Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - EPIQ SYSTEMS INC | Financial_Report.xls |

| EX-31.1 - EX-31.1 - EPIQ SYSTEMS INC | a2223052zex-31_1.htm |

| EX-32.1 - EX-32.1 - EPIQ SYSTEMS INC | a2223052zex-32_1.htm |

| EX-21.1 - EX-21.1 - EPIQ SYSTEMS INC | a2223052zex-21_1.htm |

| EX-23.1 - EX-23.1 - EPIQ SYSTEMS INC | a2223052zex-23_1.htm |

| EX-31.2 - EX-31.2 - EPIQ SYSTEMS INC | a2223052zex-31_2.htm |

| XML - IDEA: XBRL DOCUMENT - EPIQ SYSTEMS INC | R9999.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2014 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number 001-36633

EPIQ SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Missouri | 48-1056429 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

501 Kansas Avenue, Kansas City, Kansas |

66105-1300 |

|

| (Address of principal executive offices) | (Zip Code) |

913-621-9500

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act

| Title of each class | Name of exchange on which registered | |

|---|---|---|

| Common Stock, $0.01 par value | The NASDAQ Stock Market, LLC | |

| Preferred Stock Purchase Rights | The NASDAQ Stock Market, LLC |

Securities

registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of voting common stock held by non-affiliates of the registrant based upon the last reported sale price on June 30, 2014, was $438 million. There were 37,041,224 shares of common stock, $0.01 par value, outstanding at February 23, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of Form 10-K is incorporated herein by reference to the registrant's definitive Proxy Statement relating to its 2015 Annual Meeting of Shareholders, which will be filed with the Commission within 120 days after the end of the registrant's fiscal year.

This report contains statements that relate to future events and expectations and, as such, constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, any projection or expectation of earnings, revenue or other financial items; the plans, strategies and objectives of management for future operations; factors that may affect our operating results; effects of current or future economic conditions or performance; industry trends; expectations regarding the current review process of strategic and financial alternatives; and other matters that do not relate strictly to historical facts or statements of assumptions underlying any of the foregoing. Forward-looking statements are subject to a number of known and unknown risks, uncertainties and other factors and are not guarantees of future performance. Actual results, performance or outcomes may differ materially from those expressed in or implied by those forward-looking statements. Many of these statements are found in the "Business" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of this report.

Forward-looking statements may be identified by words or phrases such as "believe," "expect," "anticipate," "should," "planned," "projected," "forecasted," "may," "estimated," "goal," "objective," "seeks," and "potential," and variations of these words and similar expressions or negatives of these words. Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, provide a "safe harbor" for forward-looking statements. In order to comply with the terms of the safe harbor, and because forward-looking statements involve future risks and uncertainties, Item 1A, "Risk Factors" of this report lists a variety of factors that could cause actual results and experience to differ materially from the anticipated results or other expectations expressed in our forward-looking statements. Such forward-looking statements speak only as of the date of this Form 10-K. We undertake no obligation to update publicly or revise any forward-looking statements contained in this report or in future communications to reflect future events or developments, except as required by law.

Unless expressly indicated or the context requires otherwise, the terms "Epiq," "Company," "we," "us," and "our" in this report refer to Epiq Systems, Inc., and where appropriate, to one or more of our wholly owned subsidiaries.

Company Overview

Epiq is a leading global provider of integrated technology solutions for the legal profession. We combine proprietary software, deep subject matter expertise, highly responsive customer service and a global infrastructure to assist our clients with the technology requirements for complex matters. We offer these capabilities across a variety of practice areas including bankruptcy, litigation, class action, antitrust, investigations and regulatory compliance. Our solutions are designed to streamline the administration of bankruptcy, litigation, investigations, financial transactions and regulatory compliance matters. We offer innovative managed technology solutions for eDiscovery, document review, legal notification, claims administration and controlled disbursement of funds.

Our team includes former practicing litigators, bankruptcy attorneys, plaintiff's counsel, defense counsel, eDiscovery counsel and other professionals who are leaders in their areas of expertise. While we do not offer clients legal advice (because we are not a law firm), we draw heavily from our subject matter expertise in the legal profession to assist clients in achieving the best outcome on each project on which we are retained.

Our clients include top tier law firms, the in-house legal departments of major corporations, trustees, specialty fiduciaries and other professionals. Among law firms, we work extensively with Am Law 100 firms in the U.S., Magic Circle firms in the U.K. and leading boutique or specialty law firms in most geographies. Among corporate clients, we have substantial relationships with large, multinational companies in a variety of industries, including financial services, pharmaceuticals, insurance, technology and others. The global nature of our business continues to grow. With full-service offices (i.e., locations having a data center, on-site technical staff, on-site project management capabilities and local consulting capacities) around the world, Epiq offers a geographic reach to support client relationships wherever we are needed.

We were incorporated in the State of Missouri on July 13, 1988, and on July 15, 1988 acquired all of the assets of an unrelated predecessor corporation.

Additional information is incorporated herein by reference to Part II, Item 7. Management's Discussion and Analysis.

Financial Information About Segments

Our operating business is organized into two reportable segments: the Technology segment ("Technology") and the Bankruptcy and Settlement Administration segment ("Bankruptcy and Settlement Administration").

Segment revenue, a performance measure of profit and additional financial data, and commentary on recent financial results for reportable segments are provided in the Results of Operation in Part II, Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations" and in Note 14 to the Consolidated Financial Statements.

IT Capabilities

Our software and IT capabilities include significant in-house fulfillment capabilities. Our office locations in New York, Kansas City and Portland have internal abilities for high-speed printing and

1

mailing, call center operations, and disbursement and tax records preparation. The combination of software, IT and fulfillment resources enables Epiq to act as a single-source solution for even the largest, most complex matters in the markets where we compete.

Network infrastructure is an essential component of our technology strategy because most of our software is utilized by our customers within a hosted environment and we manage a high volume of client data. A single large client engagement may entail over 100 million documents or 100 terabytes of information and may include complex structured data (i.e., databases) and unstructured data (e.g., email archives). We operate eDiscovery data centers in the United States, Canada, China, Hong Kong, Japan and the United Kingdom. Our data centers provide reliable, secure access to our software environments and to customer databases. Information security is of paramount importance in any managed technology business, and Epiq incorporates best practices designed to protect sensitive customer data.

Trademarks and Patents

Our trademarks, service marks, and registered marks include, without limitation, AACER®, MY AACER®, AACER EXTRA EDITION®, Extra Edition®, Epiq AnalyticsSM, Epiq Access™, Epiq®, EPIQ LOGO®, Epiq Mailing CenterSM, Epiq Noticing CenterSM, Epiq Systems®, EPIQ SYSTEMS LOGO®, Bankruptcy Link®, Case Power®, CasefilePRO®, ClaimsMatrix®, CreditorMatrix®, Claims FacilitatorSM, Digital Practice®, DebtorMatrix®, DocuMatrix®, DMX™, DMXSM, DMX Mobile™, DMX MobileSM, DocuMatrix MobileSM, DocuMatrix Mobile™, Documatrix MobileSM, eDataMatrix®, eDataMatrixSM, eMax®, Encore Discovery Solutions®, Encore Discovery Solutions Knowledge. Innovation. Results LOGO®, Encore Legal Solutions®, Encore Lex Solutio®, IQ Review®, LegalMatrix®, LoanMatrix®, Q™, Q LOGO™, MINUS –10 0X SOFTWARE LOGO®, TCMS®, and TCMSWeb®. The trademarks and service marks (denoted by ™ and SM) have been filed but are not yet registered and do not include common law marks; the registered marks (denoted by ®) have remaining durations ranging from 2015 through 2024. Our patents include Epiq eDiscovery Solutions, Inc.: U.S. Patent No. 7,496,556 and Epiq eDiscovery Solutions, Inc., U.S. Patent Application Number 13/528,049, filed June 20, 2012, patent pending.

Narrative Description of Business

Technology

Our Technology segment provides eDiscovery managed services and technology solutions comprised of consulting, collections and forensics, processing, search and review, production of documents and document review services to companies and law firms. Our eDataMatrix® and third-party software analyzes, filters, removes duplicates and produces documents for review. Documents are made available primarily through a hosted environment, and our DocuMatrix® and third-party software allow for efficient attorney review and data requests. Our customers are typically large corporations that use our products and services cooperatively with their legal counsel to manage the eDiscovery process for litigation, investigations, anti-trust filings and regulatory matters, and data requests.

The substantial volume of electronic documents and other data used by businesses has changed the dynamics of how attorneys support discovery in complex litigation, investigations and data requests. Due to the complexity of matters, the volume of data that is maintained electronically, and the volume of documents that is produced, law firms have become increasingly reliant on electronic evidence management systems to organize and manage the litigation discovery process.

Following is a description of the significant sources of revenue in our Technology segment.

- •

- Consulting, forensics and collection service fees based on the number of hours that services are provided.

2

- •

- Fees related to the conversion of data into an organized, searchable electronic database. The amount earned varies primarily on the

number of documents produced or volume of data processed.

- •

- Hosting fees based on the amount of data stored.

- •

- Document review fees based on the number of hours spent reviewing documents, the number of pages reviewed, or the amount of data reviewed.

Bankruptcy and Settlement Administration

Our Bankruptcy and Settlement Administration segment provides managed services and technology solutions that address the needs of our customers with respect to litigation, claims and project administration, compliance matters, controlled disbursements, corporate restructuring, bankruptcy, class action and mass tort proceedings.

Bankruptcy is an integral part of the United States' economy. As of the most recently reported data by the Administrative Office of the U.S. Courts for the fiscal years ended December 31, 2014, 2013 and 2012 there were approximately 0.94 million, 1.07 million and 1.22 million new bankruptcy filings, respectively.

- •

- Total bankruptcy filings for the year ended December 31, 2014 decreased 12% versus the year ended December 31, 2013.

During the year ended December 31, 2014, Chapter 7 filings decreased 15%, Chapter 11 filings decreased 19% and Chapter 13 filings decreased 7%.

- •

- Total bankruptcy filings for the year ended December 31, 2013 decreased 12% versus the year ended December 31, 2012. During the year ended December 31, 2013, Chapter 7 filings decreased 14%, Chapter 11 filings fell 13% and Chapter 13 filings decreased 9%.

This segment provides solutions that address the needs of Chapter 7, Chapter 11 and Chapter 13 bankruptcy trustees to administer bankruptcy proceedings and of debtor corporations that file a plan of reorganization.

- •

- Chapter 7 is a liquidation bankruptcy for individuals or businesses that, as measured by the number of new cases filed in the

year ended December 31, 2014, accounted for approximately 66% of all bankruptcy filings. In a Chapter 7 case, the debtor's assets are liquidated and the resulting cash proceeds

are used by the Chapter 7 bankruptcy trustee to pay creditors. Chapter 7 cases typically last several years.

- •

- Chapter 11 is a reorganization model of bankruptcy for corporations that, as measured by the number of new cases filed in the

year ended December 31, 2014, accounted for less than 1% of all bankruptcy filings. Chapter 11 generally allows a company, often referred to as the debtor-in-possession, to continue

operating under a plan of reorganization to restructure its business and to modify payment terms of both secured and unsecured obligations. Chapter 11 bankruptcy engagements are generally

long-term, multi-year assignments that provide revenue visibility into future periods.

- •

- Chapter 13 is a reorganization model of bankruptcy for individuals that, as measured by the number of new cases filed in the year ended December 31, 2014, accounted for approximately 33% of all bankruptcy filings. In a Chapter 13 case, debtors make periodic cash payments into a reorganization plan and a Chapter 13 bankruptcy trustee uses these cash payments to make monthly distributions to creditors. Chapter 13 cases typically last between three and five years.

We provide our Chapter 7 products and services to our trustee customers at no direct charge, and they maintain deposit accounts for bankruptcy cases under their administration at a designated banking

3

institution. We have arrangements with various banks under which we provide the bankruptcy trustee case management software and related services, and the bank provides the bankruptcy trustee with deposit-related banking services.

Our trustee services deposit portfolio averaged approximately $1.7 billion for both 2014 and 2013, and our interest-based deposit fees continued at low pricing levels under our agreements due to the low short-term interest rate environment.

The key participants in a bankruptcy proceeding include the debtor-in-possession, the debtor's legal counsel, the creditors, the creditors' legal counsel, and the bankruptcy judge. Chapter 7 and Chapter 13 cases also include a professional bankruptcy trustee, who is responsible for administering the bankruptcy case. The end-user customers of our Chapter 7 and Chapter 13 bankruptcy services and products, including TCMS ® and Case Power ® case management solutions, are professional bankruptcy trustees, and of our Chapter 11 services and products, including DebtorMatrix®, are debtor corporations that file a plan of reorganization. The Executive Office for United States Trustees, a division of the United States Department of Justice, appoints all bankruptcy trustees. A United States trustee is appointed in most federal court districts and generally has responsibility for overseeing the integrity of the bankruptcy system. The bankruptcy trustee's primary responsibilities include liquidating the debtor's assets or collecting funds from the debtor, distributing the collected funds to creditors pursuant to the orders of the bankruptcy court and preparing regular status reports for the Executive Office for United States Trustees and for the bankruptcy court. Trustees manage an entire caseload of bankruptcy cases simultaneously.

Our proprietary software product, AACER® (Automated Access to Court Electronic Records) ("AACER®"), assists creditors including banks, mortgage processors and their administrative services professionals to streamline processing of their portfolios of loans in bankruptcy cases. AACER® electronically monitors developments in all United States bankruptcy courts and applies sophisticated algorithms to classify docket filings automatically in each case to facilitate the management of large bankruptcy claims operations. By implementing AACER®, clients achieve greater accuracy in faster timeframes, with significant cost savings compared to manual attorney review of each case in the portfolio. Banking PortalTM, a centralized hub for processing online banking transactions across Epiq's family of Chapter 7 products, facilitates the rapid on-boarding of new banks and provides e-banking capabilities.

Class action refers to litigation in which class representatives bring a lawsuit against a defendant company or other persons on behalf of a large group of similarly affected persons. Mass tort refers to class action cases that are particularly large or prominent. Class action and mass tort litigation is often complex and the cases, including administration of any settlement, may last several years. Key participants in this marketplace include law firms that specialize in representing class action and mass tort plaintiffs and other law firms that specialize in representing defendants.

Following is a description of the significant sources of revenue in our Bankruptcy and Settlement Administration segment.

- •

- Professional service fees and other support service fees contingent upon the month-to-month delivery of services such as data

conversion, claims processing, claims reconciliation, project management, professional services, call center support, website development and administration, and controlled disbursements. The amount

we earn varies primarily on the size and complexity of the engagement.

- •

- Deposit-based fees earned on a percentage of Chapter 7 assets placed on deposit with a designated financial institution by our trustee clients, to whom we provide, at no charge, software licenses, limited hardware and hardware maintenance, and post-contract customer support services. Service fees earned that are based on assets placed on deposit by our trustee

4

- •

- Legal noticing fees for services to parties of interest in bankruptcy, class action, and other administrative matters, including

direct notification and media campaign and advertising management in which we coordinate notification, primarily through print media outlets, to potential parties of interest for a particular client

engagement.

- •

- Data hosting fees and volume-based fees.

- •

- Monitoring and noticing fees earned based on monthly or on-demand requests for information provided through our AACER®

software product.

- •

- Reimbursed expenses, primarily related to postage on mailing services and other pass-through expenses.

clients may vary based on fluctuations in short-term interest rates and changes in service fees assessed on such deposits.

Competition

Technology

The eDiscovery market is highly fragmented, extremely competitive and continuously evolving. Competitors include Kroll Ontrack (Altegrity Inc.), FTI Consulting, Inc., Huron Consulting Group Inc., The Dolan Company, Symantec Corporation, Recommind, Inc., Xerox, Autonomy (Hewlett-Packard), DTI, Inc., and Navigant Consulting, Inc. Competition is primarily based on the quality of service, technology innovations, and price.

Bankruptcy and Settlement Administration

Our bankruptcy services compete in a more mature market. We are one of two primary providers in the Chapter 7 bankruptcy market, along with Bankruptcy Management Solutions, Inc. In the Chapter 11 bankruptcy market, our primary competitors include Kurtzman Carson Consultants LLC (Computershare), Prime Clerk, The Garden City Group, Inc. (Crawford & Company), Donlin Recano & Co., and AlixPartners LLP. In both the Chapter 7 and Chapter 11 markets there are also several smaller competitors. In the Chapter 13 market, our primary competitor is Bankruptcy Software Specialists, LLC. Competition is primarily based on quality of service and technology solutions. Competitors for our AACER® product include American InfoSource and LexisNexis® Banko® Solutions.

The primary competitors with our settlement administration business are The Garden City Group, Inc., Rust Consulting, Inc., Kurtzman Carson Consultants LLC (Computershare), and Gilardi & Co LLC, as well as several smaller competitors. Competition is primarily based on the quality of service, technology solutions, and price.

In addition to the competitors mentioned above, certain law firms, accounting firms, management consultant firms, turnaround specialists, and crisis management firms offer products and services that compete with our products and services in each of our segments.

Key competitive factors and the relative strength of our products and services versus our competitors are directly and indirectly affected by our technology solutions, the quality of our services, price, ease of use of our technology solutions, data security, quality of our technical support, reliability, and our domain expertise. Our ability to continually innovate and differentiate our product and service offerings has enabled us to achieve and maintain leadership positions in the various markets that we serve.

5

Sales and Marketing

Our sales executives market our products and services directly to prospective customers and referral law firms through direct sales and longstanding relationships. We focus on attracting and retaining customers by providing exceptional integrated technology solutions and superior customer service. Our client support specialists are responsible for providing ongoing support services for our clients. Our employees attend industry trade shows, speak on panels and participate and conduct educational programs, publish articles and papers, and conduct direct mail campaigns and advertise in trade journals. We maintain a website that clients and potential clients may access to obtain additional information related to solutions we offer.

Government Regulation

Our products and services are not directly regulated by the government. However, our bankruptcy customers are subject to significant regulation under the United States Bankruptcy Code, the Federal Rules of Bankruptcy Procedure and local rules and procedures established by bankruptcy courts. The Executive Office for United States Trustees, a division of the United States Department of Justice, oversees the federal bankruptcy system and establishes administrative rules governing our clients' activities. Class action and mass tort cases, as well as eDiscovery requirements related to litigation, are subject to various federal and state laws, as well as rules of evidence and rules of procedure established by the courts.

The United States Supreme Court approved certain regulations within the Federal Rules of Civil Procedure regarding the discovery in litigation of certain electronically stored information. These regulations have been effective since December 1, 2006. Among other things, these regulations (i) require early attention by parties in litigation to meet and confer regarding discovery issues and to develop a discovery plan that identifies and addresses the parties' electronically stored information, (ii) expand the reach of federal court subpoenas to include electronically stored information, (iii) allow for parties to object to production of electronically stored information that is not reasonably accessible due to the undue burden or cost associated with such retrieval, and (iv) provide a "safe harbor" to parties unable to provide electronically stored information lost or destroyed as a result of the routine, good-faith operation of an electronic information system. While these federal rules do not apply in state court proceedings, the civil procedure rules of many states have been closely modeled on these provisions. We anticipate the federal and state court discovery rules relating to electronic documents and information will continue to evolve and affect the way we develop and implement technology and service solutions to those changing discovery rules.

Employees

As of December 31, 2014, we employed approximately 1,100 full-time employees, none of whom is covered by a collective bargaining agreement. We believe the relationship with our employees is good.

Financial Information About Geographic Areas

For the years ended December 31, 2014, 2013 and 2012, approximately 87%, 89% and 93%, respectively, of our consolidated revenues were generated from services provided within the United States. For each of the years ended December 31, 2014 and 2013, approximately 93% and 96% of our long-lived assets were located within the United States, respectively.

Available Information

Our internet address is www.epiqsystems.com. We make a variety of information available, free of charge, at our Investor Relations website, www.epiqsystems.com/investors.php. This information includes our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q, our Current

6

Reports on Form 8-K, and any amendments to those reports as soon as reasonably practicable after we electronically file those reports with or furnish them to the SEC, as well as our code of ethics and other governance documents.

The public may read and copy materials filed by us with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file documents electronically with the SEC at www.sec.gov.

The contents of these websites, or the information connected to those websites, are not incorporated into this report. References to websites in this report are provided as a convenience and do not constitute, and should not be viewed as, incorporation by reference of the information contained on, or available through, the website.

7

Certain factors may have a material adverse effect on our business, financial condition, and results of operations. You should consider carefully the risks and uncertainties described below, in addition to other information contained in this Annual Report on Form 10-K, including our consolidated financial statements and related notes. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business. If any of the following risks actually occurs, our business, financial condition, results of operations, and future prospects could be materially and adversely affected.

We compete with other third-party providers on the basis of the technological features, capabilities and price of our products and services, and we could lose existing customers and fail to attract new business if we do not keep pace with technological changes and offer competitive pricing for our products and services.

The markets for our products and services are competitive, continually evolving and subject to technological change. We believe that key competitive factors in the markets we serve include the breadth and quality of system and software solution offerings, the stability of our information systems, the features and capabilities of the product and service offerings, the pricing of our products and services, and the potential for future product and service enhancements. Our success depends upon our ability to keep pace with technological change and to introduce, on a timely and cost-effective basis, new and enhanced software solutions and services that satisfy changing client requirements. If we do not keep pace with technological changes, we could lose existing customers and fail to attract new business. Likewise, technology products and services can become more price sensitive over time, and if we are not able to maintain price competitive products and services, we could lose existing customers and fail to attract new customers. The impact of not keeping pace with technological changes or maintaining competitive pricing could adversely affect our results of operations.

Security problems with our systems, software products or services, including the improper disclosure of personal or corporate data, could harm our reputation and cause us to lose existing customers and fail to attract new customers, cause increased cybersecurity protection costs and general service costs, and result in liability and increased expense for litigation and diversion of management time.

We store and process large amounts of our customers' confidential information and personally identifiable information. Our software products enable our customers to store and process personal data and confidential information. We have included security features in our products and processes that are intended to protect the privacy and integrity of data, including confidential client or consumer data. Security is critical given the confidential nature of the information contained in our systems. It is possible that our security controls, our selection and training of employees, and other practices we follow may not prevent the improper disclosure of confidential or personally identifiable information. Such disclosure could harm our reputation and cause us to lose existing customers or fail to attract new customers and subject us to liability in regulatory proceedings and private litigation under laws that protect personal data, resulting in loss of revenue or increased costs. Improper disclosure of personal or corporate data could result in lawsuits or regulatory proceedings alleging damages, and the perception that our products and services do not adequately protect the privacy of personal information and could inhibit sales of our products and services. Defending these types of claims could result in increased expenses for litigation and claims settlement and a significant diversion of our management's attention. Additionally, our software products, the systems on which the products are used, and our processes may not be impervious to intentional break-ins ("hacking"), cyber-attacks or other disruptive disclosures or problems, whether as a result of inadvertent third-party action, employee action, malfeasance, or otherwise. Hacking, cyber-attacks or other disruptive problems could result in the diversion of our development resources, damage to our reputation, increased cybersecurity protection

8

costs and general service costs and impaired market acceptance of our products and services, any of which could result in lower revenues or higher expenses.

Errors or fraud related to our business processes could cause increased expense for litigation and diversion of management attention.

We administer claims, disburse funds, generate and distribute legal notices, provide data productions and provide professional services for third parties. Errors or fraud could occur, for example, in the payment of bankruptcy or settlement claims in a case we are administering. Errors or fraud related to the processing or payment of these claims or errors related to the delivery of professional services could result in the diversion of management resources, damage to our reputation, increased service costs or impaired market acceptance of our services, any of which could result in higher expenses and lower revenues. Additionally, these types of errors or fraud could result in lawsuits alleging damages. Defending these types of claims could result in increased expenses for litigation and claims settlement and a significant diversion of our management's attention.

Interruptions or delays in service at the data centers we utilize could impair the delivery of our service and harm our business.

We provide services through computer hardware that is located in data centers operated by unrelated third parties. We do not control the operation of these facilities, which increases our vulnerability to problems with the services they provide, and they are subject to damage or interruption from earthquakes, floods, fires, power loss, terrorist attacks, telecommunications failures and similar events. These facilities are also subject to break-ins, sabotage, intentional acts of vandalism and similar misconduct. The occurrence of any of these events, a decision to close a facility without adequate notice, or other unanticipated problems at a facility could result in interruptions in certain of our services. In addition, the failure by our vendor to provide our required data communications capacity could result in poor service or interruptions in our service. Any damage to, or failure of, our systems or services could reduce our revenue, cause us to issue credits or pay penalties, cause customers to terminate their agreements with us and adversely affect our ability to secure business in the future. Our business will be harmed if our customers and potential customers believe our services are unreliable.

Releases of new software products or upgrades to our existing software products or licensed third-party software may have undetected errors, or may not operate as intended or achieve our customer's desired objectives, which could cause litigation claims against us, damage to our reputation, or loss of business.

Certain of our services utilize software solutions developed by us or third parties for the needs of our customers. New releases of software products are issued to our customers periodically. Complex software products, such as those we offer, can contain undetected errors when first introduced or as new versions are released, or may fail to operate as intended or achieve the customer's desired objectives. Any introduction of new software products or upgrade to existing software products has a risk of undetected errors. These undetected errors may be discovered only after a product has been installed and used either in our internal processing or by our customers. Likewise, the software products we acquire in business acquisitions have a risk of undetected errors.

Any undetected errors, difficulties in installing and maintaining our software products or upgrade releases, difficulties training customers and their staffs on the utilization of new software products or upgrade releases, or the failure to achieve the customer's desired objectives, may result in a delay or loss of revenue, diversion of development resources, damage to our reputation, the loss of that customer, loss of future business, increased service costs, potential litigation claims against us, or impaired market acceptance of our products.

9

We rely on third-party hardware and software, which could cause errors or failures of our software or services.

We rely on hardware purchased or leased and software licensed from third parties for our service offerings. The hardware is typically standardized hardware from national vendors. The software licenses are generally standardized, commercial software licenses from national software vendors. We are generally able to select from a number of competing hardware and software applications, and, from time to time, we have changed the hardware and software technologies incorporated into our software products and solutions. Any errors or defects in third-party hardware or software incorporated into our products could result in a failure of our service or errors in our software, which in turn could adversely affect our customer relationships and result in the loss of customers, the loss of future business, potential litigation claims against us, and damage to our reputation.

Upgrades and implementation of the Company's financial, operating and information systems may adversely affect our business or the results of operations or the effectiveness of internal control over financial reporting.

If the Company's systems do not operate as intended, it could adversely affect financial, operating and information systems, our ability to produce financial and operational reports, and/or the effectiveness of internal control over financial reporting. In addition, in the ordinary course of business, our information systems will continue to require modification and refinements to address growth and changing business requirements, including requirements related to our international operations. In addition, our systems may require modification to enable us to comply with changing regulatory requirements, which could be expensive to implement and may divert management's attention from other key initiatives. In addition, our operations could be adversely affected, if we are unable to timely or effectively modify our systems as necessary.

We depend upon our key personnel, and we may not be able to retain them or to attract, assimilate and retain highly qualified employees in the future.

Our future success may depend upon the continued service of our senior management and certain of our key technical and sales personnel and our continuing ability to attract, assimilate and retain highly qualified technical, managerial, and sales and marketing personnel. The loss of services from any of these persons may significantly delay or prevent the achievement of our business objectives. We maintain key-man life insurance policies on our Chief Executive Officer and our President and Chief Operating Officer but we do not carry key-man life insurance on any other key personnel. We have entered into employment agreements with our executive officers that contain restrictive covenants relating to non-competition and non-solicitation of our customers and employees. Nevertheless, each executive officer may terminate his or her employment at any time without cause or good reason, and so as a practical matter these agreements do not guarantee the continued service of these executives. The loss of the services of any executive officer or other key personnel, including key technical and sales professionals, or the inability to hire or retain qualified personnel in the future could have a material adverse impact on our results of operations.

The integration of acquired businesses is time consuming, may distract our management from our other operations, may not be effective, and can be expensive, all of which could reduce or eliminate our expected earnings.

We have acquired businesses in the past and we may consider opportunities in the future to acquire other companies, assets or product lines that complement or expand our business. If we are unsuccessful in integrating these companies or product lines with our existing operations, or if integration is more difficult than anticipated, we may experience disruptions to our operations. A difficult or unsuccessful integration of an acquired business could have an adverse effect on our results of operations.

10

Some of the risks that may affect our ability to integrate or realize any anticipated benefits from companies or businesses we acquire include those associated with:

- •

- unexpected losses of key employees or customers of the acquired business;

- •

- conforming standards, processes, systems, procedures and controls of the acquired business with our operations;

- •

- increasing the scope, geographic diversity and complexity of our operations;

- •

- difficulties in transferring processes and know-how;

- •

- difficulties in the assimilation of acquired operations, technologies or products;

- •

- diversion of management's attention from other business concerns to the acquired business; and

- •

- adverse effects on existing business relationships with customers.

We have international business operations, which subjects us to additional risks associated with these international operations.

We have international operations with offices and data centers in Canada, Hong Kong, Japan and the United Kingdom, and another data center in China, all primarily related to our eDiscovery business. We could continue to expand internationally by entering into other world markets, including the recent formation of Epiq Systems Germany GmbH. It requires management attention and financial resources to develop successful global operations. In addition, new operations in geographies we may enter may not be immune from possible government monitoring or intrusion.

Global operations are subject to additional inherent risks, including certain risks that are not present with our domestic operations, and our future results could be adversely affected by a variety of uncontrollable and changing factors. These include:

- •

- difficulties and costs in recruiting effective management for international operations;

- •

- foreign certification, licensing and regulatory requirements, which may be substantially more complex or burdensome than our domestic

requirements;

- •

- unexpected changes in foreign regulatory requirements;

- •

- risk associated with selecting or terminating partners for foreign expansions, including marketing agents, distributors or other

strategic partners for particular markets;

- •

- changes to or reduced protection of intellectual property rights in some countries;

- •

- risk associated with fluctuations in currency exchange rates;

- •

- consequences from changes in applicable international tax laws;

- •

- risk associated with local ownership and/or investment requirements, as well as difficulties in obtaining financing in foreign

countries for local operations;

- •

- political and economic instability, national calamities, war, and terrorism;

- •

- reduced protection of confidential consumer information in some countries; and

- •

- different or additional functionality requirements for our software and services.

If we are not able to quickly adapt to or effectively manage our geographic markets outside of the U.S., our business prospects and results of operations could be negatively impacted.

11

We may be sued by third parties for alleged infringement of their proprietary rights.

The software and internet industries are characterized by the existence of a large number of patents, trademarks, and copyrights and by frequent litigation based on allegations of infringement or other violations of intellectual property rights. We have received in the past, and may receive in the future, communications from third parties alleging that we have infringed on the intellectual property rights of others. Our technologies may not be able to withstand any third-party claims or rights against their use. Any intellectual property claims, with or without merit, could be time-consuming and expensive to resolve, could divert management attention from executing our business plan, and could require us to pay monetary damages or enter into royalty or licensing agreements. In addition, certain customer agreements require us to indemnify our customers for third-party intellectual property infringement claims, which would increase the cost to us of an adverse ruling on such a claim. An adverse determination could also prevent us from offering our service to others, which could result in a loss of revenues and profits.

Future government legislation or changes in court rules could adversely affect our operating results.

Our products and services are not directly regulated by the government. Both of our reportable segments and the customers served by those segments are, however, directly or indirectly affected by federal and state laws and regulations and court rules. For example, bankruptcy reform legislation, class action and tort reform legislation and amendments to the Federal Rules of Civil Procedure regarding discovery of "electronically stored information" have all affected our customers, and indirectly, our business. Future federal or state legislation or court rules, or court interpretations of those laws and rules, could adversely affect the markets we serve and thus could have an adverse impact on our revenues and results of operations.

Goodwill and intangible assets comprise a significant portion of our total assets. We assess goodwill for impairment at least annually, which could result in a material, non-cash write-down and could have an adverse effect on our results of operations and financial condition.

The carrying value of our goodwill was approximately $404.2 million, or approximately 55% of our total assets, as of December 31, 2014. We assess goodwill for impairment on an annual basis at a reporting unit level. Goodwill is assessed between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying value. Our impairment reviews require extensive use of accounting judgment and financial estimates. Application of alternative assumptions and definitions, such as reviewing goodwill for impairment at a different organization level, could produce significantly different results. We may be required to recognize impairment of goodwill based on future economic factors such as unfavorable changes in our stock price and market capitalization or unfavorable changes in the estimated future discounted cash flows of our reporting units. Impairment of goodwill could result in material charges that could, in the future, result in a material, non-cash write-down of goodwill, which could have an adverse effect on our results of operations and financial condition.

Due to uncertainties regarding the economic environment, there can be no assurances that our estimates and assumptions made for purposes of our annual goodwill impairment test will prove to be accurate predictions of the future. If our assumptions regarding forecasted revenues or margins of certain of our reporting units are not achieved, we may be required to record goodwill impairment losses in future periods. It is not possible at this time to determine if any such future impairment loss would occur, and if it does occur, whether such charge would be material.

12

Our quarterly results have fluctuated in the past and may fluctuate in the future. If they do, our operating results may not meet the expectations of securities analysts or investors. This could cause fluctuations in the market price of our common stock.

Our quarterly results have fluctuated in the past and may fluctuate in the future. Our quarterly revenues and operating results can be difficult to forecast. Our business will continue to be affected by a number of factors, any one of which could substantially affect our results of operations for a particular fiscal quarter. Specifically, our quarterly results from operations can vary due to:

- •

- the initiation or termination of a large engagement;

- •

- the timing, size, cancellation or rescheduling of customer orders;

- •

- fluctuations in short-term interest rates;

- •

- unanticipated technology or other expenses;

- •

- changes in financial accounting and reporting standards, interpretations or positions that govern the preparation of our financial

statements;

- •

- unexpected legal or regulatory expenses;

- •

- fluctuations in the trustee services deposit portfolio; and

- •

- fluctuations in number of bankruptcy filings.

It is possible that our future quarterly results from operations from time to time will not meet the expectations of securities analysts or investors. This could cause a material decrease in the market price of our common stock.

The market price of our common stock may be volatile even if our quarterly results do not fluctuate significantly.

Even if we report stable or increased earnings, the market price of our common stock may be volatile. There are a number of factors, beyond earnings fluctuations, that can affect the market price of our common stock, including the following:

- •

- the average daily trading volume of our stock is low compared to total outstanding shares;

- •

- a decrease in market demand for our stock;

- •

- downward revisions in securities analysts' estimates;

- •

- announcements of technological innovations or new product or services offerings developed by us or our competitors;

- •

- announcements pertaining to the Company's review of strategic and financial alternatives;

- •

- receipt of unsolicited letters expressing interest in acquiring the Company;

- •

- legal proceedings;

- •

- the degree of customer acceptance of new products or enhancements offered by us; and

- •

- general market conditions and other economic factors.

In addition, the stock market has experienced significant price and volume fluctuations that have often been unrelated to the operating performance of particular companies. The market price of our common stock has been volatile and this is likely to continue.

13

We are in the process of conducting a review of strategic and financial alternatives that could adversely impact our business or our stock price.

In September 2014, we announced that our Board commenced a process to explore a full range of strategic and financial alternatives, which may include among other things, acquisitions, divestitures, or a going-private or recapitalization transaction, in order to determine a course of action that is in the best interest of all shareholders. We have also received unsolicited letters expressing interest in acquiring the Company and in conducting a proxy contest. The strategic review process, as well as the unsolicited letters, could expose us to a number of risks, including fluctuations in our stock price in response to developments or speculation regarding any developments related to the review of strategic and financial alternatives and/or expressed interests; distraction of management; difficulties in hiring, retaining and motivating key personnel as a result of uncertainty generated by the strategic review and/or expressed interests or any related developments; difficulties in maintaining relationships or arrangements with customers, suppliers and other third parties; substantial increases in general and administrative expenses associated with the need to retain and compensate legal, financial, and other advisors as a result of the strategic review and/or expressed interests; and litigation in connection with the strategic review and/or expressed interests or any related developments or actions. There can be no assurance that the strategic review and/or expressed interests will result in consummation of any transaction. The occurrence of any one or more of the above risks could have an adverse impact on our business, stock price, financial results, liquidity, and financial condition.

We may not pay cash dividends on our common stock in the future and our common stock may not appreciate in value or even maintain the price at which it was purchased.

There is no assurance that we will continue to pay cash dividends on our common stock in the future. Certain provisions in our credit agreement dated August 27, 2013 as subsequently amended on March 26, 2014 and January 26, 2015 (the "Credit Agreement"), governing our senior secured credit facility may restrict our ability to pay dividends in the future. Subject to any financial covenants in current or future financing agreements that directly or indirectly restrict the payment of dividends, the payment of dividends is within the discretion of our Board of Directors (the "Board") and will depend upon our future earnings and cash flow from operations, our capital requirements, our financial condition and any other factors that the Board may consider. Unless we continue to pay cash dividends on our common stock in the future, the success of an investment in our common stock will depend entirely upon its future appreciation. Our common stock may not appreciate in value or even maintain the price at which it was purchased.

Debt covenants in the Credit Agreement governing our credit facility require us to maintain compliance with certain financial ratios and other requirements. If we are not able to maintain compliance with these requirements, all of our then-outstanding debt could become immediately due and payable.

Our $400.0 million credit facility consists of a senior revolving loan and a senior secured term loan. The Credit Agreement contains a financial covenant related to a net leverage ratio (as defined in the Credit Agreement) which is not permitted to exceed 4.50 to 1.00 as well as other customary covenants related to limitations on (i) creating liens, debt, guarantees or other contingent obligations, (ii) engaging in mergers, acquisitions and consolidations, (iii) paying dividends or other distributions to, and redeeming and repurchasing securities from, equity holders, (iv) prepaying, redeeming or repurchasing subordinated or junior debt, and (v) engaging in certain transactions with affiliates, in each case, subject to customary exceptions. The amounts outstanding under the credit facility may be accelerated upon the occurrence of an event of default under the Credit Agreement. While we do not presently expect to be in violation of any of these requirements, no assurances can be given that we will be able to remain in compliance. There can be no assurance that our actual financial results will match our projected results or that we will not violate such covenants. Any failure to continue to comply with

14

such requirements could materially adversely affect our borrowing ability and access to liquidity, and thus our overall financial condition.

If interest rates increase, our net income could be negatively affected.

The variable interest rates applicable to borrowings under our credit facility would expose us to adverse changes in interest rates in a rising interest rate environment. When and to the extent appropriate, we use derivative financial instruments as part of our financial risk management strategy to reduce our exposure to interest rate risks. In November 2013, we entered into a two-year 3% interest rate cap agreement for a notional amount of $150.0 million equal to the portion of the senior secured term loan being hedged. As of December 31, 2014, the hedge was determined to be highly effective and is expected to continue to be highly effective in mitigating the risks of rising interest rates. In April 2014 we entered into a forward interest rate swap effective from August 31, 2015 through August 27, 2020, with a notional amount of approximately $73.7 million equal to the portion of the outstanding amortized principal amount of the senior secured term loan being hedged as of the effective date of the forward interest rate swap. Under the swap we will pay a fixed amount of interest of 2.81% on the notional amount and the swap counterparty will pay a floating amount of interest based on LIBOR with a one-month designated maturity subject to a floor of 0.75% which is consistent with the Company's obligation under the term loan. The interest rate swap contains a floor of 0.75% to ensure that the one-month LIBOR received on each settlement of the interest rate swap cannot go below 0.75%.

There is no assurance that our financial risk management strategy will be successful in reducing the risks inherent in exposures to interest rate fluctuations.

We may issue additional shares of our common stock and/or preferred stock, which may materially and adversely affect the market price of our common stock.

We are authorized to issue up to 100,000,000 shares of common stock and 2,000,000 shares of preferred stock. We may conduct future offerings of our common stock or preferred stock to fund acquisitions, finance operations or for general corporate purposes. In addition, we may also issue common stock under our equity awards programs. Any issuance of additional common stock will dilute the ownership interest of our existing common stockholders, and may cause the trading price of our common stock to decline. As of February 23, 2015, there were 37,041,224 shares of common stock outstanding and no shares of preferred stock outstanding.

Our articles of incorporation (as amended), our amended and restated bylaws and Missouri law contain provisions that could be used by us to discourage or prevent a takeover of our Company.

Some provisions of our articles of incorporation (as amended) and our amended and restated bylaws could make it more difficult for a third party to acquire control of our Company or to remove our current Board and management, even if the change of control or removal of our Board and management would be beneficial to certain shareholders. For example, our articles of incorporation include "blank check" preferred stock provisions, which permit our Board to issue one or more series of preferred stock without shareholder approval. In conjunction with the issuance of a series of preferred stock, the Board is authorized to fix the rights of that series, including voting rights, liquidation preferences, conversion rights and redemption privileges. The Board could issue a series of preferred stock to a friendly investor and use one or more of these features of the preferred stock to discourage or prevent a takeover of the Company. Additionally, our articles of incorporation do not permit cumulative voting in the election of directors. Cumulative voting, if available, would enable minority shareholders to elect one or more representatives to the Board in certain circumstances, which could be used by third parties to facilitate a takeover of our Company that was opposed by our Board or management. Our amended and restated bylaws impose advance notice requirements for stockholder

15

proposals and nominations of directors to be considered at stockholders' meetings. A third party attempting to acquire us may have difficulty in complying with those requirements.

In addition, the General and Business Corporation Law of Missouri, under which we are incorporated, provides that any merger involving the Company must be approved by the holders of not less than two-thirds of the outstanding shares of capital stock entitled to vote on the merger. Presently, our only outstanding voting securities are our shares of common stock. Accordingly, shareholders with voting power over as little as one-third of our outstanding common stock could block a merger proposal, even if that merger proposal was supported by our Board or shareholders holding a majority of our then outstanding shares of common stock.

Our Shareholders Rights Plan could make it more difficult for a third party to acquire control of the Company, which could have a negative effect on the price of our common stock.

In September 2014, we adopted a Shareholders Rights Plan (the "Rights Plan"), which could discourage potential acquisition proposals and could delay or prevent a change in control of the Company or a change in our management or Board, even in situations that may be considered beneficial by some of our shareholders. The Rights Plan may substantially dilute the stock ownership of a person or group that attempts to acquire a large interest without first negotiating with our Board. This and other anti-takeover measures could also adversely affect the price of our common stock.

General economic conditions and the cyclical nature of certain markets we serve may adversely affect our results of operations and financial condition.

Our financial performance depends, in large part, on conditions in the markets we serve and on the general condition of the global economy, which impacts these markets. Any sustained weakness in demand for our products and services resulting from a downturn of or uncertainty in the global economy or in any specific market we serve may adversely affect our results of operations and financial condition. For example, any decrease in litigation filings, class action proceedings and settlement administrations or bankruptcy filings may reduce the demand for our products and services in our Bankruptcy and Settlement Administration segment and Technology segment. Specifically, our Bankruptcy and Settlement Administration segment has experienced decreased operating revenues as a result of declines in the number of new bankruptcy cases. We expect the trend of decreased bankruptcy filings to continue into 2015, which may adversely affect our results of operations and financial condition.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

Our corporate headquarters are located in a 69,000-square-foot facility in Kansas City, Kansas which includes a 20,000 square foot expansion completed in 2013. This property serves as collateral under our credit facility. We also have significant leased offices in: New York, New York; Phoenix, Arizona; and Portland, Oregon; in addition to smaller leased offices in Chicago, Illinois; Dallas, Texas; Hartford, Connecticut; Los Angeles, California; Miami, Florida; Washington, D.C.; and Wilmington, Delaware. Our international offices are located in: Hong Kong; London, United Kingdom; Tokyo, Japan; and Toronto, Canada.

We operate data centers in the United States, Canada, China, Hong Kong, Japan, and the United Kingdom. Our data centers provide reliable, secure access to our software environments and to customer databases.

16

We are at times involved in litigation and other legal claims in the ordinary course of business. When appropriate in management's estimation, we may record reserves in our financial statements for pending litigation and other claims. Although it is not possible to predict with certainty the outcome of litigation, we do not believe that any of the current pending legal proceedings to which we are a party will have a material impact on our results of operations, financial condition or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

17

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is traded under the symbol "EPIQ" on the NASDAQ Global Market. The following table shows the reported high and low sales prices for our common stock as reported by NASDAQ and dividend information for the calendar quarters of 2014 and 2013.

| |

Common Stock Market Prices |

|

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Dividends Declared (per share) |

|||||||||

| |

High | Low | ||||||||

2014 |

||||||||||

First Quarter |

$ | 16.15 | $ | 13.05 | $ | 0.09 | ||||

Second Quarter |

14.46 | 11.68 | $ | 0.09 | ||||||

Third Quarter |

19.59 | 13.21 | $ | 0.09 | ||||||

Fourth Quarter |

19.95 | 15.16 | $ | 0.09 | ||||||

2013 |

||||||||||

First Quarter |

$ | 14.07 | $ | 12.17 | $ | 0.09 | ||||

Second Quarter |

14.22 | 11.56 | $ | 0.09 | ||||||

Third Quarter |

13.90 | 11.99 | $ | 0.09 | ||||||

Fourth Quarter |

16.73 | 13.17 | $ | 0.09 | ||||||

Dividend Policy

We do not have a formal dividend policy. Any declarations and payments of dividends to holders of our common stock are at the discretion of the Board of Directors, which depends on many factors, including our financial condition, earnings, capital requirements and other factors that the Board deems relevant. There is no assurance that we will continue to pay cash dividends on our common stock in the future, or that any such dividends will be comparable to those previously declared. Any future declarations of dividends and the establishment of future record and payment dates are subject to the final determination of our Board.

Under our Credit Agreement, our ability to declare and pay dividends and repurchase securities from equity holders is limited by a requirement that such payments are not to exceed, in the aggregate, 50% of net income, as adjusted, on a cumulative basis for all quarterly periods from the closing date of the credit facility and ending prior to the date of payment or repurchase. Adjustments to Consolidated Net Income (as defined in the Credit Agreement) include among other items, the exclusion of extraordinary items, specified severance costs, cumulative effect of a change in accounting principle, intangible asset amortization and impairment charges, non-cash compensation expense, cumulative effect of foreign currency translations, and gains or losses from discontinued operations. Further, we are unable to declare and pay dividends and repurchase securities from equity holders if our net leverage ratio (as defined in the Credit Agreement) would exceed 4.25 to 1.0.

Holders

As of February 23, 2015, there were 99 stockholders of record of our common stock. Holders of record do not include an indeterminate number of beneficial holders whose shares may be held through brokerage accounts and clearing agencies.

18

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

On November 6, 2013, our Board approved and authorized the repurchase, on or prior to December 31, 2015, of outstanding shares of our common stock up to an aggregate of $35.0 million (the "2014 Share Repurchase Program"). The 2014 Share Repurchase Program became effective on January 1, 2014. There were no repurchases of shares of common stock under the 2014 Share Repurchase Program during the year ended December 31, 2014.

We also have a policy that requires us to repurchase shares of our common stock to satisfy employee tax withholding obligations upon the vesting of restricted stock awards or the exercise of stock options and, at the participant's election, shares of common stock surrendered to the Company as payment of the exercise price of stock options exercised under the amended and restated Epiq Systems, Inc. 2004 Equity Incentive Plan (the "Current Plan"). During the year ended December 31, 2014, we repurchased an aggregate 323,090 shares for approximately $4.0 million to satisfy employee tax withholding and exercise price obligations upon the vesting of restricted stock awards and stock option exercises under the Current Plan. There were no such repurchases of shares of common stock under the Current Plan in the three months ended December 31, 2014. Shares of common stock surrendered by participants to the Company as payment of the exercise price arising from the exercise of stock options are included in "Stock option exercises" in the Consolidated Statements of Changes in Equity.

Recent Sales of Unregistered Securities

None.

Stock Performance Graph

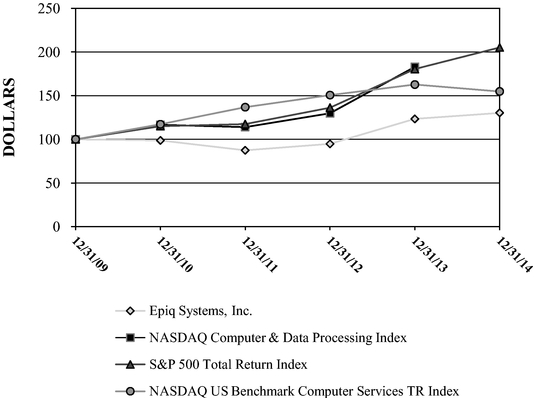

The following graphs show the total shareholder return of an investment of $100 in cash for (i) Epiq's common stock, (ii) the NASDAQ Stock Market Computer & Data Processing Index(1), (iii) the Standard & Poor's 500 Total Return Index and (iv) the NASDAQ US Benchmark Computer Services TR Index for our last five fiscal years (December 31, 2009 through December 31, 2014). All values assume reinvestment of the full amount of any dividends. The information below shall not be deemed "soliciting material" or "filed" with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

19

Comparison of Five-Year Cumulative Total Return Among

Epiq Systems, Inc., NASDAQ Computer & Data Processing Index(1), S&P 500

Total Return Index and NASDAQ US Benchmark Computer Services

TR Index

- (1)

- Prior to December 31, 2014, NASDAQ Global Markets discontinued the reporting of the NASDAQ Computer & Data Processing Index to external users and, therefore, we are unable to report data for such index as of December 31, 2014 without unreasonable effort. As a result, we replaced this index with the NASDAQ US Benchmark Computer Services Total Return Index, which we believe includes investments that are similar to the NASDAQ Computer & Data Processing Index.

ITEM 6. SELECTED FINANCIAL DATA

The following table presents selected historical financial data for the five years ended December 31, 2010 through December 31, 2014.

| |

Year Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2014 | 2013 | 2012 | 2011(1) | 2010(2) | |||||||||||

| |

(in thousands, except per share data) |

|||||||||||||||

Income Statement Data: |

||||||||||||||||

Operating revenue |

$ | 444,118 | $ | 438,690 | $ | 344,750 | $ | 261,265 | $ | 217,595 | ||||||

Reimbursable expenses |

30,352 | 43,393 | 28,335 | 22,061 | 29,571 | |||||||||||

Total revenue |

474,470 | 482,083 | 373,085 | 283,326 | 247,166 | |||||||||||

Income from operations |

10,801 | 29,220 | 44,651 | 26,623 | 28,469 | |||||||||||

Net income (loss) |

(1,337 | ) | 11,110 | 22,427 | 12,080 | 13,929 | ||||||||||

Basic net income (loss) per share |

(0.04 | ) | 0.31 | 0.62 | 0.34 | 0.38 | ||||||||||

Diluted net income (loss) per share |

(0.04 | ) | 0.30 | 0.61 | 0.33 | 0.36 | ||||||||||

Cash dividends declared per common share |

0.36 | 0.36 | 0.385 | 0.205 | 0.07 | |||||||||||

Balance Sheet Data: |

||||||||||||||||

Total assets |

$ | 738,252 | $ | 747,781 | $ | 654,716 | $ | 678,664 | $ | 478,218 | ||||||

Long-term obligations (excluding current maturities) |

302,522 | 299,108 | 203,288 | 247,994 | 86,860 | |||||||||||

- (1)

- Reflects

the acquisitions of Encore Intermediate Holdco, Inc. on April 4, 2011 ("Encore") and De Novo Legal LLC on

December 28, 2011.

- (2)

- Reflects the acquisition of Jupiter eSources LLC on October 1, 2010.

20

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the sections entitled "Forward-Looking Statements," "Risk Factors," "Selected Financial Data," and "Financial Statements and Supplementary Data" included in this report.

Executive Summary

Epiq is a leading global provider of integrated technology solutions for the legal profession. We combine proprietary software, deep subject matter expertise, highly responsive customer service delivery and a global infrastructure to assist our customers with the technology requirements for complex matters. We offer these capabilities across a variety of practice areas including bankruptcy, litigation, class action, antitrust, investigations and regulatory compliance.

Our two reportable segments are Technology and Bankruptcy and Settlement Administration.

Technology provides eDiscovery managed services and technology solutions comprised of consulting, collections and forensics, processing, search and review, production of documents and document review services to companies and law firms.

Bankruptcy and Settlement Administration provides managed services and technology solutions that address the needs of our customers with respect to litigation, claims and project administration, compliance matters, controlled disbursements, corporate restructuring, bankruptcy and class action proceedings.

Investing in proprietary software development maximizes our competitiveness in the marketplace and distinguishes us from our competitors. Beyond our proprietary software we also incorporate various licensed third-party software products in our solution set allowing us to expand our solutions.

Network infrastructure is an essential component of our technology strategy because most of our software is utilized by our customers within a hosted environment and we manage a high volume of client data. A single large client engagement may entail over 100 million documents or 100 terabytes of information and may include complex structured data (i.e., databases) and unstructured data (e.g., email archives). We operate eDiscovery data centers in the United States, Canada, China, Japan and the United Kingdom. Our data centers provide reliable, secure access to our software environments and to customer databases. Information security is paramount in any managed technology business, and Epiq incorporates best practices designed to protect sensitive customer data.

Our software and IT capabilities include significant in-house fulfillment capabilities. Our office locations in New York, Kansas City and Portland have internal abilities for high-speed printing and mailing, call center operations, and disbursement and tax records preparation. The combination of software, IT and fulfillment resources enables Epiq to act as a single-source solution for even the largest, most complex matters in the markets where we compete.

We work in niche, specialty areas which require deep subject matter expertise—such as litigation, investigations, bankruptcy, mergers and acquisitions, mass tort, settlements and class action—which have distinctive practices and requirements. Technology alone is insufficient to bring about a successful outcome on a sophisticated client matter; it is often the application of the technology and the expertise of our staff that create the most value for our client. We have a worldwide team of executives, client services specialists and technical consultants on whom clients rely for expert advice—whether delivered at the client's site or from one of our office locations. Our team includes former practicing litigators, bankruptcy attorneys, plaintiff's counsel, defense counsel, eDiscovery counsel and other professionals who are leaders in their areas of expertise. While we do not offer clients legal advice (because we are

21

not a law firm), we draw heavily from our subject matter expertise in the legal profession to assist clients in achieving the best outcome on each project for which we are retained.