Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(X) ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d)

OF THE SECURITIES EXCHANGE ACT of 1934

For the fiscal year ended December 31, 2014

OR ( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 0-53211

EMERGING CTA PORTFOLIO L.P.

(Exact name of registrant as specified in its charter)

| New York | 04-3768983 | |

|

| ||

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

c/o Ceres Managed Futures LLC

522 Fifth Avenue

New York, New York 10036

(Address and Zip Code of principal executive offices)

(855) 672-4468

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Redeemable Units of Limited Partnership Interest

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes No X

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes X No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes X No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this form 10-K [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | Accelerated filer | Non-accelerated filer X | Smaller reporting company | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes No X

Limited Partnership Redeemable Units with an aggregate value of $125,862,256 were outstanding and held by non-affiliates as of the last business day of the registrant’s most recently completed second fiscal quarter.

As of February 28, 2015, 82,185.2672 Limited Partnership Class A Redeemable Units were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

[None]

PART I

Item 1. Business.

(a) General Development of Business. Emerging CTA Portfolio L.P. (the “Partnership”) is a limited partnership that was organized on July 7, 2003 under the partnership laws of the State of New York. The objective of the Partnership is to achieve capital appreciation through the allocation of assets to early-stage commodity trading advisors, or established advisors employing early-stage strategies, which engage, directly and indirectly, in speculative trading of a diversified portfolio of commodity interests, including futures, options on futures, forward, options on forward, spot and swap contracts, cash commodities and any other rights or interest pertaining thereto including interest in commodity pools. The Partnership may also enter into swap and other derivative transactions with the approval of the General Partner (defined below). The sectors traded include U.S. and international markets for currencies, livestock, energy, grains, metals, indices, lumber, softs and U.S. and non-U.S. interest rates. The Partnership directly and through its investments in the Funds (as defined below), may trade futures, forward and option contracts of any kind. The commodity interests that are traded by the Partnership and the Funds are volatile and involve a high degree of market risk.

Between December 1, 2003 (the commencement of the offering period) and August 5, 2004, 20,872 redeemable units of limited partnership interest (“Redeemable Units”) were sold at $1,000 per Redeemable Unit. The proceeds of the initial offering were held in an escrow account until August 6, 2004, at which time they were remitted to the Partnership for trading. The Partnership privately and continuously offers Redeemable Units to qualified investors. There is no maximum number of Redeemable Units that may be sold by the Partnership. Subscriptions of additional Redeemable Units and additional general partner contributions and redemptions of Redeemable Units for the years ended December 31, 2014, 2013 and 2012 are reported in the Statements of Changes in Partners’ Capital on page 53 under “Item 8. Financial Statements and Supplementary Data.”

Ceres Managed Futures LLC, a Delaware limited liability company, acts as the general partner (the “General Partner”) and commodity pool operator of the Partnership. The General Partner is wholly owned by Morgan Stanley Smith Barney Holdings LLC (“MSSB Holdings”). MSSB Holdings is ultimately owned by Morgan Stanley. Morgan Stanley is a publicly held company whose shares are listed on the New York Stock Exchange. Morgan Stanley is engaged in various financial services and other businesses. Prior to June 28, 2013, Morgan Stanley indirectly owned a majority equity interest in MSSB Holdings and Citigroup Inc. indirectly owned a minority equity interest in MSSB Holdings. Prior to July 31, 2009, the date as of which MSSB Holdings became its owner, the General Partner was wholly owned by Citigroup Financial Products Inc., a wholly owned subsidiary of Citigroup Global Markets Holdings Inc., the sole owner of which is Citigroup Inc. As of December 31, 2014, all trading decisions for the Partnership are made by the Advisors (as defined below).

During the year ended December 31, 2014, the Partnership’s/Funds’ commodity broker was Morgan Stanley and Co. LLC (“MS&Co.”), a registered futures commission merchant. During prior periods included in this report, Citigroup Global Markets Inc. (“CGM”) also served as a commodity broker.

As of September 1, 2011, the Partnership began offering three classes of limited partnership interests: Class A Redeemable Units, Class D Redeemable Units and Class Z Redeemable Units; each of which will be referred to as a “Class” and collectively referred to as the “Classes.” All Redeemable Units issued prior to September 1, 2011 were deemed “Class A Redeemable Units.” The rights, liabilities, risks, and fees associated with investment in the Class A Redeemable Units were not changed. Class A Redeemable Units and Class D Redeemable Units are available to taxable U.S. individuals and institutions, as well as U.S. tax exempt individuals and institutions. Class Z Redeemable units will be offered to certain employees of Morgan Stanley Smith Barney LLC, currently doing business as Morgan Stanley Wealth Management (“Morgan Stanley Wealth Management”) and its affiliates (and their family members). The Class of Redeemable Units that a limited partner of the Partnership (each a “Limited Partner”) receives upon subscription will generally depend upon the amount invested in the Partnership or the status of the Limited Partner, although the General Partner may determine to offer Redeemable Units to investors at its discretion. As of December 31, 2014, there were no Redeemable Units outstanding in Class D or Class Z.

1

As of December 31, 2014, all trading decisions were made for the Partnership by its trading advisors (the “Advisors”) either directly, through individually managed accounts, or indirectly, through investments in other collective investment vehicles. Blackwater Capital Management, LLC (“Blackwater”), The Cambridge Strategy (Asset Management) Limited (“Cambridge”), Centurion Investment Management, LLC (“Centurion”), Perella Weinberg Partners Capital Management LP (“Perella”), SECOR Capital Advisors, LP (“SECOR”) and Willowbridge Associates Inc. (“Willowbridge”) served as the Partnership’s major commodity trading advisors. In addition, the General Partner has allocated the Partnership’s assets to additional non-major trading advisors (i.e. commodity trading advisors allocated less than 10% of the Partnership’s assets). Information about advisors allocated less than 10% of the Partnership’s assets may not be disclosed. The General Partner may allocate less than 10% of the Partnership’s assets to a new trading advisor or another trading program of a current Advisor. The Advisors are not affiliated with one another, are not affiliated with the General Partner, MS&Co. or CGM and are not responsible for the organization or operation of the Partnership. References herein to the “Advisors” may also include, as relevant, reference to 300 North Capital LLC (“300 North Capital”), Altis Partners (Jersey) Limited (“Altis”), Cirrus Capital Management LLC (“Cirrus”), Flintlock Capital Asset Management, LLC (“Flintlock”), J E Moody & Company LLC (“JE Moody”), PGR Capital LLP (“PGR”), Principle Capital Management LLC (“Principle”) and Waypoint Capital Management LLC (“Waypoint”).

The Partnership will be liquidated upon the first to occur of the following: December 31, 2023; the net asset value per unit of limited partnership interest of any Class decreases to less than $400 as of the close of any business day; or under certain other circumstances as defined in the Fourth Amended and Restated Limited Partnership Agreement of the Partnership (the “Limited Partnership Agreement”). In addition, the General Partner may, in its sole discretion, cause the Partnership to be liquidated if the aggregate net assets of the Partnership decline to less than $1,000,000.

The assets allocated to Centurion for trading are invested directly pursuant to Centurion’s Short Term Systematic Strategy Program.

On November 1, 2005, the assets allocated to Altis for trading were invested in CMF Altis Partners Master Fund L.P. (“Altis Master”), a limited partnership organized under the partnership laws of the State of New York. The Partnership purchased 4,898.1251 units of the Altis Master with cash equal to $4,196,275 and a contribution of open commodity futures and forward contracts with a fair value of $701,851. The Partnership fully redeemed its investment in Altis Master on August 31, 2012 for cash equal to $2,728,991.

On March 1, 2010, the assets allocated to Waypoint for trading were invested in the Waypoint Master Fund L.P. (“Waypoint Master”), a limited partnership organized under the partnership laws of the State of New York. The Partnership purchased 26,581.6800 units of Waypoint Master with cash equal to $26,581,680. The Partnership fully redeemed its investment in Waypoint Master on November 30, 2013 for cash equal to $4,378,673.

On November 1, 2010, the assets allocated to PGR for trading were invested in the PGR Master Fund L.P. (“PGR Master”), a limited partnership organized under the partnership laws of the State of Delaware. The Partnership purchased 14,913.0290 units of PGR Master with cash equal to $14,913,029. The Partnership fully redeemed its investment in PGR Master on December 31, 2013 for cash equal to $14,986,312.

2

On November 1, 2010, the assets allocated to Blackwater for trading were invested in the Blackwater Master Fund L.P. (“Blackwater Master”), a limited partnership organized under the partnership laws of the State of Delaware. The Partnership invested in Blackwater Master with cash equal to $15,674,694. Blackwater Master permits accounts managed by Blackwater using the Blackwater Global Program, a proprietary, systematic trading program, to invest together in one trading vehicle. The General Partner is also the general partner of Blackwater Master. Individual and pooled accounts currently managed by Blackwater, including the Partnership, are permitted to be limited partners of Blackwater Master. The General Partner and Blackwater believe that trading through this structure should promote efficiency and economy in the trading process.

On January 1, 2011, the assets allocated to JE Moody for trading were invested in JEM Master Fund L.P. (“JEM Master”), a limited partnership organized under the partnership laws of the State of Delaware. The Partnership purchased 19,624.4798 units of JEM Master with cash equal to $19,624,480. The Partnership fully redeemed its investment in JEM Master on October 31, 2013 for cash equal to $4,400,957.

On January 1, 2011, the assets allocated to Cirrus for trading were invested in CMF Cirrus Master Fund L.P. (“Cirrus Master”), a limited partnership organized under the partnership laws of the State of Delaware. The Partnership purchased 22,270.9106 units of Cirrus Master with cash equal to $22,270,911. The Partnership fully redeemed its investment in Cirrus Master on August 31, 2013 for cash equal to $9,645,872.

On May 1, 2011, the assets allocated to Flintlock for trading were invested in FL Master Fund L.P. (“FL Master”), a limited partnership organized under the partnership laws of the State of Delaware. The Partnership invested in FL Master with cash equal to $23,564,973. The Partnership fully redeemed its investment in FL Master on October 31, 2012 for cash equal to $14,864,699.

On September 1, 2012, the assets allocated to Cambridge for trading were invested in Cambridge Master Fund L.P. (“Cambridge Master”), a limited partnership organized under the partnership laws of the State of Delaware. The Partnership invested in Cambridge Master with cash equal to $3,000,000. Cambridge Master permits accounts managed by Cambridge using the Asian Markets Alpha Programme and the Emerging Markets Alpha Programme, each a proprietary, systematic trading program, to invest together in one trading vehicle. The General Partner is also the general partner of Cambridge Master. Individual and pooled accounts currently managed by Cambridge, including the Partnership, are permitted to be limited partners of Cambridge Master. The General Partner and Cambridge believe that trading through this structure should promote efficiency and economy in the trading process. The General Partner and Cambridge agreed that Cambridge will trade the Partnership’s assets allocated to Cambridge at a level that is up to 1.5 times the amount of assets allocated. The amount of leverage may be increased or decreased in the future. However, in no event will the amount of leverage be greater than 2 times the amount of assets allocated.

On January 1, 2013, the assets allocated to Willowbridge for trading using its wPraxis Futures Trading Approach were invested in CMF Willowbridge Master Fund L.P. (“Willowbridge Master”), a limited partnership organized under the partnership laws of the State of New York. The Partnership invested in Willowbridge Master with cash equal to $29,484,306. Willowbridge Master permits accounts managed by Willowbridge using the wPraxis Futures Trading Approach, a proprietary, discretionary trading program, to invest together in one trading vehicle. The General Partner is also the general partner of Willowbridge Master. Individual and pooled accounts currently managed by Willowbridge, including the Partnership, are permitted to be limited partners of Willowbridge Master. The General Partner and Willowbridge believe that trading through this structure should promote efficiency and economy in the trading process. The General Partner and Willowbridge agreed that Willowbridge will trade the Partnership’s assets allocated to Willowbridge at a level that is up to 3 times the amount of assets allocated. Effective February 28, 2013, Willowbridge ceased trading the Partnership’s assets using its MStrategy Trading Approach.

3

On March 1, 2013, the assets allocated to Principle for trading were invested in Principle Master Fund L.P. (“Principle Master”), a limited partnership organized under the partnership laws of the State of Delaware. The Partnership invested in Principle Master with cash equal to $6,503,661. The Partnership fully redeemed its investment in Principle Master on July 31, 2014 for cash equal to $12,165,827.

On March 1, 2013, the assets allocated to 300 North Capital for trading were invested in 300 North Capital Master Fund L.P. (“300 North Master”), a limited partnership organized under the partnership laws of the State of Delaware. The Partnership invested in 300 North Master with cash equal to $10,000,000. The Partnership fully redeemed its investment in 300 North Master on October 31, 2014 for cash equal to $12,374,970.

On August 1, 2013, the assets allocated to SECOR for trading were invested in SECOR Master Fund L.P. (“SECOR Master”), a limited partnership organized under the partnership laws of the State of Delaware. The Partnership invested in SECOR Master with cash equal to $10,000,000. SECOR Master permits accounts managed by SECOR using a variation of the program traded by SECOR Alpha Master Fund L.P., a proprietary, systematic trading program, to invest together in one trading vehicle. The General Partner is also the general partner of SECOR Master. Individual and pooled accounts currently managed by SECOR, including the Partnership, are permitted to be limited partners of SECOR Master. The General Partner and SECOR believe that trading through this structure should promote efficiency and economy in the trading process. The General Partner and SECOR agreed that SECOR will trade the Partnership’s assets allocated to SECOR at a level that is up to 1.5 times the amount of assets allocated.

On September 1, 2014, the assets allocated to Perella for trading were invested in PGM Master Fund L.P. (“PGM Master”), a limited partnership organized under the partnership laws of the State of Delaware. The Partnership invested in PGM Master with cash equal to $10,500,000. PGM Master permits accounts managed by Perella using a selected variation of the program traded by PWP Global Macro Master Fund L.P., a proprietary, systematic trading system, to invest together in one trading vehicle. The General Partner is also the general partner of PGM Master. Individual and pooled accounts currently managed by Perella are permitted to be limited partners of PGM Master. The General Partner and Perella believe that trading through this structure should promote efficiency and economy in the trading process. For the PGM Master account, Perella will generally target a 15% annualized volatility over the long-term.

The General Partner is not aware of any material changes to any of the trading programs discussed above during the fiscal period ended December 31, 2014.

Blackwater Master’s, Cambridge Master’s, PGM Master’s, SECOR Master’s and Willowbridge Master’s (collectively, the “Funds”) and the Partnership’s trading of futures, forward, swap and option contracts, as applicable, on commodities is done primarily on U.S. commodity exchanges and foreign commodity exchanges. During the year ended December 31, 2014, the Funds and the Partnership engaged in such trading through commodity brokerage accounts maintained with MS&Co. During prior periods included in this report, the Partnership and the Funds engaged in such trading through commodity brokerage accounts maintained with CGM. References herein to “Funds” may also include, as relevant, reference to 300 North Master, Altis Master, Cirrus Master, FL Master, JEM Master, PGR Master, Principle Master and Waypoint Master.

A limited partner in the Funds may withdraw all or part of their capital contribution and undistributed profits, if any, from the Funds as of the end of any month (the “Redemption Date”) after a request has been made to the General Partner at least three business days in advance of the Redemption Date. Such withdrawals are classified as a liability when the limited partner elects to redeem and informs the Funds.

4

Management, administrative and incentive fees are charged at the Partnership level. All clearing fees (defined below) are borne by the Partnership directly and indirectly through its investment in the Funds. Professional fees and other expenses are borne by the Funds and allocated to the Partnership, and also charged directly at the Partnership level. All other fees are charged at the Partnership level.

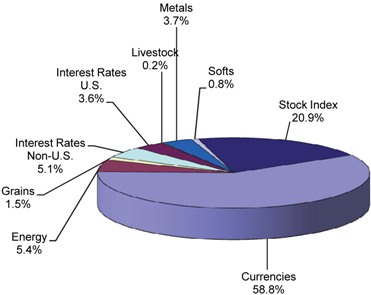

For the period January 1, 2014 through December 31, 2014, the approximate average market sector allocation for the Partnership was as follows:

At December 31, 2014, the Partnership had approximately 16.0% of Blackwater Master, 68.5% of Cambridge Master, 100% of PGM Master, 100% of SECOR Master and 3.8% of Willowbridge Master. At December 31, 2013, the Partnership had approximately 100% of 300 North Master, 38.8% of Blackwater Master, 15.2% of Willowbridge Master, 58.2% of PGR Master (prior to its redemption on December 31, 2013), 69.9% of Cambridge Master, 100% of Principle Master and 100% of SECOR Master. It is the Partnership’s intention to continue to invest in the Funds. The performance of the Partnership is directly affected by the performance of the Funds. Expenses to investors as a result of investment in the Funds are approximately the same as trading directly and the redemption rights are not affected.

The General Partner and each limited partner share in the profits and losses of the Partnership in proportion to the amount of Partnership interest owned by each except that no limited partner shall be liable for obligations of the Partnership in excess of its capital contribution and profits, if any, net of distributions and losses, if any.

The General Partner administers the business and affairs of the Partnership, including selecting one or more advisors to make trading decisions for the Partnership. The Partnership pays the General Partner a monthly administrative fee equal to 1/12 of 1% (1.0% per year) of month-end Net Assets. Prior to October 1, 2014, the Partnership paid the General Partner a monthly administrative fee equal to 1/24 of 1% (0.5% per year) of month-end Net Assets. Month-end Net Assets, for the purpose of calculating administrative fees, are Net Assets, as defined in the Limited Partnership Agreement, prior to the reduction of the current month’s management fee, the incentive fee accrual, the administrative fee, the ongoing selling agent fee and any redemptions or distributions as of the end of such month. The Partnership will also pay the General Partner an incentive fee payable annually equal to 5% of the Partnership’s overall New Trading Profits, as defined in the Limited Partnership Agreement, earned in each calendar year. For the years ended December 31, 2014, 2013 and 2012, there were no incentive fees earned by the General Partner.

5

Pursuant to the terms of the management agreements (each, a “Management Agreement” and collectively, the “Management Agreements”) with each Advisor, the Partnership is obligated to pay the Advisors a monthly management fee. Blackwater receives a monthly management fee equal to 0.75% per year of month-end net assets allocated to Blackwater. Prior to December 1, 2013, Blackwater received a monthly management fee equal to 1.25% per year. SECOR receives a monthly management fee equal to 2.0% per year of month-end net assets allocated to SECOR. Cambridge receives a monthly management fee equal to 1.5% per year of month-end net assets allocated to Cambridge. Willowbridge receives a monthly management fee equal to 1.5% per year of month-end net assets allocated to Willowbridge. Perella receives a monthly management fee equal to 1.5% per year of month-end net assets allocated to Perella. Centurion receives a monthly management fee equal to 1.25% per year of month-end net assets allocated to Centurion. Prior to its termination on July 31, 2014, Principle received a monthly management fee equal to 1.5% per year of month-end net assets allocated to Principle. Prior to its termination on October 31, 2014, 300 North Capital received a monthly management fee equal to 1.5% per year of month-end net assets allocated to 300 North Capital. Month-end Net Assets, for the purpose of calculating management fees, are Net Assets, as defined in the Limited Partnership Agreement, prior to the reduction of the current month’s management fee, the incentive fee accrual, the administrative fee, the ongoing selling agent fee and any redemptions or distributions as of the end of such month. The Management Agreements generally continue in effect until June 30 of each year and are renewable by the General Partner for additional one-year periods upon 30 days’ prior notice to the Advisor. Management Agreements generally may be terminated upon notice by either party.

In addition, the Partnership is obligated to pay each Advisor an incentive fee, payable quarterly, equal to 20% for Blackwater, Centurion, Perella, SECOR and Willowbridge, and equal to 15% for Cambridge, of the New Trading Profits, as defined in each Management Agreement, earned by each Advisor for the Partnership during each calendar quarter. Prior to its termination on July 31, 2014, Principle was eligible to receive an incentive fee, payable quarterly, equal to 17.5% of the New Trading Profits, as defined in its Management Agreement with the General Partner, earned by Principle for the Partnership during each calendar quarter. Prior to its termination on October 31, 2014, 300 North Capital was eligible to receive an incentive fee, payable quarterly, equal to 17.5% of the New Trading Profits, as defined in its Management Agreement with the General Partner, earned by 300 North Capital for the Partnership during each calendar quarter. To the extent an Advisor incurs a loss for the Partnership, the Advisor will not receive an incentive fee until the Advisor recovers the net loss incurred and earns additional trading profits for the Partnership.

During the third quarter of 2013, the Partnership entered into a Customer Agreement with MS&Co. (the “MS&Co. Customer Agreement”). Under the MS&Co. Customer Agreement, the Partnership pays trading fees for the clearing and, where applicable, execution of transactions, as well as exchange, clearing, user, give-up, floor brokerage and National Futures Association (“NFA”) fees (collectively, the “MS&Co. clearing fees”) directly and through its investment in the Funds. MS&Co. clearing fees are allocated to the Partnership based on its proportionate share of each Fund. All of the Partnership’s assets not held in the Funds’ accounts at MS&Co. are deposited in the Partnership’s account at MS&Co. The Partnership’s cash is deposited by MS&Co. in segregated bank accounts to the extent required by Commodity Futures Trading Commission (“CFTC”) regulations. MS&Co. has agreed to pay the Partnership interest on 100% of the average daily equity maintained in cash in the Partnership’s (or the Partnership’s allocable portion of a Fund’s) brokerage account at the rate equal to the monthly average of the 4-Week U.S. Treasury bill discount rate. The MS&Co. Customer Agreement may generally be terminated upon notice by either party.

During the second quarter of 2013, Cambridge Master entered into a foreign exchange brokerage account agreement with MS&Co. and commenced foreign exchange trading through an account at MS&Co. on or about May 1, 2013. During the third quarter of 2013, Willowbridge Master, SECOR Master, Cambridge Master and Principle Master entered into a futures brokerage account agreement with MS&Co. Willowbridge Master, SECOR Master, Cambridge Master and Principle Master commenced futures trading through accounts at MS&Co. on or about July 29, 2013, August 1, 2013, September 1, 2013 and September 27, 2013, respectively. During the fourth quarter of 2013, 300 North Master and Blackwater Master entered into a futures brokerage account agreement with MS&Co. and commenced futures trading through accounts at MS&Co. on or about October 2, 2013 and October 3, 2013, respectively. During the third quarter of 2014, PGM Master entered into a futures brokerage account agreement and a foreign exchange brokerage account agreement with MS&Co. and commenced trading through accounts at MS&Co. on or about September 1, 2014. Under the foreign exchange brokerage account agreement, the Partnership pays trading fees for the clearing and where applicable, execution of foreign exchange transactions, as well as applicable exchange, clearing, user, give-up, floor brokerage and NFA fees (collectively, the “foreign exchange clearing fees”) through its investment in Cambridge Master and PGM Master.

6

During the fourth quarter of 2013, the Partnership entered into a Selling Agent Agreement with Morgan Stanley Wealth Management (the “Selling Agreement”). Under the Selling Agreement with Morgan Stanley Wealth Management, the Partnership pays Morgan Stanley Wealth Management a monthly ongoing selling agent fee. Prior to April 1, 2014, this monthly ongoing selling against fee was equal to (i) 7/24 of 1% (3.5% per year) of month-end Net Assets for Class A Redeemable Units, (ii) 5/48 of 1% (1.25% per year) of month-end Net Assets for Class D Redeemable Units and (iii) 1/24 of 1% (0.50% per year) of month-end Net Assets for Class Z Redeemable Units. Effective April 1, 2014, the monthly ongoing selling agent fee was reduced to 5/24 of 1% (2.5% per year) for Class A Redeemable Units. Effective October 1, 2014, the monthly ongoing selling agent fee was (i) reduced to 4/24 of 1% (2.0% per year) for Class A Redeemable Units, (ii) reduced to 3/48 of 1% (0.75% per year) for Class D Redeemable Units and (iii) eliminated for Class Z Redeemable Units. Morgan Stanley Wealth Management pays a portion of its ongoing selling agent fees to properly registered or exempted financial advisors who have sold Redeemable Units. Month-end Net Assets, for the purpose of calculating ongoing selling agent fees are Net Assets, as defined in the Limited Partnership Agreement, prior to the reduction of the current month’s ongoing selling agent fee, incentive fee accrual, management fee, the administrative fee, other expenses and any redemptions or distributions as of the end of such month.

Prior to and during part of the third quarter of 2013, the Partnership was a party to a Customer Agreement with CGM (the “CGM Customer Agreement”). Under the CGM Customer Agreement, the Partnership paid CGM a monthly brokerage fee equal to (i) 7/24 of 1% (3.5% per year) of month-end Net Assets for Class A Redeemable Units, (ii) 5/48 of 1% (1.25% per year) of month-end Net Assets for Class D Redeemable Units and (iii) 1/24 of 1% (0.50% per year) of month-end Net Assets for Class Z Redeemable Units. Month-end Net Assets, for the purpose of calculating brokerage fees, were Net Assets, as defined in the Limited Partnership Agreement, prior to the reduction of the current month’s brokerage fees, incentive fee accruals, the monthly management fees, the administrative fee and other expenses and any redemptions or distributions as of the end of such month. The Partnership paid for exchange, service, clearing, user, give-up, floor brokerage and NFA fees (collectively the “CGM clearing fees,” and together with the MS&Co. clearing fees and foreign exchange clearing fees, the “clearing fees”) directly and through its investment in the Funds. CGM clearing fees were allocated to the Partnership based on its proportionate share of each Fund. During the term of the CGM Customer Agreement, all of the Partnership’s assets that were not held in the Funds’ accounts at CGM were deposited in the Partnership’s account at CGM. The Partnership’s cash was deposited by CGM in segregated bank accounts to the extent required by CFTC regulations. CGM paid the Partnership interest on 100% of the average daily equity maintained in cash in the Partnership’s (or the Partnership’s allocable portion of a Fund’s) brokerage account at a 30-day U.S. Treasury bill rate determined weekly by CGM based on the average non-competitive yield on 3-month U.S. Treasury bills maturing 30 days from the date on which such weekly rate is determined. The Partnership has terminated the CGM Customer Agreement.

Clearing fees will be paid for the life of the Partnership, although the rate at which such fees are paid may be changed.

Administrative fees, management fees, incentive fees and all other expenses of the Partnership are allocated proportionally to each class based on the Net Asset Value of the class.

(b) Financial Information about Segments. The Partnership’s business consists of only one segment, speculative trading of commodity interests. The Partnership does not engage in sales of goods or services. The Partnership’s net income (loss) from operations for the years ended December 31, 2014, 2013, 2012, 2011 and 2010 is set forth under “Item 6. Selected Financial Data.” The Partnership’s Capital as of December 31, 2014 was $114,627,992.

(c) Narrative Description of Business.

See Paragraphs (a) and (b) above.

(i) through (xii) — Not applicable.

(xiii) — The Partnership has no employees.

(d) Financial Information About Geographic Areas. The Partnership does not engage in the sale of goods or services or own any long-lived assets, and therefore this item is not applicable.

(e) Available Information. The Partnership does not have an Internet address. The Partnership will provide paper copies of its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports free of charge upon request.

(f) Reports to Security Holders. Not applicable.

(g) Enforceability of Civil Liabilities Against Foreign Persons. Not applicable.

(h) Smaller Reporting Companies. Not applicable.

7

Item 1A. Risk Factors.

As a result of leverage, small changes in the price of the Partnership’s positions may result in major losses.

The trading of commodity interests is speculative, volatile and involves a high degree of leverage. A small change in the market price of a commodity interest contract can produce major losses for the Partnership. Market prices can be influenced by, among other things, changing supply and demand relationships, governmental, agricultural, commercial and trade programs and policies, national and international political and economic events, weather and climate conditions, insects and plant disease, purchases and sales by foreign countries and changing interest rates.

An investor may lose all of its investment.

Due to the speculative nature of trading commodity interests, an investor could lose all of its investment in the Partnership.

The Partnership will pay substantial fees and expenses regardless of profitability.

Regardless of its trading performance, the Partnership will incur fees and expenses, including ongoing selling agent fees, administrative fees, clearing fees and management fees. Substantial incentive fees may be paid to one or more of the Advisors even if the Partnership experiences a net loss for the full year.

An investor’s ability to redeem Redeemable Units is limited.

An investor’s ability to redeem Redeemable Units is limited, and no market exists for the Redeemable Units.

Conflicts of interest exist.

The Partnership is subject to numerous conflicts of interest including those that arise from the facts that:

| 1. | The General Partner and the Partnership’s /Funds’ commodity broker are affiliates; |

| 2. | Each of the Advisors, the Partnership’s /Funds’ commodity broker and their principals and affiliates may trade in commodity interests for their own accounts; and |

| 3. | An investor’s financial advisor will receive ongoing compensation for providing services to the investor’s account. |

Investing in Redeemable Units might not provide the desired diversification of an investor’s overall portfolio.

The Partnership is intended as an aggressive alternative investment for a portion of a sophisticated investor’s portfolio. The primary objective of the Partnership is capital appreciation, as opposed to many other managed futures funds whose primary objectives are portfolio diversification and generating returns that are independent of stocks and bonds.

Past performance is no assurance of future results.

The Advisors’ trading strategies may not perform as they have performed in the past. The Advisors have from time to time incurred substantial losses in trading on behalf of clients.

An investor’s tax liability may exceed cash distributions.

Investors are taxed on their share of the Partnership’s income, even though the Partnership does not intend to make any distributions.

The General Partner may allocate the Partnership’s assets to undisclosed advisors.

The General Partner at any time may select and allocate the Partnership’s assets to undisclosed advisors. Investors may not be advised of such changes in advance. Investors must rely on the ability of the General Partner to select commodity trading advisors and allocate assets among them.

Regulatory changes could restrict the Partnership’s operations and increase its operational costs.

Regulatory changes could adversely affect the Partnership by restricting its markets or activities, limiting its trading and/or increasing the costs or taxes to which investors are subject. Pursuant to the mandate of the Dodd-Frank Wall Street Reform and Consumer Protection Act, signed into law on July 21, 2010, the CFTC and the Securities and Exchange Commission (the “SEC”) have promulgated rules to regulate swaps dealers and to mandate additional reporting and disclosure requirements and continue to promulgate rules regarding capital and margin requirements, to require that certain swaps be traded on an exchange or swap execution facilities, and to require that derivatives (such as those traded by the Partnership) be moved into central clearinghouses. In addition, the prudential regulators that oversee many swap dealers have also proposed rules regarding capital requirements for such swap

8

dealers and margin requirements for derivatives. These rules may negatively impact the manner in which swap contracts are traded and/or settled, increase the cost of such trading, and limit trading by speculators (such as the Partnership) in futures and over-the-counter (“OTC”) markets.

Speculative position and trading limits may reduce profitability.

The CFTC and U.S. exchanges have established “speculative position limits” on the maximum net long or net short positions which any person or a group of persons may hold or control in particular futures, options on futures and swaps that perform a significant price discovery function. Most exchanges also limit the amount of fluctuation in commodity futures contract prices on a single trading day. The Advisors believe that established speculative position and trading limits will not have a materially adverse effect on trading for the Partnership. The trading instructions of an advisor, however, may have to be modified, and positions held by the Partnership/Funds may have to be liquidated, in order to avoid exceeding these limits. Such modification or liquidation could adversely affect the operations and profitability of the Partnership by increasing transaction costs to liquidate positions and limiting potential profits on the liquidated position.

In November 2013, the CFTC proposed new rules that, if adopted in substantially the same form, will impose position limits on certain futures and option contracts and physical commodity swaps that are “economically equivalent” to such contracts. If enacted, these rules could have an adverse effect on the Advisors’ trading for the Partnership.

Item 2. Properties.

The Partnership does not own or lease any properties. The General Partner operates out of facilities provided by Morgan Stanley and/or one of its subsidiaries.

Item 3. Legal Proceedings.

This section describes the major pending legal proceedings, other than ordinary routine litigation incidental to the business, to which MS&Co. or its subsidiaries is a party or to which any of their property is subject. There are no material legal proceedings pending against the Partnership or the General Partner.

On June 1, 2011, Morgan Stanley & Co. Incorporated converted from a Delaware corporation to a Delaware limited liability company. As a result of that conversion, Morgan Stanley & Co. Incorporated is now named Morgan Stanley & Co. LLC (“MS&Co.”).

MS&Co. is a wholly-owned, indirect subsidiary of Morgan Stanley, a Delaware holding company. Morgan Stanley files periodic reports with the SEC as required by the Exchange Act, which include current descriptions of material litigation and material proceedings and investigations, if any, by governmental and/or regulatory agencies or self-regulatory organizations concerning Morgan Stanley and its subsidiaries, including MS&Co. As a consolidated subsidiary of Morgan Stanley, MS&Co. does not file its own periodic reports with the SEC that contain descriptions of material litigation, proceedings and investigations. As a result, please refer to the “Legal Proceedings” section of Morgan Stanley’s SEC 10-K filings for 2014, 2013, 2012, 2011 and 2010.

In addition to the matters described in those filings, in the normal course of business, each of Morgan Stanley and MS&Co. has been named, from time to time, as a defendant in various legal actions, including arbitrations, class actions, and other litigation, arising in connection with its activities as a global diversified financial services institution. Certain of the legal actions include claims for substantial compensatory and/or punitive damages or claims for indeterminate amounts of damages. Each of Morgan Stanley and MS&Co. is also involved, from time to time, in investigations and proceedings by governmental and/or regulatory agencies or self-regulatory organizations, certain of which may result in adverse judgments, fines or penalties. The number of these investigations and proceedings has increased in recent years with regard to many financial services institutions, including Morgan Stanley and MS&Co.

MS&Co. is a Delaware limited liability company with its main business office located at 1585 Broadway, New York, New York 10036. Among other registrations and memberships, MS&Co. is registered as a futures commission merchant and is a member of the National Futures Association.

Regulatory and Governmental Matters.

MS&Co. has received subpoenas and requests for information from certain federal and state regulatory and governmental entities, including among others various members of the RMBS Working Group of the Financial Fraud Enforcement Task Force, such as the United States Department of Justice, Civil Division and several state Attorney General’s Offices, concerning the origination, financing, purchase, securitization and servicing of subprime and non-subprime residential mortgages and related matters such as residential mortgage backed securities (“RMBS”), collateralized debt obligations (“CDOs”), structured investment vehicles (“SIVs”) and credit default swaps backed by or referencing mortgage pass-through certificates.

9

These matters, some of which are in advanced stages, include, but are not limited to, investigations related to MS&Co.’s due diligence on the loans that it purchased for securitization, MS&Co.’s communications with ratings agencies, MS&Co.’s disclosures to investors and MS&Co.’s handling of servicing and foreclosure related issues.

On February 25, 2015, MS&Co. reached an agreement in principle with the United States Department of Justice, Civil Division and the United States Attorney’s Office for the Northern District of California, Civil Division (collectively, the “Civil Division”) to pay $2.6 billion to resolve certain claims that the Civil Division indicated it intended to bring against MS&Co. While MS&Co. and the Civil Division have reached an agreement in principle to resolve this matter, there can be no assurance that MS&Co. and the Civil Division will agree on the final documentation of the settlement.

In May 2014, the California Attorney General’s Office (“CAAG”), which is one of the members of the RMBS Working Group, indicated that it has made certain preliminary conclusions that MS&Co. made knowing and material misrepresentations regarding RMBS and that it knowingly caused material misrepresentations to be made regarding the Cheyne SIV, which issued securities marketed to the California Public Employees Retirement System. The CAAG has further indicated that it believes MS&Co.’s conduct violated California law and that it may seek treble damages, penalties and injunctive relief. MS&Co. does not agree with these conclusions and has presented defenses to them to the CAAG.

On September 16, 2014, the Virginia Attorney General’s Office filed a civil lawsuit, styled Commonwealth of Virginia ex rel. Integra REC LLC v. Barclays Capital Inc., et al., against MS&Co. and several other defendants in the Circuit Court of the City of Richmond related to RMBS. The lawsuit alleges that MS&Co. and the other defendants knowingly made misrepresentations and omissions related to the loans backing RMBS purchased by the Virginia Retirement System (“VRS”). The complaint alleges VRS suffered total losses of approximately $384 million on these securities, but does not specify the amount of alleged losses attributable to RMBS sponsored or underwritten by MS&Co. The complaint asserts claims under the Virginia Fraud Against Taxpayers Act, as well as common law claims of actual and constructive fraud, and seeks, among other things, treble damages and civil penalties. On January 20, 2015, the defendants filed a demurrer to the complaint and a plea in bar seeking dismissal of the complaint.

In October 2014, the Illinois Attorney General’s Office (“IL AG”) sent a letter to MS&Co. alleging that MS&Co. knowingly made misrepresentations related to RMBS purchased by certain pension funds affiliated with the State of Illinois and demanding that MS&Co. pay the IL AG approximately $88 million. MS&Co. does not agree with these allegations and has presented defenses to them to the IL AG.

On January 13, 2015, the New York Attorney General’s Office (“NYAG”), which is also a member of the RMBS Working Group, indicated that it intends to file a lawsuit related to approximately 30 subprime securitizations sponsored by MS&Co. The NYAG indicated that the lawsuit would allege that MS&Co. misrepresented or omitted material information related to the due diligence, underwriting and valuation of the loans in the securitizations and the properties securing them and indicated that its lawsuit would be brought under the Martin Act. MS&Co. does not agree with the NYAG’s allegations and has presented defenses to them to the NYAG.

On September 2, 2011, the Federal Housing Finance Agency, as conservator for Fannie Mae and Freddie Mac, filed 17 complaints against numerous financial services companies, including MS&Co. and certain affiliates. A complaint against MS&Co. and certain affiliates and other defendants was filed in the Supreme Court of the State of New York, New York County (“Supreme Court of NY”), styled Federal Housing Finance Agency, as Conservator v. Morgan Stanley et al. The complaint alleges that defendants made untrue statements and material omissions in connection with the sale to Fannie Mae and Freddie Mac of residential mortgage pass-through certificates with an original unpaid balance of approximately $11 billion. The complaint raised claims under federal and state securities laws and common law and seeks, among other things, rescission and compensatory and punitive damages. On February 7, 2014, the parties entered into an agreement to settle the litigation. On February 20, 2014, the court dismissed the action.

On June 5, 2012, MS&Co. consented to and became the subject of an Order Instituting Proceedings Pursuant to Sections 6(c) and 6(d) of the Commodity Exchange Act, as amended, Making Findings and Imposing Remedial Sanctions by the CFTC to resolve allegations related to the failure of a salesperson to comply with exchange rules that prohibit off-exchange futures transactions unless there is an exchange for related position (“EFRP”). Specifically, the CFTC found that from April 2008 through October 2009, MS&Co. violated Section 4c(a) of the Commodity Exchange Act, as amended, and CFTC Regulation 1.38 by executing, processing and reporting numerous off-exchange futures trades to the Chicago Mercantile Exchange (“CME”) and Chicago Board of Trade (“CBOT”) as EFRPs in violation of CME and CBOT rules because those trades lacked the corresponding and related cash, OTC swap, OTC option, or other OTC derivative position. In addition, the CFTC found that MS&Co. violated CFTC Regulation 166.3 by failing to supervise the handling of the trades at issue and failing to have adequate policies and procedures designed to detect and deter the violations of the Commodity Exchange Act, as amended, and CFTC Regulations. Without admitting or denying the underlying allegations and without adjudication of any issue of law or fact, MS&Co. accepted and consented to entry of findings and the imposition of a cease and desist order, a fine of $5,000,000, and undertakings related to public statements, cooperation and payment of the fine. MS&Co. entered into corresponding and related settlements with the CME and CBOT in which the CME found that MS&Co. violated CME Rules 432.Q and 538 and fined MS&Co. $750,000 and CBOT found that MS&Co. violated CBOT Rules 432.Q and 538 and fined MS&Co. $1,000,000.

10

On July 23, 2014, the SEC approved a settlement by MS&Co. and certain affiliates to resolve an investigation related to certain subprime RMBS transactions sponsored and underwritten by those entities in 2007. Pursuant to the settlement, MS&Co. and certain affiliates were charged with violating Sections 17(a)(2) and 17(a)(3) of the Securities Act, agreed to pay disgorgement and penalties in an amount of $275 million and neither admitted nor denied the SEC’s findings.

Other Litigation.

On December 23, 2009, the Federal Home Loan Bank of Seattle filed a complaint against MS&Co. and another defendant in the Superior Court of the State of Washington, styled Federal Home Loan Bank of Seattle v. Morgan Stanley & Co. Inc., et al. The amended complaint, filed on September 28, 2010, alleges that defendants made untrue statements and material omissions in the sale to plaintiff of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly sold to plaintiff by MS&Co. was approximately $233 million. The complaint raises claims under the Washington State Securities Act and seeks, among other things, to rescind the plaintiff’s purchase of such certificates. On October 18, 2010, defendants filed a motion to dismiss the action. By orders dated June 23, 2011 and July 18, 2011, the court denied defendants’ omnibus motion to dismiss plaintiff’s amended complaint and on August 15, 2011, the court denied MS&Co.’s individual motion to dismiss the amended complaint. On March 7, 2013, the court granted defendants’ motion to strike plaintiff’s demand for a jury trial. At December 25, 2014, the current unpaid balance of the mortgage pass-through certificates at issue in this action was approximately $53 million, and the certificates had not yet incurred actual losses. Based on currently available information, MS&Co. believes it could incur a loss in this action up to the difference between the $53 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against MS&Co., plus pre- and post-judgment interest, fees and costs. MS&Co. may be entitled to be indemnified for some of these losses and to an offset for interest received by the plaintiff prior to a judgment.

On March 15, 2010, the Federal Home Loan Bank of San Francisco filed two complaints against MS&Co. and other defendants in the Superior Court of the State of California. These actions are styled Federal Home Loan Bank of San Francisco v. Credit Suisse Securities (USA) LLC, et al., and Federal Home Loan Bank of San Francisco v. Deutsche Bank Securities Inc. et al., respectively. Amended complaints filed on June 10, 2010 allege that defendants made untrue statements and material omissions in connection with the sale to plaintiff of a number of mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The amount of certificates allegedly sold to plaintiff by MS&Co. in these cases was approximately $704 million and $276 million, respectively. The complaints raise claims under both the federal securities laws and California law and seek, among other things, to rescind the plaintiff’s purchase of such certificates. On August 11, 2011, plaintiff’s federal securities law claims were dismissed with prejudice. The defendants filed answers to the amended complaints on October 7, 2011. On February 9, 2012, defendants’ demurrers with respect to all other claims were overruled. On December 20, 2013, plaintiff’s negligent misrepresentation claims were dismissed with prejudice. A bellwether trial was scheduled to begin in January 2015. MS&Co. was not a defendant in connection with the securitizations at issue in that trial. On May 23, 2014, plaintiff and the defendants in the bellwether trial filed motions for summary adjudication. On October 15, 2014, these motions were denied. On December 29, 2014 and January 13, 2015, the defendants in the bellwether trial informed the court that they had reached a settlement in principle with plaintiff. At December 25, 2014, the current unpaid balance of the mortgage pass-through certificates at issue in these cases was approximately $283 million, and the certificates had incurred actual losses of approximately $7 million. Based on currently available information, MS&Co. believes it could incur a loss for this

11

action up to the difference between the $283 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against MS&Co., or upon sale, plus pre- and post-judgment interest, fees and costs. MS&Co. may be entitled to be indemnified for some of these losses and to an offset for interest received by the plaintiff prior to a judgment.

On July 15, 2010, China Development Industrial Bank (“CDIB”) filed a complaint against MS&Co., styled China Development Industrial Bank v. Morgan Stanley & Co. Incorporated et al., which is pending in the Supreme Court of NY. The complaint relates to a $275 million credit default swap referencing the super senior portion of the STACK 2006-1 CDO. The complaint asserts claims for common law fraud, fraudulent inducement and fraudulent concealment and alleges that MS&Co. misrepresented the risks of the STACK 2006-1 CDO to CDIB, and that MS&Co. knew that the assets backing the CDO were of poor quality when it entered into the credit default swap with CDIB. The complaint seeks compensatory damages related to the approximately $228 million that CDIB alleges it has already lost under the credit default swap, rescission of CDIB’s obligation to pay an additional $12 million, punitive damages, equitable relief, fees and costs. On February 28, 2011, the court denied MS&Co.’s motion to dismiss the complaint. Based on currently available information, MS&Co. believes it could incur a loss of up to approximately $240 million plus pre- and post-judgment interest, fees and costs.

On October 15, 2010, the Federal Home Loan Bank of Chicago filed a complaint against MS&Co. and other defendants in the Circuit Court of the State of Illinois, styled Federal Home Loan Bank of Chicago v. Bank of America Funding Corporation et al. A corrected amended complaint was filed on April 8, 2011. The corrected amended complaint alleges that defendants made untrue statements and material omissions in the sale to plaintiff of a number of mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans and asserts claims under Illinois law. The total amount of certificates allegedly sold to plaintiff by MS&Co. at issue in the action was approximately $203 million. The complaint seeks, among other things, to rescind the plaintiff’s purchase of such certificates. The defendants filed a motion to dismiss the corrected amended complaint on May 27, 2011, which was denied on September 19, 2012. On December 13, 2013, the court entered an order dismissing all claims related to one of the securitizations at issue. After that dismissal, the remaining amount of certificates allegedly issued by MS&Co. or sold to plaintiff by MS&Co. was approximately $78 million. At December 25, 2014, the current unpaid balance of the mortgage pass-through certificates at issue in this action was approximately $54 million, and the certificates had not yet incurred actual losses. Based on currently available information, MS&Co. believes it could incur a loss in this action up to the difference between the $54 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against MS&Co., plus pre- and post-judgment interest, fees and costs. MS&Co. may be entitled to be indemnified for some of these losses and to an offset for interest received by the plaintiff prior to a judgment.

On July 18, 2011, the Western and Southern Life Insurance Company and certain affiliated companies filed a complaint against MS&Co. and other defendants in the Court of Common Pleas in Ohio, styled Western and Southern Life Insurance Company, et al. v. Morgan

12

Stanley Mortgage Capital Inc., et al. An amended complaint was filed on April 2, 2012 and alleges that defendants made untrue statements and material omissions in the sale to plaintiffs of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The amount of the certificates allegedly sold to plaintiffs by MS&Co. was approximately $153 million. The amended complaint raises claims under the Ohio Securities Act, federal securities laws, and common law and seeks, among other things, to rescind the plaintiffs’ purchases of such certificates. On May 21, 2012, the Morgan Stanley defendants filed a motion to dismiss the amended complaint, which was denied on August 3, 2012. MS&Co. filed its answer on August 17, 2012. MS&Co. filed a motion for summary judgment on January 20, 2015. Trial is currently scheduled to begin in July 2015. At December 25, 2014, the current unpaid balance of the mortgage pass-through certificates at issue in this action was approximately $110 million, and the certificates had incurred actual losses of approximately $2 million. Based on currently available information, MS&Co. believes it could incur a loss in this action up to the difference between the $110 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against MS&Co., or upon sale, plus pre- and post-judgment interest, fees and costs. MS&Co. may be entitled to an offset for interest received by the plaintiff prior to a judgment.

On November 4, 2011, the Federal Deposit Insurance Corporation (“FDIC”), as receiver for Franklin Bank S.S.B., filed two complaints against MS&Co. in the District Court of the State of Texas. Each was styled Federal Deposit Insurance Corporation as Receiver for Franklin Bank, S.S.B. v. Morgan Stanley & Company LLC F/K/A Morgan Stanley & Co. Inc. and alleged that MS&Co. made untrue statements and material omissions in connection with the sale to plaintiff of mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The amount of certificates allegedly underwritten and sold to plaintiff by MS&Co. in these cases was approximately $67 million and $35 million, respectively. The complaints each raised claims under both federal securities law and the Texas Securities Act and each seeks, among other things, compensatory damages associated with plaintiff’s purchase of such certificates. On June 7, 2012, the two cases were consolidated. MS&Co. filed a motion for summary judgment and special exceptions, which was denied in substantial part on April 26, 2013. The FDIC filed a second amended consolidated complaint on May 3, 2013. MS&Co. filed a motion for leave to file an interlocutory appeal as to the court’s order denying its motion for summary judgment and special exceptions, which was denied on August 1, 2013. On October 7, 2014, the court denied MS&Co.’s motion for reconsideration of the court’s order denying its motion for summary judgment and special exceptions and granted its motion for reconsideration of the court’s order denying leave to file an interlocutory appeal. On November 21, 2014, MS&Co. filed a motion for summary judgment, which was denied on February 10, 2015. The Texas Fourteenth Court of Appeals denied Morgan Stanley’s petition for interlocutory appeal on November 25, 2014. Trial is currently scheduled to begin in July 2015.

On April 25, 2012, The Prudential Insurance Company of America and certain affiliates filed a complaint against MS&Co. and certain affiliates in the Superior Court of the State of New Jersey, styled The Prudential Insurance Company of America, et al. v. Morgan Stanley, et al. On October 16, 2012, plaintiffs filed an amended complaint. The amended complaint alleges that defendants made untrue statements and material omissions in connection with the sale to plaintiffs of certain mortgage pass-through certificates backed by securitization trusts containing

13

residential mortgage loans. The total amount of certificates allegedly sponsored, underwritten and/or sold by MS&Co. is approximately $1.073 billion. The amended complaint raises claims under the New Jersey Uniform Securities Law, as well as common law claims of negligent misrepresentation, fraud, fraudulent inducement, equitable fraud, aiding and abetting fraud, and violations of the New Jersey RICO statute, and includes a claim for treble damages. On March 15, 2013, the court denied the defendants’ motion to dismiss the amended complaint. On January 2, 2015, the court denied defendants’ renewed motion to dismiss the amended complaint. At December 25, 2014, the current unpaid balance of the mortgage pass-through certificates at issue in this action was approximately $605 million, and the certificates had not yet incurred actual losses. Based on currently available information, MS&Co. believes it could incur a loss in this action up to the difference between the $605 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against MS&Co., plus pre- and post-judgment interest, fees and costs. MS&Co. may be entitled to be indemnified for some of these losses and to an offset for interest received by the plaintiff prior to a judgment.

On April 20, 2011, the Federal Home Loan Bank of Boston filed a complaint against MS&Co. and other defendants in the Superior Court of the Commonwealth of Massachusetts styled Federal Home Loan Bank of Boston v. Ally Financial, Inc. F/K/A GMAC LLC et al. An amended complaint was filed on June 29, 2012 and alleges that defendants made untrue statements and material omissions in the sale to the plaintiff of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly issued by MS&Co. or sold to plaintiff by MS&Co. was approximately $385 million. The amended complaint raises claims under the Massachusetts Uniform Securities Act, the Massachusetts Consumer Protection Act and common law and seeks, among other things, to rescind the plaintiff’s purchase of such certificates. On May 26, 2011, defendants removed the case to the United States District Court for the District of Massachusetts. On October 11, 2012, defendants filed motions to dismiss the amended complaint, which were granted in part and denied in part on September 30, 2013. The defendants filed an answer to the amended complaint on December 16, 2013. Plaintiff has voluntarily dismissed its claims against MS&Co. with respect to two of the securitizations at issue, such that the remaining amount of certificates allegedly issued by MS&Co. or sold to plaintiff by MS&Co. is approximately $358 million. At December 25, 2014, the current unpaid balance of the mortgage pass-through certificates at issue in this action was approximately $65 million, and the certificates had not yet incurred actual losses. Based on currently available information, MS&Co. believes it could incur a loss in this action up to the difference between the $65 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against MS&Co., or upon sale, plus pre- and post-judgment interest, fees and costs. MS&Co. may be entitled to be indemnified for some of these losses and to an offset for interest received by the plaintiff prior to a judgment.

On February 14, 2013, Bank Hapoalim B.M. filed a complaint against MS&Co. and certain affiliates in the Supreme Court of NY, styled Bank Hapoalim B.M. v. Morgan Stanley et al. The complaint alleges that defendants made material misrepresentations and omissions in the sale to plaintiff of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly sponsored, underwritten and/or sold by MS&Co. to plaintiff was approximately $141 million. The complaint alleges causes of action against MS&Co. for common law fraud, fraudulent concealment, aiding

14

and abetting fraud, and negligent misrepresentation, and seeks, among other things, compensatory and punitive damages. On April 22, 2014, the defendants’ motion to dismiss was denied in substantial part. On August 29, 2014, MS&Co. filed its answer to the complaint, and on September 18, 2014, MS&Co. filed a notice of appeal from the ruling denying defendants’ motion to dismiss. At December 25, 2014, the current unpaid balance of the mortgage pass-through certificates at issue in this action was approximately $72 million, and the certificates had not yet incurred actual losses. Based on currently available information, MS&Co. believes it could incur a loss in this action up to the difference between the $72 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against MS&Co., or upon sale, plus pre- and post-judgment interest, fees and costs.

On May 3, 2013, plaintiffs in Deutsche Zentral-Genossenschaftsbank AG et al. v. Morgan Stanley et al. filed a complaint against MS&Co., certain affiliates, and other defendants in the Supreme Court of NY. The complaint alleges that defendants made material misrepresentations and omissions in the sale to plaintiffs of certain mortgage pass-through certificates backed by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly sponsored, underwritten and/or sold by MS&Co. to plaintiff was approximately $694 million. The complaint alleges causes of action against MS&Co. for common law fraud, fraudulent concealment, aiding and abetting fraud, negligent misrepresentation, and rescission and seeks, among other things, compensatory and punitive damages. On June 10, 2014, the court denied the defendants’ motion to dismiss the case. On July 10, 2014, MS&Co. filed a renewed motion to dismiss with respect to two certificates at issue in the case. On August 4, 2014, claims regarding two certificates were dismissed by stipulation. After these dismissals, the remaining amount of certificates allegedly issued by MS&Co. or sold to plaintiff by MS&Co. was approximately $644 million. On October 13, 2014, MS&Co. filed its answer to the complaint. At December 25, 2014, the current unpaid balance of the mortgage pass-through certificates at issue in this action was approximately $294 million, and the certificates had incurred actual losses of approximately $79 million. Based on currently available information, MS&Co. believes it could incur a loss in this action up to the difference between the $294 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against MS&Co., or upon sale, plus pre- and post-judgment interest, fees and costs. MS&Co. may be entitled to be indemnified for some of these losses.

On September 23, 2013, the plaintiff in National Credit Union Administration Board v. Morgan Stanley & Co. Inc., et al. filed a complaint against MS&Co. and certain affiliates in the United States District Court for the Southern District of New York. The complaint alleges that defendants made untrue statements of material fact or omitted to state material facts in the sale to the plaintiff of certain mortgage pass-through certificates issued by securitization trusts containing residential mortgage loans. The total amount of certificates allegedly sponsored, underwritten and/or sold by MS&Co. to the plaintiff was approximately $417 million. The complaint alleges causes of action against MS&Co. for violations of Section 11 and Section 12(a)(2) of the Securities Act, violations of the Texas Securities Act, and violations of the Illinois Securities Law of 1953 and seeks, among other things, rescissory and compensatory damages. The defendants filed a motion to dismiss the complaint on November 13, 2013. On January 22, 2014 the court granted defendants’ motion to dismiss with respect to claims arising under the Securities Act and denied defendants’ motion to dismiss with respect to claims arising

15

under Texas Securities Act and the Illinois Securities Law of 1953. On November 17, 2014, the plaintiff filed an amended complaint. On December 15, 2014, defendants answered the amended complaint. At December 25, 2014, the current unpaid balance of the mortgage pass-through certificates at issue in this action was approximately $208 million, and the certificates had incurred actual losses of $27 million. Based on currently available information, MS&Co. believes it could incur a loss in this action up to the difference between the $208 million unpaid balance of these certificates (plus any losses incurred) and their fair market value at the time of a judgment against MS&Co., or upon sale, plus pre- and post-judgment interest, fees and costs. MS&Co. may be entitled to be indemnified for some of these losses and to an offset for interest received by the plaintiff prior to a judgment.

Additional lawsuits containing claims similar to those described above may be filed in the future. In the course of its business, MS&Co., as a major futures commission merchant, is party to various civil actions, claims and routine regulatory investigations and proceedings that the General Partner believes do not have a material effect on the business of MS&Co. MS&Co. may establish reserves from time to time in connections with such actions.

Item 4. Mine Safety Disclosures. Not applicable.

16

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

| (a) | Market Information. The Partnership has issued no stock. There is no public market for the Redeemable Units. |

| (b) | Holders. The number of holders of Class A Redeemable Units as of February 28, 2015 was 1,247. There are no Redeemable Units outstanding in Class D or Class Z. |

| (c) | Dividends. The Partnership did not declare any distributions in 2014 or 2013. The Partnership does not intend to declare distributions in the foreseeable future. |

| (d) | Securities Authorized for Issuance Under Equity Compensation Plans. None. |

| (e) | Performance Graph. Not applicable. |

| (f) | Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities. For the year ended December 31, 2014, there were subscriptions of 5,734.0090 Class A Redeemable Units totaling $7,249,416. For the year ended December 31, 2013, there were subscriptions of 14,027.6290 Class A Redeemable Units totaling $19,089,652. For the year ended December 31, 2012, there were subscriptions of 30,140.7402 Class A Redeemable Units totaling $42,474,029 and General Partner contributions representing 217.0440 Class A unit equivalents totaling $300,000. |

The Redeemable Units were issued in reliance upon applicable exemptions from registration under Section 4(a)(2) of the Securities Act of 1933, as amended, and Section 506 of Regulation D promulgated thereunder. The Redeemable Units were purchased by accredited investors as described in Regulation D. In determining the applicability of the exemption, the General Partner relied on the fact that the Redeemable Units were purchased by accredited investors in a private offering.

Proceeds from the subscriptions of Redeemable Units are used in the trading of commodity interests including futures, swap, option and forward contracts.

| (g) | Purchases of Equity Securities by the Issuer and Affiliated Purchasers. The following chart sets forth the purchases of Class A Redeemable Units by the Partnership. |

| Period |

Class A (a) Total Number of Redeemable |

Class A (b) Average |

(c) Total Number of Redeemable Units Purchased as Part of Publicly Announced Plans or Programs |

(d) Maximum Number (or Approximate Dollar Value) of Redeemable Units that May Yet Be Purchased Under the Plans or Programs | ||||

| October 1, 2014 – |

1,852.7860 | $1,249.30 | N/A | N/A | ||||

| November 1, 2014 – |

3,014.0530 | $1,292.63 | N/A | N/A | ||||

| December 1, 2014 – |

1,460.4890 | $1,354.30 | N/A | N/A | ||||

| 6,327.3280 | $1,294.18 |

| * | Generally, Limited Partners are permitted to redeem their Redeemable Units as of the end of each month on three business days’ notice to the General Partner. Under certain circumstances, the General Partner can compel redemption, although to date the General Partner has not exercised this right. Purchases of Redeemable Units by the Partnership reflected in the chart above were made in the ordinary course of the Partnership’s business in connection with effecting redemptions for Limited Partners. |

| ** | Redemptions of Redeemable Units are effected as of the end of each month at the net asset value per Redeemable Unit as of that day. No fee will be charged for redemptions. |

17

Item 6. Selected Financial Data.

Net realized and unrealized trading gains (losses), interest income, net income, increase (decrease) in net asset value per unit and net asset value per unit for the years ended December 31, 2014, 2013, 2012, 2011 and 2010 and total assets at December 31, 2014, 2013, 2012, 2011 and 2010 were as follows:

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Net realized and unrealized trading gains (losses) net of brokerage/ongoing selling agent fees and clearing fees of $4,627,992, $7,866,581, $8,887,705, $8,438,594 and $7,138,973, respectively |

$ |

2,667,788 |

|

$ |

4,318,748 |

|

$ | (7,868,879 | ) | $ | 3,654,017 | $ | 14,772,228 | |||||||

| Interest income |

25,253 | 65,605 | 128,362 | 64,743 | 189,515 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| $ | 2,693,041 | $ | 4,384,353 | $ | (7,740,517 | ) | $ | 3,718,760 | $ | 14,961,743 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | (3,537,926 | ) | $ | (1,322,351 | ) | $ | (13,841,843 | ) | $ | (3,727,719 | ) | $ | 9,108,040 | ||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Increase (decrease) in net asset value per unit for Class A |

$ | 3.90 | $ | (9.41 | ) | $ | (90.03 | ) | $ | (29.76 | ) | $ | 73.22 | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net asset value per unit |

$ | 1,354.30 | $ | 1,350.40 | $ | 1,359.81 | $ | 1,449.84 | $ | 1,479.60 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 119,213,383 | $ | 170,252,847 | $ | 197,607,809 | $ | 207,893,019 | $ | 187,096,653 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

18

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Overview

The Partnership, directly and through its investments in the Funds, aims to achieve substantial capital appreciation and permit investors to diversify a traditionally structured stock and bond portfolio. The Partnership attempts to accomplish its objectives through speculative trading in U.S. and international markets for currencies, interest rates, stock indices, agricultural and energy products and precious and base metals directly, or through investments in the Funds. The Partnership/Funds may employ futures, option on futures, forward, option on forward, spot and swap contracts, cash commodities and any other rights or interest pertaining thereto, in those markets. The Partnership/Funds may also enter into swap and other derivative transactions with the approval of the General Partner.