Attached files

Exhibit 10.24

Rosetta Stone Inc. 2009 Omnibus Incentive Plan

2013 Rosetta Stone Inc. Long Term Incentive Program (LTIP)

Effective January 1, 2013 - Amended as of March 29, 2013

I. | LTIP Goals |

The purpose of the 2013 Rosetta Stone Inc. Long Term Incentive Program (the “LTIP”) is to:

• | Motivate senior management to achieve key financial and strategic business objectives of Rosetta Stone Inc., and its Subsidiary Corporations (individually and/or collectively, as applicable, “Rosetta Stone” or the “Company”); |

• | Offer eligible employees of the Company a competitive total compensation package; |

• | Reward employees in the success of the Company; |

• | Provide ownership in the Company; and |

• | Retain key talent. |

Pursuant to Section 15.2 of the Rosetta Stone Inc. 2009 Omnibus Incentive Plan (the “Plan”), the Compensation Committee of the Company’s Board of Directors (“the Committee”) has adopted this LTIP to set forth the terms and conditions for Performance Stock Awards and cash payments to be granted and/or paid to eligible Employees under the Plan. Except as provided herein, all terms and definitions of the Plan are incorporated herein by reference.

The LTIP will be administered by the Committee in accordance with the Plan. The Committee shall have the power to interpret all provisions in the LTIP. If the LTIP conflicts with any provisions of the Plan, the provisions of the Plan shall govern in all cases. The Committee reserves the right to amend or terminate the LTIP as set forth in the Plan.

Awards granted under the LTIP are intended to qualify as “qualified performance-based compensation” as defined in Code Section 162(m) (including any amendment to Code Section 162(m)) and any Treasury Regulations or rulings issued thereunder that are requirements for qualifications. The LTIP shall be deemed amended to the extent necessary to conform to such requirements and the Committee may take such actions as it may deem necessary to ensure that such Awards will so qualify.

II. | Approval by Stockholders of the Company |

Before any payment of cash or the granting of Performance Stock Awards pursuant to an Award granted under the LTIP can be made, the material terms of the Performance Goals(s) must be disclosed to, and subsequently approved by, the Company’s stockholders in accordance with Treasury Regulation Section 1.162-27(e)(4). If the Company’s stockholders have not approved (or do not approve, if applicable) the Performance Goal(s) and the terms of this LTIP prior to the end of the 2013 fiscal year, then any Award under the LTIP shall be null and void, and any Employee who has received an Award under the LTIP shall have no rights to any payment of cash or Performance Stock Awards pursuant to such Award.

III. | LTIP Participants, Administration and Effective Date |

The Employees who are currently employed in the following positions are eligible to receive Awards under this LTIP: Chief Executive Officer (“CEO”); Chief Financial Officer; Chief Information Officer; Chief Innovation Officer; Chief Product Officer; General Counsel; Senior Vice President, Human Resources; President, Global Consumer; President, Global Institutions and other executives (each, an "Executive" and collectively, the "Executives”) as approved by the Committee from time-to-time.

An Executive is eligible to participate in the LTIP only if all of the following criteria are met:

• | Designated as eligible to participate by the Committee; |

• | Renders overall satisfactory work performance; and |

• | Continued active employment with the Company through the date any Award is granted under this LTIP. |

The Committee determines, at its sole discretion, whether Awards of cash and/or Performance Stock Awards will be granted.

The LTIP shall be effective from January 1, 2013 (“Effective Date”) until December 31, 2014 (the “Program Period”).

IV. | LTIP Details |

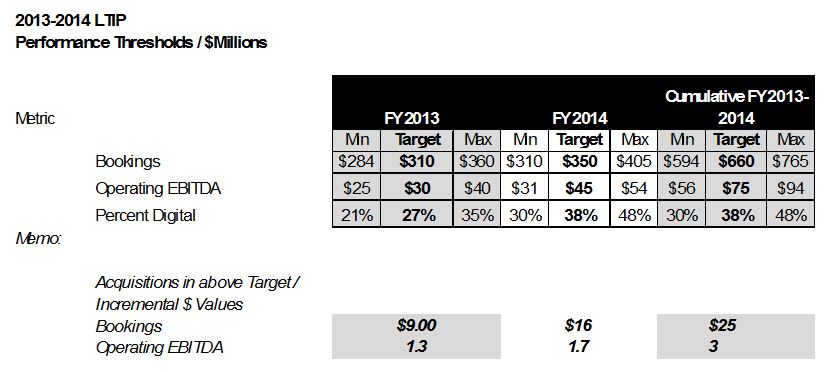

Executives designated by the Committee may receive Performance Stock Awards and cash upon the Company’s achievement of the following specified performance goals during the Program Period: (i) Bookings; (ii) Operating EBITDA; and (iii) Percentage Digital Sales (each, a “Performance Goal”).

“Bookings” means executed sales contracts by the Company that are either recorded immediately as revenue or as deferred revenue.

“Operating EBITDA” means GAAP net income or loss plus interest expense, income tax expense, depreciation, amortization, and stock-based compensation expenses, plus the change in deferred revenues.

“Percentage Digital Sales” means the percentage of all new unit sales of Global Consumer which are downloaded (e.g., TOTALe), online (e.g., OSUB, TOSUB, ReFLEX), renewals and paid Apps.

Unless specified otherwise by the Committee in an Award Agreement at the time an Award is granted, the Committee shall appropriately adjust any evaluation of performance under a Performance Goal to exclude the items listed in Section 9.2 of the Plan.

An Executive’s individual amount of Performance Stock Awards and cash he or she may be able to receive will be provided in the Award Agreement. The Executive’s incentive target is determined as a multiple of the Executive’s base salary in effect as of December 31, 2012. The CEO’s incentive target is 3x base salary, while all other Executives are at 1x base salary. The incentive target value in each Executive’s Award shall consist of 70% in Performance Stock Awards and 30% in cash. Each Executive’s target Performance Stock Award is based on valuation as of January 1, 2013. Stock valuation is based on the monthly average of the closing price of a share of Stock from December 1, 2012 to January 1, 2013. If at any time a new Executive is added to this Plan, upon approval by the Committee, the Executive’s incentive target for his or her Award will be determined and valued upon the effective date of participation.

In order for the granting of any Performance Stock Award or any cash payment to be made under this LTIP, the Company must meet the minimum threshold requirements for each of the three Performance Goals for the 2014 fiscal year, regardless of the 2013 fiscal year results and/or the total results for each Performance Goal for the Program Period. In addition, each Performance Goal is mutually exclusive of the other two Performance Goals.

Vesting and payout levels upon achievement of each Performance Goal:

• | Minimum = If the minimum threshold of each Performance Goal for the Program Period is achieved, then 50% of the targeted amount under the Executive’s Award for both Performance Stock Awards and cash shall vest and become payable. |

• | Target = If the target threshold of each Performance Goal for the Program Period is achieved, then 100% of the targeted amount under the Executive’s Award for both Performance Stock Awards and cash shall vest and become payable. |

• | Maximum = If the maximum threshold for each Performance Goal for the Program Period is achieved, then 200% of the targeted amount under the Executive’s Award for both Performance Stock Awards and cash shall vest and become payable. |

Subject to the other requirements under this LTIP: (a) if only the Minimum threshold for one out of the three Performance Goals has been achieved during the Program Period, then one third (1/3) of the 50% of the targeted amount under the Executive’s Award for both Performance Stock Awards and cash shall vest and become payable; and (b) if only the Minimum threshold for two out of the three Performance Goals has been achieved during the Program Period, then two thirds (2/3) of the 50% of the targeted amount under the Executive’s Award for both Performance Stock Awards and cash shall vest and become payable.

Achievement levels in between the performance thresholds of each Performance Goal will be interpolated to determine vesting and payout amounts of Awards. The minimum vesting and payout amount of any Award can be zero. The maximum payout for any Award granted under this LTIP is 200% of target Performance Awards and target cash.

After the completion of the Program Period but prior to any payment of any Award granted under this LTIP, the Committee shall certify in writing the level of achievement, if any, of each Performance Goal. The Committee shall not increase any amount of payment, whether in cash and/or Performance Stock Awards, payable under a Award granted under this LTIP.

All determinations under this LTIP, including, without limitation, as to the achievement of any Performance Goal, the number of Performance Stock Awards to be granted, if any, and the amount of any cash to be paid, shall be determined by the Committee in its sole discretion. All decisions by the Committee shall be final and binding.

Notwithstanding any other provisions in the LTIP to the contrary, the following provisions shall apply to all Awards granted under the LTIP. Generally, in the event of any change in the outstanding shares of Stock (including, without limitation, the value thereof) after the Effective Date by reason of any share dividend or split, reorganization, recapitalization, merger, consolidation, spin-off, combination or exchange of shares or other corporate exchange, or any distribution to stockholders of shares other than regular cash dividends, or any transaction similar to the foregoing, the Committee in its sole discretion and without liability to any person shall make such substitution or adjustment, if any, as it deems to be equitable as to: (i) the number or kind of shares or other securities issued or reserved for issuance pursuant to the LTIP or pursuant to outstanding Awards; (ii) the maximum number of shares for which Awards (including limits established for Performance Stock Awards or other stock-based Awards) may be granted during a calendar year to any participant; and/or (iii) any other affected terms of such Awards; provided, such substitution or adjustment shall be in compliance with the requirements of Code Section 162(m).

Any payment of cash or granting of Performance Stock Awards under this LTIP will be distributed or granted to Executives within 45 days of the end of the Program Period, upon approval from the Committee of the Company’s achievement of the Performance Goals in accordance with the terms of this LTIP. If Performance Stock Awards are granted, the shares of such Award will be 100% vested as of the date of grant.

V. | Recipient Notification and LTIP Acceptance |

Executives will receive notification from the Company or the Company’s designated equity broker notifying him or her of the cash award and grant of Performance Stock Awards, as well as any additional instructions to accept or take ownership of the shares of Performance Stock Awards.

VI. | Changes in Employment |

a. New Hires and Rehires - Executives hired or rehired after the Effective Date will be eligible for a prorated Award as determined in the sole discretion of the Committee, unless eligible for the entire period per contractual obligation and the Executive is not a “covered employee” under Code Section 162(m). There will be no retroactive Awards of Performance Stock Awards.

b. Leaves of Absence - Awards are not prorated for approved leaves of absence.

c. Job Changes - In the event that an Executive’s job changes during the course of the Program Period, individual LTIP eligibility will be reviewed on a case-by-case basis by the Company’s CEO and the Committee. The Committee is responsible for approving eligibility in the LTIP in its sole discretion.

d. Voluntary Termination or Termination for Cause - If an Executive voluntarily terminates for any reason other than for retirement (as provided for below) or is terminated for Cause (as defined in an Executive’s employment agreement with the Company in effect as of the Effective Date or, if there is no employment agreement in effect, then as defined in Section 4.7 of the Plan), prior to the end of the Program Period, the Executive will forfeit eligibility and not be entitled to any payout under this LTIP, except as otherwise provided by contractual obligation or directed by the Committee in its sole discretion and the Executive is not a “covered employee” under Code Section 162(m).

e. Approved Disability, Retirement, or Involuntary Termination By the Company Without Cause - If an Executive retires (where retirement is determined by the Committee in its sole discretion based on the age of the Executive and other factors the Committee deems relevant, including compliance with Code Section 162(m)), is involuntarily terminated by the Company without Cause, or has his or her employment terminated due to approved disability, cash awards and shares of Performance Stock Awards, prorated based on the number of full calendar months Executive was

employed during the Program Period, will be distributed and granted at the same time as other payments (if any) made under this LTIP after the completion of the Performance Period, unless otherwise directed by contractual obligation and the Executive is not a “covered employee” under Code Section 162(m).

VII. | No Employment Rights |

The LTIP is not intended to be a contract of employment. Both the Executives and the Company have the right to end their employment or service relationship with or without Cause or notice (subject to the terms of any separate written employment agreement). The payment of an Award shall not obligate the Company to pay any Executive any particular amount of remuneration, to continue the employment or services of the Executive after the payment, or to make further payments to the Executive at any time thereafter.

VIII. Other Provisions

A. | No Fiduciary Relationship. The Committee shall have no duty to manage or operate this LTIP in order to maximize the benefits granted to the participants, but rather shall have full discretionary power to make all management and operational decisions. This LTIP shall not be construed to create a fiduciary relationship between the Committee and the participants. |

B. | General Creditor Status. The participants shall, in no event, be regarded as standing in any position, if at all, other than as a general creditor of the Company with respect to any rights derived from the existence of the LTIP and shall receive only the Company’s unfunded and unsecured promise to pay benefits under the LTIP. |

C. | Non-alienation of Benefits. No participant or his beneficiaries shall have the power or right to transfer, anticipate, or otherwise encumber the participant’s interest under the LTIP. The provisions of the LTIP shall inure to the benefit of each participant and his or her beneficiaries, heirs, executors, administrators or successors in interest. |

D. | Severability. If any provision of this LTIP is held invalid or unenforceable, the invalidity or unenforceability shall not affect the remaining parts of the LTIP, and the LTIP shall be enforced and construed as if such provision had not been included. |

E. | Tax Treatment. The Company shall have the authority and the right to deduct or withhold, report or require a participant to remit to the Company, an amount sufficient to satisfy federal, state, local and foreign taxes (including any social insurance, payroll tax, or payment on account) required by law to be withheld with respect to any taxable event concerning a participant arising in connection with an Award. |

F. | Amendment. This LTIP may be wholly or partially amended or otherwise modified, suspended or terminated at any time or from time to time by the Committee. |

The Company has caused this LTIP to be executed by its duly authorized corporate officer effective as of January 1, 2013.

ROSETTA STONE INC.

By:

Name:

Title:

Date: