Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SONIC AUTOMOTIVE INC | d879229d8k.htm |

| EX-99.1 - EX-99.1 - SONIC AUTOMOTIVE INC | d879229dex991.htm |

| EX-99.3 - EX-99.3 - SONIC AUTOMOTIVE INC | d879229dex993.htm |

Q4 2014

EARNINGS REVIEW February 24, 2015

Exhibit 99.2 |

2

FORWARD-LOOKING STATEMENTS

This

presentation

contains

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation Reform Act of 1995. These statements relate to future events, are not

historical facts and are based on our current expectations and assumptions regarding

our business, the economy and other future conditions. These statements can

generally be identified by lead-in words such as “believe”, “expect”,

“anticipate”, “intend”, “plan”, “foresee”,

“may” ,”will”

and other similar words. Statements that describe

our Company’s objectives, plans or goals are also forward-looking statements.

Examples of such forward- looking information we may be discussing in this

presentation include, without limitation, anticipated 2014 industry new vehicle sales

volume, the implementation of growth and operating strategies, including acquisitions

of dealerships and properties, the development of open points and stand-alone pre-owned

stores, the return of capital to shareholders , anticipated future success and impacts from

the implementation of our strategic initiatives and earnings per share

expectations. You are cautioned that these forward-looking statements are not

guarantees of future performance, involve risks

and

uncertainties

and

actual

results

may

differ

materially

from

those

projected

in

the

forward-looking

statements as a result of various factors. These risks and uncertainties include, among

other things, (a) economic conditions in the markets in which we operate, (b) the

success of our operational strategies, (c) our relationships with the automobile

manufacturers, (d) new and pre-owned vehicle sales volume, and (e) earnings

expectations for the year ended December 31, 2014. These risks and uncertainties, as well as

additional factors that could affect our forward-looking statements, are described in our

Form 10-K for the year ending December 31, 2013.

These forward-looking statements, risks, uncertainties and additional factors speak only

as of the date of this presentation. We undertake no obligation to update any

such statements. |

CONTENT

•

STRATEGIC FOCUS

•

FINANCIAL RESULTS

•

OPERATIONS REVIEW

•

SUMMARY AND OUTLOOK

3 |

4

STRATEGIC FOCUS

1.

Growth

•

One Sonic-One Experience

•

EchoPark

®

•

Acquisitions & Open Points

2.

Own Our Properties

3.

Return Capital to Shareholders |

STRATEGIC

FOCUS ONE SONIC-ONE EXPERIENCE

5

•

Goals

–

1 Associate, 1 Price, 1 Hour

–

Improve Transparency; Increase Trust

–

Operational Efficiencies

•

Pilot Stores Underway

•

24 Month Implementation

Result -

Increase Market Share and Customer Retention |

6

STRATEGIC FOCUS

ONE SONIC-ONE EXPERIENCE (cont’d)

Speed Up the Transaction

No Negotiation

Reduce Paperwork

Electronic Signature

One Associate One Guest

Technology Driven

Training Supported

Reduce Headcount Through

Attrition

Creates Significant Cost

Savings

Create Trust & Transparency

Increased CSI, ASI and

Market Share

Brand the Retail Stores

Increased Market Share &

Margins

Creates More of a Specialty

Retail Experience

Apple, Starbucks, etc. |

7

STRATEGIC FOCUS

EchoPark

®

•

Hub Opened November 3

•

2 Neighborhood Stores

Opened in January 2015

•

Expect at least 2 more in 2015 |

8

STRATEGIC FOCUS

ACQUISITIONS & OPEN POINTS

•

Purchased Four Franchises: Jaguar (Q1),

Nissan (Q3), Chevy and Land Rover (Q4) during

2014

–

Estimated Annual Revenues of $156 million

•

Open Points

–

Mercedes Benz in Dallas Market

–

Audi in Pensacola Market

–

Nissan in TN Market

–

Exploring Opportunities in Other Markets |

9

STRATEGIC FOCUS

OWN OUR PROPERTIES

2007

2008

2011

2012

2013

2014

Proj. -

2017

0%

12%

18%

23%

31%

36%

49% |

10

STRATEGIC FOCUS

RETURN CAPITAL TO SHAREHOLDERS

•

Unused Authorization of Approximately $ 79 million

•

Quarterly Dividend of $0.025 Per Share

Shares

(in thousands)

Average Price /

Share

$

(in millions)

2014 Activity

2,256

$ 23.51

$ 53.0 |

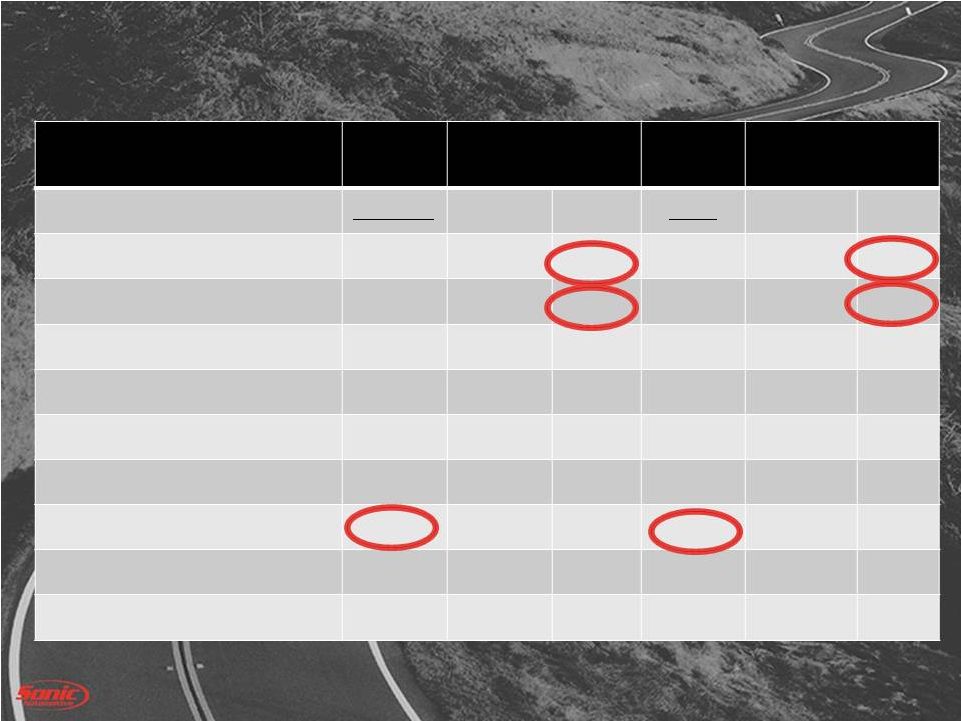

Q4

& FY 2014 FINANCIAL REVIEW |

ADJUSTED

Q4 & FY 2014 RESULTS B/(W) than Q4

2013

B/(W) than 2013

(amounts in millions, except per share data)

Q4 2014

$

%

2014

$

%

Revenue

$ 2,352

$ 36

1.6%

$ 9,197

$ 354

4.0%

Gross Profit

$ 349

$ 10

2.9%

$ 1,366

$ 64

4.9%

Operating Profit

(1)

$ 70

$ 1

1.4%

$ 235

($ 10)

(4.1%)

Interest & Other

(1)

($ 17)

$ 1

7.4%

($ 72)

$ 5

6.1%

Continuing Ops:

Profit (after tax)

(1)

$ 33

($3)

(8.5%)

$ 100

($ 8)

(7.7%)

Diluted EPS

(1)

$ 0.63

($ 0.04)

(6.0%)

$ 1.90

($ 0.13)

(6.0%)

SG&A as % of Gross

(1)

75.5%

(30 bps)

78.6%

(150 bps)

Discontinued Ops Profit/(Loss) (after tax)

($ 1)

$ 1

($2 )

$ 1

12

(1) –

Amounts are adjusted. See appendix for reconciliation of adjusted amounts to GAAP

amounts |

13

(amounts in millions, except per share date)

Q4 2014

Q4 2013

Pre-Tax

EPS

Pre-Tax

EPS

Reported EPS

$ 0.52

$ 0.55

Storm Damage

$ 1.5

$ 0.03

$ 0.0

$ 0.00

Gain on Disposal

($ 0.2)

($ 0.00)

$ 0.0

$ 0.00

Impairment

$ 6.4

$ 0.08

$ 9.9

$ 0.12

Adjusted EPS

$ 0.63

$ 0.67

EchoPark

$ 7.1

$ 0.08

$ 2.2

$ 0.03

Comparable EPS

$ 0.71

$ 0.70

EPS WALK–

Q4 |

EPS

WALK– FY 2014

14

(amounts in millions, except per share date)

2014

2013

Pre-Tax

EPS

Pre-Tax

EPS

Reported EPS

$ 1.87

$ 1.59

Storm Damage

$ 4.0

$ 0.05

$ 0.0

$ 0.00

Legal

$ 1.1

$0.01

$ 0.0

$ 0.00

Gain on Disposal

($ 10.7)

($ 0.11)

$ 0.0

$ 0.00

Impairment

$ 6.6

$ 0.08

$ 9.9

$ 0.11

Debt Refi

$ 0.0

$ 0.00

$ 29.0

$ 0.33

Adjusted EPS

$ 1.90

$ 2.03

EchoPark®

$ 15.7

$ 0.18

$ 5.5

$ 0.07

Comparable EPS

$ 2.08

$ 2.10 |

ECHOPARK

– Q4 & FY 2014 RESULTS

15

(amounts in millions, except per share data)

Q4 2014

B/(W)

than Q4

2013

FY 2014

B/(W)

than FY

2013

Revenue

$ 5.4

$ 5.4

$ 5.4

$ 5.4

Gross Profit

$ 0.5

$ 0.5

$ 0.5

$ 0.5

Operating Profit

($ 7.0)

($ 4.8)

($ 15.6)

($ 10.1)

Interest & Other

($0.1 )

($ 0.1)

($ 0.1)

($ 0.1)

Pre-tax Profit (Loss)

($ 7.1)

($ 4.9)

($ 15.7)

($ 10.2) |

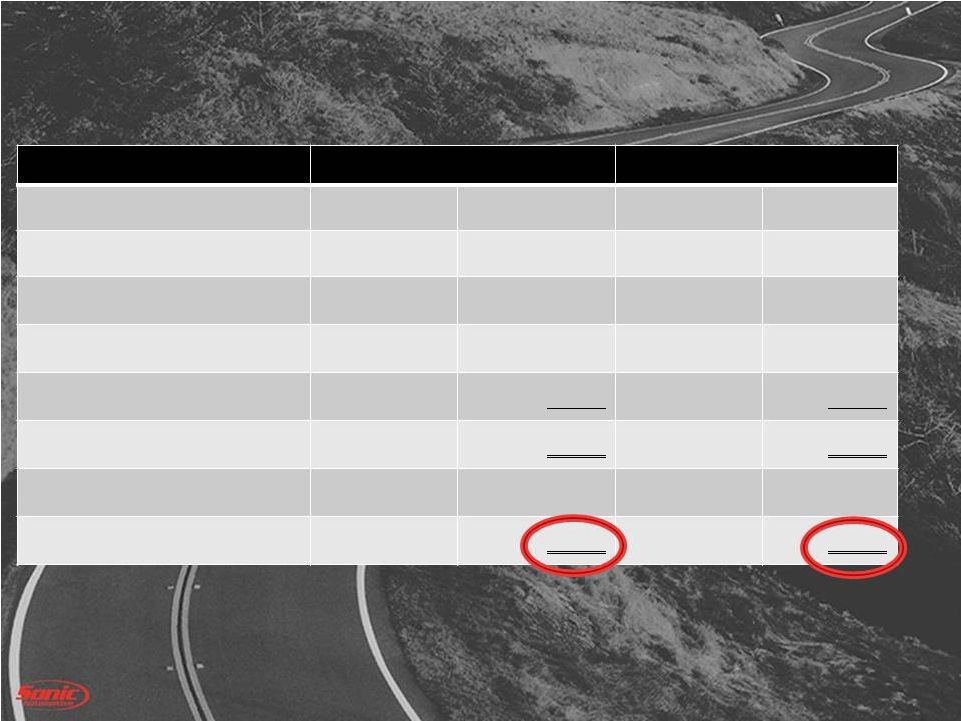

ADJUSTED

SG&A TO GROSS 16

75.5%

75.2%

Note: See Appendix for reconciliation to GAAP amounts

78.6%

77.1%

Q4 2014

Q4 2013

FY 2014

FY 2013

4.4%

4.5%

4.2%

4.3%

44.6%

44.7%

46.8%

46.2%

7.6%

7.5%

7.8%

8.1%

18.9%

18.5%

19.8%

18.5%

Advertising

Comp

Rent & Related

Other |

SG&A

TO GROSS WALK – Q4

17

Note: See Appendix for reconciliation to GAAP amounts

Q4 2014

Adjusted

Less:

EchoPark

Less: OSOE

Less:

Centralization

Q4 2014 Adj

for Initiatives

75.5%

(1.9%)

(1.1%)

(0.3%)

72.2%

210 bps

Better than

Q4 2013 of

74.3% |

SG&A

TO GROSS WALK – FY 2014

18

Note: See Appendix for reconciliation to GAAP amounts

FY 2014

Adjusted

Less:

EchoPark

Less: OSOE

Less:

Centralization

FY 2014 Adj

for Initiatives

78.6%

(1.1%)

(0.8%)

(0.2%)

76.5% |

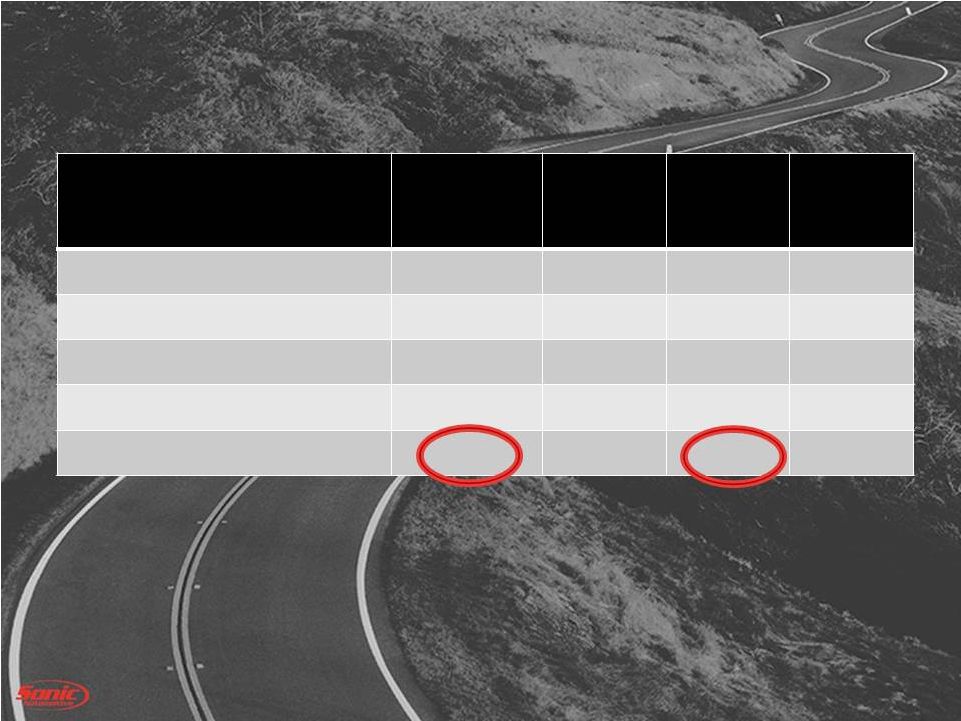

STRATEGIC INITIATIVE INVESTMENTS

19

(in millions)

2014

Estimated 2015

EchoPark®

$ 15.7

$ 13.3

One Sonic-One Experience

$ 10.4

$ 10.0

Centralization of Business Office

$ 2.1

$ 5.0 |

CAPITAL

SPEND (amounts in millions)

YTD 2014

Estimated

2015

Real Estate & Facility Related

$ 124.3

$159.1

All Other Cap Ex

39.6

42.0

Subtotal

$ 163.9

$ 201.1

Less: Mortgage Funding

(44.4)

(100.6)

Total Cash Used –

Cap Ex

$ 119.5

$ 100.5

Note –

Spending excludes the effect of franchise acquisitions.

20 |

LIQUIDITY

(amounts in millions)

Q4 2014

Q4 2013

Cash

$ 4.2

$3.0

Revolver Availability

165.4

126.0

Used floor plan availability

22.6

27.1

Floor plan deposit balance

57.5

65.0

Total

$ 249.7

$221.1

21 |

DEBT

COVENANTS Covenant

Actual Q4

2014

Liquidity Ratio

>= 1.05

1.20

Fixed Charge Coverage Ratio

>= 1.20

1.61

Total Lease Adjusted Leverage

Ratio

<= 5.50

4.12

Compliant with all Covenants

22 |

OPERATIONS

REVIEW |

NEW

VEHICLE RETAIL SAME STORE

Q4 2014

Q4 2013

B/(W)

Volume

34,371

32,756

4.9%

Selling Price

$ 38,571

$ 38,287

0.7%

Gross Margin %

5.9%

6.4%

(50 bps)

GPU

$ 2,269

$ 2,435

($ 166)

Gross Profit

$ 78 million

$ 80 million

(2.2%)

SAAR (includes fleet)

16.8 million

15.6 million

7.2%

24 |

25

Q4 REVENUE MIX

Industry

Growth

Ford

(0.7%)

GM (includes

Cadillac)

8.7%

Chrysler

21.0%

Honda

3.3%

Toyota

7.4%

Nissan

7.1%

MB

0.8%

BMW

6.7%

Lexus

9.2%

Audi

16.9%

Ford,

7.1%

GM

(includes

Cadillac),

7.8%

Chrysler,

0.0%

Honda,

22.3%

Toyota,

14.0%

Nissan,

0.0%

Other

Import,

6.1%

MB, 8.5%

BMW,

19.1%

Lexus,

5.0%

Audi,

3.6%

Other

Luxury,

6.5% |

Q4 2014 vs. Q4

2013 NEW VEHICLE -

BRAND

18.7%

8.0%

2.3%

7.0%

5.4%

22.5%

4.8%

13.8%

4.0%

% Sonic Unit Sales

BMW

MB

Cadillac

Ford

GM

Honda

Lexus

Toyota

Audi

21%

(1%)

(12%)

(5%)

10%

7%

2%

5%

16%

7%

1%

(13%)

(1%)

10%

3%

9%

7%

17%

Sonic

Industry

26 |

USED

VEHICLE RETAIL SAME STORE

Q4 2014

Q4 2013

B/(W)

Retail Volume

25,784

25,322

1.8%

Used Retail GPU

$ 1,433

$ 1,353

$ 80

Used to New

0.75 : 1

0.77 : 1

(0.02)

Vehicles / store / month (all stores)

88

86

2

27 |

FIXED

OPS SAME STORE

28

QTD YOY Gross Profit Change Breakdown:

Q4 2014

B/(W)

than 2013

(amounts in millions)

$

%

Revenue

$

318.0

$ 11.9

3.9%

Gross Profit

$ 153.7

$ 6.5

4.4%

•

Customer Pay Up 0.1%

•

Whsl. Parts Up 1.6%

•

Internal & Sublet Up 8.1%

•

Warranty Up 12.1% |

OSOE |

30

OSOE

•

Low turnover as a result of the changes

•

January is our first full month and share is reacting positively

•

We are easily doing deals in less than an hour if that is a guest wish

•

Customer feedback is fantastic

•

Our training is excellent

•

We are attracting a new type of employee

•

New CRM tool and Showroom technology is working properly and a

competitive advantage

•

Competition is reacting to our moves –

pricing and advertising

•

F&I continues to improve

•

Marketing begins in February for the Charlotte Market

•

No plans to move to next market until Charlotte share and profit

goals

are met

•

Website performance issues (resolved)

•

SEO/SEM performance issues (improving)

•

BDC / GEC conversion (improving)

•

Pricing tool is not complete (new car –

90 days out)

•

Inventory purchase tool not complete (new car -

6 months out)

EARLY OBSERVATIONS

OPPORTUNITIES |

31

OSOE –

MARKET SHARE

Market Share is

Stabilizing

17.8%

14.4%

13.2%

12.9%

14.2%

13.1%

14.6%

18.0%

20.8%

15.8%

16.0%

15.1%

15.8%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

22.0%

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Town & Country Toyota

•

October 2014 -

T&C Toyota Soft

Open

•

November 2014

–

First Full

Month for Toyota

•

December

2014

–

Other

Charlotte

Stores Soft Open

•

January 2015 –

First Full Month

for Other Charlotte Stores |

32

OSOE –

MARKET SHARE

20.6%

17.7%

19.5%

18.3%

17.0%

16.9%

13.9%

18.5%

17.3%

12.3%

16.0%

13.3%

15.9%

10.0%

15.0%

20.0%

25.0%

30.0%

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Town & Country Ford

18.5%

20.1%

15.9%

18.5%

20.1%

16.3%

17.0%

15.4%

16.3%

14.9%

12.4%

14.5%

16.9%

10.0%

15.0%

20.0%

25.0%

30.0%

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Fort Mill Ford |

33

OSOE –

MARKET SHARE

42.5%

41.1%

40.7%

51.1%

30.0%

44.4%

43.5%

46.6%

40.5%

50.6%

40.5%

31.7%

42.6%

30.0%

35.0%

40.0%

45.0%

50.0%

55.0%

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Infiniti of South Charlotte

35.7%

32.5%

47.5%

41.7%

38.7%

36.7%

40.4%

40.0%

37.1%

45.7%

32.2%

26.5%

41.3%

20.0%

25.0%

30.0%

35.0%

40.0%

45.0%

50.0%

55.0%

60.0%

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Jan-15

Cadillac of South Charlotte |

EchoPark

® |

35

EARLY OBSERVATIONS

•

Very low to no turnover

•

Fantastic guest experience –

take a look at the testimonials from Yelp, Yahoo, Google –

that’s what we are looking for!

•

Reconditioning levels are very high

•

F&I performance ahead of projection with no F&I office

•

EchoPark SIMS -

Excellent inventory management system (buying, intercompany

movement) –

performance is above expectations with no inventory issues

•

Appraisal process –

is fantastic and a favorite of our guests

•

Volume has started off very well

•

Store technology is strong and improving

OPPORTUNITIES

•

Website performance issues (not resolved)

•

Same as OSOE Stores; working to resolve but website performance is not

acceptable and will be resolved in the coming weeks

•

SEO/SEM performance issues (plan being implemented)

•

Weather has been a big issue –

held up openings of 2 locations

•

Pricing system –

delayed completion will start 3/1/15

EchoPark® |

36

EchoPark®

Openings:

Hub

–

11/3/2014

Centennial –

12/26/2015

Highlands Ranch –

1/26/2015

0

82

126

150

0

0

35

6

0

20

40

60

80

100

120

140

160

Unit Volume

HUB

Centennial

Highlands Ranch |

SUMMARY |

Continued to grow the top-line in each revenue

category achieving record results

The franchised dealership landscape supported our

operating initiatives

Significant milestones / achievements in 2014

•

Opening of EchoPark

®

•

Rollout of One Sonic-One Experience

•

Gained ground on owning properties –

now at 36%

•

Returned $82.8 million to shareholders through

share repurchases and dividends

SUMMARY

38 |

2015

PLAN 2015 Plan

Expect new car industry volume to be between 16.5M to

17.0M units

We will continue to increase pre-owned volume in the mid-

single digits

Expect fixed operations to grow at mid-single digits

Costs

related

to

EchoPark

®

,

One

Sonic-One

Experience,

and centralization to continue

2015 Continued Ops EPS Guidance:

•

New Car Franchise Business

$2.01 -

$2.11

•

Effect of EchoPark

®

($0.16)

•

Total Sonic

$1.85 -

$1.95

39 |

|

Appendix

41 |

NON-GAAP RECONCILIATIONS

42

Fourth Quarter Ended

Year Ended

2014

2013

2014

2013

SG&A Reconciliation:

As Reported

264,402

$

254,647

$

1,067,433

$

1,003,125

$

Pre-tax Adjustments:

Fire and severe storm damage

(961)

-

(3,965)

-

Legal and other

(575)

-

(1,105)

-

Gain on disposal of

franchises 254

-

10,743

-

Total pre-tax

adjustments (1,282)

-

5,673

-

Adjusted SG&A

263,120

$

254,647

$

1,073,106

$

1,003,125

$

SG&A as % of Gross Reconciliation:

As Reported

75.9%

75.2%

78.1%

77.1%

Pre-tax Adjustments:

Fire and severe storm damage

(0.3%)

0.0%

(0.2%)

0.0%

Legal and other

(0.2%)

0.0%

(0.1%)

0.0%

Gain on disposal of franchises

0.1%

0.0%

0.8%

0.0%

Total pre-tax adjustments

(0.4%)

0.0%

0.5%

0.0%

Adjusted SG&A as % of Gross

75.5%

75.2%

78.6%

77.1%

December 31,

(In thousands)

This release contains certain non-GAAP financial measures (the

"Adjusted" amounts) as defined under SEC rules, such as, but not limited to, adjusted income

from continuing operations and related earnings per share data.

The Company has reconciled these measures to the most directly comparable GAAP measures

(the "Reported" amounts) in the release. The Company

believes that these non-GAAP financial measures improve the transparency of the Company’s

disclosure by providing period-to-period comparability of the

Company’s results from operations. December 31,

(In thousands) |

43

NON-GAAP RECONCILIATIONS

Fourth Quarter Ended

Year Ended

2014

2013

2014

2013

Operating Profit Reconciliation:

As Reported

62,470

$

59,264

$

233,613

$

234,603

$

Pre-tax Adjustments:

Fire and severe storm damage

961

-

3,965

-

Legal and other

575

-

1,105

-

Impairment

charges 6,379

9,873

6,586

9,872

Gain on disposal of franchises

(254)

-

(10,743)

-

Total pre-tax

adjustments 7,661

9,873

913

9,872

Adjusted Operating Profit

70,131

$

69,137

$

234,526

$

244,475

$

Profit from Continuing Operations (after-tax) Reconciliation:

As Reported

26,957

$

29,562

$

98,559

$

84,678

$

After-tax Adjustments:

Fire and severe storm damage

594

-

2,683

-

Legal and other

355

-

749

-

Impairment

charges 3,943

6,022

4,459

6,022

Gain on disposal of franchises

(157)

-

(7,273)

-

Permanent tax

difference from disposals 853

-

853

-

Debt

Refinancing -

-

-

17,704

Total after-tax adjustments

5,588

6,022

1,471

23,726

Adjusted Profit from Continuing Operations

(after-tax) 32,545

$

35,584

$

100,030

$

108,404

$

December 31,

(In thousands)

December 31,

(In thousands) |

NON-GAAP RECONCILIATIONS

44

Fourth Quarter Ended December 31, 2014

Income (Loss)

Income (Loss)

From Continuing

From Discontinued

Operations

Average

Net Income (Loss)

Weighted

Per

Per

Per

Average

Share

Share

Share

Shares

Amount

Amount

Amount

Amount

Amount

Amount

(In thousands, except per share amounts)

Reported:

Earnings (loss) and shares . . . . . . . . . . . . . . . . . .

51,272

26,957

$

(831)

$

26,126

$

Effect of participating securities:

Non-vested restricted stock

and stock units . . . . . . . . . . . . . . . . . . . . . . .

(86)

-

(86)

Basic earnings (loss) and shares . . . . . . . . . . . . .

51,272

26,871

$

0.52

$

(831)

$

(0.01)

$

26,040

$

0.51

$

Effect of dilutive securities:

Stock compensation plans . . . . . . . . . . . . . . . .

562

Diluted earnings (loss) and shares (1) . . . . . . . .

. 51,834

26,871

$

0.52

$

(831)

$

(0.02)

$

26,040

$

0.50

$

Adjustments (net of tax):

Fire and severe storm damage . . . . . . . . . . . . . . .

594

$

0.01

$

-

$

-

$

594

$

0.01

$

Legal and other. . . . . . . . . . . . . . . . . . . . . . . . . .

. 355

-

-

-

355

-

Impairment charges. . . . . . . . . . . . . . . . . . . . . . .

3,943

0.08

-

-

3,943

0.08

Gain on disposal of franchises . . . . . . . . . . . . . .

(157)

-

-

-

(157)

-

Permanent tax difference from disposals . . . . . .

853

0.02

-

853

0.02

Total adjustments . . . . . . . . . . . . . . . . . . . . . .

5,588

$

0.11

$

-

$

-

$

5,588

$

0.11

$

Adjusted:

Earnings (loss) and

Diluted earnings (loss) per share . . . . . . . . . . .

32,545

$

0.63

$

(831)

$

(0.02)

$

31,714

$

0.61

$

(1) Expenses attributable to the EchoPark® initiative were $0.08

per fully diluted share in the fourth quarter of 2014. Fourth

Quarter Ended December 31, 2013 Income (Loss)

Income (Loss)

From Continuing

From Discontinued

Operations

Operations

Net Income (Loss)

Weighted

Per

Per

Per

Average

Share

Share

Share

Shares

Amount

Amount

Amount

Amount

Amount

Amount

(In thousands, except per share amounts)

Reported:

Earnings (loss) and shares . . . . . . . . . . . . . . . . . .

52,492

29,562

$

(1,478)

$

28,084

$

Effect of participating securities:

Non-vested restricted stock

and stock units . . . . . . . . . . . . . . . . . . . . . . .

(208)

-

(208)

Basic earnings (loss) and shares . . . . . . . . . . . . .

52,492

29,354

$

0.56

$

(1,478)

$

(0.03)

$

27,876

$

0.53

$

Effect of dilutive securities:

Stock compensation plans . . . . . . . . . . . . . . . .

482

Diluted earnings (loss) and shares (2). . . . . . .

. . 52,974

29,354

$

0.55

$

(1,478)

$

(0.02)

$

27,876

$

0.53

$

Adjustments (net of tax):

Impairment Charges . . . . . . . . . . . . . . . . . . . . . .

6,022

$

0.11

$

-

$

-

$

6,022

$

0.11

$

Effect of two-class method & rounding . . . . . . .

-

0.01

-

(0.01)

-

-

Total adjustments . . . . . . . . . . . . . . . . . . . . . .

6,022

$

0.12

$

-

$

(0.01)

$

6,022

$

0.11

$

Adjusted:

Earnings (loss) and

Diluted earnings (loss) per share . . . . . . . . . . .

35,584

$

0.67

$

(1,478)

$

(0.03)

$

34,106

$

0.64

$

(2) Expenses attributable to the EchoPark® initiative were $0.03

per fully diluted share in the fourth quarter of 2013. |

45

NON-GAAP RECONCILIATIONS

Year Ended December 31, 2014

Income (Loss)

Income (Loss)

From Continuing

From Discontinued

Operations

Operations

Net Income (Loss)

Weighted

Per

Per

Per

Average

Share

Share

Share

Shares

Amount

Amount

Amount

Amount

Amount

Amount

(In thousands, except per share amounts)

Reported:

Earnings (loss) and shares . . . . . . . . . . . . . . . . . .

52,065

98,559

$

(1,342)

$

97,217

$

Effect of participating securities:

Non-vested restricted stock

and stock units . . . . . . . . . . . . . . . . . . . . . . .

(311)

-

(311)

Basic earnings (loss) and shares . . . . . . . . . . . . .

52,065

98,248

$

1.89

$

(1,342)

$

(0.03)

$

96,906

$

1.86

$

Effect of dilutive securities:

Contingently convertible

debt (5.0% Convertible Notes) . . . . . . . . . . .

-

-

-

-

Stock compensation plans . . . . .

. . . . . . . . . . . 498

Diluted earnings (loss) and shares (3). . . . . . . . .

52,563

98,248

$

1.87

$

(1,342)

$

(0.03)

$

96,906

$

1.84

$

Adjustments (net of tax):

Fire and severe storm damage . . . . . . . . . . . . . . .

2,685

$

0.05

$

-

$

-

$

2,685

$

0.05

$

Legal and other. . . . . . . . . . . . . . . . . . . . . . . . . .

. 749

0.01

-

-

749

0.01

Impairment charges. . . . . . . . . . . . . . . . . . . . . . .

4,459

0.08

-

-

4,459

0.08

Gain on disposal of franchises . . . . . . . . . . . . . .

(7,273)

(0.14)

-

-

(7,273)

(0.14)

Permanent tax difference from disposals . . . . . .

853

0.02

-

-

853

0.02

Lease exit adjustments . . . . . . . . . . . . . . . . . . . .

-

-

(844)

(0.02)

(844)

(0.02)

Effect of two-class method & rounding . . . . . . .

-

0.01

-

0.01

-

0.02

Total adjustments . . . . . . . . . . . . . . . . . . . . . .

1,473

$

0.03

$

(844)

$

(0.01)

$

629

$

0.02

$

Adjusted:

Earnings (loss) and

Diluted earnings (loss) per share . . . . . . . . . . .

100,032

$

1.90

$

(2,186)

$

(0.04)

$

97,846

$

1.86

$

(3) Expenses attributable to the EchoPark® initiative were $0.18

per fully diluted share in the year ended December 31, 2014. Year

Ended December 31, 2013 Income (Loss)

Income (Loss)

From Continuing

From Discontinued

Operations

Operations

Net Income (Loss)

Weighted

Per

Per

Per

Average

Share

Share

Share

Shares

Amount

Amount

Amount

Amount

Amount

Amount

(In thousands, except per share amounts)

Reported:

Earnings (loss) and shares . . . . . . . . . . . . . . . . . .

52,556

84,678

$

(3,060)

$

81,618

$

Effect of participating securities:

Non-vested restricted stock

and stock units . . . . . . . . . . . . . . . . . . . . . . .

(601)

-

(601)

Basic earnings (loss) and shares . . . . . . . . . . . . .

52,556

84,077

$

1.60

$

(3,060)

$

(0.06)

$

81,017

$

1.54

$

Effect of dilutive securities:

Stock compensation plans . . . . . . . . . . . . . . . .

385

Diluted earnings (loss) and shares (4) . . . . . . . .

. 52,941

84,077

$

1.59

$

(3,060)

$

(0.06)

$

81,017

$

1.53

$

Adjustments (net of tax):

Impairment Charges . . . . . . . . . . . . . . . . . . . . . .

6,022

$

0.11

$

-

$

-

$

6,022

$

0.11

$

Double-carry interest & refinancing . . . . . . . . . .

17,704

0.33

-

-

17,704

0.33

Debt extinguishment charges . . . . . . . . . . . . . . . .

-

-

-

-

-

-

Effect of two-class method & rounding . . . . . . .

-

-

-

0.01

-

0.01

Total adjustments . . . . . . . . . . . . . . . . . . . . . .

23,726

$

0.44

$

-

$

0.01

$

23,726

$

0.45

$

Adjusted:

Earnings (loss) and

Diluted earnings (loss) per share . . . . . . . . . . .

108,404

$

2.03

$

(3,060)

$

(0.05)

$

105,344

$

1.98

$

(4) Expenses attributable to the EchoPark® initiative were $0.07

per fully diluted share in the year ended December 31, 2014. |

|