Attached files

| file | filename |

|---|---|

| EX-1 - EXHIBIT 1 - Max Sound Corp | f10k2014ex_i.htm |

| EX-3 - EXHIBIT 3 - Max Sound Corp | f10k2014ex_iii.htm |

| EX-5 - EXHIBIT 5 - Max Sound Corp | f10k2014ex_v.htm |

| EX-8 - EXHIBIT 8 - Max Sound Corp | f10k2014ex_vii.htm |

| EX-11 - EXHIBIT 11 - Max Sound Corp | companycertification10k.htm |

| EX-10 - CERTIFICATION CFO - Max Sound Corp | halperncertification10k.htm |

| EX-9 - CERTIFICATION CEO - Max Sound Corp | blaisurecertification10k.htm |

| EX-7 - EXHIBIT 7 - Max Sound Corp | f10k2014ex_vi.htm |

| EX-2 - EXHIBIT 2 - Max Sound Corp | f10k2014ex_ii.htm |

| EX-4 - EXHIBIT 4 - Max Sound Corp | f10k2014ex_iv.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______to______.

Commission file number 000-51886

| MAX SOUND CORPORATION | ||

| (Exact name of registrant as specified in its charter) | ||

| Delaware | 26-3534190 | |

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) | |

2902A Colorado Avenue Santa Monica, CA 90404 |

90404 | |

| (Address of principal executive offices) | (Zip Code) | |

| Registrant’s telephone number, including area code: 888-777-1987 | ||

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.00001 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if

any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | | Accelerated filer | | |

Non-accelerated filer (Do not check if a smaller reporting company) |

| Smaller reporting company | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No

The Aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2014 as approximately $14,241,146.

As of March 24, 2015, the registrant had 285,044,350 shares issued and outstanding.

Documents Incorporated by Reference:

None.

TABLE OF CONTENTS

| PART I | ||

| ITEM 1. | BUSINESS | 1 |

| ITEM 1A. | RISK FACTORS | 9 |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | 9 |

| ITEM 2. | PROPERTIES | 9 |

| ITEM 3. | LEGAL PROCEEDINGS | 9 |

| ITEM 4. | MINE SAFETY DISCLOSURES | 11 |

| PART II | ||

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 12 |

| ITEM 6. | SELECTED FINANCIAL DATA | 22 |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 23 |

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 35 |

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 36 |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 18 |

| ITEM 9A. | CONTROLS AND PROCEDURES | 18 |

| PART III | ||

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 63 |

| ITEM 11. | EXECUTIVE COMPENSATION | 65 |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 67 |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 67 |

| ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | 68 |

| PART IV | ||

| ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 68 |

| SIGNATURES | 69 | |

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-Q (this “Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

CERTAIN TERMS USED IN THIS REPORT

When this report uses the words “we,” “us,” “our,” and the “Company,” they refer to Max Sound Corporation, and “SEC” refers to the Securities and Exchange Commission.

PART I

ITEM 1. BUSINESS

Overview

Max Sound Corporation (“we,” “us,” “our,” or the “Company”) was incorporated in the State of Delaware on December 9, 2005 as 43010, Inc. to engage in any lawful corporate undertaking, including, but not limited to, locating and negotiating with a business entity for combination in the form of a merger, stock-for-stock exchange or stock-for-assets exchange. On October 7, 2008, pursuant to the terms of a stock purchase agreement, Mr. Greg Halpern purchased a total of 100,000 shares of our common stock from Michael Raleigh for an aggregate of $30,000 in cash. The total of 100,000 shares represents 100% of our issued and outstanding common stock at the time of the transfer. As a result, Mr. Halpern became our sole shareholder. As part of the acquisition, and pursuant to the Stock Purchase Agreement, Michael Raleigh, our then President, CEO, CFO, and Chairman resigned from all the positions he held in the company, and Mr. Halpern was appointed as our President, CEO CFO and Chairman. The original business model was developed by Mr. Halpern in September of 2008 and began when he joined the Company on October 7, 2008. In October 2008, we became a development stage company focused on creating an Internet search engine and networking web site.

From October 2008 until January 17, 2011, Mr. Halpern was our CEO, and during that time the Company was focused on developing their Internet search engine and networking web site. In January of 2010, the Company launched their Internet search engine and networking website. In 2011, the Company decided to abandon its social networking website. On May 11, 2010, the Company acquired the worldwide rights, title, and interest to all fields of use for MAX-D.

On January 17, 2011, Mr. Halpern resigned as the Company’s CEO and John Blaisure was appointed as CEO. In February of 2011, the Company elected to change its business operations and focus primarily on developing and launching the MAX-D technology. Our current website (www.maxsound.com) is used to showcase the MAX-D technology. On March 8, 2011, the Company changed its name to Max Sound Corporation, and its trading symbol on the OTC Bulletin Board to MAXD.

MAX Sound Corporation owns the worldwide rights to all fields of use to MAX-D HD Audio, which was invented by Lloyd Trammell, a top sound designer and audio engineer who helped develop and sell the first working Surround Sound System to Hughes Aircraft. Mr. Trammell, who is now the CTO of MAX-D, also developed MIDI for Korg and owns five patents in dimensional sound processing. We believe that MAX-D is to Audio what High Definition is to Video. MAX-D works by converting all audio files to their highest possible acoustically perfect equivalent without increasing files size or bandwidth usage.

The Company shall act as the exclusive agent to facilitate and negotiate any opportunities on behalf of EA Technology to Companies, Organizations and other qualified entities. Upon any closing, EA shall receive 50% of gross dollars and the Company shall receive the other 50% at the time of a completion of any transaction opportunity, including legal settlements after subtracting applicable contingent legal fees. In the event the Company sublicenses EA to other entities, profits shall be split 50/50.

On May 22, 2014, MaxD entered into a representation agreement with architect Eli Attia giving MAXD the exclusive rights to sue violators of Eli Attia’s intellectual property rights. MAXD has since filed suit against Google, Inc., Flux Factory, and various executives of these companies for misappropriation of trade secrets.

On May 28, 2014, the Company entered into a license agreement with Akyumen Technologies Corp. (“Akyumen”), an original equipment manufacturer of mobile devices, for the non-exclusive, non-transferable, indivisible worldwide license rights to the use of Company’s API technology in Akyumen’s mobile devices. The license is for five years and is renewable, with the Company’s approval, at Akyumen’s request.

| 1 |

As consideration for the above-referenced license rights, Akyumen agreed to pay the Company royalties of $2.50 per Akyumen device that utilizes the API technology, to be payable on a monthly basis within 15 days after the close of the calendar month. Akyumen also agreed to pay, within three months of first sale, 50% of non-recurring engineering costs to port the Technology onto the operating systems of the Akyumen devices, inclusive of any local fees, taxes, or other charges.

In December 2014, the CEO of Akyumen notified the Company that Akyumen entered into a contract in Asia representing five million mobile device units, and further that the company is engaged in high level discussions with major cellular carriers in Europe and the Middle East, estimating that another ten million mobile device units should come from those regions in the year 2015. Moreover, Akyumen announced in November 2014 the building of a five million state of the art manufacturing and assembly facility in Bahrain allowing the company the ability to produce over ten million units for that region.

The Company continues to work with Akyumen executives and developers to assist in getting the MAX-D-HD Audio ported onto their mobile devices and into the consumer marketplace. While the Akyumen product continues to improve the company still needs to increase positive consumer reviews and excitement.

On June 16, 2014, MAXD entered into a license and revenue share agreement with LOOKHU, an online subscription service that delivers movies, music, television shows, apps and games. The agreement grants LOOKHU non-exclusive, non-transferable, indivisible worldwide license rights to the distribution and use of the Company’s Application Programming Interface (“API”) audio processor technology. The license is for five years and is renewable, with the Company’s approval, at LOOKHU’s request. The Company is continuing to work closely with the LOOKHU program developers, and is building the LOOKHU/MAX-D HD powered version, which product the Company expects with no assurances to be available in late first quarter 2015.

As consideration for the above-referenced license rights, LOOKHU agreed to pay the Company royalties of $0.25 per month per paid subscription to the technology, to be payable on a monthly basis. Additionally, LOOKHU agreed to pay the Company 4% of the net advertising revenue derived from advertising that utilizes the technology, to be payable on a quarterly basis.

Additionally, for the term of the agreement, the parties agreed to split, on a 50/50 basis, net revenue derived from sales of digital music or songs played from a LOOKHU software player, to be payable on a monthly basis.

No later than June 20, 2014, MAXD entered into a representation agreement with VSL Communications, Inc., making MAXD the exclusive agent to VSL to enforce all rights with respect to patented technology owned by VSL subsidiary Vedanti Systems Limited. In particular, last summer, the Company announced that it had acquired a worldwide license and representation rights to a patented video and data technology “Optimized Data Transmission System and Method” which enables end-user licensees to transport 100% of data bandwidth content in only 3% of the bandwidth with the identical lossless quality. Significantly, this represents thirty three times reduction associated with transport cost and the time it takes for the video or digital content to be viewed by an end-user. As described more fully in the Legal Proceedings Section, The Company has since filed suit against Google, Inc., YouTube, LLC, and On2 Technologies, Inc., alleging willful infringement of the patent.

| 2 |

Description of Our Business

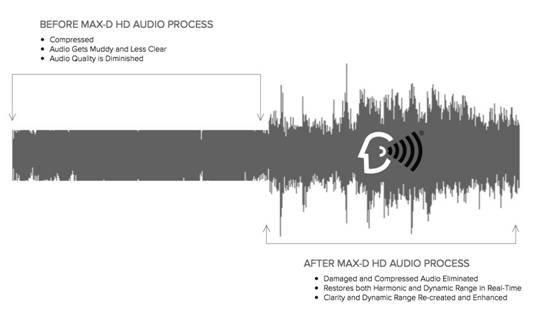

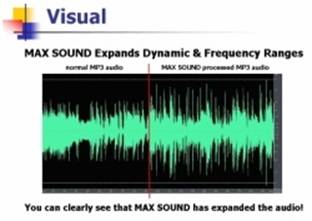

Max Sound (MAX-D) is engaged in activities to sell and license products and services based on its patent-pending MAX-D HD Audio Technology for sound recording and playback that dramatically improves the listener’s experience. The MAXD-D HD Audio Technology delivers high definition audio without increasing file size.

The Company is marketing MAX-D on the basis that it is to audio what HD is to video. MAX-D technology improves all types of audio; moreover, it is intended to be particularly valuable in improving the ever-growing use of compressed audio and video as used in mp3 files, iPods, internet, and satellite/terrestrial broadcasting. For example, a listener using a portable mp3 player with MAX-D will experience sound quality that is comparable to the original CD before it was converted into an mp3 file. In another example, cell phone users using a cell phone equipped with MAX-D will hear the other person's voice as if they are speaking directly in front of them. The Company believes that the MAX-D HD is better for a consumers hearing than today’s highly compressed audio and anticipate that continued research and development will support the Company’s position. In numerous consumer audio tests, MAXD-D HD sounded better to consumers than high resolution WAV files. Importantly, MAX-D HD remains one tenth the size of a WAV file, and in the Company’s opinion offers more clarity, dimension, articulation and impact in every range of the audio spectrum to the listener The Company’s current business model is to license the technology to content creators, manufacturers, and network broadcasters. The Company’s patent-pending technology stands customer ready today. The Company’s market pursuits include motion picture, music recording, video game, broadcasting, internet video and audio, automobile infotainment systems and consumer electronics.

The Company has grown this year to a staff of 18, including employees and sub-contractors. We now have an infrastructure that is allowing us to expand and execute quickly. In addition we have established business relationships with the leading companies in the Smartphone, Tablet, Chip, Music and Consumer Retail business. The Company is now executing its “Go To Market” strategy and sales programs as a first market mover solving the degraded compressed audio issues plaguing the audio currently being consumed. These companies dominate the multi-media and electronics technology arena providing audio delivery across all channels of the exploding smartphone tablet device phenomenon.

Qualcomm

We have entered into a license agreement with Qualcomm that enables our MAX-D technology to be on Qualcomm’s Snapdragon DSP. The license agreement is automatically renewable for one-year periods unless terminated by either party with 30 days prior written notice. By residing on the Qualcomm Snapdragon DSP, the MAX-D HD Audio Technology will have the ability to control and convert to HD Audio up to 8 audio processes simultaneously. This will include Cellular Voice transmission and termination, streaming video, streaming audio and all content stored on the device in memory. Qualcomm currently has a significant portion of the entire global chip market for all smartphones and tablets and they believe their growth rate mirrors the industry. We anticipate a strong adoption from the OEMs licensing the MAX-D technology. Now that MAX-D is part of the Snapdragon Chip, we believe MAX-D can be successfully deployed on the chip, and will have the ability to be offered to up to 86 of Qualcomm’s OEM’s on potentially hundreds of millions of devices every quarter.

Since the Company’s debut at the Qualcomm Upling conference in San Diego over a year ago, we remain engaged with some of the largest OEM’s in the smart phone device market. Our sales and marketing team are continuing in advanced high-level strategic meetings with industry leaders in the chip manufacturing and device hardware sectors. The Company is operating under several NDA’s and R&D Test Agreements with today’s most well-known industry to implement and license the MAX-D HD onto their platforms.

| 3 |

About MAX-D:

The MAX-D software improves the sound heard from any device. Consumers have unknowingly sacrificed better audio quality for portable convenience and MAX-D rectifies this problem by:

| | analyzing what content is missing from the compressed audio signal; | |

| | dynamically resynthesizing lost harmonics and natural sound fields in real time; | |

| | maximizing the output potential of any device without increasing original file size; and | |

| | without requiring consumers or OEM’s to change equipment or infrastructure.

|

MAX-D Benefits:

| | Increases dynamic range, eliminates destructive effects of audio compression with no increase in file size or transmission bandwidth; | |

| | High-resolution audio reproduction with an omni-directional sound field using only two speakers; | |

| | “Real” three-dimensional sound field, versus artificial sound field created by competing technologies; and | |

| | More realistic “live performance” quality of all recordings with optimal dynamic range, bass response and overall clarity

|

| 4 |

|

|

MAX-D Markets:

MAX-D can be used in a variety of venues and applications that provide audio capability, as categorized below:

| | MOBILE - Communication | Voice – Data | Entertainment | |

| | ENTERTAINMENT - Music | Movies | Audiobooks | Streaming Content | Live Events | |

| | MULTI-MEDIA - Computing | Gaming | |

| | CONSUMER - Home Theater | Portable Audio Players | Live Concert Sound | Automotive |

We intend to license the MAX-D technology to creators of film, music, broadcast, and gaming content and selling them the service of applying the MAX-D technology to their end product. MAX-D is fully compatible with existing playback technology. We believe that no current competitor can provide the level of sound quality and end user experience that MAX-D delivers. MAX-D technology is ready for these markets now. We also intend to license the technology to manufacturers of consumer electronics products such as portable mp3 players, TV’s, Set Top Boxes, Car Stereo, Home Theatre, Smartphones and Tablets.

The Company is making positive inroads in the motion picture industry. Many of the post-production facilities are now requesting a MAX-D HD Box. The Max-D HD box is a small Windows-based computer that allows audio engineers to apply our patent pending MAX-D HD Audio technology to protect the original audio quality as it is compressed and distributed downstream throughout the internet in all compressed formats. We now have internal testing boxes completed, and anticipate delivering the first boxes to several markets in Q2 2015, and one of the

| 5 |

top post film production houses is now engaged with us negotiating their first feature film deal to employ MAX-D HD Audio.

MAX-D Revenue Model:

The Company expects to derive its revenue through the licensing of its MAX-D technology. The Company is negotiating the licensing of its HD Audio Technology onto hardware and software across the primary vertical markets in Entertainment, Multi-media and Mobile Communications technology. It is also negotiating the “White Labeling,” or the adding of a customizable feature to the Liquid Spins Music Store, into all of these sectors and national retailers as well.

In 2014, the Company nearly tripled its Mobile App user base (with no dedicated marketing budget being employed –until we expect later in 2015). We currently have over 80,000 subscribers on the free version of our HD Audio App for MP3’s on Android. We also are in the final weeks of Beta testing our latest MAX-D HD Apple iOs App that will support current iPhones and iPads. We anticipate a Q2 2015 launch onto the Apple store.

In addition, the Company is now exploring a subscription based revenue model, which would offer millions of consumers a Max-D HD Audio experience on a 30 day free trial basis, and following the free trial the opportunity to upgrade to a paid annual subscription.

MAX-D Embedded Chip Solution: The MAX-D Embedded Chip technology is being designed to restore the natural sound field, causing compressed audio to sound like the original audio at playback time in any device. The audio does not have to be pre-processed or encoded. The Chip is being designed to be imbedded into TV Receivers, Digital Projection TVs, LCD TVs, Plasma TVs, Component DVD Players/Recorders, DVD Recorders, Set-Top Boxes, Personal Video Recorders (PVRs), Direct Broadcast Satellite (DBS) Receivers, Personal Computers, Satellite Radio Receivers, Mobile Video Devices, Domestic Factory Installed Auto Sound, Camcorders, MP3 Players, Electronic Gaming Hardware, Wireless Telephones, Cell Phones, and Personal Digital Assistants (PDAs).

MAX-D Dynamic Software Module: Max Sound has delivered and is working to implement an application programming interface (“API”) for all Internet applications to process all audio/video content streamed or downloaded by consumers. Viable target candidates within the next 24 months include streaming movie and music services such as Netflix and Spotify. Companies selling downloaded MP3’s are also expected to find immense value in our technology due to their dominance in web-based audio and video. This Module is a lossless dynamic process requiring no destructive encoding or decoding and needs no additional hardware or critical monitoring stage after processing. In addition, no specialized decoder is necessary on any audio system.

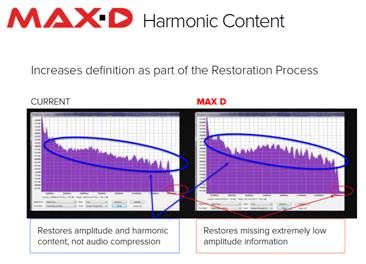

Technology

MAX-D is a unique approach to processing sound, based on the physics of acoustics rather than electronics. Remarkably simple to deploy, MAX-D is a new technology that dramatically raises the standard for sound quality, with no corresponding increase in file size or transmission channel bandwidth. This is accomplished by processing audio with our proprietary, patent-pending process. This embedded and duplicating format either remains the same, or can be converted to whatever format the user desires, while retaining unparalleled fidelity and dynamic range.

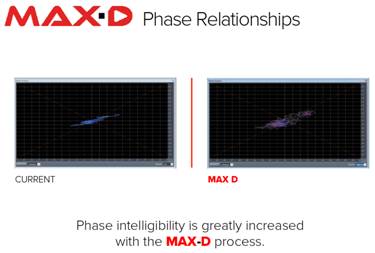

MAX-D restores the original recorded acoustical space in any listening environment. MAX-D is the only technology that both aligns phase and corrects phase distortion in a completed recording. MAX-D supplies missing audio content by adding acoustics and frequency response lost in the original recording or in the compression and transmission processes. MAX-D corrects and optimizes harmonic content and low frequency responses, greatly enhancing acoustic accuracy and we believe reduces ear fatigue.

| 6 |

MAX-D integrates time, phase, harmonics, dynamics, and sub-harmonic region optimizations in a fully dynamic fashion. MAX-D is a lossless dynamic process, requiring no destructive encoding/decoding process, or any specialized decoder at all. MAX-D needs no additional hardware or critical monitoring stage after processing. The end result is that every aspect of audio processed with MAX-D - voice, instrument, or special effects - sounds refreshingly clear, realistic, and natural. The MAX-D HD Audio Technology creates an optimum sound field throughout every listening environment – from the corners of a theater; on your living room couch; to the back seat of your car.

MAXD-D HD Audio Technology requires no equipment changeover and can be embedded into any product (e.g. speakers, headphones, mobile devices), or online content delivery systems (e.g. streaming, cable, video games) to provide better sounding audio.

Market

MAX-D products and services are designed and intended to solve problems and add value to audio components of several separate industries, including consumer electronics, motion picture, broadcasting, video game, recording, cell phone, internet, and VOIP applications.

2014 was a year of creating relationships with companies across all vertical markets understanding the value of those industries and what it would mean to Max-D. It became clear that the device market was the largest for potential revenue and profits for the Company. Our license agreement with Qualcomm has established the foundation for entry into this market. The MAX-D HD Audio player App provided the consumer the ability to experience MAX-D. The acquisition of Liquid Spins provided a music gateway directly to the retail consumer and the record labels and the ability to provide MAX-D HD Audio.

List of 2014 contracted companies:

| Qualcomm | (Leader in Chips for Smartphones & Tablets)

|

The Company is now positioned to pursue the following expansion strategies:

| | Launch MAX-D audio on the Qualcomm Snapdragon DSP, which stands to make MAX-D audio available on potentially hundreds of millions of devices that can be licensed by up to 86 OEMs around the world. | |

| | Grow the MAX-D HD Audio Apps user base and begin selling a paid version of the App. | |

| | Deploy MAX-D APIs for use in streaming online Video/Audio and stand alone Audio services. |

Competition

The Company’s management believes there are no current competitors capable of delivering the high quality of audio products and services produced by the company. Although other companies, like DTS or Dolby, have technologies that enhance sound; we do not believe these technologies negatively affect the Company because the MAX-D process can enhance the other audio company’s technology.

We believe we will be considered friendly competition in the future for three reasons; (1) we believe that MAX-D technology delivers the best sound quality available today, (2) MAX-D does not require any additional equipment; and (3) MAX-D makes any competition’s audio processes sound better.

Intellectual Property

Max-D and HD Audio technologies and designs are Patent Pending and Trademarked. On February 8, 2011, the words “Max Sound” was issued to the Company by the U.S. Patent and Trademark office under Serial Number 85050705, and the words “HD Audio” are pending under Serial Number 85232456 for the following applications: Computer application software for mobile phones, namely, software for HD audio; Computer

| 7 |

hardware and software systems for delivery of improved HD audio; Computer hardware for communicating audio, video and data between computers via a global computer network, wide-area computer networks, and peer-to-peer computer networks; Computer software for manipulating digital audio information for use in audio media applications; Computer software to control and improve computer and audio equipment sound quality; Digital materials, namely, CD's, DVD's, MP3's, streaming media, movies, videos, music, concerts, news, pre-recorded video, downloadable audio and video and high definition audio and video featuring improved HD audio; Digital media, namely, pre-recorded DVDs, downloadable audio and video recordings, and CDs featuring and promoting improved HD audio; Digital media, namely, pre-recorded video cassettes, digital video discs, digital versatile discs, downloadable audio and video recordings, DVDs, and high definition digital discs featuring improved HD audio; Digital media, namely, CD's, DVD's, MP3's, movies, videos, music, concerts, news, pre-recorded video, downloadable and streaming audio and video and high definition audio and video featuring improved HD audio; Downloadable MP3 files, MP3 recordings, on-line discussion boards, webcasts, webinars and podcasts featuring music, audio books in the field of entertainment and general subjects, and news broadcasts; Software to control and improve audio equipment sound quality; Sound recordings featuring improved HD audio.

The Company is in the process of filing 70 additional patents for its technology.

Research and Development

The Company throughout 2014 has continued to focus on research and development initiatives concerning the MAX-D HD Audio Technologies now that the Company is entering into the licensing phase. The Company is working with strategic partners who are now integrating or assisting with the development of the Company’s application on their respective platforms. The Company’s development team is concentrating on enhancing the existing MAX-D HD, and is also developing additional API interfaces. The MAX-D API can be deployed across all streaming platforms along with most audio/video web-based services including audio hardware such as speakers and audio receivers including car smart head units. In 2014, the Company completed testing for industry the MAX-D HD Audio boxes and the MAXD –D Accurate Voice. Significantly, in 2014 the Company achieved breakthroughs in the software development of MAX-D HD for Android OS, Windows OS, Apple OS and a universal MAX-D API. In the fiscal years ended December 31, 2014 and 2013, the Company spent $304,300 and $370,225 respectively, on research and development activities relating to the build-out for the Company’s App for Windows Linix and IOS, as well as the MAX-D’s 300 KB API.

Employees

As of December 31, 2014, we had 14 employees, of which all were full-time.

Anticipated Milestones for the Next Twelve Months

For the next twelve months, our most important goal is to become cash flow positive by growing Max Sound HD Audio sales through licensing and recurring revenue streams. Our goal is to have this growth improve our stock value and investor liquidity. We expect our financial requirements to increase with the additional expenses needed to promote the MAX-D HD Audio Technology. We plan to fund these additional expenses by equity loans from our existing lines of credit and we are also considering various private funding opportunities until such time that our revenue stream is adequate enough to provide the necessary funds.

Over the next twelve months, our focus will be in the achieving and implementing the following:

| 1. | The marketing of the MAX-D Android and Windows APP for tablets and smartphones in addition to an APP that will run on the Apple OS into the direct consumer market. |

| 2. | The include the ability to stream content through the MAX-D Apps. |

| 8 |

| 3. | MAX-D is in the Qualcomm Snapdragon DSP through the Hexagon program. We will seek adoption of the MAX-D HD Audio Technology by Qualcomm’s OEMs. |

| 4. | Deployment of Max Sound HD Audio appliances for key industry engineers and internet streaming companies allowing them to broadcast in MAX-D. |

| 5. | Early adoption from the movie industry producing “Mastered in MAX-D” content. |

Long-Term Goals

| 1. | Increase Max Sound’s customer base substantially producing large consumer adoption and branding.

| |

| 2. | Make a financial return on the investments of the last year, with increased sales and reduction of indirect costs, to become cash flow positive and then profitable in 2015.

| |

| 3. | Increased adoption by industry leaders and differentiated as a deliverer of game-changing audio technology.

| |

| 4. | Explore the applicability of Liquid Spins in future agreements with MAX-D. |

Where You Can Find More Information

We are a publicly reporting company under the Exchange Act and are required to file periodic reports with the Securities and Exchange Commission. The public may read and copy any materials we file with the Commission at the SEC's Public Reference Room at 100 F Street, NE., Washington, DC 20549, on official business days during the hours of 10 a.m. to 3 p.m. The public may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission and state the address of that site (http://www.sec.gov). In addition, you can obtain all of the current filings at our Internet website at www.maxsound.com.

ITEM 1A. RISK FACTORS

Not applicable for smaller reporting companies.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable for smaller reporting companies.

ITEM 2. PROPERTIES.

Office Arrangements and Operational Activities

In November 2010, we leased our MAX-D post production facility at 2902A Colorado Ave., Santa Monica, CA, 90404. The lease is for two years with one-year renewable options.

ITEM 3. LEGAL PROCEEDINGS.

From time to time, the Company may become involved in various lawsuits and legal proceedings, which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm its business.

On February 21, 2012, the Company filed a suit for breach of contract, intentional misrepresentation, negligent

| 9 |

misrepresentation, fraud, false advertising, and unfair competition with a former consultant. It seeks damages due to their alleged failure to meet the contractual requirements regarding promotions. The defendant has been served. In September of 2014, the Company received a Default Judgment against the Defendant. The Company is vigorously pursuing collection on this judgment.

On August 14, 2012, the Company, along with two shareholders of the Company, were named as a defendant in an action filed in the Superior Court for the State of California and the County of San Diego. The plaintiff alleges he was terminated by his former employer “Acoustics Control Sciences, LLC” (which is a company that is not affiliated with Max Sound Corporation) in August 2008 without receiving wages and other compensation allegedly due him. The plaintiff further claims that two of the members or “shareholders” of Acoustics Control Sciences, LLC, wrongfully transferred a patent owned by his former employer and this transfer prevented his former employer from paying the wages alleged due. According to the plaintiff, when the assets of his former employer were sold to the Company, Max Sound Corporation became a successor-in-interest to the plaintiff’s former employer. Plaintiff thus seeks unpaid wages and other compensation from each alleged successor-in-interest named in his complaint. This case will be vigorously prosecuted and has a good likelihood of success.

On August 11, 2014, the Company and VSL simultaneously filed trade secret and patent infringement actions against Google, Inc., and its subsidiaries YouTube, LLC, and On2 Technologies, Inc., relating to proprietary and patented technology owned by Vedanti Systems Limited (“Vedanti”), a subsidiary of VSL. The patent infringement complaint was originally filed in the U.S. District Court for the District of Delaware; the trade secret suit was filed in Superior Court of California, County of Santa Clara. On September 30, 2014, the Company filed notices of voluntary dismissal without prejudice as to both lawsuits. On October 1, 2014, the Company amended the patent complaint and filed it in the U.S. District Court for the Northern District of California. In this patent lawsuit, which remains pending, the Company contends that, in 2010, while Google was in discussions with Vedanti about the possibility of acquiring Vedanti's patented digital video streaming techniques and other proprietary methods, Google gained access to and received technical guidance regarding Vedanti’s proprietary codec, a computer program capable of encoding and decoding a digital data stream or signal. The lawsuit further alleges that soon after Google and Vedanti initiated negotiations, Google willfully infringed Vedanti's patent by incorporating Vedanti's patented technology into Google's own VP8, VP9, WebM, YouTube, Google Adsense, Google Play, Google TV, Chromebook, Google Drive, Google Chromecast, Google Play-per-view, Google Glasses, Google+, Google’s Simplify, Google Maps, and Google Earth, without compensating Vedanti for such use. Plaintiffs are seeking a permanent injunction against Google, compensatory damages, as well as treble damages. As exclusive agent to VSL to enforce all rights with respect to the subject technology, the Company has hired Grant & Eisenhofer PA and Buether Joe & Carpenter LLC to represent the Company in the suit on a contingency fee basis. The case will be vigorously prosecuted, and the Company believes it has a good likelihood of success.

Additionally, on December 5, 2014, the Company, along with renowned architect Eli Attia, filed a lawsuit in the Superior Court of California, County of Santa Clara, against Google, its co-founders Sergey Brin and Larry Page, Google’s spinoff company Flux Factory, and senior executives of Flux. Plaintiffs’ allege misappropriation of trade secrets, breach of contract and other contract-related claims, breach of confidence, slander of title, violation of California’s Unfair Competition Law (California Business and Professionals Code §§ 17200 et seq.), and fraud, and also bring a claim for declaratory relief. The lawsuit contends that Google and the other Defendants stole Mr. Attia’s trade secrets, proprietary information, and know-how regarding a revolutionary architecture design and building process that he alone had invented, known as Engineered Architecture. Defendants are alleged to have engaged Mr. Attia in 2010 and 2011 to translate his architectural technology into software for a proof of concept, with the goal of determining at that point whether to continue with full-scale development with Mr. Attia. Instead, the lawsuit claims that once Mr. Attia had disclosed the trade secrets and proprietary information Defendants needed to bring the technology to market, they severed ties with Mr. Attia, and continued to use his technology without a license and without compensation, in order to bring the technology to market themselves. Plaintiffs seek a permanent injunction against Google, damages (including punitive damages), and restitution. As exclusive agent to Eli Attia to enforce all rights with respect to the subject technology, the Company has retained

| 10 |

Buether Joe & Carpenter LLC to represent the Company in the suit, on a contingency fee basis. The case will be vigorously prosecuted, and the Company believes it has a good likelihood of success.

On September 8 and 9, 2014, respectively, the Company and VSL were granted preliminary injunctions by the District Court of Berlin, Germany, against the Chinese company Shenzhen KTC Technology Co. Ltd. and the French company Pact Informatique S.A. Both companies have been offering products at the International Consumer Electronics Trade Show 2014 in Berlin, which, according to the company’s claim and the Preliminary Injunctions issued by the Court, infringed the rights to a patent. This patent is the German is the German part of the patent on optimized data transmission, owned by Vedanti, which is already asserted the United States infringement proceedings. The products in question are tablet computers and smart phones with Android OS and with the ability to encode videos in the format H.264. The injunctions were issued ex-parte and can be appealed by the Defendants. However, currently there are no indications that any prospective appeals will be interposed. The Company can still enforce claims for cost reimbursement with regard to these legal proceedings.

On December 2, 2014, the Company filed a patent infringement action against Google, Inc., Germany GmBH, Google Commerce Ltd. and YouTube LLC with the District Court of Mannheim, Germany. The asserted patent infringement concerns the same patent infringement asserted in the in the prior Germany Preliminary Injunctions described herein. The Complaint alleges that Google Inc. and it above-named subsidiaries are offering and selling products which can also decode and show videos, which have been encoded in a patent protected and proprietary way. The complaint also avers that YouTube LLC offers to German customers, which are encoded and transmitted in a manner claimed and protected by the patent. The Company mainly seeks a permanent injunction against the Defendants, damages and information regarding past infringements.

On January 21, 2015, the Company filed a patent infringement action against Netflix Inc., Netflix Luxembourg S.a.r.l. and Netflix International B.V. with the District Court of Mannheim, Germany. The asserted patent is the same patent as in the German proceedings against Google Inc. and its subsidiaries. The Complaint alleges that Netflix Inc. and its subsidiaries are offering and transmitting video streams to German customers as part of their video-on-demand business model; the videos being encoded and transmitted in a manner claimed and protected by the patent. The Company primarily seeks a permanent injunction against the Defendants, plus damages and information regarding past infringements.

The Company intends to vigorously prosecute these various patent infringement litigations. The Company believes it has a good likelihood of success associated with these patent infringement lawsuits. However, no assurance can be given by the Company as to the ultimate outcome of these actions or its effect on the Company. The law firm is prosecuting these action on a pure contingency fee basis.

On January 26, 2015, the Company was named as a defendant in an action filed in the Superior Court for the State of California and the County of Los Angeles captioned Bibicoff Family Trust v. Max Sound Corporation (Case No. SC123679). In the complaint the plaintiff alleges a cause of action for breach of contract associated with the non-payment by the Company for certain services plaintiff agreed to provide to the Company. The Company interposed a cross-complaint against plaintiffs averring causes of action for breach of contract, fraud, and negligent misrepresentation by defendants with respect to defendants’ fraudulent and intentional undisclosed inability to perform the services that plaintiffs’ agreed to perform that are the subject of this dispute. This lawsuit will be vigorously defended and prosecuted. While this lawsuit is in its nacency, the Company believes there is a strong likelihood of success on the merits with respect to the defending and prosecuting this action.

No assurance can be given as to the ultimate outcome of these actions or its effect on the Company.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

PART II

| 11 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information

Our shares of common stock are traded on the OTC Bulletin Board under the symbol “MAXD.” The following table sets forth, for the period indicated, the high and low bid quotations for the Company’s common stock. These quotations represent inter-dealer quotations, without adjustment for retail markup, markdown or commission, and may not represent actual transactions.

Price

| High | Low | |||||||

| 2013 | ||||||||

| First quarter | $ | .39 | $ | .19 | ||||

| Second quarter | $ | .32 | $ | .17 | ||||

| Third quarter | $ | .30 | $ | .18 | ||||

| Fourth quarter | $ | .28 | $ | .18 | ||||

| 2014 | ||||||||

| First quarter | $ | .22 | $ | .09 | ||||

| Second quarter | $ | .18 | $ | .08 | ||||

| Third quarter | $ | .28 | $ | .08 | ||||

| Fourth quarter | $ | .13 | $ | .05 | ||||

Holders

As of March 31, 2015, in accordance with our transfer agent records, we had 1,576 record holders of our Common Stock. This number excludes individual stockholders holding stock under nominee security position listings.

Dividends

To date, we have not declared or paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable future on our common stock, when issued pursuant to this offering. Although we intend to retain our earnings, if any, to finance the exploration and growth of our business, our Board of Directors will have the discretion to declare and pay dividends in the future.

Payment of dividends in the future will depend upon our earnings, capital requirements, and other factors, which our Board of Directors may deem relevant.

Securities Authorized For Issuance Under Equity Compensation Plans.

None.

Stock Option Grants

On January 17, 2011, the Company executed an employment agreement with an executive to be the President and CEO for five years. As compensation for services, the executive will receive a monthly compensation of $8,000 beginning after the completion of at least one million dollars of new funding to the Corporation or can be paid as commissions from sales brought to the Company, whichever comes first. In addition to the base salary, the employee is entitled to receive a 20% commission of all sales the executive is directly responsible for bringing to

| 12 |

the Company. The agreement also calls for the executive to receive, upon execution of the agreement, three million shares of Rule 144 common stock and twelve million options, which are good for three years, to buy shares of Rule 144 common stock at $0.12/share. As a supplement to the agreement, on February 4, 2011, the executive received an additional twenty million common shares directly from the Chairman of the Company. On August 25, 2011, the agreement was updated to increase the monthly compensation to $12,000 per month beginning September 1, 2011, terminate the initial 20% commission on sales and to add a commission on sales equal to 10% of gross quarterly profits. On December 31, 2012, the agreement was updated to eliminate his previous annual bonus entitlement, which was previously 10% of revenues. In exchange for this consideration, the Company agreed that his bonus will be decreased to 7% of net profits which may be received in cash or Rule 144 stock or any combination. The agreement also called for the employee to receive health benefits. In May of 2013, the Company amended the agreement for the President and CEO to receive monthly compensation of $18,000 beginning May 1, 2013.

On October 1, 2011, the Company executed an employment agreement with its Chief Technical Officer (“CTO”). The term of the agreement is for five years. As compensation for services, the CTO will receive a monthly compensation of $10,000, monthly commission equal to 5% of all profits derived from the sales of all products and services related to Max Sound, and an annual bonus of 5% of all profits derived from the sales of all products and services related to Max Sound that is over one million dollars. In addition to the base salary, the employee is entitled to receive health benefits. Effective January 1, 2012, the Company increased the monthly compensation to $12,000. On December 31, 2012 the Company amended the agreement that effective January 1, 2013 the CTO will receive 300,000 shares of common stock and 700,000 three year options at 50 cents per share. On December 31, 2012, the agreement was also updated to eliminate his previous commission and annual bonus entitlement. Executive shall now be entitled to a commission on all sales of the Company equal to 6% of net profits. For the year ended 2013, the Company issued 300,000 common shares valued at $90,000.

On January 9, 2013, the Company executed an employment agreement with its Director of New Business Development. The term of the agreement is for three years. As compensation for services, the Director will receive a monthly compensation of $10,000. Upon the first million dollars in gross sales the salary will increase to $12,000 per month. In addition, the Director will receive up to 1,000,000 shares of common stock payable in lots of 125,000 per quarter beginning on January 1, 2013. Also, employee for the first eight quarters of employment has a right to earn 125,000 additional 3 year stock options with a strike price of $0.50 per share as follows:

| | For each million of new gross sales - 125,000 additional 3-year stock options with a strike price of $.50 per share. |

For the year ended December 31, 2014 and year ended December 31, 2013, the employee received 375,000 and 500,000 shares with a fair value of $95,625 and $127,500, respectively.

On July 7, 2014, the Company issued 2,866,652 options to buy common shares of the Company’s stock at $.10 per share, good for three years to the Company’s CFO.

Recent Sales of Unregistered Securities

Note Conversions

On January 3, 2014, the Company entered into a conversion agreement with Dominion Capital, LLC relating to a convertible promissory note dated May 5, 2013, with the original principal amount of $277,778 for 352,734 shares based on a conversion price of $0.142125 per share (See Note 6 to the Accompanying Financial Statements).

On January 7, 2014, the Company entered into a conversion agreement with Redwood Management, LLC relating to a convertible promissory note dated June 17, 2013, with the original principal amount of $166,667 for 360,490 shares based on a conversion price of $0.1388 per share (See Note 6 to the Accompanying Financial Statements).

On January 7, 2014, the Company entered into a conversion agreement with JMJ Financial relating to a convertible promissory note dated June 27, 2013, with the original principal amount of $50,000 for 300,000

| 13 |

shares based on a conversion price of $0.1295 per share (See Note 6 to the Accompanying Financial Statements).

On January 8, 2014, the Company entered into a conversion agreement with BOU Trust relating to a convertible promissory note dated June 17, 2013, with the original principal amount of $111,111 for 80,109 shares based on a conversion price of $0.1268 per share (See Note 6 to the Accompanying Financial Statements).

On January 15, 2014, the Company entered into a conversion agreement with Redwood Management, LLC relating to a convertible promissory note dated June 17, 2013, with the original principal amount of $166,667 for 505,050 shares based on a conversion price of $0.1325 per share (See Note 6 to the Accompanying Financial Statements).

On January 21, 2014, the Company entered into a conversion agreement with Dominion Capital, LLC relating to a convertible promissory note dated May 23, 2013, with the original principal amount of $277,778 for 646,465 shares based on a conversion price of $0.1268 per share (See Note 6 to the Accompanying Financial Statements).

On January 29, 2014, the Company entered into a conversion agreement with Vista Capital Investments, LLC relating to a convertible promissory note dated May 3, 2013, with the original principal amount of $25,000 for 93,591 shares based on a conversion price of $0.1127 per share (See Note 6 to the Accompanying Financial Statements).

On February 5, 2014, the Company entered into a conversion agreement with JMJ Financial relating to a convertible promissory note dated June 27, 2013, with the original principal amount of $50,000 for 266,599 shares based on a conversion price of $0.0996 per share (See Note 6 to the Accompanying Financial Statements).

On February 11, 2014, the Company entered into a conversion agreement with Dominion Capital, LLC relating to a convertible promissory note dated May 23, 2013, with the original principal amount of $277,778 for 496,278 shares based on a conversion price of $0.1008 per share (See Note 6 to the Accompanying Financial Statements).

On February 12, 2014, the Company entered into a conversion agreement with BOU Trust relating to a convertible promissory note dated June 17, 2013, with the original principal amount of $111,111 for 67,340 shares based on a conversion price of $0.099 per share (See Note 6 to the Accompanying Financial Statements).

On February 12, 2014, the Company entered into a conversion agreement with BOU Trust relating to a convertible promissory note dated June 17, 2013, with the original principal amount of $111,111 for 44,893 shares based on a conversion price of $0.099 per share (See Note 6 to the Accompanying Financial Statements).

On February 14, 2014, the Company entered into a conversion agreement with Asher Enterprises, Inc. relating to a convertible promissory note dated August 8, 2013, with the original principal amount of $103,500 for 477,897 shares based on a conversion price of $0.0847 per share (See Note 6 to the Accompanying Financial Statements).

On February 18, 2014, the Company entered into a conversion agreement with Dominion Capital, LLC relating to a convertible promissory note dated June 3, 2013, with the original principal amount of $277,778 for executed by a note holder for 511,771 shares based on a conversion price of $0.0978 per share (See Note 6 to the Accompanying Financial Statements).

On February 18, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible promissory note dated May 2, 2013, with the original principal amount of $166,000 for 110,943 shares based on a conversion price of $0.13 per share (See Note 6 to the Accompanying Financial Statements). Given the conversion occurred subsequent to the maturity date of the note, the Company recorded a $4,423 loss on conversion.

On February 19, 2014, the Company entered into a conversion agreement with Vista Capital Investments, LLC relating to a convertible promissory note dated August 9, 2013, with the original principal amount of $25,000 for 147,929 shares based on a conversion price of $0.0910 per share (See Note 6 to the Accompanying Financial Statements). Conversion related to penalty fees incurred totaling $6,583.

On February 24, 2014, the Company entered into a conversion agreement with Asher Enterprises, Inc. relating to

| 14 |

a convertible promissory note dated August 8, 2013, with the original principal amount of $103,500 for 580,645 shares based on a conversion price of $0.0818 per share (See Note 6 to the Accompanying Financial Statements).

On February 27, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible promissory note dated May 2, 2013, with the original principal amount of $166,000 for 196,592 shares based on a conversion price of $0.12 per share (See Note 6 to the Accompanying Financial Statements). Given the conversion occurred subsequent to the maturity date of the note, the Company recorded a $8,591 loss on conversion.

On February 28, 2014, the Company entered into a conversion agreement with Vista Capital Investments, LLC relating to a convertible promissory note dated August 9, 2013, with the original principal amount of $25,000 for 250,000 shares based on a conversion price of $0.0763 per share (See Note 6 to the Accompanying Financial Statements). Conversion related to penalty fees incurred totaling $6,113.

On March 3, 2014, the Company entered into a conversion agreement with Dominion Capital, LLC relating to a convertible promissory note dated June 3, 2013, with the original principal amount of $277,778 for 612,745 shares based on a conversion price of $0.0817 per share (See Note 6 to the Accompanying Financial Statements).

On March 4, 2014, the Company entered into a conversion agreement with Asher Enterprises, Inc. relating to a convertible promissory note dated August 8, 2013, with the original principal amount of $103,500 for 339,940 shares based on a conversion price of $0.0686 per share (See Note 6 to the Accompanying Financial Statements).

On March 6, 2014, the Company entered into a conversion agreement with Dominion Capital, LLC relating to a convertible promissory note dated May 23, 2013, with the original principal amount of $277,778 for 631,313 shares based on a conversion price of $0.0792 per share (See Note 6 to the Accompanying Financial Statements).

On March 12, 2014, the Company entered into a conversion agreement with Dominion Capital, LLC relating to a convertible promissory note dated June 3, 2013, with the original principal amount of $277,778 for 851,426 shares based on a conversion price of $0.0784 per share (See Note 6 to the Accompanying Financial Statements).

On March 13, 2014, the Company entered into a conversion agreement with Vista Capital Investments, LLC relating to a convertible promissory note dated August 9, 2013, with the original principal amount of $25,000 for 352,801 shares based on a conversion price of $0.07 per share (See Note 6 to the Accompanying Financial Statements). Conversion related to penalty fees incurred totaling $9,580.

On March 19, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible promissory note dated May 2, 2013, with the original principal amount of $166,000 for 229,753 shares based on a conversion price of $0.09 per share (See Note 6 to the Accompanying Financial Statements). Given the conversion occurred subsequent to the maturity date of the note, the Company recorded a $6,795 loss on conversion.

On March 24, 2014, the Company entered into a conversion agreement with Dominion Capital, LLC relating to a convertible promissory note dated June 3, 2013, with the original principal amount of $277,778 for 1,260,835 shares based on a conversion price of $0.0705 per share (See Note 6 to the Accompanying Financial Statements).

On March 25, 2014, the Company issued 8,000 shares of common stock for accrued interest having a fair value of $1,020 ($.01275 / share).

On March 31, 2014, the Company entered into a conversion agreement with JMJ Financial relating to a convertible promissory note dated August 21, 2013, with the original principal amount of $50,000 for 1,002,999 shares based on a conversion price of $0.0658 per share (See Note 6 to the Accompanying Financial Statements).

On April 1, 2014, the Company entered into a conversion agreement with Redwood Management, LLC relating to a convertible promissory note dated October 3, 2013 with the original principal amount of $221,000 for 3,134,751 shares based on a conversion price of $0.0705 per share (See Note 6 to the Accompanying Financial Statements).

On April 3, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible

| 15 |

promissory note dated August 19, 2013 with the original principal amount of $227,222 for 1,503,382 shares based on a conversion price of $0.0665 per share (See Note 6 to the Accompanying Financial Statements).

On April 7, 2014, the Company entered into a conversion agreement with Vista Capital Investments, LLC relating to a convertible promissory note dated October 7, 2013 with the original principal amount of $25,000 for 621,227 shares based on a conversion price of $0.0611 per share (See Note 6 to the Accompanying Financial Statements).

On April 18, 2014, the Company entered into a conversion agreement with Asher Enterprises, Inc. relating to a convertible promissory note dated October 10, 2013 with the original principal amount of $78,500 for 652,529 shares based on a conversion price of $0.0613 per share (See Note 6 to the Accompanying Financial Statements).

On April 23, 2014, the Company entered into a conversion agreement with Redwood Management, LLC relating to a convertible promissory note dated October 3, 2013 with the original principal amount of $221,000 for 118,062 shares based on a conversion price of $0.0681 per share (See Note 6 to the Accompanying Financial Statements).

On April 24, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible promissory note dated August 19, 2013 with the original principal amount of $227,222 for 864,304 shares based on a conversion price of $0.05785 per share (See Note 6 to the Accompanying Financial Statements).

On April 24, 2014, the Company entered into a conversion agreement executed with Asher Enterprises, Inc. relating to a convertible promissory note dated October 10, 2013 with the original principal amount of $78,500 for 719,171 shares based on a conversion price of $0.0579 per share (See Note 6 to the Accompanying Financial Statements).

On May 8, 2014, the Company entered into a conversion agreement with Vista Capital Investments, LLC relating to a convertible promissory note dated October 7, 2013 with the original principal amount of $25,000 for 222,064 shares based on a conversion price of $0.0563 per share (See Note 6 to the Accompanying Financial Statements).

On May 14, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible promissory note dated August 19, 2013 with the original principal amount of $227,222 for 540,655 shares based on a conversion price of $0.0555 per share (See Note 6 to the Accompanying Financial Statements).

On May 15, 2014, the Company entered into a conversion agreement with Dominion Capital, LLC relating to a convertible promissory note dated June 3, 2013 with the original principal amount of $277,778 executed by a note holder for 763,942 shares based on a conversion price of $0.06545 per share (See Note 6 to the Accompanying Financial Statements).

On May 20, 2014, the Company entered into a conversion agreement with Vista Capital Investments, LLC relating to a convertible promissory note dated October 7, 2013 with the original principal amount of $25,000 for 507,292 shares based on a conversion price of $0.0561 per share (See Note 6 to the Accompanying Financial Statements).

On May 22, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible promissory note dated August 19, 2013 with the original principal amount of $227,222 for 535,628 shares based on a conversion price of $0.056 per share (See Note 6 to the Accompanying Financial Statements).

On May 28, 2014, the Company entered into a conversion agreement with Dominion Capital, LLC relating to a convertible promissory note dated June 3, 2013 with the original principal amount of $277,778 executed by a note holder for 103,842 shares based on a conversion price of $0.0642 per share (See Note 6 to the Accompanying Financial Statements).

On May 30, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible promissory note dated August 19, 2013 with the original principal amount of $227,222 for 350,177 shares based on a conversion price of $0.057114 per share (See Note 6 to the Accompanying Financial Statements).

On June 9, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible

| 16 |

promissory note dated August 19, 2013 with the original principal amount of $227,222 for 314,842 shares based on a conversion price of $0.0611 per share (See Note 6 to the Accompanying Financial Statements).

On June 10, 2014, the Company entered into a conversion agreement with JMJ Financial relating to a convertible promissory note dated December 9, 2013 with the original principal amount of $100,000 executed by a note holder for 550,000 shares based on a conversion price of $0.062627 per share (See Note 6 to the Accompanying Financial Statements).

On June 10, 2014, the Company entered into a conversion agreement with Vista Capital Investments, LLC relating to a convertible promissory note dated December 6, 2013 with the original principal amount of $25,000 for 162,338 shares based on a conversion price of $0.0616 per share (See Note 6 to the Accompanying Financial Statements).

On June 16, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible promissory note dated October 7, 2013 with the original principal amount of $282,778 for 469,366 shares based on a conversion price of $0.063916 per share (See Note 6 to the Accompanying Financial Statements).

On June 17, 2014, the Company entered into a conversion agreement with Asher Enterprises, Inc. relating to a convertible promissory note dated December 11, 2013 with the original principal amount of $153,500 for 635,930 shares based on a conversion price of $0.0629 per share (See Note 6 to the Accompanying Financial Statements).

On June 19, 2014, the Company entered into a conversion agreement with Asher Enterprises, Inc. relating to a convertible promissory note dated December 11, 2013 with the original principal amount of $153,500 for 818,331 shares based on a conversion price of $0.0611 per share (See Note 6 to the Accompanying Financial Statements).

On June 23, 2014, the Company entered into a conversion agreement with Asher Enterprises, Inc. relating to a convertible promissory note dated December 11, 2013 with the original principal amount of $153,500 for 725,000 shares based on a conversion price of $0.06 per share (See Note 6 to the Accompanying Financial Statements).

On June 30, 2014, the Company entered into a conversion agreement with Asher Enterprises, Inc. relating to a convertible promissory note dated December 11, 2013 with the original principal amount of $153,500 for 465,954 shares based on a conversion price of $0.0561 per share (See Note 6 to the Accompanying Financial StatementsSee Note 6).

On July 14, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible promissory note dated October 7, 2013 with the original principal amount of $282,778 for 1,105,481 shares based on a conversion price of $0.054275 per share (See Note 6 to the Accompanying Financial Statements).

On July 16, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible promissory note dated October 7, 2013 with the original principal amount of $282,778 for 1,092,399 shares based on a conversion price of $0.054925 per share (See Note 6 to the Accompanying Financial Statements).

On July 1, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible promissory note dated October 7, 2013 with the original principal amount of $282,778 for 549,451 shares based on a conversion price of $0.0546 per share (See Note 6 to the Accompanying Financial Statements).

On August 1, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible promissory note dated October 7, 2013 with the original principal amount of $282,778 for 673,446 shares based on a conversion price of $0.089094 per share (See Note 6 to the Accompanying Financial Statements).

On August 4, 2014, the Company entered into a conversion agreement with Tonaquint, Inc. relating to a convertible promissory note dated October 7, 2013 with the original principal amount of $282,778 for 881,419 shares based on a conversion price of $0.089094 per share (See Note 6 to the Accompanying Financial Statements).

On July 3, 2014, the Company entered into a conversion agreement with JMJ Financial relating to a convertible

| 17 |

promissory note dated December 9, 2013 with the original principal amount of $100,000 for 600,000 shares based on a conversion price of $0.058823 per share (See Note 6 to the Accompanying Financial Statements).

On July 22, 2014, the Company entered into a conversion agreement with JMJ Financial relating to a convertible promissory note dated December 9, 2013 with the original principal amount of $100,000 for 953,405 shares based on a conversion price of $0.057983 per share (See Note 6 to the Accompanying Financial Statements).

On July 11, 2014, the Company entered into a conversion agreement with Vista Capital Investments, LLC relating to a convertible promissory note dated December 6, 2013 with the original principal amount of $25,000 for 169,463 shares based on a conversion price of $0.0590 per share (See Note 6 to the Accompanying Financial Statements).

On July 15, 2014, the Company entered into a conversion agreement with Vista Capital Investments, LLC relating to a convertible promissory note dated December 6, 2013 with the original principal amount of $25,000 for 178,360 shares based on a conversion price of $0.0590 per share (See Note 6 to the Accompanying Financial Statements).

On August 5, 2014, the Company entered into a conversion agreement with Iliad Research and Trading, LP relating to a convertible promissory note dated December 30, 2013 with the original principal amount of $282,778 for 1,399,619 shares based on a conversion price of $0.08931 per share (See Note 6 to the Accompanying Financial Statements).

On September 12, 2014, the Company entered into a conversion agreement with Iliad Research and Trading, LP relating to a convertible promissory note dated December 30, 2013 with the original principal amount of $282,778 for 307,692 shares based on a conversion price of $0.0975 per share (See Note 6 to the Accompanying Financial Statements).

On September 23, 2014, the Company entered into a conversion agreement with Iliad Research and Trading, LP relating to a convertible promissory note dated December 30, 2013 with the original principal amount of $282,778 for 357,782 shares based on a conversion price of $0.08385 per share (See Note 6 to the Accompanying Financial Statements).

On August 25, 2014, the Company entered into a conversion agreement with JMJ Financial relating to a convertible promissory note dated February 20, 2014 with the original principal amount of $50,000 for 350,000 shares based on a conversion price of $0.102550 per share (See Note 6 to the Accompanying Financial Statements).

On September 9, 2014, the Company entered into a conversion agreement with JMJ Financial relating to a convertible promissory note dated February 20, 2014 with the original principal amount of $50,000 for 260,744 shares based on a conversion price of $0.102083 per share (See Note 6 to the Accompanying Financial Statements).

On July 30, 2014, the Company entered into a conversion agreement with Vista Capital Investments, LLC relating to a convertible promissory note dated January 28, 2014 with the original principal amount of $25,000 for 505,297 shares based on a conversion price of $0.0604 per share (See Note 6 to the Accompanying Financial Statements).

On September 15, 2014, the Company entered into a conversion agreement with Asher Enterprises, Inc. relating to a convertible promissory note dated March 7, 2014 with the original principal amount of $103,500 for 307,692 shares based on a conversion price of $0.0975 per share (See Note 6 to the Accompanying Financial Statements).

On September 16, 2014, the Company entered into a conversion agreement with Asher Enterprises, Inc. relating to a convertible promissory note dated March 7, 2014 with the original principal amount of $103,500 for 344,296 shares based on a conversion price of $0.0973 per share (See Note 6 to the Accompanying Financial Statements).

On September 22, 2014, the Company entered into a conversion agreement with Asher Enterprises, Inc. relating to a convertible promissory note dated March 7, 2014 with the original principal amount of $103,500 for 526,103 shares based on a conversion price of $0.0839 per share (See Note 6 to the Accompanying Financial Statements).

On October 9, 2014, the Company entered into a conversion agreement with Vista Capital Investments, LLC

| 18 |

relating to a convertible promissory note dated January 28, 2014 with the original principal amount of $25,000 for 150,000 shares based on a conversion price of $0.0666 per share (See Note 6 to the Accompanying Financial Statements).

On October 9, 2014, the Company entered into a conversion agreement with Iliad Research and Trading, LP relating to a convertible promissory note dated December 30, 2013 with the original principal amount of $282,778 for 483,668 shares based on a conversion price of $0.0620 per share (See Note 6 to the Accompanying Financial Statements).

On October 16, 2014, the Company entered into a conversion agreement with KC Gamma Opportunity Fund LLP relating to a convertible promissory note dated October 2, 2013 with the original principal amount of $110,000 for 1,386,667 shares based on a conversion price of $0.0825 per share (See Note 6 to the Accompanying Financial Statements).

On October 22, 2014, the Company entered into a conversion agreement with Iliad Research and Trading, LP relating to a convertible promissory note dated December 30, 2013 with the original principal amount of $282,778 for 484,974 shares based on a conversion price of $0.0619 per share (See Note 6 to the Accompanying Financial Statements).

On October 23, 2014, the Company entered into a conversion agreement with KBM Worldwide relating to a convertible promissory note dated April 17, 2014 with the original principal amount of $78,500 for 354,267 shares based on a conversion price of $0.0621 per share (See Note 6 to the Accompanying Financial Statements).

On October 27, 2014, the Company entered into a conversion agreement with KBM Worldwide relating to a convertible promissory note dated April 17, 2014 with the original principal amount of $78,500 for 960,386 shares based on a conversion price of $0.0621 per share (See Note 6 to the Accompanying Financial Statements).

On October 31, 2014, the Company entered into a conversion agreement with Iliad Research and Trading, LP relating to a convertible promissory note dated December 30, 2013 with the original principal amount of $282,778 for 520,336 shares based on a conversion price of $0.0577 per share (See Note 6 to the Accompanying Financial Statements).

On November 10, 2014, the Company entered into a conversion agreement with LG Capital relating to a convertible promissory note dated May 1, 2014 with the original principal amount of $105,000 for 541,435 shares based on a conversion price of $0.0577 per share (See Note 6 to the Accompanying Financial Statements).