Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 Q414 EARNINGS RELEASE - U.S. CONCRETE, INC. | usc4q14earningsrelease.pdf |

| 8-K - 8-K - U.S. CONCRETE, INC. | form8-kq414earningsrelease.htm |

1 NEWS RELEASE Contact: Matt Brown Senior Vice President and CFO U.S. Concrete, Inc. 817-835-4105 FOR IMMEDIATE RELEASE U.S. CONCRETE ANNOUNCES FOURTH QUARTER AND FULL-YEAR 2014 RESULTS Fourth Quarter Highlights • Quarterly earnings per diluted share of $0.40, excluding derivative loss, impairment loss, non-cash stock compensation and acquisition related expenses • Adjusted EBITDA increased 94.6% year-over-year, to $17.4 million • Consolidated revenue increased 21.2%, to $179.5 million Like-for-like consolidated revenue increased 11.8% • Ready-mixed concrete revenue increased 17.4%, to $158.8 million Like-for-like ready-mixed concrete revenue increased 10.8% • Ready-mixed concrete sales volume rose 9.7%, to approximately 1.4 million cubic yards Like-for-like ready-mixed concrete sales volume increased 4.6% • Ready-mixed concrete average sales price improved 7.2%, to $115.05 per cubic yard Like-for-like ready-mixed concrete average sales price improved 6.0% • Aggregate products sales volume rose 36.9%, to approximately 1.2 million tons • Aggregate products average sales price improved 5.9%, to $9.59 per ton • Consolidated gross profit increased $11.6 million with margin improvement of 390 basis points Full-Year Highlights • Adjusted EBITDA increased 55.7% year-over-year, to $75.2 million • Consolidated revenue increased 17.6%, to $703.7 million Like-for-like consolidated revenue increased 15.1% • Ready-mixed concrete revenue increased 16.0%, to $632.8 million Like-for-like ready-mixed concrete revenue increased 14.1% • Ready-mixed concrete volume rose 9.0%, to approximately 5.7 million cubic yards Like-for-like ready-mixed concrete volume increased 7.5% • Ready-mixed concrete average sales price improved 6.6%, to $110.85 per cubic yard Like-for-like ready-mixed concrete average sales price improved 6.3% • Consolidated gross profit increased $30.9 million with margin improvement of 190 basis points • Record EBITDA margin of 10.7%

2 EULESS, TEXAS – March 5, 2015 – U.S. Concrete, Inc. (NASDAQ: USCR) today reported adjusted EBITDA of $17.4 million in the fourth quarter of 2014, compared to $9.0 million in the fourth quarter of 2013. Adjusted EBITDA margin, which is adjusted EBITDA as a percentage of revenue, was 9.7% for the fourth quarter of 2014, compared to 6.0% in the fourth quarter of 2013. Net income was $0.9 million, or $0.06 per diluted share, for the fourth quarter of 2014, compared to net loss of $(5.1) million, or $(0.38) per diluted share, in the fourth quarter of 2013. Excluding derivative loss, impairment loss, non- cash stock compensation expense and acquisition related expenses, adjusted net income for the fourth quarter of 2014 was $5.6 million, or $0.40 per diluted share. William J. Sandbrook, President and Chief Executive Officer of U.S. Concrete, stated “The fourth quarter was an exclamation point on the end of an extremely successful 2014 for U.S. Concrete. We delivered outstanding organic growth in revenue and profit in all of our regions and both segments. EBITDA margins were at a record high, further validating the operating leverage of our business and the focused execution of our operating plan. In addition, we are very excited about the progress we made in our acquisition strategy during the year, particularly the momentum gained from fourth quarter transactions that kicked off a great start to the new year. Each of our acquisitions allows us to capitalize on various aspects of our growth strategy. Our recent acquisition of the largest independent producer of ready-mixed concrete in San Francisco's East Bay market will further expand our presence in another diverse, high growth market. The addition of six ready-mixed concrete plants in Texas and Staten Island, New York will further strengthen our position in these core markets. Our new aggregate distribution terminals in New York City will enhance our vertical integration and improve our operating efficiencies in the markets of New York City's five boroughs and Long Island. The addition of the two largest volumetric concrete businesses in Texas is a unique opportunity to expand into enhanced product offerings with high margins within our core ready-mixed concrete segment. "The outlook for 2015 is extremely encouraging. Annual construction starts in the United States are the highest they have been since 2008. The 2015 Dodge Construction Outlook projects additional growth of 9% in 2015, with commercial building and residential growth of 15%. Our markets have historically and are projected to continue to outpace the national average for construction starts. "Texas led the nation in job growth with 15.9% of the nation's jobs added during 2014. All of the eleven major industries of the Texas economy had net employment growth in 2014. The oil and gas industry accounts for only 3% of the overall Texas economy and 1% of the employment in Texas, creating very minimal direct exposure to U.S. Concrete's diverse portfolio of operations in the state. The favorable business climate, economic diversity and commitment to infrastructure growth, as evidenced by the approval of Proposition 1, will provide a platform for continued growth and allow us to capitalize on this more certain transportation funding mechanism. Further, the Dallas/Ft. Worth regional economy is even less energy dependent than the state as a whole with only 1% of its economy reliant on natural resources and can boast of one of the most broadly diversified economies in the nation. Additionally, its world-class transportation infrastructure makes it an international gateway. The region ranks among the top three in the nation for business expansions, relocations and employment growth, with 18 Fortune 500 companies headquartered in the area. It is home to the nation's third busiest airport, the largest domestic

3 airline in the country and the world's first fully industrial airport. Its central location, low cost of living and pro-business mindset make it an ideal climate for continued growth in the future. "In California, construction job growth in the Bay Area grew 5.7% in 2014 due to the highly publicized 'building boom' in San Francisco. The city has issued record permits for new projects over the past twelve months and expects double digit growth again in 2015. We are excited about our recent expansion in the East Bay and our opportunity to take advantage of the accelerated growth in the San Francisco market. "New York City construction starts in 2014 were easily at their highest point since 2008 with a 31% increase over 2013. Housing starts rose in value for the fourth consecutive year with an increase of 73% over 2013. There is a well defined surge in residential construction in New York City with eight of the top ten projects by value being multi-family luxury apartments. Construction starts in the non-residential sector in 2014 increased 26% over the prior year and 2015 is shaping up to be a blockbuster year with the resumption of full-scale construction at 3 World Trade Center and two major projects at Hudson Yards, which collectively represent nearly 6.5 million square feet of new office space. "With the backdrop of extremely robust regional economies represented in our operating footprint, we will continue to build on our improved business results with a relentless focus on our two-pronged strategy to (i) grow organically through operating excellence, superior product delivery and service and (ii) expand through acquisitions that bolster our existing market positions and capitalize on opportunities in new high-growth markets. The disciplined execution of our strategic plan remains the focus of our entire U.S. Concrete team as we continue to increase shareholder value." FOURTH QUARTER 2014 RESULTS (all comparisons, unless noted, are versus the prior year quarter) Consolidated Results Consolidated fourth-quarter revenue increased 21.2% to $179.5 million, compared to $148.1 million in the prior-year period. Acquisitions made during 2014 contributed $13.8 million of revenue to the fourth quarter of 2014. SG&A expenses for the quarter were $18.4 million, compared to $14.5 million in the prior year. As a percentage of total revenue, SG&A expenses were 10.3% compared to 9.8% in the prior year. Excluding non-cash stock compensation and acquisition related legal and professional fees, SG&A was 8.8% of total revenue compared to 9.1% in the prior year. For the full year, SG&A expenses, excluding non-cash stock compensation and acquisition related legal and professional fees, were 7.9% of revenue compared to 8.9% in the prior year. Consolidated gross profit increased $11.6 million with a 390 basis point expansion in margin year-over-year. Consolidated adjusted EBITDA of $17.4 million, increased $8.5 million with a 370 basis point expansion in margin year-over-year. Ready-Mixed Concrete Revenue from the ready-mixed concrete segment increased $23.6 million, or 17.4%, driven by both volume and pricing. The Company’s ready-mixed concrete sales volume was 1.4 million cubic yards, up 9.7% over prior year. Ready-mixed concrete

4 average sales price per cubic yard increased $7.69, or 7.2%, to $115.05 compared to $107.36 in the prior year. Ready-mixed concrete adjusted EBITDA of $21.1 million, increased 76.6% with a 450 basis point expansion in margin and a 190 basis point improvement in raw material spread year-over-year. Acquisitions made during 2014 contributed 63 thousand cubic yards, $8.9 million of revenue and $1.0 million of EBITDA to the ready-mixed concrete segment during the fourth quarter of 2014. Aggregate Products Aggregate products segment revenue increased $4.1 million, or 40.4%, to $14.1 million due to increased volume and pricing. Aggregate products sales volume of 1.2 million tons increased 329 thousand tons, an improvement of 36.9% over prior year. Aggregate products average sales price per ton increased 5.9% over prior year to $9.59 per ton. Aggregate products adjusted EBITDA of $3.2 million, increased 25.1% year-over-year. Liquidity and Capital Resources The Company’s free cash flow in the fourth quarter of 2014 was $17.9 million, compared to $(8.9) million in the prior year. The increase in free cash flow was due to improved financial performance and continued focus on management of working capital. Cash provided by operating activities in the fourth quarter of 2014 was $20.4 million compared to cash used in operations in the prior year of $2.7 million. For the full year of 2014, cash provided by operating activities was $51 million, an increase of 111% over prior year. The Company’s net debt at December 31, 2014 was $190.2 million, up $88.8 million from December 31, 2013. The increase in net debt was due to a reduction in cash and cash equivalents and additional debt incurred during the year for the financing of mixer truck additions. The decrease in cash and cash equivalents for the twelve months ended December 31, 2014 was primarily due to the successful deployment of capital raised in the prior year bond offering for execution of our acquisition strategy and increased capital expenditures for mixer trucks and plant improvements to support the growing demand in our markets. Net debt at December 31, 2014 was comprised of total debt of $220.4 million, less cash and cash equivalents of $30.2 million. Ready-mixed backlog at the end of the fourth quarter of 2014 was approximately 4.8 million cubic yards, up 11.4% compared to the end of the fourth quarter of 2013. CONFERENCE CALL U.S. Concrete has scheduled a conference call for Thursday, March 5, 2015 at 10:00 a.m. Eastern time, to review its fourth quarter 2014 results. To participate in the call, dial Toll-free: (877) 312-8806 – Conference ID: 87734385 at least ten minutes before the conference call begins and ask for the U.S. Concrete conference call. A replay of the conference call will be available after the call under the investor relations section of the Company’s website at www.us-concrete.com. Investors, analysts and the general public will also have the opportunity to listen to the conference call over the Internet by accessing www.us-concrete.com. To listen to the live call on the Web, please visit the Web site at least 15 minutes early to

5 register, download and install any necessary audio software. For those who cannot listen to the live Web cast, an archive will be available shortly after the call under the investor relations section of the Company’s website at www.us-concrete.com. USE OF NON-GAAP FINANCIAL MEASURES This press release uses the non-GAAP financial measures “adjusted EBITDA,” “adjusted net income (loss),” “adjusted EBITDA margin,” “free cash flow” and “net debt.” The Company has included adjusted EBITDA and adjusted EBITDA margin in this press release because it is widely used by investors for valuation and comparing the Company’s financial performance with the performance of other building material companies. The Company also uses adjusted EBITDA and adjusted EBITDA margin to monitor and compare the financial performance of its operations. Adjusted EBITDA does not give effect to the cash the Company must use to service its debt or pay its income taxes, and thus does not reflect the funds actually available for capital expenditures. In addition, the Company’s presentation of adjusted EBITDA and adjusted EBITDA margin may not be comparable to similarly titled measures that other companies report. The Company considers free cash flow to be an important indicator of its ability to service debt and generate cash for acquisitions and other strategic investments. The Company believes that net debt is useful to investors as a measure of its financial position. The Company presents adjusted net income (loss) and adjusted net income (loss) per share to provide more consistent information for investors to use when comparing operating results for the fourth quarter and full year of 2014 to the fourth quarter and full year of 2013. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s reported operating results or cash flow from operations or any other measure of performance as determined in accordance with GAAP. See the attached “Additional Statistics” for reconciliation of each of these non-GAAP financial measures to the most comparable GAAP financial measures for the quarters and years ended December 31, 2014 and 2013. ABOUT U.S. CONCRETE U.S. Concrete services the construction industry in several major markets in the United States through its two business segments: ready-mixed concrete and aggregate products. The Company has 126 standard ready-mixed concrete plants, 16 volumetric ready-mixed concrete facilities, and 10 producing aggregates facilities. During 2014, U.S. Concrete produced approximately 5.7 million cubic yards of ready-mixed concrete and approximately 4.7 million tons of aggregates. For more information on U.S. Concrete, visit www.us-concrete.com. CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS This press release contains various forward-looking statements and information that are based on management's belief, as well as assumptions made by and information currently available to management. These forward-looking statements speak only as of the date of this press release. The Company disclaims any obligation to update these statements and cautions you not to rely unduly on them. Forward-looking information includes, but is not limited to, statements regarding: the stability of the business; encouraging nature of third quarter volume and pricing increases; ready-mix backlog; ability to maintain our cost structure and the improvements achieved during our restructuring and monitor fixed costs; ability to maximize liquidity, manage variable costs, control capital spending and monitor working capital usage; and the adequacy of current liquidity. Although U.S. Concrete believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that those expectations will prove to have been correct. Such statements are subject to certain risks, uncertainties and assumptions, including, among other matters: general and regional economic conditions; the level of activity in the construction industry; the ability of U.S. Concrete to complete acquisitions and to effectively integrate the operations of acquired companies; development of adequate management infrastructure; departure of key personnel; access to labor; union disruption; competitive factors; government regulations; exposure to environmental and other liabilities; the cyclical and seasonal nature of U.S. Concrete's business; adverse weather conditions; the availability and pricing of raw materials; the availability of refinancing alternatives; and general risks related to the industry and markets in which U.S. Concrete operates. Should one or more of these risks materialize, or should underlying assumptions prove incorrect, actual results or outcomes may vary materially from those expected. These

6 risks, as well as others, are discussed in greater detail in U.S. Concrete's filings with the Securities and Exchange Commission, including U.S. Concrete's Annual Report on Form 10-K for the year ended December 31, 2014 and subsequent Quarterly Reports on Form 10-Q. (Tables Follow)

7 U.S. CONCRETE, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share amounts) (Unaudited) Three months ended December 31, Twelve months ended December 31, 2014 2013 2014 2013 Revenue $ 179,510 $ 148,144 $ 703,714 $ 598,155 Cost of goods sold before depreciation, depletion and amortization 145,780 126,012 573,318 498,660 Selling, general and administrative expenses 18,415 14,504 61,850 59,424 Depreciation, depletion and amortization 7,457 4,778 23,849 18,868 Gain on sale of assets (319) (167) (625) (232) Income from operations 8,177 3,017 45,322 21,435 Interest expense, net 5,286 3,495 20,431 11,332 Derivative loss (1,250) (4,135) (3,556) (29,964) Gain (loss) on extinguishment of debt 11 (1,646) 11 985 Other income, net 779 414 2,385 1,771 Income (loss) from continuing operations before income taxes 2,431 (5,845) 23,731 (17,105) Income tax expense (benefit) 616 (542) 2,156 1,168 Net income (loss) from continuing operations 1,815 (5,303) 21,575 (18,273) (Loss) income from discontinued operations, net of taxes (948) 165 (993) (1,856) Net income (loss) $ 867 $ (5,138) $ 20,582 $ (20,129) Basic income (loss) per share: Income (loss) from continuing operations $ 0.13 $ (0.39) $ 1.59 $ (1.42) (Loss) income from discontinued operations, net of taxes (0.07) 0.01 (0.07) (0.14) Net income (loss) per share – basic $ 0.06 $ (0.38) $ 1.52 $ (1.56) Diluted income (loss) per share: Income (loss) from continuing operations $ 0.13 $ (0.39) $ 1.55 $ (1.42) (Loss) income from discontinued operations, net of taxes (0.07) 0.01 (0.07) (0.14) Net income (loss) per share – diluted $ 0.06 $ (0.38) $ 1.48 $ (1.56) Weighted average shares outstanding: Basic 13,545 13,535 13,541 12,917 Diluted 13,925 13,535 13,898 12,917

8 U.S. CONCRETE, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) December 31, 2014 December 31, 2013 ASSETS Current assets: Cash and cash equivalents $ 30,202 $ 112,667 Trade accounts receivable, net 114,902 92,163 Inventories 31,722 27,610 Deferred income taxes 1,887 708 Prepaid expenses 3,965 3,416 Other receivables 6,519 3,205 Assets held for sale 3,779 — Other current assets 301 2,457 Total current assets 193,277 242,226 Property, plant and equipment, net 176,524 138,560 Goodwill 50,757 11,646 Intangible assets, net 31,720 13,073 Other assets 8,250 8,485 Total assets $ 460,528 $ 413,990 LIABILITIES AND EQUITY Current liabilities: Accounts payable $ 48,705 $ 38,518 Accrued liabilities 50,391 42,950 Current maturities of long-term debt 5,104 3,990 Liabilities held for sale 902 — Derivative liabilities 25,246 21,690 Total current liabilities 130,348 107,148 Long-term debt, net of current maturities 215,333 210,154 Other long-term obligations and deferred credits 6,940 7,921 Deferred income taxes 6,427 5,040 Total liabilities 359,048 330,263 Commitments and contingencies Equity: Preferred stock, $0.001 par value per share (10,000 shares authorized; none issued) — — Common stock, $0.001 par value per share (100,000 shares authorized; 14,675 and 14,450 shares issued, respectively; and 13,978 and 14,036 shares outstanding, respectively) 15 14 Additional paid-in capital 156,745 152,695 Accumulated deficit (42,743) (63,325) Treasury stock, at cost (697 and 414 common shares, respectively) (12,537) (5,657) Total equity 101,480 83,727 Total liabilities and equity $ 460,528 $ 413,990

9 U.S. CONCRETE, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) Twelve months ended December 31, 2014 2013 CASH FLOWS FROM OPERATING ACTIVITIES: Net income (loss) $ 20,582 $ (20,129) Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation, depletion and amortization 23,849 19,016 Debt issuance cost amortization 1,679 2,164 (Gain) loss on extinguishment of debt (11) (985) Amortization of facility exit costs — (142) Amortization of discount on long-term incentive plan and other accrued interest 425 512 Net loss on derivative 3,556 29,964 Loss on impairment of long-lived assets 900 — Net gain on sale of assets (1,265) (13) Deferred income taxes 864 818 Deferred rent — 510 Provision for doubtful accounts and customer disputes 1,533 1,103 Stock-based compensation 3,655 5,429 Changes in assets and liabilities, excluding effects of acquisitions: Accounts receivable (13,466) (8,982) Inventories (2,534) (2,574) Prepaid expenses and other current assets 217 2,497 Other assets and liabilities, net (380) (2,732) Accounts payable and accrued liabilities 11,311 (2,276) Net cash provided by operating activities 50,915 24,180 CASH FLOWS FROM INVESTING ACTIVITIES: Purchases of property, plant and equipment (32,584) (19,988) Payments for acquisitions (89,602) (4,410) Proceeds from disposals of property, plant and equipment 3,708 627 (Payments for) proceeds from disposals of business units — (2,333) Net cash used in investing activities (118,478) (26,104) CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from revolver borrowings 213 137,302 Repayments of revolver borrowings (213) (150,602) Proceeds from debt issuance — 200,000 Repayments of debt — (61,113) Proceeds from exercise of stock options and warrants 396 224 Payments of other long-term obligations (2,250) — Payments for other financing (5,194) (1,995) Debt issuance costs (974) (9,063) Payments for share repurchases (4,824) — Other treasury share purchases (2,056) (4,913) Net cash (used in) provided by financing activities (14,902) 109,840 NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS (82,465) 107,916 CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 112,667 4,751 CASH AND CASH EQUIVALENTS AT END OF PERIOD $ 30,202 $ 112,667

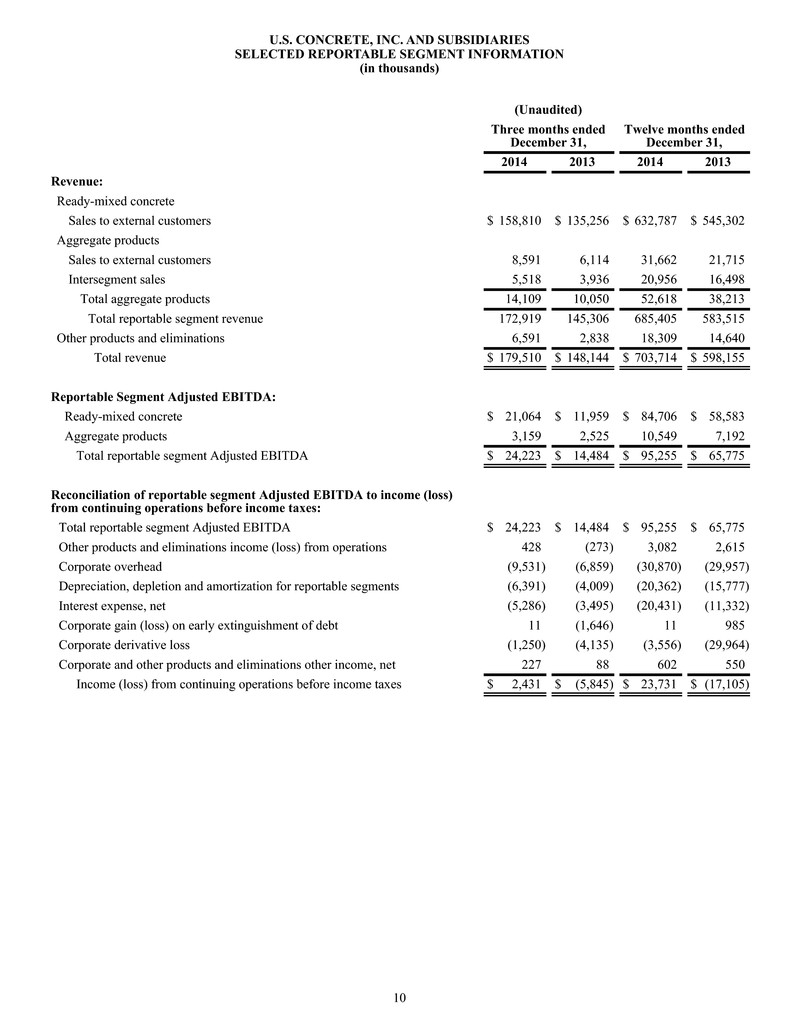

10 U.S. CONCRETE, INC. AND SUBSIDIARIES SELECTED REPORTABLE SEGMENT INFORMATION (in thousands) (Unaudited) Three months ended December 31, Twelve months ended December 31, 2014 2013 2014 2013 Revenue: Ready-mixed concrete Sales to external customers $ 158,810 $ 135,256 $ 632,787 $ 545,302 Aggregate products Sales to external customers 8,591 6,114 31,662 21,715 Intersegment sales 5,518 3,936 20,956 16,498 Total aggregate products 14,109 10,050 52,618 38,213 Total reportable segment revenue 172,919 145,306 685,405 583,515 Other products and eliminations 6,591 2,838 18,309 14,640 Total revenue $ 179,510 $ 148,144 $ 703,714 $ 598,155 Reportable Segment Adjusted EBITDA: Ready-mixed concrete $ 21,064 $ 11,959 $ 84,706 $ 58,583 Aggregate products 3,159 2,525 10,549 7,192 Total reportable segment Adjusted EBITDA $ 24,223 $ 14,484 $ 95,255 $ 65,775 Reconciliation of reportable segment Adjusted EBITDA to income (loss) from continuing operations before income taxes: Total reportable segment Adjusted EBITDA $ 24,223 $ 14,484 $ 95,255 $ 65,775 Other products and eliminations income (loss) from operations 428 (273) 3,082 2,615 Corporate overhead (9,531) (6,859) (30,870) (29,957) Depreciation, depletion and amortization for reportable segments (6,391) (4,009) (20,362) (15,777) Interest expense, net (5,286) (3,495) (20,431) (11,332) Corporate gain (loss) on early extinguishment of debt 11 (1,646) 11 985 Corporate derivative loss (1,250) (4,135) (3,556) (29,964) Corporate and other products and eliminations other income, net 227 88 602 550 Income (loss) from continuing operations before income taxes $ 2,431 $ (5,845) $ 23,731 $ (17,105)

11 U.S. CONCRETE, INC. ADDITIONAL STATISTICS (Unaudited) We report our financial results in accordance with generally accepted accounting principles in the United States (“GAAP”). However, our management believes that certain non-GAAP performance measures and ratios, which our management uses in managing our business, may provide users of this financial information additional meaningful comparisons between current results and results in prior operating periods. See the table below for (1) presentations of our adjusted EBITDA, adjusted EBITDA margin and Free Cash Flow for the quarters and years ended December 31, 2014 and 2013, and Net Debt as of December 31, 2014 and December 31, 2013 and (2) corresponding reconciliations to GAAP financial measures for the quarters and year ended December 31, 2014 and 2013 and as of December 31, 2014 and December 31, 2013. We have also provided below (1) the impact of non-cash stock compensation expense, derivative losses, gain (loss) on extinguishment of debt, acquisition related professional fees, officer severance and expenses related to the Company’s relocation of the corporate headquarters on net income (loss) and net income (loss) per share and (2) corresponding reconciliations to GAAP financial measures for the quarters and years ended December 31, 2014 and 2013. We have also shown below certain Ready-Mixed Concrete Statistics for the quarters and years ended December 31, 2014 and 2013. We define adjusted EBITDA as our net income (loss) from continuing operations, plus the provision (benefit) for income taxes, net interest expense, depreciation, depletion and amortization, non-cash stock compensation expense, derivative (gain) loss, (gain) loss on extinguishment of debt, officer severance and expense related to the Company’s relocation of the corporate headquarters. We define adjusted EBITDA margin as the amount determined by dividing adjusted EBITDA by total revenue. We have included adjusted EBITDA and adjusted EBITDA margin in the accompanying tables because they are widely used by investors for valuation and comparing our financial performance with the performance of other building material companies. We also use adjusted EBITDA and adjusted EBITDA margin to monitor and compare the financial performance of our operations. Adjusted EBITDA does not give effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for capital expenditures. In addition, our presentation of adjusted EBITDA may not be comparable to similarly titled measures other companies report. We define adjusted net income (loss) and adjusted net income (loss) per share as net income (loss) and net income (loss) per share excluding derivative loss, (gain) loss on extinguishment of debt, impairment loss on long-lived assets, non-cash stock compensation expense, acquisition related professional fees and expense related to the Company’s relocation of the corporate headquarters. We present adjusted net income (loss) and adjusted net income (loss) per share to provide more consistent information for investors to use when comparing operating results for the quarters and years ended December 31, 2014 and 2013. We define Free Cash Flow as cash provided by (used in) operations less capital expenditures for property, plant and equipment, net of disposals. We consider Free Cash Flow to be an important indicator of our ability to service our debt and generate cash for acquisitions and other strategic investments. We define Net Debt as total debt, including current maturities and capital lease obligations, minus cash and cash equivalents. We believe that Net Debt is useful to investors as a measure of our financial position. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported operating results or cash flow from operations or any other measure of performance prepared in accordance with GAAP.

12 Three months ended December 31, 2014 2013 (In thousands, except average price amounts and net income (loss) per share) Ready-Mixed Concrete Statistics: Average price per cubic yard (in dollars) $ 115.05 $ 107.36 Volume in cubic yards 1,377 1,255 Aggregate Products Statistics: Average price per ton (in dollars) $ 9.59 $ 9.06 Sales volume in tons 1,221 891 Adjusted Net Income and EPS: Net Income (loss) $ 867 $ (5,138) Add: Derivative loss 1,250 4,135 Add: (Gain) loss on extinguishment of debt (11) 1,646 Add: Impairment loss on long-lived assets 900 — Add: Non-cash stock compensation expense 1,008 708 Add: Acquisition related professional fees 1,551 381 Add: Expenses related to corporate headquarters’ relocation — 38 Adjusted net income $ 5,565 $ 1,770 Net income (loss) per diluted share (1) $ 0.06 $ (0.38) Impact of derivative loss 0.09 0.30 Impact of loss on extinguishment of debt — 0.12 Impact of loss on impairment of long-lived assets 0.06 — Impact of non-cash stock compensation expense 0.07 0.05 Impact of acquisition related professional fees 0.11 0.03 Impact of expenses related to corporate headquarters’ relocation — — Adjusted net income per diluted share $ 0.40 $ 0.13 Adjusted EBITDA reconciliation: Net income (loss) from continuing operations $ 1,815 $ (5,303) Income tax expense (benefit) 616 (542) Interest expense, net 5,286 3,495 Derivative loss 1,250 4,135 Depreciation, depletion and amortization 7,457 4,778 (Gain) loss on extinguishment of debt (11) 1,646 Non-cash stock compensation expense 1,008 708 Expenses related to corporate headquarters' relocation — 38 Adjusted EBITDA $ 17,421 $ 8,955 Adjusted EBITDA margin 9.7% 6.0% Free Cash Flow reconciliation: Net cash provided by (used in) operating activities $ 20,372 $ (2,659) Less: capital expenditures (3,424) (6,623) Plus: proceeds from the sale of property, plant and equipment 947 409 Free Cash Flow $ 17,895 $ (8,873) As of As of December 31, 2014 December 31, 2013 Net Debt reconciliation: Total debt, including current maturities and capital lease obligations $ 220,437 $ 214,144 Less: cash and cash equivalents 30,202 112,667 Net Debt $ 190,235 $ 101,477 (1) Net loss per diluted share for the three months ended December 31, 2013 excludes common stock equivalents of 254 thousand shares from our options and restricted stock that are included in adjusted net income per diluted share as their impact is anti-dilutive based on the net loss for the period.

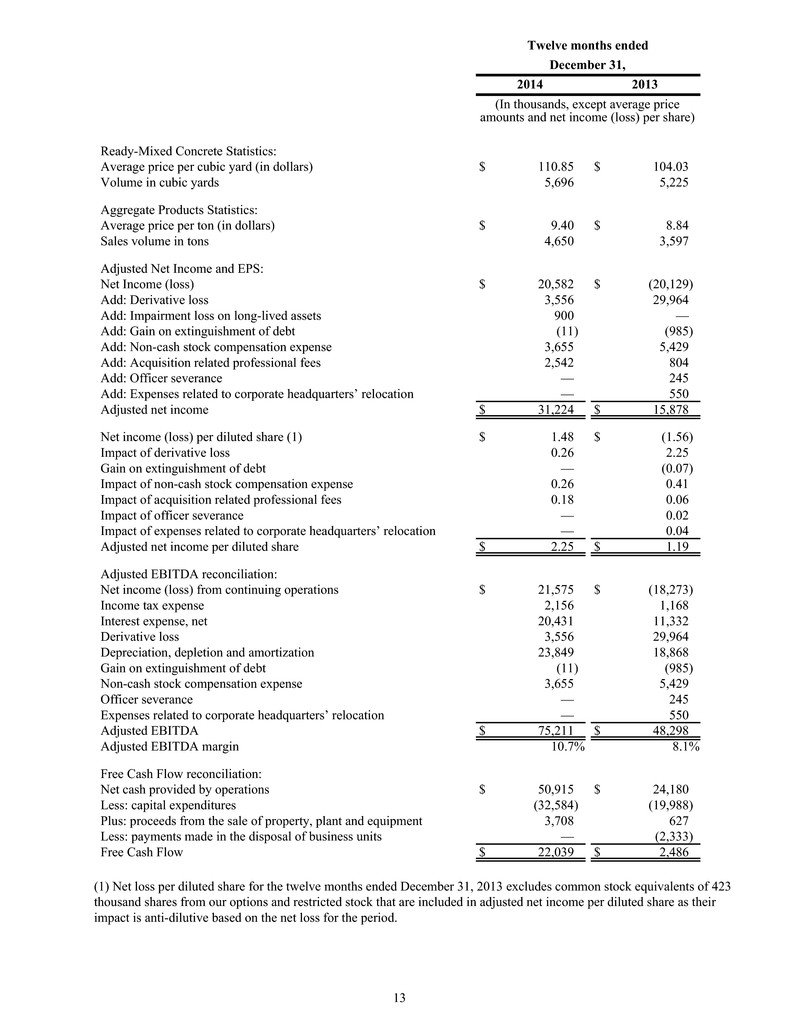

13 Twelve months ended December 31, 2014 2013 (In thousands, except average price amounts and net income (loss) per share) Ready-Mixed Concrete Statistics: Average price per cubic yard (in dollars) $ 110.85 $ 104.03 Volume in cubic yards 5,696 5,225 Aggregate Products Statistics: Average price per ton (in dollars) $ 9.40 $ 8.84 Sales volume in tons 4,650 3,597 Adjusted Net Income and EPS: Net Income (loss) $ 20,582 $ (20,129) Add: Derivative loss 3,556 29,964 Add: Impairment loss on long-lived assets 900 — Add: Gain on extinguishment of debt (11) (985) Add: Non-cash stock compensation expense 3,655 5,429 Add: Acquisition related professional fees 2,542 804 Add: Officer severance — 245 Add: Expenses related to corporate headquarters’ relocation — 550 Adjusted net income $ 31,224 $ 15,878 Net income (loss) per diluted share (1) $ 1.48 $ (1.56) Impact of derivative loss 0.26 2.25 Gain on extinguishment of debt — (0.07) Impact of non-cash stock compensation expense 0.26 0.41 Impact of acquisition related professional fees 0.18 0.06 Impact of officer severance — 0.02 Impact of expenses related to corporate headquarters’ relocation — 0.04 Adjusted net income per diluted share $ 2.25 $ 1.19 Adjusted EBITDA reconciliation: Net income (loss) from continuing operations $ 21,575 $ (18,273) Income tax expense 2,156 1,168 Interest expense, net 20,431 11,332 Derivative loss 3,556 29,964 Depreciation, depletion and amortization 23,849 18,868 Gain on extinguishment of debt (11) (985) Non-cash stock compensation expense 3,655 5,429 Officer severance — 245 Expenses related to corporate headquarters’ relocation — 550 Adjusted EBITDA $ 75,211 $ 48,298 Adjusted EBITDA margin 10.7% 8.1% Free Cash Flow reconciliation: Net cash provided by operations $ 50,915 $ 24,180 Less: capital expenditures (32,584) (19,988) Plus: proceeds from the sale of property, plant and equipment 3,708 627 Less: payments made in the disposal of business units — (2,333) Free Cash Flow $ 22,039 $ 2,486 (1) Net loss per diluted share for the twelve months ended December 31, 2013 excludes common stock equivalents of 423 thousand shares from our options and restricted stock that are included in adjusted net income per diluted share as their impact is anti-dilutive based on the net loss for the period.