsistent. Additionally, we believe that our pricing and focus on distributor and end-customer relationships allow us to compete favorably with traditional utilities in the regions we service.

Although the cost to produce clean, reliable, renewable energy is becoming more competitive with traditional fossil fuel sources, it generally remains more expensive to produce, and the reliability of its supply is less consistent than traditional fossil fuel. Deregulation and consumer preference are becoming important factors in increasing the development of alternative energy projects.

We believe that governments and consumers recognize the importance of renewable energy resources in the energy mix, and are facilitating the implementation of wind and other renewable technologies. We believe that we can compete favorably with our competitors given that the key competitive factors for wind and solar project development and operation include, without limitation:

| ● | site selection and acquisition; | |

| ● | permit and project development experience; | |

| ● | relationship with government authorities and knowledge of local policies; | |

| ● | ability to secure high-quality, Tier 1 panels and balance-of-system components at favorable prices and terms; and | |

| ● | expertise in permit and project development. |

However, we cannot guarantee that some of our competitors do not or will not have advantages over us in terms of greater operational, financial, technical, management or other resources in particular markets or in general. Wind and solar power has certain advantages and disadvantages when compared to other power generating technologies. The advantages include the ability to deploy products in many sizes and configurations, install products almost anywhere in the world, provide reliable power for many applications and reduce air, water and noise pollution.

| 16 |

Employees

We currently have 47 full-time employees, of which 28 are hourly workers in the manufacturing facility. We employ 19 full time personnel in sales, engineering, management and administrative capacity. None of our employees are represented by a labor union.

RISKS RELATED TO OUR BUSINESS

We have a short operating history and have not produced significant revenues over a period of time. This makes it difficult to evaluate our future prospects and increases the risk that we will not be successful.

We have a short operating history with our current business model, which involves the manufacture, marketing and distribution of products producing solar and wind renewable energy. While we have been in existence since 2008, we have only generated revenues in the last few years, and our operations have not yet been profitable. No assurances can be given that we will generate any significant revenue in the future. As a result, we have a very limited operating history for you to evaluate in assessing our future prospects. Our operations have not produced significant revenues over a period of time, and may not produce significant revenues in the near term, which may harm our ability to obtain additional financing and may require us to reduce or discontinue our operations. You must consider our business and prospects in light of the risks and difficulties we will encounter as an early-stage company in a new and rapidly evolving industry. We may not be able to successfully address these risks and difficulties, which could significantly harm our business, operating results, and financial condition.

We have a history of losses which may continue and which may negatively impact our ability to achieve our business objectives.

For the years ended December 31, 2014 and 2013, we incurred net losses of approximately $11,270,000 and $4,845,000 respectively. In addition, at December 31, 2014, we had an accumulated deficit of approximately $21,750,000. We cannot assure you that we can achieve or sustain profitability on a quarterly or annual basis in the future. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise. There can be no assurance that future operations will be profitable. Revenues and profits, if any, will depend upon various factors, including whether we will be able to continue expansion of our revenue. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

We expect to rely upon strategic relationships in order to execute our business plan and the Company may not be able to consummate the strategic relationships necessary to execute its business plan.

We plan to enter into and rely on strategic relationships with other parties, in particular to acquire rights necessary to develop and build proposed projects and to develop and build such projects. These strategic relationships could include licensing agreements, partnerships, joint ventures, or even business combinations. We believe that these relationships will be particularly important to our future growth and success due to our size and resources and the resources necessary to complete our proposed projects. We may, however, not be able to successfully identify potential strategic relationships. Even if we do identify one or more potentially beneficial strategic relationships, we may not be able to consummate these relationships on favorable terms or at all, obtain the benefits it anticipates from such relationships or maintain such relationships. In addition, the dynamics of our relationships with possible strategic partners may require us to incur expenses or undertake activities it would not otherwise be inclined to undertake in order to fulfill our obligations to these partners or maintain the our relationships.

To the extent we consummate strategic relationships: it may become reliant on the performance of independent third parties under such relationships. Moreover, certain potentially critical strategic relationships are only in the early stages of discussion and have not been officially agreed to and formalized. If strategic relationships are not identified, established or maintained, or are established or maintained on terms that become unfavorable, our business prospects may be limited, which could have a negative impact on our ability to execute our business plan, diminish our ability to conduct our operations and/or materially and adversely affect our business and financial results.

Project development or construction activities may not be successful and proposed projects may not receive required permits or construction may not proceed as planned.

The development and construction of our proposed projects will involve numerous risks. We may be required to spend significant sums for preliminary engineering, permitting, legal, and other expenses before we can determine whether a project is feasible, economically attractive or capable of being built. Success in developing a particular project is contingent upon, among other things: (i) negotiation of satisfactory engineering, procurement and construction agreements; (ii) receipt of required governmental permits and approvals, including the right to interconnect to the electric grid on economically acceptable terms; (iii) payment of interconnection and other deposits (some of which may be non-refundable); (iv) obtaining construction financing; and (v) timely implementation and satisfactory completion of construction.

Successful completion of a particular project may be adversely affected by numerous factors, including: (i) delays in obtaining required governmental permits and approvals with acceptable conditions; (ii) uncertainties relating to land costs for projects on land subject to Bureau of Land Management procedures; (iii) unforeseen engineering problems; (iv) construction delays and contractor performance shortfalls; (v) work stoppages; (vi) cost over-runs; (vii) equipment and materials supply; (viii) adverse weather conditions; and (ix) environmental and geological conditions.

| 17 |

The solar industry competes with both conventional power industries and other renewable power industries.

The solar industry faces intense competition from all other players within the energy industry, including both conventional energy providers such as nuclear, natural gas and fossil fuels as well as other renewable energy providers, including geothermal, hydropower, biomass, wind, nuclear energy, natural gas and other fossil fuels. Other energy sources may benefit from innovations that reduce costs, increase safety or otherwise improve their competitiveness. New natural resources may be discovered, or global economic, business or political developments may disproportionately benefit conventional energy sources or other renewable energy sources at the expense of solar. Governments may strengthen their support for other renewable energy sources and reduce their support for the solar industry. For instance, the recent decline in oil prices has adversely impacted the competitiveness of solar energy. Failure for our customers, other business partners or us to compete with the providers of other energy sources may materially and adversely affect our business, results of operations and financial condition.

The report of our independent registered public accounting firm contains an emphasis paragraph that indicates there is substantial doubt concerning our ability to continue as a going concern as a result of our recurring losses from operations and working capital deficiencies.

Our audited consolidated financial statements for the fiscal years ended December 31, 2014 and 2013 were prepared on a going concern basis in accordance with GAAP. The going concern basis of presentation assumes that we will continue in operation and be able to realize our assets and discharge our liabilities and commitments in the normal course of business. In order for us to continue operations beyond the next twelve months, we must be able discharge our liabilities and commitments in the normal course of business; generate operating income; reduce operating expenses; produce cash from our operating activities, and potentially raise additional funds to meet our working capital needs. We cannot guarantee that we will be able to generate operating income, reduce operating expenses, produce cash from our operating activities, or obtain additional funds through either debt or equity financing transactions, or that such funds, if available, will be obtainable on satisfactory terms. If we are unable to reduce operating expenses, produce cash from our operating activities, or obtain additional funds through either debt or equity financing transactions, we may be unable to continue to fund our operations, provide our services or realize value from our assets and discharge our liabilities in the normal course of business. These uncertainties raise substantial doubt about our ability to continue as a going concern. If we become unable to continue as a going concern, we may have to liquidate our assets, and might realize significantly less than the values at which they are carried on our consolidated financial statements, and stockholders may lose all or part of their investment in our common stock. The accompanying financial statements do not contain any adjustments as a result of this uncertainty.

To execute our overall business strategy, we require additional working capital, which may not be available on terms favorable to us or at all. If additional capital is not available or is available at unattractive terms, we may be forced to delay, reduce the scope of or eliminate our operations, including our research and development programs.

We have an ambitious business plan for strong growth of our business, which will require us to raise additional financing to supplement our cash flows from operations to fully execute. We will require additional financing to execute our business strategy. To the extent we raise additional capital through the sale of equity securities, the issuance of those securities could result in dilution to our shareholders. In addition, if we obtain debt financing, a substantial portion of our operating cash flow may be dedicated to the payment of principal and interest on such indebtedness, thus limiting funds available for our business activities. If adequate funds are not available, we may be required to delay, reduce the scope of or eliminate our research and development programs, reduce our marketing and sales efforts or reduce or curtail our operations. In addition, we may be required to obtain funds through arrangements with collaborative partners or others that may require us to relinquish rights to technologies or products that we would otherwise seek to develop or commercialize ourselves or license rights to technologies or products on terms that are less favorable to us than might otherwise be available.

There can be no assurance that if we were to need additional funds to meet obligations we have incurred, or may incur in the future, that additional financing arrangements would be available in amounts or on terms acceptable to us, if at all. Furthermore, if adequate additional funds are not available, we may be required to delay, reduce the scope of, or eliminate material parts of the implementation of our business strategy.

| 18 |

We face strong competition from other energy companies, including traditional and renewable providers.

The energy provider business is highly competitive. Our competitors range in size from small companies focusing on single products to large multinational corporations that manufacture and supply many types of products. Our main competitors vary by region and product. We compete against other renewable energy providers, including wind, solar, hydropower and geo-thermal, as well as traditional electricity providers. Almost all of our competitors have greater financial and other resources than we do and may be able to grow more quickly through strategic acquisitions and may be able to better respond to changing business and economic conditions. Our net income could be adversely affected by competitors’ product innovations and increased pricing pressure. Individual competitors have advantages and strengths in different sectors of our markets, in different products and in different areas, including manufacturing and distribution systems, geographic market presence, customer service and support, breadth of product, delivery time and price. Many of our competitors also have greater access to capital and technological resources and we may not be able to compete successfully with them.

Our lack of diversification will increase the risk of an investment in us, and our financial condition and results of operations may deteriorate if we fail to diversify.

Our current business focuses primarily on one product in the renewable energy space, our SolarMill. We are also working to bring other products to market, including the TowerMill and MobileMill. Larger companies have the ability to manage their risk by diversification. However, we currently lack diversification, specifically in terms of the nature of our business. As a result, we will likely be impacted more acutely by factors affecting our industry in which we operate, than we would if our business were more diversified, enhancing our risk profile.

If we fail to successfully introduce new products, we may lose market position.

New products, product improvements, line extensions or new services will be an important factor in our sales growth. If we fail to identify emerging consumer and technological trends, to maintain and improve the competitiveness of our existing products or to successfully introduce new products on a timely basis, we may lose market position. Continued product development and marketing efforts have all the risks inherent in the development of new products and line extensions, including development delays, the failure of new products and line extensions to achieve anticipated levels of market acceptance and the cost of failed product introductions.

Our continued success depends on our ability to protect our intellectual property. The failure to do so could impact our profitability and stock price.

Our success depends, in part, on our ability to obtain and enforce patents, maintain trade-secret protection and operate without infringing on the proprietary rights of third parties. Litigation can be costly and time consuming. Litigation expenses could be significant. While we have been issued patents and have registered trademarks with respect to our products and technology, our competitors may infringe upon our patents or trademarks, independently develop similar or superior products or technologies, duplicate our designs, trademarks, processes or other intellectual property or design around any processes or designs on which we have or may obtain patents or trademark protection. In addition, it is possible that third parties may have or acquire other technology or designs that we may use or desire to use, so that we may need to acquire licenses to, or to contest the validity of, such third-party patents or trademarks. Such licenses may not be made available to us on acceptable terms, if at all, and we may not prevail in contesting the validity of such third-party rights.

In addition to patent and trademark protection, we also protect trade secrets, know-how and other confidential information against unauthorized use by others or disclosure by persons who have access to them, including our employees, through contractual arrangements. These agreements may not provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of such trade secrets, know-how or other proprietary information. If we are unable to maintain the proprietary nature of our technologies, we may lose market share to competing products using the same or similar technology.

Litigation brought by third parties claiming infringement of their intellectual property rights or trying to invalidate intellectual property rights owned or used by us may be costly and time consuming.

We may face lawsuits from time to time alleging that our products infringe on third-party intellectual property, and/or seeking to invalidate or limit our ability to use our intellectual property. If we become involved in litigation, we may incur substantial expense defending these claims and the proceedings may divert the attention of management, even if we prevail. An adverse determination in proceedings of this type could subject us to significant liabilities, allow our competitors to market competitive products without a license from us, prohibit us from marketing our products or require us to seek licenses from third parties that may not be available on commercially reasonable terms, if at all.

| 19 |

Product liability claims could have a material adverse effect on our operating results and negatively impact our stock price.

We face an inherent business risk of exposure to product liability claims arising from the alleged failure of our products. Any material uninsured losses due to product liability claims that we experience could subject us to material losses. We could be required to recall or redesign our products if they prove to be defective. We maintain insurance against product liability claims, but it is possible that our insurance coverage will not continue to be available on terms acceptable to us or that such coverage will not be adequate for liabilities actually incurred. A successful claim brought against us in excess of available insurance coverage, or any claim or product recall that results in significant expense or adverse publicity against us, could have a material adverse effect on our business, operating results and financial condition.

Our executive officers and other key personnel are critical to our business, and our future success depends on our ability to retain them.

Our success depends to a significant extent upon the continued services of Mr. Daniel Bates, our President and Chief Executive Officer and Mr. Travis Campbell, our Chief Operating Officer. Mr. Bates has overseen WindStream Sub since its inception in 2008 and provides leadership for our growth and operations strategy as well as being an inventor on our patents. Mr. Campbell provides significant business development and international operations experience. Loss of the services of Messrs. Bates or Campbell would have a material adverse effect on our growth, revenues, and prospective business. The loss of any of our key personnel, or the inability to attract and retain qualified personnel, may significantly delay or prevent the achievement of our research, development or business objectives and could materially adversely affect our business, financial condition and results of operations.

Any employment agreement we enter into will not ensure the retention of the employee who is a party to the agreement. In addition, we have only limited ability to prevent former employees from competing with us. Furthermore, our future success will also depend in part on the continued service of our key sales and marketing personnel and our ability to identify, hire, and retain additional personnel. We experience intense competition for qualified personnel and may be unable to attract and retain the personnel necessary for the development of our business.