Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Vapor Group, Inc. | Financial_Report.xls |

| EX-32.1 - CERTIFICATION - Vapor Group, Inc. | vpor_ex321.htm |

| EX-31.2 - CERTIFICATION - Vapor Group, Inc. | vpor_ex312.htm |

| EX-31.1 - CERTIFICATION - Vapor Group, Inc. | vpor_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2014

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to _____________

Commission File No.: 000-27795

|

VAPOR GROUP, INC. |

|

(Exact name of registrant as specified in its charter) |

|

Florida |

98-0427526 |

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

3901 SW 47th AVENUE, SUITE 415

DAVIE, FLORIDA 33314

(Address of principal executive offices)

Registrant’s telephone number, including area code: (954) 792-8450

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant has (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ¨ No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

¨ |

Accelerated filer |

¨ |

|

Non-accelerated filer |

¨ |

Smaller reporting company |

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and ask price of such common equity, as of the last business day of the registrant's most recently completed fiscal quarter ended December 31, 2014 was $2,969,495. (This calculation is based on historical data at December 31, 2014). For purposes of the foregoing calculation only, directors, executive officers, and holders of 10% or more of the issuer’s common capital stock have been deemed affiliates.

The number of shares outstanding of the Registrant’s Common Stock as of March 30, 2015 is 2,658,813,601.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

|

2

|

TABLE OF CONTENTS

|

ITEM 1. |

BUSINESS. |

6 | |||

|

ITEM 1A. |

RISK FACTORS |

9 | |||

|

ITEM 1B. |

UNRESOLVED STAFF COMMENTS. |

19 | |||

|

ITEM 2. |

PROPERTIES. |

19 | |||

|

ITEM 3. |

LEGAL PROCEEDINGS. |

19 | |||

|

ITEM 4. |

MINE SAFETY DISCLOSURE. |

19 | |||

|

ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

20 | |||

|

ITEM 6. |

SELECTED FINANCIAL DATA. |

30 | |||

|

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

31 | |||

|

ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK. |

38 | |||

|

ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. |

38 | |||

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. |

38 | |||

|

ITEM 9A. |

CONTROLS AND PROCEDURES. |

39 | |||

|

ITEM 9B. |

OTHER INFORMATION. |

40 | |||

|

ITEM 10. |

DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE. |

41 | |||

|

ITEM 11. |

EXECUTIVE COMPENSATION. |

44 | |||

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT. |

45 | |||

|

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. |

46 | |||

|

ITEM 14. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

46 | |||

|

ITEM 15. |

EXHIBITS, FINANCIAL STATEMENT SCHEDULES. |

47 |

|

3

|

|

4

|

INTRODUCTORY COMMENT

This Annual Report on Form 10-K ("Annual Report"), in particular the Management’s Discussion and Analysis of Financial Condition and Results of Operations appearing in Item 7 herein ("MD&A") contains certain "forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give expectations or forecasts of future events. The reader can identify these forward-looking statements by the fact that they do not relate strictly to historical or current facts. They use words such as "believe(s)," "goal(s)," "target(s)," "estimate(s)," "anticipate(s)," "forecast(s)," "project(s)," plan(s)," "intend(s)," "expect(s)," "might," may" and other words and terms of similar meaning in connection with a discussion of future operating, financial performance or financial condition. Forward-looking statements, in particular, include statements relating to future actions, prospective services or products, future performance or results of current and anticipated services or products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, trends of operations and financial results.

Any or all forward-looking statements may turn out to be wrong, and, accordingly, readers are cautioned not to place undue reliance on such statements, which speak only as of the date of this Annual Report. These statements are based on current expectations and current the current economic environment. They involve a number of risks and uncertainties that are difficult to predict. These statements are not guarantees of future performance; actual results could differ materially from those expressed or implied in the forward-looking statements. Forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Many such factors will be important in determining the Company's actual results and financial condition. The reader should consider the following list of general factors that could affect the Company's future results and financial condition.

Among the general factors that could cause actual results and financial condition to differ materially from estimated results and financial condition are:

|

· |

The success or failure of management's efforts to implement their business strategy |

|

· |

The ability of the Company to raise sufficient capital to meet operating requirements |

|

· |

The uncertainty of consumer demand for our products and services; |

|

· |

The ability of the Company to compete with major established companies; |

|

· |

Heightened competition, including, with respect to pricing, entry of |

|

· |

New competitors and the development of new products by new and existing competitors; |

|

· |

Absolute and relative performance of our products and services; |

|

· |

The effect of changing economic conditions; |

|

· |

The ability of the Company to attract and retain quality employees and management; |

|

· |

The current global recession and financial uncertainty; and |

|

· |

Other risks which may be described in future filings with the U.S. Securities and Exchange Commission ("SEC"). |

No assurances can be given that the results contemplated in any forward-looking statements will be achieved or will be achieved in any particular timetable. We assume no obligation to publicly correct or update any forward-looking statements as a result of events or developments subsequent to the date of this Annual Report. The reader is advised, however, to consult any further disclosures we make on related subjects in our filings with the SEC.

|

5

|

PART I

ITEM 1. BUSINESS.

Corporate Overview and History of Vapor Group, Inc.

We were originally incorporated under the laws of Canada on January 15, 1990, under the name "Creemore Star Printing, Inc." We changed our name on June 15, 2003 to "Smitten Press: Local Lore and Legends, Inc." We domesticated in the State of Nevada by filing Articles of Incorporation in Nevada on May 8, 2007, and we were incorporated in the State of Nevada on May 8, 2007, as SmittenPress: Local Lore and Legends, Inc. On April 30, 2010, our Board of Directors approved a change in our name to DataMill Media Corp., effective at the close of business on June 30, 2010. In June 2011, we completed our initial public offering of 5,000,000 shares of Common Stock and received $100,000 in proceeds from the offering.

We were a management consulting firm that planned to educate and assist small businesses. However, after we completed our initial public offering, we explored opportunities to acquire operating companies to enhance shareholder value. On September 2, 2011, we entered into a Share Exchange Agreement with Young Aviation, LLC, founded in 2004, a broker and supplier of parts, components and products to the general aviation (that is, non-military and commercial airline) and aerospace markets (“Young Aviation”).

On September 19, 2011, we amended our Articles of Incorporation to (i) increase our authorized capital stock to 500,000,000 shares of Common Stock and (ii) effect a 10:1 forward stock split. On October 3, 2011, we closed the Share Exchange Agreement, wherein Young Aviation became a wholly-owned subsidiary. On November 10, 2011, a majority of our shareholders approved a change of our name to AvWorks Aviation Corp., effective November 30, 2011, to reflect the Company’s new business focus.

As a result of execution of the Share Exchange Agreement on October 3, 2011 in which the Company acquired Young Aviation: (a) the Company ceased being a "shell company" as that term is defined in Section 12b-2 of the Securities Exchange Act of 1934; (b) Joel Young, an individual, became the owner of 165,000,000 shares of restricted common stock of the Company or 61.11% of the total of 270,020,145 issued and outstanding shares of common stock of the Company as of that date, making him the Company’s majority shareholder; and (c) the Board of Directors of the Company appointed Joel A. Young as its President, CEO and sole Director. Following Joel Young’s acceptance of this appointment, all prior officers and directors of the Company resigned.

The acquisition of Young Aviation was by reverse merger and resulted in a change in control of the Company and new management ‘s abandonment of its former management consulting business with a new focus solely on the business of Young Aviation. Subsequently, as the result of the slow growth of such operations, in early 2013 the Company decided to seek other business opportunities, including a business combination.

On August 1, 2013, the Board of Directors accepted the consent of Michael Zoyes to become a member of its Board of Directors, the President/CEO, Secretary, Treasurer and CFO of the Company replacing Joel Young who resigned as its sole officer and director. Mr. Young did not resign as a result of any disagreement with the Company on any matter relating to its operations, policies or practices, and remained available to it in an advisory capacity while Mr. Zoyes pursued a strategy of seeking a business combination partner for the Company.

|

6

|

On September 3, 2013, the majority shareholder of the Company, being the record holder of 165,000,000 shares of restricted common stock of the Company (61.11% of the 270,020,145 shares of common stock issued and outstanding), and Corporate Excellence Consulting, Inc., a Florida corporation, the holder of 1,000,000 shares of the Series A Preferred Stock of the Company (100% of the issued and outstanding shares of preferred stock of the Company), (collectively, the “Sellers), entered into a share purchase agreement (the “Share Purchase Agreement”) with Dror Svorai, an individual, (the “Buyer”), and the future President and CEO of the Company (post-Merger Agreement as hereinafter described). In accordance with this Agreement, the Sellers agreed to sell and transfer over time their shares of restricted common stock and Series A Preferred Stock of the Company to the Buyer for a total purchase price of $115,000. The Share Purchase Agreement provided that the purchase price is to be paid on or before February 13, 2014 and that as the purchase price is being paid by the Buyer, the shares of common and preferred stock were to be released pro-rata to the Buyer by the Sellers. The Share Purchase Agreement was completed and paid-in-full within its terms, and the sale and transfer of the common stock and Series A Preferred Stock to the Buyer was finalized on February 20, 2014. The sale and purchase of the 165,000,000 shares of common stock of the Company constitutes 49.34% of the total issued and outstanding shares of the Company of 334,381,399 as of April 11, 2014, and the sale and purchases of the 1,000,000 shares of Series A Preferred Stock constitutes 100% of the total issued and outstanding shares of preferred stock which has over 50% voting control of the Company. As a result, Dror Svorai, an individual, is the controlling shareholder of the Company.

Effective on September 23, 2013, the Board of Directors accepted the consent of Joe Eccles, to become a member of its Board of Directors, the President/CEO, Secretary, Treasurer and CFO of the Company replacing Michael Zoyes who resigned as its sole officer and director. Mr. Zoyes did not resign as a result of any disagreement with the Company on any matter relating to its operations, policies or practices. Mr. Eccles served as the Company’s sole officer and director until January 22, 2014 at which time the Company entered into the Merger Agreement as hereinafter discussed.

On November 11, 2013, The Board of Directors and stockholders owning or having voting authority over a majority of the voting capital stock of the Company, voted in favor of an amendment to the Articles of Incorporation to affect a reverse stock split of all of the outstanding shares of Common Stock, at a ratio of one-for-thirty. The reverse split which was pending per completion of a FINRA review was subsequently cancelled by the Board of Directors on March 13, 2014, as filed on Form 8-K on March 18, 2014.

On January 22, 2014, the Company entered into an Agreement of Merger and Plan of Reorganization ("Merger Agreement") by and among the Company and the Vapor Group, Inc., a Florida corporation ("Vapor Group") and the shareholders of Vapor Group (the “Vapor Group Shareholders”), pursuant to which the Company will acquire 100% of the issued and outstanding shares of Vapor Group from the Vapor Group Shareholders in return for the issuance of 750,000,000 shares of its common stock. As a condition to be met prior to the closing of the Merger Agreement, the Company was required to increase its authorized shares of common stock to 2,000,000,000 from 500,000,000, which it did by filing an amendment to its Articles of Incorporation with the State of Florida on January 10, 2014, which amendment was accepted by the State of Florida on January 15, 2014 thereby increasing its authorized shares. The Merger Agreement subsequently became effective as of January 27, 2014 with its filing in the State of Florida.

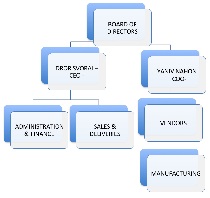

As a result of the Merger Agreement: (i) the Vapor Group assumed management control of the Company and established its business model and operations as the primary business operations of the Company; (ii)Joe Eccles resigned as the sole officer and director of the Company; (iii) Dror Svorai consented to act as a member of the Board of Directors, Chairman of the Board of Directors and as the President/Chief Executive Officer, and Treasurer of the Company; (iv) Yaniv Nahon consented to act as a member of the Board of Directors and as a Vice President/Chief Operating Officer, and Secretary of the Company; and (v) Jorge Schcolnik consented to act as a member of the Board of Directors and Vice President/Chief Financial Officer of the Company.

|

7

|

Mr. Eccles did not resign as a result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

The biographies of the new directors and officers to be elected and appointed respectively are set forth below as follows:

Dror Svorai. Mr. Svorai, President and Chief Executive Officer and Treasurer of the Vapor Group, Inc., is a founder in 2012 of the Vapor Group, Inc., and its subsidiaries, Total Vapor Inc., Vapor 123, Inc. and Vapor Products, Inc. For the past two years he has overseen the day-to-to operations of these companies and managed their steady growth. In the ten years prior to 2012, Mr. Svorai has served in executive positions, including president and chief executive officer of several companies, and has maintained an ongoing involvement in several private real estate ventures. Before then, Mr. Svorai also was involved in investments of real estate, and was a business owner in the garment industry and the private jet industry. From 1997 until 2001, Mr. Svorai was the founder and chief executive officer of Ocean Drive of Orlando. From 1998 until 2003, Mr. Svorai was the founder and chief executive officer of Ocean Drive Fashion. From 2003 until 2006 Mr. Svorai was the founder and chief executive officer of the D & D Fashion Group Inc.

Yaniv Nahon. Mr. Nahon established the first e-cigarette retail business in Southwest Florida in 2008. Since 2008, he has remained focused on the development and marketing of e-cigarettes at both the wholesale and retail levels, owning an operating his own retail businesses. In 2012 he joined Vapor Group as Vice President and Chief Operating Officer having overall responsibility for product development, quality control and the supply chain. Mr. Nahon is also the corporate Secretary of the Vapor Group and a member of its Board of Directors.

Jorge Schcolnik. In September 2013, Mr. Schcolnik became Vice President, Chief Financial Officer and a member of Board of Directors of the Vapor Group. During the past five years, Mr. Schcolnik has been involved in several large international companies. Mr. Schcolnik was one of the founders of Integral Bioenergies Systems SL, a company located in Spain, where he was involved in its restructure and ultimate sale in 2008. Mr. Schcolnik was associated with E-Libro Corp. for which he deployed the digital publishing market in Argentina. He was also associated with the Federal and City of Buenos Aires Government for the company's academic platform. Since 2010, Mr. Schcolnik has been an officer in Advanced Envirotec Corp., Advanced Copisa Environmental Corp. and other environmental remediation companies. Since 1995, Mr. Jorge Schcolnik has also been representing the State of Buenos Aires, Argentina, within the United States in a number of capacities Commencing 1999, Mr. Schcolnik acted as the chief advisor to the Small and Medium Sized Enterprises Secretariat of the Republic of Argentina based in the United States. Mr. Schcolnik held that position until 2001. During 2001, Mr. Schcolnik participated as a co-founder of Enterprise Buenos Aires Corp., which was later transformed into EBA PLC Corp., a company dedicated to the development of power-line communications. EBA PLC Corp. became a prominent company within the power line communications industry as after two years it was sold in a transaction involving several million US Dollars. Mr. Schcolnik was born in Buenos Aires, Argentina, in 1945 and moved to the United States in September 1995.

Business of Vapor Group, Inc.

The principal business of Vapor Group, Inc., www.vaporgroup.com, (“Vapor Group”) is in the designing, developing, manufacturing and marketing high quality, vaporizers and e-cigarettes and accessories which use state-of-the-art electronic technology and specially formulated, “Made in the USA” e-liquids, which may or may not contain nicotine. Vapor Group offers a range of products and unique e-liquid flavors that it believes are unmatched in its industry. Its products are marketed under the Vapor Group, Total Vapor, Vapor 123, and Vapor Products brands, each of which is also a wholly-owned subsidiary of the same name. It sells nationwide through distributors, wholesalers and directly to consumers through its own websites and direct response advertising, and also owns as a wholly-owned subsidiary, Total Vapor Opportunities, Inc., a pending franchisor of “Total Vapor” retail stores in the continental U.S. In addition, Vapor Group owns as a wholly-owned subsidiary, VGR Media, Inc., www.vgr-media.com, a full service interactive advertising agency, offering Vapor Group’s products, and more generally customized performance marketing solutions to help marketers of consumer products acquire new customers and maximize their return on investment. VGR Media operates in the U.S. and sells domestically and internationally.

Vapor Group, Inc. and its subsidiaries are managed by a highly experienced team of executives committed to responsible business policies and practices, including the marketing of our products only to those eighteen years of age or older, not making or avoiding claims about our product health benefits, and fulfilling the requirements of all applicable laws and regulations.

|

8

|

ITEM 1A. RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

Risks Relating to Our Business

WE RELY UPON KEY MEMBERS OF OUR MANAGEMENT TEAM AND OTHER KEY PERSONNEL AND A LOSS OF KEY PERSONNEL COULD PREVENT OR SIGNIFICANTLY DELAY THE ACHIEVEMENT OF OUR GOALS.

Our success will depend to a large extent on the abilities and continued services of key members of our management team including our President and CEO, and Vice President and COO, as well as other key personnel. The loss of these key members of our management team or other key personnel could prevent or significantly delay the implementation of our business plan, research and development and marketing efforts. If we continue to grow, we will need to add additional management and other personnel. Our success will depend on our ability to attract and retain highly skilled personnel and our efforts to obtain or retain such personnel may not be successful.

WE HAVE LIMITED RESOURCES AND WILL NEED ADDITIONAL FINANCING IN ORDER TO EXECUTE OUR BUSINESS PLAN AND CONTINUE AS A GOING CONCERN.

We have limited resources and our cash on hand may not be sufficient to satisfy our cash requirements during the next twelve months. The financial statements included in this annual report do not include any adjustment to asset values or recorded amounts of liability that might be necessary in the event we are unable to continue as a going concern. If we are in fact unable to continue as a going concern, shareholders may lose their entire investment in our common stock.

IF WE ARE UNABLE TO MANAGE ANY FUTURE GROWTH EFFECTIVELY, OUR PROFITABILITY AND LIQUIDITY COULD BE ADVERSELY AFFECTED.

Our growth is expected to place significant strain on our limited research and development, sales and marketing, operational and administrative resources. To manage any future growth, we must continue to improve our operational and financial systems and expand, train and manage our employee base. We also need to improve our supply chain management and quality control operations and hire and train new employees, including sales and customer service representatives and operations managers. If we are unable to manage our growth effectively, our profitability and liquidity could be adversely affected.

IF OUR DEVELOPED TECHNOLOGY OR TECHNOLOGY UNDER DEVELOPMENT DOES NOT ACHIEVE MARKET ACCEPTANCE, PROSPECTS FOR OUR GROWTH AND PROFITABILITY WOULD BE LIMITED.

Our future success depends on market acceptance of the technology used in our products and our technology currently under development. Although adoption of e-cigarettes has grown in recent years, adoption of such products has only recently begun, is still limited and faces significant challenges. Potential customers may be reluctant to adopt e-cigarette products as an alternative to traditional smoking because of its higher initial cost or perceived risks relating to its novelty, reliability, usefulness, quality and cost-effectiveness when compared to other established smoking products on the market. Changes in economic and market conditions may also affect the marketability of e-cigarette products. Even if e-cigarette products continue to achieve performance improvements and cost reductions, limited customer awareness of their benefits, lack of widely accepted standards governing them and customer unwillingness to adopt their use in favor of entrenched solutions could significantly limit the demand for such products and adversely impact our results of operations.

|

9

|

E-CIGARETTE PRODUCTS ARE SUBJECT TO RAPID TECHNOLOGICAL CHANGES. IF WE FAIL TO ACCURATELY ANTICIPATE AND ADAPT TO THESE CHANGES, THE PRODUCTS WE SELL WILL BECOME OBSOLETE, CAUSING A DECLINE IN OUR SALES AND PROFITABILITY.

E-cigarette products are subject to rapid technological changes that often cause product obsolescence. Companies within the e-cigarette industry are continuously developing new products with heightened performance and functionality. This puts pricing pressure on existing products and constantly threatens to make them, or causes them to be, obsolete. If we fail to accurately anticipate the introduction of new technologies, we may possess significant amounts of obsolete inventory that can only be sold at substantially lower prices and profit margins than we anticipated. In addition, if we fail to accurately anticipate the introduction of new technologies or are unable to develop the planned new technologies, we may be unable to compete effectively due to our failure to offer products most demanded by the marketplace. If any of these failures occur, our sales, profit margins and profitability will be adversely affected.

WE MAY BE SUBJECT IN THE FUTURE TO BURDENSOME GOVERNMENTAL REGULATION.

The e-cigarette industry is relatively new and the manufacture and distribution of its products is not currently subject to consistent or significant amounts of governmental regulation. Over time, we may become subject to burdensome and costly governmental regulation at the municipal, state and federal levels. The cost of compliance with such regulation may be costly, and may negatively impact our future revenues, profits, and the manner in which we distribute and market our products.

IF WE ARE UNABLE TO INCREASE PRODUCTION CAPACITY FOR OUR PRODUCTS IN A COST EFFECTIVE AND TIMELY MANNER, WE MAY INCUR DELAYS IN SHIPMENT AND OUR REVENUES AND REPUTATION IN THE MARKETPLACE COULD BE HARMED.

An important part of our business plan is the expansion of production capacity for our products. In order to fulfill anticipated demand for our products, we invest in capacity in advance of actual customer orders, typically based on preliminary, non-binding indications of future demand. As customer demand for our products changes, we must be able to adjust our production capacity to meet demand while keeping costs down. Uncertainty is inherent within our facility and capacity expansion, and unforeseen circumstances could offset the anticipated benefits, disrupt our ability to provide products to our customers and impact product quality.

Our ability to successfully increase production capacity in a cost effective and timely manner will depend on a number of factors, including the following: (i) our ability to transition production in our manufacturing facility; (ii) the ability of contract manufacturers to allocate more of their existing capacity to us or their ability to add new capacity quickly; (iii) the ability of any future contract manufacturers to successfully implement our manufacturing processes; (iv) the availability of critical components and subsystems used in the manufacture of our products; (v) our ability to effectively establish adequate management information systems, financial controls and supply chain management and quality control procedures; and (vi) the occurrence of equipment failures, power outages, environmental risks or variations in the manufacturing process.

If we are unable to increase production capacity for our products in a cost effective and timely manner while maintaining adequate quality, we may incur delays in shipment or be unable to meet increased demand for our products which could harm our revenues and operating margins and damage our reputation and our relationships with current and prospective customers. Conversely, due to the proportionately high fixed cost nature of our business (such as facility expansion costs), if demand does not increase at the rate forecasted, we may not be able to reduce manufacturing expenses or overhead costs at the same rate as demand decreases, which could also result in lower margins and adversely impact our business and results of operations.

|

10

|

WE INTEND TO ASSEMBLE AND MANUFACTURE CERTAIN OF OUR PRODUCTS AND OUR SALES, RESULTS OF OPERATIONS AND REPUTATION COULD BE MATERIALLY ADVERSELY AFFECTED IF THERE IS A DISRUPTION AT OUR ASSEMBLY AND MANUFACTURING FACILITY.

Our assembly and manufacturing operations for our products is based in Davie, Florida. The operation of this facility involves many risks, including equipment failures, natural disasters, industrial accidents, power outages and other business interruptions. We could incur significant costs to maintain compliance with, or due to liabilities under, environmental laws and regulations, the violation of which could lead to significant fines and penalties. Although we intend to carry business interruption insurance and third-party liability insurance to cover certain claims in respect of personal injury or property or environmental damage arising from accidents on our properties or relating to our operations, any existing insurance coverage may not be sufficient to cover all risks associated with our business. As a result, we may be required to pay for financial and other losses, damages and liabilities, including those caused by natural disasters and other events beyond our control, out of our own funds, which could have a material adverse effect on our business, financial condition and results of operations. Additionally, any interruption in our ability to assemble, manufacture or distribute our products could result in lost sales, limited revenue growth and damage to our reputation in the market, all of which would adversely affect our business.

Additionally, we intend to rely on arrangements with independent shipping companies, such as United Parcel Service, Inc. and Federal Express Corp., for the delivery of certain components and subsystems from vendors and products to our customers in both the United States and abroad. The failure or inability of these shipping companies to deliver components, subsystems or products timely, or the unavailability of their shipping services, even temporarily, could have a material adverse effect on our business. We may also be adversely affected by an increase in freight surcharges due to rising fuel costs or added security.

WE MAY UTILIZE A CONTRACT MANUFACTURER TO MANUFACTURE CERTAIN OF OUR PRODUCTS AND ANY DISRUPTION IN THIS RELATIONSHIP MAY CAUSE US TO FAIL TO MEET OUR CUSTOMERS’ DEMANDS AND MAY DAMAGE OUR CUSTOMER RELATIONSHIPS.

Although we intend to assemble and manufacture certain of our products, we may depend on a third party contract manufacturer to manufacture a portion of our products elsewhere. This manufacturer will need to provide the necessary facilities and labor to manufacture these products, which may be primarily high volume products. Our reliance on a contract manufacturer involves certain risks, including the following: (i) lack of direct control over production capacity and delivery schedules; (ii) risk of equipment failures, natural disasters, industrial accidents, power outages and other business interruptions; (iii) lack of direct control over quality assurance and manufacturing yield; and (iv) risk of loss of inventory while in transit.

If a potential contract manufacturer were to terminate its arrangements with us or fail to provide the required capacity and quality on a timely basis, we would experience delays in the manufacture and shipment of our products until alternative manufacturing services could be contracted or offsetting internal manufacturing processes could be implemented. Any significant shortages or interruption may cause us to be unable to timely deliver sufficient quantities of our products to satisfy our contractual obligations and particular revenue expectations. Moreover, even if we timely locate substitute products and their price materially exceeds the original expected cost of such products, then our margins and results of operations would be adversely affected.

To qualify a contract manufacturer, familiarize it with our products, quality standards and other requirements and commence volume production may be a costly and time-consuming process. If we are required to choose a contract manufacturers for any reason, our revenue, gross margins and customer relationships could be adversely affected.

|

11

|

OUR INDUSTRY IS HIGHLY COMPETITIVE AND IF WE ARE NOT ABLE TO COMPETE EFFECTIVELY, INCLUDING AGAINST LARGER E-CIGARETTE MANUFACTURERS WITH GREATER RESOURCES, OUR PROSPECTS FOR FUTURE SUCCESS WILL BE JEOPARDIZED.

Our industry is highly competitive. We face competition from both traditional smoking technologies provided by numerous vendors as well as from e-cigarette products provided by a growing roster of industry participants. The e-cigarette industry is characterized by rapid technological change, short product lifecycles and frequent new product introductions, and a competitive pricing environment. These characteristics increase the need for continual innovation and provide entry points for new competitors as well as opportunities for rapid market share shifts.

Currently, we view our primary competition to be from large, established companies in the traditional e-cigarette industry. Certain of these companies also provide, or have undertaken initiatives to develop, e-cigarette products as well as other similar or related products. Additionally, we face competition from a fragmented universe of smaller niche or low-cost offshore providers of e-cigarette products. We also anticipate that larger e-cigarette manufacturers may seek to compete with us by introducing products similar to ours.

Some of our current and future competitors are larger companies with greater resources to devote to research and development, manufacturing and marketing, as well as greater brand name recognition. Some of our more diversified competitors could also compete more aggressively with us by subsidizing losses in their e-cigarette businesses with profits from other lines of business. Moreover, if one or more of our competitors or suppliers were to merge with one another, the change in the competitive landscape could adversely affect our customer, channel or supplier relationships, or our competitive position. Additionally, any loss of a key channel partner, whether to a competitor or otherwise, could severely and rapidly damage our competitive position. To the extent that competition in our markets intensifies, we may be required to reduce our prices in order to remain competitive. If we do not compete effectively, or if we reduce our prices without making commensurate reductions in our costs, our net sales and profitability, and our future prospects for success, may be harmed.

IF WE DO NOT PROPERLY ANTICIPATE THE NEED FOR CRITICAL RAW MATERIALS AND COMPONENTS, WE MAY BE UNABLE TO MEET THE DEMANDS OF OUR CUSTOMERS, WHICH COULD REDUCE OUR COMPETITIVENESS, CAUSE A DECLINE IN OUR MARKET SHARE AND HAVE A MATERIAL ADVERSE EFFECT ON OUR RESULTS OF OPERATIONS.

We depend on our suppliers for certain standard components as well as custom components critical to the manufacture of our products. We currently rely on a select number of suppliers for the components, including “e-liquids”, used in the production of our products. We depend on our vendors to supply such materials in a timely manner in adequate quantities and consistent quality and at reasonable costs. Should any of our suppliers be unable to fulfill an order for us, finding a suitable alternative supply of the required component that meets our strict specifications and obtaining them in needed quantities may be a time-consuming process, and we may not be able to find an adequate alternative source of supply at an acceptable cost. Any significant interruption in the supply of these raw materials and components could have a material adverse effect on our results of operations.

OUR FINANCIAL RESULTS MAY VARY SIGNIFICANTLY FROM PERIOD-TO-PERIOD DUE TO UNPREDICTABLE SALES CYCLES IN CERTAIN OF THE MARKETS INTO WHICH WE SELL OUR PRODUCTS, AND CHANGES IN THE MIX OF PRODUCTS WE SELL DURING A PERIOD, WHICH MAY LEAD TO VOLATILITY IN OUR STOCK PRICE.

The size and timing of our potential revenue from sales to our customers is difficult to predict and is market dependent. Our sales efforts will often require us to educate our customers about the use and benefits of our products, including their technical and performance characteristics. We intend to spend substantial amounts of time and money on our sales efforts and there is no assurance that these investments will produce any sales within expected time frames or at all. Given the potentially large size of purchase orders for our products, particularly in the retail distribution market, the loss of or delay in the signing of a customer order could significantly reduce our revenue in any period. Our revenues in each period may also vary significantly as a result of purchases, or lack thereof, by potential significant customers. Because most of our operating and capital expenses will be incurred based on the estimated number of product purchases and their timing, they are difficult to adjust in the short term. As a result, if our revenue falls below our expectations or is delayed in any period, we may not be able to proportionately reduce our operating expenses or manufacturing costs for that period, and any reduction of manufacturing capacity could have long-term implications on our ability to accommodate future demand.

|

12

|

Our profitability from period-to-period may also vary significantly due to the mix of products that we may sell in different periods. Consequently, sales of individual products may not necessarily be consistent across periods, which could affect product mix and cause gross and operating profits to vary significantly. As a result of these factors, we believe that quarter-to-quarter comparisons of our operating results cannot necessarily be relied upon to be meaningful and that these comparisons cannot be relied upon as indicators of future performance.

OUR PRODUCTS MAY CONTAIN DEFECTS THAT COULD REDUCE SALES, RESULT IN COSTS ASSOCIATED WITH THE RECALL OF THOSE ITEMS AND RESULT IN CLAIMS AGAINST US.

The manufacture of our products involves highly complex processes. Despite testing by us and our customers, defects have been and could be found in our existing or future products. These defects may cause us to incur significant warranty, support and repair costs, and costs associated with recall may divert the attention of our engineering personnel from our product development efforts and harm our relationships with customers and our reputation in the marketplace. We generally provide lifetime warranty on our products, and such warranty may require us to repair, replace or reimburse the purchaser for the purchase price of the product, at the customer’s discretion. Moreover, even if our products meet standard specifications, our customers may attempt to use our products in applications they were not designed for, resulting in product failures and creating customer dissatisfaction. These problems could result in, among other things, a delay in the recognition or loss of revenues, loss of market share or failure to achieve market acceptance. Defects, integration issues or other performance problems in our products could also result in personal injury or financial or other damages to our customers for which they might seek legal recourse against us. We may be the target of product liability lawsuits and could suffer losses from a significant product liability judgment against us if the use of our products at issue is determined to have caused injury. A significant product recall or product liability case could also result in adverse publicity, damage to our reputation and a loss of customer confidence in our products and adversely affect our results of operations.

IF WE ARE UNABLE TO OBTAIN AND PROTECT OUR INTELLECTUAL PROPERTY RIGHTS, OUR ABILITY TO COMMERCIALIZE OUR PRODUCTS COULD BE SUBSTANTIALLY LIMITED.

As of the date of this Annual Report, we have filed for the registration and protection of certain trademarks in the U.S. Our applications may not be granted. Because trademarks involve complex legal, technical and factual questions, the issuance, scope, validity and enforceability of them cannot be predicted with certainty. Competitors may develop products similar to our products that do not conflict with our trademark rights. Others may challenge our trademarks and, as a result, any of our trademarks could be narrowed or invalidated. In some cases, we may rely on confidentiality agreements or trade secret protections to protect our proprietary technology. Such agreements, however, may not be honored and particular elements of our proprietary technologies may not qualify as protectable trade secrets under applicable law. In addition, others may independently develop similar or superior technology, and in the absence of applicable prior patents, we would have no recourse against them.

OUR BUSINESS MAY BE IMPAIRED BY CLAIMS THAT WE, OR OUR CUSTOMERS, INFRINGE INTELLECTUAL PROPERTY RIGHTS OF OTHERS.

Our industry is characterized by vigorous protection and pursuit of intellectual property rights. These traits may result in significant and often protracted and expensive litigation. In addition, we may inadvertently infringe on patents or rights owned by others and licenses might not be available to us on reasonable or acceptable terms or at all. Litigation to determine the validity of patents, trademarks or claims by third parties of infringement of patents, trademarks or other intellectual property rights could result in significant legal expense and divert the efforts of our personnel and management, even if the litigation results in a determination favorable to us. Third parties have and may in the future attempt to assert infringement claims against us, or our wholesale customers, with respect to our products. In the event of an adverse result in such litigation, we could be required to pay substantial damages; stop the manufacture, use and sale of products found to be infringing; incur asset impairment charges; discontinue the use of processes found to be infringing; expend significant resources to develop non-infringing products or processes; or obtain a license to use third party technology and whether or not the result is adverse to us, we may have to indemnify our wholesale customers if they were brought into the litigation.

|

13

|

FAILURE TO ACHIEVE AND MAINTAIN EFFECTIVE INTERNAL CONTROLS COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR OPERATIONS AND OUR STOCK PRICE.

We are subject to Section 404 of the Sarbanes-Oxley Act of 2002, which requires an annual management assessment of the effectiveness of our internal control over financial reporting. Effective internal controls are necessary for us to produce reliable financial reports, and failure to achieve and maintain effective internal controls over financial reporting could cause investors to lose confidence in our operating results, and could have a material adverse effect on our business and on the price of our common stock. Because of our status as a smaller reporting company registrant as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, the independent registered public accounting firm auditing our financial statements has not been required to attest to, and report on, the effectiveness of our internal control over financial reporting.

IF WE ARE UNABLE TO ATTRACT, HIRE AND RETAIN QUALIFIED SALES AND MANAGEMENT PERSONNEL, THE COMMERCIAL OPPORTUNITY FOR OUR PRODUCTS AND SERVICES MAY BE DIMINISHED.

Currently, our sales force consists of three full-time sales representatives. We may not be able to attract, hire, train and retain qualified sales and sales management personnel. If we are not successful in our efforts to maintain and grow a qualified sales force, our ability to independently market and promote our products may be impaired. In such an event, we would likely need to establish collaboration, co-promotion, distribution or other similar arrangement to market and sell our products. However, we might not be able to enter into such an arrangement on favorable terms, if at all. Even if we are able to effectively maintain a qualified sales force, our sales force may not be successful in commercializing our products and services.

IF WE FAIL TO ATTRACT AND RETAIN KEY PERSONNEL, OR TO RETAIN OUR EXECUTIVE MANAGEMENT TEAM, WE MAY BE UNABLE TO SUCCESSFULLY DEVELOP OR COMMERCIALIZE OUR PRODUCTS.

Our success depends in part on our continued ability to attract, retain and motivate highly qualified managerial personnel. We are highly dependent upon our executive management team. The loss of the services of any one or more of the members of our executive management team could delay or prevent the successful completion of some of our development and commercialization objectives.

Recruiting and retaining qualified sales and marketing personnel is critical to our success. We may not be able to attract and retain these personnel on acceptable terms given the competition among numerous pharmaceutical and biotechnology companies for similar personnel. In addition, we rely on consultants and advisors, including scientific and clinical advisors, to assist us in formulating our development and commercialization strategy. Our consultants and advisors may also be employed by companies and may have commitments under consulting or advisory contracts with other entities that may limit their availability to us.

IF THE ESTIMATES THAT WE MAKE, OR THE ASSUMPTIONS UPON WHICH WE RELY, IN PREPARING OUR FINANCIAL STATEMENTS PROVE INACCURATE, OUR FUTURE FINANCIAL RESULTS MAY VARY FROM EXPECTATIONS.

Our financial statements have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of our financial statements requires us to make estimates and judgments that affect the reported amounts of our assets, liabilities, stockholders’ equity, revenues and expenses, the amounts of charges accrued by us and related disclosure of contingent assets and liabilities. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. We cannot assure you, therefore, that there may not be material fluctuations between our estimates and the actual results.

|

14

|

THE CURRENT GLOBAL ECONOMIC DOWNTURN OR RECESSION MAY NEGATIVELY AFFECT OUR BUSINESS.

The current global economic downturn or recession could negatively affect our sales because many consumers consider the purchase of our products and services as discretionary. We cannot predict the timing or duration of the economic slowdown or recession or the timing or strength of a subsequent recovery, worldwide, or in the specific end markets we serve. If the market for our products and services significantly deteriorates due to the economic situation, our business, financial condition or results of operations could be materially and adversely affected.

Risks Related To Our Common Stock

OUR COMMON STOCK IS CLASSIFIED AS A “PENNY STOCK” AS THAT TERM IS GENERALLY DEFINED IN THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, TO MEAN EQUITY SECURITIES WITH A PRICE OF LESS THAN $5.00. OUR COMMON STOCK WILL BE SUBJECT TO RULES THAT IMPOSE SALES PRACTICE AND DISCLOSURE REQUIREMENTS ON BROKER-DEALERS WHO ENGAGE IN CERTAIN TRANSACTIONS INVOLVING A PENNY STOCK.

We will be subject to the penny stock rules adopted by the Securities and Exchange Commission that require brokers to provide extensive disclosure to its customers prior to executing trades in penny stocks. These disclosure requirements may cause a reduction in the trading activity of our common stock, which in all likelihood would make it difficult for our stockholders to sell their securities.

Rule 3a51-1 of the Securities Exchange Act of 1934 establishes the definition of a “penny stock,” for purposes relevant to us, as any equity security that has a minimum bid price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to a limited number of exceptions which are not available to us. It is likely that our shares will be considered to be penny stocks for the immediately foreseeable future. This classification severely and adversely affects any market liquidity for our common stock.

For any transaction involving a penny stock, unless exempt, the penny stock rules require that a broker or dealer approve a person’s account for transactions in penny stocks and the broker or dealer receive from the investor a written agreement to the transaction setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience and objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable for that person and that that person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, which, in highlight form, sets forth:

|

· |

The basis on which the broker or dealer made the suitability determination, and |

|

· |

That the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

FINRA SALES PRACTICE REQUIREMENTS MAY LIMIT A STOCKHOLDER'S ABILITY TO BUY AND SELL OUR STOCK.

The Financial Industry Regulatory Authority ("FINRA") has adopted rules that relate to the application of the Commission's penny stock rules in trading our securities and require that a broker/dealer have reasonable grounds for believing that the investment is suitable for that customer, prior to recommending the investment. Prior to recommending speculative, low priced securities to their non-institutional customers, broker/dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative, low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker/dealers to recommend that their customers buy our common stock which may have the effect of reducing the level of trading activity and liquidity of our common stock. Further, many brokers charge higher transactional fees for penny stock transactions. As a result, fewer broker/dealers may be willing to make a market in our common stock thereby reducing a shareholder's ability to resell shares of our common stock.

|

15

|

IF WE FAIL TO COMPLY WITH THE RULES UNDER THE SARBANES-OXLEY ACT RELATED TO ACCOUNTING CONTROLS AND PROCEDURES OR IF MATERIAL WEAKNESSES OR OTHER DEFICIENCIES ARE DISCOVERED IN OUR INTERNAL ACCOUNTING PROCEDURES, OUR STOCK PRICE COULD DECLINE SIGNIFICANTLY.

Section 404 of the Sarbanes-Oxley Act requires annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our independent auditors addressing these assessments. We are in the process of documenting and testing our internal control procedures, and we may identify material weaknesses in our internal control over financial reporting and other deficiencies. If material weaknesses and deficiencies are detected, it could cause investors to lose confidence in our Company and result in a decline in our stock price and consequently affect our financial condition. In addition, if we fail to achieve and maintain the adequacy of our internal controls, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to helping prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock could drop significantly. In addition, we cannot be certain that additional material weaknesses or significant deficiencies in our internal controls will not be discovered in the future.

OUR COMMON STOCK MAY BE THINLY TRADED, LIQUIDITY LIMITED, AND WE MAY BE UNABLE TO OBTAIN LISTING OF OUR COMMON STOCK ON A MORE LIQUID MARKET.

Our common stock is quoted on the OTC which provides significantly less liquidity than a securities exchange (such as the American or New York Stock Exchange) or an automated quotation system (such as the Nasdaq National Market or SmallCap Market). There is uncertainty that we will ever be accepted for a listing on an automated quotation system or a securities exchange.

Often there is currently a limited volume of trading in our common stock, and on many days there has been no trading activity at all. The purchasers of shares of our common stock may find it difficult to resell their shares at prices quoted in the market or at all.

Certain stockholders control a large percentage of our common stock and Series A Preferred Shares and therefore the current stockholders will continue to control the Company, and their interests may be different from yours, as a result, you may have no effective voice in our management.

The Company’s President and CEO and Vice President and COO will retain control of the Company as a result of their ownership of the Series A and Series B Preferred Stock. Management’s interests may be different from yours, and as a result, the shareholders may have no effective voice in managing the affairs of the Company.

FUTURE SALES OF SHARES OF OUR COMMON STOCK MAY DECREASE THE PRICE FOR SUCH SHARES.

Actual sales, or the prospect of sales by our shareholders, may have a negative effect on the market price of the shares of our common stock. We may also register certain shares of our common stock that are subject to outstanding convertible securities, if any, or reserved for issuance under our stock option plans, if any. Once such shares are registered, they can be freely sold in the public market upon exercise of the options. If any of our shareholders either individually or in the aggregate causes a large number of securities to be sold in the public market, or if the market perceives that these holders intend to sell a large number of securities, such sales or anticipated sales could result in a substantial reduction in the trading price of shares of our common stock and could also impede our ability to raise future capital.

|

16

|

CURRENT SHAREHOLDERS WILL BE IMMEDIATELY AND SUBSTANTIALLY DILUTED UPON A MERGER OR BUSINESS COMBINATION.

To the extent that additional shares of common stock are issued in connection with a merger or business combination, our shareholders could experience significant dilution of their respective ownership interests. Furthermore, the issuance of a substantial number of shares of common stock may adversely affect prevailing market prices, if any, for the common stock and could impair our ability to raise additional capital through the sale of equity securities.

THE COMPANY HAS NOT PAID DIVIDENDS, NOR DOES IT INTEND TO.

The Company has paid no dividends on its Common Stock to date, and there are no plans to pay any in the foreseeable future. Initial earnings which the Company may realize, if any, will be retained to finance growth of the Company. Any future dividends, of which there can be no assurance, will be directly dependent upon the earnings of the Company, its financial requirements and other factors.

OUR COMMON STOCK MAY BE SUBJECT TO PRICE VOLATILITY UNRELATED TO OUR OPERATIONS.

The market price of our common stock could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting our competitors or us. In addition, the stock market is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock.

SECURITIES ANALYSTS MAY NOT PROVIDE COVERAGE OF OUR COMMON STOCK OR MAY ISSUE NEGATIVE REPORTS, WHICH MAY HAVE A NEGATIVE IMPACT ON THE MARKET PRICE OF OUR COMMON STOCK.

Securities analysts have not historically provided research coverage of our common stock and may elect not to do so in the future. If securities analysts do not cover our common stock, the lack of research coverage may cause the market price of our common stock to decline. The trading market for our common stock may be affected in part by the research and reports that industry or financial analysts publish about our business. If one or more of the analysts who elects to cover us downgrades our stock, our stock price would likely decline substantially. If one or more of these analysts ceases coverage of us, we could lose visibility in the market, which in turn could cause our stock price to decline. In addition, rules mandated by the Sarbanes-Oxley Act of 2002 and a global settlement reached in 2003 between the SEC, other regulatory agencies and a number of investment banks have led to a number of fundamental changes in how analysts are reviewed and compensated. In particular, many investment banking firms are required to contract with independent financial analysts for their stock research. It may be difficult for companies such as ours, with smaller market capitalizations, to attract independent financial analysts that will cover our common stock. This could have a negative effect on the market price of our stock.

|

17

|

Other Risks

MERGERS OF THE TYPE THAT WE HAVE UNDERGONE ARE OFTEN SCRUTINIZED BY REGULATORS AND WE MAY ENCOUNTER FUTURE DIFFICULTIES OR DELAYS IN OBTAINING FUTURE REGULATORY APPROVALS WHICH WOULD NEGATIVELY IMPACT OUR FINANCIAL CONDITION AND THE VALUE AND LIQUIDITY OF YOUR SHARES OF COMMON STOCK.

On June 29, 2005, the SEC adopted rules dealing with private company mergers into dormant or inactive public companies. As a result, it is likely that we will be scrutinized carefully by the SEC and possibly by the Financial Industry Regulatory Authority (“FINRA”) which could result in difficulties or delays in achieving SEC clearance of any future registration statements or other SEC filings that we may pursue, in attracting FINRA-member broker-dealers to serve as market-makers in our common stock, or in achieving admission to one of the Nasdaq stock markets or any other national securities market. As a consequence, our financial condition and the value and liquidity of your shares of our common stock may be negatively impacted.

THE ELIMINATION OF MONETARY LIABILITY AGAINST OUR DIRECTORS, OFFICERS AND EMPLOYEES UNDER FLORIDA LAW AND THE EXISTENCE OF INDEMNIFICATION RIGHTS TO OUR DIRECTORS, OFFICERS AND EMPLOYEES MAY RESULT IN SUBSTANTIAL EXPENDITURES BY US AND MAY DISCOURAGE LAWSUITS AGAINST OUR DIRECTORS, OFFICERS AND EMPLOYEES.

Our Bylaws contain specific provisions that eliminate the liability of our directors for monetary damages to our company and shareholders, and we are prepared to give such indemnification to our directors and officers to the extent provided by Florida law. We may also have contractual indemnification obligations under our employment agreements with our officers. The foregoing indemnification obligations could result in our company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit our company and shareholders.

EMPLOYEES

The Company currently has approximately twenty employees including its officers and directors.

BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS

Our Company has not been involved in any bankruptcy, receivership or any similar proceeding, and, except as set forth herein, we have not had or been a party to any material reclassifications, mergers or consolidations during the previous five (5) years.

DOMAIN NAMES - None

MAJOR CUSTOMERS - None

RESEARCH AND DEVELOPMENT ACTIVITIES

The Company has not performed any customer-sponsored research and development activities relating to any new products or services during 2013 or 2014.

ENVIRONMENTAL LAWS

We do not handle, store or transport hazardous materials or waste products. We abide by all applicable federal, state and local laws and regulations governing the use, manufacture, storage, handling and disposal of hazardous materials and waste products. We do not anticipate the cost of complying with these laws and regulations to be material.

|

18

|

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

Office Locations

Until January 22, 2014, we maintained our principal offices at 10778 NW 53rd Street, Suite E, Sunrise Florida 33352, occupying an executive office of 500 square feet, for which no rent was paid through the year end of December 31, 2013. Following the completion of the Merger, as recorded on January 27, 2014, our headquartered address changed to 3701 SW 47th Avenue, Suite 415, Davie, Florida 33314, the principal rented office and manufacturing facility of Vapor Group, Inc., consisting of approximately 7,600 square feet of office, manufacturing and warehouse space in a one story industrial park complex.

ITEM 3. LEGAL PROCEEDINGS.

There are no pending legal or governmental proceedings relating to our Company to which we are a party, and to our knowledge, there are no material proceedings to which any of our directors, executive officers or affiliates are a party adverse to us or which have a material interest adverse to us.

ITEM 4. MINE SAFETY DISCLOSURE.

Not applicable.

|

19

|

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

As of the date of this Annual Report, the Company's Common Stock is quoted on the Over-the-Counter Pink-Sheets under the symbol "VPOR" which was changed by FINRA from the old symbol, “SPLI”, on April 29, 2014. The market for the Company's Common Stock is limited, volatile and sporadic and the price of the Company's Common Stock could be subject to wide fluctuations in response to quarterly variations in operating results, news announcements, trading volume, sales of Common Stock by officers, directors and principal shareholders of the Company, general market trends, changes in the supply and demand for the Company's shares, and other factors. The following table sets forth the high and low sales prices for each quarter relating to the Company's Common Stock for the last two fiscal years. These quotations reflect inter-dealer prices without retail mark-up, markdown, or commissions, and may not reflect actual transactions.

| High | Low | |||||||

|

Fiscal 2013 |

||||||||

|

1Q2013 |

$ |

0.0020 |

$ |

0.0007 |

||||

|

2Q2013 |

$ |

0.0014 |

$ |

0.0006 |

||||

|

3Q2013 |

$ |

0.0017 |

$ |

0.0006 |

||||

|

4Q2013 |

$ |

0.0019 |

$ |

0.0060 |

||||

|

Fiscal 2014 |

||||||||

|

1Q2014 |

$ |

0.4180 |

$ |

0.0006 |

||||

|

2Q2014 |

$ |

0.3045 |

$ |

0.0530 |

||||

|

3Q2014 |

$ |

0.0819 |

$ |

0.0138 |

||||

|

4Q2014 |

$ |

0.0310 |

$ |

0.0031 |

||||

Description of Securities

Our authorized capital stock consists of 4,500,000,000 shares of common stock, par value $0.001 per share, and 15,000,000 shares of preferred stock, $0.001 par value per share. As of March 30, 2015, 2,658,813,601 shares of our common stock were issued and outstanding.

Common Stock. Our Articles of Incorporation, as amended on October 28, 2014, January 29, 2015 and March 10, 2015, respectively, to increase the total number of authorized shares of common stock, provide that we are authorized to issue up to 4.5 billion (4,500,000,000) shares of common stock with a par value of $.001 per share.

Each outstanding share of common stock entitles the holder thereof to one vote per share on all matters. Stockholders do not have preemptive rights to purchase shares in any future issuance of our common stock. Upon our liquidation, dissolution or winding up, and after payment of creditors and preferred stockholders, if any, our assets will be divided pro-rata on a share-for-share basis among the holders of the shares of common stock.

The holders of shares of our common stock are entitled to dividends out of funds legally available when and as declared by our board of directors. Our board of directors has never declared a cash dividend and does not anticipate declaring any dividend in the foreseeable future. Should we decide in the future to pay dividends, as a holding company, our ability to do so and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries and other holdings and investments. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including as a result of restrictive covenants in loan agreements, restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions. In the event of our liquidation, dissolution or winding up, holders of our common stock are entitled to receive, ratably, the net assets available to stockholders after payment of all creditors and preferred stockholders.

|

20

|

Preferred Stock. Our Articles of Incorporation, as amended, also provide that we are authorized to issue up to fifteen million (15,000,000) shares of preferred stock with a par value of $.001 per share. As of the date of this report, there are two series of Preferred Stock designated, Series A and Series B, of which there are 1,000,000 shares of Series A Preferred Stock issued and outstanding and no shares of Series B Preferred Stock issued and outstanding. Our Board of Directors has the authority, without further action by the shareholders, to issue from time to time the preferred stock in one or more series for such consideration and with such relative rights, privileges, preferences and restrictions that the Board may determine. The preferences, powers, rights and restrictions of different series of preferred stock may differ with respect to dividend rates, amounts payable on liquidation, voting rights, conversion rights, redemption provisions, sinking fund provisions and purchase funds and other matters. The issuance of preferred stock could adversely affect the voting power or other rights of the holders of common stock.

Series A Preferred Stock. There are 1,000,000 shares of preferred stock designated as Series A Preferred Stock. Each share of Series A Preferred Stock has a par value of $.001 per share and a stated value equal to $.001. The Holders of outstanding Series A Preferred Stock shall be entitled to participate in any dividends declared on the Corporation’s common stock .In addition to voting as a class as to all matters that require class voting under the Florida Business Corporation Act, the Holders of the Series A Preferred Stock shall vote on all matters with the holders of the Common Stock (and not as a separate class) on ten thousand votes per share (10,000:1) basis. The Holders of the Series A Preferred Stock shall be entitled to receive all notices relating to voting as are required to be given to the holders of the Common Stock. The Series A Preferred Stock shall, with respect to rights on liquidation, rank equivalent to all classes of the common stock, $.001 par value per share (collectively, the "Common Stock" or "Common Shares"), of the Corporation. Shares of Series A Preferred Stock may not be redeemed by the Corporation. Each share of Series A Preferred Stock is not convertible into any other class of capital stock.

Series B Preferred Stock. On March 11, 2014, the Company designated 10,000,000 shares of the 15,000,000 authorized shares of preferred stock as Series B Preferred Stock. Each share of Series B Preferred Stock has a par value of $.001 per share and a stated value equal to $.001. The Holders of outstanding Series B Preferred Stock shall be entitled to participate in any dividends declared on the Corporation’s common stock .In addition to voting as a class as to all matters that require class voting under the Florida Business Corporation Act, the Holders of the Series B Preferred Stock shall vote on all matters with the holders of the Common Stock (and not as a separate class) on an eighteen hundred vote per share (1,800:1) basis. The Holders of the Series B Preferred Stock shall be entitled to receive all notices relating to voting as are required to be given to the holders of the Common Stock. The Series B Preferred Stock shall, with respect to rights on liquidation, rank equivalent to all classes of the common stock, $.001 par value per share (collectively, the "Common Stock" or "Common Shares"), of the Corporation. Shares of Series B Preferred Stock may not be redeemed by the Corporation. Each share of Series B Preferred Stock shall be convertible, without the payment of any additional consideration by the holder thereof and at the option of the holder thereof, at any time after the Series B Issue Date at the conversion ratio of one (1) share of Series B Preferred Stock for eighteen hundred (1,800) shares of Common Stock.

|

21

|

Holders

As of March 30, 2015, there are two holders of our preferred stock who are also officers and directors of the Company and approximately 75 shareholders of record of the common stock.

Transfer Agent and Registrar

On March 25, 2014, the Corporation appointed VStock Transfer, LLC, 77 Spruce Street, Suite 201, Cedarhurst, NY 11516 as its transfer agent and registrar for its common stock, replacing Interwest Transfer Co., 1981 Murray Holladay Road, Suite 100 Salt Lake City, Utah 84117, as its transfer agent and registrar for its common stock.

Our common stock is considered a "penny stock." The application of the "penny stock" rules to our common stock could limit the trading and liquidity of the common stock, adversely affect the market price of our common stock and increase your transaction costs to sell those shares. The Commission has adopted regulations which generally define a "penny stock" to be any equity security that has a market price (as defined) of less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions.

Shareholders should be aware that, according to SEC Release No. 34-29093 dated April 17, 1991, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. The occurrence of these patterns or practices could increase the volatility of our share price.

Our management is aware of the abuses that have occurred historically in the penny stock market.

Dividends

The Company has not declared any cash dividends with respect to its common stock or preferred stock during the last two fiscal years and does not intend to declare dividends in the foreseeable future. There are no material restrictions limiting or that are likely to limit the Company's ability to pay dividends on its outstanding securities.

|

22

|

Recent Sales of Unregistered Securities

On January 22, 2014, the Company entered into an Agreement of Merger and Plan of Reorganization ("Merger Agreement") by and among the Company and the Vapor Group, Inc., a Florida corporation ("Vapor Group") and its shareholders, pursuant to which the Company will acquire 100% of the issued and outstanding shares of Vapor Group, in return for the issuance of 750,000,000 shares of its common stock following completion of a pending 30:1 reverse split of the Company’s common stock. On March 7, 2014, per a filing of an 8-K dated March 13, 2014, the Company and the other parties to the Merger Agreement amended the Merger Agreement such that:

(a) The Company’s Series B Preferred Stock shall be issued in lieu of the issuance of the consideration of 750,000,000 shares of its Common Stock per the Merger Agreement, post an announced 30:1 reverse split, issuable to the Vapor Group Shareholders under the terms and conditions of the Merger Agreement;