Attached files

| file | filename |

|---|---|

| EX-31 - EXHIBIT 31 - Heyu Leisure Holidays Corp | v404441_ex31.htm |

| EX-32 - EXHIBIT 32 - Heyu Leisure Holidays Corp | v404441_ex32.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Heyu Leisure Holidays Corp | Financial_Report.xls |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) | |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR | |

| 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-55068

HEYU LEISURE HOLIDAYS CORPORATION

(Exact name of registrant as specified in its charter)

CLOUD RUN ACQUISITION CORPORATION

(Former Name of Registrant as Specified in its Charter)

| Delaware | 46-3601223 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

Westwood Business Center

611 South Main Street

Grapevine, Texas 76051

(Address of principal executive offices) (zip code)

Registrant's telephone number, including area code: (+86) 592 504 9622

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $.0001 par value per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer", "non-accelerated filer", and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer ¨ | Accelerated filer | ¨ |

| Non-accelerated filer ¨ | Smaller reporting company | x |

| (do not check if smaller reporting company) | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

x Yes ¨ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

$ 0

Indicate the number of shares outstanding of each of the registrant's classes of common stock as of the latest practicable date.

| Class | Outstanding at |

| March 26, 2015 | |

| Common Stock, par value $0.0001 | 60,000,000 |

| Documents incorporated by reference: | None |

PART I

| Item 1. | Business |

Heyu Leisure Holidays Corporation (formerly Cloud Run Acquisition Corporation) ("Heyu" or the "Company") was incorporated on July 2, 2013 under the laws of the State of Delaware to engage in any lawful corporate undertaking, including, but not limited to, selected mergers and acquisitions.

In addition to a change in control of its management and shareholders, the Company's operations to date have been limited to issuing shares and filing a registration statement on Form 10 pursuant to the Securities Exchange Act of 1934. The Company was formed to provide a method for a foreign or domestic private company to become a reporting company with a class of securities registered under the Securities Exchange Act of 1934.

On January 13, 2014, the Company redeemed an aggregate of 20,000,000 of the then 20,000,000 shares of outstanding stock at a redemption price of $.0001 per share for an aggregate redemption price of $2,000.

James Cassidy and James McKillop, both directors of the Company and the then president and vice president, respectively, resigned such directorships and all offices of the Company. Neither Messrs. Cassidy nor McKillop retain any shares of the Company's common stock.

Ban Siong Ang was named as the sole director of the Company and serves as its Chief Executive Officer and interim Chief Financial Officer.

On January 14, 2014 the Company issued 1,000,000 shares of its common stock at par of $0.0001 representing 100% of the then total outstanding 1,000,000 shares of common stock.

The Company has entered into an agreement with Tiber Creek Corporation of which the former president of the Company is the president and controlling shareholder. Tiber Creek Corporation assists companies to become public reporting companies and for the preparation and filing of a registration statement pursuant to the Securities Act of 1933, and the introduction to brokers and market makers.

On August 8, 2014, the Company issued additional 59,000,000 shares of its common stock at par of $0.0001. Accordingly, the total outstanding of common stock is 60,000,000 shares as at December 31, 2014. Hung Seng Tan is appointed as the Executive Director and Guan Chuan Tan is appointed as the Director of the Company during the year. Ban Siong Ang is appointed as Managing Director and serves as Chief Executive Officer subsequent to the new appointment of Directors.

SUBSEQUENT EVENT

On February 9, 2015, Heyu Leisure Holidays Corporations (“the Registrant”), completed the acquisition of Heyu Capital Ltd (“Heyu Capital”), a limited company formed under the law of Hong Kong, in a stock for stock transaction (“the acquisition”). The purpose of the Acquisition was to facilitate and prepare the registrant for a registration statement an Public offering of Securities.

The acquisition was effectuated by the registrant through the exchange of 40,000,000 Shares of Common Stock of Heyu Capital for 1,000 Shares of Common Stock of the registrant. As a result of Acquisition, all of the outstanding shares of Common Stock of Heyu Capital were exchanged for, and converted into, 1,000 Shares of Common Stock of the Registrant. Hence, the registrant issuance a total of 1,000 Shares of Common Stock of the Registrant in the Acquisition.

Heyu Capital was incorporated June 27, 2013 under the laws of Hong Kong.

On December 18, 2013, Heyu Capital registered 100% equity interest in Xiamen Heyu, but not yet contributes any capital into Xiamen Heyu as of December 31, 2013. Heyu Capital contribute capital of $966,130 in Xiamen Heyu as of December 31, 2014. Since its inception, Xiamen Heyu Hotel Management Ltd has focused on marketing and negotiations to manage and operate hotels in China.

On January 25, 2014, Xiamen Heyu entered into a Share Transfer Agreement with existing shareholders of Xiamen Wujiaer Hotel Ltd with a consideration of $622,379 (approximately 3,800,000 in RMB) in cash for the acquisition.

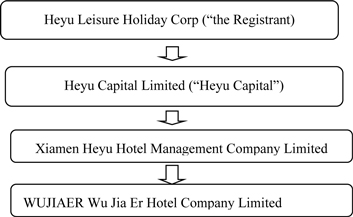

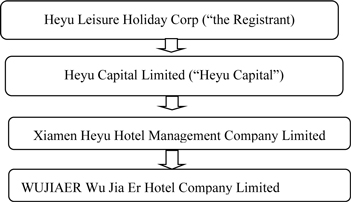

As a result of Acquisition, each of Heyu Capital, Xiamen Heyu and Xiamen Wujiaer become wholly owned subsidiaries of the Registrant as follow:

CURRENT ACTIVITIES

The Company has not entered into any definitive or binding agreements and there are no assurances that such transactions will occur, it is actively pursuing the following avenues of development:

The Company intends to operate and manage budget hotels chains in China. The Company intends that it will develop its business plan through the acquisition or business combination with an existing private company in China or otherwise through growth and development of its projects. No agreements have been executed and if the Registrant makes any acquisitions, mergers or other business combination, it will file a Form 8-K.

It is anticipated that such private company will bring with it to such merger key operating business activities and a business plan. As of the date of this Report, no agreements have been executed to effect such a business combination and although the Company anticipates that it will effect such a business combination there is no assurance that such combination will be consummated.

If and when the Company chooses to enter into a business combination with such private company or another, it will likely file a registration statement after such business combination is effected.

A combination will normally take the form of a merger, stock-for-stock exchange or stock-for-assets exchange. The Company may wish to structure the business combination to be within the definition of a tax-free reorganization under Section 351 or Section 368 of the Internal Revenue Code of 1986, as amended.

As of December 31, 2014, the Company had not generated revenues and had no income or cash flows from operations since inception. At December 31, 2014, the Company had sustained a net loss of $41,085 and had an accumulated deficit of $45,492.

The Company's independent auditors have issued a report raising substantial doubt about the Company's ability to continue as a going concern. At present, the Company has no operations and the continuation of the Company as a going concern is dependent upon financial support from its stockholders, its ability to obtain necessary equity financing to continue operations and/or to successfully locate and negotiate with a business entity for a business combination that would provide a basis of possible operations.

There is no assurance that the Company will ever be profitable.

| Item 2. | Properties |

The Company has no properties and at this time has no agreements to acquire any properties. The Company currently uses the offices of its president at no cost to the Company.

| Item 3. | Legal Proceedings |

There is no litigation pending or threatened by or against the Company.

| Item 4. | Mine Safety Disclosures. |

Not applicable.

PART II

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

There is currently no public market for the Company's securities.

Once and if a business combination is effected, the Company may wish to cause the Company's common stock to trade in one or more United States securities markets. The Company anticipates that it will take the steps required for such admission to quotation following the business combination or at some later time.

At such time as it qualifies, the Company may choose to apply for quotation of its securities on the OTC Bulletin Board.

The OTC Bulletin Board is a dealer-driven quotation service. Unlike the Nasdaq Stock Market, companies cannot directly apply to be quoted on the OTC Bulletin Board, only market makers can initiate quotes, and quoted companies do not have to meet any quantitative financial requirements. Any equity security of a reporting company not listed on the Nasdaq Stock Market or on a national securities exchange is eligible.

Since inception, the Company has sold securities which were not registered as follows:

| NUMBER OF | ||||||||||

| DATE | NAME | SHARES | CONSIDERATION | |||||||

| July 9, 2013 | James Cassidy | 10,000,000 | $ | 1,000 | ||||||

| (10,000,000 redeemed 1/13/2014) | ||||||||||

| July 9, 2013 | James McKillop | 10,000,000 | $ | 1,000 | ||||||

| (10,000,000 redeemed 1/13/2014) | ||||||||||

| January 14, 2014 | Ban Siong Ang | 1,000,000 | $ | 100 | ||||||

| August 8, 2014 | Ban Siong Ang | 46,388,604 | $ | 4,538 | ||||||

| Hooi Pheng Ang | 254,569 | $ | 26 | |||||||

| Teik Kui Ang | 651,854 | $ | 65 | |||||||

| Xin Chen | 109,354 | $ | 11 | |||||||

| Tek Mun Chin | 340,000 | $ | 34 | |||||||

| ShuHui Dai | 257,416 | $ | 26 | |||||||

| XieMing Fan | 66,000 | $ | 7 | |||||||

| HaiBin Gao | 80,000 | $ | 8 | |||||||

| Boon Hong Haw | 2,000,000 | $ | 200 | |||||||

| JianShu Huang | 60,000 | $ | 6 | |||||||

| QingQiang Li | 42,854 | $ | 4 | |||||||

| EnYu Lin | 70,000 | $ | 7 | |||||||

| FenJin Lin | 40,000 | $ | 4 | |||||||

| Tiang Lee Ng | 4,272,419 | $ | 427 | |||||||

| Wee Lee Sim | 60,000 | $ | 6 | |||||||

| Swiss Teo Swee Kiong | 103,064 | $ | 10 | |||||||

| Guan Chuan Tan | 300,000 | $ | 30 | |||||||

| Hang Kiang Tan | 60,000 | $ | 6 | |||||||

| Hung Seng Tan | 1,484,423 | $ | 149 | |||||||

| Hup Teong Tan | 90,000 | $ | 9 | |||||||

| Kwee Huwa Tan | 349,550 | $ | 35 | |||||||

| Lan Tan | 78,209 | $ | 8 | |||||||

| Lee Hiang Tan | 97,355 | $ | 10 | |||||||

| XiaoDi Rao | 153,709 | $ | 15 | |||||||

| ShuYing Wang | 105,354 | $ | 11 | |||||||

| MeiMei Weng | 147,355 | $ | 15 | |||||||

| Kean Heong Wong | 76,203 | $ | 8 | |||||||

| XiuHua Xian | 200,000 | $ | 20 | |||||||

| MeiJiao Xu | 166,354 | $ | 17 | |||||||

| ZhuEn Xu | 50,000 | $ | 5 | |||||||

| TaoYing Yang | 241,098 | $ | 24 | |||||||

| ZhenYu Zeng | 180,354 | $ | 20 | |||||||

| DeZhao Zhang | 100,000 | $ | 10 | |||||||

| XiuMei Zheng | 525,355 | $ | 53 | |||||||

| BingRen Zhong | 408,387 | $ | 41 | |||||||

| MeiYun Zhong | 119,064 | $ | 12 | |||||||

| WenJin Zhong | 121,354 | $ | 12 | |||||||

| XingEn Zhong | 84,710 | $ | 9 | |||||||

| XingHua Zhong | 65,032 | $ | 7 | |||||||

| Item 6. | Selected Financial Data. |

There is no selected financial data required to be filed for a smaller reporting company.

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations |

The Company has no operations nor does it currently engage in any business activities generating revenues. The Company's principal business objective is to achieve a business combination with a target company.

As of December 31, 2014, the Company had not generated revenues and had no income or cash flows from operations until acquisition. At December 31, 2014, the Company had sustained a net loss of $41,805 and had an accumulated deficit of $45,492.

The Company's independent auditors have issued a report raising substantial doubt about the Company's ability to continue as a going concern. At present, the Company has no operations and the continuation of the Company as a going concern is dependent upon financial support from its stockholders, its ability to obtain necessary equity financing to continue operations and/or to successfully locate and negotiate with a business entity for the combination of that target company with the Company.

The Company intends to operate and manage budget hotels chains in China. The Company intends that it will develop its business plan through the acquisition or business combination with an existing private company in China or otherwise through growth and development of its projects. No agreements have been executed and if the Registrant makes any acquisitions, mergers or other business combination, it will file a Form 8-K.

A likely target company with which the Company may effect a business combination is one seeking the perceived benefits of a reporting corporation. Such perceived benefits may include facilitating or improving the terms on which additional equity financing may be sought, providing liquidity for incentive stock options or similar benefits to key employees, increasing the opportunity to use securities for acquisitions, providing liquidity for shareholders and other factors. Business opportunities may be available in many different industries and at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities difficult and complex.

In analyzing prospective a business combination, the Company may consider such matters as the available technical, financial and managerial resources; working capital and other financial requirements; history of operations, if any; prospects for the future; nature of present and expected competition; the quality and experience of management services which may be available and the depth of that management; the potential for further research, development, or exploration; specific risk factors not now foreseeable but which may be anticipated; the potential for growth or expansion; the potential for profit; the perceived public recognition or acceptance of products, services, or trades; name identification; and other relevant factors. This discussion of the proposed criteria is not meant to be restrictive of the virtually unlimited discretion of the Company to search for and enter into potential business opportunities.

It is anticipated that any securities issued in any such business combination would be issued in reliance upon exemption from registration under applicable federal and state securities laws. In some circumstances, however, as a negotiated element of its transaction, the Company may agree to register all or a part of such securities immediately after the transaction is consummated or at specified times thereafter. If such registration occurs, it will be undertaken by the surviving entity after the Company has entered into an agreement for a business combination or has consummated a business combination. The issuance of additional securities and their potential sale into any trading market which may develop in the Company's securities may depress the market value of the Company's securities in the future if such a market develops, of which there is no assurance.

While the terms of a business transaction to which the Company may be a party cannot be predicted, it is expected that the parties to the business transaction will desire to avoid the creation of a taxable event and thereby structure the acquisition in a tax-free reorganization under Sections 351 or 368 of the Internal Revenue Code of 1986, as amended.

2014 Year-End Analysis

The Company has received no income, has had minimum operations and expenses, other than Delaware state fees and incorporation and accounting fees as required for incorporation and for the preparation of the Company's financial statements until its acquisition.

As of December 31, 2014, the Company had not generated revenues and had no income or cash flows from operations until acquisition. At December 31, 2014, the Company had sustained a net loss of $41,805 and had an accumulated deficit of $45,492.

| Item 8. | Financial Statements and Supplementary Data |

The financial statements for the year ended December 31, 2014 are attached hereto.

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

There were no disagreements with the Company's accountants on accounting or financial disclosure for the period covered by this report.

| Item 9A. | Controls and Procedures |

Pursuant to Rules adopted by the Securities and Exchange Commission. the Company carried out an evaluation of the effectiveness of the design and operation of its disclosure controls and procedures pursuant to Exchange Act Rules. This evaluation was done as of the end of the fiscal year under the supervision and with the participation of the Company's principal executive officer (who is also the principal financial officer).

There have been no significant changes in internal controls or in other factors that could significantly affect internal controls subsequent to the date of the evaluation. Based upon that evaluation, the principal executive officer believes that the Company's disclosure controls and procedures are effective in gathering, analyzing and disclosing information needed to ensure that the information required to be disclosed by the Company in its periodic reports is recorded, summarized and processed timely. The principal executive officer is directly involved in the current day-to-day operations of the Company.

Management's Report of Internal Control over Financial Reporting

The Company is responsible for establishing and maintaining adequate internal control over financial reporting in accordance with the Rule 13a-15 of the Securities Exchange Act of 1934. The Company's officer, its president, conducted an evaluation of the effectiveness of the Company's internal control over financial reporting as of December 31, 2014, based on the criteria establish in Internal Control Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, management concluded that the Company's internal control over financial reporting was not effective as of December 31, 2014, based on those criteria. A control system can provide only reasonably, not absolute, assurance that the objectives of the control system are met and no evaluation of controls can provide absolute assurance that all control issues have been detected.

Anton & Chia, the independent registered public accounting firm for the Company, has not issued an attestation report on the effectiveness of the Company's internal control over financial reporting.

Changes in Internal Control Over Financial Reporting

There have been no changes in the Company's internal controls over financial reporting during its fourth fiscal quarter that have materially affected, or are reasonably likely to materially affect, its internal control over financial reporting.

| Item 9B. | Other Information |

Not applicable.

PART III

| Item 10. | Directors, Executive Officers, and Corporate Governance; |

The Directors and Officers of the Company are as follows:

| Name | Age | Position | Year Commenced | |||

| Boon Hong Haw | 46 | Chairman of the Board | 2014 | |||

| Ban Siong Ang | 40 | CEO, and Group Managing Director | 2014 | |||

| Hung Seng Tan | 53 | Executive Director | 2014 | |||

| Guan Chuan Tan | 48 | Director | 2014 | |||

| Kean Tat Che | 32 | CFO | 2014 | |||

| Timi Ecimovic | 73 | Non-executive Director | 2014 | |||

| Mei Yun Zhong | 39 | Non-executive Director | 2014 | |||

| Stephan Truly Busch | 65 | Non-executive Director | 2014 | |||

| Kwee Huwa Tan | 50 | Non-executive Director | 2014 | |||

| Shanmuga Ratnam | 58 | Independent Non-executive Director | 2014 | |||

| M. Shahid Siddiqi | 72 | Independent Non-executive Director | 2014 | |||

| Hakikur Rahman | 57 | Independent Non-executive Director | 2014 | |||

| Lay Hoon Ong | 42 | Independent Non-executive Director | 2014 |

Management of the Company

On January 24, 2014 James Cassidy and James McKillop, both directors of the Company and the then president and vice president, respectively, resigned as directors and all offices of the Company.

Ban Siong Ang was named as the sole director of the Company and appointed its Chief Executive Officer and Chief Financial Officer.

On August 8, 2014, Hung Seng Tan is appointed as Executive Director and Guan Chuan Tan is appointed as the Director of the company during the year. Ban Siong Ang is appointed as Managing Director and serves as Chief Executive Officer subsequent to the appointment of new Directors.

In 2014, Boon Hong How was appointed as the Chairman of Board of Director. Timi Ecimovic, Mei Yun Zhong, Stephan Truly Busch and Kwee Huwa Tan were appointed as Non-executive Director. Shanmuga Ratnam, M. Shahid Siddiqi, Hakikur Rahman and Lay Hoon Ong were appointed as Independent non-executive Director of the Company.

On October 16, 2014, Kean Tat Che was appointed as Chief Financial Officer subsequent to the appointment of non-executive and Independent non-executive Director.

Boon Hong Haw

Boon Hong Haw is one of the Internationally well-known Environmentalists, Educationalists, Social Scientists, Strategic planners, authors, Peace Sustainable Makers and Consultant/Specialist on International Business & Entrepreneurial Development, leadership, Corporate Social & Sustainable Responsibilities, Financial & Economic, Management, Marketing, Cross-Cultural Resource, Human Rights and the creative management of change. Also he is an intellectual luminary of great repute and a human dynamo of hard work and unstinted service. Through these profound contributions have gained him rich experiences in life and helped needy at large so do he received more than 150 national and international awards recognition. He has no conflict of interest in any business arrangement involving the Company. He has had no convictions for any offences within the past ten years.

Ban Siong Ang

Ban Siong Ang graduated from USQ, Australia in 1998 and completed his Doctor of Business Administration from Ansted University in 2011. Upon his graduation, he worked for the Bursa Malaysia. In 2006, he started his business venture journey in China until now. He is responsible in the formulation and implementation of the HEYU Group’s corporate strategies as well as in charge of the corporate finance and investment management aspects of the Group due to his acute knowledge with rich experience, strong commitment, innovative and dynamic personality. He obtained few Professional Institution Fellowship recognitions from the United Kingdom and also as a member of “The Academic Council on the United Nations System (ACUNS)” in Canada.

In view of Mr. Ang humanitarian contributions, he was certified as ASRIA CSR-CAP in recognizing his outstanding contributions to establish, promote and protect humanity, Peace, Culture Human resource development and Education for the well-being of human society through volunteerism. He was also bestowed the Royal Orders from the State of Pahang in Malaysia. In addition, he also sits on the Directors of several private limited companies in Malaysia, Hong Kong and China.

Hung Seng Tan

Hung Seng Tan possesses a Bachelor degree in Civil Engineering from Ansted University. Prior to start his own business venture in Malaysia he has been in employment at many Restaurants in the United States for few years. Today he is a prominent hand on specialist in town with 30 years’ experience in the field of Quarry Business (River and Marine Sand Exploratory) and also in the area of earth works construction project to which he has completed many important infrastructure projects in Malaysia. He sits on the Directors of several private limited companies in Malaysia.

Guan Chuan Tan

Guan Chuan Tan possesses a Bachelor and Master in Business Administration from Ansted University. He has engaged in restaurant and property industry for over 30 years. He started to serve as Executive Director of Aniseed Group to take charge of culinary and food development since 2008. Besides that, he is the Executive Director of Lava Group and CEO of Buddhist Temple at Dallas Texas in US.

Kean Tat Che

Kean Tat Che is the member of CPA Australia (Certified Public Accountant) and possesseed Bachelor of Commerce (Accounting and Finance) from University of Adelaide, Australia. He does have 10 years of experience in accounting, auditing, corporate finance and corporate exercise in big four accounting firm and public listed companies in Malaysia, China and Singapore. Prior of joining, he served as Vice President in Auscar Group (Malaysia) and Senior Finance Manager in Tropicana Berhad, a public listed company in Malaysia.

Timi Ecimovic

Timi Ecimovic was the Ex-Chairman of the World Thinkers’ Forum cum one of the chapter’s founding members of the World Thinkers’ Panel on the Sustainable Future of Humankind (WTP-SFH) in China. He has more than 300 professional publications including 20 books, several book chapters in the field of Environmental Sciences, Physics of the Nature, System thinking, Climate Change System, Corporate and Individual Social Responsibility, etc. Also he is the Chair of ASRIA’s CSR-CAP, Professor cum Program Director of Ansted University’s School of Environmental Sciences, Ex-Head of SEM Institute for Climate Change, active member of the European Academy of Sciences and Arts, was an International Consultant Socio-Economic and Sport Fishing for The Food and Agriculture Organization of the United Nations (UN FAO) in Rome, Italy. He received the public certificate The Citizen of the Earth XXI, 2012.

Mr. Timi Ecimovic has been nominated by many institutions in the world for the Nobel Prize in Physics. He has been serving as Chairman for the World Thinkers’ Forum, The Chancellor of the World Philosophical Forum University, and many of his activities have been broadcasted via various media channels through press, magazines, journals TV shows and radio presentations including Kaleidoscope of the United Nations Children’s Fund (UNICEF).

Mei Yun Zhong

Mei Yun Zhong was possessed Bachelor of Business Administration from Ansted University. In view of her strong interest in doing business with good leadership skill, she was appointed by one of the China Insurance Companies as a Director of Life Insurance Department for few years. She has many years of marketing experiences in the Insurance and Healthcare products industries in China. Also she is a Regional exclusive agent for HEYU Healthcare products since 2012.

Stephan Truly Busch

Stephan Truly Busch has been in the teaching profession for over 40 years at different German schools in Germany. He is a well-known English teacher in Germany, also fluent in German, Bosnian, Croatian and Serbian languages. He completed his Doctor of Education at Ansted University and serves as an Evaluation expert for European credentials. He has also managed several soccer teams throughout Germany

Kwee Huwa Tan

Kwee Huwa Tan possessed Bachelor of Business Administration from Ansted University. She does have 25 years of experience in beauty care business. Presently she is the Principal Consultant for HEYU Healthcare division in the aspect of beauty and cosmetology. Besides that she has established Slynn International Beauty Group in year 2000, integrating scientific research, marketing, training and professional beauty in business territories covering mainland China, Southeast Asia, Europe, America and China Taiwan region. She has been enthusiastic about public welfare, involving social welfare activities and contribution diligently.

Shanmuga Ratnam

Shanmuga Ratnam was an ex-banker and served as head of department in the FOREX exchange for 25 years in the financial institution in Malaysia. He is Ansted University Doctorate Alumni cum Honorary Advisory Council member in Malaysia. Also he obtained few Professional Institution Fellowship recognitions from the United Kingdom and travel extensively to various countries to serve as invited speaker.

M. Shahid Siddiqi

M. Shahid Siddiqi is one of the founding members of the World Thinkers’ Panel on the Sustainable Future of Humankind (WTP-SFH). A Notary Public in the State of California, United States. Board of Advisor cum Professor in Business & Accounting for Ansted University, retired Tax Consultant in the United States and Canada, President/CEO, Avon Income Tax Services Inc., Deputy Governor for American Biographical Institute Research Association. Author of taxation and accounting resource books as well as listed in Who’s who publications.

Md. Hakikur Rahman

Md. Hakikur Rahman is specialized in the field of Computer Engineering. He is Ansted University Doctorate alumni cum Honorary Advisory Council member. Also he is a trained and qualified Electrical & Electronics Engineer and has been serving as faculty members for various Universities in Portugal and Bangladesh. He is the Chief Editor of the Advances in Knowledge Communities and Social Networks (AKCSN) Book series and International Journal of Information and Communication technology for Human Development (IJICTHD); He has contributed over 45 book chapters, authored/edited about 20 books and published more than 100 articles/papers on ICT for Development (knowledge management, e-governance, e-learning, data mining applications and Internet governance).

Lay Hoon Ong

Lay Hoon Ong has 20 years of experience in directing business administrative and accounting aspects in the field of Education Institution, Publication, Insurance, Business Consultancy, Manufacturing and Industrial Services. Although this kind of task is considered extremely challenging but she never stopped learning the new approaches and improve herself along the journey as a dedicated Administrative Management Director. In view of her international voluntary contributions for many successful conference event projects, she was awarded an Honorary Doctorate degree BALKAN Academy of Science, Technology and Management in Sofia, Bulgaria in 2005. In addition, she also sits on the Directors of several private limited companies in Malaysia.

Conflicts of Interest

Mr. Ang, the Chief Executive officer and managing director of the Company, is also an executive officer of the potential target company with whom the Company is considering in regard to effecting a business combination. Such a business combination may result in a benefit to the target company and its shareholders.

There are no binding guidelines or procedures for resolving potential conflicts of interest. Failure by management to resolve conflicts of interest in favor of the Company could result in liability of management to the Company. However, any attempt by shareholders to enforce a liability of management to the Company would most likely be prohibitively expensive and time consuming.

Code of Ethics

The Company has not at this time adopted a Code of Ethics pursuant to rules described in Regulation S-K. The Company has only three shareholders, one of whom also serves as the director and key executive officer. The Company has no operations or business and does not receive any revenues or investment capital. The adoption of an Ethical Code at this time would not serve the primary purpose of such a code to provide a manner of conduct as the development, execution and enforcement of such a code would be by the same persons and only persons to whom such code applied. Furthermore, because the Company does not have any activities, there are activities or transactions which would be subject to this code. At the time the Company enters into a business combination or other corporate transaction, the current officer and director may recommend that such a code be adopted.

Corporate Governance

For reasons similar to those described above, the Company does not have a nominating nor audit committee of the board of directors. The Company has no activities, and receives no revenues. At such time that the Company enters into a business combination and/or has additional shareholders and a larger board of directors and commences activities, the Company will propose creating committees of its board of directors, including both a nominating and an audit committee. Because there are only three shareholders of the Company, there is no established process by which shareholders to the Company can nominate members to the Company's board of directors. Similarly, however, at such time as the Company has more shareholders and an expanded board of directors, the new management of the Company may review and implement, as necessary, procedures for shareholder nomination of members to the Company's board of directors.

| Item 11. | Executive Compensation |

The Company's officer and director do not receive any compensation for services rendered to the Company, nor has any former officer or director received any compensation in the past. The sole officer and director is not accruing any compensation pursuant to any agreement with the Company.

No retirement, pension, profit sharing, stock option or insurance programs or other similar programs have been adopted by the Company for the benefit of its employees.

The Company does not have a compensation committee for the same reasons as described above.

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

The following table sets forth, as of December 31, 2014, each person known by the Company to be the officer or director of the Company or a beneficial owner of five percent or more of the Company's common stock. The Company does not have any compensation plans and has not authorized any securities for future issuance. Except as noted, the holder thereof has sole voting and investment power with respect to the shares shown.

| Name and Address | Amount of Beneficial | Percent of | ||||||

| of Beneficial Owner | Ownership | Outstanding Stock(1) | ||||||

| Ang Ban Siong | 46,388,604 | 77 | % | |||||

| Boon Hong How | 2,000,000 | 3 | % | |||||

| Tan Hung Seng | 1,484,423 | 2.5 | % | |||||

| Tan Guan Chuan | 300,000 | 0.5 | % | |||||

| Tiang Lee Ng | 4,272,419 | 7 | % | |||||

| Item 13. | Certain Relationships and Related Transactions and Director Independence |

Ban Siong Ang is the majority shareholder of the Company and also serves as its Chief Executive Director and Managing director. Hung Seng Tan is the brother-in-law of Ban Siong Ang.

As the organizers and developers of Cloud Run Acquisition Corporation the predecessor name to the Company, James Cassidy and James McKillop may be considered promoters. Mr. Cassidy provided services to the Company without charge consisting of preparing and filing the charter corporate documents and preparing its registration statement of Form 10. Tiber Creek Corporation, a company of which Mr. Cassidy is the sole director, officer and shareholder, paid all expenses incurred by the Company until January 24, 2014 the date of the change in control,

without repayment.

| Item 14. | Principal Accounting Fees and Services. |

The Company has no activities, no income and no expenses except for independent audit and incorporation and Delaware state fees. The Company's current and former president donated their time in preparation and filing of all state and federal required taxes and reports.

Audit Fees

The aggregate fees incurred for each of the last two years for professional services rendered by the independent registered public accounting firm for the audits of the Company's annual financial statements and review of financial statements included in the Company's Form 10-K and Form 10-Q reports and services normally provided in connection with statutory and regulatory filings or engagements were as follows:

| December 31, 2013 | December 31, 2014 | |||||||

| Audit-Related Fees | $ | 10,000 | $ | 25,000 | ||||

The Company does not currently have an audit committee serving and as a result its board of directors performs the duties of an audit committee. The board of directors will evaluate and approve in advance, the scope and cost of the engagement of an auditor before the auditor renders audit and non-audit services. The Company does not rely on pre-approval policies and procedures.

PART IV

| Item 15. | Exhibits, Financial Statement Schedules |

There are no financial statement schedules nor exhibits filed herewith. The exhibits filed in earlier reports and the Company's Form 10 are incorporated herein by reference.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FINANCIAL STATEMENTS

| ANTON & CHIA | CERTIFIED PUBLIC ACCOUNTANTS |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Heyu Leisure Holidays Corporation

(Formerly known as Cloud Run Acquisition Corporation)

We have audited the accompanying balance sheet of Heyu Leisure Holidays Corporation (formerly known as Cloud Run Acquisition Corporation) (the "Company") as of December 31, 2014 and 2013, and the related statements of operations, change in stockholders' equity (Deficit), and cash flows for the years then ended. Heyu Leisure Holiday Corporation management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Heyu Leisure Holiday Corporation as of December 31, 2014 and 2013, and the results of its operations and its cash flows for the periods ended December 31, 2014 and from inception to December 31, 2014, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has had no revenues and income since inception. These conditions, among others, raise substantial doubt about the Company's ability to continue as a going concern. Management's plans concerning these matters are also described in Note 2, which includes the raising of additional equity financing or merger with another entity. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Anton & Chia LLP

Newport Beach, CA

March 26, 2015

HEYU LEISURE HOLIDAYS CORPORATION

BALANCE SHEETS

| December 31, | December 31, | |||||||

| 2014 | 2013 | |||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash | $ | — | $ | 2,000 | ||||

| Total assets | — | 2,000 | ||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Related party payable | $ | 29,985 | $ | — | ||||

| Accrued liabilities | 5,200 | 1,150 | ||||||

| Total liabilities | 35,185 | 1,150 | ||||||

| Stockholders' equity/ (deficit) | ||||||||

| Preferred stock, $0.0001 par value, 20,000,000 shares authorized; none issued and outstanding | ||||||||

| Common stock, $0.0001 par value, 100,000,000 shares authorized; 60,000,000 and 20,000,000 shares issued and outstanding as of December 31,2014 and December 31, 2013, respectively. | 6,000 | 2,000 | ||||||

| Additional paid-in capital | 1,307 | 257 | ||||||

| Accumulated deficit | (45,492 | ) | (1,407 | ) | ||||

| Total stockholders' equity (deficit) | (35,185 | ) | 850 | |||||

| Total liabilities and stockholders' equity (deficit) | — | $ | 2,000 | |||||

The accompanying notes are an integral part of these financial statements

| 2 |

HEYU LEISURE HOLIDAYS CORPORATION

STATEMENTS OF OPERATIONS

| For the year ended December 31, | For the period from July 2, 2013 (Inception) to December 31, | |||||||

| 2014 | 2013 | |||||||

| Revenue | $ | - | $ | - | ||||

| Operating expenses | 41,085 | 1,407 | ||||||

| Loss before income | (41,085 | ) | (1,407 | ) | ||||

| Income tax | - | - | ||||||

| Net loss | $ | (41,085 | ) | $ | (1,407 | ) | ||

| Loss per share - basic and diluted | $ | (0.00 | ) | $ | (0.00 | ) | ||

| Weighted average shares-basic and diluted | 25,167,123 | 20,000,000 | ||||||

The accompanying notes are an integral part of these financial statements

| 3 |

HEYU LEISURE HOLIDAYS CORPORATION

STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

| Deficit | ||||||||||||||||||||

| Accumulated | ||||||||||||||||||||

| Additional | During the | Total | ||||||||||||||||||

| Common Stock | Paid-In | Development | Stockholders' | |||||||||||||||||

| Shares | Amount | Capital | Stage | Equity | ||||||||||||||||

| Balance July 2, 2012 | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

| Issuance of Common Stock | 20,000,000 | 2,000 | - | - | 2,000 | |||||||||||||||

| Additional paid-in capital | - | - | 257 | - | 257 | |||||||||||||||

| Net loss | - | - | - | (1,407 | ) | (1,407 | ) | |||||||||||||

| Balance, December 31, 2013 | 20,000,000 | $ | 2,000 | $ | 257 | $ | (1,407 | ) | $ | 850 | ||||||||||

| Redemption of common Stock | (20,000,000 | ) | $ | (2,000 | ) | $ | - | $ | - | $ | (2000 | ) | ||||||||

| Issuance of common stock | 60,000,000 | 6,000 | - | - | $ | 6,000 | ||||||||||||||

| Additional paid-in capital | - | - | 1,050 | - | 1,050 | |||||||||||||||

| Net loss | - | - | - | 41,085 | (41,085 | ) | ||||||||||||||

| Balance, December 31, 2014 | 60,000,000 | $ | 6,000 | $ | 1,307 | $ | 42,492 | $ 35, 185 | ||||||||||||

The accompanying notes are an integral part of these financial statements

| 4 |

HEYU LEISURE HOLIDAYS CORPORATION

STATEMENTS OF CASH FLOWS

| For the Period | ||||||||

| For the | from July 2, 2013 | |||||||

| year ended | (Inception) to | |||||||

| December 31, 2014 | December 31, 2013 | |||||||

| OPERATING ACTIVITIES | ||||||||

| Net loss | $ | 41,085 | $ | (657 | ) | |||

| Changes in Operating Assets and | ||||||||

| Accrued liabilities | 4,050 | 400 | ||||||

| Net cash (used in)/ generated from operating activities | 37,035 | (257 | ) | |||||

| FINANCING ACTIVITIES | ||||||||

| Proceeds from issuance of common stock | 6,000 | 2,000 | ||||||

| Due to related party | 29,985 | - | ||||||

| Redemption of common stock | (2,000 | ) | - | |||||

| Proceeds from stockholders' additional contribution | 1,050 | 257 | ||||||

| Net cash provided by financing activities | 35, 035 | 2, 257 | ||||||

| Net change in cash | (2,000 | ) | 2,000 | |||||

| Cash, beginning of period | 2,000 | - | ||||||

| Cash, end of period | $ | - | $ | 2,000 | ||||

The accompanying notes are an integral part of these financial statements

| 5 |

HEYU LEISURE HOLIDAYS CORPORATION

Notes to the Financial Statements

NOTE 1 NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

NATURE OF OPERATIONS

Cloud Run Acquisition Corporation ("Cloud Run" or "the Company") was incorporated on July 9, 2013 under the laws of the state of Delaware to engage in any lawful corporate undertaking, including, but not limited to, selected mergers and acquisitions. The Company has been in the developmental stage since inception and its operations to date have been limited to issuing shares to its original shareholders. The Company will attempt to locate and negotiate with a business entity for the combination of that target company with Orange Run. The combination will normally take the form of a merger, stock-for-stock exchange or stock-for-assets exchange. In most instances the target company will wish to structure the business combination to be within the definition of a tax-free reorganization under Section 351 or Section 368 of the Internal Revenue Code of 1986, as amended. No assurances can be given that the Company will be successful in locating or negotiating with any target company. The Company has been formed to provide a method for a foreign or domestic private company to become a reporting company with a class of securities registered under the Securities Exchange Act of 1934.

BASIS OF PRESENTATION

The summary of significant accounting policies presented below is designed to assist in understanding the Company's financial statements. Such financial statements and accompanying notes are the representations of the Company's management, who are responsible for their integrity and objectivity. These accounting policies conform to accounting principles generally accepted in the United States of America ("GAAP") in all material respects, and have been consistently applied in preparing the accompanying financial statements.

| 6 |

USE OF ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents include cash on hand and on deposit at banking institutions as well as all highly liquid short-term investments with original maturities of 90 days or less. The Company has no cash equivalents as of December 31, 2014.

CONCENTRATION OF RISK

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash. The Company places its cash with high quality banking institutions. The Company did not have cash balances in excess of the Federal Deposit Insurance Corporation limit as of December 31, 2014 and 2013.

INCOME TAXES

Under ASC 740, "Income Taxes," deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Valuation allowances are established when it is more likely than not that some or all of the deferred tax assets will not be realized. As of December 31, 2014 and 2013, there were no deferred taxes due to the uncertainty of the realization of net operating loss or carry forward prior to expiration.

LOSS PER COMMON SHARE

Basic loss per common share excludes dilution and is computed by dividing net loss by the weighted average number of common shares outstanding during the year. Diluted loss per common share reflect the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock or resulted in the issuance of common stock that then shared in the loss of the entity. As of December 31, 2014 and 2013, there are no outstanding dilutive securities.

| 7 |

FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company follows guidance for accounting for fair value measurements of financial assets and financial liabilities and for fair value measurements of nonfinancial items that are recognized or disclosed at fair value in the financial statements on a recurring basis. Additionally, the Company adopted guidance for fair value measurement related to nonfinancial items that are recognized and disclosed at fair value in the financial statements on a nonrecurring basis. The guidance establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to measurements involving significant unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows:

Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

Level 3 inputs are unobservable inputs for the asset or liability. The carrying amounts of financial assets such as cash approximate their fair values because of the short maturity of these instruments.

NOTE 2 - GOING CONCERN

The Company has not yet generated any revenue since inception to date and has sustained operating losses during the year ended December 31, 2014. The Company had negative working capital of $35,185 and an accumulated deficit of $45,492 as of December 31, 2014. The Company's continuation as a going concern is dependent on its ability to generate sufficient cash flows from operations to meet its obligations and/or obtaining additional financing from its members or other sources, as may be required.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern; however, the above condition raises substantial doubt about the Company's ability to do so. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result should the Company be unable to continue as a going concern.

| 8 |

In order to maintain its current level of operations, the Company will require additional working capital from either cash flow from operations or from the sale of its equity. However, the Company currently has no commitments from any third parties for the purchase of its equity. If the Company is unable to acquire additional working capital, it will be required to significantly reduce its current level of operations.

NOTE 3 - RECENT ACCOUNTING PRONOUNCEMENTS

In June 2014, the FASB issued ASU 2014-10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements. ASU 2014-10 eliminates the distinction of a development stage entity and certain related disclosure requirements, including the elimination of inception-to-date information on the statements of operations, cash flows and stockholders’ equity. The amendments in ASU 2014-10 will be effective prospectively for annual reporting periods beginning after December 15, 2014, and interim periods within those annual periods, however early adoption is permitted. The company adopted ASU 2014-10 in 2014, thereby no longer presenting or disclosing any information required by Topic 915.

In August 2014, the FASB issued Accounting Standards Update No. 2014-15, “Disclosure of Uncertainties About an Entity’s Ability to Continue as a Going Concern” (“ASU 2014-15”), which requires management to perform interim and annual assessments on whether there are conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern within one year of the date the financial statements are issued and to provide related disclosures, if required. ASU 2014-15 is effective for the Company for our fiscal year ending October 31, 2017. Early adoption is permitted. The company adopted this pronouncement which did not have a significant impact on its financial statements.

Other recent accounting pronouncements issued by the FASB (including its Emerging Issues Task Force) and the United States Securities and Exchange Commission did not or are not believed by management to have a material impact on the Group's present or future financial statements

| 9 |

NOTE 4 STOCKHOLDERS' EQUITY

The Company is authorized to issue 100,000,000 shares of common stock and 20,000,000 shares of preferred stock.

In July, 2013, the Company issued 20,000,000 common shares to two directors and officers for an aggregated amount of $2,000 in cash.

On January 13, 2014, the following events occurred which resulted in a change of control of the Company:

The Company redeemed an aggregate of 20,000,000 of the then 20,000,000 shares of outstanding stock at a redemption price of $.0001 per share for an aggregate redemption price of $2,000.

James Cassidy and James McKillop, both directors of the Company and the then president and vice president, respectively, resigned such directorships and all offices of the Company. Neither Messrs. Cassidy nor McKillop retain any shares of the Company's common stock.

Ban Siong Ang was named as Sole Director of the Company and serves as its Chief Executive Officer. On January 14, 2014, the Company issued 1,000,000 shares of its common stock at par representing 100% of the then total outstanding 1,000,000 shares of common stock.

On August 8, 2014, the Company issued additional 59,000,000 shares of its common stock at par value for an aggregated amount of $5,900 in cash. Accordingly, the total outstanding of common stock is 60,000,000 shares as at December 31, 2014. These securities cannot be sold, transferred or otherwise disposed of by any investor to any other person or entity unless subsequently registered under the Securities Act of 1933, as amended, and under applicable law of the state or jurisdiction where sold, transferred or disposed of, unless such sale, transfer or disposition shall qualify under an allowed exemption to such registration.

Hung Seng Tan is appointed as the Executive Director and Guan Chuan Tan is appointed as the Director of the Company during the period. Ban Siong Ang is appointed as Managing Director and serves as Chief Executive Officer subsequent to the appointment of new Directors.

| 10 |

SUBSEQUENT EVENT

On February 9, 2015, Heyu Leisure Holidays Corporations (“the Registrant”), completed the acquisition of Heyu Capital Ltd (“Heyu Capital”), a limited company formed under the law of Hong Kong, in a stock for stock transaction (“the acquisition”). The purpose of the Acquisition was to facilitate and prepare the registrant for a registration statement an Public offering of Securities.

The acquisition was effectuated by the registrant through the exchange of 40,000,000 Shares of Common Stock of Heyu Capital for 1,000 Shares of Common Stock of the registrant. As a result of Acquisition, all of the outstanding shares of Common Stock of Heyu Capital were exchanged for, and converted into, 1,000 Shares of Common Stock of the Registrant. Hence, the registrant issuance a total of 1,000 Shares of Common Stock of the Registrant in the Acquisition.

The following diagram illustrates the Registrant corporate and ownership structure, the place of formation and the ownership interests of Registrant’s subsidiaries after merger of Heyu Capital and its subsidiaries.

| 11 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| HEYU LEISURE HOLIDAYS CORPORATION | ||

| Formerly Cloud Run Acquisition Corporation | ||

| By: | /s/ Ban Siong Ang | |

| Chief Executive Officer | ||

| Dated: March 26, 2015 | ||

| By: | /s/ Kean Tat Che | |

| Chief Financial Officer | ||

Dated: March 26, 2015

Pursuant to the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| NAME | OFFICE | DATE | ||

| /s/ Ban Siong Ang | Director | March 26, 2015 |