Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - HACKETT GROUP, INC. | Financial_Report.xls |

| EX-31.1 - EX-31.1 - HACKETT GROUP, INC. | hckt-20150102ex311dc7e75.htm |

| EX-32 - EX-32 - HACKETT GROUP, INC. | hckt-20150102xex32.htm |

| EX-23.1 - EX-23.1 - HACKETT GROUP, INC. | hckt-20150102ex2318dbfbd.htm |

| EX-31.2 - EX-31.2 - HACKETT GROUP, INC. | hckt-20150102ex312869bc7.htm |

| EX-21.1 - EX-21.1 - HACKETT GROUP, INC. | hckt-20150102ex211b3d0b4.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED January 2, 2015

OR

|

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 0-24343

The Hackett Group, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

FLORIDA |

65-0750100 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

1001 Brickell Bay Drive, Suite 3000 Miami, Florida |

33131 |

|

(Address of principal executive offices) |

(Zip Code) |

(305) 375-8005

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

(Title of each class)

|

(Name of each exchange on which registered)

|

|

Common Stock, par value $.001 per share |

NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large Accelerated Filer |

☐ |

Accelerated Filer |

☒ |

|

|

|

|

|

|

Non-accelerated Filer |

☐ (Do not check if a smaller reporting company) |

Smaller reporting company |

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ◻ No ☒

The aggregate market value of the common stock held by non-affiliates of the registrant was $132,322,230 on June 27, 2014 based on the last reported sale price of the registrant’s common stock on the NASDAQ Global Market.

The number of shares of the registrant’s common stock outstanding on March 10, 2015 was 29,842,993.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference certain portions of the registrant’s proxy statement for its 2015 Annual Meeting of Shareholders filed with the Commission not later than 120 days after the end of the fiscal year covered by this report.

THE HACKETT GROUP, INC.

TABLE OF CONTENTS

|

|

|

|

|

|

|

Page |

|

FORM 10-K PART I |

||

|

ITEM 1. |

3 | |

|

ITEM 1A. |

9 | |

|

ITEM 1B. |

12 | |

|

ITEM 2. |

12 | |

|

ITEM 3. |

12 | |

|

ITEM 4. |

12 | |

|

PART II |

||

|

ITEM 5. |

13 | |

|

ITEM 6. |

16 | |

|

ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

17 |

|

ITEM 7A. |

24 | |

|

ITEM 8. |

25 | |

|

ITEM 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

51 |

|

ITEM 9A. |

51 | |

|

ITEM 9B. |

53 | |

|

PART III |

||

|

ITEM 10. |

55 | |

|

ITEM 11. |

55 | |

|

ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

55 |

|

ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

55 |

|

ITEM 14. |

55 | |

|

PART IV |

||

|

ITEM 15. |

55 | |

| 56 | ||

| 57 | ||

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report and the information incorporated by reference in it include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in these sections. All statements regarding our expected financial position and operating results, our business strategy, our financing plans and forecasted demographic and economic trends relating to our industry are forward-looking statements. These statements can sometimes be identified by our use of forward-looking words such as “may,” “will,” “anticipate,” “estimate,” “expect,” or “intend” and similar expressions. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the results, performance or achievements expressed or implied by the forward-looking statements. We cannot promise you that our expectations in such forward-looking statements will turn out to be correct. Factors that could impact such forward-looking statements include, among others, our ability to attract additional business, the timing of projects and the potential for contract cancellation by our customers, changes in expectations regarding the business and information technology industries, our ability to attract and retain skilled employees, possible changes in collections of accounts receivable due to the bankruptcy or financial difficulties of our customers, risks of competition, price and margin trends, and changes in general economic conditions, foreign exchange rates and interest rates. An additional description of our risk factors is described in Part I – Item 1A. “Risk Factors”. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

PART I

GENERAL

In this Annual Report on Form 10-K, unless the context otherwise requires, “Hackett,” the “Company,” “we,” “us,” and “our” refer to The Hackett Group, Inc. and its subsidiaries and predecessors. We were originally incorporated on April 23, 1997.

Hackett is a global strategic advisory firm and a leader in best practice advisory, benchmarking, and transformation consulting services, including shared services, offshoring and outsourcing advice. Utilizing best practices and implementation insights from more than 11,000 benchmarking studies, executives use Hackett’s empirically-based approach to quickly define and prioritize initiatives to enable world-class performance. Through its Archstone Consulting group (“Archstone”), Hackett offers Strategy and Operations consulting services in the Consumer and Industrial Products, Pharmaceutical, Manufacturing and Financial Services industry sectors. Through its REL group, Hackett offers working capital solutions focused on delivering significant cash flow improvements. Through its Enterprise Resource Planning Solutions group (“ERP Solutions”), Hackett offers business application consulting services that help maximize returns on investments for SAP technologies. Hackett has worked with over 5,000 major corporations and government agencies, including 93% of the Dow Jones Industrials, 86% of the Fortune 100, 87% of the DAX 30 and 51% of the FTSE 100.

Although we continued to experience gradual economic improvement in the U.S. during 2014, corporate decision making in Western Europe decision continued to be volatile throughout the year. As we enter 2015, we expect U.S. market conditions to continue to be healthy. Relative to International, which is primarily Western Europe, we expect activity to be stable to improving. However, we continue to expect decision making to remain volatile when compared to the U.S. marketplace. We expect 2.0% to 3.0% GDP growth in the U.S.; however, we remain cautious about our expectations for improved demand in Western Europe but we know most recent growth revision for the region calls for 1+% GDP growth. Global organizations continue to recognize the need to drive sustainable productivity improvement as they look to be competitive in the growing but complex global economy. Global growth opportunities require organizations to build global standards and to drive operating excellence based on the regional growth opportunities defined by the markets that they serve. We believe that many organizations have yet to make the global and regional organizational changes commensurate with the varying regional market conditions. We believe that our offerings are well aligned with the demands that all organizations will continue to experience during a period of slow and volatile economic growth. We will continue to ensure that our clients understand that our unique intellectual capital along with our expanding implementation capabilities will enable them to identify and implement necessary performance improvement initiatives in a targeted and timely manner.

Specifically, organizations must make certain that they have an operating platform or service delivery strategy that ensures that their underlying business processes allow them to strategically support their operations and to optimize their results in the current economic environment. To do so, organizations will have to understand and decide how best to organize, enable, source and manage their critical business processes while both leveraging global standards and resources, and executing based on the specific regional requirements. We believe companies will continue to place increased emphasis on risk management and tangible return on their business and technological investments. We believe large enterprises will continue to focus their performance improvement spending on strategies and tools that help them generate more value from their business investments in the form of enhanced productivity and efficiency. We also expect companies to continue to look for ways to centralize, standardize and automate business processes and to do so by leveraging educated, low-cost labor markets. In today’s environment, we believe that our Company is uniquely qualified to help them achieve their targeted results in a timely manner.

3

OUR PROPRIETARY BEST PRACTICE IMPLEMENTATION INTELLECTUAL CAPITAL

Hackett uses its proprietary Best Practice Implementation (“BPI”) intellectual capital to help clients improve their performance. Our benchmark offerings allow clients to empirically quantify their performance improvement opportunity at an actionable level. Utilizing the performance metrics and our vast repository of best practices, combined with the global strategy and implementation insight of our transformation and technology associates, Hackett has created a series of organizational process and technology tools that allow clients to effect proven sustainable performance improvement. Our proprietary BPI intellectual capital, which is imbedded within our global delivery methodology, allows us to help clients accelerate their time to benefit.

Our BPI approach leverages our inventory of Hackett-Certified™ practices, observed through benchmark and other BPI engagements, to correlate best practices with superior performance levels. We utilize Capability Maturity Models to better understand our client’s capabilities and organizational maturity, so that we can determine the level of performance that they can realistically pursue. In addition, we utilize Hackett’s intellectual capital in the form of best practice process flows and software configuration guides to integrate Hackett’s empirically proven best practices directly into business processes and workflows that are enabled by enterprise software applications. The repository of best practice process flows and software configuration guides reside in the Best Practice Intelligence Center portal and are used on a project to ensure that best practices are identified and implemented, whenever possible. This coordinated approach addresses people, process, information and technology.

Because Hackett solutions are based on Hackett-Certified™ best practices, we believe that clients gain significant advantages. Clients can have confidence that their solutions are based on strategies from the world’s leading companies. More importantly, Hackett solutions deliver enhanced efficiency, improved effectiveness and reduced implementation risk.

The BPI approach often begins with a clear understanding of current performance, which is normally gained through benchmarking key processes and comparing the results to world-class levels and industry standards captured in the Hackett database. We then help clients prioritize and select the appropriate best practices to implement through a coordinated performance improvement strategy. Without a coordinated strategy that addresses the seven key business components which include organization and governance, process design, process sourcing, service placement, information, enabling technology and skills and talent, we believe companies risk losing a significant portion of business case benefits of their investments. We have designed detailed best practice process flows based on Hackett’s deep knowledge of world-class business performance which enable clients to streamline and automate key processes, and generate performance improvements quickly and efficiently at both the functional and enterprise level.

Similarly, we integrate Hackett-Certified™ best practices directly into technology solutions. We believe it is imperative that companies simplify and automate processes to meet best practice standards before new technology implementations and upgrades are completed. The automation of inefficient processes only serves to continue to drive up costs, cycle times and error rates. We have completed detailed fit-gap analyses in most functional areas of major business application packages from Oracle and SAP to determine their ability to support best practices. Application-specific tools, implementation guides and process flows allow us to optimize the configuration of best of breed software, while limiting customization. BPI establishes the foundation for improved performance.

We believe the combination of optimized processes, best practice-based business applications and enhanced business intelligence environments allow our clients to achieve and sustain significant business performance improvement. The specific client circumstances normally dictate how they engage us. Our goal is to be responsive to client needs, and to establish a continuous and trusted relationship. We have developed a series of offerings that allow us to efficiently help the client without regard to where they are in their performance improvement lifecycle.

COMPETITION

The strategic business advisory and technology consulting marketplace continues to be extremely competitive. The marketplace will remain competitive as companies continue to look for ways to improve their organizational effectiveness. Our competitors include international accounting firms; international, national and regional strategic consulting and systems implementation firms; and the IT services divisions of application software firms. Mergers and consolidations throughout our industry have resulted in higher levels of competition. We believe that the principal competitive factors in the industries in which we compete include skills and capabilities of people, innovative services and product offerings, perceived ability to add value, reputation and client references, price, scope of services, service delivery approaches, technical and industry expertise, quality of services and solutions, ability to deliver results on a timely basis, availability of appropriate resources, and global reach and scale. We acknowledge that many of our competitors are larger but we believe very few of our competitors have proprietary intellectual capital similar to the performance metrics and BPI insight that emanates from our Transformational Benchmark and Executive Advisory offerings.

In spite of our size relative to our competitor group, we believe our competitive position is distinct. With Hackett’s best practice intellectual capital and its direct link to our BPI approach, we believe we can empirically and objectively assist our clients. Our ability to apply best practices to client operations via proven techniques is at the core of our competitive standing.

Similarly, we believe that Hackett is the definitive source for best practice performance metrics and strategies. Hackett is the only organization that has conducted more than 11,000 benchmark studies over 21 years at over 3,500 clients, generating

4

proprietary data sets spanning performance metrics and correlating best practices with superior performance. The combination of Hackett benchmark data, along with deep expertise and knowledge in evaluating, designing and implementing business transformation strategies, delivers a powerful and distinct value proposition for our clients.

Our culture of client collaboration leverages the power of our cross-functional and service line teams to increase revenue and strengthen relationships. We believe that this culture, along with our intellectual capital-centric approach, gives us a competitive advantage.

STRATEGY

Our focus will be on executing the following strategies:

|

· |

Expand our brand or market permission to our other offerings. We believe that our long term growth prospects lie in our ability to extend our unique market permission to help clients measure their performance improvement opportunity, using our proprietary benchmark database into our other offerings. We have started to extend our permission through the strategic relationship that results from our Executive Advisory Programs. However, our most significant growth opportunity is in our ability to extend our brand and market permission into our enterprise transformation and other best practice implementation offerings which create a significant opportunity to grow revenue per client. |

|

· |

Continue to position and grow Hackett as an IP-centric strategic advisory organization. We believe that the Hackett brand is widely recognized for benchmarking metrics and best practice strategies. By building a series of highly complementary on-site and off-site offerings that allow our clients access to our Intellectual Property (“IP”) which is based on our best practice process and technology implementation insight, we are able to build trusted strategic relationships with our clients. Depending upon where our clients are in their assessment or implementation of performance improvement initiatives, we offer them a combination of offerings that support their efforts. If they need on-site planning, design and/or implementation support, we offer them a combination of benchmarking and transformation support. If they need off-site access to our IP and advisors to help them either assess or execute on their own, they can avail themselves of our Executive Advisory Programs. The key is for the client to know that we can support them strategically by leveraging our unique IP and insight so that we are able to build a strategic relationship which is appropriate for them. We also believe that clients that value our IP will turn to us for other services when the need arises, allowing us over time to ascribe a larger amount of our total revenue to a growing client base, which will improve the predictability of our results. What is clearly different as we enter 2015 is that we now see the potential to leverage our IP through new external channels. We are now exploring ways to use our IP to help others sell and deliver their offerings, thereby extending the value add they deliver to their clients, and perhaps also providing us with an opportunity to introduce our other services. |

|

· |

Introduce New IP–centric Offerings. We have developed a new performance management dashboard called the “Hackett Performance Exchange”,” HPE.” In 2013 and 2012, we worked closely with our participating launch member clients to validate our targeted functionality and value proposition. This new dashboard offering should allow us to benchmark and monitor the performance improvement opportunity of key operating processes. This offering securely extracts operating information directly from a client’s ERP system which allows them to measure and compare their performance to Hackett peer and world class standards. For clients that run current versions of Oracle and SAP software, this solution is fully automated, requiring limited client time to set up and populate and also provides for electronic access over various devices. In addition to HPE, we also continue to look for ways to leverage our proprietary “IP” through new offerings and other external channels. |

|

· |

Continue to expand our BPI tools. BPI incorporates intellectual capital from Hackett into our implementation tools and techniques. For clients, the end results are tangible cost and performance gains and improved returns on their organizational and technology investments. Many clients attribute their decision to employ us based on our BPI approach and tools. Our objective is to help clients make smarter business process and software configuration decisions as a result of our BPI methods and knowledge. We are continuously updating our BPI content and tools through benchmarking, enterprise transformation and research activities. Additional BPI updates are also driven by new software releases that drive innovation in business process automation. In 2015, we expect to further invest in the automation and further integration of our various metrics, best practices and best practice acceleration tools. |

|

· |

Create strategic relationships that help us leverage and expand our Hackett intellectual capital base as well as grow our revenue. We continue to believe that there are other organizations which can help us grow revenue and intellectual capital consistent with our strategy. Such relationships include programs that we have executed with other consulting organizations, industry trade groups and software providers. |

|

· |

Recruit and develop talent. As we continue to grow and realize the potential of our business model, it has become increasingly evident that the primary limit to our growth will be our ability to attract, retain, develop and motivate associates. We continue to invest in associate development programs that are specifically targeted to improve our go-to-market and delivery execution. |

|

· |

Leverage our offshore capabilities. Leveraging an offshore resource capability to support the delivery of our offerings has been a key strategy for our organization. Our facilities in Hyderabad, India and Montevideo, Uruguay (Oracle EPM business acquired in 2014) allow us to increase operational efficiencies and build targeted key capabilities that can appropriately support the delivery of our offerings and internal functional teams. |

5

|

· |

Seek out strategic acquisitions. We will continue to pursue strategic acquisitions that strengthen our ability to compete and expand our IP. We believe that our unique Hackett access and our BPI approach, coupled with our strong balance sheet and infrastructure, can be utilized to support a larger organization. We plan to pursue acquisitions that are accretive or have strong growth prospects, and most importantly, have strong synergy with our best practice intellectual capital focus. |

OUR OFFERINGS

We offer a comprehensive range of services, including executive advisory programs, benchmarking, business transformation and technology consulting services. With strategic and functional knowledge in finance, human resources, information technology, procurement, supply chain management, corporate services, customer service, and sales and marketing, our expertise extends across the enterprise. We have completed successful engagements in a variety of industries, including automotive, consumer goods, financial services, technology, life sciences, manufacturing, media and entertainment, retail, telecommunications, transportation and utilities.

The Hackett Group

|

· |

Executive Advisory Programs |

On-demand access provides world-class performance metrics, peer-learning opportunities and best practice implementation advice. The scope of Hackett’s advisory programs is defined by business function (Executive Advisory) and by end-to-end process coverage (Process Advisory). Our advisory programs include a mix of the following deliverables:

|

· |

Advisor Inquiry: Hackett’s inquiry services are used by clients for quick access to fact-based advice on proven approaches and methods to increase the efficiency and effectiveness of selling, general and administrative processes. |

|

· |

Best Practice Research: Empirically-based research and insight derived from Hackett benchmark, performance and transformation studies. Our research provides detailed insights into the most significant proven approaches in use at world-class organizations that yield superior business results. |

|

· |

Peer Interaction: Regular member-led webcasts, annual Best Practice Conferences, annual Member Forums, membership performance surveys and client-submitted content, provide ongoing peer learning and networking opportunities. |

|

· |

Best Practice Intelligence Center: Online, searchable repository of best practices, performance metrics, conference presentations and associated research available to Executive Advisory Program Members and their support teams. |

|

· |

Benchmarking Services |

Our benchmarking group dates back to 1991, and has measured and evaluated the efficiency and effectiveness of enterprise functions for over 5,000 organizations globally. This includes 93% of the Dow Jones Industrials, 86% of the Fortune 100, 87% of the DAX 30 and 51% of the FTSE 100. Ongoing studies are conducted in a wide range of areas, including selling, general and administrative, finance, human resources, information technology, procurement, enterprise performance management, shared service centers and working capital management. Hackett has identified over 2,000 best practices for over 105 processes in these key functional areas and uses proprietary performance measurement tools and data collection processes that enable companies to complete the performance measurement cycle and identify and quantify improvement opportunities in as little as four weeks. Benchmarks are used by our clients to objectively establish priorities, generate organizational consensus, align compensation to establish performance goals, and develop the required business case for business and technology investments.

|

· |

Business Transformation |

Our Business Transformation programs help clients develop a coordinated strategy for achieving performance improvements across the enterprise. Our experienced teams utilize Hackett performance measurement data to link performance gains to industry best practices. Our strategic capabilities include operational assessments, process and organization design, change management and the effective application of technology. We combine best practices knowledge with business expertise and broad technology capabilities, which we believe enables our programs to optimize return on client investments in people, process, technology and information.

Through REL, a global leader in generating cash flow improvement from working capital, we offer services which are designed to help companies improve cash flow from operations through improved working capital management, reduced costs and increased service quality.

ERP Solutions

Our ERP Solutions professionals help clients choose and deploy the software applications that best meet their needs and objectives. Our expertise is focused on SAP ERP (with primary focus on Life Sciences and Consumer Goods). The group offers comprehensive services from planning, architecture, and vendor evaluation and selection through implementation, customization, testing and integration. Comprehensive fit-gap analyses of all major packages against Hackett Best Practices are utilized by our ERP Solutions teams. BPI tools and templates help integrate best practices into business and analytical applications. The group also offers post-implementation support, change management, exception management, process transparency, system documentation and end-user

6

training, all of which are designed to enhance return on investment. We also provide off-shore application development and Application Maintenance and Support (“AMS”) services. These services include post-implementation support for select business application and infrastructure platforms. Our ERP Solutions group also includes a division responsible for the sale of the SAP suite of ERP applications.

During the quarter ended March 29, 2013, we exited the Oracle ERP implementation business practice, which is separate and distinct from our Oracle Enterprise Performance Management (“EPM”) practice.

See Note 1 and Note 17 to our consolidated financial statements included in this Annual Report on Form 10-K regarding segment reporting and geographic and service group information.

CLIENTS

We focus on developing long-term client relationships with Global 2000 firms and other sophisticated buyers of business and IT consulting services. During 2014, 2013 and 2012, our ten most significant clients accounted for 21%, 20% and 18% of revenue, respectively, and during each year one client generated 3% of total revenue for each year. We believe that we have achieved a high level of satisfaction across our client base. The responses to our client satisfaction surveys have been positive. We receive surveys from a significant number of our engagements which are utilized in a rigorous process to improve our delivery execution, sales processes, methodologies and training.

BUSINESS DEVELOPMENT AND MARKETING

Our extensive client base and relationships with Global 2000 firms remain our most significant sources of new business. Our revenue generation strategy is formulated to ensure that we are addressing multiple facets of business development. The categories below define our business development resources. Our primary goal is to continue to increase awareness of our brand which we have created around Hackett’s empirical knowledge capital and BPI in the extended enterprise that we now serve. We have a regional sales and market development effort in both North America and Europe, so we can better coordinate the sales and marketing messages from our various offerings. Our compensation programs for our associates reflect an emphasis on optimizing our total revenue relationship with our clients while continuing to emphasize the growth of our Executive Advisory Program clients. Our technology groups, we have continued to utilize Hackett intellectual capital that resides in our BPI tools as a way to differentiate the relationships we have with the software providers and with our clients.

BUSINESS DEVELOPMENT RESOURCES

Although virtually all of our advisors and consultants have the ability to and are expected to contribute to new revenue opportunities, our primary internal business development resources are comprised of the following:

|

· |

The Leadership Team, Principals and Senior Directors are comprised of our senior leaders who have a combination of executive, regional, practice and anchor account responsibilities. In addition to their management responsibilities, this group of associates is responsible for growing the business by fostering executive-level relationships within accounts and leveraging their existing contacts in the marketplace. |

|

· |

The Sales Organization is comprised of associates who are 100% dedicated to generating sales. They are deployed geographically in key markets, are primarily focused on developing new relationships and are aligned to our core practice areas within their target accounts. They also handle opportunities in their geographic territories as they arise. |

|

· |

The Business Development Associates are comprised of trained groups of telemarketing specialists who are conversant with their respective solution areas. Lead generation is coordinated with our marketing and sales groups to ensure that our inbound and outbound efforts are synchronized with targeted marketing and sales programs. |

|

· |

The Delivery Organization is comprised of our billable associates who work at client locations. We encourage associates to pursue additional business development opportunities through their normal course of delivering existing projects thereby helping us expand our business within existing accounts. |

In addition to our business development resources, we have a corporate marketing and communications organization responsible for overseeing our marketing programs, public relations and employee communications activities.

We have organized our market focus into the following categories:

|

· |

Strategic Accounts are comprised of large prospects and existing relationships which we believe will have a significant revenue relationship within the next 18 months. Strategic account criteria include the size of the company, industry affiliation, propensity to buy external consulting services and contacts within the account. The sales representative working closely with regional leadership is primarily responsible for identifying business opportunities in the account, acting as the single point of coordination for the client, and performing the general duties of account manager. |

7

|

· |

Regional Accounts are accounts within a specified geographic location. These accounts mostly include large prospects, dormant clients, existing medium-sized clients and mid-tier market accounts and are handled primarily on an opportunistic basis, except for active clients where delivery teams are focused on driving additional revenue. |

|

· |

Strategic Alliance Accounts are accounts that allow us to partner with organizations of greater scale or different skill sets or with software developers enabling all parties to jointly market their products and services to prospective clients. |

MANAGEMENT SYSTEMS

Our management control systems are comprised of various accounting, billing, financial reporting, human resources, marketing and resource allocations systems, many of which are integrated with our knowledge management system, Mind~Share. We believe that Mind~Share significantly enhances our ability to serve our clients efficiently by allowing our knowledge-base to be shared by all associates worldwide on a real-time basis. Our well-developed, flexible, scalable infrastructure has allowed us to quickly integrate the new employees and business systems we have acquired.

TALENT MANAGEMENT

We fully believe that our culture fosters intellectual creativity, collaboration and innovation. We believe in building relationships with both our associates and clients. We believe the best solutions come from teams of diverse individuals addressing problems collectively and from multiple dimensions, including the business, technological and human dimensions. We believe that the most effective working environment is one where everyone is encouraged to contribute and is rewarded for that contribution. Our core values are the strongest expression of our working style and represent what we stand for. These core values are:

|

· |

Continuous development of our associates, our unique content business model and our knowledge base; |

|

· |

Diversity of backgrounds, skills and experiences; |

|

· |

Knowledge capture, contribution and utilization; and |

|

· |

Collaboration with one another, our partners and our clients. |

Our human resources staff includes seasoned professionals in North America, Europe and Asia Pacific who support our practices by, among other things, administering our benefit programs and facilitating the hiring process. Our human resources staff also includes dedicated individuals who recruit consultants with both business and technology expertise. Our recruiting team supports our hiring process by focusing on the highest demand solution areas of our business to ensure an adequate pipeline of new associates. We also have an employee referral program, which rewards existing employees who source new hires.

As of January 2, 2015, we had 904 associates, excluding subcontractors, 78% of whom were billable professionals. We do not have any associates that are subject to collective bargaining arrangements; however, in France our associates enjoy the benefit of certain government regulations based on industry classification. We have entered into nondisclosure and non-solicitation agreements with virtually all of our personnel. From time to time, we also engage consultants as independent contractors.

COMMUNITY INVOLVEMENT

One important way we put our values into action is through our commitment to the communities where we work. The mission of our Community Councils, which operate in each of the cities where we have offices, is to strive to make the markets, communities and clients we serve better than how we found them. We do so by building a strong sense of community, with collaboration and personal interaction from all of our associates, through both volunteer and service programs and social gatherings.

INTELLECTUAL PROPERTY

We have obtained trademark registrations for The Hackett Group and Book of Numbers and various other names and logos, and we own registrations for certain of our other trademarks in the United States and abroad. We believe that the establishment of these marks is an important part to our strategy of expanding the brand recognition we have built around our empirical knowledge capital.

AVAILABLE INFORMATION

We make our public filings with the Securities and Exchange Commission (“SEC”), including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all exhibits and amendments to these reports, available free of charge at our website www.thehackettgroup.com as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Any material that we file with the SEC may be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 or at www.sec.gov. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

Also available on our website, free of charge, are copies of our Code of Conduct and Ethics, and the charters for the Audit Committee, Compensation Committee and Nominating and Governance Committee of our Board of Directors. We intend to disclose

8

any amendment to, or waiver from, a provision of our Code of Conduct and Ethics applicable to our senior financial officers, including our Chief Executive Officer, Chief Operating Officer, Chief Financial Officer and Corporate Controller on our website within four business days following the date of the amendment or waiver.

Our business is subject to risks. The following important factors could cause actual results to differ materially from those contained in forward-looking statements made in this Annual Report on Form 10-K or printed elsewhere by management from time to time.

Our results of operations could be negatively affected by global and regional economic conditions.

Global and regional economic conditions may affect our clients’ businesses and the markets they serve. A substantial or prolonged economic downturn, weak or uncertain economic conditions or similar factors could adversely affect our clients’ financial condition which may reduce our clients’ demand for our services, force price reductions, cause project cancellations, or delay consulting services for which they have engaged us. In addition, if we are unable to successfully anticipate the changing economic conditions, we may be unable to effectively plan for and respond to those changes, and our business could be negatively affected.

Our quarterly operating results may vary.

Our financial results may fluctuate from quarter to quarter. In future quarters, our operating results may not meet public market analysts’ and investors’ expectations. If that happens, the price of our common stock may fall. Many factors can cause these fluctuations, including:

|

· |

number, size, timing and scope of client engagements; |

|

· |

customer concentration; |

|

· |

long and unpredictable sales cycles; |

|

· |

contract terms of client engagements; |

|

· |

degrees of completion of client engagements; |

|

· |

client engagement delays or cancellations; |

|

· |

competition for and utilization of employees; |

|

· |

how well we estimate the resources and effort we need to complete client engagements; |

|

· |

the integration of acquired businesses; |

|

· |

pricing changes in the industry; |

|

· |

economic conditions specific to business and information technology consulting; and |

|

· |

global economic conditions. |

A high percentage of our operating expenses, particularly personnel and rent, are fixed in advance of any particular quarter. As a result, if we experience unanticipated changes in client engagements or in consultant utilization rates, we could experience large variations in quarterly operating results and losses in any particular quarter. Due to these factors, we believe our quarter-to-quarter operating results should not be used to predict future performance.

If we are unable to maintain our reputation and expand our brand name recognition, we may have difficulty attracting new business and retaining current clients and employees.

We believe that establishing and maintaining a good reputation and name recognition are critical for attracting and retaining clients and employees in our industry. We also believe that the importance of reputation and name recognition will continue to increase due to the number of providers of business consulting and IT services. If our reputation is damaged or if potential clients are not familiar with us or with the solutions we provide, we may be unable to attract new, or retain existing, clients and employees. Promotion and enhancement of our name will depend largely on our success in continuing to provide effective solutions. If clients do not perceive our solutions to be effective or of high quality, our brand name and reputation will suffer. In addition, if solutions we provide have defects, critical business functions of our clients may fail, and we could suffer adverse publicity as well as economic liability.

We depend heavily on a limited number of clients.

We have derived, and believe that we will continue to derive, a significant portion of our revenue from a limited number of clients for which we perform large projects. In 2014, our ten largest clients accounted for 21% of our aggregate revenue. In addition, revenue from a large client may constitute a significant portion of our total revenue in any particular quarter. Our customer contracts generally can be cancelled for convenience by the customer upon 30 days’ notice. The loss of any of our large clients for any

9

reason, including as a result of the acquisition of that client by another entity, our failure to meet that client’s expectations, the client’s decision to reduce spending on technology-related projects, or failure to collect amounts owed to us from our client could have a material adverse effect on our business, financial condition and results of operations.

We have risks associated with potential acquisitions or investments.

Since our inception, we have expanded through acquisitions. In the future, we plan to pursue additional acquisitions as opportunities arise. We may not be able to successfully integrate businesses which we may acquire in the future without substantial expense, delays or other operational or financial problems. We may not be able to identify, acquire or profitably manage additional businesses. Also, acquisitions may involve a number of risks, including:

|

· |

diversion of management’s attention; |

|

· |

failure to retain key personnel; |

|

· |

failure to retain existing clients; |

|

· |

unanticipated events or circumstances; |

|

· |

unknown claims or liabilities; |

|

· |

amortization of certain acquired intangible assets; and |

|

· |

operating in new or unfamiliar geographies. |

Client dissatisfaction or performance problems at a single acquired business could have a material adverse impact on our reputation as a whole. Further, we cannot assure you that our future acquired businesses will generate anticipated revenue or earnings.

Difficulties in integrating businesses we acquire in the future may demand time and attention from our senior management.

Integrating businesses we acquire in the future may involve unanticipated delays, costs and/or other operational and financial problems. In integrating acquired businesses, we may not achieve expected economies of scale or profitability, or realize sufficient revenue to justify our investment. If we encounter unexpected problems as we try to integrate an acquired firm into our business, our management may be required to expend time and attention to address the problems, which would divert their time and attention from other aspects of our business.

Our markets are highly competitive.

We may not be able to compete effectively with current or future competitors. The business consulting and IT services markets are highly competitive. We expect competition to further intensify as these markets continue to evolve. Some of our competitors have longer operating histories, larger client bases, longer relationships with their clients, greater brand or name recognition and significantly greater financial, technical and marketing resources than we do. As a result, our competitors may be in a stronger position to respond more quickly to new or emerging technologies and changes in client requirements and to devote greater resources than we can to the development, promotion and sale of their services. Competitors could lower their prices, potentially forcing us to lower our prices and suffer reduced operating margins. We face competition from international accounting firms; international, national and regional strategic consulting and systems implementation firms; and the IT services divisions of application software firms.

In addition, there are relatively low barriers to entry into the business consulting and IT services market. We do not own any patented technology that would stop competitors from entering this market and providing services similar to ours. As a result, the emergence of new competitors may pose a threat to our business. Existing or future competitors may develop and offer services that are superior to, or have greater market acceptance, than ours, which could significantly decrease our revenue and the value of your investment.

We may not be able to hire, train, motivate, retain and manage professional staff.

To succeed, we must hire, train, motivate, retain and manage highly skilled employees. Competition for skilled employees who can perform the services we offer is intense. We might not be able to hire enough skilled employees or train, motivate, retain and manage the employees we hire. This could hinder our ability to complete existing client engagements and bid for new ones. Hiring, training, motivating, retaining and managing employees with the skills we need is time-consuming and expensive.

We could lose money on our contracts.

As part of our strategy, from time to time, we enter into capped or fixed-price contracts, in addition to contracts based on payment for time and materials. Because of the complexity of many of our client engagements, accurately estimating the cost, scope and duration of a particular engagement can be a difficult task. We maintain an Office of Risk Management (“ORM”) that evaluates and attempts to mitigate delivery risk associated with complex projects. In connection with their review, ORM analyzes the critical estimates associated with these projects. If we fail to make these estimates accurately, we could be forced to devote additional

10

resources to these engagements for which we will not receive additional compensation. To the extent that an expenditure of additional resources is required on an engagement, this could reduce the profitability of, or result in a loss on, the engagement. We may be unsuccessful in negotiating with clients regarding changes to the cost, scope or duration of specific engagements. To the extent we do not sufficiently communicate to our clients, or our clients fail to adequately appreciate the nature and extent of any of these types of changes to an engagement, our reputation may be harmed and we may suffer losses on an engagement.

Lack of detailed written contracts could impair our ability to recognize revenue for services performed, collect fees, protect our IP and protect ourselves from liability to others.

We protect ourselves by entering into detailed written contracts with our clients covering the terms and contingencies of the client engagement. In some cases, however, consistent with what we believe to be industry practice, work is performed for clients on the basis of a limited statement of work or verbal agreement before a detailed written contract can be finalized. Revenue is not recognized on a project prior to receiving a signed contract. To the extent that we fail to have detailed written contracts in place, our ability to collect fees, protect our IP and protect ourselves from liability to others may be impaired.

Our corporate governance provisions may deter a financially attractive takeover attempt.

Provisions of our charter and by-laws may discourage, delay or prevent a merger or acquisition which shareholders may consider favorable, including transactions in which shareholders would receive a premium for their shares. These provisions include the following:

|

· |

shareholders must comply with advance notice requirements before raising a matter at a meeting of shareholders or nominating a director for election; |

|

· |

our Board of Directors is staggered into three classes and the members may be removed only for cause upon the affirmative vote of holders of at least two-thirds of the shares entitled to vote; |

|

· |

we would not be required to hold a special meeting to consider a takeover proposal unless holders of more than a majority of the shares entitled to vote on the matter were to submit a written demand or demands for us to do so; and |

|

· |

our Board of Directors may, without obtaining shareholder approval, classify and issue up to 1,250,000 shares of preferred stock with powers, preferences, designations and rights that may make it more difficult for a third party to acquire us. |

We may lose large clients or may not be able to secure targeted follow-on work or client retention rates.

Our client engagements are generally short-term arrangements, and most clients can reduce or cancel their contracts for our services with a 30 days’ notice and without penalty. As a result, if we lose a major client or large client engagement, our revenue will be adversely affected. We perform varying amounts of work for specific clients from year to year. A major client in one year may not use our services in another year. In addition, we may derive revenue from a major client that constitutes a large portion of total revenue for particular quarters. If we lose any major clients or any of our clients cancel programs or significantly reduce the scope of a large engagement, our business, financial condition, and results of operations could be materially and adversely affected. Also, if we fail to collect a large accounts receivable, we could be subjected to significant financial exposure. Consequently, you should not predict or anticipate our future revenue based upon the number of clients we currently have or the number and size of our existing client engagements.

We also derive a portion of our revenue from annual memberships for our Executive Advisory Programs. Our growth prospects therefore depend on our ability to achieve and sustain renewal rates on programs and to successfully launch new programs. Failure to achieve expected renewal rate levels or to successfully launch new programs and services could have an adverse effect on our operating results.

If we are unable to protect our IP rights or infringe on the IP rights of third parties, our business may be harmed.

We rely upon a combination of nondisclosure and other contractual arrangements and trade secrets, copyright and trademark laws to protect our proprietary rights and the proprietary rights of third parties from whom we license IP. Although we enter into confidentiality agreements with our employees and limit distribution of proprietary information, there can be no assurance that the steps we have taken in this regard will be adequate to deter misappropriation of our IP, or that we will be able to detect unauthorized use and take appropriate steps to enforce our IP rights.

Although we believe that our services do not infringe on the IP rights of others and that we have all rights necessary to utilize the IP employed in our business, we are subject to the risk of claims alleging infringement of third-party IP rights. Any claims could require us to spend significant sums in litigation, pay damages, develop non-infringing IP or acquire licenses to the IP that is the subject of asserted infringement.

11

The market price of our common stock may fluctuate widely.

The market price of our common stock could fluctuate substantially due to:

|

· |

future announcements concerning us or our competitors; |

|

· |

quarterly fluctuations in operating results; |

|

· |

announcements of acquisitions or technological innovations; |

|

· |

changes in earnings estimates or recommendations by analysts; or |

|

· |

current market volatility. |

In addition, the stock prices of many business and technology services companies fluctuate widely for reasons which may be unrelated to operating results. Fluctuation in the market price of our common stock may impact our ability to finance our operations and retain personnel.

We earn revenue, incur costs and maintain cash balances in multiple currencies, and currency fluctuations could adversely affect our financial results.

We have increasing international operations, where we earn revenue and incur costs in various foreign currencies, primarily the British Pound, the Euro and the Australian Dollar. Doing business in these foreign currencies exposes us to foreign currency risks in numerous areas, including revenue, purchases, payroll and investments. Certain foreign currency exposures are naturally offset within an international business unit, because revenue and costs are denominated in the same foreign currency, and certain cash balances are held in U.S. Dollar denominated accounts. However, due to the increasing size and importance of our international operations, fluctuations in foreign currency exchange rates could materially impact our results.

Our cash position includes amounts denominated in foreign currencies. We manage our worldwide cash requirements considering available funds from our subsidiaries and the cost effectiveness with which these funds can be accessed. The repatriation of cash balances from certain of our subsidiaries outside the U.S. could have adverse tax consequences and be limited by foreign currency exchange controls. However, those balances are generally available without legal restrictions to fund ordinary business operations. Any fluctuations in foreign currency exchange rates could materially impact the availability and amount of these funds available for transfer.

ITEM 1B.UNRESOLVED STAFF COMMENTS

None.

Our principal executive office is currently located at 1001 Brickell Bay Drive, Suite 3000, Miami, Florida 33131. The lease on this premise covers 10,896 square feet and expires June 30, 2020. We also have offices in Atlanta, Chicago, New York, Philadelphia, San Francisco, Frankfurt, London, Amsterdam, Paris, Montevideo, Hyderabad and Sydney. As of January 2, 2015, we had operating leases that expire on various dates through December 2022. We believe that we will be able to obtain suitable new or replacement space as needed. We do not own real estate and do not intend to invest in real estate or real estate-related assets.

We are involved in legal proceedings, claims, and litigation arising in the ordinary course of business not specifically discussed herein. In the opinion of management, the final disposition of such matters will not have a material adverse effect on our consolidated financial position, cash flows or results of operations.

ITEM 4.MINE SAFETY DISCLOSURES

Not applicable.

12

PART II

ITEM 5.MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is traded under the NASDAQ symbol, "HCKT". The following table sets forth for the fiscal periods indicated, the high and low sales prices of the common stock, as reported on the NASDAQ:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014 |

|

High |

|

Low |

||

|

Fourth Quarter |

|

$ |

9.37 |

|

$ |

5.82 |

|

Third Quarter |

|

$ |

6.41 |

|

$ |

5.80 |

|

Second Quarter |

|

$ |

6.48 |

|

$ |

5.78 |

|

First Quarter |

|

$ |

6.30 |

|

$ |

5.76 |

|

|

|

|

|

|

|

|

|

2013 |

|

High |

|

Low |

||

|

Fourth Quarter |

|

$ |

7.48 |

|

$ |

5.47 |

|

Third Quarter |

|

$ |

7.13 |

|

$ |

5.14 |

|

Second Quarter |

|

$ |

5.30 |

|

$ |

4.42 |

|

First Quarter |

|

$ |

5.09 |

|

$ |

3.89 |

The closing sale price for the common stock on March 10, 2015, was $8.97.

As of March 10, 2015, there were 284 holders of record of our common stock and 29,842,993 shares of common stock outstanding.

Securities Authorized for Issuance under Equity Compensation Plans

Information appearing under the caption “Equity Compensation Plan Information” in the 2015 Proxy Statement is hereby incorporated by reference.

13

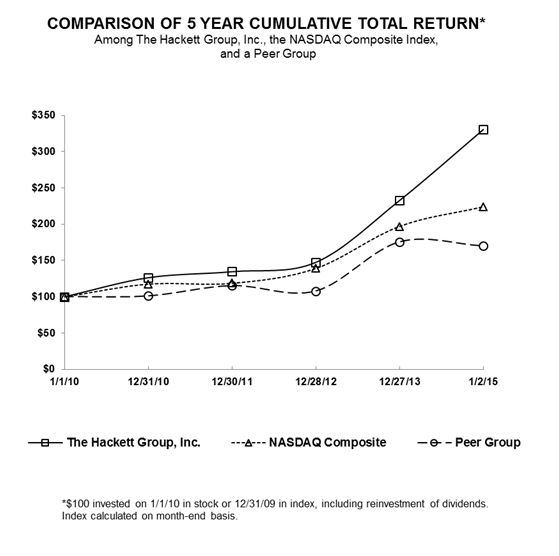

Performance Graph

The following graph compares our cumulative total shareholder return since January 1, 2010 with the NASDAQ Composite Index and a peer group index composed of other companies with similar business models identified below. The graph assumes that the value of the investment in our common stock and each index (including reinvestment of dividends) was $100 on January 1, 2010.

|

1/1/10 |

12/31/10 |

12/30/11 |

12/28/12 |

12/27/13 |

1/2/15 |

|||||||||||||

|

The Hackett Group, Inc. |

$ |

100.00 |

$ |

126.26 |

$ |

134.53 |

$ |

147.43 |

$ |

232.78 |

$ |

330.62 | ||||||

|

NASDAQ Composite Index |

$ |

100.00 |

$ |

117.61 |

$ |

118.70 |

$ |

139.00 |

$ |

196.83 |

$ |

223.74 | ||||||

|

Peer Group |

$ |

100.00 |

$ |

101.04 |

$ |

115.27 |

$ |

107.78 |

$ |

175.70 |

$ |

170.10 | ||||||

The Peer Group includes Edgewater Technology, Inc., FTI Consulting, Inc., Huron Consulting Group, Inc., Information Services Group, Inc., and The Corporate Executive Board Company.

Company Dividend Policy

In December 2012, we announced an annual dividend program. In 2014, we paid an annual dividend of $0.12 per share or $3.5 million to shareholders of record as of close of business on December 10, 2014. In December 2013 and 2012, we paid annual dividends of $0.10 per share, or $3.1 million to shareholders of record as of close on business December 10, 2013 and December 20, 2012, respectively. Subsequent to January 2, 2015, we announced an increase in the dividend from $0.12 to $0.14 per share, which will be paid on a semi-annual basis in 2015. Our credit agreement contains restrictions on our ability to declare dividends and repurchase shares. The declaration of dividends shall at all times be subject to the final determination of our Board of Directors that a

14

dividend is prudent at that time in consideration of the needs of the business and other factors including the ability to pay dividends under our credit agreement.

Purchases of Equity Securities

On October 15, 2013, we completed a tender offer to purchase approximately 1.0 million shares of our common stock at a purchase price of $7.00 per share, for an aggregate cost of $6.9 million, excluding fees and expenses related to the tender offer. The 1.0 million shares accepted for purchase represented approximately 3% of our issued and outstanding shares of common stock at that time. See Note 12 to our consolidated financial statements included in this Annual Report on Form 10-K.

On March 21, 2012, we completed a tender offer to purchase 11.0 million shares of our common stock at a purchase price of $5.00 per share, for an aggregate cost of approximately $55.0 million, excluding fees and expenses related to the tender offer. The 11.0 million shares accepted for purchase represented approximately 27% of our issued and outstanding shares of common stock at that time. See Note 12 to our consolidated financial statements included in this Annual Report on Form 10-K.

We have an ongoing authorization from our Board of Directors to repurchase shares of our common stock in the open market or in negotiated transactions, excluding the above mentioned tender offer transaction. The repurchase plan was first announced on July 30, 2002. All repurchases are made in the open market or through privately negotiated transactions, subject to market conditions and trading restrictions. There is no expiration date on the current authorization and we did not make any determination to suspend or cancel purchases under the program. The following table summarizes our share repurchases during the year ended January 2, 2015:

|

Total Number |

Maximum Dollar |

|||||||||

|

of Shares Purchased |

Value of Shares That |

|||||||||

|

Total Number |

Average |

as Part of Publicly |

May Yet be Purchased |

|||||||

|

of Shares |

Price Paid |

Announced |

Under the |

|||||||

|

Period |

Purchased |

per Share |

Program |

Program |

||||||

|

Balance as of December 27, 2013 |

— |

$ |

— |

— |

$ |

4,594,028 | ||||

|

December 28, 2013 to September 26, 2014 |

1,692,254 |

$ |

6.07 | 1,692,254 |

$ |

4,321,933 | ||||

|

September 27, 2014 to October 24, 2014 |

108,113 |

$ |

6.08 | 108,113 |

$ |

3,665,104 | ||||

|

October 25, 2014 to November 21, 2014 |

— |

$ |

— |

— |

$ |

3,665,104 | ||||

|

November 22, 2014 to January 2, 2015 |

— |

$ |

— |

— |

$ |

3,665,104 | ||||

| 1,800,367 |

$ |

6.07 | 1,800,367 | |||||||

During 2014, our Board of Directors authorized an additional $10.0 million to repurchase shares of our common stock. As of January 2, 2015, the cumulative authorization was for up to $95.0 million with cumulative purchases under the plan of $91.3 million, leaving $3.7 million available for future purchases.

15

ITEM 6. SELECTED FINANCIAL DATA

The following consolidated financial data sets forth our selected financial information as of and for each of the years in the five-year period ended January 2, 2015, and has been derived from our audited consolidated financial statements. The selected consolidated financial data should be read together with our consolidated financial statements, related notes thereto and with “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|||||||||||||

|

|

|

January 2, |

|

December 27, |

|

December 28, |

|

December 30, |

|

December 31, |

|||||

|

|

|

2015 |

|

2013 |

|

2012 |

|

2011 |

|

2010 |

|||||

|

Consolidated Statement of Operations Data: |

|

|

(in thousands, except per share data) |

||||||||||||

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue before reimbursements |

|

$ |

213,519 |

|

$ |

200,391 |

|

$ |

199,749 |

|

$ |

186,676 |

|

$ |

171,302 |

|

Reimbursements |

|

|

23,218 |

|

|

23,439 |

|

|

22,987 |

|

|

22,387 |

|

|

18,966 |

|

Total revenue (1) |

|

|

236,737 |

|

|

223,830 |

|

|

222,736 |

|

|

209,063 |

|

|

190,268 |

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of service: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personnel costs before reimbursable expenses (2) |

|

|

138,958 |

|

|

130,456 |

|

|

125,912 |

|

|

115,719 |

|

|

105,334 |

|

Reimbursable expenses |

|

|

23,218 |

|

|

23,439 |

|

|

22,987 |

|

|

22,387 |

|

|

18,966 |

|

Total cost of service |

|

|

162,176 |

|

|

153,895 |

|

|

148,899 |

|

|

138,106 |

|

|

124,300 |

|

Selling, general and administrative costs |

|

|

61,386 |

|

|

54,208 |

|

|

56,997 |

|

|

54,058 |

|

|

53,774 |

|

Bargain purchase gain from acquisition (3) |

|

|

(3,015) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Restructuring costs (benefit) |

|

|

3,604 |

|

|

— |

|

|

(211) |

|

|

— |

|

|

— |

|

Total costs and operating expenses |

|

|

224,151 |

|

|

208,103 |

|

|

205,685 |

|

|

192,164 |

|

|

178,074 |

|

Operating income |

|

|

12,586 |

|

|

15,727 |

|

|

17,051 |

|

|

16,899 |

|

|

12,194 |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash acquisition earn-out shares re-measurement gain |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,727 |

|

Interest (expense) income, net (4) |

|

|

(620) |

|

|

(465) |

|

|

(610) |

|

|

33 |

|

|

22 |

|

Income from continuing operations before income taxes |

|

|

11,966 |

|

|

15,262 |

|

|

16,441 |

|

|

16,932 |

|

|

13,943 |

|

Income tax expense (benefit) (5) |

|

|

2,255 |

|

|

6,398 |

|

|

(478) |

|

|

(4,495) |

|

|

(26) |

|

Income from continuing operations |

|

|

9,711 |

|

|

8,864 |

|

|

16,919 |

|

|

21,427 |

|

|

13,969 |

|

(Loss) income from discontinued operations |

|

|

— |

|

|

(135) |

|

|

(222) |

|

|

342 |

|

|

258 |

|

Net income |

|

$ |

9,711 |

|

$ |

8,729 |

|

$ |

16,697 |

|

$ |

21,769 |

|

$ |

14,227 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income per common share from continuing operations |

|

$ |

0.34 |

|

$ |

0.29 |

|

$ |

0.54 |

|

$ |

0.54 |

|

$ |

0.34 |

|

(Loss) income per common share from discontinued operations |

|

|

— |

|

|

— |

|

|

(0.01) |

|

|

0.01 |

|

|

0.01 |

|

Net income per common share |

|

$ |

0.34 |

|

$ |

0.29 |

|

$ |

0.53 |

|

$ |

0.55 |

|

$ |

0.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income per common share from continuing operations |

|

$ |

0.33 |

|

$ |

0.28 |

|

$ |

0.51 |

|

$ |

0.51 |

|

$ |

0.33 |

|

(Loss) income per common share from discontinued operations |

|

|

— |

|

|

(0.01) |

|

|

(0.01) |

|

|

0.01 |

|

|

0.01 |

|

Net income per common share |

|

$ |

0.33 |

|

$ |

0.27 |

|

$ |

0.50 |

|

$ |

0.52 |

|

$ |

0.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

28,718 |

|

|

30,283 |

|

|

31,704 |

|

|

39,895 |

|

|

40,349 |

|

Diluted |

|

|

29,881 |

|

|

32,116 |

|

|

33,511 |

|

|

41,875 |

|

|

42,372 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalent |

|

$ |

14,608 |

|

$ |

18,199 |

|

$ |

16,906 |

|

$ |

32,936 |

|

$ |

25,337 |

|

Restricted cash |

|

$ |

— |

|

$ |

354 |

|

$ |

683 |

|

$ |

885 |

|

$ |

1,610 |

|

Working capital |

|

$ |

18,246 |

|

$ |

25,897 |

|

$ |

23,761 |

|

$ |

42,013 |

|

$ |

27,243 |

|

Total assets |

|

$ |

152,786 |

|

$ |

150,318 |

|

$ |

153,921 |

|

$ |

167,426 |

|

$ |

150,801 |

|

Long-term debt |

|

$ |

18,263 |

|

$ |

19,029 |

|

$ |

22,105 |

|

$ |

— |

|

$ |

— |

|

Shareholders' equity |

|

$ |

89,788 |

|

$ |

93,176 |

|

$ |

94,726 |

|

$ |

130,248 |

|

$ |

113,240 |

|

Dividends paid per share |

|

$ |

0.12 |

|

$ |

0.10 |

|

$ |

0.10 |

|

$ |

— |

|

$ |

— |

|

(1) |

In January 2014, we acquired Technolab, an EPM AMS business. As a result of the acquisition, our 2014 results of operations included $10.3 million in total revenue from Technolab. |

|

(2) |

Fiscal year 2014 includes acquisition-related compensation expense of $4.3 million from the acquisition of Technolab, an EPM AMS business. |

|

(3) |

Fiscal year 2014 includes a bargain purchase gain from the acquisition of Technolab, an EPM AMS business. See Note 16 to our consolidated statements included in this Annual Report. |

|

(4) |

Interest expense relates to the Credit Facility which was entered into in February 2012. |

|

(5) |

Fiscal years 2012 and 2011 include the benefit for the release of $6.7 million and $5.3 million, respectively, of deferred income tax asset valuation allowance. |

16

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

Hackett, originally incorporated on April 23, 1997, is a leading strategic advisory and technology consulting firm that enables companies to achieve world-class business performance. By leveraging the comprehensive Hackett database, the world’s leading repository of enterprise business process performance metrics and best practice intellectual capital, our business and technology solutions help clients improve performance and maximize returns on technology investments.