Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PATTERSON UTI ENERGY INC | d883447d8k.htm |

Raymond James

36

th

Annual Institutional Investors Conference

March 3-4, 2015

Exhibit 99.1 |

Forward Looking Statements

2

This material and any oral statements made in connection with this material

include "forward-looking statements" within the meaning of

the Securities Act of 1933 and the Securities Exchange Act of

1934. Statements made which provide the Company’s or

management’s intentions, beliefs, expectations or predictions for

the future are forward-looking statements and are inherently uncertain. The

opinions, forecasts, projections or other statements other than

statements of historical fact, including, without limitation, plans and

objectives of management of the Company are forward-looking

statements. It is important to note that actual results could

differ materially from those discussed in such forward-looking

statements. Important factors that could cause actual results to differ

materially include the risk factors and other cautionary statements

contained from time to time in the Company’s SEC filings, which may

be obtained by contacting the Company

or

the

SEC.

These

filings

are

also

available

through

the

Company’s

web

site

at

http://www.patenergy.com

or

through

the

SEC’s

Electronic

Data

Gathering

and

Analysis

Retrieval

System

(EDGAR)

at

http://www.sec.gov.

We

undertake

no

obligation to publicly update or revise any forward-looking

statement. Statements made in this presentation include

non-GAAP financial measures. The required reconciliation to

GAAP financial measures are included on our website and at the end of

this presentation. |

Patterson-UTI Energy is a leading

provider of contract drilling and

pressure pumping services

3 |

Contract Drilling

•

High quality fleet of land drilling

rigs including 149 APEX

®

rigs

•

Leader in walking rig technology for

pad drilling applications

•

Large footprint across North

American drilling markets

Patterson-UTI reported results for the year ended December 31, 2014

4

Pressure

Pumping

41%

Oil &

Natural

Gas

1%

Contract

Drilling

58%

Components of Revenue |

Pressure Pumping

•

High quality fleet of modern pressure

pumping equipment

•

A leader in natural gas bi-fuel

technology

•

Strong reputation for regional

knowledge and efficient operations

Patterson-UTI reported results for the year ended December 31, 2014

5

Pressure

Pumping

41%

Oil &

Natural

Gas

1%

Contract

Drilling

58%

Components of Revenue |

Contract Drilling |

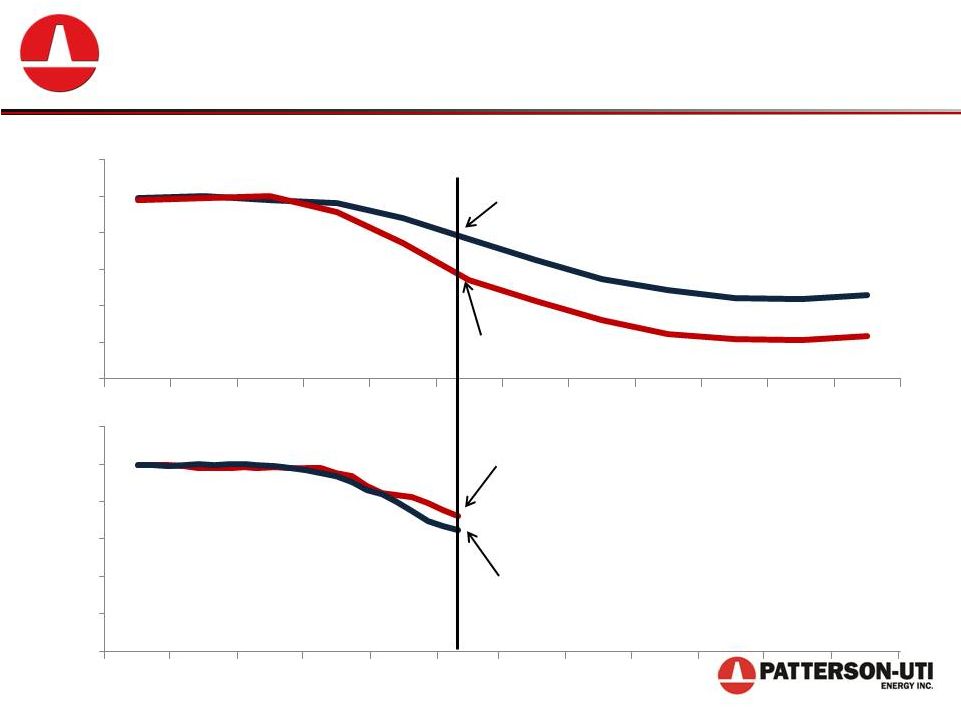

Improved Performance

2008 -

2009

Total Baker Hughes U.S. Land Rig Count: -23%

Total PTEN U.S. Rig Count: -

46%

2014 -

2015

Total PTEN U.S. Rig Count: -28%

Total Baker Hughes U.S. Land Rig Count: -35%

Baker Hughes and Patterson-UTI U.S. Land Rig Counts as of February 27, 2015

0%

20%

40%

60%

80%

100%

120%

U.S. Rig Count Downturn

0%

20%

40%

60%

80%

100%

120% |

A Rig Fleet Transformation

8

Mechanical

Patterson-UTI Energy Total Rig Fleet

Mechanical

December 2009

Projected December 2015

Other

Electric

APEX®

Other

Electric

APEX® |

…and Expected as of December 31, 2015

APEX-XK

1500™

APEX-XK

1000™ APEX

WALKING ®

APEX 1500

®

APEX 1000

®

Total APEX

®

Rigs

Class

APEX

®

Rigs as of March 3, 2015

53

4

49

44

11

161

12/31/2015

A leader in high specification drilling rigs

41

4

49

44

11

149

3/3/2015

APEX

®

Rig Fleet

9 |

Permian Basin

32 Rigs

Large Geographic Footprint

10

PTEN’s Active U.S. Land Drilling Rigs

as of February 27, 2015

Appalachia

35 Rigs

East Texas

14 Rigs

Mid-Continent

16 Rigs

South Texas

32 Rigs

Rockies

26 Rigs |

Patterson-UTI Energy

…the impact of APEX®

rigs has been transformative! |

Increasing APEX

®

Drilling Activity

12

Active APEX

®

Rig Count

0

20

40

60

80

100

120

140

160 |

PTEN Relative Active Rig Count by Rig Class

13

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

APEX®

Other Electric

Mechanical |

Greater Stability of Utilization

14

APEX

®

Rig Utilization

0%

20%

40%

60%

80%

100%

120% |

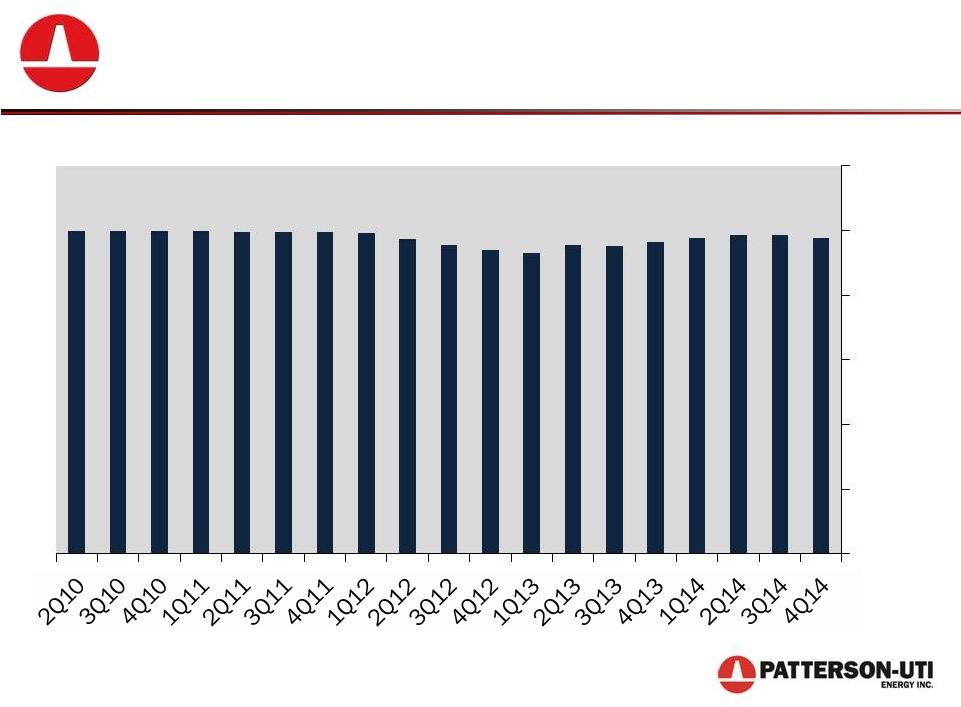

Improving Average Rig Revenue Per Day

15

Patterson-UTI Total Average Rig Revenue Per Day

Excludes

early-termination

revenues

during

the

third

and

fourth

quarter

of

2013

of

$3,600

per

day

and

$130

per day, respectively.

10,000

12,000

14,000

16,000

18,000

20,000

22,000

24,000

26,000 |

Adjusted EBITDA Contribution from High

Specification Rigs

16

Preferred rigs account for approximately

89% of Adjusted EBITDA in Contract Drilling

APEX®

&

Other

Electric

Mechanical

2010

2011

2012

2013

2014

Excludes early-termination revenues during the third and fourth quarter of

2013 of $62.8 million and $2.4 million, respectively. |

Patterson-UTI Energy

…the APEX®

rig outlook remains strong! |

18

U.S. Rig Count % by Drilling Type

Continued Demand for APEX

®

Rigs

Source: Baker Hughes North America Rotary Rig Count

0%

10%

20%

30%

40%

50%

60%

70%

80%

% Horizontal

% Vertical |

AC-powered rigs have increased as a

percentage of the horizontal rig count

Total U.S. Horizontal Rig Count by Power Type

Continued Demand for APEX

®

Rigs

Analysis from Patterson-UTI Energy based on data from RigData and company

filings. 19

SCR

AC

Mechanical |

Patterson-UTI Energy

…Patterson-UTI is a technology leader!

|

APEX WALKING

®

Rigs

21

•

Capable of walking with drill pipe

and collars racked in the mast

•

Full multi-directional walking

capability

•

Walking times average 45 minutes

for 10’

–

15’

well spacing

http://patenergy.com/drilling/technology/apexwalk

21 |

Strong Demand for Pad Drilling

22

•

Pad drilling is contributing to

increasing rig efficiency

•

Pad drilling capable rigs are

highly utilized

•

Most new APEX

®

rigs are

expected to have walking

systems

http://patenergy.com/drilling/technology

22 |

APEX-XK™

Rig Walking on Pad

23

http://patenergy.com/drilling/technology/apexwalk/

Video of

APEX-XK™

Rig

23 |

The APEX-XK

™

24

•

Enhanced mobility including more

efficient rig up and rig down

•

Greater clearance under rig floor for

optional walking system

•

Advanced environmental spill

control integrated into drilling floor

•

Minimized number of truck loads for

rig moves

•

Available in both 1500 HP and 1000

HP

http://patenergy.com/drilling/technology

24 |

Enhancing our Position in Pad Drilling

25

Walking Systems Can be Added to Any Rig in Our Fleet…

…Allowing for True Multi-Directional Pad Drilling Capabilities

25 |

Enhancing our Position in Pad Drilling

26

http://patenergy.com/drilling/technology

26 |

Early Adopter of Natural Gas Engines

27

http://patenergy.com/drilling/technology

27 |

Using Natural Gas as a Fuel Source

28

•

First contract driller to use GE’s

Waukesha natural gas engines on

a modern land rig

•

54 rigs currently configured to use

natural gas as the primary fuel

source including 10 natural gas

powered rigs and 44 bi-fuel

capable rigs

•

We plan to add bi-fuel systems to

four contracted new APEX

®

rigs to

be completed in 2015

•

Natural gas powered rigs can

result in up to 80% lower fuel

costs

http://patenergy.com/drilling/technology

28 |

Pressure Pumping |

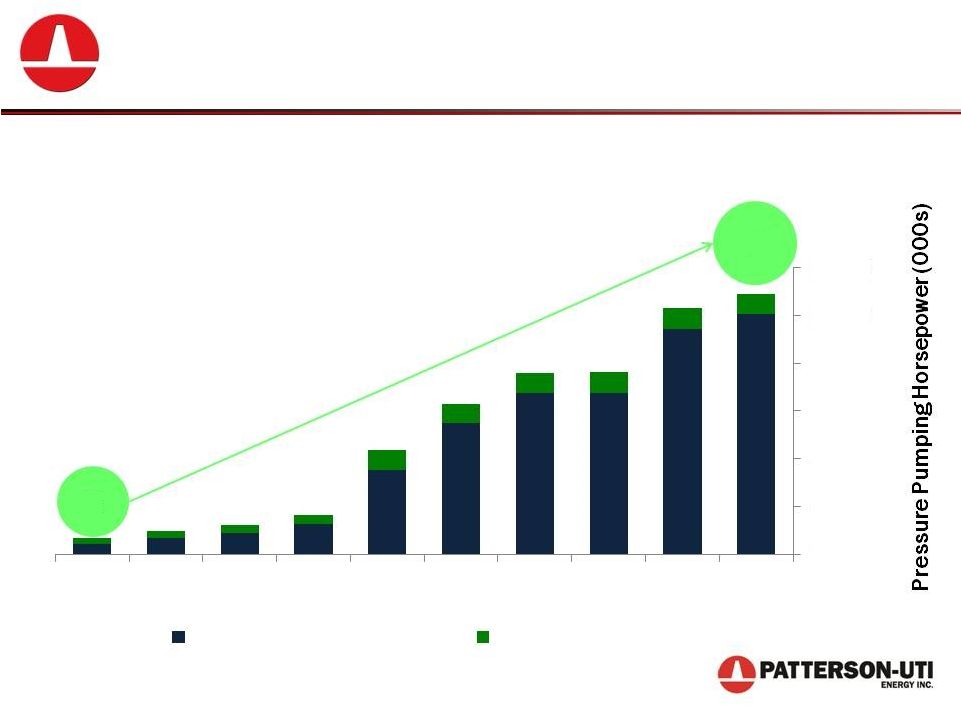

Growing Pressure Pumping Business

30

Investments in Pressure Pumping…

…Have Increased Fleet Size and Quality

65

1,100

0

200

400

600

800

1000

1200

2006

2007

2008

2009

2010

2011

2012

2013

2014

June

2015E

Year End

Fracturing Horsepower

Other Horsepower |

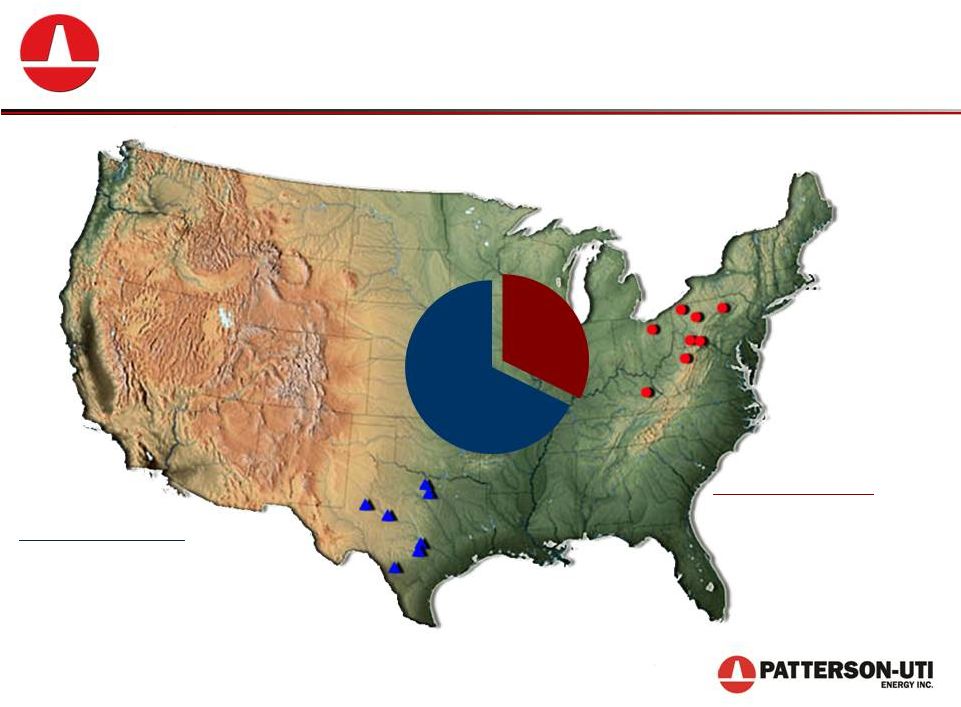

Fracturing horsepower: 638,800

Other horsepower: 32,165

Fracturing horsepower: 303,800

Other horsepower: 54,700

A Significant Player in Regional Markets

Pressure Pumping Areas

31

Horsepower distribution as of December 31, 2014

32%

68%

Fracturing Horsepower

Southwest Region:

Northeast Region: |

A Leader in Bi-Fuel Technology

•

Engines can burn a fuel mix

comprised of up to 70% natural

gas

•

Comparable torque and

horsepower to an all diesel engine

•

Reduces operating costs by

lowering fuel costs

•

Good for environmental

sustainability

http://patenergy.com/pressurepumping/services

32 |

A Leader in Bi-Fuel Technology

33

http://patenergy.com/pressurepumping/services

33 |

A Leader in Bi-Fuel Technology

34

•

One of the largest bi-fuel frac

fleets in the Marcellus

•

Approximately 1,800 stages

completed using natural gas as a

fuel source

•

Replaced approximately 1.2

million gallons of diesel with

cleaner burning natural gas

•

Eliminated 9.0 million pounds of

transportation loads on local

roads

http://patenergy.com/pressurepumping/services

34 |

Comprehensive Lab Services

http://patenergy.com/pressurepumping/services

35 |

Financial Flexibility |

Investing in Our Company

37

Capital Expenditures and Acquisitions

($ in millions)

2015 Capital expenditure forecast as of February 5, 2015

$598

$637

$445

$453

$976

$1,012

$974

$662

$1,229

$750

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015E |

Strong Financial Position

38

•

History of returning capital to investors

–

Cash Dividend

•

Initiated cash dividend in 2004

•

Doubled quarterly cash dividend to $0.10 per share in

February 2014

–

Stock Buyback

•

Total of $857 million repurchased since 2005

•

Approximately $187 million remaining authorization as of

December 31, 2014

•

Returned approximately $1.3 billion to shareholders

since 2005 |

Strong Financial Position

39

Total Liquidity

($ in millions)

Liquidity defined as end of period cash plus availability under revolving line

of credit *

Subsequent to December 31, 2014, we received an $82 million federal income tax

refund. The refund, along with other cash generated was used to

repay $103 million outstanding under our revolving line of credit. As of

February 10, 2015, availability under the revolving credit facility was $260

million. 2006

2007

2008

2009

2010

2011

2012

2013

2014

Pro Forma

2014*

Year End

Line of Credit Availability

Cash |

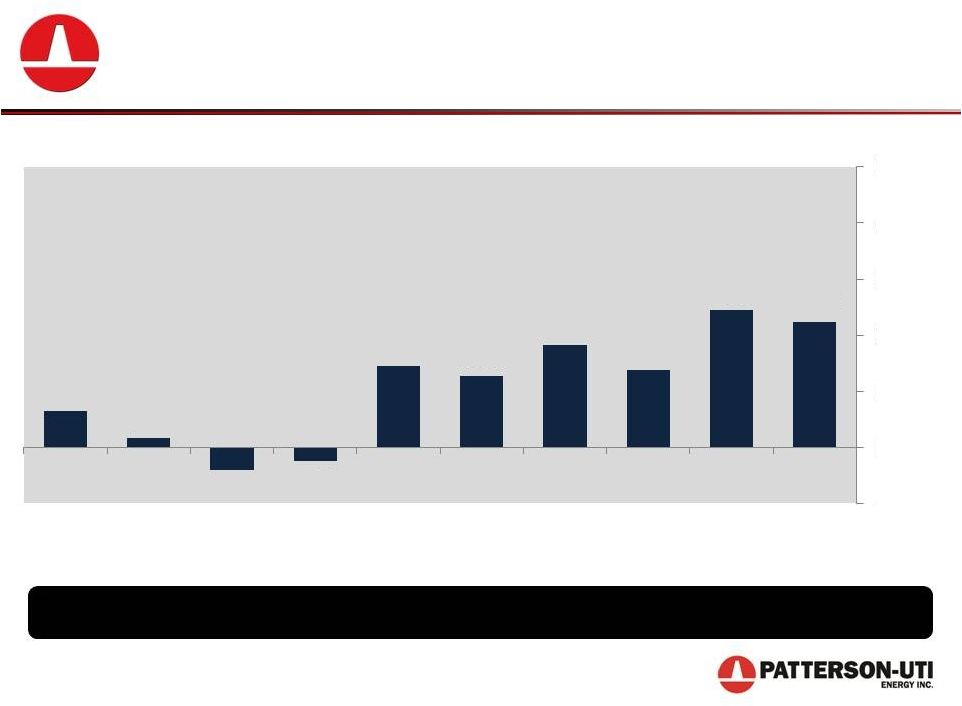

Strong Financial Position

40

Net Debt to Capital Ratio

$600 million of debt not due until at least 2020

*

Subsequent to December 31, 2014, we received an $82 million federal income tax

refund. The refund, along with other cash generated was used to

repay $103 million outstanding under our revolving line of credit. As of

February 10, 2015, availability under the revolving credit facility was $260

million. 6%

2%

-4%

-2%

15%

13%

18%

14%

24%

22%

-10%

0%

10%

20%

30%

40%

50%

2006

2007

2008

2009

2010

2011

2012

2013

2014

Pro Forma

2014*

Year End |

Why Invest in Patterson-UTI Energy?

•

Continuing Transformation

–

Committed to high-spec land rigs where

demand remains strong

–

Creating value through focus on well

site execution

•

Technology leader

–

Leader in walking rigs for pad drilling

–

Innovator in use of natural gas as a fuel

source for both drilling and pressure

pumping

•

Financially flexible

–

Strong balance sheet

–

History of share buybacks

–

Dividends

41 |

Raymond James

36

th

Annual

Institutional

Investors

Conference

March 3-4, 2015 |

43

Contract Drilling Capital Expenditures and Acquisitions

($ in millions)

Investing in Our Drilling Rig Fleet

More than $5 billion invested since 2005

2015 Capital expenditure forecast as of February 5, 2015

$531

$540

$361

$395

$656

$785

$745

$505

$772

$525

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015E |

Investing in Pressure Pumping

44

Pressure Pumping Capital Expenditures and Acquisitions

($ in millions)

More Than $1.4 billion invested since 2005

2015 Capital expenditure forecast as of February 5, 2015

$41

$48

$61

$43

$289

$198

$194

$123

$418

$200

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015E |

Term Contract Coverage

45

Based on term contracts in place as of February 5, 2015

An average of 138 rigs expected under term contract in the first

quarter of 2015

An average of 104 rigs expected under term contract during

2015

Drilling term contract revenue backlog of $1.5 billion at

December 31, 2014

Due to market conditions, we have received, and expect to

continue to receive, notice from some customers to

terminate term contracts. The receipt of early termination

payments will result in earlier than planned cash inflows and

reduced term contract revenue backlog. |

Strong Financial Position

•

Total liquidity of approximately $200 million*

–

$43.0 million of cash at December 31, 2014

–

$157 million revolver availability at December 31, 2014*

•

$942.5 million net debt at December 31, 2014*

–

24.5% Net Debt/Total Capitalization*

–

$300 million of 4.97% Series A notes due October 5, 2020

–

$300 million of 4.27% Series B notes due June 14, 2022

–

$82.5 million of 5-year term loan

–

$303 million outstanding under revolving line of credit

•

No equity sales in last 14 years

•

Reduced share count by 26.0 million shares since 2005

46

*

Subsequent to December 31, 2014, we received an $82 million federal income tax

refund. The refund, along with other cash generated was used to

repay $103 million outstanding under our revolving line of credit. As of

February 10, 2015, availability under the revolving credit facility was $260

million. |

PATTERSON-UTI ENERGY, INC.

Non-GAAP Financial Measures (Unaudited)

(dollars in thousands)

Non-GAAP Financial Measures

47

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2014

2013

2014

2013

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization

(Adjusted EBITDA)(1):

Net income

$

57,583

$

16,591

$

162,664

$

188,009

Income tax expense

41,216

9,475

91,619

108,432

Net interest expense

8,034

6,947

28,846

27,441

Depreciation, depletion, amortization and impairment

180,157

183,118

718,730

597,469

Adjusted EBITDA

$

286,990

$

216,131

$1,001,859

$

921,351

Total revenue

$

901,219

$

658,772

$3,182,291

$2,716,034

Adjusted EBITDA margin

31.8%

32.8%

31.5%

33.9%

Adjusted EBITDA by operating segment:

Contract drilling

$

208,200

$

172,178

$

765,874

$

704,990

Pressure pumping

78,763

45,757

236,676

217,228

Oil and natural gas

7,671

8,757

37,094

44,348

Corporate and other

(7,644)

(10,561)

(37,785)

(45,215)

Consolidated Adjusted EBITDA

$

286,990

$

216,131

$1,001,859

$

921,351

(1)

The company makes use of financial measures that are not calculated in

accordance with U.S. generally accepted accounting principles (“GAAP”) to help in the

assessment of ongoing operating performance. These non-GAAP financial

measures are reconciled to their most directly comparable GAAP measures in the tables

above. We define Adjusted EBITDA as net income plus net interest expense,

income tax expense and depreciation, depletion, amortization and impairment

expense. We present Adjusted EBITDA because we believe it provides additional

information with respect to both the performance of our fundamental business

activities and our ability to meet our capital expenditures and working capital

requirements. Adjusted EBITDA is not defined by GAAP and, as such, should not be

construed as an alternative to net income (loss) or operating cash flow. We

define margin as revenues less direct operating costs. We present margin because we

believe it to be the component of our earnings most impacted by the variability

in our contract drilling and pressure pumping operations. Margin is not defined by

GAAP and, as such, should not be construed as an alternative to net income

(loss). |

Non-GAAP Financial Measures

48

2014

2013

2012

2011

2010

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization

(Adjusted EBITDA)(1):

Net income (loss)

$

162,664

$

188,009

$

299,477

$

322,413

$

116,942

Income tax expense (benefit)

91,619

108,432

176,196

187,938

72,856

Net interest expense (income)

28,846

27,441

22,196

15,465

11,098

Depreciation, depletion, amortization and impairment

718,730

597,469

526,614

437,279

333,493

Net impact of discontinued operations

-

-

-

(209)

1,778

Adjusted EBITDA

$

1,001,859

$

921,351

$

1,024,483

$

962,886

$

536,167

Total revenue

$

3,182,291

$

2,716,034

$

2,723,414

$

2,565,943

$

1,462,931

Adjusted EBITDA margin

31.5%

33.9%

37.6%

37.5%

36.7%

PATTERSON-UTI ENERGY, INC.

Non-GAAP Financial Measures (Unaudited)

(dollars in thousands)

The company makes use of financial measures that are not calculated in

accordance with U.S. generally accepted accounting principles (“GAAP”) to help in the

assessment of ongoing operating performance. These non-GAAP financial

measures are reconciled to their most directly comparable GAAP measures in the tables above.

We define Adjusted EBITDA as net income plus net interest expense, income tax

expense and depreciation, depletion, amortization and impairment expense. We present

Adjusted EBITDA because we believe it provides additional information with

respect to both the performance of our fundamental business activities and our ability to meet

our capital expenditures and working capital requirements. Adjusted EBITDA is

not defined by GAAP and, as such, should not be construed as an alternative to net income

(loss) or operating cash flow. We define margin as revenues less direct

operating costs. We present margin because we believe it to be the component of our earnings

most impacted by the variability in our contract drilling and pressure pumping

operations. Margin is not defined by GAAP and, as such, should not be construed as an

alternative to net income (loss).

(1) |