Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CENTERPOINT ENERGY INC | d881643dex991.htm |

| 8-K - 8-K - CENTERPOINT ENERGY INC | d881643d8k.htm |

The Benefits of

a Diversified Electric & Natural Gas Portfolio Full Year 2014 Earnings

Supplemental Materials

February 26, 2015

Exhibit 99.2 |

investors.centerpointenergy.com

February 26, 2015

Cautionary Statement Regarding

Forward-Looking Information

This presentation contains statements concerning our expectations, beliefs, plans, objectives, goals,

strategies, future events or performance and underlying assumptions

and

other

statements

that

are

not

historical

facts.

These

statements

are

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation Reform Act of 1995. You should not place undue reliance on forward-looking statements.

Actual results may differ materially from those expressed or implied

by

these

statements.

You

can

generally

identify

our

forward-looking

statements

by

the

words

“anticipate,”

“believe,”

“continue,”

“could,”

“estimate,”

“expect,”

“forecast,”

“goal,”

“intend,”

“may,”

“objective,”

“plan,”

“potential,”

“predict,”

“projection,”

“should,”

“will,”

or other similar words. The absence of these words, however,

does not mean that the statements are not forward-looking.

We have based our forward-looking statements on our management's beliefs and assumptions based on

information currently available to our management at the time the statements are made. We

caution you that assumptions, beliefs, expectations, intentions, and projections about future events may and often do vary

materially

from

actual

results.

Therefore,

we

cannot

assure

you

that

actual

results

will

not

differ

materially

from

those

expressed

or

implied

by

our

forward-looking

statements.

Some of the factors that could cause actual results to differ from those expressed or implied by our

forward-looking statements include but are not limited to the timing and impact of future

regulatory, legislative and IRS decisions, financial market conditions, future market conditions, and other factors described in CenterPoint

Energy,

Inc.’s

Form

10-K

for

the

period

ended

December

31,

2014

under

“cautionary

statement

regarding

forward-looking

information,”

“Risk

Factors”

and

“

–

Liquidity and Capital Resources –

Other Matters –

Other Factors That Could Affect Cash Requirements”

and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations -

Certain Factors Affecting Future Earnings,”

and in other filings with the SEC by CenterPoint Energy, which can be found at

www.centerpointenergy.com

on

the

Investor

Relations

page

or

on

the

SEC’s

website

at

www.sec.gov

.

This presentation contains time sensitive information that is accurate as of the date hereof.

Some of the information in this presentation in unaudited and may be subject to change.

We undertake no obligation to update the information presented herein except as required by law.

Investors and others should note that we may announce material information using SEC filings, press

releases, public conference calls, webcasts and the Investors page of our website. In the

future, we will continue to use these channels to distribute material information about the Company and to communicate

important information about the Company, key personnel, corporate initiatives, regulatory updates and

other matters. Information that we post on our website could be deemed material;

therefore, we encourage investors, the media, our customers, business partners and others interested in our Company to review the information

we post on our website.

Use

of

Non-GAAP

Financial

Measures

In addition to presenting its financial results in accordance with generally accepted accounting

principles (“GAAP”), CenterPoint Energy also provides guidance based

on

adjusted

diluted

earnings

per

share,

which

is

a

non-GAAP

financial

measure.

Generally,

a

non-GAAP

financial

measure

is

a

numerical

measure

of a

company’s

historical

or

future

financial

performance

that

excludes

or

includes

amounts

that

are

not

normally

excluded

or

included

in

the

most

directly

comparable

GAAP financial measure.

A reconciliation of net income and diluted earnings per share to the basis used in providing 2014

guidance is provided in this presentation on slide 5.

Management evaluates financial performance in part based on adjusted diluted earnings per share and

believes that presenting this non-GAAP financial measure enhances an investor’s

understanding of CenterPoint Energy’s overall financial performance by providing them with an additional meaningful and relevant

comparison of current and anticipated future results across periods by excluding items that Management

does not believe most accurately reflect its fundamental business performance, which items

include the items reflected in the reconciliation table on page 5 of this presentation.

This non-GAAP financial measure should be

considered as a supplement and complement to, and not as a substitute for, or superior to, the most

directly comparable GAAP financial measure and may be different than non-GAAP financial

measures used by other companies. 2 |

investors.centerpointenergy.com

February 26, 2015

2014 Year Highlights

3

•

New management team in place with the right mix of industry experience and functional knowledge

•

Utility

Operations:

Strong

financial

and

operational

performances

Sustained strong economic activity with the addition of nearly 55,000 new meters for Houston

Electric and nearly 36,000 new Gas Utility customers

Continued interest in our transmission rights-of-way for our electric utility

Rate changes and cost management efforts led to a record performance for our natural gas

utilities

Invested over $1.4 billion in our utility operations, up 14 percent from 2013, to address

increasing demands associated with system safety, reliability, growth and ongoing

maintenance ERCOT endorsed an approximately $300 MM transmission line, the Brazos

Valley Connection, expected to be in service by summer of 2018

•

Enable Midstream Partners:

Completed their initial public offering

Contributed substantially all of CenterPoint’s remaining interest in Southeast Supply

Header, LLC (SESH) to Enable in May of 2014, increasing CenterPoint Energy’s

limited partner interest in Enable from approximately 54.7% to approximately

55.4% •

Increased dividend 4.2% in January 2015; a 19% increase in the quarterly dividend since the

formation of Enable in May 2013 |

investors.centerpointenergy.com

February 26, 2015

2014 Forecast Summary

4

Compound Annual Growth Rates

2013 -2018 Forecast

(Provided June 2014)

1

2014 –

2019 Forecast

(Provided Feb 2015)

2

Houston Electric Rate Base

7-10%

8-10%

Houston Electric Operating Income

5-7%

5-7%

4

Gas Utilities Rate Base

8-10%

8-10%

Gas Utilities Operating Income

4-6%

4-6%

4

Consolidated Rate Base

7-10%

8-10%

Utility Operations Earnings

4-6%

3

4-6%

3, 4

1

The 2013 –

2018 forecast does not assume the utilization of bonus depreciation

2

The 2014 –

2019 forecast does not assume bonus depreciation for 2015 and beyond

3

Earnings are expected to be lower during initial years and higher during later years of the

forecast 4

The operating and earnings growth rates utilize the same adjustment methodology used to

determine the 2014 $0.70 utility operations baseline 5-Year Capital Investment

2014 -2018 Forecast

(Provided June 2014)

2015 –

2019 Forecast

(Provided Feb 2015)

Houston Electric

$3.7 -

$4.5 B

$4.4 B

Gas Utilities

$2.2 -

$2.6 B

$2.7 B

Utility Operations

$6.2 -

$7.4 B

$7.4 B

shown on the next slide |

investors.centerpointenergy.com

February 26, 2015

2014 EPS Reconciliation to 2015 Utility Operations Guidance

Range of $0.71 to $0.75 per diluted share

5

2014 Fully Diluted EPS

$ 1.42

On an adjusted guidance basis:

ZENS-related mark to market gains

(0.12)

CES MTM gain

(0.04)

Pension Curtailment loss

0.01

2014 Consolidated EPS on a guidance basis

$ 1.27

Deferred Tax Benefit

(0.07)

2014 Fully Adjusted EPS

$ 1.20

Midstream Investments

(0.44)

2014 Fully Adjusted Utility Operations EPS

$ 0.76

1

2

(1)

The Equity Amortization schedule on page 19 details the decrease between the

2014 actual and 2015 projected equity returns

(2)

2008 Energy Efficiency Cost Recovery Factor Appeal details are provided in the

2014 10-K |

investors.centerpointenergy.com

February 26, 2015

Electric Transmission and Distribution Utility

2014 Operating Income Drivers

6 |

investors.centerpointenergy.com

February 26, 2015

Electric Transmission and Distribution Utility

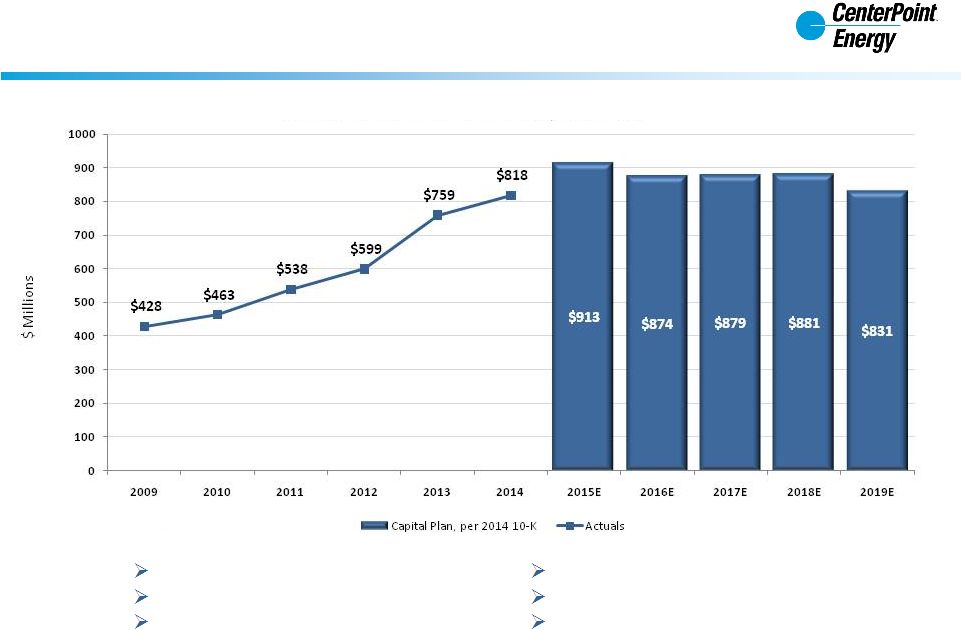

Capital Investment Growth

7

$4.4 Billion 2015 –

2019 Capital Plan

Capital Plan Includes:

1

A portion of the Houston Import Project

Brazos Valley Connection ¹

Reliability/Resiliency

Technology

Customer Growth

Infrastructure improvements

Reliability and Technology |

investors.centerpointenergy.com

February 26, 2015

Electric Transmission & Distribution Utility

Capital Expenditures

2014A

2015E

2016E

2017E

2018E

2019E

Transmission

37%

36%

41%

40%

33%

24%

Distribution

59%

63%

56%

55%

63%

74%

8 |

investors.centerpointenergy.com

February 26, 2015

$6.3 Billion Projected 2019 Rate Base

Electric Transmission and Distribution Utility

9

Note: The estimated average annual rate base is subject to change due to actual capital

investment, effects of bonus depreciation, deferred taxes, and actual rate base

authorized. As an example of the impact of bonus depreciation, 2018 rate base was reduced by approximately $100 MM as a result of the bonus

depreciation passed for 2014. Forecasts do not assume bonus depreciation is passed in

2015 and beyond. Projected Average Rate Base |

investors.centerpointenergy.com

February 26, 2015

Natural Gas Utilities

2014 Operating Income Drivers

10 |

investors.centerpointenergy.com

February 26, 2015

Natural Gas Utilities

Capital Investment Growth

11

$2.7 Billion 2015 –

2019 Capital Plan

Replacing aging infrastructure

Customer growth investment

System-wide AMR; 3.4 million meters by Q4 2015

Minnesota Belt Line Project; $400 million over 12

years

Capital Plan Includes: |

investors.centerpointenergy.com

February 26, 2015

Natural Gas Utilities

Capital Expenditures

12

Capital Recovery Method

2014A

2015E

2016E

2017E

2018E

2019E

Annual Mechanisms

48%

52%

43%

55%

59%

59%

Rate Cases

52%

48%

57%

45%

41%

41%

Note: Annual mechanisms reduce the recovery lag time versus traditional rate cases.

|

investors.centerpointenergy.com

February 26, 2015

$3.5 Billion Projected 2019 Rate Base

Natural Gas Utilities

13

Note: The estimated average annual rate base is subject to change due to actual capital

investment, effects of bonus depreciation, deferred taxes, and actual rate base

authorized. As an example of the impact of bonus depreciation, 2018 rate base was reduced by approximately $64 MM as a result of the bonus depreciation

passed for 2014. Forecasts do not assume bonus depreciation is passed in 2015 and

beyond. Projected Average Rate Base |

investors.centerpointenergy.com

February 26, 2015

CenterPoint Energy Services (CES)

2014 Operating Income Drivers

14 |

investors.centerpointenergy.com

February 26, 2015

Rate Mechanism and Estimated Timing

15

Estimated rate filing timelines as of December 31, 2014:

* MRP (not shown) is filed monthly. Texarkana TX is not included in Act 310

filings. Natural Gas Utilities

Houston Electric

Note:

Assumes

DCRF

or

similar

mechanisms

will

be

in

place

after

original

DCRF

sunsets

on

January

1,

2017

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Minnesota

Arkansas

& Texarkana TX *

Oklahoma

PBRC

PBRC

PBRC

PBRC

PBRC

Louisiana

RSP

RSP

RSP

RSP

RSP

RRA

RRA

RRA

RRA

RRA

Jurisdiction

2015

2016

2017

2018

2019

Mississippi

East Texas

Texas Coast

Rate Case

Rate Case

Rate Case

Houston Gas

South Texas

Rate Case

cont. 2020

Rate Case

Rate Case

Rate Case

Rate Case

cont. in 2020

Rate Case

BDA

BDA

310

310

GRIP

310

GRIP

GRIP

GRIP

GRIP

GRIP

GRIP

GRIP

GRIP

Interim

Rates

BDA

310

Interim

Rates

GRIP

BDA

310

GRIP

GRIP

GRIP

GRIP

GRIP

GRIP

GRIP

GRIP

GRIP

GRIP

GRIP

BDA

GRIP

GRIP

310

GRIP

Interim

Rates

GRIP

GRIP |

investors.centerpointenergy.com

February 26, 2015

2014 Financial Results

Midstream Operating Income moved to Equity Income on May 1, 2013

16

Operating Income

Equity Income

As reported, 12 months ended December 31

Note: Both 2013 and 2014 had $5 million in basis difference accretion

Key Enable Midstream Dates

•

For the four months ended April 30, 2013,

CenterPoint Energy maintained a 50%

ownership interest in SESH and reported its

results as Equity Income

•

Enable Midstream Partners, formed May 1,

2013, which includes CenterPoint Energy’s

former Interstate Pipelines and Field Services

segments and a 24.95% interest in SESH

•

Effective May 1, 2013 midstream operations

are reported as

Equity Income as part of

CenterPoint Energy’s midstream investment

segment

•

On April 16, 2014, Enable completed its IPO,

reducing CenterPoint Energy’s interest in

Enable from approximately 58.3% to 54.7%

•

Between May 1, 2013 and May 30, 2014,

CenterPoint

maintained a 25.05% ownership

interest in SESH

•

On May 30, 2014, CenterPoint contributed to

Enable a 24.95% interest in SESH, which

increased CenterPoint

Energy’s limited

partner interest in Enable from approximately

54.7% to approximately 55.4% |

investors.centerpointenergy.com

February 26, 2015

17

Debt and Capitalization Ratios

Excluding Transition and System Restoration Bonds

($ in millions)

December 31,

December 31,

2014

2013

Short-term Debt:

Short-term borrowings

53

$

43

$

Current portion of transition and system restoration bonds*

372

354

Indexed debt (ZENS)**

152

143

Current portion of other long-term debt

271

-

Long-term Debt:

Transition and system restoration bonds*

2,674

3,046

Other

5,335

4,771

Total Debt

8,857

$

8,357

$

Less: Transition and system restoration bonds (including current portion)*

3,046

3,400

Total Debt, excluding transition and system restoration bonds

5,811

$

4,957

$

Total Shareholders' Equity

4,548

$

4,329

$

Total Capitalization, excluding transition and system restoration bonds

10,359

$

9,286

$

Total Debt/Total Capitalization, excluding transition and system restoration bonds

56.1%

53.4%

*

**

The debt component reflected on the financial statements was $152 million and $143 million as of

December 31, 2014 and December 31, 2013, respectively. The principal amount on which 2%

interest is paid was $828 million on each of December 31, 2014 and December 31, 2013.

The contingent principal amount was $751 million and $763 million as of December 31, 2014 and December 31, 2013, respectively. At

maturity or upon redemption, holders of ZENS will receive cash at the higher of the contingent

principal amount or the value of the reference shares of Time Warner Inc., Time Warner Cable

Inc., AOL Inc. and Time Inc. The value of the reference shares was $930 million and $767

million as of December 31, 2014 and December 31, 2013, respectively.

The transition and system restoration bonds are serviced with dedicated revenue streams, and the

bonds are non-recourse to CenterPoint Energy and CenterPoint Energy Houston

Electric. |

investors.centerpointenergy.com

February 26, 2015

Liquidity and Credit Ratings

18

Moody's

S&P

Fitch

Debt Rated

Rating

Outlook

a

Rating

Outlook

b

Rating

Outlook

CenterPoint Energy Sr Unsecured

Baa1

Stable

BBB+

Stable

BBB

Stable

CenterPoint Energy Houston Electric Sr Secured

A1

Stable

A

Stable

A

Stable

CenterPoint Energy Resources Corp. Sr Unsecured

Baa2

Stable

A-

Stable

BBB

Stable

a

A

Moody’s

rating

outlook

is

an

opinion

regarding

the

likely

direction

of

an

issuer's

rating

over

the

medium

term.

b

An S&P rating outlook assesses the potential direction of long-term credit rating over the

intermediate to longer term. c

A

Fitch

rating

outlook

indicates

the

direction

a

rating

is

likely

to

move

over

a

one-

to

two-year

period.

(in millions)

Source of Liquidity on 02/17/2015

Facility

Size

Amount

Utilized

1

Amount

Unutilized

CenterPoint Energy, Inc. Revolver

$ 1,200

$ 170

2

$ 1,030

CenterPoint Houston Electric, LLC Revolver

300

4

3

296

CenterPoint Energy Resources Corp. Revolver

600

248

4

352

Total Bank Facilities

$ 2,100

$ 422

$ 1,678

Investments in Money Market Funds

0

Available Liquidity

$ 1,678

1

Based on the consolidated debt to capitalization covenant in the CenterPoint Energy, Inc. revolving

credit facility and the revolving credit facility of each of CenterPoint Energy Houston

Electric, LLC and CenterPoint Energy Resources Corp., the full capacity of such revolving

credit facilities, which aggregated $2.1 billion, could have been utilized at December 31,

2014. 2

Represents outstanding letters of credit of $6 million and outstanding commercial paper of $164

million. 3

Represents outstanding letters of credit.

4

Represents outstanding commercial paper.

C |

investors.centerpointenergy.com

February 26, 2015

19

Estimated Amortization for Pre-Tax Equity Earnings

Associated

with

the

Recovery

of

Certain

Qualified

Cost

and

Storm

Restoration

Costs

The

amounts

reflected

for

2015

through

2024

are

based

on

CenterPoint

Energy’s

estimates

as

of

December

31,

2014.

However,

the

equity

returns

to

be

recognized

in

future periods with respect to each series of transition or system restoration bonds, as applicable,

will be periodically subject to adjustment based on tariff adjustments for any overcollections

or undercollections of transition charges or system restoration charges, as applicable. The equity return amounts reflected in the table are

reported in the financial statements of CenterPoint Energy and CenterPoint Energy Houston Electric as

revenues from electric transmission and distribution utility. TBC II

TBC III

TBC IV

SRBC

Total

2005

213,804

$

-

$

-

$

-

$

213,804

$

2006

6,644,004

-

-

-

6,644,004

2007

7,140,194

-

-

-

7,140,194

2008

6,673,765

4,743,048

-

-

11,416,813

2009

7,279,677

6,074,697

-

95,841

13,450,215

2010

9,071,326

5,745,580

-

2,657,384

17,474,291

2011

9,902,590

6,994,650

-

2,840,737

19,737,978

2012

9,717,059

6,837,290

27,873,514

2,473,992

46,901,855

2013

10,383,183

7,251,470

24,082,419

2,235,567

43,952,640

2014

11,442,612

8,699,455

42,944,063

3,680,587

66,766,717

2015

12,386,321

11,321,735

18,385,219

1,847,199

43,940,475

2016

11,998,830

8,301,168

29,248,671

2,795,079

52,343,747

2017

12,939,614

8,587,569

29,899,025

2,944,601

54,370,809

2018

13,946,918

9,293,326

30,817,623

3,115,549

57,173,417

2019

7,910,151

9,643,393

31,870,399

3,311,435

52,735,378

2020

-

842,583

32,937,717

3,506,718

37,287,017

2021

-

-

34,186,583

3,705,250

37,891,833

2022

-

-

35,552,782

2,244,613

37,797,395

2023

-

-

36,978,374

36,978,374

2024

-

-

30,008,722

30,008,722

137,650,048

$

94,335,964

$

404,785,110

$

37,454,553

$

674,225,675

$

As of December 31, 2014

The table provides

1)

the pre-tax equity return recognized by

CenterPoint

Energy, Inc. (CenterPoint

Energy)

during each of the years 2005 through 2014

related to CenterPoint

Energy Houston Electric,

LLC’s (CEHE) recovery of certain qualified costs

or storm restoration costs, as applicable,

pursuant to the past issuance of transition

bonds by CenterPoint

Energy Transition Bond

Company II, LLC (Transition BondCo

II) and

CenterPoint

Energy Transition Bond Company

III, LLC (Transition BondCo

III) or CenterPoint

Energy Transition Bond Company IV, LLC

(Transition BondCo

IV) or system restoration

bonds by CenterPoint

Energy Restoration Bond

Company, LLC (System Restoration BondCo), as

applicable and

2)

the estimated pre-tax equity return currently

expected to be recognized in each of the years

2015 through 2024 related to CEHE’s recovery

of certain qualified costs or storm restoration

costs, as applicable, pursuant to the past

issuance of transition bonds by Transition

BondCo

II, Transition BondCo

III or Transition

BondCo

IV or system restoration bonds by

System Restoration BondCo, as applicable. |