Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - China Xingbang Industry Group Inc. | Financial_Report.xls |

| EX-21.1 - LIST OF SUBSIDIARIES - China Xingbang Industry Group Inc. | f10k2014ex21i_chinaxing.htm |

| EX-32.1 - CERTIFICATION - China Xingbang Industry Group Inc. | f10k2014ex32i_chinaxing.htm |

| EX-31.1 - CERTIFICATION - China Xingbang Industry Group Inc. | f10k2014ex31i_chinaxing.htm |

| EX-31.2 - CERTIFICATION - China Xingbang Industry Group Inc. | f10k2014ex31ii_chinaxing.htm |

| EX-32.2 - CERTIFICATION - China Xingbang Industry Group Inc. | f10k2014ex32ii_chinaxing.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

Or

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _____________

Commission file number: 000-18606

CHINA XINGBANG INDUSTRY GROUP, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 99-0366034 | |

| (State

or other jurisdiction of incorporation or organization) |

(IRS

Employer Identification No.) |

No. 1108 Sai Wei Avenue,

Hi-Tech Development Zone,

Xinyu City,

Jiangxi Province, P.R.C.

(Address of Principal Executive Offices, Including Zip Code)

Registrant’s telephone number: (011) 86 7907123318

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Title of each class: Common Stock, $0.001 Par Value Per Share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report(s)), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☐ | Smaller reporting company ☒ | |

| (Do not check if a smaller reporting company) | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of the last business day of the registrant’s most recently completed second fiscal quarter, there was no active public trading market for our shares of common stock on OTC QB. Since our revenue is less than $50 million during the fiscal year ended 2014, we are a smaller reporting company.

There were a total of 81,244,000 shares of the registrant’s common stock outstanding as of March 27, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

TO ANNUAL REPORT ON FORM 10-K

FOR FISCAL YEAR ENDED DECEMBER 31, 2014

FORWARD-LOOKING STATEMENTS

This report includes “forward-looking statements.” The words “may,” “will,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “aim,” “seek” and similar expressions as they relate to us or our management are intended to identify these forward-looking statements. All statements by us regarding our expected financial position, revenues, cash flows and other operating results, business strategy, legal proceedings and similar matters are forward-looking statements. Our expectations expressed or implied in these forward-looking statements may not turn out to be correct. Our results could be materially different from our expectations because of various risks, including the risks discussed in this report under “Part I — Item 1A — Risk Factors.” Any forward-looking statement speaks only as of the date as of which such statement is made, and, except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances, including unanticipated events, after the date as of which such statement was made.

Use of Certain Defined Terms

In this Annual Report on Form 10-K, unless the context requires or is otherwise specified, references to the “Company,” “we,” “us,” “our” and similar expressions include the following entities (as defined herein):

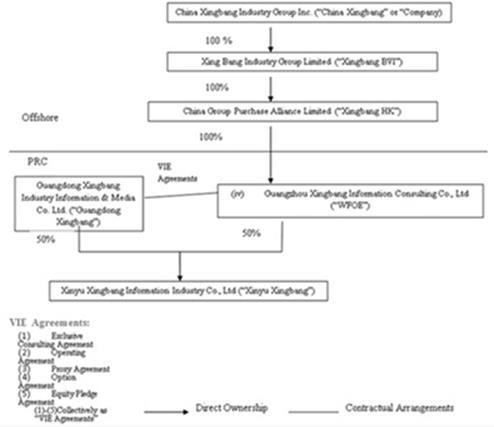

(i) China Xingbang Industry Group Inc., a Nevada corporation (“Xingbang NV”);

(ii) Xing Bang Industry Group Limited, a British Virgin Islands company and a wholly-owned subsidiary of the Registrant (“Xingbang BVI ”);

(iii) China Group Purchase Alliance Limited, a Hong Kong company and a wholly-owned subsidiary of Xingbang BVI (“Xingbang HK ”);

(iv) Guangzhou Xingbang Information Consulting Co., Ltd., a wholly foreign-owned enterprise, or the “ WFOE ”, formed in the People’s Republic of China (“ PRC ”) and a wholly-owned subsidiary of Xingbang HK;

(v) Guangdong Xingbang Industry Information & Media Co. Ltd., our principal operating subsidiary, which is a Chinese variable interest entity that the WFOE controls through certain contractual arrangements (“ Guangdong Xingbang ”); and

(vi) Xinyu Xingbang Information Industry Co., Ltd., an entity incorporated in the PRC in which the WFOE and Guangdong Xingbang each own a 50% equity interest (“ Xinyu Xingbang ”).

General

We are a Nevada holding company which, through our wholly owned subsidiaries Xingbang BVI and Xingbang HK, owns the WFOE, which controls Guangdong Xingbang, a variable interest entity, through a series of VIE contractual arrangements. Guangdong Xingbang and the WFOE each invested $787,030 (RMB 5,000,000) in Xinyu Xingbang and each owns 50% of the equity interest of Xinyu Xingbang. Guangdong Xingbang, which was founded in January 2005, and Xinyu Xingbang, which was founded in June 2012, are our only operating entities.

Based in the city of Xinyu Jiangxi Province, China (the “PRC”), Xinyu Xingbang is a company principally engaged in the operation of a business to business to customer (“B2B2C”) e-commerce platform in the PRC for manufacturers, distributors and other businesses in the lighting, ceramics and other home furnishings industry in the PRC.

We generated revenue of $37,518 and $19,853 for our fiscal year ended 2014 and 2013 respectively representing an increase of 89%. During 2014, we had one revenue stream, which is an e-commerce related service. Our revenue from providing e-commerce related services was $37,518 and $0 in 2014 and 2013, representing an increase of 100% as we started generating revenue from our e-commerce business. Advertising and consulting revenue were discontinued in 2013 as a result of the change of our business model to focus on revamping our e-commerce business.

| 1 |

Recent Developments

Xinyu Xingbang had an agency agreement with Xinyu Zhongxing Decoration Technicians Network Company Limited, (“Zhongxing Decoration”), an entity owned by Mr. Yao and his spouse, pursuant to which Zhongxing Decoration agreed to identify appropriate candidates to serve as technical service stations for Xinyu Xingbang. Xinyu Xiangbang was obligated to pay Zhongxing Decoration an annual commission to Zhongxing Decoration. Starting from January 2015, in order to have a closer cooperation with technical service stations, Xinyu Xingbang, Zhongxing Decoration and technical service stations entered into a third party agreement pursuant to which Zhongxing Decoration no longer acted as the middle person, allowing Xinyu Xingbang to directly sign cooperation agreements with technical service stations.

Business Strategy

We made a significant shift of our business model in 2010, from being a print media based advertising operator and consulting services provider to an operator of a B2B2C e-commerce platform in the home furnishing industry. We intend to:

| ● | Operate a B2B2C e-commerce platform, called ju51 Online Shopping Mall (“ju51 Online Mall” or “ju51 Mall”), to be the significant revenue contributor of our whole business; |

| ● | Provide searching, directory and other services through "Qiuying”, an online application and information portal, to help home furnishing companies in setting up a franchise service platform on Ju51 Mall; and |

| ● | Phase in other home furnishing sectors, including bathroom supplies, hardware, home textiles, closets, tiles and floor, doors and windows, furniture, home appliances, interior painting and home décor by having dedicated newspaper and dedicated market places in the ju51 Online Mall. In addition, we plan to develop distinct newspaper for each of these sectors, as well as have a distinct “market place” or “channel” for each such sector in the ju51 Mall. |

We expect to receive franchise fees from businesses in the home furnishing industry when they open product flagship stores in the Ju51 Mall and commissions from manufacturers for their sales through the flagship stores on Ju51 Mall. We also expect to receive service charges from service flagship stores when they list their company information on the Ju51 Mall and allow customers to reach out to each of them directly. We also plan to generate revenue from Media Integrated Advertising Communication Package, which include corporate press release writing, integrated, industry or local portal press release, classification website news release, Ju51 website “Recommendation” column display and IT industry channel first screen banner. The package also includes advertising services to businesses in the home furnishing industry through various media including Internet, TV, newspaper, periodicals, outdoor media and etc.

| 2 |

Corporate Structure and Related Agreements

Our organizational structure is summarized below:

Pursuant to the VIE Agreements, the WFOE effectively assumed management of the business activities of Guangdong Xingbang and has the right to appoint all executives and senior management and the members of the board of directors of Guangdong Xingbang. The VIE Agreements are comprised of a series of agreements, including an Exclusive Consulting Services Agreement, Operating Agreement, Voting Rights Proxy Agreement, Equity Pledge Agreement and Option Agreement, through which the WFOE has the right to advise, consult, manage and operate Guangdong Xingbang for an annual consulting service fee in the amount of 100% of Guangdong Xingbang’s annual net income. Mr. Xiaohong Yao (“Mr. Yao”) and his spouse, Ms. Dongmei Zhong (“Ms. Zhong”), who are the only stockholders of Guangdong Xingbang (the “ Guangdong Xingbang Stockholders ”), have pledged their right, title and equity interests in Guangdong Xingbang as security for the WFOE to collect consulting services fees through Equity Pledge Agreement. In order to further reinforce the WFOE’s rights to control and operate Guangdong Xingbang, the Guangdong Xingbang Stockholders have granted the WFOE an exclusive right and option to acquire all of their equity interests in Guangdong Xingbang through an Option Agreement.

| ● | Equity Interest Pledge Agreement. As of May 13, 2011, the WFOE and the Guangdong Xingbang Stockholders entered into Equity Interest Pledge Agreements, pursuant to which each stockholder pledges all of his shares of Guangdong Xingbang to the WFOE in order to guarantee cash-flow payments under the Consulting Services Agreement. The Equity Pledge Agreement further entitles the WFOE to collect dividends from Guangdong Xingbang during the term of the pledge. The Equity Pledge Agreement is effective for the maximum period of time permitted by Chinese law, which is currently 20 years. In the event Guangdong Xingbang fails to cure a material breach, the WFOE may, among other remedies available, terminate this agreement. |

| 3 |

| ● | Consulting Service Agreement. As of May 13, 2011, Guangdong Xingbang and the WFOE entered into a Consulting Services Agreement which provides that the WFOE will be the exclusive provider of consulting and management services to Guangdong Xingbang and Guangdong Xingbang will pay all of its net income to the WFOE quarterly for such services. Any such payment from the WFOE to the Company needs to comply with applicable Chinese laws affecting payments from Chinese companies to non-Chinese companies. See “Risk Factors – Risks Associated With Doing Business in China.” The Consulting Services Agreement is effective until it is terminated by either party in the event the other party becomes bankrupt or insolvent, if the WFOE ceases operations, or if circumstances arise which materially and adversely affect the performance or the objectives of the agreement. The WFOE may also terminate such agreement with or without cause. |

| ● | Option Agreement. Pursuant to the Option Agreement among the WFOE, Guangdong Xingbang and each Guangdong Xingbang Stockholder, the Guangdong Xingbang Stockholders have granted the WFOE an exclusive right and option to acquire all of their equity interests in Guangdong Xingbang upon an event of default. The Operating Agreement is effective for the maximum period of time permitted by Chinese law (currently 20 years). |

| ● | Voting Right Proxy Agreement. Pursuant to the Voting Right Proxy Agreement among the WFOE, Guangdong Xingbang and the Guangdong Xingbang Stockholders, the Guangdong Xingbang Stockholders have granted the WFOE a voting and proxy right to vote their equity interest in Guangdong Xingbang. The Voting Right Proxy Agreement is effective until terminated by mutual agreement or by the WFOE with 30 days prior written notice. |

Although we did not obtain any legal opinion from, nor been advised by any PRC legal counsel, management believes the above corporate structure complies with the PRC legal restrictions on foreign investment in the publication and e-commerce industries.

Xinyu Xingbang was incorporated in the PRC in June 2012 for the purpose of continuing the business of Guangdong Xingbang as Guangdong Xingbang winds down its operations. Pursuant to the Articles of Associations of Xinyu Xingbang, Guangdong Xingbang and the WFOE each invested $787,030 (RMB 5,000,000) in Xinyu Xingbang and each owns 50% of the equity interest of Xinyu Xingbang. Under the Xinyu Xingbang Articles of Association, the WFOE is entitled to appoint the sole director and all members of the management team of Xinyu Xingbang and the WFOE is entitled to receive 99.99% of Xinyu Xingbang’s net profit. Based on the relevant PRC regulations, an Internet Content Provider license, or ICP license, issued by the Chinese Ministry of Industry and Information Technology, is required for Xinyu Xingbang to conduct business as currently contemplated. In order to be granted the ICP license, foreign investor’s ownership of Xinyu Xingbang cannot exceed 50%. Xinyu Xingbang obtained its ICP license in February 2013. Guangdong Xingbang granted an exclusive license to Xinyu Xingbang to permit Xinyu Xingbang to use the trademark, domain names, intellectual property rights and any know-how Guangdong Xingbang owns. Guangdong Xingbang also assigned the management right and right to receive revenue from the ju51 Mall to Xinyu Xingbang. Guangdong Xingbang, which does not have any revenue - generating operations, will continue its corporate existence to hold the equity interest in Xinyu Xingbang.

| 4 |

Products and Services

E-commerce platform services through ju51 Online Mall

We intend to provide an extensive e-commerce platform to provide value added services to manufacturers, distributors, retailers, decoration companies, and decoration technicians in the home furnishing industry while serving consumers through the ju51 Mall. “Ju51” sounds similar to the Chinese words of “juwu you,” which means “worry-free living” in Mandarin. When fully constructed, the ju51 Mall is expected to have ten marketplaces targeting ten sectors in the home furnishing industry, including light and lighting, bath and kitchen supplies, hardware, home textiles, residential furniture, office furniture, tiles, floor, doors and windows, home appliances, interior painting and home décor and security monitoring system. Since its launch in August 2011, we explored different business strategies to maximize revenue generation through the ju51 Mall.

We have two different types of flagship stores in the Ju51 Mall, i.e. product flagship stores and service flagship stores.

The manufacturers open product flagship stores where they showcase and sell their products, list prices for products and process orders placed online by consumers. We also have technical service stations on our ju51Mall, which are primarily operated by brick-and-mortar retailers and decoration companies which have physical stores. A technical service station acts as a shopping guide and provides product support and services. When a consumer places orders online directly with flagship stores, the technical service station located closest to the consumer will receive the order simultaneously and provide product support and services, such as returns, exchanges, refunds and installation, through its own brick-and-mortar store. The reason for having technical service stations as shopping guides is to address the Chinese consumers’ concern about return or exchange of products ordered online. Generally we only develop one technical service station within a county or a district of a city to protect their economic interest. We currently have the technical service stations act as distributors and promote our services in local markets. Customers may avoid paying the shipping fees by picking up the product at a local technical service station. In addition to technical service stations, we also intend to have decoration technicians to act as shopping guides to help increase sales volume in the ju51 Mall. Guangdong Xingbang gathered information from technical service stations and founded a web portal named China Decoration Technician Network at http://www.zgzxjg.com, which is intended to review and certify decoration technicians. Customers placing orders through the decoration technicians will enjoy special discounts compared to the retail price listed on the ju51 Mall. We also expect to develop different categories of Ju51 Mall memberships where the members will enjoy special discounts in order to promote sales in the ju51 Mall. A technical service station can earn commission as a percentage of the retail price, and the technical service station is related to the e-commerce platform. A decoration technician will also earn commissions, paid by flagship stores, based on a percentage of the amount he or she sells as a shopping guide. Our business model is designed to make sure consumers will receive quality products and services and have a quality shopping experience at the ju51 Mall. We expect the current business model will keep retail prices at the ju51 Mall at a competitive level.

We have not completed any transactions from product flagship stores within the e-commerce platform. No commission has therefore been generated for the year ended December 31, 2014.

We had an agency agreement with Zhongxing Decoration. Pursuant to the Agency Agreement, Zhongxing Decoration agreed to identify appropriate candidate to serve as technical service station. We were obligated to pay Zhongxing Decoration a commission of 5% of the sales closed by flagship stores on Ju51 Mall, 100% of the technical service station annual fee, and a commission of 10% of the franchise annual fee. Starting from January 2015, in order to have a more direct cooperation with technical service stations, Xinyu Xingbang, Zhongxing Decoration and technical service stations entered into certain three party agreements pursuant to which Zhongxing Decoration shall no longer act as the middle person, allowing Xinyu Xingbang to directly enter into cooperation agreement with technical service stations.

Ju51 Mall also provides a platform for service flagship stores to list their company information and allow customers to reach out to each of them directly. Each business shall pay a service charge of RMB2,000 for 1-2 years of services. As of December 31, 2014, 612 companies have paid the service charges. Businesses are required to have their own stores prior to be franchised as service flagship stores in the platform. As of December 31, 2014, an aggregate of 661 businesses have signed the franchise agreements as service flagship stores, of which 632 had their online stores set up and are selling their products, and 612 stores have paid the service charges.

We have generated $22,208 revenue from e-commmerce platform during the year ended December 31, 2014. We have made substantial progress in setting up our infrastructure and have established 184 technical service stations as of December 31, 2014.

| 5 |

Advertising services through e-commerce platform

We may generate advertising revenue on the e-commerce platform. We anticipate to get paid by businesses in the home furnishing industry that put advertisements in the Ju51 Mall. Moreover, we plan to develop distinct newspapers for each of these sectors, as well as have a distinct “market place” or “channel” for each such sector in the ju51 Mall.

During the year ended December 31, 2014, we started to promote a Media Integrated Advertising Communication Package at a flat fee, ranging from RMB50,000 to RMB500,000 depending on the broadcasting frequency. The services to be provided include corporate press release writing, integrated, industry or local portal press release, classification website news release, Ju51 website platform front page display, Ju51 website “Recommendation” column display, and IT industry channel first screen banner. The service also includes advertising services to businesses in the home furnishing industry through various media including Internet, TV, newspaper, periodicals, outdoor media and etc. We entered into a contract with one client in July 2014, and expect to sign up more customers during 2015; though there can be no assurance that we will be successful in doing so.

We had an agency agreement with Zhongxing Decoration. Pursuant to the Agency Agreement, Zhongxing Decoration agreed to identify appropriate candidate to serve as technical service station. We were obligated to pay Zhongxing Decoration a commission of 5% of the sales closed by flagship stores on Ju51 Mall, 100% of the technical service station annual fee, and a commission of 10% of the franchise annual fee. Starting from January 2015, in order to have a more direct cooperation with technical service stations, Xinyu Xingbang, Zhongxing Decoration and technical service stations entered into certain three party agreements pursuant to which Zhongxing Decoration shall no longer act as the middle person, allowing Xinyu Xingbang to directly enter into cooperation agreement with technical service stations.

Competition

General competitive advantages

As a previous leading print media operator in the lighting and ceramics sectors, we believe there are several key factors that will continue to differentiate us from our competitors in terms of e-commerce platform and targeting the home furnishing industry:

| ● | In-depth knowledge of the home furnishing industry and extensive database of the market players in the industry; |

| ● | Profound advertising and marketing experience and capability in the home furnishing industry; |

| ● | Good relationships with manufacturers, distributors and retailers in the home furnishing industry; and |

| ● | Strong capability to group the most reputable manufacturers and brands in a single online platform, namely our ju51 online mall. |

Ju51 Mall competitive advantages

As for our e-commerce related services, our competitors may include: (1) other B2C e-commerce companies, such as Qijia Net, Liba Net, 360 buy and Taobao Mall, which have been selling products in the home furnishing industry, and Kuba Net, Vancl, which have announced an intention to sell products in the home furnishing industry; (2) other e-commerce related service providers, namely e-commerce platform operators, such as Taobao Mall and QQ Mall; (3) brick and mortar retailers and distributors, many of which possess significant brand recognition, sales volume and customer bases, and some of which currently sell, or in the future may sell, products or services through the internet; and (4) a number of indirect competitors, including well established portals and internet search engines that are involved in e-commerce, either directly or in collaboration with other retailers. Although we face intense competition, we believe our ju51 Mall has the following competitive advantages:

| ● | Good relationship with brand manufacturers who will set up product flagship stores in the ju51 Mall to showcase their products; |

| 6 |

| ● | Quality products for sale in the ju51 Mall as a result of our strict evaluation of manufacturers seeking to open product flagship stores; |

| ● | Reliable delivery and installation services provided by technical service stations; |

| ● | Reliable and timely after-sale services, as only brick and mortar retailers or decoration companies are franchised to be technical service stations in the ju51 Mall; and |

| ● | Consumer confidence due to our consumer protection fund keeping in custodian with China Consumer Protection Foundation, dedicated to compensate consumers in case of dissatisfaction with products and services purchased from the ju51 Mall. |

Sales and Marketing

Since February 2012, we started to search for technical service stations with interior designers and decoration technicians and set up a website, “China Decoration Technicians Network” at http://www.zgzxjg.com, as part of our sales effort. The “China Decoration Technicians Network” is developed by Guangdong Xingbang to disclose information from technical service stations. The technical service stations function as our local representative offices. The interior designers and decoration technicians help us reach out to consumers and act as shopping guides using the technical service stations as their base. Consumers who place orders through the introduction of decoration technicians will enjoy special “membership price”, which is less than the direct sale price listed on the ju51 Mall. Interior designers and decoration technicians earn commissions from the flagship stores.

| 7 |

IT Support

We have an in-house information technology research, development and operation center to support the ju51 Mall and our other web portals. We currently have 89 employees as technology support staff including system designers, webpage designers and IT engineers working on the construction and maintenance of the ju51 Online Mall. We intend to increase our investment in our web design and e-commerce construction capability to support the operation of the ju51 Online Mall.

We believe we have access to reliable and secure network infrastructure which provides sufficient support to our operations. Our web portals are connected to the Internet by reputable Internet connection operators such as China United Network Communication Group Company Limited (or China Unicom) and China Telecom Corporation (or China Telecom). Our 100 servers are located at four places, namely 21Vianet Asia Pacific Computer House, China Net Center Jiaochang Xi Computer House, China Net Center Sun City Computer House and our headquarters. These telecommunication operators provide us with support services twenty-four hours per day, seven days per week. They also provide connectivity for our servers through multiple high-speed connections.

Research and Development

Our own IT department has developed certain software and applications and obtained 30 computer software copyright registrations with the Chinese Copyright Bureau since 2008. Our IT staff, with the possible collaboration of outside IT consultants, will continue to design and develop applications geared toward e-commerce and peripheral products.

Intellectual Property

We have registered three trademarks in seven classes with the China Trademark Office with a valid term effective through 2019 or 2020, including the symbolic variation of the Chinese character “Xingbang”, Chinese character of “Light City” and www.lightcity.cn, and Chinese character of “Ju Wu You” and www.ju51.com. In 2008 and 2009, we obtained software copyright registration with the Copyright Bureau for 30 software applications we developed. We also have registered 174 domain names with the China Domain Name Administrative Center, which are renewable annually upon payment of certain fees.

Employees

As of December 31, 2014, we had 113 full-time employees compared to 51 full-time employees as of December 2013. The increase is part of our overall strategy to further develop on our e-commerce business. We believe we have a good relationship with our current employees.

Government Regulation

General

The media and advertising industry in China is governed by the State Council, which is the highest authority in the executive branch of China’s central government, and several ministries and agencies under its authority, including the State Administration for Industry and Commerce (“SAIC”), the State Administration of Radio, Film and Television (“SARFTA”), the General Administration of Press and Publication, the Ministry of Culture and the State Council News Office.

| 8 |

Regulations Regarding Foreign Investment in the Chinese Media and Value Added Telecommunication Sector

On July 6, 2005, the Chinese government promulgated Certain Opinions on the Introduction of Foreign Investment in Cultural Fields, which provide an overall framework with respect to foreign investments in Chinese media and other cultural sectors. This document specifies the areas in which foreign investments are permitted or prohibited in accordance with China’s commitments regarding its entry into the World Trade Organization, or WTO. Under the document, foreign investment in the media sector is permitted in the areas of printing of packaging and decorating materials, redistributing books, newspaper, periodicals, producing of recordable disks, duplication of read only disks, engaging in works of art and the construction and operation of performance sites, cinema, event brokerage agencies and movie technology. In addition, because the current PRC regulations only permit operation of media companies by state-owned enterprises or very few selected privately-owned businesses, we are unable to obtain our own Standard Serial Number. Ever since the inception of our newspaper, we have been distributing our newspaper as supplements to the Shopping Guide pursuant to authorization given by Shopping Guide.

Our online shopping mall and websites may be regarded as value added telecommunications services under relevant PRC laws. Foreign direct investment in telecommunications companies in China is regulated by the Regulations for the Administration of Foreign-Invested Telecommunications Enterprises (or the FITE Regulations), which were issued by the PRC State Council on December 11, 2001 and amended on September 10, 2008. The FITE Regulations stipulate that telecommunications enterprises in the PRC with foreign investors (or FITEs) must be established as Sino-foreign equity joint ventures. Under the FITE Regulations and in accordance with WTO-related agreements, the foreign party to a FITE engaging in value-added telecommunications services may hold up to 50% of the equity of the FITE, with no geographic restrictions on its operations. The PRC government has not made any further commitment to liberalize its regulation of FITEs.

Our management believes, subject to the uncertainties and risks disclosed elsewhere in this registration statement under the heading “Risk Factors”, the ownership structure of our WFOE complies with all existing laws, rules and regulations of the PRC and each of such companies has the full legal right, power and authority, and has been duly approved, to carry on and engage in the business described in its business license. We have not obtained any legal opinion from, or otherwise been advised by, any PRC legal counsel with respect to our VIE arrangements.

Censorship of Advertising Content by the Chinese Government

The advertising industry in China is governed by the Advertising Law which came into effect in February 1995. In addition, principal regulations governing advertising services in China include: (1) the Advertising Administrative Regulations, effective December 1987; and (2) the Implementing Rules for the Advertising Administrative Regulations, effective January 2005. Chinese advertising laws and regulations set forth certain content requirements for advertisements in China, which include prohibitions on, among other things, misleading content, superlative wording, socially destabilizing content, or content involving obscenities, the supernatural, violence, discrimination or infringement of the public interest. There are specific restrictions and requirements regarding advertisements that relate to matters such as patented products or processes, pharmaceuticals, medical instruments, agrochemicals, veterinary pharmaceuticals, foodstuff, alcohol, cosmetics and others. In addition, all advertisements relating to pharmaceuticals, medical instruments, agrochemicals and veterinary pharmaceuticals advertised through radio, film, television, newspaper, periodical and other forms of media, together with any other advertisements which are subject to censorship by administrative authorities according to relevant laws and administrative regulations, must be submitted to the relevant administrative authorities for content approval prior to dissemination.

| 9 |

Advertisers, advertising operators and advertising distributors are required by Chinese advertising laws and regulations to ensure that the content of the advertisements they prepare or distribute are true and in full compliance with applicable laws. In providing advertising services, advertising operators and advertising distributors must review the prescribed supporting documents in connection with any advertisements and verify that the content of such advertisements comply with applicable Chinese laws and regulations. In addition, prior to distributing advertisements for certain commodities that are subject to government censorship and approval, advertising distributors are required to ensure that governmental review has been performed and approval obtained. Violation of these regulations may result in penalties, including fines, confiscation of advertising income, orders to cease dissemination of advertisements and orders to publish an advertisement correcting the misleading information. In circumstances involving serious violations, the relevant administrative authorities may order violators to cease their advertising business operations. Furthermore, advertisers, advertising operators or advertising distributors may be subject to civil liability if they infringe on the legal rights and interests of third parties in the course of their advertising business. At the present time, we are not subject to any of the penalties mentioned above.

Our business, operations and financial condition are subject to various risks. Some of these risks are described below and you should take these risks into account in making a decision to invest in our common stock. If any of the following risks actually occur, we may not be able to conduct our business as currently planned and our financial condition and operating results could be seriously harmed. In that case, the market price of our common stock could decline and our stockholders could lose all or part of their investment in our common stock.

Risks Related to Our Business

The substantial and continuing net losses, and significant on-going working capital deficit incurred in the past few years, may require us to change our business plan or even may cause us not to be able to continue our operations if sufficient funding and/or additional cash from revenues is not realized. This raises doubt as to our ability to continue as a going concern.

Our operations resulted in a net loss of $3,474,219 and used cash in operations of $2,485,774 for the year ended December 31, 2014. As of December 31, 2014, we had an unappropriated accumulated deficit of $8,500,442 and a working capital deficiency of $7,982,920. Our independent registered auditors indicated in their audit report for fiscal year ended December 31, 2014 that these factors raised substantial doubt about our ability to continue as a going concern.

Our ability to continue as a going concern is dependent on our ability to meet our obligations, to obtain additional financing as may be required until such time as we can generate sources of recurring revenues and to ultimately attain profitability.

The Company expects to finance its operations primarily through capital contributions from stockholders and related entities. However, management cannot provide any assurance that we will obtain required capital on terms acceptable to us. If we are unable to secure additional capital, as circumstances require, or do not succeed in meeting our profit objectives we may be required to change or cease our operations.

If we are unable to execute our e-commerce business strategy, our business and future prospects may be materially and adversely affected.

We have limited experience in e-commerce. Since our inception, we attempted to conduct business to consumer business (“B2C”) in 2006 and business to consumer web portal business (“B2B”) in 2009. Both efforts were terminated. We started operation of the ju51 Online Mall, a B2B2C business, in 2011. Although we have derived some experience through our past operation of e-commerce businesses, we cannot assure you that we have sufficient management experience, human resources and technical capability to operate this new line of business. We explored different business models since the launch of the ju51 Mall in 2011. However, we have revised our business models a few times so far and have not been able to generate significant revenue from the ju51 Mall. Our ability to achieve satisfactory financial results in our new line of business is unproven. Failure to execute our e-commerce strategy in the development and operation of the ju51 Online Mall may result in negative results of operation and may harm our future growth prospects.

Execution of our current business strategy depends on related entities controlled by Mr. Yao, our CEO and principal stockholders. Mr. Yao’s potential conflicts of interest with us may adversely affect our business.

Guangdong Xingbang is jointly owned by Mr. Yao and Ms. Zhong, who are husband and wife. Mr. Yao and Ms. Zhong also jointly own 55.39% of our common stock. We also have a series of transactions with Xinyu Xingbang Industry Co, Ltd (“Xinyu Industry”), an entity owned by Mr. Yao and his spouse. We also have been dependent on the loan proceeds from Mr. Yao and his affiliates to fund our operations. Mr. Yao and Ms. Zhong may not act completely in the best interests of us or our stockholders (as opposed to their personal interest) and there may be conflicts of interest which may not be resolved in our favor. For example, Mr. Yao and Ms. Zhong may cause Guangdong Xingbang to delay the payment of consulting services fees the WFOE or they may cause Guangdong Xingbang to unlawfully terminate the VIE Agreements. There may be conflicts of interest between their duties to us and their interests as the stockholders of Guangdong Xingbang. We cannot assure you that they will act entirely in our interests when conflicts of interest arise or that conflicts of interest will be resolved in our favor. In the event they decided not to fund our operations or terminate the related entities’ relationship with us, we would suffer significant disruption of our business. In addition, Mr. Yao and Ms. Zhong could violate their non-competition or employment agreements with us or their legal duties by diverting business opportunities from us, resulting in our loss of corporate opportunities. If we are unable to resolve any such conflicts, or if we suffer significant delays or other obstacles as a result of such conflicts, our business and operations could be severely disrupted, which could materially and adversely affect our results of operations and damage our reputation.

| 10 |

Current economic conditions and the global financial crisis may have an impact on our business and financial condition in ways that we currently cannot predict.

Our results of operations are sensitive to changes in overall economic and political conditions that impact consumer spending and consumer purchases of home furnishing products. Decoration services tend to decline during recession. The current uncertainty arising out of domestic and global economic conditions, including the recent disruption in credit markets, poses a risk to the PRC economy, and may impact our ability to increase our income. As a result, there has been a shift away from discretionary spending for advertising and marketing services. Continued tightness within our clients marketing budgets may adversely affect our financial condition and results of operations, resulting in a reduction in our revenues.

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations.

Our limited operating history in the advertising and consulting industry may not provide a meaningful basis for evaluating our business prospects. We started our advertising and consulting business in 2002. We are in the process of shifting our focus to becoming an e-commerce operator. Although our revenues have grown rapidly since inception, we cannot guarantee that we will maintain profitability or that we will not incur net losses in the future. We will continue to encounter risks and difficulties that companies at a similar stage of development frequently experience, including the potential failure to:

| ● | Obtain sufficient working capital to support our expansion; |

| ● | Expand our services and offerings and maintain the quality of our advertising services; |

| ● | Maintain our proprietary technology; |

| ● | Manage our expanding operations and continue to fill customers’ orders on time; |

| ● | Maintain adequate control of our expenses allowing us to realize anticipated revenue growth; |

| ● | Implement our product development, marketing and sales strategies and adapt and modify them as needed; |

| ● | Integrate any future acquisitions; and |

| ● | Anticipate and adapt to changing conditions in the Chinese home furnishings industry resulting from changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics. |

If we are unable to address any or all of the foregoing risks, our business may be materially and adversely affected.

| 11 |

In the event Xinyu Xingbang fails to maintain its ICP license, we may have to abandon or substantially change our current business strategy.

Xinyu Xingbang received its ICP license in February 2013. In the event Xinyu Xingbang could not maintain its ICP license or such license is revoked by the competent government authority due to change of applicable PRC laws with regard to foreign investment in telecommunication industry, we may have to abandon or substantially change or business strategy which may results in material negative effect on our results of operations.

We may not be able to effectively control and manage our growth.

If our business and markets grow and develop as we expect, it will be necessary for us to finance and manage expansion in an orderly fashion. We may face challenges in managing new lines of business, expanding product offerings and in integrating acquired businesses with our own. This will increase demands on our existing management and facilities. Failure to manage this growth and expansion could interrupt or adversely affect our operations, cause production backlogs, longer product development time frames and administrative inefficiencies.

We will likely need to raise additional funds in the future to grow our business, which funds may not be available on acceptable terms or at all, and without additional funds, we may not be able to maintain or expand our business.

Although our cash generated from operations are decreased significantly, it is a result from a switch of business focus. However, we believe that we will be sufficient to fund our present operations by advances from stockholders and related companies. It is likely that in the future we will require substantial funds in order to fund operating expenses associated with the expansion of the ju51 Online Mall into other home furnishing sectors, to fund acquisition of other businesses, and to cover public company costs. Without enough funds, we may not be able to meet these goals. We may seek additional funding through public or private financing or through collaborative arrangements with strategic partners.

You should also be aware that in the future:

| ● | We cannot be certain that additional capital will be available on favorable terms, if at all; |

| ● | Any available additional financing may not be adequate to meet our goals; and |

| ● | Any equity financing would result in dilution to stockholders. |

If we cannot raise additional funds when needed, or on acceptable terms, we may not be able to effectively execute our growth strategy, take advantage of future opportunities, or respond to competitive pressures or unanticipated requirements. In addition, we may be required to scale back or discontinue our production and development program, or obtain funds through strategic alliances that may require us to relinquish certain rights.

Our business depends heavily on the market recognition of our brand and our reputation in the home furnishing industry, and any harm to our brand or failure to maintain and enhance our brand recognition may materially and adversely affect our business, financial condition and results of operations.

We believe that the market recognition of our brand and our reputation have significantly contributed to the success of our business. Maintaining and enhancing the recognition and reputation of our brand are critical to our success. Many factors, some of which are beyond our control, are important to maintaining our reputation, including our ability to maintain a client’s positive experience with our services as the end consumers’ preferences evolve and as we develop the new e-commerce business and expand into new sectors in the home furnishing industry.

| 12 |

In addition, the following factors are important to maintain our established market position as we continue the development of ju51 Online Mall:

| ● | Our ability to increase brand awareness among existing and potential customers through various means of marketing and promotional activities; |

| ● | Our ability to effectively control the product quality of flagship stores and to monitor service performance of flagship stores and technical service stations as we continue to develop our marketplace program; and |

| ● | Any negative media publicity about e-commerce, its security or product quality associated with e-commerce operators in China. |

If we are unable to maintain our reputation, further enhance our brand recognition and increase positive awareness of our website, our results of operations and future growth prospectus may be materially and adversely affected.

For our e-commerce business, we face intense competition. If we cannot compete successfully against competitors, we may not be able to acquire meaningful market share.

The operating environment for the ju51 Mall is competitive. Our competitors may include: (1) other B2C e-commerce companies, such as Qijia Net, Liba Net and Taobao Mall; (2) brick and mortar retailers and distributors, many of which possess significant brand recognition, sales volume and customer bases, and some of which currently sell, or in the future may sell, products or services through the internet; and (3) a number of indirect competitors, including well established portals and internet search engines that are involved in e-commerce, either directly or in collaboration with other retailers. Although we believe our planned business model is substantially different from other e-commerce operators in the home furnishing industry, there is no assurance that these competitors, or new ones, will not set up similar or even superior business models than ours.

We face a variety of competitive challenges including: keeping products offered in the ju51 Online Mall competitive in price, quality products and after sale service to consumers; maintaining favorable brand recognition; providing quality services to the business that pay service charges to us; and conducting strong and effective marketing campaigns. If we cannot properly address these challenges, our business and prospects will be materially and adversely affected.

Some of our competitors have significantly greater financial, marketing and other resources than us. In addition, other online retailers may be acquired by, receive investment from or enter into strategic relationships with, well-established and well-financed companies or investors which would ask them to terminate their relationship with us. Increased competition may reduce our operating margins, market share and brand recognition, or force us to incur losses. There can be no assurance that we will be able to compete successfully against current and future competitors, and competitive pressures may have a material adverse effect on our business, prospects, financial condition and results of operations.

The proper functioning of our website will be essential to our business and any failure to maintain the satisfactory performance and integrity of our website will materially and adversely affect our business, reputation, financial condition and results of operations.

The satisfactory performance, reliability and availability of our website, our transaction-processing systems and our network infrastructure will be critical to our success and our ability to attract and retain customers and maintain adequate customer service levels. Our revenues will depend on retaining a number of flagship stores and technical service stations. Any system interruptions caused by telecommunications failures, computer viruses, hacking or other attempts to harm our systems that result in the unavailability or slowdown of our website or reduced order fulfillment or other performance slowdown will reduce the volume of ju51 online mall products sold and the attractiveness of the ju51 Online Mall. Our servers will also be vulnerable to computer viruses, physical or electronic break-ins and similar disruptions, which could lead to interruptions, delays, loss of data or the inability to accept and fulfill customer orders. We may also experience interruptions caused by reasons beyond our control.

| 13 |

We will use externally developed systems for our website and substantially all aspects of transaction processing, including order management, cash, debit card and credit card processing, purchasing, inventory management and shipping. We intend to upgrade and expand our systems and to integrate newly developed or purchased software with our existing systems to support the smooth operation of our ju51 Online Mall. Failure to develop and upgrade our existing technology, transaction-processing systems or network infrastructure to accommodate increased traffic on our website or increased sales volume through our transaction-processing systems may cause unanticipated system disruptions, slower response time, degradation in levels of customer service and impaired quality and speed of order fulfillment, which would have a material adverse effect on our business, reputation, financial condition and future growth prospects.

If we fail to successfully adopt new technologies or adapt our website and systems to customer requirements or emerging industry standards, our e-commerce business, prospects and financial results will likely be materially and adversely affected.

To remain competitive, we will have to continue to enhance and improve the responsiveness, functionality and features of our website. The internet and e-commerce industry are characterized by rapid technological evolution, changes in user requirements and preferences, frequent introductions of new products and services embodying new technologies and the emergence of new industry standards and practices that could render our existing proprietary technologies and systems obsolete. Our success will depend, in part, on our ability to identify, develop, acquire or license leading technologies useful in our business, enhance our existing services, develop new services and technologies that address the increasingly sophisticated and varied needs of our existing and prospective customers, and respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis. The development of website and other proprietary technology entails significant technical and business risks. There can be no assurance that we will be able to use new technologies effectively or adapt our website, proprietary technologies and transaction-processing systems to customer requirements or emerging industry standards. If we are unable to adapt in a cost-effective and timely manner in response to changing market conditions or customer requirements, whether for technical, legal, financial or other reasons, our business, prospects, financial condition and results of operations would be materially adversely affected.

Any interruption in the operation of our data centers for an extended period will likely have an adverse impact on our e-commerce business.

Our ability to accurately process and fulfill orders placed on the ju51 Mall and provide high-quality customer service will depend on the efficient and uninterrupted operation of our data centers and logistics centers. Our data centers and logistics centers may be vulnerable to damage caused by fire, flood, power loss, telecommunications failure, break-ins, earthquake, human error and other events. In addition, we do not have additional back-up systems or a formal disaster recovery plan and do not carry business interruption insurance to compensate for losses that may occur. The occurrence of any of the foregoing risks will likely have a material adverse effect on our business, prospects, reputation, financial condition and future operating prospects.

Failure to protect confidential information of our ju51 Online Mall customers and our network against security breaches will likely damage our reputation and brand and substantially harm our business and results of operations.

A significant challenge to online commerce and communications is the secure transmission and retention of confidential information over public networks. Management anticipates all product orders will be made through our website. All the online payments for our ju51 Online Mall products will be settled through third-party online payment services. In such transactions, maintaining complete security for the transmission of confidential information on our website, such as customers’ credit card numbers and expiration dates, personal information and billing addresses, is essential to maintain consumer confidence. We will have limited influence over the security measures of third-party online payment service providers. In addition, we will hold certain private information about our ju51 Online Mall customers, such as their names, addresses, phone numbers and browsing and purchasing records. We may not be able to prevent third parties, such as hackers or criminal organizations, from stealing information provided by our customers to us through our website. In addition, our flagship stores and technical service stations may violate their confidentiality obligations and disclose information about our customers. Any compromise of our security or third-party service providers’ security could have a material adverse effect on our reputation, business, prospects, financial condition and results of operations. Although we have had no such issues to date, we cannot assure you that events concerning leak of confidential information out of our control will not occur in the future, which could cause serious harm to our brand and reputation.

| 14 |

In addition, significant capital and other resources may be required to protect against security breaches or to alleviate problems caused by such breaches. The methods used by hackers and others engaged in online criminal activity are increasingly sophisticated and constantly evolving. Even if we are successful in adapting to and preventing new security breaches, any perception by the public that online commerce and transactions, or the privacy of user information, are becoming increasingly unsafe or vulnerable to attack could inhibit the growth of e-commerce and other online services generally, which in turn may reduce the revenue from our e-commerce service offering.

We will depend on independent third parties for the operation and maintenance of our e-commerce business and any interruption with these parties may adversely affect our results of operation.

Our ju51 Online Mall is a B2B2C e-commerce platform for manufacturers, dealers, retailers and consumers. We will depend on a number of independent third parties to generate revenues for the ju51 Mall. We will depend on manufacturers who will open flagship stores to showcase and sell their products, list prices for products, and process orders placed online by consumers. We will depend on technical service stations, previously named “direct sale stores,” who are retailers or decoration companies to provide product support and services to consumers. Our revenue will rely on the commission payable by manufacturers for the flagship stores and franchise fees payable by retailers or decoration companies for the technical service stations. The manufacturers will pay commission, based on a percentage of sales generated through our site and the retailers will pay a fixed amount of franchise fees. We will rely on third parties to provide a secured payment system. In addition, although we operate and maintain the website ourselves, we will depend on telecommunication service providers to provide Internet connection and other parties to host our servers. Failure of any of these independent third parties to provide quality products and services to customers or to maintain our website may negatively impact the shopping experience in our ju51 Online Mall and damage our market reputation and adversely affect our business and results of operations.

We will incur significant costs on a variety of marketing efforts designed to increase sales of products on our ju51 Online Mall and some marketing campaigns and methods may turn out to be ineffective.

We rely on a variety of different marketing efforts tailored to our target customers to increase sales of products on our ju51 Online Mall. Our marketing activities, which often involve significant costs, may not be well received by customers and may not result in the levels of product sales on our ju51 Online Mall that we anticipate. Marketing approaches and tools in the home furnishings industry in China are evolving. This further requires us to enhance our marketing campaign and experiment with new marketing approaches to keep pace with industry developments and customer preferences. Failure to refine our existing marketing approaches or to introduce new effective marketing approaches in a cost-effective manner could reduce our market share, cause our revenues to decline and negatively impact our profitability.

Our business depends and will depend substantially on the continuing efforts of our present and future executive officers, and our business may be severely disrupted if we lose, are unable to obtain or unable to replace, their services.

Our future prospects depend substantially on the continued services of our executive officers, especially Mr. Yao, our Chairman, Chief Executive Officer and President. We do not maintain key man life insurance on any of our executive officers. If one or more of our executive officers are unable or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. Therefore, our business may be severely disrupted, and we may incur additional expenses to recruit and retain new officers. In addition, if any of our executives joins a competitor or forms a competing company, we may lose some of our customers. Each of our executive officers has entered into an employment agreement with us, which contains non-compete provisions. However, if any dispute arises between our executive officers and us, we cannot assure you that we would be able to enforce these non-compete provisions in China, where these executive officers reside, in light of uncertainties with China’s legal system. Failure to retain the services of Mr. Yao or any other key employee may harm our reputation, financial prospects and future growth.

| 15 |

Our business and growth will suffer if we are unable to hire and retain key personnel that are in high demand.

Our future performance depends on our ability to attract and retain highly skilled designers, technical, marketing and sales personnel. Qualified individuals are in high demand in China, and there are insufficient experienced personnel to fill the demand. The e-commerce industry is characterized by high demand and intense competition for talent. Considering our limited operating history, our ability to train and integrate new employees into our operations may not meet the growing demands of our business. Therefore, we may not be able to attract or retain the personnel we need to succeed.

Implementation of new PRC labor contract and labor laws relating to social insurance may adversely affect our business and results of operations.

Pursuant to a new PRC labor contract law that became effective in 2008, employers in China are subject to stricter requirements in terms of signing labor contracts, paying remuneration, determining the term of employees’ probation and unilaterally terminating labor contracts. The new labor contract law and related regulations impose greater liabilities on employers and may significantly increase the costs to an employer if it decides to reduce its workforce. In the event we decide to significantly change or reduce our workforce, the new labor contract law could adversely affect our ability to make such changes in a manner that is most favorable to our business or in a timely and cost effective manner.

Companies operating in China must comply with a variety of labor laws, including certain pension, health insurance, unemployment insurance and other welfare-oriented payment obligations. Our failure to comply with these laws could have a material adverse effect on our business.

Our existing stockholders have substantial influence over our company and their interests may not be aligned with the interests of our other stockholders.

Currently, our co-founders, Mr. Yao and Ms. Zhong, who are husband and wife, jointly own an aggregate of 55.39% of our outstanding shares through Future Media International Limited, a BVI entity. Mr. Yao, as the sole director of Future Media International Limited, has substantial influence over our business, including decisions regarding mergers, consolidations and the sale of all or substantially all of our assets, election of directors and other significant corporate actions. He may take actions that are not in the best interest of us or our other stockholders. These actions may be taken even if he is opposed by our other stockholders, including those who purchase shares in future offerings. This concentration of ownership may discourage, delay or prevent a change in control of our company, which could deprive our stockholders of an opportunity to receive a premium for their shares as part of a sale of our company and may reduce the price of our shares. For more information regarding our principal stockholders and their affiliated entities, see “Corporate Structure.”

We may not be able to adequately protect our intellectual property, which could cause us to be less competitive and negatively impact our business.

We regard our trademarks, software registrations, trade secrets, domain names and other intellectual property as important to our success. We rely on trademark, patent and trade secret law, as well as confidentiality agreements with certain of our employees, to protect our proprietary rights. We include a standard confidentiality clause in our employment agreements to prevent our employees from disclosing confidential information to outside parties. No assurance can be given that our intellectual property will not be challenged, invalidated, infringed or circumvented. Any material impairment of our intellectual property rights could have a material adverse effect on our business.

In addition, intellectual property rights in China are still developing, and there are uncertainties involved in the protection and the enforcement of such rights. We will need to pay special attention to protecting our intellectual property. Failure to do so could lead to the loss of a competitive advantage that could not be compensated by our damages award.

| 16 |

Future strategic alliances or acquisitions may have a material and adverse effect on our business, reputation and results of operations.

We may in the future enter into strategic alliances with various third parties. Strategic alliances with third parties could subject us to a number of risks, including risks associated with sharing proprietary information, non-performance by the counter-party, and an increase in expenses incurred in establishing new strategic alliances, any of which may materially and adversely affect our business. We may have little ability to control or monitor their actions. To the extent strategic third parties suffer negative publicity or harm to their reputation from events relating to their business, we may also suffer negative publicity or harm to our reputation by virtue of our association with such third parties.

In addition, although we have no current acquisition plans, if we are presented with appropriate opportunities, we may acquire additional assets, products, technologies or businesses that are complementary to our existing business. Future acquisitions and the subsequent integration of new assets and businesses into our own would require significant attention from our management and could result in a diversion of resources from our existing business, which in turn could have an adverse effect on our business operations. Acquired assets or businesses may not generate the financial results we expect. In addition, acquisitions could result in the use of substantial amounts of cash, potentially dilutive issuances of equity securities, the occurrence of significant goodwill impairment charges, amortization expenses for other intangible assets and exposure to potential unknown liabilities of the acquired business. Moreover, the costs of identifying and consummating acquisitions may be significant. In addition to possible stockholders’ approval, we may also have to obtain approvals and licenses from the relevant government authorities in the PRC for the acquisitions and to comply with any applicable PRC laws and regulations, which could result in increased costs and delay.

We may need additional capital, and the sale of additional shares or other equity securities could result in dilution to our stockholders.

Although our current cash and cash equivalents and anticipated cash flow from operations are decreased significantly, it is a result from a switch of business focus. However, we believe that we will be sufficient to meet our anticipated cash needs for the foreseeable future by advances from stockholders and related companies. We may, however, require additional cash resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If these resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity securities could result in additional dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing covenants that would restrict our operations. It is uncertain whether financing will be available in amounts or on terms acceptable to us, if at all.

If we fail to implement and maintain an effective system of internal controls (or fail to remediate the material weakness in our internal control over financial reporting that has been identified), we may be unable to accurately report our results of operations or prevent misstatements, and investor confidence and the market price of our shares may be materially and adversely affected.

Our independent registered public accounting firm has not conducted an audit of our internal control over financial reporting. Since September 2012, we have engaged a consulting firm to assist us with preparation of financial statements and financial reporting. Although the consulting firm is comprised of U.S. Certified Public Accountants who are familiar with the U.S. GAAP and financial reporting requirements of U.S. publicly-listed companies, we do not have a Chief Financial Officer or internal staff with sufficient U.S. GAAP knowledge and experience in the preparation of our financial statements. This has been deemed a material weakness in our internal control over financial reporting which may result in our inability to accurately report our financial results or prevent material misstatements.

| 17 |

Our business license is subject to governmental control and renewal, and the failure to obtain renewal would cause all our operations to be suspended and have a material adverse effect on our financial condition.

We are subject to various PRC laws and regulations pertaining to the e-commerce industry. Our business license allows us to engage in e-commerce operation. However, there is no assurance that we will be able to maintain our business license. If our business license is revoked or terminated by the government, all our operations will have to be suspended, which would have a material adverse effect on our business and financial condition.

Because we may not be able to obtain business insurance in the PRC, we may not be protected from risks that are customarily covered by insurance in the United States.

Business insurance is not readily available in the PRC. To the extent we suffer a loss of a type which would normally be covered by insurance in the United States, such as general liability insurance, we would incur significant expenses in both defending any action and in paying any claims that result from a settlement or judgment. It is possible that consumers may initiate proceedings against manufacturers or distributors who advertise through our website and add us as co-defendant in such product liability actions. We have not obtained any property or liability insurance in China. Any losses incurred by us will have to be borne by us without any assistance, and we may not have sufficient capital to cover material damage to, and such loss would have a material adverse effect on, our financial condition, business and prospects.

We do not carry directors’ and officers’ liability insurance to cover any expenses and losses due to lawsuits related to financial reporting errors. Our indemnification obligations could adversely affect our business, financial condition and results of operations.

We have not obtained director and officer liability insurance to cover lawsuit expenses and losses related to financial reporting errors. Our bylaws require us to indemnify our current and former directors, officers, employees and agents against most actions of a civil, criminal, administrative or investigative nature. Generally, we are required to advance indemnification expenses prior to any final adjudication of an individual’s culpability. The expense of indemnifying our current and former directors, officers and employees and agents and the related expenses as a result of any actions related to the internal investigation and financial restatement may be significant. Therefore, our indemnification obligations could result in the diversion of our financial resources and may adversely affect our business, financial condition and results of operations.

Risks Relating to Our Corporate Structure

Our corporate structure, in particular the VIE Agreements, are subject to significant risks, as set forth in the following risk factors.

| 18 |

We did not obtain a legal opinion from PRC legal counsel with respect to our VIE arrangement. If our management’s understanding of the relevant PRC laws is incorrect and our corporate structure and the VIE Agreements are later determined by PRC government to be unenforceable, our results of operation may be materially adversely affected.

The VIE Agreements, designed to give us effective control of Guangdong Xingbang without having ownership in it, are governed by PRC laws. We did not seek PRC legal counsel’s opinion or advice when we entered into these VIE Agreements with Guangdong Xingbang. The PRC laws are complicated and fluid and there is no assurance that our understanding of the relevant PRC laws is accurate and up-to-date. If our management’s understanding of the relevant PRC laws is incorrect and our corporate structure and the VIE Agreements are later determined by PRC government to be unenforceable, our results of operation may be materially adversely affected and we may have to negotiate new business terms with the Guangdong Xingbang Stockholders.

We depend upon the VIE Agreements in conducting our business in the PRC, which may not be as effective as direct ownership.

The VIE Agreements may not be as effective in providing us with control over Guangdong Xingbang as direct ownership. The VIE Agreements are governed by PRC laws and provide for the resolution of disputes through arbitration proceedings pursuant to PRC laws. Accordingly, the VIE Agreements would be interpreted in accordance with PRC laws. If Guangdong Xingbang or its stockholders fail to perform the obligations under the VIE Agreements, including but not limited to default in payment of consulting fees under the Consulting Services Agreement, we may have to rely on legal remedies under PRC laws, including seeking specific performance or injunctive relief, and claiming damages, and there is a risk that we may be unable to obtain these remedies. The legal environment in China is not as developed as in other jurisdictions. As a result, uncertainties in the PRC legal system could limit our ability to enforce the VIE Agreements.

The pricing arrangement under the VIE Agreements may be challenged by the PRC tax authorities.

We could face adverse tax consequences if the PRC tax authorities determine that the VIE Agreements were not entered into based on arm’s length negotiations. If the PRC tax authorities determine that the VIE Agreements were not entered into on an arm’s length basis, they may adjust the income and expenses of our company for PRC tax purposes which could result in higher tax liability.

We rely on the approval certificates and business license held by Guangdong Xingbang and any deterioration of the relationship between the WFOE and Guangdong Xingbang could materially and adversely affect the overall business operation of our company.

Pursuant to the VIE Agreements, our business will be undertaken on the basis of the approvals, certificates and business license as well as other requisite licenses held by Guangdong Xingbang. The e-commerce industry in China is highly regulated by the PRC government and numerous regulatory authorities of the central PRC government are empowered to issue and implement regulations governing various aspects of the internet industry. See “PRC Regulation.” There is no assurance that Guangdong Xingbang will be able to renew its licenses or certificates when their terms expire with substantially similar terms as the ones they currently hold.

Further, our relationship with Guangdong Xingbang is governed by the VIE Agreements, which are intended to provide us, through our indirect ownership of the WFOE, with effective control over the business operations of Guangdong Xingbang. However, the VIE Agreements may not be effective in providing control over the applications for and maintenance of the licenses required for our business operations. Guangdong Xingbang could violate the VIE Agreements, go bankrupt, suffer from difficulties in its business or otherwise become unable to perform its obligations under the VIE Agreements and, as a result, our operations, reputation, business and stock price could be severely harmed.