Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

|

|

OR

|

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number: 000-54918

TOUCHPOINT METRICS, INC.

(Exact name of registrant as specified in its charter)

California

(State or other jurisdiction of incorporation or organization)

201 Spear Street, Suite 1100

San Francisco, CA 94105

(Address of principal executive offices, including zip code)

(415) 526-2655

(Registrant's telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

Securities registered pursuant to section 12(g) of the Act:

|

|

NONE

|

COMMON STOCK

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES [ ] NO [X]

Indicate by check mark if the registrant is required to file reports pursuant to Section 13 or Section 15(d) of the Act: YES [X] NO [ ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [ ] NO [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer

|

[ ]

|

Accelerated Filer

|

[ ]

|

|

Non-accelerated Filer (Do not check if a smaller reporting company)

|

[ ]

|

Smaller Reporting Company

|

[X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES [ ] NO [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of June 30, 2014: $0.19.

At March 22, 2015, 16,081,158 shares of the registrant's common stock were outstanding.

TABLE OF CONTENTS

|

Page

|

||

|

Business.

|

4

|

|

|

Risk Factors.

|

7

|

|

|

Unresolved Staff Comments.

|

8

|

|

|

Properties.

|

8

|

|

|

Legal Proceedings.

|

8

|

|

|

Mine Safety Disclosure.

|

8

|

|

|

Market for Our Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities.

|

8

|

|

|

Selected Financial Data.

|

10

|

|

|

Management's Discussion and Analysis of Financial Condition and Results of

Operation.

|

10

|

|

|

Quantitative and Qualitative Disclosures About Market Risk.

|

18

|

|

|

Financial Statements and Supplementary Data.

|

18

|

|

|

Changes in and Disagreements With Accountants on Accounting and Financial

Disclosure.

|

34

|

|

|

Controls and Procedures.

|

34

|

|

|

Other Information.

|

35

|

|

|

Directors, Executive Officers and Corporate Governance.

|

35

|

|

|

Executive Compensation.

|

39

|

|

|

Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters.

|

41

|

|

|

Certain Relationships and Related Transactions, and Director Independence.

|

42

|

|

|

Principal Accountant Fees and Services.

|

43

|

|

|

Exhibits and Financial Statement Schedules.

|

44

|

|

|

46

|

||

|

47

|

||

- 2 -

In this report, the terms "Touchpoint Metrics Inc.," "Touchpoint Metrics," "MCorp" "McorpCX" "Company," "we," "us" and "our" refer to Touchpoint Metrics Inc.

All statements included or incorporated by reference in this report, other than statements or characterizations of historical fact, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management's beliefs, and certain assumptions made by us, all of which are subject to change. Forward-looking statements can often be identified by words such as "anticipates," "expects," "intends," "plans," "predicts," "believes," "seeks," "estimates," "may," "will," "should," "would," "could," "potential," "continue," "ongoing," similar expressions, and variations or negatives of these words, and include, but are not limited to, statements regarding projected results of operations, management's future strategic plans, market acceptance and performance of our products, our ability to pay interest and principal when due on our notes, our ability to retain and hire key executives, sales and technical personnel and other employees in the numbers, with the capabilities, and at the compensation levels needed to implement our business and product plans, the competitive nature of and anticipated growth in our markets, ability to find suitable acquisitions on favorable terms, if at all, our accounting estimates, and our assumptions and judgments. These forward looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that are difficult to predict and that could cause our actual results to differ materially and adversely from those expressed in any forward-looking statement. The risks and uncertainties referred to above include, but are not limited to, our business model; our ability to develop or acquire and gain market acceptance for new products and enhancements to existing products in a cost-effective and timely manner; competitive pressures and other similar factors such as the availability and pricing of competing products and technologies and the resulting effects on sales and pricing of our products; our ability to expand or contract operations, manage expenses and grow profitability; the rate at which our present and future customers adopt our existing and future products and services; fluctuations in our operating results including our revenue mix and our rate of growth; the risk that our anticipated investments in partner relationships and additional employees will not achieve expected results; our ability to manage and expand our anticipated partner relationships; interruptions or delays in our hosting operations; general economic conditions; breaches of our security measures; our ability to protect our intellectual property from infringement, and to avoid infringing on the intellectual property rights of third parties; any unanticipated ambiguities in fair value accounting standards; fluctuations in our operating results from the impact of stock-based compensation expense; our ability to hire, retain and motivate our employees and manage our growth;; the impact of potential future acquisitions, if any, including our ability to successfully integrate the products and people that we acquire through acquisitions; and various other factors. These forward-looking statements speak only as of the date of this report. We undertake no obligation to revise or update publicly any forward-looking statement for any reason, except as otherwise required by law.

- 3 -

PART I

General

Touchpoint Metrics, Inc. ("we," "us," "our," the "Company" or "Touchpoint Metrics") was incorporated in the State of California on December 14, 2001. We are a customer experience (CX) management solutions company dedicated to helping organizations improve customer experiences, increase customer loyalty, reduce costs and increase revenue. On March 23rd 2015, we announced that we will begin doing business under the DBA McorpCX, combining our CX products and services offerings under a single go-to-market brand.

We believe that delivering better customer experiences is a powerful, sustainable way for any organization to differentiate from their competition. We are engaged in the business of developing and delivering technology-enabled products - such as Touchpoint Mapping®, an on-demand ("cloud based") suite of customer experience management software - and value-added professional services that help large, medium and small organizations to do this by improving their customer listening and customer experience management capabilities. Our technology enables an organization's personnel to leverage a common application to see where and how to improve their customers' experiences across multiple channels and touchpoints, including web, sales, marketing, contact center, social, mobile, physical locations and others.

Our value-added and professional services helps primarily large and medium organizations plan, design and deliver better customer experiences and organize to do so, in addition to analysis and review of client data gathered through our application. Other services include customer experience training, strategy consulting and business process optimization, and are directed toward increasing our customers' adoption of our products and services, helping maximize their return on investment, and improving our customers' efficiency.

We maintain our primary business address at 201 Spear Street, Suite 1100, San Francisco, CA 94105. Our telephone number is (855) 938-8100. Our registered agent for service of process is National Registered Agents, Inc. Our web address is http://www.touchpointmetrics.com. The inclusion of our internet address in this report does not include or incorporate by reference into this report any information contained on, or accessible through, our website. Our annual reports on Form 10-K, quarterly reports on Form 10-Q,current reports on Form 8-K, amendments to those reports and other Securities and Exchange Commission, or SEC, filings are available free of charge through our website as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the SEC. Our common stock trades on OTC Bulletin Board under the symbol TPOI.

Products and Services

Customer experience (CX) is defined as the sum of all experiences a customer has with a company, its goods and its services, across various touchpoints and over the duration of their relationship with that company. Customer experience management is a series of disciplines, methodologies and processes used to comprehensively understand, plan, measure and manage a customer's experiences, with the goal of improving customer perceptions. A majority of corporate executives have said that customer experience management is an important part of their organization's strategic agenda, and that it is critical to their future success. While there are multiple reasons for this, among the most widely recognized is the ability of an improved customer experience to help an organization increase customer loyalty, better compete in otherwise commoditized businesses, and drive greater revenue.

While the customer experience management ecosystem is broad and complex, our software solutions are primarily focused on the needs of large, medium and small organizations interested in voice-of-the-customer insights, and a straightforward way to measure and improve customer experience over time. By gathering and analyzing customer experience data, our solutions help companies better understand both the positive and negative customer perceptions of customer experience and the specific interactions that drive these perceptions. Our value-added and professional services help primarily large and medium organizations interpret and take action on customer data, including the ability to plan, design and deliver better customer experiences and organize to do so, consistently and over time.

Touchpoint Mapping® On-Demand

Our current software product is called Touchpoint Mapping® On-Demand. Pricing of Touchpoint Mapping On-Demand varies based on breadth of insights sought, number of employees, number of customers and customer segments, frequency of insights gathered and other variables.

Touchpoint Mapping On-Demand is a research-based software solution designed to improve customer and employee experience, brand, and loyalty. It is meant to be a comprehensive customer experience solution for customer-centric organizations to measure and gather customer data across all their touchpoints, channels and interactions with their customers. Data is analyzed and can be displayed across multiple axes including customer segments, location, time and many other variables of interest to personnel within an organization.

Our software solution gives companies the ability to pinpoint which specific touchpoints are meeting customer wants and needs and which are not, by measuring the gap between customer expectations and the actual customer experience they receive. In addition to customer data, we can collect data from an organizations employees to identify any gaps between customer and employee perceptions of experience, and can collect data from prospective and competitors' customers to provide insight on the competitive market. Our solution also provides companies with the ability to coordinate disparate resources across the organization to develop, execute and manage their brand and customer experience strategies.

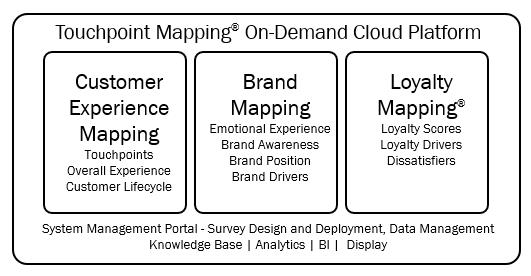

Touchpoint Mapping On-Demand is delivered through a cloud-based platform. The platform, accessible from our client portal, provides access to survey deployment, gives the ability to manage customer data and facilitates access to customer-driven business intelligence (BI) by displaying data in a series of online dashboards. Touchpoint Mapping On-Demand includes and integrates three primary measurement areas, including customer experience, brand and loyalty, which are delivered through our cloud platform as illustrated below.

Customer Experience Mapping

Customer Experience Mapping measures customer experience in three areas. The first is the degree to which individual customer interactions or touchpoints meet customer wants. The second is a measure of the overall and most recent customer experiences. And the third is a measure of the customer experience across different stages of the customer relationships lifecycle.

Brand Mapping

Brand Mapping measure brand perceptions in four areas. The first is area the degree to which the brand meets the emotional needs of customers. The second is overall awareness of an organization in the competitive market. The third is how an organization is perceived by customers in the context of its competitors. And the fourth is the degree to which brand drives engagement with an organization.

- 5 -

Loyalty Mapping®

Loyalty Mapping measures customer loyalty in four areas. The first area is through a loyalty-based customer segmentation model, segmenting customers into four groups based on degree of loyalty. The second is through loyalty metrics, such as CSAT and NPS®, or other loyalty metrics an organization may wish to assess. The third area is the measurement of loyalty drivers, which can include brand, individual touchpoints and other areas such as channel or overall experience. The last area is the measurement of dissatisfiers, which are aspects of the brand and the experience responsible for creating customer dissatisfaction.

Professional Services

Customer experience consulting services are offered primarily through our consulting services group, MCorp, which is a dba of the Company. MCorp services include customer experience management consulting in the areas of strategy development, planning, education, training and best practices, and includes the articulation of customer-centric strategies and implementation roadmaps in support of these strategies. Our software-enabled services leverage the analytical frameworks of, and in most cases the data gathered through, Touchpoint Mapping On-Demand®, with a particular focus on analytical solutions in support of customer experience improvement.

We expect that our Client Services Managers will work to drive product adoption and value by working with Touchpoint Mapping On-Demand customers over time to identify key performance indicators as measured by our software, leverage best practices, and improve customer experience, brand and customer loyalty. We offer value-added and professional services that include custom data analysis, roadmap development, implementation planning and customer experience training, among other services.

Our Strategy

Since our founding, we have been focused on customer experience improvement. The methodologies we developed and delivered as a professional services firm since that time form the foundation for our software and software enabled services today, as well as continuing to inform the delivery of our value added and professional services. After making a decision to focus on the development of on-demand and software-enabled solutions which automated significant aspects of our business, we released the initial version of our cloud-based software, Touchpoint Mapping On-Demand, to a broader market in 2013. While professional services continue to represent a majority of our revenue, we anticipate that they will continue to migrate to a secondary – though strategically critical - focus of the company. Our belief is that a combination of growing market demand for customer experience management solutions and increasing market adoption of on-demand, cloud-based software will help to pave the way for future growth of our company through a distributed, cloud-based technology solution delivered through direct sales as well as indirect sales through a planned global partner and reseller distribution channel.

Our ability to achieve our objectives will stem in large part from our ability to successfully commercialize Touchpoint Mapping® On-Demand, the licensing and adoption of our systems and methodologies, and the development of direct and indirect sales and distribution channels through which we can distribute our products and services.

Competition

The market for customer experience management solutions is highly competitive and increasingly fragmented. It is subject to rapidly changing technology, shifting organizational priorities and requirements, frequent introductions of new products and services, and increased marketing activities of other industry participants.

Multiple competitors exist in the overlapping areas of on-demand and traditional marketing research, customer relationship management (CRM) software, management consulting and customer experience management consulting. For example, many CRM software companies are beginning to include customer experience-specific insights as adjunct capabilities to their existing platforms, and others have rebranded their existing CRM software or customer satisfaction research software as customer experience software, which has the potential to create unforeseen competitive barriers and market confusion.

- 6 -

Many of our current and potential competitors have a larger market presence, greater name recognition, access to more potential customers and substantially greater financial, technical, sales and marketing, management, support and other resources than we have. As a result, many of our competitors are likely able to respond more quickly than we can to new or changing opportunities and technologies, and may devote greater resources to the marketing, promotion and sale of their products than we can.

Given the growth of customer experience management as a business discipline and on-demand software as a way for companies to better understand and manage customer experiences across their business, there are likely many competitors we have not identified. Additionally, we expect that new competitors will continue to enter the customer experience management and on demand customer experience software markets with competing products and services as the market continues to rapidly develop and mature. It is possible if not likely that these new competitors could rapidly acquire significant market share.

There are many potential unforeseen and significant market and competitive risks associated with launching any new product in any market. It is our expectation that numerous unforeseen challenges will be encountered as we continue to develop, market, distribute and sell our products and services. We cannot assure you that that we will be able to compete successfully against current or potential competitors, or that competition will not have a material adverse effect on our business, financial condition and operations.

Insurance

We maintain health, workmen's compensation, general liability, commercial auto, and professional liability/E&O insurance policies.

Employees

We currently have six full-time employees and thirteen independent contractors. We intend to hire more employees and independent contractors on an as-needed basis.

Offices

We have three business addresses. Our primary business address is located at 201 Spear Street, Suite 1100, San Francisco, CA 94105. Our additional addresses include a business office in San Anselmo, California located at 251 Sir Francis Drake Boulevard, 94960. We lease the aforementioned from the Four Kays, 2 Magnolia Avenue, San Anselmo, CA 94960 pursuant to a 36-month lease entered into on August 15, 2010 and extended on February 26, 2013 through August 31, 2016. Our monthly rental was $1,840 until August 31, 2013, $2,044 per month through August 31, 2014, and $2,095.10 through December 31, 2014.

Our office in Charlotte, North Carolina is located at 15720 John J. Delaney Dr., Suite 300, 28277. We lease the San Francisco and Charlotte spaces from DaVinci Virtual LLC, 2150 South 1300 East, Suite 200, Salt Lake City UT 84106 pursuant to a commercial lease on a month to month basis. Our monthly rental is $199.00 for our San Francisco location and $95.00 per month for our Charlotte, North Carolina location.

Government Regulation

We are not currently subject to direct federal, state or local regulation other than regulations applicable to businesses.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

- 7 -

None.

Our corporate headquarters are in a leased space located in San Francisco, California. The Company also leases office space in San Anselmo, California and Charlotte, North Carolina. We lease the San Anselmo office pursuant to a 36-month lease entered into on August 15, 2010 and extended on February 26, 2013 through August 31, 2016. Our monthly rental was $1,840 until August 31, 2013, $2,044 per month through August 31, 2014, and $2,095.10 through December 31, 2014.

We lease the San Francisco and Charlotte spaces pursuant to a commercial lease on a month to month basis. Our total monthly rental for the two locations is $294.00.

In 2007, we completed the purchase of an undeveloped tract of real property located in the unincorporated area of Blue Lakes, County of Lake, California. The real property contains five acres of land. It has no fixtures or improvements located thereon. The purchase price was $85,000 and it is carried on our books for this amount, and is included in the long term assets classification of our balance sheet as "Property and equipment, net." The real property is not used by us for our operations. It is currently unencumbered, unoccupied, remains undeveloped and unimproved, and has no associated carrying costs.

We believe that our existing facilities and offices are adequate to meet our current requirements. If we require additional space, we believe that we will be able to obtain such space on acceptable, commercially reasonable terms.

ITEM 4. MINE SAFETY DISCLOSURES.

None.

ITEM 5. MARKET FOR OUR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Our shares are traded on the Bulletin Board operated by the Financial Industry Regulatory Authority under the symbol "TPOI". FINRA cleared Pennaluna & Company for an unpriced quotation on February 13, 2013. A summary of trading by quarter for 2014 and 2013 is as follows:

|

Fiscal Year – 2014

|

High Bid

|

Low Bid

|

|

|

|

|

|

|

|

|

Fourth Quarter: 10/01/14 to 12/31/14

|

$0.40

|

$0.15

|

|

|

Third Quarter: 07/01/14 to 09/30/14

|

$0.30

|

$0.12

|

|

|

Second Quarter: 04/01/14 to 06/30/14

|

$0.43

|

$0.19

|

|

|

First Quarter: 01/01/14 to 03/31/14

|

$0.50

|

$0.43

|

- 8 -

|

Fiscal Year – 2013

|

High Bid

|

Low Bid

|

|

|

|

|

|

|

|

|

Fourth Quarter: 10/01/13 to 12/31/13

|

$1.24

|

$0.35

|

|

|

Third Quarter: 07/01/13 to 09/30/13

|

$1.25

|

$0.40

|

|

|

Second Quarter: 04/01/13 to 06/30/13

|

$5.00

|

$0.10

|

|

|

First Quarter: 01/01/13 to 03/31/13

|

$0.10

|

$0.10

|

Holders

There are 98 holders of record for our common stock. There are a total of 16,081,158 shares of common stock outstanding.

Dividends

We have not declared any cash dividends, nor do we intend to do so. We are not subject to any legal restrictions respecting the payment of dividends, except that they may not be paid to render us insolvent. Dividend policy will be based on our cash resources and needs and it is anticipated that all available cash will be needed for our operations in the foreseeable future.

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended, that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser's written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as bid and offer quotes, a dealers spread and broker/dealer compensation; the broker/dealer compensation, the broker/dealers' duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers' rights and remedies in cases of fraud in penny stock transactions; and, FINRA's toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

Securities Authorized for Issuance Under Equity Compensation Plans

|

Number of securities

|

|||

|

Number of securities to

|

Weighted-average

|

remaining available for

|

|

|

be issued upon exercise

|

exercise price of

|

future issuance under

|

|

|

of outstanding options,

|

outstanding options,

|

equity compensation plans

|

|

|

warrants and rights

|

warrants and rights

|

(excluding securities

|

|

|

Plan category

|

(a)

|

(b)

|

in column (a)) (c)

|

|

Equity compensation plans

approved by security holders

|

760,000

|

$0.40

|

1,740,000

|

|

Equity compensation plans

not approved by securities holders

|

None

|

None

|

None

|

|

Total

|

760,000

|

$0.40

|

1,740,000

|

- 9 -

Common Stock

Our authorized capital stock consists of 30,000,000 shares of common stock, no par value per share. The holders of our common stock:

|

*

|

have equal ratable rights to dividends from funds legally available if and when declared by our board of directors;

|

|

*

|

are entitled to share ratably in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs;

|

|

*

|

do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights; and

|

|

*

|

are entitled to one non-cumulative vote per share on all matters on which stockholders may vote.

|

All shares of common stock now outstanding are fully paid for and non-assessable and all shares of common stock which are the subject of this public offering, when issued, will be fully paid for and non-assessable. We refer you to our Articles of Incorporation, Bylaws and the applicable statutes of the State of California for a more complete description of the rights and liabilities of holders of our securities. All material terms of our common stock have been addressed in this section.

Outstanding Stock Options

For 2013, we granted two stock option awards, the first to Lynn Davison, which provides Ms. Davison with an option to acquire up to 300,000 shares of common stock at an exercise price of $0.40 per share over a graded vesting schedule; the second to Yann Sauvignon, which provided Mr. Sauvignon the option to acquire up to 80,000 shares of common stock at an exercise price of $0.50 per share with one-fifth of the shares vesting every six months commencing March 31, 2013. Mr. Sauvignon's shares were forfeited on November 13, 2014 and as such, are no longer outstanding.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

Cautionary Statement

This Management's Discussion and Analysis includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: "believe," "expect," "plan", "estimate," "anticipate," "intend," "project," "will," "predicts," "seeks," "may," "would," "could," "potential," "continue," "ongoing," "should" and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this Form 10-K. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or from our predictions. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events, or otherwise.

- 10 -

Overview

We are a customer experience (CX) management solutions company providing Touchpoint Mapping®, an on-demand ("cloud based") suite of customer experience software, as well as professional and related services designed to help organizations improve customer experiences, increase customer loyalty, reduce costs and increase revenue.

We believe that delivering better customer experiences is a powerful, sustainable way for any organization to differentiate from their competition. We are engaged in the business of developing and delivering technology-enabled products and professional services that help large, medium and small organizations to do this by improving their customer listening and customer experience management capabilities.

Our product, Touchpoint Mapping® On-Demand, is a research-based software solution designed to be a comprehensive customer experience solution for customer-centric organizations to measure and gather customer data across all their touchpoints, channels and interactions with their customers. It enables an organization's personnel to leverage a common application to see where and how to improve brand and customer loyalty, and their customers' experiences across multiple channels and touchpoints, including web, sales, marketing, contact center, social, mobile, physical locations and others.

Our value-added and professional services helps primarily large and medium organizations plan, design and deliver better customer experiences and organize to do so, in addition to analysis and review of client data gathered through our application. Other services include customer experience training, strategy consulting and business process optimization, and are directed toward increasing our customers' adoption of our products and services, helping maximize their return on investment, and improving our customers' efficiency.

Development of our software is ongoing, as Touchpoint Mapping On-Demand is refined and improved based on customer feedback, and as it is customized for specific organizations and industry sectors. The services delivered with Touchpoint Mapping On-Demand may include consulting and additional research services, as well as services such as assessment, integration, implementation and additional offline analysis and reporting of data. Customer experience consulting and professional services are offered primarily through our consulting services group, MCorp, which is a dba of the Company.

Though we released Touchpoint Mapping On-Demand in 2013, we cannot predict the timing or probability of generating material sales revenue from it. As of this filing, we have yet to engage the necessary sales and marketing staff or the capabilities required to capabilities to identify, develop, and close material product sales opportunities, and currently lack sufficient resources to market and sell our products in the manner which we believe is required to achieve our product sales and revenue growth objectives.

Sources of Revenue

Our revenue consisted primarily of professional and software-enabled consulting services, product sales and other revenues in 2014 and 2013. Consulting services include customer experience management consulting in the areas of strategy development, planning, education, training and program design, and includes the articulation of customer-centric strategies and implementation roadmaps in support of these strategies. Product revenue is from productized and software-enabled service sales not elsewhere classified, while other revenue includes reimbursement of related travel costs and out-of-pocket expenses.

While our plan of operations is based on migrating the majority of our service revenue from these categories to recurring SaaS subscription fees, we anticipate that fees for professional and software-enabled consulting services will remain a significant revenue source in the near future. As of December 31, 2014, we have successfully delivered certain features and functionality of our software product, Touchpoint Mapping On-Demand, to several clients. However, we have not obtained material stand-alone sales commitments for Touchpoint Mapping On-Demand, and do not anticipate being able to do so until we engage the necessary sales and marketing staff to develop and execute product sales opportunities.

- 11 -

Should we successfully obtain material sales commitments for Touchpoint Mapping On-Demand, we anticipate that subscription agreements and related professional services associated with delivering our software solutions will become a source of significant revenue. Subscriptions and associated professional services pricing are based on our gross margin objectives, growth strategies and the specific needs of our clients' organizations, measured primarily by the following metrics: breadth of insights sought, number of employees, number of customers and customer segments, frequency of insights gathered, and other variables.

Subscription agreements for our software solutions are offered as monthly term agreements which contain a minimum commitment period of at least 12 months, and which include related setup, upgrades, hosting and support. Professional services include consulting fees related to implementation, customization, configuration, training and other value added services.

Based on data gathered during the implementation stage of on-demand software and software-enabled services engagements, we believe that the average time it will take our clients from placing an order to live deployment of our products is between 30 and 45 days. We typically invoice clients upon inception of subscription agreements for setup and total subscription fees contracted over the term of the agreements, with payment due within 30 days.

Professional services related to the subscription agreements are invoiced at the inception of the professional services agreement at one-third or fifty percent of total fees, with the balance of payments due over the duration of the contract as project milestones are met. Amounts invoiced are recorded in accounts receivable and deferred revenue or revenue, depending on whether revenue recognition criteria have been met.

Cost of Revenue and Operating Expenses

Our costs of revenue and operating expenses are detailed at the sub-category level in our Income Statements. And while the financial results for these categories are further explained in the Results of Operations section below, a general description of these categories follows:

Cost of Goods Sold

Cost of goods sold consists primarily of expenses directly related to providing professional and consulting services. Those expenses include contract labor, third-party services, and materials and travel expenses related to providing professional services to our clients. As certain features of Touchpoint Mapping® On-Demand were made available for general release in 2014, costs of goods also included product-related hosting and monitoring costs, licenses for products embedded in the application, amortization of capitalized software development costs, related sales commissions, service support, account management and subscriptions, as applicable.

Should our client base grow, we intend to continue to invest additional resources in our hosting, technical support and professional services capabilities, as well as our utilization of third-party licensed software. We expect our professional services costs to increase in absolute dollars as we increase our overall revenue, but expect that professional services as a percentage of total revenue will decrease as we continue to shift our business towards sales of on-demand software solutions and software-enabled services. Because cost as a percentage of revenue is higher for professional services revenue than for software product sales revenue, a decrease in professional services as a percentage of total revenue will likely increase gross profit as a percentage of total revenue.

General and Administrative Expenses

General and administrative expenses consist primarily of salary and related expenses for management, client delivery, finance and accounting, and sales personnel. Expenses also include contract services, marketing and promotion, professional fees, software license fee expenses, administrative costs, insurance, rent and a portion of travel expenses and other overhead.

- 12 -

Sales and marketing expenses are currently reflected in salaries and wages, commissions, contract labor, marketing and promotion, and other related overhead expense categories. Since we will be recognizing revenue over the terms of the subscriptions or professional services engagements, we expect to experience a delay between increases in selling and marketing expenses and the recognition of revenue. We expect to continue to incur significant sales and marketing expenses in both absolute dollars and as a percentage of expenses as we hire sales and additional marketing personnel and increase the level of marketing activities.

We expect that total general and administrative expenses will increase as we continue to add personnel in connection with the growth of our business. In addition to increases in sales and marketing and research and development expenses, we anticipate we will also incur additional employee salaries and related expenses, professional service fees and insurance costs related to the growth of our business and operations to meet the requirements of a public company.

Critical Accounting Policies and Estimates

Our financial statements are prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, expenses and related disclosures. We evaluate our estimates and assumptions on an ongoing basis.

Our estimates are based on historical experience and various other assumptions that we believe to be reasonable under the circumstances. Our actual results could differ from these estimates. We believe that the assumptions and estimates associated with revenue recognition, income taxes, stock-based compensation, research and development costs and impairment of long-lived assets have the greatest potential impact on our financial statements. Therefore, we consider these to be our critical accounting policies and estimates.

Revenue Recognition

We enter into arrangements with multiple-deliverables that generally include nonrefundable setup fees, subscription fees, professional services and consulting fees. We account for multiple-element arrangements by following ASC 605-25, Revenue Recognition: Multiple-Element Arrangements, as amended by Accounting Standards Update (ASU) 2009-13, Multiple-Deliverable Revenue Arrangements.

Under the accounting guidance, in order to treat deliverables in a multiple-deliverable arrangement as separate units of accounting, the deliverables must have standalone value upon delivery. To date, we have concluded that subscription services and the associated nonrefundable setup fees do not have standalone value as such services are not sold separately, while professional services and consulting fees included in multiple-deliverable arrangements executed have standalone value as they are often sold separately and will have value to the customer on a standalone basis.

Under the accounting guidance, when multiple-deliverables included in an arrangement are separated into different units of accounting, the arrangement consideration is allocated to the identified separate units based on a relative selling price hierarchy. We determine the relative selling price for a deliverable based on its vendor-specific objective evidence of selling price ("VSOE"), if available, third-party evidence ("TPE"), if VSOE is not available; and our best estimate of selling price ("BESP"), if neither VSOE nor TPE is available. Due to the introduction of the new product, and its related services, and due to differences in our service offerings compared to other parties and the lack of availability of relevant third-party pricing information, we have determined that VSOE and TPE are not practical alternatives. Therefore, the company uses BESP to determine selling price of significant deliverables.

We determine BESP by considering our overall pricing objectives and market conditions. Significant pricing practices taken into consideration include our discounting practices, the size and volume of our transactions, the customer demographic and our market strategy. The determination of BESP is made through consultation with and approval by management, taking into consideration our market strategy. As our market strategy evolves, we may modify our pricing practices in the future, which could result in changes in relative selling prices, including BESP.

- 13 -

Revenue recognition requires judgment, including whether the arrangement includes multiple elements, and if so, whether VSOE or TPE of fair value exists for those elements. A portion of revenue may be recorded as unearned due to undelivered elements. Changes to the elements in a software arrangement, the ability to identify VSOE, TPE or BSEP for those elements, and the fair value of the respective elements could materially impact the amount of earned and unearned revenue. Judgment is also required to assess whether future releases of certain software represent new products or upgrades and enhancements to existing products. Variations in the actual outcome of these variables could materially impact our financial statements.

Income Taxes

No provision for income taxes at this time is being made due to the offset of cumulative net operating losses. A full valuation allowance has been established for deferred tax assets based on a "more likely than not" threshold. The ability to realize deferred tax assets depends on our ability to generate sufficient taxable income within the carry forward periods provided in the tax law. While the Company's statutory tax rate can range from 15% - 39% depending on taxable income level, the effective tax rate is 0% due to the effects of the valuation allowance described above. The Company does not have any material uncertainties with respect to its provisions for income taxes.

Stock-Based Compensation

Stock-based compensation cost is measured at the grant date using a Black-Scholes valuation model and is recognized as expense over the requisite service period. Determining the fair value of stock-based awards at the grant date requires judgment and assumptions, including expected volatility. In addition, judgment is also required in estimating the amount of stock-based awards that are expected to be forfeited. If actual results differ significantly from these estimates, stock-based compensation expense and our results of operations could be impacted.

Research and Development Costs

Costs incurred to develop Software as a Service (SaaS) products and technology enabled services consist of external direct costs of materials and services and payroll and payroll-related costs for employees who directly devote time to the project. Research and development costs incurred during the preliminary project stage were expensed as incurred. Capitalization begins when technological feasibility is established. Costs incurred during the operating stage of the software application relating to upgrades and enhancements are capitalized to the extent that they result in the extended life of the product. All other costs are expensed as incurred. Amortization of software development costs commences when the product is available for general release to customers. The capitalized costs are amortized on a straight line basis over the three year expected useful life of the software. .

Impairment of Long-Lived Assets

Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate an asset's carrying value may not be recoverable. If such circumstances are present, we assess the recoverability of the long-lived assets by comparing the carrying value to the undiscounted future cash flows associated with the related assets. If the future net undiscounted cash flows are less than the carrying value of the assets, the assets are considered impaired and an expense, equal to the amount required to reduce the carrying value of the assets to the estimated fair value, is recorded in the statements of operations. Significant judgment is required to estimate the amount and timing of future cash flows and the relative risk of achieving those cash flows.

Assumptions and estimates about future values and remaining useful lives are complex and often subjective. They can be affected by a variety of factors, including external factors such as industry and economic trends, and internal factors such as changes in our business strategy and our internal forecasts. Impairment charges could materially decrease our future net income and result in lower asset values on our balance sheet.

- 14 -

Results of Operations

|

Year Ended

|

Change from

|

Percent Change

|

||||||||||||||

|

2014

|

2013

|

Prior Year

|

from Prior Year

|

|||||||||||||

|

Revenue

|

$

|

2,056,678

|

$

|

940,315

|

$

|

1,116,363

|

118.72

|

%

|

||||||||

Revenues increased for the year ended December 31, 2014 due to increased sales of our consulting and software-enabled services, including delivery of Touchpoint Mapping® On-Demand, to a greater number of business clients.

|

Year Ended

|

Change from

|

Percent Change

|

||||||||||||||

|

2014

|

2013

|

Prior Year

|

from Prior Year

|

|||||||||||||

|

Cost of Goods Sold

|

$

|

536,606

|

$

|

344,978

|

$

|

191,628

|

55.55

|

%

|

||||||||

Cost of goods sold increased during the year ended December 31, 2014 as compared to the same period in 2013. The increase was primarily due to amortization of software development costs, product-related hosting and monitoring costs, and licenses for products embedded in Touchpoint Mapping On-Demand which began in 2013.

|

Year Ended

|

Change from

|

Percent Change

|

||||||||||||||

|

2014

|

2013

|

Prior Year

|

from Prior Year

|

|||||||||||||

|

Salaries and Wages

|

$

|

992,281

|

$

|

703,176

|

$

|

289,105

|

41.11

|

%

|

||||||||

Salaries and wages increased for the year ended December 31, 2014 as compared to the same period in 2013 due to the addition of marketing and research staff in accordance with our strategic plan. This increase also resulted from discontinuing the capitalization of certain employee payroll costs during the period as certain features of our product were made available for general release in 2013.

|

Year Ended

|

Change from

|

Percent Change

|

||||||||||||||

|

2014

|

2013

|

Prior Year

|

from Prior Year

|

|||||||||||||

|

Contract Services

|

$

|

130,104

|

$

|

117,257

|

$

|

12,847

|

10.96

|

%

|

||||||||

Contract services increased during the year ended December 31, 2014 as compared to the same period in 2013. The increase was primarily due to a change in payment structure of business development and sales personnel from hourly to a combination of hourly and commission based. Increases in contracted investor relations and accounting services were partially offset by decreases in contract business development, marketing, sales and contract product development costs incurred during this period.

|

Year Ended

|

Change from

|

Percent Change

|

||||||||||||||

|

2014

|

2013

|

Prior Year

|

from Prior Year

|

|||||||||||||

|

Other general and administrative

|

$

|

395,849

|

$

|

397,885

|

$

|

(2,036

|

)

|

(0.51

|

)%

|

|||||||

Other general and administrative costs decreased for the year ended December 31, 2014 as compared to the same period in 2013 based on the following:

|

·

|

An increase of approximately $20,000 in marketing expenses;

|

|

·

|

A decrease of approximately $58,900 in professional fees as a direct result of the decreased use of legal and advisory services related to the completion of a private placement of common stock that took place in 2013;

|

|

·

|

A decrease of approximately $17,800 in fees related to SEC and SEDAR filings, and monthly insurance premiums;

|

|

·

|

An increase of approximately $20,500 in travel and entertainment expenses associated with service engagements;

|

|

·

|

An increase of approximately $23,000 in computer and software license expenses; and

|

|

·

|

An increase of approximately $11,200 in other miscellaneous charges.

|

- 15 -

|

Year Ended

|

Change from

|

Percent Change

|

||||||||||||||

|

2014

|

2013

|

Prior Year

|

from Prior Year

|

|||||||||||||

|

Other income (expense)

|

$

|

12,278

|

$

|

(80,519

|

)

|

$

|

92,797

|

115.25

|

%

|

|||||||

Other income (expense) increased $92,797 from the year ended December 31, 2013 to the year ended December 31, 2014. This increase was primarily due to recording an unrealized gain associated with the revaluation of a promissory note from CAD to USD, and a prior year write off of leasehold improvements with a net book value of approximately $62,900; said improvements which were written off as the lease term of the subject property had been terminated. In addition, management charged an impairment of approximately $17,500 to an intangible asset based on management's 2013 year end assessment of current value.

Liquidity and Capital Resources

We measure our liquidity in a variety of ways, including the following:

|

December 31, 2014

|

December 31, 2013

|

|||||||

|

Cash and Cash Equivalents

|

$

|

649,063

|

$

|

653,990

|

||||

|

Working Capital

|

$

|

640,319

|

$

|

451,830

|

||||

For the year ended December 31, 2014, we were able to finance our operations, including capital expenditures for infrastructure, product development and marketing activities through operating activities and cash on hand.

In 2013 we were able to finance our operations, including capital expenditures for infrastructure, product development and marketing through operating activities, cash on hand, and additional private sales of common stock. On July 2, 2013 the Company completed a private placement of 2,948,856 restricted shares of common stock. Gross proceeds from that private placement totaled $1,032,100.

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. As reflected in the consolidated financial statements included in this report, for the year ended December 31, 2014, we had a net income of $3,123, and a net loss of $715,656 for the year ended December 31, 2013. We have had material operating losses and have not yet created positive cash flows.

These factors raise substantial doubt as to our ability to continue as a going concern. Our ability to continue as a going concern is entirely dependent upon our ability to achieve a level of profitability, and/or to raise additional capital through debt financing and/or through sales of common stock. We cannot provide any assurance that profits from operations, if any, will generate sufficient cash flow to meet our working capital needs and service our existing debt, nor that sufficient capital can be raised through debt or equity financing. The consolidated financial statements do not include adjustments related to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might result should we be unable to continue as a going concern.

Anticipated Uses of Cash

In 2014, our primary areas of investment were professional staff to support our services business, as well as staff to support SaaS product delivery and client relationship management. We also invested in product development and sales and marketing activities, including sales and staff, marketing and sales automation software and other related services.

- 16 -

In 2015, our primary areas of investment are expected to continue to be professional staff to support our services business, as well as staff to support SaaS product delivery and manage client relationships. We also anticipate investments in product development and sales and marketing activities, including building our sales and marketing staff, marketing and advertising services, and other related activities. A secondary area of investment may include the hiring of business development staff to support the development of our indirect distribution channels.

We currently plan to fund these planned expenditures with cash flows generated from ongoing operations during this period. We will consider raising capital through debt financing and/or additional sales of common stock if necessary. We do not intend to pay dividends in the foreseeable future.

Cash Flow for the Years Ended December 31, 2014 and 2013

Operating Activities. During the year ended December 31, 2014, we reported positive cash flows from operations of $23,134. This consisted of our net income of $3,123 adjusted by depreciation and amortization of $75,806, stock compensation expense of $47,840, an unrealized gain on foreign currency translation of $13,829, an increase in accounts receivable of $87,362, an increase of $48,002 in other assets, a decrease in accounts payable of $30,624, an increase in deferred revenue of $88,069, and a decrease of $11,877 in accrued interest.

The increase in accounts receivable was primarily due to the timing of invoicing significant clients. At December 31, 2014, three material consulting services invoices were outstanding while one material engagement invoices was outstanding at the beginning of the period. The decrease in accounts payable was primarily due to a reduced period between the incurring and payment of credit card charges related to business operations.

During the year ended December 31, 2013, we reported negative cash flows from operations of $446,688. This consisted of our net loss of $715,656 adjusted primarily by a loss on asset disposal of $62,982, depreciation and amortization of $59,072, stock compensation expense of $19,120, impairment of an intangible asset of $17,537, decrease in accounts receivable of $37,269 and an increase in accounts payable of $59,250.

The decrease in accounts receivable was primarily due to the timing of invoicing significant clients. At December 31, 2013, one material consulting services invoice was outstanding while two material engagement invoices were outstanding at the beginning of the period.

The increase in accounts payable was primarily due to entering services agreements with clients whose third-party administrator's payment terms to our contractors was approximately 45 days. Contractor payables remain recorded in accounts payable until the third-party administrator remits payment. Payment terms for contractors have historically been 30 days or less. In addition, increased spending due to a shift towards use of higher-cost contractors for consulting engagements also contributed to the increase in accounts payable.

Days Sales Outstanding (DSO) during the year ended December 31, 2014 was approximately 28 days, down from approximately 29 days during the year ended December 31, 2013. This was a direct result of entering into services agreements with clients whose payment terms more closely matched our historical 30 days.

Investing Activities. Net cash used in investing activities for the years ended December 31, 2014 and 2013 amounted to $1,811 and $38,421, respectively and primarily consisted of capitalized software development costs.

Financing Activities. Net cash provided by financing activities for years ended December 31, 2014 and 2013 amounted to $0 and $1,032,100, respectively and were primarily related to the sale of our restricted common stock.

Off Balance Sheet Arrangements

We did not have any off balance sheet arrangements as of December 31, 2014.

- 17 -

Contractual Obligations

We lease one facility in northern California from Four Kays, under an operating lease that we expect to expire in 2016. We do not have any debt capital lease obligations. As of December 31, 2014, the following table summarizes our contractual obligation under the foregoing lease agreement and the effect such obligation is expected to have on our liquidity and cash flow in future periods:

|

Payments Due by Period

|

||||||||||||||||||||

|

Total

|

Less Than

1 Year

|

1-3 Years

|

3-5 Years

|

More Than

5 Years

|

||||||||||||||||

|

Operating lease obligations

|

$

|

59,315

|

$

|

35,426

|

$

|

23,890

|

$

|

-

|

$

|

-

|

||||||||||

|

Purchase obligations

|

$

|

44,030

|

$

|

43,842

|

$

|

188

|

$

|

-

|

$

|

-

|

||||||||||

|

(a)

|

The operating lease obligations presented reflect future minimum lease payments due under the non-cancelable portions of our operating lease.

|

|

(b)

|

Purchase obligations primarily represent non-cancelable contractual obligations related to SaaS licenses.

|

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

TOUCHPOINT METRICS, INC.

INDEX TO THE FINANCIALS

|

F-1

|

||

|

FINANCIAL STATEMENTS

|

||

|

F-2

|

||

|

F-3

|

||

|

F-4

|

||

|

F-5

|

||

|

F-6

|

||

- 18 -

To the Board of Directors and Stockholders

Touchpoint Metrics, Inc.

We have audited the accompanying balance sheets of Touchpoint Metrics, Inc. ("the Company") as of December 31, 2014 and 2013 and the related statements of income, changes in stockholders' equity and cash flows for the years then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the financial statements based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company, at December 31, 2014 and 2013, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

DAVID LEE HILLARY, JR. CPA, CITP

David Lee Hillary, Jr., CPA, CITP

Noblesville, Indiana

March 5, 2014

|

5797 East 169th Street, Suite 100 Noblesville, IN 46062

|

317-222-1416

|

www.HillaryCPAgroup.com

|

F-1

- 19 -

Touchpoint Metrics, Inc.

|

December 31,

|

||||||||

|

2014

|

2013

|

|||||||

|

Assets

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

649,063

|

$

|

653,990

|

||||

|

Accounts receivable

|

162,340

|

74,978

|

||||||

|

Accounts receivable-related party

|

-

|

-

|

||||||

|

Total current assets

|

811,403

|

728,968

|

||||||

|

Long term assets:

|

||||||||

|

Property and equipment, net

|

91,048

|

91,108

|

||||||

|

Capitalized software development costs, net

|

91,378

|

164,480

|

||||||

|

Website development costs, net

|

26,250

|

-

|

||||||

|

Intangible assets, net

|

42,656

|

43,489

|

||||||

|

Other assets

|

53,955

|

5,953

|

||||||

|

Total assets

|

$

|

1,116,690

|

1,033,998

|

|||||

|

Liabilities and Shareholders' Equity

|

||||||||

|

Liabilities:

|

||||||||

|

Accounts payable

|

$

|

79,492

|

$

|

110,116

|

||||

|

Accrued liabilities

|

273

|

-

|

||||||

|

Deferred revenue

|

91,319

|

3,249

|

||||||

|

Other current liabilities, accrued interest

|

1,612

|

13,773

|

||||||

|

Notes payable

|

50,000

|

50,000

|

||||||

|

Notes payable-related party

|

86,171

|

100,000

|

||||||

|

Total liabilities

|

308,867

|

277,138

|

||||||

|

Commitments and contingencies

|

-

|

-

|

||||||

|

Shareholders' equity:

|

||||||||

|

Common stock, $0 par value, 30,000,000 shares authorized,

16,081,158 shares issued and outstanding at both

December 31, 2014 and 2013, respectively

|

-

|

-

|

||||||

|

Accumulated deficit

|

(1,858,679

|

)

|

(1,861,414

|

)

|

||||

|

Additional paid-in capital

|

2,666,502

|

2,618,274

|

||||||

|

Total shareholders' equity

|

807,823

|

756,860

|

||||||

|

Total liabilities and shareholders' equity

|

$

|

1,116,690

|

$

|

1,033,998

|

||||

The accompanying notes are an integral part of these statements.

F-2

- 20 -

Touchpoint Metrics, Inc.

|

Year Ending December 31,

|

||||||||

|

2014

|

2013

|

|||||||

|

Revenue

|

||||||||

|

Consulting services

|

$

|

1,803,997

|

$

|

902,530

|

||||

|

Products and other

|

252,681

|

37,785

|

||||||

|

Total revenue

|

2,056,678

|

940,315

|

||||||

|

Cost of goods sold

|

||||||||

|

Labor

|

265,473

|

199,444

|

||||||

|

Services

|

-

|

42,754

|

||||||

|

Products and other

|

271,133

|

102,780

|

||||||

|

Total cost of goods sold

|

536,606

|

344,978

|

||||||

|

Gross profit

|

1,520,072

|

595,337

|

||||||

|

Expenses

|

||||||||

|

Salaries and wages

|

992,281

|

703,176

|

||||||

|

Contract services

|

130,104

|

117,257

|

||||||

|

Other general and administrative

|

395,849

|

397,885

|

||||||

|

Total expenses

|

1,518,234

|

1,218,318

|

||||||

|

Net operating income / (loss)

|

1,838

|

(622,981

|

)

|

|||||

|

Interest expense

|

(10,993

|

)

|

(12,156

|

)

|

||||

|

Other income (expense)

|

12,278

|

(80,519

|

)

|

|||||

|

Income (loss) before income taxes

|

3,123

|

(715,656

|

)

|

|||||

|

Income tax provision

|

-

|

-

|

||||||

|

Net income / (loss)

|

$

|

3,123

|

$

|

(715,656

|

)

|

|||

|

Net income / (loss) per share-basic and diluted

|

$

|

0.00

|

$

|

(0.05

|

)

|

|||

|

Weighted average common shares

outstanding - basic and diluted

|

16,081,158

|

14,606,730

|

||||||

The accompanying notes are an integral part of these statements.

F-3

- 21 -

Touchpoint Metrics, Inc.

|

Common Stock

|

Additional

Paid in

|

Retained

Earnings

(Accumulated

|

||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Deficit)

|

Total

|

||||||||||||||||

|

Balance, December 31, 2012

|

13,132,302

|

$

|

-

|

$

|

1,567,054

|

$

|

(1,145,758

|

)

|

$

|

421,296

|

||||||||||

|

Stock based compensation-stock options

|

-

|

-

|

19,120

|

-

|

19,120

|

|||||||||||||||

|

Common stock issued

|

2,948,856

|

-

|

1,032,100

|

-

|

1,032,100

|

|||||||||||||||

|

Net loss

|

-

|

-

|

-

|

(715,656

|

)

|

(715,656

|

)

|

|||||||||||||

|

Balance, December 31, 2013

|

16,081,158

|

$

|

-

|

$

|

2,618,274

|

$

|

(1,861,414

|

)

|

$

|

756,860

|

||||||||||

|

Stock based compensation-stock options

|

-

|

-

|

48,228

|

(388

|

)

|

47,840

|

||||||||||||||

|

Common stock issued

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||

|

Net income

|

-

|

-

|

-

|

3,123

|

3,123

|

|||||||||||||||

|

Balance, December 31, 2014

|

16,081,158

|

$

|

-

|

$

|

2,666,502

|

$

|

(1,858,679

|

)

|

$

|

807,823

|

||||||||||

The accompanying notes are an integral part of these statements.

F-4

- 22 -

Touchpoint Metrics, Inc.

|

December 31,

|

||||||||

|

2014

|

2013

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net income / (loss)

|

$

|

3,123

|

$

|

(715,656

|

)

|

|||

|

Adjustments to reconcile net income to net

cash provided by operations:

|

||||||||

|

Depreciation and amortization

|

75,806

|

59,072

|

||||||

|

Stock compensation expense

|

47,840

|

19,120

|

||||||

|

Loss on disposal of assets

|

-

|

62,982

|

||||||

|

Impairment of intangible asset

|

-

|

17,537

|

||||||

|

Unrealized gain on foreign currency translation

|

(13,829

|

)

|

-

|

|||||

|

Accounts receivable

|

(86,985

|

)

|

35,742

|

|||||

|

Accounts receivable, related party

|

(377

|

)

|

1,527

|

|||||

|

Other assets

|

(48,002

|

)

|

5,669

|

|||||

|

Accounts payable

|

(30,624

|

)

|

59,250

|

|||||

|

Accrued liabilities

|

-

|

2,069

|

||||||

|

Deferred revenue

|

88,069

|

-

|

||||||

|

Accrued interest

|

(11,887

|

)

|

6,000

|

|||||

|

Net cash used in operating activities

|

23,134

|

(446,688

|

)

|

|||||

|

INVESTING ACTIVITIES

|

||||||||

|

Purchase of intangible assets

|

-

|

(2,500

|

)

|

|||||

|

Equipment purchases

|

(1,811

|

)

|

(4,984

|

)

|

||||

|

Capitalized web development costs

|

(26,250

|

)

|

-

|

|||||

|

Capitalized software development costs

|

-

|

(30,937

|

)

|

|||||

|

Net cash used in investing activities

|

(28,061

|

)

|

(38,421

|

)

|

||||

|

FINANCING ACTIVITIES

|

||||||||

|

Proceeds from the issuance of common stock

|

-

|

1,032,100

|

||||||

|