Attached files

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission File No. 333-1258321

5BARz International Inc.

(Name of small business issuer in its charter)

| Nevada | 26-4343002 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

|

9444 Waples Street, Suite 140 San Diego, California |

92121 |

| (Address of principal executive offices) | (Zip Code) |

877-723-7255

(Registrant’s telephone number, including area code)

| Securities registered under Section 12(b) of the Exchange Act: | |

| Title of each class registered: | Name of each exchange on which registered: |

| None | None |

| Securities registered under Section 12(g) of the Exchange Act: | |

|

Common Stock, par value $0.001 (Title of class) | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes [ ] No [X]

Check whether the issuer is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

1

Indicate by checkmark if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III if this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

Large Accelerated Filer [ ] Accelerated Filer [ ] Non-Accelerated Filer [ ] Smaller Reporting Company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes [ ] No [X]

State issuer's revenues for its most recent fiscal year: None.

At June 30, 2014, the end of our second fiscal quarter, the aggregate market value of common stock held by non-affiliates of the registrant was approximately $29,970,598 based on the closing price of $0.22 as reported on the Over-the-Counter Bulletin Board.

Number of shares of the registrant’s common stock outstanding as of March 20, 2015 was 218,974,013.

DOCUMENTS INCORPORATED BY REFERENCE: None

2

5BARz International Inc.

Form 10-K

| PART I. | ||

| Item 1. | Business | 5 |

| Item 1A. | Risk Factors | 19 |

| Item 2. | Properties | 22 |

| Item 3. | Legal Proceedings | 22 |

| Item 4. | Mine Safety Disclosures | 23 |

| PART II. | ||

| Item 5. | Market for Registrants Common Equity; Related Stockholder Matters and Issuer Purchase of Equity Securities | 24 |

| Item 6. | Selected Financial Data | 29 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Result of Operations | 30 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 35 |

| Item 8. | Financial Statements and Supplementary Data | 36 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 37 |

| Item 9A. | Controls and Procedures | 37 |

| Item 9B. | Other Information | 38 |

| PART III. | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 38 |

| Item 11. | Executive Compensation | 40 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 41 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 41 |

| Item 14. | Principal Accounting Fees and Services | 42 |

| PART IV. | ||

| Item 15. | Exhibits and Financial Statement Schedules | 44 |

| SIGNATURES | 45 |

3

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements. Forward-looking statements include those that address activities, developments or events that we expect or anticipate will or may occur in the future. All statements other than statements of historical facts contained in this Annual Report, including statements regarding our future financial position, business strategy, budgets, projected costs and plans and objectives of management for future operations, are forward-looking statements. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in the forward-looking statements. Such risks and uncertainties include those set forth under the captions "Risk Factors" beginning on page 20, "Management's Discussion and Analysis of Financial Condition and Results of Operations" beginning on page 27, and elsewhere in this Annual Report. We undertake no obligation to update or revise our forward-looking statements, whether as a result of new information, future events or otherwise. We advise you to carefully review the reports and documents we file from time to time with the Securities and Exchange Commission (the "SEC"), particularly our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K.

As used in this Annual Report, the terms "we," "us," "our," "5BARz" and the "Company" mean 5BARz International Inc. and its subsidiaries, unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

The disclosures set forth in this report should be read in conjunction with the financial statements and notes thereto of the Company for the year ended December 31, 2014. Because of the nature of a relatively new and growing company, the reported results will not necessarily reflect the operating results that will be achieved in the future.

4

PART I

Item 1. Business

General

5BARz International Inc. (“5BARz” or the “Company”) designs, manufactures and sells a line of cellular network infrastructure devices for use in the office, home and mobile market places. The Companies products incorporate multiple patented technologies to create a highly engineered, single-piece, plug ‘n play device that strengthens weak cellular signals to deliver high quality signals for voice, data and video reception on cell phones and other cellular equipped devices. The 5BARz™ solution represents a very significant improvement for cellular network carriers in providing a clear, reliable, high quality signal for their subscribers with a growing need for high quality connectivity. The Company has developed both a fixed unit, called a cellular network extender, to be used in your home or office, and a mobile device designed for use in your automobile, RV, water craft etc. The Company’s products are engineered to incorporate a great number of features more fully addressed herein. Our products are designed to significantly improve the operation of cellular networks in the vicinity of the user, reducing the frustration experienced by cellular users globally.

The Company is in the process of developing the global commercialization of the cellular network extenders through cellular network operators, with each sector of integration to be managed in geographic areas. The initial business focus is currently in India, with formative steps taken in Latin America, the U.S. and Western European market sectors.

We were incorporated in Nevada on November 17, 2008 and the Company has offices in the States of Washington, California and Florida. The address of the Company’s Innovation Center in San Diego is 9444 Waples Street, Suite 140, San Diego, California, 92121, and our centralized telephone number is 877-723-7255. Our web site is www.5BARz.com. Through a link on the Investor Relations section of our website, we make available the following filings as soon as reasonably possible after they are electronically filed with the Securities and Exchange Commission (SEC): our Annual Report on Form 10K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports filed pursuant to Section 13 (a) or 15(d) of the Exchange Act. All such filings are available free of charge. The information posted on our web site is not necessarily incorporated into this report.

Strategy and focus areas

Our focus is on three foundational priorities;

| · | Leadership in our core business, maintaining the highest standards in developing highly engineered devices to manage cellular signal in the vicinity of the user. |

| · | Effective collaboration with cellular network operators to ensure that our products fully meet their needs in providing their subscriber base with a portfolio of state of the art solutions for maintaining excellence in cellular connectivity. |

| · | Architectural design creation, to facilitate the effective integration of the Companies product into new and innovative applications, from home and office to mobile applications, applications built into automobiles, computers and numerous other specific target markets. |

The Company is uniquely positioned to take advantage of recent market transitions. As more and more users are migrating to the use of cellular equipped devices for communication, internet access, navigation and even entertainment, consumer demand for clear and consistent cellular signal has never been more important. In our opinion, this evolution driven by mobile device proliferation is in early stages. 5BARz is uniquely positioned to meet this growing demand with their developing line of product.

The Company has recently unveiled a highly evolved innovative, carrier grade device, incorporating technologies and a combination of functionality which represents the most advanced product developed in this market, to date. This next generation cellular network extender, branded as 5BARz™ incorporates patented technology to create a highly engineered, single-piece, plug ‘n play unit that stabilizes and strengthens weak cellular signals to deliver higher quality signal for voice, data and video reception on cell phones, and other cellular equipped devices.

5

The 5BARz Cellular Network Extender was unveiled at the Mobile World Congress in Barcelona, Spain, March 2014. Since that time the product has undergone significant product field testing in international locations and improvements during the year, resulting in a product which management consider to be ready for deployment.

This product supports 2G & 3G technologies for cellular devices, and has been designed in configurations which operate on either a single frequency or multiple frequencies. The technology has successfully integrated both send and receive antennae into the single device, and hosts an abundance of features which have never before been integrated into a single portable cellular device.

The Company’s initial product, the Road Warrior, won the prestigious 2010 innovation of the year award at CES (the largest consumer electronics show in the world) for achievements in product design and engineering. The Road Warrior, has passed FCC Certification, and has been produced in limited quantities to date by a contract manufacturer in the Philippines. Production of that product has been limited to a volume of 16,000 units, subject to the terms of a single purchase order and deployment strategy. 5BARz current technological developments have eclipsed the original Road Warriors produced.

Management at 5BARz are confident that this new cellular device will alleviate much of the frustration experienced by users globally associated with weak or compromised cellular signal. This technology facilitates cellular usage in areas where structures, create “cellular shadows” or weak spots within metropolitan areas, and highly congested areas such as freeways, and also serves to amplify cellular signal as users move away from cellular towers in urban areas. The market potential of the technology is far reaching.

The market opportunity for the 5BARz™ technology represents some 6.8 billion cell phone subscribers worldwide serviced by 900 cellular network operators. These cellular network operators represent the Company’s primary point of entry to the Global marketplace.

The 5BARz business opportunity to bring this state of the art technology to market represents a significant step forward in the deployment of micro-cell technology in the industry.

Company History & Corporate Development

5BARz was incorporated on November 17, 2008, is a Nevada Corporation and was a designated shell Company until 2010. In 2010 the Company acquired the “Master Global Marketing and Distribution Rights” for the marketing and distribution of 5BARz™ products throughout the world from CelLynx Inc., a California based Company. In addition to the acquisition of the marketing and distribution rights, the Company acquired a 60% interest in the underlying intellectual property comprising the 5BARz™ products, and holds a security interest over the balance of those assets.

On March 27, 2012, 5BARz acquired a 60% controlling interest in CelLynx Group Inc. and it’s consolidated subsidiary CelLynx Inc. Cellynx was the original developer of the core technology underlying the 5BARz business.

On November 10, 2011, the Company incorporated a subsidiary Company in Zurich Switzerland called 5BARz AG. At December 31, 2014, the Company held a 94.3% equity interest in that entity. 5BARz AG has been granted the exclusive rights by way of a sub-license for the Sales and Marketing of the 5BARz™ products in the region, commonly referred to as the “DACH” in Europe, comprised of Germany, Austria and Switzerland. In November 2014, the Company was advised that an investment banking firm (BDC Investment AG, “BDC”) involved in the financing 5BARz AG in Zurich Switzerland, was placed into liquidation by Swiss Authorities. Certain other Companies funded by BDC including 5BARz AG were also ordered to liquidate. On January 8, 2015, a communication was issued by FINMA announcing the cessation of the liquidation of the investment banking firm. 5BARz International, Inc. is seeking a similar termination of liquidation of their subsidiary 5BARz AG. Should the liquidation not be terminated, the agreement with 5BARz AG provides for the termination of the license agreement provided to 5BARz AG. The assets of 5BARz AG were written down to zero at December 31, 2014, representing a loss of $14,583.

6

On January 12, 2015, 5BARz International, Inc. incorporated another subsidiary Company, 5BARz International, SA DE CV in Mexico. The Company is a 99% owned subsidiary of 5BARz International, Inc. with the remaining 1% owned by Daniel Bland, the CEO of 5BARz International, Inc. The Company has obtained the necessary product approvals for the sale of the 5BARz Road Warrior product in Mexico, and has imported a limited inventory of product for resale in the Country.

On January 12, 2015, 5BARz India Private Limited was incorporated in India, a 99.9% subsidiary of 5BARz International, Inc. The Company has delivered prototype products into India in December 2014, and that product is experiencing very positive test results. The Company has developed interest in the product from Tier 1 cellular network operators in the region, with testing programs in process.

At December 31, 2014 the Company had five (5) full time employees.

Milestones

2007: A 5BARz™ working prototype was developed of an affordable consumer friendly single piece plug ‘n play booster with a minimum of 45dB of gain in both up and down paths. This was the initial proof of concept product.

July, 2008: Dollardex Group entered into an exclusive “Master Global Marketing and Distribution Agreement” (the “Distribution Agreement”) for the 5BARz™ products.

July 2009: First production run and FCC Certification of 5BARz Road Warrior

August 2009: Field testing and final modification of 5BARz Road Warrior

January 2010: 5BARz Road Warrior Selected as CES Innovations 2010 Design and Engineering Award. Marketing commenced in the Philippines for product designated for the U.S.

January 2011: 5BARz International Inc. acquires the “Master Global Marketing and Distribution Agreement” for the marketing and distribution of 5BARz™ products throughout the world, and enters into agreement for the acquisition of a 50% interest in the underlying intellectual property.

January 2011 – 5BARz International Inc. engages business development consultants in Latin America, to present the 5BARz Road Warrior product to R&D departments at major wireless carriers in the region for field testing. That program resulted in positive feedback and recommendations to help guide the further development of the product line.

March 2012 – 5BARz incorporated a subsidiary Company, 5BARz Ag, and sub-licensed that entity the Sales and Marketing Rights for the region commonly referred to as the “DACH”, (Germany, Austria and Switzerland). The Company engaged the services of BDC Investment AG, of Zurich, Switzerland to finance our subsidiary which would help to develop this marketplace.

February/March 2012 – The Company formed an Advisory Board comprised of leading executives within the technology sector to assist in the integration of the 5BARz™ technology and products into global markets. See bios in news – www.5BARz.com

Dr. Gil Amelio – Director ATT, Former CEO – Apple Computer

Mr. Marcelo Caputo – CEO Telefonica USA

Mr. Finis Connor – Founder of Seagate Technology and Connor Peripherals

March 2012 – 5BARz International Inc. completed the acquisition of a 60% interest in CelLynx Group, Inc. (the originator of the 5BARz™ technology), developing a fully integrated subsidiary for the global deployment of the 5BARz™ business opportunity.

7

August 2012 – Internal Engineering develop functional prototype units of the revised cradle-less 5BARz™ cellular network extender with several new and improved features over the Road Warrior unit.

June 2013 – Company enters into a Technical Collaboration with a leading international Cellular Network Operator, to deliver a network extender that will be designed and built, based upon the 5BARz™ patented technology, to meet the specific requirements of that wireless network operator.

October 2013 – Company opens its state-of-the-art “innovation center” in San Diego, California. The center houses the 5BARz’ engineering division as it expands operations to accelerate development of the 5BARz™ technology.

November 2013 – 5BARz appoints Gil Amelio, former CEO of Apple Computers as Chairman of the Board of 5BARz International Inc.

February 2014 – 5BARz files several new patent applications.

February 2014 – 5BARz International, Inc. unveils the 5BARz Network Extender at the Mobile Wireless Congress in Barcelona, Spain. This new product is a highly evolved, innovative, carrier grade technology and device that delivers much improved cellular signals, enhanced voice, data, and video reception, on cellular equipped devices.

August 2014 - 5BARz Hires Top Industry Executive to Launch Latin American Operations, Marcelo Caputo, a successful industry executive and former CEO of Telefonica USA.

August 2014 – 5BARz makes initial delivery of custom designed prototype device to Tier 1, Cellular network operator in Latin America, for product field testing and evaluation.

November 2014 – 5BARz completes $3.5 Million dollar private placement, proceeds used to progress the Company’s technology and product line.

January 2015 – 5BARz engages David Habiger, an industry veteran and Senior Advisor at Silver Lake Partners and Venture Partner at Pritzker Group Venture Capital, as a member of its Advisory Board.

January 2015 – 5BARz incorporates subsidiary Company in Mexico, completes approvals on Road Warrior devices and imports limited inventory of product for resale.

March 2015 – 5BARz establishes Subsidiary Company in India, and commences field trials on custom designed prototype products. The Company also commences collaboration arrangements with Tier 1 cellular operators. On March 12, 2015 the Company hired Samartha Raghava Nagabhushanam, a leading Telecom executive, to serve as Managing Director and CEO of 5BARz India.

8

The Market Opportunity

The market opportunity for the 5BARz™ technology represents nearly 7 billion cell phone subscribers worldwide and is growing as a result of the following factors;

| · | Dead zones, weak signals, and dropped calls are the biggest problems in the industry. Now, by adding internet and video, the quality issue is increasing exponentially. |

| · | 76% of cellular subscribers use their mobile phone as the primary phone |

| · | More consumers are using mobile phones for web browsing, up and down- loading photos, videos and music |

| · | More mobile phones are operating at higher frequencies which have less ability to penetrate buildings |

| · | Weak signals make internet applications inaccessible and slow and increase the drain on cell phone batteries. |

| · | Forty percent of all mobile phone users report inadequate service in their homes or office and we estimate that 60% of the 6.8 billion mobile phone users worldwide consider continuous connectivity to be very important. |

Consumer demand for quality in the cell phone user experience is becoming an increasingly important factor. The 5BARz™ technology meets this need. 5BARz is currently developing relationships with Cellular network operators internationally to integrate the 5BARz™ product into cellular networks globally.

Why Poor Signals Exist

A variety of factors may cause dropped calls and dead zones, including congestion, radio signal interference, tower hand-off, and lack of coverage. Despite continued infrastructure investment by operators, and antenna technology improvements by base station providers and mobile phone makers, these problems will continue for the foreseeable future. This is because many of the contributing factors can't be controlled by the operators and manufacturers. To understand how innovative 5BARz™ products are in improving phone signals, it's first important to understand the causes of poor signal quality.

Congestion

In 1999, sales of mobile phones surpassed combined sales of personal computers and automobiles. By 2010, mobile phones had replaced land-line phones in 30% of U.S. households. Smart phones, led by iPhones and Android phones, have become indispensible personal assistants. Laptop computer sales outnumber desktop computer sales, and most laptops are equipped with cellular data chipsets or USB modems. Apple's iPad has sparked the connected tablet market too. Vending machines, automobiles, mobile sensors, and many other devices include "machine to machine" cellular data modules. As a result, the number of cellular voice and data devices will soon exceed the number of people on Earth.

If sheer numbers weren't enough, new uses for mobile devices are causing even faster growth in bandwidth usage. Obvious uses include video entertainment, videoconferencing, downloaded and streaming music, MMS, email, and application downloads. Facebook, Twitter, Foursquare, and many other social networking applications put further load on operator networks. Also, surprising sources of traffic have emerged, such as deliberate "miscalls". A miscall is when one subscriber calls another, but hangs up before the receiving party answers. Since operators don't charge for these uncompleted calls, subscribers are using miscalls as a free way to communicate. In India, orders for milk are made this way. In Syria, five miscalls in a row signals the recipient to "go online" to the Internet and chat. In Bangladesh, it's estimated that up to 70% of traffic at peak times is due to miscalls. This practice isn't limited to countries with low per-capita income, and yet it places a high load on operator networks.

9

There are sources of congestion based on location and time, too. Transportation clusters like airports, major highway intersections, bridges, and toll road gates all bring many people together at peak times. Also, because of home land-line replacement, many residential neighborhoods have many mobile phones in simultaneous use in mornings and evenings. Lastly, local population growth and immigration can result in too many phones for existing infrastructure. Due to long planning times, investment requirements, local government permits, and construction time, it's difficult for infrastructure to keep up with the pace of change in many developing areas, especially in growth countries.

Radio Signal Interference

Interference comes from both obvious and subtle causes. Certain materials aren't transparent to radio signals, especially durable materials used in buildings, large structures, and even automobiles. As a result there are radio shadows in which a mobile phone can't sense the signal from a base station. In addition, radio signals from adjacent channels or reflected signals can interfere with each other due to wave cancellation effects. In some cases these forms of interference primarily attenuate the signal (make it weaker). However, interference can also add noise, so that the ratio of signal to noise becomes too low for the mobile phone and the base station to understand each other.

Tower Hand-Off

Mobile phone networks are called "cellular" networks because they are made up of overlapping areas of coverage that are provided by base stations in fixed locations. As a mobile subscriber travels by automobile or train, he will eventually reach the limit of a base station's coverage. At that point, his mobile phone will "hand off" to a base station for the next coverage area. If signal quality is poor due to interference, or if the new base station is congested with too many mobile phones, the subscriber's connection may be lost.

Lack of Coverage

Some rural or developing areas don't have enough people or population density for operators to justify the cost of installing base stations except at wide intervals. In these areas the signal strength from the base station or the mobile phone may be too low to create or maintain a connection. This results in "dead zones" or dropped calls.

Solutions to Poor Signal Quality

Operators know that dead zones, dropped calls, and poor voice quality are big problems, and that re-dialing while driving can be unsafe. Operators also are concerned about subscribers' ability to make emergency calls. They understand that people rely on mobile phones for business and connecting with family. As mobile phones replace landlines, operators are especially aware that mobile signal quality is critical. Operators also see that wireless data is increasingly important for personal and business use.

To help, operators work with phone and base station manufacturers to improve antenna performance. They invest in new base stations in growth areas. They invest in technologies that enable more connections per base station. Operators have even provided refunds for dropped calls.

However, many factors causing poor signal quality can't be controlled by operators. Therefore products have emerged to help, provided by operators or companies who sell to either operators or subscribers.

10

Femtocells

Operators can provide femtocells to subscribers with poor signal quality at home. Usually the subscriber pays for hardware, installation, or a monthly fee. Femtocells are carrier grade, and are like small base stations that communicate with operators by using the home Internet connection as a "backhaul". In addition to backhaul the incoming call is routed thru the internet as well, which leads to the degredation of a call when trying to access the internet as well as engaging in a call. Lastly, femtocells only work with phones from one operator, so families with phones from multiple operators may have to request multiple femtocells.

Repeaters

Repeaters are usually carrier-grade equipment and are programmed for a specific operator. They extend cellular networks into buildings and small offices. As with femtocells, installation is complex and if not done properly they can cause network problems. Unlike femtocells, repeaters do not use the local Internet connections, but rather receive and re-transmit the signals between base stations and mobile phones.

Boosters

Boosters are usually sold online and through retail. They vary widely in amplification power, quality of amplification, and power balance. For example, these products amplify signals at 1, 3, 5, or even 10 watts all the time. Using power over 1 watt increases the probability that a booster will interfere with surrounding mobile devices. Also, it would be more energy efficient to adapt amplification power as needed, rather than to simply use the same wattage constantly. Many boosters don't support balanced power in both directions between base station and mobile phone. This may result in only solving the signal quality problem in one direction. Since communication is bi-directional, this doesn't actually solve the problem. Varying quality of amplification also introduces noise, which can interfere with surrounding devices.

A New Class of Solution

5BARz has evaluated the causes of poor signal quality, the needs of both operators and subscribers, and the solutions in the market. Femtocells, repeaters, and boosters either don't solve all parts of the problem, or aren't optimal due to cost or other drawbacks. Using expertise starting with a team of engineers who designed sophisticated base station amplifiers for operators, 5BARz has developed a new class of carrier-grade technology. That engineering team grew to a multi-national teams of engineers working on project specific challenges integrated into the 5BARz™ products. The result is a highly engineered hybrid of repeaters and boosters, intended for use in automotive applications, home, and office. 5BARz has tested these products in the lab, in the real world, and with operators. These products advance the state of the art to provide the following advantages:

Low Power Use

5BARz™ products only amplify when required. The automotive products use less than 1/2 watt, while the home product uses less than 1 watt. This not only saves energy, but also minimizes interference with other wireless devices and the network itself. In fact, new rules being proposed by the U.S. Federal Communications Commission are expected to mandate low power standards such as 5BARz now provides.

Simple Setup

5BARz™ products don't require a technician to run wires, carefully determine proper location, or optimize orientation. No use of home Internet connection is required, and there are no switches or settings. The unit has a simple plug and play installation requirement.

11

Balanced Amplification

This feature, plays a key role in ensuring that the product does not interfere with the macro network, and is a feature covered by the Company’s patented technology. Receive and sent signals need automatic balance management in order for both directions of a communication channel to be improved. 5BARz™ products are not only smart about adapting amplification levels, but also about balancing amplification for incoming signals from the base station, and return signals from the mobile phone. This attribute is critical in that it ensures that the operation of the unit automatically avoids interference with the Macro Network. This automated process is a part of the 5BARz™ patented technology.

Signal Stability

5BARz has done extensive design, testing, and re-design to avoid a number of problems experienced by the antenna design of alternatives. For example, booster products can experience oscillations when people, animals, or vehicles move nearby. These oscillations can weaken the booster effect or cause interference with other wireless devices. Many booster products achieve size similar to 5BARz™' products by putting antennas close together in the same product package, but don't optimize radio wave interactions between those antennas. This weakens the boosters' effectiveness, and is one reason why other manufacturers compensate by using too much wattage, in turn wasting power and increasing the probability of interfering with other radio frequency devices and the network.

Integrated Antennae

The Company has developed and patented technology which facilitates the integration of both the receive and transmit antenna into the single device, without creating a feedback loop. This represents a very significant technological advance permitting the unit to be a self contained plug and play consumer electronic.

Broadband / Narrow band support

The Company’s products can provide amplification for bands from 5 to 60 Mhz.

Smart signal processing

The Company’s product is also capable of “interference & echo” cancellation, in addition to automatic noise suppression. As a result, the signal that reached your cell phone is both better quality and a stronger signal.

Self regulating intelligent power management

The unit is designed to sense cellular signal strength and will automatically adjust amplification to optimum levels.

Enhanced cell phone user experience

The 5BARz unit covers an area of some 4,000 square feet, providing a much increased voice experience and increased data throughput. In addition, the cell phone handset can experience power savings up to 80%.

Additional features

| · | May be factory tuned to specific channel or frequency | |

| · | Multi band 2G/3G support with 4G LTE coming soon | |

| · | No back-haul (internet access) required | |

| · | No latency | |

| · | Small footprint |

12

Intellectual property

| Title | Patent Application | Patent Issued |

| Cell Phone Signal Booster | 11/625331 – US | 8005513 |

| Dual Cancellation Loop Wireless Repeater | 12/106468 – US | |

| Wireless repeater | 13/214983 – US | |

| Wireless Repeater Management Systems | 12/328076 – US | |

| Dual Loop Active and Passive Repeater Antenna Isolation Improvement | 12/425615 – US | |

| 5BARz™ Trademark | 78/866260 | 3819815 |

| Multi-Band Wireless Repeater – CN | 200980146487.1 | |

| Multi-Band Wireless Repeater – IN | 2288/DELNP/2011 | |

| Multi-Band Wireless Repeater – KR | (PCT) 10-2011-7009297 | |

| Multi-Band Wireless Repeater – MX | MX/a/2011/002908 | 301028 |

| Multi-Band Wireless Repeater – US | 12/235313 | 8027636 |

| Remote Management of Network Extenders | 61/943319 | |

| High Gain Wireless Repeaters | 61/943145 | |

| Self Organizing Network Extenders | 61/943797 |

13

Comparative Analysis

|

|

5BARz | Femtocell | Traditional Repeaters |

| Options for Consumer | · Plug and play solutions that significantly improves wireless service | · Carrier-specific box that connects to the internet through the broadband service at the home and acts like a short-range network tower site | · Bi-directional amplifier and external antennas Installation of antennas required with minimum spacing of 35 feet or more between the antennas |

| Easy to Understand | · Simply place the unit where there is some or marginal wireless service, turn on the unit and the voice and data wireless service is improved for everyone | · Connect the unit to your broadband service where your router is located and the voice only wireless service should be improved throughout the home |

· Need to determine what the two pieces of equipment, cables, and multiple power cords are for · Complex manual … Determine the ideal location for both antennas, outdoor network antenna and indoor coverage antenna, then determine ideal location for the bi-directional amplifier for proper cable routing to the antennas · |

| Cost | · One-time equipment charge only$299 5BARz Road Warrior | · Equipment charge $250 for each carrier, 2 carrier house or SOHO equals $500 equipment charge Equipment won’t work if you change carriers Possible monthly fee Requires use of broadband service | · Equipment charge starting at $350 for dual band Professional installation starting at $200Higher performance antennas starting at $100 |

| Setup | · Plug ‘n play No adjustments One part works for all carriers | · Carrier-specific set up May require ISP support Currently Voice Only | · Go on roof to measure signal level; outdoor network antenna placement based on testing for 2 bars or more signal strength Antennas need to be spaced 35 feet or more apart |

| Reliability |

· Designed by engineers and brought to production by managers trained in the Six Sigma quality process Self contained, fewest cables/connectors · Oscillation suppression circuitry |

· Broadband vulnerable: Degraded broadband throughput Power outage Depends on carrier down/power down on carrier command Intermittent handoffs with macro network | · External antennas less reliable Connectors Outdoor mounting Oscillation prone |

| Installation | · None; Plug ‘n play | · Needs to be collocated with broadband service GPS antenna may need to be installed near a window with a cable going to the femtocell | · Professional installation recommended |

14

Products and Markets

To date the Company has introduced two products to market incorporating the 5BARz™ patented technology as follows;

| 5BARz Network Extender | 5BARz Road Warrior |

|

|

|

|

Specifications: System Gain: up to 70 dB Physical dimensions: 140 X 100 X 41 mm Weight: 300 Grams Number of simultaneous users: 10 Frequency bands supported: 2100, 850, 900, 1700 Modes: 3G/2G (Next version will support 4G) and 1800 Power consumption: 5W EIRP (uplink): 25 dBm EIRP (downlink): 10 dBm Flatness: +- 0.5dB Noise figure: < 3.5 dB Operating Temperature: 0 to 40 degrees C External supply: 100 – 240 VAC Commercial Grade Hardware Complies with new FCC requirements for BBA sold in the USA after March 2014 |

Specifications: Maximum input power: +20 dBm Output power: 0.25 watt average /1 watt maximum Service Antenna: Cigarette lighter/power cord antenna Frequency Bands: Full-band US Cellular and full-band US PCS System gain Cell/PCS: 40/45 dB, self-optimizing System noise figure: 5 dB nominal at maximum gain Power Supply: 12 VDC Power dissipation: 6 Watts Dimensions: 5.0″ x 4.75″ x 1.35″ Weight: 1 lb (0.45kg)

|

15

Markets and marketing strategy

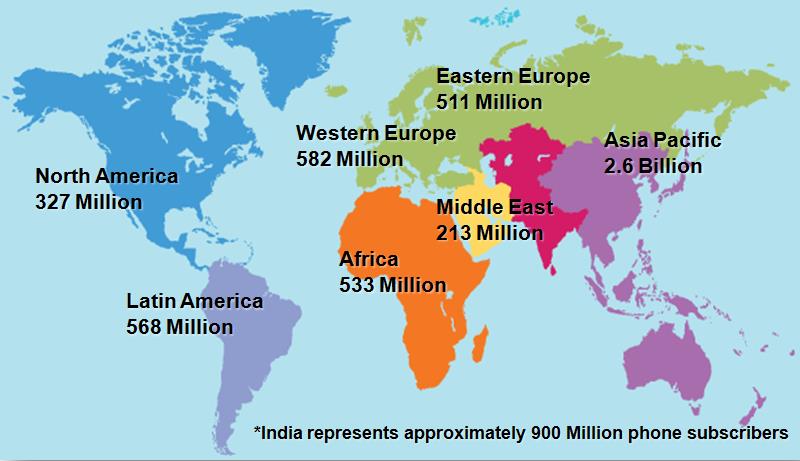

The Company’s primary entry point to markets is through collaborative arrangements with Cellular Network operators globally. That market is comprised of nearly 7 billion cellular subscribers globally segregated by geographic region as follows;

The Company has initially embarked upon a multi channel marketing strategy with initial emphasis in Latin America, India and Africa as a direct result of the very favorable factors and the stage of development of the cellular markets in those regions.

During 2011 through 2013, the Company introduced the initial product, the Road Warrior, to major wireless operators in Latin America for the purpose of their analysis of the 5BARz™ technology. It is the objective of management, that the 5BARz™ products and technology be integrated into the network infrastructure of selected cellular network operators in the region. The intent is to work with cellular network operators in integrating the fixed cellular network extenders, designed for use in the home or office markets. This fixed unit was first unveiled to the market in February 2014 at the Mobile World Congress in Barcelona Spain. These efforts have resulted in the development of a collaborative program, the first with a major global network operator in June 2013. This collaborative program has expanded from it’s inception to date with the Company building product for regions in India and South Africa as well as establishing collaborative arrangements with a greater number of network operators within those regions.

The mobile cellular network extenders (Road Warrior’s), which are not carrier specific are to be marketed through more conventional distribution channels.

16

In addition, it is the intent of management to design future applications of the Company’s technology that will be integrated into the marketplace through the redesign of the products, working in collaboration with Original Equipment Manufacturer’s (OEM’s), such as with automobile manufacturers, computer manufacturers, mobile home manufacturers etc.

The Company has been expanding its employee/consultant base in India, Latin America, and South Africa due to significant product interest in those regions. Further the Company has set a structure for the development of the German speaking market place in Europe, through a subsidiary operation 5BARz AG in Zurich Switzerland.

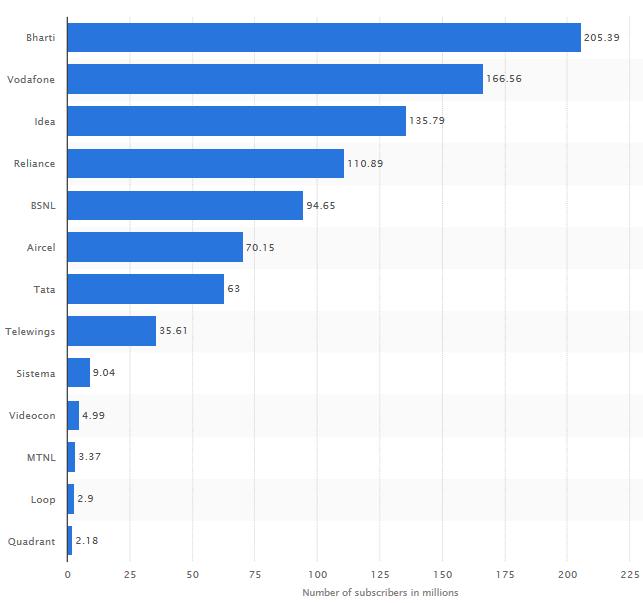

The Wireless Market in India

With a subscriber base of more than 905 million by March 2014, the Mobile telecommunications system in India is the second largest in the world and has been available to private operators since the 1990s. GSM is comfortably maintaining its position as the dominant mobile technology with 80% of the mobile subscriber market. The mobile market is operated by the following cellular network operators;

Source: Statista.com 2015

17

The Wireless Market in India – continued

On the global stage, India saw the fastest growth in new mobile-phone connections with 18 million net additions in the third quarter of 2014, according to a report by Swedish mobile network equipment maker Ericsson. The number of smartphones, which account for just 37 per cent of all mobile-phone subscriptions, is growing at 15 per cent compounded annual growth rate, and will cross 6,100 million by 2020. The falling cost of handsets, coupled with improved usability and increasing network coverage, are factors that are making mobile technology a popular phenomenon in the country.

In December 2014, 5BARz introduced a number of prototype units for use in India, to the Company’s consulting engineering team working in the country for field trials, and then to the R&D department of a select cellular network operator working in the Country. It is the objective of 5BARz to manufacture and distribute the products, working in conjunction with cellular network operators in the country.

The following factors are considered to be particularly relevant with respect to the need for the 5BARz products in India.

| · | In India the monthly churn rate for subscribers is 6% (BMI India Telecommunications Report, 2Q 2012, pp. 49-51). To provide to a cellular network operator a distinct competitive advantage, such as that provided by the 5BARz cellular network extender, could result in a substantive migration of customers to that network operator, and a reduction in churn. |

| · | As provided above, congestion is a prominent issue resulting in the degradation of cellular connectivity. India is the second most populated region in the world, and so the need for the 5BARz technology is most acute. |

| · | Mobile and Wireless Telecommunications issued a report, August 2013 which highlight a number of favorable factors being experienced in the wireless industry in India, which is positive for 5BARz entry into that market as follows; |

| o | The government has recently permitted Foreign Direct Investment in the telecom sector | |

| o | The industry has moved toward a more friendly regulatory environment | |

| o | Burgeoning data usage, has created the need for improved connectivity | |

| o | Customer’s happiness – A vital cornerstone of any service is the customer. His satisfaction is a direct indicator of running a good business. And this is primarily the service providers’ responsibility. 5BARz is offering to service providers improved connectivity for their customers. |

The LATAM Market

The Company has analyzed the fundamentals of the mobile phone market in the LATAM countries and has determined that to be a key point for market penetration for the 5BARz™ products for the following reasons;

First, the mobile phone market has just gone through a very strong decade of growth in Latin America, with mobile subscriptions having overtaken fixed lines as the preferred method of communication. As a result Latin America's mobile telephone industry has a high degree of market penetration. Mobile subscriptions totaled 88.2% of the region's population, compared to 55.2% in Asia Pacific, 90.4% in North America and 50.6% in the Middle East and Africa. Having recently invested heavily in subscription development, the cellular network operators are now focusing upon the maintenance of their substantial customer base, and the 5BARz™ technology can contribute substantially to achieving that customer satisfaction.

The mobile telephone industry in Latin America has benefited from generally opening up to competition. This provides a very fertile ground for the introduction of a technology such as 5BARz™ to secure customer retention through quality of service.

The inherent geographical difficulties in laying fixed line infrastructure have encouraged a move to mobiles, but in addition, that geography, the Andean and Rainforest regions and expanses of rural areas again benefit from the 5BARz™ technology whereby weak cellular signal is amplified within the vicinity of the user.

18

The LATAM Market – continued

Further the LATAM countries are experiencing a renewed era of strong growth, reflecting reviving economic growth and improving income levels. This again is a favorable factor for the introduction of our products to meet the growing demands of consumers.

In addition, the launch of 3G and mobile broadband services has increased demand for mobile subscriptions. Mobile broadband is particularly desirable in areas with no or limited access to cable internet services. Moving to mobiles offers consumers the benefits of on-the-move communications and advantageous introductory deals. Greater access to communications also helps to narrow regional divides. All of these factors are enhanced by the 5BARz™ experience.

Internet usage is expanding since 2010, with broadband internet subscriptions generally growing by higher rates than mobile subscriptions

Initial 3G market expansion is likely to be greater in the region's wealthier markets, such as Argentina, Chile and Mexico, and these have been specifically targeted by our Company with very favorable results.

The LATAM market is comprised of 568 million cellular subscribers.

In 2014, the Company imported 1,000 Road Warrior units into the Region and obtained necessary approval for the sale of those units in Mexico. In January 2015, the Company incorporated a subsidiary company in Mexico to commence sales of that product. The R&D team are currently working on several new and innovative products that will fit the needs of the Region.

The DACH MARKET – 5BARz AG

The DACH/D-Deutschland or Germany, A-Austria and CH-Switzerland group of countries in the European Union represents one of the most technologically advanced and progressive sectors of that economic group representing a German speaking majority population base of 90.3 million people, comprised of Germany with 78.3 million, Austria, 7.4 million, and Switzerland, 4.6 million. The Company established a 94.3% owned subsidiary, 5BARz AG to operate the sales, marketing and distribution of the Company’s products in this region of the world, pursuant to an exclusive license agreement.

The product which 5BARz introduced into India at the end of 2014, has a technical configuration design which meets the operating requirements for the majority of the 130 million subscribers in this region. The Company has developed the strategic relationships and infrastructure so that it is poised to enter this marketplace as well.

In late 2014,

5BARz International, Inc. was advised that a corporate finance company (BDC Investment AG) involved in the financing of

5BARz, was placed into liquidation by Swiss Authorities. At that time the liquidation of companies that the corporate

finance firm had funded was also ordered. This included 5BARz AG., and accordingly it was placed into

liquidation. 5BARz International, Inc. is seeking a termination of the liquidation of 5BARz AG by dealing with the Swiss

Authorities.

19

Item 1A. Risk Factors

Need For Additional Financing

The Company has very limited funds, and such funds may not be adequate to take advantage of current and planned business opportunities. Even if the Company's funds prove to be sufficient to obtain sales orders for products, the Company may not have enough capital to fully develop the opportunity. The ultimate success of the Company may depend upon its ability to raise additional capital. As additional capital is needed, there is no assurance that funds will be available from any source or, if available, that they can be obtained on terms acceptable to the Company. If not available, the Company's operations will be limited.

Ability to continue as a going concern.

The Company has incurred net losses for the period from inception November 14, 2008, to December 31, 2014. The Company has earned no revenues to date. Consequently the Company’s future is dependent upon their ability to obtain financing and to execute upon their business plan and to create future profitable operations for the business. These factors raise substantial doubt that the Company will be able to continue as a going concern. In the event that the Company cannot raise further debt or equity capital, or achieve profitable operations, the Company may have to liquidate their business interests and investors may lose their investment.

Lack of profitable operating history

The Company faces all of the risks of a new business and the special risks inherent in the investigation, acquisition, and involvement in a new business opportunity. The Company must be regarded as a new or "start-up" venture with all of the unforeseen costs, expenses, problems, and difficulties to which such ventures are subject, and consequently has a high risk or failure.

Dependence upon two directors and limited management and consultants

The Company currently has only two individuals serving as its officers and directors, and five employees and approximately twenty consultants. The Company will be heavily dependent upon their skills, talents, and abilities to implement its business plan, and secure additional personnel and may, from time to time, find that the inability of the officers and directors to fully meet the needs of the business of the Company results in a delay in progress toward implementing its business plan.

We may conduct further offerings in the future in which case investors' shareholdings may be diluted.

Since our inception, we have relied on sales of our common stock to fund our operations. We may conduct further equity offerings in the future to finance our current operations. If common stock is issued in return for additional funds, the price per share could be lower than that paid by our current stockholders. We anticipate continuing to rely on equity sales of our common stock in order to fund our business operations. If we issue additional stock, investors' percentage interests in us will be diluted. The result of this could reduce the value of current investors' stock.

20

Regulation of Penny Stocks.

The Company's securities are subject to a Securities and Exchange Commission rule that imposes special sales practice requirements upon broker-dealers who sell such securities to persons other than established customers or accredited investors. For purposes of the rule, the phrase "accredited investors" means, in general terms, institutions with assets in excess of $5,000,000, or individuals having a net worth in excess of $1,000,000 or having an annual income that exceeds $200,000 (or that, when combined with a spouse's income, exceeds $300,000). For transactions covered by the rule, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser's written agreement to the transaction prior to the sale. Consequently, the rule may affect the ability of broker- dealers to sell the Company's securities and also may affect the ability of purchasers in this offering to sell their securities in any market that might develop therefore.

In addition, the Securities and Exchange Commission has adopted a number of rules to regulate "penny stocks." Such rules include Rules 3a51-1, 15g-1, 15g-2, 15g-3, 15g-4, 15g-5, 15g-6, 15g-7, and 15g-9 under the Securities Exchange Act of 1934, as amended. Because the securities of the Company may constitute "penny stocks" within the meaning of the rules, the rules would apply to the Company and to its securities. The rules may further affect the ability of owners of Shares to sell the securities of the Company in any market that might develop for them.

Shareholders should be aware that, according to Securities and Exchange Commission, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) "boiler room" practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (iv) excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. The Company's management is aware of the abuses that have occurred historically in the penny stock market. Although the Company does not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to the Company's securities.

Our common stock is not listed on a national exchange and as a public market develops in the future, it may be limited and highly volatile, which may generally affect any future price of our common stock.

Our common stock currently is listed only in the over-the-counter market on the OTCQB, which is a reporting service and not a securities exchange. We cannot assure investors that in the future our common stock would ever qualify for inclusion on any of the NASDAQ markets for our common stock, The American Stock Exchange or any other national exchange or that more than a limited market will ever develop for our common stock. The lack of an orderly market for our common stock may negatively impact the volume of trading and market price for our common stock.

21

Any future prices for our common stock will be determined in the marketplace and may be influenced by many factors, including the following:

| · | the depth and liquidity of the markets for our common stock; |

| · | investor perception of 5BARz International Inc. and the industry in which we participate; |

| · | general economic and market conditions; |

| · | statements or changes in opinions, ratings or earnings estimates made by brokerage firms or industry analysts relating to the market in which we do business or relating to us specifically, as has occurred in the past; |

| · | quarterly variations in our results of operations; |

| · | general market conditions or market conditions specific to technology industries; and |

| · | domestic and international macroeconomic factors. |

In addition, the stock market has recently experienced extreme price and volume fluctuations. These fluctuations are often unrelated to the operating performance of the specific companies. As a result of the factors identified above, a stockholder (due to personal circumstances) may be required to sell his shares of our common stock at a time when our stock price is depressed due to random fluctuations, possibly based on factors beyond our control.

Impracticability of Exhaustive Investigation.

The Company's limited funds and the lack of full-time management will likely make it impracticable to conduct a complete and exhaustive investigation and analysis of its chosen business opportunity before the Company commits its capital or other resources thereto. Management decisions, therefore, will likely be made without detailed feasibility studies, independent analysis, market surveys and the like which, if the Company had more funds available to it, would be desirable.

Other Regulation.

The Company may be subject to regulation or licensing by federal, state, or local authorities. Compliance with such regulations and licensing can be expected to be a time-consuming, expensive process and may limit other investment opportunities of the Company.

Failure to Perform

The Company may be unable to comply with the payment terms of certain agreements providing the Company with the exclusive sales marketing and distribution rights to 5BARz™ product. In the event that the Company defaults on such agreements, the Company may be unable to maintain operations as a going concern.

Reliance on Third parties

The Company has entered into certain agreements related to the exclusive sales marketing and distribution rights. In the event that the production Company is unable or unwilling for any reason to supply product under the terms of such agreement, the Company may not be able distribute product or may have business interrupted as they secure alternative production facilities.

22

Competitive Technologies

The Companies technology relates to a market that is highly competitive and a much sought after solution by cellular networks. The Company expects to be at a disadvantage when competing with firms that have substantially greater financial and management resources and capabilities than the Company. The Company is subject to technological obsolescence should other technologies be developed which are superior to the Companies technology.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Description of Properties

The Company has a leased property in San Diego, California, referred to as the “Innovation Center” for the Company, and is the offices of the Engineering department of the Company. The location of the innovation center is 9444 Waples Street, Suite 140, San Diego, California, 92121.

In addition, the Company has a leased office in Miami, Florida which is the finance and administrative office for the Company, located at 1111 Brickell Ave., 11th Floor, Miami, Florida 33131

We believe that our existing facilities, comprised of leased facilities, are in good condition and suitable for the conduct of our business.

For additional information regarding obligations under operating leases, see Note 10 to the Consolidated Financial Statements.

Item 3. Legal Proceedings

Management is not aware of any legal proceedings contemplated by any governmental authority or any other party involving us or our properties, other than those listed below . As of the date of this Annual Report, no director, officer or affiliate is (i) a party adverse to us in any legal proceeding, or (ii) has an adverse interest to us in any legal proceedings. Management is not aware of any other legal proceedings pending or that have been threatened against us or our properties.

Prior to the Company’s investment in CelLynx, on July 19, 2010 certain claims for unpaid wages were filed against CelLynx, Inc. Judgments were obtained commencing in August 2011 for back wages by some of its former employees. Some of those claims have been partially paid and others were expected to be paid in the normal course of business or were to be otherwise defended. Those claims have now been incorporated into California Labor Commission awards in favor of those former employees. Those awards total approximately $263,000 depending on interest charges. It is the Company’s intention to pay these amounts. As of December 31, 2014 the Company accrued $263,000 in its financial statements.

On September 11, 2014, a claim was filed in the District Court of Colorado against the Company claiming unpaid fees related to an investment conference held on October 5, 2012. Accredited Members, Inc. vs. 5BARz International, Inc. 14CV32449 (Arapahoe County). The claim in the amount of $9,000 alleges that 5BARz was to pay the conference fee of $4,500 by delivery of $9,000 in common shares of the Company at a price of $0.05 per share, or 180,000 shares. The Company had disputed the claim. On February 13, 2015 the action was dismissed in return for payment of 255,000 shares of 5BARz International, Inc. common stock.

23

In November 2014, the Company was advised that an investment banking firm (BDC Investment AG) involved in the financing 5BARz AG in Zurich Switzerland, was placed into liquidation by Swiss Authorities, and at that time the liquidation of companies in the country that the investment banking firm had funded was also ordered. This included 5BARz AG., and accordingly that entity was placed into liquidation. On January 8, 2015, FINMA issued a communication advising of the cessation of the liquidation of the investment banking firm. 5BARz International, Inc. has engaged counsel and is seeking a similar termination of liquidation of their subsidiary Company.

Item 4. Mine Safety Disclosures

Not applicable

PART II

Item 5. Market for Registrants Common Equity; Related Stockholder Matters and Issuer Purchase of Equity Securities

Our common stock trades on the OTC Bulletin Board system under the symbol “BARZ”. The stock commenced trading in October 2010.

The High/Low price at which the stock traded during the two year period ended December 31, 2014 are as follows;

| Quarter Ended | High | Low |

| October 1 –December 31, 2014 | $0.19 | $0.09 |

| July 1 – September 30, 2014 | $0.23 | $0.17 |

| April 1- June 30, 2014 | $0.23 | $0.16 |

| January 1 – March 31, 2014 | $0.27 | $0.17 |

| October 1 –December 31, 2013 | $0.35 | $0.12 |

| July 1 – September 30, 2013 | $0.24 | $0.09 |

| April 1- June 30, 2013 | $0.25 | $0.05 |

| January 1 – March 30, 2013 | $0.10 | $0.05 |

Holders of Record

As of March 20, 2015, the last sale price of our common stock on the OTCBB was $0.14 per share. As of March 20, 2015, there were approximately 247 stockholders of record holding 218,974,013 common shares.

Dividend Policy

We have neither paid nor declared dividends on our common stock since our inception and do not plan to pay dividends in the foreseeable future. Any earnings that we may realize will be retained to finance our growth.

Private Placements

On January 25, 2013 the Company issued 100,000 shares and warrants in settlement of accounts payable for services rendered in the amount of $5,000.

On February 12, 2013 the Company issued 125,000 shares of common stock at a price of $0.06 per share as partial settlement of $7,500 due under a note payable.

On February 15, 2013 the Company issued 1,440,000 shares of common stock at a price of $0.05 per share, for services with a total value of $72,000.

24

On February 26, 2013 the Company issued 250,000 shares of common stock at a price of $0.04 per share, in settlement of accounts payable with a total value of $10,000.

On February 26, 2013 the Company issued 91,780 shares of common stock at a price of $0.05 per share, in settlement of accounts payable with a total value of $4,589.

On March 1, 2013 the Company issued 175,000 shares of common stock at a price of $0.05 per share, for services with a total value of $8,750.

On March 1, 2013 the Company issued 600,000 shares of common stock at a price of $0.05 per share, for aggregate proceeds of $30,000.

On March 17, 2013 the Company issued 513,827 shares of common stock at a price of $0.05 per share, in settlement of accounts payable with a total value of $25,691.

On March 31, 2013 the Company issued 100,000 shares of common stock at a price of $0.05 per share, in settlement of accounts payable with a total value of $5,000.

During the period from January 4, 2013 to June 21, 2013 the Company issued 11,735,000 units at a price of $0.05 per unit for aggregate proceeds of $586,750. Each unit is comprised of one share and one share purchase warrant to acquire a second share at a price of $0.20 per share acquired, with a two year warrant term.

On April 1, 2013 the Company issued 425,000 shares and warrants, with a two year term and $0.20 exercise price, in settlement of accounts payable with a total value of $21,250.

On April 10, 2013 the Company issued 600,000 shares of common stock at a price of $0.05 per share, for aggregate proceeds of $30,000.

On May 15, 2013 the Company issued 200,000 shares of common stock at a price of $0.05 per share for services with a total value of $10,000.

On May 23, 2013 the Company issued 200,000 shares and warrants, with a two year term and $0.20 exercise price, in settlement of accounts payable with a total value of $10,000.

On May 28, 2013 the Company issued 100,000 shares of common stock at a price of $0.05 per share, for debt with a total value of $5,000.

On July 1, 2013 the Company issued 331,200 shares and warrants, with a two year term and $0.20 exercise price, for services with a total value of $66,240.

During the period July 25, 2013 to March 6, 2014 the Company issued 29,215,000 units at a price of $0.10 per unit for aggregate proceeds of $2,921,500. Each unit is comprised of one share and one share purchase warrant to acquire a second share at a price of $0.30 per share acquired, with a two year term on the attached warrant.

During the period from September 5, 2013 to November 18, 2013 the Company issued 6,044,108 units at a price of $0.10 per unit in order to settle debts, with a total value of $604,411. Each unit is comprised of one share and one share purchase warrant to acquire a second share at a price of $0.30 per share acquired, with a two year term on the attached warrant.

On November 15, 2013 the Company issued 25,000 shares as partial conversion of a note payable at a price of $0.20 per share for a total debt reduction of $5,000.

On January 15, 2014 the Company issued 100,000 shares at a price of $0.167 per share for the settlement of notes payable with a total value of $16,700.

25

Private Placements - continued

On February 10, 2014 the Company issued 405,581 shares at a price of $0.2465 per share for services with a total fair value of $100,000.

On February 10, 2014 the Company issued 1,250,000 shares at a price of $0.23 per share for services with a total fair value of $287,500.

During the period March 6, 2014 to November 14, 2014 the Company issued 23,103,632 units at a price of $0.15 per unit for aggregate proceeds of $3,465,545. Each unit is comprised of one share and one share purchase warrant to acquire a second share at a price of $0.30 per share acquired, with a two year term on the attached warrant.

During the period April 28, 2014 to September 30, 2014 the Company issued 325,000 units at a price of $0.15 per unit for services with a total value of $48,750. Each unit is comprised of one share and one share purchase warrant to acquire a second share at a price of $0.30 per share acquired, with a two year term on the attached warrant.

On May 1, 2014 the Company issued 2,000,000 shares for services valued at $160,000.

On May 29, 2014 the Company issued 347,222 shares at a price of $0.144 per share for the settlement of notes payable with a total value of $50,000.

During the period June 1, 2014 to September 30, 2014 the Company issued 200,000 shares at a price of $0.20 per share for services with a total fair value of $40,000.

On July 8, 2014 the Company entered into a settlement for debt agreement with the Chairman of the Board, in the amount of $105,000. Pursuant to the terms of the agreement the Company issued 700,000 units at a price of $0.15 per unit. Each unit is comprised of one share and one share purchase warrant to acquire a second share at a price of $0.20 per share acquired, with a two year term on the attached warrant.

On July 16, 2014 the Company issued 11,400 shares at a price of $0.05 per share for services with a total fair value of $570.

On August 14, 2014 the Company issued 32,500 shares at a price of $0.22 per share for services with a total fair value of $7,150.

On October 1, 2014 the Company issued 25,000 shares at a price of $0.17 per share for services with a total fair value of $4,250.

On November 1, 2014 the Company issued 25,000 shares at a price of $0.14 per share for services with a total fair value of $3,500.

During the period November 21, 2014 to March 20, 2015 the Company issued 20,022,500 units at a price of $0.05 per unit for aggregate proceeds of $1,001,125. Each unit is comprised of one share and one share purchase warrant to acquire a second share at a price of $0.30 per share acquired, with a two year term on the attached warrant. The number of units within this offering that had been issued by December 31, 2014 were 15,200,000 for aggregate proceeds of $760,000.

On January 13, 2015 the Company issued 331,986 shares at a price of $0.0698 per share for the settlement of notes payable with a total value of $23,000.

On February 1, 2015 the Company issued 180,000 shares at a price of $0.05 per share for debt with a total fair value of $9,000.

On February 1, 2015 the Company issued 75,000 shares at a price of $0.05 per share for services with a total fair value of $7,500.

On February 20, 2015 the Company issued 180,000 shares at a price of $0.05 per share for services with a total fair value of $9,000.

26

Equity Compensation Plans

On May 17, 2013 the Board of Directors of the Company adopted the 2013 Stock Option plan.

| Plan Category | (a) Number of common shares to be issued pursuant to outstanding options | (b) Weighted Average exercise price of outstanding options | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

| Equity compensation plans approved by shareholders | |||

| Equity compensation plans not approved by shareholders | 12,250,000 | $0.15 | 7,750,000 |

| Total | 12,250,000 | $0.15 | 7,750,000 |

Item 6. Selected Financial Data

Not applicable for smaller reporting company.

Item 7. Management’s Discussion and Analysis of Financial Condition and Result of Operations

You should read the following discussion together with our consolidated financial statements and the related notes and other financial information included elsewhere in this report. The discussion in this report contains forward-looking statements that involve risks and uncertainties, such as statements of our plans, objectives, expectations and intentions. The cautionary statements made in this report should be read as applying to all related forward-looking statements wherever they appear in this report. Our actual results could differ materially from those discussed here.

Overview

5BARz International Inc. is the owner, developer and sales and marketing Company for a line of cellular network devices branded under the 5BARz™ . These highly engineered products are state of the art consumer electronics that manage cell signal within the proximity of the user providing much improved cellular clarity. The products are plug and play, without the need for extensive set up, and can be delivered as carrier agnostic or set to operate on a single carrier’s network. The first product brought to market is the 5BARz™ Road Warrior, a plug and play device designed for users on the go.

The Company unveiled a new version, the 5BARz™ Network Extender in February 2014 which represents a carrier grade cellular device to be used in the home or office, which is again a plug and play device with an operating radius of approximately 4,000 square feet. The Company is in the process of introducing these new units to cellular network operators globally with the intent of having those operators integrate the units into their portfolio of products for network improvement for their subscriber base.

The Company is engaged in the financing, product development and the sales and marketing activities required to launch this business globally.

The financial and business analysis below provides information we believe is relevant to an assessment and understanding of our financial position, results of operations and cash flows. This financial and business analysis should be read in conjunction with the financial statements and related notes included in this form 10-K.

27

Going Concern

The registrant has an accumulated deficit through December 31, 2014 totaling $14,862,230 and recurring losses and negative cash flows from operations. Because of these conditions, the registrant will require additional working capital to develop its business operations. The registrant's success will depend on its ability to raise money through debt and the sale of stock and the development and sale of product to meet its cash flow requirements. The ability to execute its strategic plan is contingent upon raising the necessary working capital to launch the global sales and marketing activities for the Company.

Management believes that the market sectors that it is in the process of developing in Latin America, sectors within Western Europe, and the USA will yield significant results in the current fiscal year. Further, the efforts that the Company has made to promote its business, by introducing the products to Cellular Network operators and having the products tested for technical efficacy, has positioned the Company for integration of the products through cellular network operators. Management is focused upon achieving that goal. If the Company’s capital raising efforts do not continue to be successful, the registrant's ability to continue as a going concern will be in question. The financial statements do not include any adjustments relating to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might be necessary should the registrant be unable to continue as a going concern.

Results of Operations

Year ended December 31, 2014 compared to the year ended December 31, 2013.

|

Year ended December 31 2014 |

Year ended December 31, 2013 |

Difference | ||||||||||

| Amortization and depreciation | $ | 282,636 | 10,512 | 272,124 | ||||||||

| Bank charges and interest | 74,473 | 59,056 | 15,417 | |||||||||

| Sales and marketing expenses | 1,210,812 | 194,750 | 1,016,062 | |||||||||

| Research and development | 4,123,841 | 806,047 | 3,317,794 | |||||||||

| General and administrative expenses | 3,704,013 | 2,229,904 | 1,474,109 | |||||||||

| Total Operating Expenses | 9,395,775 | 3,300,269 | 6,095,506 | |||||||||

| Other income (expenses) | (344,461 | ) | 1,003,669 | (1,348,130) | ||||||||

| Net Loss | $ | (9,740,236 | ) | (2,296,600 | ) | (7,443,636) | ||||||

The year ended December 31, 2014 reflects a net loss of $9,740,236 representing an increase in the loss of $7,443,636 compared to the year ended December 31, 2013 loss of $2,296,600.

The total operating expenses for the year ended December 31, 2014 were $9,395,775 (2013 - $3,300,269). The Company has continued to pursue the financing of its operations during the year and the commercialization of its technology, and products in India and Latin America. The Company incurred sales and marketing expenses of $1,210,812 (2013 – $194,750) and general and administrative expenses of $3,704,013 ( 2013 - $2,229,904). The most significant portion of the operating expense increase of $6,095,506 is the $3,317,794 increase in research and development expenses, resulting from the growth in the Company’s team of engineers and consultants, working in conjunction with our collaborative partners, building prototype units provided to cellular network operators for adoption by them as a part of their solutions for improved connectivity for their subscribers. The Company’s Innovation Center in San Diego California is fully operational at this time, as well as a team of engineers in India, that was not fully engaged in the prior fiscal year. The results of these efforts have made a substantive improvement in the Company’s products and technology portfolio.

28