Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - China Greenstar Corporation. | Financial_Report.xls |

| EX-32.1 - China Greenstar Corporation. | ex32-1.htm |

| EX-31.1 - China Greenstar Corporation. | ex31-1.htm |

| EX-21 - China Greenstar Corporation. | ex21.htm |

| EX-31.2 - China Greenstar Corporation. | ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2014 | |

| OR | |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from ______________ to ______________ |

Commission file number 000-54731

CHINA GREENSTAR CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 27-5213322 | |

| (State or other jurisdiction

of incorporation or organization) |

(IRS. Employer Identification No.) |

Suite B, 16/F., Ritz Plaza,

122 Austin Road

Tsim Sha Tsui, Kowloon, Hong Kong

(Address of principal executive offices, including zip code)

+852.9787.3883

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

| (Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $2,617.93 (2,379,935 shares at $0.0011)

As of April 15, 2015, there are 102,379,935 shares of common stock outstanding.

TABLE OF CONTENTS

| 2 |

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that involve assumptions, and describe our future plans, strategies, and expectations. Such statements are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words of other variations on these words or comparable terminology. These statements are expressed in good faith and based upon a reasonable basis when made, but there can be no assurance that these expectations will be achieved or accomplished.

Such forward-looking statements include statements regarding, among other things, (a) the potential markets for our products, our potential profitability, and cash flows (b) our growth strategies, (c) anticipated trends in our industry, (d) our future financing plans and (e) our anticipated needs for working capital. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under “Item 1. Business” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as in this Annual Report on Form 10-K generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors as described in this Annual Report on Form 10-K generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Annual Report on Form 10-K will in fact occur. In addition to the information expressly required to be included in this filing, we will provide such further material information, if any, as may be necessary to ensure that the required statements, in light of the circumstances under which they are made, are not misleading.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, forward-looking statements are inherently subject to known and unknown risks, business, economic and other risks and uncertainties that may cause actual results to be materially different from those discussed in these forward-looking statements. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, other than as may be required by applicable law or regulation. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed with the Securities and Exchange Commission which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operation and cash flows. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, our actual results may vary materially from those expected or projected.

In this Form 10-K, references to “we,” “our,” “us,” or the “Company” refer to China Greenstar Corporation (formerly Stark Beneficial, Inc.), a Delaware company and its consolidated subsidiaries.

Share Exchange

On December 15, 2014 (the “Closing Date”), Stark Beneficial, Inc. (“Stark”) entered into a Share Exchange Agreement (the “Exchange Agreement”), with (i) China Greenstar Holdings Limited (“Greenstar Holdings”), a company organized under the laws of British Virgin Islands, (ii) Greenstar Holdings shareholders, Forever Prosperous Holdings (China) Limited, a British Virgin Islands company (“Forever Prosperous”), Pride Sun Limited, a British Virgin Islands company (“Pride Sun“) and New Empire Ventures Limited, a British Virgin Islands company, (collectively, “Greenstar Holdings’ Shareholders”), who together owned shares constituting 100% of the issued and outstanding ordinary shares of Greenstar Holdings ( “Greenstar Holdings’ Shares”) and (iii) Michael Anthony, the principal stockholder of Stark (the “Stark Shareholder”). Pursuant to the terms of the Exchange Agreement, Greenstar Holdings Shareholders transferred all of the Greenstar Holdings Shares in exchange for the issuance of 102,100,000 shares of Stark’s common stock (the “Share Exchange”). As a result of the Share Exchange, Stark became a public company in development stage in the People’s Republic of China (the “PRC”) engaged in distributing and reselling a fuel additive and cleaner called “Greencare Product” in PRC.

| 3 |

Immediately prior to the Share Exchange, Stark cancelled and retired 2,100,000 shares of its issued and outstanding common stock and 5,000,000 shares of its preferred stock (the “Cancelled Shares”), reducing its issued and outstanding shares to 279,935 shares of common stock. A cash amount of $134,645.61 was paid to Michael Anthony, Stark’s former majority shareholder and owner of the Cancelled Shares, as consideration for cancelling the Cancelled Shares in connection with the Share Exchange. In addition, a cash amount of $215,354.39 was paid to Stark’s existing creditors reducing its liabilities at closing of the Share Exchange to $0. As a result of the cancellation of the Cancelled Shares and the Share Exchange, Stark had 102,379,935 shares of common stock issued and outstanding following the Share Exchange. On January 6, 2015, the Company filed a Certificate of Ownership and Merger with the Secretary of State of the State of Delaware, whereby the Company changed its name from Stark Beneficial, Inc. to China Greenstar Corporation.

Business Overview

We currently distribute and resell a fuel additive and cleaner called “Greencare Product” in China. Our Greencare Product is added to gasoline in order to improve fuel quality by suppressing or cleaning sediments in the fuel. Our Greencare Product improves overall engine performance, maximizes fuel burning efficiency, enhances the power of an engine and provides for cleaner emissions.

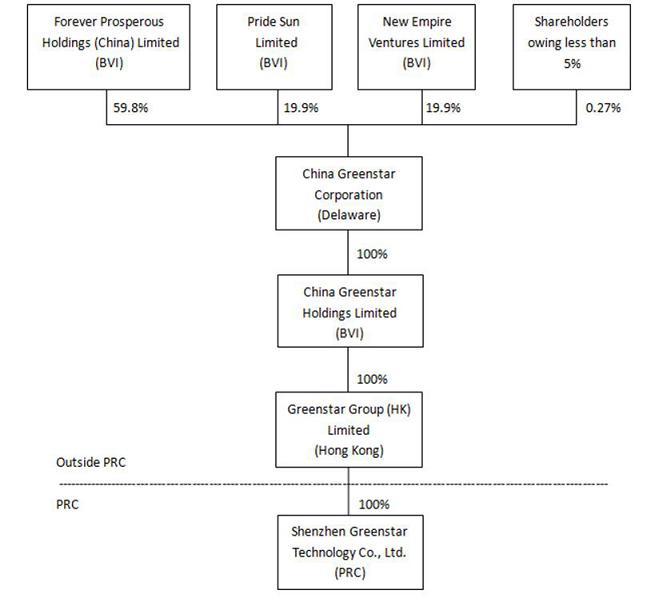

Corporate Structure

Our current corporate structure is set forth below:

| 4 |

Company Background

We are incorporated in the State of Delaware. Until we consummated on a Share Exchange on December 15, 2014, we were a shell company that had no or nominal operations and either no or nominal assets. Our wholly owned subsidiary, Greenstar Holdings was incorporated in the British Virgin Islands on July 29, 2014. Greenstar Holdings is the parent holding company of Greenstar Group (HK) Limited (“Greenstar HK”), a Hong Kong company, which was established on October 25, 2013 and Greenstar HK is the parent company of Shenzhen Greenstar Technology Co., Ltd. (“Greenstar Technology”), a wholly foreign-owned enterprise established in the People’s Republic of China. We will operate our business in China through Greenstar Technology.

Market Overview

The gasoline industry in China is predominately controlled by two large state owned enterprises: Sinopec and China National Petroleum Corporation. Most crude oil in the PRC is poor quality and oil refineries leave much to be desired. The crude oil used in refineries in Europe and in the United States is generally low in sulfur content since the majority of it comes from the North Sea and Texas where it is easy to process. Crude oil used in PRC refineries is generally high in sulfur content since it comes from the Middle East and domestic oilfields. In addition, the production techniques used in China is behind that used in Europe and the United States. China uses a technique called catalytic cracking which produces an end product that is low in octane and high in sulfur content. In the Unites States, there are three octane grades of gasoline — 87, 89 and 93. In China, there are two octane grades of gasoline — 93 and 97. However, because the grades in the two countries are based on different environmental standards and are defined according to different performance levels, the highest grade of gasoline in China is equivalent to the lowest grade of gasoline in the United States (i.e., China’s 97 is equal to the United States’ 87).

Gasoline produced in China is lower in quality than gasoline produced in Europe and the United States and is prone to the formation of sediment, leading to the deterioration of engine performance and reduced fuel efficiency. Low quality gasoline is also an important contributor to ambient air pollution in Asia resulting in emissions of hazardous materials such as carbon monoxide, hydrocarbons and nitrogen oxide. A report issued in January, 2014 showed that all 74 of China’s major cities failed to meet the nation’s air quality standards. On March 25, 2014, the World Health Organization increased its estimate for the number of premature deaths related to air pollution in China every year from the previous 3.2 million to 7 million. On the same day, the Ministry of Environmental Protection released an annual report on air quality. The document was the first national air quality report since China began monitoring PM 2.5 – inhalable matter less than 2.5 microns in diameter that can damage the lungs – in 74 major cities on January 1, 2013. The average reading of PM 2.5 concentrations in the cities was 72 micrograms per cubic meter, almost twice as high as the country’s standard of 35. The report confirmed at least 300 million Chinese people are breathing polluted air.

Over the past two decades China has experienced enormous economic development. China’s cities were filled with bicycles as recently as the 1990s, but thanks to the explosive growth of the middle class, the Chinese now own more than 120 million cars and another 120 million motor vehicles of other kinds. Fuel standards have not kept pace. In order to reduce vehicle emissions, an integrated approach is required, in which fuel additives and cleaners play a significant part.

At an annual legislative meeting in March, 2014, Premier Li Keqiang said the government will make cleaning up the air a top priority. The Chinese government has pledged to reduce significantly and even eliminate heavily polluted days by 2017. Most recently, in a historic climate change deal entered into in November, 2014, President Barack Obama and President Xi Jinping announced that the United States and China will curb their greenhouse gas emissions over the next two decades. Under the agreement, the United States would cut its 2005 level of carbon emissions by 26-28% before the year 2025. China would peak its carbon emissions by 2030 and will also aim to get 20% of its energy from zero-carbon emission sources by the same year. To positively affect world climate change, the Chinese government is trying to launch effective measures to move to cleaner sources of energy in order to mitigate the release of harmful emissions. The issues mentioned above imply that China’s green energy industry should experience significant growth in the foreseeable future.

| 5 |

Global demand is increasing for innovative environmental protection and energy solutions for sustainable economic growth. Today, China is faced with the growing challenge of reducing and controlling air pollution emissions that present serious health risks to its population and damage the environment. We believe that our Greencare Product represents a large-scale, environmentally friendly and economically feasible form for improving energy efficiency. In our opinion, our product is cost competitive, reduces pollution and greenhouse gas emissions and will help make for a greener China and better world in the years to come.

Products

We distribute one fuel additive and cleaner called Greencare Product. Our fuel additive is used for high end automobiles. We believe that our Greencare Product provides the following benefits:

Versatility: Our Greencare Product can be used directly by an automobile without any alteration to its engine. It can be used individually and also with a mixture of any ratio of standard gasoline or ethanol gasoline.

Environmental Friendliness: The automobile discharge of hazardous materials such as carbon monoxide, hydrocarbons and nitrogen oxide can be more than 40% lower when our Greencare Product is added to standard gasoline or ethanol gasoline. Our product provides one of the most effective ways for cutting down automobile discharge pollution, which in turn reduces smog and improves the overall quality of the environment.

High Octane Levels: The octane levels of our product are three to five units higher than standard gasoline. Our product is suitable for medium to high compression ratio engines and is designed to improve an engine’s explosion resistance.

Strong Propulsion: The content of our product provides for higher propulsion force when compared to similar fuel additives.

Low Energy Consumption: Our product can reduce the energy consumption of vehicles by more than 5% when calculated on the basis of equivalent fuel consumption ratios.

Long Preservation Cycles: Our product can be preserved for more than a year if the mixture with water does not exceed certain specifications and they are kept within normal temperature ranges. As a result, our product is excellent for transporting and selling over a long period of time.

Customers

We intend to target customers in a variety of markets, such as individual automobile owners, government fleets and gas stations. Many different types of automobiles operators in China have begun to adopt fuel additives in order to improve overall engine performance and maximize fuel efficiency. In addition, an increasing amount of state owned enterprises in China are faced with environmental challenges and are under regulatory directives and political pressure to reduce pollution, particularly as part of the country’s overall expansion plans.

Suppliers

We purchase our fuel additive from a third party in the PRC and resell it to customers. We are not directly involved in the production or manufacturing of fuel additives and cleaners.

Competition

The market for fuel additives and cleaners is highly competitive. Many of the producers and sellers of gasoline and diesel fuel additives are large entities that have significantly greater resources than we have. We also compete with suppliers of other alternative vehicle fuels, including ethanol, biodiesel and hydrogen fuels, as well as providers of hybrid and electric vehicles.

| 6 |

Government Regulation

Our business depends in part on environmental regulations and programs in China that promote the use of cleaner burning fuels for vehicles. Our supplier, as the producer and manufacturer of the Greencare Product, is extensively regulated by policies and regulations enacted by the PRC government relating to the production and sale of fuel additives and cleaners. The production of these materials requires approvals, licenses or permits from relevant central and local government authorities. In addition, from time to time, relevant government authorities may impose new regulations on these activities. As a reseller and distributor of fuel additives, we believe that we have obtained all necessary licenses, registrations and permits and have complied with all requirements necessary to allow us to conduct our business in the PRC.

Legal Proceedings

We are currently not a party to any legal or administrative proceedings and are not aware of any pending or threatened legal or administrative proceedings against us in all material aspects. We may from time to time become a party to various legal or administrative proceedings arising in the ordinary course of our business.

Property

The following table summarizes the location of real property we own and lease.

| Item | Address | Leased/Owned | ||

| 1 | B121, B Zone, 4th Floor, Jinhui Building, Nanhai Road, Nanshan District, Shenzhen, PRC | Leased |

Employees

As of April 15, 2015, we have 9 full-time employees.

We are compliant with local prevailing wage, contractor licensing and insurance regulations, and have good relations with our employees.

As required by PRC regulations, we participate in various employee benefit plans that are organized by municipal and provincial governments, including pension, work-related injury benefits, maternity insurance, medical and unemployment benefit plans. We are required under PRC laws to make contributions to the employee benefit plans at specified percentages of the salaries, bonuses and certain allowances of our employees, up to a maximum amount specified by the local government from time to time. Members of the retirement plan are entitled to a pension equal to a fixed proportion of the salary prevailing at the member’s retirement date.

Generally we enter into a standard employment contract with our officers and managers for a set period of years and a standard employment contract with other employees for a set period of years. According to these contracts, all of our employees are prohibited from engaging in any activities that compete with our business during the period of their employment with us.

Corporation Information

Our principal executive offices are located at Suite B, 16/F., Ritz Plaza, 122 Austin Road, Tsim Sha Tsui, Kowloon, Hong Kong. Our telephone number at this address is + 852.9787.3883.

| 7 |

Risks Related to Our Business

Our operating history makes it difficult to evaluate our future business prospects and to make decisions based on our historical performance.

We have no operating history, which makes it difficult to evaluate our business on the basis of historical operations. As a consequence, it is difficult to forecast our future results based upon our limited historical data. Because of the uncertainties related to our lack of historical operations, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in sales, product costs or expenses. If we make poor budgetary decisions as a result of unreliable historical data, we could incur greater losses, which may result in a decline in our stock price.

Our operating results may fluctuate, which makes our results difficult to predict and could cause our results to fall short of expectations.

Our operating results may fluctuate as a result of a number of factors, many outside of our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of our future performance. Our quarterly, year-to-date and annual expenses as a percentage of our revenues may differ significantly from our historical or projected rates. Our operating results in future quarters may fall below expectations. Any of these events could cause our stock price to fall. Each of the risk factors listed in this section and the following factors may affect our operating results:

| ● | Our ability to continue to attract customers; | |

| ● | Our ability to generate revenue from the product we offer; | |

| ● | The amount and timing of operating costs and capital expenditures related to the maintenance and expansion of our businesses; and | |

| ● | Our focus on long-term goals over short-term results. |

Because our business is changing and evolving, our historical operating results may not be useful to you in predicting our future operating results.

We may not be successful in implementing important strategic initiatives, which may have a material adverse impact on our business and financial results.

There is no assurance that we will be able to implement important strategic initiatives in accordance with our expectations, which may result in a material adverse impact on our business and financial results. These strategic initiatives are designed to drive long-term shareholder value and improve our company’s results of operations.

Our success depends substantially on the value of our brand.

Brand value is based in part on consumer perceptions as to a variety of subjective qualities. Even isolated business incidents that erode consumer trust, particularly if the incidents receive considerable publicity or result in litigation, can significantly reduce brand value. Consumer demand for our product could diminish significantly if we fail to preserve quality or fail to deliver a consistently positive consumer experience.

Effectively managing our growth into new geographic areas will be challenging.

Effectively managing growth can be challenging, particularly as we expand into new markets geographically where we must balance the need for flexibility and a degree of autonomy for local management against the need for consistency with the our goals, philosophy and standards. Growth can make it increasingly difficult to locate and hire sufficient numbers of key employees to meet our financial targets, to maintain an effective system of internal controls, and to train employees nationally to deliver a consistently high quality service and customer experience.

| 8 |

We face significant competition, and if we do not compete successfully against new and existing competitors, we may lose our market share, and our profitability may be adversely affected.

Increased competition could reduce our profitability and result in a loss of market share. Some of our existing and potential competitors may have competitive advantages, such as significantly greater financial, marketing or other resources, and may successfully mimic and adopt our business models. We cannot assure you that we will be able to successfully compete against new or existing competitors.

Failure to manage our growth could strain our management, operational and other resources, which could materially and adversely affect our business and prospects.

We intend to expand our operations and plan to expand rapidly in China. The continued growth of our business will result in, substantial demand on our management, operational and other resources. In particular, the management of our growth will require, among other things:

| ● | increased sales and sales support activities; | |

| ● | improved administrative and operational systems; | |

| ● | enhancements to our information technology system; | |

| ● | stringent cost controls and sufficient working capital; | |

| ● | strengthening of financial and management controls; and | |

| ● | hiring and training of new personnel. |

As we continue this effort, we may incur substantial costs and expend substantial resources. We may not be able to manage our current or future operations effectively and efficiently or compete effectively in new markets we enter. If we are not able to manage our growth successfully, our business and prospects would be materially and adversely affected.

Key employees are essential to growing our business.

Mr. Huangchen Chen and Mr. Yang Rong are essential to our ability to continue to grow our business. They have established relationships within the industries in which we will operate. If they were to leave us, our growth strategy might be hindered, which could limit our ability to increase revenue.

In addition, we face competition for attracting skilled personnel. If we fail to attract and retain qualified personnel to meet current and future needs, this could slow our ability to grow our business, which could result in a decrease in market share.

We may need additional capital and we may not be able to obtain it at acceptable terms, or at all, which could adversely affect our liquidity and financial position.

We may need additional cash resources due to changed business conditions or other future developments. If these sources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain a credit facility. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations and liquidity.

Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

| ● | investors’ perception of, and demand for, our securities; | |

| ● | conditions of the U.S. and other capital markets in which we may seek to raise funds; | |

| ● | our future results of operations, financial condition and cash flow; | |

| ● | PRC governmental regulation of foreign investment in China; | |

| ● | economic, political and other conditions in China; and | |

| ● | PRC governmental policies relating to foreign currency borrowings. |

| 9 |

We are dependent on one primary supplier which may affect our ability to supply fuel additives to our customers.

We will obtain the fuel additive that we resell from one primary supplier. The ability to deliver the product to the end user is dependent on a sufficient supply of fuel additives and if we are unable to obtain a sufficient fuel additive supply, we may be prevented from making deliveries to our customers. Any failure to obtain supplies of fuel additives could prevent us from delivering our product to our customers and could have a material adverse effect on our business and financial conditions.

We rely on computer software and hardware systems in managing our operations, the failure of which could adversely affect our business, financial condition and results of operations.

We are dependent upon our computer software and hardware systems in supporting our network and managing and monitoring programs on the network. In addition, we rely on our computer hardware for the storage, delivery and transmission of the data on our network. Any system failure which interrupts the input, retrieval and transmission of data or increases the service time could disrupt our normal operation. Any failure in our computer software or hardware systems could decrease our revenues and harm our relationships with consumers, which in turn could have a material adverse effect on our business, financial condition and results of operations.

We do not have a majority of independent directors serving on our board of directors, which could present the potential for conflicts of interest.

We do not have a majority of independent directors serving on our board of directors. In the absence of a majority of independent directors, our executive officers could establish policies and enter into transactions without independent review and approval thereof. This could present the potential for a conflict of interest between us and our stockholders, generally, and the controlling officers, stockholders or directors.

We have limited insurance coverage.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited insurance products. We have determined that the risks of disruption or liability from our business, the loss or damage to our property, including our facilities, equipment and office furniture, the cost of insuring for these risks, and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we do not have any business liability, disruption, litigation or property insurance coverage for our operations in China except for insurance on some company owned vehicles. Any uninsured occurrence of loss or damage to property, or litigation or business disruption may result in the incurrence of substantial costs and the diversion of resources, which could have an adverse effect on our operating results.

If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our common stock.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. We maintain a system of internal control over financial reporting, which is defined as a process designed by, or under the supervision of, our principal executive officer and principal financial officer, or persons performing similar functions, and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Since we recently completed the reverse acquisition of Greenstar Holdings on December 15, 2014, we have not evaluated Greenstar Holdings and its consolidated subsidiaries’ internal control systems in order to allow our management to report on our internal controls on a consolidated basis as required by the requirements of SOX 404. We will be required to complete such evaluation and include a report of management in our annual report for the fiscal year ended December 31, 2015.

| 10 |

As a public company, we will have significant additional requirements for enhanced financial reporting and internal controls. We will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our independent registered public accounting firm addressing these assessments. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company.

We cannot assure you that we will not, in the future, identify areas requiring improvement in our internal control over financial reporting. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, cause investors to lose confidence in our reported financial information and have a negative effect on the market price for shares of our common stock.

Lack of experienced officers of publicly-traded companies may hinder our ability to comply with Sarbanes-Oxley Act.

It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance staff or consultants in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with the Sarbanes-Oxley Act’s internal controls requirements, we may not be able to obtain the independent auditor certifications that Sarbanes-Oxley Act requires publicly-traded companies to obtain.

We will incur increased costs as a result of being a public company.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. In addition, the Sarbanes-Oxley Act, as well as new rules subsequently implemented by the Securities and Exchange Commission (the “SEC”), has required changes in corporate governance practices of public companies. We expect these new rules and regulations to increase our legal, accounting and financial compliance costs and to make certain corporate activities more time-consuming and costly. In addition, we will incur additional costs associated with our public company reporting requirements. We are currently evaluating and monitoring developments with respect to these new rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Risks Associated With Doing Business in China

Our operations and assets in China are subject to significant political and economic uncertainties.

Changes in PRC laws and regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business, results of operations and financial condition. Under its current leadership, the Chinese government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

| 11 |

A substantial portion of ours sales will be derived from China.

We anticipate that sales of our product in China will represent our total sales in the near future. Any significant decline in the condition of the PRC economy could adversely affect consumer demand of our product, among other things, which in turn would have a material adverse effect on our business and financial condition.

Currency fluctuations and restrictions on currency exchange may adversely affect our business, including limiting our ability to convert Chinese Renminbi into foreign currencies and, if Chinese Renminbi were to decline in value, reducing our revenue in U.S. dollar terms.

Our reporting currency is the U.S. dollar and our operations in China use their local currency as their functional currencies. Substantially all of our revenue and expenses are in Chinese Renminbi. We are subject to the effects of exchange rate fluctuations with respect to any of these currencies. For example, the value of the Renminbi depends to a large extent on Chinese government policies and China’s domestic and international economic and political developments, as well as supply and demand in the local market. Since 1994, the official exchange rate for the conversion of Renminbi to the U.S. dollar had generally been stable and the Renminbi had appreciated slightly against the U.S. dollar. However, on July 21, 2005, the Chinese government changed its policy of pegging the value of Chinese Renminbi to the U.S. dollar. Under the new policy, Chinese Renminbi may fluctuate within a narrow and managed band against a basket of certain foreign currencies. It is possible that the Chinese government could adopt a more flexible currency policy, which could result in more significant fluctuation of Chinese Renminbi against the U.S. dollar. We can offer no assurance that Chinese Renminbi will be stable against the U.S. dollar or any other foreign currency.

The income statements of our operations are translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currencies denominated transactions results in reduced revenue, operating expenses and net income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions results in increased revenue, operating expenses and net income for our international operations. We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of our foreign subsidiaries into U.S. dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign subsidiaries’ financial statements into U.S. dollars will lead to a translation gain or loss which is recorded as a component of other comprehensive income. In addition, we have certain assets and liabilities that are denominated in currencies other than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss. We have not entered into agreements or purchased instruments to hedge our exchange rate risks, although we may do so in the future. The availability and effectiveness of any hedging transaction may be limited and we may not be able to successfully hedge our exchange rate risks.

Although Chinese governmental policies were introduced in 1996 to allow the convertibility of Chinese Renminbi into foreign currency for current account items, conversion of Chinese Renminbi into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of the State Administration of Foreign Exchange, or the SAFE. These approvals, however, do not guarantee the availability of foreign currency conversion. We cannot be sure that we will be able to obtain all required conversion approvals for our operations or that Chinese regulatory authorities will not impose greater restrictions on the convertibility of Chinese Renminbi in the future. Because a significant amount of our future revenue may be in the form of Chinese Renminbi, our inability to obtain the requisite approvals or any future restrictions on currency exchanges could limit our ability to utilize revenue generated in Chinese Renminbi to fund our business activities outside of China, or to repay foreign currency obligations, including our debt obligations, which would have a material adverse effect on our financial condition and results of operations.

| 12 |

We may rely on dividends and other distributions from our PRC subsidiary to fund our cash and financing requirements, and any limitation on the ability of our subsidiary to make payments to us could materially and adversely affect our ability to conduct our business.

As an offshore holding company, we will rely principally on dividends from Greenstar Technology, our PRC subsidiary, for our cash requirements, dividends payments and other distributions to our shareholders, and to service any debt that we may incur and pay our operating expenses. The payment of dividends by entities organized in China is subject to limitations. In particular, PRC regulations permit Greenstar Technology to pay dividends only out of its accumulated profits, if any, as determined in accordance with Chinese accounting standards and regulations. In addition, Greenstar Technology is required each year to set aside at least 10% of its annual after-tax profits (as determined under PRC accounting standards) into its statutory reserve fund until the aggregate amount of that reserve reaches 50% of such entity’s registered capital. These reserves are not distributable as cash dividends.

If Greenstar Technology incurs debt on its own behalf, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us. Any limitation on the ability of Greenstar Technology to distribute dividends or other payments to us could materially and adversely limit our ability to grow, make investments or acquisitions, pay dividends and otherwise fund and conduct our business.

We may be subject to product liability claims if people or properties are harmed by the product sold by us.

The product intended to be sold by us is manufactured by a third party. The product may be defectively designed or manufactured. As a result, sales of the product could expose us to product liability claims relating to personal injury or property damage and may require product recalls or other actions. Third parties subject to such injury or damage may bring claims or legal proceedings against us as the reseller of the product. We do not currently maintain any third-party liability insurance or product liability insurance in relation to product we intend to sell. As a result, any material product liability claim or litigation could have a material and adverse effect on our business, financial condition and results of operations. Even unsuccessful claims could result in the expenditure of funds and managerial efforts in defending them and could have a negative impact on our reputation.

We may have limited legal recourse under PRC laws if disputes arise under our contracts with third parties.

The Chinese government has enacted laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, their experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial claims or to resolve commercial disputes is unpredictable. If our new business ventures are unsuccessful, or other adverse circumstances arise from these transactions, we face the risk that the parties to these ventures may seek ways to terminate the transactions, or, may hinder or prevent us from accessing important information regarding the financial and business operations of these acquired companies. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the Chinese government, and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. Any rights we may have to specific performance, or to seek an injunction under PRC law, in either of these cases, are severely limited, and without a means of recourse by virtue of the Chinese legal system, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations.

We must comply with the Foreign Corrupt Practices Act.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in mainland China. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. Although we inform our personnel that such practices are illegal, we cannot assure you that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties.

| 13 |

Changes in foreign exchange regulations in the PRC may affect our ability to pay dividends in foreign currency or conduct other foreign exchange business.

The Renminbi is not a freely convertible currency currently, and the restrictions on currency exchanges may limit our ability to use revenues generated in Renminbi to fund our business activities outside the PRC or to make dividends or other payments in United States dollars. The PRC government strictly regulates conversion of Renminbi into foreign currencies. Over the years, foreign exchange regulations in the PRC have significantly reduced the government’s control over routine foreign exchange transactions under current accounts. In the PRC, the SAFE, regulates the conversion of the Renminbi into foreign currencies. Pursuant to applicable PRC laws and regulations, foreign invested enterprises incorporated in the PRC are required to apply for foreign exchange registration. Currently, conversion within the scope of the “current account” (e.g. remittance of foreign currencies for payment of dividends, etc.) can be effected without requiring the approval of SAFE. However, conversion of currency in the “capital account” (e.g. for capital items such as direct investments, loans, securities, etc.) still requires the approval of SAFE.

PRC regulation of loans to and direct investments in PRC entities by offshore holding companies may delay or prevent us from using the proceeds of any offering to make loans or capital contributions to our PRC subsidiary, which could materially and adversely affect our liquidity and ability to fund and expand our business.

We may transfer funds to or finance Greenstar Technology, our PRC subsidiary, by means of shareholder’s loans or capital contributions. Any loans to Greenstar Technology, which is a foreign-invested enterprise, cannot exceed statutory limits based on the amount of our investments in Greenstar Technology, and shall be registered with the SAFE or its local counterparts. Furthermore, any capital contributions we make to Greenstar Technology shall be approved by the Ministry of Commerce, or the MOFCOM, or its local counterparts. We may not be able to obtain these government registrations or approvals on a timely basis, if at all. If we fail to receive such registrations or approvals, our ability to provide loans or capital contributions to Greenstar Technology may be negatively affected, which could adversely affect our liquidity and our ability to fund and expand our business.

In addition, the SAFE promulgated the Circular on the Relevant Operating Issues concerning Administration Improvement of Payment and Settlement of Foreign Currency Capital of Foreign-invested Enterprises, or SAFE Circular No. 142, on August 29, 2008. Under SAFE Circular No. 142, registered capital of a foreign invested company settled in Renminbi converted from foreign currencies may only be used within the business scope approved by the applicable governmental authority and may not be used for equity investments in the PRC, unless otherwise provided by other PRC laws or regulations. In addition, foreign-invested enterprises may not change how they use such capital without SAFE’s approval, and may not in any case use such capital to repay Renminbi loans if they have not used the proceeds of such loans. SAFE further promulgated the Circular on Further Clarification and Regulation of the Issues Concerning the Administration of Certain Capital Account Foreign Exchange Businesses, or SAFE Circular No. 45, on November 16, 2011, which expressly prohibits foreign-invested enterprises from using the registered capital settled in Renminbi converted from foreign currencies to grant loans through entrustment arrangements with a bank, repay inter-company loans or repay bank loans that have been transferred to a third party. SAFE Circular No. 142 and SAFE Circular No. 45 may significantly limit our ability to transfer the net proceeds from an offshore offering to Greenstar Technology and convert the net proceeds into Renminbi to invest in or acquire any other PRC companies, which may adversely affect our liquidity and our ability to fund and expand our business in the PRC.

A failure by the beneficial owners of our shares who are PRC residents to comply with certain PRC foreign exchange regulations could restrict our ability to distribute profits, restrict our overseas and cross-border investment activities and subject us to liability under PRC law.

The SAFE has promulgated regulations, including the Notice on Relevant Issues Relating to Domestic Residents’ Investment and Financing and Round-Trip Investment through Special Purpose Vehicles, or SAFE Circular No. 37, effective on July 14, 2014, and its appendixes, that require PRC residents, including PRC institutions and individuals, to register with local branches of the SAFE in connection with their direct establishment or indirect control of an offshore entity, for the purpose of overseas investment and financing, with such PRC residents’ legally owned assets or equity interests in domestic enterprises or offshore assets or interests, referred to in SAFE Circular No. 37 as a “special purpose vehicle.” SAFE Circular No. 37 further requires amendment to the registration in the event of any significant changes with respect to the special purpose vehicle, such as increase or decrease of capital contributed by PRC individuals, share transfer or exchange, merger, division or other material event. In the event that a PRC shareholder holding interests in a special purpose vehicle fails to fulfill the required SAFE registration, the PRC subsidiaries of that special purpose vehicle may be prohibited from making profit distributions to the offshore parent and from carrying out subsequent cross-border foreign exchange activities, and the special purpose vehicle may be restricted in their ability to contribute additional capital into its PRC subsidiary. Further, failure to comply with the various SAFE registration requirements described above could result in liability under PRC law for foreign exchange evasion.

| 14 |

These regulations apply to our direct and indirect shareholders who are PRC residents and may apply to any offshore acquisitions or share transfers that we make in the future if our shares are issued to PRC residents. To the best of our knowledge, none of our direct and indirect shareholders are PRC residents. However, if there exists any PRC residents beneficially holding interests in us without making appropriate registration pursuant to SAFE Circular No. 37, Greenstar Technology, as our PRC subsidiary, could be subject to fines and legal penalties, and the SAFE could restrict our cross-border investment activities and our foreign exchange activities, including restricting Greenstar Technology’s ability to distribute dividends to or obtain loans denominated in foreign currencies from us, or prevent us from paying dividends. As a result, our business operations and our ability to make distributions to you could be materially and adversely affected.

PRC regulations relating to mergers and acquisitions and overseas listings of domestic enterprises by foreign investors may increase the administrative burden we face and create regulatory uncertainties.

The Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rule, which became effective in September 2006 and were further amended in June 2009, requires that if an overseas company is established or controlled by PRC domestic companies or citizens intends to acquire equity interests or assets of any other PRC domestic company affiliated with the PRC domestic companies or citizens, such acquisition must be submitted to the MOFCOM, rather than local regulators, for approval. In addition, the M&A Rule requires that an overseas company controlled directly or indirectly by PRC companies or citizens and holding equity interests of PRC domestic companies needs to obtain the approval of the China Securities Regulatory Commission, or CSRC, prior to listing its securities on an overseas stock exchange. On September 21, 2006, the CSRC published a notice on its official website specifying the documents and materials required to be submitted by overseas special purpose companies seeking CSRC’s approval of their overseas listings.

While the application of the M&A Rule remains unclear, based on our understanding of current PRC laws, regulations, and the notice published on September 21, 2006, since Greenstar Technology, our operating entity, was established by means of direct investment, rather than by merger or acquisition of the equity interest or assets of any “domestic company” as defined under the M&A Rules, we believe we are not required to submit an application to the MOFCOM or the CSRC for its approval for any of our transactions.

However, we cannot assure you that PRC governmental authorities, including the MOFCOM and the CSRC, will reach the same conclusion as us. If the MOFCOM, the CSRC and/or other PRC regulatory agencies subsequently determine that the approvals from the MOFCOM and/or CSRC and/or other PRC regulatory agencies were required, our PRC business could be challenged and we may need to apply for a remedial approval and may be subject to certain administrative punishments or other sanctions from PRC regulatory agencies. The regulatory agencies may impose fines and penalties on our operations in the PRC, limit our operating privileges in the PRC, delay or restrict the repatriation of our foreign currency in our offshore bank accounts into the PRC, or take other actions that could materially and adversely affect our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our ordinary shares.

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities.

China only recently has permitted provincial and local economic autonomy and private economic activities, and, as a result, we are dependent on our relationship with the local government in the province in which we operate our business. Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, product liabilities, environmental regulations, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in PRC subsidiaries.

| 15 |

Future inflation in China may inhibit our activity to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. These factors have led to the adoption by Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our product.

We may have difficulty establishing adequate management, legal and financial controls in the PRC.

We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards. We may have difficulty establishing adequate management, legal and financial controls in the PRC.

You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based on United States or other foreign laws against us and our management.

We conduct substantially all of our operations in China and substantially all of our assets are located in China. In addition, some of our directors and executive officers may reside within China. As a result, it may not be possible to affect service of process within the United States or elsewhere outside China upon some of our directors and senior executive officers, including with respect to matters arising under U.S. federal securities laws or applicable state securities laws. It would also be difficult for investors to bring an original lawsuit against us or our directors or executive officers based on U.S. federal securities laws in a Chinese. Moreover, China does not have treaties with the United States or many other countries providing for the reciprocal recognition and enforcement of judgment of courts.

Under the EIT Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and holders of our securities.

Under the EIT Law, an enterprise established outside of China with its “de facto management body” in China is considered a “resident enterprise,” meaning that it can be treated the same as a Chinese enterprise for enterprise income tax purposes. The implementing rules of the EIT Law defines “de facto management body” as an organization that exercises “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of an enterprise. On April 22, 2009, the SAT, issued a circular, or SAT Circular No. 82, providing certain specific criteria for determining whether the “de facto management body” of a PRC-controlled enterprise that is incorporated offshore is located in China, which include all of the following conditions: (a) the location where senior management members responsible for an enterprise’s daily operations discharge their duties; (b) the location where financial and human resource decisions are made or approved by organizations or persons; (c) the location where the major assets and corporate documents are kept; and (d) the location where more than half (inclusive) of all directors with voting rights or senior management have their habitual residence.

If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we will be subject to enterprise income tax at a rate of 25% on our worldwide income as well as PRC enterprise income tax reporting obligations. This would mean that income such as interest on offering proceeds and other non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the EIT Law and its implementing rules dividends paid to us by our PRC subsidiaries would qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that a 10% withholding tax is imposed on dividends we pay to our non-PRC enterprise shareholders and with respect to gains derived by our non-PRC enterprise shareholders from transferring our shares, and a 20% withholding tax is imposed on dividends we pay to our non-PRC individual shareholders and with respect to gains derived by our non-PRC individual shareholders from transferring our shares.

| 16 |

We face uncertainties with respect to the application of the Circular on Strengthening the Administration of Enterprise Income Tax for Share Transfer by Non-PRC Resident Enterprises.

Pursuant to the Circular on Strengthening the Administration of Enterprise Income Tax for Share Transfers by Non-PRC Resident Enterprises, or SAT Circular No. 698, issued by the SAT in December 2009 with retroactive effect from January 1, 2008, if a non-resident enterprise indirectly transfers the equity interests of a PRC resident enterprise by transferring equity interests of an overseas holding company, or an Indirect Transfer, and such overseas holding company is located in a tax jurisdiction that: (i) has an effective tax rate of less than 12.5% or (ii) does not impose income tax on foreign income of its residents, the transferring nonresident enterprise must report this Indirect Transfer to the competent PRC tax authority of the PRC resident enterprise. The PRC tax authority will apply the “substance over form” principle, and as a result may disregard the existence of the overseas holding company if such overseas holding company lacks a reasonable commercial purpose and was established for the purpose of reducing, avoiding or deferring PRC tax. As a result, gains derived from such an Indirect Transfer may be subject to PRC withholding tax at a rate of up to 10%. SAT Circular No. 698 also provides that where a non-PRC resident enterprise transfers its equity interests in a PRC resident enterprise to its related parties at a price lower than the fair market value, the relevant tax authority has the power to make a reasonable adjustment to the taxable income of the transaction.

There is uncertainty as to the application of SAT Circular No. 698. While the term “Indirect Transfer” is not clearly defined, it is understood that the relevant PRC tax authorities have broad jurisdiction over requests for information regarding foreign companies having remote contact with the PRC. Moreover, the relevant authority has not yet promulgated any formal provisions or made any formal interpretation as to the procedures or format for reporting an Indirect Transfer. In addition, there have not been any formal declarations concerning how to determine whether a foreign investor has adopted an arrangement for the purpose of reducing, avoiding or deferring PRC tax. As a result, we and our non-resident investors or non-resident enterprise shareholders may be at risk of being taxed under SAT Circular No. 698 and may be required to expend valuable resources to comply with SAT Circular No. 698 or to establish that we and our non-resident enterprise investors or non-resident enterprise shareholders should not be taxed under SAT Circular No. 698, which may have a material adverse effect on our financial condition and results of operations or such non-resident investors’ or such non-resident enterprise shareholders’ investments in us.

Our Chinese operating companies are obligated to withhold and pay PRC individual income tax in respect of the salaries and other income received by their employees who are subject to PRC individual income tax. If they fail to withhold or pay such individual income tax in accordance with applicable PRC regulations, they may be subject to certain sanctions and other penalties, which could have a material adverse impact on our business.

Under PRC laws, Greenstar Technology will be obligated to withhold and pay individual income tax in respect of the salaries and other income received by their employees who are subject to PRC individual income tax. Greenstar Technology may be subject to certain sanctions and other liabilities under PRC laws in case of failure to withhold and pay individual income taxes for its employees in accordance with the applicable laws.

In addition, the SAT has issued several circulars concerning employee stock options. Under these circulars, employees working in the PRC (which could include both PRC employees and expatriate employees subject to PRC individual income tax) are required to pay PRC individual income tax in respect of their income derived from exercising or otherwise disposing of their stock options. If we implement employee stock options plan, Greenstar Technology will be obligated to file documents related to employee stock options with relevant tax authorities and withhold and pay individual income taxes for those employees who exercise their stock options. While tax authorities may advise us that our policy is compliant, they may change their policy, and we could be subject to sanctions.

| 17 |

The enforcement of labor contract law and increase in labor costs in the PRC may adversely affect our business and our profitability.

China adopted a labor contract law and its implementation rules effective on January 1, 2008 and September 18, 2008, respectively. The labor contract law was further amended on December 28, 2012. The labor contract law and its implementation rules impose more stringent requirements on employers with regard to, among others, severance payment upon permitted termination of the employment by an employer and non-fixed term employment contracts, time limits for probation period as well as the duration and the times that an employee can be placed on a fixed term employment contract. Due to the limited period of effectiveness of the labor contract law and its implementation rules, and the lack of clarity with respect to their implementation, potential penalties and fines, it is uncertain how they will impact our current employment policies and practices. Our employment policies and practices may violate the labor contract law or its implementation rules and we may be subject to related penalties, fines or legal fees. Compliance with the labor contract law and its implementation rules may increase our operating expenses, in particular our personnel expenses, as the continued success of our business depends significantly on our ability to attract and retain qualified personnel. In the event that we decide to terminate some of our employees or otherwise change our employment or labor practices, the labor contract law and its implementation rules may also limit our ability to effect those changes in a manner that we believe to be cost-effective or desirable, which could adversely affect our business and results of operations.

Additionally, PRC companies are subject to various laws and regulations regarding social insurance and housing funds, under which Greenstar Technology is required to pay employees’ pension contributions, work-related injury benefits, maternity insurances, medical and unemployment benefit plans, housing funds and other welfare-oriented payments. Greenstar Technology has not contributed social insurance premiums and housing funds for its employees in full compliance with applicable PRC laws. As such, Greenstar Technology may be ordered to compensate the cumulative amount of the under-contributed social insurance premiums and housing fund contributions and be subject to administrative penalties, including fines, and as such our business and reputation may be adversely affected.

Because Chinese laws will govern almost all of our business’ material agreements, we may not be able to enforce our rights within the PRC or elsewhere, which could result in a significant loss of business, business opportunities or capital.

The Chinese legal system is similar to a civil law system based on written statutes. Unlike common law systems, it is a system in which decided legal cases have little precedential value. Although legislation in the PRC over the past 25 years has significantly improved the protection afforded to various forms of foreign investment and contractual arrangements in the PRC, these laws, regulations and legal requirements are relatively new. Due to the limited volume of published judicial decisions, their non-binding nature, the short history since their enactments, the discrete understanding of the judges or government agencies of the same legal provision, inconsistent professional abilities of the judicators, and the inclination to protect local interest in the court rooms, interpretation and enforcement of PRC laws and regulations involve uncertainties, which could limit the legal protection available to us, and foreign investors, including you. The inability to enforce or obtain a remedy under any of our future agreements could result in a significant loss of business, business opportunities or capital and could have a material adverse impact on our business, prospects, financial condition, and results of operations. In addition, the PRC legal system is based in part on government policies and internal rules (some of which are not published on a timely basis or at all) that may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until sometime after the violation. In addition, any litigation in the PRC, regardless of outcome, may be protracted and result in substantial costs and diversion of resources and management attention.

| 18 |

Risks Relating to Our Securities

Insiders have substantial control over us, and they could delay or prevent a change in our corporate control even if our other stockholders wanted it to occur.

Our executive officers, directors, and principal stockholders hold approximately 99% of our outstanding common stock. Accordingly, these stockholders are able to control all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. This could delay or prevent an outside party from acquiring or merging with us even if our other stockholders wanted it to occur.

There may not be sufficient liquidity in the market for our securities in order for investors to sell their securities.

There is currently only a limited public market for our common stock, which is listed on the Over-the-Counter Bulletin Board, and there can be no assurance that a trading market will develop further or be maintained in the future. During the month of November 2014, there was no trading activity in our common stock. As of November 30, 2014, the closing bid price of our common stock was $0.0011 per share. As of November 30, 2014, we had approximately 310 shareholders of record of our common stock, not including shares held in street name.

The market price of our common stock may be volatile.

The market price of our common stock has been and will likely continue to be highly volatile, as is the stock market in general, and the market for OTC Bulletin Board quoted stocks in particular. Some of the factors that may materially affect the market price of our common stock are beyond our control, such as changes in financial estimates by industry and securities analysts, conditions or trends in the industry in which we operate or sales of our common stock. These factors may materially adversely affect the market price of our common stock, regardless of our performance. In addition, the public stock markets have experienced extreme price and trading volume volatility. This volatility has significantly affected the market prices of securities of many companies for reasons frequently unrelated to the operating performance of the specific companies. These broad market fluctuations may adversely affect the market price of our common stock.

Our common stock may be considered a “penny stock” and may be difficult to sell.

The SEC has adopted regulations which generally define a “penny stock” to be an equity security that has a market price of less than $5.00 per share or an exercise price of less than $5.00 per share, subject to specific exemptions. The market price of our common stock is less than $5.00 per share and, therefore, it may be designated as a “penny stock” according to SEC rules. This designation requires any broker or dealer selling these securities to disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell our common stock and may affect the ability of investors to sell their shares.

The market for penny stocks has experienced numerous frauds and abuses, which could adversely impact investors in our stock.

OTCBB securities are frequent targets of fraud or market manipulation, both because of their generally low prices and because OTCBB reporting requirements are less stringent than those of the stock exchanges or NASDAQ.

Patterns of fraud and abuse include:

| ● | Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; | |

| ● | Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; | |

| ● | “Boiler room” practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons; | |

| ● | Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and | |

| ● | Wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

| 19 |

Our management is aware of the abuses that have occurred historically in the penny stock market.

We have not paid dividends in the past and do not expect to pay dividends in the foreseeable future and any return on investment may be limited to the value of our stock.

We have never paid any cash dividends on our common stock and do not anticipate paying any cash dividends on our common stock in the foreseeable future and any return on investment may be limited to the value of our stock. We plan to retain any future earnings to finance growth.

ITEM 1B. UNRESOLVED STAFF COMMENTS

There are no unresolved comments from the Securities and Exchange Commission.

The following table summarizes the location of real property we own and lease.

| Item | Address | Leased/Owned | ||

| 1 | B121, B Zone, 4th Floor, Jinhui Building, Nanhai Road, Nanshan District, Shenzhen, PRC | Leased |

We are not engaged in any material litigation, arbitration or claim, and no material litigation, arbitration or claim is known to be pending or threatened by or against us that would have a material adverse effect on our operation results or financial condition.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

There is no change in the market for our securities as a result of the Share Exchange. Our common stock, par value $0.001, is listed for quotation in the OTCBB under the symbol “FAFA.” There is no active trading market in our securities.

Holders