Attached files

CONSTRUCTION LOAN AGREEMENT

This CONSTRUCTION LOAN AGREEMENT (this “Agreement”) is made and entered into as of the *___ day of January, 2015, by and between BARTON CREEK TECOMA I, L.L.C., a Texas limited liability company (“Borrower”), whose address is c/o Stratus Properties Inc., 212 Lavaca Boulevard, Suite 300, Austin, Texas 78701, and COMERICA BANK (“Lender”), whose address is 300 W. Sixth Street, Suite 2250, Austin, Texas 78701, Attn: Commercial Real Estate.

ARTICLE I

DEFINITION OF TERMS

1.1Definitions. As used in this Agreement, the following terms shall have the respective meanings indicated below:

Advance: A disbursement by Lender, whether by journal entry, deposit to Borrower’s account, check to third party or otherwise of any of the proceeds of the Loan, any insurance proceeds or Borrower’s Deposit.

Affidavit of Commencement: As defined in Section 5.13 hereof.

Affidavit of Completion: As defined in Section 5.14 hereof.

Agreement: This Construction Loan Agreement, as the same may from time to time be amended or supplemented.

Allocations: The line items set forth in the Budget for which Advances of Loan proceeds will be made.

Anti-Terrorism Laws: means any and all present and future judicial decisions, statutes, rulings, rules, regulations, permits, certificates, orders, and ordinances of any Governmental Authority relating to terrorism or money laundering, including, without limiting the generality of the foregoing, the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (Pub. L. No. 107-56); the Trading with the Enemy Act (50 U.S.C.A. App. 1 et seq.); the International Emergency Economic Powers Act (50 U.S.C.A. § 1701-06); Executive Order No. 13224 on Terrorist Financing, effective September 24, 2001 (relating to “Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism”) and the United States Treasury Department’s Office of Foreign Assets Control list of “Specifically Designated National and Blocked Persons” (as published from time to time in various mediums, including, without limitation, at http:www.treas.gov/ofac/t11sdn.pdf).

Appraisal means a written appraisal of the Mortgaged Property (including without limitation, the Improvements) prepared in conformance with the requirements of the Comptroller of the Currency, prepared by an appraiser designated by Lender in Lender’s sole discretion, and subject to review and adjustment consistent with Lender’s standard practices, and approved by Lender.

CONSTRUCTION LOAN AGREEMENT - Page 1

Assignment of Leases: The Assignment of Rents and Leases assigning to Lender Borrower’s interest in all leases entered into for the Mortgaged Property and all rents and other rights and benefits to which Borrower is entitled under the terms of such leases.

Borrower’s Deposit: Such cash amounts as Lender may deem necessary for Borrower to deposit with it in accordance with the provisions of Section 3.4 of this Agreement.

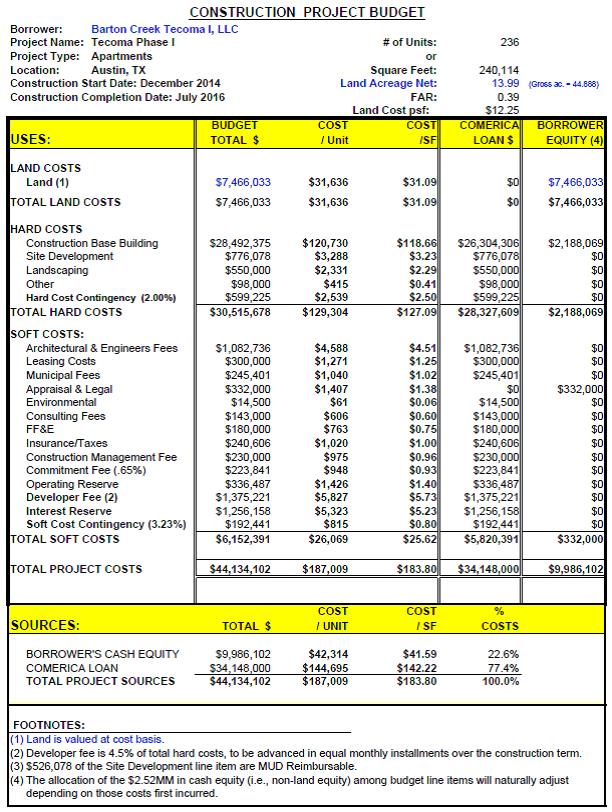

Budget: The budget which is set forth on Exhibit B attached hereto and incorporated herein by reference.

Business Day: means a weekday, Monday through Friday, except a legal holiday or a day on which banking institutions in Austin, Texas are authorized or required by law to be closed.

Charges: All fees, charges and/or other things of value, if any, contracted for, charged, received, taken or reserved by Lender in connection with the transactions relating to the Note and the other Loan Documents, which are treated as interest under applicable law.

Commencement Date: January *____, 2015.

Commitment Fee: The sum of $221,962.00 to be paid by Borrower to Lender in connection with the Loan.

Completion Date: December 31, 2016.

Construction Contract: Collectively, all contracts and agreements entered into between Borrower and Contractor pertaining to the development, construction and completion of the Improvements.

Construction Management Agreement: Collectively, all contracts and agreements entered into between Borrower (or its predecessor in interest) and Construction Manager pertaining to the development, construction and completion of the Improvements.

Construction Manager: JPB Properties Corporation, together with any other Person acceptable to Lender with whom Borrower contracts for the development, construction and completion of the Improvements or any portion thereof.

Contractor: Hinton Construction Company, Inc., together with any other Person acceptable to Lender with whom Borrower contracts for the development, construction and completion of the Improvements or any portion thereof.

Debt Service: - The product of (i) the constant monthly payment amount (i.e., payment including both principal and interest) sufficient to fully amortize (using mortgage amortization) the outstanding principal balance of the Loan plus any amounts remaining to be funded under the Loan at the time of determination in equal installments over a thirty (30) year period using an annual interest rate equal to the greatest of (a) the interest rate then in effect under the Note, (b) the then current 10-year U.S. Treasury Rate plus two percent (2.0%), or (c) six and one-half percent (6.5%), multiplied by (ii) twelve (12).

CONSTRUCTION LOAN AGREEMENT - Page 2

Debt Service Coverage Ratio: - A ratio, as determined by Lender, the first number of which is the Net Operating Income for the trailing three (3) month period as of the date of determination of the Debt Service Coverage Ratio and annualized, and the second of which is Debt Service.

Debt Yield Ratio: - The ratio expressed as a percentage, of (a) Net Operating Income as determined by Lender as of the applicable Determination Date, to (b) the outstanding balance of the Loan as of such Determination Date.

Deed of Trust: The Deed of Trust, Security Agreement and Fixture Filing dated of even date herewith pursuant to which Borrower grants a lien and security interest in and to the Mortgaged Property for the benefit of Lender to secure the Loan.

Design Professional: Stephen L. Gele Architect, Inc. and LJA Engineering, Inc., together with any other Person acceptable to Lender with whom Borrower contracts for the providing of planning, design, architectural, engineering or other similar services relating to the Improvements.

Design Services Contract: Collectively, all contracts and agreements entered into between Borrower and each Design Professional pertaining to the design, development and construction of the Improvements.

Determination Date:- The date the Debt Service Coverage Ratio is calculated for purposes of this Agreement and the other Loan Documents, and for the purposes of determining whether Borrower satisfies the conditions to an Extension Period, the Determination Date shall be the last day of the most recent calendar month ending at least thirty (30) days prior to the commencement of the Extension Period in question.

Disposition: Any sale, lease (except as expressly permitted pursuant to the Loan Documents), exchange, assignment, conveyance, transfer, trade, or other disposition of all or any portion of the Mortgaged Property (or any interest therein) or all or any part, directly or indirectly, of the beneficial ownership interest in Borrower (if Borrower is a corporation, limited liability company, partnership, general partnership, limited partnership, joint venture, trust, or other type of business association or legal entity); provided, however, a sale of the publicly traded stock of Stratus Properties Inc. shall not constitute a Disposition under the terms of this Agreement.

Draw Request: A request by Borrower to Lender for an Advance in such form and containing such information as Lender may reasonably require.

Environmental Indemnity Agreement: That certain Environmental Indemnity Agreement of even date herewith by Borrower and Guarantor, collectively as Indemnitor, in favor of Lender.

Environmental Law: Any federal, state, or local law, statute, ordinance, or regulation, whether now or hereafter in effect, pertaining to health, industrial hygiene, or the environmental conditions on, under, or about the Land or Improvements, including the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (“CERCLA”), 42 U.S.C. § 9601 et seq.; Resource, Conservation and Recovery Act (“RCRA”), 42 U.S.C. § 6901 et seq.

CONSTRUCTION LOAN AGREEMENT - Page 3

as amended by the Superfund Amendments and Reauthorization Act of 1986 (“SARA”), Pub. L. 99‑499, 100 Stat. 1613; the Toxic Substances Control Act, 15 U.S.C. § 2601 et seq.; Emergency Planning and Community Right to Know Act of 1986, 42 U.S.C. § 1101 et seq.; Clean Water Act (“CWA”), 33 U.S.C. § 1251 et seq.; Clean Air Act (“CAA”), 42 U.S.C. § 7401 et seq.; Federal Water Pollution Control Act (“FWPCA”), 33 U.S.C. § 1251 et seq.; and any corresponding state laws or ordinances including the Texas Water Code (“TWC”) § 26.001 et seq.; Texas Health & Safety Code (“THSC”) § 361.001 et seq.; Texas Solid Waste Disposal Act, Tex. Rev. Civ. Stat. Ann. art. 4477‑7; and regulations, rules, guidelines, or standards promulgated pursuant to such laws, statutes and regulations.

Event of Default: Any happening or occurrence described in Section 7.1 of this Agreement.

Extension Fee means cash in an amount equal to one-fourth of one percent (.25%) of the then outstanding principal balance of the Loan.

Extension Period: Means the First Extension Period or the Second Extension Period, as the case may be.

Financing Statement: The financing statement or financing statements (on Standard Form UCC‑1 or otherwise) covering Borrower’s personal property, as debtor, and naming Lender, as secured party, in connection with the Loan Documents.

First Extended Maturity Date: January *___, 2019.

First Extension Period means a single period of one (1) year commencing on the first (1st) day after the Initial Maturity Date.

Governmental Authority: Any and all courts, boards, agencies, commissions, offices, or authorities of any nature whatsoever for any governmental unit (federal, state, county, district, municipal, city or otherwise), whether now or hereafter in existence.

Governmental Requirements: All present and future statutes, laws, ordinances, rules, regulations, orders, writs, injunctions or decrees of any Governmental Authority applicable to Borrower, Guarantor or the Mortgaged Property.

Guarantor: Stratus Properties Inc., a Delaware corporation.

Guaranty: That or those instruments of guaranty now or hereafter in effect from Guarantor to Lender guaranteeing the repayment of all or any part of the Loan, the satisfaction of, or continued compliance with, the covenants contained in the Loan Documents, or both.

Hazardous Substance: Any substance, product, waste, or other material which is or becomes listed, regulated, or addressed as being a toxic, hazardous, polluting, or similarly harmful substance under any Environmental Law, including without limitation: (i) any substance included within the definition of “hazardous waste” pursuant to Section 1004 of RCRA; (ii) any substance included within the definition of “hazardous substance” pursuant to Section 101 of CERCLA; (iii) any substance included within (a) the definition of “regulated

CONSTRUCTION LOAN AGREEMENT - Page 4

substance” pursuant to Section 26.342(11) of TWC; or (b) the definition of “hazardous substance” pursuant to Section 361.003(11) of THSC; (iv) asbestos; (v) polychlorinated biphenyls; (vi) petroleum products; (vii) underground storage tanks, whether empty, filled or partially filled with any substance; (viii) any radioactive materials, urea formaldehyde foam insulation or radon; (ix) any substance included within the definition of “waste” pursuant to Section 30.003(b) of TWC or “pollutant” pursuant to Section 26.001(13) of TWC; and (x) any other chemical, material or substance, the exposure to which is prohibited, limited or regulated by any Governmental Authority on the basis that such chemical, material or substance is toxic, hazardous or harmful to human health or the environment.

Improvements: A 236-unit garden-style multifamily residential development, together with all other amenities, to be constructed on the Land, all as more particularly described in the Plans and Specifications.

Indebtedness: As defined in the Deed of Trust.

Initial Advance: The first Advance to be made at the time Borrower satisfies the conditions set forth in Sections 3.1 and 3.2 of this Agreement.

Initial Maturity Date means the date that is thirty-six (36) months from the date of this Agreement, being January *___, 2018.

Inspecting Person: A representative of CD Construction Consulting or another inspecting architect engaged by Lender who will, from time to time, inspect the Improvements for the benefit of Lender.

Land: The real property or interest therein described in Exhibit A attached hereto and incorporated herein by this reference upon which the Improvements are to be constructed.

Loan: The loan evidenced by the Note and governed by this Agreement.

Loan Amount: Up to a maximum amount of THIRTY-FOUR MILLION ONE HUNDRED FORTY-EIGHT THOUSAND AND NO/100 DOLLARS ($34,148,000.00).

Loan Documents: The Note, the Deed of Trust, this Agreement, the Financing Statement, the Guaranty, the Assignment of Leases, the Environmental Indemnity Agreement and any and all other documents now or hereafter executed by the Borrower, Guarantor, or any other Person in connection with the Loan, the indebtedness evidenced by the Note, or the covenants contained in this Agreement.

Loan Party: Borrower, Guarantor and any other Person obligated for the payment and performance of any of the Indebtedness and/or Obligations.

Management Agreement means the written agreement between Borrower and Manager pursuant to which Manager shall manage the Mortgaged Property and which shall be subject to the prior approval of Lender.

CONSTRUCTION LOAN AGREEMENT - Page 5

Manager means the initial property manager selected by Borrower and approved by Lender, together with any other Person with whom Borrower contracts for the management of the Mortgaged Property.

Material Adverse Effect: Any material and adverse effect on (i) the business condition (financial or otherwise), operations, prospects, results of operations, capitalization, liquidity or any properties of the Borrower or Guarantor, taken as a whole, (ii) the value of the Mortgaged Property, (iii) the ability of Borrower or any Guarantor (or if the Borrower or any Guarantor is a partnership, joint venture, trust or other type of business association, of any of the parties comprising Borrower or such Guarantor) to pay and perform the Indebtedness or any other Obligations, or (iv) the validity, enforceability or binding effect of any of the Loan Documents.

Maturity Date means the Initial Maturity Date, as may be extended to the First Extended Maturity Date and the Second Extended Maturity Date pursuant to the First Extension Period and/or the Second Extension Period, respectively, on the terms and conditions set forth in Sections 2.8 and 2.9 hereof, subject, however, to the right of acceleration as herein provided and as provided elsewhere in the Loan Documents.

Maximum Lawful Rate: The maximum lawful rate of interest which may be contracted for, charged, taken, received or reserved by Lender in accordance with the applicable laws of the State of Texas (or applicable United States federal law to the extent that it permits Beneficiary to contract for, charge, take, receive or reserve a greater amount of interest than under Texas law), taking into account all Charges (as herein defined) made in connection with the transaction evidenced by the Note and the other Loan Documents. To the extent that Lender is relying on Chapter 303 of the Texas Finance Code to determine the Maximum Lawful Rate payable on the Note and/or any other portion of the Indebtedness, Lender will utilize the weekly ceiling from time to time in effect as provided in such Chapter 303. To the extent United States federal law permits Lender to contract for, charge, take, receive or reserve a greater amount of interest than under Texas law, Lender will rely on United States federal law instead of such Chapter 303 for the purpose of determining the Maximum Lawful Rate. Additionally, to the extent permitted by applicable law now or hereafter in effect, Lender may, at its option and from time to time, utilize any other method of establishing the Maximum Lawful Rate under such Chapter 303 or under other applicable law by giving notice, if required, to Borrower as provided by applicable law.

Monthly Principal Installment: As defined in Section 2.8 of this Agreement.

Mortgaged Property: Collectively, the Land, the Improvements, and all other collateral covered by the Loan Documents.

Net Operating Income: means, as of any Determination Date, for the applicable period, the Operating Revenues actually received by Borrower from the operation of the Mortgaged Property for the period in question, less Operating Expenses incurred with respect to the Mortgaged Property for such period. Documentation of Net Operating Income shall be certified by an officer of Borrower with detail reasonably satisfactory to Lender and shall be subject to the approval of Lender, which approval shall not be unreasonably withheld.

CONSTRUCTION LOAN AGREEMENT - Page 6

Note: The Promissory Note dated as of even date herewith in the principal sum of the Loan Amount (together with all renewals and extensions thereof) executed and delivered by Borrower payable to the order of Lender, evidencing the Loan.

Obligations: Any and all of the covenants, conditions, warranties, representations, and other obligations (other than to repay the Indebtedness) made or undertaken by Borrower, Guarantor, or any other Person a party to the Loan Documents to Lender, the trustee of the Deed of Trust, or others as set forth in the Loan Documents, and in any deed, lease, sublease, or other form of conveyance, or any other agreement pursuant to which Borrower is granted a possessory interest in the Land.

Operating Expenses: - means, as of any Determination Date, the greater of (i) pro forma expenses for the Mortgaged Property as assumed in the Appraisal obtained by Lender in connection with making the Loan and (ii) for the prior three (3) month period immediately prior to the Determination Date, which sum shall then be annualized, all actual operating expenses of the Mortgaged Property for the period in question, including, without limitation, (a) ad valorem real estate taxes and assessments (on an accrual basis, based on the best information then available and approved by Lender); (b) insurance premiums (on an accrual basis, based on the best information then available and approved by Lender); and (c) operating expenses actually incurred by Borrower for the management, operation, cleaning, marketing, maintenance and repair of the Mortgaged Property, including (1) the greater of actual management fees or an assumed annual management fee of four percent (4.0%) of Operating Revenues, and (2) a replacement reserve equal to the greater of (x) actual reserves, or (y) $250 per unit. Operating Expenses for this purpose shall exclude (1) any capital expenditures; (2) any payment or expense to which the Borrower was or is to be reimbursed for costs from proceeds of the Loan, insurance, eminent domain, or any source other than Operating Revenues and (3) and any regularly scheduled payments of principal or interest due and owing under the Loan Documents. Operating Expenses shall not include any non-cash expense item such as depreciation or amortization, as such terms are used for accounting or federal income tax purposes.

Operating Revenues: - means, as of any Determination Date, for the prior three (3) month period immediately prior to the Determination Date, which sum shall then be annualized, the recurring gross income actually received by Borrower from the operation of the Mortgaged Property for the period in question, net of any concessions and further excluding (1) security deposits until and unless forfeited by the depositor; (2) any payment to Borrower from the proceeds of the Loan, insurance (other than proceeds of business interruption insurance, which shall be included to the extent such business interruption insurance proceeds are actually received by Borrower) or any other source other than Operating Revenues for reimbursement of costs; (3) advances or loans to Borrower from any partners of Borrower; and (4) other non-recurring income.

Partial Release has the meaning set forth in Section 2.10 of this Agreement.

Patriot Act: means the USA Patriot Act Title III of Pub. L. 107-56 (signed into law October 26, 2001), as amended.

CONSTRUCTION LOAN AGREEMENT - Page 7

Person: means any individual, corporation, partnership (general or limited), joint venture, limited liability company, association, trust, unincorporated association, joint stock company, government, municipality, political subdivision, agency, or other entity.

Plans and Specifications: The plans and specifications for the development and construction of the Improvements, prepared by Borrower or the Design Professional and approved by Lender as required herein, by all applicable Governmental Authorities, by any party to a purchase or construction contract with a right of approval, all amendments and modifications thereof approved in writing by the same, and all other design, engineering or architectural work, test reports, surveys, shop drawings, and related items.

Second Extended Maturity Date means January *___, 2020.

Second Extension Period means a single period of one (1) year commencing on first day immediately following the First Extension Maturity Date.

Soft Costs: All architectural, engineering, interior and landscape design, legal, consulting and other related fees, taxes on land and improvements, bond and insurance costs, and commitment fees, interest and other financing charges, all as set forth in the Budget.

Special Account: An account established by Borrower with Lender (in which Borrower shall at all times maintain a minimum balance of $1,000.00) into which all Advances made directly to Borrower will be deposited.

Subordinate Mortgage: Any mortgage, deed of trust, pledge, lien (statutory, constitutional, or contractual), security interest, encumbrance or charge, or conditional sale or other title retention agreement, covering all or any portion of the Mortgaged Property executed and delivered by Borrower, the lien of which is subordinate and inferior to the lien of the Deed of Trust.

Title Insurance: A Loan Policy of Title Insurance issued by the Title Company, on a coinsurance or reinsurance basis (with direct access endorsement or rights) if and as required by Lender, in the maximum amount of the Loan insuring or committing to insure that the Deed of Trust constitutes a valid first lien covering the Land and the Improvements, subject only to those exceptions which Lender may approve.

Title Company: The Title Company (and its issuing agent, if applicable) issuing the Title Insurance, which shall be acceptable to Lender in its sole and absolute discretion.

Treasury Rate: means the latest Treasury Constant Maturity Series yields reported, for the latest day for which such yields shall have been so reported as of the applicable Business Day, in Federal Reserve Statistical Release H.15 (519) (or any comparable successor publication) for actively traded U.S. Treasury securities having a constant maturity equal to ten (10) years. Such implied yield shall be determined, if necessary, by (i) converting U.S. Treasury bill quotations to bond-equivalent yields in accordance with accepted financial practice, and (ii) interpolating linearly between reported yields.

CONSTRUCTION LOAN AGREEMENT - Page 8

ARTICLE II

THE LOAN

2.1Agreement to Lend. Lender hereby agrees to lend up to but not in excess of the Loan Amount to Borrower, and Borrower hereby agrees to borrow such sum from Lender, all upon and subject to the terms and provisions of this Agreement, such sum to be evidenced by the Note. No principal amount repaid by Borrower may be reborrowed by Borrower. Borrower’s liability for repayment of the interest on account of the Loan shall be limited to and calculated with respect to Loan proceeds actually disbursed to Borrower pursuant to the terms of this Agreement and the Note and only from the date or dates of such disbursements. After notice to Borrower, Lender may, in Lender’s sole discretion, disburse Loan proceeds by journal entry to pay interest and financing costs and, following an uncured Event of Default, disburse Loan proceeds directly to third parties to pay costs or expenses required to be paid by Borrower pursuant to this Agreement. Loan proceeds disbursed by Lender by journal entry to pay interest or financing costs, and Loan proceeds disbursed directly by Lender to pay costs or expenses required to be paid by Borrower pursuant to this Agreement, shall constitute Advances to Borrower.

2.2Advances. The purposes for which Loan proceeds are allocated and the respective amounts of such Allocations are set forth in the Budget, which Advances shall be limited to the value of the work in place as determined by the Inspecting Person.

2.3Allocations. The Allocations shall be disbursed only for the purposes set forth in the Budget. Lender shall not be obligated to make an Advance for an Allocation set forth in the Budget to the extent that the amount of the Advance for such Allocation would, when added to all prior Advances for such Allocation, exceed the total of such Allocation as set forth in the Budget.

2.4Limitation on Advances. To the extent that Loan proceeds disbursed by Lender pursuant to the Allocations are insufficient to pay all costs required for the acquisition, development, construction and completion of the Mortgaged Property, or to the extent that Loan proceeds available to be disbursed by Lender pursuant to the Allocations are insufficient to pay all remaining costs required for the completion of the Mortgaged Property, Borrower shall pay such excess costs with funds derived from sources other than the Loan prior to any further Advances of the Loan.

2.5Reallocations. Lender reserves the right, at its option, to disburse Loan proceeds allocated to any of the Allocations for such other purposes or in such different proportions as Lender may, in its sole discretion, deem necessary or advisable. Borrower shall not be entitled to require that Lender reallocate funds among the Allocations.

2.6Contingency Allocations. Any amount allocated in the Budget for “contingencies” or other non‑specific purposes may, in the Lender’s discretion after request by Borrower, or upon Lender’s own election at any time during the existence of an Event of Default, be disbursed by Lender to pay future contingent costs and expenses of constructing, maintaining, leasing and promoting the Mortgaged Property and such other costs or expenses as Lender shall approve. Under no circumstances shall the Borrower have the right to require

CONSTRUCTION LOAN AGREEMENT - Page 9

Lender to disburse any amounts so allocated and Lender may impose such requirements and conditions as it deems prudent and necessary should it elect to disburse all or any portion of the amounts so allocated.

2.7Withholding. Lender may withhold from an Advance or, on account of subsequently discovered evidence, withhold from a later Advance under this Agreement or require Borrower to repay to Lender the whole or any part of any earlier Advance to such extent as may be necessary to protect the Lender from loss on account of (i) defective work not remedied or requirements of this Agreement not performed, (ii) liens filed or reasonable evidence indicating probable filing of liens which are not bonded, (iii) failure of Borrower to make payments to the Contractor for material or labor, except as is permitted by the Construction Contract, or (iv) a reasonable doubt that the construction of the Improvements can be completed for the balance of the Loan Amount then undisbursed. When all such grounds are removed, payment shall be made of any amount so withheld because of them.

2.8First Extension Period. Provided the following conditions precedent shall have been satisfied, then Borrower shall be entitled (the “First Extension Option”) to extend the Initial Maturity Date to the First Extended Maturity Date, subject to the satisfaction of the terms and conditions set forth in this Section. The First Extension Option shall be granted to Borrower only if all of the following conditions have been simultaneously satisfied in each instance:

a.Written notice of such extension shall be given by Borrower to Lender no sooner than ninety (90) days prior to the Initial Maturity Date and not later than thirty (30) days prior to the Initial Maturity Date; and, with such notice, Borrower shall pay to the Lender, the Extension Fee;

b.The Improvements shall have been completed in substantial accordance with the Plans and Specifications and within the Budget, and a final certificate of occupancy shall have been issued for the Improvements;

c.No Event of Default, or any event, circumstance or action of which the Borrower is aware (by notice from Lender or otherwise) and with the passage of time or failure to cure would give rise to an Event of Default, has occurred and is then existing as of the Initial Maturity Date;

d.No event, claim, liability or circumstance shall have occurred which, in the Lender’s reasonable determination, could be expected to have or have had a Material Adverse Effect as of the Initial Maturity Date;

e.Written evidence shall be provided by Borrower and such evidence shall be reasonably satisfactory to the Lender indicating that the Debt Service Coverage Ratio then equals or exceeds 1.10:1.0 (calculated on the Determination Date immediately preceding the commencement of the First Extension Period); provided, Borrower shall have the right to prepay on or before the Initial Maturity Date, without premium, penalty or fee (other than any LIBOR Costs [as defined in the Note] actually incurred by Lender), the outstanding principal of the Loan in an amount sufficient to satisfy this condition, after giving effect to such prepayment;

CONSTRUCTION LOAN AGREEMENT - Page 10

f.Lender shall have received a new Appraisal or an updated Appraisal of the Mortgaged Property, at Borrower’s expense, dated within ninety (90) days of the Initial Maturity Date, prepared by an appraiser acceptable to Lender and based upon such standards as Lender may require, which Appraisal shall confirm that the fair market value of the Mortgaged Property on an “as is” basis is not less than the value of the Mortgaged Property set forth in the Appraisal of the Mortgaged Property accepted by Lender in connection with the closing of the Loan.

During the Extension Periods, no further Advances will be available from the Loan and the Loan Documents will be deemed to be automatically modified to reduce the total committed and available amount of the Loan from its original amount to the outstanding principal amount of the Loan as of the commencement of the First Extension Period. In addition, commencing on the first (1st) day of the first month after the commencement of the First Extension Period and continuing on the first (1st) day of each month thereafter until the First Extended Maturity Date, Borrower shall pay a monthly payment of principal (each a “Monthly Principal Installment”) in an amount equal to 1/24th of the total principal which would be payable during the first twenty-four (24) months of a 30 year mortgage-style amortization of the then outstanding principal balance of the Loan based on an interest rate of six and one-half percent (6.5%) per annum, which installments of principal shall be due and payable in addition to accrued interest due and payable under the Note on each such date.

2.9Second Extension Period. Provided the following conditions precedent shall have been satisfied, then Borrower shall be entitled (the “Second Extension Option”) to extend the First Extended Maturity Date to the Second Extended Maturity Date, subject to the satisfaction of the terms and conditions set forth in this Section. The Second Extension Option shall be granted to Borrower only if all of the following conditions have been simultaneously satisfied in each instance:

a.Borrower exercised the First Extension Option;

b.Written notice of such extension shall be given by Borrower to Lender no sooner than ninety (90) days prior to the First Extended Maturity Date and not later than thirty (30) days prior to the First Extended Maturity Date; and, with such notice, Borrower shall pay to the Lender, the Extension Fee (such Extension Fee being in addition to the Extension Fee paid in conjunction with Borrower’s exercise of the First Extension Option);

c.The Improvements shall have been completed in substantial accordance with the Plans and Specifications and within the Budget, and a final certificate of occupancy shall have been issued for all of the apartment units which are a part of the Improvements;

d.No Event of Default, or any event, circumstance or action of which the Borrower is aware (by notice from Lender or otherwise) and with the passage of time or failure to cure would give rise to an Event of Default, has occurred and is then existing as of the First Extended Maturity Date;

CONSTRUCTION LOAN AGREEMENT - Page 11

e.No event, claim, liability or circumstance shall have occurred which, in the Lender’s determination, could be expected to have or have had a Material Adverse Effect as of the First Extended Maturity Date;

f.Written evidence shall be provided by Borrower and such evidence shall be reasonably satisfactory to the Lender indicating that the Debt Service Coverage Ratio then equals or exceeds 1.20:1.0 (calculated on the Determination Date immediately preceding the commencement of the Second Extension Period); provided, Borrower shall have the right to prepay on or before the First Extended Maturity Date, without premium, penalty or fee (other than any LIBOR Costs actually incurred by Lender), the outstanding principal of the Loan in an amount sufficient to satisfy this condition, after giving effect to such prepayment;

g.Lender shall have received a new Appraisal or an updated Appraisal of the Mortgaged Property, at Borrower’s expense, dated within ninety (90) days of the First Extended Maturity Date, prepared by an appraiser acceptable to Lender and based upon such standards as Lender may require, which Appraisal shall confirm that the fair market value of the Mortgaged Property on an “as is” basis is not less than the value of the Mortgaged Property set forth in the Appraisal of the Mortgaged Property accepted by Lender in connection with the closing of the Loan.

Borrower shall continue to pay a monthly payment of principal equal to the Monthly Principal Installment on the first (1st) day of each month during the Second Extension Period, which installments of principal shall be due and payable in addition to accrued interest due and payable under the Note on each such date.

2.10Partial Release. Borrower may obtain, for no consideration or payment of any kind to Lender, other than reimbursement of Lender’s actual out-of-pocket costs and expenses, including, without limitation, reasonable third-party attorney’s fees and legal expenses, incurred by Lender in connection with the Partial Release, a release of a portion of the Land from the Deed of Trust (the “Partial Release”), consisting of approximately 4.322 acres on which the wastewater treatment facilities have been constructed, which parcel of land is generally depicted and more particularly described in Exhibit F attached hereto, the legal description of which shall be acceptable to Lender and verified by a proposed replat of the Land (the “Plat”) reasonably acceptable to Lender (the “Release Parcel”), upon satisfaction of the following conditions:

a.Lender’s receipt of a copy of a recorded Plat filed of record in the Real Property Records of Travis County, Texas.

b.At least ten (10) days prior to the date of such Partial Release, Borrower shall deliver to Lender at Borrower’s expense the form of the Partial Release to be executed by Lender (which form of Partial Release must be reasonably satisfactory to Lender in form and substance); and prior to or contemporaneously with the execution and delivery of the Partial Release, Borrower shall, at its sole cost and expense, obtain and deliver to Lender a T-38 endorsement to the Title Insurance, reasonably acceptable to Lender.

CONSTRUCTION LOAN AGREEMENT - Page 12

c.With respect to any portion of the Land not released (the “Unreleased Land”), the Partial Release shall not result in leaving any of the Unreleased Land without access to utilities or access to any public roads or right-of-way, and Lender shall be reasonably satisfied that there is adequate ingress, egress and utility service to and from the Unreleased Land and dedicated public roads or rights-of-way, and adequate detention facilities (if required by any Governmental Authority) on the Unreleased Land (or perpetual, non-terminable and insurable rights of ingress, egress, utility service and detention facilities, if required by any Governmental Authority for the benefit of the Unreleased Land), such that the remaining Unreleased Land is a separate, economically viable project and otherwise complies (and will comply after the Partial Release) with all Governmental Requirements.

d.Contemporaneously with the Partial Release, the Release Parcel shall be conveyed by Borrower to Travis County Municipal Utility District No. 4, and shall be restricted to use for only the waste water treatment facilities for the Mortgaged Property and other property served by such facilities.

e.Upon the recording of the Partial Release, Borrower shall, use good faith, diligent efforts to cause the Release Parcel to constitute a separate tax lot with a separate tax assessment, independent of the Unreleased Land, and shall in any event complete the foregoing no later than December 31, 2015.

ARTICLE III

ADVANCES

3.1Conditions to Initial Advance. The obligation of Lender to make the Initial Advance hereunder and the first Advance after the closing of the Loan is subject to the prior or simultaneous occurrence of each of the following conditions:

a.Lender shall have received from Borrower all of the Loan Documents duly executed by Borrower and, if applicable, by Guarantor.

b.Lender shall have received certified copies of resolutions of each Loan Party, if such Loan Party is a corporation or limited liability company, or a certified copy of a consent of partners, if such Loan Party is a partnership, authorizing execution, delivery and performance of all of the Loan Documents and authorizing the borrowing hereunder and any guaranties executed in connection with the Loan, along with such certificates of existence, certificates of good standing and other certificates or documents as Lender may reasonably require to evidence such Loan Party’s authority.

c.Lender shall have received true copies of all organization documents of each Loan Party, including all amendments or supplements thereto, along with such certificates or other documents as Lender may reasonably require to evidence such Loan Party’s authority.

d.Lender shall have received evidence that the Mortgaged Property is not located within any designated flood plain or special flood hazard area; or evidence that

CONSTRUCTION LOAN AGREEMENT - Page 13

Borrower has applied for and received flood insurance covering the Mortgaged Property in the amount of the Loan or the maximum coverage available to Lender.

e.Lender shall have received evidence of compliance with all Governmental Requirements.

f.Lender shall have received a full‑size, single sheet copy of all recorded subdivision or plat maps of the Land approved (to the extent required by Governmental Requirements) by all Governmental Authorities, if applicable, and legible copies of all instruments representing exceptions to the state of title to the Mortgaged Property.

g.Lender shall have received policies of all‑risk builder’s risk insurance (non‑reporting form) for the construction of the Improvements, owner’s and contractor’s liability insurance, workers’ compensation insurance, and such other insurance as Lender may reasonably require, with standard endorsements attached naming Lender as the insured mortgagee or additional insured, whichever is applicable, such policies to be in form and content and issued by companies reasonably satisfactory to Lender, with copies, or certificates thereof, being delivered to Lender.

h.Lender shall have received the Title Insurance, at the sole expense of Borrower.

i.Lender shall have received from Borrower such other instruments, evidence and certificates as Lender may reasonably require, including the items indicated below:

i.Evidence that all the streets furnishing access to the Mortgaged Property have been or will be completed and dedicated to public use and accepted by applicable Governmental Authorities.

ii.A current survey of the Land prepared by a registered surveyor or engineer and certified to Lender, Borrower and the Title Company, in form and substance reasonably acceptable to Lender, showing all easements, building or setback lines, rights‑of‑way and dedications affecting said land and showing no state of facts objectionable to Lender.

iii.Evidence reasonably satisfactory to Lender showing the availability of all necessary utilities at the boundary lines of the Land (except as disclosed to Lender, and provided that in any event the Plans and Specifications provide that all such utilities will be available to the Land upon construction of the improvements contemplated thereby), including sanitary and storm sewer facilities, potable water, telephone, electricity, gas, and municipal services.

iv.Evidence that the current and proposed use of the Mortgaged Property and the construction of the Improvements complies with all Governmental Requirements.

v.An opinion of counsel for Borrower, which counsel shall be

CONSTRUCTION LOAN AGREEMENT - Page 14

satisfactory to Lender, to the effect that (i) Borrower possesses full power and authority to own the Mortgaged Property, to construct the Improvements and to perform Borrower’s obligations hereunder, and Guarantor has full power and authority to perform Guarantor’s obligations under the Guaranty and Environmental indemnity Agreement; (ii) the Loan Documents have been duly authorized, executed and delivered by Borrower and, where required, by Guarantor, and constitute the valid and binding obligations of Borrower and Guarantor, not subject to any defense based upon usury, capacity of Borrower or otherwise; (iii) the Loan Documents are enforceable in accordance with their respective terms, except as limited by bankruptcy, insolvency and other laws affecting creditors’ rights generally, and except that certain remedial provisions thereof may be limited by the laws of the State of Texas; (iv) to the knowledge of such counsel, there are no actions, suits or proceedings pending or threatened against or affecting Borrower, Guarantor or the Mortgaged Property, or involving the priority, validity or enforceability of the liens or security interests arising out of the Loan Documents, at law or in equity, or before or by any Governmental Authority, except actions, suits or proceedings fully covered by insurance or which, if adversely determined, would not substantially impair the ability of Borrower or Guarantor to pay when due any amounts which may become payable in respect to the Loan as represented by the Note; (v) to the knowledge of such counsel, neither Borrower nor Guarantor is in default with respect to any order, writ, injunction, decree or demand of any court or any Governmental Authority of which such counsel has knowledge; (vi) to the knowledge of such counsel, the consummation of the transactions hereby contemplated and the performance of this Agreement and the execution and delivery of the Guaranty will not violate or contravene any provision of any instrument creating or governing the business operations of Borrower or Guarantor and will not result in any breach of, or constitute a default under, any mortgage, deed of trust, lease, bank loan or credit agreement or other instrument to which Borrower or any Guarantor is a party or by which Borrower, Guarantor or the Mortgaged Property may be bound or affected; and (vii) such other matters as Lender may reasonably request.

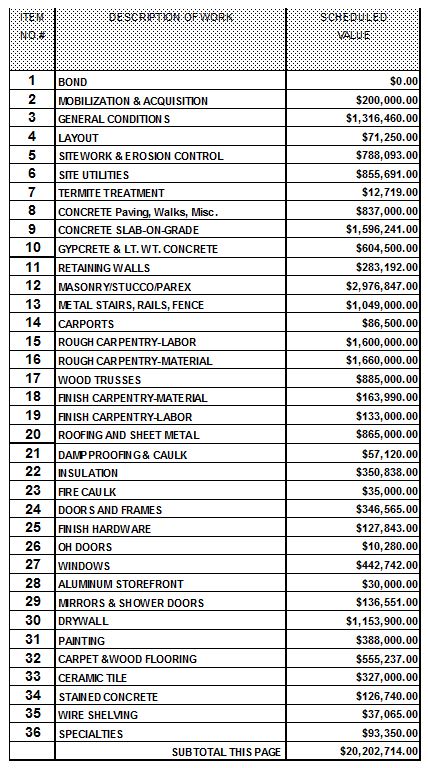

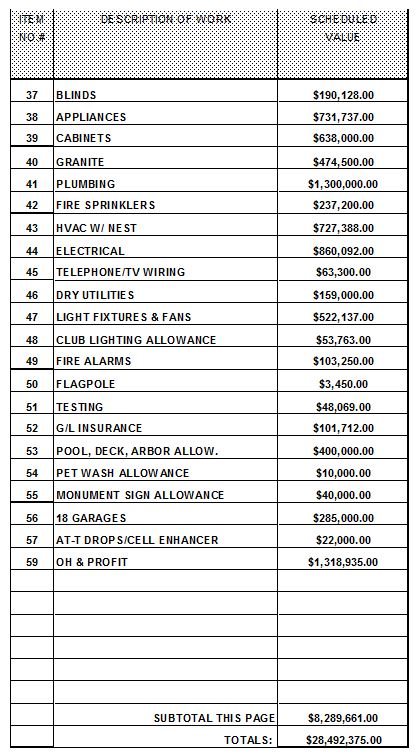

vi.A cost breakdown satisfactory to Lender showing the total costs, including, but not limited to, such related nonconstruction items as interest during construction, commitment, legal, design professional and real estate agents’ fees, plus the amount of the Land cost and direct construction costs required to be paid to satisfactorily complete the Improvements, free and clear of liens or claims for liens for material supplied and for labor services performed.

vii.Original or a copy of each Construction Contract for any Improvements then under construction.

viii.Original or a copy of each Construction Management Agreement for any Improvements then under construction.

ix.Original or a copy of each fully executed Design Services Contract for any Improvements then under construction.

CONSTRUCTION LOAN AGREEMENT - Page 15

x.Waiver of lien or lien subordination agreement(s) for the prior month’s Draw Request executed by each Contractor and by each contractor, laborer and suppliers furnishing labor or materials to the Mortgaged Property, in a form acceptable to Lender, together with Borrower’s affidavit to Lender that all changes and expenses incurred to date for the Mortgaged Property have been paid in full.

xi.A copy of the Plans and Specifications for the Improvements then under construction.

xii.Site Development Permit(s), Building permit(s) (if applicable), grading permit(s) (if applicable) and all other permits required with respect to the construction of the Improvements prior to construction of work requiring the same; accordingly, it is not a requirement for an Advance to have a permit that is not then required for the construction of Improvements then in progress.

xiii.Evidence that all zoning ordinances (if applicable) and all restrictive covenants affecting the Land permit the use for which the Improvements are intended and have been or will be complied with.

xiv.Evidence of payment of required sums for insurance, taxes, expenses, charges and fees customarily required or recommended by Lender or any Governmental Authority, corporation, or person guaranteeing, insuring or purchasing, committing to guaranty, insure, purchase or refinance the Loan or any portion thereof.

xv.A current financial statement of Guarantor certified by said Guarantor.

xvi.A Guaranty and Environmental Indemnity Agreement executed by Guarantor.

xvii.A schedule of construction progress for the Improvements with the anticipated date and amounts of each Advance for the same.

xviii.Copies of all agreements entered into by Borrower or its operating partner pertaining to the development, construction and completion of the Improvements or pertaining to materials to be used in connection therewith, together with a schedule of anticipated dates and amounts of each Advance for the same.

xix.Environmental site assessment report with respect to the Mortgaged Property prepared by a firm of engineers approved by Lender, which report shall be satisfactory in form and substance to Lender, certifying that there is no evidence that any Hazardous Substance have been generated, treated, stored or disposed of on any of the Mortgaged Property and none exists on, under or at the Mortgaged Property.

CONSTRUCTION LOAN AGREEMENT - Page 16

xx.A soils and geological report covering the Land issued by a laboratory approved by Lender, which report shall be satisfactory in form and substance to Lender, and shall include a summary of soils test borings.

xxi.Such other instruments, evidence or certificates as Lender may reasonably request.

j.Lender shall have ordered and received, at Borrower’s expense, an Appraisal of the Mortgaged Property, prepared by an appraiser acceptable to Lender and presented and based upon such standards as may be required by Lender.

k.Lender shall have received payment of the Commitment Fee.

l.Borrower shall have furnished evidence to Lender that it has contributed cash equity and/or the Land (at a value as shown on the Budget ($7,466,033)) of an amount of not less than $9,986,102.00 in the aggregate, which amount shall be used to pay for project costs in accordance with the Budget.

3.2Conditions to Advances. The obligation of Lender to make each Advance hereunder, including the Initial Advance, shall be subject to the prior or simultaneous occurrence or satisfaction of each of the following conditions:

a.The conditions to the Initial Advance shall have been satisfied.

b.No Event of Default shall have occurred and then be continuing under this Agreement or any of the other Loan Documents.

c.The Loan Documents shall be and remain outstanding and enforceable in accordance with their terms, all as required hereunder.

d.Lender shall have received a title report dated within two (2) days of the requested Advance from the Title Company showing no state of facts objectionable to Lender, including, but not limited to, a showing that title to the Land is vested in Borrower and that no claim for mechanics’ or materialmen’s liens has been filed against the Mortgaged Property, and Lender shall receive a down date endorsement to the Title Insurance in connection with such Advance confirming same.

e.A monthly construction status report for the Improvements shall be prepared and submitted by Borrower to Lender on or before the tenth (10th) day of each month, commencing upon commencement of construction of the Improvements and continuing for each month thereafter until completion of the Improvements.

f.Completion of any inspections required by Lender with respect to any work performed since the date of the last Advance.

g.The representations and warranties made by Borrower, as contained in this Agreement and in all other Loan Documents shall be true and correct in all material

CONSTRUCTION LOAN AGREEMENT - Page 17

respects as of the date of each Advance; and if requested by Lender, Borrower shall give to Lender a certificate to that effect.

h.The covenants made by Borrower to Lender, as contained in this Agreement and in all other Loan Documents shall have been fully complied with, except to the extent such compliance may be limited by the passage of time or the completion of construction of the Improvements.

i.Lender shall have received (i) a fully executed copy of each Construction Contract then in effect or copy thereof; (ii) a report of any changes, replacements, substitutions, additions or other modification in the list of contractors, subcontractors and materialmen involved or expected to be involved in the construction of the Improvements; and (iii) all permits required under Section 3.1(i)(12) above for Improvements then under construction.

j.Except in connection with the Initial Advance, Lender shall have received from Borrower a Draw Request for such Advance, completed, executed and sworn to by Borrower and Contractor, with the Inspecting Person’s approval noted thereon, stating that the requested amount does not exceed the difference of one hundred percent (100%) of the then unpaid cost of construction of the Improvements since the last certificate furnished hereunder less Retainage required hereunder for such requested amount; that said construction was performed in substantial accordance with the Plans and Specifications; and that, in the opinion of Borrower, the applicable Contractor and the applicable Design Professional, construction of the Improvements can be completed on or before the Completion Date for an additional cost not in excess of the amount then available under the Loan. To the extent approved by Lender and included in the Budget, such expenses will be paid from the proceeds of the Loan.

k.Except in connection with the Initial Advance, Borrower shall have furnished to Lender, from each contractor, subcontractor and materialman, including each Contractor, an invoice, lien waiver (on the statutory form) and such other instruments and documents as Lender may from time to time specify, in form and content, and containing such certifications, approvals and other data and information, as Lender may reasonably require. The invoice, lien waiver and other documents shall cover and be based upon work actually completed or materials actually furnished and paid under a prior application for payment. The lien waiver for the prior month’s draws of each contractor, subcontractor and materialman shall, if required by Lender, be received by Lender simultaneously with the making of any Advance hereunder for the benefit of such contractor, subcontractor or materialman.

l.There shall exist no default or breach by any obligated party (other than Lender) under the Loan Documents.

m.The Improvements shall not have been materially injured, damaged or destroyed by fire or other casualty, nor shall any part of the Mortgaged Property be subject to condemnation proceedings or negotiations for sale in lieu thereof.

CONSTRUCTION LOAN AGREEMENT - Page 18

n.All work typically done at the stage of construction when the Advance is requested shall have been done, and all materials, supplies, chattels and fixtures typically furnished or installed at such stage of construction shall have been furnished or installed.

o.All personal property not yet incorporated into the Improvements but which is to be paid for out of such Advance, must then be located upon the Land, secured in a method acceptable to Lender, and Lender shall have received evidence thereof, or if stored off-site, must be stored in a secured area and must be available for inspection by the Inspecting Person. Any materials stored off-site shall be stored in a third-party bonded warehouse acceptable to Lender, with adequate safeguards to prevent loss, theft, damage or commingling with other materials not intended to be used in the construction of the Improvements; provided, further, (i) Borrower shall give Lender prior notice of the off-site storage of any materials and (ii) any materials stored must be incorporated within 45 days after receipt of Loan proceeds from Lender to pay for such materials, unless such date is extended in writing by Lender.

p.Borrower shall have complied with all reasonable requirements of the Inspecting Person to insure compliance with the Plans and Specifications and all requirements of the Governmental Authorities.

q.Except in connection with the Initial Advance, if the Improvements are being built for any party under a purchase or construction contract, then Lender at its election may require the approval of such purchaser before making any additional Advance.

r.Borrower shall have fully completed (to the extent applicable), signed, notarized and delivered to Lender the Draw Request.

s.the Loan shall be “in balance” as provided in Section 3.4 (i.e., the unfunded Loan proceeds and any portion of the Borrower’s equity not yet expended are not sufficient to complete construction of the Improvements in accordance with the Plans and Specifications and pay for all costs of construction in connection therewith), and if Lender requires a Borrower’s Deposit in accordance with Section 3.4 below, then (x) Borrower shall have made such Borrower’s Deposit with Lender as provided thereunder and (y) Borrower shall have collaterally assigned such Borrower’s Deposit to Lender to put the Loan in balance by executing an assignment satisfactory to Lender.

t.Borrower shall have funded all Borrower equity requirements indicated on the Budget.

3.3Advance Not A Waiver. No Advance of the proceeds of the Loan shall constitute a waiver of any of the conditions of Lender’s obligation to make further Advances, nor, in the event Borrower is unable to satisfy any such condition, shall any such Advance have the effect of precluding Lender from thereafter declaring such inability to be an Event of Default.

3.4Borrower’s Deposit. If at any time after Borrower has met its funding requirements under Section 3.1(l) above with respect to its required cash equity, Lender shall in its sole discretion deem that the undisbursed proceeds of the Loan are insufficient to meet the

CONSTRUCTION LOAN AGREEMENT - Page 19

costs of completing construction of the Improvements, plus any and all Soft Costs for the Improvements, Lender may refuse to make any additional Advances to Borrower hereunder until Borrower shall have deposited with Lender sufficient additional funds (“Borrower’s Deposit”) to cover the deficiency which Lender deems to exist. Such Borrower’s Deposit will be disbursed by Lender to Borrower pursuant to the terms and conditions hereof as if they constituted a portion of the Loan being made hereunder prior to any further Advances of the Loan proceeds. Borrower agrees upon fifteen (15) days written demand by Lender to deposit with Lender such Borrower’s Deposit. Lender agrees that the Borrower’s Deposit shall be placed in an interest-bearing account. Borrower hereby grants a security interest to Lender in and to the Borrower’s Deposit and such account, and agrees that at any time during the existing of an Event of Default, Lender shall have the right to offset any Borrower’s Deposit against the Indebtedness then outstanding, in addition to any and all other remedies provided under this Agreement and the other Loan Documents or otherwise available at law or in equity.

3.5Advance Not An Approval. The making of any Advance or part thereof shall not be deemed an approval or acceptance by Lender of the work theretofore done. Lender shall have no obligation to make any Advance or part thereof after the happening of any Event of Default, but shall have the right and option so to do; provided that if Lender elects to make any such Advance, no such Advance shall be deemed to be either a waiver of the right to demand payment of the Loan, or any part thereof, or an obligation to make any other Advance.

3.6Time and Place of Advances. All Advances are to be made at the office of Lender, or at such other place as Lender may designate; and Lender shall require five (5) Business Days prior notice in writing before the making of any such Advance. Lender shall not be obligated to undertake any Advance hereunder more than once in any 30‑day period. Except as set forth in this Agreement, all Advances are to be made by direct deposit into the Special Account. In the event Borrower shall part with or be in any manner whatever deprived of Borrower’s interests in the Land, Lender may, at Lender’s option but without any obligation to do so, continue to make Advances under this Agreement, and subject to all its terms and conditions, to such Person or Persons as may succeed to Borrower’s title and interest and all sums so disbursed shall be deemed Advances under this Agreement and secured by the Deed of Trust and all other liens or security interests securing the Loan.

3.7Retainage. An amount equal to ten percent (10%) of the cost of construction of the Improvements (“Retainage”) shall be retained by Lender and shall be paid over by Lender to Borrower, provided that no lien claims are then filed against the Mortgaged Property, when all of the following have occurred to the satisfaction of Lender with respect to those Improvements covered by a Construction Contract:

a.Lender has received a completion certificate prepared by the Inspecting Person and executed by Borrower and the Design Professional stating that the Improvements have been completed in accordance with the Plans and Specifications, together with such other evidence that no mechanics or materialmen’s liens or other encumbrances have been filed and remain in effect against the Mortgaged Property which have not been bonded to Lender’s satisfaction (and otherwise in accordance with all applicable Governmental Requirements) and that all offsite utilities and streets, if any,

CONSTRUCTION LOAN AGREEMENT - Page 20

have been completed to the satisfaction of Lender and any applicable Governmental Authority;

b.each applicable Governmental Authority shall have duly inspected and approved the Improvements and issued the appropriate permit, license or certificate to evidence such approval, including without limitation, certificates of occupancy for each of the apartment units which are a part of the Improvements;

c.forty (40) days shall have elapsed from the later of (i) the date of completion of the Improvements, as specified in Texas Property Code §53.106, if the Affidavit of Completion provided for in this Agreement is filed within ten (10) days after such date of completion, or (ii) the date of filing of such Affidavit of Completion if such Affidavit of Completion is filed ten (10) days or more after the date of the completion of the Improvements as specified in Texas Property Code §53.106;

d.receipt by Lender of an as-built ALTA survey of the Mortgaged Property, in form reasonably acceptable to Lender; and

e.receipt by Lender of evidence satisfactory to Lender that payment in full has been made for all obligations incurred in connection with the construction and completion of all off‑site utilities and improvements (if any) as required by Lender or any Governmental Authority.

Notwithstanding the foregoing, (A) no Retainage will be withheld for Contractor’s purchase of lumber, trusses, framing hardware, windows, doors, wood trim, light fixtures or appliances or for the framing subcontractor’s purchase of lumber, trusses or framing hardware, and (B) no Retainage will be withheld for Contractor’s overhead and profit, and (C) Lender will disburse to Borrower the Retainage withheld by Lender with respect to a particular Retainage Milestone so that Borrower may pay all remaining amounts owed for the work performed to complete such Retainage Milestone under a particular Construction Contract, upon the satisfaction of all of the following conditions: (i) Contractor has achieved final completion of the Retainage Milestone, as inspected, verified and approved by the Inspecting Person, (ii) all materials to be supplied and all work required to be performed or constructed for such Retainage Milestone have been completed in accordance with the Construction Contract and the applicable Plans and Specifications, (iii) Borrower has provided Lender executed conditional lien waivers (in statutory form) from Contractor and all subcontractors and materialmen and suppliers who performed any of such Retainage Milestone Work, in form and substance acceptable to Lender, (iv) sixty (60) days have elapsed since completion of such Retainage Milestone work and (v) no Event of Default is then existing. The “Retainage Milestone” means each of the Retainage Milestones of the work of Contractor identified on Exhibit “G” attached hereto and incorporated herein for all purposes.

3.8No Third Party Beneficiaries. The benefits of this Agreement shall not inure to any third party, nor shall this Agreement be construed to make or render Lender liable to any materialmen, subcontractors, contractors, laborers or others for goods and materials supplied or work and labor furnished in connection with the construction of the Improvements or for debts or claims accruing to any such Persons against Borrower. Lender shall not be liable for the manner in which any Advances under this Agreement may be applied by Borrower, Contractor and any

CONSTRUCTION LOAN AGREEMENT - Page 21

of Borrower’s other contractors or subcontractors. Notwithstanding anything contained in the Loan Documents, or any conduct or course of conduct by the parties hereto, before or after signing the Loan Documents, this Agreement shall not be construed as creating any rights, claims or causes of action against Lender, or any of its officers, directors, agents or employees, in favor of any contractor, subcontractor, supplier of labor or materials, or any of their respective creditors, or any other Person other than Borrower. Without limiting the generality of the foregoing, Advances made to any contractor, subcontractor or supplier of labor or materials, pursuant to any requests for Advances, whether or not such request is required to be approved by Borrower, shall not be deemed a recognition by Lender of a third‑party beneficiary status of any such Person.

3.9Interest Reserve. The amount of the Loan was determined on the basis of the Borrower’s projection of the interest that will accrue on the disbursed principal of the Note during the construction and lease-up phase of the Loan, which interest has been estimated not to exceed $1,256,158.00 (such amount being referred to as the “Interest Reserve”). Subject to the conditions to funding Advances set forth in this Agreement, Lender will disburse on the first (1st) day of each calendar month a portion of the Loan sufficient to pay accrued interest then due and payable on the Note during the construction phase, and the amount thereof shall increase the principal of the Note and shall reduce the balance of the Interest Reserve. Under no circumstances shall any undisbursed proceeds of the Loan be disbursed to pay accrued interest thereon during the construction phase upon depletion of the balance of the Interest Reserve, or to the extent that revenues from the Mortgaged Property, after payment of all other operating expenses of the Mortgaged Property, are sufficient to pay the accrued interest or other amounts then due and payable under the Loan Documents. In lieu of disbursing Loan proceeds to Borrower for payment of accrued interest thereon during the construction phase, Lender may handle such disbursement and payment by making appropriate entries on the books and records of Lender, whereupon a statement summarizing such entries shall be furnished to Borrower.

3.10Additional Expenditures by Lender. Borrower agrees that all sums paid or expended by Lender under the terms of this Agreement in excess of the amount of the Loan shall be considered to be an additional loan to Borrower and the repayment thereof, together with interest thereon at the Default Rate (as defined in the Note), from the date of demand by Lender until the date paid, shall be secured by the Deed of Trust and the other Loan Documents and shall be immediately due and payable within ten (10) days of written notice to Borrower, and Borrower agrees to pay such sum upon demand. Nothing contained herein, however, shall obligate Lender to make such advances. In addition to the foregoing, if Borrower fails to perform any act or to take any action or to pay any amount provided to be paid by it under the provisions of any of the covenants and agreements contained in this Agreement or any other Loan Document, Lender may but shall not be obligated to perform or cause to be performed such act or take such action or pay such money, and any expenses so incurred by Lender and any money so paid by Lender shall be an advance against the Note and shall bear interest from the date of making such payment until paid at the Default Rate and shall be part of the Indebtedness secured by the Deed of Trust, and Lender upon making any such payment shall be subrogated to all rights of the Person receiving such payment. Lender will endeavor to promptly notify Borrower of such amounts paid by Lender hereunder, but Lender’s failure to do so shall not create or give rise to any liability on Lender’s part or impair or affect any of Lender’s rights and remedies under this Agreement or any of the other Loan Documents.

CONSTRUCTION LOAN AGREEMENT - Page 22

ARTICLE IV

WARRANTIES AND REPRESENTATIONS

Borrower hereby unconditionally warrants and represents to Lender, as of the date hereof and at all times during the term of the Agreement, as follows:

4.1Plans and Specifications. The Plans and Specifications for the Improvements are satisfactory to Borrower, are in compliance with all Governmental Requirements in all material respects and, to the extent required by Governmental Requirements or any effective restrictive covenant, have been approved by each Governmental Authority (or will timely be approved by the applicable Governmental Authority when required for construction) and/or by the beneficiaries of any such restrictive covenant affecting the Mortgaged Property.

4.2Governmental Requirements. No violation of any Governmental Requirements exists or will exist with respect to the Mortgaged Property and neither the Borrower nor the Guarantor is, nor will either be, in default with respect to any Governmental Requirements.

4.3Utility Services. All utility services of sufficient size and capacity necessary for the construction of the Improvements and the use thereof for their intended purposes are available (or will be available upon completion of construction of any offsite utility lines contemplated by the Plans and Specifications) at the property line(s) of the Land for connection to the Improvements, including potable water, storm and sanitary sewer, gas, electric and telephone facilities.

4.4Access. All roads necessary for the full utilization of the Improvements for their intended purposes either have been completed and dedicated to the public use and accepted by the appropriate Governmental Authority, or will be completed and dedicated to the public and accepted by the appropriate Governmental Authority in connection with the construction of the Improvements, as contemplated by the Plans and Specifications.

4.5Financial Statements. Each financial statement of Borrower and Guarantor delivered heretofore, concurrently herewith or hereafter to Lender was and will be prepared in conformity with general accepted accounting principles, or other good accounting principles approved by Lender in writing, applied on a basis consistent with that of previous statements and completely and accurately disclose the financial condition of Borrower and Guarantor (including all contingent liabilities) as of the date thereof and for the period covered thereby, and there has been no material adverse change in either Borrower’s or Guarantor’s financial condition subsequent to the date of the most recent financial statement of Borrower and Guarantor delivered to Lender.

4.6Statements. No certificate, statement, report or other information delivered heretofore, concurrently herewith or hereafter by Borrower or Guarantor to Lender in connection herewith, or in connection with any transaction contemplated hereby, contains or will contain any untrue statement of a material fact or fails to state any material fact necessary to keep the statements contained therein from being misleading, and same were true, complete and accurate as of the date hereof.

CONSTRUCTION LOAN AGREEMENT - Page 23

4.7Disclaimer of Permanent Financing. Borrower acknowledges and agrees that Lender has not made any commitments, either express or implied, to extend the term of the Loan past its stated maturity date or to provide Borrower with any permanent financing except as expressly set forth herein.

4.8No Commencement. As of the date hereof, no steps to commence construction on the Land have been taken, including, without limitation, steps to clear or otherwise prepare the Land for construction or the delivery of material for use in construction of the Improvements; and no action has been taken under the Construction Contract or any other contract or other agreement for construction which could give rise to a lien on the Land.

4.9Patriot Act. Borrower and Guarantor are in compliance with (a) the Trading with the Enemy Act, and each of the foreign assets control regulations of the United States Treasury Department (31 CFR, Subtitle B Chapter V, as amended), and all other enabling legislation or executive order relating thereto, (b) the Patriot Act, and (c) all other federal or state laws relating to “know your customer” and anti-money laundering rules and regulations. No part of the proceeds of any Loan will be used directly or indirectly for any payments to any government official or employee, political party, official of a political party, candidate for political office, or anyone else acting in an official capacity, in order to obtain, retain or direct business or obtain any improper advantage, in violation of the United States Foreign Corrupt Practices Act of 1977.

ARTICLE V

COVENANTS OF BORROWER

Borrower hereby unconditionally covenants and agrees with Lender, until the Loan shall have been paid in full and the lien of the Deed of Trust shall have been released, as follows:

5.1Commencement and Completion. Borrower will cause the construction of the Improvements to commence by the Commencement Date and to be prosecuted with diligence and continuity and will complete the same in all material respects in accordance with the Plans and Specifications for the Improvements on or before the Completion Date and within the Budget (subject to any increases in the Budget funded by additional equity contributed by Borrower or Guarantor), free and clear of liens or claims for liens for material supplied and for labor services performed in connection with the construction of the Improvements.

5.2No Changes. Borrower will not amend, alter or change (pursuant to change order, amendment or otherwise) the Plans and Specifications for the Improvements unless the same shall have been approved in advance in writing by Lender, by all applicable Governmental Authorities; provided, however, Borrower shall have the right to approve change orders without Lender’s consent which do not individually exceed $50,000.00, or in the aggregate exceed $200,000.00 for the Improvements.

5.3Advances. Borrower will receive the Advances and will hold same as a trust fund for the purpose of paying the cost of construction of the Improvements and related nonconstruction costs related to the Mortgaged Property as provided for herein. Borrower will apply the same promptly to the payment of the costs and expenses for which each Advance is made and will not use any part thereof for any other purpose.

CONSTRUCTION LOAN AGREEMENT - Page 24

5.4Lender’s Expenses. Borrower will reimburse Lender for all out‑of‑pocket expenses of Lender, including reasonable attorneys’ fees, incurred in connection with the preparation, execution, delivery, administration and performance of the Loan Documents.

5.5Surveys. Borrower will furnish Lender at Borrower’s expense (i) a foundation survey and (ii) an as‑built survey, each prepared by a registered engineer or surveyor acceptable to Lender, showing the locations of the Improvements, and certifying that same are entirely within the property lines of Land, do not encroach upon any easement, setback or building line or restrictions, are placed in accordance with the Plans and Specifications, all Governmental Requirements and all restrictive covenants affecting the Land and/or the Improvements, and showing no state of facts objectionable to Lender. All surveys shall be in form and substance and from a registered public surveyor acceptable to Lender.

5.6Defects and Variances. Borrower will, upon demand of Lender and at Borrower’s sole expense, correct any structural defect in the Improvements or any variance from the Plans and Specifications for the Improvements (except for those for which Lender’s approval is not required under Section 5.2 above) which is not approved in writing by Lender.

5.7Estoppel Certificates. Borrower will deliver to Lender, promptly after request therefor, estoppel certificates or written statements, duly acknowledged, stating the amount that has then been advanced to Borrower under this Agreement, the amount due on the Note, and whether any known offsets or defenses exist against the Note or any of the other Loan Documents.

5.8Inspecting Person. Borrower will pay the fees and expenses of, and cooperate, with the Inspecting Person and will cause the Design Professional, the Contractor, each contractor and subcontractor and the employees of each of them to cooperate with the Inspecting Person and, upon request, will furnish the Inspecting Person whatever the Inspecting Person may consider necessary or useful in connection with the performance of the Inspecting Person’s duties. Without limiting the generality of the foregoing, Borrower shall furnish or cause to be furnished such items as working details, Plans and Specifications and details thereof, samples of materials, licenses, permits, certificates of public authorities, zoning ordinances, building codes and copies of the contracts between such Person and Borrower (if applicable). Borrower will permit Lender, the Inspecting Person and their representative to enter the Mortgaged Property for the purposes of inspecting same. Borrower acknowledges that the duties of the Inspecting Person run solely to Lender and that the Inspecting Person shall have no obligations or responsibilities whatsoever to Borrower, Contractor, the Design Professional, or to any of Borrower’s or Contractor’s agents, employees, contractors or subcontractors.

5.9BROKERS. BORROWER WILL INDEMNIFY LENDER FROM CLAIMS OF BROKERS ARISING BY REASON OF THE EXECUTION HEREOF OR THE CONSUMMATION OF THE TRANSACTIONS CONTEMPLATED HEREBY TO THE EXTENT SUCH BROKER WAS CONTACTED OR HIRED BY BORROWER OR EITHER OF ITS JOINT VENTURERS.

5.10Personalty and Fixtures. Borrower will deliver to Lender, on demand, any contracts, bills of sale, statements, receipted vouchers or agreements under which Borrower

CONSTRUCTION LOAN AGREEMENT - Page 25

claims title to any materials, fixtures or articles incorporated in the Improvements or subject to the lien or security interests of the Deed of Trust.

5.11Compliance with Governmental Requirements. Borrower will comply promptly with all Governmental Requirements.