Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - URANERZ ENERGY CORP. | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - URANERZ ENERGY CORP. | exhibit31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - URANERZ ENERGY CORP. | exhibit32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - URANERZ ENERGY CORP. | exhibit31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - URANERZ ENERGY CORP. | exhibit23-1.htm |

| EX-32.1 - EXHIBIT 32.1 - URANERZ ENERGY CORP. | exhibit32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________________ to

___________________

Commission file number: 001-32974

URANERZ ENERGY

CORPORATION

(Exact Name of Registrant as Specified in its

Charter)

| Nevada | 98-0365605 |

| (State of other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) |

| organization) | |

| 1701 East “E” Street | |

| PO Box 50850, Casper, Wyoming | 82605-0850 |

| (Address of Principal Executive Offices) | (Zip Code) |

(307) 265-8900

(Registrant’s Telephone Number,

including Area Code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of Each Class | Name of Each Exchange on Which Registered |

| Common Stock: $0.001 par value | NYSE MKT |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

[ ] No [X]

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [

] No [X]

Indicate by checkmark whether the registrant (1) filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate by check mark whether the Registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large Accelerated Filer [ ] Accelerated Filer [X] Non-Accelerated Filer [ ] Smaller Reporting Company [ ]

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act).

Yes [

] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $119,038,185.

The number of shares of the Registrant’s common stock outstanding as of March 4, 2015 was 95,912,806.

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report and the exhibits attached hereto contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements concern the Company’s anticipated results and progress of the Company’s operations in future periods, planned exploration and, if warranted, development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

-

risks related to our proposed merger with Energy Fuels Inc.;

-

risks related to litigation commenced in connection with the Energy Fuels merger;

-

risks related to our limited working capital and current negative cash flow from operations;

-

risks related to our ability to achieve targeted extraction or extraction rates at our Nichols Ranch ISR Uranium Project;

-

risks related to higher than expected operating costs at our Nichols Ranch ISR Uranium Project;

-

risks related to higher than expected construction costs to expand our Nichols Ranch ISR Uranium Project;

-

risks related to our limited operating history;

-

risks related to the probability that our properties contain reserves;

-

risks related to our past losses and expected losses in the near future;

-

risks related to our need for qualified personnel for exploring for, starting and operating a mine;

-

risks related to our lack of known reserves;

-

risks related to the fluctuation of uranium prices;

-

risks related to the public acceptance of nuclear power;

-

risks related to environmental laws and regulations and environmental risks;

-

risks related to using our in-situ uranium recovery process;

-

risks related to exploration and, if warranted, development of our properties;

-

risks related to our ability to acquire necessary mining licenses or permits;

-

risks related to our ability to make property payment obligations;

-

risks related to obtaining the necessary access rights;

-

risks related to the competitive nature of the mining industry;

-

risks related to our dependence on key personnel;

-

risks related to requirements for new personnel;

-

risks related to securities regulations;

-

risks related to stock price and volume volatility;

-

risks related to dilution;

-

risks related to our lack of dividends;

-

risks related to our ability to access capital markets;

-

risks related to recent market events;

-

risks related to our issuance of additional shares of common stock;

-

risks related to acquisition and integration issues;

-

risks related to defects in title to our mineral properties;

-

risks related to our outstanding debt; and

-

risks related to our securities.

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the section headings Item 1. Description of the Business, Item 1A. Risk Factors and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, of this Annual Report (the “Annual Report”). Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Except as required by law, we disclaim any obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. We qualify all the forward-looking statements contained in this Annual Report by the foregoing cautionary statements.

GLOSSARY OF TECHNICAL TERMS

The following defined technical terms are used in this Annual Report:

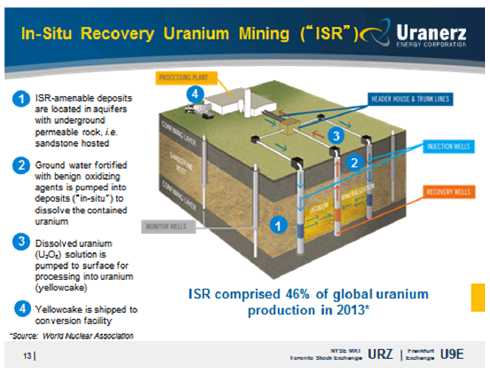

In-situ recovery (ISR): the recovery, by chemical leaching, of the uranium component of an ore body without physically extracting the ore from the ground. ISR mining utilizes injection of appropriate oxidizing chemicals into uranium-bearing sandstone deposits with extraction by extraction wells; also referred to as solution mining.

Uranium: a heavy, naturally radioactive, metallic element of atomic number 92. Its two principal isotopes are U238 and U235, of which U235 is the necessary component for the nuclear fuel cycle. “Uranium” used in this Annual Report refers to triuranium octoxide, also called “U3O8” or “yellowcake”, and is produced from uranium deposits. It is the most actively traded uranium-related commodity.

Uranium concentrate (yellowcake): a yellowish to yellow-brownish powder obtained from the chemical processing of uranium-bearing material. Yellowcake typically contains 70 to 90% U3O8 by weight.

PART 1

ITEM 1. DESCRIPTION OF BUSINESS

Corporate Background

Uranerz Energy Corporation (”Uranerz”, “Company”, “we””, “us” and “our”) was incorporated under the laws of the State of Nevada on May 26, 1999. On July 5, 2005, we changed our name from Carleton Ventures Corp. to Uranerz Energy Corporation. Our executive and operations office is located at 1701 East “E” Street, P.O. Box 50850, Casper, Wyoming U.S.A. 82605-0850. Our administrative office is located at Suite 1410 - 800 West Pender Street, Vancouver, British Columbia, Canada V6C 2V6. The telephone number for our executive office is (307) 265-8900. The telephone number for our administrative office is (604) 689-1659.

Our common stock is traded on the NYSE MKT and the Toronto Stock Exchange under the symbol “URZ” and on the Frankfurt Stock Exchange under the symbol “U9E”.

History

Uranerz was relatively inactive from 1999 until 2005 when it acquired mineral prospecting permits in Saskatchewan, mineral licenses in Mongolia and mining claims and leases in Wyoming. The Company commenced exploration in 2005 and has continued through to present. In 2007 we filed uranium mining applications for a project in Wyoming. In 2008 we sold our Mongolian properties and have terminated exploration in Saskatchewan. We continued to acquire additional mineral properties and conduct exploration drilling while pursuing mining permits in Wyoming. We refer to exploration drilling asdrilling done in search of new mineral deposits or for the possible extensions of existing deposits.

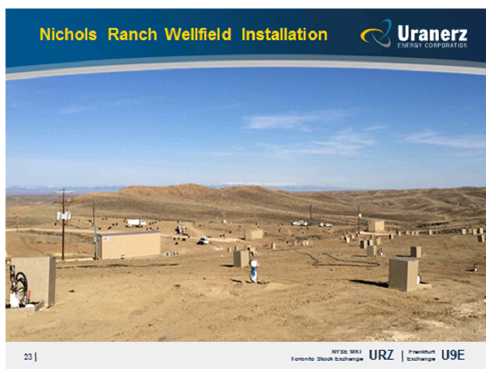

In 2011 we received regulatory approvals for the construction of our first extraction project, the Nichols Ranch ISR Uranium Project, and began construction in August of that year. Construction of the Nichols Ranch processing facility together with an initial wellfield was completed in mid-2014 when we commenced extracting uranium for sale to nuclear utility customers.

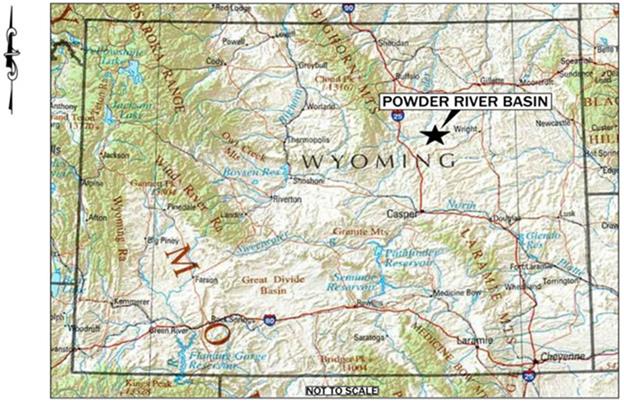

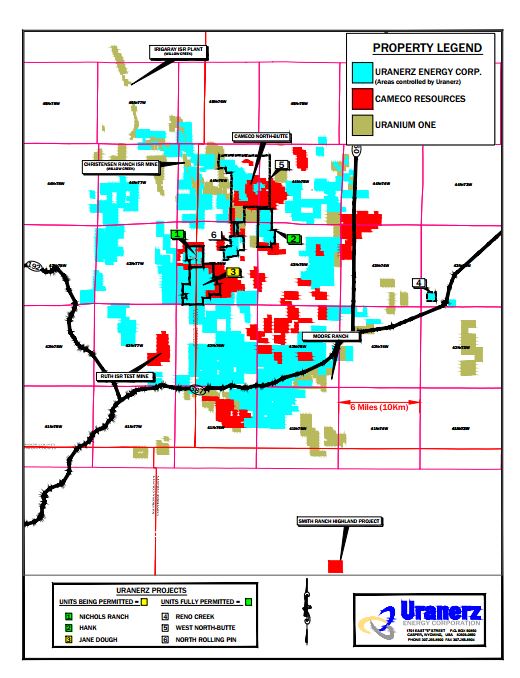

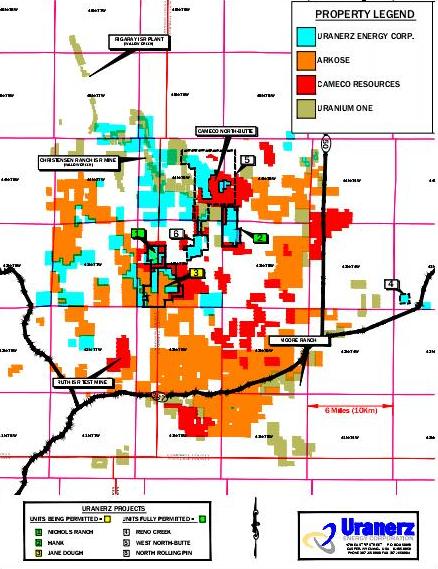

Our Business

Uranerz Energy Corporation is a U.S. uranium company with an operating ISR uranium extraction project and a portfolio of exploration-stage projects in the Powder River Basin of Wyoming, U.S.A. In-situ recovery or ”ISR” is a mining process that uses a leaching solution to dissolve uranium from underground sandstone uranium deposits. This method is the generally accepted extraction technology used in the Powder River Basin where the Company controls a large strategic land position. Our management team has specialized expertise in the ISR uranium mining method, and has a record of licensing, constructing, and operating ISR uranium projects. The following diagram illustrates the ISR mining process:

In anticipation of receiving all of the approvals necessary to begin extraction at Nichols Ranch, we commenced a marketing program for conditional sales of uranium from the Nichols Ranch ISR Uranium Project in late 2008. In July 2009, we entered into a sales agreement with Exelon Generation Company, LLC (“Exelon”) for the sale of uranium over a five year period at defined prices. The agreement with Exelon was subsequently amended to defer the delivery schedule by a year and adjust the pricing terms. On January 25, 2013 we entered into a second supply agreement with Exelon for the sale of uranium over an additional five year period commencing in 2016, at defined prices adjustable for inflation. In August of 2009, we entered into what was then our second contract for the sale of uranium to another United States nuclear utility, also over a five year period, with a pricing structure, as amended, that references both spot and long-term prices and includes floor and ceiling prices. That agreement was also subsequently amended to defer the original five year delivery period by a year, reduce the annual volumes to be supplied, and adjust the pricing terms. The amendment included the cancellation of the first year’s delivery quantity if we were unable to deliver during the first delivery year of the contract. We were unable to complete the first year delivery and the delivery period was reduced to four years. These three long-term contracts for the sale of uranium are with two of the largest nuclear utilities in the United States. These three agreements individually do not represent a majority of our targeted uranium extraction.

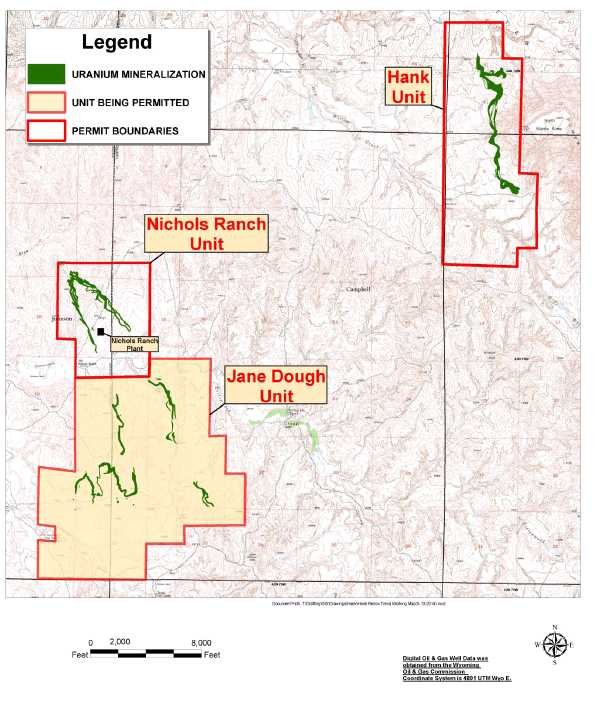

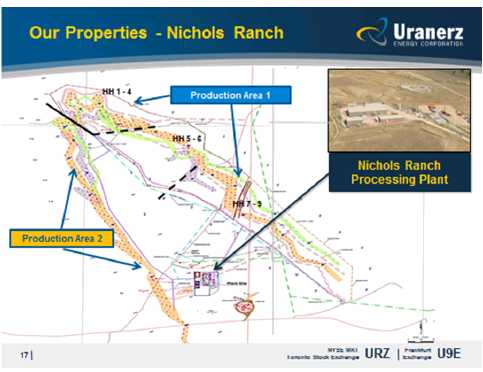

The Nichols Ranch ISR Uranium Project is currently licensed to include extraction of uranium from our Nichols Ranch Unit and our Hank Unit. Under the licensed plan, a central processing plant has been built at Nichols Ranch and a satellite processing facility is planned to be built at Hank. In March 2010, we commenced preparation of the environmental permit and license applications for our Jane Dough Unit, which is adjacent to our Nichols Ranch Unit and which will share its infrastructure. This will provide us with the option to revise our original plan of operations by bringing our Jane Dough Unit into extraction operations before the Hank Unit at our Nichols Ranch ISR Uranium Project. Due to its close proximity, extracted solutions from Jane Dough may be delivered directly to our Nichols Ranch processing facility by pipeline, thus eliminating the need for larger capital outlay as would be required to exploit Hank. Our Jane Dough Unit includes the Doughstick, South Doughstick and North Jane properties. Additional Units may be added to the extraction operations plan as we continue to assess our geological data. We plan to continue the exploration and strategic portfolio planning of our other Wyoming Powder River Basin properties through a number of strategies including acquisitions or exchanges with other ISR uranium mining companies in the area.

In December 2010, we received a Permit to Mine from the Wyoming Department of Environmental Quality – Land Quality Division (“WDEQ-LQD”). In July 2011, we received our Source Material License from the United States Nuclear Regulatory Commission (“NRC”) and immediately began construction of our Nichols Ranch ISR Uranium Project central processing plant. Construction of the Nichols Ranch processing plant was substantially completed in 2013 without elution and drying circuits, and extraction commenced in the second quarter of 2014 after final NRC inspections were completed. The Jane Dough project described above will be progressed while we are conducting extraction operations at our Nichols Ranch Unit. Our processing facility at Nichols Ranch will serve as a platform to advance our other Powder River Basin properties with potential enhanced economics for adjacent and satellite projects.

In November 2011, we signed a processing agreement with Cameco Resources (“Cameco”), a wholly-owned Wyoming subsidiary of Cameco Corporation, the world’s largest publicly-traded uranium company. Under the agreement, we agreed to deliver uranium-loaded resin extracted from our Nichols Ranch facility to Cameco’s Smith Ranch-Highland uranium mine for final processing into dried uranium concentrate packaged for shipping to a converter. Cameco’s Smith Ranch-Highland mine is located in the Powder River Basin of Wyoming approximately 25 air miles south of our Nichols Ranch Unit. Mining the Jane Dough Unit is compatible with this plan. The agreement is for a fixed term. Under the agreement, we and Cameco stipulate both a minimum quantity of uranium and a maximum quantity of uranium which will be delivered by us and processed by Cameco. A damage payment for 2013 was paid for not meeting the minimum requirement and quantities processed in 2014 exceeded the minimum delivery requirements. Under the terms of the agreement, we may have all or substantially all of the uranium extracted at Nichols Ranch through 2015 processed by Cameco. We intend to engage in negotiations in mid-2015 to extend the agreement beyond 2015. In the event that we fail to extend the agreement, we will explore alternate arrangements with operators in the area or install our own elution and packaging circuits at Nichols Ranch.

In September 2012 we submitted an application to the Wyoming Business Council for a $20,000,000 loan under the Wyoming Industrial Development Revenue Bond Program. The loan was received in December 2013 and has a seven year term and an interest rate of 5.75% per annum. We were required to make interest-only payments during the first year and in the following years the debt is amortized to include payments of principal and interest.

Our focus in 2013 was on the construction of our processing facility and installation of the environmental monitor, extraction and deep disposal wells for the Nichols Ranch ISR Uranium Project. All of these activities were completed in 2014 together with operational items and regulatory requirements for mining.

Corporate Developments in 2014

During the fiscal year ended December 31, 2014 we continued to assess properties in the Powder River Basin, filed licensing applications for the Jane Dough Unit and completed the construction of a processing facility and installation of the environmental monitor and extraction wells for the first wellfield at the Nichols Ranch ISR Uranium Project. Other significant corporate developments include the following:

-

In February 2014, our four independent directors and each of our: Chief Executive Officer, Executive Chairman, Senior Vice President, Finance & Chief Financial Officer and Senior Vice President, Legal & Corporate Secretary, all of whom held options to purchase Common Shares with exercise prices greater than $3.20 per Common Share, previously granted to them pursuant to our Amended 2005 Nonqualified Stock Option Plan (the “Plan”) entered into option surrender agreements (“Surrender Agreements”) with our Company. Pursuant to the Surrender Agreements, the independent directors and such executive officers agreed to surrender to us, for no consideration, options to purchase an aggregate of 1,814,000 Common Shares, with a weighted average exercise price of $3.43; such surrendered shares are available for future grant under the Plan;

-

In the first quarter 2014, we started commissioning our first mining Unit at our Nichols Ranch ISR Uranium Project, with the start-up of our new processing facility and the circulation of water through injection and extraction wells. On April 15, 2014, we received approval to begin the addition of oxygen and other chemicals. Through remainder of the quarter, we continued to hone plant functionality and optimize chemical additions while observing improved uranium grades. During the summer of 2014, we commenced making regular deliveries of uranium-loaded resin to Cameco Resources’ Smith Ranch uranium processing facilities for final processing into dried and drummed uranium concentrates pursuant to a toll processing agreement between the two companies. In 2014 we extracted approximately 200,000 pounds of uranium from our first wellfield and purchased 30,000 pounds for re-sale. We completed sales of uranium product in September and December 2014 totaling 175,000 pounds in accordance with long-term contracts with our nuclear utility customers.;

-

On May 1, 2014, Sandra R. MacKay, Senior Vice President, Legal & Corporate Secretary and an executive officer of our Company, tendered her resignation from employment with our Company, effective in June 2014, in order to pursue another professional opportunity;

-

In May 2014 we submitted a source material license amendment application for our Jane Dough Unit to the NRC. This amendment will add the Jane Dough Unit to the existing license for the Nichols Ranch ISR Uranium Project, which currently includes the Nichols Ranch and Hank Units. At the same time, we submitted to the Wyoming Department of Environmental Quality an amendment to our Permit to Mine to incorporate the Jane Dough Unit. The Jane Dough license/permit area is contiguous to and immediately south of the Company's wholly owned Nichols Ranch Unit which recently commenced in-situ recovery ("ISR") uranium extraction operations. In this area of the Powder River Basin, uranium mineralization commonly follows along oxidization-reduction ("redox") boundaries and these boundaries at the Nichols Ranch Unit continue southward through the Jane Dough Unit. Due to the close proximity of these two Units, the Company expects to install only the wellfields at Jane Dough and will transfer mining solutions to and from the processing plant at the Nichols Ranch Unit through pipelines. This operational configuration should avoid the expense of constructing a separate satellite plant at Jane Dough, resulting in considerable savings in capital and time, and should serve to greatly enhance the project economics and extend the useful life of the Nichols Ranch facility. Both the Wyoming DEQ and the NRC are progressing with their technical review of our application;

-

In July 2014 we issued and sold, through a syndicate of agents, 9,600,000 units of the Company ("Units") at a price per Unit of US$1.25 for aggregate gross proceeds of US$12 million. Each Unit consisted of one share of the Company's common stock and one half of one common stock purchase warrant, with each whole warrant exercisable to purchase one additional Share for a period of 30 months following the closing of the Offering at an exercise price of US$1.60, subject to adjustment and acceleration provisions; and

-

In 2014 we entered into new change in control severance agreements (the “Change in Control Severance Agreements”) with four of our officers: Executive Chairman Dennis Higgs, Chief Executive Officer Glenn Catchpole, President & Chief Operating Officer W. Paul Goranson, Senior Vice President & Chief Financial Officer Benjamin Leboe and Douglas Hirschman, Vice President, Land. The new Change in Control Severance Agreements replace and supersede change in control agreements (the “previous agreements”) between the Company and three of its executive officers: Executive Chairman Dennis Higgs, Chief Executive Officer Glenn Catchpole and Senior Vice President, Finance & Chief Financial Officer Benjamin Leboe and officer Douglas Hirschman, Vice President, Land. Under the new Change in Control Severance Agreements, these officers will be entitled to certain severance benefits if, following a “change of control” (as defined in the Change in Control Severance Agreement), the Company terminates the executive’s employment without “cause”, as defined in the agreement, or the executive terminates his employment with the Company for “good reason” (as defined in the Change in Control Severance Agreement). In such event, each executive officer would be entitled to receive his base salary through to the date of termination, a pro-rated target bonus for the year of termination and two times his base salary and target bonus, in each case as in effect on the date of the change in control, or the date of termination (whichever is higher). The new form of Change in Control Severance Agreement provides that each officer will be prohibited, for a one year period after his termination, from soliciting employees or customers or suppliers of the Company and each executive officer will be subject to confidentiality restrictions. Following termination of employment, the executive officer will be required to sign a release of claims against the Company prior to receiving severance benefits under the agreement.

Exploration activities were deferred during 2014 while we concentrated on uranium extraction, and will continue to be deferred under our current operational plan until the market for uranium improves. Our property holdings, all in the Powder River Basin, as at December 31, 2014 include:

- 100% owned properties totaling 19,801 acres; and

- 81% interest in Arkose Mining Venture properties totaling 52,818 acres.

Nonetheless, we continue to look for more prospective lands amenable to ISR mining and as a result may locate, purchase or lease additional unpatented lode mining claims; and/or purchase or lease additional fee mineral (private) lands during the next twelve months. However there is no assurance any additional properties will be acquired. Our continuing assessment of explored properties within the Arkose Mining Venture resulted in the release in 2014 of 2,575 acres of mineral leased land, and 227 mining claims totaling 3,714 acres, thus reducing carrying costs.

Information regarding the location of and access to our Wyoming properties, together with the history of operations, present condition and geology of each of our properties, is presented in Item 2 of this Annual Report under the heading: “Description of Properties”. We have no proven or probable reserves as such terms are defined in the United States Securities and Exchange Commission’s Industry Guide 7 (“Guide 7”). All of our properties are exploratory in nature.

Energy Fuels Merger Agreement

Execution of Merger Agreement

On January 4, 2015, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Energy Fuels Inc., an Ontario corporation (“Energy Fuels”), and EFR Nevada Corp., a Nevada corporation and wholly owned subsidiary of a subsidiary of Energy Fuels (“Merger Sub”). The Merger Agreement provides for a business combination whereby Merger Sub will merge with and into the Company (the “Merger”), and as a result we will continue as the surviving operating corporation and as an indirectly wholly owned subsidiary of Energy Fuels.

Pursuant to the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each issued and outstanding share of common stock of the Company (“Common Stock”) will be canceled and extinguished and automatically converted into the right to receive 0.255 common shares of Energy Fuels (the “Exchange Ratio”).

The completion of the Merger will be subject to the approval of at least a majority of the holders of the outstanding common shares of the Company, as well as at least a majority of the votes cast by the Company’s shareholders, excluding directors and officers of the Company, at a special meeting to be called to consider the Merger.

The Merger Agreement provides that, upon consummation of the Merger, Energy Fuels shall cause three nominees of the Company to be appointed to the board of directors of Energy Fuels.

In addition to the approval of the shareholders of each of the Company and Energy Fuels, as described above, the completion of the Merger will be subject to the satisfaction of other customary closing conditions, including, among others:

-

the declaration by the Securities and Exchange Commission (the “SEC”) of the effectiveness of the Registration Statement on Form F-4 to be filed by Energy Fuels with the SEC in connection with the Merger,

-

the common shares of Energy Fuels to be issued in connection with the Merger, and to be issued upon exercise of the assumed Company options and Company warrants, will have been approved (or conditionally approved, as applicable) for listing on the NYSE MKT and the Toronto Stock Exchange, and

-

the receipt of all regulatory approvals necessary for the completion of the Merger.

Each of the Company and Energy Fuels has agreed to customary and generally reciprocal representations, warranties and covenants in the Merger Agreement. Among these covenants, both the Company and Energy Fuels have agreed to conduct their respective businesses in the ordinary course during the period between the execution of the Merger Agreement and the closing of the Merger.

The Merger Agreement contains customary deal support provisions, including a reciprocal break fee of US$5,000,000 payable if the Merger is not completed under certain circumstances. In addition, the Merger Agreement includes customary and reciprocal non-solicitation covenants, as well as a reciprocal right to match any superior proposal that may arise.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, which has been filed with the SEC.

Support Agreements

Concurrent with the execution of the Merger Agreement:

-

We entered into support agreements with directors and certain officers of Energy Fuels, pursuant to which each security holder agreed, upon the terms and subject to the conditions set forth therein, (a) to vote their Energy Fuels common shares in favor of the Merger, and (b) to not sell or otherwise transfer their shares pending completion of the Merger. The security holders of Energy Fuels entering into the voting agreements collectively hold approximately 0.4% of the outstanding shares of Energy Fuels.

-

Energy Fuels entered into support agreements with the directors and certain officers of the Company, pursuant to which each security holder agreed, upon the terms and subject to the conditions set forth therein, (a) to vote their shares of the Company’s common stock for the Merger, and (b) to not sell or otherwise transfer their shares pending completion of the Merger. The shareholders of the Company entering into the voting agreements collectively hold approximately 4.0% of the outstanding shares of the Company.

Additional Information related to the Merger

This annual report may be deemed to be solicitation material in respect of the proposed business combination of the Company and Energy Fuels. In connection with the proposed Merger, Energy Fuels intends to file relevant materials with the SEC, including a registration statement on Form F-4 that will include a proxy statement of the Company that also constitutes a prospectus of Energy Fuels. STOCKHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE REGISTRATION STATEMENT AND THE PROXY STATEMENT AND PROSPECTUS INCLUDED THEREIN, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders will be able to obtain the documents free of charge at the SEC’s web site, http://www.sec.gov, and the Company’s stockholders will receive information at an appropriate time on how to obtain transaction-related documents for free from the Company. Such documents are not currently available.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Competition

Our industry is highly competitive. We compete with other mining and exploration companies in connection with the acquisition of uranium mineral properties and the equipment, materials and personnel necessary to explore and develop such properties and for the sale of uranium. There is competition for the limited number of uranium acquisition opportunities, some of which is with other companies having substantially greater financial resources, staff and facilities than we do. As a result, we may have difficulty acquiring attractive exploration properties, and exploring and developing our properties. In addition, we compete with other uranium producing companies for uranium sales contracts with uranium utilities. Due to our limited capital and personnel and the size of our operations, we are at a competitive disadvantage compared to some other companies with regard to exploration and, if warranted, development of mining properties and securing uranium sales contracts. We believe that competition for acquiring mineral prospects and entering into uranium sales contracts will continue to be intense in the future.

The availability of funds for exploration and development of uranium projects is limited, and we may find it difficult to compete with larger and more well-known uranium exploration and production companies for capital. Our inability to continue exploration and acquire new properties due to lack of funding could have a material adverse effect on our future operations and financial position.

Minerals Exploration Regulation

Our uranium mineral exploration activities and our extraction activities are subject to extensive laws and regulations governing exploration, development, production, exports, taxes, labor standards, occupational health, waste disposal, protection and remediation of the environment, protection of endangered and protected species, mine safety, toxic substances and other matters. Uranium minerals exploration is also subject to risks and liabilities associated with pollution of the environment and disposal of waste products occurring as a result of mineral exploration.

Compliance with these laws and regulations may impose substantial costs on us and will subject us to significant potential liabilities. Changes could require us to expend significant resources to comply with new laws or regulations and could have a material adverse effect on our business operations.

Mineral exploration operations are subject to comprehensive regulation which may cause substantial delays or require capital outlays in excess of those anticipated, causing an adverse effect on our business operations. Minerals exploration operations are subject to federal and state laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Minerals exploration operations are also subject to federal and state laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment. Various permits from government bodies are required for drilling operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal and state authorities may be changed and any such changes may have material adverse effects on our activities. As of the date of this annual report, other than with respect to the posting of performance surety, we have not been required to spend material amounts on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations. Environmental regulation is discussed in further detail in the following section.

For a discussion as to the specific permits and licenses that we have obtained and are required to obtain in connection with our extraction activities at the Nichols Ranch ISR Uranium Project, please see below in Item 2 – Description of Properties of this annual report under “Extraction Operations Planning and Permitting”.

Environmental Regulation

Exploration, development and extraction activities are subject to certain environmental regulations which may prevent or delay the continuance of our operations. In general, our exploration and extraction activities are subject to certain federal and state laws and regulations relating to environmental quality and pollution control. Such laws and regulations increase the costs of these activities and may prevent or delay the commencement or continuance of a given operation. Specifically, we are subject to legislation regarding emissions into the environment, water discharges, and storage and disposition of hazardous wastes. In addition, legislation has been enacted which requires facility sites to be abandoned and reclaimed to the satisfaction of state and federal authorities. Compliance with these laws and regulations has not had a material effect on our operations or financial condition to date.

Waste Disposal

The Resource Conservation and Recovery Act (“RCRA”), and comparable state statutes, affect mineral exploration and extraction activities by imposing regulations on the generation, transportation, treatment, storage, disposal and cleanup of hazardous wastes and on the disposal of non-hazardous wastes. Under the auspices of the United States Environmental Protection Agency (the “EPA”), the individual states administer some or all of the provisions of RCRA, sometimes in conjunction with their own, more stringent requirements.

CERCLA

The federal Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) imposes joint and several liability for costs of investigation and remediation and for natural resource damages, without regard to fault or the legality of the original conduct, on certain classes of persons with respect to the release into the environment of substances designated under CERCLA as hazardous substances (“Hazardous Substances”). These classes of persons or potentially responsible parties include the current and certain past owners and operators of a facility or property where there is or has been a release or threat of release of a Hazardous Substance and persons who disposed of or arranged for the disposal of the Hazardous Substances found at such a facility. CERCLA also authorizes the EPA and, in some cases, third parties to take actions in response to threats to the public health or the environment and to seek to recover the costs of such action. We may also in the future become an owner of facilities on which Hazardous Substances have been released by previous owners or operators. We may in the future be responsible under CERCLA for all or part of the costs to clean up facilities or property at which such substances have been released, and for natural resource damages.

Air Emissions

Our operations are subject to state and federal regulations for the control of emissions of air pollution. Major sources of air pollutants are subject to more stringent, federally imposed permitting requirements. Administrative enforcement actions for failure to comply strictly with air pollution regulations or permits are generally resolved by payment of monetary fines and correction of any identified deficiencies. Alternatively, regulatory agencies could require us to forego construction, modification or operation of certain air emission sources.

Clean Water Act

The Clean Water Act (“CWA”) imposes restrictions and strict controls regarding the discharge of wastes, including mineral processing wastes, into waters of the United States, a term broadly defined. Permits must be obtained to discharge pollutants into federal waters. The CWA provides for civil, criminal and administrative penalties for unauthorized discharges of hazardous substances and other pollutants. It imposes substantial potential liability for the costs of removal or remediation associated with discharges of oil or hazardous substances. State laws governing discharges to water also provide varying civil, criminal and administrative penalties, and impose liabilities in the case of a discharge of petroleum or its derivatives, or other hazardous substances, into state waters. In addition, the EPA has promulgated regulations that require us to obtain permits to discharge storm water runoff. In the event of an unauthorized discharge of wastes, we may be liable for penalties and costs.

Underground Injection Control (“UIC”) Permits

The federal Safe Drinking Water Act creates a nationwide regulatory program protecting groundwater. This act is administered by the EPA. However, to avoid the burden of dual federal and state (or Indian tribal) regulation, the Safe Drinking Water Act allows for the UIC permits issued by states (and Indian tribes determined eligible for treatment as states) to satisfy the UIC permit required under the Safe Drinking Water Act under two conditions. First, the state's program must have been granted primacy. Second, the EPA must have granted, upon request by the state, an aquifer exemption. The EPA may delay or decline to process the state's application if the EPA questions the state's jurisdiction over the mine site.

Segment Information

Segment information relating to us is provided in Note 17 to our financial statements under the section heading “Item 8. Financial Statements and Supplementary Data” below.

Employees

Currently, we have approximately fifty-seven full-time employees and five full-time consultants. We operate in established mining areas where we have found sufficient available personnel for our business plans.

Overview of Uranium Market

The primary commercial use of uranium is to fuel nuclear power plants for the generation of electricity. All the uranium extracted from our mines will be used to generate electricity.

In 2011, nuclear power plants supplied about 13% of the global electricity consumption. According to the World Nuclear Association, there are currently 437 operable reactors world-wide which required approximately 65,908 tonnes (145 million pounds) of U3O8 fuel in 2014. World-wide there are currently 70 new reactors under construction with an additional 183 reactors on order or in the planning stage and another 311 in the proposed stage.

The world continues to consume more uranium than it produces largely due to increasing energy demands in Asia. Historically the gap between demand and primary supply has been filled by stockpiled inventories and secondary supplies; however these are finite and are being drawn down. Until recently, one of the largest sources of secondary supply was the uranium derived from Russia’s Highly Enriched Uranium program with the United States. All the deliveries from this source were completed at the end of 2013; however, we still are affected by secondary supplies such as the U.S. Department of Energy uranium transfer program. The United States currently has 99 operating reactors, 5 reactors under construction and another 22 reactors at the ordered, planned or proposed stages. According to the U.S. Energy Information Agency the United States derives approximately 11% of its uranium requirements from domestic U.S. uranium mining production.

Uranium is not traded on an open market or organized commodity exchange such as the London Metal Exchange, although the New York Mercantile Exchange provides financially-settled uranium futures contracts where the size of each contract is 250 pounds of “uranium” as U3O8. Typically buyers and sellers negotiate contracts privately and usually directly. Uranium prices, both spot prices and long-term prices, are published by two independent market consulting firms, TradeTech and Ux Consulting, on a weekly basis.

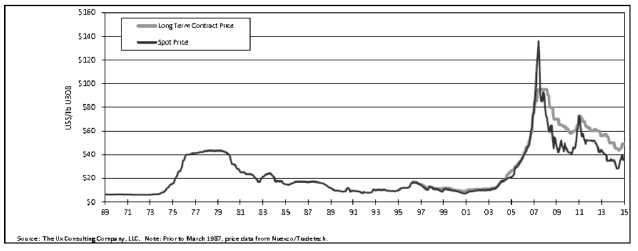

The spot and long-term price of uranium is influenced by a number of factors, some of which are international. For example, both the spot and long-term price of uranium was impacted by the accident at the Fukushima Daiichi Nuclear Plant in March 2011. The events at Fukushima created heightened concerns regarding the safety of nuclear plants and led to both temporary and permanent closures of nuclear plants. These plant closures have created uncertainty in the market.

Most nuclear utilities seek to purchase a portion of their uranium needs through long-term supply contracts with another portion being bought on the spot market in the short term. Like sellers, buyers are seeking to balance the security of long term supply with the opportunity to take advantage of price fluctuations. For this reason both buyers and sellers track current spot and long-term prices for uranium carefully, make considered projections as to future price changes, and then negotiate with one another to enter into a contract which each deems favorable to their respective interests.

The graph below shows the monthly spot and long-term uranium price from 1969 until February 2015 as reported by Ux Consulting and TradeTech.

Source: RBC Uranium Weekly Report on February10, 2015

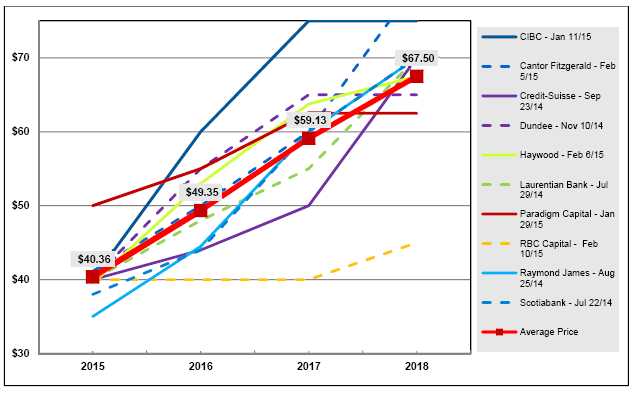

We do not provide estimates of future uranium prices. However, industry analysts endeavor to forecast future long and short term prices for uranium and many publish their analyses. An upward trend is expected by such analysts from 2015 through to 2018 and many expect that trend to continue upward. See figure below.

Source: Research analyst reports by each company.

Available Information

Detailed information about us is contained in our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other reports, and amendments to those reports, that we file with or furnish to the SEC. These reports are available free of charge on our website, www.uranerz.com, as soon as reasonably practicable after we electronically file such reports with or furnish such reports to the SEC. However, our website and any contents thereof should not be considered to be incorporated by reference into this document. We will furnish copies of such reports free of charge upon written request to our Investor Relations department. You can contact our Investor Relations department at:

Uranerz Energy Corporation

Investor Relations

Suite 1410

– 800 West Pender Street

Vancouver, BC, Canada V6C 2V6

Telephone: 1(800)

689

1659

Email: investor@uranerz.com

Additionally, our corporate governance guidelines, Code of Ethics and the charters of each of the standing committees of our Board of Directors are available on our website. We will furnish copies of such information free of charge upon written request to our Investor Relations department.

ITEM 1A. RISK FACTORS

Stockholders should carefully consider the risks and uncertainties described below.

Our failure to successfully address the risks and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations, and the trading price of our common stock may fluctuate widely. We cannot assure you that we will successfully address these risks or other unknown risks that may affect our business.

Risks Related to the Merger

The pending merger with Energy Fuels is not guaranteed to occur. If the Merger does not occur, it could have a material and adverse effect on our business, growth, revenue, liquidity and results of operations and our share price could be negatively impacted.

Completion of the Merger is conditioned upon the satisfaction of certain closing conditions, including the approval of the Merger by our shareholders, as set forth in the Merger Agreement. The required conditions to closing may not be satisfied in a timely manner, if at all, or, if permissible, waived. If the Merger is not consummated for these or any other reasons, our ongoing business may be adversely affected and will be subject to a number of risks and consequences, including the following:

-

we may be required, under certain circumstances, to pay Energy Fuels a termination fee of $5.0 million;

-

we must pay the substantial fees and expenses that we incurred related to the Merger, such as legal and accounting fees and expenses, even if the Merger is not completed and we may not be able to recover such fees and expenses from Energy Fuels;

-

under the Merger Agreement, we are subject to certain restrictions on the conduct of our business prior to completing the Merger, which restrictions could adversely affect our ability to realize certain of our business strategies, including our ability to enter into additional acquisitions or other strategic transactions;

-

matters relating to the Merger may require substantial commitments of time and resources by our management, which could otherwise have been devoted to other opportunities that may have been beneficial to us;

-

the market price of our common shares may decline to the extent that the current market price reflects a market assumption that the Merger will be completed; and

-

we may experience negative reactions to the termination of the Merger from customers, clients, business partners, lenders and employees.

In addition, any delay in the consummation of the Merger, or any uncertainty about the consummation of the Merger, may adversely affect our future business, growth, revenue, liquidity and results of operations.

Compliance with the terms of the Merger Agreement in the interim could adversely affect our business.

As a result of the pending Merger: (a) the attention of management and employees has been and will continue to be diverted from day-to-day operations as they focus on matters relating to obtaining government approvals required for the Merger and preparation for integrating our operations with those of Energy Fuels; (b) the restrictions and limitations on the conduct of our business pending the Merger have and will continue to disrupt or otherwise adversely affect our business, and may not be in the best interests of us if we were to have to act as an independent entity following a termination of the Merger Agreement; (c) our ability to retain existing employees may be adversely affected due to the uncertainties created by the Merger; and (d) our ability to maintain existing programs, or to establish new ones, may be adversely affected. Any delay in consummating the Merger may exacerbate these issues.

The Merger Agreement contains provisions that could discourage a potential competing acquirer of us.

The Merger Agreement contains provisions that, subject to limited exceptions, restrict our ability to solicit, encourage, facilitate or discuss competing third-party proposals to acquire shares or assets of us. In addition, certain shareholders holding approximately 4.0% of our issued and outstanding shares have entered into support agreements with Energy Fuels pursuant to which they have agreed to vote in favor of the Merger. These provisions and the support agreements could discourage a potential competing acquirer that might have an interest in acquiring all or a significant part of Uranerz from considering or proposing that acquisition, even if it were prepared to pay consideration with a higher per share, cash or market value than the Merger consideration proposed to be received or realized in the Merger, or might result in a potential competing acquirer proposing to pay a lower price than it might otherwise have proposed to pay because of the added expense of the $5.0 million termination fee that may become payable in certain circumstances.

If the Merger Agreement is terminated by us, we may not be able to negotiate a transaction with another party on terms comparable to, or better than, the terms of the Merger.

The consummation of the merger between us and Energy Fuels could affect the value of your investment in us.

Pursuant to the Merger Agreement, at the closing of the Merger our shareholders will exchange their shares of our common stock for shares of Energy Fuels common stock. There are a number of additional risks related to the Merger (including any failure to complete the Merger), the potential combined company following the Merger and the business of Energy Fuels that may affect your investment in us or the potential combined company. These risks include, without limitation, the following:

- the exchange ratio will not be adjusted in the event of any change in either our stock price or Energy Fuels’ stock price;

-

because the Merger will be completed after the date of the special meeting, at the time of our special meeting, the exact market value of the Energy Fuels common shares that our shareholders will receive upon completion of the Merger could be higher or lower than the market value at the time of the special meeting;

-

the Merger is subject to a number of conditions, including the receipt of consents and clearances from regulatory authorities that may not be obtained, may not be completed on a timely basis or may impose conditions that could have an adverse effect on us or Energy Fuels;

-

as the Merger does not qualify as a reorganization under Section 368(a) of the Code and is otherwise taxable to U.S. holders of our common stock, shareholders may be required to pay substantial U.S. federal income taxes as a result of completion of the Merger;

-

the rights of our shareholders who become Energy Fuels shareholders in the Merger will be governed by the Ontario Business Corporations Act (“OBCA”) and subject to Energy Fuels’ articles of incorporation and Energy Fuels’ bylaws;

-

the market price of Energy Fuels’ common shares has been, and may continue to be, volatile;

-

our current shareholders will have reduced ownership and voting interests after the Merger;

-

the Merger will result in changes to Energy Fuels’ board of directors and management that may affect the strategy and operations of the combined company as compared to that of us and Energy Fuels as they currently exist;

-

any delay in completing the Merger may reduce or eliminate the benefits expected to be achieved thereunder;

-

uncertainties associated with the Merger may cause a loss of management personnel and other key employees which could adversely affect the future business and operations following the Merger;

-

the expected benefits of the Merger may not be realized;

-

the obligations and liabilities of Energy Fuels, some of which may be unanticipated or unknown, may be greater than anticipated, which may diminish the value of Energy Fuels’ common shares;

-

Uranerz and Energy Fuels expect to incur substantial expenses related to the Merger and the integration of the two companies;

-

Uranerz and Energy Fuels may be unable to integrate their respective businesses successfully;

-

Energy Fuels’ future results will suffer if it does not effectively manage its expanded operations following the Merger;

-

the Merger may result in a loss of customers, clients and strategic alliances;

-

the market price of Energy Fuels’ common shares after the consummation of the Merger may be affected by factors different from those affecting Energy Fuels’ common shares or our common stock prior to consummation of the Merger;

-

holders of Energy Fuels convertible notes may not agree with Energy Fuel’s position that completion of the Merger will not trigger any right to cause Energy Fuels to redeem their convertible notes; and

-

third parties may terminate or alter existing contracts with us and Energy Fuels.

Lawsuits have been filed against us, Energy Fuels, and Merger Sub relating to the Merger and an adverse ruling in any such lawsuit may prevent the Merger from being completed.

Since the Merger was announced on January 5, 2015, we, certain of our officers, directors and shareholders, Energy Fuels and Merger Sub have been named as defendants in one or more of the purported shareholder class actions filed in the District Court, Clark County, Nevada and the District Court, Washoe County, Nevada, by certain of our shareholders challenging the proposed Merger and seeking damages. The actions seek, among other things, to enjoin the defendants from completing the Merger on the agreed upon terms. We believe the lawsuits to be without merit and intend to vigorously defend against the actions. However, if the plaintiffs are successful in preventing the Merger, or are awarded significant damages, it could materially and adversely affect our business, financial condition, liquidity and the market price of our common stock.

Risks Related to Our Business

Our future performance is difficult to evaluate because we have a limited operating history.

We were incorporated in 1999 and we began to implement our current business strategy in the uranium industry in the beginning of 2005 and we realized our initial revenues in 2014. Our operating cash flow needs have been financed primarily through issuances of our common stock and not through cash flows derived from our operations. As a result, we have little historical financial and operating information available to help you evaluate our performance.

Because the probability of an individual prospect ever having reserves is not known, our properties may not contain any reserves, and any funds spent on exploration may be lost.

We have no reserves as defined by SEC Industry Guide 7 and only recently commenced generating revenue from our operations. Because the probability of an individual prospect ever having reserves is uncertain, our properties may not contain any reserves, and any funds spent on exploration may be lost. We do not know with certainty that economically recoverable uranium exists on any of our properties. Further, although we have commenced uranium extraction activities at our Nichols Ranch Unit, our lack of established reserves means that we are uncertain as to our ability to continue to generate revenue from our operations. We have not to date and we may never complete a feasibility study on any of other properties and any identified deposit may never qualify as a commercially mineable (or viable) reserve. We will continue to attempt to acquire the surface and mineral rights on lands that we think are geologically favorable or where we have historical information in our possession that indicates uranium mineralization might be present.

The exploration and, if warranted, development of mineral deposits involves significant financial and other risks over an extended period of time, which even a combination of careful evaluation, experience and knowledge may not eliminate. Few properties which are explored are ultimately developed into producing mines. Major expenditures are required to establish reserves by drilling and to construct mining and processing facilities at a site. Our uranium properties are all at the exploration stage and do not contain any reserves at this time. It is impossible to ensure that the current or proposed exploration programs on properties in which we have an interest will result in the delineation of mineral reserves or in profitable commercial operations. Our operations are subject to the hazards and risks normally incident to exploration and production of uranium, precious and base metals, any of which could result in damage to life or property, environmental damage and possible legal liability for such damage. While we may obtain insurance against certain risks, the nature of these risks is such that liabilities could exceed policy limits or could be excluded from coverage. There are also risks against which we cannot insure or against which we may elect not to insure. The potential costs which could be associated with any liabilities not covered by insurance, or in excess of insurance coverage, or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, adversely affecting our future earnings and competitive position and, potentially our financial viability.

We have losses which may continue into the future. As a result, we may have to suspend or cease exploration activities.

We were incorporated in 1999 and are engaged in the business of mineral exploration. We have incurred losses since inception. We have a relatively limited exploration history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

- our ability to locate a profitable mineral property;

- our ability to obtain favorable prices for the uranium we extract;

- our ability to continue to generate revenues; and

- our ability to control costs.

Based upon current plans and markets, we expect to incur operating losses in future periods. This will happen because of low market prices for uranium and there are expenses associated with the exploration and exploitation of our mineral properties plus processing costs to produce saleable uranium. We cannot guarantee we will be successful in continuing to generate revenues in the future. Failure to continue to generate revenues and positive cash flows may cause us to suspend or cease our exploration activities.

Our past extraction operations are limited and may not be indicative of our future extraction results.

While we began extraction activities in 2014 and have started to receive revenues from extraction operations, our results to date are limited. We may encounter issues in the future that results in our extraction activities varying from our past results. These risks include unanticipated variances in the uranium mineralization at our projects, unexpected mechanical and system failures with our in situ extraction operations, including failures with drill holes, water lines, pumps and processing facilities, unexpected shortages in necessary operating materials or equipment, accidents, power outages, water shortages, unexpected issues with obtaining and maintaining our operating permits and other required licenses, labor and employment issues, changes in government regulations and other unanticipated issues which could cause our results to vary in the future. If our extraction operations are not successful in the future, we may have to cease such operations, which would eliminate our revenue generating activities and potentially cause us to reduce or stop our extraction activities.

Because some of our officers and directors do not have technical training or experience in exploring for, starting, and operating a mine, we may have to hire qualified personnel. If we can’t locate qualified personnel, we may have to suspend or cease exploration activity.

Some, but not all, of our officers and directors have experience with exploring for, starting, and operating a mine. Because some of our officers and directors are inexperienced with exploring for, starting, and operating a mine, we may have to hire qualified persons to perform surveying, exploration, and water management of our properties. Some of our officers and directors have no direct training or experience in these areas and as a result may not be fully aware of many of the specific requirements related to working within the industry. Their decisions and choices would typically take into account standard engineering or managerial approaches mineral exploration companies commonly use. However, our exploration activities, earnings and ultimate financial success could suffer irreparable harm due to certain of management’s decisions. As a result we may have to suspend or cease exploration activities, or any future warranted activities.

Our future profitability will be dependent on uranium prices.

Since our revenues are expected to be derived from the sale of uranium, our net earnings, if any, can be affected by the long- and short-term market price of yellowcake (U3O8). Uranium prices are subject to fluctuation. The price of uranium has been and will continue to be affected by numerous factors beyond our control. With respect to uranium, such factors include the demand for nuclear power, political and economic conditions in uranium producing and consuming countries, uranium supply from secondary sources, uranium production levels and costs of production. Spot prices for U3O8 were at $20.00 per pound U3O8 in December 2004, and then increased to $35.25 per pound in December 2005 and $72.00 per pound in December 2006. During 2007 the spot price reached a high of $138.00 per pound. The spot price of U3O8 was approximately $90.00 per pound in December 2007. The spot price declined during 2008, reaching a low of $44.00 per pound in October. In 2009, the spot price of U3O8 had a high of $51.50 and a low of $42.00. In 2010, the spot price had a high of $62.50 and a low of $40.75. In 2011, the spot price had a high of $74.00 and a low of $48.00. In 2012, the spot price had a high of $52.50 and a low of $40.75. In 2013, the spot price reached a high of $44.00 and a low of $34.00. In 2014, the spot price had a high of $40.00 and a low of $28.00. The spot price of U3O8 was approximately $35.75 per pound and the long term price was approximately $49.50 per pound at the end of December 2014.

Public acceptance of nuclear energy is uncertain.

The demand for uranium as a source of energy and growth in that demand is dependent on society’s acceptance of nuclear technology as a means of generating electricity. A major incident at a nuclear power plant anywhere in the world, such as that which occurred at Japan’s Fukushima Daiichi nuclear power station in March of 2011 following a major earthquake and tsunami, or an accident relating to the transportation of new or spent nuclear fuel, could negatively impact the continuing public acceptance of nuclear energy and the future prospects for nuclear power generation, which may have a material adverse effect on the nuclear industry and the results of our operations and revenues.

Our operations are subject to environmental regulation and environmental risks.

We are required to comply with applicable environmental protection laws and regulations and permitting requirements, and we anticipate that we will be required to continue to do so in the future. The material laws and regulations within the U.S. that we must comply with are the National Environmental Protection Act (“NEPA”), Atomic Energy Act, Uranium Mill Tailings Radiation Control Act of 1978 (“UMTRCA”), Clean Air Act, Clean Water Act, Safe Drinking Water Act, Federal Land Policy Management Act, National Park System Mining Regulations Act, and the State Mined Land Reclamation Acts or State Department of Environmental Quality regulations, as applicable. We are required to comply with the Atomic Energy Act, as amended by UMTRCA, by applying for and maintaining a Source Material license from the US Nuclear Regulatory Commission. Uranium operations must conform to the terms of such license, which include provisions for protection of human health and the environment from endangerment due to radioactive materials. The license encompasses protective measures consistent with the Clean Air Act and the Clean Water Act. We intend to utilize specific employees and consultants in order to comply with and maintain our compliance with the above laws and regulations.

The uranium industry is subject not only to the worker health and safety and environmental risks associated with all mining businesses, but also to additional risks uniquely associated with uranium mining and processing. The possibility of more stringent regulations exists in the areas of worker health and safety, the disposition of wastes, the decommissioning and reclamation of exploration and in-situ recovery mining sites, and other environmental matters, each of which could have a material adverse effect on the costs or the viability of a particular project. We cannot predict what environmental legislation, regulation or policy will be enacted or adopted in the future or how future laws and regulations will be administered or interpreted. The recent trend in environmental legislation and regulation, generally, is toward stricter standards and this trend is likely to continue in the future. This recent trend includes, without limitation, laws and regulations relating to air and water quality, mine reclamation, waste handling and disposal, the protection of certain species and the preservation of certain lands. These regulations may require the acquisition of permits or other authorizations for certain activities. These laws and regulations may also limit or prohibit activities on certain lands. Compliance with more stringent laws and regulations, as well as potentially more vigorous enforcement policies or stricter interpretation of existing laws, may necessitate significant capital outlays, may materially affect our results of operations and business, or may cause material changes or delays in our intended activities.

Our operations may require additional analysis in the future including environmental and social impact and other related studies. Certain activities require the submission and approval of environmental impact assessments. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers, and employees. There can be no assurance that we will be able to obtain or maintain all necessary permits that may be required to continue operations or exploration of properties or, if feasible, to commence construction and operation of mining facilities at such properties at economically justifiable costs.

We intend to extract uranium from our properties using the in-situ recovery mining process which may not be successful.

We intend to extract uranium from our properties using in-situ recovery mining, which is suitable for extraction of certain types of uranium deposits. This process requires in-situ recovery mining equipment and trained personnel. Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, and certain equipment such as drilling rigs and other equipment that we might need to conduct exploration and, if warranted, development. We will attempt to locate additional products, equipment and materials as needed. If we cannot find the products and equipment we need, we will have to suspend our exploration and, if warranted, development plans until we do find the products and equipment we need.

We face risks related to exploration and mine construction, if warranted, on our properties.

Our level of profitability, if any, in future years will depend to a great degree on uranium prices and whether any of our exploration stage properties can be brought into production. The exploration for and development of mineral deposits involves significant risks. It is impossible to ensure that the current and future exploration programs and/or feasibility studies on our existing properties will establish reserves. Whether a uranium ore body will be commercially viable depends on a number of factors, including, but not limited to: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; uranium prices, which cannot be predicted and which have been highly volatile in the past; mining, processing and transportation costs; perceived levels of political risk and the willingness of lenders and investors to provide project financing; labor costs and possible labor strikes; and governmental regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting materials, foreign exchange, environmental protection, employment, worker safety, transportation, and reclamation and closure obligations.

We are subject to the risks normally encountered in the mining industry, such as:

- the discovery of unusual or unexpected geological formations;

- accidental fires, floods, earthquakes, volcanic eruptions, and other natural disasters;

- unplanned power outages and water shortages;

- controlling water and other similar mining hazards;

- operating labor disruptions and labor disputes;

- the ability to obtain suitable or adequate machinery, equipment, or labor;

- our liability for pollution or other hazards; and

- other known and unknown risks involved in the conduct of exploration, the operation of mines and the market for uranium.

The development of mineral properties is affected by many factors, including, but not limited to: the cost of operations; variations in the grade of ore; fluctuations in metal markets; costs of extraction and processing equipment; availability of equipment and labor; labor costs and possible labor strikes; government regulations, including without limitation, regulations relating to taxes, royalties, allowable production, importing and exporting of minerals; foreign exchange; employment; worker safety; transportation; and environmental protection. Depending on the price of uranium, we may determine that it is impractical to continue operation of our Nichols Ranch project. Such a decision would negatively affect our results of operations and our financial condition.

Because we may be unable to meet property payment obligations or be unable to acquire or maintain necessary mining licenses and leases, we may lose interests in our exploration properties.

The agreements pursuant to which we acquired our interests in some of our properties provide that we must make a series of cash payments over certain time periods, expend certain minimum amounts on the exploration of the properties or contribute our share of ongoing expenditures. If we fail to make such payments or expenditures in a timely fashion, we may lose our interest in those properties. Further, even if we do complete exploration activities, we may not be able to obtain the necessary licenses to conduct extraction operations on the properties, and thus would realize no benefit from our exploration activities on the properties. In addition, there is no assurance that we will be able to hold or maintain ownership of all our property rights and, if not, the area for us to explore and conduct extraction activities could be reduced.

Our mineral properties may be subject to defects in title.

We own, lease, or have under option, mining claims, mineral claims or concessions and fee mineral leases which constitute our property holdings. The ownership and validity or title of unpatented mining claims and concessions are often uncertain and may be contested. We also may not have, or may not be able to obtain, all necessary surface rights to develop a property. We have not conducted title research in relation to many of our mining claims and concessions to ensure clean title. We cannot guarantee that title to our properties will not be challenged. Title insurance is generally not available for mineral properties and our ability to ensure that we have obtained secure claim to individual mineral properties or mining concessions may be severely constrained. Our mineral properties may be subject to prior unregistered agreements, transfers or claims, and title may be affected by, among other things, undetected defects. We may incur significant costs related to defending the title to our properties. A successful claim contesting our title to a property may cause us to compensate other persons or perhaps reduce our interest in the affected property or lose our rights to explore and, if warranted, develop that property. This could result in us not being compensated for our prior expenditures relating to the property. Also, in any such case, the investigation and resolution of title issues would divert our management's time from ongoing exploration and, if warranted, development programs.

Because we may be unable to secure access rights, we may be unable to explore and/or develop our properties.

Our mineral rights do not always include rights of access or use of the surface of lands. We require agreements with land owners for these rights which may be difficult to obtain and which may require cash payments.

Because mineral exploration and mine construction activities are inherently risky, we may be exposed to environmental liabilities.