Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF DELOITTE & TOUCHE LLP - CENTURY ALUMINUM CO | a20141231q4ex231.htm |

| EX-4.10 - FIRST SUPPLEMENTAL INDENTURE - CENTURY ALUMINUM CO | a20141231q4ex410.htm |

| EX-10.3 - SECOND AMENDMENT TO LOAN AND SECURITY AGREEMENT - CENTURY ALUMINUM CO | a20141231q4ex103.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - CENTURY ALUMINUM CO | a20141231q4ex211.htm |

| EX-32.1 - SECTION 1350 CERTIFICATION - CENTURY ALUMINUM CO | a20141231q4ex321.htm |

| EX-31.1 - RULE 13A-14(A)/15D-14(A) CERTIFICATIONS - CENTURY ALUMINUM CO | a20141231q4ex311.htm |

| EX-24.1 - POWERS OF ATTORNEY - CENTURY ALUMINUM CO | a20141231q4ex241.htm |

| EX-10.2 - FIRST AMENDMENT TO LOAN AND SECURITY AGREEMENT - CENTURY ALUMINUM CO | a20141231q4ex102.htm |

| EX-10.25 - AMENDED AND RESTATED ANNUAL INCENTIVE PLAN - CENTURY ALUMINUM CO | a20141231q4ex1025.htm |

| EXCEL - IDEA: XBRL DOCUMENT - CENTURY ALUMINUM CO | Financial_Report.xls |

| EX-10.5 - FOURTH AMENDMENT TO LOAN AND SECURITY AGREEMENT - CENTURY ALUMINUM CO | a20141231q4ex105.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission File Number 1-34474

CENTURY ALUMINUM COMPANY

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 13-3070826 (IRS Employer Identification No.) |

One South Wacker Drive Suite 1000 Chicago, Illinois (Address of registrant’s principal offices) | 60606 (Zip Code) |

Registrant’s telephone number, including area code: (312) 696-3101

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: | Name of each exchange on which registered: |

Common Stock, $0.01 par value per share | NASDAQ Stock Market LLC |

Preferred Stock Purchase Rights | (NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in a definitive proxy or information statement incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one)

Large Accelerated Filer | ý | Accelerated Filer | ¨ | Non-Accelerated Filer (Do not check if a smaller reporting company) | ¨ | Smaller Reporting Company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

Based upon the closing price of the registrant’s common stock on the NASDAQ Global Select Market on June 30, 2014, the approximate aggregate market value of the common stock held by non-affiliates of the registrant was approximately $808,000,000. As of January 31, 2015, 89,064,582 shares of common stock of the registrant were issued and outstanding.

Documents Incorporated by Reference:

All or a portion of Items 10 through 14 in Part III of this Form 10-K are incorporated by reference to the Registrant’s definitive proxy statement on Schedule 14A for its 2015 Annual Meeting of Stockholders, which will be filed within 120 days after the close of the fiscal year covered by this report on Form 10-K, or if the Registrant’s Schedule 14A is not filed within such period, will be included in an amendment to this Report on Form 10-K which will be filed within such 120 day period.

TABLE OF CONTENTS | PAGE | |

PART I | ||

PART II | ||

PART III | ||

PART IV | ||

Forward-Looking Statements

This Annual Report on Form 10-K includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to the "safe harbor" created by section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Forward-looking statements are statements about future events and are based on our current expectations. These forward-looking statements may be identified by the words "believe," "expect," "target," "anticipate," "intend," "plan," "seek," "estimate," "potential," "project," "scheduled," "forecast" or words of similar meaning, or future or conditional verbs such as "will," "would," "should," "could," "might," or "may."

Forward-looking statements in this Annual Report and in our other reports with the Securities and Exchange Commission (the "SEC"), for example, may include statements regarding:

• | Future global and local financial and economic conditions; |

• | Our assessment of the aluminum market and aluminum prices (including premiums); |

• | The future financial and operating performance of the Company, its subsidiaries and its projects; |

• | Future earnings, operating results and liquidity; |

• | Future inventory, production, sales, cash costs and capital expenditures; |

• | Our business objectives, strategies and initiatives, the growth of our business (including with respect to production and production capacity) and our competitive position and prospects; |

• | Our ability to procure alumina, carbon products and other raw materials and our assessment of pricing and costs and other terms relating thereto; |

• | Our ability to access existing or future financing arrangements; |

• | Our ability to repay debt in the future, including the E.ON contingent obligation; |

• | Estimates of our pension and other postretirement liabilities and future payments, property plant and equipment impairment, environmental liabilities and other contingent liabilities and contractual commitments; |

• | Our ability to successfully manage transmission issues and market power price risk and to control or reduce power costs; |

• | Our assessment of power pricing and our ability to successfully obtain and/or implement long-term competitive power arrangements for our operations and projects, including at Mt. Holly and Ravenswood; |

• | Negotiations with labor unions representing our employees at Hawesville and Grundartangi; |

• | Our ability to successfully produce value-added products at our smelters; |

• | Future construction investment and development, including the Helguvik project, the restart of the second baking furnace at Vlissingen and our expansion project at Grundartangi, including our ability to secure sufficient amounts of power, future capital expenditures, the costs of completion or cancellation, timing, production capacity and sources of funding; |

• | Our ability to derive benefit from acquisitions, including the acquisitions of our Mt. Holly and Sebree smelters, and to successfully integrate these operations with the rest of our business; |

• | Our ability to realize the potential benefits to be provided to Grundartangi and our planned Helguvik smelter from the purchase by Century Vlissingen of carbon anode production assets in the Netherlands; |

• | Our plans with respect to restarting operations at our Ravenswood, West Virginia smelter, and potential curtailment of other domestic assets; |

• | The anticipated impact of recent accounting pronouncements or changes in accounting principles; |

• | Our anticipated tax liabilities, benefits or refunds including the realization of U.S. and certain foreign deferred tax assets; |

• | Our assessment of the ultimate outcome of outstanding litigation and environmental matters and liabilities relating thereto; and |

• | The effect of future laws and regulations. |

1

Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from future results expressed, projected or implied by those forward-looking statements. Important factors that could cause actual results and events to differ from those described in such forward-looking statements can be found in the risk factors and forward-looking statements cautionary language contained in Item 1A, "Risk Factors" in this Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and in other filings made with the SEC. Although we have attempted to identify those material factors that could cause actual results or events to differ from those described in such forward-looking statements, there may be other factors that could cause results or events to differ from those anticipated, estimated or intended. Many of these factors are beyond our ability to control or predict. Given these uncertainties, the reader is cautioned not to place undue reliance on our forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

PART I

Throughout this Annual Report on Form 10-K, and unless expressly stated otherwise or as the context otherwise requires, "Century Aluminum Company," "Century Aluminum," "Century," the "Company," "we," "us," and "our" refer to Century Aluminum Company and its subsidiaries.

Item 1. Business.

Overview

Century Aluminum Company is a global producer of primary aluminum and operates aluminum reduction facilities, or "smelters," in the United States and Iceland. We operate three U.S. aluminum smelters, in Hawesville, Kentucky ("Hawesville"), Robards, Kentucky ("Sebree") and Mt. Holly, South Carolina ("Mt. Holly"), and one smelter in Grundartangi, Iceland ("Grundartangi"). We also own an aluminum reduction facility in Ravenswood, West Virginia ("Ravenswood"), the operations of which have been curtailed since 2009, and have commenced construction on a new aluminum reduction facility in Helguvik, Iceland ("Helguvik" or the "Helguvik project"), construction of which is currently curtailed.

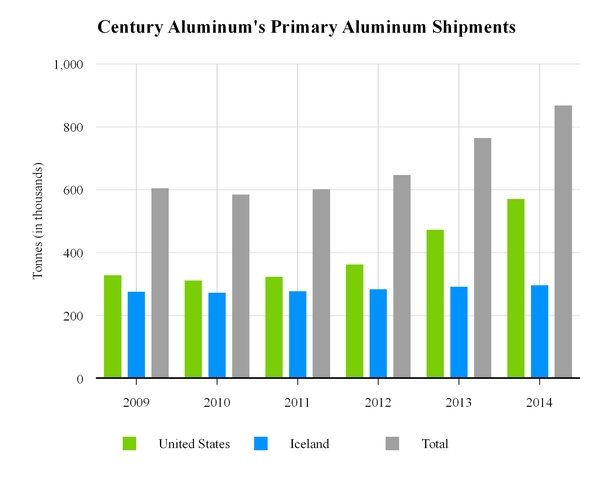

Primary aluminum is an internationally traded commodity and its price is effectively determined on the London Metal Exchange (the "LME"). Our primary aluminum facilities produce standard grade and value-added primary aluminum products. Our current annual primary aluminum production capacity is approximately 1,166,000 tonnes per year ("tpy"), of which 170,000 tpy remained curtailed as of December 31, 2014. We produced approximately 881,000 tonnes of primary aluminum in 2014.

In addition to our primary aluminum assets, we also own, through our wholly-owned subsidiary Century Aluminum Vlissingen B.V. ("Century Vlissingen"), a carbon anode production facility located in Vlissingen, the Netherlands ("Vlissingen") and hold a 40% interest in Baise Haohai Carbon Co., Ltd. ("BHH"), a joint venture that owns and operates a carbon anode and cathode facility located in the Guangxi Zhuang Autonomous Region of south China. Carbon anodes are used in the production of primary aluminum and both BHH and Vlissingen currently supply carbon anodes to Grundartangi.

We operate our business through one reportable segment, primary aluminum. Additional information about our segment reporting and certain geographic information is available in Note 20, "Business segments" to the consolidated financial statements included herein.

Century Aluminum Company is a Delaware corporation with principal executive offices located at One South Wacker Drive, Suite 1000, Chicago, Illinois 60606.

2

Strategic Objectives

Our strategic objective is to maximize the financial returns we generate for our stockholders by: (a) optimizing our safety and environmental performance; (b) improving our cost structure for our existing assets by managing costs and improving productivity and efficiency; (c) pursuing upstream investment opportunities in bauxite mining, alumina refining and the production of other key operating supplies; and (d) expanding our primary aluminum business by improving and investing in the facilities we currently own as well as constructing, investing in or acquiring additional capacity.

The following table shows our primary aluminum shipment volumes since 2009.

Primary Aluminum Facilities

Our primary aluminum smelters and their respective capacities are shown in the following table:

Facility | Location | Operational | Annual Production Capacity (tpy) (1) | Ownership Percentage |

Grundartangi (2) | Grundartangi, Iceland | 1998 | 298,000 | 100% |

Hawesville | Hawesville, Kentucky, USA | 1970 | 252,000 | 100% |

Sebree | Robards, Kentucky, USA | 1973 | 215,000 | 100% |

Mt. Holly (3) | Goose Creek, South Carolina, USA | 1980 | 231,000 | 100% |

Ravenswood (4) | Ravenswood, West Virginia, USA | 1957 | 170,000 | 100% |

Helguvik (5) | Helguvik, Iceland | N/A | N/A | 100% |

(1) | The numbers in this column reflect each facility’s highest annual production for the last five fiscal years through and including the fiscal year ended December 31, 2014, or, in the case of Ravenswood, its rated capacity. |

3

(2) | Production at Grundartangi has increased by approximately 12,000 tonnes as a result of an ongoing 40,000 tpy expansion project that began in 2012. |

(3) | In December 2014, we acquired the remaining 50.3% ownership stake in the Mt. Holly facility and now own 100% of the facility. |

(4) | In February 2009, we conducted an orderly curtailment of the plant operations at Ravenswood. We may restart the curtailed operations upon the realization of several objectives, including an expectation of higher long-term LME prices, negotiation of a competitive power agreement, passage of supporting legislation and a new labor agreement. |

(5) | The Helguvik project is expected to have a rated production capacity of up to 360,000 tpy. During 2014, project activity and spending remained at modest levels. We currently expect to restart major construction activity upon successful resolution of ongoing discussions with the contracted power suppliers for the project or procurement of another cost-effective source of power. See "Electrical Power Supply Agreements." |

Grundartangi

The Grundartangi facility, located in Grundartangi, Iceland, is a primary aluminum reduction facility owned and operated by our wholly-owned subsidiary, Nordural Grundartangi ehf. Grundartangi is our most modern and lowest cost facility. Operations began in 1998 and production capacity has expanded significantly since that time to its current annual production capacity of approximately 298,000 tonnes. Grundartangi is currently in the process of a multi-year expansion project that is expected to ultimately increase production capacity at the smelter by approximately 40,000 tpy in the aggregate. Grundartangi produces standard-grade aluminum and in 2014 began production of a foundry alloy product, which is a value-added product that is sold at a premium to standard-grade. We currently expect foundry alloy to account for approximately 50,000 tpy of our total production capacity at Grundartangi in 2015.

Grundartangi operates under various long-term permits and agreements with the Government of Iceland, local municipalities and Faxafloahafnir sf (which operates the harbor at Grundartangi and is jointly owned by several municipalities). Grundartangi is currently in the process of expanding its operating permit for aluminum production to accommodate its current expansion project.

Hawesville

Hawesville, located adjacent to the Ohio River near Hawesville, Kentucky, is a primary aluminum reduction facility owned and operated by our wholly-owned subsidiary, Century Kentucky, Inc. ("CAKY"). Hawesville has an annual production capacity of approximately 252,000 tonnes.

Hawesville is our largest U.S. smelter and the largest producer of high purity primary aluminum in North America. Four of Hawesville's five potlines are specially configured and operated to produce high purity primary aluminum. The average purity level of primary aluminum produced by these potlines is 99.9%, compared to standard-purity aluminum which is approximately 99.7%. High purity primary aluminum is sold at a premium to standard-purity aluminum. Hawesville’s specially configured facility is also capable of providing high-conductivity metal used in electrical wire and cable products as well as for certain aerospace applications. Hawesville delivers a significant portion of its products in molten form to its customers.

Sebree

Sebree, located adjacent to the Green River near Robards, Kentucky, is a primary aluminum reduction facility owned and operated by our wholly-owned subsidiary, Century Aluminum Sebree LLC ("Century Sebree"). Sebree began operations in 1973 and was acquired by Century in 2013. Sebree has an annual production capacity of approximately 215,000 tonnes.

Sebree produces standard-grade aluminum that is cast into several products, such as billet, foundry, slab and sow. In 2014, we also began production of a small form foundry line that we expect to account for approximately 35,000 tpy of our total production capacity at Sebree in 2015. Billet, foundry and slab are value-added primary aluminum products and are sold at a premium to sow. More than half of Sebree's production is cast into billet, which is primarily used by extruders and the automotive industry.

4

Mt. Holly

Mt. Holly, located in Goose Creek, South Carolina, is a primary aluminum reduction facility owned and operated by our wholly-owned subsidiary, Century Aluminum of South Carolina, Inc. ("CASC"). Mt. Holly was built in 1980 and is the most recently constructed aluminum reduction facility in the United States. Mt. Holly was operated as a joint venture between us and Alumax of South Carolina Inc. ("Alumax of SC") until our wholly-owned subsidiary, Berkeley Aluminum, Inc. ("Berkeley"), acquired Alumax of SC in December 2014. More information on the acquisition is available in Note 2 "Business acquisitions" to the consolidated financial statements included herein.

Mt. Holly has an annual production capacity of approximately 231,000 tonnes. Mt. Holly produces standard-grade aluminum that is cast into tee bars as well as several value-added products, including billet and foundry products. These value-added primary aluminum products are sold at a premium to standard-grade primary aluminum.

Ravenswood

The Ravenswood facility, located adjacent to the Ohio River near Ravenswood, West Virginia, is owned and operated by our wholly-owned subsidiary, Century Aluminum of West Virginia, Inc. ("CAWV"). Built in 1957, Ravenswood has a rated annual production capacity of approximately 170,000 tonnes.

In February 2009, we conducted an orderly curtailment of the plant operations at Ravenswood. We continue to evaluate a possible restart of our idled Ravenswood smelter subject to market conditions and the achievement of other objectives, including a competitively priced power arrangement and a new labor agreement.

We continue to engage in discussions with Appalachian Power Company ("APCo") and other stakeholders. Until those discussions have progressed further it is not possible to predict when or if a restart of the plant might occur.

Helguvik project

The Helguvik project site is located approximately 30 miles from the city of Reykjavik, Iceland and is owned through our wholly-owned subsidiary, Nordural Helguvik ehf.

We commenced construction of the Helguvik project in June 2008. In late 2008, we significantly reduced construction activity and spending on the project in response to the global financial crisis and deterioration of Icelandic economic and political conditions, including the financial condition of our contracted power suppliers. Capitalized costs for the project through December 31, 2014 were approximately $148 million. Construction activity and spending on the project remain significantly curtailed pending confirmation from the contracted power suppliers or potentially other power suppliers that they will deliver the required power per an agreed schedule. See "Supply Contracts – Electrical Power Supply Agreements" below for further discussion of our power arrangements at Helguvik.

We currently expect to restart construction activity at Helguvik upon successful resolution of the power supply issues. See Item 1A, "Risk Factors – Construction at our Helguvik smelter site has been significantly curtailed. Substantial delay in the completion of this project may increase its cost, subject us to losses and impose other risks to completion that are not foreseeable at this time" and "If we are unable to procure a reliable source of power, the Helguvik project may not be feasible."

In connection with the construction of the Helguvik project, we have entered into an investment agreement with the Government of Iceland governing, among other things, the fiscal regime associated with the project and including a commitment by the Government of Iceland to assist us in obtaining necessary regulatory approvals for completion of the Helguvik project. We have also entered into a transmission agreement with the national transmission company, Landsnet hf ("Landsnet"), to provide an electrical power transmission system to the Helguvik project. We have also entered into a site and harbor agreement, as well as technology and equipment supply agreements with respect to the Helguvik project.

We have received a positive opinion from the Icelandic Planning Agency on the Environmental Impact Assessment for the proposed Helguvik smelter as well as an Operating License enabling production of up 250,000 tpy.

5

Carbon Products Facilities

Our carbon anode and cathode production facilities and their respective capacities are shown in the following table:

Carbon Anode Facilities:

Facility | Location | Type | Annual Production Capacity (tpy) (1) | Ownership Percentage |

Vlissingen | Vlissingen, the Netherlands | Carbon anodes | 75,000 | 100% |

BHH | Guangxi Zhuang, China | Carbon anode, cathode and graphitized products | 180,000 anode; 20,000 cathode/graphitized products | 40% |

(1) | The numbers in this column reflect each facility’s rated production capacity. |

Vlissingen

Vlissingen, located in Vlissingen, the Netherlands, is a carbon anode production facility owned and operated by Century Vlissingen. Century purchased the facility in June 2012. Production at Vlissingen, which had been curtailed by its previous owner, was restarted in late 2013 with an initial annual carbon anode production capacity of 75,000 tonnes. In the third quarter of 2014, we began a project to restart the second baking furnace, which is expected to increase total annual production capacity to 150,000 tonnes. The project is currently expected to be completed by the end of 2015.

Baise Haohai Carbon Company, Ltd.

BHH is a carbon anode and cathode facility located in the Guangxi Zhuang Autonomous Region of south China. The facility began operations in 2008. BHH is operated as a joint venture between one of our wholly-owned subsidiaries, which owns a 40% stake in the company, and Guangxi Qiangqiang Carbon Co., Ltd., which holds the remaining 60% ownership interest and is the operator of this facility. The BHH facility has a carbon anode production capacity of 180,000 tpy and a cathode baking and graphitization capacity of 20,000 tpy.

Pricing

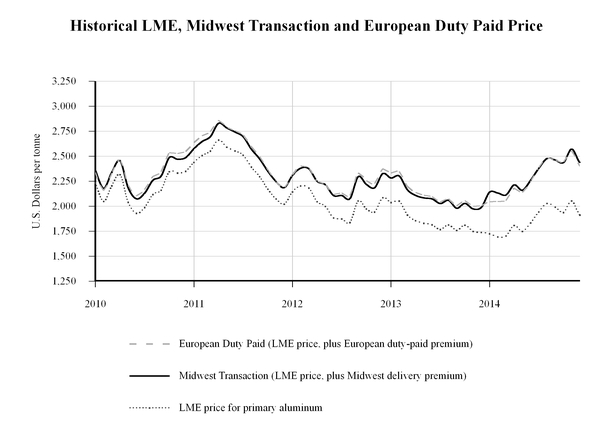

Generally, we price our products at a "market" price, in which the customer pays a regional delivery premium over the LME price, plus any value-added product premiums. Our operating results are highly sensitive to changes in the LME price of primary aluminum and the value of regional delivery and product premiums, as well as the cost of electrical power, raw materials and other operating supplies used in production. As a result, from time to time, we assess the appropriateness of mitigating the effects of fluctuations in these items through the use of various fixed-price commitments and financial instruments.

Customer Base

For the year ended December 31, 2014, we derived approximately 77% of our consolidated sales from our two major customers: Glencore plc (together with its subsidiaries, "Glencore") and Southwire Company ("Southwire").

Hawesville supplied approximately 98,000 tonnes of primarily high-conductivity molten aluminum to Southwire’s adjacent wire and cable manufacturing facility in 2014. The price for aluminum delivered to Southwire was variable and determined by reference to the LME price for primary aluminum, plus the Midwest regional delivery premium (the "Midwest Transaction Price") plus additional product premiums. Our metal sales agreement with Southwire expired at the end of 2014.

Pursuant to several agreements with Glencore, we expect to sell substantially all of our production to Glencore in 2015. With respect to Century’s Icelandic production, Grundartangi has entered into an aluminum supply agreement with Glencore pursuant to which Glencore will purchase substantially all primary aluminum produced at Grundartangi from 2014 through 2017 at market prices, less commitments under existing tolling contracts (the "Glencore Grundartangi Metal Agreement"). The price for aluminum delivered to Glencore is determined by reference to the LME price for primary aluminum, plus the European Duty Paid premium and any applicable product premiums. Grundartangi sold to Glencore approximately 155,000 tonnes of aluminum under this agreement in 2014 and currently estimates that it will sell Glencore approximately 205,000 tonnes in 2015. Grundartangi also has a long-term tolling agreement with Glencore for 90,000 tpy through July 2016. Under this agreement, Glencore provides Grundartangi alumina and receives primary aluminum in return for tolling fees that are

6

based on the price of primary aluminum. With respect to its North American production, Century has entered into an aluminum supply agreement with Glencore pursuant to which Glencore will purchase substantially all of our primary aluminum production in North America in 2015 and 2016 at market prices determined by reference to the Midwest Transaction Price plus additional product premiums.

Additional information about the revenues from these major customers is available in Note 20, "Business segments" to the consolidated financial statements included herein.

Energy, Key Supplies and Raw Materials

We consume the following key supplies, energy and raw materials in the primary aluminum reduction process:

● | electrical power | ● | carbon anodes | ● | liquid pitch | |

● | alumina | ● | cathode blocks | ● | calcined petroleum coke | |

● | aluminum fluoride | ● | natural gas | ● | silicon carbide | |

Electrical power, alumina, carbon anodes and labor are the principal components of cost of goods sold. These components together represented over 75% of our cost of goods sold for the year ended December 31, 2014. We have long-term contracts to attempt to ensure the future availability of many of our cost components. For a description of certain risks related to our raw materials, supplies and labor, see Item 1A, "Risk Factors" in this Annual Report on Form 10-K.

Alumina Supply Agreements

The majority of the alumina required for our operations is supplied by Glencore under long-term alumina supply agreements. Grundartangi also tolls alumina provided by Glencore into primary aluminum pursuant to the tolling agreement described above. The remainder of our alumina requirements are supplied under long-term supply agreements with Noranda and BHP Billiton. A summary of our alumina supply agreements is provided below:

Supplier | Quantity | Term | Pricing |

Glencore (1) | Variable | Through December 31, 2017 | Variable, LME-based |

Noranda Alumina LLC ("Noranda") | Approximately 390,000 tpy | Through December 31, 2016 | Variable, LME-based |

BHP Billiton | Approximately 150,000 tpy | Through December 31, 2015 | Variable, based on published alumina index |

(1) | Under the terms of this agreement, Glencore will provide alumina supply for all of Century's requirements during the contract term, net of the other existing contractual commitments set forth above. For 2015, we have agreed to price all of our requirements under this agreement based on a published alumina index. |

7

Electrical Power Supply Agreements

The table below summarizes our long-term power supply agreements:

Facility | Supplier | Term | Pricing |

Grundartangi | Landsvirkjun | Through 2019 - 2036 | Variable rate based on the LME price for primary aluminum |

Orkuveita Reykjavíkur ("OR") | |||

HS Orka hf ("HS") | |||

Hawesville | Kenergy Corporation ("Kenergy") | Through December 31, 2023 | Variable rate based on market prices |

Sebree | Kenergy | Through December 31, 2023 | Variable rate based on market prices |

Mt. Holly | South Carolina Public Service Authority | Through December 31, 2015 | Variable rate based in part on a fixed price, with fuel cost adjustment clause and in part on natural gas prices |

Ravenswood | Appalachian Power Company | Evergreen | Based on published tariff |

Helguvik | OR | Approximately 25 years from the dates of each phase of power delivery under the respective power agreements | Variable rate based on the LME price for primary aluminum |

HS | |||

Electrical power represents our single highest cost of goods sold. We may enter into forward contracts or other hedging arrangements to mitigate our electrical power or natural gas price risk, but did not hold any such contracts as of December 31, 2014. The paragraphs below summarize the sources of power and the long-term power arrangements for each of our operations.

Grundartangi. Power is supplied to Grundartangi from hydroelectric and geothermal sources under long-term power purchase agreements with HS, Landsvirkjun and OR at prices indexed to the price of primary aluminum, which provides a "natural hedge" of our largest production cost. The expiration dates of these power purchase agreements range from 2019 through 2036 (subject to extension). The agreements contain take-or-pay obligations with respect to a significant percentage of the total committed and available power under each agreement.

Hawesville. Effective August 2013, we entered into a power supply arrangement with Kenergy and Big Rivers Electric Company ("Big Rivers") which provides market-based power to the Hawesville smelter. Under this arrangement, the power companies purchase power on the open market and pass it through to Hawesville at Midcontinent Independent System Operator ("MISO") pricing plus transmission and other costs incurred by Kenergy. In connection with this power arrangement, CAKY has received approval from applicable regional transmission organizations and regulatory bodies regarding grid stability and energy import capability. Effective January 1, 2015, new agreements were approved by the Kentucky Public Service Commission pursuant to which EDF Trading North America, LLC ("EDF") replaced Big Rivers as our market participant with MISO under this arrangement. See Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations - Electrical Power Developments in the United States in 2014."

Sebree. Effective February 2014, we entered into a power supply arrangement with Kenergy and Big Rivers which provides market based power to the Sebree smelter. Similar to the arrangement at Hawesville, the power companies purchase power on the open market and pass it through to Sebree at MISO pricing plus transmission and other costs incurred by Kenergy. Effective January 1, 2015, new agreements were approved by the Kentucky Public Service Commission pursuant to which EDF replaced Big Rivers as our market participant with MISO under this arrangement. See Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations - Electrical Power Developments in the United States in 2014."

Mt. Holly. Power is supplied to Mt. Holly pursuant to a power agreement with South Carolina Public Service Authority ("Santee Cooper") with an effective term through December 2015. This agreement provides power for Mt. Holly’s full production capacity requirements at prices based on published rate schedules (which are subject to change), with adjustments for fuel prices and other items. The agreement restricts Mt. Holly’s ability to reduce its power consumption (or the associated

8

payment obligations) below contracted levels and to terminate the agreement, unless, in each case, the LME falls below certain negotiated levels.

Under this agreement, Mt. Holly receives all or a portion of its supplemental power requirements from an off-system natural gas-fired power generation facility. The energy charge for supplemental power from the off-system facility is based, among other factors, on the cost of natural gas rather than Santee Cooper's system average fuel costs, which are primarily coal-based.

On June 30, 2014, Mt. Holly gave notice to Santee Cooper under the Santee Cooper Agreement to reduce the contract demand to zero effective December 31, 2015. We are continuing discussions with Santee Cooper and other parties regarding power arrangements for Mt. Holly following December 31, 2015. See "Item 1A, "Risk Factors — If we are unable to enter into a new power contract for Mt. Holly, we may be unable to operate Mt. Holly at a profitable level or at all."

Ravenswood. Ravenswood currently purchases a limited amount of power from APCo as necessary to maintain its curtailed smelter. Power is supplied under the APCo Agreement at prices set forth in published tariffs (which are subject to change), with certain adjustments.

Helguvik. We have entered into power purchase agreements with HS and OR for the provision of power to the Helguvik project. These power purchase agreements provide power at LME-based variable rates and contain take-or-pay obligations with respect to a significant percentage of the total committed and available power under such agreements. The agreements contain certain conditions to HS’s and OR’s obligations. HS (with respect to all phases) and OR (with respect to all phases other than the first phase) have alleged that certain of these conditions have not been satisfied. The first stage of power under the OR power purchase agreement (approximately 47.5 MW) became available in the fourth quarter of 2011 and is currently being utilized at Grundartangi. In July 2014, HS commenced arbitration proceedings against Nordural Helguvik ehf seeking, among other things, an order declaring that the conditions to the power contract have not been fulfilled and that the power contract is therefore no longer valid. Nordural Helguvik ehf is in discussions with both HS and OR with respect to such conditions and other matters pertaining to these agreements.

In June 2014, Nordural Helguvik ehf entered into a supplemental power contract with OR. The supplemental power contract will expire in October 2036 (or upon the occurrence of certain earlier events) and will provide Grundartangi or Helguvik with supplemental power at LME-based rates, as may be requested from Grundartangi or Helguvik from time to time.

See Note 15, "Commitments and contingencies" to the consolidated financial statements included herein for additional information concerning our power arrangements. See "Item 1A, "Risk Factors — If we are unable to procure a reliable source of power, the Helguvik project may not be feasible."

Employees

As of December 31, 2014, we have approximately 2,400 employees.

Labor Agreements

The bargaining unit employees at our Grundartangi, Vlissingen, Hawesville, Sebree and Ravenswood smelters, representing approximately 59% of our total workforce, are represented by labor unions. Our employees at Mt. Holly are not represented by a labor union.

A summary of our key labor agreements is provided below:

Facility | Organization | Term |

Grundartangi | Icelandic labor unions | Through December 31, 2014 |

Hawesville | USWA | Through March 31, 2015 |

Sebree | USWA | Through October 28, 2019 |

Vlissingen | FME | Through May 1, 2015 |

Ravenswood | USWA | Expired August 31, 2010 |

9

81% of Grundartangi’s workforce is represented by five labor unions, governed by a labor agreement that establishes wages and work rules for covered employees. This agreement expired on December 31, 2014. Since such time, we have been operating under the terms of the expired agreement while we engage in negotiations with the unions regarding the terms of a new agreement. 80% of Vlissingen's workforce is represented by the Federation for the Metal and Electrical Industry ("FME"), governed by a labor agreement that expires on May 1, 2015. The FME negotiates working conditions with trade unions on behalf of its members.

54% of our U.S. based workforce is represented by the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union ("USWA"). CAKY’s Hawesville employees represented by the USWA are under a collective bargaining agreement that expires on March 31, 2015. CAKY is currently in negotiations with the USWA with respect to a new agreement. In July 2014, Century Sebree entered into a new collective bargaining agreement with the USWA for its employees at the Sebree smelter. The agreement is effective through October 28, 2019. The labor agreement for CAWV’s Ravenswood plant employees represented by the USWA expired on August 31, 2010.

Competition

The market for primary aluminum is global, and demand for aluminum varies widely from region to region. We compete with U.S. and international companies in the aluminum industry as well as with materials such as steel, copper, carbon fiber, composites, plastic and glass, each of which may be substituted for aluminum in certain applications.

Our Hawesville plant is located adjacent to Southwire, a large purchaser of aluminum for electrical wire and cable products. This location allows Hawesville to deliver a portion of its production in molten form, saving casting costs, and providing a competitive advantage over other potential suppliers. In addition, Hawesville is the largest producer of high purity aluminum in North America.

We believe that the proximity of Iceland to European markets provides a competitive advantage for Grundartangi. We believe that this location offers Century logistical benefits and freight savings compared to our competitors outside the European Economic Area ("EEA"). As a member of the EEA, Iceland has duty free access to these European markets. In addition, the proximity to our customer base in key manufacturing areas in the United States provides a competitive advantage in freight costs over our foreign competitors.

We produce several primary products at our facilities, such as billet, foundry, slab and sow. Billet, foundry and slab are value-added primary aluminum products for which we receive a product premium above the LME and regional premiums.

For additional information, see Item 1A, "Risk Factors - We may be unable to continue to compete successfully in the highly competitive markets in which we operate."

Financial Information about Segments and Geographic Areas

We operate in one reportable segment, primary aluminum. Additional information about our segment reporting and certain geographic information is available in Note 20, "Business segments" to the consolidated financial statements included herein.

Environmental Matters

We are subject to various environmental laws and regulations in the countries in which we operate. We have spent, and expect to continue to spend, significant amounts for compliance with those laws and regulations. In addition, some of our past manufacturing activities have resulted in environmental consequences that require remedial measures. Under certain environmental laws, which may impose liability regardless of fault, we may be liable for the costs of remediation of contaminated property, including our current and formerly owned or operated properties or adjacent areas, or for the amelioration of damage to natural resources. We believe, based on currently available information, that our current environmental liabilities are not likely to have a material adverse effect on Century. However, we cannot predict the requirements of future environmental laws and future requirements at current or formerly owned or operated properties or adjacent areas or the outcome of certain existing litigation to which we are a party. Such future requirements or events may result in unanticipated costs or liabilities that may have a material adverse effect on our financial condition, results of operations or liquidity. More information concerning our environmental contingencies can be found in Note 15, "Commitments and contingencies" to the consolidated financial statements included herein.

10

Intellectual Property

We own or have rights to use a number of intellectual property rights relating to various aspects of our operations. We do not consider our business to be materially dependent on any of these intellectual property rights.

Disclosure Pursuant to Section 219 of the Iran Threat Reduction and Syria Human Rights Act

Section 219 of the Iran Threat Reduction and Syria Human Rights Act of 2012 ("ITRA"), effective August 10, 2012, added a new subsection (r) to Section 13 of the Exchange Act, which requires issuers that file periodic reports with the SEC to disclose in their annual and quarterly reports whether, during the reporting period, they or any of their "affiliates" (as defined in Rule 12b-2 under the Exchange Act) have knowingly engaged in specified activities or transactions relating to Iran, including activities not prohibited by U.S. law and conducted outside the U.S. by non-U.S. affiliates in compliance with applicable laws. Issuers must also file a notice with the SEC if any disclosable activity under ITRA has been included in an annual or quarterly report.

Because the SEC defines the term "affiliate" broadly, our largest stockholder may be considered an affiliate of the Company despite the fact that the Company has no control over its largest stockholder’s actions or the actions of its affiliates. As such, pursuant to Section 13(r)(1)(D)(iii) of the Exchange Act, the Company hereby discloses the following information provided by our largest stockholder regarding transactions or dealings with entities controlled by the Government of Iran ("the GOI"):

During 2014, as previously reported, a non-U.S. affiliate of the largest stockholder of the Company ("the non-U.S. Stockholder Affiliate") entered into sales contracts for agricultural products for delivery to Iranian entities wholly or majority owned by the GOI. The non-U.S. Stockholder Affiliate performed its obligations under the contracts in compliance with applicable sanction laws and, where required, with the necessary prior approvals by the relevant governmental authorities.

The gross revenue of the non-U.S Stockholder Affiliate related to these contracts did not exceed the value of $162 million for the twelve months ended December 31, 2014. The non-U.S. Stockholder Affiliate does not allocate net profit on a country-by-country or activity-by-activity basis, but estimates that the net profit attributable to the contracts would not exceed a small fraction of the gross revenue from such contracts. It is not possible to determine accurately the precise net profit attributable to such contracts.

The contracts disclosed above do not violate applicable sanctions laws administered by the U.S. Department of the Treasury, Office of Foreign Assets Control, and are not the subject of any enforcement action under Iran sanction laws.

In compliance with applicable economic sanctions and in conformity with US secondary sanctions, the non-U.S. Stockholder Affiliate expects to continue to engage in similar activities in the future.

Century and its global subsidiaries had no transactions or activities requiring disclosure under ITRA, nor were we involved in the transactions described in this section. As of the date of this report, the Company is not aware of any other activity, transaction or dealing by it or any of its affiliates during the twelve months ended December 31, 2014 that requires disclosure in this report under Section 13(r) of the Exchange Act.

Available Information

Additional information about Century may be obtained from our website, which is located at www.centuryaluminum.com. Our website provides access to periodic filings we have made through the EDGAR filing system of the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports. We also make available on our website a copy of our code of ethics that applies to all employees and ownership reports filed on Forms 3, 4 and 5 by our directors, executive officers and beneficial owners of more than 5% of our outstanding common stock. Reports that we have filed with the SEC are also available on the SEC website at www.sec.gov. In addition, we will make available free of charge copies of our Forms 10-K, Forms 10-Q and Forms 8-K upon request. Requests for these documents can be made by contacting our Investor Relations Department by mail at: One South Wacker Drive, Suite 1000, Chicago, IL 60606, or by phone at: (312) 696-3101. Information contained in our website is not incorporated by reference in, and should not be considered a part of, this Annual Report on Form 10-K.

11

Item 1A. Risk Factors

The following describes certain of the risks and uncertainties we face that could cause our future results to differ materially from our current results and from those anticipated in our forward-looking statements. These risk factors should be considered together with the other risks and uncertainties described in Item 7, "Management’s Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere herein. This list of significant risk factors is not all-inclusive or necessarily in order of importance.

Declines in aluminum prices could have a material adverse effect on our earnings and cash flows.

Our operating results depend on the market for primary aluminum, which is a highly cyclical commodity with prices that are affected by global and regional supply and demand, political and economic conditions and other related factors. The price of primary aluminum may also be impacted by LME inventory levels. Aluminum warehouse inventory levels remain at high levels. Continued high inventory levels, or the release of such inventory into the market, may cause primary aluminum prices and regional delivery and product premiums to decline. Historically, aluminum prices have been volatile, and we expect such volatility to continue. The cash aluminum price, as quoted on the LME (the largest component of the overall price), averaged approximately $1,867 per tonne in 2014, which is below the average price of approximately $2,061 per tonne for the previous five years. The LME cash aluminum price on February 27, 2015 was $1,794 per tonne. Although Midwest and European Duty Paid premiums reached levels in 2014 higher than historical averages, these premiums may decrease, which would have a negative impact on our results of operations. Declines in aluminum prices (and regional delivery, product and other premiums) may materially and adversely affect our liquidity, the amount of cash flow we have available for our capital expenditures and other operating expenses, our ability to access the credit and capital markets and our results of operations. If the price we realize for our products falls below our cost of production, we may choose or be forced to curtail all or a portion of our operations or otherwise restructure our operations. There can be no assurance that we will be able to take actions necessary to curtail or otherwise restructure our operations, if these steps are required.

Increases in energy costs adversely affect our business.

Electricity represents our single largest operating cost. As a result, the availability of electricity at competitive prices is critical to the profitability of our operations. Each of our Hawesville and Sebree plants receives electricity under market-based electricity contracts. Market-based electricity contracts expose us to market price volatility and fluctuations and there can be no assurance that such market-based power supply arrangements will result in lower electricity costs. Electrical power prices have fluctuated significantly in recent years (for instance, as a result of extreme weather conditions), without any direct relationship to the price of aluminum. Increased electricity and energy prices could have a material adverse effect on our business, financial position, results of operations and liquidity.

A significant portion of the electrical power currently supplied to Mt. Holly is produced by natural gas. An increase in the price of natural gas would therefore increase the price that Mt. Holly pays for electricity. The Mt. Holly power contract also has take-or-pay type provisions, so our financial position, results of operations and cash flows from our Mt. Holly operations may be adversely affected by the price for electrical power even if we curtail unprofitable production capacity at this facility.

Losses caused by disruptions in our supply of power would adversely affect our operations.

We use large amounts of electricity to produce primary aluminum. Any loss of power which reduces the amperage to our equipment or causes an equipment shutdown would result in a reduction in the volume of molten aluminum produced, and prolonged losses of power may result in the hardening or "freezing" of molten aluminum in the pots where it is produced, which could require an expensive and time consuming restart process. Disruptions in the supply of electrical power to our facilities can be caused by a number of circumstances, including unusually high demand, blackouts, equipment or transformer failure, human error, malicious acts, natural disasters or other catastrophic events. Our market-based power supply arrangements further increase the risk that disruptions in the supply of electrical power to our domestic operations could occur. Under these arrangements, we have greater exposure to transmission line outages, problems with grid stability and limitations on energy import capability. An alternative supply of power in the event of a disruption may not be feasible. If a disruption in the supply of electrical power at one of our facilities were to occur, we may lose production for a prolonged period of time, experience pot instability that could decrease levels of productivity and incur significant losses. Such a condition may also force a curtailment of all or part of the production at any of these facilities and could have a material adverse effect on our business, financial position, results of operations and liquidity.

12

We operate our plants at close to peak amperage. Accordingly, even partial failures of high voltage equipment could affect our production. We maintain property and business interruption insurance to mitigate losses resulting from catastrophic events, but are required to pay significant amounts under the deductible provisions of those insurance policies. In addition, the coverage under those policies may not be sufficient to cover all losses, or may not cover certain events. Certain of our insurance policies do not cover any losses that may be incurred if our suppliers are unable to provide power under certain circumstances. Certain losses or prolonged interruptions in our operations may trigger a default under certain of our outstanding indebtedness and could have a material adverse effect on our business, financial position, results of operations and liquidity.

If we are unable to enter into a new power contract for Mt. Holly, we may be unable to operate Mt. Holly at a profitable level or at all.

In June 2014, Mt. Holly notified Santee Cooper of its election to reduce its contract demand to zero effective December 31, 2015. We are currently in discussions with Santee Cooper regarding power arrangements for Mt. Holly following December 31, 2015, but no assurance can be given that we will come to an agreement on terms that are favorable to us, or at all. If a favorable power arrangement for Mt. Holly is not reached and approved prior to December 31, 2015, we may be unable to operate the Mt. Holly facility at a profitable level or at all. Closure of the Mt. Holly facility would impose various costs on us that could have a material adverse effect on our business, financial condition, results of operations and liquidity. In addition, uncertainty regarding the future operation of Mt. Holly may damage our relationships with our customers, suppliers, employees and other stakeholders, whether or not Mt. Holly is ultimately closed. We may need to take actions to terminate certain customer and supply contracts or curtail individual potlines well in advance of any plant closure. Customers and suppliers may also become unwilling to renew existing contracts or enter into new contracts with us. It may also become more difficult to attract and retain employees. Such actions and events could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Curtailment of unprofitable aluminum production at our facilities could have a material adverse effect on our business, financial position, results of operations and liquidity.

Curtailing unprofitable production to reduce our operating costs requires us to incur substantial expenses, both at the time of the curtailment and on an ongoing basis. Our facilities are subject to contractual and other fixed costs that continue even if we curtail operations at these facilities. These costs reduce the cost saving advantages of curtailing unprofitable aluminum production.

If we are unable to realize the intended cost saving effects of any production curtailment, including at our currently curtailed Ravenswood facility, we may have to seek bankruptcy protection for some or all of our subsidiaries; we could also be forced to divest some or all of these subsidiaries. If we were to seek bankruptcy protection for any of these subsidiaries, we would face additional risks. Such action could cause concern among our customers and suppliers, distract our management and our other employees and subject us to increased risks of lawsuits. Other negative consequences could include negative publicity, which could have an impact on the trading price of our securities and affect our ability to raise capital in the future.

Any curtailments of our operations, or actions taken to seek bankruptcy protection or divest some or all of our subsidiaries, could have a material adverse effect on our business, financial position, results of operations and liquidity.

Construction at our Helguvik smelter site has been significantly curtailed. Substantial delay in the completion of, or failure to complete, this project may increase its cost, subject us to losses and impose other risks to completion that are not foreseeable at this time.

Nordural Helguvik ehf, our indirect, wholly-owned subsidiary, has significantly curtailed construction activity and spending at our Helguvik project in response to ongoing negotiations with the power companies contracted to provide power to the Helguvik project. See "If we are unable to procure a reliable source of power, the Helguvik project may not be feasible," and "If economic, financial and political conditions in Iceland were to deteriorate, our financial position and results of operations could be adversely impacted." Nordural Helguvik ehf cannot be certain when or if it will restart major construction and engineering activities or ultimately complete the Helguvik project or, if completed, that the Helguvik smelter would operate in a profitable manner. We will not realize any return on our significant investment in the Helguvik project until we are able to commence Helguvik operations in a profitable manner. If we fail to achieve operations at Helguvik, we may have to recognize a loss on our investment, which would have a material adverse impact on our earnings.

13

Many of the contractual arrangements related to the Helguvik project have time periods for performance. The delay in restarting major construction and completing the Helguvik project has caused Nordural Helguvik ehf to renegotiate and extend, or undertake to renegotiate and extend, existing contractual commitments, including with respect to power, transmission, technology, equipment and construction. There can be no assurance that the contractual arrangements and conditions, including extensions, necessary to proceed with construction of the Helguvik project will be obtained or satisfied on a timely basis or at all. In addition, such approvals or extensions may be subject to conditions that are unfavorable or make the project impracticable or less attractive from a financial standpoint. We may also become liable to some of our suppliers for damages relating to delays in the project.

Even if we were to receive the necessary approvals and extensions on terms that we determine are acceptable, the construction of this project is a complex undertaking. There can be no assurance that we will be able to complete the project within our projected budget and schedule. To successfully execute this project, in addition to procuring a reliable source of power, we may need to arrange additional financing and secure a supply of necessary raw materials. Furthermore, unforeseen technical difficulties could increase the cost of the project, delay the project or render the project infeasible.

We intend to finance our future capital expenditures from available cash, cash flow from operations and accessing capital markets. We may be unable to raise additional capital, or do so on attractive terms, due to a number of factors, including a lack of demand, poor economic conditions, interruptions in the capital markets, unfavorable interest rates or our financial condition or credit rating at the time. If additional capital resources are unavailable, we may further curtail construction and development activities.

Further delay in the completion of the project or increased costs could have a material adverse effect on our business, financial condition, results of operations and liquidity.

If we are unable to procure a reliable source of power, the Helguvik project may not be feasible.

The Helguvik project will require generation and transmission of a substantial amount of electricity to power the smelter. Nordural Helguvik ehf has entered into agreements with two providers of power, HS and OR. Each of HS and OR has alleged that certain conditions to the delivery of power under the power agreements have not yet been satisfied. In July 2014, HS commenced arbitration proceedings against Nordural Helguvik ehf seeking, among other things, an order declaring, (i) that the conditions to the power contract have not been fulfilled and, (ii) that the power contract is therefore no longer valid. If we are unable to reach agreement with each of HS and OR, we may have to seek alternative sources of power or incur substantially increased power costs and may be unable to complete the Helguvik project. Due to the limited number of Icelandic power providers with resources sufficient to provide power to the Helguvik project (only three are currently in operation in Iceland), we may find it difficult or impossible to procure additional sources of power if HS and OR do not perform under their existing agreements and may be unable to complete construction of the smelter. If we agree to pay increased prices for power or substantially delay or are unable to complete the Helguvik project, we may have to recognize a substantial loss on our investment. Any failure to complete the Helguvik project, or any further delays in completing the project could have a material adverse effect on our business, financial condition, results of operations and liquidity.

The generation of the contracted power for the Helguvik project will also require successful development of new energy sources by our contracted power providers and completion of the necessary transmission infrastructure to service the Helguvik project. If there are construction delays or technical difficulties in developing these new energy sources or transmission infrastructure, power may be delayed or may not be available. Development of the generation and transmission infrastructure is expensive and requires significant resources from the power and transmission providers. Factors which could delay or impede the generation and transmission of electric power are substantially beyond our ability to control, influence or predict, including the power and transmission providers’ ability to finance and obtain necessary permits, real property and other rights for the development of new energy sources and associated transmission infrastructure. In addition, if Nordural Helguvik ehf is unable to proceed with the Helguvik project, it may incur significant reimbursement obligations for certain costs incurred by third party providers under transmission and other agreements entered into in connection with the Helguvik project and remain subject to significant power commitments already confirmed under its agreement with OR. If the power or transmission providers are unable to provide or transmit the contracted amounts of power, such failure could substantially delay or make the Helguvik project infeasible and could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Any restart of the Ravenswood smelter would involve significant risks and uncertainties.

In 2009, we curtailed all operations at our Ravenswood smelter. We may restart the curtailed operations upon the realization of several objectives, including an expectation of high long-term aluminum prices, a competitively priced power

14

agreement, passage of supporting legislation and a new labor agreement. If we are unable to realize these and other objectives, a restart of the Ravenswood smelter may not be feasible. Any potential restart of operations at the Ravenswood smelter would involve significant risks and uncertainties, including, significant costs and liabilities incurred to pursue a restart that does not occur or that does not achieve the anticipated benefits. Additionally, it may be challenging for us to manage our existing business as we restart operations at Ravenswood.

Accordingly, any potential restart of operations at Ravenswood might not ultimately improve our competitive position and business prospects as anticipated and may subject us to additional liabilities that could have a material adverse effect on our business, financial position, results of operations and liquidity.

We may be unable to realize the expected benefits of our capital projects.

From time to time, we undertake strategic capital projects in order to enhance, expand and/or upgrade our facilities and operational capabilities. For instance, within the past several years we have undertaken major expansions of our Grundartangi and Vlissingen facilities. Our ability to achieve the anticipated increased revenues or otherwise realize acceptable returns on these investments or other strategic capital projects that we may undertake is subject to a number of risks, many of which are beyond our control, including a variety of market, operational, permitting, and labor-related factors. In addition, the cost to implement any given strategic capital project ultimately may prove to be greater than originally anticipated. If we are not able to achieve the anticipated results from the implementation of any of our strategic capital projects, or if we incur unanticipated implementation costs or delays, our results of operations and financial position may be materially adversely affected.

Our failure to maintain satisfactory labor relations could adversely affect our business.

The bargaining unit employees at our Grundartangi, Hawesville, Sebree, Vlissingen and Ravenswood facilities are represented by labor unions, representing 59% of our total workforce as of December 31, 2014. If we fail to maintain satisfactory relations with any labor union representing our employees, our labor contracts may not prevent a strike or work stoppage at any of these facilities in the future. The collective bargaining agreement at our Grundartangi facility expired on December 31, 2014. Since such time, we have been operating under the terms of the expired agreement while we engage in negotiations with the unions regarding the terms of a new agreement. In addition, the collective bargaining agreements for our Hawesville and Vlissingen locations expire in March and May of 2015, respectively. We may not be able to renegotiate these or our other labor contracts on satisfactory terms. As part of any negotiation, we may reach agreements with respect to future wages and benefits that may have a material adverse effect on our future business, financial condition, results of operations and liquidity. In addition, negotiations could divert management attention or result in strikes, lock-outs or other work stoppages. Any threatened or actual work stoppage in the future or inability to renegotiate our collective bargaining agreements could prevent or significantly impair our ability to conduct production operations at our facilities subject to these collective bargaining agreements, which could have a material adverse effect on our business, financial position, results of operations and liquidity.

Disruptions to, or changes in the terms of, our raw material and electrical power supply arrangements could increase our production costs.

Our business depends upon the adequate supply of alumina, electrical power, aluminum fluoride, calcined petroleum coke, pitch, carbon anodes and cathodes and other materials at competitive prices. Disruptions to the supply of these production inputs could occur for a variety of reasons, including disruptions of production at a particular supplier’s facility or power plant. For some of these production inputs, such as power and anode supply, we rely on a limited number of suppliers. Many of our supply agreements are short term or expire in the next few years. We can provide no assurance that we will be able to renew such agreements at commercially favorable terms, if at all.

Any supply disruption may require us to purchase these products on less favorable terms than under our current agreements due to the limited number of suppliers of these products or other market conditions. In some instances, we may be unable to secure alternative supply of these resources. In addition, we may not be able to obtain alumina or power in the future at prices that are based on the LME. Because we sell our products based on the LME price for primary aluminum, we would not be able to pass on any increased costs of raw material that are not linked to the LME price to our customers. A disruption in our materials or electricity supply may adversely affect our operating results if we are unable to secure alternate supplies of materials or electrical power at comparable prices.

15

Certain of our alumina and electrical power supply contracts contain "take-or-pay" obligations.

We have obligations under certain contracts to take-or-pay for specified quantities of alumina and electrical power over the term of those contracts regardless of our operating requirements. Our financial position and results of operations may therefore be adversely affected by the market price for alumina and electrical power even if we were to curtail unprofitable production capacity or delay construction of new capacity, as we will continue to incur costs under these contracts to meet or settle our contractual take-or-pay obligations. If we were unable to use such electrical power or raw materials in our operations or sell them at prices consistent with or greater than our contract costs, we could incur significant losses under these contracts. In addition, these commitments may also limit our ability to take advantage of favorable changes in the market prices for electrical power or raw materials and may have a material adverse effect on our business, financial position, results of operations and liquidity.

We could be adversely affected by the loss of a major customer or changes in the business or financial condition of our major customers.

For the year ended December 31, 2014, we derived approximately 77% of our consolidated sales from two major customers: Southwire and Glencore. Beginning in 2015, we expect to sell all or substantially all of our production to Glencore. A significant downturn or deterioration in the business or financial condition of any major customer could have a material adverse effect on our results of operations. In addition, any significant reduction in purchases from any major customer, loss of this customer or failure to renew our current agreement with Glencore at all or on as favorable terms could have a material adverse effect on our business, financial position, results of operations and liquidity.

New LME warehousing rules could cause aluminum prices to decrease.

The LME has adopted new rules, effective as of February 1, 2015, which require LME warehouses, under certain conditions, to deliver out more aluminum than they take in. These or other new rules could cause an increase in the supply of aluminum to enter the physical market and may cause regional delivery premiums, product premiums and LME aluminum prices to fall. Declines in aluminum prices (and regional delivery, product and other premiums) may materially and adversely affect our liquidity, the amount of cash flow we have available for our capital expenditures and other operating expenses, our ability to access the credit and capital markets and our results of operations.

International operations expose us to political, regulatory, currency and other related risks.

We receive a significant portion of our revenues from our international operations, primarily in Iceland. These operations expose us to risks, including unexpected changes in foreign laws and regulations, political and economic instability, challenges in managing foreign operations, increased costs to adapt our systems and practices to those used in foreign countries, taxes, export duties, currency restrictions and exchange, tariffs and other trade barriers, and the burdens of complying with a wide variety of foreign laws and regulations. Changes in foreign laws and regulations are generally beyond our ability to control, influence or predict and future adverse changes in these laws could have a material adverse effect on our business, financial position, results of operations and liquidity.

Our international operations are also exposed to risks related to the challenges in obtaining permits necessary to run them. For example, the Grundartangi expansion project is subject to the receipt of an operating permit from Icelandic regulators. If we are unable to obtain this permit, we will not be permitted to produce more than 300,000 tpy of primary aluminum at Grundartangi and we will only realize a partial return on our significant investment in the Grundartangi expansion project.

In addition, we may be exposed to fluctuations in currency exchange rates. As a result, an increase in the value of foreign currencies relative to the U.S. dollar could increase our operating expenses which are denominated and payable in those currencies. As we continue to explore other opportunities outside the U.S., including the expansion programs at Grundartangi and Vlissingen and the Helguvik project, our currency risk with respect to the Icelandic krona ("ISK"), the euro and other foreign currencies will significantly increase.

16

If economic, financial and political conditions in Iceland were to deteriorate, our financial position and results of operations could be adversely impacted.

Iceland is important to our business. Disruptions in Iceland’s economic, financial and political systems have decreased the stability of Iceland’s economy and financial markets and made cash management activities in Iceland more challenging. For example, the Icelandic government and the Central Bank of Iceland are restricting the transfer of funds into and outside of Iceland. While we are currently exempt from these foreign currency rules, we cannot control further actions by the Central Bank of Iceland which might restrict our ability to transfer funds through the Icelandic banking system and outside of Iceland. While we currently maintain essentially all of our Icelandic operating funds in accounts outside of Iceland, and are receiving substantially all of our customer payments in such accounts, a portion of our funds remain in the Icelandic banks to meet local working capital requirements. In addition, as payables become due in Iceland, we must transfer funds through the Icelandic banking system. If economic, financial or political conditions in Iceland deteriorate, or if counterparties and lenders become unwilling to engage in normal banking relations with and within Iceland, our ability to operate our Grundartangi smelter, including paying vendors, processing payroll and receiving payments, as well as our ability to complete the Helguvik project, could be adversely impacted, any of which could have a material adverse effect on our business, financial position, results of operations and liquidity.

Because we own less than a majority of some of our operating assets, we cannot exercise complete control over their operations.

We have a joint venture agreement pursuant to which we hold a 40% stake in BHH, a carbon anode and cathode facility located in the Guangxi Zhuang Autonomous Region of south China. Because we beneficially own less than a majority of the ownership interests in BHH, we have limited control of the operations of this facility. While we seek to exert as much influence with respect to the management and operation of this facility as possible, we are dependent on our co-owner to operate such assets. Our co-owner may have interests, objectives and incentives with respect to such assets that differ from our own.

We require substantial resources to pay our operating expenses and fund our capital expenditures.

We require substantial resources to pay our operating expenses and fund our capital expenditures, including construction at our Helguvik project and the expansion programs at Grundartangi and Vlissingen. In addition, if we were to resume operations at our Ravenswood smelter, we would incur substantial capital expenditures, working capital funding and operating expenses. If we are unable to generate funds from our operations to pay our operating expenses and fund our capital expenditures and other obligations, our ability to continue to meet these cash requirements in the future could require substantial liquidity and access to sources of funds, including from capital and credit markets.

If funding is not available when needed, or is available only on unacceptable terms, we may be unable to respond to competitive pressures, take advantage of market opportunities or fund operations, capital expenditure or other obligations, any of which could have a material adverse effect on our business, financial position, results of operations and liquidity.

Our ability to access the credit and capital markets on acceptable terms may be limited due to our credit ratings, our financial condition or the deterioration of these markets.

Our credit rating was, and continues to be, adversely affected by unfavorable market and financial conditions. Our existing credit ratings, or any future negative actions the credit agencies may take, could affect our ability to access the credit and capital markets in the future and could lead to worsened trade terms, increasing our liquidity needs. An inability to access capital and credit markets when needed in order to refinance our existing debt or raise new debt or equity could have a material adverse effect on our business, financial position, results of operations and liquidity.

We require significant cash flow to meet our debt service requirements, which increases our vulnerability to adverse economic and industry conditions, reduces cash available for other purposes and limits our operational flexibility.

As of December 31, 2014, we had an aggregate of approximately $255 million of outstanding debt and we may incur additional debt in the future.

17

The level of our debt could have important consequences, including:

• | increasing our vulnerability to adverse economic and industry conditions; |