Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - ZS Pharma, Inc. | d846181dex312.htm |

| EX-14 - EX-14 - ZS Pharma, Inc. | d846181dex14.htm |

| EX-32.1 - EX-32.1 - ZS Pharma, Inc. | d846181dex321.htm |

| EX-31.1 - EX-31.1 - ZS Pharma, Inc. | d846181dex311.htm |

| EX-23.1 - EX-23.1 - ZS Pharma, Inc. | d846181dex231.htm |

| EX-32.2 - EX-32.2 - ZS Pharma, Inc. | d846181dex322.htm |

| EXCEL - IDEA: XBRL DOCUMENT - ZS Pharma, Inc. | Financial_Report.xls |

| EX-10.17 - EX-10.17 - ZS Pharma, Inc. | d846181dex1017.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2014.

or

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number 001-36489

ZS PHARMA, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 26-3305698 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 508 Wrangler Drive, Suite 100 Coppell, Texas |

75019 | |

| (Address of principal executive offices) | (Zip Code) | |

(877) 700-0240

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.001 par value | The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates of the registrant on June 30, 2014 (the last business day of the registrant’s most recently completed second fiscal quarter) was $65,017,780.

As of March 3, 2015, the registrant had 20,902,312 shares of common stock outstanding, with a par value of $0.001.

DOCUMENTS INCORPORATED BY REFERENCE

No items are incorporated by reference into this Form 10-K.

Table of Contents

i

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would,” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

| • | our expectations regarding the timing of reporting primary endpoint results from our ongoing clinical trials of sodium zirconium cyclosilicate (ZS-9); |

| • | our expectations regarding the timing of submitting an NDA to the FDA and MAA to the EMA and the likelihood of regulatory approval for ZS-9; |

| • | our expectations regarding the potential market size and the size of the patient populations for ZS-9, if approved for commercial use; |

| • | projections relating to the ability and timing of competitive products to enter the market; |

| • | our expectations regarding our ability to successfully commercialize ZS-9, if approved; |

| • | estimates of our expenses, future revenue, capital requirements and needs for additional financing; |

| • | our expectations regarding the number of nephrologists and cardiologists that we plan to target; |

| • | our ability to develop, acquire and advance product candidates into, and successfully complete, clinical trials; |

| • | our ability to produce ZS-9 in commercial quantities in higher capacity reactors; |

| • | the scope of protection we are able to establish and maintain for intellectual property rights covering ZS-9 and our other potential product candidates; |

| • | the expected results and timing related to our competitors’ efforts to obtain intellectual property protection for their compounds; |

| • | the implementation of our business model and strategic plans for our business and technology; |

| • | our expectations regarding our future costs of goods; |

| • | the initiation, timing, progress and results of future nonclinical studies, clinical trials and research and development programs; |

| • | our ability to maintain and establish collaborations or obtain additional funding; |

| • | our expectations regarding the time during which we will be an emerging growth company under the JOBS Act; |

| • | our financial performance; and |

| • | developments and projections relating to our competitors and our industry. |

Any forward-looking statements in this Annual Report on Form 10-K are based on management’s current expectations, estimates, forecasts, and projections about our business and the industry in which we operate and management’s beliefs and assumptions and are not guarantees of future performance or development and involve known and unknown risks, uncertainties, and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this Annual Report on Form 10-K may turn out to be inaccurate. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under Part I, Item 1A. Risk Factors and elsewhere in this Annual Report on Form 10-K. You are urged to consider these factors carefully in evaluating the forward-looking statements. These forward-looking statements speak only as of the date of this Annual Report on Form 10-K. Except as required by law, we assume

Table of Contents

no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future. You should, however, review the factors and risks we describe in the reports we will file from time to time with the SEC after the date of this Annual Report on Form 10-K.

EXPLANATORY NOTE

Throughout this Annual Report on Form 10-K (“Form 10-K”), we refer to ZS Pharma, Inc. as “we”, “us”, “our” or the “Company”. We were incorporated in Delaware in February 2008 under the name ZS Pharma, Inc. We commenced operations in November 2008. Our principal executive offices are located at 508 Wrangler Drive, Suite 100, Coppell, Texas 75019, and our telephone number is (877) 700-0240. Our website address is www.zspharma.com.

2

Table of Contents

PART I. — BUSINESS FACTORS

| ITEM 1. | BUSINESS |

Overview

We are a biopharmaceutical company focused on the development and commercialization of highly selective, non-absorbed drugs to treat renal, cardiovascular, liver and metabolic diseases. Our proprietary zirconium silicate technology allows us to create highly selective ion traps that can reduce toxic levels of specific electrolytes without disturbing the balance of other electrolytes. Our initial focus is on the development of sodium zirconium cyclosilicate (ZS-9), our product candidate for which we recently completed two Phase III clinical trials for the treatment of hyperkalemia, a life-threatening condition in which elevated levels of potassium in the blood (greater than 5.0 mEq/L) increase the risk of muscle dysfunction, including cardiac arrhythmias and sudden cardiac death. We have designed our development program based on input from the United States Food and Drug Administration, or FDA, including a recent pre-NDA meeting, and European Medicines Agency, or EMA, and plan to submit our New Drug Application, or NDA, in the United States in the second quarter of 2015 and our Marketing Authorization Application, or MAA, in Europe in the second half of 2015 with the goal of obtaining approval for the treatment of acute and chronic hyperkalemia, regardless of the underlying disease state. If we receive regulatory approval, we intend to commercialize ZS-9 for the treatment of hyperkalemia in the United States with our own specialty sales force targeting nephrologists and cardiologists and intend to seek one or more partners for commercialization in markets outside of the United States.

As of March 1, 2015, we have enrolled over 1,474 patients in our clinical studies. In our ongoing long-term studies, patients have safely received once-daily ZS-9 for over 10 months. We have completed three, double-blind, randomized placebo controlled clinical studies with ZS-9 that together enrolled 1,101 patients with hyperkalemia, including patients with chronic kidney disease (CKD), heart failure (HF), type 2 diabetes and those on renin-angiotensin aldosterone system (RAAS) inhibitor therapy. Our first in-man study, ZS002, was completed in May 2012 and our first Phase III study, ZS003, was completed in November 2013. Our second Phase III study, ZS004, was completed in September 2014. All three trials met their pre-specified primary efficacy endpoints with clinically meaningful and statistically significant results. We announced the top-line results for ZS004 in September 2014, and presented detailed primary and secondary endpoint results for ZS004 at the American Heart Association Scientific Sessions on November 17, 2014. The ZS004 study results were simultaneously published in the Journal of the American Medical Association, and we announced the publication of detailed results from the ZS003 study in the New England Journal of Medicine on November 21, 2014. We initiated an extension to the ZS004 study, or ZS004e, and a long-term safety study, ZS005, in the second quarter of 2014. We expect to file our NDA with the FDA in the second quarter of 2015 and our MAA with the EMA in the second half of 2015.

ZS-9 is an insoluble, non-absorbed zirconium silicate with a clearly defined three-dimensional crystalline lattice structure that was designed and engineered to preferentially trap potassium ions. Sodium Polystyrene Sulfonate, or SPS (e.g., Kayexalate), the current standard of care for hyperkalemia in the United States, is a nonselective polymer resin. In contrast to nonselective polymer resins, the potassium selectivity of ZS-9 enables high in-vitro binding capacity for potassium ions even in the presence of other competing ions. Head-to-head in-vitro experiments demonstrate that ZS-9 has roughly ten times the potassium binding capacity of SPS. In our clinical studies to date, this selectivity has resulted in the following important differentiating characteristics for ZS-9 that we believe support its potential use to treat acute and chronic hyperkalemia:

| • | high efficacy, with 98% of patients from our completed clinical trials receiving at our top dose returning to a normal level of potassium (between 3.5 and 5.0 mEq/L) in their blood, which is referred to as normokalemia, within 48 hours; |

| • | rapid onset of action, with statistically significant reductions in potassium observed at one hour and a median time to normalization of serum potassium levels of 2.2 hours in our most recently completed clinical trial following a single 10g dose; |

3

Table of Contents

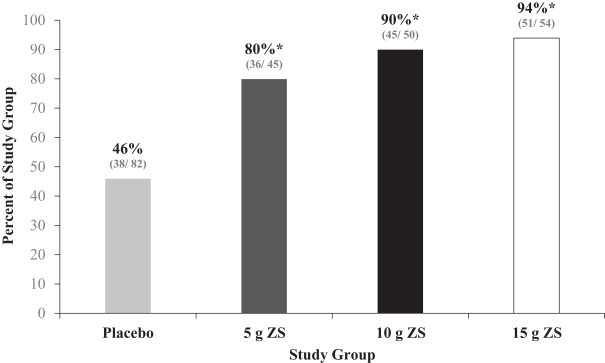

| • | ability in our studies to date to safely and effectively maintain normokalemia over 28 days, with 80%, 90%, and 94% of patients on once-daily 5g, 10g, and 15g of ZS-9, respectively, controlled in ZS004; |

| • | normalization of bicarbonate levels in patients with metabolic acidosis (low blood pH); |

| • | reduction in the levels of serum aldosterone, high levels of aldosterone have been implicated in the progression of cardiovascular and kidney diseases; |

| • | potential suitability for chronic, once daily administration; |

| • | non-absorbed, with no evidence of systemic absorption in our human and animal studies to date; |

| • | well-tolerated in our studies to date, including our long-term studies where patients have been receiving once-daily ZS-9 for over 10 months, with a low rate of hypokalemia and an incidence of adverse events similar to placebo; |

| • | administered as a convenient oral suspension powder or dissolvable tablets; |

| • | no clinically significant effects on other electrolytes that are critical for normal physiological functioning, including sodium, calcium and magnesium; and |

| • | stability at room temperature with a long shelf-life, which we expect will simplify distribution, physician sampling and storage for both physicians and patients. |

Hyperkalemia occurs frequently in patients with CKD, HF and type 2 diabetes, each of which has a high and increasing incidence worldwide. We estimate the number of patients in the United States with CKD will increase from approximately 26 million in 2009 to approximately 46 million by 2022. Hyperkalemia can also arise from the use of RAAS inhibitors, which cause the kidney to retain potassium, thereby increasing serum potassium levels. RAAS inhibitors (such as Angiotensin Converting Enzyme inhibitors (ACEs), or Angiotensin Receptor Blockers (ARBs)) are commonly prescribed for patients with hypertension, HF and CKD, and have been proven in large outcomes studies to reduce morbidity, mortality and progression of disease in these patients. As a result of these studies, RAAS inhibitors are the third most commonly prescribed class of medication in the United States. However, RAAS inhibitors’ mechanism of action results in the retention of potassium, often forcing physicians to choose between the risk of hyperkalemia and the benefits of RAAS therapy.

The current standard of care for hyperkalemia is SPS, which was approved in 1958 as a drug efficacy study implementation, or DESI, drug. The safety and efficacy of SPS have never been proven in randomized, controlled trials. SPS is poorly tolerated by most patients and causes a high incidence of gastrointestinal, or GI, side effects, including nausea, vomiting, constipation, intestinal necrosis and diarrhea, which leads to poor compliance and renders the drug unsuitable for chronic use. For patients with hyperkalemia, we believe ZS-9 represents a well-tolerated alternative to SPS that can rapidly lower and maintain serum potassium at normal levels and may allow physicians to avoid reducing the use of RAAS inhibitors.

We believe a significant commercial opportunity exists for ZS-9 in the United States and internationally. If approved, we plan to commercialize ZS-9 in the United States with a specialty sales force focused on a subset of the approximately 5,000 practicing nephrologists and approximately 15,000 practicing non-interventional cardiologists currently treating our target patient populations. In addition, we intend to make ZS-9 available as a safe and effective therapy in the hospital setting for the rapid treatment of acute hyperkalemia. We believe that ZS-9 will be a useful therapy to treat hyperkalemia, regardless of the underlying cause, and will allow patients to benefit from the cardio-renal protective effect of RAAS therapies. We plan to commercialize ZS-9 internationally with one or more partners. Over time, we intend to build a pipeline of product candidates using our proprietary zirconium silicate technology, which provides the opportunity to target indications susceptible to treatment by non-absorbed binders in the GI tract. We are in nonclinical development with an ammonium binding candidate, ZS-1, which is currently being evaluated as a treatment for patients suffering from disorders associated with high blood ammonia levels, or hyperammonemia.

We have assembled an experienced management team with extensive pharmaceutical development, manufacturing, reimbursement and commercialization expertise from pharmaceutical and biotechnology

4

Table of Contents

companies, including, among others, Merck and Co., Affymax, Genentech, Adams Respiratory Therapeutics, Bone Care International, Novo Nordisk, Encysive, Genzyme and Amgen. Members of our team have led the discovery, development, manufacturing and commercialization of several therapeutics in the renal field, including Omontys, Hectorol and Phoslo.

Our Strategy

Our strategy is to develop and commercialize a product portfolio of novel therapeutics to treat renal, cardiovascular, liver and metabolic diseases. The key elements of our strategy are to:

| • | Obtain FDA, EMA and other international regulatory approvals to market our lead product candidate, ZS-9, for the treatment of hyperkalemia. We have completed our Phase II study and two Phase III studies and are also conducting a long-term safety and efficacy study. Based on the feedback from our recently completed pre-NDA meeting, we believe these studies will serve as the basis for demonstrating safety and efficacy in our NDA and MAA submissions, which we plan to file in the second quarter and second half of 2015, respectively. The FDA has informed us that it does not plan at this time to conduct an advisory committee meeting to review ZS-9, but such decisions are subject to potential revision. |

| • | Commercialize ZS-9 in the United States. If approved, we plan to commercialize ZS-9 in the United States with our own specialty sales force focused on a subset of the approximately 5,000 practicing nephrologists and approximately 15,000 practicing non-interventional cardiologists treating our target patient populations. Based on average annual disease prevalence rates from multi-year surveys conducted between 1999 and 2004 for CKD and between 2005 and 2008 for HF, when applied to 2010 U.S. Census Data, we estimate there are approximately 19 million stage 3 or 4 CKD patients and 5.7 million HF patients in the United States. Based on the medical literature, nearly 4 million patients have hyperkalemia due to their compromised kidney function, type 2 diabetes, and/or use of cardio-renal protective RAAS inhibitors. We believe that, if approved, ZS-9 will address an unmet need for a well-tolerated, effective treatment for hyperkalemia and believe a significant commercial opportunity exists for ZS-9 in the United States. |

| • | Commercialize ZS-9 outside of the United States with one or more partners. We believe the prevalence of CKD and HF in Europe and Japan is similar to that of the United States and is growing rapidly. As a result of the increasing global prevalence of CKD, HF and type 2 diabetes, and wide use of RAAS inhibitors, we believe attractive opportunities exist for ZS-9 for the treatment of hyperkalemia in international markets. Outside of the United States, we may seek partners with international sales expertise who can sell ZS-9 in target markets. These partnerships could be structured to provide us with an opportunity to receive milestone or other one-time payments as well as royalties on product sales. |

| • | Manufacture in-house. We believe that the proprietary manufacturing processes and know-how that we have developed to manufacture zirconium silicates will provide us with a competitive advantage. We currently manufacture ZS-9 in-house in two facilities from readily available starting materials under carefully optimized conditions using specialized equipment. We are in the process of increasing our manufacturing capacity to support anticipated commercial scale quantities, and installed a 2,000 liter commercial scale reactor during the second quarter of 2014 and received delivery of a second 2,000 liter commercial scale reactor in the fourth quarter of 2014. We believe our in-house manufacturing capabilities will better ensure our ability to meet market demand and will allow us to achieve attractive cost of goods if ZS-9 is approved. |

| • | Leverage our proprietary technology to build our pipeline over time. Over time, we intend to build a pipeline of products using our proprietary zirconium silicate technology, which provides the opportunity to target indications susceptible to treatment by non-absorbed binders in the GI tract. We are in nonclinical development with an ammonium binding candidate, ZS-1, which is currently being evaluated as a treatment for patients suffering from disorders associated with hyperammonemia, and we plan to continue to evaluate our zirconium silicate technology for other indications. |

5

Table of Contents

| • | Acquire or in-license additional specialty products. If we are able to successfully launch ZS-9, we intend to leverage our commercial infrastructure by acquiring or licensing rights to products prescribed by the physicians targeted by our specialty sales force. |

Hyperkalemia Background

Potassium’s Role in the Body

Potassium plays a critical role in human physiology. It is needed for membrane activation (in order to propagate electrochemical signals between neurons), ion and solute transport and the regulation of cell volume. Potassium is absorbed from the diet passively, while excretion of potassium is mainly a regulated active process through the kidneys. Due to fluctuations in dietary potassium intake, the body has developed methods to retain potassium when intake is low and to increase potassium excretion when potassium intake is high. Under normal conditions, serum potassium levels are maintained in the range of 3.5 to 5.0 mEq/L by hormones such as insulin, which acts to shift potassium into cells, and aldosterone, which acts on the kidneys and the colon to stimulate the secretion of excess potassium. In healthy individuals, the kidneys excrete 90% to 95% of the absorbed dietary potassium, with the remaining 5% to 10% excreted in the colon. Elevated potassium levels in the body can disrupt the membrane activation in cardiac cells that regulate the electrical impulses that cause the heart muscles to contract. Decreased contraction of the cardiac tissue may cause fatal heart arrhythmias and is the main risk for patients with hyperkalemia.

Causes of Hyperkalemia

There are several possible causes of hyperkalemia, including:

| • | decreased excretion of potassium by the kidneys, which is common in patients with CKD and HF because the kidney is the primary organ involved in potassium removal; |

| • | imbalances of potassium between the extracellular and intracellular fluid compartments, which is common in patients with type 2 diabetes, due to insulin’s role in shifting potassium into the intracellular compartments; and |

| • | use of a number of commonly used drugs that cause elevated potassium levels, including RAAS inhibitors, transplant medicines and nonsteroidal anti-inflammatory drugs. |

Consequences of Hyperkalemia

The impact of hyperkalemia on mortality is well documented and is a result of potassium’s importance in regulating electrochemical signals in nerve and muscle cells. Cardiac arrhythmias are the leading cause of mortality in hyperkalemia patients, and the condition can develop with few symptoms until cardiac arrhythmias manifest and hospitalization is required. Several studies have independently documented the risk of death or cardiac events associated with hyperkalemia in many different patient populations, including those with previous acute myocardial infarctions, previously hospitalized veterans, intensive care patients, dialysis patients and veterans with HF on medication for hypertension.

The morbidity and mortality impact of hyperkalemia is significant. Hyperkalemia is detected in between 1% and 10% of all hospitalized patients. In a 2009 study published in the Archives of Internal Medicine, the one-day mortality rate was up to 17 times higher for admitted patients with serum potassium above 6.0 mEq/L versus those with serum potassium less than 5.5 mEq/L. Even patients with between 5.5 and 6.0 mEq/L of serum potassium had a one-day mortality rate six times higher than those with less than 5.5 mEq/L.

Another study published in the Journal of the American Medical Association in 2012 showed that sudden death and serious cardiac events increased as serum potassium levels rose above 4.5 mEq/L. This retrospective study was the largest of its kind and examined 38,689 patients from 67 hospitals over a nine-year period. The percentage of patients with in-hospital mortality or in-hospital ventricular fibrillation or cardiac arrest was determined across several ranges of post-admission serum potassium. Although hyperkalemia patients

6

Table of Contents

represented only 3.2% of the total patient population, they accounted for 16% of the total hospital deaths. The results demonstrate that high serum potassium levels are a risk factor for cardiac events and mortality. We believe that a well-tolerated treatment that effectively lowers and maintains normal levels of serum potassium would provide significant clinical benefits to these patients and reduce their risk of mortality and cardiac events.

Additional studies have provided further evidence that reducing excess serum potassium levels in hyperkalemia patients reduces mortality risk. One study found reduced serum potassium levels resulting from common therapies led to a statistically significant increase in survival rates. Another study, in hospitalized patients receiving critical care, showed that the reduction of serum potassium by more than 1 mEq/L 48 hours after hospitalization decreases the risk of patient mortality. These studies suggest that treating hyperkalemia in the acute and chronic settings can have a significant impact on patient outcomes by reducing the risk of death.

Cardio-Renal Protective RAAS Inhibitor Therapy is Limited by Hyperkalemia

Maximum doses of RAAS inhibitors are widely recommended for patients with hypertension, HF, CKD and type 2 diabetes in order to regulate blood pressure. Large outcomes studies have shown that RAAS inhibitors can significantly decrease hospitalization, morbidity and mortality in these patients. However, inhibition of the RAAS pathway also promotes potassium retention by reducing aldosterone, a hormone involved in potassium secretion, leading to hyperkalemia. As a consequence, physicians are often forced to make the choice between the risk of hyperkalemia and the benefits of RAAS inhibitor therapy.

Outcomes Studies Demonstrate the Importance of RAAS Inhibitor Therapy

Large outcomes studies have demonstrated that RAAS inhibitors significantly improve the health of patients. RAAS inhibitors reduce mortality and hospitalization rates in HF patients by improving heart function. The inhibitors also reduce all-cause mortality by minimizing damage to secondary organs such as the kidneys and delaying the progression of type 2 diabetes. A prominent study, the Randomized Aldactone Evaluation Study, or RALES, in HF patients showed a significant reduction in death and hospitalization with the aldosterone inhibitor spironolactone and demonstrated that dose optimization plays a significant role in the efficacy of these drugs. Patients receiving spironolactone had a much higher probability of survival, especially at later time points after treatment began. Overall the risk of death was 30% lower in the spironolactone group compared to the placebo group.

Both the rate of admission for hyperkalemia and the rate of in-hospital death attributed to hyperkalemia increased following the publication of RALES. The rate of hospital admission due to hyperkalemia increased dramatically from a rate of 2.4 per 1000 patients prior to RALES to approximately 11 per 1000 in the two years following RALES publication (p<0.001). Furthermore, the rate of in-hospital death from hyperkalemia increased from approximately 0.3 per 1000 patients to 2 per 1000 patients after RALES (p<0.001). These data are not surprising given the effect of RAAS inhibitors, such as spironolactone, on potassium retention and the association of hyperkalemia with mortality.

The Eplerenone Post-Acute Myocardial Infarction Heart Failure Efficacy and Survival Study, or EPHESUS, a 6,632 patient randomized, placebo-controlled study published in 2003 described the benefit of eplerenone, an aldosterone blocker, on mortality and morbidity in patients with HF who had a previous myocardial infarction. Another study, the Reduction of Endpoints in Non-Insulin-Dependent Diabetes Mellitus (or adult-onset or type 2 diabetes) with the Angiotension II Antagonist Losartan, which is referred to as the RENAAL study, demonstrated that the use of the angiotensin receptor blocker losartan resulted in a 28% reduction in progression to end-stage renal disease, corresponding to a two year delay in reaching end-stage renal disease and reduced hospitalization in type 2 diabetics. This trial specifically highlights the benefits of RAAS inhibition on non-heart conditions.

As a result of these compelling outcomes studies, high dose RAAS therapy is guideline recommended by the American Heart Association, the Kidney Disease Outcomes Quality Initiative, American Association of Family Physicians, and the American Diabetes Association, making it the third most commonly prescribed class

7

Table of Contents

of medication in the United States. The guidelines recommend monitoring serum potassium levels while utilizing RAAS therapy and reducing use of RAAS therapy if serum potassium levels near or exceed 5 mEq/L.

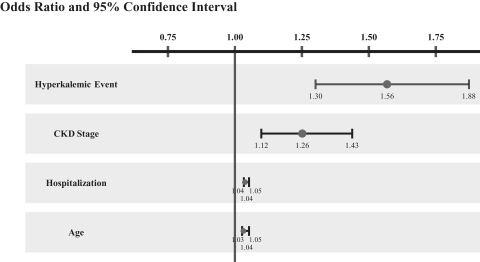

Hyperkalemia Predicts Mortality for Patients on RAAS Inhibitors

A 2012 study published in the American Journal of Cardiology in 2012 found that hyperkalemia is the top predictor of all-cause mortality in cardiovascular patients with CKD on anti-hypertensive drugs. Historically, hyperkalemia has been seen as secondary to more serious conditions such as CKD or HF. However, as illustrated in the graph below, hyperkalemia was found to be more likely than factors such as age, hospitalization or CKD stage to predict mortality in cardiovascular disease patients with CKD receiving antihypertensive drugs, indicating that hyperkalemia is an independent predictor of mortality separate from other conditions such as CKD or HF. In the graph below, an odds ratio in excess of 1 illustrates a positive correlation between the underlying risk factor and the resulting co-morbidity, or mortality in this case. Generally, a higher odds ratio signifies an increased risk of mortality due to the corresponding underlying risk.

Predictors of All-cause Mortality in Cardiovascular Disease Patients with CKD Receiving Antihypertensive Drugs

Source: Jain et al. American Journal Cardiology. 2012 May 15;109(10):1510-3

Full Benefits of RAAS Inhibitors are Not Realized Due to Hyperkalemia

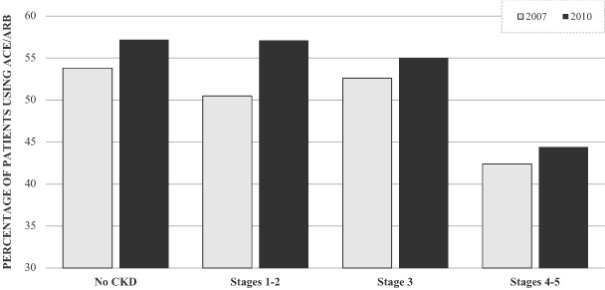

Due to the risk of hyperkalemia, a large percentage of patients are either not treated with RAAS inhibitor therapy, or are undertreated, despite clear guideline recommendations and proven patient benefit. According to articles in the American Heart Journal and the European Heart Journal, over 50% of HF patients are on suboptimal RAAS inhibitor doses and up to 15% of HF patients are not on RAAS inhibitor treatment at all. In CKD patients with type 2 diabetes, over 70% are not treated or are being treated below the recommended dose. The 2012 U.S. Renal Data Survey shows that RAAS inhibitor usage in the Medicare population declines as CKD stage progresses and suggests this decline is likely due to the impact of hyperkalemia. The graph below shows the percentage of patients on ACE inhibitors or ARBs for 2007 and 2010. Although the percentage of patients using ACE inhibitors or ARBs, a RAAS inhibitor, increased from 2007 to 2010, there was an approximate 20% decline in the patients with stage 4 or 5 CKD who were taking ACE inhibitors or ARBs as compared to patients in earlier stages of the disease. We believe a well-tolerated and effective potassium-reducing agent would allow patients to avoid the hyperkalemia associated with RAAS therapy while receiving the full benefit of these medications, including reduced mortality and slowed progression to end stage renal disease.

8

Table of Contents

ACE and ARB Inhibitor Utilization in Patients with Advancing Cardiovascular Disease

Current Treatments for Hyperkalemia

In the hospital setting, hyperkalemia is currently treated with drugs that support heart function and temporarily reduce serum potassium by shifting potassium into the cells. However, no treatment is currently available to effectively and safely remove excess potassium and maintain normal levels of serum potassium. SPS (e.g., Kayexalate), which was approved in 1958 as a DESI drug, is the current standard of care for potassium reduction, but its safety and efficacy have never been proven in randomized, controlled trials. SPS is poorly tolerated by most patients and causes a high incidence of GI side effects, including nausea, vomiting, constipation, intestinal necrosis and diarrhea, which leads to poor compliance and renders the drug unsuitable for chronic use. In addition, in 2009, the FDA issued a warning for colonic necrosis that sparked a debate in the medical community on whether SPS should ever be used. Low potassium diets are widely prescribed, but enforcing compliance is difficult and, as the underlying disease biology progresses, dietary restrictions become ineffective. For patients on RAAS inhibitors, limiting or removing RAAS medications decreases potassium, but puts patients at a higher risk of mortality and/or more rapid disease progression due to uncontrolled hypertension. Given the widely recognized limitations of existing therapies, we believe that there is a significant unmet need and market for a well-tolerated, effective treatment for hyperkalemia.

Key Properties of ZS-9

ZS-9 is a highly stable, non-absorbed zirconium silicate with a defined three-dimensional crystalline lattice that was designed and engineered to preferentially trap potassium ions throughout the GI tract. We are developing ZS-9 to be administered orally at doses of 10g given three times per day to treat acute hyperkalemia and at doses of 5g to 15g given once per day to prevent the reoccurrence of hyperkalemia. The compound is made via a two-step, proprietary manufacturing process using readily available starting materials. ZS-9 is formulated as a room temperature, stable, dry, odorless, tasteless powder that is filled into packets or bottles or pressed into a dissolvable tablet and is easily suspendable in small amounts of water (40-120 mL). Another formulation of ZS-9 that we are developing is an enema for pediatric and hospital use. In our clinical studies to date, we have observed that ZS-9 acts as soon as one hour after administration of a 10g dose and that once daily administration maintains normal potassium levels for 28 days in our ZS004 Phase III study and over 10 months in our long-term safety studies.

9

Table of Contents

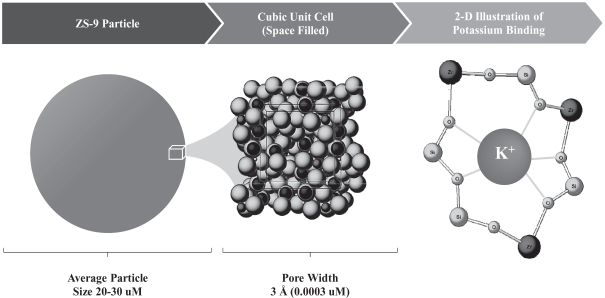

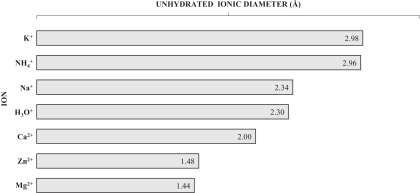

ZS-9 Crystal Structure is Specific for Potassium

We have designed ZS-9 to efficiently bind and remove potassium from the body thereby reducing serum potassium levels and treating hyperkalemia. ZS-9 is a microporous zirconium silicate compound comprised of zirconium, silicon and oxygen atoms covalently bound to one another and arranged to form ion-binding pores that exchange hydrogen and sodium for potassium. The figure below shows an atomic depiction of the ion binding pores as well as the ionic diameter of some common ions, with each image in the figure depicting a reduction in scale.

Cubic Lattice Structure is Comprised of Pores

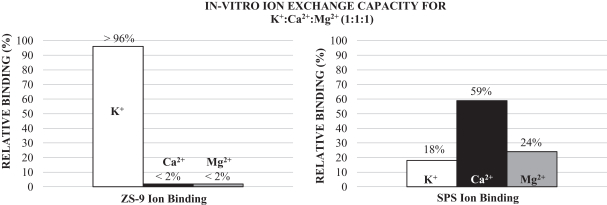

The oxygen atoms in the crystal structure are arranged in a way that disfavors the binding of smaller and larger ions such as magnesium, calcium and sodium, and thus the compound can preferentially trap potassium even in the presence of other positive ions. In contrast, organic polymers like SPS are non-selective and bind potassium only in areas of high potassium concentration like the colon, thus the onset of activity is dependent on gastrointestinal transit time and begins hours to days after administration. This inherent difference in selectivity was demonstrated in-vitro by comparing the binding of ZS-9 and SPS in the presence of potassium (K+), calcium (Ca2+) and magnesium (Mg2+) ions at a 1:1:1 ratio. Whereas SPS shows a preference for Ca2+ over K+ or Mg2+, ZS-9 is nearly 100% selective for K+ (depicted in the figure below). Based on these in vitro studies, ZS-9 has approximately ten times the total potassium binding capacity of SPS.

10

Table of Contents

We believe ZS-9’s high selectivity for potassium enables ZS-9 to absorb potassium immediately on ingestion and throughout the GI tract, even in locations where potassium is not the most abundant ion. In our clinical studies to date this selectivity has resulted in the following important differentiating characteristics for ZS-9: high efficacy in patients treated in our studies to date at modest dose amounts; a rapid onset of action as soon as one hour after a 10g dose by acting early in the GI tract where potassium is not the most abundant ion; and well tolerated with no material effect on other important electrolytes that are critical for normal human function.

Absorption, Distribution, Metabolism and Excretion, or ADME, and Physical Properties of ZS-9

ZS-9 is a non-absorbed, odorless, tasteless substance that has been formulated as a powder and tablet. ZS-9 is insoluble in typical solvents and passes through the GI tract without degradation. The compound does not swell in the presence of water, enabling it to be effectively eliminated from the body without the need for a laxative to avoid constipation caused by organic polymers such as SPS. ZS-9 is thermally stable and does not require refrigeration or any special handling.

To date, we have not observed evidence of ZS-9 absorption in animals or humans. ZS-9 is substantially in a spherical form, having an average diameter of approximately 20 to 30 micrometers, which is too large to be absorbed into the body. We conducted in-vivo recovery studies in rats which recovered greater than 98% of the dosage of ZS-9 administered, similar to the level of recovery of the control compound. In addition, high sensitivity analysis of samples collected from 6 month rat, 9 month dog, and 28 day human studies have shown no sign of ZS-9 absorption with a limit of detection of 10 parts per 1,000,000,000. We believe these studies provide evidence that ZS-9 is excreted in feces and is not systemically absorbed. In addition, we believe ZS-9 is essentially insoluble under physiologic conditions. Exposure of the powder form of ZS-9 to simulated gastric and intestinal fluids for an extended period of time resulted in negligible increases in the levels of zirconium, silicon and oxygen in solution. These experiments suggest that the amount of zirconium available for absorption from a 10g dose of ZS-9 would be 0.00028 mg. Compared to the average range of between 1.0 and 9.0 mg of zirconium found in the average daily human diet, ZS-9 is not expected to be a significant source of dietary zirconium intake.

In addition, zirconium has a long safety history in biomedical applications including hip and knee implants and nephrology applications such as hemofiltration, hemodialysis, peritoneal dialysis, and in the design and construction of wearable artificial kidneys. Notably zirconium containing sorbent columns have been used in over 6,000,000 dialysis sessions since the 1970’s without safety issues and zirconium containing sorbent columns are currently being developed by Fresenius, a leading dialysis provider. In sorbent hemodialysis sessions, patients with CKD with little or no kidney function have their blood exposed directly to zirconium containing columns. The amount of zirconium directly released into the blood of patients during each session has been quantified to be 0.758 mg, or almost 3,000 times that which could be absorbed from a 10g dose of ZS-9. Zirconium is commonly found in quantities much higher than the theoretical amount of zirconium released from

11

Table of Contents

a 10g dose of ZS-9 as shown in the table below. Given experience with zirconium compounds in biomedical applications for over 40 years and the non-absorbed nature of ZS-9, and other zirconium compounds, we expect ZS-9 will be well tolerated and safe in man.

Relative Zirconium Levels

| Product |

Amount | Relative to ZS-9 | ||||||

| 85g Antiperspirant Stick |

2,295 mg | 8,196,429x | ||||||

| Soil |

300 mg/L | 1,071,429x | ||||||

| Human Body Content |

300 mg | 1,071,429x | ||||||

| Daily Food Content |

3.65 mg | 13,036x | ||||||

| Zirconium from 4 Hour Sorbent Hemodialysis |

0.758 mg | 2,707x | ||||||

| Daily Drinking Water Content |

0.65 mg | 2,321x | ||||||

| Sea Water |

0.004 mg/L | 14x | ||||||

| Soluble Zirconium from 10g of ZS-9* |

0.00028 mg | 1.0x | ||||||

| * | Amount of zirconium in solution after exposing to simulated gastric and simulated intestinal fluids for a period of 24 hours (calculations assume all of the soluble Zr from ZS-9 is absorbed). |

ZS-9 Clinical Development Program and Regulatory Pathway

Overview

We are advancing ZS-9 through a clinical development program with the goal of obtaining approval for the treatment of acute and chronic hyperkalemia, regardless of the underlying cause. We submitted an Investigational New Drug, or IND, application for ZS-9 as a treatment for hyperkalemia with, and such application was acknowledged by, the FDA in December 2010. As of March 1, 2015, our clinical program has enrolled 1,474 patients, which is representative of the hyperkalemia population, including patients with CKD, HF, type 2 diabetes and those on RAAS inhibitor therapy. We have completed ZS002, ZS003 and ZS004, which resulted in positive Phase II and Phase III data. We initiated an 11 month extension to the ZS004 study, ZS004e, and a 12 month long-term safety study, ZS005, in the second quarter of 2014. We received guidance from the FDA on the non clinical requirements and clinical program for the development of ZS-9, including a recent pre NDA meeting, and we believe that we have incorporated this guidance into our development program. As is typically the case, the FDA may provide additional guidance or change its guidance as our drug candidates move through development, clinical trials and the regulatory approval process. We plan to submit our NDA in the second quarter of 2015 and MAA in the second half of 2015.

To date, daily administration of ZS-9 has been observed to lower, and maintain control of, serum potassium levels while maintaining a favorable tolerability profile. The acute portion of our most recent pivotal Phase III trial, ZS004, showed clinically meaningful reductions in serum potassium that were statistically significant, with a median time to normalization of 2.2 hours, and 84% and 98% of subjects becoming normokalemic after receiving 10g of ZS-9 three times a day for 24 and 48 hours, respectively. In addition, the extension portion of this trial demonstrated that the reductions achieved in the acute phase could be maintained in 80%, 90%, and 94% of patients using 5g, 10g, or 15g of ZS-9 administered once daily, respectively. These results were statistically significant when compared to patients randomized to placebo who had their potassium level revert to near pretreatment levels. These positive results are supported by results from our Phase II study, ZS002, and our first Phase III study, ZS003, which also showed statistically significant reductions in serum potassium levels, with 99% of patients becoming normokalemic after receiving 10g of ZS-9 given three times a day for 48 hours, and sustained potassium reductions in patients using 5g and 10g of ZS-9 administered once daily.

To date, ZS-9 was observed to have a favorable safety profile and was well-tolerated across trial populations, including CKD, HF and type 2 diabetes subjects and patients that are taking RAAS therapy. In the

12

Table of Contents

completed trials, the most common adverse events were mild-to-moderate GI symptoms, including nausea, vomiting, constipation and diarrhea. These events occurred at a similar rate and severity as placebo treated patients. No serious adverse events were deemed attributable to ZS-9. In contrast, the product label of SPS, the only approved potassium-binding treatment, includes warnings of severe GI side effects which can be fatal, including GI necrosis, bleeding and perforation.

We expect that the NDA and MAA will include the results from the Phase II trial (ZS002), the Phase III trial (ZS003) and the Phase III one month randomized withdrawal study, ZS004. We expect to include safety data from the long-term studies ZS004e and ZS005 as part of our submission package and provide updates at regular intervals during FDA review. The ZS002 study and both Phase III studies were published in peer reviewed journals, the ZS002 study was published in Kidney International, the ZS003 study was published in the New England Journal of Medicine (NEJM) and the ZS004 study was published in the Journal of the American Medical Association (JAMA). If all of the planned studies are completed (ZS002, ZS003, ZS004 and ZS005), approximately 1,500 patients will have been exposed to ZS-9. We discussed the design of these studies and the adequacy of our proposed clinical package with the FDA in our recent pre NDA meeting.

Clinical Program

The table below summarizes our clinical development program for ZS-9, which began with ZS002, a dose escalating, double-blind, randomized, placebo-controlled Phase II study in hyperkalemic patients with CKD, including those on RAAS inhibitor therapy, in November 2011. Following the positive results of this trial, we conducted ZS003, a double-blind, randomized, placebo-controlled Phase III study in a representative population of hyperkalemic patients including those with CKD, HF, type 2 diabetes and those on RAAS therapy. The goal of this study was to confirm the acute findings observed in our ZS002 Phase II study and explore ZS-9’s ability to maintain normal levels of serum potassium for an extended period regardless of etiology. Following the positive results of this trial, we conducted ZS004, a double-blind, randomized, placebo-controlled Phase III study in patients with higher baseline potassium levels, including those with CKD, HF, type 2 diabetes and those on RAAS therapy. The goal of this study was to establish the dose for once daily maintenance treatment and explore ZS-9’s ability to maintain normal levels of serum potassium in patients with higher baseline potassium levels over a longer time period. We recently reported clinically meaningful and statistically significant results from ZS004 and have initiated two additional studies to explore long-term treatment with ZS-9. The first study, ZS004e, is an 11 month open label extension study for subjects completing ZS004 and the second study, ZS005, is a 12 month exposure study designed to establish long-term safety and efficacy.

| Trial (Phase) |

Trial Design |

Patient Population |

Treatment Duration |

Objective |

Key Results | |||||

| ZS002 (II) |

Double-blind RCT | N=90 5.0 to 6.0 mEq/L |

48 hours | Proof of concept for ZS-9 rapidly lowering K+ levels |

Met primary endpoint for the 3g and 10g doses | |||||

| ZS003 (III) |

Double-blind RCT | N=753 Hyperkalemia, regardless of etiology, 5.0 to 6.5 mEq/L |

14 days | Confirm dose for rapid K+ control and proof of concept for maintenance dosing |

Met primary endpoint for the 2.5g, 5g and 10g doses, and met secondary endpoint for 5g and 10g doses in the maintenance phase | |||||

13

Table of Contents

| Trial (Phase) |

Trial Design |

Patient Population |

Treatment Duration |

Objective |

Key Results | |||||

| ZS004 (III) |

Double-blind RCT | N=258 Hyperkalemia, regardless of etiology, >5.0 mEq/L |

1 month | Establish a maintenance dose |

Met primary endpoint at all doses with 80%, 90%, and 94% normokalemic at 5g, 10g and 15g QD doses, respectively | |||||

| ZS004/e (III) |

Double-blind RCT | N=258 Hyperkalemia, regardless of etiology, >5.0 mEq/L |

11 months | Establish a maintenance dose |

Ongoing; initiated March 2014 | |||||

| ZS005 (III) |

Open label safety | N=750 Hyperkalemia, regardless of etiology, >5.0 mEq/L |

Up to 12 months |

Establish long-term safety and efficacy |

Ongoing; initiated second quarter of 2014 | |||||

Safety and tolerability data from the completed trials (2 days, 14 days, and 28 days of treatment) suggests that ZS-9 is safe and well-tolerated. Adverse events potentially related to ZS-9 have primarily been mild-to-moderate transient GI symptoms in approximately 5% of subjects, a rate comparable to placebo. In one study, the ZS004 study, mild-to-moderate cases of edema were observed in approximately 2% to 14% of subjects; however rates of edema from our ongoing 12 month long-term studies are lower and comparable to placebo rates observed in previous studies. Only one serious adverse event was assessed as being possibly related to study drug (a case of gastroenteritis in ZS003), but when the study was unblinded, the patient who experienced the serious adverse event was found to have received placebo. All other serious adverse events reported to date have been assessed as unrelated to ZS-9.

Phase II Study

ZS002 First-In-Man Proof-of-Concept Trial (Completed)

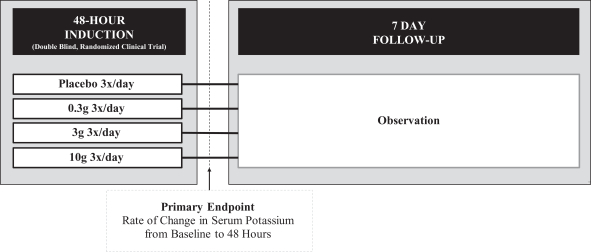

In this first trial, we conducted a double-blind, randomized, placebo-controlled study that tested three doses of ZS-9 in 90 patients with CKD (as measured by estimated glomerular filtration rate (a measurement of overall renal function), or eGFR, of 30-60 mL/min, which corresponds to Stage 3 CKD) and with mild to moderate hyperkalemia (5.0-6.0 mEq/L). For patient safety reasons, patients with serum potassium levels over 6.0 mEq/L were not allowed to participate in the study due to the potential that such patients would receive placebo. The study was designed to explore ZS-9’s ability to rapidly treat hyperkalemia. Patients received 0.3, 3 or 10g of ZS-9 or placebo three times daily with meals for 48 hours. Potassium levels were measured at multiple time points during the 48 hour treatment phase as well as once daily during the five day follow up period. The primary endpoint of the study was the rate of change in serum potassium over 48 hours. The study design is illustrated in the figure below.

14

Table of Contents

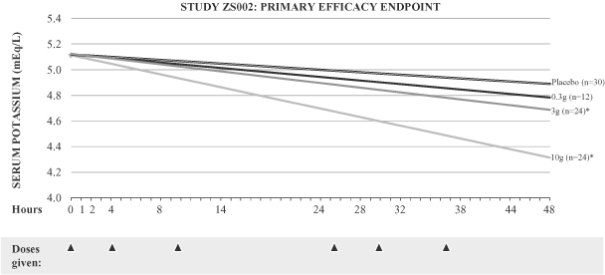

Study ZS002: Trial Design

As shown below, we observed a dose dependent relationship between ZS-9 and serum potassium levels, with the study meeting the primary endpoint for the 3g (p=0.048) and 10g (p<0.0001) doses of ZS-9. Of particular note, the 10g dose produced a significant decrease in serum potassium, reducing levels by a mean of 0.92 mEq/L in only 38 hours. The onset of action was rapid, and patients receiving the 10g dose achieved statistically significant efficacy one hour after the first dose of ZS-9.

Study ZS002: Results

| Placebo | 0.3g 3x/day | 3g 3x/day | 10g 3x/day | |||||

| Primary Endpoint (p-value) |

N/A | 0.4203 | 0.0480 | <0.0001 | ||||

| Mean K+ Change at 48h mEq/L (14h post last dose) |

-0.20 | -0.30 | -0.35 | -0.68 | ||||

| Max K+ Change at 38h mEq/L (4h post last dose) |

-0.26 | -0.39 | -0.42 | -0.92 |

15

Table of Contents

Study ZS002: ZS-9 Demonstrates Dose Dependent Efficacy Over 48 Hours

| * | p-value <0.05 |

Statistically significant results at various levels are denoted by p-values in the figures above and below. The p-value is the probability that the reported result was achieved purely by chance (e.g., a p-value of less than or equal to 0.01 means that there is a 1% chance that the difference between the placebo group and the treatment group is purely due to chance). A p-value of less than or equal to 0.05 is a commonly used criterion for statistical significance. The symbol “n” is used to denote sample size per group.

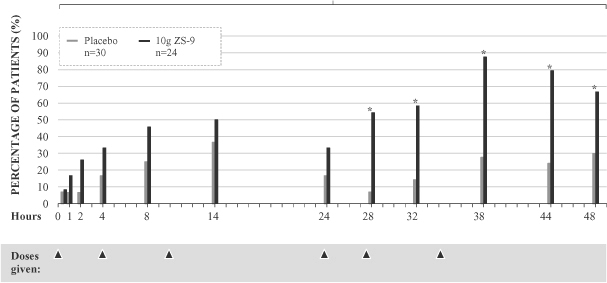

Within 38 hours, 100% of patients receiving the 10g dose had serum potassium levels less than 5.0 mEq/L and approximately 88% had serum potassium levels less than or equal to 4.5 mEq/L. The percentage of patients with serum potassium levels less than or equal to 4.5 mEq/L during the 48 hour treatment period is displayed in the graph below. Furthermore, patients on RAAS inhibitor therapy showed similar responses to those not on RAAS inhibitor therapy. The data suggests that ZS-9 can treat hyperkalemia caused by RAAS inhibitor therapy.

16

Table of Contents

Study ZS002: Percentage of Patients Below 4.5 mEq/L

| * | p-value <0.05 |

In this study, potassium levels rose in patients after ZS-9 therapy was halted, reverting to near baseline levels after only a few days without therapy. This rapid rebound shows that patients with a hyperkalemic episode will rapidly return to an elevated risk state if therapy is not maintained.

The adverse event profile of ZS-9 was favorable. There were no discontinuations and no treatment related serious adverse events. Transient minimal to mild GI adverse events, including nausea, vomiting, constipation and diarrhea, were the most frequent adverse events reported. Consistent with ZS-9’s mechanism of action, the amount of potassium excreted in 24 hour urine collections decreased in ZS-9 treated subjects relative to placebo treated subjects. Importantly, urinary sodium excretion was similar in ZS-9 and placebo treated subjects and no clinically significant changes in non-potassium serum electrolytes or cases of significant hypokalemia were observed.

17

Table of Contents

Phase III Studies

ZS003 (Complete)

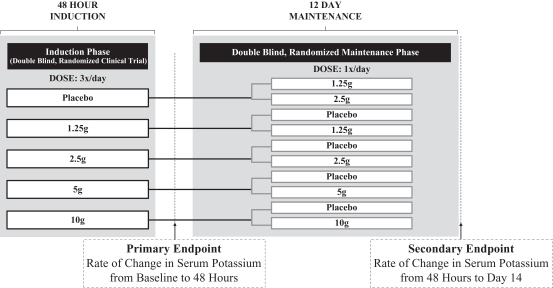

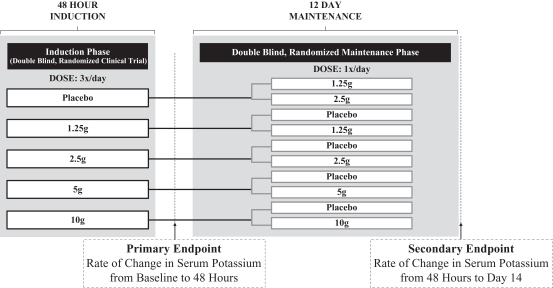

ZS003 was a two part double-blind, randomized, placebo-controlled, pivotal Phase III clinical trial that enrolled 753 patients with hyperkalemia (indicated by potassium levels between 5.0 and 6.5 mEq/L), and included patients with CKD, HF, type 2 diabetes and those on RAAS inhibitor therapy. Results of the study were initially presented at a symposium at the American Society of Nephrology and were later published in the New England Journal of Medicine. The study was designed to confirm ZS-9’s ability to rapidly treat hyperkalemia in the induction phase and to maintain normokalemia in the maintenance phase. Patients were randomized to receive one of four doses of ZS-9 (1.25g, 2.5g, 5g or 10g) or placebo, administered three times daily for the initial 48 hours, or the induction phase. The primary endpoint was the rate of change in serum potassium from baseline throughout the 48 hour induction phase, which was the same primary endpoint used in the ZS002 study. Patients that normalized at a potassium level between 3.5 and 5.0 mEq/L in the induction phase were then randomized to active drug (1.25g, 2.5g, 5g or 10g) or placebo administered once-daily for 12 days during the maintenance phase. The endpoint for the randomized withdrawal maintenance phase was the rate of change in serum potassium during the 12-day dosing period. The study design is illustrated in the figure below.

Study ZS003: Trial Design

ZS003 Phase III Demographics

Demographics of the patient population enrolled in the pivotal Phase III trial were substantially the same as that studied in the Phase II trial and the patient population being enrolled in our ongoing studies. We have tested a representative population of patients with hyperkalemia, representative of the patient population we are seeking to treat. Patients were eligible for enrollment if they had elevated potassium levels, defined as serum potassium greater than 5.0 mEq/L. Although not a criteria for entry, most patients had one of the following conditions which predisposed them to hyperkalemia: CKD, HF, type 2 diabetes and/or were taking RAAS inhibitor therapy. The pivotal Phase III trial was conducted with clinical sites in the United States, Australia and South Africa. Enrollment was completed within 10 months, suggesting the high prevalence of hyperkalemia, and approximately 94% of patients were from the United States.

18

Table of Contents

Study ZS003: Patient Demographics

| Placebo (n=158) |

1.25g (n=154) |

2.5g (n=141) |

5g (n=157) |

10g (n=143) |

||||||||||||||||

| Age (years) at Screening |

65.6 | 65.4 | 65.9 | 65.2 | 66.2 | |||||||||||||||

| Male (%) |

62.0 | 53.9 | 64.5 | 61.1 | 55.9 | |||||||||||||||

| Female (%) |

38.0 | 46.1 | 35.5 | 38.9 | 44.1 | |||||||||||||||

| White (%) |

86.1 | 85.1 | 88.7 | 84.1 | 83.9 | |||||||||||||||

| Black or African American (%) |

10.8 | 13.0 | 7.8 | 12.7 | 13.3 | |||||||||||||||

| Asian (%) |

1.3 | 0.0 | 3.5 | 1.9 | 1.4 | |||||||||||||||

| American Indian or Alaska Native (%) |

1.3 | 0.0 | 0.0 | 0.6 | 0.7 | |||||||||||||||

| Native Hawaiian or other Pacific Islander (%) |

0.6 | 1.9 | 0.0 | 0.0 | 0.7 | |||||||||||||||

| Other (%) |

0.0 | 0.0 | 0.7 | 0.6 | 0.0 | |||||||||||||||

| Multiple Races Checked (%) |

0.0 | 0.0 | 0.7 | 0.0 | 0.0 | |||||||||||||||

| Weight (kg) at Baseline |

87.6 | 87.6 | 83.1 | 89.5 | 87.0 | |||||||||||||||

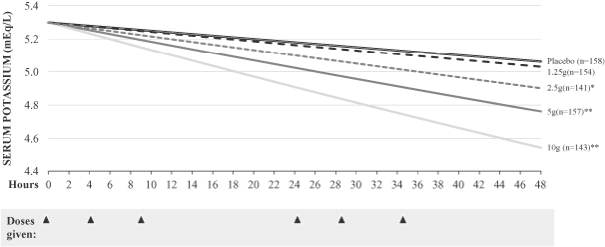

ZS003 Phase III Induction Phase Results

The trial met the primary efficacy endpoint for the induction phase at the 2.5g, 5g and 10g doses compared to placebo. ZS-9 showed significant, rapid and dose-dependent reductions in serum potassium at the 2.5g, 5g and 10g doses within hours of administration of the first dose. At the highest dose tested, 10g, mean serum potassium reduction was -0.73 mEq/L and 99% of patients had normal potassium values within 48 hours. Similar to the results seen in our Phase II study, ZS002, statistically significant reductions in potassium were observed one hour after the first 10g dose of ZS-9.

Study ZS003: Primary Endpoint Rate of

Change of Serum Potassium Over 48 Hours

| 1.25g | ||||||||||||||||||||

| p-Value of Primary Endpoint |

N/A | 0.5 | 0.0009 | <0.0001 | <0.0001 | |||||||||||||||

| Mean K+ Change at 48 hours (14 hours post last dose) (mEq/L) |

-0.25 | -0.30 | -0.46 | -0.54 | -0.73 | |||||||||||||||

Study ZS003: Primary Efficacy Endpoint

| * | p-value <0.05 |

| ** | p-value <0.0001 |

19

Table of Contents

ZS-9 was equally efficacious across patient subsets. Patients with CKD, HF, type 2 diabetes and those taking RAAS inhibitor therapy all received the same magnitude of potassium lowering as the entire intent to treat, or ITT, population. In contrast, subjects with higher starting potassium levels had a higher response to ZS-9. Patients with pretreatment potassium levels in excess of 5.5 mEq/L (average baseline 5.84 mEq/L) saw an average decrease of 1.1 mEq/L at 48 hours while those with starting potassium levels at or below 5.3 mEq/L had an average decrease of 0.6 mEq/L at the highest dose. We believe that ZS-9 works in conjunction with normal potassium excretion mechanisms to remove potassium when it is above 5.0 mEq/L, but as serum potassium drops below 5.0 mEq/L, the body lowers physiologic excretion to avoid hypokalemia, defined as serum potassium level below 3.5 mEq/L. This may explain why hypokalemia has been rare within the dose range administered despite ZS-9’s rapid and potent ability to remove potassium. In study ZS003, hypokalemia occurred in only two patients (0.3% of all enrolled patients) in the induction and maintenance phases. Even in those two cases, the hypokalemia was mild (3.1 and 3.4 mEq/L, respectively), transient and did not require any treatment.

Study ZS003: Reduction in Serum Potassium Levels Across Patient Subgroups

| Placebo | 1.25g | 2.5g | 5.0g | 10.0g | ||||||||||||||||

| Overall ITT Populations |

-0.25 | -0.30 | -0.46 | -0.54 | -0.73 | |||||||||||||||

| Disease Subsets (n; %) |

||||||||||||||||||||

| CKD (463; 61.5%) |

-0.22 | -0.31 | -0.43 | -0.58 | -0.83 | |||||||||||||||

| Diabetes (451; 60%) |

-0.25 | -0.25 | -0.47 | -0.52 | -0.74 | |||||||||||||||

| HF (300; 39.8%) |

-0.24 | -0.27 | -0.46 | -0.52 | -0.78 | |||||||||||||||

| RAAS inhibitors (491; 65.2%) |

-0.24 | -0.28 | -0.48 | -0.53 | -0.73 | |||||||||||||||

| Starting Serum K+ (or S-K) |

||||||||||||||||||||

| Baseline S-K < 5.3 (n=427) |

-0.15 | -0.23 | -0.39 | -0.39 | -0.57 | |||||||||||||||

| Baseline S-K 5.4-5.5 (n=152) |

-0.37 | -0.37 | -0.49 | -0.65 | -0.99 | |||||||||||||||

| Baseline S-K > 5.5 (n=174) |

-0.42 | -0.34 | -0.55 | -0.87 | -1.10 | |||||||||||||||

| eGFR (mL/min/1.73m2) eGFR <15 (n=56) |

-0.17 | -0.15 | -0.49 | -0.70 | -1.03 | |||||||||||||||

| eGFR 15-29 (n=209) |

-0.25 | -0.27 | -0.41 | -0.63 | -0.87 | |||||||||||||||

| eGFR 30-60 (n=296) |

-0.22 | -0.30 | -0.43 | -0.54 | -0.79 | |||||||||||||||

| eGFR >60 (n=183) |

-0.34 | -0.40 | -0.53 | -0.44 | -0.47 | |||||||||||||||

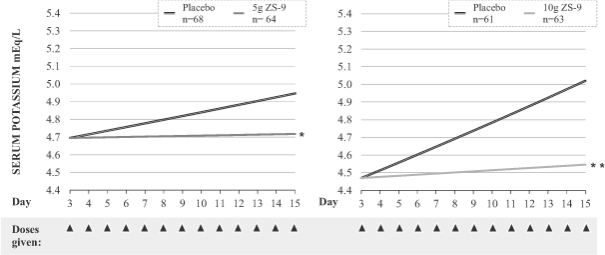

ZS003 Phase III Extended Phase Results

The maintenance portion of our Phase III study was a randomized withdrawal design. Patients that became normokalemic after receiving ZS-9 during the induction phase were re-randomized to receive once daily placebo or once daily ZS-9 at the same dose level as they had received three times daily during the induction phase. Thus, patients who had received 10g three times per day in the induction phase were randomized to receive 10g of ZS-9 once per day or 10g of placebo once per day. Results from the maintenance portion of the Phase III study were released in January 2014. The results from this portion of the study met the predefined efficacy endpoints at the 5g and 10g doses when compared with their respective placebo groups (p=0.0075 and <0.0001). Patients who received 5g of ZS-9 once daily during the maintenance portion had an increase of 0.11 mEq/L compared to a placebo increase of serum potassium levels of 0.25 mEq/L. Patients who received 10g of ZS-9 once daily during the maintenance portion had an increase in average potassium levels of 0.06 mEq/L compared to an average increase in placebo patients of 0.58 mEq/L. At the end of the maintenance period, when ZS-9 was no longer administered, average potassium levels increased to near baseline levels, similar to the levels in those patients that received placebo during the maintenance portion.

20

Table of Contents

Normokalemia Maintained in Extended Phase at 5g and 10g Once Daily

| * | p <0.05 |

| ** | p <0.0001 |

Study ZS003: 10g ZS-9 Maintains Potassium Levels

| * | p-value <0.05 |

Bars indicate 95% confidence level

ZS003 Phase III Adverse Events

In study ZS003, our largest clinical study, the incidence of adverse events in patients taking ZS-9 was similar to placebo. Given the high rate of GI adverse events seen with SPS, we believe the low incidence of reported GI adverse events in the study is of particular note. For example, the highest dose tested during the dose intensive induction phase, 10g of ZS-9 given three times per day (30g per day), displayed a GI event rate of 3.5%

21

Table of Contents

relative to a placebo rate of 5%. Urinary tract infections, or UTIs, were observed more frequently in ZS-9 treated patients than those receiving placebo, however the UTIs did not appear to be dose related, the overall incidence was consistent with what would be expected in a patient population with significant co-morbidities such as CKD, type 2 diabetes, and HF, and more ZS-9 treated patients had urinary tract infections at the initiation of the study than the patients receiving placebo which may explain this finding. In our most recent completed study, ZS004, UTIs occurred at the same rate as placebo.

Study ZS003: Percentage (Number) of Patients with Treatment Emergent Adverse Events

| Induction Phase |

Maintenance Phase |

|||||||||||||||

| Placebo (n=158) |

ZS-9 (n=595) |

Placebo (n=216) |

ZS-9 (n=327) |

|||||||||||||

| All Adverse Events |

10.8 | % | 12.9 | % | 24.5 | % | 25.1 | % | ||||||||

| (17 | ) | (77 | ) | (53 | ) | (82 | ) | |||||||||

| Gastrointestinal Events |

5.2 | % | 3.5 | % | 3.7 | % | 5.5 | % | ||||||||

| (8 | ) | (21 | ) | (8 | ) | (18 | ) | |||||||||

In general, there were no clinically meaningful treatment-related changes in most laboratory parameters. Hypokalemia (defined in this trial as a serum potassium level less than 3.5 mEq/L) occurred in two subjects out of the 753 subjects in the study (0.3% of all enrolled patients), none of whom had any complications related to hypokalemia. In both cases, hypokalemia was mild (3.4 and 3.1 mEq/L, respectively), transient and did not require any treatment. No statistically significant changes in serum sodium or magnesium levels were observed. There was a small decrease in the average serum calcium levels in the ZS-9 group that was statistically different to the mean change from baseline in the placebo group at the highest doses tested. These changes were deemed not to be clinically significant and all patients remained in the normal range.

Adverse events were generally mild or moderate and transient in nature. There were a total of 16 serious adverse events reported in the study, 15 of which were assessed by the study investigators and by us as not related to ZS-9. Only one serious adverse event, a case of gastroenteritis, was classified as being possibly related to study drug; however, when the data was unblinded, this event occurred in a patient treated with placebo. The remaining 15 non-related serious adverse events were well distributed between ZS-9 and placebo, and there was no dose dependent relationship within the four ZS treatment groups.

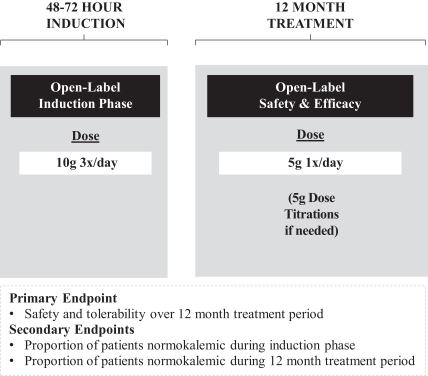

ZS004 (Complete)

ZS004, also known as the HARMONIZE study, was a two part double-blind, randomized, placebo controlled, pivotal Phase III withdrawal study designed to confirm the dosing for chronic administration of ZS-9. The results of the trial were presented on November 17, 2014 at a symposium at the American Heart Association meeting and simultaneously published in the Journal of the American Medical Association. The trial consisted of an open label induction phase followed by a month long randomized, double-blind, placebo-controlled withdrawal phase. In the open-label acute phase of the study, 258 patients received 10g of ZS-9 administered three times daily with meals for 48 hours and were monitored to establish the speed and magnitude of serum K+ reduction. Then, patients who achieved normokalemia (K+ levels between 3.5 and 5.0 mEq/L) were randomized in a double-blind fashion to one of three doses of ZS-9 (5g (N=45), 10g (N=51), or 15g (N=56)) or placebo (N=85) administered once-daily for 28 days (the double-blind randomized withdrawal phase). The primary efficacy endpoint compared the mean serum K+ level of each ZS-9 treatment group to that of placebo over the interval between day 8 and day 29 of the double-blind randomized withdrawal phase. Key secondary efficacy endpoints included the proportion of patients with mean K+ <5.1 mEq/L between day 8 and day 29, median time to normalization, change from baseline in serum K+ and the proportion of patients achieving normokalemia. Patients who completed this initial 28-day randomized phase were eligible to enroll in an ongoing 11 month open-label extension study, ZS004e.

22

Table of Contents

Study ZS004: Trial Design

ZS004 Phase III Demographics

Demographics of the patient population enrolled in the pivotal Phase III trial were substantially the same as that studied in the previous Phase II and Phase III trials, however given the efficacy observed in previous studies, patients were permitted entry into the study even with potassium levels in excess of 6.5 mEq/L, the range of baseline potassium levels was 5.1-7.4 mEq/L. We believe the ZS004 trial tested a representative population of hyperkalemic patients, which included those with CKD (eGFR<60mL/min/1.73m2; 69%), HF (NYHA Class I-IV; 36%), type 2 diabetes (66%) and those on RAAS inhibitor therapy (70%) from a range of ethnic backgrounds (white (83%); African American (14%); Asian (2%); other (1%)). The demographic and other baseline characteristics of subjects treated in the Maintenance Phase were generally similar among the Maintenance Phase treatment groups. The pivotal Phase III trial was conducted at 49 clinical sites in the United States, Australia and South Africa. Enrollment was completed within four months, suggesting the high prevalence of hyperkalemia, with approximately 80% of patients from the United States.

23

Table of Contents

Study ZS004 Patient Demographics

Baseline Characteristics

| Open Label |

Randomized Phase |

|||||||||||||||||||

| 10g (n=258) |

Placebo (n=85) |

5g (n=45) |

10g (n=51) |

15g (n=56) |

||||||||||||||||

| Median Age years |

65 | 66 | 64 | 65 | 65 | |||||||||||||||

| Male % |

58 | 52 | 60 | 53 | 71 | |||||||||||||||

| White % |

83 | 86 | 80 | 86 | 82 | |||||||||||||||

| Black % |

14 | 12 | 18 | 10 | 16 | |||||||||||||||

| BL Serum K+ <5.5 mEq/ L % |

46 | 51 | 51 | 37 | 43 | |||||||||||||||

| BL Serum K+ 5.5-<6.0 mEq/ L % |

39 | 35 | 38 | 45 | 46 | |||||||||||||||

| BL Serum K+ ³6.0 mEq/ L % |

15 | 14 | 11 | 18 | 11 | |||||||||||||||

| RAAS inhibitors % |

70 | 72 | 73 | 71 | 59 | |||||||||||||||

| Heart Failure % |

36 | 31 | 40 | 35 | 45 | |||||||||||||||

| Diabetes Mellitus % |

66 | 64 | 58 | 75 | 70 | |||||||||||||||

| Baseline eGFR <60 % |

69 | 61 | 69 | 75 | 73 | |||||||||||||||

| Brain Natriuretic Peptide pg/mL |

126 | 101 | 175 | 101 | 152 | |||||||||||||||

ZS004 Phase III Open Label Induction Phase Results

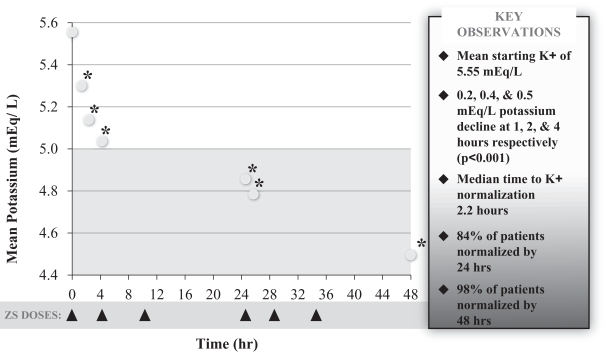

Similar to the results seen in our previous studies, statistically significant reductions in potassium were observed one hour after the first 10g dose of ZS-9. Median time to normokalemia was 2.2 hours with 84% of patients achieving normokalemia within 24 hours and 98% within 48 hours. Mean potassium decreased from a baseline level of 5.6 mEq/L to 5.4 mEq/L at one hour, 5.2 mEq/L (-0.4 mEq/L) at two hours, 5.1 mEq/L (-0.5 mEq/L) at four hours, and 4.5 mEq/L (-1.1 mEq/L) at 48 hours (p-value <0.05 at all time points). In the induction phase, there were no reports of edema, and adverse events were reported in 7.8% of patients and GI adverse events were reported in only 3.9% of patients. All events were considered mild or moderate in severity and the most common adverse events were diarrhea (1.2%), as well as constipation, dizziness and nausea (all 0.8%).

24

Table of Contents

Study ZS004: Open Label Induction Phase Serum Potassium Over 48 Hours

Results: Open-Label Phase

| * | p-value <0.001 |

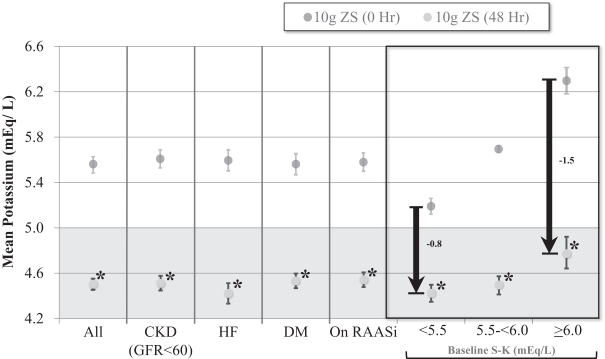

ZS-9 was equally efficacious across patient subsets. Patients with CKD, HF, type 2 diabetes and those taking RAAS inhibitor therapy all showed the same magnitude of potassium lowering as the entire population. In contrast, responses were larger in patients with higher levels of hyperkalemia; patients with baseline serum K+ <5.5 mEq/L had a change of -0.8 mEq/L at 48 hours, compared to those with baseline serum K+ in the range of 5.5-5.9 mEq/L and those with a baseline >6 mEq/L which had changes of -1.2 and -1.5 mEq/L respectively. Notably, in patients with severe hyperkalemia (K+ ³6.0 mEq/L), ZS-9 produced mean changes of -0.5 mEq/L at one hour and -0.7 mEq/L at two hours suggesting a potential for use in emergency and acute settings.

25

Table of Contents

Study ZS004: Reduction in Serum Potassium Levels Across Patient Subgroups

Open Label Phase: Consistent Results in All Subgroups

| * | P value<0.0001 |

Error bars represent ±95 confidence intervals

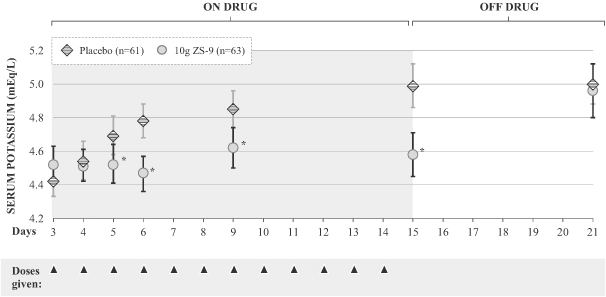

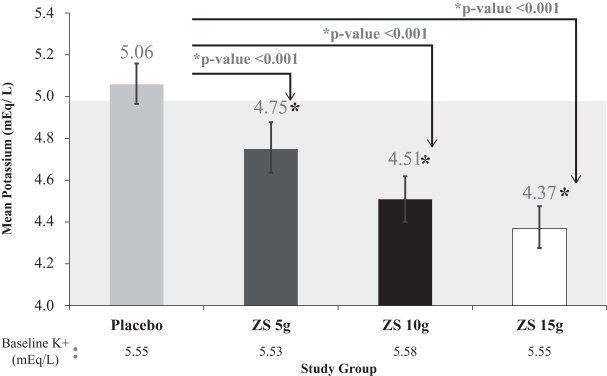

ZS004 Phase III Extended Phase Results

The primary endpoint was assessed in the second phase of the Phase III study, which was a double-blind, placebo controlled, randomized withdrawal design. Patients that became normokalemic after receiving ZS-9 during the induction phase were randomized to receive once daily placebo or 5g, 10g, or 15g of once daily ZS-9. The ZS004 trial met the primary efficacy endpoint by demonstrating that all three doses (5g, 10g, and 15g) of once daily ZS-9 maintained mean potassium at lower levels than placebo over the day 8 to 28-day period (placebo average was 5.1 mEq/L vs. 4.8, 4.5, and 4.4 mEq/L for 5g, 10g, and 15g, respectively, p-value £0.001 for all doses). Significantly higher proportions of patients had mean serum potassium (K+) levels in the normal range (K more than 3.4mEq/L and less than 5.1mEq/L) while on ZS-9 than placebo (80%, 90%, and 94% at the 5g, 10g and 15g dose, respectively, compared with 46% on placebo).

26

Table of Contents

ZS004 Meets Primary Endpoint for all Doses Tested in Extended Phase

Achieves Primary Endpoint, Mean K+ Maintenance on Days 8-29 for All Doses

| * | Error bars represent ±95 confidence intervals |

27

Table of Contents

Study ZS004: Proportion of Patients with Mean Serum in the Normal Range in the Extended Phase

Randomized Phase: Proportion of Patients with Mean K <5.1 mEq/L during Days 8-29

| * | P value<0.001 |

ZS004 Phase III Adverse Events

In the ZS004 study, ZS-9 appeared to be well tolerated. The rate of adverse events and rate of GI adverse events were generally similar across placebo and ZS-9 treated groups with no dose dependent effects on overall rates. There were a total of 10 serious adverse events reported in patients receiving ZS-9 during the study, all of which were assessed by the study investigators and by us as not related to ZS-9. The serious adverse events were distributed across ZS-9 groups, and there was no dose dependent relationship.

Study ZS004: Percentage (Number) of Patients with Treatment Emergent Adverse Events

| Randomized Phase |

Maintenance Phase |

|||||||||||||||

| Placebo (n=85) |

5 g (n=45) |

10 g (n=51) |

15 g (n=56) |

|||||||||||||

| All Adverse Events |

31.8 | % | 53.3 | % | 29.4 | % | 44.6 | % | ||||||||

| (27 | ) | (24 | ) | (15 | ) | (25 | ) | |||||||||

| Gastrointestinal Events |

14.1 | % | 6.7 | % | 2 | % | 8.9 | % | ||||||||

| (12 | ) | (3 | ) | (1 | ) | (5 | ) | |||||||||

The adverse events with the highest rates in ZS004 were anemia, constipation, edema, nasopharyngitis, and upper respiratory tract infections. The incidence of urinary tract infections was low with one case reported in each of the placebo (1.2%), 5g (2.2%), and 15g (1.8%) groups and no reported cases in the 10g group. Constipation was more frequent on placebo, whereas peripheral edema, mostly foot and ankle swelling, was

28

Table of Contents

more frequent on ZS-9. There were six cases of constipation on placebo (7.1%) compared to no cases on 5g, one case on 10g (2.0%), and one case on 15g (1.8%). There were 14 cases of edema: two cases of edema on placebo (2.4%), one case on 5g (2.2%), three cases on 10g (5.9%), and eight cases on 15g (14.3%). Seven cases of edema resolved or did not require treatment during study (one case on 5g, all three cases on 10g, and three cases on 15g). Of the 14 patients with edema, 13 completed the study. Each of the subjects who had edema events were receiving multiple types of medications for treatment of hypertension, of which edema is a common adverse effect. The majority of the subjects also had CKD and most had a medical history of edema. None of the edema events were considered related to ZS-9, and most were mild or moderate in severity. This conclusion is supported by data from the long term ZS004e and ZS005 extension studies which to date do not show an increased rate of edema at 15g, or any other dose, after ten months of treatment.