Attached files

ARTICLES OF AMENDMENT

TO THE

ARTICLES OF INCORPORATION

OF

GARB CORPORATION

Pursuant to the provisions of the Utah Business Corporation Act, the undersigned corporation hereby adopts the following Articles of Amendment to its Articles of Incorporation.

First: The name of the Corporation is Garb Corporation.

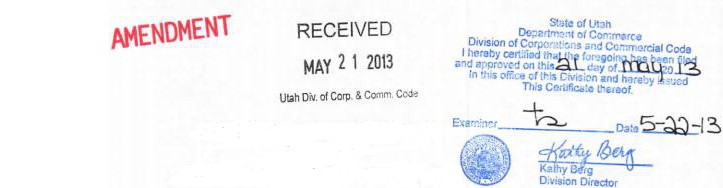

Second: The following amendment was adopted by a shareholders meeting on May 18th, 2013 and was ratified and approved by a meeting of the Board of Directors of Garb Corporation by unanimous consent on May 20th, 2013 in the manner prescribed by the Articles of Incorporation and the Utah Business Corporation Act:

Third: The number of Garb Common Stock shares issued and outstanding on said date was 33,876,715,153.5 common shares. The number of shares entitled to vote thereon was 33,876,715,153.5 common shares, representing.

The number of Garb Class A Preferred Stock issued and outstanding on said date was 7 shares of Class A Preferred. The number of shares entitled to vote thereon was 7 Class A Preferred representing over 78% of all voting rights in Garb. All 7 Garb Class A Preferred Stock was present at the meeting, representing 100% of all Class A Preferred Stock.

The number of Garb Class B Preferred Stock issued and outstanding on said date was 4,494,298 shares of Class B Preferred. The number of shares entitled to vote thereon was 4,494,298 Class B Preferred, representing less than 3.5% of Garb’s voting rights. 4,300,000 Garb Class B Preferred Shares were present at the meeting representing 95.67% of all Garb Class B Preferred Stock.

Forth: The number of common shares voted for said amendments were 412,586,791.5 common shares, the number of shares voted against such amendments were nil and 33,464,128,362 were abstained from voting or were not present, representing less 15% of Garb’s voting rights.

Fifth: Class A Preferred Shares was entitled to vote thereon as a class and Class B was entitled to vote as a Class as per Article of Incorporations Filed March 11, 2010.

Class A Preferred Shareholders of record voted unanimously to approve the changes to the Articles of Incorporation. Class A Preferred Shareholders represented over 78% of all Garb shareholders.

All of the Directors of Garb Oil & Power Corporation has unanimously approved the following amendment to the Articles of Incorporation of this corporation:

A new Article IV is hereby inserted in the Articles of Incorporation of Garb Corporation in replacement of the existing Article IV to read as follows:

ARTICLE IV

SECTION 1.

The aggregate number of shares which the corporation shall have authority to issue is Fifty Billion shares (50,000,000,000) of common stock having no par value. Two (2) new classes of preferred stock, Class A Preferred Stock, Class B Preferred Stock, will be adopted by the corporation with the designations, preference, rights, powers, duties, limitations and authorities as described below. All voting rights of the corporation shall be exercised by the holders of common stock, except for the designations, preferences, rights, powers, duties, limitations and authorities vested and assigned to the new Two (2) classes of preferred A and B stock as described below:

ARTICLE VI

SECTION 2.

CERTIFICATE

OF DESIGNATIONS, PREFERENCES,

RIGHTS AND LIMITATIONS

OF CLASS A PREFERRED STOCK

2.1 DESIGNATION. This class of stock of this corporation shall be named and designated “Class A Preferred Stock”. It shall have 1,000,000 shares authorized at $0.0001 par value per share and will be issued from time to time at the discretion of the Board.

2.2 CONVERSION RIGHTS.

a. If at least one share of Class A Preferred Stock is issued and outstanding, then the total aggregate issued shares of Class A Preferred Stock at any given time, regardless of their number, shall be convertible into the number of shares of Common Stock which equals four times the sum of: i) the total number of shares of Common Stock which are issued and outstanding at the time of conversion, plus ii) the total number of shares of Class B Preferred Stocks which are issued and outstanding at the time of conversion.

b. Each individual share of Class A Preferred Stock shall be convertible into the number of shares of Common Stock equal to:

[four times the sum of: {all shares of Common Stock issued and outstanding at time of conversion + all shares of Class B Preferred Stocks issued and outstanding at time of conversion}]

Minus:

[the number of shares of Class A Preferred Stock issued and outstanding at the time of conversion]

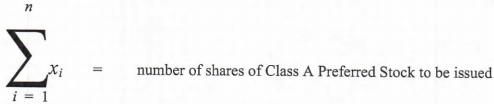

2.3 ISSUANCE. Shares of Preferred Stock may only be issued in exchange for the partial or full retirement of debt held by Management, employees or consultants, or as directed by a majority vote of the Board of Directors. The number of Shares of Preferred Stock to be issued to each qualified person (member of Management, employee or consultant) holding a Note shall be determined by the following formula:

For retirement of debt:

where X1 + X2 + X3 ...+...Xn represent the discrete notes and other obligations owed the lender (holder), which are being retired.

2.4 VOTING RIGHTS.

a. If at least one share of Class A Preferred Stock is issued and outstanding, then the total aggregate issued shares of Class A Preferred Stock at any given time, regardless of their number, shall have voting rights equal to four times the sum of: i) the total number of shares of Common Stock which are issued and outstanding at the time of voting, plus ii) the total number of shares of Class B Preferred Stocks which are issued and outstanding at the time of voting.

b. Each individual share of Class A Preferred Stock shall have the voting rights equal to:

[four times the sum of: {all shares of Common Stock issued and outstanding at time of voting + all shares of Class B Preferred Stocks issued and outstanding at time of voting}]

minus:

[the number of shares of Class A Preferred Stock issued and outstanding at the time of voting]

ARTICLE IV

SECTION 3.

CERTIFICATE OF DESIGNATIONS, PREFERENCES,

RIGHTS AND LIMITATIONS

OF CLASS B PREFERRED STOCK

3.1. DESIGNATION AND NUMBER OF SHARES. 10,000,000 shares of Class B Preferred Stock, par value $0.001 per share (the “Preferred Stock”), are authorized pursuant to Article IV of the Corporation’s Amended Certificate of Incorporation (the “Class B Preferred Stock” or “Class B Preferred Shares”) and will be issued from time to time at the discretion of the Board.

3.2. DIVIDENDS. The holders of Class B Preferred Stock shall be entitled to receive dividends when, as and if declared by the Board of Directors, in its sole discretion.

3.3. LIQUIDATION RIGHTS. Upon any liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, before any distribution or payment shall be made to the holders of any stock ranking junior to the Class B Preferred Stock, the holders of the Class B Preferred Stock shall be entitled to be paid out of the assets of the Corporation an amount equal to $1.00 per share or, in the event of an aggregate subscription by a single subscriber for Class B Preferred Stock in excess of $100,000, $0.997 per share (as adjusted for any stock dividends, combinations, splits, recapitalizations and the like with respect to such shares) (the “Preference Value”), plus all declared but unpaid dividends, for each share of Class B Preferred Stock held by them. After the payment of the full applicable Preference Value of each share of the Class B Preferred Stock as set forth herein, the remaining assets of the Corporation legally available for distribution, if any, shall be distributed ratably to the holders of the Corporation’s Common Stock.

3.4. CONVERSION AND ANTI-DILUTION. (a) Each share of Class B Preferred Stock shall be convertible, at any time, and/or from time to time, into the number of shares of the Corporation’s common stock, no par value per share (the “Common Stock”) equal to the price of the Class B Preferred Stock as stated in 3.6 of the Articles of Incorporation, divided by the par value of the Class B Preferred Stock of $0.001, subject to adjustment as may be determined by the Board of Directors from time to time (the “Conversion Rate”). For example, assuming a $2 price per share of Class B Preferred Stock, and a par value of $0.001 per share for Class B Preferred Stock, each share of Class B Preferred Stock would be convertible into 2,000 shares of Common Stock. Such conversion shall be deemed to be effective on the business day (the “Conversion Date”) following the receipt by the Corporation of written notice from the holder of the Class B Preferred Stock of the holder’s intention to convert the shares of Class B Stock, together with the holder’s stock certificate or certificates evidencing the Class B Preferred Stock to be converted.

(b) Promptly after the Conversion Date, the Corporation shall issue and deliver to such holder a certificate or certificates for the number of full shares of Common Stock issuable to the holder pursuant to the holder’s conversion of Class B Preferred Shares in accordance with the provisions of this Section. The stock certificate(s) evidencing the Common Stock shall be issued with a restrictive legend indicating that it was issued in a transaction exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), and that it cannot be transferred unless it is so registered, or an exemption from registration is available, in the opinion of counsel to the Corporation. The Common Stock shall be issued in the same name as the person who is the holder of the Class B Preferred Stock unless, in the opinion of counsel to the Corporation, such transfer can be made in compliance with applicable securities laws. The person in whose name the certificate(s) of Common Stock are so registered shall be treated as a holder of shares of Common Stock of the Corporation on the date the Common Stock certificate(s) are so issued.

All shares of Common Stock delivered upon conversion of the Class B Preferred Shares as provided herein shall be duly and validly issued and fully paid and nonassessable. Effective as of the Conversion Date, such converted Class B Preferred Shares shall no longer be deemed to be outstanding and all rights of the holder with respect to such shares shall immediately terminate except the right to receive the shares of Common Stock issuable upon such conversion.

(c) The Corporation covenants that, within 30 days of receipt of a conversion notice from any holder of shares of Class B Preferred Stock wherein which such conversion would create more shares of Common Stock than are authorized, the Corporation will increase the authorized number of shares of Common Stock sufficient to satisfy such holder of shares of Class B submitting such conversion notice.

(d) Shares of Class B Preferred Stock are anti-dilutive to reverse splits, and therefore in the case of a reverse split, are convertible to the number of Common Shares after the reverse split as would have been equal to the ratio established in Section 3.4(a) prior to the reverse split. The conversion rate of shares of Class B Preferred Stock, however, would increase proportionately in the case of forward splits, and may not be diluted by a reverse split following a forward split.

3.5 VOTING RIGHTS. Each share of Class B Preferred Stock shall have ten votes for any election or other vote placed before the shareholders of the Company.

3.6 PRICE.

(a) The initial price of each share of Class B Preferred Stock shall be $2.50.

(b) The price of each share of Class B Preferred Stock may be changed either through a majority vote of the Board of Directors through a resolution at a meeting of the Board, or through a resolution passed at an Action Without Meeting of the unanimous Board, until such time as a listed secondary and/or listed public market develops for the shares.

3.7 LOCK-UP RESTRICTIONS ON CONVERSION. Shares of Class B Preferred Stock may not be converted into shares of Common Stock for a period of: a) six (6) months after purchase, if the Company voluntarily or involuntarily files public reports pursuant to Section 12 or 15 of the Securities Exchange Act of 1934; or b) twelve (12) months if the Company does not file such public reports.

| Adopted this 18th day of May, 2013 | |

| by the majority of shareholders. | |

|

|

| John Rossi, Shareholder 4 Shares Class A Preferred Stock | |

|

|

| Igor Plahuta, Shareholder 2 Shares Class A Preferred Stock | |

|

|

| Alan Fleming, Shareholder 1 Share Class A Preferred Stock |

|

Garb Corporation 5248 Pinemont Dr., Suite C 110 Murray, Utah 84123 Phone: 801-738-1355 Email: info@garbmail.com Web: www.garbop.com |

May 20, 2013

To: TO WHOM IT MAY CONCERN

Re: GARB CORPORATION

I John Rossi President/CEO/Corporate Secretary of Garb Corporation (ex Garb Oil & Power Corporation) declare that the signatures contained in the attached Board of Directors resolution are the real and true signatures of Alan Fleming and Igor Plahuta. Both respectively, singularly and combined, are Directors of Garb Corporation and have signed the attached Board Resolution to initiate and finalize the changes contained within.

In faith and trust,

|

|

| John Rossi | |

| CEO, President, Corporate Secretary | |

| Garb Corporation |

APPENDIX A

The “Written consent to action from shareholders letter”

Resolution of Shareholders of Garb Corporation from

Written consent to action from shareholders letter signed and

endorsed May 18th, 2013

The following written consent to action from shareholders letter is endorsed by John Rossi, Igor Plahuta and Alan Fleming, which combined detain the over 80% majority of all issued and outstanding shares of Garb Corporation as per Article 4 of the Articles of Incorporation and as per company ByLaws Article 2, section 2.12.

The written consent to action from shareholders deliberates effective immediately the change to the Articles of Incorporation and specifically Article IV as designated below:

Voted and approved by John Rossi, Igor Plahuta and Alan Fleming representing combined over 80% of Garb Corporation’s shareholders voting rights.

|

| John Rossi, Shareholder 4 Shares Class A Preferred Stock |

|

| Igor Plahuta, Shareholder 2 Shares Class A Preferred Stock |

|

| Alan Fleming, Shareholder 1 Share Class A Preferred Stock |

|

Garb Corporation 5248 Pinemont Dr., Suite C 110 Murray, Utah 84123 Phone: 801-738-1355 Email: info@garbmail.com Web: www.garbop.com |

May 20, 2013

To: TO WHOM IT MAY CONCERN

Re: GARB CORPORATION

I John Rossi President/CEO/Corporate Secretary of Garb Corporation (ex Garb Oil & Power Corporation) declare that the signatures contained in the attached Board of Directors resolution are the real and true signatures of Alan Fleming and Igor Plahuta. Both respectively, singularly and combined, are Directors of Garb Corporation and have signed the attached Board Resolution to initiate and finalize the changes contained within.

In faith and trust,

|

|

| John Rossi | |

| CEO, President, Corporate Secretary | |

| Garb Corporation |

GARB CORPORATION

(a Utah corporation)

Resolution number: Q2-05202013

Unanimous Written Consent of Directors

To Action Taken Without a Meeting

The undersigned, being all of the directors of Garb Corporation, a Utah corporation (hereinafter called the “Corporation”), acting pursuant to the Utah Revised Statutes, hereby waive all notice of the time, place and purposes of a meeting of the Board of Directors of the Corporation and hereby unanimously consent and agree to the adoption of the following resolutions:

WHEREAS, the Corporation requires changing the Articles of Incorporation, Article IV as per Shareholders meeting held May 18th, 2013, see attached as appendix A.

RESOLVED, that it is hereby authorized and approved: The changes to the Articles of Incorporation and specifically Article IV as designated below from Shareholders meeting held May 18th, 2013.

RESOLVED, FURTHER, that the officers of the Corporation be, and they hereby are, authorized and directed to take all such further action and to execute, deliver, certify and file all such instruments and documents in the name and on behalf of the Corporation and under its corporate seal or otherwise, and to pay such taxes and expenses, as in their judgment shall be necessary or advisable in order to carry out fully the intent and to accomplish the purposes of the foregoing resolutions, and each of them.

This Consent may be executed in counterparts, all of which taken together shall constitute one and the same instrument.

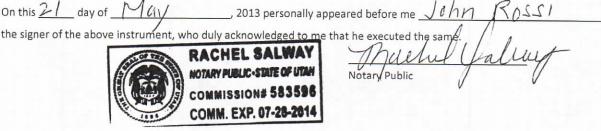

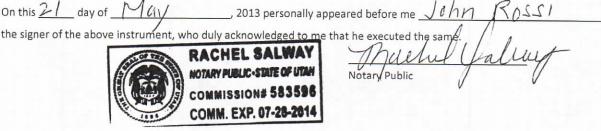

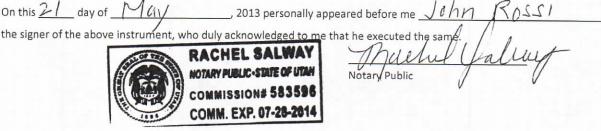

IN WITNESS WHEREOF, the undersigned have executed this Consent as of the 20th day of May, 2013.

|

| John Rossi – Chair |

|

| Igor Plahuta – Director |

|

| Alan Fleming – Director |

|

Garb Corporation 5248 Pinemont Dr., Suite C 110 Murray, Utah 84123 Phone: 801-738-1355 Email: info@garbmail.com Web: www.garbop.com |

May 20, 2013

To: TO WHOM IT MAY CONCERN

Re: GARB CORPORATION

I John Rossi President/CEO/Corporate Secretary of Garb Corporation (ex Garb Oil & Power Corporation) declare that the signatures contained in the attached Board of Directors resolution are the real and true signatures of Alan Fleming and Igor Plahuta. Both respectively, singularly and combined, are Directors of Garb Corporation and have signed the attached Board Resolution to initiate and finalize the changes contained within.

In faith and trust,

|

|

| John Rossi | |

| CEO, President, Corporate Secretary | |

| Garb Corporation |