Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - DallasNews Corp | Financial_Report.xls |

| EX-32 - EXHIBIT SOX 906 - DallasNews Corp | ex322014q4.htm |

| EX-12 - RATIO OF EARNINGS TO FIXED CHARGES - DallasNews Corp | ex122014q4.htm |

| EX-99.1 - EXHIBIT CLASSIFIED VENTURES FINANCIALS - DallasNews Corp | ex9912014q4.htm |

| EX-99.2 - EXHIBIT WANDERFUL MEDIA FINANCIALS - DallasNews Corp | ex9922014q4.htm |

| EX-31.1 - EXHIBIT SOX 302 CEO - DallasNews Corp | ex3112014q4.htm |

| EX-23.2 - MOSS ADAMS CONSENT - DallasNews Corp | ex2322014q4.htm |

| EX-23.1 - KPMG CONSENT - DallasNews Corp | ex2312014q4.htm |

| EX-31.2 - EXHIBIT SOX 302 PFO - DallasNews Corp | ex3122014q4.htm |

| EX-23.3 - PWC CONSENT - DallasNews Corp | ex2332014q4.htm |

| EX-10.2 - EXHIBIT 10.2 (1) AMENDED AND RESTATED SAVINGS PLAN - DallasNews Corp | ex10212014q4.htm |

| EX-21 - SUBSIDIARIES - DallasNews Corp | ex212014q4.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2014

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file no. 1-33741

(Exact name of registrant as specified in its charter)

Delaware | 38-3765318 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

P. O. Box 224866, Dallas, Texas 75222-4866 | (214) 977-8200 | |

(Address of principal executive offices, including zip code) | (Registrant’s telephone number, including area code) | |

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of each exchange on which registered | |

Series A Common Stock, $.01 par value Preferred Share Purchase Rights | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: | ||

Series B Common Stock, $.01 par value (Title of class) | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer: o | Accelerated filer: þ | Non-accelerated filer: o | Smaller reporting company: o | |||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the registrant’s voting stock held by nonaffiliates on June 30, 2014, based on the closing price for the registrant’s Series A Common Stock on such date as reported on the New York Stock Exchange, was approximately $223,440,910.*

Shares of Common Stock outstanding at February 27, 2015: 21,730,792 shares (consisting of 19,342,555 shares of Series A Common Stock and 2,388,237 shares of Series B Common Stock).

* For purposes of this calculation, the market value of a share of Series B Common Stock was assumed to be the same as the share of Series A Common Stock into which it is convertible.

Documents incorporated by reference:

Selected designated portions of the registrant’s definitive proxy statement, relating to the Annual Meeting of Shareholders to be held on May 14, 2015, are incorporated by reference into Parts II and III of this Annual Report.

A. H. Belo Corporation 2014 Annual Report on Form 10-K

A. H. BELO CORPORATION

FORM 10-K

TABLE OF CONTENTS

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

A. H. Belo Corporation 2014 Annual Report on Form 10-K

PART I

Item 1. Business

A. H. Belo Corporation and subsidiaries (“A. H. Belo” or the “Company”), headquartered in Dallas, Texas, is a leading local news and information publishing company with commercial printing, distribution and direct mail capabilities, as well as expertise in emerging media and digital marketing. With a continued focus on extending the Company’s media platform, A. H. Belo is able to deliver news and information in innovative ways to a broad spectrum of audiences with diverse interests and lifestyles.

The Company publishes The Dallas Morning News (www.dallasnews.com), Texas’ leading newspaper and winner of nine Pulitzer Prizes; the Denton Record-Chronicle (www.dentonrc.com), a daily newspaper operating in Denton, Texas, and various niche publications targeting specific audiences. A. H. Belo also offers digital marketing solutions through 508 Digital and Your Speakeasy, LLC and provides event promotion and marketing services through Crowdsource.

In February 2008, the Company separated its publishing operations from its former parent in a spin-off transaction and A. H. Belo became an independent registrant listed on the New York Stock Exchange (NYSE trading symbol: AHC). All dollar amounts in this Annual Report on Form 10-K are in thousands, except per share amounts, unless the context requires otherwise.

The Dallas Morning News’ first edition was published on October 1, 1885. It is one of the leading metropolitan newspapers in America and its success is founded upon the highest standards of journalistic excellence, with an emphasis on comprehensive local news and information and community service. The newspaper is distributed primarily in Dallas County and 10 surrounding counties. This coverage area represents one of the most populous and fastest growing metropolitan areas in the country. The Dallas Morning News has been awarded nine Pulitzer Prizes for news reporting, editorial writing and photography. The Dallas Morning News also publishes Briefing, a newspaper distributed four days per week at no charge to nonsubscribers in select coverage areas; and Al Dia, an award-winning Spanish-language newspaper published on Wednesdays and Sundays and distributed at no charge in select coverage areas. Other news products are also published targeting various communities in the North Texas area. The Dallas Morning News’ financial and operating results include the financial and operating results of the Denton Record-Chronicle.

In 2014, the Company completed the sale of substantially all of the assets and certain liabilities comprising the newspaper operations of The Providence Journal, a daily newspaper in Providence, Rhode Island, and the oldest continuously-published daily newspaper in the United States. In 2013, the Company completed the sale of The Press-Enterprise, a daily newspaper in Riverside, California, which serves the Inland Southern California region. Upon completion of these sales, the Company no longer owns newspaper operations in either Providence, Rhode Island or Riverside, California. The Company continues to hold and market for sale certain land and buildings in Providence, Rhode Island, which served as the administrative headquarters of The Providence Journal. The Company also retains the obligation for the A. H. Belo Pension Plan II, which provides benefits to former employees of The Providence Journal Company. These dispositions and the results of operations associated with The Providence Journal and The Press-Enterprise are reported as discontinued operations in the Company’s financial statements included herein. Amounts included in this Annual Report on Form 10-K exclude results of operations related to The Providence Journal and The Press-Enterprise unless otherwise indicated.

A. H. Belo Corporation 2014 Annual Report on Form 10-K | PAGE 1 | |

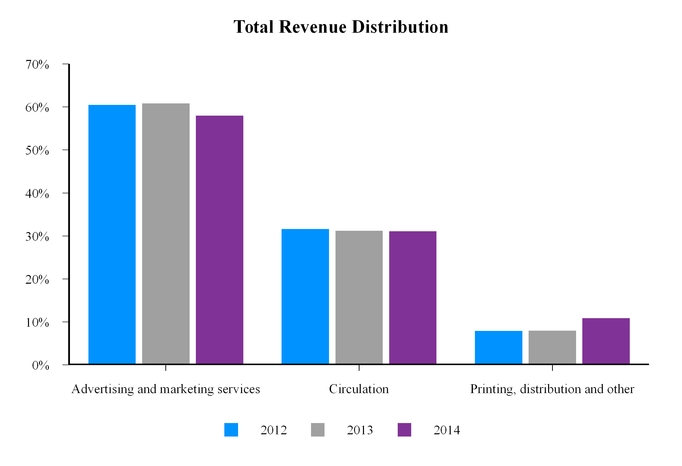

The Company’s primary revenue is derived from advertising sold in published issues of its newspapers and on the Company’s websites, the sale of marketing services, the sale of newspapers to subscribers and single copy customers, and commercial printing and distribution. The following sets forth the Company’s distribution of revenue in 2014, 2013 and 2012:

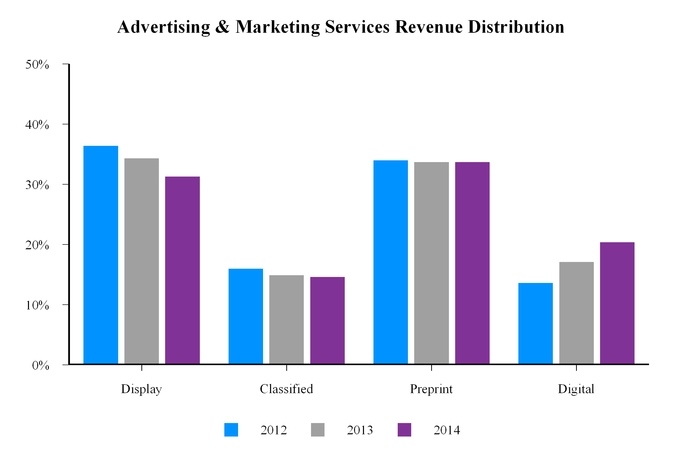

Advertising and Marketing Services Revenue

Advertising and marketing services revenue accounted for approximately 58.0 percent of total revenue for 2014. The Company has a comprehensive portfolio of print and digital advertising products and marketing services which include:

• | Display – Display revenue results from sales of advertising space within the Company’s core newspapers and niche publications to local, regional or national businesses with local operations, affiliates or resellers. |

• | Classified – Classified revenue, which includes automotive, real estate, employment and other, results from sales of advertising space in the classified and other sections of the Company’s newspapers. |

• | Preprint – Preprint revenue results from sales of preprinted advertisements or circulars inserted into the Company’s core newspapers and niche publications, or distributed by mail or third-party distributors to households in targeted areas in order to provide total market coverage for advertisers. The Company’s capabilities allow its advertisers to selectively target preprint distribution at the sub-zip code level in order to optimize coverage for the advertisers’ locations. |

• | Digital – Digital advertising revenue includes the sales of display advertisements and classified advertisements on the Company’s websites and on third-party websites, such as cars.com, Yahoo! and monster.com. The Company offers digital advertising through programmatic channels which provides placement and targeting efficiencies within an integrated advertising and marketing campaign to customers. |

Marketing services revenue, also a component of digital advertising revenue, is generated by 508 Digital and Your Speakeasy, LLC (“Speakeasy”). Services provided are directed towards small to middle-market size businesses and include development of mobile websites, search engine marketing and optimization, social media account management and content marketing for its customers’ web presence.

PAGE 2 | A. H. Belo Corporation 2014 Annual Report on Form 10-K |

In addition to daily newspapers, the Company publishes a number of niche publications which provide a vehicle for delivery of display, classified, preprint and digital advertising, typically to nonsubscribers of the Company’s core newspapers and typically at no charge. These publications target specific demographic groups or geographies and include Spanish-language newspapers, lifestyle publications and luxury publications that target high-income consumers. Most niche publications have related websites and mobile applications, allowing digital access by consumers. The niche publications provide unique content, but also incorporate the news content from the core newspapers while leveraging the Company’s printing, distribution and technology infrastructure to drive additional advertising revenue at a low incremental cost. From time to time, the Company produces magazines or special newspaper editions to promote business, sporting or other events in the North Texas area, such as the Top 100 Places to Work or the John F. Kennedy's 50th Anniversary reprint edition. These publications allow the Company to generate revenue through advertising sales in the publications and through increased circulation or fees for the publications. A few of these publications are part of broader event-based campaigns supported by Crowdsource, which promotes events and provides exposure for the Company’s tradename throughout our geographic market.

The Company operates the largest newsroom in Texas. The combined reach of the Company’s core daily newspapers, digital platforms and niche publications allows the Company to maintain its position as a primary local media publisher in the area. The Company leverages its market position, products and distribution resources to provide direct mail advertising, total market coverage, zoned editions and event-based publications which enable the Company’s advertisers to reach new or targeted markets. These products allow existing advertisers to reach their target audience through integrated advertising campaigns, while also providing the Company a portfolio of products with which to attract new advertisers.

The following sets forth the distribution of the Company’s advertising and marketing services revenue in 2014, 2013 and 2012 by product type.

As the newspaper industry continues to face challenges in maintaining display and classified revenues, the Company continually seeks to stabilize and grow advertising revenues through strategic diversification in advertising and marketing services products. The Company has identified and developed new product and investment opportunities that leverage the scale of its news content and its operating infrastructure, as well as complement the Company’s advertising customers, subscriber base and digital platforms. In 2012, 508 Digital was formed as a division of The Dallas Morning News, offering digital marketing services to small companies in the Dallas metropolitan area that include development of mobile websites, search engine marketing and optimization and social

A. H. Belo Corporation 2014 Annual Report on Form 10-K | PAGE 3 | |

media marketing for its customers’ web presence. Also in 2012, the Company and a Dallas-based advertising agency formed Speakeasy, which targets middle-market business customers and provides turnkey social media account management and content marketing services. In addition to these digital initiatives, the Company produces certain niche products, such as FD, an award-winning luxury magazine and website targeting affluent residents in the Dallas area, and other entertainment, luxury and wedding guide publications and related websites.

The Company is currently exploring further opportunities to grow and diversify revenue through acquisition or investment in advertising or marketing services companies with established financial performance and strong management teams. Acquisition and investment efforts are focused on businesses with products and services that complement the existing advertising and marketing services currently offered. In 2015, the Company expanded its marketing services offerings through the acquisition of three related businesses providing a marketing automation platform, search engine marketing, direct mail and promotional products. These businesses will provide the Company greater prominence as a market leader, offering to new and existing customers an integrated print and digital solution for their advertising and marketing requirements.

Circulation Revenue

Circulation revenue, which includes subscription and single copy sales revenue related to the Company’s core newspapers in print and digital formats, accounted for approximately 31.1 percent of total revenue for 2014, consistent with the 31.2 percent in 2013. A. H. Belo’s steadfast commitment to producing superior, unduplicated local content enables the Company’s newspapers to charge premium subscription rates. The Dallas Morning News’ goal is to maximize the amount of recurring revenue from consumers of the Company’s print and digital products and to reduce reliance on advertising revenue. Although circulation volumes continue to face negative pressures, the Company believes many subscribers in the North Texas area are willing to pay for premium content. Accordingly, the Company continuously assesses the content provided to subscribers and their willingness and ability to pay higher rates by geographic area. In 2014 and 2013, the Company implemented effective rate increases to subscribers and retailers. As part of the Company’s strategy to provide premium print content to subscribers, the Company offers in its Sunday edition, inserts from certain national newspapers, such as The Washington Post or The New York Times. In addition, periodically throughout the year, various special interest magazines, such as Healthy Living or Your Money, will be included with Sunday editions as a part of subscribers’ home delivery news package. Subscriber and retail rates for these editions will reflect a charge for this content.

In October 2013, The Dallas Morning News discontinued the paywall established in 2011 which restricted access for nonsubscribers to certain premium content on dallasnews.com. Research conducted since the establishment of the paywall suggested core seven-day subscribers would continue to consume news content primarily through print media even when lower digital subscription rates were offered. Starting in October 2013, news content on dallasnews.com became accessible to everyone, free of charge. The website provides expanded news and entertainment videos and greater access to content through social media sites. In addition to the free website, the Company offers a paid digital replica version of The Dallas Morning News to subscribers who prefer to consume news content through a digital device in a more traditional format.

The Company’s news websites offer users late-breaking and other up-to-date news coverage, user-generated content, advertising, e-commerce and other services. The Company seeks to position dallasnews.com as the premier provider of on-line local news, event and entertainment news and advertising in the North Texas area. Readers can access news content across multiple digital platforms and obtain relevant local customized content and advertising. In addition to providing a digital replica of certain publications through its ePapers, the Company offers mobile websites and mobile applications for smart phones, tablets and e-readers. The Company’s journalists have expanded their reach and deepened their engagement with audiences by delivering news and content through social media platforms, such as blogs, Facebook and Twitter, which direct traffic to its core websites. In 2014, the dallasnews.com was redesigned to provide a single, unified website built for mobile use first and designed to be responsive for all devices. These enhancements allow the website to quickly respond as technology evolves and new media are introduced, such as wearable devices or hybrid phone or tablet devices. The enhancements also collect better data on how users interact with the Company’s content in order to support informed choices related to native application strategies.

PAGE 4 | A. H. Belo Corporation 2014 Annual Report on Form 10-K |

Readership of the Company’s newspapers is tracked by Scarborough Research, which estimated the number of individuals reading a newspaper print edition to be approximately 1,345,000 for The Dallas Morning News, as reported in the September 2014 Publishers’ Statements, which are subject to audit. This readership volume represents a reach of approximately 28.4 percent of the designated market for this newspaper in the Company’s circulation area. The average print and digital volumes associated with A. H. Belo’s primary daily newspaper and niche publications are reported and verified by a circulation audit agency, as set forth in the table below.

2014 | 2013 | 2012 | |||||||||||||||

Newspaper | Daily Circulation(a) | Sunday Circulation | Daily Circulation(a) | Sunday Circulation | Daily Circulation(a) | Sunday Circulation | |||||||||||

The Dallas Morning News Group | |||||||||||||||||

The Dallas Morning News (b) | 272,245 | 382,300 | 271,189 | 379,379 | 267,058 | 372,930 | |||||||||||

Niche publications (b) | 118,760 | 325,492 | 118,626 | 324,536 | 120,299 | 327,719 | |||||||||||

Total | 391,005 | 707,792 | 389,815 | 703,915 | 387,357 | 700,649 | |||||||||||

(a) | Daily circulation is defined as a Monday through Saturday six-day average. |

(b) | Average circulation data for The Dallas Morning News includes its niche publications and the Denton Record-Chronicle, which are obtained from the Publisher’s Statement for the six-month periods ended September 30, 2014, 2013 and 2012, respectively, as filed with the Alliance for Audited Media (the “Audit Bureau”). The September 2014 statements are subject to audit. Year-over-year increases in reported daily circulation for 2014 and 2013 for The Dallas Morning News are due to increased reported digital subscribers for each of these periods. |

Printing, Distribution and Other Revenue

Printing, distribution and other revenue accounted for approximately 10.9 percent of total revenue for 2014 and includes commercial printing, distribution, direct mail and event-based services. The Company provides commercial printing services for certain national newspapers that require regional printing. The Company also prints various local and regional newspapers, including the Fort Worth Star-Telegram, which was added in 2014. Newsprint used in the production of large national newspapers is generally provided by the customer. Home delivery and retail outlet distribution services are also provided for other national and regional newspapers delivered into the Company’s coverage areas. The Company also operates a direct mail service business in Phoenix, Arizona.

Through Crowdsource, the Company’s newly-formed subsidiary providing marketing and promotional support to event organizers, the Company leverages its subscriber and advertiser base to promote community events, such as One Day University, an educational speaker event; Untapped Festivals, LLC (“Untapped”), which hosts festivals providing food, craft beer and entertainment across major Texas cities; and other community-related events.

Raw Materials and Distribution

The basic material used in publishing newspapers is newsprint. Currently, most of the Company’s newsprint is obtained through a purchasing consortium. Management believes the Company’s sources of newsprint, along with available alternate sources, are adequate for the Company’s current needs.

During 2014, Company operations consumed 33,717 metric tons of newsprint at an average purchase price of $617 per metric ton. Consumption of newsprint in 2013 was 36,979 metric tons at an average cost of $620 per metric ton.

The Company’s newspapers and other commercial print products are produced at its facility in Plano, Texas. Distribution of printed products to subscribers, retailers and newsstands is made under terms of agreements with third-party distributors. The Company believes a sufficient number of third-party distributors exist to allow uninterrupted distribution of the Company’s products.

Other Interests

In addition to its core newspaper operations, A. H. Belo owns the following investment interests:

• | Wanderful Media, LLC (“Wanderful”) – The Company owns a 13.0 percent interest in Wanderful, which operates FindnSave.com, a digital shopping platform on both desktop and mobile where consumers can find national and local retail goods and services for sale. This platform combines local media participation with advanced search and database technology to allow a consumer to view online sales circulars and local advertised offers, or search for an item and receive a list of local advertisers and the price and terms offered for the searched item. It also provides key logistics technology and incentives to drive consumers to retailer locations through a geo-fence platform. |

A. H. Belo Corporation 2014 Annual Report on Form 10-K | PAGE 5 | |

• | ResponseLogix, Inc., operating as Digital Air Strike (www.digitalairstrike.com) – The Company owns a 2.1 percent interest in Digital Air Strike, which provides automotive dealers a suite of digital marketing communications, behavioral targeting and social media solutions. |

• | Sawbuck Realty, Inc., operating as Homesnap (www.homesnap.com) – The Company owns a 19.8 percent interest in Homesnap, a free online real estate search platform with brokerage partnerships, that can be accessed through its website and mobile applications, allowing users to gather current information on real estate listings. |

In 2014, the Company sold its 3.3 percent interest in Classified Ventures, LLC (“Classified Ventures”) to Gannett Co., Inc., along with other unit holders. The two principal business operated by Classified Ventures included cars.com and apartments.com. The Company renegotiated its affiliate agreement with Classified Ventures, allowing the Company to continue to resell advertising on cars.com for the next five years.

The Company owns a 70.0 percent interest in Speakeasy and a 51.0 percent interest in Untapped. The assets, liabilities and results of operations from these companies are reported within the A. H. Belo consolidated financial statements as the Company has a controlling financial interest in these investments.

Competitive Strengths and Challenges

The Company’s strengths are:

• | established, well-known and trusted brands within each of its markets |

• | the ability to develop innovative new product and service offerings which leverage the Company’s brand equity, existing content, distribution platforms, technologies and relationships |

• | product or service offerings that allow the Company to offer advertisers a customized and integrated advertising and marketing solution through desired media channels |

• | sufficient liquidity to allow the Company to opportunistically invest in or acquire businesses that complement the Company’s advertising or marketing services business |

• | an affluent and educated demographic base in its market |

• | the ability to market print or digital products and services to large and targeted audiences at low marginal costs |

• | sales personnel with knowledge of the marketplaces in which the Company conducts its business and relationships with current and potential advertising clients |

• | the ability to effectively manage operating costs according to market pressures |

The Company’s newspapers and other print media continue to experience challenges to maintain and grow advertising and circulation revenue primarily due to increased competition from other media, particularly the Internet. The decline in advertising revenue was particularly realized in the display and classified categories, as advertisers shift from print to other media. In response, the Company has developed or acquired capabilities to offer customers advertising and marketing solutions through multiple media channels. The Company also continues to diversify its revenue base by leveraging the available capacity of its existing assets to provide print and distribution services for newspapers and other customers requiring these services, by introducing new advertising and marketing services products, by increasing circulation prices and through growth of the Company’s event based business.

As a result of declining print circulation, the Company has developed broad digital strategies designed to provide readers with multiple platforms for obtaining online access to local news coverage while protecting the Company’s core print business. The Company continues to obtain additional key demographic data from readers, which allows the Company to provide content most desired by readers and to modify marketing and distribution strategies to target and reach audiences most valued by advertisers. The Company has implemented a programmatic digital advertising platform which provides digital ad placement and targeting efficiencies and increases utilization of digital inventory within the Company’s websites as well as on external websites. The Company has established strategic relationships with major Internet companies and invested in certain companies with innovative products and technologies. The Company also increased its focus on neighborhood and other local community and regional news, both in print and online.

PAGE 6 | A. H. Belo Corporation 2014 Annual Report on Form 10-K |

Strategy

A. H. Belo is committed to producing positive net income and cash flow and creating value for shareholders over the long-term through stock price appreciation and dividends. The Company continuously evaluates its operations and investments against various economic factors to determine the appropriate holding strategies.

A. H. Belo’s business model evolved in 2014 as it no longer encompasses the newspaper operations in Rhode Island and California. The sales of The Providence Journal in September 2014 and The Press-Enterprise in November 2013 allowed the Company to profitably divest of these operations which operated in markets facing strong competitive pressures and local economic challenges. As a result of these dispositions, the Company’s management team is focused on its Texas operations and the development of new business initiatives in this area.

The Company also divested its interest in Classified Ventures, whose operations included cars.com and apartments.com, while retaining its affiliate agreement for five years with a buyer’s option to renew, allowing the Company to continue reselling advertising on this platform as part of its continuing operations.

The Company is committed to providing the leading digital and print platforms for delivering news of the highest quality and integrity in the North Texas area, as well as creating and developing innovative print and digital products addressing the needs of consumers and advertisers. The Company intends to achieve these objectives through the following strategies:

• | market existing print and digital products in an integrated manner that creates sustainable revenue and earnings |

• | diversify revenue streams through acquisition or investment in established and profitable businesses complementing the Company’s advertising and marketing services |

• | produce quality local content to drive revenue over digital and print platforms |

• | optimize and leverage marketing and sales capabilities, including consumer demographic data, to implement initiatives that enable advertisers to reach high value consumers more effectively |

• | increase circulation of niche products and special edition publications in targeted areas to provide greater coverage for advertisers |

• | increase utilization of operating assets through marketing of printing and distribution services to third parties |

• | continue to align costs with revenue, maintain strong liquidity to support future business and product initiatives and provide flexibility to meet strategic investment opportunities and other cash flow requirements |

In 2014 and 2013, the Company was successful in divesting of investments, newspaper assets and operations in Rhode Island and California, and non-core real estate assets, all at opportunistic prices. Sales proceeds received from these divestitures have been used to return money to shareholders, provide additional contributions to the Company’s pension plans, and invest in new businesses that complement and leverage our existing core operations. However, the Company continues to be challenged to locate new investments that will provide near and long term returns to replace the ongoing loss of revenue from declining advertising and circulation revenue. The Company continuously evaluates and implements measures to control operating expenses as it seeks to develop and grow new businesses, including divesting of unprofitable products and services, adjusting the Company’s workforce and benefits to align with revenues and market conditions, and restructuring the Company’s newspapers through organizational realignments. Returns on operating and investing assets are continually evaluated to ensure the appropriate return on investment is achieved and that capital is deployed to the benefit of its shareholders.

Competition

The Company’s newspapers, niche publications and related websites primarily serve audiences in the North Texas area. The Company’s newspapers compete for advertising revenue in its newspapers and websites with other print and digital media companies. Advertising revenues in the Company’s newspapers and on its websites are responsive to circulation and traffic volumes, demographics of its subscriber base, advertising results, rates and customer service. Advertising on digital platforms is highly competitive and largely dominated by large Internet companies. As advertisers reallocate marketing expenditures from print to digital channels, the Company believes its strong local brand, its suite of print and digital advertising and marketing service products, affiliate agreements with large Internet advertisers, and its programmatic digital advertising platform allow it to offer unique advertising and marketing solutions to local businesses on a competitive scale.

The Dallas Morning News has the highest paid print circulation volumes in the North Texas area while competing with one other metropolitan newspaper in parts of its geographic market. Circulation revenues are primarily challenged due to free and readily

A. H. Belo Corporation 2014 Annual Report on Form 10-K | PAGE 7 | |

accessible news, entertainment, advertising and other content available through the Internet. This secular shift from print to digital media continues as consumer lifestyles embrace technological advancements, particularly with mobile devices, which provide access to a wide variety of digital news and advertising alternatives, including news and social media websites, online advertising networks and exchanges, online classified services, and direct email advertising. Competition for readers is primarily based on the mode of delivery, quality of the Company’s journalism, price, timeliness of its interaction with audiences and customer service. News and other digital content produced by the Company’s newspapers and niche publications is available through its websites and through email. The Company offers the latest technology for accessing digital content on mobile devices and through personal computers. Journalists engage online readers through blogs, Twitter and other social media posts. The Company has modified its websites to provide greater video content and advertising, links to other sites sought by readers, improved layouts, and a better interface with mobile applications.

Seasonality

A. H. Belo’s advertising revenues are subject to moderate seasonality, with advertising revenue typically higher in the fourth calendar quarter of each year because of the holiday shopping season. The level of advertising sales in any period may also be affected by advertisers’ decisions to increase or decrease their advertising expenditures in response to anticipated consumer demand and general economic conditions.

Employees

As of December 31, 2014, the Company had approximately 1,100 full-time and 90 part-time employees.

Available Information

A. H. Belo maintains its corporate website at www.ahbelo.com. The Company makes available on its website, free of charge, this Annual Report on Form 10-K, its quarterly reports on Form 10-Q, its current reports on Form 8-K and amendments to those reports, as filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, as soon as reasonably practicable after the reports are electronically filed with or furnished to the Securities and Exchange Commission (the “SEC”).

PAGE 8 | A. H. Belo Corporation 2014 Annual Report on Form 10-K |

Item 1A. Risk Factors

Sections of this Annual Report on Form 10-K and management’s comments from time to time may contain forward-looking statements that are subject to risks and uncertainties. These statements are based on management’s current knowledge and estimates of factors affecting the Company’s operations, both known and unknown. Readers are cautioned not to place undue reliance on such forward-looking information as actual results may differ materially from those currently anticipated. In addition, a number of other factors (those identified elsewhere in this document and others, both known and unknown) may cause actual results to differ materially from expectations.

A. H. Belo’s businesses operate in highly competitive media markets, and the Company’s ability to maintain market share and generate revenue depends on how effectively the Company competes with existing and new competition.

The Company’s businesses operate in highly competitive media markets. A. H. Belo’s newspapers compete for advertising and circulation revenue with other newspapers, websites, digital applications, magazines, television, radio, direct mail and other media. The continued expansion of digital media and communications, particularly social media, mobile applications and the proliferation of tablet and mobile devices has increased some consumers’ preferences to receive all or part of their news and information digitally. Websites such as craigslist.org, monster.com and cars.com provide a cost efficient platform for reaching wide but targeted audiences for classified advertising. Websites such as Facebook, Twitter, Google and Yahoo! are successful in gathering national, local and entertainment news and information from multiple sources and attracting a broad readership base.

Historically, newspaper publishing was viewed as a cost-effective method of delivery for various forms of advertising to a large audience. The continued development and deployment of new technologies and greater competition from other media increases the challenge to the Company to provide competitive offerings to retain its print, as well as digital, advertisers and subscribers.

A. H. Belo’s ability to stabilize advertising and circulation revenue through price and volume increases may be affected by competition from other forms of media and other publications available in the Company’s various markets, declining consumer spending on discretionary items like newspapers, decreasing amounts of free time and declining frequency of regular newspaper buying among certain demographic groups. The Company may also incur higher costs competing for paid circulation, and if the Company is not able to compete effectively for advertising dollars and paid circulation, revenue may decline and the Company’s financial condition and results of operations may be adversely affected.

Purchasing practices of national advertisers could negatively impact the Company’s pricing and ability to up-sell other products, which could result in lower revenues.

Many national advertisers which place advertising in the Company’s newspapers are centralizing purchasing functions and streamlining the buying and negotiating process. This has resulted in the commoditization of certain advertising products, which limits the Company’s ability to promote its position in the market, the customer service value of its relationship with the advertiser, or the benefits of its suite of products, including the Company’s ability to up-sell other products. This also may put the Company in competition with other advertising companies that are able to offer lower prices for a larger geographical area than the Company covers. Accordingly, the Company could experience a decline in pricing which could result in a decline in revenue.

A. H. Belo may be unsuccessful in providing desired types of news and information content on digital platforms.

The Company increased the functionality of the websites associated with its core newspapers and offered applications for smart phones, tablet devices and e-readers. These digital platforms provide consumers varying levels of access to similar content offered within the respective newspaper, as well as late-breaking local, national and international news stories and interactive content, such as video, blogs and Twitter feeds. However, the frequency, types and depth of news desired by digital users may not be predictable or consistent with the news and other content offered on the Company’s digital platforms and the costs to attract and retain such consumers may be unprofitable to the Company’s operations.

The Company holds significant cash reserves from the sales of its newspapers and investments and may not be successful in deploying these reserves in a profitable manner, and if additional capital resources are desired, the Company may not be able to obtain capital on favorable terms, if at all.

At December 31, 2014, the Company held $158,171 in cash and cash equivalents, largely due to the disposition of its interest in Classified Ventures and the sale of The Providence Journal. The Company’s future growth and profitability may be dependent upon its ability to profitably invest its capital in products and businesses that produce profitable revenue and generate acceptable returns on investment. The Company may not be able to find suitable opportunities to reinvest available cash, which could adversely impact the return on capital, or may make investments that do not yield the expected returns. If the Company deploys a substantial portion of the cash reserves, it may need additional financing to execute on current or future business strategies, including: developing new products internally, diversifying revenue streams by acquiring or investing in established and profitable businesses;

A. H. Belo Corporation 2014 Annual Report on Form 10-K | PAGE 9 | |

making required investments in its operating infrastructure in order to support revenue growth; or otherwise responding to competitive pressures. The Company’s ability to raise financial capital in the future may be hindered due to uncertainty regarding A. H. Belo or the newspaper industry’s prospective performance. If adequate funds are not available or are not available on acceptable terms, if and when needed, the Company’s ability to conduct acquisitions, make investments in its businesses, take advantage of unanticipated opportunities, or otherwise respond to competitive pressures, could be significantly limited.

There can be no assurance that the Company’s product and service initiatives will be successful.

The Company has introduced new product and service initiatives designed to grow advertising and market services revenue and to respond to challenges of maintaining revenue in existing markets. These initiatives may not be successful for advertisers, may not be scalable or profitable and could result in unprofitable financial performance.

Decreases in circulation may adversely affect A. H. Belo’s advertising and circulation revenue.

A. H. Belo’s newspapers, and the newspaper industry as a whole, are challenged to maintain and grow print circulation volume. To the extent circulation volume declines cannot be offset by rate increases the Company will realize lower circulation revenue. Further, circulation volume declines could also result in lower rates and volumes for advertising revenue.

The Company’s potential inability to successfully execute cost control measures could result in total operating costs that are greater than expected.

The primary costs of the Company’s operations include employee compensation and benefits; followed by distribution costs, newsprint and other production materials and technology costs. The Company has taken steps to lower its costs through selling or discontinuing production of unprofitable operations and products, reducing personnel and employee benefits and implementing general cost control measures. Although the Company continues its cost control efforts, the Company may be unable to match revenue declines with offsetting cost reductions.

Certain operating costs may not fluctuate directly with the changes in revenue volumes, which could result in lower margins if advertising and circulation volumes decline. The Company could also experience inflationary pressures from suppliers and be unable to generate additional revenue or additional cost reductions to offset these inflationary pressures. The Company utilizes outside service providers to distribute its newspapers, and certain preprint advertising are distributed through the mail. Higher fuel costs or higher postage rates could result in higher direct costs incurred by the Company to distribute its products. The basic raw material for newspapers is newsprint. The price of newsprint has historically fluctuated significantly. Consolidation in the North American newsprint industry reduced the number of suppliers and led to paper mill closures and conversions to other grades of paper, which in turn decreased overall newsprint capacity and increased the likelihood of higher prices.

Recently implemented health care mandates may require the Company to evaluate the scope of health care benefits offered to its workforce and the method in which health care benefits are delivered. These mandates may require an expansion of coverage and benefits offered to employees that could increase the Company’s cost to provide medical benefits to employees. Additionally, as the economy recovers from the recent recession, competition for qualified personnel may require the Company to spend more on compensation costs, including employee benefits, to attract and retain its workforce.

The Company may not be able to pass on to customers these potential cost increases given the significant competition for advertising dollars and the ability of customers to obtain their news from other media at a low cost. If the Company does not achieve expected savings or if operating costs increase due to the creation and development of new products or otherwise, total operating costs may be greater than anticipated.

The Company believes appropriate steps are being taken to control costs. However, if the Company is not successful in matching revenue declines with corresponding cost reductions, the quality of the Company’s product’s could be affected as well as the Company’s ability to generate future profits. These events could result in impairment to the Company’s goodwill and other long-lived assets.

A. H. Belo has had turnover in its senior executive management. A. H. Belo depends on key personnel and may not be able to operate and grow its business effectively if the Company is unable to replace executive officers or loses the services of other senior executive officers or key operational employees or is unable to attract and retain qualified personnel in the future.

A. H. Belo relies on the efforts of its senior executive officers and other management. The Company’s chief financial officer has recently departed the Company for another executive position, and the Company’s controller is serving as its principal financial officer until a new chief financial officer is hired. The position of a senior vice president is being eliminated, and his corporate secretarial duties will be reallocated to the Company’s general counsel. In addition, the editor of its flagship paper, The Dallas Morning News, has recently announced his retirement in May 2015. An executive has been hired for the role of editor. In addition,

PAGE 10 | A. H. Belo Corporation 2014 Annual Report on Form 10-K |

operating executives have recently been appointed to the key operational roles of chief revenue officer and chief digital officer of The Dallas Morning News. The success of the Company’s businesses depends heavily on their ability to successfully execute the required responsibilities of these roles as well as the Company’s ability to retain current management and to attract and retain qualified personnel in the future. Competition for senior management personnel is intense and A. H. Belo may not be able to retain its key personnel or hire suitable replacements. In addition, reductions in staff and in employee benefits could adversely affect the Company’s ability to attract and retain key employees. The Company has not entered into employment agreements with key management personnel and does not have “key person” insurance for any of its senior executive officers or other key personnel. A. H. Belo has a change in control severance plan covering key management personnel that is triggered under certain conditions if a change in control occurs.

Market conditions could increase the funding requirements associated with the Company’s pension plans.

The Company is the sole sponsor of A. H. Belo Pension Plans I and II (collectively, the “A. H. Belo Pension Plans”) and is required to meet certain pension funding requirements as established under the Employment Retirement Income Security Act (“ERISA”). Instability in global and domestic capital markets may result in low returns on the assets contributed to the A. H. Belo Pension Plans. Additionally, low yields on corporate bonds may decrease the discount rate, resulting in a higher funding obligation. Although legislation was enacted into law in 2012 which provided limited funding relief, these conditions could materially increase the funding requirements associated with the A. H. Belo Pension Plans, which could have an adverse impact on the Company’s liquidity and financial condition.

Adverse results from new litigation or governmental proceedings or investigations could adversely affect A. H. Belo’s business, financial condition and results of operations.

From time to time, A. H. Belo and its subsidiaries are subject to litigation, governmental proceedings and investigations. Adverse determinations in any such matters could require A. H. Belo to make monetary payments or result in other sanctions or findings that could affect adversely the Company’s business, financial condition and results of operations.

A. H. Belo’s directors and executive officers have significant combined voting power and significant influence over its management and affairs.

A. H. Belo directors and executive officers hold approximately 54.4 percent of the voting power of the Company’s outstanding voting stock as of December 31, 2014. A. H. Belo’s Series A common stock has one vote per share and Series B common stock has 10 votes per share. Except for certain extraordinary corporate transactions, generally all matters to be voted on by A. H. Belo’s shareholders must be approved by a majority of the voting power of the Company’s outstanding voting stock, voting as a single class. Certain extraordinary corporate transactions, such as a merger, consolidation, sale of all or substantially all of the Company’s assets, dissolution of the Company, the alteration, amendment, or repeal of A. H. Belo’s bylaws by shareholders and certain amendments to A. H. Belo’s certificate of incorporation, require the affirmative vote of the holders of at least two-thirds of the voting power of the outstanding voting stock, voting as a single class. Accordingly, A. H. Belo’s directors and executive officers will have significant influence over the Company’s management and affairs and over all matters requiring shareholder approval, including the election of directors and significant corporate transactions. This ownership may limit other shareholders’ ability to influence corporate matters and, as a result, A. H. Belo may take actions that some shareholders do not view as beneficial.

A. H. Belo Corporation 2014 Annual Report on Form 10-K | PAGE 11 | |

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The Company’s principal operations are located as follows:

Operations | Ownership | Location |

A. H. Belo and The Dallas Morning News | ||

Corporate and The Dallas Morning News’ headquarters | Owned | Dallas, Texas, downtown |

Printing facilities | Owned | Plano, Texas |

Denton Record-Chronicle offices | Owned | Denton, Texas, downtown |

Direct mail offices and warehouse | Leased | Phoenix, Arizona |

In addition to the properties above, the Company holds various real estate assets in Texas and Rhode Island that are nonessential to operations including various commercial buildings, parking lots and land. These real estate assets are currently marketed for sale and are included in property, plant and equipment in the Company’s consolidated balance sheets.

Item 3. Legal Proceedings

A number of legal proceedings are pending against A. H. Belo. In the opinion of management, liabilities, if any, arising from these legal proceedings would not have a material adverse effect on A. H. Belo’s results of operations, liquidity or financial condition.

PAGE 12 | A. H. Belo Corporation 2014 Annual Report on Form 10-K |

PART II

Item 4. Mine Safety Disclosures

None.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Company’s authorized common equity consists of 125,000,000 shares of common stock, par value $.01 per share. The Company has two series of common stock outstanding, Series A and Series B. Shares of the two series are identical in all respects except as noted herein. Shares of Series B common stock are entitled to 10 votes per share on all matters submitted to a vote of shareholders, and shares of Series A common stock are entitled to one vote per share. Transferability of the Series B common stock is limited to family members and affiliated entities of the holder. Shares of Series B common stock are convertible at any time on a one-for-one basis into shares of Series A common stock and upon a transfer other than as described above, shares of Series B common stock automatically convert into Series A common stock. Shares of the Company’s Series A common stock are traded on the New York Stock Exchange (NYSE trading symbol: AHC) and began trading on February 11, 2008. There is no established public trading market for shares of Series B common stock.

The declaration of dividends is subject to the discretion of A. H. Belo’s board of directors. The determination as to the amount declared and its timing depends on, among other things, A. H. Belo’s results of operations and financial condition, capital requirements, other contractual restrictions, prospects, applicable law, general economic and business conditions and other future factors that are deemed relevant. The board of directors generally declares dividends the quarter preceding its stated measurement and payment dates. A. H. Belo cannot provide any assurance that future dividends will be declared and paid due to the foregoing factors and the factors discussed in “Item 1A. Risk Factors” and elsewhere in this Annual Report on Form 10-K. The table below sets forth the high and low sales prices reported on the New York Stock Exchange for a share of the Company’s common stock and the recorded cash dividends per share declared for the past two years.

Stock Price | Dividends | ||||||||||||||

High | Low | Close | Declared | ||||||||||||

2014 | |||||||||||||||

Fourth quarter | $ | 13.34 | $ | 10.37 | $ | 10.38 | $ | 2.33 | |||||||

Third quarter | 12.17 | 10.20 | 10.67 | 0.08 | |||||||||||

Second quarter | 12.83 | 10.47 | 11.85 | 1.58 | |||||||||||

First quarter | 13.00 | 7.37 | 11.58 | 0.08 | |||||||||||

2013 | |||||||||||||||

Fourth quarter | $ | 8.60 | $ | 6.91 | $ | 7.47 | $ | 0.08 | |||||||

Third quarter | 8.05 | 6.57 | 7.85 | 0.08 | |||||||||||

Second quarter | 7.25 | 5.48 | 6.86 | 0.08 | |||||||||||

First quarter | 6.00 | 4.72 | 5.84 | 0.06 | |||||||||||

The closing price of the Company’s Series A common stock as reported on the New York Stock Exchange on February 27, 2015, was $8.69. The approximate number of shareholders of record of the Company’s Series A and Series B common stock at the close of business on February 27, 2015, was 419 and 185, respectively.

Equity Compensation Plan Information

The information set forth under the heading “Equity Compensation Plan Information” contained in the definitive Proxy Statement for the Company’s Annual Meeting of Shareholders, to be held on May 14, 2015, is incorporated herein by reference.

Issuer Purchases of Equity Securities

The Company repurchases shares of its common stock from time to time pursuant to publicly announced share repurchase programs. During 2014, the Company repurchased 449,436 Series A shares at a cost of $4,974. All purchases were made through open market transactions and were recorded as treasury stock.

A. H. Belo Corporation 2014 Annual Report on Form 10-K | PAGE 13 | |

The following table contains information for shares repurchased during the fourth quarter of 2014. None of the shares in this table were repurchased directly from any of our officers or directors.

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs | |||||||||

October 2014 | 45,616 | $ | 11.06 | 867,065 | 632,935 | ||||||||

November 2014 | 37,343 | 11.58 | 904,408 | 595,592 | |||||||||

December 2014 | 40,228 | 12.27 | 944,636 | 555,364 | (a) | ||||||||

(a) | Share repurchases are made pursuant to a share repurchase program authorized by the Company’s board of directors. A total of 1,000,000 shares were authorized by the Company’s board of directors in the fourth quarter of 2012 and an additional 500,000 shares were authorized in the fourth quarter 2013. |

Sales of Unregistered Securities

During 2014, 2013 and 2012, shares of the Company’s Series B common stock in the amounts of $8,918, $4,401 and $12,961, respectively, were converted, on a one-for-one basis, into shares of Series A common stock. The Company did not register the issuance of these securities under the Securities Act of 1933 (the “Securities Act”) in reliance upon the exemption under Section 3(a)(9) of the Securities Act.

PAGE 14 | A. H. Belo Corporation 2014 Annual Report on Form 10-K |

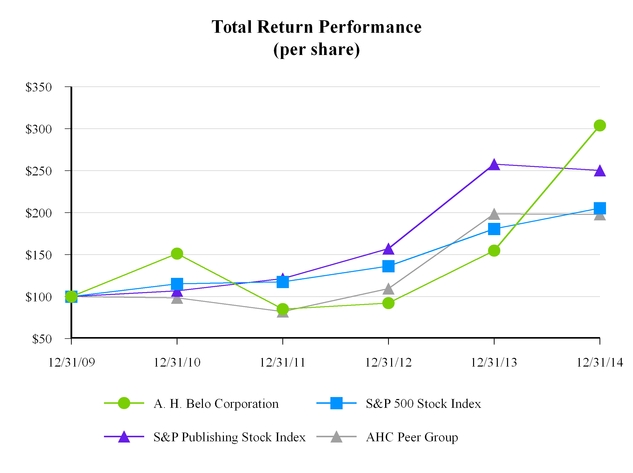

Performance Graph

The following graph and related information shall not be deemed “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act or Exchange Act, each as amended, except to the extent that the Company specifically incorporates it by reference into such filing.

The graph below compares the annual cumulative shareholder return on an investment of $100 on December 31, 2009, with a closing price of $5.76 per share, in A. H. Belo’s Series A common stock, based on the market price of the Series A common stock and assuming reinvestment of dividends, with the cumulative total return, assuming reinvestment of dividends, of a similar investment in (1) companies on the Standard & Poor’s 500 Stock Index, (2) companies on the Standard & Poor’s Publishing Stock Index and (3) the 2014 group of peer companies selected on a line-of-business basis and weighted for market capitalization. In future periods, the Company will compare stock performance to the S&P Publishing Stock Index rather than a peer group. The 2014 group of peer companies, which includes Gannett Co., Inc., The E. W. Scripps Company, Journal Communications, Inc., Lee Enterprises, Incorporated, The McClatchy Company, Media General, Inc and The New York Times Company, is presented for comparative purposes. A. H. Belo is not included in the calculation of peer group cumulative total shareholder return on investment.

A. H. Belo Corporation 2014 Annual Report on Form 10-K | PAGE 15 | |

Item 6. Selected Financial Data

The table below sets forth selected financial data of the Company for each of the years ended 2010 through 2014. For a more complete understanding of this selected financial data, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and accompanying notes.

As of and for the years ended December 31, | |||||||||||||||||||

In thousands, except per share amounts | 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||

Total net operating revenue | $ | 272,788 | $ | 276,183 | $ | 280,924 | $ | 299,131 | $ | 314,049 | |||||||||

Total operating costs and expense (a) | 280,474 | 274,961 | 276,790 | 301,398 | 458,670 | ||||||||||||||

Income (loss) from operations | (7,686 | ) | 1,222 | 4,134 | (2,267 | ) | (144,621 | ) | |||||||||||

Total other income (expense), net (b) | 99,671 | 2,154 | 2,766 | (966 | ) | 6,239 | |||||||||||||

Income tax provision (benefit) (c) | 5,978 | 1,460 | 1,793 | 5,163 | (7,088 | ) | |||||||||||||

Income (loss) from continuing operations | 86,007 | 1,916 | 5,107 | (8,396 | ) | (131,294 | ) | ||||||||||||

Income (loss) from discontinued operations (d) | 6,770 | 14,010 | (4,688 | ) | (2,537 | ) | 7,059 | ||||||||||||

Net loss attributable to noncontrolling interests (e) | (152 | ) | (193 | ) | (107 | ) | — | — | |||||||||||

Net income (loss) attributable to A. H. Belo Corporation | $ | 92,929 | $ | 16,119 | $ | 526 | $ | (10,933 | ) | $ | (124,235 | ) | |||||||

Total assets | $ | 298,747 | $ | 279,218 | $ | 291,939 | $ | 345,088 | $ | 420,049 | |||||||||

Total liabilities | $ | 172,728 | $ | 110,442 | $ | 189,879 | $ | 223,609 | $ | 220,176 | |||||||||

Total shareholders’ equity | $ | 126,019 | $ | 168,779 | $ | 102,060 | $ | 121,479 | $ | 199,873 | |||||||||

Cash dividends recorded per share | $ | 4.07 | $ | 0.28 | $ | 0.48 | $ | 0.18 | $ | — | |||||||||

(a) | In 2014, the Company recorded a $7,648 charge to pension expense related to the recognition or prior year actuarial losses associated with liquidated pension obligations in conjunction with the Company’s continued de-risking efforts. |

In 2010, the Company recorded a loss of $132,346 related to the withdrawal of the Company from a defined benefit plan of the former parent company. The assets and obligations related to current and former employees participating in this plan were transferred into two newly formed defined benefit pension plans created and sponsored solely by the Company. A final settlement adjustment of $1,988 was recorded to expense in 2011 relating to the finalization of plan assets and obligations assumed.

(b) | In 2014, Classified Ventures, an equity-method investee, sold its apartments.com business unit and the Company recorded a gain of $18,479 related to the sale. On October 1, 2014, the Company completed a transaction with Gannett Co. Inc. and other unit holders of Classified Ventures whereby Gannett acquired all membership interests from the unit holders for Classified Ventures’ remaining business which primarily consists of cars.com. The Company recorded a gain of $77,092 related to the transaction. Other income of $3,540 was recorded for the receipt of an economic parity payment from the former parent company in conjunction with the dissolution of the jointly-owned partnership holding the Company’s investment in Classified Ventures. |

(c) | In 2010, the Company’s former parent company amended its 2008 federal income tax return in order to generate an $4,732 tax refund related to Company losses carried back against this return. In 2013, the Company effectively completed the U.S. federal audit for tax years 2008 and 2009 which resulted in a 2013 refund of $1,334 due to the carryback of taxable losses to a prior tax return of the former parent company. |

(d) | In 2014, the Company sold the operations of The Providence Journal and in 2013, the Company sold the operations of The Press-Enterprise, both of which are reported as discontinued operations for the periods presented above. |

(e) | In 2014, the Company acquired a 51% interest in Untapped Festivals, LLC. In 2012, the Company acquired a 70 percent interest in Your Speakeasy, LLC. The Company consolidates the results of operations related to these investments and records the interests of other owners as noncontrolling interests. |

PAGE 16 | A. H. Belo Corporation 2014 Annual Report on Form 10-K |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

The following information should be read in conjunction with the other sections of this Annual Report on Form 10-K. Statements in this Annual Report on Form 10-K concerning A. H. Belo’s business outlook or future economic performance, anticipated profitability, revenues, expenses, dividends, capital expenditures, investments, dispositions, impairments, business initiatives, acquisitions, pension plan contributions and obligations, real estate sales, working capital, future financings and other financial and non-financial items that are not historical facts, are “forward-looking statements” as the term is defined under applicable federal securities laws. Forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from those statements.

Such risks, uncertainties and factors include, but are not limited to the following: changes in capital market conditions and prospects, changes in advertising demand and newsprint prices; newspaper circulation trends and other circulation matters, including changes in readership methods, patterns and demography; audits and related actions by the Alliance for Audited Media; challenges implementing increased subscription pricing and new pricing structures; challenges in achieving expense reduction goals in a timely manner and the resulting potential effect on operations; challenges attracting and retaining key personnel; challenges in consummating asset acquisitions or dispositions upon acceptable terms; technological changes; development of Internet commerce; industry cycles; changes in pricing or other actions by new and existing competitors and suppliers; consumer acceptance of new products and business initiatives; labor relations; regulatory, tax and legal changes; adoption of new accounting standards or changes in existing accounting standards by the Financial Accounting Standards Board or other accounting standard-setting bodies or authorities; the effects of Company acquisitions, dispositions and co-owned ventures and investments; pension plan matters; general economic conditions and changes in interest rates; significant armed conflict; acts of terrorism; and other factors beyond the Company’s control, as well as other risks described elsewhere in this Annual Report on Form 10-K and in the Company’s other public disclosures and filings with the SEC.

OVERVIEW

A. H. Belo, headquartered in Dallas, Texas, is a leading local news and information publishing company with commercial printing, distribution and direct mail capabilities, as well as expertise in emerging media and digital marketing. With a continued focus on extending the Company’s media platform, A. H. Belo is able to deliver news and information in innovative ways to a broad spectrum of audiences with diverse interests and lifestyles.

The Company publishes The Dallas Morning News (www.dallasnews.com), Texas’ leading newspaper and winner of nine Pulitzer Prizes; the Denton Record-Chronicle (www.dentonrc.com), a daily newspaper operating in Denton, Texas, and various niche publications targeting specific audiences. A. H. Belo offers digital marketing solutions through 508 Digital and Your Speakeasy, LLC and provides event promotion and marketing services through Crowdsource.

A. H. Belo intends for the discussion of its financial condition and results of operations that follows to provide information that will assist in understanding its financial statements, the changes in certain key items in those statements from period to period, and the primary factors that accounted for those changes, as well as how certain accounting principles, policies and estimates affect its financial statements.

Certain current and prior year amounts related to The Providence Journal and The Press-Enterprise have been recast as discontinued operations. Amounts in Management’s Discussion and Analysis reflect continuing operations of the Company unless otherwise noted. The results from continuing operations consist primarily of The Dallas Morning News and corporate activities.

Overview of Significant Transactions from Continuing Operations

Operating results for 2014, 2013 and 2012 reflect continued challenges in print advertising revenue trends, primarily due to volume and rate declines, partially offset by increases in the Company’s digital advertising and marketing services revenues.

The Company continues its efforts to diversify revenues through leveraging its brand, its personnel and its infrastructure in both organic new product development and in pursuit of acquisitions of related advertising and marketing services companies. During 2014, the Company expanded the reach of its Crowdsource event marketing subsidiary by acquiring a controlling interest in Untapped Festivals and the assets of Savor Dallas. In January 2015, the Company acquired majority ownership of three companies specializing in local marketing automation, search engine marketing, direct mail and promotional products. These acquisitions will complement and expand the product and service offerings currently available to A. H. Belo clients, thereby strengthening the Company’s diversified product portfolio and allowing for greater penetration in a competitive advertising market. The Company incurred $577 of legal and due diligence costs in 2014, which were charged to operating expense, in conjunction with these acquisitions.

A. H. Belo Corporation 2014 Annual Report on Form 10-K | PAGE 17 | |

During 2014, the results of operations of the Company were influenced by several significant transactions and events. In the first quarter, the Company commenced printing services of the Fort Worth Star-Telegram at the Company’s printing operations in Plano, Texas. The agreement between The Dallas Morning News, Inc. and Star-Telegram, Inc. is for an initial term of 10 years and has a renewal option to extend the contract.

In April 2014, the Company received a cash distribution of $18,861 from Classified Ventures, an equity method investee, for its portion of the net sales proceeds for apartments.com, and recorded a gain of $18,479. In October 2014, the Company completed a transaction with Gannett Co. Inc. and other unit holders of Classified Ventures whereby Gannett acquired all membership interests from the unit holders for Classified Ventures’ remaining business, which primarily consists of cars.com. The Company received pre-tax cash proceeds, net of selling costs, of $77,661. Escrow proceeds of $3,280 will be received within one year. The Company recorded a gain of $77,092 related to the transaction. The Company entered into a new, five-year affiliate agreement with Classified Ventures that will allow The Dallas Morning News to continue to resell cars.com products and services exclusively in its local market. The affiliate agreement increases the wholesale rate that the Company will pay to Classified Ventures for selling cars.com products. Other income of $3,540 was recorded in July 2014 for the receipt of an economic parity payment from the former parent company in conjunction with the dissolution of the jointly-owned partnership holding the Company’s investment in Classified Ventures.

The Company determined that an other-than-temporary decline in the value of its investment in Wanderful Media occurred after evaluating the estimated fair value of the investee as determined by an independent valuation specialist and recorded an impairment charge of $1,871, reducing the carrying value of the investment. The Company attributes the impairment primarily to a decline in business related to Wanderful Media’s legacy products. An additional contribution of $1,909 was made in the second quarter of 2014 to provide capital for development of new product offerings as Wanderful Media establishes its market presence.

In the fourth quarter of 2014, the Company completed an effort to continue to de-risk its pension plans, and lump sum payments totaling $52,919, funded from the plans’ master trust account, were made to certain participants accepting the lump sum offers. The liquidation reduced the Company’s pension benefit obligation by approximately $70,000, and a non-cash charge of $7,648 was recorded to pension expense due to the recognition of prior year actuarial losses associated with the liquidated pension obligations. Required contributions of $9,927 were made to the pension plans in 2014. A voluntary payment of $20,000 was made in December 2014 to improve the unfunded position of the pension plans and to lower the tax obligations for the 2014 tax year as these payments are deductible for tax purposes. As a result of the de-risking settlements and the voluntary contributions in 2014, the Company does not expect to make any required pension contributions in 2015.

During 2014, the Company completed several transactions resulting in the sale of various real properties. Net proceeds totaling $3,408 were received in the third quarter for the sales of land and buildings in Riverside, California related to a former commercial printing operation and 97 acres of undeveloped land in southern Dallas, Texas, resulting in gains totaling $862. In the fourth quarter, the Company sold the land and building related to its former commercial packaging operation in southern Dallas, Texas. Net proceeds of $6,677 were received related to the sale, generating a gain of $1,827.

As a result of the above transactions, the Company is in a taxable position as of December 31, 2014.

Special dividends were recorded in the second and fourth quarters of 2014 of $1.50 and $2.25 per share, respectively, totaling $83,967, in order to return to shareholders cash held by the Company which exceeded forecasted liquidity requirements. Quarterly dividends of $0.08 per share returned $7,193 to shareholders and holders of RSUs throughout the year. The Company announced on December 11, 2014, a dividend of $0.08 per share payable on March 6, 2015, to shareholders of record and holders of RSUs as of the close of business on February 13, 2015.

In addition, the Company purchased 449,436 of its Series A common shares during the year through open market transactions for $4,974, which are recorded as treasury stock.

PAGE 18 | A. H. Belo Corporation 2014 Annual Report on Form 10-K |

RESULTS OF CONTINUING OPERATIONS

Consolidated Results of Continuing Operations

This section contains a discussion and analysis of net operating revenues, expenses and other information relevant to an understanding of results of operations for 2014, 2013 and 2012.

The table below sets forth the components of A. H. Belo’s net operating revenues for the last three years.

Years Ended December 31, | ||||||||||||||||||||||||||

2014 | Percent of Total Revenue | Percentage Change | 2013 | Percent of Total Revenue | Percentage Change | 2012 | Percent of Total Revenue | |||||||||||||||||||

Advertising and marketing services | $ | 158,183 | 58.0 | % | (5.8 | )% | $ | 167,945 | 60.8 | % | (1.3 | )% | $ | 170,113 | 60.5 | % | ||||||||||

Display | 49,558 | (14.0 | )% | 57,640 | (6.8 | )% | 61,843 | |||||||||||||||||||

Classified | 23,097 | (7.9 | )% | 25,089 | (8.1 | )% | 27,299 | |||||||||||||||||||

Preprint | 53,272 | (5.8 | )% | 56,562 | (2.3 | )% | 57,910 | |||||||||||||||||||

Digital | 32,256 | 12.6 | % | 28,654 | 24.3 | % | 23,061 | |||||||||||||||||||

Circulation | 84,922 | 31.1 | % | (1.6 | )% | 86,274 | 31.2 | % | (2.7 | )% | 88,662 | 31.6 | % | |||||||||||||

Printing, distribution and other | 29,683 | 10.9 | % | 35.1 | % | 21,964 | 8.0 | % | (0.8 | )% | 22,149 | 7.9 | % | |||||||||||||

$ | 272,788 | 100.0 | % | (1.2 | )% | $ | 276,183 | 100.0 | % | (1.7 | )% | $ | 280,924 | 100.0 | % | |||||||||||

The Company’s primary revenues are generated from advertising within its core newspapers, niche publications and related websites and from subscription and single copy sales of its printed newspapers. As a result of competitive and economic conditions, the newspaper industry has faced significant revenue decline over the past decade. The Company has sought to diversify its revenues through development and investment in new product offerings, increased circulation rates and leveraging of its existing assets to offer cost efficient printing and distribution services to its local markets. Through these efforts, the Company limited

the year-over-year revenue decline in 2014 to its lowest point since its separation from the former parent company in 2008.