Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SEABOARD CORP /DE/ | Financial_Report.xls |

| EX-21 - EX-21 - SEABOARD CORP /DE/ | a14-24467_1ex21.htm |

| EX-31.1 - EX-31.1 - SEABOARD CORP /DE/ | a14-24467_1ex31d1.htm |

| EX-32.2 - EX-32.2 - SEABOARD CORP /DE/ | a14-24467_1ex32d2.htm |

| EX-32.1 - EX-32.1 - SEABOARD CORP /DE/ | a14-24467_1ex32d1.htm |

| EX-31.2 - EX-31.2 - SEABOARD CORP /DE/ | a14-24467_1ex31d2.htm |

| 10-K - 10-K - SEABOARD CORP /DE/ | a14-24467_110k.htm |

Exhibit 13

2014 Annual Report

SEABOARD CORPORATION

Description of Business

Seaboard Corporation is a diverse global agribusiness and transportation company. In the United States, Seaboard is primarily engaged in pork production and processing and ocean transportation. Overseas, Seaboard is primarily engaged in commodity merchandising, grain processing, sugar production and electric power generation. Seaboard also has an interest in turkey operations in the United States.

Table of Contents

|

Letter to Stockholders |

2 |

|

Principal Locations |

5 |

|

Division Summaries |

6 |

|

Summary of Selected Financial Data |

8 |

|

Company Performance Graph |

9 |

|

Quarterly Financial Data (unaudited) |

10 |

|

Management’s Discussion & Analysis of Financial Condition and Results of Operations |

11 |

|

Management’s Responsibility for Consolidated Financial Statements |

25 |

|

Management’s Report on Internal Control over Financial Reporting |

25 |

|

Report of Independent Registered Public Accounting Firm on Consolidated Financial Statements |

26 |

|

Report of Independent Registered Public Accounting Firm on Internal Control over Financial Reporting |

27 |

|

Consolidated Statements of Comprehensive Income |

28 |

|

Consolidated Balance Sheets |

29 |

|

Consolidated Statements of Cash Flows |

30 |

|

Consolidated Statements of Changes in Equity |

31 |

|

Notes to Consolidated Financial Statements |

32 |

|

Stockholder Information |

60 |

This report, including information included or incorporated by reference in this report, contains certain forward-looking statements with respect to the financial condition, results of operations, plans, objectives, future performance and business of Seaboard Corporation and its subsidiaries (Seaboard). Forward-looking statements generally may be identified as statements that are not historical in nature and statements preceded by, followed by or that include the words: “believes,” “expects,” “may,” “will,” “should,” “could,” “anticipates,” “estimates,” “intends,” or similar expressions. In more specific terms, forward-looking statements, include, without limitation: statements concerning the projection of revenues, income or loss, capital expenditures, capital structure or other financial items, including the impact of mark-to-market accounting on operating income; statements regarding the plans and objectives of management for future operations; statements of future economic performance; statements regarding the intent, belief or current expectations of Seaboard and its management with respect to: (i) Seaboard’s ability to obtain adequate financing and liquidity; (ii) the price of feed stocks and other materials used by Seaboard; (iii) the sales price or market conditions for pork, grains, sugar, turkey and other products and services; (iv) the recorded tax effects under certain circumstances and changes in tax laws; (v) the volume of business and working capital requirements associated with the competitive trading environment for the Commodity Trading and Milling segment; (vi) the charter hire rates and fuel prices for vessels; (vii) the fuel costs and related spot market prices in the Dominican Republic; (viii) the effect of the fluctuation in foreign currency exchange rates; (ix) the profitability or sales volume of any of Seaboard’s segments; (x) the anticipated costs and completion timetable for Seaboard’s scheduled capital improvements, acquisitions and dispositions; or (xi) other trends affecting Seaboard’s financial condition or results of operations, and statements of the assumptions underlying or relating to any of the foregoing statements.

This list of forward-looking statements is not exclusive. Seaboard undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changes in assumptions or otherwise. Forward-looking statements are not guarantees of future performance or results. They involve risks, uncertainties and assumptions. Actual results may differ materially from those contemplated by the forward-looking statements due to a variety of factors. The information contained in this report, including, without limitation, the information under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Letter to Stockholders” identifies important factors which could cause such differences.

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Letter to Stockholders

Letter to Stockholders is intentionally omitted from Exhibit 13 and will be included in printed Annual Report.

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Letter to Stockholders

Letter to Stockholders is intentionally omitted from Exhibit 13 and will be included in printed Annual Report.

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Letter to Stockholders

Letter to Stockholders is intentionally omitted from Exhibit 13 and will be included in printed Annual Report.

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Principal Locations

|

Corporate Office |

|

Flour Mills of Ghana |

|

Seaboard de Nicaragua, S.A. |

|

Seaboard Corporation |

|

Ghana |

|

Nicaragua |

|

Merriam, Kansas |

|

Life Flour Mill Ltd.* |

|

Seaboard del Peru, S.A. |

|

Pork |

|

Nigeria |

|

Peru |

|

Seaboard Foods LLC |

|

LMM Farine, S.A. |

|

Kingston Wharves Limited* |

|

Pork Division Office |

|

Madagascar |

|

Seaboard Freight & Shipping Jamaica |

|

Merriam, Kansas |

|

Congo Poultry Limited* |

|

Limited |

|

Processing Plant |

|

Minoterie de Matadi, S.A.R.L.* |

|

Jamaica |

|

Guymon, Oklahoma |

|

Societe Africaine de Developpement |

|

Seaboard Honduras, S.de R.L. de C.V. |

|

High Plains Bioenergy, LLC |

|

Industriel Alimentaire* |

|

Honduras |

|

Guymon, Oklahoma |

|

Democratic Republic of Congo |

|

Seaboard Marine (Trinidad) Ltd. |

|

Seaboard de Mexico USA LLC |

|

Minoterie du Congo, S.A. |

|

Trinidad |

|

Mexico |

|

Republic of Congo |

|

Seaboard Marine of Haiti, S.E. |

|

Daily’s Premium Meats, LLC* |

|

Moderna Alimentos, S.A.* |

|

Haiti |

|

Salt Lake City, Utah |

|

Molinos Champion, S.A.* |

|

SEADOM, S.A. |

|

Missoula, Montana |

|

Ecuador |

|

Dominican Republic |

|

Commodity Trading and Milling |

|

Paramount Mills (Pty) Ltd.* |

|

SeaMaritima S.A. de C.V. |

|

Commodity Trading Operations |

|

South Africa |

|

Mexico |

|

Australia* |

|

National Milling Corporation Limited |

|

Sugar |

|

Canada |

|

Zambia |

|

Alconoa S.R.L. |

|

Chapel Hill, North Carolina |

|

Unga Holdings Limited* |

|

Ingenio y Refineria San Martin del |

|

Colombia |

|

Kenya and Uganda |

|

Tabacal SRL |

|

Ecuador |

|

Marine |

|

Argentina |

|

Greece |

|

Seaboard Marine Ltd. |

|

Power |

|

Isle of Man |

|

Marine Division Office |

|

Transcontinental Capital Corp. |

|

Kenya |

|

Miami, Florida |

|

(Bermuda) Ltd. |

|

Peru* |

|

Port Operations |

|

Dominican Republic |

|

Singapore |

|

Brooklyn, New York |

|

Turkey |

|

South Africa |

|

Houston, Texas |

|

Butterball LLC* |

|

Africa Poultry Development Limited* |

|

Miami, Florida |

|

Division Office |

|

Kenya and Zambia |

|

New Orleans, Louisiana |

|

Garner, North Carolina |

|

Belarina Alimentos S.A.* |

|

Agencias Generales Conaven, C.A. |

|

Processing Plants |

|

Brazil |

|

Venezuela |

|

Huntsville, Arkansas |

|

Compania Industrial de Productos |

|

Agencia Maritima del Istmo, S.A. |

|

Ozark, Arkansas |

|

Agreopecuarios SA* |

|

Costa Rica |

|

Carthage, Missouri |

|

Rafael del Castillo & Cia. S.A* |

|

Cayman Freight Shipping Services, Ltd. |

|

Mt. Olive, North Carolina |

|

Colombia |

|

Cayman Islands |

|

Further Processing Plants |

|

Gambia Milling Corporation* |

|

JacintoPort International LLC |

|

Jonesboro, Arkansas |

|

Gambia |

|

Houston, Texas |

|

Montgomery, Illinois |

|

National Milling Company |

|

Representaciones Maritimas y Aereas, S.A. |

|

Other |

|

of Guyana, Inc. |

|

Guatemala |

|

Mount Dora Farms de Honduras, |

|

Guyana |

|

Sea Cargo, S.A. |

|

S.R.L. |

|

Les Moulins d’Haiti S.E.M.* |

|

Panama |

|

Honduras |

|

Haiti |

|

Seaboard de Colombia, S.A. |

|

Mount Dora Farms Inc. |

|

Lesotho Flour Mills Limited* |

|

Colombia |

|

Houston, Texas |

|

Lesotho |

|

|

|

|

*Represents a non-controlled, non-consolidated affiliate

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Division Summaries

Pork Division

Seaboard was a pioneer in the vertical integration of the U.S. pork industry and its Pork Division is one of the largest producers and processors in the United States. Seaboard is able to efficiently control pork production across the entire life cycle of the hog, beginning with research and development in nutrition and genetics and extending to the production of high quality meat products at our processing and further processing facilities.

Seaboard’s hog processing facility is located in Guymon, Oklahoma. The facility is a double shift operation that processes approximately 20,000 hogs per day and generally operates at capacity. Weekend shifts are added as market conditions dictate. Hogs processed at the plant are primarily Seaboard raised hogs. In addition, the remaining hogs processed are raised by third parties and purchased under contract or occasionally in the open market. Seaboard produces and sells fresh and frozen pork products to further processors, food service operators, grocery stores, distributors and retail outlets throughout the United States. Seaboard also sells to distributors, trading companies and further processors in Japan, Mexico and numerous other foreign markets.

Seaboard’s hog production facilities consist of genetic and commercial breeding, farrowing, nursery and finishing buildings located in Oklahoma, Kansas, Texas and Colorado. These facilities have a capacity to produce over four million hogs annually. Seaboard owns and operates five centrally located feed mills to provide formulated feed to these hogs.

Seaboard produces biodiesel at a facility in Guymon, Oklahoma. The biodiesel is primarily produced from pork fat from Seaboard’s Guymon pork processing plant and from animal fat supplied by non-Seaboard facilities. The biodiesel is sold to blenders for distribution and in the retail markets. The facility can also produce biodiesel from vegetable oil.

Seaboard’s Pork Division has an agreement with a similar size pork processor, Triumph Foods LLC (Triumph), to market substantially all of the pork products produced at Triumph’s plant in St. Joseph, Missouri. The agreement enhances the efficiency of Seaboard’s sales and marketing efforts and expands Seaboard’s geographic footprint. Seaboard receives a fee on a per head basis on all Triumph products. In 2014, Seaboard was ranked number 3 in pork production and number 4 in processing in the U.S. (including Triumph volume).

As of September 27, 2014, Seaboard’s Pork Division sold to Triumph a 50% interest in its processed meats division, Daily’s Premium Meats (Daily’s). As a result, Seaboard’s Pork Division now has a 50% non-controlling interest in Daily’s. Daily’s produces and markets raw and pre-cooked bacon, ham and sausage primarily for the food service industry and, to a lesser extent, retail markets. Daily’s has two further processing plants located in Salt Lake City, Utah and Missoula, Montana. Seaboard and Triumph each supply raw product to Daily’s.

Commodity Trading and Milling Division

Seaboard’s Commodity Trading and Milling Division is an integrated agricultural commodity trading and processing and logistics operation. This division sources, transports and markets approximately nine million metric tons per year of wheat, corn, soybean meal and other commodities primarily to third party customers and affiliated companies. These commodities are purchased worldwide, with primary destinations in Africa, South America and the Caribbean. Seaboard integrates the delivery of commodities to its customers through the use of company owned and short-term chartered bulk carriers.

Seaboard’s Commodity Trading and Milling Division operates facilities in 23 countries. The commodity trading business has ten offices in nine countries in addition to two non-consolidated affiliates in two other countries. The grain processing businesses operate facilities at 31 locations in 16 countries, and include five consolidated and fourteen non-consolidated affiliates primarily in Africa, South America and the Caribbean. Seaboard and its affiliates produce approximately four million metric tons of wheat flour, maize meal and manufactured feed per year in addition to other related grain based products.

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Division Summaries

Marine Division

Seaboard’s Marine Division provides cargo shipping services between the United States, the Caribbean Basin and Central and South America. Seaboard’s primary operations, located in Miami, include an off-port warehouse for cargo consolidation and temporary storage and a terminal at Port Miami. At the Port of Houston, Seaboard operates a cargo terminal facility that includes on-dock warehouse space for temporary storage of bagged grains, resins and other cargoes. Seaboard also makes scheduled vessel calls to Brooklyn, New York, New Orleans, Louisiana and various foreign ports in the Caribbean Basin and Central and South America.

This Division’s fleet consists of chartered and, to a lesser extent, owned vessels, and includes dry, refrigerated and specialized containers and other cargo related equipment. Seaboard is the largest shipper in terms of cargo volume in Port Miami. Seaboard provides extensive service between our domestic ports of call and multiple foreign destinations.

To maximize fleet utilization, Seaboard uses a network of offices and agents throughout the United States, Canada, Latin America and the Caribbean Basin to sell freight to and from multiple points. Seaboard’s full service capabilities allow transport by truck or rail of import and export cargo to and from various U.S. ports. Seaboard’s frequent sailings and fixed-day schedules allow customers to coordinate manufacturing schedules and maintain inventories at cost-efficient levels.

Sugar Division

In Argentina, Seaboard grows sugarcane, produces and refines sugar and produces alcohol. The sugar is primarily marketed locally, with some exports to the United States and other South American countries. Seaboard’s sugar processing plant, one of the largest in Argentina, has an annual capacity to produce approximately 250,000 metric tons of sugar and approximately 15 million gallons of alcohol per year. The mill is located in the Salta Province of Argentina, with administrative offices in Buenos Aires. Land owned by Seaboard in Argentina is planted primarily with sugarcane, which supplies the majority of the raw material processed. Depending on local market conditions, sugar may also be purchased from third parties for resale. In addition, this division sells dehydrated alcohol to certain oil companies under the Argentine governmental bio-ethanol program, which requires alcohol to be blended with gasoline. This division also owns a 51 megawatt cogeneration power plant. The plant is fueled by the burning of sugarcane by-products during the harvest season, which is typically between May and November.

Power Division

In the Dominican Republic, Seaboard is an independent power producer generating electricity for the local power grid from one owned floating power generating facility with a capacity to generate 108 megawatts. Seaboard previously leased another facility under a short-term lease which was canceled during 2014. Seaboard is not directly involved in the transmission or distribution of electricity. Seaboard primarily sells power on the spot market. Principal buyers are government-owned distribution companies and partially government-owned generation companies.

Other Divisions

Seaboard has a 50 percent non-controlling voting interest in Butterball, LLC (Butterball). Butterball is the largest vertically integrated producer, processor and marketer of branded and non-branded turkey and other products in the United States. Butterball has four processing plants, two further processing plants and numerous live production and feed milling operations located in North Carolina, Arkansas, Missouri, Illinois and Kansas. Butterball produces approximately one billion pounds of turkey each year. Butterball is a national supplier to retail and foodservice outlets, and also exports products to Mexico and numerous other foreign markets.

Seaboard processes jalapeño peppers at its plant in Honduras, which are primarily shipped to and sold in the United States.

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Summary of Selected Financial Data

|

|

|

Years ended December 31, |

| |||||||||||||

|

(Thousands of dollars except per share amounts) |

|

2014 |

|

2013 |

|

2012 |

|

2011 |

|

2010 |

| |||||

|

Net sales |

|

$ |

6,473,076 |

|

$ |

6,670,414 |

|

$ |

6,189,133 |

|

$ |

5,746,902 |

|

$ |

4,385,702 |

|

|

Operating income |

|

$ |

423,559 |

|

$ |

204,864 |

|

$ |

309,661 |

|

$ |

407,204 |

|

$ |

321,066 |

|

|

Net earnings attributable to Seaboard |

|

$ |

365,270 |

|

$ |

205,236 |

|

$ |

282,311 |

|

$ |

345,847 |

|

$ |

283,611 |

|

|

Basic earnings per common share |

|

$ |

309.96 |

|

$ |

171.92 |

|

$ |

234.54 |

|

$ |

284.66 |

|

$ |

231.69 |

|

|

Total assets |

|

$ |

3,677,320 |

|

$ |

3,418,048 |

|

$ |

3,347,781 |

|

$ |

3,006,728 |

|

$ |

2,734,086 |

|

|

Long-term debt, less current maturities |

|

$ |

- |

|

$ |

80,480 |

|

$ |

120,825 |

|

$ |

116,367 |

|

$ |

91,407 |

|

|

Stockholders’ equity |

|

$ |

2,720,273 |

|

$ |

2,479,970 |

|

$ |

2,308,189 |

|

$ |

2,079,467 |

|

$ |

1,778,249 |

|

|

Dividends per common share |

|

$ |

- |

|

$ |

- |

|

$ |

12.00 |

|

$ |

- |

|

$ |

9.00 |

|

As of September 27, 2014, Seaboard’s Pork segment sold to Triumph Foods LLC a 50% interest in Daily’s Premium Meats, its processed meats division. Included in net earnings attributable to Seaboard for 2014 is a gain on sale of controlling interest in subsidiary of $40,233,000 net of taxes, or $34.14 per common share ($65,955,000 gain before taxes).

On January 2, 2013, the American Taxpayer Relief Act of 2012 (the Tax Act) was signed into law. As the Tax Act was signed into law in 2013, the effects of the retroactive provisions in the new law on current and deferred taxes assets and liabilities for Seaboard were recorded in the first quarter of 2013. The total impact was a tax benefit of $7,945,000, or $6.66 per common share, recorded in the first quarter of 2013 related to certain 2012 income tax credits. In addition to this amount was a credit of approximately $11,260,000, or $9.43 per common share, for 2012 Federal blender’s credits that was recognized as revenues in the first quarter of 2013. There was no tax expense on this transaction.

In December 2012, Seaboard declared and paid a dividend of $12.00 per common share. The increased amount of the dividend (which has historically been $0.75 per common share on a quarterly basis or $3.00 per common share on an annual basis) represented a prepayment of the annual 2013, 2014, 2015 and 2016 dividends ($3.00 per common share per year). Seaboard does not currently intend to declare any further dividends for the years 2015 and 2016. Seaboard did not declare a dividend in 2014, 2013 and 2011. In 2010, Seaboard declared and paid dividends of $9.00 per common share, which included a prepayment of the annual 2011 and 2012 dividends ($3.00 per common share per year). Basic and diluted earnings per common share are the same for all periods presented.

In 2011, Seaboard closed the sale of its two floating power generating facilities in the Dominican Republic resulting in a gain on sale of assets of $52,923,000, or $43.56 per common share, included in operating income. There was no tax expense on this transaction.

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

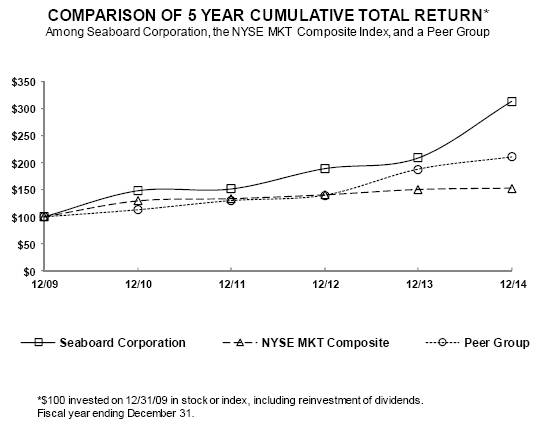

Company Performance Graph

The Securities and Exchange Commission requires a five-year comparison of stock performance for Seaboard with that of an appropriate broad equity market index and similar industry index. Seaboard’s common stock is traded on the NYSE MKT (formerly the NYSE Amex Equities) and provides an appropriate comparison for Seaboard’s stock performance. Because there is no single industry index to compare stock performance, the companies comprising the Dow Jones Food and Marine Transportation Industry indices (the “Peer Group”) were chosen as the second comparison.

The following graph shows a five-year comparison of cumulative total return for Seaboard, the NYSE MKT Index and the companies comprising the Dow Jones Food and Marine Transportation Industry indices, weighted by market capitalization for the five fiscal years commencing December 31, 2009 and ending December 31, 2014. The information presented in the performance graph is historical in nature and is not intended to represent or guarantee future returns.

The comparison of cumulative total returns presented in the above graph was plotted using the following index values and common stock price values:

|

|

|

12/31/09 |

|

12/31/10 |

|

12/31/11 |

|

12/31/12 |

|

12/31/13 |

|

12/31/14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Seaboard Corporation |

|

$ 100.00 |

|

$ 148.31 |

|

$ 151.66 |

|

$ 189.39 |

|

$ 209.23 |

|

$ 314.26 |

|

|

NYSE MKT Composite |

|

$ 100.00 |

|

$ 129.56 |

|

$ 133.75 |

|

$ 140.87 |

|

$ 150.79 |

|

$ 153.24 |

|

|

Peer Group |

|

$ 100.00 |

|

$ 113.14 |

|

$ 130.19 |

|

$ 140.29 |

|

$ 188.47 |

|

$ 211.18 |

|

SEABOARD CORPORATION

Quarterly Financial Data (unaudited)

|

(UNAUDITED) |

|

1st |

|

2nd |

|

3rd |

|

4th |

|

Total for |

| ||||||

|

(Thousands of dollars except per share amounts) |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

the Year |

| ||||||

|

2014 |

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Net sales |

|

$ |

1,479,636 |

|

$ |

1,694,591 |

|

$ |

1,622,641 |

|

$ |

1,676,208 |

|

$ |

6,473,076 |

| |

|

Operating income |

|

$ |

65,203 |

|

$ |

134,339 |

|

$ |

96,086 |

|

$ |

127,931 |

|

$ |

423,559 |

| |

|

Net earnings attributable to Seaboard |

|

$ |

48,166 |

|

$ |

93,677 |

|

$ |

104,749 |

|

$ |

118,678 |

|

$ |

365,270 |

| |

|

Earnings per common share |

|

$ |

40.55 |

|

$ |

79.01 |

|

$ |

89.49 |

|

$ |

101.39 |

|

$ |

309.96 |

| |

|

Dividends per common share |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

- |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Closing market price range per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

High |

|

$ |

2,771.00 |

|

$ |

3,069.45 |

|

$ |

3,097.60 |

|

$ |

4,197.95 |

|

|

| |

|

|

Low |

|

$ |

2,455.01 |

|

$ |

2,356.00 |

|

$ |

2,480.15 |

|

$ |

2,606.00 |

|

|

| |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Net sales |

|

$ |

1,582,296 |

|

$ |

1,684,039 |

|

$ |

1,648,105 |

|

$ |

1,755,974 |

|

$ |

6,670,414 |

| |

|

Operating income |

|

$ |

63,458 |

|

$ |

53,549 |

|

$ |

33,770 |

|

$ |

54,087 |

|

$ |

204,864 |

| |

|

Net earnings attributable to Seaboard |

|

$ |

57,454 |

|

$ |

39,547 |

|

$ |

30,969 |

|

$ |

77,266 |

|

$ |

205,236 |

| |

|

Earnings per common share |

|

$ |

47.98 |

|

$ |

33.07 |

|

$ |

25.99 |

|

$ |

64.91 |

|

$ |

171.92 |

| |

|

Dividends per common share |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

- |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Closing market price range per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

High |

|

$ |

2,881.94 |

|

$ |

2,825.92 |

|

$ |

2,945.00 |

|

$ |

2,874.99 |

|

|

| |

|

|

Low |

|

$ |

2,504.00 |

|

$ |

2,594.78 |

|

$ |

2,680.00 |

|

$ |

2,695.70 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

On December 19, 2014, the Tax Increase Prevention Act of 2014 (the 2014 Tax Act) was signed into law. The 2014 Tax Act extended for 2014 only many expired corporate income tax provisions that impact current and deferred taxes for financial reporting purposes. The total annual effects of the provisions in the new law on current and deferred taxes assets and liabilities for Seaboard were recorded in the fourth quarter of 2014. The impact was a tax benefit of $11,410,000, or $9.75 per common share, primarily related to certain income tax credits. In addition to this amount was a credit of $15,450,000, or $13.20 per common share, for the 2014 Federal blender’s credits that was recognized as revenues in the fourth quarter of 2014. There was no tax expense on this transaction.

As of September 27, 2014, Seaboard’s Pork segment sold to Triumph Foods LLC a 50% interest in Daily’s Premium Meats, its processed meats division. Included in net earnings attributable to Seaboard for third and fourth quarters of 2014 is a gain on sale of controlling interest in subsidiary of $39,279,000 and $954,000, respectively, net of taxes, or $33.56 per common share and $0.82 per common share, respectively ($65,955,000 total gain before taxes).

On January 2, 2013, the American Taxpayer Relief Act of 2012 (the Tax Act) was signed into law. As the Tax Act was signed into law in 2013, the effects of the retroactive provisions in the new law on current and deferred taxes assets and liabilities for Seaboard were recorded in the first quarter of 2013. The total impact was a tax benefit of $7,945,000, or $6.63 per common share, recorded in the first quarter of 2013 related to certain 2012 income tax credits. In addition to this amount was a credit of approximately $11,260,000, or $9.40 per common share, for 2012 Federal blender’s credits that was recognized as revenues in the first quarter of 2013. There was no tax expense on this transaction.

No dividends were paid during 2014 or 2013 as they were declared and prepaid in December 2012. During 2014, Seaboard repurchased 1,667 and 16,738 common shares in the first and second quarters, respectively. During 2013, Seaboard repurchased 147, 4,945, 1,338 and 2,275 common shares in the first, second, third and fourth quarters, respectively.

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Management’s Discussion & Analysis

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

Seaboard is a diverse global agribusiness and transportation company, with operations in several industries. Most of the sales and costs of Seaboard’s segments are significantly influenced by worldwide fluctuations in commodity prices and changes in foreign political and economic conditions. Accordingly, sales, operating income and cash flows can fluctuate significantly from year to year. As each segment operates in distinct industries and different geographical locations, management evaluates their operations separately. Seaboard’s reporting segments are based on information used by Seaboard’s Chief Executive Officer in his capacity as chief operating decision maker to determine allocation of resources and assess performance.

Pork Segment

The Pork segment is primarily a U.S. business, with some export sales to Japan, Mexico, and numerous other foreign markets. Revenues from the sale of pork products are primarily generated from a single hog processing plant in Guymon, Oklahoma, which generally operates at daily double shift processing capacity of approximately 20,000 hogs and a ham boning and processing plant in Mexico. In 2014, Seaboard raised approximately 75% of the hogs processed at the Guymon plant, with the remaining hog requirements purchased primarily under contracts from independent producers. This segment is Seaboard’s most capital intensive segment, representing approximately 49% of Seaboard’s total fixed assets in addition to material amounts of inventories.

Within the portfolio of Seaboard’s businesses, management believes profitability of the Pork segment is most susceptible to commodity price fluctuations. As a result, this segment’s operating income and cash flows can materially fluctuate from year to year, significantly affecting Seaboard’s consolidated operating income and cash flows. Sales prices are directly affected by both domestic and worldwide supply and demand for pork products and other proteins. Feed accounts for the largest input cost in raising hogs and is materially affected by price changes for corn and soybean meal. Market prices for hogs purchased from third parties for processing at the plant also represent a major cost factor. With the Guymon plant generally operating at capacity, Seaboard is constantly looking for ways to enhance the facility’s operational efficiency while also looking to increase margins by introducing new, higher value products.

The Pork segment also produces biodiesel which is sold to third parties. Biodiesel is produced from pork fat from Seaboard’s pork processing plant and from animal fat purchased from third parties. The processing plant also is capable of producing biodiesel from vegetable oil.

The Pork segment has an agreement with Triumph Foods LLC (Triumph) to market substantially all of the pork products produced at Triumph’s plant in St. Joseph, Missouri. The Pork segment markets the related pork products for a fee primarily based on the number of head processed by Triumph. Triumph has processing capacity similar to that of Seaboard’s Guymon plant and operates with an integrated model similar to Seaboard’s. Seaboard’s sales prices for its pork products are primarily based on a margin sharing arrangement that considers the average sales price and mix of products sold from both Seaboard’s and Triumph’s hog processing plants.

At the end of the third quarter of 2014, Seaboard’s Pork segment sold to Triumph a 50% interest in its processed meats division, Daily’s Premium Meats (Daily’s). As a result, Seaboard’s Pork segment now has a 50% non-controlling interest in Daily’s. Daily’s produces and markets raw and pre-cooked bacon, ham and sausage primarily for the food service industry and, to a lesser extent, retail markets. Daily’s has two further processing plants located in Salt Lake City, Utah and Missoula, Montana. Seaboard and Triumph each supply raw product to Daily’s.

Commodity Trading and Milling Segment

The Commodity Trading and Milling segment, which is managed under the name of Seaboard Overseas and Trading Group, primarily operates overseas and is an integrated agricultural commodity trading and processing and logistics operation with locations in Africa, South America, the Caribbean, Europe and Asia. These foreign operations can be significantly impacted by changes in local crop production, political instability and local government policies, as well as fluctuations in economic and industry conditions and currency fluctuations. This segment’s sales are also significantly affected by fluctuating prices of various commodities, such as wheat, corn, soybean meal and, to a lesser degree, various other agricultural commodity products. Although this segment owns four ships, the majority of the third party trading business is transacted with short-term chartered ships. Freight rates, influenced by available charter capacity for worldwide trade in bulk cargoes, and related fuel costs affect business volumes and margins. The grain processing businesses, both consolidated and non-consolidated affiliates, operate in foreign and, in most cases, lesser developed countries. Flour exports of various countries can exacerbate volatile market conditions that

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Management’s Discussion & Analysis

may have a significant impact on both the trading and milling businesses’ sales and operating income. This segment is Seaboard’s most working capital intensive segment, representing approximately 39% of Seaboard’s total working capital at December 31, 2014, and primarily consisted of inventories and receivables.

The majority of the Commodity Trading and Milling segment’s sales derive from its commodity trading business in which agricultural commodities are sourced from multiple origins and delivered to third party and affiliate customers in various international locations. The execution of these purchase and delivery transactions have long cycles of completion which may extend for several months with a high degree of price volatility. As a result, these factors can significantly affect sales volumes, operating income, working capital and related cash flows from quarter to quarter. Profit margins are sometimes protected by using commodity derivatives and other risk management practices. Seaboard invested in several entities in recent years and continues to seek opportunities to expand its trading and milling businesses.

Marine Segment

The Marine segment provides cargo shipping services primarily between the United States and 26 countries in the Caribbean Basin, Central and South America. Fluctuations in economic conditions and political instability in the regions or countries in which Seaboard operates, most notably Venezuela in recent years, may affect trade volumes and operating profits. In addition, cargo rates can fluctuate depending on local supply and demand for shipping services. This segment time-charters or leases the majority of its ocean cargo vessels and is thus affected by fluctuations in charter hire rates, as well as fuel costs.

Seaboard continues to explore ways to increase volumes on existing routes, while seeking opportunities to broaden its route structure in the regions it serves.

Sugar Segment

The Sugar segment operates a vertically integrated sugar and alcohol production facility in Argentina. This segment’s sales and operating income are significantly affected by local and worldwide sugar prices. Domestic sugar production levels in Argentina may affect the local price. Global sugar price fluctuations, to a lesser extent, have an impact in Argentina as well. Depending on local market conditions, this business purchases sugar from third parties for resale. Over the past several years, Seaboard has taken a number of steps to enhance the efficiency of its operations and expand its sugar and alcohol production capacity. This segment sells dehydrated alcohol to certain oil companies under an Argentine government bio-ethanol program, which mandates alcohol to be blended with gasoline. This segment also owns a 51 megawatt cogeneration power plant which is fueled by the burning of sugarcane by-products during the harvest season, which is typically between May and November.

The functional currency of the Sugar segment is the Argentine peso. The currency exchange rate can have an impact on reported U.S. dollar sales, operating income and cash flows. Following several years of heavy capital investment in this segment to expand production capacity and to construct a 51 megawatt cogeneration power plant, financing needs for this segment were minimal in 2014 and should remain minimal in 2015. Seaboard continues to explore various ways to improve and expand this segment.

Power Segment

The Power segment is an independent power producer in the Dominican Republic (DR) generating electricity from a system of diesel engines mounted on a floating power generating facility for the local power grid. Seaboard previously leased another facility under a short-term lease which was canceled during 2014. Seaboard primarily sells power on the spot market primarily to government-owned distribution companies and partially government-owned generation companies. This segment is subject to delays in obtaining timely collections from sales to these government related entities. In some prior years, operating cash flows have fluctuated from inconsistent customer collections.

Supply of power in the DR is determined by a government body and is subject to fluctuations based on government budgetary constraints. While fuel is this segment’s largest cost component and is subject to price swings, higher fuel costs generally have been passed on to customers. Seaboard may pursue further power industry investments in the future.

Turkey Segment

In December 2010, Seaboard purchased a 50 percent non-controlling voting interest in Butterball, LLC (Butterball). Butterball is a vertically integrated producer, processor and marketer of branded and non-branded turkey and other products. Butterball has four processing plants, two further processing plants and numerous live production and feed milling operations located in North Carolina, Arkansas, Missouri, Illinois and Kansas. Sales prices are directly

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Management’s Discussion & Analysis

affected by both domestic and worldwide supply and demand for turkey products and other proteins. Feed accounts for the largest input cost in raising turkeys and is materially affected by price changes for corn and soybean meal. As a result, commodity price fluctuations can significantly affect the profitability and cash flows of Butterball. The turkey business is seasonal only on the whole bird side, with Thanksgiving and Christmas holidays driving the majority of those sales.

LIQUIDITY AND CAPITAL RESOURCES

Summary of Sources and Uses of Cash

Cash and short-term investments as of December 31, 2014 increased $181.3 million from December 31, 2013. The increase was primarily the result of net cash from operating activities of $374.1 million, proceeds from sale of controlling interest in subsidiary of $74.1 million and increases in notes payable of $16.9 million. Partially offsetting the increase was cash used for capital expenditures of $121.2 million, principal payments of long-term debt of $91.4 million, repurchases of common stock of $53.8 million and investments in affiliates of $31.4 million. Cash from operating activities increased $249.1 million for 2014 primarily as a result of changes in working capital, principally from changes in receivables. Receivables were relatively unchanged for 2014 compared to 2013, principally related to significant collections of past due amounts in the Power segment offsetting other segments’ increases, while receivables increased significantly in 2013 compared to 2012 for the Power segment and U.S. income tax receivables.

Cash and short-term investments as of December 31, 2013 decreased $15.3 million from December 31, 2012. The decrease was primarily the result of cash used for capital expenditures of $149.7 million, principal payments of long-term debt of $53.8 million, investments in and advances to affiliates discussed below of $39.5 million, and repurchases of common stock of $23.6 million. Partially offsetting the decrease was net cash from operating activities of $125.0 million, principal repayments received on notes receivable from affiliate of $81.4 million and an increase in notes payable of $41.1 million. Cash from operating activities for 2013 decreased $136.7 million compared to 2012, primarily as a result of timing of payments related to certain current liabilities in the Commodity Trading and Milling and, to a lesser degree, Power segments as total current liabilities decreased in 2013 while they increased in 2012.

Capital Expenditures, Acquisitions and Other Investing Activities

During 2014, Seaboard invested $121.2 million in property, plant and equipment, of which $54.2 million was expended in the Pork segment, $21.4 for the Commodity Trading and Milling segment and $29.4 million in the Marine segment. The Pork segment expenditures were primarily for improvements to existing facilities and related equipment, additional finishing barns and compressed natural gas semi-tractors and related refueling stations. The Commodity Trading and Milling segment expenditures were primarily for payments related to building four vessels as discussed below. The Marine segment expenditures were primarily for purchases of cargo carrying and handling equipment. All other capital expenditures were of a normal recurring nature and primarily included replacements of machinery and equipment, and general facility modernizations and upgrades.

The total 2015 capital expenditures budget is $229.1 million. The Pork segment plans to spend $71.3 million primarily for improvements to existing facilities and related equipment, additional finishing barns and compressed natural gas semi-tractors and related refueling stations. The Commodity Trading and Milling segment plans to spend $75.2 million primarily for payments of $58.8 million for four dry bulk vessels being built for a total estimated cost of $90.0 million and improvements to existing facilities and related equipment. However, Seaboard currently anticipates selling and leasing back these four vessels as they are completed which would result in Seaboard receiving back the amounts spent to build at each individual lease inception with no gain or loss on sale. Payments under the lease agreements will be finalized upon delivery of the vessels. The four vessels are scheduled for delivery in 2015. The Marine segment has budgeted $62.1 million primarily for additional cargo carrying and handling equipment and purchase of an additional containerized cargo vessel. In addition, management will be evaluating whether to purchase additional containerized cargo vessels for the Marine segment during 2015. The balance of $20.5 million is planned to be spent in all other businesses primarily for normal upgrades to existing operations. Management anticipates paying for these capital expenditures from a combination of available cash, the use of available short-term investments and Seaboard’s available borrowing capacity.

During 2013, Seaboard invested $149.7 million in property, plant and equipment, of which $79.6 million was expended in the Pork segment, $24.2 million in the Commodity Trading and Milling segment, $22.8 million in the Marine segment, $17.1 million in the Sugar segment and $4.2 million in the Power segment. The Pork segment expenditures were primarily for additional finishing barns, semi-tractors, improvements to existing facilities and

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Management’s Discussion & Analysis

related equipment and construction of a new feed mill. The Commodity Trading and Milling segment expenditures were primarily for the purchase of two dry bulk vessels and improvements to existing facilities and related equipment. The Marine segment expenditures were primarily for purchases of cargo carrying and handling equipment. In the Sugar segment, the capital expenditures were primarily for normal upgrades to existing operations, including cane re-planting. All other capital expenditures were of a normal recurring nature and primarily included replacements of machinery and equipment, and general facility modernizations and upgrades.

During 2012, Seaboard invested $158.8 million in property, plant and equipment, of which $52.3 million was expended in the Pork segment, $22.8 million in the Commodity Trading and Milling segment, $35.4 million in the Marine segment, $22.1 million in the Sugar segment and $25.0 million in the Power segment. The Pork segment expenditures were primarily for additional finishing barns, improvements to existing facilities and related equipment and construction of a new feed mill. The Commodity Trading and Milling segment expenditures were primarily for the purchase of a dry bulk vessel and for a down payment of $8.3 million made in July 2012 on four dry bulk vessels being built as discussed above. The Marine segment expenditures were primarily for purchases of cargo carrying and handling equipment and the purchase of a cargo vessel. In the Sugar segment, the capital expenditures were primarily for expansion of cane growing operations and normal upgrades to existing operations. The Power segment expenditures were primarily used to complete the construction in the Dominican Republic of a 108 megawatt power generating facility, which began commercial operations in March 2012. The total cost of the project was $136.0 million, including capitalized interest. All other capital expenditures were of a normal recurring nature and primarily included replacements of machinery and equipment, and general facility modernizations and upgrades.

As of September 27, 2014, Seaboard’s Pork segment sold to Triumph Foods, LLC a 50% interest in its Daily’s Premium Meats division for cash of $74.1 million. In September 2014, Seaboard invested $17.3 million in a cargo terminal business in Jamaica for a 21% non-controlling interest. See Note 4 to the Consolidated Financial Statements for further discussion.

In September 2013, Seaboard invested $17.0 million in a flour production business in Brazil for a 50% non-controlling equity interest and provided a $13.0 million long-term loan to this business. See Note 4 to the Consolidated Financial Statements for further discussion. Also in September 2013, Seaboard invested $7.4 million in a flour milling business located in South Africa for a 49% non-controlling interest. In July 2013, Seaboard acquired a 50% non-controlling interest in a flour milling business located in Gambia by making a total investment in and advances to this affiliate of $9.1 million during 2013.

On December 31, 2012, Seaboard provided a loan of $81.2 million to its non-consolidated affiliate, Butterball, LLC (Butterball) to fund its purchase of assets from Gusto Packing Company, Inc. On March 28, 2013, Butterball repaid in full this $81.2 million loan. See Note 4 to the Consolidated Financial Statements for further discussion of these transactions.

Beginning in 2010, Seaboard invested in a bakery built in the Democratic Republic of Congo for a 50 percent non-controlling interest in this business. During 2014, 2013 and 2012, Seaboard invested $2.6 million, $4.5 million, and $24.8 million, respectively, in equity, long-term advances and long-term notes receivable for a total investment of $53.4 million in this business. The bakery began operations in the fourth quarter of 2012. See Note 4 to the Consolidated Financial Statements for further discussion of this investment.

Starting in 2011, Seaboard began to invest in various limited partnerships as a limited partner that are expected to enable Seaboard to obtain certain low income housing tax credits over a period of approximately ten years. During 2014, 2013 and 2012, Seaboard invested $0.1 million, $3.8 million and $8.4 million, respectively. Additional investments are required to be made in future years but are not deemed material in total.

In February 2015, Seaboard committed to invest in a limited liability company that will operate a refined coal processing plant in Oklahoma. Production of refined coal generates federal income tax credits. Seaboard’s funding commitment for this company can vary depending on production and, based on current production estimates, is anticipated to be approximately $7.0 million in 2015 with anticipated future annual contributions of between $4.0 million and $9.0 million per year until 2021, for a total estimate of approximately $53.0 million.

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Management’s Discussion & Analysis

Financing Activities, Debt and Related Covenants

The following table presents a summary of Seaboard’s available borrowing capacity as of December 31, 2014. At December 31, 2014, there were no borrowings outstanding under the committed lines of credit and borrowings under the uncommitted lines of credit totaled $75.5 million, with all such borrowings related to foreign subsidiaries. On October 24, 2014, Seaboard entered into a Credit Agreement for a committed line of credit totaling $50.0 million related to a foreign subsidiary for the Commodity Trading and Milling segment. This credit facility matures on October 23, 2015. See Note 7 to the Consolidated Financial Statements for further discussion.

|

|

|

Total amount |

| |

|

(Thousands of dollars) |

|

available |

| |

|

Long-term credit facility – committed |

|

$ |

200,000 |

|

|

Short-term credit facility – committed |

|

50,000 |

| |

|

Short-term uncommitted demand notes |

|

243,620 |

| |

|

Total borrowing capacity |

|

493,620 |

| |

|

Amounts drawn against lines |

|

(75,524 |

) | |

|

Letters of credit reducing borrowing availability |

|

(1,544 |

) | |

|

Available borrowing capacity at December 31, 2014 |

|

$ |

416,552 |

|

|

|

|

|

| |

In July 2014, Seaboard provided notice of optional prepayment to its lenders related to a credit agreement with an original maturity date of 2021. The total principal payment of $85.5 million was made on August 29, 2014. During 2012, Seaboard borrowed $32.7 million from this credit agreement. In November 2013, Seaboard provided notice of call for early redemption to holders of certain Industrial Development Revenue Bonds (IDRBs) effective December 20, 2013 and paid $18.0 million in the fourth quarter of 2013. In April 2013, Seaboard provided notice of call for early redemption to holders of certain IDRBs effective May 13, 2013 and paid $10.8 million in the second quarter of 2013. In December 2012, Seaboard provided notice of call for early redemption to holders of certain IDRBs effective January 14, 2013 and paid $13.0 million in the first quarter of 2013. See Note 7 to the Consolidated Financial Statements for further discussion.

As of December 31, 2014, Seaboard has capacity under existing loan covenants to undertake additional debt financings of approximately $2,185.5 million. As of December 31, 2014, Seaboard was in compliance with all restrictive covenants related to these loans and facilities. See Note 7 to the Consolidated Financial Statements for a summary of the material terms of Seaboard’s credit facilities, including financial ratios and covenants.

As of December 31, 2014, Seaboard had cash and short-term investments of $527.0 million, additional total working capital of $891.1 million and a $200.0 million long-term committed line of credit maturing on February 20, 2018. Accordingly, management believes Seaboard’s combination of internally generated cash, liquidity, capital resources and borrowing capabilities will be adequate for its existing operations and any currently known potential plans for expansion of existing operations or business segments for 2015. Management intends to continue seeking opportunities for expansion in the industries in which Seaboard operates, utilizing existing liquidity, available borrowing capacity and other financing alternatives.

As of December 31, 2014, $76.7 million of the $527.0 million of cash and short-term investments were held by Seaboard’s foreign subsidiaries and Seaboard could be required to accrue and pay taxes to repatriate these funds if needed for Seaboard’s operations in the U.S. However, Seaboard’s intent is to permanently reinvest these funds outside the U.S. and current plans do not demonstrate a need to repatriate them to fund Seaboard’s U.S. operations.

Seaboard used cash to repurchase 18,405, 8,705 and 12,937 shares of common stock at a total price of $53.8 million, $23.6 million and $26.8 million in 2014, 2013 and 2012, respectively. See Note 11 to the Consolidated Financial Statements for further discussion.

In December 2012, Seaboard declared and paid a dividend of $12.00 per share on the common stock which represented a prepayment of the annual 2013, 2014, 2015 and 2016 dividends ($3.00 per share per year). Seaboard does not currently intend to declare any further dividends for the years 2015 and 2016. Seaboard did not declare or pay any dividends in 2014, 2013 and 2011. In December 2010, Seaboard declared and prepaid the 2012 and 2011 dividends of $3.00 per share per year.

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Management’s Discussion & Analysis

Contractual Obligations and Off-Balance Sheet Arrangements

The following table provides a summary of Seaboard’s contractual obligations as of December 31, 2014.

|

|

|

Payments due by period |

| |||||||||||||

|

|

|

|

|

Less than |

|

1-3 |

|

3-5 |

|

More than |

| |||||

|

(Thousands of dollars) |

|

Total |

|

1 year |

|

years |

|

years |

|

5 years |

| |||||

|

Vessel time and voyage-charter commitments |

|

$ |

174,529 |

|

$ |

58,223 |

|

$ |

38,366 |

|

$ |

36,500 |

|

$ |

41,440 |

|

|

Contract grower finishing agreements |

|

41,455 |

|

11,124 |

|

20,622 |

|

9,687 |

|

22 |

| |||||

|

Other operating lease payments |

|

332,626 |

|

25,407 |

|

47,479 |

|

47,351 |

|

212,389 |

| |||||

|

Total lease obligations |

|

548,610 |

|

94,754 |

|

106,467 |

|

93,538 |

|

253,851 |

| |||||

|

Other long-term liabilities |

|

87,746 |

|

4,283 |

|

12,968 |

|

15,217 |

|

55,278 |

| |||||

|

Short-term notes payable |

|

75,524 |

|

75,524 |

|

- |

|

- |

|

- |

| |||||

|

Interest payments |

|

7,739 |

|

4,288 |

|

2,257 |

|

1,050 |

|

144 |

| |||||

|

Other purchase commitments |

|

1,055,414 |

|

786,288 |

|

212,902 |

|

56,158 |

|

66 |

| |||||

|

Total contractual cash obligations and commitments |

|

$ |

1,775,033 |

|

$ |

965,137 |

|

$ |

334,594 |

|

$ |

165,963 |

|

$ |

309,339 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

The Marine segment enters into contracts to time-charter vessels for use in its operations. To support the operations of the Pork segment, Seaboard has contract grower finishing agreements in place with farmers to raise a portion of Seaboard’s hogs. Seaboard has entered into grain and feed ingredient purchase contracts to support the live hog operations of the Pork segment, and has contracted for the purchase of additional hogs from third parties. The Commodity Trading and Milling segment enters into commodity purchase contracts, primarily to support sales commitments. Seaboard also leases various facilities and equipment under non-cancelable operating lease agreements. Seaboard guarantees to third parties were not material as of December 31, 2014. See Note 10 to the Consolidated Financial Statements for a further discussion and for a more detailed listing of other purchase commitments.

Other long-term liabilities in the table above represent expected benefit payments for various non-qualified pension plans and supplemental retirement arrangements as discussed in Note 9 to the Consolidated Financial Statements, which are unfunded obligations that are deemed to be employer contributions. No contributions are planned at this time to the two qualified pension plans. Non-current deferred income taxes and certain other long-term liabilities on the Consolidated Balance Sheets are not included in the table above as management is unable to reliably estimate the timing of the payments for these items. In addition, deferred revenues and other deferred credits included in other long-term liabilities on the Consolidated Balance Sheets have been excluded from the table above since they do not represent contractual obligations.

Interest payments in the table above include the net payments for interest rate exchange agreements based on the fixed amounts paid and the variable amount received, which is estimated using the projected yield as of December 31, 2014.

RESULTS OF OPERATIONS

Net sales for the years ended December 31, 2014, 2013 and 2012 were $6,473.1 million, $6,670.4 million and $6,189.1 million, respectively. The decrease in net sales for 2014 compared to 2013 primarily reflected lower sales volume for the Power segment, lower cargo volumes in certain markets for the Marine segment and lower volumes of sugar sold for the Sugar segment. The increase in net sales for 2013 compared to 2012 primarily reflected higher sales for commodity trading from increased volumes to third parties and, to a lesser extent, increased sale prices as discussed below.

Operating income for the years ended December 31, 2014, 2013 and 2012 were $423.6 million, $204.9 million and $309.7 million, respectively. The increase for 2014 compared to 2013 primarily reflected higher prices for pork products sold. The decrease for 2013 compared to 2012 primarily reflected increased operating costs and lower cargo rates for the Marine segment, lower sale prices and increased production costs for the sugar segment, and lower margins on wheat sales to a non-consolidated affiliate in Africa and, to a lesser extent, to third parties for the Commodity Trading and Milling segment. Partially offsetting the decrease was higher biodiesel margins primarily from increased government payments for the Pork segment.

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Management’s Discussion & Analysis

Pork Segment

|

(Dollars in millions) |

|

2014 |

|

2013 |

|

2012 |

| |||

|

Net sales |

|

$ |

1,717.3 |

|

$ |

1,713.1 |

|

$ |

1,638.4 |

|

|

Operating income |

|

$ |

349.0 |

|

$ |

147.7 |

|

$ |

122.6 |

|

|

Income from affiliate |

|

$ |

3.7 |

|

$ |

- |

|

$ |

- |

|

Net sales for the Pork segment increased $4.2 million for the year ended December 31, 2014 compared to 2013. The increase was primarily the result of higher prices for pork products sold. Partially offsetting the increase was lower sales volume of pork products from processing fewer internally grown hogs, lower sales prices and volumes for biodiesel, decreased payments received from the U.S. Government for biodiesel production, and the decrease in fourth quarter sales from the sale of a 50% interest in Daily’s as discussed in Note 4 to the Consolidated Financial Statements. In December 2014, the Federal blender’s credit that Seaboard is entitled to receive for biodiesel it blends was reinstated for 2014, retroactive to January 1, 2014. As a result, the 2014 Federal blender’s credit of $15.5 million was recorded as revenues in the fourth quarter of 2014. See Note 12 to the Consolidated Financial Statements for further discussion of the Federal blender’s credit.

Operating income increased $201.3 million for the year ended December 31, 2014 compared to 2013. The increase was primarily the result of higher prices for pork products sold and, to a lesser extent, lower feed costs for hogs internally grown. Partially offsetting the increase was lower margins for biodiesel from items discussed above and increased costs for third party hogs.

Management is unable to predict future market prices for pork products or the cost of feed. In addition, the Federal blender’s credit expired December 31, 2014. However, management anticipates positive operating income for this segment in 2015, although significantly lower than 2014.

Income from affiliate is from Seaboard’s 50% proportionate share of 2014 fourth quarter earnings from Daily’s, accounted for using the equity method, as discussed in Note 4 to the Consolidated Financial Statements.

Net sales for the Pork segment increased $74.7 million for the year ended December 31, 2013 compared to 2012. The increase primarily reflected higher prices for pork products sold in the domestic market and increased payments received from the U.S. government for biodiesel production in 2013 compared to 2012. Partially offsetting the increase were lower sales volume of pork products in the domestic market and lower prices for biodiesel sold in 2013 compared to 2012. U.S. Government payments included credits of $11.3 million recorded as revenues in the first quarter of 2013 related to the Tax Act, for the total Federal blender’s credits for 2012. See Note 12 to the Consolidated Financial Statements for further discussion of the Federal blender’s credit.

Operating income increased $25.1 million for the year ended December 31, 2013 compared to 2012. The increase was the result of higher biodiesel margins primarily from increased government payments, including the credit of $11.3 million, discussed above. Higher prices for pork products were offset by increased costs, principally for hogs internally grown and, to a lesser extent, for third party hogs. However, higher feed costs were offset by positive changes from using the LIFO method for determining certain inventory costs.

Commodity Trading and Milling Segment

|

(Dollars in millions) |

|

2014 |

|

2013 |

|

2012 |

| ||||

|

Net sales |

|

$ |

3,499.3 |

|

$ |

3,501.5 |

|

$ |

3,023.5 |

| |

|

Operating income as reported |

|

$ |

53.9 |

|

$ |

38.3 |

|

$ |

71.9 |

| |

|

Mark-to-market adjustments |

|

(12.5 |

) |

|

3.7 |

|

0.9 |

| |||

|

Operating income excluding mark-to-market adjustments |

|

$ |

41.4 |

|

$ |

42.0 |

|

$ |

72.8 |

| |

|

Income (loss) from affiliates |

|

$ |

(23.7 |

) |

$ |

(0.6 |

) |

$ |

10.5 |

| |

|

|

|

|

|

|

|

|

| ||||

Net sales for the Commodity Trading and Milling segment decreased $2.2 million for the year ended December 31, 2014 compared to 2013. Lower sales prices for various commodities were principally offset by higher sales volumes for such commodities, especially corn.

Operating income increased $15.6 million for the year ended December 31, 2014, compared to 2013. The increase primarily reflected fluctuations of $16.2 million of marking to market derivative contracts as discussed below. Excluding the effects of mark-to-market adjustment for derivatives contracts as discussed below, operating income

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Management’s Discussion & Analysis

decreased $0.6 million. The decrease primarily reflected recoveries of $5.2 million in 2013 of inventory write-downs for customer contract performance issues recognized in prior years partially offset by improved operating income at certain milling locations.

Due to worldwide commodity price fluctuations, the uncertain political and economic conditions in the countries in which Seaboard operates and the current volatility in the commodity markets, management is unable to predict future sales and operating results for this segment. However, management anticipates positive operating income for this segment in 2015, excluding the effects of marking to market derivative contracts.

Had Seaboard not applied mark-to-market accounting to its derivative instruments, operating income for this segment in 2014 would have been lower by $12.5 million and in 2013 and 2012 would have been higher by $3.7 million and $0.9 million, respectively. While management believes its commodity futures and options and foreign exchange contracts are primarily economic hedges of its firm purchase and sales contracts or anticipated sales contracts, Seaboard does not perform the extensive record-keeping required to account for these types of transactions as hedges for accounting purposes. Accordingly, while the changes in value of the derivative instruments were marked to market, the changes in value of the firm purchase or sales contracts were not. As products are delivered to customers, these existing mark-to-market adjustments should be primarily offset by realized margins or losses as revenue is recognized over time and thus, these mark-to-market adjustments could reverse in fiscal 2015. Management believes eliminating these adjustments, as noted in the table above, provides a more reasonable presentation to compare and evaluate period-to-period financial results for this segment.

Loss from affiliates for the year ended December 31, 2014 increased by $23.1 million from 2013. The increase primarily reflected a $10.8 million write-down recorded in the fourth quarter of 2014 as a result of a decline in value considered other than temporary for Seaboard’s investment in a bakery located in the Democratic Republic of Congo and losses incurred in 2014 from an affiliate in Brazil newly invested by Seaboard during the latter part of 2013. See Note 4 to the Consolidated Financial Statements for further discussion of the write-down and investments in these affiliates. Based on the uncertainty of local political and economic environments in the countries in which Seaboard’s affiliates operate, management cannot predict future results.

Net sales for the Commodity Trading and Milling segment increased $478.0 million for the year ended December 31, 2013 compared to 2012. The increase primarily reflected higher sales for commodity trading from increased volumes to third parties for wheat, soybean meal and various agricultural commodities and, to a lesser extent, increased sale prices for soybean meal and soybeans.

Operating income decreased $33.6 million for the year ended December 31, 2013, compared to 2012. The decrease primarily reflected certain unfavorable market conditions which resulted in lower margins on wheat sales to a non-consolidated affiliate in Africa and, to a lesser extent, to third parties. Partially offsetting the decrease were recoveries of $5.2 million in 2013 of the inventory write-downs for customer contract performance issues recognized in prior years. Excluding the effects of the mark-to-market adjustments for derivative contracts as discussed below, operating income decreased $30.8 million for 2013 compared to 2012.

Income from affiliates for the year ended December 31, 2013 decreased by $11.1 million from 2012. The decrease was primarily the result of certain unfavorable market conditions for an affiliate in Africa. Based on the uncertainty of local political and economic environments in the countries in which the flour and feed mills operate, management cannot predict future results.

Marine Segment

|

(Dollars in millions) |

|

2014 |

|

2013 |

|

2012 |

| |||

|

Net sales |

|

$ |

852.7 |

|

$ |

913.8 |

|

$ |

969.6 |

|

|

Operating income (loss) |

|

$ |

(2.7 |

) |

$ |

(25.8 |

) |

$ |

26.1 |

|

Net sales for the Marine segment decreased $61.1 million for the year ended December 31, 2014, compared to 2013. The decrease was primarily the result of lower cargo volumes in certain markets, most notably Venezuela, during 2014 compared to 2013.

Operating loss decreased by $23.1 million for the year ended December 31, 2014, compared to 2013. The decrease, which occurred during the second half of 2014, was primarily the result of lower voyage costs, such as fuel costs and, to a lesser extent, charter hire, on a per unit shipped basis partially offset by lower operating results related to the Venezuela operations. Management cannot predict

changes in future cargo volumes and cargo rates or to what

|

|

2014 Annual Report |

|

SEABOARD CORPORATION

Management’s Discussion & Analysis

extent changes in economic conditions in markets served will affect net sales or operating income during 2015. However, based on recent improved market conditions, management anticipates this segment will be profitable in 2015.

Net sales for the Marine segment decreased $55.8 million for the year ended December 31, 2013, compared to 2012. The decrease was primarily the result of lower volumes in certain markets, most notably Venezuela, and, to a lesser extent, decreased cargo rates in certain markets served during 2013 compared to 2012.

Operating income decreased by $51.9 million for the year ended December 31, 2013, compared to 2012. The decrease was primarily the result of increased trucking costs and certain terminal operating costs on a per unit shipped basis impacted by the decreased volumes and, to a lesser extent, decreased cargo rates noted above.

Sugar Segment

|

(Dollars in millions) |

|

2014 |

|

2013 |

|

2012 |

| |||

|

Net sales |

|

$ |

199.5 |

|

$ |

245.5 |

|

$ |

288.3 |

|

|

Operating income |

|

$ |

26.6 |

|

$ |

24.5 |

|

$ |

60.2 |

|

|

Income from affiliates |

|

$ |

0.7 |

|

$ |

0.6 |

|

$ |

0.1 |

|

Net sales for the Sugar segment decreased $46.0 million for the year ended December 31, 2014 compared to 2013. The decrease primarily reflected lower volumes of sugar sold and, to a much lesser extent, lower sales prices for sugar. Sugar sales are denominated in Argentine pesos and the lower sales prices for sugar in terms of U.S. dollars was the result of the exchange rate changes as the Argentine peso continued to weaken against the U.S. dollar in 2014, especially in the first quarter of 2014. Management cannot predict sugar and alcohol prices for 2015, but management anticipates that the Argentine peso may continue to weaken against the U.S. dollar.

Operating income increased $2.1 million for the year ended December 31, 2014 compared to 2013. The increase primarily represents a $4.3 million gain recorded in the second quarter of 2014 from a final insurance settlement for property damage and business interruption claims related to prior years and lower selling, general and administrative expenses from the exchange rate changes discussed above. Partially offsetting the increase was lower income from sugar sales as a result of lower volumes of sugar sold and lower sales prices as noted above. Management anticipates positive operating income for this segment in 2015, although lower than 2014.

Net sales for the Sugar segment decreased $42.8 million for the year ended December 31, 2013 compared to 2012. The decrease primarily reflects lower sales prices for sugar and, to a lesser extent, lower volumes of sugar sold. Sugar sales are denominated in Argentine pesos and the lower sales prices for sugar in terms of U.S. dollars were primarily the result of the exchange rate differences as the Argentine peso continued to weaken against the U.S, dollar in 2013. Partially offsetting the decrease in net sales was increased sales volume of alcohol.