Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Biostar Pharmaceuticals, Inc. | ex32-1.htm |

| EX-31.1 - EX-31.1 - Biostar Pharmaceuticals, Inc. | ex31-1.htm |

| EX-21 - EX-21 - Biostar Pharmaceuticals, Inc. | ex21.htm |

| EX-32.2 - EX-32.2 - Biostar Pharmaceuticals, Inc. | ex32-2.htm |

| EX-23.2 - EX-23.2 - Biostar Pharmaceuticals, Inc. | ex23-2.htm |

| EX-31.2 - EX-31.2 - Biostar Pharmaceuticals, Inc. | ex31-2.htm |

| EX-23.4 - EX-23.4 - Biostar Pharmaceuticals, Inc. | ex23-4.htm |

| EX-23.3 - EX-23.3 - Biostar Pharmaceuticals, Inc. | ex23-3.htm |

| EX-23.1 - EX-23.1 - Biostar Pharmaceuticals, Inc. | ex23-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Biostar Pharmaceuticals, Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended: December 31, 2014

Or

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ______________ to _______________

Commission File Number: 001-34708

BIOSTAR PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

Maryland

|

20-8747899

|

|

|

(State or other jurisdiction of incorporation of origination)

|

(I.R.S. Employer Identification Number)

|

|

No. 588 Shiji Xi Avenue

Xianyang, Shaanxi Province

People’s Republic of China

|

712046

|

|

|

(Address of principal executive offices)

|

(Zip code)

|

86-29-33686638

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities Registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

NASDAQ Stock Market LLC

(NASDAQ Capital Market)

|

Securities Registered pursuant to Section 12(g) of the Act: Common stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

||

|

Non-accelerated filer ¨

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of the close of business on June 28, 2014, the aggregate market value of the voting stock (common stock) held by non-affiliates of the registrant was approximately $20,772,864 based on the closing sale price of $1.45 per share of our common stock on NASDAQ Stock Market LLC on the same date.

As of March 25, 2015, the Company had 15,476,113 shares of common stock issued and outstanding.

TABLE OF CONTENTS

TO ANNUAL REPORT ON FORM 10-K

FOR YEAR ENDED DECEMBER 31, 2014

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

4

|

|

|

Item 1A.

|

19

|

|

|

Item 1B.

|

33

|

|

|

Item 2.

|

33

|

|

|

Item 3.

|

34

|

|

|

Item 4.

|

34

|

|

|

PART II

|

||

|

Item 5.

|

35

|

|

|

Item 6.

|

35

|

|

|

Item 7.

|

36

|

|

|

Item 7A.

|

45

|

|

|

Item 8.

|

F-1

|

|

|

Item 9.

|

46

|

|

|

Item 9A.

|

46

|

|

|

Item 9B.

|

47

|

|

PART III

|

||

|

Item 10.

|

48

|

|

|

Item 11.

|

51

|

|

|

Item 12.

|

54

|

|

|

Item 13.

|

56

|

|

|

Item 14.

|

56

|

|

PART IV

|

Item 15.

|

57

|

|

|

58

|

||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

All statements contained in this Annual Report on Form 10-K (“Form 10-K”) for Biostar Pharmaceuticals, Inc., other than statements of historical facts, that address future activities, events or developments are forward-looking statements, including, but not limited to, statements containing the words “believe,” “anticipate,” “expect” and words of similar import. These statements are based on certain assumptions and analyses made by us in light of our experience and our assessment of historical trends, current conditions and expected future developments as well as other factors we believe are appropriate under the circumstances. However, whether actual results will conform to the expectations and predictions of management is subject to a number of risks and uncertainties that may cause actual results to differ materially.

Such risks include, among others, the following: national and local general economic and market conditions; our ability to sustain, manage or forecast our growth; raw material costs and availability; new product development and introduction; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; the loss of significant customers or suppliers; fluctuations and difficulty in forecasting operating results; changes in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; the ability to protect technology; and other factors referenced in this and previous filings.

Consequently, all of the forward-looking statements made in this Form 10-K are qualified by these cautionary statements and there can be no assurance that the actual results anticipated by management will be realized or, even if substantially realized, that they will have the expected consequences to or effects on our business operations.

These statements reflect our current view of future events and are subject to certain risks and uncertainties as noted below. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results could differ materially from those anticipated in these forward-looking statements. Actual events, transactions and results may materially differ from the anticipated events, transactions or results described in such statements. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance that our expectations will materialize. Many factors could cause actual results to differ materially from our forward looking statements including those set forth in Item 1A of this report. Other unknown, unidentified or unpredictable factors could materially and adversely impact our future results. We undertake no obligation and do not intend to update, revise or otherwise publicly release any revisions to our forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of any unanticipated events.

We file reports with the Securities and Exchange Commission (“SEC” or “Commission”). We make available on our website (http://www.andatee.com) free of charge our public reports filed pursuant to the Exchange Act and amendments to those reports as soon as reasonably practicable after we electronically file such materials with or furnish them to the SEC. Information appearing at our website is not a part of this Annual Report on Form 10-K. You can also read and copy any materials we file with the Commission at its Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. In addition, the Commission maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission, including our reports.

Our fiscal year begins on January 1, and ends on December 31, and any references herein to “Fiscal 2014” mean the year ended December 31, 2014, and references to other “Fiscal” years mean the year ending December 31, of the year indicated.

We obtained statistical data, market data and other industry data and forecasts used in this Form 10-K from publicly available information. While we believe that the statistical data, industry data, forecasts and market research are reliable, we have not independently verified the data, and we do not make any representation as to the accuracy of that information.

PART I

ITEM 1. BUSINESS

Overview

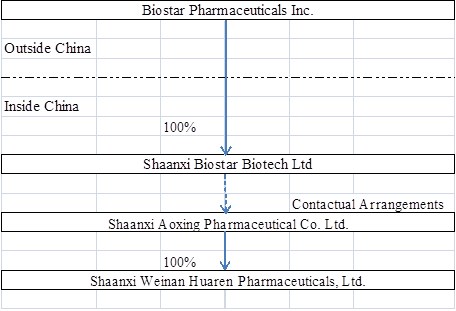

Biostar Pharmaceuticals, Inc. (“Biostar”) is a holding company that, through our wholly-owned subsidiary Shaanxi Biostar Biotech, Ltd. (“Shaanxi Biostar”) and our variable interest entities ("VIEs") Shaanxi Aoxing Pharmaceutical Co., Ltd. (“Aoxing Pharmaceutical”), and Shaanxi Weinan Huaren Pharmaceuticals Ltd. (“Shaanxi Weinan”) develops, manufactures and markets pharmaceutical products for a variety of diseases and conditions in the People’s Republic of China (the “PRC” or “China”).

Corporate Organization and History

Biostar was incorporated in the State of Maryland on March 27, 2007. Through the steps described immediately below, we became the indirect holding company for Aoxing Pharmaceutical, a medical and pharmaceutical developer, manufacturer and marketer in the PRC on November 1, 2007.

On June 15, 2007, we formed Shaanxi Biostar in the PRC as our wholly-owned subsidiary. Because Shaanxi Biostar is wholly-owned by Biostar, a U.S. company, it is a wholly foreign-owned enterprise, or WFOE, under PRC laws.

Aoxing Pharmaceutical was formed on May 8, 1997, as a limited liability company under the laws of the PRC. Its current registered address is No. 588 Shiji Xi Road, Xianyang, Shaanxi Province, PRC, and its registered capital is Renminbi (“RMB”) 61,800,000.

On November 1, 2007, Shaanxi Biostar and Aoxing Pharmaceutical entered into a series of agreements (collectively the “Contractual Arrangements”) pursuant to which we have acquired control over Aoxing Pharmaceutical and which requires us to consolidate the profits and losses of Aoxing Pharmaceutical under U.S. Generally Accepted Accounting Principles (“GAAP”):

Management Entrustment Agreement. Pursuant to the management entrustment agreement, Aoxing Pharmaceutical and its shareholders agreed to transfer control, or entrust, the operations and management of Aoxing Pharmaceutical’s business to Shaanxi Biostar. Shaanxi Biostar manages the operations and assets of Aoxing Pharmaceutical, controls all of the cash flow of Aoxing Pharmaceutical through a bank account controlled by Shaanxi Biostar, is entitled to all of the net profits of Aoxing Pharmaceutical as a management fee, and is obligated to pay all payables and loan payments of Aoxing Pharmaceutical. In addition, Shaanxi Biostar has been granted certain rights which include, in part, the right to appoint and terminate members of Aoxing Pharmaceutical’s board of directors, hire management and administrative personnel and control decisions relating to entering and performing customer contracts and other instruments. We anticipate that Aoxing Pharmaceutical will continue to be the contracting party under its customer contracts, bank loans and certain other instruments unless Shaanxi Biostar exercises its option. Global Law Office, our PRC counsel, has advised us that in their opinion the management entrustment agreement is legal and enforceable under PRC law. In exchange for causing Aoxing Pharmaceutical to enter into the management entrustment agreement, we issued an aggregate of 6,610,771 shares our common stock to the shareholders of Aoxing Pharmaceutical, which was allocated based on their respective pro rata ownership of Aoxing Pharmaceutical.

On May 6, 2008, Shaanxi Biostar entered into an amended and restated management entrustment agreement with Aoxing Pharmaceutical and its shareholders in order to remove a provision that allows the management entrustment agreement to be terminated at a mutually agreed date. As amended and restated, the management entrustment agreement, and all of the attendant rights of Shaanxi Biostar, remains in effect until such time that Shaanxi Biostar acquires all of the assets or equity of Aoxing Pharmaceutical under the terms of the exclusive option agreement as more fully described below, or until Aoxing Pharmaceutical ceases its business operations.

Voting Proxy Agreement. In order to give us further control over Aoxing Pharmaceutical, Aoxing Pharmaceutical’s shareholders entered into a voting proxy agreement with Shaanxi Biostar, whereby these shareholders irrevocably and exclusively appointed the members of Shaanxi Biostar's board of directors as their proxies to vote on all Aoxing Pharmaceutical matters that require shareholder approval, including, without limitation, the right to appoint members of Aoxing Pharmaceutical’s board of directors. The voting proxy agreement further provides that Shaanxi Biostar will appoint all members of Biostar’s board of directors to Aoxing Pharmaceutical’s board of directors. As the composition of Biostar’s board of director changes, Shaanxi Biostar must accordingly remove and appoint new members to Aoxing Pharmaceutical’s board of directors. The voting proxy agreement terminates upon the exercise of the option by Shaanxi Biostar to purchase the shares of Aoxing Pharmaceutical as described below, and is governed by the laws of the PRC.

Exclusive Option Agreement. In order to permit Aoxing Pharmaceutical to become an indirectly wholly-owned subsidiary of Biostar when permitted under PRC law, Aoxing Pharmaceutical and its shareholders entered into an exclusive option agreement with Shaanxi Biostar, whereby Aoxing Pharmaceutical’s shareholders granted Shaanxi Biostar an irrevocable and exclusive purchase option (the “Option”) to acquire Aoxing Pharmaceutical's equity and/or remaining assets, but only to the extent that the acquisition does not violate limitations imposed by PRC law on such transactions. Current PRC law does not specifically provide for the equity of a non-PRC entity to be used as consideration for the purchase of a PRC entity's assets or equity unless the value of the shares are equal to or greater than the value of the enterprise acquired. In addition, there is a lengthy appraisal process which must be approved by the provincial PRC government entities. The consideration for the exercise of the Option is to be determined by the parties and memorialized in future definitive agreements setting forth the kind and value of such consideration.

We will consider exercising the Option under such circumstances we believe will be in the best interests of the Company and our shareholders, and the exclusive option agreement has been drafted to give us such flexibility. In considering whether or not we will exercise the Option, we may consider such factors as: (1) if the exercise price can be lower than the appraised value under current PRC law, (2) availability of funds, (3) any relevant tax considerations at the time, (4) any other relevant PRC laws that may exist at the time, (5) the value of our shares that were previously paid to Aoxing Pharmaceutical’s shareholders, and (6) whether or not the exercise of the Option will provide any other additional benefits to us or our shareholders. Upon exercise of the Option, the parties will prepare transfer documents to be submitted for governmental approval and work together to obtain all approvals and permits. The exclusive option agreement may be terminated by the agreement of all parties or by Shaanxi Biostar with 30 days’ notice, and is governed by the laws of the PRC.

Share Pledge Agreement. In order to further solidify our control over Aoxing Pharmaceutical, Shaanxi Biostar and Aoxing Pharmaceutical’s shareholders entered into a share pledge agreement, whereby Aoxing Pharmaceutical’s shareholders pledged all of their equity interests in Aoxing Pharmaceutical, including the proceeds thereof, to guarantee the performance by the shareholders of all of the agreements they entered into with Shaanxi Biostar. Upon breach by any shareholder of any of the Contractual Arrangements, Shaanxi Biostar is entitled by operation of law to become the beneficial owner of the shareholders’ equity interests of Aoxing Pharmaceutical. Prior to termination of the share pledge agreement, the pledged equity interests of Aoxing Pharmaceutical cannot be transferred without Shaanxi Biostar's prior written consent. The share pledge agreement will not terminate until agreed to by all of the parties in writing, and is governed by the laws of the PRC.

The Contractual Arrangements described above were utilized instead of a direct acquisition of the assets, common stock or a share exchange because we could not pay cash to directly or indirectly acquire Aoxing Pharmaceutical or its assets. PRC law permits the purchase of equity interests, or assets of a PRC entity by a non-PRC entity for cash. The purchase price must be based on the appraised value of the equity or assets. Because we did not have sufficient cash to pay the estimated full value of all of the assets of Aoxing Pharmaceutical, we, through Shaanxi Biostar, entered into the Contractual Arrangements in exchange for the right to exercise functional control over Aoxing Pharmaceutical, and we obtained substantially the same result as a direct share exchange with Aoxing Pharmaceutical.

On October 29, 2014, following to the change in registered owners of Aoxing Pharmaceutical, a set of new agreements had been entered into with all the existing registered owners of Aoxing Pharmaceutical on the same date.

On October 29, 2014, a set of new Contractual Agreements had been entered into with all the existing registered owners of Aoxing Pharmaceutical. The agreements are merely replacement of the agreements dated May 24, 2013 and therefore, there is no significant change in the contractual terms between the agreements dated October 29, 2014, May 24, 2013, July 9, 2010 and November 1, 2007. The existing registered owners of Aoxing Pharmaceutical, Shaanxi Biostar and Biostar had mutually agreed that no consideration would be paid upon the execution of the agreements on October 29, 2014. The interest of Biostar in Aoxing Pharmaceutical was not affected by the replacement for the Agreements.

Shaanxi Biostar’s control over Aoxing Pharmaceutical under the Contractual Arrangements requires us to consolidate its financial statements pursuant to the Accounting Standards Codification ("ASC") 810, Consolidation because Aoxing Pharmaceutical is considered a VIE of Shaanxi Biostar. ASC 810, Consolidation requires a VIE to be consolidated by any company that is subject to a majority of the risk of loss for the variable interest entity or is entitled to receive a majority of the variable interest entity’s residual returns. Since Shaanxi Biostar is the primary and only beneficiary of Aoxing Pharmaceutical (the VIE), ASC 810 Consolidation requires the consolidation of its financial statements with Shaanxi Biostar and ultimately consolidated with Shaanxi Biostar’s parent company, Biostar.

In October 2011, Aoxing Pharmaceutical entered into a Share Transfer Agreement to acquire Shaanxi Weinan Huaren Pharmaceuticals, Ltd. (“Shaanxi Weinan”) from the holders of 100% of equity interests in Shaanxi Weinan. The aggregate purchase price is RMB 61 million (approximately $9.55 million), in cash and payable in several tranches. Shaanxi Weinan owns drug approvals and permits for a portfolio of 86 drugs and one health product, all of which were added to the Company’s current drug portfolio following the completion of this acquisition. The Company completed this acquisition on October 25, 2011.

The following diagram illustrates our current corporate structure:

On March 11, 2013, Aoxing Pharmaceutical entered into a supplemental agreement to the Share Transfer Agreement with all the former equity holders of Shaanxi Weinan to acquire 13 drug approval numbers which were excluded from the Share Transfer Agreement due to incomplete reregistration. Following the execution of the supplemental agreement, the Company will acquire the ownership of the 13 drug approval numbers for which reregistration has been completed. The aggregate purchase price is RMB 66 million (approximately $10.6 million) for the 13 drug approval numbers, of which RMB 30 million (approximately $4.8 million) was paid on November 26, 2012, RMB 25 million (approximately $4.0 million) was paid on December 31, 2012 and the balance of RMB 11 million (approximately $1.8 million) shall be paid in the Company’s common stock. Based on an agreed issuance price of $1.10 per share, RMB 11 million is equivalent to 1,602,564 shares of common stock of the Company. The Company completed this acquisition in April 2013.

On March 10, 2014, Biostar and certain institutional investors entered into a securities purchase agreement (the “Purchase Agreement”) in connection with an offering (“Offering”) pursuant to which the Company agreed to sell, and the investors agreed to purchase 1,650,000 shares of the Company’s common stock and warrants to purchase up to 660,000 shares of the Company’s common stock, for aggregate gross proceeds, before deducting fees to the placement agents and other estimated offering expenses payable by the Company, of approximately $4.1 million. The warrants will be immediately exercisable upon issuance and will remain exercisable for three years thereafter at an exercise price of $3.23 per share. The exercise price and number of shares underlying the warrants are subject to adjustment in the case of stock splits, stock dividends, combinations of shares and similar recapitalization transactions. The net proceeds from the offering will be used for working capital and other general corporate purposes. Moody Capital Solutions, Inc. and Axiom Capital Management, Inc. served as the placement agents for the offering. The Offering was effected as a takedown off the Company’s shelf registration statement on Form S-3 (File No. 333-192963), which became effective on January 3, 2014, pursuant to a prospectus supplement filed with the Securities and Exchange Commission.

When we sell our equity or borrow funds, we expect the proceeds will be forwarded to Aoxing Pharmaceutical and accounted for as a loan to Aoxing Pharmaceutical and eliminated during consolidation. We may also use the proceeds to repurchase our capital stock or for our corporate overhead expenses. If we borrow funds we expect to be the primary obligor on any debt.

Neither Biostar nor Shaanxi Biostar has any operations or plans to have any operations in the future other than acting as a holding company and management company for Aoxing Pharmaceutical and raising capital for its operations. However, we reserve the right to change our operating plans regarding Biostar and Shaanxi Biostar.

Our Business

We develop, manufacture and market pharmaceutical products in the PRC for a variety of diseases and conditions. Our most popular product is the Xin Ao Xing Oleanolic Acid Capsule, an over-the-counter (“OTC”) medicine for chronic hepatitis B and a disease affecting approximately 10% of the Chinese population. Our current product line also includes twelve other OTC products, seventeen prescription-based pharmaceuticals.

Our products are derived from medicinal herbs that are either grown at our own facility or purchased from our suppliers. We rely on approximately four suppliers for our raw materials. For Fiscal 2014, we purchased most our raw materials from suppliers because most of the herbs planted at our facility were not yet ready for harvest or use.

We devote substantial resources to the research and development of new products that must be approved by the regulatory agencies. We currently have eight products under development to complement our existing product line, one of which is currently awaiting approval from the China Military Food and Drug Administration of the PRC. We have adopted international manufacturing standards and currently hold one patent, with two additional patents pending approval. We are subject to extensive government regulation which is discussed in detail in the section below called “Government Regulation.” In the event that a new product is not approved or it is found in violation of these laws and regulations, it could have a materially adverse effect on the prospects of our business operations.

Our products are currently being sold in over 28 provinces in the PRC through 63 distributors and an established network of more than 226 dedicated sales people. In addition, we have been enhancing our marketing efforts with the launch of our internet-based China Hepatitis Internet Hospital since June 2009. The multi-function website is designed to be a one-stop portal for HBV patients, providing current and relevant information on HBV and treatment options as well as a convenient method to purchase our HBV medicine. Registered users can secure a membership card for a fee of RMB 200 (approximately $25). Members are entitled to a 20% discount on diagnosis and medical services provided on CHIH, free expert diagnosis and free medicine delivery, and a wide range of inquiry, instruction and other complementary services. Registered users can also seek medical advice from a pool of HBV health professionals without having to go to the hospital. CHIH will facilitate our ability to provide customer service and add purchasing convenience for our consumers.

In 2013, we improve our customer portfolio and provide subcontracting services to hospital which provides the prescription. For the year ended 31 December 2014 and 2013, the subcontracting services income to hospital contributes $18.1 million and $8.7 million, respectively.

Our Products

The table below summarizes the pharmaceutical products that are currently manufactured and sold by us in the PRC:

|

Name

|

Treatments

|

Benefits and Side Effects

|

SFDA Classification

|

|||

|

XinAoxing Oleanolic Acid Capsule

|

Hepatitis B

|

Relieves hepatic injury, reduce glutamic-pyruvic transaminase activity, reduce r-GLO. Believed to promote hepatic cell regeneration, to be effective in hepatic coma treatment, to inhibit fibrous hyperplasia and prevent hepatocirrhosis. Used to reduce hepatic damage caused by HBV regeneration.

|

OTC

|

|||

|

Ganwang Compound Paracetamol Capsule

|

Colds, runny nose, sore throat pain, headache and fever

|

Relieves the symptoms of the common cold, including runny nose, sniffles and sneezing. Some patients experience symptoms of anorexia, queasiness and upset stomach after use.

|

OTC

|

|||

|

Tianqi Dysmenorrhea Capsule

|

Dysmenorrhea

|

Traditional Chinese medicine used for treatment of pain and other symptoms associated with menstruation. There are no known side effects.

|

OTC

|

|||

|

Danshen Granule

|

Coronary heart disease, myocarditis and angina pectoris

|

Believed to stimulate circulation to end stasis, regulating the flow of qi (vital energy) to alleviate pain. There are no known side effects.

|

Prescription

|

|||

|

Taohuasan Pediatric Medicine

|

Bronchial congestion and coughs

|

Used for the treatment for children’s cough and respiratory tract infection. There are no known side effects.

|

Prescription

|

|||

|

Hernia Belt

|

Hernia

|

Relieves hernia, no side effects

|

Medical Device

|

|||

|

Tangning Capsule

|

Diabetes

|

Believed to treat type II diabetes

|

Nutrient, OTC

|

|||

|

Yizi Capsule

|

Fertility

|

Believed to aid fertility and helps in fetal development during pregnancy

|

Nutrient, OTC

|

|||

|

Shengjing Capsule

|

Kidney

|

Believed to replenish kidney function

|

Nutrient, OTC

|

|||

|

Aoxing Ointment

|

Psoriasis, vitiligo and various dermatitis

|

Used to treat psoriasis, vitiligo and various dermatitis

|

Nutrient, OTC

|

|||

|

Jingang Tablets

|

For waist and knees, impotence, nocturnal emission, premature ejaculation, frequent urination

|

Warming Yang and tonifying kidney, strong gluten Zhuanggu

|

Prescription

|

|||

|

Compound Paracetamol and Amantadine Hydrochloride Tablets

|

Colds, influenza

|

Used to alleviate the symptoms of fever, headache, aching limbs, sneezing, runny nose, stuffy nose, sore throat caused by common cold and influenza.

|

OTC

|

|||

|

Danxiang Rhinitis Tablets

|

For chronic simple rhinitis, allergic rhinitis, acute and chronic sinusitis.

|

Anti-inflammatory heat, expelling wind and cold, analgesic Tongqiao.

|

Prescription

|

|||

|

Deafness Tongqiao pills

|

For hepatobiliary Huosheng, head dazzling swelling, deafness and tinnitus, ear pus, dry stool, urine-yellow.

|

Heat purging fire, dampness purge.

|

OTC

|

|

Yanlixiao Capsules

|

For heat syndrome bacillary dysentery, acute tonsillitis, acute and chronic bronchitis, acute gastroenteritis, acute mastitis and other infectious diseases.

|

Clearing and detoxifying, anti-inflammatory.

|

Prescription

|

|||

|

Piracetam Tablets

|

Adapt to acute and chronic cerebrovascular disease, traumatic brain injury, memory loss, mild and moderate brain dysfunction caused by multiple reasons of a variety of toxic encephalopathy. And also for children retarded mental development.

|

Prescription

|

||||

|

Huangyangning Tablets

|

For the patients with the symptoms of chest stuffiness and pains, Knotted and intermittent pulse; coronary heart disease, arrhythmias

|

Help Qi and blood circulation; relieve pain

|

Prescription

|

|||

|

Hyperthyroidism Capsules

|

For the patients of hyperthyroidism with the symptoms of palpitations, sweating, irritability, dry throat, rapid pulse, and other symptoms of hyperthyroidism.

|

Pingganqianyang, Ruanjiansanjie.

|

Prescription

|

|||

|

Zhitongtougu Ointment

|

Joint pain, swelling, tenderness or dysfunction.

|

Expelling wind and cold, blood stagnation line,tongluo and relieving pain. For the patients of knee, lumbar blood stasis.

|

OTC

|

|||

|

Fosfomycin Calcium Capsules

|

Oral. For the following infections caused by pathogen that is sensitive of fosfomycin pathogens: 1. Intestinal infections: bacterial enteritis, dysentery. 2. Urinary tract infections: cystitis, pyelonephritis,urethritis. 3. Dermatology and soft tissue infections: furunculosis, hidradenitis, lymphadenitis, folliculitis. 4. Respiratory tract infection: Nasopharyngitis, tonsillitis, bronchitis. 5. Ophthalmology: hordeolum, dacryocystitis. 6. GynaeVaginitis, cervicitis.

|

Prescription

|

||||

|

Qianlietong Capsules

|

For acute prostatitis, prostatic hyperplasia.

|

Qingrejiedu, Qinglishizhuo, Liqihuoxue, Anti-inflammatory and relieving pain.

|

||||

|

Wenweishu Capsules

|

For chronic gastritis, pain of epigastric cold.

|

OTC

|

||||

|

Yituo Erythromycin particles

|

1. The alternative medicine for the patients who is sensitive to penicillin: 2. Legionella 3. Mycoplasma pneumoniae pneumonia 4. genitourinary infection caused by other chlamydia, mycoplasma. 6. Chlamydia trachomatis conjunctivitis. 7. Oral infections caused by anaerobic bacteria. 8. Campylobacter jejuni enteritis. 9. Pertussis. 10. Rheumatic fever recurrence, infective endocarditis.

|

Prescription

|

||||

|

Chuzhang Zehaifu Tablets

|

For cataract.

|

Clear the abnormalities black bile and danyezhi chuzhang mingmu.

|

OTC

|

|

Compound Danshen tablets

|

Coronary heart disease, myocarditis and angina pectoris.

|

Huoxuehuayu,Liqizhitong. For chest pain caused by Qizhixueyu, symptoms like chest tightness, precordial pain; Coronary heart disease and angina pectoris with above syndrome.

|

Prescription

|

|||

|

Muxiang Shunqi Pills

|

Abdominal pain, bloating.

|

Xingqihuashi, Strong spleen and stomach. For distension, abdominal distention, nausea and vomiting, loss of appetite caused by the dampness obstructing spleen and stomach, chest and diaphragm.

|

||||

|

Sifangwei Capsules

|

Stomach pain, Hyperacidity

|

Smoothing the liver stomach pain, Acid to relieve pain. For stomach pain, too much gastric acidity, indigestion, stomach and duodenum ulcer with the above symptoms caused by liver stomach discord.

|

Prescription

|

|||

|

Aspirin Enteric-coated Tablets

|

Antithrombotic

|

Prevention of transient ischemic attack, myocardial infarction, atrial fibrillation, unstable angina.

|

Prescription

|

Xin Ao Xing Oleanolic Acid Capsule, also known as Ao Xing Liver Cure, is the only non-prescription drug currently being sold on the market for the sub-category of Oleanolic Acid that has been approved by the SFDA for the treatment of chronic hepatitis B virus (“HBV”), which is prevalent in the PRC. It is estimated that more than 130 million people are infected with HBV, or 10% of the population (some estimates are as high as 15% of the population) in the PRC. According to the World Health Organization, approximately about 1 million people die from hepatic failure, hepatocirrhosis and primary hepatoma caused by HBV infection per year; however, it was not until December 2, 2005, that the Chinese government first issued an HBV prevention manual for the general public.

There are two kinds of medicine typically used for antivirotic treatment: interferon and ribonucleotide analog, both of which do not kill the HBV directly, but inhibit the metabolizing of HBV replication. Their side effects, however, include damage to normal healthy cells, and they require prolonged treatment periods of more than one year and high costs. (Source: Pharmacopoeia of the People's Republic of China).

Our Xin Ao Xing Oleanolic Acid Capsule is a pentacyclic triterpenoid which contains extracts from natural plants, Fructus Ligustri Lucidi and Hemsleya, and is the only SFDA-approved product to be manufactured as an OTC hepatitis B medicine in the PRC. It is also certified by the Chinese Medical Association as a specific product for hepatitis B treatment. Its pharmacological actions include the relief of hepatic injury, reduction of glutamic-pyruvic transaminase activity, promotion of hepatic cell regeneration, the inhibition of fibrous hyperplasia and prevention of hepatocirrhosis.

We estimate the demand for medicines treating hepatitis B amount to approximately $8 billion annually. We believe that we are positioned to become a leader in the sale of OTC medicines for the treatment of hepatitis B as our Xin Ao Xing Oleanolic Acid Capsule is the only oral OTC drug approved by the SFDA for such treatment. We continue to aggressively advertise this product and have started various promotion programs since 2011.

In addition, following our acquisition of Shaanxi Weinan, we added 86 additional drugs and one health product to our current line. The 86 drugs include 60 prescription and 26 OTC drugs. We continued manufacturing and marketing Shaanxi Weinan’s existing products: Fosfomycin Calcium (prescription drug used to fight urinary tract infections), Huangyangning Tablets (prescription drug used for the treatment of cardiovascular disease), Zhitong Tougu Plaster Cream (OTC cream used as a pain reliever), Jiakangling Capsule (prescription drug used for the treatment of hyperthyroidism), Qianlietong Capsule (prescription drug used to diagnose benign prostatic hypertrophy), and Wenweishu Capsules (prescription drug used to treat chronic gastritis). We also started to manufacture and market a number of new products including: Compound Paracetamol and Amantadine Hydrochloride (OTC drug used to fight the common cold), Danshen Tablets (prescription drug used for the treatment of coronary heart disease), Piracetam Tablets (prescription drug used for the treatment of cerebrovascular disease), Erythromycin Estolate Coated Particles (prescription drug used as anti-bacterial anti-inflammatory).

Upon completion of the supplemental agreement with former equity holders of Shanxi Weinan, we acquired additional drug approval numbers, which cover 13 drugs including Jing Kong Tablet, Vitiligo Capsule, Danxiangrhinitis Tablets, Azithromycin Dispersible Tablet, Gynecological Leucorrhea Tablet, Chu Zhang Ze Haipu Tablets, Antideaf Otic Pill, Deafness Tongqiao Pills, Warm Palace Pregnant Son Pill, Peikun Pill, Four Square Stomach Capsule, Quick-Acting Anti-Inflammation Capsule, and Legalon Capsule.

Most of these drugs target widespread diseases and conditions affecting all ages, are sold in local pharmacies and hospitals in China, are included in the National Essential Medicines List and in most cases, are covered by personal health insurance.

Due to change of the PRC government regulations and policies, we stopped manufacturing 5 products including Hernia Belt, Tangning Capsule, Yizi Capsule, Shengjing Capsule and Aoxing Ointment.

Market for Our Products

Based on data that we have compiled from the business intelligence service DataMonitor, over the past decade, the Chinese medicine and pharmaceutical industry has developed at an annual growth rate of over 16%, making it one of the fastest growing industries in the Chinese economy. The PRC is among the ten largest medicine manufacturing countries and medical raw materials exporting countries in the world. With approximately one-fifth of the world's population and a fast-growing gross domestic product, the PRC presents significant potential for the pharmaceutical industry. We believe that the burgeoning market provides many business opportunities for us. We are pursuing opportunities in several sectors that we believe will experience high growth and that we can address with our manufacturing and distribution expertise. The following is a brief overview of these potential sectors:

Hepatitis

We estimate that there are approximately 120 million hepatitis patients in the PRC. Currently, the most common way to establish an effective treatment protocol is through a doctor or hospital. As many patients have chronic HBV, ailments are prevalent and typically become more severe if not properly treated. However, HBV patients in the PRC also bear substantial psychological pressure, since it is very contagious. Infected patients are often fearful that their relatives, friends and coworkers will become aware of their circumstances and wind up soliciting treatment in secret, if at all. In addition to producing a medicine to treat HBV, we have launched CHIH, an internet portal designed to promote our product while providing HBV patients with current and relevant treatment information at the same time. We are positioning ourselves as a leader in HBV treatment.

Coronary Disease

According to the World Heart Federation, cardiovascular disease is the leading cause of death in the developing world (with the exception of sub-Saharan Africa). Its rise is linked to the increase in prevalence of risk factors such as tobacco use and relative lack of access to interventions to managing the ensuing disease. In the PRC, annual direct costs are estimated at (euro) 30.76 billion or 4% percent of gross national income. The PRC is facing an increase in cardiac disease on two fronts. We believe that in urban and upscale areas, heart disease is on the rise as the prevailing lifestyles have appeared to result in higher incidents of stress, poorer nutrition, decreased physical activity and increase in tobacco use. Within the rural provinces, we believe that impoverishment is also contributing to the rise in coronary disease as most villages have no or limited access to medical help. Our Danshen Granule has been accepted as a product for the treatment of coronary heart disease, myocarditis and angina pectoris and we are marketing the product within the rural and urban markets.

Dysmenorrhe

As the PRC continues to develop, the demand by women for products to treat their health concerns will continue to rise. We believe that our Tianqi Dysmenorrhea Capsule is positioned to take a leading role in this sector.

Influenza

Influenza is one of the most common recurring diseases in the PRC. It has been estimated that there is an annual market of $6.25 billion for flu-related healthcare in the PRC, 85% of which is in the form of OTC consumption. Some of our pharmaceutical and nutrient products are designed to relieve symptoms associated with the flu.

The Rural Market

Modern medicine is not yet established in much of rural PRC. Frequently-occurring respiratory, digestive, and infectious diseases (such as hepatitis) often result in far more severe symptoms than would occur with proper treatment. Patients in remote areas are often lucky to be tended to by a technical school graduate at a village "clinic" with treatments passed down from generation to generation; professional doctors are few and far between. According to a Hai Tong Securities Industry Research report, median family incomes in many parts of western PRC are less than $100 per year, yet a day in the hospital can cost $25 and when medicines, procedures and other services are added this can exceed $50.

As the PRC government works to improve the overall health of its population, the rural markets represent a significant opportunity for growth. This sector has typically been neglected by the PRC's pharmaceutical and medicine industry, as there is minimal healthcare infrastructure or standardized health care service in much of rural PRC. As part of a strategy to improve rural healthcare, the PRC's central government has initiated and launched its "New Rural Medical Care Cooperative Program" since 2008, with the intention of achieving full coverage of all rural citizens by 2010. With an estimated 900 million rural farmers throughout the nation, the implementation of this program provides substantial opportunity for market expansion in this sector, where expenditures are estimated at nearly $5.6 billion in the 3 years ending 2011 - with 80% of that budget to be paid by the regional provincial governments in mid and western PRC. Of these rural markets the provinces of Shaanxi, Sichuan, Chongqing, Gansu, Henan, Hubei, and Hunan are expected to comprise 30% of the market, or $1.7 billion. We believe that we are established within the rural marketplace and have developed a targeted, aggressive sales and marketing campaign designed to expand our presence of all of our products in this sector.

Pediatric Medicine

Increased access to information through education programs and the general promotion of good health within the PRC are helping to generate demand for products designed specifically for children. Furthermore, as the PRC continues to advocate the one child per family policy, parents' demands for quality children's medicines are increasing, as is the interest in brand differentiation. However, at present, few manufacturing plants specialize in pediatric medicine and there is no leading national brand. Approximately 90% of general pharmaceuticals and medicines utilized in the PRC have no corresponding pediatric formula for their drugs, leaving substantial opportunity for growth. We plan to introduce new products to address these issues. In particular, we plan to enhance production of our pediatric medicines and market our pediatric cough medication.

Respiratory Disease

With the aggravation of air pollution and worsening environmental conditions, the incidence of respiratory diseases remains high in the PRC. Influenza is one of the most common diseases in the PRC, and according to the Ministry of Health of the PRC, an estimated 75% of the population suffers from influenza every year and 5.5% suffer from tracheitis caused by influenza. This rate is more than 15% for senior citizens, who often suffer from influenza more than 3 times per year.

As is shown in the related statistics in the National Health Care Department in the PRC, the percentage of the population suffering from some form of respiratory diseases in the PRC is approximately 6.94%, or approximately 80 million people suffering from respiratory diseases every year. The four common respiratory diseases - acute nasopharyngitis, influenza, tonsillar tracheitis, and chronic bronchitis - account for 80% of the respiratory diseases in the PRC. Our Taohuasan Pediatrics Medicine is used to treat respiratory disease in children.

Industry Consolidation

In 2003, the Chinese government issued “The Medicine Management Law”, “Pharmaceutical Manufacturing Quality Management Specifications” and implemented the Good Manufacturing Practices (“GMP”). This action has, and will continue to result in, industry consolidation as those companies without GMP certificates and without qualified facilities, capital or management expertise necessary to secure approval are forced to find strategic alternatives or cease operations. Since 2003, the number of pharmaceutical companies in the PRC has decreased rather significantly, from 6,700 to approximately 3,600. This trend has also resulted in significant opportunity for us, as we plan to identify companies that have similar products or other assets, but an inability to bring them to market.

Our Customers

Our top ten customers accounted for 63% and 51% of our total sales in fiscal 2014 and 2013, respectively. Two of our top customers individually accounted for 30% and 19% respectively, and totally accounted for 49% of our net sales in fiscal 2014. Two of our top ten customers accounted for 34% of our total net sales in fiscal 2013. Please refer to our financial statements relating to Risks Concentration.

Competition

The pharmaceutical industry both within the PRC and globally is intensely competitive and is characterized by rapid and significant technological progress. Our competitors, both domestic and international, include large pharmaceutical companies, universities, and public and private research institutions that currently engage in or may engage in efforts related to the discovery and development of new pharmaceuticals. Many of these entities have substantially greater research and development capabilities and financial, scientific, manufacturing, marketing and sales resources than us, as well as more experience in research and development, clinical trials, regulatory matters, manufacturing, marketing and sales.

The following table lists the primary competitors for each of our current product offerings as well as the nutrient products that we are licensed to produce:

|

Products

|

Competitors

|

|

Xin Ao Xing Oleanlic Acid Capsule

|

Wulanhaote Zhong Meng pharmaceutical Co., Ltd., Yang Ling Mai Di Sen Pharmaceutical Co., Ltd. and other suppliers of prescription medicines that are used for hepatitis treatment

|

|

Ganwang Compound Paracetamol & Amantadine Hydrochloride Capsule

|

Jiang Xi Ren He Pharmaceuticals, Inc. and Hainan Asia Pharmaceuticals, Inc.

|

|

Danshen Granule

|

Yun Nan Yong An Pharmaceuticals, Inc. and Hai Nan Min Hai Pharmaceuticals, Ltd.

|

|

Taohuasan Pediatric Medicine

|

Shandong Bai Cao Pharmaceuticals, Ltd., and Chang Chun Ren Min Pharmaceuticals, Ltd.

|

|

Tianqi Dysmenorrhea Capsule

|

Yun Nan Yu Xi City Wei He Pharmaceutical, Ltd., and Shandong Phoenix Pharmaceuticals, Ltd.

|

|

Nutrient Products

|

Wulanhaote Zhong Meng Pharmaceutical Co., Ltd., Yang Ling Mai Di Sen Pharmaceutical Co., Ltd. and other traditional Chinese medicine suppliers

|

Of these companies, our three major competitors are Wulanhaote Zhong Meng Pharmaceutical Co., Ltd., Yang Ling Mai Di Sen Pharmaceutical Co., Ltd., and Inner Mongolia Ku Lun Pharmaceutical, Co., Ltd. because some of their products are sold in the same markets as ours. Additionally, only Shan Dong Phoenix Pharmaceutical Inc., Yun Nan Yu Xi Wei He Pharmaceutical, Ltd., Yang Ling Mai Di Sen Pharmaceutical Co., Ltd., and Yun Nan Yong An Pharmaceuticals, Co., Ltd. hold GMP certificates.

Sources and Availability of Raw Materials and Principal Suppliers

Our principal raw materials are the active ingredients for each of our products. We currently have the ability to source part of the Danshen raw materials internally, while the remaining part of the Danshan raw materials and other raw materials, as well as packaging materials, are sourced from various independent suppliers in the PRC.

Third party vendors are selected based on a number of factors, including quality, timely delivery, cost and technical capability. Management also conducts periodic onsite reviews of our suppliers’ facilities. The vast majority of our raw material needs are readily available. We try to maintain relationships with at least two vendors for each major raw material in order to ensure a reliable supply at reasonable prices.

We rely on a number of suppliers for our raw materials and packaging materials.

In Fiscal 2014, Xi’an Chinese Medicine and Herbs Factory (“Xi’an Chinese Medicine”), Shaanxi Haoyuan Chinese Medicine and Herbs Factory (“Haoyuan”) and Xianyang Wenlin Color Printing Co., Ltd. (“Wenlin”) accounted for approximately 29%, 22% and 10% of our total raw material purchase, respectively. In Fiscal 2013, Xi’an Chinese Medicine and Herbs Factory (“Xi’an Chinese Medicine”), Shaanxi Haoyuan Chinese Medicine and Herbs Factory (“Haoyuan”) and Xianyang Wenlin Color Printing Co., Ltd. (“Wenlin”) accounted for approximately 20%, 15% and 10% of our total raw material purchase, respectively.

We have also been cultivating herbs since October 2008, including salvia miltiorrhiza, priclklyash peel, eucommia bark, gingko, honeysuckle, shizandra berry, scutellaeria baicalensis georgi, milk veteh and radix codonopsitis. Once completed, we will be able to process these herbs into raw materials for our products. We estimate there is an annual increase of 10% to 20% in production of Danshen in the coming years. Other herbs will be ready for harvest in three years. We will also be able to sell excesses on the market as raw materials.

Intellectual Property

We rely on a combination of trademark, patent and trade secret protection laws in the PRC, as well as confidentiality procedures and contractual provisions to protect our intellectual property. We also require our employees to execute confidentiality and trade secret agreements.

We currently hold one patent for the production method of our Aoxing Ganbao product, with two additional patents pending approval, and 9 registered trademarks in the PRC, and own the rights to the internet domain names www.biostarpharmaceuticals.com and www.aoxing-group.com. Our patent, patent number ZL2007100180930, was approved on September 16, 2009, and is valid for twenty years.

Below is a list of our trademarks, all registered with Trademark Bureau of SAIC (State Administration of Industry and Commerce) by Aoxing Pharmaceutical.

|

Trade Mark

|

Term

|

|

“Yi Wen Ling” & device (Certificate: No. 1008816)

|

May 21, 2007 to May 20, 2017

|

|

“Zhong Ao” & device. (Certificate: No. 1728599)

|

March 14, 2012 to March 13, 2022

|

|

“Xin Tai Ke” & device (Certificate No. 1908333)

|

September 28, 2012 to September 27, 2022

|

|

“Gan Wang” & device, (Certificate No. 3001006)

|

November 14, 2012 to November 13, 2022

|

|

“Hei Gen” (Certificate: No. 3168882)

|

July 7, 2003 to July 6, 2013

|

|

“Shi Li Ming” (Certificate: No. 3180355)

|

August 7, 2003 to August 6, 2013 (applying for extension)

|

|

“Aoxing No.1” (Certificate: No. 3168883)

|

February 21, 2004 to February 20, 2024

|

|

“Cha Ge De ” & device (Certificate: No. 4770095)

|

December 21, 2008 to December 20, 2108

|

|

“Cha Ge De Ri” & device (Certificate: No. 1624463)

|

August 28, 2011 to August 27, 2021

|

|

“Ao Xing Xin Le” & device (Certificate: No. 4319027)

|

November 28, 2007 to November 27, 2017

|

|

“Yin Shi” & device (Certificate: No. 3650168)

|

November 21, 2005 to November 20, 2015

|

|

“KangbinDu” & device (Certificate: No. 3832841)

|

April 14, 2006 to April 13, 2016

|

|

“Shabinjun & device (Certificate: No. 3832844)

|

April 14, 2006 to April 13, 2016

|

|

“KangbinDu” & device (Certificate: No. 7858678)

|

January 14, 2011 to January 13, 2021

|

|

“XinNao No.1” (Certificate: No. 3619525)

|

October 14, 2005 to October 13, 2015

|

|

“Baoertong” & device (Certificate: No. 3829856)

|

June 14, 2006 to June 13, 2016

|

Bio-pharmaceutical companies are at times involved in litigation based on allegations of infringement or other violations of intellectual property rights. Furthermore, the application of laws governing intellectual property rights in China and abroad is uncertain and evolving and could involve substantial risks to us.

Government Regulation

The testing, approval, manufacturing, labeling, advertising and marketing, post-approval safety reporting, and export of our products are extensively regulated by governmental authorities in the PRC. We are also subject to the Drug Administration Law of the PRC, which governs the licensing, manufacturing, marketing and distribution of pharmaceutical products in the PRC and sets penalties for violations of the law. We are also subject to various other regulations and permit systems by the Chinese government. These regulations and their impact on our business are set forth in more detail below.

|

Drug Administration Law of the PRC was promulgated by the Standing Committee of National People’s Congress on February 28, 2001 and effective as of December 1, 2001, and its implementing guidelines were promulgated by the State Council on August 4, 2004 and effective as of September 15, 2002. According to Drug Administration Law of the PRC and its implementing guidelines, a pharmaceutical manufacturer is required to obtain a Pharmaceutical Manufacturing Permit and Drug Approval Number for each manufactured drug from the relevant SFDA’s provincial branch, which will be valid for five years and is renewable upon application before expiration. Accordingly, we are required to apply for these approvals and any extensions thereof for each of our products.

|

|

Administration Regulations for Drug Registration was promulgated by the SFDA on July 10, 2007, and was effective as of October 1, 2007. The Administration Regulations for Drug Registration specifies the requirements and procedure for obtaining a Drug Approval Number for a new drug. It includes the requirements for clinical trial of new drugs, procedure for registering imported medicine and reporting and approval procedure for generic medicine. The Drug Approval Number is valid for five years and can be re-registered upon expiration. We are required to obtain a Drug Approval Number for each of our new drugs and reapply for an extension prior to the expiration date the drugs.

|

|

Good Manufacturing Practices (GMP) for Pharmaceutical Products, as revised in 1998 was promulgated by the SFDA on June 18, 1999 and became effective as of August 1, 1999, and the Authentication Regulations for Drug GMP was promulgated by the SFDA on September 7, 2005 and became effective on October 1, 2005. A pharmaceutical manufacturer must meet the GMP standards and obtain the GMP Certificate with a five-year validity period from SFDA. Before the GMP Certification expires, the pharmaceutical manufacturer must apply again and complete the relevant procedures, which may take about 120 working days, to obtain a new GMP Certificate. On October 24, 2007, the SFDA issued new guidelines for authentication standards of GMP, effective as of January 1, 2008. The new guideline may result in a rise of cost for a pharmaceutical manufacturer to meet the new standards in order to maintain the GMP qualification. If a pharmaceutical manufacturer fails to obtain or maintain GMP Certification and still carries on production of its drugs, it will be fined and its Pharmaceutical Manufacturing Permit may be revoked under serious circumstances. We are required to apply for a GMP certificate for each of our products and reapply prior to the expiration date and maintain our Pharmaceutical Manufacturing Permit.

|

|

Administration Regulations for Drug Call-back was promulgated by the SFDA on December 10, 2007 and effective on the same day. According to the Administration Regulations for Drug Call-back, the pharmaceutical manufacturer should establish a drug call-back system and collect information regarding the drug safety. If a manufacturer discovers any unreasonable danger of drug that threatens people’s safety and health, it should immediately stop the manufacturing and sale of such drug, notify the distributors and report to the branch of the SFDA. This regulation also stipulates the procedures of drug call-back and danger valuation standards established and maintain a drug call back system in conformance the regulations.

|

|

Administration Regulations for Drug Instructions and Labels was promulgated by the SFDA on March 15, 2006 and was effective as of June 1, 2006. According to Administration Regulations for Drug Instructions and Labels, the contents of instructions and labels of each drug must be approved by the SFDA, and the smallest packing unit of drug shall be attached with instruction. We have developed, received approval and maintain drug labeling in conformance with the regulations for our existing products and must do so for new products.

|

|

Supervision Administration Regulations for Drug Distribution was promulgated by the SFDA on January 31, 2007 and effective as of May 1, 2007. According to Supervision Administration Regulations for Drug Distribution, a pharmaceutical manufacturer can only sell drugs produced by itself, and it shall not sell drugs produced by other manufacturers or produced by itself but for commissioning manufacturing purposes. We do not resell drugs from any other pharmaceutical manufacturers.

|

|

Regulations for Drug Advertisement Censoring was promulgated by the SFDA and State Administration for Industry and Commerce (the “SAIC”) on March 13, 2007 and effective as of May 1, 2007. The Standards for Drug Advertisement Censoring and Publication was promulgated by the SFDA and the SAIC on March 3, 2007 and made effective as of May 1, 2007. According to Regulations for Drug Advertisement Censoring, a pharmaceutical manufacturer must obtain a Drug Advertisement Approval Number from the provincial branch of the SFDA which is valid period of one year if the drug advertisement describes the functions or benefits of a drug. However, if an over the counter drug advertisement in any media, or a prescription drug advertisement in professional medical magazine, only refers to the name of the drug, including the general name and commercial name, without any other addition promotional information, the advertisement does not need to be censored or approved. We have obtained a Drug Advertisement Approval Number for all our drugs and review all of our OTC drug advertisements so that they are in conformance with the regulations relating to advertising these products.

|

|

|

Food Hygiene Law and Rules on Food Hygiene Certification mandates that a distributor of nutritional supplements and other food products must obtain a food hygiene certificate from relevant provincial or local health regulatory authorities. The grant of such certificate is subject to an inspection of the distributor’s facilities, warehouses, hygienic environment, quality control systems, personnel and equipment. The food hygiene certificate is valid for four years, and the holder must apply for renewal of the certificate within six months prior to its expiration.

|

We have enjoyed a sound, cooperative working relationship with the Shaanxi People's Government and related government departments since our founding. Adjustments to our operating strategies and long-term business plans have been unanimously approved by relevant departments and by provincial-level government entities.

The SFDA

The application and approval procedure in the PRC for a newly developed drug has numerous steps. For each new product, we prepare documentation covering pharmacological, toxicity, pharmacokinetics and drug metabolism studies in addition to providing samples of the drug. The documentation and samples are then submitted to the provincial SFDA. This process typically takes approximately three months. After the documentation and samples have been approved by the provincial SFDA, the provincial administration submits the approved documentation and samples to the SFDA. The SFDA examines the documentation and tests the samples and presents the findings to the New Drug Examination Committee for approval. If the application is approved by the SFDA, the SFDA will issue a clinical trial license to the applicant for clinical trials. This clinical trial license approval typically takes one year, followed by approximately two years of trials, depending on the category and class of the new drug. The SFDA then examines the documentation from the trial and, if approved, issues the new drug license to the applicant. This process usually takes eight months. The entire process takes anywhere from three to four years.

The SFDA and the China Traditional Medicine Administration Bureau regulate the process for new drug approval and licensing in the PRC, which can involve many levels of authority, lacking in transparency, and presents one of the greatest obstacles for companies to introduce new drugs into the market. One of the preliminary aspects of the application process involves a review of the Chinese market's need for a particular drug. If the SFDA determines that the market niche for a particular drug is saturated, the drug will not receive further consideration and the licensing application will be denied. According to industry analysts, eighty-five percent of applications for new drugs licensing is determined by SFDA to be in saturated markets and thus are not considered for approval. Only fifteen percent of new-to-market drug applications are considered for approval by the SFDA.

Furthermore, only companies that meet the GMP standard may apply for new drug approvals with the SFDA. The SFDA estimates that less than 20% out of the 6,000 pharmaceutical companies in the PRC currently meet the GMP standard.

We estimate that the cost to receive approval from the SFDA for a new product will range from RMB 1.1 million (approximately $174,000) to RMB 4.15 million (approximately $659,000).

Our receipt of a GMP certificate and approval by the SFDA of our prescription and OTC drugs represent a significant competitive advantage as these approvals present a significant barrier to entry by new companies hoping to enter the pharmaceutical drug industry.

Nevertheless, the new drugs we seek to bring to market are regulated by the SFDA and the China Traditional Medicine Administration Bureau and are estimated to now cost between RMB 1.1 million (approximately $174,000) to RMB 4.15 million (approximately $659,000) per product which must be provided through our cash flow or from financing activities as new products are introduced. In addition, our new products may not pass the clinical review and testing process which can negatively affect our cash flow and income.

We are subject to possible administrative and legal proceedings and actions by these various regulatory bodies. Such actions may include product recalls, seizures and other civil and criminal sanctions which could have a materially adverse effect on our prospects.

Environmental Regulation

Our operations and facilities are subject to environmental laws and regulations stipulated by the national and the local environment protection bureaus in the PRC. Relevant laws and regulations include provisions governing air emissions, water discharge and the management and disposal of hazardous substances and wastes. The PRC regulatory authorities require pharmaceutical companies to carry out environmental impact studies before engaging in new construction projects to ensure that their production processes meet the required environmental standards.

We maintain controls at our production facilities to facilitate compliance with environmental rules and regulations. We are not aware of any investigations, prosecutions, disputes, claims or other proceedings in respect of environmental protection, nor have we been subject to any action by any environmental administration authorities of the PRC. To our knowledge, our operations meet or exceed the existing requirements of the PRC.

Advertising Laws

Advertisement Law of the People’s Republic of China and Rules of Medicine Advertisements Management from State Admission for Industry and Commerce, Regulations on Control of Advertisements (tentative) from State Council provide guidelines for advertising prescription and OTC drugs and nutrients. The rules limit where advertisements may be placed and govern the claims that may be made by the manufacturer.

Product Liability and Consumers Protection

Product liability claims may arise if the products sold have any harmful effect on the consumers. The injured party may make a claim for damages or compensation. The General Principles of the Civil Law of the PRC, which became effective in January 1987, state that manufacturers and sellers of defective products causing property damage or injury shall incur civil liabilities for such damage or injuries.

The Product Quality Law of the PRC was enacted in 1993 and amended in 2000 to strengthen the quality control of products and protect consumers’ rights and interests. Under this law, manufacturers and distributors who produce or sell defective products may be subject to confiscation of earnings from such sales, revocation of business licenses and imposition of fines, and in severe circumstances, may be subject to criminal liability.

The Law of the PRC on the Protection of the Rights and Interests of Consumers was promulgated on October 31, 1993 and became effective on January 1, 1994 to protect consumers’ rights when they purchase or use goods or services. All business operators must comply with this law when they manufacture or sell goods and/or provide services to customers. In extreme situations, pharmaceutical product manufacturers and distributors may be subject to criminal liability if their goods or services lead to the death or injuries of customers or other third parties.

Circular 106

On May 31, 2007, China’s State Administration of Foreign Exchange (“SAFE”) issued an official notice known as “Circular 106”, which requires the owners of any Chinese companies to obtain SAFE’s approval before establishing any offshore holding company structure in so-called “round-trip” investment transactions for foreign financing as well as subsequent acquisition matters in China. Likewise, the “Provisions on Acquisition of Domestic Enterprises by Foreign Investors”, issued jointly by Ministry of Commerce (“MOFCOM”), State-owned Assets Supervision and Administration Commission, State Taxation Bureau, State Administration for Industry and Commerce, China Securities Regulatory Commission and SAFE in September 2006, impose approval requirements from MOFCOM for “round-trip” investment transactions, including acquisitions in which equity was used as consideration.

Dividend Distribution

The principal laws, rules and regulations governing dividends paid by our PRC affiliated entities include the Company Law of the PRC (1993), as amended in 2006, Wholly Foreign Owned Enterprise Law (1986), as amended in 2000, and Wholly Foreign Owned Enterprise Law Implementation Rules (1990), as amended in 2001. Under these laws and regulations, each of our consolidated PRC entities, including wholly foreign owned enterprises, or WFOEs, and domestic companies in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, each of our consolidated PRC entities, including WFOEs and domestic companies, is required to set aside at least 10% of its after-tax profit based on PRC accounting standards each year to its statutory surplus reserve fund until the accumulative amount of such reserve reaches 50% of its respective registered capital. These reserves are not distributable as cash dividends. As of December 31, 2014, the accumulated balance of our statutory reserve funds reserves amounted to RMB 55 million (approximately $7.4 million) and the accumulated profits of our consolidated PRC entities that were available for dividend distribution amounted to RMB 288.2 million (approximately $41.3 million).

Foreign Exchange Regulation

The ability of our PRC affiliated entities to make dividends and other payments to the Company may also be restricted by changes in applicable foreign exchange and other laws and regulations.

Foreign currency exchange regulation in the PRC is primarily governed by the following rules:

|

·

|

Foreign Exchange Administration Rules (1996), as amended in August 2008, or the Exchange Rules;

|

|

·

|

Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996), or the Administration Rules.

|

Currently, under the Administration Rules, Renminbi is freely convertible for current account items, including the distribution of dividends, interest payments, trade and service related foreign exchange transactions, but not for capital account items, such as direct investments, loans, repatriation of investments and investments in securities outside of the PRC, unless the prior approval of the State Administration of Foreign Exchange (the “SAFE”) is obtained and prior registration with the SAFE is made. Foreign-invested enterprises like Shaanxi Biostar that need foreign exchange for the distribution of profits to its shareholders may effect payment from their foreign exchange accounts or purchase and pay foreign exchange rates at the designated foreign exchange banks to their foreign shareholders by producing board resolutions for such profit distribution. Based on their needs, foreign-invested enterprises are permitted to open foreign exchange settlement accounts for current account receipts and payments of foreign exchange along with specialized accounts for capital account receipts and payments of foreign exchange at certain designated foreign exchange banks.

Although the current Exchange Rules allow the convertibility of Chinese Renminbi into foreign currency for current account items, conversion of Chinese Renminbi into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of SAFE, which is under the authority of the People’s Bank of China. These approvals, however, do not guarantee the availability of foreign currency conversion. The Company cannot be sure that it will be able to obtain all required conversion approvals for its operations or the Chinese regulatory authorities will not impose greater restrictions on the convertibility of Chinese Renminbi in the future. Currently, most of the Company’s retained earnings are generated in Renminbi. Any future restrictions on currency exchanges may limit the Company’s ability to use its retained earnings generated in Renminbi to make dividends or other payments in U.S. dollars or fund possible business activities outside China.

Taxation

The PRC Enterprise Income Tax Law, or the EIT Law provides that enterprises established outside of China whose “de facto management bodies” are located in China are considered “resident enterprises” and are generally subject to the uniform 25% enterprise income tax rate as to their worldwide income. Under the implementation regulations for the EIT Law, “de facto management body” is defined as a body that has material and overall management and control over the manufacturing and business operations, personnel and human resources, finances and treasury, and acquisition and disposition of properties and other assets of an enterprise. Although substantially all of our operational management is currently based in the PRC, it is unclear whether PRC tax authorities would treat us as a PRC resident enterprise.

Under the EIT Law and implementation regulations, PRC income tax at the rate of 10% is applicable to dividends payable to investors that are “non-resident enterprises,” which do not have an establishment or place of business in the PRC, or which have such establishment or place of business but the relevant income is not effectively connected with the establishment or place of business, to the extent such dividends are derived from sources within the PRC. Similarly, any gain realized on the transfer of shares by such investors is also subject to 10% PRC income tax if such gain is regarded as income derived from sources within the PRC. If we are considered a PRC “resident enterprise,” it is unclear whether dividends we pay with respect to our common shares, or the gain you may realize from the transfer of our common shares, would be treated as income derived from sources within the PRC and be subject to PRC income tax. It is also unclear whether, if we are considered a PRC “resident enterprise,” holders of our common shares might be able to claim the benefit of income tax treaties entered into between China and other countries.

Price Controls

The retail prices of some pharmaceutical products sold in China, primarily those included in the national and provincial medical insurance catalogs and those pharmaceutical products whose production or distribution are deemed to constitute monopolies, are subject to price controls in the form of fixed prices (for non-profit medical institutions) or price ceilings. Manufacturers or distributors cannot freely set or change the retail price for any price-controlled product above the applicable price ceiling or deviate from the applicable fixed price imposed by the PRC government. The prices of medicines that are not subject to price controls are determined freely at the discretion of the respective pharmaceutical companies, subject to notification to the provincial pricing authorities.