Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - EXPEDITORS INTERNATIONAL OF WASHINGTON INC | a201410-kex32.htm |

| EX-21.1 - EXHIBIT 21.1 - EXPEDITORS INTERNATIONAL OF WASHINGTON INC | a201410-kex211.htm |

| EX-23.1 - EXHIBIT 23.1 - EXPEDITORS INTERNATIONAL OF WASHINGTON INC | a201410-kex231.htm |

| EX-31.2 - EXHIBIT 31.2 - EXPEDITORS INTERNATIONAL OF WASHINGTON INC | a201410-kex312.htm |

| EX-31.1 - EXHIBIT 31.1 - EXPEDITORS INTERNATIONAL OF WASHINGTON INC | a201410-kex311.htm |

| EX-10.23 - EXHIBIT 10.23 - EXPEDITORS INTERNATIONAL OF WASHINGTON INC | a201410-kex1023.htm |

| EXCEL - IDEA: XBRL DOCUMENT - EXPEDITORS INTERNATIONAL OF WASHINGTON INC | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

Q | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 0-13468

EXPEDITORS INTERNATIONAL OF WASHINGTON, INC.

(Exact name of registrant as specified in its charter)

Washington | 91-1069248 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

1015 Third Avenue, 12thFloor, Seattle, Washington | 98104 |

(Address of principal executive offices) | (Zip Code) |

(206) 674-3400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, par value $.01 per share | NASDAQ Global Select Market | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | x | Accelerated filer | o | ||

Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | o | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant, based upon the closing price as of the last business day of the most recently completed second fiscal quarter ended June 30, 2014, was approximately $8,510,744,390.

At February 23, 2015, the number of shares outstanding of registrant’s Common Stock was 191,752,027.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for the Registrant’s 2015 Annual Meeting of Shareholders to be held on May 21, 2015 are incorporated by reference into Part III of this Form 10-K.

Forward-Looking Statements

In accordance with the provisions of the Private Securities Litigation Reform Act of 1995, the Company is making readers aware that forward-looking statements, because they relate to future events, are by their very nature subject to many important risk factors which could cause actual results to differ materially from those contained in the forward-looking statements. For additional information about forward-looking statements and for an identification of risk factors and their potential significance, see “Safe Harbor for Forward-Looking Statements Under Private Securities Litigation Reform Act of 1995; Certain Cautionary Statements” immediately preceding Part II, Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 1A - "Risk Factors" in this report. Forward-looking statements speak only as of the date they were made. The Company undertakes no obligation to update these statements in light of subsequent events or developments.

PART I

ITEM 1—BUSINESS

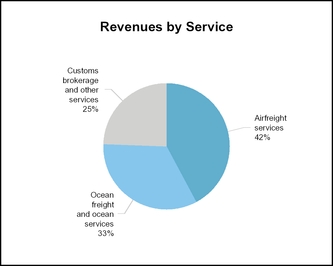

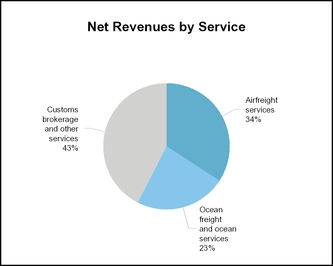

Expeditors International of Washington, Inc. ("the Company") is engaged in the business of providing global logistics services. The Company offers its customers a seamless international network of people and integrated information systems supporting the movement and strategic positioning of goods. The Company’s primary services include air and ocean freight transportation and customs brokerage. The Company also provides additional services including order management, time-definite transportation, warehousing and distribution, cargo insurance, and customized logistics solutions. As a third party logistics provider, the Company purchases cargo space from carriers, including airlines and ocean shipping lines, on a volume basis and resells that space to its customers. The Company does not compete for overnight courier or small parcel business and does not own aircraft or steamships. The following charts show the Company's 2014 revenues and net revenues (a non-GAAP measure calculated as revenues less directly related operating expenses) by service type:

Beginning in 1981, the Company’s primary business focus was on airfreight shipments from Asia to the United States and related customs brokerage and other services. In the mid-1980’s, the Company began to expand its service capabilities in export airfreight, ocean freight and distribution services. Today the Company offers a complete range of global logistics services to a diversified group of customers, both in terms of industry specialization and geographic location. As opportunities for profitable growth arise, the Company plans to create new offices. While the Company has historically expanded through organic growth, the Company has also been open to growth through acquisition of, or establishing joint ventures with, existing agents or others within the industry.

At January 31, 2015, the Company, including its majority-owned subsidiaries, is organized functionally in geographic operating segments and operates full service offices in the regions identified below. Full service offices have also been established in locations where the Company maintains unilateral control over assets and operations and where the existence of the parent-subsidiary relationship is maintained by means other than record ownership of voting stock.

The Company operates full service offices in the following geographic operating segments:

• | Americas |

◦ | United States (47) |

◦ | Other North America (10) |

◦ | Latin America (15) |

• | Asia Pacific (42) |

• | Europe (50) |

• | Middle East, Africa and India (22) |

The Company also maintains sales and satellite offices which are aligned with and dependent on one or more full service offices. Additionally, the Company contracts with independent agents to provide required services and has established 46 such relationships world-wide.

| 1.

For information concerning the amount of revenues, net revenues, operating income, identifiable assets, capital expenditures, depreciation and amortization and equity attributable to the geographic areas in which the Company conducts its business, see Note 10 to the consolidated financial statements.

Airfreight Services

Airfreight services accounted for approximately 42 percent of the Company's total revenues and 34 percent of total net revenues in each of the last three years. When performing airfreight services, the Company typically acts either as a freight consolidator or as an agent for the airline which carries the shipment. When acting as a freight consolidator, the Company purchases cargo space from airlines on a volume basis and resells that space to its customers at lower rates than the customers could obtain directly from airlines on an individual shipment. The Company issues a House Airway Bill (HAWB) to its customers as its contract of carriage and separately receives a Master Airway Bill from the airlines when the freight is physically tendered. When moving shipments between points where the nature or volume of business does not facilitate consolidation, the Company receives and forwards individual shipments as the agent of the airline which carries the shipment. Whether acting as a consolidator or agent, the Company offers its customers knowledge of optimum routing, familiarity with local business practices, knowledge of export and import documentation and procedures, the ability to arrange for ancillary services, and assistance with space availability in periods of peak demand.

In its airfreight operations, the Company receives shipments from its customers, determines the routing, consolidates shipments bound for a particular airport distribution point, and selects the airline for transportation to the distribution point. At the distribution point, the Company or its agent arranges for the consolidated lot to be broken down into its component shipments and for the transportation of the individual shipments to their final destinations.

The Company estimates its average airfreight consolidation weighs approximately 2,800 pounds and a typical consolidation includes merchandise from several shippers. Because shipment by air is relatively expensive compared with ocean transportation, air shipments are generally characterized by a high value-to-weight ratio, the need for rapid delivery, or both.

The Company typically delivers shipments from a Company warehouse at the origin to the airline after consolidating the freight into containers or onto pallets. Shipments normally arrive at the destination distribution point within forty-eight hours after such delivery. During peak shipment periods, cargo space available from the scheduled air carriers can be limited and backlogs of freight shipments may occur. When these conditions exist, the Company may charter aircraft to meet customer demand.

The Company consolidates individual shipments based on weight and volume characteristics in cost-effective combinations. Typically, as the weight or volume of a shipment increases, the cost per pound/kilo or cubic inch/centimeter charged by the Company decreases. The rates charged by airlines also generally decrease as the weight or volume of the shipment increases. As a result, by aggregating shipments and presenting them to an airline as a single shipment, the Company is able to obtain a lower rate per pound/kilo or cubic inch/centimeter than that which it charges to its customers for the individual shipment, while generally offering the customer a lower rate than could be obtained from the airline for an unconsolidated shipment.

The Company’s airfreight net revenues for a consolidated shipment include the differential between the rate charged to the Company by an airline and the rate which the Company charges to its customers, commissions paid to the Company by the airline carrying the freight and fees for ancillary services. Such ancillary services provided by the Company include preparation of shipping and customs documentation, packing, crating, insurance services, negotiation of letters of credit, and the preparation of documentation to comply with local export laws. When the Company acts as an agent for an airline handling an unconsolidated shipment, its net revenues are primarily derived from commissions paid by the airline and fees for ancillary services paid by the customer.

Management believes that the ownership of aircraft would subject the Company to undue business risks, including large capital outlays, increased fixed operating expenses, volatile fuel prices, problems of fully utilizing aircraft and competition with airlines. Because the Company relies on commercial airlines to transport its shipments, changes in carrier financial stability, policies and practices such as pricing, payment terms, scheduling, capacity and frequency of service may adversely affect its business.

Over the last two years, airline profitability has improved though many air carriers remain highly leveraged with debt. Carriers continue to merge and consolidate operations and reduce available capacity to improve financial results. Some airlines have significantly reduced their reliance on cargo-only aircraft to service their airfreight customers as high technology consumer products continue to decrease in size and weight and as customers remain focused on improving supply-chain efficiency, seek to reduce overall logistics costs by negotiating lower rates and by utilizing ocean freight whenever possible. The reduction in capacity allows asset-based carriers to raise rates in the face of declining or stable demand. When fewer planes are flying, the Company has fewer shipping options from which to craft service offerings to meet customers’ needs. The combination of reduced capacity, higher rates and less frequent flights could challenge the Company’s ability to maintain historical unitary profitability.

Recent declines in oil prices did not significantly impact airfreight buy and sell rates in 2014. However, in 2015 airfreight customers have begun to seek reductions in rates related to lower oil prices. Currently, there is uncertainty as to how buy rates will be impacted due to a number of factors, including that some air carriers having hedged fuel costs through 2015. Presently, most carriers have not incorporated lower fuel costs in their pricing structure. Because fuel is an integral part of carriers' costs and impacts both the Company's cargo space buy rates and its sell rates to customers, the Company would expect its airfreight revenues and costs to decline should lower fuel prices persist. The Company would not expect an adverse effect on airfreight net revenues resulting from a decline in oil prices.

Ocean Freight and Ocean Services

Ocean freight services accounted for approximately 33 percent of the Company's total revenues and 23 percent of total net revenues in each of the past three years. The Company operates Expeditors International Ocean, Inc. (“EIO”), an Ocean Transportation Intermediary, sometimes referred to as a Non-Vessel Operating Common Carrier (“NVOCC”) which specializes in ocean freight services in most major trade lanes in the world. EIO also provides service, on a smaller scale, to and from any location where the Company has an office or agent. Ocean freight services are comprised of three basic services: ocean freight consolidation (EIO), direct ocean forwarding and order management.

| 2.

Ocean freight consolidation: As an NVOCC, EIO contracts with ocean shipping lines to obtain transportation for a fixed number of containers between various points during a specified time period at an agreed rate. EIO handles full container loads for customers that do not want to contract directly with the ocean carriers and for those customers that prefer to supplement their carrier strategy with an NVOCC. EIO also solicits Less-than Container Load (“LCL”) freight to fill the containers and charges lower rates than those available directly from shipping lines. The Company issues a House Ocean Bill ("HOBL") to customers as the contract of carriage and receives a separate Master Ocean Bill of Lading ("MOBL") when freight is physically tendered. Revenues from fees charged to customers for ancillary services which the Company may provide include the preparation of shipping and customs documentation, packing, crating, insurance services, negotiation of letters of credit, and the preparation of documentation to comply with local export laws.

Direct ocean forwarding: When the customer contracts directly with the steamship line, the Company acts as an agent of the customer and derives its revenues from commissions paid by the steamship line and handling fees paid by the customer. In such arrangements, no HOBL is issued by the Company. The carrier issues a MOBL directly to the customer who employs the Company to create documentation, manage shipment information and arrange various services to facilitate the shipment of goods. The MOBL shows the customer as the shipper.

Order management: Order management provides services which manage origin consolidation, supplier performance, carrier allocation, carrier performance, container management, document management, destination management and PO/SKU visibility through a web based application. Customers have the ability to monitor and report against near real time status of purchase orders from the date of creation through final delivery. Item quantities, required ship dates, commodity descriptions, estimated vs. actual ex-factory dates, container utilization, and document visibility are many of the managed functions that are visible and reportable via the web. Order management is available for various modes of transportation including ocean, air, truck and rail. Order management revenues are derived from services provided to the shipper as well as management fees associated with managing purchase order execution against customer specific rules. One basic function of Order management involves arranging cargo from many suppliers in a particular origin and “consolidating” these shipments into the fewest possible number of containers to maximize space utilization and minimize cost. Through origin consolidation, customers can reduce the number of containers shipped by putting more product in larger and fewer containers.

Ocean carriers incurred substantial operating losses in recent years, and many are highly leveraged with debt. While the overall global volumes have increased slightly over recent years, many carriers continue to take delivery of new ships which creates excess capacity. This excessive capacity causes most carriers to redeploy ships and modify sailing schedules to improve financial results. The potential combination of reduced sailing schedules and pricing volatility could impact the Company’s ability to maintain historical unitary profitability.

Recent declines in oil prices did not significantly impact ocean freight buy and sell rates in 2014. However, in 2015 ocean freight customers have begun to seek reductions in rates related to lower oil prices. Currently, there is uncertainty as to how buy rates will be impacted due to a number of factors. Presently, most carriers have not incorporated lower fuel costs in their pricing structure. Because fuel is an integral part of carriers' costs and impacts both the Company's cargo space buy rates and its sell rates to customers, the Company would expect its ocean freight revenues and costs to decline should lower fuel prices persist. The Company would not expect an adverse effect on ocean freight net revenues resulting from a decline in oil prices.

Customs Brokerage and Other Services

Customs brokerage and other services accounted for approximately 25 percent of the Company's total revenues and 43 percent of total net revenues in each of the past three years. As a customs broker, the Company assists importers to clear shipments through customs by preparing required documentation, calculating and providing for payment of duties and other taxes on behalf of the importer, arranging for any required inspections by governmental agencies, and arranging for delivery. Changing regulations, the commodities being cleared and the time sensitive nature of the border brokerage business require the Company to continue to make enhancements to its systems in order to provide competitive service. The Company provides customs clearance services in connection with many of the shipments it handles in its transportation services. However, substantial customs brokerage revenues are derived from customers that elect to use a competitor for transportation services. Conversely, shipments handled by the Company may be processed by another customs broker selected by the customer.

The Company also provides other value added services at destination such as warehousing and distribution, time-definite transportation services (Transcon) and consulting services, none of which are currently individually significant to the Company’s total revenues and net revenues. The Company's distribution and warehousing services include distribution center management, inventory management, order fulfillment, returns programs and order level services. Transcon is a multi-modal product, which offers time-definite, intra-continental transportation solutions, often by ground and other specialty handling services. The Company’s wholly-owned subsidiary, Expeditors Tradewin, L.L.C., responds to customer driven requests for customs consulting services. Fees for these non-transactional services are based upon hourly billing rates and bids for mutually agreed projects.

Marketing and Customers

The Company provides specific solutions tailored to each customer's individual business needs from order inception through order delivery. Although the domestic importer usually designates the logistics company and the services that will be required, the foreign shipper may also participate in this selection process. Therefore, the Company coordinates its marketing program to reach both domestic importers and their overseas suppliers.

The Company’s efforts are focused on optimizing its customers’ supply chains. Therefore, the Company's marketing efforts target professionals in logistics, international and domestic transportation, customs, compliance and purchasing departments of existing and potential customers. The district manager of each office is responsible for marketing, sales coordination, and operations in the area in which he or she is located. All employees are responsible for customer service and retention.

The Company staffs its offices largely with managers and other key personnel who are citizens of the nations in which they operate and who have extensive experience in global logistics. Marketing and customer service staffs are responsible for marketing and selling the Company’s services directly to customers and prospects who may select or influence the selection of logistics service providers and for ensuring that customers receive timely and efficient service. The Company believes that its expertise in supplying solutions customized to the needs of its customers, its emphasis on coordinating its origin and destination customer service and marketing activities, and the incentives it gives to its managers have been important elements of its success.

| 3.

The goods handled by the Company are generally a function of the products which dominate international trade between any particular origin and destination. Shipments of computers and components, electronic and consumer goods, medical equipment, pharmaceutical products, retail goods, automotive parts, aviation parts, industrial equipment and oil and energy equipment comprise a significant percentage of the Company’s business. Typical import customers include retailers and distributors of consumer electronics, department store chains, clothing and shoe wholesalers, and high-tech, industrial and automotive manufacturers. The Company has also established industry vertical teams located throughout its network that focus on aviation and aerospace, healthcare, oil and energy, and retail and fashion. Historically, no single customer has accounted for five percent or more of the Company’s net revenues.

Competition

The global logistics services industry is intensely competitive and is expected to remain so for the foreseeable future. There are a large number of companies competing in one or more segments of the industry, but the number of firms with a global network that offer a full complement of logistics services is more limited. Many of these competitors have significantly more resources than the Company. Depending on the location of the shipper and the importer, the Company must compete against both the niche players and larger entities. The industry continues to experience consolidations into larger firms striving for stronger and more complete multinational and multi-service networks. However, regional and local competitors still maintain a strong market presence in certain areas.

The primary competitive factors in the global logistics services industry continue to be price and quality of service, including reliability, responsiveness, expertise, convenience, and scope of operations. The Company emphasizes quality customer service and believes that its prices are competitive with the prices of others in the industry. Larger customers utilize the services of multiple logistics providers and implement more sophisticated and efficient procedures for the management of their logistics supply chains by embracing strategies such as just-in-time inventory management. Accordingly, timely and accurate information integrated into customer service capabilities are a significant factor in attracting and retaining customers. This information integrated into customer service capabilities includes customized Electronic Data Interchange (“EDI”), on-line freight tracing and tracking applications and customized reporting. Customized EDI applications allow the transfer of key information between customers’, service providers' and the Company’s systems. Freight tracing and tracking applications provide customers with near real time visibility to the location, transit time and estimated delivery time of inventory in transit.

Management believes that the ability to develop and deliver innovative solutions to meet customers’ increasingly sophisticated information requirements is a critical factor in the ongoing success of the Company. The Company devotes a significant amount of resources towards the maintenance and enhancement of systems that currently meet these customer demands. Management believes that the Company’s existing systems are competitive with the systems currently in use by other logistics services companies with which it competes.

Unlike many of its competitors, who have tended to grow by merger and acquisition, the Company operates the same transportation and accounting computer software, running on a common hardware platform, in all of its full-service locations. Small and middle-tier competitors, in general, do not have the resources available to develop these customized systems. Historically, growth through aggressive acquisition has proven to be a challenge for many of the Company’s competitors and typically involves the purchase of significant “goodwill.” As a result, the Company has pursued a strategy emphasizing organic growth supplemented by certain strategic acquisitions.

The Company’s ability to attract, retain, and motivate highly qualified personnel with experience in global logistics services is an essential, if not the most important, element of its ability to compete in the industry. To this end, the Company has adopted incentive compensation programs which make percentages of an operating unit's net revenues or profits available to managers for distribution among key personnel. The Company believes that these incentive compensation programs, combined with its experienced personnel and its ability to coordinate global marketing efforts, provide it with a distinct competitive advantage.

Currency and Dependence on Service Providers

The nature of the Company’s worldwide operations necessitates the Company dealing with a multitude of currencies other than the U.S. dollar. This results in the Company being exposed to the inherent risks of volatile international currency markets and governmental interference. Some of the countries where the Company maintains offices and/or agency relationships have strict currency control regulations which influence the Company’s ability to hedge foreign currency exposure. The Company tries to compensate for these exposures by accelerating international currency settlements among its offices or agents.

In addition, the Company’s ability to provide services to its customers is highly dependent on good working relationships with a variety of entities including airlines, ocean steamship lines, ground transportation providers and governmental agencies. The Company considers its current working relationships with these entities to be satisfactory. However, changes in the financial stability and operating capabilities and capacity of asset-based carriers, space allotments available from carriers, governmental regulation or deregulation efforts, modernization of the regulations governing customs brokerage, and/or changes in governmental restrictions, quota restrictions or trade accords could affect the Company’s business in unpredictable ways.

Seasonality

Historically, the Company’s operating results have been subject to seasonal trends with the first quarter being the weakest and the third and fourth quarters being the strongest. This pattern has been the result of, or influenced by, numerous factors including weather patterns, national holidays, consumer demand, new product launches, economic conditions and a myriad of other similar and subtle forces. The Company cannot accurately forecast many of these factors, nor can the Company estimate accurately the relative influence of any particular factor and, as a result, there can be no assurance that historical patterns will continue in future periods.

| 4.

Environmental

In the United States, the Company is subject to Federal, state and local provisions regulating the discharge of materials and emissions into the environment or otherwise for the protection of the environment. Similar laws apply in many other jurisdictions in which the Company operates. Although current operations have not been significantly affected by compliance with these environmental laws, governments, service providers and customers are becoming increasingly sensitive to environmental issues, and the Company cannot predict what impact future environmental regulations may have on its business. The Company does not anticipate making any material capital expenditures for environmental control purposes during 2015.

Employees

At January 31, 2015, the Company employed approximately 14,670 people, 5,290 in the United States and 990 in the balance of North America, 760 in Latin America, 3,780 in Asia Pacific, 2,510 in Europe, and 1,340 in the Middle East, Africa and India. The Company is not a party to any collective bargaining agreement and considers its relations with its employees to be satisfactory.

In order to retain the services of highly qualified, experienced, and motivated employees, the Company places considerable emphasis on its non-equity incentive compensation programs.

Other Information

The Company was incorporated in the State of Washington in May 1979. Its executive offices are located at 1015 Third Avenue, 12thFloor, Seattle, Washington, and its telephone number is (206) 674-3400.

The Company’s Internet address is http://www.expeditors.com. The Company makes available free of charge through its Internet website its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (SEC).

| 5.

Executive Officers of the Registrant

The following table sets forth the names, ages, and positions of current executive officers of the Company.

Name | Age | Position | ||

Jeffrey S. Musser | 49 | President, Chief Executive Officer and director | ||

James L.K. Wang | 66 | President-Asia and director | ||

R. Jordan Gates | 59 | President and Chief Operating Officer and director | ||

Philip M. Coughlin | 54 | President-Global Geographies and Operations | ||

Rommel C. Saber | 57 | President-Europe, Africa, Near/Middle East and Indian Subcontinent | ||

Eugene K. Alger | 54 | Executive Vice President-Global Services | ||

Bradley S. Powell | 54 | Senior Vice President and Chief Financial Officer | ||

Christopher J. McClincy | 40 | Senior Vice President and Chief Information Officer | ||

Benjamin G. Clark | 46 | Senior Vice President-General Counsel | ||

Jeffrey S. Musser joined the Company in February 1983 and was promoted to District Manager in October 1989. Mr. Musser was elected to Regional Vice President in September 1999, Senior Vice President-Chief Information Officer in January 2005 and to Executive Vice President and Chief Information Officer in May 2009. On December 19, 2013, Mr. Musser was appointed as President and Chief Executive Officer succeeding Peter J. Rose as Chief Executive Officer effective March 1, 2014 and was elected by the Board of Directors as a director effective March 1, 2014.

James L.K. Wang has served as a director and the Managing Director of Expeditors International Taiwan Ltd., the Company’s former exclusive Taiwan agent, since September 1981. In 1991, Mr. Wang’s employment agreement was assigned to E.I. Freight (Taiwan), Ltd., the Company’s exclusive Taiwan agent through 2004 and is now assigned to ECI Taiwan Co. Ltd., a wholly-owned subsidiary of the Company. Mr. Wang was elected a director of the Company and its Director-Far East in October 1988, Executive Vice President in January 1996 and President-Asia Pacific in May 2000.

R. Jordan Gates joined the Company as its Controller-Europe in February 1991. Mr. Gates was elected Chief Financial Officer and Treasurer of the Company in August 1994, Senior Vice President-Chief Financial Officer and Treasurer in January 1998, Executive Vice President-Chief Financial Officer and Treasurer in May 2000 and President and Chief Operating Officer in January 2008. Mr. Gates was also elected as a director in May 2000.

Philip M. Coughlin joined the Company in October 1985 and was promoted to District Manager in August 1986. Mr. Coughlin was elected Regional Manager in January 1991, Regional Vice President in January 1992, Senior Vice President of North America in September 1999 and to Executive Vice President-North America in March 2008. In June 2014, Mr. Coughlin was promoted to President-Global Geographies and Operations.

Rommel C. Saber joined the Company as Directors-Near/Middle East in February 1990. Mr. Saber was elected Senior Vice President-Sales and Marketing in January 1993, Senior Vice President-Air Export in September 1993, Senior Vice President Near/Middle East and Indian Subcontinent in July 1997, Executive Vice President-Europe, Africa and Near/Middle East in August 2000 and President-Europe, Africa, Near/Middle East and Indian Subcontinent in February 2006. In May 2014, the Company announced that Mr. Saber would retire at the end of the first quarter of 2015.

Eugene K. Alger joined the Company in October 1982 and was promoted to District Manager in May 1983. Mr. Alger was elected Regional Vice President in January 1992, Senior Vice President of North America in September 1999 and to Executive Vice President-North America in March 2008. In June 2014, Mr. Alger was promoted to Executive Vice President-Global Services.

Bradley S. Powell joined the Company as Chief Financial Officer in October 2008 and was elected Senior Vice President and Chief Financial Officer in February 2012. Prior to joining the Company, Mr. Powell served as President and Chief Financial Officer of Eden Bioscience Corporation, a publicly-traded biotechnology company, from December 2006 to September 2008 and as Vice President and Chief Financial Officer from July 1998 to December 2006.

Christopher J. McClincy joined the Company in July 1998 and was promoted to Vice President-Information Services in April 2009. In February 2014, Mr. McClincy was promoted to Senior Vice President and Chief Information Officer.

Benjamin G. Clark joined the Company in February 2015 as Senior Vice President - General Counsel. Preceding Expeditors Mr. Clark served as Executive Vice President and General Counsel of the Dematic Group, a global provider of intelligent intralogistics and materials handling solutions. Prior to his experience with Dematic, Mr. Clark spent four years as the Vice President and Deputy General Counsel for the publicly traded Celanese Corporation, a global technologies and specialty materials company. From 2002 to 2009 Mr. Clark worked for Honeywell International, Inc., where he held progressively responsible roles concluding as the Vice President and General Counsel, Aerospace Global Operations.

Regulation and Security

With respect to the Company’s activities in the air transportation industry in the United States, it is subject to regulation by the Transportation Security Administration (“TSA”) of the Department of Homeland Security as an indirect air carrier. All United States indirect air carriers are required to maintain prescribed security procedures and are subject to periodic audits by TSA. The Company’s overseas offices and agents are licensed as airfreight forwarders in their respective countries of operation. The Company is licensed in each of its offices, or in the case of its newer offices, has made application for a license as an airfreight forwarder by the International Air Transport Association (“IATA”). IATA is a voluntary association of airlines and air transport related entities which prescribes certain operating procedures for airfreight forwarders acting as agents for its members. The majority of the Company’s airfreight forwarding business is conducted with airlines which are IATA members.

The Company is licensed as an Ocean Transportation Intermediary (“OTI”) (sometimes referred to as NVOCC-Non-Vessel Operating Common Carrier) by the Federal Maritime Commission (“FMC”). The FMC has established certain qualifications for shipping agents, including certain surety bonding requirements. The FMC is also responsible for the economic regulation of OTI/NVOCC activity originating or terminating in the United

| 6.

States. To comply with these economic regulations, vessel operators and NVOCCs, such as EIO, are required to file tariffs electronically which establish the rates to be charged for the movement of specified commodities into and out of the United States. The FMC has the power to enforce these regulations by assessing penalties.

The Company is licensed as a customs broker by Customs and Border Protection (“CBP”) of the Department of Homeland Security nationally and in each U.S. customs district in which it does business. All United States customs brokers are required to maintain prescribed records and are subject to periodic audits by CBP. In other jurisdictions in which the Company performs customs clearance services, the Company is licensed by the appropriate governmental authority where such license is required to perform these services. The Company participates in various governmental supply chain security programs, such as the Customs-Trade Partnership Against Terrorism (“C-TPAT”) in the United States and additional security initiatives, such as Authorized Economic Operator ("AEO"), as they continue to be enacted by different governments.

The Company does not believe that current United States and foreign governmental regulations impose significant economic restraint upon its business operations. In general, the Company conducts its business activities in each country through a wholly or majority-owned subsidiary corporation that is organized and existing under the laws of that country. However, the regulations of foreign governments can impose barriers to the Company’s ability to provide the full range of its business activities in a wholly or majority United States-owned subsidiary. For example, foreign ownership of a customs brokerage business is prohibited in some jurisdictions and less frequently the ownership of the licenses required for freight forwarding and/or freight consolidation is restricted to local entities. When the Company encounters this sort of governmental restriction, it works to establish a legal structure that meets the requirements of the local regulations while also giving the Company the substantive operating and economic advantages that would be available in the absence of such regulation. This can be accomplished by creating a joint venture or exclusive agency relationship with a qualified local entity that holds the required license.

The continuing global terrorist threat and governments’ overriding concern for the safety of passengers and citizens who import and/or export goods into and out of their respective countries has resulted in a proliferation of cargo security and other regulations over the past several years. Many of these regulations are complex and require varying degrees of interpretation. While these regulations have already created a marked difference in the security and other arrangements required to move shipments around the globe, regulations are expected to become more stringent in the future. As governments look for ways to minimize the exposure of their citizens to potential terror related incidents, the Company and its competitors in the transportation business may be required to incorporate security and other procedures within their scope of services to a far greater degree than has been required in the past. The Company feels that increased security and other requirements may involve further investments in technology and more sophisticated screening procedures being applied to cargo, customers, vendors and employees. The Company’s position is that any increased cost of compliance with security regulations will be passed through to those who are beneficiaries of the Company’s services.

Cargo Liability

When acting as an airfreight consolidator, the Company assumes a carrier’s liability for lost or damaged shipments. This legal liability is typically limited by contract to the lower of the transaction value or the released value (19 Special Drawing Rights per kilo unless the customer declares a higher value and pays a surcharge), except in the absence of an appropriate airway bill or if the loss or damage is caused by willful misconduct. The airline which the Company utilizes to make the actual shipment is generally liable to the Company in the same manner and to the same extent. When acting solely as the agent of the airline or shipper, the Company does not assume any contractual liability for loss or damage to shipments tendered to the airline.

When acting as an ocean freight consolidator, the Company assumes a carrier’s liability for lost or damaged shipments. This liability is typically limited by contract to the lower of the transaction value or the released value ($500 per package or customary freight unit unless the customer declares a higher value and pays a surcharge). The steamship line which the Company utilizes to make the actual shipment is generally liable to the Company in the same manner and to the same extent. In its ocean freight forwarding and customs clearance operations, the Company does not assume liability for lost or damaged shipments.

When providing ground transportation services as a carrier, the Company assumes a carrier’s liability for lost or damaged shipments. This liability is typically limited by contract to the lower of the transaction value or the released value (generally $0.50 per pound though the released value can vary from country to country) unless the customer declares a higher value and pays a surcharge. The ground carrier which the Company utilizes to make the actual shipment is generally liable to the Company in the same manner and to the same extent.

When providing warehousing and distribution services, the Company limits its legal liability by contract and tariff to an amount generally equal to the lower of fair value or $0.50 per pound with a maximum of $50 per “lot” — which is defined as the smallest unit that the warehouse is required to track.

In certain circumstances, the Company will assume additional limited liability. The Company maintains cargo legal liability insurance covering claims for losses attributable to missing or damaged shipments for which it is legally liable. The Company also maintains insurance coverage for the property of others which is stored in Company warehouse facilities. This insurance coverage is provided by a Vermont U.S. based insurance entity wholly-owned by the Company. The coverage is fronted and reinsured by a global insurance company. The total risk retained by the Company in 2014 was $5 million. In addition, the Company is licensed as an insurance broker through its subsidiary, Expeditors Cargo Insurance Brokers, Inc. and places insurance coverage for other customers.

| 7.

ITEM 1A – RISK FACTORS

RISK FACTORS | DISCUSSION AND POTENTIAL SIGNIFICANCE | |

International Trade | The Company primarily provides services to customers engaged in international commerce. Everything that affects international trade has the potential to expand or contract the Company’s primary market and adversely impact its operating results. For example, international trade is influenced by: | |

• currency exchange rates and currency control regulations; | ||

• interest rate fluctuations; | ||

• changes in governmental policies, such as taxation, quota restrictions, other forms of trade barriers and/or restrictions and trade accords; | ||

• changes in and application of international and domestic customs, trade and security regulations; | ||

• wars, strikes, civil unrest, acts of terrorism, and other conflicts; | ||

• natural disasters and pandemics; | ||

• changes in consumer attitudes regarding goods made in countries other than their own; | ||

• changes in availability of credit; | ||

• changes in the price and readily available quantities of oil and other petroleum-related products; and | ||

• increased global concerns regarding working conditions and environmental sustainability. | ||

Third Party Service Providers | As a non-asset based provider of global logistics services, the Company depends on a variety of asset-based third party providers. The quality and profitability of the Company depend upon effective selection, management and discipline of third party providers. In recent years, many of the Company’s third party service providers have incurred significant operating losses and are highly leveraged with debt. Changes in the financial stability, operating capabilities and capacity of asset-based carriers and space allotment made available to the Company by asset-based carriers could affect the Company in unpredictable ways. Any combination of reduced airfreight or ocean freight capacity, pricing volatility or more limited carrier transportation schedules could negatively impact the Company’s ability to maintain historical profitability. The Company’s freight carriers are subject to increasingly stringent laws protecting the environment, which could directly or indirectly have a material adverse effect on the Company’s business. Future regulatory developments in the U.S. and abroad could adversely affect operations and increase operating costs in transportation industries, which in turn could increase the Company’s purchased transportation costs. If the Company is unable to pass such costs on to its customers, its business and results of operations could be materially and adversely affected. | |

Predictability of Results | The Company is not aware of any accurate means of forecasting short-term customer requirements. However, long-term customer satisfaction depends upon the Company’s ability to meet these unpredictable short-term customer requirements. Personnel costs, the Company’s single largest expense, are always less flexible in the very near term as the Company must staff to meet uncertain demand. As a result, short-term operating results could be disproportionately affected. A significant portion of the Company’s revenues are derived from customers in retail industries whose shipping patterns are tied closely to consumer demand, and from customers in industries whose shipping patterns are dependent upon just-in-time production schedules. Therefore, the timing of the Company’s revenues are, to a large degree, impacted by factors out of the Company’s control, such as a sudden change in consumer demand for retail goods, product launches and/or manufacturing production delays. Additionally, many customers ship a significant portion of their goods at or near the end of a quarter, and therefore, the Company may not learn of a shortfall in revenues until late in a quarter. To the extent that a shortfall in revenues or earnings was not expected by securities analysts or investors, any such shortfall from levels predicted by securities analysts or investors could have an immediate and adverse effect on the trading price of the Company’s stock. | |

Foreign Operations | The majority of the Company’s revenues and operating income comes from operations conducted outside the United States. To maintain a global service network, the Company may be required to operate in hostile locations and in dangerous situations. In addition, the Company operates in parts of the world where common business practices could constitute violations of the anti-corruption laws, rules, regulations and decrees of the United States, including the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act and of all other countries in which the Company conducts business; as well as trade control laws, or laws, regulations and Executive Orders imposing embargoes and sanctions; and anti-boycott laws and regulations. Compliance with these laws, rules, regulations and decrees is dependent on the Company’s employees, service providers, agents, third party brokers and customers, whose individual actions could violate these laws, rules, regulations and decrees. Failure to comply could result in substantial penalties and additional expenses, damage to the Company’s reputation and restrictions on its ability to conduct business. | |

| 8.

RISK FACTORS | DISCUSSION AND POTENTIAL SIGNIFICANCE | |

Key Personnel | The Company is a service business. The quality of this service is directly related to the quality of the Company’s employees. Identifying, training and retaining key employees is essential to continued growth and future profitability. Effective succession planning is an important element of the Company's programs. Failure to ensure an effective transfer of knowledge and smooth transitions involving key employees could hinder the Company's ability to execute on its business strategies and level of service. Senior management of the Company includes employees with long tenures, many of whom are approaching retirement age and some of whom announced their retirement in 2014. The loss of the services of one or more key personnel could have an adverse effect on the Company’s business. The Company must continue to develop and retain management personnel to address issues of succession planning. The Company believes that its compensation programs, which have been in place since the Company became a publicly traded entity, are one of the unique characteristics responsible for differentiating its performance from that of many of its competitors. Significant changes to its compensation programs could affect the Company’s performance and ability to attract and retain key personnel. Continued loyalty to the Company will not be assured by contract. | |

Technology | The Company relies heavily and must compete based upon the flexibility and sophistication of the technologies utilized in performing its core businesses. Future results depend upon the Company's success in the cost effective development, maintenance and integration of secure communication and information systems technologies, including those acquired from and maintained by third parties. As the Company and its customers continue to increase reliance on these systems and as additional features are added, the risks also increase. The Company has begun upgrading many of its systems, including core operations and accounting. This process is inherently complex and if not managed properly could lead to disruptions in the Company's operations. The Company has implemented processes and procedures to mitigate these risks; however, these measures cannot assure the prevention of a serious negative event in the future. Any significant disruptions to the Company’s global systems or the Internet for any reason, which could include equipment or network failures, power outages, sabotage, employee error or other actions, cyber-attacks or other security breaches, geo-political activity or natural disasters, would have a material negative effect on the Company's results and could include loss of revenue, business disruptions including the inability to timely process shipments, loss of property including trade secrets and confidential information, legal claims and proceedings, reporting delays or errors, interference with regulatory reporting, significant remediation costs, an increase in costs to protect the Company's systems and technology and damage to its reputation. | |

Growth | The Company has historically relied primarily upon organic growth and has tended to avoid growth through acquisition. Future results will depend upon the Company’s ability to anticipate and adapt to constantly evolving supply chain requirements and innovations. To continue to grow organically, the Company must gain profitable market share and successfully develop and market new service offerings. When investment opportunities arise, the Company’s success will be dependent on its ability to evaluate and integrate the acquisitions. | |

Regulatory Environment | The Company is affected by ever increasing regulations from a number of sources in the United States and in foreign locations in which the Company operates. Many of these regulations are complex and require varying degrees of interpretation and increase the Company's costs. The current business environment tends to stress the avoidance of risk through regulation and oversight, the effect of which is likely to be unforeseen costs and potentially unforeseen consequences. In reaction to the continuing global terrorist threat, governments around the world are continuously enacting or updating security regulations. These regulations are multi-layered, increasingly technical in nature and characterized by a lack of harmonization of substantive requirements amongst various governmental authorities. Furthermore, the implementation of these regulations, including deadlines and substantive requirements, is driven by political urgencies rather than the industries’ realistic ability to comply. Failure to consistently and timely comply with these regulations, or the failure, breach or compromise of the Company’s policies and procedures or those of its service providers or agents, may result in increased operating costs, damage to the Company’s reputation, restrictions on operations and/or fines and penalties. | |

| 9.

RISK FACTORS | DISCUSSION AND POTENTIAL SIGNIFICANCE | |

Competition | The global logistics services industry is intensely competitive and is expected to remain so for the foreseeable future. There are a large number of companies competing in one or more segments of the industry, but the number of firms with a global network that offer a full complement of logistics services is more limited. Many of these competitors have significantly more resources than the Company. Depending on the location of the shipper and the importer, the Company must compete against both the niche players and larger entities, including some carriers. The primary competitive factors are price and quality of service. Many larger customers utilize the services of multiple logistics providers. Customers regularly solicit bids from competitors in order to improve service, pricing and contractual terms such as seeking longer payment terms, higher or unlimited liability limits and performance penalties. Increased competition and competitors' acceptance of expanded contractual terms could result in reduced revenues, reduced margins, higher operating costs or loss of market share, any of which would damage the Company’s results of operations and financial condition. | |

Taxes | The Company is subject to many taxes in the United States and foreign jurisdictions. In many of these jurisdictions, the tax laws are very complex and are open to different interpretations and application. Tax authorities frequently implement new taxes and change their tax rates and rules, including interpretations of those rules. The Company is regularly under audit by tax authorities. Although the Company believes its tax estimates are reasonable, the final determination of tax audits, including transfer pricing inquiries, could be materially different from the Company’s tax provisions and accruals and negatively impact its financial results. | |

Litigation/Investigations | As a multinational corporation, the Company is subject to formal or informal investigations or litigation from governmental authorities or others in the countries in which it does business. These investigations and other periodic investigations may require management time and could cause the Company to incur substantial additional legal and related costs, which may include fines and/or penalties that could have a material impact on the Company’s results of operations and operating cash flows. The Company may also become subject to other civil litigation arising from such investigations or litigation, including but not limited to shareholder class action lawsuits and derivative claims made on behalf of the plaintiffs. | |

Economic Conditions | The global economy and capital and credit markets continue to experience uncertainty and volatility. Unfavorable changes in economic conditions may result in lower freight volumes and adversely affect the Company’s revenues and operating results, as experienced in 2009 and 2012. These conditions may adversely affect certain of the Company’s customers, carriers and third party services providers. Were that to occur, the Company’s revenues and net earnings could also be adversely affected. Should customers’ ability to pay deteriorate, additional bad debts may be incurred. These unfavorable conditions can create situations where rate increases charged by carriers and other service providers are implemented with little or no advanced notice. The Company often times cannot pass these rate increases on to its customers in the same time frame, if at all. As a result, the Company’s yields and margins can be negatively impacted, as experienced in 2012 and parts of 2013 and 2014, particularly with ocean freight. | |

Catastrophic Events | A disruption or failure of the Company’s systems or operations in the event of a major earthquake, weather event, cyber-attack, terrorist attack, strike, civil unrest, pandemic or other catastrophic event could cause delays in providing services or performing other mission-critical functions. The Company’s corporate headquarters, and certain other critical business operations are in the Seattle, Washington area, which is near major earthquake faults. A catastrophic event that results in the destruction or disruption of any of the Company’s critical business or information technology systems could harm the Company’s ability to conduct normal business operations and its operating results. | |

| 10.

ITEM 1B — UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2 — PROPERTIES

The Company owns the following properties:

Location | Nature of Property | |

United States: | ||

Washington, Seattle | Corporate headquarters | |

California, Brisbane | Office and warehouse building | |

California, Hawthorne | Office and warehouse building | |

Florida, Miami | Office and warehouse building | |

Illinois, Bensenville | Office and warehouse building | |

New Jersey, Edison | Office and warehouse building | |

New York, Inwood | Office and warehouse building | |

Texas, Humble | Office and warehouse building | |

Washington, SeaTac | Office building | |

Washington, Spokane | Office building | |

Asia Pacific: | ||

China, Beijing | Office and warehouse building | |

China, Shanghai | Office building | |

China, Shenzhen | Offices | |

China, Tianjin | Offices | |

Hong Kong, Kowloon | Offices | |

Korea, Seoul | Office and warehouse | |

Taiwan, Taipei | Offices | |

Europe: | ||

Belgium, Brussels | Office and warehouse building | |

England, London | Office and warehouse building | |

Ireland, Cork | Office and warehouse building | |

Ireland, Dublin | Office and warehouse building | |

Latin America: | ||

Costa Rica, Alajuela | Office building | |

Middle East: | ||

Egypt, Cairo | Office and warehouse building | |

The Company leases and maintains 79 additional offices and warehouse locations in the United States and 377 leased locations throughout the world, primarily located close to an airport, ocean port, or on an important border crossing. The majority of these facilities contain warehouse facilities. Lease terms are either on a month-to-month basis or terminate at various times through 2025. See Note 8 to the Company’s consolidated financial statements for lease commitments. The Company will investigate the possibility of building or buying suitable facilities. The Company believes that current leases can be extended and that suitable alternative facilities are available in the vicinity of each present facility should extensions be unavailable at the conclusion of current leases.

ITEM 3 — LEGAL PROCEEDINGS

The Company is involved in claims, lawsuits, government investigations and other legal matters that arise in the ordinary course of business and are subject to inherent uncertainties. Currently, in management's opinion and based upon advice from legal advisors, none of these matters are expected to have a significant effect on the Company's operations or financial position. As of December 31, 2014, the amounts accrued for these claims, lawsuits, government investigations and other legal matters are not significant to the Company's operations or financial position. At this time the Company is unable to estimate any additional loss or range of reasonably possible losses, if any, beyond the amounts recorded, that might result from the resolution of these matters.

| 11.

ITEM 4 — MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5 — MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company's common stock trades on The NASDAQ Global Select Market. The following table sets forth the high and low sale prices for the Company’s common stock as reported by The NASDAQ Global Select Market under the symbol EXPD.

Common Stock | Common Stock | |||||||||||||||||

Quarter | High | Low | Quarter | High | Low | |||||||||||||

2014 | 2013 | |||||||||||||||||

First | $ | 45.69 | $ | 38.42 | First | $ | 43.80 | $ | 35.33 | |||||||||

Second | $ | 46.80 | $ | 38.54 | Second | $ | 40.71 | $ | 34.83 | |||||||||

Third | $ | 45.78 | $ | 39.97 | Third | $ | 45.48 | $ | 37.79 | |||||||||

Fourth | $ | 47.24 | $ | 38.14 | Fourth | $ | 46.90 | $ | 41.79 | |||||||||

There were 1,018 shareholders of record as of February 23, 2015. This figure does not include a substantially greater number of beneficial holders of the Company’s common stock, whose shares are held of record by banks, brokers and other financial institutions.

The Board of Directors declared semi-annual dividends per share during the two most recent fiscal years paid as follows:

June 16, 2014 | $ | 0.32 | |

December 15, 2014 | $ | 0.32 | |

June 17, 2013 | $ | 0.30 | |

December 16, 2013 | $ | 0.30 | |

ISSUER PURCHASES OF EQUITY SECURITIES

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs | |||||||||

October 1-31, 2014 | — | $ | — | — | 15,757,532 | ||||||||

November 1-30, 2014 | 491,441 | $ | 46.07 | 491,441 | 15,775,012 | ||||||||

December 1-31, 2014 | 1,184,000 | $ | 44.75 | 1,184,000 | 14,221,713 | ||||||||

Total | 1,675,441 | $ | — | 1,675,441 | 14,221,713 | ||||||||

In November 1993, the Company’s Board of Directors authorized a Non-Discretionary Stock Repurchase Plan for the purpose of repurchasing the Company’s common stock in the open market with the proceeds received from the exercise of stock options. On February 9, 2009, the Plan was amended to increase the authorization to repurchase up to 40 million shares of the Company’s common stock. This authorization has no expiration date. This plan was disclosed in the Company’s annual report on Form 10-K filed on March 31, 1995. In the fourth quarter of 2014, 160,853 shares of common stock were repurchased under the Non-Discretionary Stock Repurchase Plan.

In November 2001, under a Discretionary Stock Repurchase Plan, the Company’s Board of Directors authorized the repurchase of the Company's common stock in the open market to reduce the issued and outstanding stock down to 200 million shares. The Board of Directors amended the plan on February 24, 2014, to authorize repurchases down to 190 million shares of common stock and on February 24, 2015, further authorized repurchases down to 188 million shares of common stock. The maximum number of shares available for repurchase under this plan will increase as the total number of outstanding shares increases. This authorization has no expiration date. In the fourth quarter of 2014, 1,514,588 shares of common stock were repurchased under the Discretionary Stock Repurchase Plan. These discretionary repurchases included 65,588 shares that were made to limit the growth in the number of issued and outstanding shares resulting from stock option exercises and 1,449,000 shares to reduce the number of total shares outstanding.

| 12.

The graph below compares Expeditors International of Washington, Inc.'s cumulative 5-Year total shareholder return on common stock with the cumulative total returns of the S&P 500 index and the NASDAQ Transportation index. The graph assumes that the value of the investment in our common stock and in each of the indexes (including reinvestment of dividends) was $100 on 12/31/2009 and tracks it through 12/31/2014.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among Expeditors International of Washington, Inc., the S&P 500 Index,

and the NASDAQ Transportation Index

12/09 | 12/10 | 12/11 | 12/12 | 12/13 | 12/14 | ||||||||||||||

Expeditors International of Washington, Inc. | $ | 100.00 | $ | 158.45 | $ | 120.16 | $ | 117.76 | $ | 133.68 | $ | 136.68 | |||||||

Standard and Poor's 500 Index | 100.00 | 115.06 | 117.49 | 136.30 | 180.44 | 205.14 | |||||||||||||

NASDAQ Transportation | 100.00 | 128.91 | 111.44 | 122.10 | 161.38 | 229.56 | |||||||||||||

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

| 13.

ITEM 6 — SELECTED FINANCIAL DATA

Financial Highlights

In thousands except share and per share data

2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||

Revenues | $ | 6,564,721 | 6,080,257 | 5,992,215 | 6,161,537 | 5,978,286 | ||||||||||

Net revenues1 | 1,981,427 | 1,882,853 | 1,835,370 | 1,907,516 | 1,703,499 | |||||||||||

Net earnings attributable to shareholders | 376,888 | 348,526 | 333,360 | 385,679 | 344,172 | |||||||||||

Diluted earnings attributable to shareholders per share | 1.92 | 1.68 | 1.57 | 1.79 | 1.59 | |||||||||||

Basic earnings attributable to shareholders per share | 1.92 | 1.69 | 1.58 | 1.82 | 1.62 | |||||||||||

Dividends declared and paid per common share | 0.64 | 0.60 | 0.56 | 0.50 | 0.40 | |||||||||||

Working capital | 1,305,467 | 1,545,069 | 1,515,041 | 1,490,738 | 1,278,377 | |||||||||||

Total assets | 2,890,905 | 3,014,812 | 2,954,125 | 2,866,827 | 2,679,179 | |||||||||||

Shareholders’ equity | 1,868,408 | 2,084,783 | 2,027,699 | 2,003,638 | 1,740,906 | |||||||||||

Weighted average diluted shares outstanding | 196,768,067 | 206,895,473 | 211,935,171 | 215,033,580 | 216,446,656 | |||||||||||

Weighted average basic shares outstanding | 196,146,676 | 205,994,656 | 210,422,945 | 212,117,511 | 212,283,966 | |||||||||||

_______________________

1Non-GAAP measure calculated as revenues less directly related operating expenses attributable to the Company's principal services.

SAFE HARBOR FOR FORWARD-LOOKING STATEMENTS UNDER PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995; CERTAIN CAUTIONARY STATEMENTS

This Annual Report on Form 10-K for the fiscal year ended December 31, 2014 contains “forward-looking statements,” as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. From time to time, the Company or its representatives have made or may make forward-looking statements, orally or in writing. Such forward-looking statements may be included in, but not limited to, press releases, oral statements made with the approval of an authorized executive officer or in various filings made by the Company with the Securities and Exchange Commission. Statements including those preceded by, followed by or that include the words or phrases “will likely result”, “are expected to”, "would expect", "would not expect", “will continue”, “is anticipated”, “estimate”, “project”, "plan", "believe", "probable", "reasonably possible" "may", "could", "should", "intends", "foreseeable future" or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are qualified in their entirety by reference to and are accompanied by the discussion in Item 1A of certain important factors that could cause actual results to differ materially from such forward-looking statements.

The risks included in Item 1A are not exhaustive. Furthermore, reference is also made to other sections of this report which include additional factors which could adversely impact the Company’s business and financial performance. Moreover, the Company operates in a very competitive and rapidly changing global environment. New risk factors emerge from time to time and it is not possible for management to predict all of such risk factors, nor can it assess the impact of all of such risk factors on the Company’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Accordingly, forward-looking statements cannot be relied upon as a guarantee of actual results.

Shareholders should be aware that while the Company does, from time to time, communicate with securities analysts, it is against the Company’s policy to disclose to such analysts any material non-public information or other confidential commercial information. Accordingly, shareholders should not assume that the Company agrees with any statement or report issued by any analyst irrespective of the content of such statement or report. Furthermore, the Company has a policy against issuing financial forecasts or projections or confirming the accuracy of forecasts or projections issued by others. Accordingly, to the extent that reports issued by securities analysts contain any projections, forecasts or opinions, such reports are not the responsibility of the Company.

ITEM 7 — MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

Expeditors International of Washington, Inc. is a global logistics company. The Company's services include air and ocean freight consolidation and forwarding, customs clearance, warehousing and distribution, purchase order management, vendor consolidation, time-definite transportation services, cargo insurance and other logistics solutions. The Company does not compete for overnight courier or small parcel business. As a non-asset based carrier, the Company does not own or operate transportation assets.

The Company derives its revenues from three principal sources: 1) airfreight services, 2) ocean freight and ocean services, and 3) customs brokerage and other services. These are the revenue categories presented in the financial statements.

The Company generates the major portion of its air and ocean freight revenues by purchasing transportation services on a wholesale basis from direct (asset-based) carriers and reselling those services to its customers on a retail basis. The difference between the rate billed to customers (the sell rate) and the rate paid to the carrier (the buy rate) is termed “net revenue” (a non-GAAP measure), “yield or "margin." By consolidating shipments from multiple customers and concentrating its buying power, the Company is able to negotiate favorable buy rates from the direct carriers, while at the same time offering lower sell rates than customers would otherwise be able to negotiate themselves. The most significant drivers of changes in gross revenues and related transportation expenses are volume, sell rates and buy rates. Volume has a similar effect on the change in both gross revenues and related transportation expenses in each of the Company's three primary sources of revenue.

| 14.

In most cases the Company acts as an indirect carrier. When acting as an indirect carrier, the Company will issue a House Airway Bill (HAWB) or a House Ocean Bill of Lading (HOBL) to customers as the contract of carriage. In turn, when the freight is physically tendered to a direct carrier, the Company receives a contract of carriage known as a Master Airway Bill for airfreight shipments and a Master Ocean Bill of Lading for ocean shipments. In these transactions, the Company is the primary obligor and is required to compensate direct carriers for services performed regardless of whether customers accept the service, has latitude in establishing price, has discretion in selecting the direct carrier and has credit risk. The Company is the principal in these transactions and reports revenue and the related expenses on a gross basis.

For revenues earned in other capacities, for instance, when the Company does not issue a HAWB or a HOBL or otherwise acts solely as an agent for the shipper, only the commissions and fees earned for such services are included in revenues. In these transactions, the Company is not a principal and reports only commissions and fees earned in revenue.

Customs brokerage and other services involves providing services at destination, such as helping customers clear shipments through customs by preparing and filing required documentation, calculating and providing for payment of duties and other taxes on behalf of customers as well as arranging for any required inspections by governmental agencies, and arranging for delivery. These are complicated functions requiring technical knowledge of customs rules and regulations in the multitude of countries in which the Company has offices.

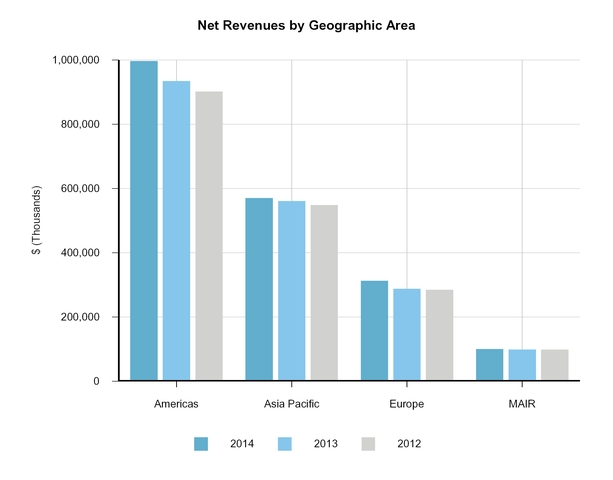

The Company is managed along four geographic areas of responsibility: Americas; Asia Pacific; Europe; and Middle East, Africa and India (MAIR). Each area is divided into sub-regions which are composed of operating units with individual profit and loss responsibility. The Company’s business involves shipments between operating units and typically touches more than one geographic area. The nature of the international logistics business necessitates a high degree of communication and cooperation among operating units. Because of this inter-relationship between operating units, it is very difficult to examine any one geographic area and draw meaningful conclusions as to its contribution to the Company’s overall success on a stand-alone basis. The following chart shows net revenues by geographic areas of responsibility for the years ended December 31, 2014, 2013 and 2012:

The Company’s operating units share revenue using the same arms-length pricing methodologies the Company uses when its offices transact business with independent agents. The Company charges its subsidiaries and affiliates for services rendered in the United States on a cost recovery basis. The Company’s strategy closely links compensation with operating unit profitability. Individual success is closely linked to cooperation with other operating units within the network.

The mix of services varies by segment based primarily on the import or export orientation of local operations in each region. In accordance with the Company's revenue recognition policy (see Note 1. E to the consolidated financial statements of this report), almost all freight revenues and related expenses are recorded at origin and shipment profits are split between origin and destination offices by recording a commission fee or profit share revenue at destination and a corresponding commission or profit share expense as a component of origin consolidation costs. The Asia Pacific segment is the Company's largest export oriented region and accounted for 49% of revenues and 39% of operating income for the year

| 15.