Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Neoleukin Therapeutics, Inc. | Financial_Report.xls |

| EX-32.1 - EX-32.1 - Neoleukin Therapeutics, Inc. | d851032dex321.htm |

| EX-32.2 - EX-32.2 - Neoleukin Therapeutics, Inc. | d851032dex322.htm |

| EX-31.1 - EX-31.1 - Neoleukin Therapeutics, Inc. | d851032dex311.htm |

| EX-23.1 - EX-23.1 - Neoleukin Therapeutics, Inc. | d851032dex231.htm |

| EX-31.2 - EX-31.2 - Neoleukin Therapeutics, Inc. | d851032dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-36327

Aquinox Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 98-0542593 | |

| (State or other Jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

450-887 Great Northern Way,

Vancouver, B.C., Canada V5T 4T5

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (604) 629-9223

Securities registered pursuant to Section 12(b) of the Act:

| Title of class |

Name of each exchange on which registered | |

| Common Stock, par value $0.000001 | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $41,572,146 as of the last business day of the registrant’s most recently completed second fiscal quarter, based upon the closing sale price on The NASDAQ Global Market reported for such date. Excludes an aggregate of 6,286,523 shares of the registrant’s common stock held as of such date by officers, directors and stockholders that the registrant has concluded are or were affiliates of the registrant. Exclusion of such shares should not be construed to indicate that the holder of any such shares possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant or that such person is controlled by or under common control with the registrant.

There were 10,717,128 shares of the registrant’s Common Stock issued and outstanding as of March 12, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference from the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A, not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K, in connection with the Registrant’s 2015 Annual Meeting of Stockholders (the “2015 Proxy Statement”).

Table of Contents

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2014

TABLE OF CONTENTS

| Page | ||||||

| PART I | ||||||

| Item 1. | 3 | |||||

| Item 1A. | 27 | |||||

| Item 1B. | 55 | |||||

| Item 2. | 55 | |||||

| Item 3. | 55 | |||||

| Item 4. | 55 | |||||

| PART II | ||||||

| Item 5. | 56 | |||||

| Item 6. | 58 | |||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

60 | ||||

| Item 7A. | 68 | |||||

| Item 8. | 69 | |||||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

93 | ||||

| Item 9A. | 93 | |||||

| Item 9B. | 93 | |||||

| PART III | ||||||

| Item 10. | 94 | |||||

| Item 11. | 94 | |||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

94 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

94 | ||||

| Item 14. | 94 | |||||

| PART IV | ||||||

| Item 15. | 95 | |||||

| 96 | ||||||

Except as otherwise indicated herein or as the context otherwise requires, references in this report to “Aquinox,” “the company,” “we,” “us,” “our” and similar references refer to Aquinox Pharmaceuticals, Inc., a Delaware corporation, which we refer to in this report as Aquinox USA, and Aquinox Pharmaceuticals (Canada) Inc., a corporation under the Canada Business Corporations Act and a wholly owned subsidiary of Aquinox USA, which we refer to in this report as AQXP Canada. This report contains registered marks, trademarks and trade names of other companies. All other trademarks, registered marks and trade names appearing in this report are the property of their respective holders.

2

Table of Contents

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions, including those relating to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “project,” “believe,” “estimate,” “predict,” “potential,” “intend” or “continue,” the negative of terms like these or other comparable terminology, and other words or terms of similar meaning in connection with any discussion of future operating or financial performance. These statements are only predictions. All forward-looking statements included in this Annual Report on Form 10-K are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements. Any or all of our forward-looking statements in this document may turn out to be wrong. Actual events or results may differ materially. Our forward-looking statements can be affected by inaccurate assumptions we might make or by known or unknown risks, uncertainties and other factors. We discuss many of these risks, uncertainties and other factors in this Annual Report on Form 10-K in greater detail under the heading “Item 1A—Risk Factors.” We caution investors that our business and financial performance are subject to substantial risks and uncertainties.

| Item 1. | Business. |

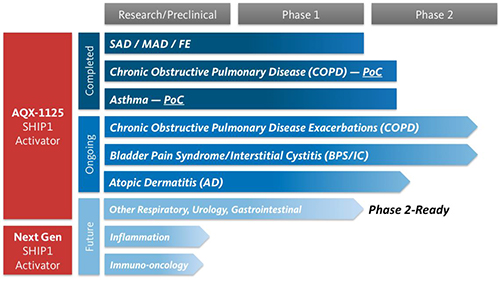

Overview

We are a clinical-stage pharmaceutical company discovering and developing targeted therapeutics in disease areas of inflammation and immuno-oncology. Our primary focus is anti-inflammatory product candidates targeting SHIP1, which is a key regulator of an important cellular signaling pathway in immune cells, known as the PI3K pathway. Our lead product candidate, AQX-1125, is a small molecule activator of SHIP1 suitable for oral, once daily dosing. Having successfully completed multiple preclinical studies and clinical trials with AQX-1125, we are now advancing through Phase 2 development in several initial indications. We have successfully completed three clinical trials with AQX-1125 dosed as a once daily oral product, with over 100 subjects having received AQX-1125 to date. We are currently investigating AQX-1125 in three Phase 2 clinical trials, one in Chronic Obstructive Pulmonary Disease (COPD), one in Bladder Pain Syndrome/Interstitial Cystitis (BPS/IC), and one in Atopic Dermatitis (AD). COPD, BPS/IC and severe forms of AD are debilitating chronic inflammatory diseases affecting millions of people worldwide.

Inflammation may be reduced by activation of SHIP1, a natural modulator of the PI3K pathway. If the PI3K pathway is overactive, immune cells often produce an abundance of pro-inflammatory signaling molecules which migrate to and concentrate in tissues, resulting in excessive or chronic inflammation. Drugs activating SHIP1 may reduce the function and migration of immune cells and have an anti-inflammatory effect. In addition, because SHIP1 is predominantly present in immune cells, off-tissue toxicities may be minimized. Immune cells with lowered levels of SHIP1 cause abnormal inflammation at mucosal surfaces in response to inflammatory stimuli. Accordingly, we are targeting inflammatory diseases that occur at the skin and at mucosal surfaces, including those of the respiratory, urinary and gastrointestinal tracts, for which we believe there is broad therapeutic and market potential.

Our longer-term strategy is to broaden our development activities for AQX-1125 and to advance next generation SHIP1 activators for the treatment of additional inflammatory diseases and cancer.

SHIP1 and the PI3K Pathway

Role and Regulation of the PI3K Pathway

The PI3K pathway is a cellular signaling pathway that has been linked to a diverse group of cellular functions and biological processes such as cell activation and migration, which are related to inflammation, and cell growth, proliferation and survival, which are related to cancer. As a result, the PI3K pathway is heavily researched by the academic community as well as pharmaceutical and biotechnology companies in the areas of immune disorders and cancer.

In the PI3K pathway, the key messenger molecule is phosphatidylinositiol-3,4,5-trisphosphate, or PIP3, which initiates the signaling pathway. In cells derived from bone marrow tissues (e.g. immune cells), the key enzymes that control levels of PIP3 are the PI3 kinase, or PI3K, and the phosphatases, phosphatase and tensin homolog, or PTEN, and SH2-containing inositol-5’-phosphatase 1, or SHIP1. PI3K generates PIP3, thus initiating the signaling pathway. This signaling is reduced by degradation of PIP3 by PTEN and SHIP1. PTEN is generally considered to be constantly working in the pathway, whereas SHIP1 is activated when the cell is stimulated. In preclinical studies, PTEN has been shown to suppress cancer by controlling cell proliferation, whereas SHIP1, when functioning, has been demonstrated to control inflammation by reducing cell migration and activation.

If the PI3K pathway is overactive, immune cells can produce an abundance of pro-inflammatory signaling molecules and migrate to and concentrate in tissues, resulting in excessive or chronic inflammation. SHIP1 is predominantly expressed in cells derived from bone marrow tissues, which are mainly immune cells. Consequently, drugs that activate SHIP1 can reduce the function and migration of immune cells and have an anti-inflammatory effect.

3

Table of Contents

SHIP1 as a Drug Target

Inflammation can be reduced by activation of SHIP1, taking advantage of the natural modulation of the PI3K pathway. When activated, SHIP1 redirects signaling in immune cells to reduce their activation and migration, thereby reducing inflammation while still allowing these cells to maintain cell growth and survival. Our scientific founders, based at the University of British Columbia, were the first to discover SHIP1 and show that small molecules could activate it, thereby making it a potential target for a new class of anti-inflammatory drugs. Additionally, academic scientists have shown that certain immune cell cancers have suppressed levels of SHIP1, making such cancers also potential targets for SHIP1 activators.

SHIP1 is predominantly present in immune cells. Therefore, SHIP1 activators target immune cells to cause an anti-inflammatory effect while minimizing effects in other tissues. We believe AQX-1125 is the only SHIP1 activator currently in clinical trials and that no SHIP1 activator has yet received marketing approval as a treatment for disease in humans.

Our approach also targets a unique activation site in SHIP1 called the C2 binding domain. We have demonstrated that targeting the C2 binding domain does not significantly activate or inhibit other enzymes, imparting target selectivity and further limiting potential off-target toxicities. Historically, phosphatases such as SHIP1 have been found to be poor drug targets based upon efforts to develop inhibitors of these enzymes, since the binding sites for inhibitors are similar across the family of phosphatases, resulting in poor selectivity and leading to undesired off-target toxicities. The unique activation site of SHIP1 enables this important phosphatase as a drug target.

The SHIP1 Knockout Mouse Provides a Roadmap for Clinical Development

Our scientific founders developed a strain of genetically modified mouse, which we refer to as the SHIP1 knockout mouse, with an immune system that lacks the presence of SHIP1. This SHIP1 knockout mouse has been useful for determining which diseases develop when the PI3K pathway is unregulated by SHIP1. A SHIP1 knockout mouse is viable and fertile and does not exhibit abnormal inflammation if raised under sterile conditions. However, if exposed to environmental inflammatory challenges like allergens or bacteria, a SHIP1 knockout mouse develops severe progressive inflammation and fibrosis of its airways, similar to respiratory diseases seen in humans. In addition, a SHIP1 knockout mouse, when exposed, develops inflammation of the urinary bladder, and gastrointestinal lining.

Abnormal inflammation observed in a SHIP1 knockout mouse occurs at mucosal surfaces, including those of the respiratory, urinary and, gastrointestinal linings. These surfaces are important barriers between the body and the external environment. Chronic inflammation at the surfaces of the body, such as the skin and mucosal surfaces, reduces the effectiveness of these barriers and may lead to a variety of diseases.

Potential Clinical Indications

Given our findings with respect to the SHIP1 knockout mouse, we are focused on diseases characterized by inflammation at the surfaces of the body. There is a broad range of diseases characterized by inflammation of the body’s surfaces and we believe there is broad therapeutic and market potential for drugs that can activate SHIP1. Inflammatory diseases of the mucosal surfaces of the respiratory, urinary and gastrointestinal tracts are increasing worldwide in both number and incidence. In addition, we are exploring inflammatory diseases of the skin, which shares similar properties to that of mucosal surfaces and is a large barrier to the environment by surface area.

A number of diseases are characterized by skin or mucosal inflammation including:

Lung/Airway

Moderate-Severe COPD

Chronic Sinusitis

Severe Asthma

Non-CF Bronchiectasis

Churg-Strauss Syndrome

Idiopathic Pulmonary Fibrosis

Urinary Tract

BPS/IC

Glomerulonephritis

Gastrointestinal Tract

Eosinophilic Esophagitis

Crohn’s Disease

Ulcerative Colitis

Skin

Moderate-Severe Atopic Dermatitis

4

Table of Contents

We are currently conducting three Phase 2 clinical trials, one in COPD, one in BPS/IC and one in AD. In the future, we expect to expand our clinical development into other inflammatory diseases. We have selected these initial indications based on the following criteria:

| • | large patient populations with generally inadequate therapy to facilitate rapid enrollment in clinical trials; |

| • | an attractive commercial opportunity with limited competition; and |

| • | an acute phase of the disease or an endpoint that could reasonably be affected in three months of treatment. |

Our Discovery Platform

We believe our discovery platform enables us to discover new drug candidates that selectively target SHIP1 to modulate activated immune cells while minimizing their toxicity to normal cells. Our discovery platform includes:

| • | a novel in vitro, high throughput assay to screen SHIP1 activators; |

| • | a patented approach to screening drugs against the C2 binding domain; |

| • | the use of the SHIP1 knockout mouse to produce cells for in vitro experiments or for in vivo studies to determine the selectivity and specificity of our compounds; and |

| • | an extensive library of chemical compounds that are known to be SHIP1 activators. |

Our discovery platform was initially applied to the screening of a natural product library of compounds to identify potential SHIP1 activators, which SHIP1 activators were covered by an exclusive license from the University of British Columbia. We chemically modified these initial compounds to improve their activity and pharmaceutical properties, which resulted in several classes of SHIP1 activator compounds being developed. From these compound classes, we developed a key understanding of the chemical structured characteristics of SHIP1 activators. With this understanding of what compounds activate SHIP1 and their chemical structures, we identified additional compound classes in other libraries of interest. We acquired one proprietary compound library of interest from Biolipox AB, with all patents transferred to us without any future royalty obligations. We screened compounds from this acquired library and confirmed that it contained SHIP1 activators, including a compound that was the basis for AQX-1125.

Our Pipeline

AQX-1125 is our clinical-stage product candidate. In addition, we have several other pre-clinical candidates that also target SHIP1 and that have both similar and distinct properties from AQX-1125, with some showing preliminary evidence of enhanced anti-inflammatory and anti-cancer properties.

The development status of AQX-1125 and our next generation product candidates is summarized below:

AQX-1125

AQX-1125 is our lead product candidate and has generated positive clinical data from three completed clinical trials, including two proof-of-concept trials, one in COPD and one in allergic asthma, demonstrating a favorable safety profile and anti-inflammatory activity. Importantly, our clinical trial results were consistent with the pharmaceutical properties and anti-inflammatory activities demonstrated in our preclinical studies. AQX-1125 is a once daily oral capsule with many desirable pharmaceutical properties. We are currently investigating AQX-1125 in three Phase 2 clinical trials, one in COPD, one in BPS/IC and one in AD. For AQX-1125, we retain full worldwide rights and hold patents with terms through at least 2024.

5

Table of Contents

AQX-1125 Activates SHIP1, Reducing Inflammation

AQX-1125 is an activator of SHIP1, which controls the PI3K cellular signaling pathway. If the PI3K pathway is overactive, immune cells can produce an abundance of pro-inflammatory signaling molecules and the cells migrate to and concentrate in tissues, resulting in excessive or chronic inflammation. SHIP1 is predominantly expressed in cells derived from bone marrow tissues, which are mainly immune cells. Therefore drugs that activate SHIP1 can reduce the function and migration of immune cells and have an anti-inflammatory effect. By controlling the PI3K pathway, AQX-1125 reduces immune cell function and migration by targeting a mechanism that has evolved in nature to maintain homeostasis of the immune system.

AQX-1125 has Desirable Pharmaceutical Properties

In addition to demonstrating strong in vitro and in vivo activity, AQX-1125 was also selected as a lead candidate based on its many desirable pharmaceutical properties. It is highly water-soluble and does not require complex formulation for oral administration. AQX-1125 has low plasma protein binding, is not metabolized and is excreted un-metabolized in both urine and feces. After oral or intravenous dosing, AQX-1125 reaches high concentrations in respiratory, urinary, and gastrointestinal tracts, all of which have mucosal surfaces of therapeutic interest. In humans, AQX-1125 has shown pharmacokinetic properties suitable for once-a-day dosing. In addition, the absorption of the drug candidate is equivalent whether taken with or without food.

AQX-1125 is Active in a Broad Range of Preclinical Inflammatory Studies

We have demonstrated compelling preclinical activity in a broad range of relevant inflammatory studies including preclinical models of COPD, asthma, pulmonary fibrosis, BPS/IC, AD, and inflammatory bowel disease (IBD). In these studies we have seen a meaningful reduction in the relevant immune cells that are the cells that cause inflammation, such as neutrophils, eosinophils and macrophages, and a reduction in the symptoms of inflammation, such as pain and swelling. The following table summarizes these supportive results from our preclinical in vivo studies with AQX-1125:

| CLINICAL |

ANIMAL MODEL |

PRIMARY ENDPOINT | ||

| COPD/Respiratory | LPS Airway Inflammation (Rat) | Reduction of neutrophils | ||

| Ovalbumin Airway Inflammation (Rat) | Reduction of eosinophils | |||

| Smoke Airway Inflammation (Mouse) | Reduction of neutrophils | |||

| Bleomycin Fibrosis (Mouse) | Reduction of fibrosis and increase in survival | |||

| BPS/IC | Cyclophosphamide Bladder Cystitis (Rat) | Reduction of inflammation, pain and hemorrhage | ||

| Carrageenan Paw Edema (Mouse) | Reduction of edema | |||

| IBD | TNBS IBD (Rat) | Reduction of adhesions/strictures and inflammation | ||

| AD | Passive Cutaneous Anaphylaxis (Mouse) | Reduction of edema | ||

| Phorbol Myristate Acetate (Mouse) | Reduction of edema and neutrophil recruitment | |||

| Carrageenan Paw Edema (Mouse) | Reduction of edema | |||

| Psoriasis (Mouse) | Reduction of erythema and scaling |

The activity, efficacy and potency seen with AQX-1125 in preclinical studies compare favorably to published results with corticosteroids. In addition, AQX-1125 demonstrated compelling activity in the smoke airway inflammation and bleomycin fibrosis models, which are known to be steroid refractory (i.e., do not respond to corticosteroids). We believe this broad anti-inflammatory profile is not typical among other drugs in development and supports the therapeutic potential and continued development of AQX-1125.

AQX-1125 has Demonstrated Desirable Properties in Three Completed Clinical trials

Overall, more than 100 subjects have received AQX-1125 in three separate completed trials. An overview of these clinical trials is described below.

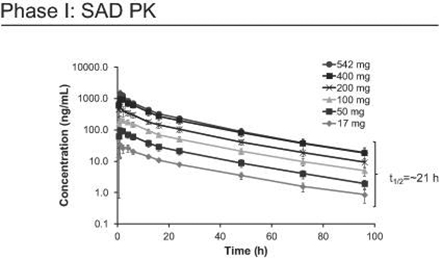

Phase 1 Safety Trial

We conducted a Phase 1, three-part, randomized, placebo-controlled, dose escalation trial of the safety, tolerability, pharmacokinetics and food effect of AQX-1125 in normal healthy subjects. This trial investigated single doses of AQX-1125 ranging from 17 mg to 542 mg (single ascending dose, or SAD, part, n = 16), daily doses ranging from 100 mg to 542 mg for up to ten days (multiple ascending dose, or MAD, part, n = 18) and daily dose of 200 mg for seven days in fasted or fed subjects (food effect part, n = 12).

6

Table of Contents

In the SAD part of our Phase 1 trial, AQX-1125 demonstrated desirable pharmaceutical properties: it is rapidly and nearly completely absorbed; it has dose proportional pharmacokinetics; and it has a consistent plasma half-life of approximately 21 hours. The results of the SAD part of our Phase 1 trial are shown below.

From a safety perspective, there were no drug-related adverse events reported in the SAD part.

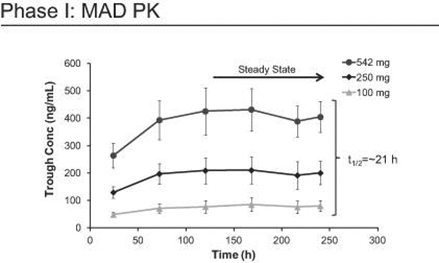

In the MAD part of our Phase 1 trial, which studied AQX-1125 for ten days, AQX-1125 reached steady state levels after the first four days of dosing and again had dose proportional pharmacokinetics and a consistent half-life. The results of the MAD part of our Phase 1 trial are shown below.

The most frequently reported drug-related and dose-related adverse events in the MAD part were related to gastrointestinal upset. All other adverse events were at a similar level to those reported with placebo. All adverse events were short-lived, observed in the first seven days of dosing, and resolved without treatment or long-term effects. Based on these data, treatment with single daily doses of either 100 mg, 250 mg or 542 mg AQX-1125 for ten days was generally well tolerated in healthy subjects. The maximum tolerated dose was considered not to be reached. In the food effect part of the trial, the absorption of the drug was considered equivalent whether taken with or without food.

The Phase 1 safety trial demonstrated that AQX-1125 has many desirable pharmaceutical properties. The consistent pharmacokinetics and safety profile of AQX-1125, combined with its high level of bioavailability, low protein binding and lack of metabolism, contribute to the consistent results to date from subject to subject, which we believe are positive attributes for future clinical trials and commercialization.

Following the completion of the Phase 1 safety trial, we initiated two proof-of-concept clinical trials of inflammation to demonstrate the first evidence of AQX-1125 activity, and importance of SHIP1 as a target, in humans.

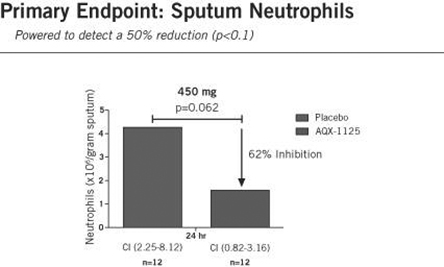

Phase 1b COPD Proof-of-Concept Trial

The first proof-of-concept trial was conducted to evaluate the anti-inflammatory properties, safety and pharmacokinetics of AQX-1125 following a lipopolysaccharide (LPS) challenge in healthy subjects. In the LPS challenge, patients inhale aerosolized LPS which induces an acute inflammatory response that is characterized by the activation and migration of neutrophils into the lung and results in a mild, transient and fully reversible impairment in pulmonary function. The inflammatory response induced by LPS inhalation (in

7

Table of Contents

healthy volunteers) is considered a model of the inflammatory mechanisms seen in patients with COPD. This type of proof-of-concept trial has been undertaken by other pharmaceutical companies to evaluate other anti-inflammatory therapies for COPD. This type of trial needs to be conducted in healthy volunteers whose normal lungs can tolerate the inflammatory response to LPS, as exposing COPD patients to LPS could induce a dangerous exacerbation.

Our trial was designed to investigate two doses of AQX-1125, 450 mg and 200 mg, in a placebo controlled crossover format where each subject received either drug for seven days, followed by placebo for seven days, or vice versa. The 450 mg part of the trial was successfully completed. Following seven days of once-daily treatment with 450 mg AQX-1125 or placebo, subjects (n = 18) were challenged with 50 µg of LPS at two hours following the last dose on day seven. AQX-1125 met its primary endpoint in the 450 mg dose part by reducing sputum neutrophils by approximately 62% (p=0.062) compared to placebo. AQX-1125 also showed a reduction in sputum IL-6 and, although not statistically significant, showed a trend towards a reduction in sputum IL-8, both of which are important cytokines in the activation and recruitment of neutrophils. In addition to the effects on neutrophils and cytokines, a trend towards reduction in other immune cells in sputum, namely eosinophils and macrophages, was also observed. The reduction of sputum neutrophil levels compares favorably to published results for anti-inflammatory drugs that are in development, or have been approved, for the treatment of COPD. The results of the 450 mg dose part of our trial are shown below.

The results of the 200 mg dose (n = 18) part of the trial were limited to safety and pharmacokinetic measurements. Due to a technical processing error at a third-party laboratory, we were unable to measure the magnitude of sputum neutrophil inhibition.

Reported adverse events were mild to moderate, with the majority being similar to reports from other published LPS challenge trials and relate to the administration of LPS (e.g., fever, chills, malaise, cough, chest tightness, headache and muscle pain). The most frequently reported dose-related adverse event was gastrointestinal upset. All adverse events resolved without treatment or long-term effects.

The results for AQX-1125 compare favorably with published results for other oral drugs studied in similar LPS challenge trials that either are in development or have been approved for the treatment of COPD. This proof-of-concept trial supported further development of AQX-1125 in COPD.

Phase 2a Allergic Asthma Inflammation Proof-of-Concept Trial

The second proof-of-concept trial evaluated the anti-inflammatory properties, safety and pharmacokinetics of AQX-1125 following an inhaled allergen challenge in mild to moderate asthmatics. Allergen, when inhaled, is a pro-inflammatory stimulus and in general can be used to evaluate the effects of anti-inflammatory compounds on allergic inflammation. Following inhalation of allergen, asthmatics develop an acute asthmatic attack which peaks at 20 to 30 minutes. Even if initially treated with bronchodilators, approximately 50% of these subjects develop secondary airway inflammation, known as the late asthmatic response (LAR), between four and ten hours after inhalation. This type of proof-of-concept trial has been undertaken by other pharmaceutical companies to evaluate the ability of other anti-inflammatory therapies to prevent or reduce the LAR.

AQX-1125 (450 mg) was investigated in a randomized, double-blind, placebo-controlled crossover format. Steroid-naïve asthmatics (n = 22) were randomized to AQX-1125 followed by placebo, or to placebo followed by AQX-1125, for seven days each. The primary efficacy measure was the LAR as measured by the forced expiratory volume in one second (FEV1) from four to ten hours after allergen challenge (AUC4-10). The trial met its primary endpoint by demonstrating an approximate 20% improvement in the LAR by 450 mg of AQX-1125 versus placebo (p = 0.027) and although not statistically significant, a reduction in all immune cells that were measured in sputum.

8

Table of Contents

All of the adverse events reported in the trial were mild to moderate, with the most frequently reported being headaches and gastrointestinal upset. All adverse events resolved without treatment or long-term effects.

The results for AQX-1125 compare favorably with published results for other drugs studied in similar allergic challenge trials that are either in development or that have been approved. More importantly, this proof-of-concept trial provides evidence of the ability of AQX-1125 to modulate allergic responses at a mucosal surface after exposure to an allergen. We believe this may imply usefulness for AQX-1125 in a range of diseases characterized by allergic inflammation such as chronic sinusitis, eosinophilic esophagitis and diseases that may have an allergic component, such as BPS/IC and AD.

AQX-1125 Safety Profile

Safety data have been obtained from over 100 subjects from our three completed trials who have been exposed to doses of AQX-1125 ranging from 17 mg to 542 mg for up to ten consecutive days. All of the treatment-related adverse events reported to date in the completed trials have been mild to moderate in intensity, and there have been no deaths, no withdrawals due to treatment-related adverse events and no serious adverse events or suspected unexpected serious adverse events (SUSAR) reported.

In addition, there have been no drug-related, clinically significant, adverse changes in any laboratory parameter in the completed trials. The most frequent dose-related adverse event that increased with increasing dose was gastrointestinal disorder, which was intermittent and resolved without treatment or long-term effects. Frequency of gastrointestinal adverse events decreased with lower dose and with reduced fasting time, consistent with the adverse events being associated with irritation of the gastrointestinal lining from the rapid dissolution and absorption of AQX-1125. For the current and future trials, AQX-1125 will be administered with food with the goal of avoiding gastrointestinal events. The adverse events noted for AQX-1125 have been consistent across all trials completed to date.

Clinical Trial Summary

Based on our three completed clinical trials, we have demonstrated that AQX-1125:

| • | has desirable pharmacokinetic, absorption and excretion properties that make it suitable for once daily oral administration; |

| • | is generally well tolerated, exhibiting mild to moderate adverse events primarily related to gastrointestinal upset that resolve without treatment or long-term effects and are reduced by taking the drug candidate with food; and |

| • | has anti-inflammatory properties consistent with those exhibited in preclinical studies and exhibited activity in two trials using two distinct inflammatory challenges. |

Development Plan

Based upon the supportive preclinical and clinical data generated to date, we have advanced AQX-1125 to three Phase 2 trials. In general, the factors we considered most important in selecting our Phase 2 trials were:

| • | large patient populations with generally inadequate current therapy; |

| • | an attractive commercial opportunity with limited competition; and |

| • | an acute phase of the disease or an endpoint that could reasonably be affected in three months of treatment. |

While we believe there is an expansive list of potential clinical indications that could potentially benefit from treatment with AQX-1125, we selected COPD, BPS/IC and AD for further Phase 2 evaluation based on the preceding factors.

Dose Selection for Phase 2

We selected 200 mg once daily as the most appropriate dose for our Phase 2 COPD, BPS/IC and AD trials based upon preclinical efficacy/target coverage experiments, regulatory considerations and human dosing/activity results from Phase 1 and 2a. Human doses as low as 70 mg daily would provide blood levels of AQX-1125 equal to or greater than the average blood levels needed to achieve maximum efficacy in animal models. From our preclinical pharmacodynamic/pharmacokinetic (PK/PD) studies the observed maximal efficacy occurs in animal models at an average plasma concentration of 90 ng/ml (40-140 ng/ml). We believe 200 mg daily will provide excess target coverage (281 ng/ml) and an appropriate safety margin for extended duration dosing (e.g. six weeks or greater in current Phase 2 trials). From a safety perspective, in our completed trials a 200 mg dose was demonstrated to have a side effect profile equivalent to placebo and the plasma drug concentration in humans at this dose corresponds with a dose in animals that caused no toxicity for up to 13 weeks. We expect that future development of AQX-1125 will include clinical trials that will explore lower doses of AQX-1125, as establishing the minimally effective dose is an important endpoint for drugs that are intended for extended or chronic dosing.

Chronic Obstructive Pulmonary Disease

COPD is a lung disease frequently associated with cigarette smoking and air pollution. COPD is characterized by progressive loss of lung function and chronic inflammation of the airways. The disease is estimated to affect up to 600 million people worldwide with estimates of the number of people suffering from the moderate and severe forms that most frequently require treatment ranging from 65 million to over 200 million. It is the third leading cause of death in the United States and worldwide. COPD affects almost 25 million people in the United States alone, at an estimated annual economic burden of $50 billion. COPD is the leading cause of urgent hospitalization in developed countries.

9

Table of Contents

COPD Exacerbations — COPD patients suffer periodic episodes with severe worsening of symptoms, known as exacerbations. Exacerbations are characterized by severe airway inflammation triggered by various factors, such as viral or bacterial infection, or environmental irritants. Symptoms include cough, difficulty breathing, elevated mucous production, reduced tolerance to exertion and fatigue, and these symptoms typically worsen over time and often cause feelings of suffocation, panic and anxiety. Exacerbations can be so severe that they lead to respiratory failure and death. These exacerbations have a profoundly negative impact on the quality of life and long-term survival of patients and cause significant challenges for healthcare systems and the global economy. Each year, on average, COPD patients experience one or two exacerbations, which may be classified as mild, moderate or severe (requiring hospitalization). Of COPD patients, 22-40% die within one year of a severe exacerbation and 66% die within three years. Since exacerbations involve severe increased airway inflammation, treatment with potent anti-inflammatories that reduces the recruitment of immune cells (especially neutrophils) to the lungs is a potentially promising strategy to reduce exacerbations.

A 2009 study by Hurst, et al, of COPD patients demonstrated that there are generally two categories of patients with COPD exacerbations: those with infrequent exacerbations (stable) and those with frequent exacerbations (unstable). This was the first study to document the major finding that in unstable patients, exacerbations tend to cluster together; therefore patients that have had an exacerbation are at highest risk of having secondary exacerbations within the next eight weeks. The unstable COPD patients tend to have clusters of exacerbations on an annual basis, often having a second or even third exacerbation within eight to 12 weeks of their first. The study reported that approximately 27% of patients on study had a second, discrete exacerbation within eight weeks of their most recent exacerbation. This is consistent with a United Kingdom national audit of COPD outcomes, in which 34% of 1,221 hospitalized patients with exacerbations of COPD were readmitted in the subsequent three months. In contrast, the stable COPD population is characterized by effective treatment and resolution of their first exacerbation and typically no further worsening of their symptoms for at least 12 weeks.

A medical editorial that reviewed the results of the Hurst study suggested that it may be of particular importance, regardless of exacerbation frequency, to target patients after an initial exacerbation. It would be clinically important to prevent a second exacerbation in a COPD patient who has had a recent first exacerbation. However, clinical trials to date with preventive medications have, by virtue of their exclusion criteria, not addressed this issue. Most COPD clinical trials with bronchodilators, either alone or in combination with inhaled corticosteroids, have intentionally excluded patients that experienced a recent COPD exacerbation. The data presented by Hurst and colleagues suggest that this is an incorrect approach, because it is these very patients who are most at risk for recurrent exacerbations and who can be expected to drive clinical trial outcomes. We believe that a trial design that intentionally enrolls patients that have experienced a recent exacerbation to prevent a recurrent exacerbation represents an important opportunity for anti-inflammatory therapy.

COPD Current Therapy — Most marketed therapies for COPD are inhaled drugs directed towards managing symptoms by dilating narrowed airways (bronchodilators) often in combination with inhaled corticosteroids intended to open the airways to improve the ease of breathing. These inhaled therapies have modest effects on slowing the progression of COPD or reducing exacerbations. With over two decades of innovation and incremental improvement from new bronchodilator approvals, the majority of moderate and severe COPD patients still suffer from periodic exacerbations and approximately two-thirds of these patients have multiple exacerbations per year. The scientific literature also questions the value of inhaled corticosteroids in the treatment of COPD and links their use to increased risk of pneumonia and yeast infections of the mouth and throat.

The standard treatment following an exacerbation is a combination of antibiotics and/or oral corticosteroids, both of which can only be used for short durations — typically ten to 14 days due to toxicities or risk of resistance from prolonged use. Following treatment and withdrawal from oral corticosteroids, unstable COPD patients frequently have a re-emergence of exacerbation symptoms within a two-month period that can lead to hospitalization or urgent care.

The recently approved phosphodiesterase-4 or PDE4 inhibitor, roflumilast (Daliresp), for the treatment of severe COPD associated with chronic bronchitis, is the only approved oral therapy indicated as a treatment to reduce the risk of COPD exacerbations in patients with severe COPD associated with chronic bronchitis and a history of exacerbations. Roflumilast has demonstrated some ability in reducing exacerbations but its clinical use is limited due to its side effect profile. Despite their limitations and restricted use, the evidence that both oral corticosteroids and roflumilast can reduce and treat exacerbations provide the precedent that oral anti-inflammatory therapy is an important strategy for improving the management of COPD. We believe that there is a significant medical need for new oral therapies to treat the acute and chronic lung inflammation that COPD patients experience, to reduce the severity, duration and reoccurrence of exacerbations and to slow or prevent disease progression. We believe that the anti-inflammatory properties that we have observed for AQX-1125 to date compare favorably with roflumilast and oral corticosteroids while having a safety profile potentially more suitable for prolonged use.

The Flagship Trial: AQX-1125 in COPD Patients with Frequent Exacerbations — Our Phase 2 trial, known as the Flagship trial, is evaluating the effect of AQX-1125 compared to placebo in approximately 400 unstable moderate to severe COPD patients who have experienced a recent exacerbation and at least two other exacerbations in the prior 18 months. We believe this trial targets the COPD patients in greatest need and with the highest likelihood of responding to anti-inflammatory therapy. Enrolling patients who are expected to have frequent exacerbations permits the trial design to allow fewer patients and shorter required dosing to see a positive outcome compared to historical trials of bronchodilators. The trial is sized to detect a significant change in the primary

10

Table of Contents

endpoint of the change in the severity, duration and reoccurrence of exacerbations in patients treated with AQX-1125 versus placebo, as measured by EXACT-PRO, a patient-reported tool that measures symptoms. We are evaluating AQX-1125 administered as once daily oral 200 mg capsules for 12 weeks in this multi-center, randomized, double-blind, placebo-controlled Phase 2 trial to reduce the severity, duration and reoccurrence of exacerbations on top of standard of care. This trial is being conducted in Northern and Central Europe, Australia, New Zealand, and the United States. The Flagship trial is being conducted in hospitals, outpatient clinics and research units and has completed enrollment of 400 patients. Top-line data is expected near mid-year 2015. COPD patients were randomized to receive either AQX-1125 or placebo in addition to the current standard of care. Full results are expected to be submitted for publication and presented at a leading medical conference. If positive results in this trial are achieved, we intend to meet with the FDA and other regulatory authorities to determine the most appropriate path to marketing approval for AQX-1125.

We believe the selection of COPD as a targeted clinical indication matches well with the demonstrated ability of AQX-1125, in both preclinical studies and clinical trials, to reduce inflammation, in particular neutrophils, in the airways in response to environmental inflammatory stimuli. The trial includes COPD patients with frequent exacerbations. This allows for shorter trial duration and reduced number of patients needed to see sufficient clinical events to detect the effects of AQX-1125 in a 12-week trial. This novel trial design utilizes the recently developed EXACT-PRO measurement tool, which is a highly sensitive patient reported questionnaire utilizing electronic diaries for accurate and reliable capture of data on the daily symptoms affecting COPD patients.

The EXAcerbations of Chronic pulmonary disease Tool (EXACT), a patient-reported outcome (PRO), or EXACT-PRO, is a recent development for research of exacerbations in COPD patients. EXACT-PRO was designed to standardize the method for evaluating the frequency, severity and duration of exacerbations. The EXACT-PRO initiative was spearheaded by United Biosource Corporation, an Express Scripts Company, with input from the FDA and was funded by a consortium of pharmaceutical companies, including AstraZeneca plc, Almirall S.A., Bayer AG, Bohringer Ingleheim Corporation, Forest Pharmaceuticals, Inc., GlaxoSmithKline plc, Merck & Co., Inc., Novartis AG, Ortho-McNeil Pharmaceutical, a division of Johnson & Johnson, Pfizer, Inc. and Sunovion Pharmaceuticals, Inc. It is available in more than 40 languages and has been tested in a number of validation studies in approximately 50 countries, with a comprehensive evidence dossier submitted to the FDA and EMA for qualification of this tool for use in Phase 3 trials.

EXACT-PRO provides data and quantification of numerous symptoms on a daily basis, thereby providing more robust and continuous measure of the effects of AQX-1125 on COPD exacerbations. We believe EXACT scores may be particularly useful in studying an exacerbation patient’s recovery pattern, allowing a more sensitive measure of a patient’s progress, rather than simply whether a patient has experienced another exacerbation or deteriorated to the point where the patient requires hospitalization, which was a typical endpoint prior to the development of EXACT-PRO. We are not aware of any other clinical trial utilizing EXACT scores as a primary endpoint in a Phase 2 or Phase 3 trial conducted over 12 weeks or longer. The FDA has accepted our IND application for the Flagship trial and we shared the use of EXACT-PRO as our primary endpoint for this trial; however, we do not know whether the FDA will accept EXACT-PRO as a primary endpoint for Phase 3 trials instead of more traditional COPD trial endpoints. Overall, we believe that we will collect substantially more data by using EXACT-PRO compared to traditional COPD trial endpoints that will be beneficial in guiding our marketing approval strategy for AQX-1125.

Bladder Pain Syndrome/Interstitial Cystitis

BPS/IC is a chronic urinary bladder disease characterized by erosion of the lining and chronic inflammation of the bladder, pelvic pain and increased urinary urgency and/or frequency. Stress or a change in diet has been known to trigger BPS/IC symptoms. BPS/IC affects men and women of all ages. BPS/IC currently affects an estimated 14 million people in the United States and is accepted to be one of the most challenging urological conditions without effective therapy.

Chronic inflammation within the bladder wall can lead to damage and fibrotic changes in the bladder. There have been several studies linking allergic sensitivity to worsening BPS/IC symptoms. Furthermore, the inflammation leads to the release of mediators that irritate and trigger surrounding nerve tissue and causes radiating pain. For many BPS/IC sufferers, their symptoms of constant pain and urinary frequency are severe and adversely affect all major aspects of their lives, including overall physical and emotional health, employment, social and intimate relationships, and leisure activities.

The diagnosis of BPS/IC is often challenging and is based on exclusion of other diseases, including bladder cancer, kidney stones, vaginitis, endometriosis, sexually transmitted diseases and prostate infections. BPS/IC is generally diagnosed through cystoscopy or hydrodistention under anesthesia; however, many cases are overlooked. Sometimes patients have to see a number of doctors and specialists over a period of several years to obtain a correct diagnosis.

BPS/IC Current Therapies — There is no known cure for BPS/IC, although a number of therapies can relieve symptoms. The only approved oral therapy is an agent, pentosan polysulfate (Elmiron), first approved in 1996, which helps to temporarily restore the bladder lining. Other therapies include such approaches as antihistamines, low dose antidepressants to fight neurogenic pain and analgesics. Most BPS/IC patients continue to suffer this debilitating condition, despite treatment with existing therapies. Most current therapies and those in development are focused solely on symptomatic relief of BPS/IC.

11

Table of Contents

In addition to oral therapies, direct instillation of drugs into the bladder via catheter (intravesical therapy) has been shown to provide temporary relief of symptoms. Dimethylsulfoxide (DMSO; RIMSO-50) is the only drug approved by the FDA for bladder instillation for BPS/IC. It offers anti-inflammatory, muscle relaxant and analgesic effects. DMSO is used alone or in combination with heparin, corticosteroids, bicarbonate and a local anesthetic (lidocaine) for intravesical administration.

Corticosteroids have also been reported to work via transurethral injection into the bladder wall or instillation into the bladder. Prolonged use of corticosteroids by BPS/IC patients is associated with bladder wall scarring. The American Urological Association guidelines for BPS/IC specifically state that corticosteroids are not recommended and should be avoided for chronic treatment of BPS/IC. Nonetheless, there is supporting evidence that achieving sufficient concentration of an anti-inflammatory compound in the bladder can reduce the pain and urinary symptoms associated with BPS/IC.

Instillation therapies are invasive and inconvenient, and oral therapies can offer significant potential advantages for BPS/IC patients. However, despite precedents for BPS/IC anti-inflammatory therapies, there are no satisfactory oral therapies currently available. We believe there is a significant medical need for new and innovative treatments that target the underlying inflammatory disease process.

The Leadership Trial: AQX-1125 in BPS/IC patients — Our Phase 2 trial, known as the Leadership trial, is investigating the ability of AQX-1125, compared to placebo, to reduce pain and urinary symptoms in approximately 70 BPS/IC patients. We believe AQX-1125 is a candidate for evaluation in BPS/IC due to the fact that it has demonstrated activity in both preclinical studies and clinical trials relevant to BPS/IC, is delivered to the bladder via the bloodstream, and in pre-clinical studies, is eliminated, unmetabolized, into the urine, thereby achieving high concentrations proximate to the inflamed bladder wall. The Leadership trial is a multi-center randomized, double-blind, placebo-controlled Phase 2 trial of AQX-1125 once daily oral 200 mg capsules for six weeks in women suffering from chronic pain associated with BPS/IC. The trial is sized to detect a statistically significant change in the primary endpoint of the difference in the change from baseline in the mean daily bladder pain score based on an 11-point numeric rating scale at two, four and six weeks recorded by electronic diary. We have now completed enrolment for the Leadership trial. With 69 patients randomized to date and a higher completion rate than forecast for the trial, we have met our enrolment objectives. Top-line data is expected near mid-year 2015. Full results are expected to be submitted for publication and presented at a leading medical conference. If positive results are achieved in this trial, we intend to meet with the FDA and other regulatory authorities to determine the most appropriate path to marketing approval for AQX-1125.

We believe that we have incorporated strategies into our Phase 2 trial for AQX-1125 in BPS/IC that address the shortcomings of prior published trials by other companies, and capitalize on the properties of our product candidate. We have designed our Leadership trial to:

| • | require cystoscopic confirmation of inflammation of a patient’s bladder for entry in the trial to ensure the enrollment of the proper patient population; |

| • | measure patients over a six-week period, which we believe will provide a measure of therapeutic activity of AQX-1125 over a period that should both be sufficient to see improvement in pain and urinary symptoms but also long enough to minimize the risk that placebo effects could confound the trial results; |

| • | utilize a trial size sufficient to detect a change in pain, which is our primary endpoint, as measured by electronic diaries; and |

| • | administer a once daily oral 200 mg capsule dose that we expect to achieve concentrations both in the blood stream and in the urine that are significantly higher than we anticipate is required to activate SHIP1 in affected tissues. |

Atopic Dermatitis

AD, often referred to as atopic eczema or just eczema, is an uncomfortable, relapsing, non-contagious, inflammatory skin disorder that is typically characterized by dry, itchy skin. AD lesions have a tendency to weep, crack, swell or crust-over and are at heightened risk for infection. AD symptoms manifest as redness, scaling, and loss of the surface of the skin. Atopic dermatitis is the most common of the many types of eczema and is frequently associated with other allergic disorders, especially asthma and hay fever. AD has been traced to a defect of the immune system within the skin but the cause of the disease is largely unknown, although a genetic component is well-recognized. The prevalence of AD in adults and children ranges from 1%-20% worldwide. An estimated 17.8 million people in the United States are affected by AD, which is considered under diagnosed by physicians. Approximately two-thirds of people in the United States diagnosed with AD suffer from the moderate to severe form of the disease, where existing therapies are often ineffective or unsuitable for long-term treatment.

AD is diagnosed based on the presentation of pruritis (itchy skin) in association with two to three other typical AD symptoms, which could include dry, scaly skin, the presence of papules, skin lesions, oozing rash, inflammation, and lichenification (thickening of the skin). Rashes and papules generally appear on the hands, ankles, neck or behind the knees or elbows. Bleeding and/or secondary infections are more common in severe cases of AD. Flares of AD are diagnosed as mild, moderate, or severe, although symptoms can occur at all levels of severity at varying degrees of intensity. Patients may be diagnosed with severe or refractory AD based on the symptoms appearing over a large area of the body, the intensity of the symptoms and the impact on the patient’s quality of life. Failure to respond to treatment may also lead to a diagnosis of severe AD.

12

Table of Contents

AD Current Therapies — There is no known cure for AD. Most current therapies and those in development are intended to alleviate symptoms, improve the condition of the skin, reduce the number of flares, and improve the patient’s quality of life. Treatment is complex due to varying efficacy among products and individual response to therapies over time. Treatment generally consists of a combination of preventative care, such as keeping the skin hydrated and avoiding allergens, and therapies to reduce and alleviate symptoms as well as lengthen the remission period between flares. Mild AD is generally treated through patient education in conjunction with the use of emollients and bath oils while moderate disease often adds topical corticosteroids into the treatment paradigm.

While there is no standardized treatment algorithm, severe or refractory patients are typically prescribed higher potency topical corticosteroids with the potential addition of topical calcineurin inhibitors (TCIs) and/or systemic corticosteroids. Though higher potency topical corticosteroids are generally considered efficacious, efficacy can vary depending on the individual patient’s severity of disease, use of the product, and the product itself. Furthermore, higher potency topical corticosteroids are not recommended for sensitive areas such as the face, are not suitable for prolonged use, and are not effective in treating pruritis.

TCIs are normally prescribed when a patient is not, or is no longer, responding adequately to treatment with topical corticosteroids, to treat sensitive areas of the body in concert with topical corticosteroids, or if a patient has concerns about the side effects of corticosteroid treatment. However, TCIs are only indicated for short-term non-continuous use as side effects can include burning, itching, and/or sensitivity to light.

Systemic corticosteroids are also sometimes administered in the short-term to control severe flares that are not responding to other therapies. Because of their safety profile, they are not generally used for on-going or chronic treatment. These systemic corticosteroids can be injected, inhaled, or taken orally.

Daily applications of, or applications multiple times per day with, topical therapies can be inconvenient or impractical for severe patients whose percent body surface area (%BSA) affected with AD is often higher than 25%, thus oral therapies can offer significant potential advantages for AD patients. Despite precedents for anti-inflammatory AD therapies, there are no oral anti-inflammatory therapies currently approved by the FDA for AD. We believe there is a significant medical need for new and innovative treatments that target the underlying inflammatory disease process and that reduce the severity, duration and reoccurrence of flares while having a safety profile potentially more suitable for prolonged use.

The Kinship Trial: AQX-1125 in AD patients – Our Phase 2 trial, known as the Kinship trial, is investigating the ability of AQX-1125, compared to placebo, to improve AD symptoms. This trial is a randomized, double-blind, multicenter, placebo-controlled Phase 2 trial evaluating the efficacy and safety of AQX-1125 once daily oral 200 mg capsules for twelve weeks in approximately 50 adult patients with mild to moderate atopic dermatitis in order to obtain proof of concept from patients suffering from this disease. The trial, which initiated enrolment in December 2014, is being conducted at clinical research centers in Canada and is anticipated to complete with full enrollment and initial results in the first quarter of 2016. Full results are expected to be submitted for publication and presented at a leading medical conference in 2016. The Kinship trial’s primary endpoint is change from baseline in Total Lesion Symptom Score (TLSS) at Week 12 of treatment. The TLSS is a comprehensive assessment of AD symptoms where AQX-1125 may have a beneficial effect. Secondary endpoints include safety, pharmacokinetics and additional parameters for assessing AD symptoms.

Expanded Clinical Indications for AQX-1125

We have demonstrated compelling preclinical efficacy with AQX-1125 in a broad range of relevant inflammatory and fibrotic models of inflammation including models of respiratory, urinary and gastrointestinal tract and skin inflammation. We have previously stated an intention to initiate a fourth Phase 2 trial in chronic rhinosinusitis with nasal polyps in the first half of 2015. To focus our resources, we intend to delay the initiation of this trial until after the completion of the Leadership and Flagship trials. We believe our preclinical data and clinical proof-of-concept trial results support the potential for AQX-1125 to treat a range of diseases characterized by mucosal inflammation such as, chronic sinusitis, nephritis, eosinophilic esophagitis and inflammatory bowel disease.

We are currently evaluating a range of clinical indications for inclusion into our development plan for AQX-1125. In addition to the relevance of SHIP1 as a target, and the properties of AQX-1125, each disease and patient population must also be considered based on its relative unmet medical need, market opportunity, the competitive environment and feasibility of clinical/regulatory pathway. We believe that there are multiple value creating opportunities in further expanding the clinical indications for which AQX-1125 is being evaluated.

Next Generation SHIP1 Activators

We have several next generation product candidates in preclinical development that are also SHIP1 activators and intend to advance these through additional preclinical evaluation.

We believe there are anti-inflammatory diseases that would be better addressed by next generation SHIP1 activators that have different properties from AQX-1125 such as concentrating in different tissues, having a different duration of action or being more suitable for different routes of administration.

13

Table of Contents

We also intend to explore the role of SHIP1 activators in the treatment of cancer. Academic scientists have shown that in certain immune cell cancers the suppressed activity of SHIP1 could play a central role in the deregulation of PI3K pathway and tumor growth. Restoration of the SHIP1 activity by activators may make immune cell cancers more susceptible to chemotherapy. In addition, there is evidence that activating SHIP1 can reduce the chronic inflammation surrounding solid tumors, making these tumors more susceptible to chemotherapy. The treatment of cancer by modulating the PI3K pathway via SHIP1 offers a potentially promising new approach to improve the treatment of either immune cell cancers or solid tumors.

We believe next generation product candidates in the treatment of inflammation and cancer offer significant market potential.

Strategy

We intend to maintain and strengthen our leadership position in the development of small molecule drugs that target SHIP1. We intend to participate in the potential commercialization of AQX-1125 and other potential drug candidates that we develop with a focus on building a targeted commercial infrastructure focusing on specialist physicians for the United States and Canada. For territories outside of the United States and Canada and to target primary care physicians globally, for which our potential drug candidates may have a market, it is our intention to identify a strategic partner to fully optimize the commercial potential of AQX-1125 and other potential drug candidates that we may develop. We have a management team with broad-based experience and expertise that span drug discovery through Phase 3 trials and regulatory filings. The key components of our strategy are to:

| • | Target large, underserved markets with limited competition and an attractive path to approval. We prioritize clinical indications that are characterized by significant economic burden and are currently under-invested by the pharmaceutical industry, thereby limiting potential competition. We believe our current product candidate offers an innovative treatment option with an attractive approval pathway in COPD, BPS/IC and AD. COPD, for example, is estimated to affect up to 600 million people worldwide, with current inhaled therapies having modest effects on slowing progression or reducing exacerbations. Our Flagship trial targets unstable COPD patients in greatest need and with the highest likelihood of responding to anti-inflammatory therapy. We believe enrolling those who experience frequent exacerbations creates the opportunity to demonstrate effect with fewer patients and shorter required dosing. |

| • | Focus on successfully developing AQX-1125 for a range of inflammatory diseases. We are focused on successfully executing the completion of our current Phase 2 trials in COPD, BPS/IC and AD. We will undertake additional work necessary for regulatory approval that may reduce the overall development time. Some of these activities are already underway and others will be undertaken in the future. These activities include: chronic toxicity studies in rat and dog and reproductive toxicity studies; chemistry, manufacturing and control, or CMC activities, including final dosage form development, process development, additional active pharmaceutical ingredient, or API, and final drug product manufacturing, and process validation; and supportive clinical trial work. We also intend to initiate additional Phase 2 trials with AQX-1125 focusing on additional diseases of the respiratory, urinary and gastrointestinal tracts and skin that would complement our ongoing evaluation of AQX-1125 in COPD, BPS/IC and AD. |

| • | Advance our next generation compounds in indications not covered by AQX-1125. We believe there are anti-inflammatory diseases that would be better addressed by our next generation SHIP1 activators that have different properties from AQX-1125 such as concentrating in different tissues, having a different duration of action or being more suitable for different routes of administration. We already have a significant library of candidate compounds and will advance these through additional preclinical evaluation. We also intend to explore the role of SHIP1 activators in the treatment of cancer. Each of these applications offers significant market potential. We intend to advance one next generation product candidate for either an inflammatory disease or for the treatment of cancer to clinical trials by 2016. |

| • | Evaluate on a selective basis strategic partnerships to maximize the commercial potential of AQX-1125 and actively pursue partnerships for our next generation and other non-core assets. From a commercialization strategy perspective, we have intentionally maintained full commercial rights to our product candidates to date. A decision on partnering will be made at the time when our available data supports a well-defined path to approval and market, as this timing will enable us to capture maximum value from our product candidates. We intend to explore a variety of alternatives for the potential commercialization of AQX-1125 on a global basis, including direct commercialization, co-promotion or selective territorial out-licensing of rights to a third party. It is our intention to participate in the potential commercialization of AQX-1125 in the United States and Canada and to seek a strategic partner for other territories. By retaining worldwide rights to AQX-1125 through early development we have maintained flexibility for any future commercialization of AQX-1125. We intend to pursue a similar strategy for our next generation product candidates, except for those that require expertise outside our core-areas or require resources beyond those available to us. For non-core assets, as we advance our next generation product candidates, we intend to seek early partnerships to defray the cost, risk and infrastructure requirements in order to further their commercial development. |

14

Table of Contents

Research and Development

Since commencing operations, we have dedicated a significant portion of our resources to the development of product candidates, particularly AQX-1125. We incurred research and development expenses of $18.1 million, $7.6 million and $6.0 million during the years ended December 31, 2014, 2013 and 2012, respectively. We anticipate that a significant portion of our operating expenses will continue to be related to research and development as we continue to advance AQX-1125 and our future product candidates.

Intellectual Property

Our commercial success depends in part on our ability to obtain and maintain patent and other proprietary protection for AQX-1125 and our future product candidates, novel biological discoveries, screening and drug development technologies such as our SHIP1 discovery platform, manufacturing and process discoveries, and other inventions that are important to our business, as well as to operate without infringing the proprietary rights of others and to prevent others from infringing our proprietary rights. We strive to protect our intellectual property through a combination of patent, copyright, trademark and trade secrets laws, as well as through confidentiality provisions in our contracts.

With respect to AQX-1125 and our future product candidates, we endeavor to obtain and maintain patent protection in the United States and internationally on all patentable aspects of AQX-1125 and our other pipeline products, as it is critical to our global business strategy. Our patenting strategy is initially to pursue patent protection covering both compositions of matter and methods of use of AQX-1125 and our future product candidates and then seek to obtain additional patent protection throughout the development process on other aspects of our technology that would potentially enhance our competitive exclusivity and commercial success. Such additional means of protection may include filing applications with claims to additional methods of use, processes of manufacture, methods of screening, biomarkers, and companion diagnostics. We also rely on continuing technological innovation, know-how and trade secrets relating to our discovery platform and product candidates and seek to protect and maintain the confidentiality of proprietary information to protect aspects of our business that are not amenable to, or that we do not consider appropriate for, patent protection.

The patent positions of biotechnology companies like ours are generally uncertain and involve complex legal, scientific and factual questions. In addition, the coverage claimed in a patent application can be significantly reduced before the patent is issued, and its scope can be reinterpreted, or the patent held invalid after issuance. Consequently, we may not be able to obtain or maintain adequate patent protection for AQX-1125 or any of our future product candidates. We cannot predict whether the patent applications we are currently pursuing will issue as patents in any particular jurisdiction or whether the claims of any issued patents will provide sufficient proprietary protection from competitors. Any patents that we hold may be challenged, circumvented or invalidated by third parties. For a more comprehensive discussion of the risks related to our intellectual property, please see the section of this Annual Report captioned “Risk Factors—Risks Related to Intellectual Property.”

Our patent estate on a worldwide basis includes approximately 27 issued patents and approximately 17 pending patent applications that we are actively prosecuting and/or maintaining. These figures include patents and patent applications to which we hold exclusive commercial rights under our licenses from third parties. Our solely owned issued patents include seven U.S. patents and 11 foreign patents and our solely owned patent applications include one U.S. application and 12 foreign patent applications.

Intellectual Property Relating to AQX-1125

We are the sole owner of a patent portfolio that includes issued patents and pending patent applications covering compositions of matter and methods of use of AQX-1125. We acquired these patents and applications relating to AQX-1125 by way of an asset purchase from Biolipox AB in August 2009. This patent portfolio includes four issued United States patents and 11 foreign patents issued in Europe, Japan, Canada, Korea, Mexico, Norway, Russia, Australia and New Zealand. Our issued patents cover the composition of matter of both the class of compounds to which AQX-1125 belongs, and AQX-1125 specifically, as well as methods for using AQX-1125. The foreign patents will expire in 2024, while the U.S. patents will expire in 2024-28, excluding patent term extensions that may be available in the United States under the Hatch-Waxman Act or in foreign countries under similar statutes. The expiration dates of the issued U.S. patents relating to AQX-1125 include patent term adjustment (PTA) under the provisions of 35 U.S.C. §154; namely, we have received a PTA extension of 1,379 days for U.S. Patent 7,601,874, which covers the composition of matter of AQX-1125, and a PTA extension of 58 days for U.S. Patent 8,084,503 which covers the methods of using AQX-1125.

Patent Terms

The term of individual patents and patent applications listed in previous sections will depend upon the legal term of the patents in the countries in which they are obtained. In most countries, the patent term is 20 years from the date of filing of the patent application (or parent application, if applicable). For example, if an international Patent Cooperation Treaty, or PCT, application is filed, any patent issuing from the PCT application in a specific country expires 20 years from the filing date of the PCT application. In the United States, however, if a patent was in force on June 8, 1995, or issued on an application that was filed before June 8, 1995, that patent will have a term that is the greater of 20 years from the filing date or 17 years from the date of issue.

In the United States, the Hatch-Waxman Act permits the patent term of a patent that covers an FDA-approved drug to be eligible for patent term extension, or PTE, of up to five years beyond the original expiration of the patent. This patent term restoration acts as compensation for the patent term lost during product development and the FDA regulatory review process if approval of the

15

Table of Contents

application for the product is the first permitted commercial marketing of a drug or biological product containing the active ingredient. The length of the patent term extension is related to the length of time the drug is under regulatory review, and is generally one-half the time between the effective date of an IND and the submission date of a NDA plus the time between the submission date of a NDA and the approval of that application. Patent term extension under the Hatch-Waxman Act cannot extend the remaining term of a patent beyond a total of 14 years from the date of product approval and only one patent applicable to an approved drug may be extended. Similar provisions are available in Europe and other foreign jurisdictions to extend the term of a patent that covers an approved drug. In the future, if and when our products receive FDA approval, we anticipate applying for patent term extensions on patents covering those products. We intend to seek patent term extensions to any of our issued patents in any jurisdiction where these are available, however there is no guarantee that the applicable authorities, including the FDA in the United States, will agree with our assessment of whether such extensions should be granted, and if granted, the length of such extensions.

Trade Secrets

In addition to patents, we also rely upon proprietary know-how (including trade secrets) to protect our technology and maintain and develop our competitive position. In some situations, maintaining information as a trade secret may be more appropriate to protect the type of technology than filing a patent application. We seek to protect our confidential and proprietary information in part by confidentiality agreements and it is our policy to require employees, consultants, scientific advisors, outside scientific collaborators, sponsored researchers, and contractors to execute such agreements upon the commencement of a relationship with us. These agreements provide that all confidential information concerning our business or financial affairs developed or made known to the individual during the course of the individual’s relationship with us is to be kept confidential and not disclosed to third parties except in specific circumstances. We also employ invention assignment clauses in our agreements to grant us ownership of technologies that are developed through a relationship with a third party. Our agreements with employees also provide that all inventions conceived by the employee in the course of employment with us or from the employee’s use of our confidential information are our exclusive property. We also seek to preserve our trade secrets by maintaining physical security of our premises and physical and electronic security of our information technology systems.