Attached files

| file | filename |

|---|---|

| EX-31.2 - RIGHTSCORP, INC. | ex31-2.htm |

| EX-32.2 - RIGHTSCORP, INC. | ex32-2.htm |

| EX-31.1 - RIGHTSCORP, INC. | ex31-1.htm |

| EX-32.1 - RIGHTSCORP, INC. | ex32-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - RIGHTSCORP, INC. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 000-55097

RIGHTSCORP, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 33-1219445 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

3100 Donald Douglas Loop North Santa Monica, CA |

90405 | |

| (Address of principal executive offices) | (Zip Code) |

(310) 751-7510

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes [ ] No [X]

Indicate by checkmark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the proceeding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [ ] (Do not check if a smaller reporting company) | Smaller reporting company | [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, as of June 30, 2014, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $22.8 million based upon the last sales price of the common stock as of such date. Solely for purposes of this disclosure, shares of common stock held by executive officers, directors and beneficial holders of 10% or more of the outstanding common stock of the registrant as of such date have been excluded because such persons may be deemed to be affiliates.

As of March 2, 2015, there are 89,896,421 shares of common stock outstanding.

TABLE OF CONTENTS

| 2 |

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that involve assumptions, and describe our future plans, strategies, and expectations. Such statements are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words of other variations on these words or comparable terminology. These statements are expressed in good faith and based upon a reasonable basis when made, but there can be no assurance that these expectations will be achieved or accomplished.

Such forward-looking statements include statements regarding, among other things, (a) the potential markets for our products, our potential profitability, and cash flows (b) our growth strategies, (c) anticipated trends in our industry, (d) our future financing plans and (e) our anticipated needs for working capital. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under “Item 1. Business” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as in this Annual Report on Form 10-K generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors as described in this Annual Report on Form 10-K generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Annual Report on Form 10-K will in fact occur. In addition to the information expressly required to be included in this filing, we will provide such further material information, if any, as may be necessary to ensure that the required statements, in light of the circumstances under which they are made, are not misleading.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, forward-looking statements are inherently subject to known and unknown risks, business, economic and other risks and uncertainties that may cause actual results to be materially different from those discussed in these forward-looking statements. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, other than as may be required by applicable law or regulation. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed with the Securities and Exchange Commission which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operation and cash flows. Our actual results may vary materially from those expected or projected.

| 3 |

Background

Rightscorp, Inc., a Nevada corporation, was incorporated in Nevada on April 9, 2010. Since the closing of the Reverse Acquisition on October 25, 2013 (discussed below), we have been the parent company of Rightscorp, Inc., a Delaware corporation.

On October 25, 2013 (the “Merger Closing Date”), we entered into and closed an Agreement and Plan of Merger (the “Merger Agreement”), with Rightscorp Merger Acquisition Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of ours (the “Subsidiary”) and Rightscorp, Inc., a Delaware corporation (“Rightscorp Delaware”). Pursuant to the Merger Agreement, (i) the Subsidiary merged into Rightscorp Delaware, such that Rightscorp Delaware became a wholly-owned subsidiary of our company, (ii) we issued (a) 45,347,102 shares (the “Acquisition Shares”), of our common stock to the shareholders of Rightscorp Delaware representing approximately 65.9% of our aggregate issued and outstanding common stock following the closing of the Merger Agreement (following the Share Cancellation and the Private Placement, each as defined below), in exchange for all of the issued and outstanding shares of common stock of Rightscorp Delaware, (b) outstanding warrants to purchase 1,831,969 shares of common stock of Rightscorp Delaware were converted into outstanding warrants to purchase 5,312,703 shares of our common stock, and (iii) outstanding convertible notes in the aggregate amount of $233,844 (including outstanding principal and accrued interest thereon) of Rightscorp Delaware were amended to be convertible into shares of our common stock at a conversion price of $0.1276.

In connection with the Merger Agreement and the Financing (defined below), as of the Merger Closing Date we issued and sold an aggregate of 950,000 units (the “Private Placement”), for a purchase price of $0.50 per unit, with each unit consisting of one share of common stock and an eighteen month warrant to purchase one share of common stock with an exercise price of $0.75 (the “Private Placement Warrants”).

In connection with the Merger Agreement and the Private Placement, in addition to the foregoing:

| (i) | Effective on the Merger Closing Date, 21,000,000 shares of common stock were returned to us for cancellation (the “Share Cancellation”). | |

| (ii) | Effective on the Merger Closing Date, the following individuals were appointed as executive officers and directors of our company: |

| Name | Title | ||

| Christopher Sabec | Chief Executive Officer, President, and Chairman of the Board of Directors | ||

| Robert Steele | Chief Financial Officer, Chief Operating Officer, Chief Technology Officer, and Director | ||

| Brett Johnson | Director |

| (iii) | Effective July 15, 2013, we amended our articles of incorporation to change our name from “Stevia Agritech Corp.” (“Stevia”) to “Rightscorp, Inc.” | |

| (iv) | On June 18, 2013, we entered into a financing agreement (the “Financing Agreement”) with Hartford Equity Inc. (“Hartford”), under which Hartford agreed to purchase, directly or through its associates, an aggregate of $2,050,000 of common stock and warrants (the “Financing”). The Private Placement described above will be deemed part of the Financing such that as of the Merger Closing Date we closed on $475,000 of the Financing (which amounts were advanced by us to Rightscorp Delaware prior to the Merger Closing Date) and Hartford, directly or through its associates, agreed to purchase an additional $1,575,000 in common stock and warrants from us within 14 months from the Closing Date. As of March 2, 2015, we have yet to receive $375,000 of the $1,575,000, which includes a $21,000 increase to the total amount agreed to be purchased. |

Effective on the Merger Closing Date, pursuant to the Merger Agreement, Rightscorp Delaware became our wholly owned subsidiary. The acquisition of Rightscorp Delaware is treated as a reverse acquisition (the “Reverse Acquisition”), and the business of Rightscorp Delaware became our business. At the time of the Reverse Acquisition, Stevia was not engaged in any significant active business.

References to “we”, “us”, “our” and similar words refer to the Company and its wholly-owned subsidiary, Rightscorp Delaware, unless the context otherwise requires, and prior to the effectiveness of the Reverse Acquisition, these terms refer to Rightscorp Delaware. References to “Stevia” refer to the Company and its business prior to the Reverse Acquisition.

Rightscorp Delaware is a Delaware corporation formed on January 20, 2011.

| 4 |

We are a technology company and have a patent-pending, proprietary method for collecting payments from illegal downloaders of copyrighted content via notifications sent to their internet service providers (ISPs).

Our principal office is located at 3100 Donald Douglas Loop North, Santa Monica, CA 90405. Our telephone number is (310) 751-7510. Our website address is www.rightscorp.com.

Overview

According to Netnames, 22% of all internet traffic is used for peer-to-peer filesharing, the great majority of which infringes on copyrights, while according to Sandivine, 27% of all US internet upload traffic is peer-to-peer filesharing, the majority of which infringes on copyrights. We believe that this means that every creator of music, movies, TV shows, books and software is faced with the reality that their work, their property and their content may end up being distributed on the internet against their wishes, to their economic detriment and without receiving compensation. We protect copyright holders’ rights by seeking to assure they get paid for their copyrighted IP. We offer and sell a service to copyright owners under which copyright owners retain us to identify infringements and collect settlement payments from Internet users who have infringed on their copyrights. Without Rightscorp, Inc., any creator of music, motion pictures, television shows, books and software is faced with the reality that their work and property may be distributed for free worldwide on the internet. Without Rightscorp, there is little recourse available to them to reduce the harm they incur from the illegal distribution. With Rightscorp, every content creator has the opportunity to get compensated and enforce their rights.

“Piracy isn’t just draining record-label revenue-it’s threatening the economic viability of creating content,” said Robert Levine, author of Free Ride: How Digital Parasites Are Destroying the Culture Business and How the Culture Business Can Fight Back in Billboard.com November 02, 2011. Some recent statistics continue to tell this story. For example:

| ● | Music revenues for the first half of 2014 were down 5% versus the first half of 2013. This follows years of consecutive decline. | |

| ● | According to Nashville Songwriters Association International, the number of full-time songwriters in Nashville has dropped 80% since 2000. This was a new low point since data tracking began in 1991.1 | |

| ● | According to the WGA West, screenwriters’ earnings were down nearly 25 percent in 2013 from 2009.2 | |

| ● | According to the Bureau of Labor Statistics, there were 39,260 people in the United States classified as “Musicians and Singers” in 2013. This is down 27% from 53,940 in 2002.3,4 |

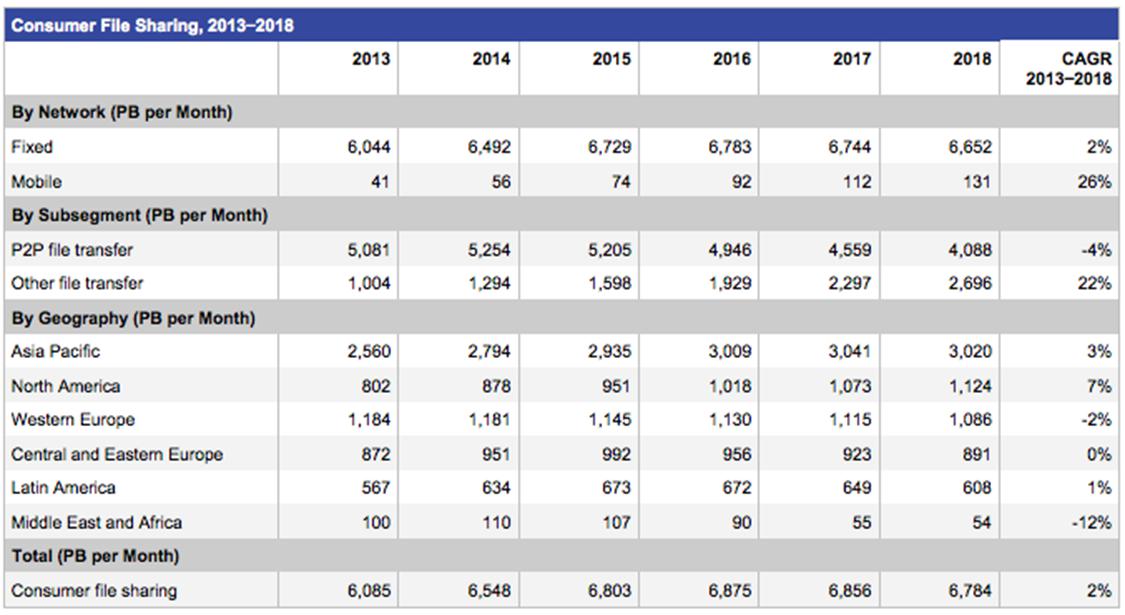

Meanwhile, peer-to-peer content piracy continues of thrive and expand even as content creators face such significant reductions in business and income. The amount of internet traffic used by peer-to-peer filesharing grew 18% from 674 Petabytes a month to 802 Petabytes a month from 2010 to 2013 (Sources: Cisco Visual Networking Index: Forecast and Methodology, 2010–2015; Cisco VNI: Forecast and Methodology, 2013 – 2018). One petabyte (PB) equals 1 million gigabytes (GB), which is the equivalent of 1.6 million CDs. Eight hundred Petabytes per month is the equivalent of 1.3 billion CDs per month. In 2013, Netnames found that the majority of peer-to-peer filesharing infringes on copyright from 78.1% for music to 92.9% for television. According to Sandvine, 27% of all US internet upload traffic is peer-to-peer filesharing. Cisco forecasts that file sharing will grow 42% to 999 Petabytes per month by 2018. Rightscorp is tracking millions of US internet subscribers on the ISPs that do not forward Rightscorp notices. These millions of subscribers are repeatedly illegally distributing Rightscorp’s clients’ copyrights to users around the globe even after their ISPs have been sent millions of notices.

After we have received an order from a client, our software monitors the global P2P file sharing networks to detect illegally distributed digital media. The technology sends automated notices of the infringing activity to ISPs and the ISP forwards these notices, which contain settlement offers, to their infringing customers. The notice to ISPs and settlement offers identify the date, time, title of copyrighted intellectual property and other specific technology identifiers to confirm the infringement by the ISPs customer. Infringers who accept our settlement offers then remit payment to us for the copyright infringement and we share the payments with the copyright owners.

1 http://www.tennessean.com/story/entertainment/music/2015/01/04/nashville-musical-middle-class-collapses-new-dylans/21236245/

2 http://www.hollywoodreporter.com/news/hollywood-salaries-revealed-movie-stars-737321

3 http://www.bls.gov/oes/current/oes272042.htm

4 http://www.bls.gov/oes/2002/oes272042.htm

| 5 |

We generate revenues by retaining a portion of the settlement payments we receive from copyright infringers. Our customers, the copyright holders, benefit from our service as we share a portion of the settlement with them. This helps them recapture the revenues they lost when their copyrighted material was illegally copied and distributed. Current customers include, but are not limited to, BMG Rights Management, Round Hill Music, Shapiro/Bernstein and The Orchard. We have successfully obtained settlement payments from more than 180,000 individual cases of copyright infringement. To date, we have closed infringements and received settlement payments from subscribers on more than 233 ISPs including five of the top 10 US ISPs: Comcast, Charter, CenturyLink, Mediacom and Suddenlink. We believe ISPs that participate with us and our clients by forwarding notices of infringement achieve compliance with their obligations under Digital Millennium Copyright Act (or DMCA), as discussed below. Conversely, we believe that ISPs that do not participate and do not have a policy for terminating repeat infringers fail to comply with the DMCA, which may result in liability for them.

Dependence on Major Customers

For the year ended December 31, 2013, our contract with BMG Rights Management accounted for approximately 25% of our sales, and our contract with Warner Bros. Entertainment accounted for 7% of our sales. For the year ended December 31, 2014, our contract with BMG Rights Management accounted for approximately 76% of our sales, and our contract with Warner Bros. Entertainment accounted for 13% of our sales. Our standard contract with customers is for an initial one-year term, which renews automatically for successive one-month terms, unless either party terminates upon 30 days’ written notice to the other party.

Legal Framework

The challenge for copyright owners is that the legal framework now in place requires the copyright owner to monitor and notice and document each individual act of infringement against the copyright owner in order to protect its rights. We believe the content business views this as an insurmountable and costly task. As described above, our Rightscorp software provides a solution by monitoring the global P2P file sharing networks to detect illegally distributed digital media.

ISP Safe Harbor

Courts have found businesses that have been involved in contributing to copyright infringement liable for damages. In Fonovisa v. Cherry Auction, a swap meet run by Cherry Auction was held liable to Fonovisa (the copyright owner) for damages. As the Court observed, “it would be difficult for the infringing activity to take place in the massive quantities alleged without the support services provided by the swap meet,” including the provision of space, utilities, parking, advertising, plumbing and customer”

Section 512(i) of the DMCA provides a conditional safe harbor protection from such third party liability. It states as follows:

| ● | (i) Conditions for Eligibility | |||

| (1) Accommodation of technology - The limitations on liability established by this section shall apply to a service provider only if the service provider: | ||||

| (A) has adopted and reasonably implemented, and informs subscribers and account holders of the service provider’s system or network of, a policy that provides for the termination in appropriate circumstances of subscribers and account holders of the service provider’s system or network who are repeat infringers; and | ||||

| (B) accommodates and does not interfere with standard technical measures. | ||||

Thus, under federal law, ISPs are only eligible for “Safe Harbor” protection from vicarious liability from their subscribers’ copyright infringements if they have “reasonably implemented a policy that provides for the termination of subscribers who are repeat infringers.” In accordance with the DMCA, we have developed a technology and a process for identifying repeat infringers, documenting infringements and sending ISPs notice of repeat infringement and monitoring the termination, or lack thereof, of repeat infringers. As there is no case law regarding this “Safe Harbor” provision, ISPs’ interpretations of their responsibilities vary. We have utilized this Safe Harbor provision to obtain various levels of cooperation from ISPs, which in many cases include the forwarding of our notices and the termination of repeat infringers who do not accept our settlement offers. To qualify for the “Safe Harbor” protection, ISPs have an incentive to forward our notices and terminate repeat infringers, and infringers in turn have an incentive to accept our settlement offers, so as to avoid termination of services from the ISPs.

Digital Copyrights & Piracy Background

In 1999, Shawn Fanning, an 18 year old college student, changed the music industry with his creation of a digital file sharing program called Napster, a software program that allowed computer users to share and swap files, specifically music, through a centralized file server. By the spring of 2000, Napster had several hundred thousand users and by February 2001 had grown to over 50 million users.

| 6 |

In September 2013, Netnames, a market research and consultancy firm, reported that P2P traffic that infringes on copyrights had become 22% of all internet traffic (not including traffic that infringes on pornographic copyrights). In other words, 22% of all Internet traffic was at the time made up of illegal downloading and distribution of mainstream, high-quality movies, music, games, and software. The report states that “worldwide, 432 million unique internet users explicitly sought infringing content during January 2013. Despite some discrete instances of success in limiting infringement, the piracy universe not only persists in attracting more users year on year but hungrily consumes increasing amounts of bandwidth.”

In three key regions (North America, Europe, and Asia-Pacific), the absolute amount of bandwidth consumed by the infringing use of BitTorrent comprised 6,692 petabytes of data in 2013, an increase of 244.9% from 2011.

In the same three regions, infringing use of BitTorrent in January 2013 accounted for:

178.7 million unique internet users, an increase of 23.6% from November 2011; and

7.4 billion page views, an increase of 30.6% from November 2011.

According to the Global Internet Phenomena Report in Sandvine, 1H 2014, P2P file sharing accounted for approximately 27% of all North American upstream Internet traffic.

Enacted in 1997, The Digital Millennium Copyright Act (or DMCA) heightened the penalties for copyright infringement on the Internet and established the eligibility for Safe Harbor from liability of the providers of on-line services for copyright infringement by their users.

To combat online copyright infringement, the media industry and their partners have spent extraordinary amounts of money and resources searching for a technology breakthrough to protect copyrighted works. These technologies have often referred to as Digital Rights Management (or DRM). DRM technologies attempt to prevent digital music player technology from allowing reproduction. DRM suffers from the inherent problem that if a reasonably technologically savvy person can listen to a music file, he can find a way to make a copy that does not have the DRM technology. These efforts failed to stem the tide of illegal downloading, and the industry turned to aggressive litigation tactics. Notwithstanding the continued efforts of the media industry, including the use of DRM technologies, many popular TV and film properties are available in high quality online soon after release and in some cases prior to release. Thus, we do not believe that DRM technologies will be able to prevent widespread unauthorized use of copyrighted content.

Beginning in 2002, the Recording Industry Association of America (or RIAA), the trade group that represents the U.S. Music Industry, filed the first lawsuits against individuals who were suspected of illegally downloading music. By October 2008, RIAA had filed 30,000 lawsuits against individual downloaders. As of February 2012, most of the 30,000 cases settled out of court for between $3,000 and $5,000, two cases have been tried. Jamie Thomas received a judgment for $1.5m for distributing 24 songs and Joel Tenenbaum received a judgment for $675,000 for downloading and distributing 31 songs.

Even with 30,000 lawsuits filed and millions of dollars collected, P2P traffic had still grown worldwide to represent more than 40% of all consumer Internet traffic in 2008. Then in December 2008, the RIAA announced that it would stop suing individual infringers.

The P2P Landscape

The P2P landscape has several distinct areas: protocols, networks, access tools, software businesses, open source developers, indexing and search sites and dark businesses.

The most popular access tool is BitTorrent in the U.S. (uTorrent, Vuze, Frostwire, Popcorn Time).

We believe the reason P2P is such a persistent and a prominent feature of the Internet is that it requires only a relatively small number of individual, voluntary users anywhere in the world for its existence. It requires no financing or fixed infrastructure to exist. The protocols are open specifications that any computer programmer can obtain and read to develop software for interacting with the different P2P networks. There are free access tools available for all networks. The networks are simply a collection of users who have downloaded and installed one of the many free access tools. There are operating companies like BitTorrent, Inc. that market and sell the BitTorrent software.

A user downloads BitTorrent software or any number of other free BitTorrent clients, installs it on his computer, and searches for content on Google. The user simply types any artists’ name or the name of any movie or software followed by the word “torrent” into Google. For instance after entering “Adele Torrent” into Google, millions of web pages offering her music for free will be listed. The user selects the version they want from the web page link.

Once a file has been requested and starts to download, the downloading computer also starts to upload pieces of the file to the network. In the P2P world, essentially, everyone is an uploader. On BitTorrent, once the “downloader” has obtained enough of the file, the computer becomes an uploader.

| 7 |

Then, the BitTorrent website explains what happens next, including the encouragement to assist in distributing content:

“When BitTorrent finishes downloading a file, the bar becomes solid green and the newly downloaded file becomes a new ’seed’ — a complete version of the file. It will continue to seed the file to other interested users until you tell it not to by pausing it or removing the torrent from your queue. The more clients that seed the file, the easier it is for everyone to download it. So, if you can, please continue to seed the file for others by keeping it in your queue for a while at least.”

Additionally, BitTorrent Private host/tracker sites such as Demonoid operate like public ones except that they restrict access to registered users and keep track of the amount of data each user uploads and downloads, in an attempt to reduce leeching.

BitTorrent search engines allow the discovery of torrent files that are hosted and tracked on other sites; examples include Kick Ass Torrents, Torrentz, The Pirate Bay and isoHunt. These sites allow the user to ask for content meeting specific criteria (such as containing a given word or phrase) and retrieve a list of links to torrent files matching those criteria.

In 2008, it was revealed that just one BitTorrent hosting/tracker site was making $4 million a year on advertising. The USC-Annenberg Innovation Lab released a study in January 2012 that found many Internet ad networks profiting from piracy with Google #2 in the list. We believe P2P continues for several reasons:

| ● | It does not require any central organization that can be threatened or stopped; |

| ● | What centralization does exist can be located in offshore domiciles that do not respect international intellectual property; |

| ● | In the U.S., ISP’s cannot monitor (and hence interrupt) specific portions of their customers’ traffic without a warrant; |

| ● | In the U.S., ISP’s have no liability for failing to suspend or terminate subscribers who are repeatedly distributing copyrighted content unless the copyright owner has sent them notice of repeated infringement; and |

| ● | Until we developed our software, there had been no scalable technology capable of identifying repeat infringers, recording infringements and sending notices of repeated infringement. |

While this extraordinary proliferation of the use of the Internet has facilitated the ease of illegally sharing all digitized content, the exchange of music files via P2P sharing sites vastly exceeds all other areas of the entertainment consumption on a per-unit basis. Accordingly, we believe an expectation has been interwoven into the current generation of Internet users, which content is and should be free.

Industry Losses Due To Piracy

The US home video industry generated approximately $18.2B in sales in 2013, down from $25B in 2006. This includes Netflix, Amazon, Blu-ray, DVD, PPV and VOD. Recorded music sales were $7B in 2013 down from $12B in 2000, including streaming revenues as well as iTunes and CDs. From 2012 to 2013, US sales of digital music tracks declined 6% and sales of CDs and digital albums declined 8% year over year. According to the US Bureau of Labor Statistics, people marking their occupation as musician decreased 22% from 53,940 in 2002 to 42,100 in 2012.

Our Service & How it Works

We have developed a technology that we sell as a service to copyright owners to collect settlement payments from consumers who have illegally downloaded copyrighted content. We are selling our services into the untapped market for monetizing billions of copyright violations worldwide.

Our technology system monitors the global P2P file sharing networks and sends via email to ISPs notifications of copyright infringement by the ISPs’ customers with date, time, copyright title and other specific technology identifiers. Each notice also includes a settlement offer. We pay the copyright owner a percentage of these settlements. By accepting our settlement offers, infringers avoid potential legal action by the copyright holders. Our service provides ISPs a no-cost compliance tool for reducing repeat infringement on their network.

Under our business model, the copyright owner signs a simple agreement authorizing us to monitor the P2P networks and collect settlement payments on its behalf. With respect to music, every mp3 file that is downloaded has at least two copyrights, a sound recording copyright and a publishing copyright. The publishing copyright is the right to use the song and is separate from the sound recording copyright which includes the right to place the song in a movie, re-record the song, or print the lyrics and melody on sheet music. Under U.S. copyright law, each copyright owner has the exclusive right to copy and distribute their respective copyrights. If someone uses “file sharing” software to “share” a specific song, they are violating the copyright owner’s exclusive right of copying and distribution, and they have incurred a potential civil liability.

| 8 |

Our technology monitors the Internet all of the time looking for infringements. When it detects an infringement, we receive the following data:

|

● | Date and Time of infringement; |

| ● | Filename; | |

| ● | ISP Name; | |

| ● | IP Address; and | |

| ● | Additional information related to our trade secrets. |

We send this data to the ISP in an automated computer format. The ISP is expected to send our communication to their subscriber. This notice is sent to the customer by its ISP, so it is clearly not “spam”.

We have written, designed and we own the technology for:

| ● | listening to the P2P networks and finding infringements; | |

| ● | sending the DMCA notices; and | |

| ● | receiving payments. |

The user who receives the notice reads that they could be liable for $150,000 in damages, but if they click on the link supplied, they can enter a credit card and they can will settle the matter between them and the copyright owner for $20 per infringement. Repeat infringers are put on a list sent weekly to ISPs demanding that their service be terminated pursuant to 17 USC 512 (i). Once the user makes the settlement payment, they are removed from the list. If subscribers have had their service terminated, and have since settled their open infringement cases with us, their ISP is notified immediately so service can be restored.

Once we receive the settlement amount, we split the payment half/half with the copyright owner, less certain costs. Most infringers receive and settle multiple infringement notices.

Our current technology can send tens of millions of notices per month. We can quickly scale this system to send hundreds of millions notices per month.

We provide a free compliance solution to ISPs to reduce their third-party liability for repeat copyright infringements occurring on their network. Every U.S. ISP has a Rightscorp web page “dashboard” that they can log into and in real-time see each subscriber account that is infringing copyright by copyright. The dashboard also displays the history of the repeat infringers on their network and gives them immediate feedback on those that have settled their cases with the copyright holder.

We provide a free solution to every copyright holder. Every copyright holder who has retained us has a Rightscorp web page “dashboard” that they can log into and in real-time see each ISP subscriber account that is infringing copyright by copyright. The dashboard also displays the history of the repeat infringers on each ISPs network and gives them immediate feedback on infringers who have settled their cases with the copyright holder and those that continue to infringe after their ISP having received notice.

Similar to an anti-virus software company, where new a virus appears and an anti-virus software has to investigate the new virus and update their software to address the new virus, we must update our software when new P2P technologies appear. For example, when we launched in 2011, Limewire, also known as Gnutella, was the dominant P2P platform for music piracy. In less than twelve months the dominant platform for music piracy shifted to BitTorrent. As a result, to maintain the efficacy of our software, we were required to write new software. We will seek to stay abreast of similar future changes. We cannot be certain of the cost and time that will be required to adapt to new peer-to-peer technologies.

| 9 |

Product Roadmap

Our “next generation” technology is called Scalable Copyright. Its implementation will require the agreement of the ISPs. We have had discussions with multiple ISPs about implementing Scalable Copyright, and intend to intensify those efforts. In the Scalable Copyright system, subscribers receive each notice directly in their browser. Single notices can be read and bypassed similar to the way a software license agreement works. Once the internet account receives a certain number of notices over a certain time period, the screen cannot be bypassed until the settlement payment is received. ISPs have the technology to display our notices in subscribers’ browsers in this manner. We provide the data at no charge to the ISPs. With Scalable Copyright, ISPs will be able to greatly reduce their third-party liability and the music and home video industries will be able to return to growth along with the internet advertising and broadband subscriber industries.

Sales and Marketing

Our sales process involves seeking to acquire more rights to monitor and collect settlements for infringements on specific copyrights. As we acquire more rights and incorporate them into our system, our revenues increase. For example, there are 26 million songs and other copyrighted works on Apple iTunes, all of which are rights that can potentially generate revenue for our company. We are approaching copyright holders in the music publishing, recorded music, motion picture, television, eBook publishing, video game, software and mobile application industries. We have the greatest penetration within the music publishing space where we are in significant discussions with the majority of major copyright holders.

We are penetrating the music, motion picture, and software industry through our extensive personal contacts, referral partners and industry conferences. Christopher Sabec, our CEO, has been a successful entertainment executive and artist manager. In the music space, we attend conferences such as MIDEM, Musexpo, and the National Music Publishing Association’s Annual Meeting where we have an opportunity to meet with industry decision makers. For 2014 and 2015, we have identified the top 100 key decision makers and gatekeepers in the music publishing, recorded music, motion picture, eBook publishing industries. We reach out to these decision makers directly or through referral partners who make introductions. In some cases these referral partners may receive some compensation.

We are in discussions with multiple industry-wide trade groups in the music and eBook space. Our goal is to get industry-wide adoption through these trade groups. More specifically:

| ● | We have met with one trade group in person three times since 2012. We have had two in person meetings with the President of this group. We met with the Senior Vice President and General Counsel for the third time in February 2015. Our CEO has been in regular communication with the Senior Vice President and General Counsel by email and telephone since 2012. Our President has been in regular communication with their CTO since 2012. The purpose of these discussions is to obtain additional rights to monitor the copyrights of their members. We believe that subsequent discussions will result in their members signing up. |

| ● | We have met with another trade group in person three times. We met with their General Counsel for the third time in February 2015. The purpose of these discussions is to obtain additional rights to monitor the copyrights of their members. Since discussions were initiated, some members have signed up. We believe that subsequent discussions will result in additional members signing up. |

| ● | We have had two meetings with another trade group. Our CEO met with their President in 2014. The purpose of these discussions is to obtain additional rights to monitor the copyrights of their members. Since discussions were initiated, some members have signed up. We believe that subsequent discussions will result in additional members signing up. |

| ● | We met with the entire anti-piracy task force of another trade group in 2012. In attendance were representatives from several companies operating in this sphere. We have been in contact by email and telephone with their representative. The purpose of these discussions is to obtain additional rights to monitor the copyrights of their members. We believe that subsequent discussions will result in members signing up. |

We believe our value proposition is unique and attractive — rather than asking copyright holders to pay us, we pay copyright holders. The decision-maker is faced with a large amount of conflicting information surrounding the topic of peer-to-peer piracy. Our sales cycle is about communicating the following information to the decision-makers within a rights holding organization:

| ● | U.S. ISP’s have a safe harbor that is conditional on terminating repeat copyright infringers. |

| ● | Rightscorp has the technology to identify these repeat infringers. |

| 10 |

| ● | ISP’s either need to work with copyright holders to reduce repeat infringers identified by Rightscorp or face significant liability. |

| ● | Without real sanctions, subscribers will largely ignore notices and continue to violate copyright law. |

| ● | Graduated-response style interdiction is too costly to scale to any significant portion of total infringements and yields little or no results. |

| ● | Due to the structure of the Internet, copyright cannot be enforced without participation of the ISP’s. |

| ● | ISP’s have no incentive to participate in any meaningful way without copyright holders sending them notices. |

| ● | The cost to send a meaningful amount of notices is prohibitive without our system.

|

| ● | Rightscorp, Inc. pays copyright holders while educating infringers that peer-to-peer file-sharing of their products is a violation of U.S. Federal law. |

| ● | Our system provides due process through warnings with escalating sanctions that can resolve large numbers of copyright violations. |

| ● | Peer-to-peer networks do not require search engines. A small percentage of requests for content originate from Google or Bing searches. We believe that attempts to get search engines to block links and sites will have no effect on piracy. |

Growth Strategy

We have several “touch points” in our revenue model where we seek to increase revenues.

| 1. | By adding more copyrights we seek to detect infringements of, which increases the number of notices we send; |

| 2. | By increasing the number of ISP’s who acknowledge our notices; |

| 3. | By increasing the number of notices that each ISP confirms and forwards; |

| 4. | By compelling the ISP to improve “throughput” processes. This may involve ISP’s calling subscribers. Our goal is to get ISP’s to deploy “re-direct” screens similar to the screen a hotel guest sees when he first uses the Internet in a hotel room. A repeat infringer would be redirected to the Rightscorp payment page and would be unable to browse the Internet until they have settled; |

| 5. | By increasing response rates (the number of subscribers who have received notices and agree to settle). We may seek to do this through public relations, through examples in the press of infringers who were sued by copyright owners, by improving the educational and motivational aspects of the notice, web site and payment process and by having ISP’s terminate repeat infringers until they settle; |

| 6. | By sending non-compliant ISP’s weekly termination demands to terminate service to non-responding repeat infringers pursuant to 17 USC 512 (i); and |

| 7. | By giving copyright holders who wish to litigate the highest quality litigation support data that includes the history of the subscriber’s ISP being sent notices while they continue to violate copyright law. |

We believe that if we are successful in our combined use of these strategies our revenues and margins could potentially increase exponentially.

| 11 |

Intellectual Property

We have 32 patent applications pending worldwide for our proprietary system of detecting and seeking settlement payments for repeat copyright infringers. The patent applications were filed between May 9, 2011 and January 12, 2015 and each patent application’s respective status before the U.S. Patent & Trademark Office (USPTO) is detailed below. The pending patent applications include 25 patent applications in countries such as Australia, Brazil, Canada, China, India, Israel, Japan , Hong Kong and the European Union, as well 7 US patent applications. The 7 US patent applications include patent applications 13/437,756 and 13/485,178, which contain the methods for identifying repeat infringers that we believe will create a significant barrier to entry for anyone attempting to market a scalable copyright monetization system in the peer-to-peer (P2P) space. In addition, the 7 U.S. patent applications also include U.S. Patent application 13/103,795 which includes methods for using peer-to-peer infringement data to sell legitimate products to infringers. Comcast announced they may do this in August 2013.

| Country | Status | Application Number | Filing Date | Title | Action Status | |||||

| US | Pending | 13/103,795 | May 9, 2011 | System and Method for Determining Copyright Infringement and Collecting Royalties Therefor | This application currently stands rejected by the USPTO. The rejection is a Final Rejection*. Applicants have appealed the USPTO’s Final Rejection* to the Patent Trial and Appeal Board (PTAB). Applicant currently awaits a decision from the PTAB as to whether the USPTO’s rejection will be affirmed or overturned. | |||||

| US | Pending | 61/774,107 | March 7, 2013 | Print Anti-Piracy Campaign | This provisional application was filed to secure an effective filing date of March 7, 2013 for the subject matter disclosed by the patent application. This provisional application is now expired, but was refiled as provisional application no. 61/942,707 on Feb. 21, 2014. | |||||

| US | Published | 13/437,756 | April 2, 2012 | System to Identify Multiple Copyright Infringements | This application currently stands rejected by the USPTO. The rejection is a Final Rejection*. Applicant has submitted a request for continued examination (RCE). The RCE secures an opportunity for the Applicant to submit additional arguments to overcome the USPTO’s Final Rejection* of the patent application. Applicant is currently preparing a response to the USPTO’s rejections. | |||||

| US | Published | 13/485,178 | May 31, 2012 | System to Identify Multiple Copyright Infringements and Collecting Royalties | This application currently stands rejected by the USPTO. The rejection is a Non-Final Rejection**. Applicant is currently preparing a response to the Non-Final Rejection. | |||||

| WO | Published | PCT/US12/31894 | April 2, 2012 | System to Identify Multiple Copyright Infringements | This international patent application was filed to secure the right to file a patent application in a subset of foreign countries designated by the international patent application. Based on this international application, entered the national stage in the European Union (EP2695099), China (CN103688265), Canada (CA2834853), and Australia (AU2012236069). | |||||

| WO | Published | US12/40234 | May 31, 2012 | System to Identify Multiple Copyright Infringements and Collecting Royalties | This international patent application was filed to secure the right to file a patent application in a subset of foreign countries designated by the international patent application. Based on this international application, entered the national stage in Japan (JP2014523559 & JP2014238849), the European Union (EP2715595 & EP2715595), China (CN103875002), Canada (CA2837604), and Australia (AU2012262173). |

| 12 |

| US | Published | 13/594,596 | August 24, 2012 | System to Identify Multiple Copyright Infringements | This international patent application was filed to secure the right to file a patent application in a subset of foreign countries designated by the international patent application. Based on this international application, entered the national stage in Japan (JP2014523559 & JP2014238849), the European Union (EP2715595 & EP2715595), China (CN103875002), Canada (CA2837604), and Australia (AU2012262173). | |||||

| WO | Published | PCT/ US2012/052325 | August 24, 2012 | System to Identify Multiple Copyright Infringements | This international patent application was filed to secure the right to file a patent application in a subset of foreign countries designated by the international patent application. Based on this international application, entered the national stage in Japan (JP2014529805), the European Union (EP2748718), China (CN104040531), Canada (CA2846241), and Australia (AU2012298708). | |||||

| US | Pending | 62/082,789 | November 21, 2014 | System to Verify User Download or Streaming of Multimedia Content | This provisional application was filed to secure an effective filing date of November 21, 2014 for the subject matter disclosed by the patent application. | |||||

| US | Pending | 62/102,354 | January 12, 2015 | System and Method for Generating and Communicating Activity Reports | This provisional application was filed to secure an effective filing date of January 12, 2015 for the subject matter disclosed by the patent application. |

*Final Rejection – a USPTO office action made by the examiner where the applicant is entitled to file an appeal to the PTAB or make a request for continued examination with, or without, amendment so long as a new issue is raised for consideration by the examiner

**Non-Final Rejection – a USPTO Office action made by the examiner where the applicant is entitled to reply and request reconsideration, with or without making an amendment

We plan to register trademarks for Rightscorp and Scalable Copyright.

Our software is copyrighted and contains trade secrets.

Of the patent applications listed in the table above, the US versions of the applications filed on April 2, 2012 and May 31, 2012 are of greater importance to us than the others. We believe that the patent applications were rejected by the USPTO on invalid grounds and that the appeals currently being prepared will ultimately succeed. However, we cannot assure you that we will in fact be proven correct in our belief. If these two applications are not successfully appealed, our business could be materially and adversely affected, as more fully described under the risk factor appearing under the heading “Our ability to protect our intellectual property and proprietary technology through patents and other means is uncertain and may be inadequate, which would have a material and adverse effect on us” above.

Competition

We potentially compete with companies in the copyright monetization space.

The copyright monetization space is comprised of companies focused on new digital technologies, as well as existing established copyright monetization companies and societies. Examples of other pure-play digital copyright monetization companies are Soundexchange and TuneSat.

TuneSat monitors hundreds of TV channels and millions of websites around the world, helping copyright holders collect millions of dollars that would otherwise have been lost. They are not focused on the peer-to-peer space.

Soundexchange helps artists and copyright holders get compensated when their work is broadcast by non-interactive digital radio. Soundexchange has collected in excess of $1.5 billion annually.

| 13 |

Companies in the multi-billion dollar legacy copyright monetization space include ASCAP, BMI, SESAC and the Harry Fox Agency.

There are several companies in the anti-piracy space. Most of these companies specialize in litigation support. It would be a conflict of interest for them to be in the litigation support and settlement business. MarkMonitor (formerly DtecNet) currently provide the data to the RIAA that the RIAA uses for monitoring P2P activity on a fee for service business model. Irdeto also provides litigation support on a fee for service business model.

We believe other competitors use more aggressive litigation that drives settlement through threats of costly lawsuits, which we believe is not a scalable model. One competitor is located in Los Angeles, CA. We are the only company that we are aware of that uses proprietary technology to detect repeat infringers and therefore we believe that we are the only company to have legal leverage with ISPs, compelling the ISP to deliver settlement notices by leveraging the DMCA. We do not send notices related to pornographic content.

We are seeking to build and maintain our competitive advantage in four ways.

| ● | First, we build and maintain competitive advantage by being first to market in the U.S. and by aggressively closing contracts to represent copyrighted intellectual property; |

| ● | Second, we will maintain our advantage by building on our relationships with the ISP’s. We will attend and speak at strategic trade shows to develop greater awareness of the ISP’s liability and our no-cost solution to help them mitigate that liability. We will educate industry analysts who follow the ISP’s that are public companies as to the significant liability that ISP’s have; |

| ● | Third, we have filed five full and provisional patents; and |

| ● | Fourth, by developing a reputation of being a quality solution provider with copyright holders, developers of copyrighted intellectual property and ISP’s we will develop and maintain a leadership position as a leading service provider. |

Additionally, we send correspondence to the ISPs from time to time and as necessary to advise them that certain infringements have not ceased and that they should adopt, reasonably implement, and inform their subscribers and account holders of a policy that provides for the termination in appropriate circumstances of subscribers and account holders of their system or networks who are repeat infringers. In addition, we advise these ISP’s of certain liabilities that they may incur should they not change their practices.

Certain other companies that may potentially compete with us, such as MarkMonitor and Irdeto (which provide certain “brand protection” and similar services) have greater financial resources and longer operating histories than us. It is possible that they may develop and offer services more directly competitive to ours, by developing and offering new methods of copyright monetization or anti-piracy technology that could take market share from us.

We have not had any discussions regarding streaming service affecting our business. Data traffic used for filesharing in North America grew from 674 PB a month in 2010 to 801 PB a month 2013 and is forecast to grow between now and 2018 as shown in the table below.

| 14 |

Global Consumer File-Sharing Traffic, 2010-2018

Source: Cisco VNI, 2014

http://www.cisco.com/c/en/us/solutions/collateral/service-provider/ip-ngn-ip-next-generation-network/white_paper_c11-481360.pdf

http://www.ciscovni.com/forecast-widget/advanced.html

Employees

As of March 2, 2015, we had 21 employees.

| 15 |

Risks Related to our Company and our Business

We have a limited operating history and are subject to the risks encountered by early-stage companies.

Rightscorp Delaware was formed on January 20, 2011. Because we have a limited operating history, our operating prospects should be considered in light of the risks and uncertainties frequently encountered by early-stage companies in rapidly evolving markets. These risks include:

| ● | risks that we may not have sufficient capital to achieve our growth strategy; | |

| ● | risks that we may not develop our product and service offerings in a manner that enables us to be profitable and meet our customers’ requirements; | |

| ● | risks that our growth strategy may not be successful; and | |

| ● | risks that fluctuations in our operating results will be significant relative to our revenues. |

These risks are described in more detail below. Our future growth will depend substantially on our ability to address these and the other risks described in this section. If we do not successfully address these risks, our business would be significantly harmed.

We have a history of operating losses and we may need additional financing to meet our future long term capital requirements.

We have a history of losses and may continue to incur operating and net losses for the foreseeable future. As of December 31, 2014, we had a working capital deficit of $1,180,394, and stockholders’ deficit of $923,222. We incurred a net loss of $2,852,705 for the year ended December 31, 2014 and a net loss of approximately $2,042,779 for the year ended December 31, 2013. As of December 31, 2014, our accumulated deficit was approximately $7,093,377. We have not achieved profitability on an annual basis. We may not be able to reach a level of revenue to achieve profitability. If our revenues grow slower than anticipated, or if operating expenses exceed expectations, then we may not be able to achieve profitability in the near future or at all, which may depress our stock price.

While we anticipate that our current cash, cash equivalents and cash generated from operations, and the capital raised subsequent to the year ended December 31, 2014 will be sufficient to meet our projected operating plans for a period of at least 12 months from March 2, 2015, we may require additional funds, either through additional equity or debt financings or collaborative agreements or from other sources. We have no commitments to obtain such additional financing, and we may not be able to obtain any such additional financing on terms favorable to us, or at all. In the event that we are unable to obtain additional financing, we may be unable to implement our business plan. Even with such financing, we have a history of operating losses and there can be no assurance that we will ever become profitable.

We may need significant additional capital, which we may be unable to obtain.

We may need to obtain additional financing over time to fund operations. Our management cannot predict the extent to which we will require additional financing, and can provide no assurance that additional financing will be available on favorable terms or at all. The rights of the holders of any debt or equity that may be issued in the future could be senior to the rights of common shareholders, and any future issuance of equity could result in the dilution of our common shareholders’ proportionate equity interests in our company. Failure to obtain financing or an inability to obtain financing on unattractive terms could have a material adverse effect on our business, prospects, results of operation and financial condition.

Our resources may not be sufficient to manage our potential growth; failure to properly manage our potential growth would be detrimental to our business.

We may fail to adequately manage our potential future growth. Any growth in our operations will place a significant strain on our administrative, financial and operational resources, and increase demands on our management and on our operational and administrative systems, controls and other resources. We cannot assure you that our existing personnel, systems, procedures or controls will be adequate to support our operations in the future or that we will be able to successfully implement appropriate measures consistent with our growth strategy. As part of this growth, we may have to implement new operational and financial systems, procedures and controls to expand, train and manage our employee base, and maintain close coordination among our technical, accounting, finance, marketing and sales staff. We cannot guarantee that we will be able to do so, or that if we are able to do so, we will be able to effectively integrate them into our existing staff and systems. To the extent we acquire businesses, we will also need to integrate and assimilate new operations, technologies and personnel. If we are unable to manage growth effectively, such as if our sales and marketing efforts exceed our capacity to install, maintain and service our products or if new employees are unable to achieve performance levels, our business, operating results and financial condition could be materially and adversely affected.

| 16 |

We will need to increase the size of our organization, and we may be unable to manage rapid growth effectively.

Our failure to manage growth effectively could have a material and adverse effect on our business, results of operations and financial condition. We anticipate that a period of significant expansion will be required to address possible acquisitions of business, products, or rights, and potential internal growth to handle licensing and research activities. This expansion will place a significant strain on management, operational and financial resources. To manage the expected growth of our operations and personnel, we must both improve our existing operational and financial systems, procedures and controls and implement new systems, procedures and controls. We must also expand our finance, administrative, and operations staff. Our current personnel, systems, procedures and controls may not adequately support future operations. Management may be unable to hire, train, retain, motivate and manage necessary personnel or to identify, manage and exploit existing and potential strategic relationships and market opportunities.

We are dependent on the continued services and performance of our senior management, the loss of any of whom could adversely affect our business, operating results and financial condition.

Our future performance depends on the continued services and continuing contributions of our senior management to execute our business plan, and to identify and pursue new opportunities and product innovations. The loss of services of senior management, particularly Christopher Sabec and Robert Steele, Rightscorp Delaware’s founders, could significantly delay or prevent the achievement of our strategic objectives. The loss of the services of senior management for any reason could adversely affect our business, prospects, financial condition and results of operations.

Our ability to protect our intellectual property and proprietary technology through patents and other means is uncertain and may be inadequate, which would have a material and adverse effect on us.

Our success depends significantly on our ability to protect our proprietary rights to the technologies used in our products. In particular, we have thirty-two patent applications pending worldwide for our system of identifying and collecting settlement payments for repeat copyright infringements. Even if our pending patents are granted, we cannot assure you that we will be able to control all of the rights for all of our intellectual property. We rely on patent protection, as well as a combination of copyright, trade secret and trademark laws and nondisclosure, confidentiality and other contractual restrictions to protect our proprietary technology, including our licensed technology. However, these legal means afford only limited protection and may not adequately protect our rights or permit us to gain or keep any competitive advantage. For example, our pending United States and foreign patent applications may not issue as patents in a form that will be advantageous to us or may issue and be subsequently successfully challenged by others and invalidated. Both the patent application process and the process of managing patent disputes can be time-consuming and expensive. Competitors may be able to design around our patents or develop products which provide outcomes which are comparable or even superior to ours. Steps that we have taken to protect our intellectual property and proprietary technology, including entering into confidentiality agreements and intellectual property assignment agreements with some of our officers, employees, consultants and advisors, may not provide meaningful protection for our trade secrets or other proprietary information in the event of unauthorized use or disclosure or other breaches of the agreements. Furthermore, the laws of foreign countries may not protect our intellectual property rights to the same extent as do the laws of the United States.

In the event a competitor infringes upon our licensed or pending patent or other intellectual property rights, enforcing those rights may be costly, uncertain, difficult and time consuming. Even if successful, litigation to enforce our intellectual property rights or to defend our patents against challenge could be expensive and time consuming and could divert our management’s attention. We may not have sufficient resources to enforce our intellectual property rights or to defend our patents rights against a challenge. The failure to obtain patents and/or protect our intellectual property rights could have a material and adverse effect on our business, results of operations and financial condition.

Our patent applications and licenses may be subject to challenge on validity grounds, and our patent applications may be rejected.

We rely on our patent applications, licenses and other intellectual property rights to give us a competitive advantage. Whether a patent application should be granted, and if granted whether it would be valid, is a complex matter of science and law, and therefore we cannot be certain that, if challenged, our patents (should any be granted), patent applications and/or other intellectual property rights would be upheld. If one or more of these intellectual property rights are invalidated, rejected or found unenforceable, that could reduce or eliminate any competitive advantage we might otherwise have had.

We may become subject to claims of infringement or misappropriation of the intellectual property rights of others, which could prohibit us from developing our products, require us to obtain licenses from third parties or to develop non-infringing alternatives and subject us to substantial monetary damages.

Third parties could, in the future, assert infringement or misappropriation claims against us with respect to products we develop. Whether a product infringes a patent or misappropriates other intellectual property involves complex legal and factual issues, the determination of which is often uncertain. Therefore, we cannot be certain that we have not infringed the intellectual property rights of others. Our potential competitors may assert that some aspect of our product infringes their patents. Because patent applications may take years to issue, there also may be applications now pending of which we are unaware that may later result in issued patents upon which our products could infringe. There also may be existing patents or pending patent applications of which we are unaware upon which our products may inadvertently infringe.

| 17 |

Any infringement or misappropriation claim could cause us to incur significant costs, place significant strain on our financial resources, divert management’s attention from our business and harm our reputation. If the relevant patents in such claim were upheld as valid and enforceable and we were found to infringe them, we could be prohibited from selling any product that is found to infringe unless we could obtain licenses to use the technology covered by the patent or are able to design around the patent. We may be unable to obtain such a license on terms acceptable to us, if at all, and we may not be able to redesign our products to avoid infringement. A court could also order us to pay compensatory damages for such infringement, plus prejudgment interest and could, in addition, treble the compensatory damages and award attorney fees. These damages could be substantial and could harm our reputation, business, financial condition and operating results. A court also could enter orders that temporarily, preliminarily or permanently enjoin us and our customers from making, using, or selling products, and could enter an order mandating that we undertake certain remedial activities. Depending on the nature of the relief ordered by the court, we could become liable for additional damages to third parties.

The prosecution and enforcement of patents licensed to us by third parties are not within our control. Without these technologies, our product may not be successful and our business would be harmed if the patents were infringed or misappropriated without action by such third parties.

We have obtained licenses from third parties for patents and patent application rights related to the products we are developing, allowing us to use intellectual property rights owned by or licensed to these third parties. We do not control the maintenance, prosecution, enforcement or strategy for many of these patents or patent application rights and as such are dependent in part on the owners of the intellectual property rights to maintain their viability. Without access to these technologies or suitable design-around or alternative technology options, our ability to conduct our business could be impaired significantly.

We may not be successful in the implementation of our business strategy or our business strategy may not be successful, either of which will impede our development and growth.

Our business strategy involves having copyright owners agree to use our service. Our ability to implement this business strategy is dependent on our ability to:

| ● | predict copyright owner’s concerns; | |

| ● | identify and engage copyright owners; | |

| ● | convince ISPs to accept our notices; | |

| ● | establish brand recognition and customer loyalty; and | |

| ● | manage growth in administrative overhead costs during the initiation of our business efforts. |

We do not know whether we will be able to continue successfully implementing our business strategy or whether our business strategy will ultimately be successful. In assessing our ability to meet these challenges, a potential investor should take into account our limited operating history and brand recognition, our management’s relative inexperience, the competitive conditions existing in our industry and general economic conditions. Our growth is largely dependent on our ability to successfully implement our business strategy. Our revenues may be adversely affected if we fail to implement our business strategy or if we divert resources to a business that ultimately proves unsuccessful.

We have limited existing brand identity and customer loyalty; if we fail to market our brand to promote our service offerings, our business could suffer.

Because of our limited operating history, we currently do not have strong brand identity or brand loyalty. We believe that establishing and maintaining brand identity and brand loyalty is critical to attracting customers to our program. In order to attract copyright holders to our program, we may be forced to spend substantial funds to create and maintain brand recognition among consumers. We believe that the cost of our sales campaigns could increase substantially in the future. If our branding efforts are not successful, our ability to earn revenues and sustain our operations will be harmed.

Promotion and enhancement of our services will depend on our success in consistently providing high-quality services to our customers. Since we rely on technology partners to provide portions of the service to our customers, if our suppliers do not send accurate and timely data, or if our customers do not perceive the products we offer as superior, the value of the our brand could be harmed. Any brand impairment or dilution could decrease the attractiveness of our services to one or more of these groups, which could harm our business, results of operations and financial condition.

| 18 |

Our service offerings may not be accepted.

As is typically the case involving service offerings, anticipation of demand and market acceptance are subject to a high level of uncertainty. The success of our service offerings primarily depends on the interest of copyright holders in joining our service. In general, achieving market acceptance for our services will require substantial marketing efforts and the expenditure of significant funds, the availability of which we cannot be assured, to create awareness and demand among customers. We have limited financial, personnel and other resources to undertake extensive marketing activities. Accordingly, we cannot assure you that any of our services will be accepted or with respect to our ability to generate the revenues necessary to remain in business.

A competitor with a stronger or more suitable financial position may enter our marketplace.

To our knowledge, there is currently no other company offering a copyright settlement service for P2P infringers. The success of our service offerings primarily depends on the interest of copyright holders in joining our service, as opposed to a similar service offered by a competitor. If a direct competitor arrives in our market, achieving market acceptance for our services may require additional marketing efforts and the expenditure of significant funds, the availability of which we cannot be assured, to create awareness and demand among customers. We have limited financial, personnel and other resources to undertake additional marketing activities. Accordingly, no assurance can be given that we will be able to win business from a stronger competitor.

A significant portion of our revenue is dependent upon a small number of customers and the loss of any one of these customers would negatively impact our revenues and our results of operations.

We derived approximately 25% of our revenues from a contract with one customer in 2013. For the year ended December 31, 2013, we derived approximately 32% of our revenues from contracts with two customers. We derived approximately 77% of our revenues from a contract with one customer during the year ended December 31, 2014. For the year ended December 31, 2014, we derived approximately 90% of our revenues from contracts with two customers. Our standard contract, which is entitled a Representation Agreement, with customers is for an initial six month term, and renews automatically for successive one month terms, unless either party terminates upon 30 days’ written notice to the other party. If any of our major customers were to terminate their business relationships with us, our operating results would be materially harmed.

Our exposure to outside influences beyond our control, including new legislation or court rulings could adversely affect our enforcement activities and results of operations.

Our enforcement activities are subject to numerous risks from outside influences, including the following:

| ● | Legal precedents could change which could either make enforcement of our client’s copyright rights more difficult, or which could make out-of-court settlements less attractive to either our clients or potential infringers. | |

| ● | New legislation, regulations or rules related to copyright enforcement could significantly increase our operating costs or decrease our ability to effectively negotiate settlements. | |

| ● | Changes in consumer privacy laws could make internet service providers more reluctant to identify their end users or may otherwise make identification of individual infringers more difficult. |

The occurrence of any one of the foregoing could significantly damage our business and results of operations.

Software defects or errors in our products could harm our reputation, result in significant costs to us and impair our ability to sell our products, which would harm our operating results.

Our products may contain undetected defects or errors when first introduced or as new versions are released, which could materially and adversely affect our reputation, result in significant costs to us and impair our ability to sell our products in the future. The costs incurred in correcting any defects or errors may be substantial and could adversely affect our operating results.

Enforcement actions against individuals may result in negative publicity which could deter customers from doing business with us.

In the past, online trademark infringement cases have garnered significant press coverage. Coverage which is sympathetic to the infringing parties or which otherwise portrays our Company in a negative light, whether or not warranted, may harm our reputation or cause our clients to have concerns about being associated with us. Such negative publicity could decrease the demand for our products and services and adversely affect our business and operating results.

| 19 |

Litigation may harm our business.

Substantial, complex or extended litigation could cause us to incur significant costs and distract our management. For example, lawsuits by employees, stockholders, collaborators, distributors, customers, competitors or others could be very costly and substantially disrupt our business. Disputes from time to time with such companies, organizations or individuals are not uncommon, and we cannot assure you that we will always be able to resolve such disputes or on terms favorable to us. Unexpected results could cause us to have financial exposure in these matters in excess of recorded reserves and insurance coverage, requiring us to provide additional reserves to address these liabilities, therefore impacting profits.

If we experience a significant disruption in our information technology systems or if we fail to implement new systems and software successfully, our business could be adversely affected.

We depend on information systems throughout our company to control our manufacturing processes, process orders, manage inventory, process and bill shipments and collect cash from our customers, respond to customer inquiries, contribute to our overall internal control processes, maintain records of our property, plant and equipment, and record and pay amounts due vendors and other creditors. If we were to experience a prolonged disruption in our information systems that involve interactions with customers and suppliers, it could result in the loss of sales and customers and/or increased costs, which could adversely affect our overall business operation.

Risks Related to the Securities Markets and Ownership of our Equity Securities

Our common stock is thinly traded, so you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares.