Exhibit 99.1

This presentatiy contain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. The use of words such as "believes," "expects," "anticipates," "intends," "plans," "estimates," "should," "likely" or similar expressions, indicates a forward-looking statement. These statements are subject to risks and uncertainties and are based on the beliefs and assumptions of management, and information currently available to management. The actual results could differ materially from a conclusion, forecast or projection in the forward-looking information. Certain material factors or assumptions were applied in drawing a conclusion or making a forecast or projection as reflected in the forward-looking information. The identification in this presentation of factors that may affect the company’s future performance and the accuracy of forward-looking statements is meant to be illustrative and by no means exhaustive.

All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Factors that could cause the company’s actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to: the success of the company’s exploration and development efforts; the price of oil and gas; the worldwide economic situation; changes in interest rates or inflation; the ability of the company to transport gas; willingness and ability of third parties to honor their contractual commitments; the company’s ability to raise additional capital, as it may be affected by current conditions in the stock market and competition in the oil and gas industry for risk capital; the company’s capital costs, which may be affected by delays or cost overruns; costs of production; environmental and other regulations, as the same presently exist or may later be amended; the company’s ability to identify, finance and integrate any future acquisitions; and the volatility of the company’s stock price

|

Key Statistics

|

|

|

Stock Price (03/05/15)

|

$11.61

|

|

52 Week High/Low

|

$14.11-$8.05

|

|

Shares Outstanding (02/15/15) Diluted

|

105 M

|

|

Public Float

|

95 M

|

|

Options Outstanding @ avg. price $5.94 (02/15/15)

|

2.2 M

|

|

Avg. Daily Vol. (3 month)

|

1.9 M

|

|

Market Capitalization

|

$1,219 M

|

|

Institutional Holdings

|

72%

|

|

Insider & Employee Holdings, est.

|

10%

|

|

Fiscal Year End

|

August 31

|

|

Cash & Short Term Investments (02/15/15)

|

$237 M

|

|

Total Debt (02/15/15)

|

$146 M

|

•Edward Holloway, co-CEO

•33 years as an executive of oil and gas companies focused on the Wattenberg Field in the D-J Basin

•Built three Wattenberg companies and sold each of them to larger, public companies

•William Scaff, Jr., co-CEO

•Over 30 years of management in the oil and gas industry with focus on the D-J Basin

•Frank (Monty) Jennings, CFO

•More than 35 years of accounting and finance experience, including oil & gas exploration and production

•Craig Rasmuson, COO

•9 years in the oil and gas industry all focused on the D-J Basin

•Valerie Dunn, Secretary/Controller

• Ms. Dunn has been Controller of SYRG since 2008 and appointed Secretary in 2014. She has 30 years of experience in oil & gas accounting for Wattenberg based companies

•Ron Morgenstern, VP of Land & Business Development

•More than 38 years managing lease assets in various basins in the Rocky Mountains, including the DJ Basin

•Jon Kruljac, VP, Capital Markets & Investor Relations

•30 years of experience in capital markets including 23 years of focus on small cap, Rocky Mountain E&P companies

•Brant DeMuth CFA, VP, Finance

•30 years of experience in the oil & gas industry including 20 years of providing capital to industry participants

High rate of return projects generate strong cash flow to be reinvested toward production and asset growth

No long term drilling contracts in place, allowing the company flexibility to spend capital when and where it is most economic

Low debt to market capitalization (<15%**) and low cost of debt (less than 3% interest rate)

Lowered estimated completed well costs by 10-20% to $3.1mm-$3.8mm * for 2015

Recent equity offering of $190mm strengthens the balance sheet and allows the company to take advantage of potential acquisitions and development opportunities

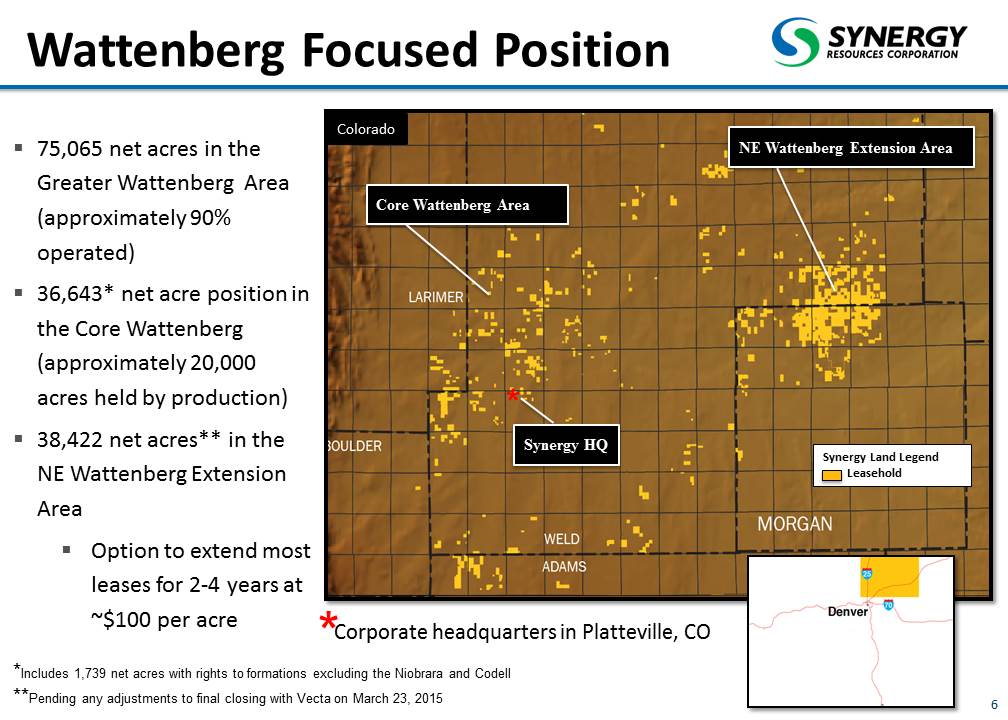

-75,065 net acres in the Greater Wattenberg Area (approximately 90% operated)

-36,643* net acre position in the Core Wattenberg (approximately 20,000 acres held by production)

-38,422 net acres** in the NE Wattenberg Extension Area

-Option to extend most leases for 2-4 years at ~$100 per acre

-36,643 net acre position in the Core Wattenberg

-39 Horizontal wells drilled and completed on 7 SYRG pads with 100% success rate

-One rig contracted - Currently drilling 11 HZ wells on Cannon Pad finishing in late May

-Completion phase on 29 wells to begin mid-March 2015 - Start with Kiehn/Weis Pad and then move to Geis Pad in May when the Lucerne II Plant is online

=Potential for 40 gross wells to come on production by Aug 31st, 2015

§38,422 Net Acres pro forma for recent transaction with non-op partner

§Increased SYRG working interest to 65% and added 10,000 net acres to its leasehold

§Operated Horizontal Drilling Program to Commence by 5/31/15

§Targeting the lower Greenhorn Lincoln Lime Formation

•Exploration agreement with a private operator on SYRG Leasehold:

•Participate in up to 10 wells covering 8,000 net acres in Dundy Co. Nebraska

•Estimated vertical completed well cost - $550k-$650k

•Synergy will pay 3/8ths of well cost

•Retain a 50% WI and overriding royalty

•Activity commenced January, 2015

•long term leases with85% Net RevenueInterest

•Private competitorsincluding Berexco,Murfin Drilling Co, and Mull Drilling Companyare active in the area.

Crude locally refined

§63,465 net acres, with long term leases and 85% NRI

§Proven shallow Niobrara dry gas field, economic above $4/mcf

§2 days to drill and complete vertical wells (est. cost $250k)

§Area has existing gas gathering and processing infrastructure

§Numerous deeper exploratory tests being drilled by other operators

|

Firm

|

Analyst

|

|

Brean Capital

|

Curtis Trimble

|

|

Canaccord Genuity

|

Stephen Berman, CFA

|

|

Clarkson Capital Markets

|

Jeffrey R. Connolly, CFA

|

|

Cowen and Company

|

Christopher Walling

|

|

Euro Pacific Equities

|

Joel Musante, CFA

|

|

FBR & Co.

|

Megan Repine

|

|

Global Hunter Securities

|

Mike Kelly

|

|

GMP Securities

|

Ipsit Mohanty

|

|

Iberia Capital Partners

|

David Beard, CFA

|

|

Imperial Capital

|

Kim Pacanovsky Ph. D

|

|

Johnson Rice & Co.

|

Welles Fitzpatrick

|

|

Key Banc

|

David Decklebaum

|

|

Northland Capital Markets

|

Mo Dahhane

|

|

Roth Capital Partners

|

Joe Reagor

|

|

Stephens Inc.

|

Ben Wyatt

|

|

Stifel

|

Michael Scialla

|

|

SunTrust Robinson Humphrey

|

Ryan Oatman, CFA

|

|

Wunderlich Securities

|

Irene Haas

|

Please note that any opinions, estimates or forecasts regarding Synergy Resources performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of Synergy Resources or its management. Synergy Resources does not by its reference above imply its endorsement of or concurrence with such information, conclusions or recommendations. This list includes analysts currently known by Synergy Resources to follow the company, but may not be complete and may change as firms add or delete coverage. Synergy Resources does not undertake any duty to update this information or any information provided by third parties.