Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2014

or

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number 001-12019

QUAKER CHEMICAL CORPORATION

(Exact name of Registrant as specified in its charter)

|

A Pennsylvania Corporation

|

No. 23-0993790

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

One Quaker Park, 901 E. Hector Street,

Conshohocken, Pennsylvania

|

19428-2380

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (610) 832-4000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each Exchange on which registered

|

|

|

Common Stock, $1.00 par value

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files) Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x

|

Accelerated filer ¨

|

|

|

Non-accelerated filer ¨

(Do not check if smaller reporting company)

|

Smaller reporting company ¨

|

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

State the aggregate market value of voting and non-voting common equity held by non-affiliates of the Registrant. (The aggregate market value is computed by reference to the last reported sale on the New York Stock Exchange on June 30, 2014): $1,002,670,297

Indicate the number of shares outstanding of each of the Registrant’s classes of common stock as of the latest practicable date: 13,304,569 shares of Common Stock, $1.00 Par Value, as of January 31, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement relating to the Annual Meeting of Shareholders to be held on May 6, 2015 are incorporated by reference into Part III.

PART I

As used in this Report, the terms “Quaker,” the “Company,” “we” and “our” refer to Quaker Chemical Corporation, its subsidiaries, and associated companies, unless the context otherwise requires.

Item 1. Business.

General Description

Quaker develops, produces, and markets a broad range of formulated chemical specialty products and offers chemical management services (“CMS”) for various heavy industrial and manufacturing applications in a global portfolio throughout its four regions: the North America region, the Europe, Middle East and Africa (“EMEA”) region, the Asia/Pacific region and the South America region. The principal products and services in Quaker’s global portfolio include: (i) rolling lubricants (used by manufacturers of steel in the hot and cold rolling of steel and by manufacturers of aluminum in the hot rolling of aluminum); (ii) corrosion preventives (used by steel and metalworking customers to protect metal during manufacture, storage, and shipment); (iii) metal finishing compounds (used to prepare metal surfaces for special treatments such as galvanizing and tin plating and to prepare metal for further processing); (iv) machining and grinding compounds (used by metalworking customers in cutting, shaping, and grinding metal parts which require special treatment to enable them to tolerate the manufacturing process, achieve closer tolerance, and improve tool life); (v) forming compounds (used to facilitate the drawing and extrusion of metal products); (vi) bio-lubricants (mainly used in machinery of the forestry and construction industries); (vii) hydraulic fluids (used by steel, metalworking, and other customers to operate hydraulically activated equipment); (viii) chemical milling maskants for the aerospace industry and temporary and permanent coatings for metal and concrete products; (ix) construction products, such as flexible sealants and protective coatings, for various applications; (x) specialty greases; (xi) die casting lubricants; and (xii) programs to provide chemical management services. Individual product lines representing more than 10% of consolidated revenues for any of the past three years are as follows:

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

|

Rolling lubricants

|

|

20.1

|

%

|

|

20.7

|

%

|

|

20.7

|

%

|

|

|

Machining and grinding compounds

|

|

16.3

|

%

|

|

17.7

|

%

|

|

17.6

|

%

|

|

|

Hydraulic fluids

|

|

13.0

|

%

|

|

12.9

|

%

|

|

13.5

|

%

|

|

|

Corrosion preventives

|

|

12.5

|

%

|

|

12.5

|

%

|

|

12.4

|

%

|

|

A substantial portion of Quaker’s sales worldwide are made directly through its own employees and its CMS programs with the balance being handled through distributors and agents. Quaker employees visit the plants of customers regularly and, through training and experience, identify production needs which can be resolved or alleviated either by adapting Quaker’s existing products or by applying new formulations developed in Quaker’s laboratories. Quaker relies less on the use of advertising, and more heavily upon its reputation in the markets which it serves. Generally, separate manufacturing facilities of a single customer are served by different personnel.

As part of the Company’s CMS, certain third-party product sales to customers are managed by the Company. Where the Company acts as principal, revenues are recognized on a gross reporting basis at the selling price negotiated with its customers. Where the Company acts as an agent, such revenue is recorded using net reporting as service revenues at the amount of the administrative fee earned by the Company for ordering the goods. Third-party products transferred under arrangements resulting in net reporting totaled $46.8 million, $41.6 million and $39.3 million for 2014, 2013 and 2012, respectively. The Company recognizes revenue in accordance with the terms of the underlying agreements, when title and risk of loss have been transferred, when collectability is reasonably assured, and when pricing is fixed or determinable. This generally occurs for product sales when products are shipped to customers or, for consignment-type arrangements, upon usage by the customer and, for services, when they are performed. License fees and royalties are included in other income when the amounts are recognized in accordance with their agreed-upon terms, when performance obligations are satisfied, when the amount is fixed or determinable, and when collectability is reasonably assured.

During 2014, the Company’s acquisition activity included the November 2014 purchase of Binol AB (“Binol”) for approximately $19.1 million. Binol is a leading bio-lubricants producer with environmentally friendly technology and products for the metalworking and forestry and construction industries. In addition, the Company acquired ECLI Products, LLC (“ECLI”) in August 2014 for approximately $53.1 million. ECLI is a specialty grease manufacturer for OEM first-fill customers across several industry sectors, including automotive, industrial, aerospace/military, electronics, office automation and natural resources. Finally, in June 2014, the Company acquired the remaining 49% ownership interest in its Australian affiliate, Quaker Chemical (Australasia) Pty. Limited, for approximately $7.6 million.

Competition

The chemical specialty industry comprises a number of companies of similar size as well as companies larger and smaller than Quaker. Quaker cannot readily determine its precise position in every industry it serves. Based on information available to Quaker, however, it is estimated that Quaker holds a leading global position (among a group in excess of 25 other suppliers) in the market for process fluids to produce sheet steel. It is also believed that Quaker holds significant global positions in the markets for process fluids

1

in portions of the automotive and industrial markets. The offerings of many of our competitors differ from those of Quaker, with some who offer a broad portfolio of fluids, including general lubricants, to those who have a more specialized product range, and, all of whom, provide different levels of technical services to individual customers. Competition in the industry is based primarily on the ability to provide products that meet the needs of the customer, render technical services and laboratory assistance to the customer and, to a lesser extent, on price.

Major Customers and Markets

In 2014, Quaker’s five largest customers (each composed of multiple subsidiaries or divisions with semi-autonomous purchasing authority) accounted for approximately 18% of our consolidated net sales, with the largest customer (Arcelor-Mittal Group) accounting for approximately 9% of our consolidated net sales. A significant portion of Quaker’s revenues are realized from the sale of process fluids and services to manufacturers of steel, automobiles, appliances, and durable goods, and, therefore, Quaker is subject to the same business cycles as those experienced by these manufacturers and their customers. Furthermore, steel customers typically have limited manufacturing locations as compared to metalworking customers and generally use higher volumes of products at a single location. Accordingly, the loss or closure of one or more steel mills or other major sites of a significant customer could have a material adverse effect on Quaker’s business.

Raw Materials

Quaker uses over 1,000 raw materials, including mineral oils and derivatives, animal fats and derivatives, vegetable oils and derivatives, ethylene derivatives, solvents, surface active agents, chlorinated paraffinic compounds, and a wide variety of other organic and inorganic compounds. In 2014, three raw material groups (mineral oils and derivatives, animal fats and derivatives, and vegetable oils and derivatives) each accounted for at least 10% of the total cost of Quaker’s raw material purchases. The price of mineral oil and its derivatives can be affected by the price of crude oil and their refining capacity. In addition, animal fat and vegetable oil prices are impacted by increased biodiesel consumption. Accordingly, significant fluctuations in the price of crude oil could have a material effect upon certain products used in the Company’s business. Many of the raw materials used by Quaker are “commodity” chemicals, and, therefore, Quaker’s earnings could be affected by market changes in raw material prices. Reference is made to the disclosure contained in Item 7A of this Report.

Patents and Trademarks

Quaker has a limited number of patents and patent applications, including patents issued, applied for, or acquired in the United States and in various foreign countries, some of which may prove to be material to its business. Principal reliance is placed upon Quaker’s proprietary formulae and the application of its skills and experience to meet customer needs. Quaker’s products are identified by trademarks that are registered throughout its marketed area.

Research and Development—Laboratories

Quaker’s research and development laboratories are directed primarily toward applied research and development since the nature of Quaker’s business requires continual modification and improvement of formulations to provide chemical specialties to satisfy customer requirements. Quaker maintains quality control laboratory facilities in each of its manufacturing locations. In addition, Quaker maintains facilities in Conshohocken, Pennsylvania; Santa Fe Springs, California; Batavia, New York; Aurora, Illinois; Dayton, Ohio; Uithoorn, The Netherlands; Karlshamn, Sweden; Rio de Janiero, Brazil; and Qingpu, China that are devoted primarily to applied research and development.

Research and development costs are expensed as incurred. Research and development expenses during 2014, 2013 and 2012 were $22.1 million, $21.6 million and $20.0 million, respectively.

Most of Quaker’s subsidiaries and associated companies also have laboratory facilities. Although not as complete as the laboratories mentioned above, these facilities are generally sufficient for the requirements of the customers being served. If problems are encountered which cannot be resolved by local laboratories, such problems are generally referred to the laboratory staff in Conshohocken, Santa Fe Springs, Uithoorn or Qingpu.

Regulatory Matters

In order to facilitate compliance with applicable Federal, state, and local statutes and regulations relating to occupational health and safety and protection of the environment, the Company has an ongoing program of site assessment for the purpose of identifying capital expenditures or other actions that may be necessary to comply with such requirements. The program includes periodic inspections of each facility by Quaker and/or independent experts, as well as ongoing inspections and training by on-site personnel. Such inspections address operational matters, record keeping, reporting requirements and capital improvements. Capital expenditures directed solely or primarily to regulatory compliance amounted to approximately $0.8 million, $0.6 million and $1.0 million in 2014, 2013 and 2012, respectively. In 2015, the Company expects to incur approximately $2.1 million for capital expenditures directed primarily to regulatory compliance.

2

Number of Employees

On December 31, 2014, Quaker’s consolidated companies had approximately 1,941 full-time employees of whom 626 were employed by the parent company and its U.S. subsidiaries and 1,315 were employed by its non-U.S. subsidiaries. Associated companies of Quaker (in which it owns less than 50% and has significant influence) employed 70 people on December 31, 2014.

Company Segmentation

The Company’s reportable operating segments evidence the structure of the Company’s internal organization, the method by which the Company’s resources are allocated and the manner by which the Company assesses its performance. The Company’s reportable operating segments are organized by geography as follows: North America, EMEA, Asia/Pacific and South America. See Note 4 of Notes to Consolidated Financial Statements included in Item 8 of this Report.

Non-U.S. Activities

Since significant revenues and earnings are generated by non-U.S. operations, Quaker’s financial results are affected by currency fluctuations, particularly between the U.S. Dollar and the E.U. Euro, the Brazilian Real, the Chinese Renminbi and the Indian Rupee, and the impact of those currency fluctuations on the underlying economies. Incorporated by reference is (i) the foreign exchange risk information contained in Item 7A of this Report, (ii) the geographic information in Note 4 of Notes to Consolidated Financial Statements included in Item 8 of this Report and (iii) information regarding risks attendant to foreign operations included in Item 1A of this Report.

Quaker on the Internet

Financial results, news and other information about Quaker can be accessed from the Company’s website at http://www.quakerchem.com. This site includes important information on the Company’s locations, products and services, financial reports, news releases and career opportunities. The Company’s periodic and current reports on Forms 10-K, 10-Q and 8-K, including exhibits and supplemental schedules filed therewith, and amendments to those reports, filed with the Securities and Exchange Commission (“SEC”) are available on the Company’s website, free of charge, as soon as reasonably practicable after they are electronically filed with or furnished to the SEC. Information contained on, or that may be accessed through, the Company’s website is not incorporated by reference in this Report and, accordingly, you should not consider that information part of this Report.

Factors that May Affect Our Future Results

(Cautionary Statements under the Private Securities Litigation Reform Act of 1995)

Certain information included in this Report and other materials filed or to be filed by Quaker with the SEC (as well as information included in oral statements or other written statements made or to be made by us) contain or may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements can be identified by the fact that they do not relate strictly to historical or current facts. We have based these forward-looking statements on our current expectations about future events. These forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, intentions, financial condition, results of operations, future performance, and business, including:

|

|

•

|

statements relating to our business strategy;

|

|||

|

•

|

our current and future results and plans; and

|

||||

|

|

•

|

statements that include the words “may,” “could,” “should,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan” or similar expressions.

|

|||

Such statements include information relating to current and future business activities, operational matters, capital spending, and financing sources. From time to time, oral or written forward-looking statements are also included in Quaker’s periodic reports on Forms 10-K, 10-Q and 8-K, press releases, and other materials released to, or statements made to, the public.

Any or all of the forward-looking statements in this Report, in Quaker’s Annual Report to Shareholders for 2014, and in any other public statements we make may turn out to be wrong. This can occur as a result of inaccurate assumptions or as a consequence of known or unknown risks and uncertainties. Many factors will be important in determining our future performance. Consequently, actual results may differ materially from those that might be anticipated from our forward-looking statements.

We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. However, any further disclosures made on related subjects in Quaker’s subsequent reports on Forms 10-K, 10-Q and 8-K should be consulted. These forward-looking statements are subject to risks, uncertainties and assumptions about us and our operations that are subject to change based on various important factors, some of which are beyond our control. A major risk is that the demand for the Company’s products and services is largely derived from the demand for its customers’ products, which subjects the Company to uncertainties related to downturns in a customer’s business and unanticipated customer production shutdowns. Other major risks and uncertainties include, but are not limited to, significant increases in raw material costs, worldwide economic and political conditions, foreign currency fluctuations, terrorist attacks and other acts of violence, each of which is discussed in greater detail in Item 1A of this Report. Furthermore, the Company is subject to the same business cycles as those experienced by steel,

3

automobile, aircraft, appliance, and durable goods manufacturers. These risks, uncertainties, and possible inaccurate assumptions relevant to our business could cause our actual results to differ materially from expected and historical results. Other factors beyond those discussed in this Report could also adversely affect us. Therefore, we caution you not to place undue reliance on our forward-looking statements. This discussion is provided as permitted by the Private Securities Litigation Reform Act of 1995.

Item 1A. Risk Factors.

Changes to the industries and markets that Quaker serves could have a material adverse effect on the Company’s liquidity, financial position and results of operations.

The chemical specialty industry comprises a number of companies of similar size as well as companies larger and smaller than Quaker. It is estimated that Quaker holds a leading and significant global position in the markets for process fluids to produce sheet steel and significant global positions in portions of the automotive and industrial markets. The industry is highly competitive, and a number of companies with significant financial resources and/or customer relationships compete with us to provide similar products and services. Our competitors may be positioned to offer more favorable pricing and service terms, resulting in reduced profitability and a loss of market share for us. In addition, several competitors could potentially consolidate their businesses to gain scale to better position their product offerings, which could have a negative impact to our profitability and market share. Historically, competition in the industry has been based primarily on the ability to provide products that meet the needs of the customer and render technical services and laboratory assistance to the customer and, to a lesser extent, on price. Factors critical to the Company’s business include successfully differentiating the Company’s offering from its competition, operating efficiently and profitably as a globally integrated whole, and increasing market share and customer penetration through internally developed business programs and strategic acquisitions.

The business environment in which the Company operates remains uncertain. The Company is subject to the same business cycles as those experienced by steel, automobile, aircraft, appliance, and durable goods manufacturers. A major risk is that the Company’s demand is largely derived from the demand for its customers’ products, which subjects the Company to uncertainties related to downturns in our customers’ business and unanticipated customer production shutdowns or curtailments. The Company has limited ability to adjust its cost level contemporaneously with changes in sales and gross margins. Thus, a significant downturn in sales or gross margins due to weak end-user markets, loss of a significant customer, and/or rising raw material costs could have a material adverse effect on the Company’s liquidity, financial position, and results of operations.

Our business depends on attracting and retaining qualified management personnel.

The unanticipated departure of any key member of our management team could have an adverse effect on our business. Given the relative size of the Company and the breadth of its global operations, there are a limited number of qualified management personnel to assume the responsibilities of management level employees, should there be turnover. In addition, because of the specialized and technical nature of our business, our future performance is dependent on the continued service of, and our ability to attract and retain, qualified management, commercial and technical personnel. Competition for such personnel is intense, and we may be unable to continue to attract or retain such personnel. In an effort to mitigate such risks, the Company utilizes retention bonuses, offers competitive pay and maintains continued succession planning, but there can be no assurance that these mitigating factors will be adequate to attract or retain qualified management personnel.

Inability to obtain sufficient price increases or contract concessions to offset increases in the costs of raw material could result in a loss of sales and/or market share and could have a material adverse effect on the Company’s liquidity, financial position and results of operations. Conversely, an inability to implement timely price decreases to compensate for changes in raw material costs could result in a loss of sales and/or market share and could have a material adverse effect on the Company’s liquidity, financial position and results of operations.

Quaker uses over 1,000 raw materials, including mineral oils and derivatives, animal fats and derivatives, vegetable oils and derivatives, ethylene derivatives, solvents, surface active agents, chlorinated paraffinic compounds, and a wide variety of other organic and inorganic compounds. In 2014, three raw material groups (mineral oils and derivatives, animal fats and derivatives, and vegetable oils and derivatives) each accounted for at least 10% of the total cost of Quaker’s raw material purchases. The price of mineral oils and derivatives can be affected by crude oil pricing and their refining capacity. In addition, many of the raw materials used by Quaker are “commodity” chemicals. Accordingly, Quaker’s earnings can be impacted by market changes in raw material prices.

In the past, Quaker has experienced volatility in its raw material costs, particularly crude oil derivatives. In addition, refining capacity can be constrained by various factors, which can further contribute to volatile raw material costs and negatively impact margins. Animal fat and vegetable oil prices also can be impacted by increased biodiesel consumption. Although the Company has been successful in the past in recovering a substantial amount of the raw material cost increases while retaining its customers, there can be no assurance that the Company can continue to recover higher raw material costs or retain customers in the future. Conversely, the Company has been successful in maintaining acceptable levels of margin in periods of raw material decline, but there can be no assurance that the Company can continue to maintain its margins, through appropriate price and contract concessions, while retaining all customers in the future. As a result of the Company’s past pricing actions, in periods of rising and declining costs, customers may become more likely to consider competitors’ products, some of which may be available at a lower cost. A significant loss of customers could result in a material adverse effect on the Company’s results of operations.

4

Availability of raw materials, including sourcing from some single suppliers and some suppliers in volatile economic environments, could have a material adverse effect on the Company’s liquidity, financial position and results of operations.

The chemical specialty industry can experience some tightness of supply for certain raw materials. In addition, in some cases, we choose to source from a single supplier and/or suppliers in economies that have experienced instability. Any significant disruption in supply could affect our ability to obtain raw materials, which could have a material adverse effect on our liquidity, financial position and results of operations. In addition, the Company’s raw materials are subject to various regulatory laws, and a change in the ability to legally use such raw materials may impact Quaker’s liquidity, financial position and results of operations.

Loss of a significant manufacturing facility may materially and adversely affect the Company’s liquidity, financial position and results of operations.

Quaker has multiple manufacturing facilities throughout the world. In certain countries, such as Brazil and China, there is only one such facility. If one of the Company’s facilities is damaged to such extent that production is halted for an extended period, the Company may not be able to timely supply its customers. This could result in a loss of sales over an extended period or permanently. The Company does take steps to mitigate against this risk, including contingency planning and procuring property and casualty insurance (including business interruption insurance). Nevertheless, the loss of sales in any one region over any extended period of time could have a significant material adverse effect on Quaker’s liquidity, financial position and results of operations.

Bankruptcy of a significant customer could have a material adverse effect on our liquidity, financial position and results of operations.

A significant portion of Quaker’s revenues is derived from sales to customers in the steel and automotive industries; including some of our larger customers, where a number of bankruptcies have occurred in the past and where companies have experienced financial difficulties. As part of the bankruptcy process, the Company’s pre-petition receivables may not be realized, customer manufacturing sites may be closed or contracts voided. The bankruptcy of a major customer could have a material adverse effect on the Company’s liquidity, financial position and results of operations. Steel customers typically have limited manufacturing locations as compared to metalworking customers and generally use higher volumes of products at a single location. The loss or closure of one or more steel mills or other major sites of a significant customer could have a material adverse effect on Quaker’s business.

During 2014, our five largest customers (each composed of multiple subsidiaries or divisions with semi-autonomous purchasing authority) together accounted for approximately 18% of our consolidated net sales, with the largest customer (Arcelor-Mittal Group) accounting for approximately 9% of our consolidated net sales.

Failure to comply with any material provision of our credit facility or other debt agreements could have a material adverse effect on our liquidity, financial position and results of operations.

The Company maintains a $300.0 million unsecured multicurrency credit facility (the “Credit Facility”) with a group of lenders, which can be increased to $400.0 million at the Company’s option if lenders agree to increase their commitments and the Company satisfies certain conditions. The Credit Facility, which matures in 2018, provides the availability of revolving credit borrowings. In general, the borrowings under the Credit Facility bear interest at either a base rate or LIBOR rate plus a margin based on the Company’s consolidated leverage ratio.

The Credit Facility contains certain limitations on investments, acquisitions and liens, as well as default provisions customary for facilities of its type. While these covenants and restrictions are not currently considered to be overly restrictive, they could become more difficult to comply with as our business or financial conditions change. In addition, deterioration in the Company’s results of operations or financial position could significantly increase borrowing costs.

Quaker is exposed to market rate risk for changes in interest rates, due to the variable interest rate applied to the Company’s borrowings under its Credit Facility. Accordingly, if interest rates rise significantly, the cost of debt to Quaker will increase, perhaps significantly, depending on the extent of Quaker’s borrowings under the Credit Facility. At December 31, 2014, the Company had $58.4 million in outstanding borrowings under the Credit Facility. Incorporated by reference is the interest rate risk information contained in Item 7A of this report.

Environmental laws and regulations and/or pending and future legal proceedings may materially and adversely affect the Company’s liquidity, financial position, results of operations and reputation in the markets it serves.

The Company is a party to proceedings, cases, and requests for information from, and negotiations with, various claimants and Federal and state agencies relating to various matters, including environmental matters. An adverse result in one or more matters or any potential future matter of a similar nature could materially and adversely affect the Company’s liquidity, financial position, results of operations and reputation in the markets it serves. Incorporated herein by reference is the information concerning pending asbestos-related litigation against an inactive subsidiary, amounts accrued associated with certain environmental non-capital remediation costs and other potential commitments or contingencies highlighted in Note 23, of Notes to Consolidated Financial Statements, which appears in Item 8 of this Report.

5

Compliance with a complex global regulatory environment could have an impact on the Company’s public perception and/or a material adverse effect on the Company’s liquidity, financial position and results of operations.

Changes in the Company’s regulatory environment, particularly, but not limited to, the United States, Brazil, China and the European Union, could lead to heightened regulatory scrutiny, could adversely impact our ability to continue selling certain products in our domestic or foreign markets and could increase the cost of doing business. For instance, the European Union’s Registration, Authorization and Restriction of Chemicals (“REACH” and analogous non-E.U. laws and regulations), or other similar laws and regulations, could result in fines, ongoing monitoring and other future business activity restrictions, which could have a material adverse effect on the Company’s liquidity, financial position and results of operations. In addition, non-compliance with the U.S. Foreign Corrupt Practices Act (“FCPA”), the UK Bribery Act and other similar laws and regulations, could result in a negative impact to the Company’s reputation, potential fines or ongoing monitoring, which could also have an adverse effect on the Company.

Climate change and greenhouse gas restrictions may materially affect the Company’s liquidity, financial position and results of operations.

The Company is subject to various regulations regarding its emission of greenhouse gases in its manufacturing facilities. In addition, a number of countries have adopted, or are considering the adoption of regulatory frameworks to reduce greenhouse gas emissions. These include adoption of cap and trade regimes, carbon taxes, increased efficiency standards and incentives or mandates for renewable energy. These requirements could make our products more expensive and reduce demand for our products. Current and pending greenhouse gas regulations may also increase our compliance costs.

Potential product, service or other related liability claims could have a material adverse effect on the Company’s liquidity, financial position and results of operations.

The development, manufacture and sale of specialty chemical products and other related services involve inherent exposure to potential product liability claims, service level claims, product recalls and related adverse publicity. Any of these potential product or service risks could also result in substantial and unexpected expenditures and affect customer confidence in our products and services, which could have a material adverse effect on the Company’s liquidity, financial position and results of operations. Although the Company maintains product and other general liability insurance, there can be no assurance that this type or the level of coverage would be adequate to cover these potential risks. In addition, the Company may not be able to continue to maintain its existing insurance or obtain comparable insurance at a reasonable cost, if at all, in the event a significant product or service claim arises.

We may be unable to adequately protect our proprietary rights, which may limit the Company’s ability to compete in its markets.

Quaker has a limited number of patents and patent applications, including patents issued, applied for, or acquired in the United States and in various foreign countries, some of which may prove to be material to its business. Principal reliance is placed upon Quaker’s proprietary formulae and the application of its skills and experience to meet customer needs. Also, Quaker’s products are identified by trademarks that are registered throughout its marketed area. Despite our efforts to protect such proprietary information through patent and trademark filings, through the use of appropriate trade secret protections and through the inability of certain products to be effectively replicated by others, it is possible that competitors or other unauthorized third parties may obtain, copy, use or disclose our technologies, products, and processes. In addition, the laws and/or judicial systems of foreign countries in which we design, manufacture, market and sell our products may afford little or no effective protection of our proprietary technology. These potential risks to our proprietary information could subject the Company to increased competition and negative impacts to our liquidity, financial position and results of operations.

We might not be able to timely develop, manufacture and gain market acceptance of new and enhanced products required to maintain or expand our business.

We believe that our continued success depends on our ability to continuously develop and manufacture new products and product enhancements on a timely and cost-effective basis, in response to customers’ demands for higher performance process chemicals, coatings, greases and other chemical products. Our competitors may develop new products or enhancements to their products that offer performance, features and lower prices that may render our products less competitive or obsolete and, as a consequence, we may lose business and/or significant market share. The development and commercialization of new products requires significant expenditures over an extended period of time, and some products that we seek to develop may never become profitable. In addition, we may not be able to develop and introduce products incorporating new technologies in a timely manner that will satisfy our customers’ future needs or achieve market acceptance.

An inability to appropriately capitalize on Company growth, including prior or future acquisitions, may adversely affect the Company’s liquidity, financial position and results of operations.

Quaker has completed several acquisitions recently and in the past and, also, may continue to seek acquisitions to grow its business in the future. In addition, the Company continues to grow organically through increased end market growth and incremental market share.

6

The success of the Company’s growth depends on its ability to successfully integrate such opportunities, including, but not limited to, the following:

|

•

|

successfully execute the integration or consolidation of the acquired or additional business into existing processes and operations;

|

|

|

•

|

develop or modify financial reporting, information systems and other related financial tools to ensure overall financial integrity and adequacy of internal control procedures;

|

|

|

•

|

identify and take advantage of potential cost reduction opportunities, while maintaining legacy business and other related attributes; and

|

|

|

•

|

further penetrate existing and new markets with the product capabilities acquired in acquisitions.

|

The Company may fail to derive significant benefits or may not create the appropriate infrastructure to support such additional business, which could have a material adverse effect on liquidity, financial position and results of operations. Also, if the Company fails to achieve sufficient financial performance from an acquisition, certain long-lived assets, such as property, plant and equipment, goodwill or other intangible assets, could become impaired and result in the recognition of an impairment loss.

The scope of our international operations subjects the Company to risks, including, but not limited to, risks from changes in trade regulations, currency fluctuations, and political and economic instability.

Since significant revenues and earnings are generated by non-U.S. operations, Quaker’s financial results are affected by currency fluctuations, particularly between the U.S. Dollar and the E.U. Euro, the Brazilian Real, the Chinese Renminbi, and the Indian Rupee, and the impact of those currency fluctuations on the underlying economies. During the past three years, sales by non-U.S. subsidiaries accounted for approximately 60% to 65% of our annual consolidated net sales. Generally, all of the Company’s operations use the local currency as their functional currency. The Company generally does not use financial instruments that expose it to significant risk involving foreign currency transactions; however, the size of its non-U.S. activities has a significant impact on reported operating results and attendant net assets. Therefore, as exchange rates vary, Quaker’s results can be materially affected. Incorporated by reference is the foreign exchange risk information contained in Item 7A of this Report and the geographic information in Note 4 of Notes to Consolidated Financial Statements included in Item 8 of this Report.

The Company often sources inventory among its worldwide operations. This practice can give rise to foreign exchange risk resulting from the varying cost of inventory to the receiving location, as well as from the revaluation of intercompany balances. The Company mitigates this risk through local sourcing efforts.

Additional risks associated with the Company’s international operations include, but are not limited to, the following:

|

|

•

|

changes in economic conditions from country to country, similar to past instability in certain European economies;

|

|

|

•

|

changes in a country’s political condition, such as the current political unrest in the Middle East;

|

|

•

|

trade protection measures;

|

|

|

|

•

|

longer payment cycles;

|

|

|

•

|

licensing and other legal requirements;

|

|

|

•

|

restrictions on the repatriation of our assets, including cash;

|

|

|

•

|

the difficulties of staffing and managing dispersed international operations;

|

|

|

•

|

less protective foreign intellectual property laws;

|

|

|

•

|

legal systems that may be less developed and predictable than those in the United States; and

|

|

•

|

local tax issues.

|

The breadth of Quaker’s international operations subjects the Company to various local non-income taxes, including value-added-taxes (“VAT”). With VAT and other similar taxes, the Company essentially operates as an agent for various jurisdictions by collecting VAT-related taxes from customers and remitting those amounts to the taxing authorities on the goods it sells. The laws and regulations regarding VAT-related taxes can be complex and vary widely among countries, as well as among individual jurisdictions within a given country, and for the same products, making full compliance difficult. As VAT and other similar taxes are often charged as a percentage of the selling price of the goods sold, the amounts involved can be material. Should there be non-compliance by the Company, it may need to remit funds to the tax authorities prior to collecting the appropriate amounts from the customers or jurisdictions, which may have been incorrectly paid. In addition, the Company may choose for commercial reasons not to seek repayment from certain customers. This could have a material adverse effect on the Company’s liquidity, financial position and results of operations. See Note 23 of Notes to Consolidated Financial Statements, included in Item 8 of this Report, which is incorporated herein by this reference, for further discussion.

Disruption of critical information systems or material breaches in the security of our systems may adversely affect our business and our customer relationships.

Quaker relies on information technology systems to process, transmit, and store electronic information in our day-to-day operations. The Company also relies on its technology infrastructure, among other functions, to interact with customers and suppliers,

7

fulfill orders and bill, collect and make payments, ship products, provide support to customers, fulfill contractual obligations and otherwise conduct business. Our information technology systems may be subjected to computer viruses or other malicious codes, unauthorized access attempts, and cyber-attacks, any of which, if successful, could result in data leaks or otherwise compromise our confidential or proprietary information and disrupt our operations. Cybersecurity incidents, such as these, are becoming more sophisticated and frequent, and there can be no assurance that our protective measures will prevent security breaches that could have a significant impact on our business, reputation and financial results. Failure to monitor, maintain or protect our information technology systems and data integrity effectively or, to anticipate, plan for and recover from significant disruptions to these systems could have a material adverse effect on our business, results of operations or financial condition.

Terrorist attacks, other acts of violence or war, natural disasters or other uncommon global events may affect the markets in which we operate and our profitability.

Terrorist attacks, other acts of violence or war, natural disasters or other uncommon global events may negatively affect our operations. There can be no assurance that there will not be further terrorist attacks against the U.S. or other locations where we do business. Also, other uncommon global events, such as earthquakes, fires and tsunami, cannot be predicted. Terrorist attacks, other acts of violence or armed conflicts, and natural disasters may directly impact our physical facilities or those of our suppliers or customers. Additional terrorist attacks or natural disasters may disrupt the global insurance and reinsurance industries with the result that we may not be able to obtain insurance at historical terms and levels, if at all, for all of our facilities. Furthermore, any of these events may make travel and the transportation of our supplies and products more difficult and more expensive and ultimately affect the sales of our products. The consequences of terrorist attacks, other acts of violence or armed conflicts, natural disasters or other uncommon global events can be unpredictable, and we may not be able to foresee events, such as these, that could have an adverse effect on our business.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Quaker’s corporate headquarters and a laboratory facility are located in its North American segment’s Conshohocken, Pennsylvania office. The Company’s other principal facilities in its North American segment are located in Aurora, Illinois; Detroit, Michigan; Middletown, Ohio; Santa Fe Springs, California; Batavia, New York; Dayton, Ohio; and Monterrey, N.L., Mexico. The Company’s EMEA segment has principal facilities in Uithoorn, The Netherlands; Santa Perpetua de Mogoda, Spain; Karlshamn, Sweden; and Tradate, Italy. The Company’s Asia/Pacific segment operates out of its principal facilities located in Qingpu, China; Kolkata, India; and Sydney, Australia, while its South American segment operates out of its principal facility in Rio de Janeiro, Brazil. With the exception of the Conshohocken, Santa Fe Springs, Aurora, Karlshamn, and Sydney sites, which are leased, the remaining principal facilities are owned by Quaker and, as of December 31, 2014, were mortgage free. Quaker also leases sales, laboratory, manufacturing, and warehouse facilities in other locations.

Quaker’s principal facilities (excluding Conshohocken) consist of various manufacturing, administrative, warehouse, and laboratory buildings. Substantially all of the buildings (including Conshohocken) are of fire-resistant construction and are equipped with sprinkler systems. All facilities are primarily of masonry and/or steel construction and are adequate and suitable for Quaker’s present operations. The Company has a program to identify needed capital improvements that are implemented as management considers necessary or desirable. Most locations have various numbers of raw material storage tanks ranging from 2 to 58 at each location with a capacity ranging from 1,000 to 82,000 gallons and processing or manufacturing vessels ranging in capacity from 7 to 16,000 gallons.

Each of Quaker’s non-U.S. associated companies (in which it owns a less than 50% interest and has significant influence) owns or leases a plant and/or sales facilities in various locations, with the exception of Primex, Ltd.

Item 3. Legal Proceedings.

The Company is a party to proceedings, cases, and requests for information from, and negotiations with, various claimants and Federal and state agencies relating to various matters, including environmental matters. For information concerning pending asbestos-related litigation against an inactive subsidiary, amounts accrued associated with certain environmental non-capital remediation costs and the Company’s value-added tax dispute settlements, reference is made to Note 23 of Notes to Consolidated Financial Statements, included in Item 8 of this Report, which is incorporated herein by this reference. The Company is a party to other litigation which management currently believes will not have a material adverse effect on the Company’s results of operations, cash flow or financial condition.

Item 4. Mine Safety Disclosures.

Not Applicable

8

Item 4(a). Executive Officers of the Registrant.

Set forth below is information regarding the executive officers of the Company, each of whom (with the exception of Ms. Loebl, Mr. Steeples and Mr. Hostetter) has been employed by the Company for more than five years, including the respective positions and offices with the Company held by each over the respective periods indicated. Each of the executive officers, with the exception of Mr. Hostetter, is elected annually to a one-year term. Mr. Hostetter is considered an executive officer in his capacity as principal accounting officer for purposes of this item.

|

Name, Age, and Present

Position with the Company

|

|

Business Experience During the Past Five

Years and Period Served as an Officer

|

|

|

Michael F. Barry, 56

Chairman of the Board, Chief Executive Officer

and President and Director

|

|

Mr. Barry, who has been employed by the Company since 1998, has served as Chairman of the Board since May 2009, in addition to his position as Chief Executive Officer and President held since October 2008. He served as Senior Vice President and Managing Director – North America from January 2006 to October 2008. He served as Senior Vice President and Global Industry Leader – Metalworking and Coatings from July 2005 through December 2005. He served as Vice President and Global Industry Leader – Industrial Metalworking and Coatings from January 2004 through June 2005 and Vice President and Chief Financial Officer from 1998 to August 2004.

|

|

|

Margaret M. Loebl, 55

Vice President, Chief Financial Officer

and Treasurer

|

|

Ms. Loebl, has served as Vice President, Chief Financial Officer and Treasurer since she joined the Company in June 2012. Prior to joining the Company, Ms. Loebl, from August 2011 to December 2011, provided senior executive-level financial consulting services in Paris, France, for Constellium, a leader in the manufacturing of high-quality aluminum products and solutions. Prior to joining Constellium, she served from October 2008 through December 2010 as Corporate Vice President, Chief Financial Officer and Treasurer of TechTeam Global, Inc., a provider of information technology and business process outsourcing services. Ms. Loebl served as an Executive in Residence at the University of Illinois in support of the University’s Finance Academy from August 2007 to December 2008.

|

|

|

D. Jeffry Benoliel, 56

Vice President and Global Leader –

Metalworking, Can, Mining and Corporate Secretary

|

|

Mr. Benoliel, who has been employed by the Company since 1995, has served as Global Leader – Mining since May 1, 2014, in addition to his position as Vice President and Global Leader – Metalworking, Can and Corporate Secretary since July 2013. He served as Vice President – Global Metalworking and Fluid Power and Corporate Secretary from June 2011 through June 2013, and until March 2012 also held the position of General Counsel. He served as Vice President – Global Strategy, General Counsel and Corporate Secretary from October 2008 until mid-June 2011 and Vice President, Secretary and General Counsel from 2001 through September 2008.

|

|

|

Joseph A. Berquist, 43

Vice President and Managing

Director – North America

|

Mr. Berquist, who has been employed by the Company since 1997, has served as Vice President and Managing Director – North America since April 2010. He served as Senior Director, North America Commercial from October 2008 through March 2010.

|

||

|

Ronald S. Ettinger, 62

Vice President – Human Resources

|

Mr. Ettinger, who has been employed by the Company since 2002, has served as Vice President-Human Resources since December 2011. He served as Director-Global Human Resources from August 2005 through November 2011.

|

||

9

|

Name, Age, and Present

Position with the Company

|

|

Business Experience During the Past Five

Years and Period Served as an Officer

|

|

|

Shane W. Hostetter, 33

Global Controller

|

Mr. Hostetter, who has been employed by the Company since July 2011, has served as Global Controller since September 1, 2014. He served as Corporate Controller from May 2013 to August 2014. He served as Assistant Global Controller from July 2011 to May 2013. Prior to joining the Company, Mr. Hostetter led the financial reporting department for Pulse Electronics Corporation (formerly Technitrol, Inc.) from May 2008 to June 2011.

|

||

|

Dieter Laininger, 52

Vice President and Managing

Director – South America and

Global Leader – Primary Metals

|

Mr. Laininger, who has been employed by the Company since 1991, has served as Vice President and Managing Director – South America, since January 2013, in addition to his position as Vice President and Global Leader – Primary Metals, to which he was appointed in June 2011. He served as Industry Business Director for Steel and Metalworking – EMEA from March 2001 through July 2011.

|

||

|

Joseph F. Matrange, 73

Vice President and Global Leader – Coatings

|

Mr. Matrange, who has been employed by the Company since 2000, has served as Vice President and Global Leader – Coatings since October 2008. He has also served as President of AC Products, Inc., a California subsidiary, since October 2000, and Epmar Corporation, a California subsidiary, since April 2002.

|

||

|

Jan F. Nieman, 54

Vice President and Global Leader – Grease and Fluid Power, Global Strategy and Marketing

|

|

Mr. Nieman, who has been employed by the Company since 1992, has served as Vice President – Global Strategy and Marketing since May 1, 2014, in addition to his position as Global Leader – Grease and Fluid Power since August 2013. He also served as Global Leader – Mining from August 2013 through April 30, 2014. He served as Vice President and Managing Director – Asia/Pacific from February 2005 through July 2013.

|

|

|

Wilbert Platzer, 53

Vice President and Managing

Director – EMEA

|

|

Mr. Platzer, who has been employed by the Company since 1995, has served as Vice President and Managing Director – EMEA since January 2006.

|

|

|

Adrian Steeples, 54

Vice President and Managing

Director – Asia/Pacific

|

Mr. Steeples, who has been employed by the Company since 2010, has served as Vice President and Managing Director – Asia/Pacific since July 2013. He served as Industry Business Director – Metalworking from March 2011 through June 2013, and Manager, European and Global Special Projects, from May 2010 through February 2011. Prior to joining the Company, he worked for the BP Group serving as BP/Castrol European and Asian Pacific Sales Director in Industrial Lubricants and Services from January 2009 through December 2009.

|

||

10

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The Company’s common stock is listed on the New York Stock Exchange (“NYSE”) under the trading symbol KWR. The following table sets forth, for the calendar quarters during the two most recent fiscal years, the range of high and low sales prices for the common stock as reported on the NYSE composite tape (amounts rounded to the nearest penny), and the quarterly dividends declared and paid:

|

|

Price Range

|

|

Dividends

|

|

Dividends

|

||||||||||||||||||

|

|

2014

|

|

2013

|

|

Declared

|

|

Paid

|

||||||||||||||||

|

|

High

|

|

Low

|

|

High

|

|

Low

|

|

2014

|

|

2013

|

|

2014

|

|

2013

|

||||||||

|

First quarter

|

$

|

80.91

|

|

$

|

65.19

|

|

$

|

63.50

|

|

$

|

54.24

|

|

$

|

0.250

|

|

$

|

0.245

|

|

$

|

0.250

|

|

$

|

0.245

|

|

Second quarter

|

|

81.70

|

|

|

71.16

|

|

|

67.27

|

|

|

53.54

|

|

|

0.30

|

|

|

0.25

|

|

|

0.250

|

|

|

0.245

|

|

Third quarter

|

|

79.59

|

|

|

69.17

|

|

|

73.41

|

|

|

61.67

|

|

|

0.30

|

|

|

0.25

|

|

|

0.30

|

|

|

0.25

|

|

Fourth quarter

|

|

93.56

|

|

|

67.29

|

|

|

81.52

|

|

|

70.02

|

|

|

0.30

|

|

|

0.25

|

|

|

0.30

|

|

|

0.25

|

There are no restrictions that currently materially limit the Company’s ability to pay dividends or that the Company believes are likely to materially limit the payment of future dividends. If a default under the Company’s primary credit facility were to occur and continue, the payment of dividends would be prohibited. Reference is made to the “Liquidity and Capital Resources” disclosure contained in Item 7 of this Report.

As of January 16, 2015, there were 935 shareholders of record of the Company’s common stock, its only outstanding class of equity securities.

Every holder of Quaker common stock is entitled to one vote or ten votes for each share held of record on any record date depending on how long each share has been held. As of January 16, 2015, 13,302,967 shares of Quaker common stock were issued and outstanding. Based on the information available to the Company on January 16, 2015, as of that date the holders on record of 789,299 shares of Quaker common stock would have been entitled to cast ten votes for each share, or approximately 39% of the total votes that would have been entitled to be cast as of that record date, and the holders on record of 12,513,668 shares of Quaker common stock would have been entitled to cast one vote for each share, or approximately 61% of the total votes that would have been entitled to be cast as of that date. The number of shares that are indicated as entitled to one vote includes those shares presumed to be entitled to only one vote. Because the holders of these shares may rebut this presumption, the total number of votes entitled to be cast as of January 16, 2015 could be more than 20,406,658.

Reference is made to the information in Item 12 of this Report under the caption “Equity Compensation Plans,” which is incorporated herein by this reference.

The following table sets forth information concerning shares of the Company’s common stock acquired by the Company during the fourth quarter of the fiscal year covered by this Report:

|

Issuer Purchases of Equity Securities

|

|

||||||||||

|

|

|

|

|

|

|

|

|

(c)

|

|

(d)

|

|

|

|

|

|

|

|

|

|

|

Total Number of

|

|

Maximum Number

|

|

|

|

|

|

(a)

|

|

(b)

|

|

Shares Purchased

|

|

of Shares that May

|

|

|

|

|

|

|

Total Number

|

|

Average

|

|

as part of Publicly

|

|

Yet Be Purchased

|

|

|

|

|

|

|

of Shares

|

|

Price Paid

|

|

Announced Plans

|

|

Under the Plans

|

|

|

|

Period

|

|

Purchased (1)

|

|

per Share (2)

|

|

or Programs (3)

|

|

or Programs (3)

|

|

||

|

October 1 - October 31

|

|

1,175

|

|

$

|

82.08

|

|

—

|

|

252,600

|

|

|

|

November 1 - November 30

|

|

—

|

|

|

—

|

|

—

|

|

252,600

|

|

|

|

December 1 - December 31

|

|

—

|

|

|

—

|

|

—

|

|

252,600

|

|

|

|

Total

|

|

1,175

|

|

$

|

82.08

|

|

—

|

|

252,600

|

|

|

|

(1)

|

All of the 1,175 shares acquired by the Company during the period covered by this report were acquired from employees upon their surrender of previously owned shares in payment of the exercise price of employee stock options exercised, for the payment of taxes upon exercise of employee stock options or for the payment of taxes upon vesting of restricted stock.

|

|

(2)

|

The price paid per share, in each case, represented the closing price of the Company’s common stock on the date of exercise or vesting, as specified by the plan pursuant to which the applicable option or restricted stock was granted.

|

11

|

(3)

|

On February 15, 1995, the Board of Directors of the Company authorized a share repurchase program authorizing the repurchase of up to 500,000 shares of Quaker common stock, and, on January 26, 2005, the Board authorized the repurchase of up to an additional 225,000 shares. Under the 1995 action of the Board, 27,600 shares may yet be purchased. Under the 2005 action of the Board, none of the shares authorized have been purchased and, accordingly, all of those shares may yet be purchased. Neither of the share repurchase authorizations has an expiration date.

|

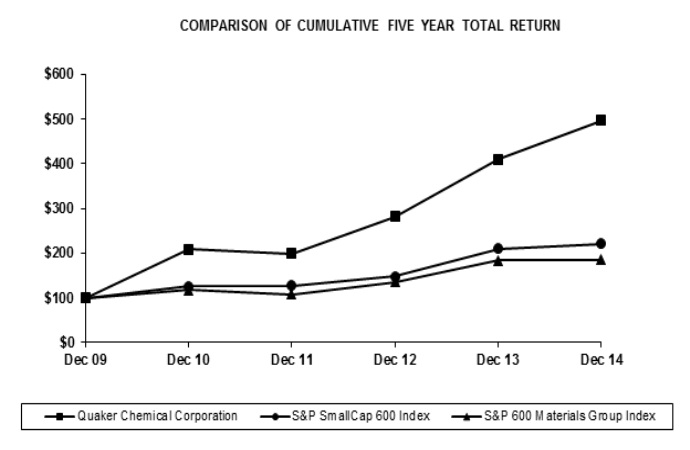

The following graph compares the cumulative total return (assuming reinvestment of dividends) from December 31, 2009 to December 31, 2014 for (i) Quaker’s common stock, (ii) the S&P SmallCap 600 Index (the “SmallCap Index”), and (iii) the S&P 600 Materials Group Index (the “Materials Group Index”). The graph assumes the investment of $100 on December 31, 2009 in each of Quaker’s common stock, the stocks comprising the SmallCap Index and the stocks comprising the Materials Group Index.

|

|

12/31/2009

|

12/31/2010

|

12/31/2011

|

12/31/2012

|

12/31/2013

|

12/31/2014

|

|||||

|

Quaker

|

$100.00

|

$208.75

|

$199.57

|

$282.27

|

$410.14

|

$497.14

|

|||||

|

SmallCap Index

|

100.00

|

126.31

|

127.59

|

148.42

|

209.74

|

221.81

|

|||||

|

Materials Group Index

|

100.00

|

118.27

|

108.50

|

135.95

|

184.62

|

185.17

|

12

Item 6. Selected Financial Data.

The following table sets forth selected financial data for the Company and its consolidated subsidiaries (in thousands, except dividends and per share data):

|

|

|

|

|

Year Ended December 31,

|

|||||||||||||

|

|

|

|

|

|

2014 (1)

|

|

|

2013 (2)

|

|

|

2012 (3)

|

|

|

2011 (4)

|

|

|

2010 (5)

|

|

Summary of Operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Net sales

|

$

|

765,860

|

|

$

|

729,395

|

|

$

|

708,226

|

|

$

|

683,231

|

|

$

|

544,063

|

||

|

|

Income before taxes and equity in net income of

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

associated companies

|

|

78,293

|

|

|

72,826

|

|

|

62,948

|

|

|

59,377

|

|

|

46,213

|

|

|

Net income attributable to Quaker Chemical Corporation

|

|

56,492

|

|

|

56,339

|

|

|

47,405

|

|

|

45,892

|

|

|

32,120

|

||

|

|

Per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Net income attributable to Quaker Chemical

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporation Common Shareholders - basic

|

$

|

4.27

|

|

$

|

4.28

|

|

$

|

3.64

|

|

$

|

3.71

|

|

$

|

2.85

|

|

|

|

Net income attributable to Quaker Chemical

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporation Common Shareholders - diluted

|

$

|

4.26

|

|

$

|

4.27

|

|

$

|

3.63

|

|

$

|

3.66

|

|

$

|

2.80

|

|

|

|

Dividends declared

|

|

1.150

|

|

|

0.995

|

|

|

0.975

|

|

|

0.955

|

|

|

0.935

|

|

|

|

|

Dividends paid

|

|

1.10

|

|

|

0.99

|

|

|

0.97

|

|

|

0.95

|

|

|

0.93

|

|

|

Financial Position

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Working capital

|

$

|

226,617

|

|

$

|

197,991

|

|

$

|

170,018

|

|

$

|

152,900

|

|

$

|

114,291

|

||

|

|

Total assets

|

|

665,526

|

|

|

584,146

|

|

|

536,634

|

|

|

511,152

|

|

|

452,868

|

||

|

|

Long-term debt

|

|

75,328

|

|

|

17,321

|

|

|

30,000

|

|

|

46,701

|

|

|

73,855

|

||

|

|

Total equity

|

|

365,135

|

|

|

344,696

|

|

|

289,676

|

|

|

261,357

|

|

|

190,537

|

||

Notes to the above table (in thousands):

|

(1)

|

The results of operations for 2014 include equity income from a captive insurance company of $2,412 after tax; offset by an after-tax charge of $321 related to the currency conversion of the Venezuelan Bolivar Fuerte to the U.S. Dollar at the Company’s 50% owned affiliate in Venezuela; $1,166 of charges related to cost streamlining initiatives in the Company’s EMEA and South American segments; a $902 charge related to a UK pension plan amendment; and $825 of charges related to certain customer bankruptcies.

|

|

(2)

|

The results of operations for 2013 include equity income from a captive insurance company of $5,451 after tax; an increase to other income of $2,540 related to a mineral oil excise tax refund; and an increase to other income of $497 related to a change in an acquisition-related earnout liability; partially offset by an after-tax charge of $357 related to the currency conversion of the Venezuelan Bolivar Fuerte to the U.S. Dollar at the Company’s 50% owned affiliate in Venezuela; $1,419 of charges related to cost streamlining initiatives in the Company’s EMEA and South American segments; and a $796 net charge related to a non-income tax contingency.

|

|

(3)

|

The results of operations for 2012 include equity income from a captive insurance company of $1,812 after tax; and an increase to other income of $1,737 related to a change in an acquisition-related earnout liability; partially offset by a charge of $1,254 related to the bankruptcy of certain customers in the U.S.; and a charge of $609 related to CFO transition costs.

|

|

(4)

|

The results of operations for 2011 include equity income from a captive insurance company of $2,323 after tax; an increase to other income of $2,718 related to the revaluation of the Company’s previously held ownership interest in Tecniquimia Mexicana S.A de C.V. to its fair value; and an increase to other income of $595 related to a change in an acquisition-related earnout liability.

|

|

(5)

|

The results of operations for 2010 include equity income from a captive insurance company of $313 after tax; offset by a final charge of $1,317 related to the retirement of the Company’s former Chief Executive Officer in 2008; a net charge of $4,132 related to a non-income tax contingency; a $322 after-tax charge related to the currency conversion of the Venezuelan Bolivar Fuerte to the U.S. Dollar at the Company’s 50% owned affiliate in Venezuela; and a $564 after-tax charge related to an out-of-period adjustment at the Company’s 40% owned affiliate in Mexico.

|

13

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Executive Summary

Quaker Chemical Corporation is a leading global provider of process fluids, chemical specialties, and technical expertise to a wide range of industries, including steel, aluminum, automotive, mining, aerospace, tube and pipe, cans, and others. For nearly 100 years, Quaker has helped customers around the world achieve production efficiency, improve product quality, and lower costs through a combination of innovative technology, process knowledge, and customized services. Headquartered in Conshohocken, Pennsylvania USA, Quaker serves businesses worldwide with a network of dedicated and experienced professionals whose mission is to make a difference.

Overall, the Company performed very well in 2014, as its sales and earnings continued a trend of year-over-year growth and, also, solid cash flow generation. The Company’s 2014 performance was driven by a 5% increase in net sales on increased product volumes, which was consistent with the growth of its gross profit on stable margins of 35.7% and 35.8% in 2014 and 2013, respectively. Selling, general and administrative expenses (“SG&A”) increased $6.0 million from 2013, due to several factors including higher acquisition-related costs and higher labor-related costs on increased sales and merit inflation, net of lower incentive compensation and the effects of foreign currency exchange rate translation. However, SG&A, as a percentage of sales, decreased to 25.6% from 26.0% in 2013, which increased the Company’s operating income to 10.1% of sales in 2014 compared to 9.8% in 2013. The year-over-year improvement in the Company’s operating performance was negatively impacted by other items, such as lower other income and a higher tax rate, as compared to 2013, which are further discussed in the Company’s Consolidated Operations Review section of this Item, below.

From a business perspective, the Company’s performance in 2014 was highlighted by continued volume gains over all of its regions, with the exception of South America, where we continue to be adversely impacted by low end-user production and foreign exchange. Related to the remaining regions, North America continues to experience higher sales levels and a slight increase in gross margin on an improving domestic economy. Similarly, both EMEA and Asia/Pacific experienced higher sales volume on continued market share gains. In addition, North America and Europe’s sales increased from recent acquisitions, but the segments’ overall net performance were minimally impacted, due to acquisition-related costs and initial fair value accounting adjustments. Overall, each of the three regions’ improved sales were partially offset by higher manufacturing costs, direct SG&A costs and other labor-related costs on increased volume levels and overall merit inflation. Similarly, South America had year-over-year impacts due to normal merit increases, which the Company continues to temper through certain actions, such as its most recent cost streamlining activity in the fourth quarter of 2014.

The net result was earnings per diluted share of $4.26 in 2014 compared to $4.27 in 2013, with non-GAAP earnings per diluted share increasing 11% to $4.26 in 2014 from $3.84 in 2013. Also, consistent with the operating income trends discussed above, the Company’s adjusted EBITDA approximated $100 million in 2014, which was an increase of 11% from $89.6 million in 2013. See the Non-GAAP Measures section in this Item, below.