Attached files

| file | filename |

|---|---|

| 10-K - 10-K - CRA INTERNATIONAL, INC. | a2223362z10-k.htm |

| 10-K - 10-K - CRA INTERNATIONAL, INC. | a2223362zf1_10-03.pdf |

| EX-10.23 - EX-10.23 - CRA INTERNATIONAL, INC. | a2223362zex-10_23.htm |

| EX-21.1 - EX-21.1 - CRA INTERNATIONAL, INC. | a2223362zex-21_1.htm |

| EX-23.1 - EX-23.1 - CRA INTERNATIONAL, INC. | a2223362zex-23_1.htm |

| EX-23.2 - EX-23.2 - CRA INTERNATIONAL, INC. | a2223362zex-23_2.htm |

| EX-31.1 - EX-31.1 - CRA INTERNATIONAL, INC. | a2223362zex-31_1.htm |

| EX-31.2 - EX-31.2 - CRA INTERNATIONAL, INC. | a2223362zex-31_2.htm |

| EX-32.1 - EX-32.1 - CRA INTERNATIONAL, INC. | a2223362zex-32_1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - CRA INTERNATIONAL, INC. | Financial_Report.xls |

Exhibit 10.35

EXECUTION COPY

Carr Real Estate Services, Inc.

ADDENDUM NO. 3 TO LEASE

THIS ADDENDUM NO. 3 TO LEASE (“Addendum No. 3”) is dated as of the 18th day of November, 2005 by and between 1201 F STREET L.L.C., a Delaware limited liability company (“Lessor”), and CRA INTERNATIONAL, INC., formerly known as CHARLES RIVER ASSOCIATES INCORPORATED, a Massachusetts corporation (“Lessee”).

W I T N E S S E T H:

WHEREAS, by Lease dated November 29, 1999, as amended by Addendum No. 1 dated December 2, 1999, and Addendum No. 2 dated September 22, 2000 (as amended, the “Lease”), Lessor leased to Lessee and Lessee leased from Lessor, approximately forty-four thousand eight hundred forty-five (44,845) square feet of rentable area on the sixth (6th), seventh (7th), and eighth (8th) floors of the office building located at 1201 F Street, N.W., Washington, D.C. 20004 (such area being hereinafter referred to as the “Demised Premises,” and the building being hereinafter referred to as the “Building”); and

WHEREAS, Lessee wishes to exercise its option under Section 9(A) of the Lease to expand into the First Option Space, such First Option Space consisting of approximately three thousand four hundred fifty-one (3,451) square feet of rentable area on the eighth (8th) floor of the Building;

WHEREAS, Lessor and Lessee desire to revise and modify the Lease with respect to the following provisions:

1. Demised Premises

2. Rent

3. Allowance

4. Parking

5. Operating Expenses, Operating Costs and Real Estate Taxes

6. Broker and Agent

7. Other Terms and Provisions

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein, the parties agree as follows:

1. DEMISED PREMISES

Lessee agrees to lease from Lessor, and Lessor agrees to lease to Lessee, additional rentable square feet amounting to approximately 3,451 square feet of rentable area, as measured in accordance with the Washington, D.C. Association of Realtors Standard Method of Measurement dated January 1, 1989, on the eighth (8th) floor of the Building, and commonly known as Suite 850, the additional area being identified on the attached floor plan and made part of this Addendum No. 3 as Exhibit A (said rentable area being hereinafter referred to as the “First Option Space”). Effective from and after the First Option Space Commencement Date (as hereinafter defined), the First Option Space shall be deemed part of the Demised Premises (as such term is defined in the Lease) such that the Demised Premises shall amount to a total rentable area of approximately forty-eight thousand two hundred ninety-six (48,296) square feet on the sixth, seventh, and eighth floors of the Building.

The term of the Lease with respect to the First Option Space shall commence on the date on which Lessor delivers possession of the First Option Space to Lessee in its current, “as-is” condition (the “First Option Space Commencement Date”), and shall be coterminous with the term of the Lease and any extension thereof. Notwithstanding the foregoing, Lessee’s obligation to pay rent with respect to the First Option Space shall begin on the earlier of (x) the date that is sixty (60) days after the First Option Space Commencement Date and (y) the date on which Lessee commences to use the First Option Space for the normal conduct of business (the “First Option Space Rent Commencement Date”).

It is presently anticipated that the First Option Space Commencement Date will occur on December 1, 2005. Notwithstanding the foregoing, if the First Option Space Commencement Date does not occur on such date, then, Lessor, its agents, and employees shall not be liable or responsible for any claims, damages, or liabilities arising in connection therewith or by reason thereof, nor shall Lessee be excused from its obligations to perform under the Lease, and this Addendum No. 3 shall not be rendered void or voidable as a result thereof.

When Lessee accepts possession of the First Option Space, Lessor and Lessee shall execute the “Declaration as to Date of Delivery and Acceptance of Possession of First Option Space,” attached hereto as Exhibit B, which shall specify the First Option Space Commencement Date. Within ten (10) days after the First Option Space Rent Commencement Date has occurred, Lessor and Lessee shall execute the Declaration as to First Option Space Rent Commencement Date attached hereto as Exhibit B-1 which shall specify the First Option Space Rent Commencement Date.

Except as may be set forth in Section 3 of this Addendum No. 3, and except as to latent defects not reasonably discoverable upon initial inspection, Lessee accepts possession of the First Option Space in its “as is” condition existing on the First Option Space Commencement Date, without requiring any alterations, improvements, or decorations to be made by Lessor at Lessor’s expense.

2. RENT

The Monthly Rent for the First Option Space, which Lessee hereby agrees to pay in advance to Lessor and Lessor hereby agrees to accept shall be as follows:

|

|

|

|

|

Rate Per Square |

| ||

|

Period |

|

Monthly Rent |

|

Foot Per Year |

| ||

|

First Option Space Rent Commencement Date through August 31, 2006 (last day of the Sixth Lease Year) |

|

$ |

10,537.05 |

|

$ |

36.64 |

|

|

Seventh Lease Year |

|

$ |

10,746.99 |

|

$ |

37.37 |

|

|

Eighth Lease Year |

|

$ |

10,962.68 |

|

$ |

38.12 |

|

|

Ninth Lease Year |

|

$ |

11,181.24 |

|

$ |

38.88 |

|

|

Tenth Lease Year |

|

$ |

11,405.56 |

|

$ |

39.66 |

|

|

Eleventh Lease Year |

|

$ |

11,632.75 |

|

$ |

40.45 |

|

3. ALLOWANCE

Lessor shall provide to Lessee a cash construction allowance (the “First Option Space Remodeling Allowance”) in an amount equal to Thirty-Four Thousand Five Hundred Ten and 00/100 Dollars ($34,510.00) computed as the product of (i) 3,451 (i.e., the number of square feet of rentable area in the First Option Space), and (ii) Ten and 00/100 Dollars ($10.00). The First Option Space Remodeling Allowance may be used to pay any and all costs associated with the design or construction of Lessee’s improvements to the First Option Space and/or other portions of the Demised Premises, including the costs of permits, licenses and construction management fees, life safety systems and sprinkler installations within the First Option Space, space planning, architectural and design fees, phone and computer cabling and installation costs, and costs of fixtures, furnishings, and equipment. Any portion of the First Option Space Remodeling Allowance not applied to design or construction of improvements to the First Option Space and/or other portions of the Demised Premises as aforesaid may be applied by Lessee to pay Monthly Rent and Estimated Payments first due and owing under the Lease. The First Option Space Remodeling Allowance shall be disbursed on a monthly basis in accordance with the same procedures utilized with respect to disbursement of the Allowance (as defined in the Lease), provided that all requisitions may be submitted no later than December 31, 2006.

4. PARKING

From and after the First Option Space Commencement Date, Lessee’s allocation of parking contracts pursuant to Section 7 of the Lease shall be increased from thirty-five (35) contracts to thirty-seven (37) contracts. Such additional contracts shall be made available on the same terms and conditions as set forth in Section 7 of the Lease (and divided into Basic Parking Allocation and Additional Parking Allocation (as such terms are defined in the Lease) on the same percentage basis).

5. OPERATING EXPENSES, OPERATING COSTS AND REAL ESTATE TAXES

All of Lessee’s obligations pursuant to the section of the Lease entitled “OPERATING EXPENSES, OPERATING COSTS AND REAL ESTATE TAXES” shall continue unchanged, except that the percentage of Lessee’s proportionate share of Operating Expenses, Operating Costs, and Real Estate Taxes shall be revised and increased to reflect the addition of the First Option Space to the Demised Premises in accordance with the calculation of such percentage set forth in the section of the Lease entitled “OPERATING EXPENSES, OPERATING COSTS AND REAL ESTATE TAXES,” such revised percentage to become effective as of the First Option Space Rent Commencement Date, with appropriate pro rata adjustments being made in the calculation of Lessee’s proportionate share of the Operating Expenses, Operating Costs, and Real Estate Taxes for the calendar year in which such revised percentage becomes effective. Accordingly, effective as of the First Option Space Rent Commencement Date: (i) Lessee’s proportionate share of Operating Expenses (as defined in the Lease) shall be 21.62%; (ii) Lessee’s proportionate share of Operating Costs (as defined in the Lease) shall be 22.65%; and (iii) Lessee’s proportionate share of Real Estate Taxes (as defined in the Lease) shall be 21.62%.

6. BROKER AND AGENT

Lessor and Lessee each represent and warrant one to another that, except as hereinafter set forth, neither of them has employed any broker in carrying on the negotiations, or had any dealings with any broker, relating to this Addendum No. 3. Lessee represents that it has employed CB Richard Ellis as its broker; Lessor represents that it has employed Carr Real Estate Services as its broker. Lessor, pursuant to a separate written agreement, has agreed to pay the commission of the aforementioned brokers. Lessor shall indemnify and hold Lessee harmless, and Lessee shall indemnify and hold Lessor harmless, from and against all claim or claims for brokerage or other commission arising from or out of any breach of the foregoing representation and warranty by the respective indemnitor.

7. OTHER TERMS AND PROVISIONS

All other provisions of the Lease shall remain in effect and unchanged except as modified herein, and all terms, covenants and conditions shall remain in effect as modified by this Addendum No. 3. If any provision of this Addendum No. 3 conflicts with the Lease, the provisions of this Addendum No. 3 shall control.

IN WITNESS WHEREOF, Lessor and Lessee have caused this Addendum No. 3 to be signed in their names under seal by themselves or by their duly authorized representatives and delivered as their act and deed, intending to be legally bound by all its terms and conditions.

|

|

LESSOR: | ||

|

|

| ||

|

|

1201 F STREET, LLC, | ||

|

|

a Delaware limited liability company | ||

|

|

| ||

|

|

By: |

CarrAmerica Realty, L.P., | |

|

|

|

a Delaware limited partnership, | |

|

|

|

its managing member | |

|

|

| ||

|

|

By: |

CarrAmerica Realty GP Holdings, LLC, | |

|

|

|

a Delaware limited liability company, | |

|

|

|

its general partner | |

|

|

| ||

|

|

By: |

CarrAmerica Realty Operating Partnership, L.P., | |

|

|

|

a Delaware limited partnership, | |

|

|

|

its sole member | |

|

|

| ||

|

|

By: |

CarrAmerica Realty Corporation, | |

|

|

|

a Maryland corporation, | |

|

|

|

its general partner | |

|

|

|

| |

|

|

|

By: |

/s/ Phillip S. Thomas, Jr. |

|

|

|

Name: |

Phillip S. Thomas, Jr. |

|

|

|

Title: |

Managing Director |

|

|

| ||

|

|

| ||

|

|

LESSEE: | ||

|

|

| ||

|

|

CRA INTERNATIONAL, INC., formerly known | ||

|

|

as CHARLES RIVER ASSOCIATES | ||

|

|

INCORPORATED, a Massachusetts corporation | ||

|

|

By: |

/s/ Wayne Mackie |

(SEAL) |

|

|

Name: |

Wayne Mackie | |

|

|

Title: |

CFO | |

EXHIBIT A

Floor Plan of the First Option Space

[To Be Attached]

EXHIBIT A

DEMISED PREMISES: Suite A

Approximately 3,451 square feet commonly known as Suite 850

EXHIBIT B

DECLARATION AS TO DATE OF DELIVERY

AND ACCEPTANCE OF POSSESSION OF

FIRST OPTION SPACE

Attached to and made a part of Addendum No. 3 dated November 18, 2005, to that certain Office Lease dated November 29, 1999 (as amended, the “Lease”) entered into by and between 1201 F STREET L.L.C, a Delaware limited liability company, as Lessor, and CRA INTERNATIONAL, INC., formerly known as CHARLES RIVER ASSOCIATES INCORPORATED, a Massachusetts corporation, as Lessee.

Lessor and Lessee do hereby declare and evidence that possession of the First Option Space was accepted by Lessee in its “as is” condition on the 1st day of December, 2005. For purposes of the Lease, the First Option Space Commencement Date is established as the 1st day of December, 2005. As of the date of delivery and acceptance of possession of the First Option Space as herein set forth, there is no right of set off against rents claimed by Lessee against Lessor.

[Signatures on following page]

|

|

LESSOR: | |||

|

|

| |||

|

|

1201 F STREET, LLC, | |||

|

|

a Delaware limited liability company | |||

|

|

| |||

|

|

By: |

CarrAmerica Realty, L.P., | ||

|

|

|

a Delaware limited partnership, | ||

|

|

|

its managing member | ||

|

|

| |||

|

|

By: |

CarrAmerica Realty GP Holdings, LLC, | ||

|

|

|

a Delaware limited liability company, | ||

|

|

|

its general partner | ||

|

|

| |||

|

|

By: |

CarrAmerica Realty Operating | ||

|

|

|

Partnership, L.P., | ||

|

|

|

a Delaware limited partnership, | ||

|

|

|

its sole member | ||

|

|

| |||

|

|

By: |

CarrAmerica Realty Corporation, | ||

|

|

|

a Maryland corporation, | ||

|

|

|

its general partner | ||

|

|

| |||

|

|

|

By: |

/s/ Phillip S. Thomas, Jr. | |

|

|

|

Name: |

Phillip S. Thomas, Jr. | |

|

|

|

Title: |

Managing Director | |

|

|

| |||

|

|

LESSEE: | |||

|

|

| |||

|

|

CRA INTERNATIONAL, INC., formerly | |||

|

|

known as CHARLES RIVER ASSOCIATES | |||

|

|

INCORPORATED, a Massachusetts | |||

|

|

corporation | |||

|

|

| |||

|

|

By: |

/s/ Wayne Mackie | ||

|

|

Name: |

Wayne Mackie | ||

|

|

Title: |

CFO | ||

EXHIBIT B-1

DECLARATION AS TO FIRST OPTION SPACE

RENT COMMENCEMENT DATE

Attached to and made a part of Addendum No. 3 dated , 2005, to that certain Office Lease dated November 29, 1999 (as amended, the “Lease”) entered into by and between 1201 F STREET L.L.C, a Delaware limited liability company, as Lessor, and CRA INTERNATIONAL, INC., formerly known as CHARLES RIVER ASSOCIATES INCORPORATED, a Massachusetts corporation, as Lessee.

Landlord and Tenant do hereby declare and evidence that the First Option Space Rent Commencement Date is , 200 .

[Signatures on following page]

|

|

LESSOR: | |||

|

|

| |||

|

|

1201 F STREET, LLC, | |||

|

|

a Delaware limited liability company | |||

|

|

| |||

|

|

By: |

CarrAmerica Realty, L.P., | ||

|

|

|

a Delaware limited partnership, | ||

|

|

|

its managing member | ||

|

|

| |||

|

|

By: |

CarrAmerica Realty GP Holdings, LLC, | ||

|

|

|

a Delaware limited liability company, | ||

|

|

|

its general partner | ||

|

|

| |||

|

|

By: |

CarrAmerica Realty Operating | ||

|

|

|

Partnership, L.P., | ||

|

|

|

a Delaware limited partnership, | ||

|

|

|

its sole member | ||

|

|

| |||

|

|

By: |

CarrAmerica Realty Corporation, | ||

|

|

|

a Maryland corporation, | ||

|

|

|

its general partner | ||

|

|

| |||

|

|

|

By: |

/s/ Phillip S. Thomas, Jr. | |

|

|

|

Name: |

Phillip S. Thomas, Jr. | |

|

|

|

Title: |

Managing Director | |

|

|

| |||

|

|

LESSEE: | |||

|

|

| |||

|

|

CRA INTERNATIONAL, INC., formerly | |||

|

|

known as CHARLES RIVER ASSOCIATES | |||

|

|

INCORPORATED, a Massachusetts | |||

|

|

corporation | |||

|

|

| |||

|

|

By: |

/s/ Wayne Mackie | ||

|

|

Name: |

Wayne Mackie | ||

|

|

Title: |

CFO | ||

ADDENDUM NO. 4 TO LEASE

THIS ADDENDUM NO. 4 TO LEASE (“Addendum No. 4”) is dated as of the 1st day of December, 2009 by and between 1201 F STREET L.P., a Delaware limited partnership (“Lessor”) (successor in interest to 1201 F Street L.L.C.), and CRA INTERNATIONAL, INC., formerly known as Charles River Associates Incorporated, a Massachusetts corporation (“Lessee”).

W I T N E S S E T H:

WHEREAS, by Lease dated November 29, 1999 (the “Original Lease”), as amended by Addendum No. 1 dated as of December 2, 1999, Addendum No. 2 dated as of September 22, 2000, and Addendum No. 3 dated as of November 18, 2005 (collectively, the “Lease”), Lessor leased to Lessee and Lessee leased from Lessor, approximately forty-eight thousand two hundred ninety-six (48,296) square feet of rentable area on the sixth (6th ), seventh (7th), and eighth (8th) floors of the office building located at 1201 F Street, N.W., Washington, D.C. 20004 (such area being hereinafter referred to as the “Demised Premises,” and the building being hereinafter referred to as the “Building”); and

WHEREAS, Lessee has requested that the Lease be terminated with regard to approximately 11,696 rentable square feet in the Demised Premises (i.e., the sixth (6th) floor space under lease to Lessee) (the “Give-Back Premises”), which Give-Back Premises is identified on Exhibit A-1 attached hereto and made a part hereof, and Lessor, upon receipt of Lessee’s request, has agreed to the requested termination of the Lease with regard to the Give-Back Premises upon the terms and conditions hereinafter set forth in the body of this Addendum No. 4;

WHEREAS, the term of the Lease (the “Initial Term”) currently is scheduled to expire on October 31, 2010, and Lessee has requested that the term of the Lease be extended for an additional period of five (5) years (the “First Extension Term”, and with the Initial Term, the “Lease Term”);

WHEREAS, Lessee has accepted Lessor’s proposed terms and conditions with respect to the Extension Term and the surrender of the Give-Back Premises;

WHEREAS, unless otherwise provided herein, all terms used in this Addendum No. 4 that are defined in the Lease shall have the meanings provided for in the Lease; and

WHEREAS, Lessor and Lessee desire to formally reflect their understandings and agreements with respect to the foregoing and as to certain other matters, and therefore to revise and modify the Lease accordingly, with respect to the following provisions:

1. Method of Measurement

2. Partial Surrender with Regard to Give-Back Premises

3. Demised Premises

4. First Extension Term

5. Addendum No. 4 Letter of Credit

6. Turnkey Buildout

7. Hold Space

8. Right of Opportunity

9. Second Extension Term

10. Parking

11. Storage Space

12. Sublease and Assignment

13. Compliance with Laws

14. Subordination and Lender Approval

15. Notices

16. Broker and Agent

17. Exculpation

18. Tax Status of Beneficial Partner

19. Options

20. Confidentiality

21. Other Terms and Provisions

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein, the parties agree as follows:

1. METHOD OF MEASUREMENT

(A) The parties acknowledge and agree that the Building and the Demised Premises have been remeasured in accordance with a modified version of the Standard Method of Measuring Floor Areas in Office Buildings, ANSI/BOMA Z-65.1-1996 (“BOMA”). Based thereon, the Building contains 228,868 rentable square feet of office area and 14,475 rentable square feet of retail area. With respect to Lessee’s obligations under the Lease (as amended hereby) (i) as to the Hold Space (as hereinafter defined) if leased by Lessee hereunder, (ii) as to any ROFO Space (as hereinafter defined) if leased by Lessee hereunder, and (iii) as to the entire Demised Premises if the Lease is extended for the Second Extension Term (as hereinafter defined) commencing on the Second Extension Term Commencement Date (as hereinafter defined), any calculations herein based upon square footage (including, but not limited to, Monthly Rent and Lessee’s proportionate share of Operating Expenses, Operating Costs and Real Estate Taxes) shall be computed based upon the BOMA methodology.

(B) Unless and until the Lease (as amended hereby) is extended for the Second Extension Term, Lessee’s obligations under the Lease for the remainder of the Lease Term (i.e., until October 31, 2015) with respect to the Demised Premises not inclusive of the Hold Space or any ROFO Space that are based on square footage amounts shall not be adjusted to reflect such remeasurement and, instead, will continue to reflect the measurement of the Demised Premises based on the methodology set forth in Section 49 of the Original Lease as un-amended by this Addendum No. 4.

2. PARTIAL SURRENDER WITH REGARD TO GIVE-BACK PREMISES

(A) Subject to the exercise by Lessee of the Hold Space Option (as hereinafter

defined) and/or Right of Opportunity (as hereinafter defined), the Lease shall be and is hereby irrevocably terminated as to the Give-Back Premises effective as of 11:59 p.m. on the date that is thirty (30) days following of Substantial Completion (as defined in Section 6(E) below) of Lessor’s work in connection with the Turnkey Buildout (as hereinafter defined) (the “Give-Back Premises Termination Date”). The Give-Back Premises is identified on the floor plan attached hereto as Exhibit A-1 and made a part hereof, so that the Lease shall be deemed to be of no further force and effect thereafter with regard to the Give-Back Premises, subject to conditions otherwise set forth herein. Lessor and Lessee, as of the Give-Back Premises Termination Date, shall be and are hereby equally released and discharged from any obligations to observe the terms and conditions of the Lease with regard to the Give-Back Premises after the Give-Back Premises Termination Date; provided, however, that both parties shall comply with the conditions otherwise set forth herein, and Lessee shall remain fully obligated with regard to the Give-Back Premises for all rent and other charges incurred through December 31, 2009 (the “Give-Back Premises Rent Termination Date”) (including amounts with respect thereto billed subsequent to such date) under the terms of the Lease. Subject to Section 2(C) below, from and after the Give-Back Premises Rent Termination Date and continuing through the Give-Back Premises Termination Date, Lessee shall pay no Monthly Rent or Operating Expenses, Operating Costs and Real Estate Taxes with respect to its occupancy of the Give-Back Premises.

(B) The Lease with regard to the Give-Back Premises shall terminate without payment of damages, expenses, penalty, or any other compensation or consideration from Lessor to Lessee.

(C) On or before the Give-Back Premises Termination Date, Lessee shall deliver the Give-Back Premises to Lessor in “as is”, broom clean condition, and free and clear of all tenancies and occupancies, whether by lease, sublease or otherwise; provided that, Lessee may surrender the Give-Back Premises with some or all of the workstations and IT equipment (e.g., phone switch, racks, server) presently located at the Give-Back Premises remaining in place. Such surrender of the Give-Back Premises may be in phases to the extent provided pursuant to Section 6(B) hereunder and the Construction Plan (as hereinafter defined) attached hereto. Notwithstanding the foregoing, in the event that Lessee does not vacate the Give-Back Premises on or before the Give-Back Premises Termination Date due to (i) an event of Lessee Delay (as defined in Section 6(D) below) or (ii) any other reason except a force majeure event or condition, then for each day of such delay in the surrender of the Give-Back Premises beyond the Give-Back Premises Termination Date, Lessee shall be obligated to pay, per diem, one hundred percent (100%) of the Monthly Rent and its proportionate share of Operating Expenses, Operating Costs and Real Estate Taxes that otherwise would have been due and owing had the Give-Back Premises Rent Termination Date not occurred, until such date as Lessee vacates the Give-Back Premises in accordance with this Section 2(C). Upon the full surrender of the Give-Back Premises by Lessee, the parties shall execute a certificate setting forth the date for such event in the form attached hereto as Exhibit C-2 and made a part hereof.

(D) From and after the Give-Back Premises Termination Date, Exhibit A-3 to the Lease shall be deemed deleted in its entirety and of no further force and effect.

3. DEMISED PREMISES

(A) Following the Give-Back Premises Termination Date, the Lease with regard to the remainder of the Demised Premises shall remain in full force and effect for the remainder of the Lease Term, including any further extension terms provided herein, and shall remain unmodified, except as specifically provided for herein.

(B) From and after the Give-Back Premises Termination Date, but subject to the exercise by Lessee of the Hold Space Option, Right of Opportunity and/or Second Extension Option (as hereinafter defined) (in which case the square footage of the Demised Premises shall be increased and/or be deemed increased to reflect the BOMA remeasurement), the Demised Premises shall be deemed to contain 36,600 rentable square feet and shall be identified on the floor plan attached hereto as Exhibit A-2 and made a part thereof.

(C) From and after the Give-Back Premises Termination Date, Lessee shall cooperate with Lessor to allow Lessor to remove the interior connecting stairway between the seventh (7th) floor of the Building and the Give-Back Premises, close the slab floor opening remaining after removal of the Connecting Stairway, install carpeting on the re-slabbed area and perform related cosmetic work (the “Connecting Stairway Work”). In connection therewith, (i) Lessee acknowledges that the making of the Connecting Stairway Work may take place during normal business hours, but that Lessor shall perform any Connecting Stairway Work that affects Lessee’s use of the Demised Premises outside of normal business hours unless it is impracticable to do so, (ii) Lessor shall have the right to access the Demised Premises in connection with the Connecting Stairway Work, (iii) to the extent the Connecting Stairway remains open and intact prior to the completion of the Connecting Stairway Work, Lessor and Lessee shall prevent access by their respective employees and other parties under their control to the Connecting Stairway (provided that, the foregoing shall not apply with respect to Lessor’s employees, contractors and other parties under its control who are involved with the planning, performance and oversight of the Connecting Stairway Work); and (iv) the performance of the Connecting Stairway Work shall be subject to the conditions set forth in Sections 22(C) and 44 of the Lease. Notwithstanding the foregoing, (a) if Lessee exercises the Hold Option, Lessor shall not perform the Connecting Stairway Work and the Connecting Stairway shall remain intact for the remainder of the Lease Term, and (b) if Lessee does not exercise the Hold Option, then Lessor shall keep the Connecting Stairway intact and not perform the Connecting Stairwell Work until such time as Lessee has affirmatively waived its exercise of the Hold Option or the time period for Lessee’s exercise of such Hold Option has passed without action on the part of Lessee, whichever is earlier.

(D) From and after January 1, 2010 (i.e., the day immediately following the Give-Back Premises Rent Termination Date) and continuing through October 31, 2010 (i.e., the end of the Initial Term):

(1) The Monthly Rent with respect to the Demised Premises shall be as follows:

|

Period |

|

Monthly Rent |

|

Annual Amount |

| ||

|

|

|

|

|

|

| ||

|

January 1, 2010 — August 31, 2010 |

|

$ |

120,963.00 |

|

$ |

39.66 |

|

|

September 1, 2010 — October 31, 2010 |

|

$ |

123,372.50 |

|

$ |

40.45 |

|

Such Monthly Rent shall be payable in accordance with the provisions for the payment of Monthly Rent under Section 4 of the Lease. No abatement or other concession whatsoever shall apply to such Monthly Rent.

(2) All of Lessee’s obligations under the Lease with respect to its payments of its proportionate share of Operating Expenses, Operating Costs and Real Estate Taxes (as provided in Section 6 of the Original Lease, as amended by Section 3 of Addendum No. 2 and Section 5 of Addendum No. 3) shall continue unchanged; provided that as a result of Lessee being released from payment of rent for the Give-Back Premises after the Give-Back Premises Rent Termination Date, (i) Lessee’s proportionate share of Operating Expenses (as defined in the Lease) shall be 16.23%; (ii) Lessee’s proportionate share of Operating Costs (as defined in the Lease) shall be 17.09%; and (iii) Lessee’s proportionate share of Real Estate Taxes (as defined in the Lease) shall be 16.23%.

4. FIRST EXTENSION TERM

(A) The First Extension Term shall commence on November 1, 2010 (the “First Extension Term Commencement Date”) and shall expire on October 31, 2015 (the “First Extension Term Expiration Date”). The renewal of the Initial Term for the First Extension Term pursuant to this Addendum No. 4 (including the option to further extend the Lease for the Second Extension Term as provided in Section 9 below) is in lieu of, and in full satisfaction of, Lessee’s option to extend the Lease pursuant to Section 8 of the Original Lease, and such Section 8 of the Original Lease is hereby deleted and shall be of no further force or effect.

(B) The Monthly Rent during the First Extension Term (the “First Extension Term Monthly Rent”) shall commence to be due and owing on November 1, 2010, and shall be as follows:

|

Period |

|

First Extension |

|

Annual Amount |

| ||

|

|

|

|

|

|

|

|

|

|

November 1, 2010 — October 31, 2011 |

|

$ |

125,050.00 |

|

$ |

41.00 |

|

|

November 1, 2011 — October 31, 2012 |

|

$ |

127,856.00 |

|

$ |

41.92 |

|

|

November 1, 2012 — October 31, 2013 |

|

$ |

130,753.50 |

|

$ |

42.87 |

|

|

November 1, 2013 — October 31, 2014 |

|

$ |

133,681.50 |

|

$ |

43.83 |

|

|

November 1,2014 — October 31, 2015 |

|

$ |

136,701.00 |

|

$ |

44.82 |

|

The First Extension Term Monthly Rent shall be payable in accordance with the provisions for the payment of Monthly Rent under Section 4 of the Lease. No abatement or other concession whatsoever shall apply to the First Extension Term Monthly Rent. The foregoing

notwithstanding, Lessor agrees to abate and forgive the First Extension Term Monthly Rent in the aggregate amount of Three Hundred Seventy-Five Thousand One Hundred Fifty and 00/100 Dollars ($375,150.00), such abatement to be applied in six (6) equal consecutive monthly installments of Sixty-Two Thousand Five Hundred Twenty-Five and 00/100 Dollars ($62,525.00) each against the First Extension Term Monthly Rent due and owing from November 2010 through April 2011.

(C) From and after November 1, 2010, all of Lessee’s obligations with respect to its payments of its proportionate share of Operating Expenses, Operating Costs and Real Estate Taxes (as provided in Section 6 of the Original Lease, as amended by Section 3 of Addendum No. 2, Section 5 of Addendum No. 3 and Section 3(D) of this Addendum No. 4) shall continue unchanged. Notwithstanding the foregoing, Lessor agrees to abate and forgive fifty percent (50%) of Lessee’s proportionate share of Operating Expenses, Operating Costs and Real Estate Taxes under the Lease (as amended hereby) due and owing during the first six (6) months of the First Extension Term (i.e., November 2010 through April 2011). In connection therewith, (1) Lessee’s Estimated Payments with respect to Operating Expenses, Operating Costs and Real Estate Taxes during such months shall be adjusted to reflect such abatement, and (2) Lessee’s Net Obligations attributable to such months (i.e., as set forth in the true-up statements delivered by Lessor pursuant to Section 6(J) of the Original Lease with respect to calendar years 2010 and 2011, as applicable) shall be adjusted to reflect such abatement.

5. ADDENDUM NO. 4 LETTER OF CREDIT

(A) Simultaneously with its execution of this Addendum No. 4, Lessee shall, at its election, deliver to Lessor either (1) an unconditional, irrevocable letter of credit in the amount of Two Hundred Thousand and 00/100 Dollars ($200,000.00) (the “Replacement Letter of Credit”) or (2) an amendment to the existing letter of credit issued by Citizens Bank and delivered by Lessee pursuant to Section 5 of the Original Lease in the amount of One Hundred Seventy Thousand Three Hundred Sixty-Seven and 16/100 Dollars ($170,367.16) (the “Current Letter of Credit”), which amendment shall increase the Current Letter of Credit by Twenty-Nine Thousand Six Hundred Thirty-Two and 84/100 Dollars ($29,632.84) to a total amount of Two Hundred Thousand and 00/100 Dollars ($200,000.00) (the “Amended Letter of Credit”) (with the Replacement Letter of Credit and the Amended Letter of Credit, as the case may be, being hereinafter referred to as the “Addendum No. 4 Letter of Credit”). The Addendum No. 4 Letter of Credit shall serve as security for the payment and performance by Lessee of all of Lessee’s obligations, covenants, conditions and agreements under the Lease (as amended hereby). The Addendum No. 4 Letter of Credit shall be in a form reasonably acceptable to Lessor, and shall reference this Addendum No. 4. Landlord hereby approves Citizens Bank as the issuer of the Addendum No. 4 Letter of Credit.

(B) Lessor’s rights and obligations with respect to the Addendum No. 4 Letter of Credit and its ability to draw thereon in the event of a default by Lessee under the Lease (as amended hereby) shall continue to be governed by Section 5 of the Lease (as amended by this Section 5 hereunder), except that from and after the date hereof:

(i) Any and all references in Section 5 of the Original Lease to “Deposit” and

“Letter of Credit” shall be deemed to refer to the Addendum No. 4 Letter of Credit.

(ii) The entire first (1st) paragraph of Section 5 of the Original Lease shall be deemed deleted and of no further force and effect.

(iii) Clause (g) in the second (2nd) paragraph of Section 5 of the Original Lease shall be deemed deleted and replaced with the following: “(g) at least thirty (30) days prior to then-current expiration date of such letter of credit, either (1) renewed (or automatically and unconditionally extended) from time to time through the sixtieth (60th) day after the expiration of the First Extension Term (including any further extensions thereof), or (2) replaced with cash in the amount of Two Hundred Thousand and 00/100 Dollars ($200,000.00). If Lessee elects to replace the letter of credit with cash as provided in the immediately foregoing sentence, then (1) such cash deposit shall thereafter be referred to as the ‘Addendum No. 4 Security Deposit’, and any and all references in this Lease to ‘Addendum No. 4 Letter of Credit’ shall be deemed deleted and replaced with ‘Addendum No. 4 Security Deposit’; and (2) Lessor shall have the right, but shall not be obligated, to apply all or any portion of such cash deposit to cure any default by Lessee beyond any applicable notice and cure period under this Lease, in which event Lessee shall be obligated to promptly deposit with Lessor the amount necessary to restore the deposit to its original amount.”

(iv) The last sentence of the second (2nd) paragraph of Section 5 of the Original Lease shall be deemed deleted and of no further force or effect.

(v) The following language shall be deemed added to Section 5 of the Original Lease as the fourth (4th) and third (3rd) to last sentences of the second (2nd) paragraph thereof: “Except as otherwise expressly set forth in the Lease, Lessor shall only draw upon the Addendum No. 4 Letter of Credit upon the occurrence of a default (or if Lessor is precluded by law from sending any notice necessary to establish that a default has occurred, the failure of Lessee to make any payment of rent within five (5) business days after the same is due). Upon the occurrence of a default beyond any applicable notice and cure period under this Lease, Lessor shall be entitled to draw on the Addendum No. 4 Letter of Credit in whole or in part and apply cash then held as a security deposit (including any amount(s) drawn on the Letter of Credit) in the amount necessary to cure the applicable default.”

(C) If Lessee elects to deliver a Replacement Letter of Credit hereunder, then within five (5) business days following Lessee’s delivery thereof: (1) Lessor shall return to Lessee the Current Letter of Credit (provided, that Lessee or the issuing bank shall send Lessor an acknowledgment of its receipt of the Current Letter of Credit), and (2) Lessor shall execute any commercially reasonable document(s) requested by the issuer of such letter of credit in order to effect a cancellation of the Current Letter of Credit.

6. TURNKEY BUILDOUT

(A) Lessor shall provide Lessee with a “turnkey” build-out of the Demised Premises (the “Turnkey Buildout”), based on the preliminary pricing and scope of work described in Exhibit D-1 attached hereto and made a part hereof (the “Preliminary Pricing”). The Turnkey Buildout will include the hard and soft costs associated with the construction of improvements to

the Demised Premises, including, without limitation, the costs of the Connecting Stairway Work and Lessor’s project management fees and architectural and engineering fees in connection therewith. Should the final pricing of the Turnkey Buildout increase by more than five percent (5%) from the Preliminary Pricing due to (i) a change in scope of work requested by Lessee, (ii) further clarification of representations or assumptions made by Lessee that were underlying the Preliminary Pricing, or (iii) a Lessee Delay (as hereinafter defined), then any costs of the Turnkey Buildout in excess of the sum of (x) the Preliminary Pricing and (y) five percent (5%) of the Preliminary Pricing (the “Excess Costs”) shall either, at Lessee’s election, (a) be paid directly by Lessee to Lessor within ten (10) days following an invoice for such costs accompanied by reasonable backup documentation of such costs, or (b) be treated as an assumed loan, which shall be fully amortized over the remainder of the Lease Term (including the First Extension Term) from and after the date of election in equal monthly installments. If Lessee elects option (b) in the immediately preceding sentence, Lessee shall be obligated to pay, as additional rent under the Lease (as amended hereby), the monthly amortized amount of the Excess Costs together with interest on the outstanding balance of such costs at a fixed annual rate equal to nine percent (9%) per annum. The amount of such monthly payments shall be confirmed in writing by the parties following Lessee’s election to amortize the Excess Costs. If the Lease (as amended hereby) is terminated prior to the expiration of the Lease Term hereof for any reason other than a default of Lessor, Lessee shall, upon demand, deliver to Lessor a repayment of the Excess Costs equal to the then-current balance of the assumed loan as of the termination date.

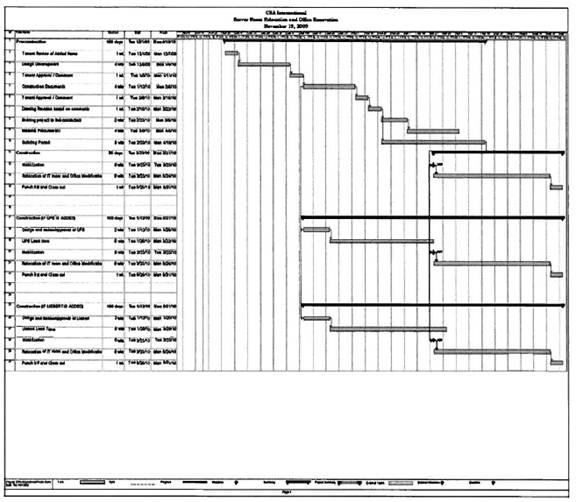

(B) Lessor and Lessee have mutually agreed upon a final schematic drawing and design and construction schedule (the “Construction Plan”), which is attached hereto as Exhibit D-2 and made a part hereof. The Construction Plan sets forth, among other items, (1) the frequency and procedures for progress updates and site visits, and (2) the phasing of Lessee’s move-out of the Give-Back Premises. Lessee agrees not to unreasonably withhold, condition or delay its approval of (i) plans and specifications (working and final) for the Turnkey Buildout that are submitted for Lessee’s review by Lessor, Lessor’s architect and/or Lessor’s contractor and (ii) any modifications that increase the construction budget, unless, however, the modification causes there to be any Excess Cost, in which event Lessee may withhold approval in its sole discretion (except to the extent such modification is required to comply with Applicable Laws (as hereinafter defined) (a “Required Modification”), in which case Lessee’s consent may not be unreasonably withheld, delayed or conditioned, but with Lessee expressly having the right to request value engineering in connection with such Required Modification). The timeframes for the preparation and review of such plans and specifications and/or budgetary modifications shall be as set forth in the Construction Plan, and shall be strictly adhered to. Upon the Substantial Completion of the Turnkey Buildout, the parties shall execute a certificate setting forth the date for such event in the form attached hereto as Exhibit C-1 and made a part hereof.

(C) Lessor will contract for the improvements to the Demised Premises in connection with the Turnkey Buildout and will select a general contractor and subcontractors. Lessor’s project management fee shall be equal to three and one-half percent (3.5%) of the construction bid. Lessor hereby approves Lessee’s request that TPG/The Phillip’s Group be retained as Lessor’s architect in connection with the Turnkey Buildout.

(D) For purposes of this Addendum No. 4, “Lessee Delay” shall be defined as follows: to the extent that Lessor has an obligation to design, construct, repair, rebuild, restore, install, order, obtain or complete any improvements in connection with the Turnkey Buildout, a delay in Lessor’s completion thereof caused by:

(i) Lessee’s request for value engineering (including, without limitation, in connection with a Required Modification pursuant to Section 6(B) above) or any changes to any drawings, plans or specifications for the Turnkey Buildout (notwithstanding Lessor’s approval of such changes) after Lessor and Lessee have approved such drawings, plans or specifications;

(ii) Lessee’s request for improvements, items, materials, finishes or installations (“Items/Finishes”) that are not consistent with the standards to which the base building systems have been designed; provided that, (1) Lessor (or Lessor’s contractor) shall notify Lessee of such lack of consistency with base building systems standards at the time such Item/Finish is requested or as soon as reasonably possible thereafter, and (2) following such notice, Lessee shall have a reasonable time period to reasonably select an alternative Item/Finish;

(iii) Lessee’s request for Items/Finishes, other than (a) high temperature sprinkler heads or (b) Items/Finishes that match or are substantially similar to Lessee’s existing standard Items/Finishes (“Lessee Standard Items/Finishes”), that are not available as needed to meet Lessor’s (or Lessor’s contractor’s) schedule for Substantial Completion; provided that, (1) Lessor (or Lessor’s contractor) shall notify Lessee of any potential long lead items to the extent known to Lessor (or Lessor’s contractor) at the time such material, finish or installation is requested or as soon as reasonably possible thereafter, and (2) if the particular Item/Finish that is not available is a Lessee Standard Item/Finish, and the request for such Item/Finish cannot reasonably be accommodated within a reasonable period of time, then Lessee shall reasonably select an alternative Item/Finish;

(iv) Lessee’s request for or design of improvements that include items or improvements not typically found in the office space at first-class office buildings of comparable age and size in the downtown area of the District of Columbia; provided that, Lessor and Lessee agree that the design of a new IT equipment room for Lessee in the Demised Premises (replacing Lessee’s current IT equipment room which is located within the Give-Back Premises) shall be considered a typical improvement for purposes of this subsection (iv) so long as the design thereof substantially replicates the design of the existing IT equipment room;

(v) Lessee’s or Lessee’s agent’s, representative’s or contractor’s interference with the work of Lessor, Lessor’s architect, or Lessor’s contractor; provided that, Lessor shall reasonably endeavor to provide Lessee with an opportunity to eliminate such conduct or circumstances that would constitute Lessee Delay under this subsection (v) by attempting to contact by telephone Peter Smichenko, Director of Real Estate and Administration, Phone (617) 331-6988 or Maria Rivera, DC Office Manager, Phone 202-294-6982 (or such other management officials as may be reasonably designated by Lessee), to explain the issue at hand;

(vi) Lessee’s unreasonable withholding, conditioning or delaying of approval to (1) the plans and specifications prepared in connection with the Turnkey Buildout, and (2) any modifications to the construction budget to the extent the same are required to comply with Applicable Laws (i.e., a Required Modification pursuant to Section 6(B) above);

(vii) Lessee’s failure to fully and timely comply with all deadlines and other terms and conditions of the Construction Plan or this Addendum No. 4; or

(viii) any other act or omission by Lessee, or any employee, architect, agent, representative or contractor of Lessee (each party other than Lessee itself being a “Lessee Party”) constituting a Lessee Delay under the terms and conditions of this Addendum No. 4 or the Construction Plan attached hereto; provided that, if Lessor has actual knowledge of such act or omission by a Lessee Party immediately after such act or omission occurs, Lessor shall reasonably endeavor to provide Lessee with an opportunity to eliminate such conduct or circumstances that would constitute Lessee Delay under this subsection (viii) by attempting to contact by telephone Peter Smichenko, Director of Real Estate and Administration, Phone (617) 331-6988 or Maria Rivera, DC Office Manager, Phone 202-294-6982 (or such other management officials as may be reasonably designated by Lessee), to explain the issue at hand.

(E) For purposes of this Addendum No. 4, “Substantial Completion” or “Substantially Completed” means that the construction of improvements to the Demised Premises in connection with the Turnkey Buildout has been completed, as reasonably determined by Landlord’s architect (based on the ability of Tenant to beneficially use and occupy such improved portions of the Demised Premises for their intended purposes), in accordance with (a) the applicable provisions of this Addendum No. 4 and the Construction Plan attached hereto, (b) the plans and specifications for such work, and (c) all Applicable Laws, except for minor details of construction, decoration and mechanical adjustments, if any, the noncompletion of which does not materially interfere with Lessee’s use of the Demised Premises or which in accordance with good construction practices should be completed after the completion of other work in the Demised Premises or Building.

7. HOLD SPACE

(A) Provided no default by Lessee exists on the date Lessee notifies Lessor of its intent to exercise this right, Lessee shall have the option to add to the Demised Premises an additional area of approximately 3,557 - 5,251 square feet (as determined by Lessor and measured under BOMA) of rentable area on the sixth (6th) floor of the Building, as indicated on the floor plan attached hereto as Exhibit A-3 and made a part hereof (such space being identified as the “Hold Space”, and such option being hereinafter referred to as the “Hold Space Option”), which Hold Space is a portion of the Take-Back Premises. The Hold Space shall, at minimum, consist of the space identified on Exhibit A-3 as “Space B.” Lessor may, at its option, also include as part of the Hold Space all or a portion of the space identified on Exhibit A-3 as “Space C.” The final configuration of the Hold Space is subject to code compliance. Lessor shall deliver the Hold Space separately demised from the remainder of the sixth (6th) floor with a demising wall constructed, but Lessor shall have no obligation to perform any further work with respect to the Hold Space or the delivery thereof. Lessee may exercise the Hold Space

Expansion Option by giving written notice to Lessor no later than September 30, 2010 (the “Lessee Hold Space Option Notice”). If Lessee delivers the Lessee Hold Space Option Notice, Lessor shall deliver the Hold Space to Lessee not later than four (4) months following the date of Lessee’s Hold Space Option Notice (the “Anticipated Hold Space Delivery Date”). Lessee may not lease less than all of the Hold Space. Lessee shall have no right to rescind its election to lease the Hold Space. Prior to September 30, 2010, Lessor shall have no right to lease or license Space B to a third party, but such space may be utilized by Lessor or its affiliate or parent entities for internal use. Upon Lessee’s acceptance of possession of Hold Space, Lessor and Lessee shall execute a certificate specifying the Hold Space Commencement Date and the Hold Space Rent Commencement Date in the form attached hereto as Exhibit E.

(B) Lessee’s exercise of the Hold Space Option shall be subject to the following conditions: (i) Lessee shall accept the Hold Space as part of the Demised Premises, in its then “as is” condition; (ii) the term of the Lease with regard to the Hold Space (the “Hold Space Term”) shall commence on the date on which Lessor delivers possession of the Hold Space to Lessee (the “Hold Space Commencement Date”), and the Hold Space Term shall be coterminous with the Lease Term and any further extension thereof; (iii) Lessee’s obligation to pay Monthly Rent for the Hold Space (the “Hold Space Monthly Rent”) shall commence on the earlier of (a) the date that is sixty (60) days following the Hold Space Commencement Date and (b) the date upon which Lessee commences occupancy of the Hold Space for its actual conduct of business (the “Hold Space Rent Commencement Date”); (iv) Section 6 of the Original Lease (as amended by Section 3 of Addendum No. 2, Section 5 of Addendum No. 3 and Section 3(D) of this Addendum No. 4) shall continue to be in full force and effect with respect to Hold Space, provided that with respect thereto: (1) Lessee’s Proportionate Share of Operating Expenses and Real Estate Taxes shall be computed based on a fraction, the numerator of which is the rentable square footage of the Hold Space and the denominator of which is the total of the rentable office and retail area in the Building measured as of the Hold Space Rent Commencement Date, (2) Lessee’s Proportionate Share of Operating Costs shall be computed based on a fraction, the numerator of which is the rentable square footage of the Hold Space and the denominator of which is the total of the rentable office area in the Building measured as of the Hold Space Commencement Date and (3) Lessee shall be liable for, and shall commence Estimated Payments of, Operating Expenses, Operating Costs and Real Estate Taxes on the Hold Space Rent Commencement Date; (iv) the Monthly Rent for the Hold Space (the “Hold Space Monthly Rent”) on a square foot basis shall be equal to the then-escalated Monthly Rent of the Demised Premises per rentable square foot, and thereafter for the Lease Term the Hold Space Monthly Rent shall be subject to escalations at the same time and at the same rate as with respect to the Demised Premises (but with no abatement of Hold Space Monthly Rent being provided in connection therewith); and (v) all other terms and conditions of the Lease (as amended hereby) shall be generally applicable to the Hold Space, except as the same are specifically modified by the mutual agreement of the parties at that time.

(C) Lessor shall provide to Lessee a cash construction allowance (the “Hold Space Allowance”) equal to the product of (i) a fraction, the numerator of which is the rentable square footage of the Hold Space, and the denominator of which is the rentable square footage of the Demised Premises exclusive of the Hold Space), (ii) a fraction, the numerator of which is the number of days remaining in the Lease Term as of the Hold Space Rent Commencement Date,

and the denominator of which is the total number of days in the Lease Term from and after January 1, 2010, and (iii) $563,819.36 (i.e., the total project budget for the Turnkey Buildout as listed on the Preliminary Pricing). The Hold Space Allowance may be used to pay (i) the “hard” and “soft” costs of any improvements to be constructed or installed by Lessee within the Hold Space (the “Hold Space Improvements”) (including all architectural, engineering, design, cabling, wiring, sprinkler system, fire/life safety equipment and permit fees), and (ii) the Excess Costs and/or the costs of any Alterations to the Demised Premises not inclusive of the Hold Space (the “Non Hold Space Improvements”); provided that, if Lessee elects to use a portion of the Hold Space Allowance for Non Hold Space Improvements, then the Hold Space Improvements must be finished to, at minimum, a level in keeping with the standards for finishes of office space in first-class office buildings in downtown Washington, D.C. Lessee shall not be entitled to a credit for Hold Space Monthly Rent for any unused portion of the Hold Space Allowance. The Hold Space Improvements shall be designed, constructed and performed and the Hold Space Allowance shall be disbursed in accordance with Section 12 of the Original Lease and the provisions of this Section 7(C) hereunder.

In connection with the Hold Space Improvements, Lessee shall select an architect and an engineer, subject to Lessor’s reasonable approval. Lessor and Lessee shall develop a mutually satisfactory architectural design schedule and construction schedule. Lessee is required to submit to Lessor design and architectural drawings (the “Hold Space Improvements Design Drawings”) and mechanical and electrical working drawings (the “Hold Space Improvements Working Drawings”) for all of the Hold Space Improvements. Construction of any Hold Space Improvements will not be commenced until the appropriate final approvals of the Hold Space Design Drawings and Hold Space Working Drawings are obtained, which approvals by Lessor shall not be unreasonably withheld, delayed or conditioned. Lessee is responsible for the payment of all architectural and engineering fees, which shall be debited against the Hold Space Allowance. Lessee shall obtain at its sole expense all occupancy and building permits necessary for Lessee to lawfully improve and occupy the Hold Space during the then remaining Lease Term (and any extensions thereof), which may also be funded out of the Hold Space Allowance.

The Hold Space Allowance shall be disbursed by Lessor, from and after the Hold Space Commencement Date, but not later than the date that is six (6) months following the Hold Space Commencement Date, on a monthly basis as costs are incurred, to (i) Lessee for reimbursement of approved expenditures made by Lessee; or (ii) directly to Lessee’s general contractors, architects and engineers (but not other vendors or subcontractors), such direct disbursements to be made only upon Lessor’s receipt of a written request from Lessee authorizing such disbursements. In order to request a disbursement of the Hold Space Allowance by Lessor, Lessee shall submit to Lessor (i) executed service or work contracts with contractors (reasonably approved by Lessor) for work to be performed and in which an advance payment is required; (ii) construction requisitions for work in progress with a certification of a space planner or architect that the work has been completed to the level specified in the requisition; (iii) paid invoices for fully completed services or construction work, with any such construction work previously reviewed and reasonably approved by Lessor; and/or (iv) such other documents and information as Lessor may reasonably request. Lessee shall also furnish Lessor with partial lien waivers from its general contractor(s) and subcontractors, current through the most recent requisition of the Hold Space Allowance, and a final release of lien from any contractor whose

work has been completed, it being understood that all contracts with general contractors shall provide for a retainage of 10% or such lower amount as may be reasonably approved by Lessor, such retainage to be paid upon delivery of the lien release and receipt of a certificate from the architect stating that such work has been completed (including completion of the “punch list”). Lessor shall promptly review the requisition materials submitted by Lessee, and, provided such materials are complete, and further provided that the aggregate disbursements of the Hold Space Allowance (including the disbursement then being requisitioned by Lessee) do not exceed the total amount of the Hold Space Allowance, Lessor shall make the requested disbursement in accordance with the following schedule: if Lessor receives Lessee’s requisition materials on or before the twentieth (20th) day of a month, Lessor will make the requested disbursement not later than on the last day of the first calendar month following the calendar month during which Lessor received such requisition materials (it being understood that if Lessor receives Lessee’s requisition materials after the twentieth (20th) day of a month, Lessor will make such disbursement not later than on the last day of the second calendar month following the calendar month during which Lessor received such requisition materials). In the event the request is not complete with regard to the supporting documentation, then Lessor shall promptly notify Lessee of the deficiency.

In connection with the Hold Space Improvements, Lessor’s affiliate, Tishman Speyer (“TS”) shall, at Lessee’s election, act as Lessee’s project manager for which TS shall be paid a fee of three and one-half percent (3.5%) of the construction bid for the Hold Space Improvements, such fee to be debited from the Hold Space Allowance. If Lessee does not elect to utilize TS as its project manager, TS shall monitor the work on behalf of Lessor, for which TS shall be paid a fee of one percent (1%) of the construction bid for the Hold Space Improvements, such fee to be debited against the Hold Space Allowance.

(D) From and after the Hold Space Rent Commencement Date, Lessee shall be provided with (i) additional parking permits (at the prevailing market rate for such permits) in the ratio of one (1) contract for every fifteen hundred (1,500) square feet of rentable area in the Hold Space (BOMA measured), with such entitlement to parking permits being otherwise subject to Section 10 of this Addendum No. 4, and (ii) its pro rata share of additional directory strips in the building directory.

8. RIGHT OF OPPORTUNITY

(A) Right of Opportunity.

(1) Subject to the provisions of this Section 8, if, during the Lease Term (but not any further extensions thereof), if any portion of the Give-Back Premises becomes available for lease from Lessor (or Lessor reasonably anticipates that such space will become available for lease from Lessor) (the “ROFO Space”), Lessor shall so notify Lessee (the “Lessor’s ROFO Notice”) of the anticipated availability date (the “ROFO Commencement Date”), and Lessee shall have the right to lease all (but not less than all) of the ROFO Space (the “Right of Opportunity”) by delivering Lessee’s notice of such election to Lessor (“Lessee’s ROFO Notice”) within ten (10) business days after Lessor gives Lessor’s ROFO Notice to Lessee.

(2) Any provision of the Lease (as amended hereby) to the contrary notwithstanding, Lessee’s Right of Opportunity shall be subject to the following:

(a) With respect to any ROFO Space available for lease as of the Give-Back Premises Termination Date, Lessee’s Right of Opportunity shall not apply to such ROFO Space until Lessor has entered into a lease with a third-party tenant for such ROFO Space containing such terms as Lessor deems acceptable in Lessor’s sole discretion (including, without limitation, any fixed expansion or extension rights that Lessor might grant such tenant(s) for such ROFO Space) with a third-party tenant and the term of such lease has expired with respect to such ROFO Space (including, without limitation, the expiration of any lease term extension period(s)) or otherwise been terminated.

(b) If Lessee notifies Lessor that Lessee elects not to lease a ROFO Space or if Lessee fails to timely deliver Lessee’s ROFO Notice to Lessor with respect thereto, Lessee’s Right of Opportunity shall not apply to such ROFO Space until Lessor has thereafter entered into a lease for such ROFO Space with a third-party tenant under one or more leases containing such terms as Lessor deems acceptable in Lessor’s sole discretion (including, without limitation, any right of opportunity or other expansion rights that Lessor might grant such tenant(s) for such ROFO Space) and Lessor’s Right of Opportunity shall not apply to such space until the term of such lease has expired with respect to such ROFO Space (including, without limitation, the expiration of any lease term extension period(s)) or otherwise been terminated.

(c) The fixed expansion or extension rights of the third party tenant(s) taking all or any portion of the Give-Back Premises pursuant to the initial lease-up following Lessee’s surrender of the Give-Back Premises hereunder (a “Lease-Up Tenant’s Rights”).

(B) Conditions to Exercise. Lessee’s exercise of its Right of Opportunity shall be subject to the following conditions at the time of such exercise: (i) the Lease (as amended hereby) is in full force and effect; (ii) no default by Lessee then exists beyond any applicable notice and cure period; (iii) Lessee has timely exercised the Right of Opportunity, with time being of the essence; (iv) the Lease (as amended hereby) had not been assigned in a transaction requiring Lessor’s consent pursuant to Section 11 of the Original Lease (as amended and restated by Section 12 below) (Lessor acknowledging that Lessor’s consent is not required for an assignment of the Lease or sublet of the Demised Premises to any subsidiary, affiliate or successor (as those terms are defined in Section 11 of the Original Lease)); and (v) Lessee is occupying for the conduct of Lessee’s business therein more than seventy percent (70%) of the rentable area of the Demised Premises. If Lessee exercises its Right of Opportunity, Lessee may not thereafter revoke such exercise.

(C) Condition of ROFO Space. Lessee shall take the ROFO Space in “as is” condition.

(D) ROFO Space Rent. The annual rate for Monthly Rent payable for an applicable ROFO Space shall be the annual ROFO Rate for the ROFO Space as of the ROFO Commencement Date (the “ROFO Calculation Date”), with such ROFO Rate being escalated annually on each anniversary of the ROFO Calculation Date by the market escalation rate that

shall be determined as part of the determination of the ROFO Rate. The “ROFO Rate” shall mean the Market Base Rent (as defined in Section 8 of the Original Lease). Subject to the provisions of this Section, the calculation of ROFO Rate shall take into account all relevant factors. If the ROFO Rate includes any out-of-pocket monetary concession (such as a tenant improvement allowance) to be provided by Lessor, Lessor shall have the option to either directly provide such monetary concession or indirectly provide such monetary concession by equitably reducing the ROFO Rate by the economic value of such concession over the then remaining Term.

(E) Procedure for Determining Monthly Rent.

(1) Lessor shall advise Lessee (the “ROFO Rent Notice”) of Lessor’s determination of ROFO Rate within ten (10) days after receiving Lessee’s ROFO Notice. If Lessee does not accept Lessor’s determination of the ROFO Rate, the parties shall meet and seek in good faith to reach agreement on the ROFO Rate during the thirty (30) day period that begins when Lessor receives Lessee’s ROFO Notice (the “ROFO Negotiation Period”).

(2) If Lessor and Lessee do not agree upon the ROFO Rate in writing within the ROFO Negotiation Period, the provisions of Section 9(D)(2) below shall govern the determination of the ROFO Rate, except that all references in Section 9(D)(2) to:

the “Extension Rate” shall mean the “ROFO Rate,”

the “Extension Negotiation Period” shall mean the “ROFO Negotiation Period;” and

the “Extension Rent Notice” shall mean the “ROFO Rent Notice.”

If the Monthly Rent payable for a ROFO Space is not determined prior to the day on which Lessee commences to lease the ROFO Space, Lessee shall pay Monthly Rent for the ROFO Space in an amount equal to the rentable square foot rate then payable for the then current Demised Premises (the “ROFO Interim Rent”). Upon final determination of the Monthly Rent for the ROFO Space, Lessee shall commence paying such Monthly Rent as so determined, and within ten (10) days after such determination Lessee shall pay any deficiency in prior payments of Monthly Rent or, if the Monthly Rent as so determined shall be less than the ROFO Interim Rent, Lessee shall be entitled to a credit against the next succeeding installments of Monthly Rent in an amount equal to the difference between each installment of ROFO Interim Rent and the Monthly Rent as so determined which should have been paid for such installment until the total amount of the over payment has been recouped.

(F) Except to the extent expressly set forth in this Section to the contrary, if Lessee elects to lease ROFO Space, such space shall become subject to the Lease (as amended hereby) upon the same terms and conditions as are then applicable to the then current Demised Premises. The foregoing notwithstanding, any tenant improvement allowances, free rent periods, moving allowances or other special concessions granted to Lessee with respect to the then current Demised Premises shall not apply to the ROFO Space.

(G) If Lessee exercises its right to lease ROFO Space, the term of Lessee’s lease of the ROFO Space shall: (a) commence upon the date (the “ROFO Space Commencement Date”) that is the later of: (i) the date of availability specified in Lessor’s ROFQ Notice, or (ii) the date Lessor tenders possession of the ROFO Space in the condition required under Section 8(C) above, and (b) expire upon the expiration of the Lease Term, including any further extensions thereof. Provided Lessor has complied with the terms of the following sentence, Lessor will have no liability to Lessee if Lessor does not deliver the ROFO Space to Lessee on the date of availability specified in Lessor’s ROFO Notice for any causes beyond the reasonable control of Lessor. Lessor will promptly commence and diligently pursue obtaining possession of the ROFO Space (including, if necessary, by initiating legal proceedings) so that Lessor can tender the ROFO Space to Lessee; provided, however, if Lessor has not tendered possession of the ROFO Space to Lessee within one hundred eighty (180) days after the date of availability specified in Lessor’s ROFO Notice (which date shall not be extended by Force Majeure), Lessee’s sole remedy shall be to terminate its election to lease the ROFO Space by notifying Lessor in writing within thirty (30) days after the expiration of said one hundred eighty (180) day period. Lessor shall have no obligation to make any payment to the occupant or to give any other concession to such occupant in order to induce such occupant to vacate and surrender possession of any ROFO Space.

(H) Recomputation. Except to the extent expressly set forth in the Lease (as amended hereby) to the contrary, upon Lessee’s leasing of ROFO Space, the rentable area of the Demised Premises and term “Demised Premises” shall be deemed amended to include such ROFO Space and Lessee’s proportionate share and all other computations made under the Lease (as amended hereby) based upon or affected by the rentable area of the Demised Premises shall be recomputed to include such ROFO Space; provided that, the computation of the square footage of the ROFO Space shall be based on BOMA.

(I) Parking and Directory Strips. From and after the ROFO Space Commencement Date, Lessee shall be provided with (i) additional parking permits (at the prevailing market rate for such permits) in the ratio of one (1) contract for every fifteen hundred (1,500) square feet of rentable area in the ROFO Space (BOMA measured), with such entitlement to parking permits being otherwise subject to Section 10 of this Addendum No. 4, and (ii) its pro rata share of additional directory strips in the building directory.

9. SECOND EXTENSION TERM

(A) Second Extension Term. Lessee shall have the right to extend the Lease Term for all of the Demised Premises for one (1) additional extension term of five (5) years (the “Second Extension Term,” and with the option hereunder referred to as the “Second Extension Option”). The Second Extension Term, if exercised, shall commence on November 1, 2015 (the “Second Extension Term Commencement Date”) and expire on October 31, 2020, unless the Second Extension Term shall sooner terminate pursuant to any of the terms of the Lease (as amended hereby) or otherwise. The Second Extension Term shall commence only if Lessee notifies Lessor in writing (an “Extension Notice”) of Lessee’s exercise of the Second Extension Option not earlier than May 1, 2014 nor later than August 1, 2014.

The Second Extension Term shall be upon all of the agreements, terms, covenants and conditions of the Lease (as amended hereby), except that (x) the Monthly Rent for the Second Extension Term (the “Second Extension Term Monthly Rent”) shall be determined as provided in Section 9(C) hereunder, (y) the Demised Premises shall be deemed to consist of 39,624 rentable square feet (i.e., as re-measured under BOMA), and (z) Lessee shall have no further right to extend the Lease Term beyond the Second Extension Term.

Upon the commencement of the Second Extension Term, any reference to the “Lease Term,” the “term of this Lease” or any similar expression shall be deemed to include the Second Extension Term and the expiration of the Second Extension Term shall become the expiration date of the Lease. Any termination, cancellation or surrender of the entire interest of Lessee under the Lease (as amended hereby) at any time during the Lease Term shall terminate any right of extension of Lessee hereunder.

(B) Conditions to Exercise. Lessee’s exercise of any right to extend the Lease Term for the Second Extension Term shall be subject to the following conditions at the time of such exercise: (i) the Lease (as amended hereby) is in full force and effect; (ii) no default by Lessee under the Lease then exists beyond any applicable notice and cure period; (iii) Lessee has timely exercised the extension option, with time being of the essence; (iv) the Lease (as amended hereby) has not been assigned, other than to a subsidiary, affiliate or successor, or (v) not more than thirty percent (30%) of the Demised Premises is then under sublet, other than to a subsidiary, affiliate or successor. Except as expressly set forth in Section 9(D)(2) below, if Lessee exercises the Second Extension Option, Lessee may not thereafter revoke such exercise.

(C) Second Extension Term Monthly Rent.

(1) The Second Extension Term Monthly Rent shall be based on the annual Extension Rate for the Demised Premises as of the Second Extension Term Commencement Date (the “Extension Calculation Date”), with such Extension Rate being escalated annually on each anniversary of the Extension Calculation Date by the market escalation rate that shall be determined as part of the determination of the Extension Rate (the “Escalation Rate”). “Extension Rate” shall mean the Market Base Rent (as defined in Section 8 of the Original Lease). Subject to the provisions of this Section, the calculation of the Extension Rate shall take into account all relevant factors. If the Extension Rate includes any out-of-pocket monetary concession (such as a tenant improvement allowance) to be provided by Lessor, Lessor shall have the option to either directly provide such monetary concession or indirectly provide such monetary concession by equitably reducing the Extension Rate by the economic value of such concession over the then remaining Term.

(D) Procedure for Determining Second Extension Term Monthly Rent.

(1) Lessor shall advise Lessee (the “Extension Rent Notice”) of Lessor’s determination of the Extension Rate within thirty (30) days after receiving the Extension Notice. If Lessee does not accept Lessor’s determination of the Extension Rate, the parties shall meet and seek in good faith to reach agreement on the Extension Rate during the thirty (30) day period that begins when Lessee receives the Extension Rent Notice (the “Extension Negotiation

Period”).

(2) If Lessor and Lessee do not agree upon the Extension Rate in writing within the Extension Negotiation Period, such disagreement shall, unless Lessee revokes the exercise of the Second Extension Option by written notice to Lessor given no later than five (5) business days following expiration of the Extension Negotiation Period, be resolved by arbitration in accordance with the then prevailing Expedited Procedures of the American Arbitration Association or its successor for arbitration of commercial disputes, except that the Expedited Procedures shall be modified as follows:

(a) Either party may start the arbitration process by notifying the other party that the notifying party desires that the Extension Rate be resolved by arbitration, which notice shall include the name and address of the person to act as the arbitrator on the notifying party’s behalf. The arbitrator shall be a real estate broker with at least ten (10) years full-time commercial brokerage experience who is familiar with the Extension Rate of office space in first-class office buildings in the downtown area of the District of Columbia. Within ten (10) business days after the service of the demand for arbitration, the receiving party shall give notice to the party demanding arbitration specifying the name and address of the person designated by the receiving party to act as arbitrator on its behalf, which arbitrator shall be similarly qualified. If the receiving party fails to notify the party demanding arbitration of the appointment of the receiving party’s arbitrator within such ten (10) business day period, and such failure continues for three (3) business days after the demanding party delivers a second notice to the receiving party, then the arbitrator appointed by the demanding party shall be the arbitrator to determine the Extension Rate for the Demised Premises.